Similar presentations:

Elements of Econometrics. Lecture 24. Revision Time Series 1

1.

Elements of Econometrics.Lecture 24.

Revision Time Series 1.

ICEF, 2022-2023

2.

Basic Regression Analysis with Time Series Data• The nature of time series data

• Temporal ordering of observations; may not be arbitrarily reordered

• Typical features: serial correlation/nonindependence of observations

• How should we think about the randomness in time series data?

– The outcome of economic variables (e.g. GDP, Inflation Rates) is uncertain; they

should therefore be modeled as random variables.

– Time series are sequences of random variables (= stochastic processes)

– Randomness does not come from sampling from a population.

– “Sample” = the one realized path of the time series out of the many possible paths

the stochastic process could have taken.

3.

Time Series Data Specifics Essential for Regression Models• Assumption B.2 is irrelevant (the observations do not look as being taken

randomly from fixed populations): B.2 to be replaced by another assumption

There may be regularities in the time series and in their relationships: trends,

seasonalities, autocorrelations in variables and disturbance terms, lags (fixed

or distributed); to be identified and dealt with

• Some regularities in the data (nonstationarity) may lead to estimation of

spurious regressions: the data/model has to be transformed to provide

desirable estimators’ properties

4.

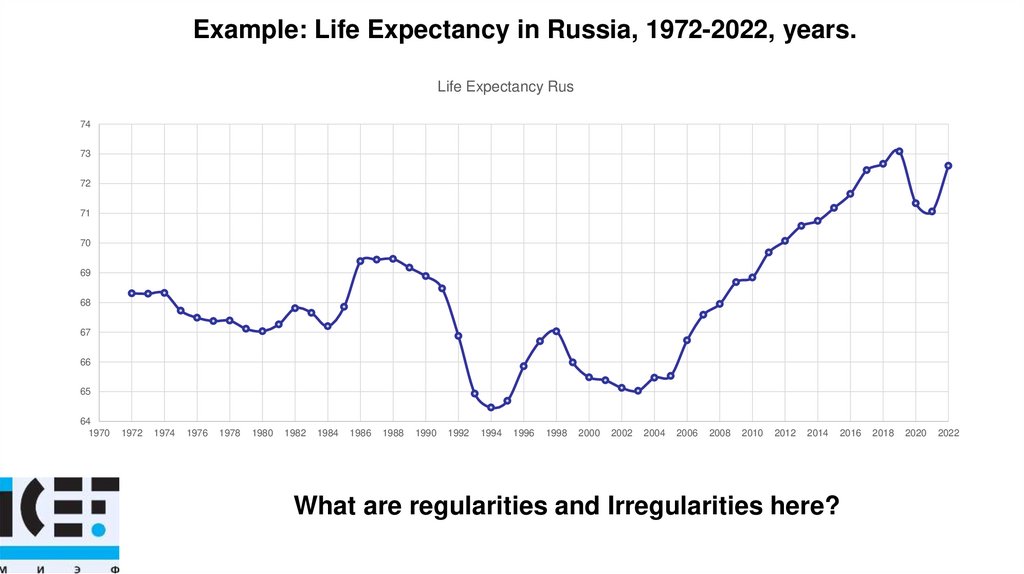

Example: Life Expectancy in Russia, 1972-2022, years.Life Expectancy Rus

74

73

72

71

70

69

68

67

66

65

64

1970

1972

1974

1976

1978

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

What are regularities and Irregularities here?

2018

2020

2022

5.

