Similar presentations:

Forecasting with bayesian techniques MP

1.

Bayesian Models and Bayesian VARsJoint Vienna Institute/ IMF ICD

Macro-econometric Forecasting and Analysis

JV16.12, L08, Vienna, Austria, May 23, 2016

Presenter

Mikhail Pranovich

2.

Lecture Objectives• Introduce the idea of and rationale for Bayesian perspective and

Bayesian VARs

• Understand the idea of prior distribution of parameters,

Bayesian update and posterior distribution

• Become familiar with prior distributions for VAR parameters,

which allow for analytical representation of moments for

posterior distribution of VAR parameters

• Understand the idea and implementation of the DSGE-VAR

approach

2

3. Introduction: Two Perspectives in Econometrics

Let θ be a vector of parameters to be estimated using data

–

For example, if yt i.i.d. N(μ,σ2), then θ=[μ,σ2] are to be

estimated from a sample {yt}

Classical perspective:

–

there is an unknown true value for θ

–

we obtain a point estimator as a function of the data:

θˆ

Bayesian perspective:

–

θ is an unknown random variable, for which we have initial

uncertain beliefs - prior prob. distribution

–

we describe (changing) beliefs about θ in terms of probability

distribution (not as a point estimator!)

3

4. Outline

1. Why a Bayesian Approach to VARs?2. Brief Introduction to Bayesian Econometrics

3. Analytical Examples

Estimating a distribution mean

Linear Regression

4. Analytical priors and posteriors for BVARs

5. Prior selection in applications (incl. DSGE-VARs)

This training material is the property of the International Monetary Fund (IMF) and is intended for use in

IMF’s Institute for Capacity development (ICD) courses. Any reuse requires the permission of ICD.

4

5. Why a Bayesian Approach to VAR?

• Dimensionality problem with VARs:yt c A( L) yt 1 et ,

E{et et' } e

y contains n variables, p lags in the VAR

• The number of parameters in c and A is n(1+np), and the number of

parameters in Σ is n(n+1)/2

– Assume n=4, p=4, then we are estimating 78 parameters, with n=8, p=4, we

have 133 parameters

• A tension: better in-sample fit – worse forecasting performance

– Sims (Econometrica, 1980) acknowledged the problem:

“Even with a small system like those here, forecasting, especially over relatively long horizons,

would probably benefit substantially from use of Bayesian methods or other mean-squareerror shrinking devices…”

5

6. Why a Bayesian Approach to VAR? (2)

• Usually, only a fraction of estimated coefficients are statisticallysignificant

– parsimonious modeling should be favored

• What could we do?

– Estimate a VAR with classical methods and use standard tests to

exclude variables (i.e. reduce number of lags)

– Use Bayesian approach to VAR which allows for:

• interaction between variables

• flexible specification of the likelihood of such interaction

6

7. Combining information: prior and posterior

Bayesian coefficient estimates combine information in the

prior with evidence from the data

Bayesian estimation captures changes in beliefs about model

parameters

–

Prior: initial beliefs (e.g., before we saw data)

–

Posterior: new beliefs = evidence from data + initial

beliefs

7

8. Shrinkage

• There are many approachesparameterization in VARs

to

reducing

over-

– A common idea is shrinkage

• Incorporating prior information is a way of introducing

shrinkage

– The prior information can be reduced to a few parameters, i.e.