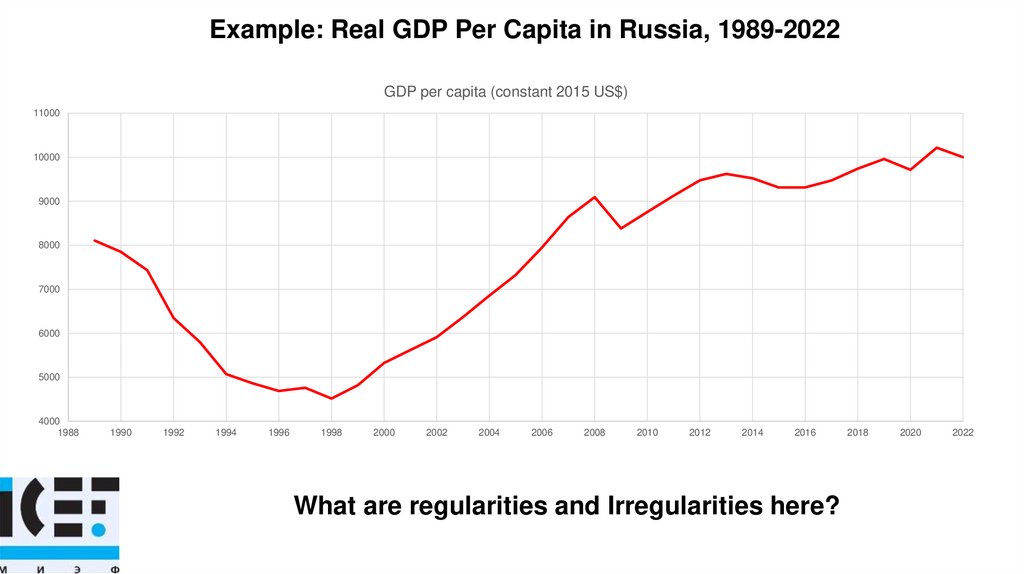

Example: Real GDP Per Capita in Russia, 1989-2022GDP per capita (constant 2015 US$)

11000

10000

9000

8000

7000

6000

5000

4000

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

What are regularities and Irregularities here?

2018

2020

2022

6.

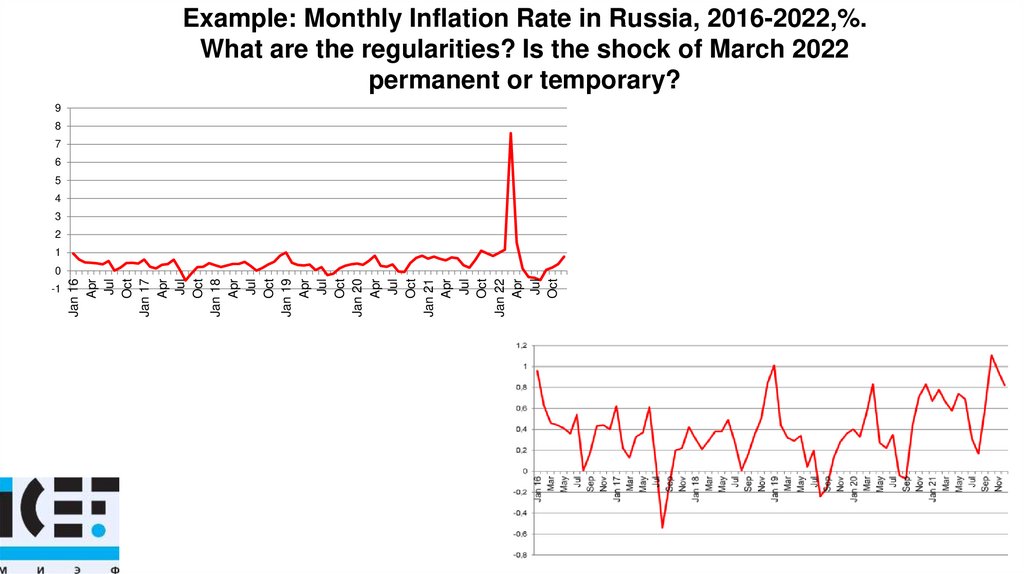

Example: Monthly Inflation Rate in Russia, 2016-2022,%.What are the regularities? Is the shock of March 2022

permanent or temporary?

9

8

7

6

5

4

3

2

1

-1

Jan 16

Apr

Jul

Oct

Jan 17

Apr

Jul

Oct

Jan 18

Apr

Jul

Oct

Jan 19

Apr

Jul

Oct

Jan 20

Apr

Jul

Oct

Jan 21

Apr

Jul

Oct

Jan 22

Apr

Jul

Oct

0

7.