hyperparameters

8

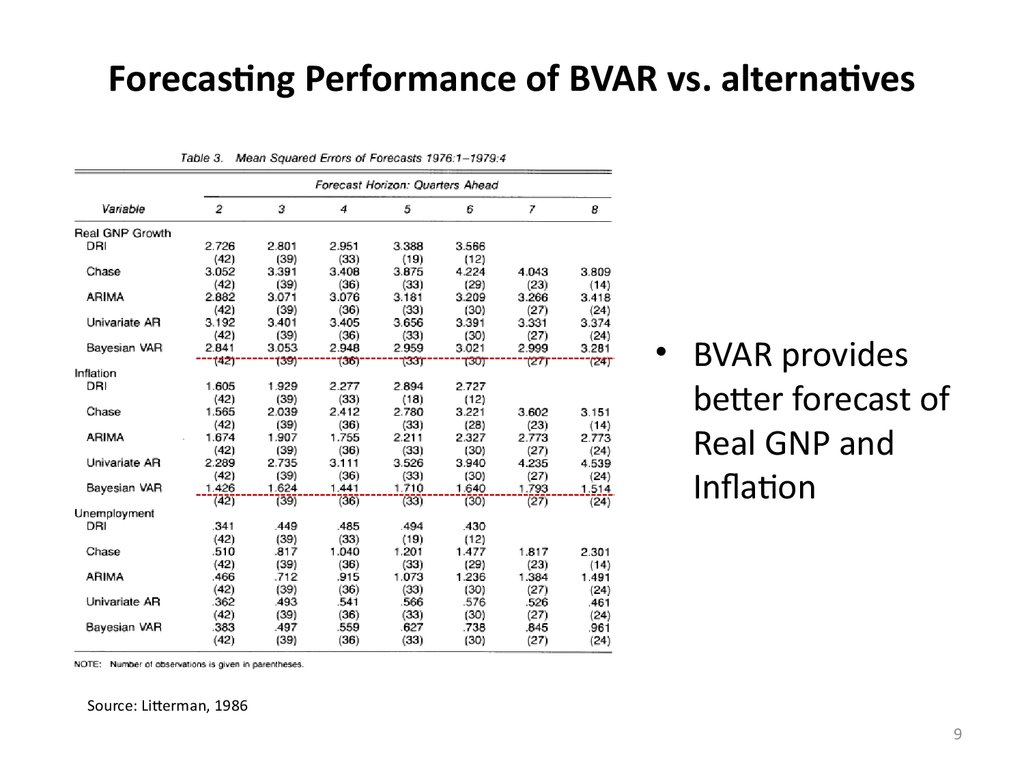

9. Forecasting Performance of BVAR vs. alternatives

• BVAR providesbetter forecast of

Real GNP and

Inflation

Source: Litterman, 1986

9

10. Introduction to Bayesian Econometrics: Objects of Interest

Objects of interest:

–

Prior distribution: p ( )

–

Likelihood function: f ({ yt } | ) - likelihood of data at a given value of θ

–

Joint distribution (of unknown parameters and observables/data):

f ({ yt }, ) f ({ yt } | ) p ( )

–

–

Marginal likelihood:

f ({ yt })

Posterior distribution:

f ({ y }, )d f ({ y } | ) p ( ) d

t

t

f ({ yt }, ) f ({ yt } | ) p ( )

p ( | { yt })

f ({ yt })

f ({ yt })

i.e. what we learned about the parameters

(1) having

prior and (2) observing the

data

10

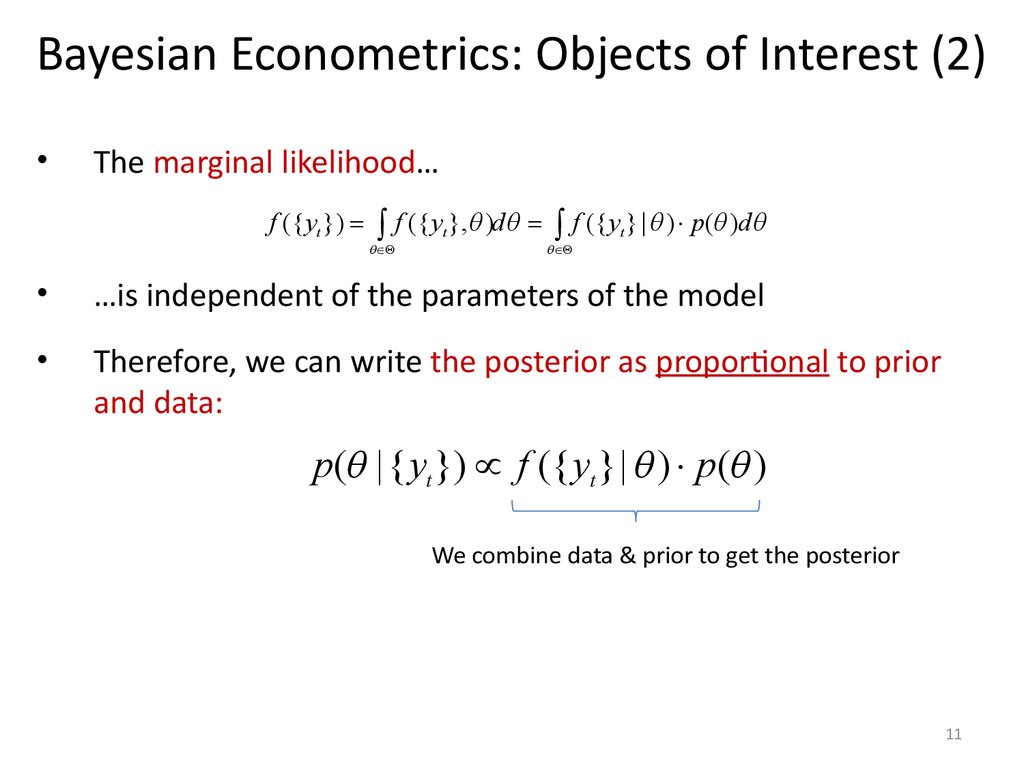

11. Bayesian Econometrics: Objects of Interest (2)

The marginal likelihood…

f ({ yt })

f ({ y }, )d f ({ y } | ) p ( )d

t

t

…is independent of the parameters of the model

Therefore, we can write the posterior as proportional to prior

and data:

p ( | { yt }) f ({ yt } | ) p ( )

We combine data & prior to get the posterior

11

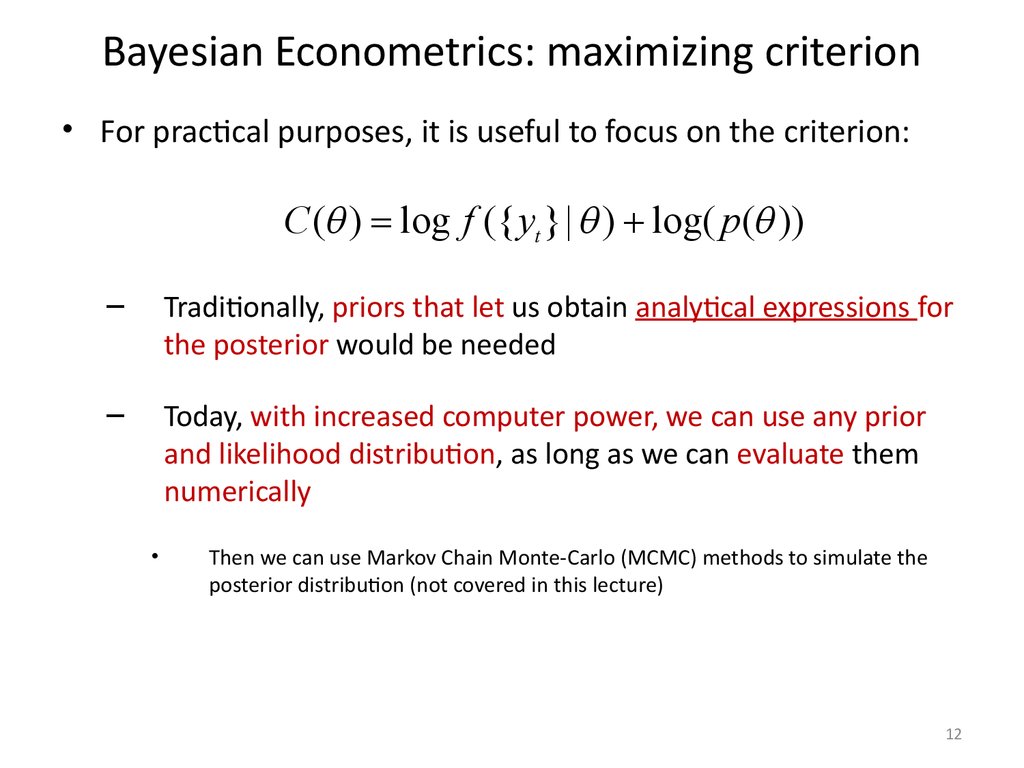

12. Bayesian Econometrics: maximizing criterion

• For practical purposes, it is useful to focus on the criterion:C ( ) log f ({ yt } | ) log( p ( ))

–

Traditionally, priors that let us obtain analytical expressions for

the posterior would be needed

–

Today, with increased computer power, we can use any prior

and likelihood distribution, as long as we can evaluate them

numerically

Then we can use Markov Chain Monte-Carlo (MCMC) methods to simulate the

posterior distribution (not covered in this lecture)