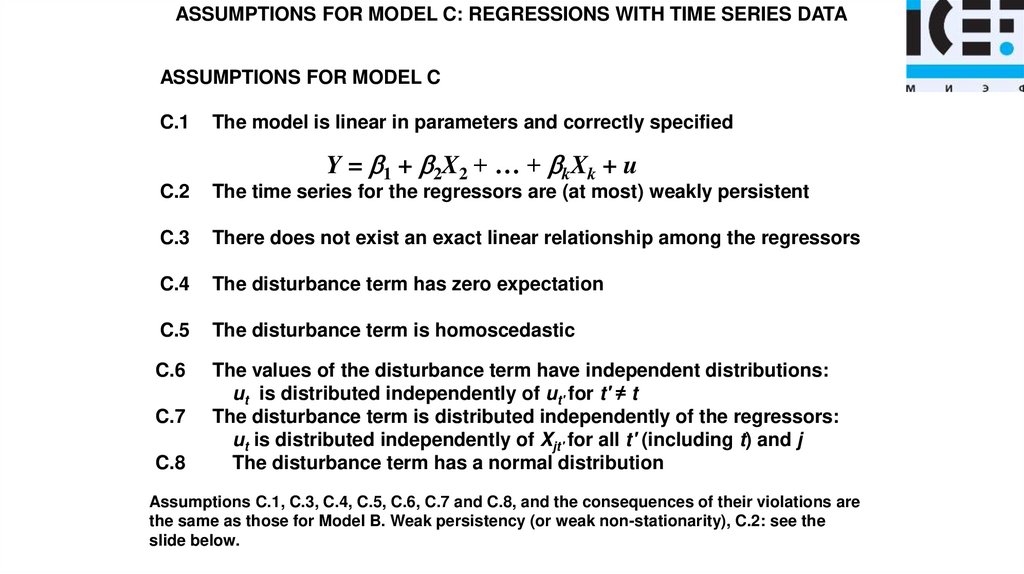

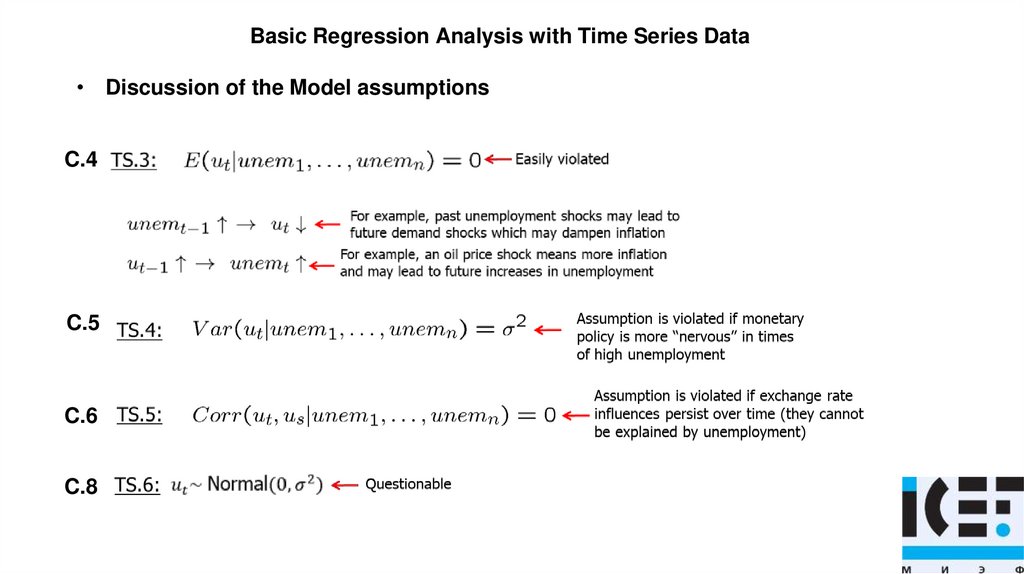

ASSUMPTIONS FOR MODEL C: REGRESSIONS WITH TIME SERIES DATAASSUMPTIONS FOR MODEL C

C.1

The model is linear in parameters and correctly specified

Y = b1 + b2X2 + … + bkXk + u

C.2

The time series for the regressors are (at most) weakly persistent

C.3

There does not exist an exact linear relationship among the regressors

C.4

The disturbance term has zero expectation

C.5

The disturbance term is homoscedastic

C.6

The values of the disturbance term have independent distributions:

ut is distributed independently of ut' for t' ≠ t

The disturbance term is distributed independently of the regressors:

ut is distributed independently of Xjt' for all t' (including t) and j

The disturbance term has a normal distribution

C.7

C.8

Assumptions C.1, C.3, C.4, C.5, C.6, C.7 and C.8, and the consequences of their violations are

the same as those for Model B. Weak persistency (or weak non-stationarity), C.2: see the

slide below.

8.

Stationary Stochastic ProcessesStationarity (strong stationarity) of a stochastic process Xt is

observed if the joint distribution of Xt1,Xt2,…,Xtm is identical to

the joint distribution of Xt1+t,Xt2+t,…,Xtm+t for any m,t,t1,…,tm.

A stochastic process is weakly stationary (or covariance

stationary) if E(Xt) is constant, Var(Xt) is constant, and for any

t,s ≥ 1, Cov(Xt, Xt+s) depends only on s and not on t

If for a weakly stationary process Cov(Xt,Xt+s) → 0 as s → ∞,

the process is called weakly dependent (or weakly persistent)

9.

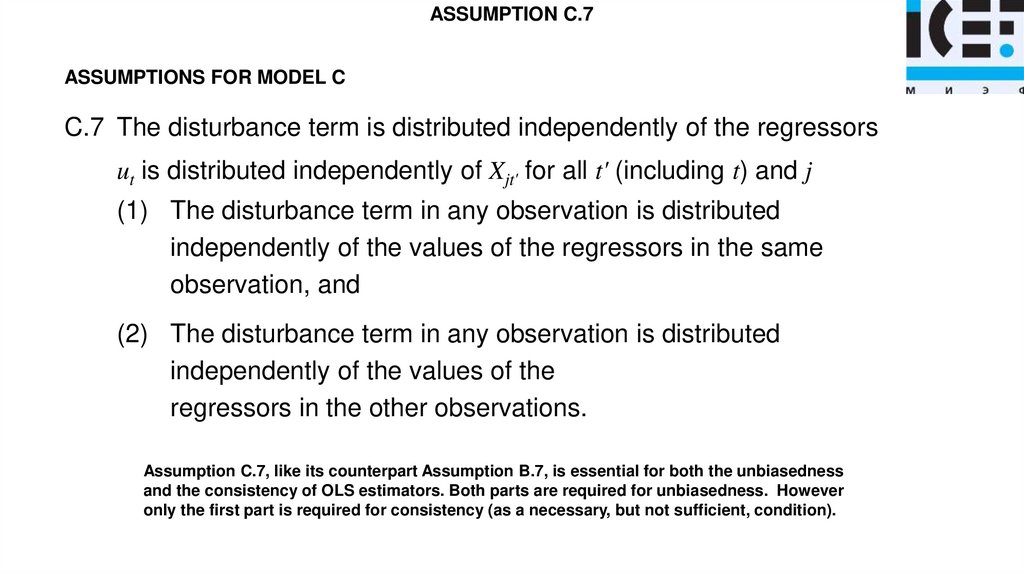

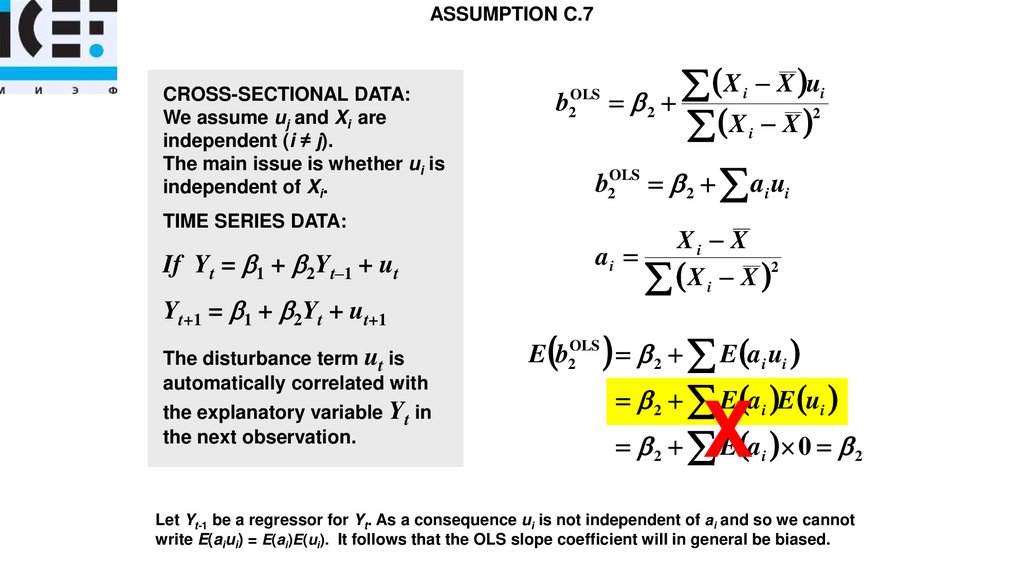

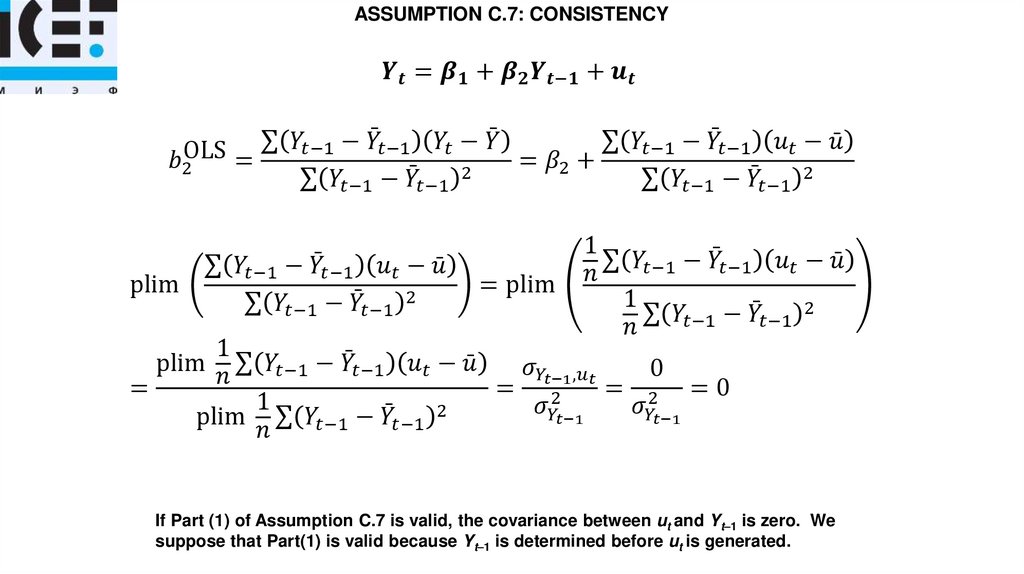

ASSUMPTION C.7ASSUMPTIONS FOR MODEL C

C.7 The disturbance term is distributed independently of the regressors

ut is distributed independently of Xjt' for all t' (including t) and j

(1) The disturbance term in any observation is distributed

independently of the values of the regressors in the same

observation, and

(2) The disturbance term in any observation is distributed

independently of the values of the

regressors in the other observations.

Assumption C.7, like its counterpart Assumption B.7, is essential for both the unbiasedness

and the consistency of OLS estimators. Both parts are required for unbiasedness. However

only the first part is required for consistency (as a necessary, but not sufficient, condition).

10.

UNBIASEDNESSσ

economics

economics