12

13. Bayesian Econometrics : maximizing criterion (2)

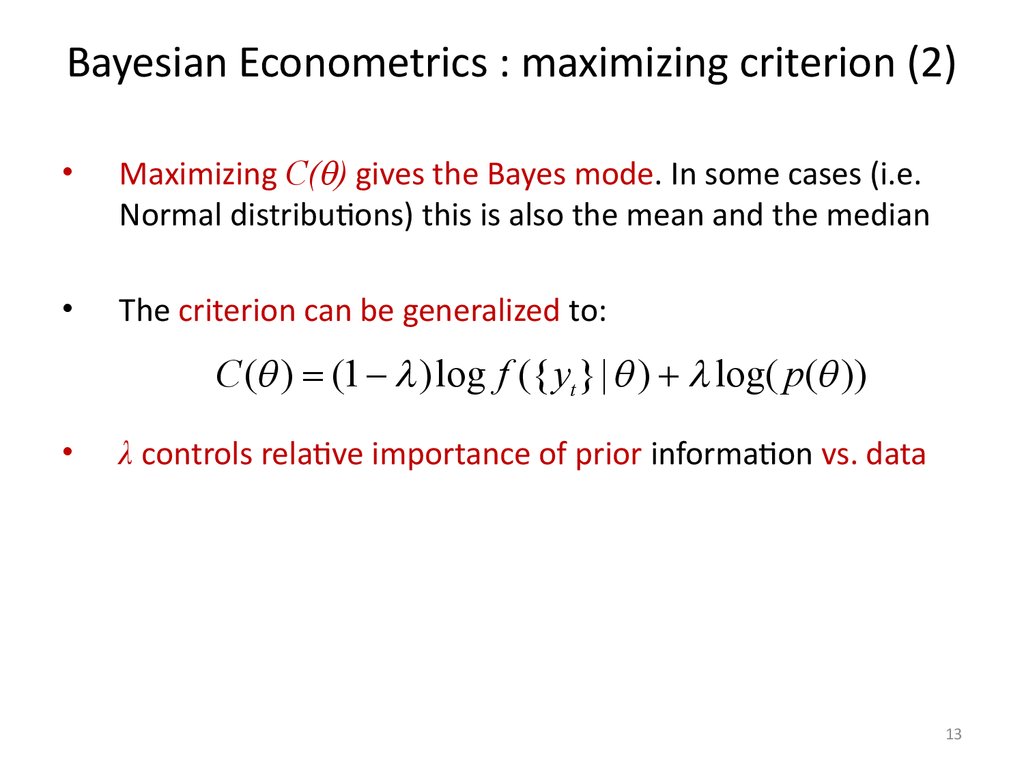

Maximizing C( ) gives the Bayes mode. In some cases (i.e.

Normal distributions) this is also the mean and the median

The criterion can be generalized to:

C ( ) (1 ) log f ({ yt } | ) log( p ( ))

λ controls relative importance of prior information vs. data

13

14. Analytical Examples

• Let’s work on some analytical examples:1. Sample mean

2. Linear regression model

14

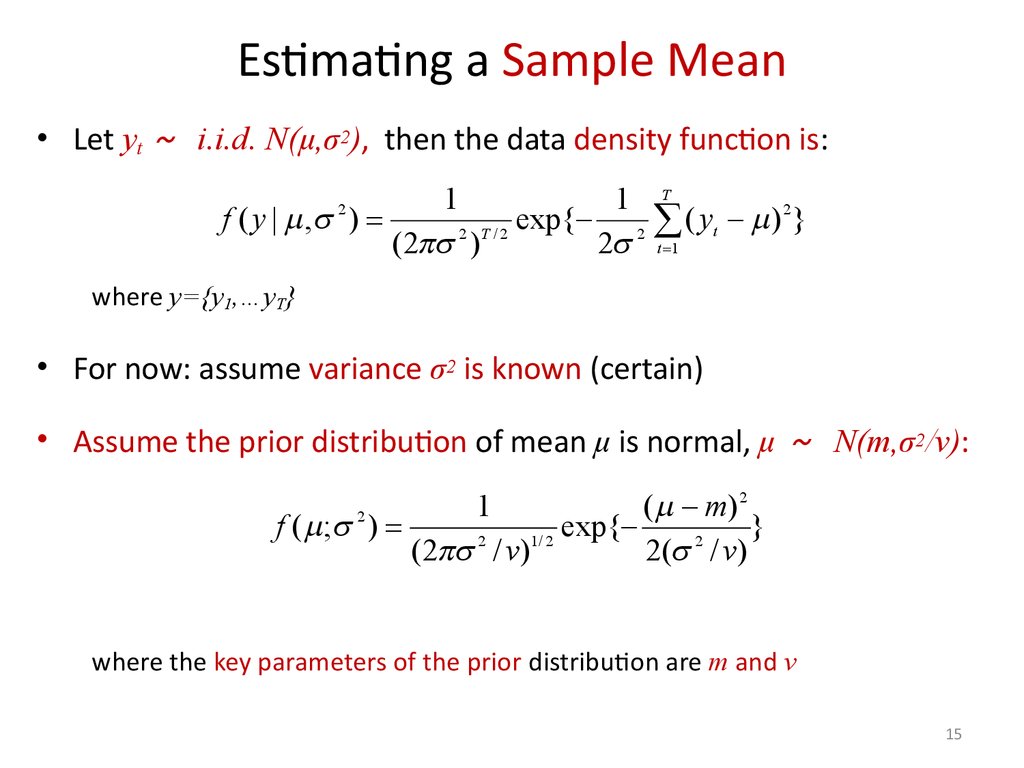

15. Estimating a Sample Mean

• Let yt i.i.d. N(μ,σ2), then the data density function is:1

1 T

2

f ( y | , )

exp{

(

y

)

}

t

2 T /2

2

(2 )

2 t 1

2

where y={y1,…yT}

• For now: assume variance σ2 is known (certain)

• Assume the prior distribution of mean μ is normal, μ N(m,σ2/ν):

( m) 2

f ( ; )

exp{

}

2

1/ 2

2

(2 / v)

2( / v)

2

1

where the key parameters of the prior distribution are m and ν

15

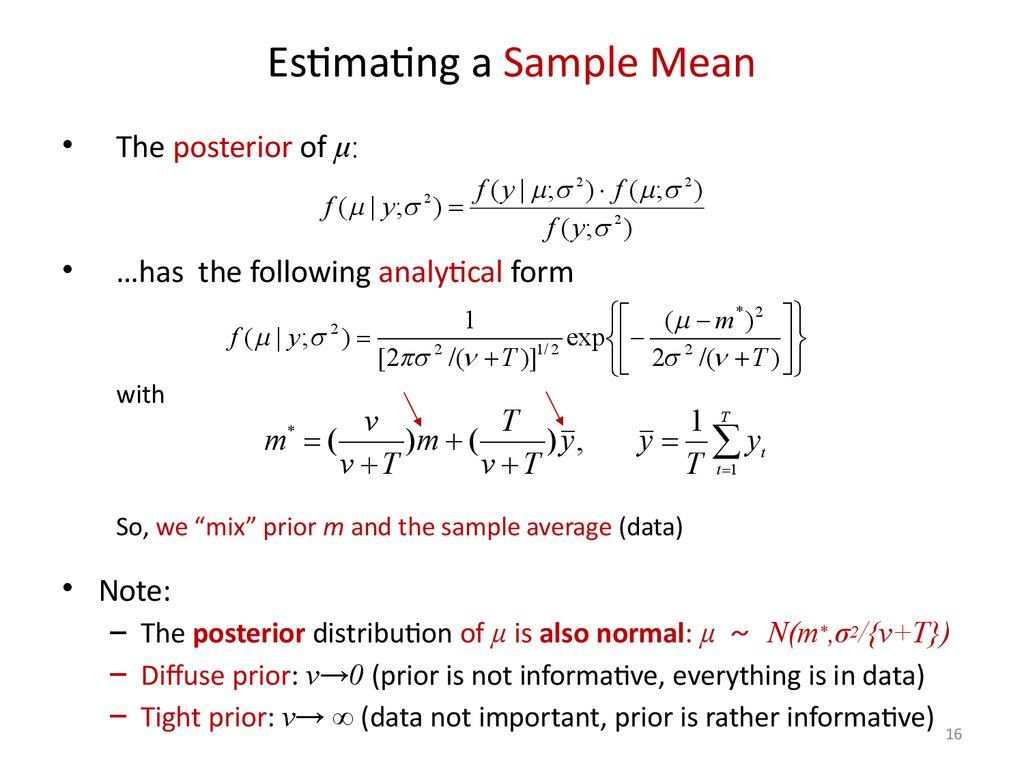

16. Estimating a Sample Mean

The posterior of μ:

f ( y | ; 2 ) f ( ; 2 )

f ( | y; )

f ( y ; 2 )

2

…has the following analytical form

( m* ) 2

1

f ( | y; )

exp 2

2

1/ 2

[2 /( T )]

2

/(

T

)

2

with

v

T

m (

)m (

) y,

v T

v T

*

1 T

y yt

T t 1

So, we “mix” prior m and the sample average (data)

• Note:

– The posterior distribution of μ is also normal: μ N(m*,σ2/{ν+T})

– Diffuse prior: ν→0 (prior is not informative, everything is in data)

– Tight prior: ν→ ∞ (data not important, prior is rather informative) 16

17. Estimating a Sample Mean: Example

• Assume the true distribution is Normal yt~N(3,1)– So, μ=3 is known to… God

• A researcher (one of us) does not know μ

– for him/her it is a normally distributed random variable μ~N(m,1/v)

• The researcher initially believes that m=1 and ν=1, so his/her prior

is μ~N(1,1)

0.4

0.35

0.3

0.25

0.2

0.15

0.1

0.05

0

4

2

0

2

4

6

8

10

17

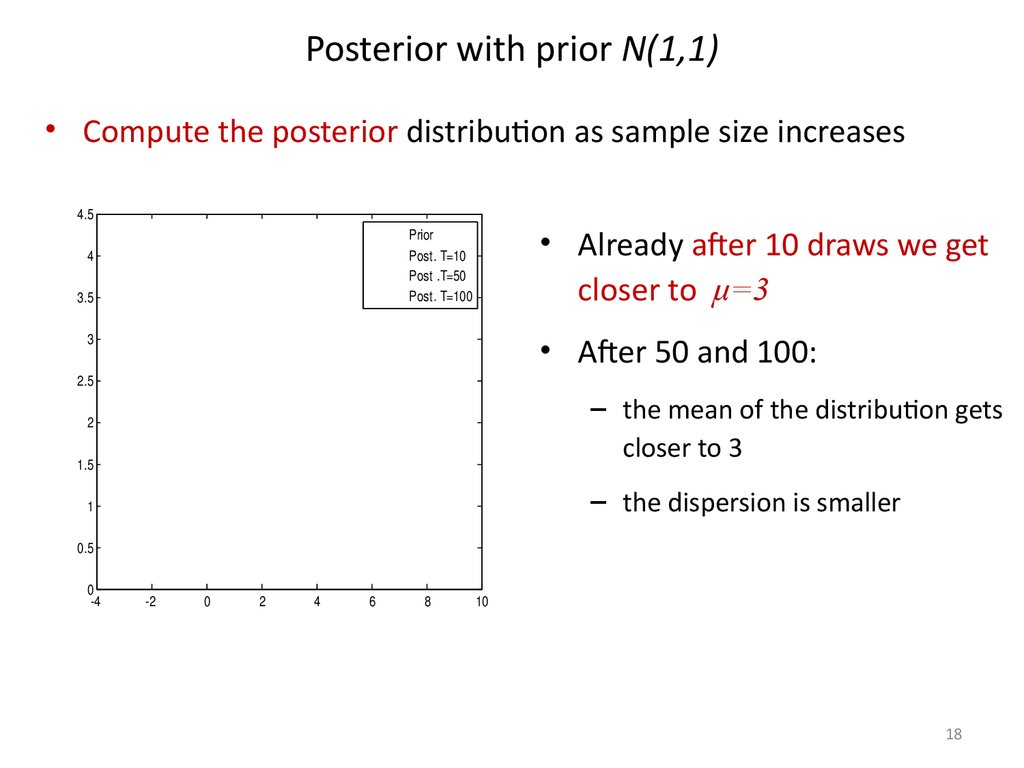

18. Posterior with prior N(1,1)

• Compute the posterior distribution as sample size increases4.5

Prior

Post. T=10

Post .T=50

Post. T=100

4

3.5

• Already after 10 draws we get

closer to μ=3

• After 50 and 100:

3

2.5

– the mean of the distribution gets

closer to 3

2

1.5

– the dispersion is smaller

1

0.5

0

4

2

0

2

4

6

8

10

18

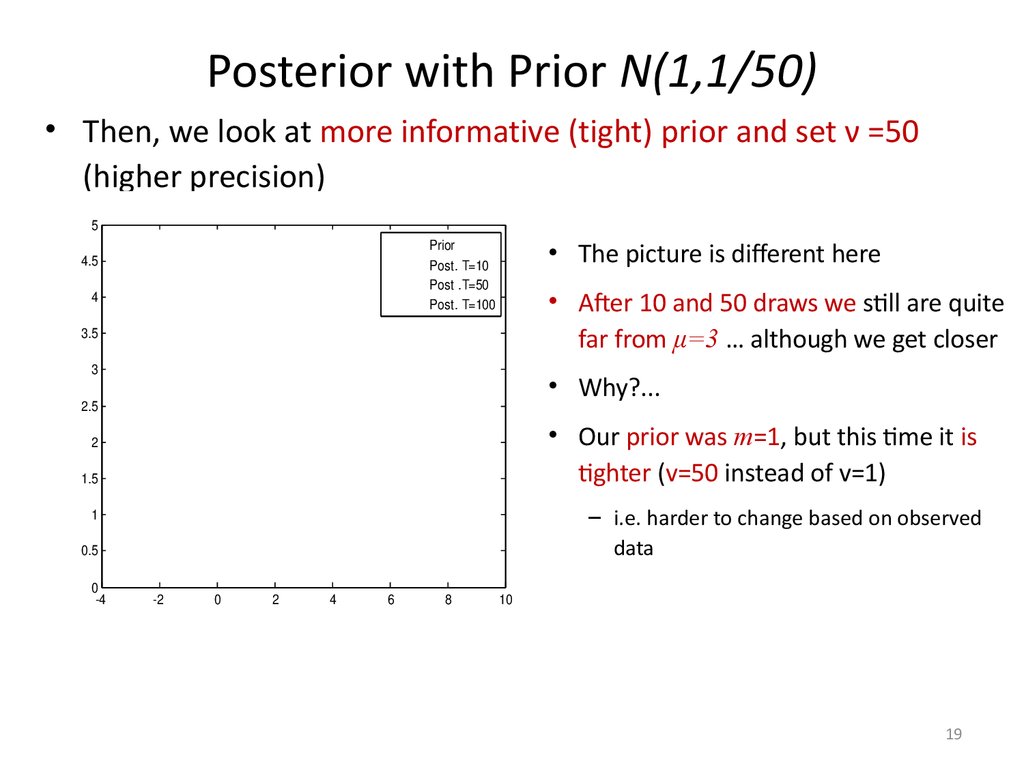

19. Posterior with Prior N(1,1/50)

• Then, we look at more informative (tight) prior and set ν =50(higher precision)

5

• The picture is different here

Prior

Post. T=10

Post .T=50

Post. T=100

4.5

4

• After 10 and 50 draws we still are quite

far from μ=3 … although we get closer

3.5

3

• Why?...

2.5

• Our prior was m=1, but this time it is

tighter (v=50 instead of v=1)

2

1.5

– i.e. harder to change based on observed

data

1

0.5

0

4

2

0

2

4

6

8

10

19

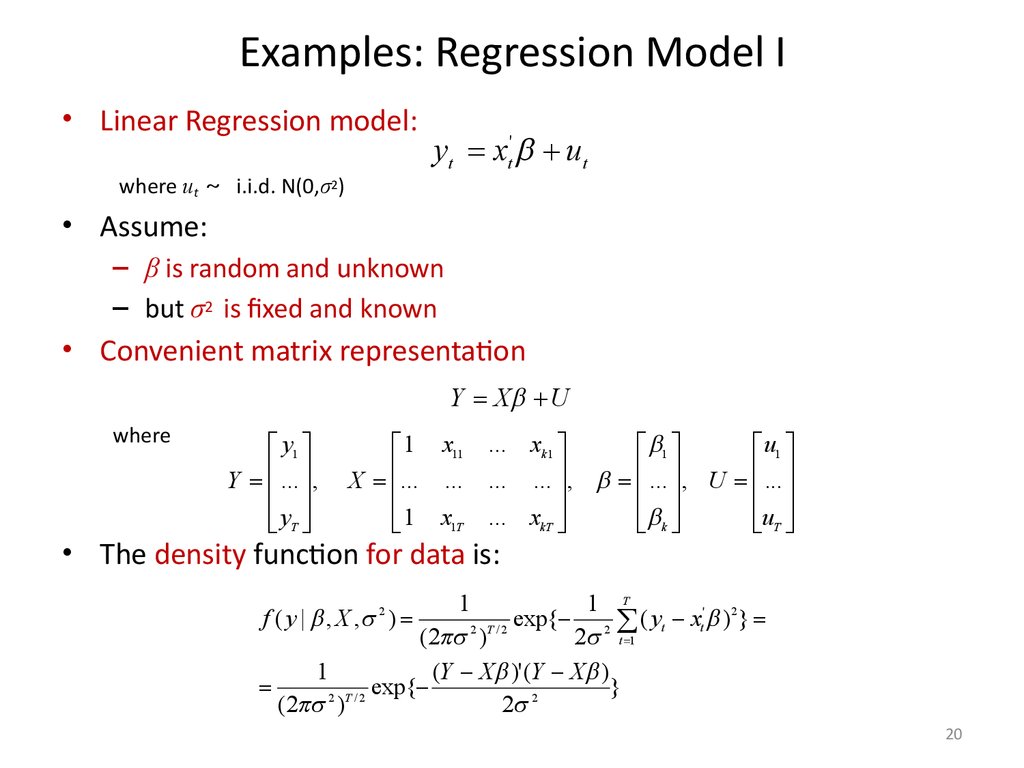

20. Examples: Regression Model I

• Linear Regression model:where ut i.i.d. N(0,σ2)

yt xt' ut

• Assume:

– β is random and unknown

– but σ2 is fixed and known

• Convenient matrix representation

Y X U

where

y1

Y ... ,

yT

1 x11

X ... ...

1 x1T

... xk 1

1

u1

... ... , ... , U ...

k

uT

... xkT

• The density function for data is:

1

1 T

f ( y | , X , )

exp{ 2 ( yt xt' ) 2 }

2 T /2

(2 )

2 t 1

1

(Y X )' (Y X )

exp{

}

(2 2 )T / 2

2 2

2

20

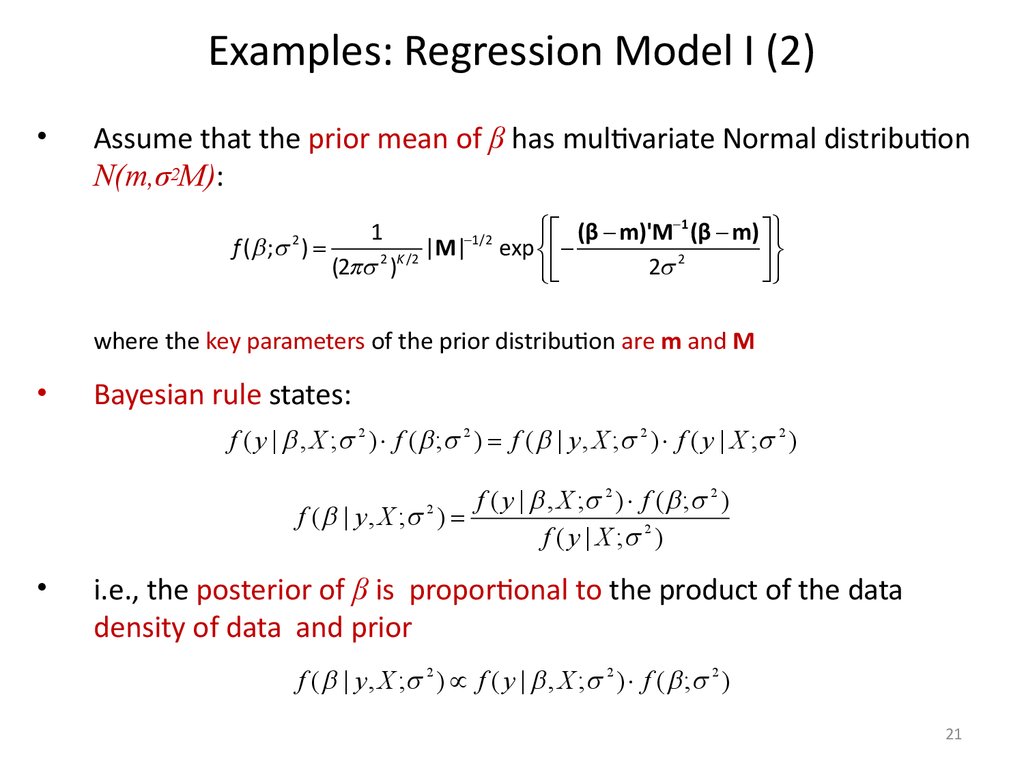

21. Examples: Regression Model I (2)

Assume that the prior mean of β has multivariate Normal distribution

N(m,σ2M):

ï (β m)'M 1 (β m) ï

1

1/2

f ( ; )

|M| exp

2 K /2

(2 )

2 2

ï

ï

2

where the key parameters of the prior distribution are m and M

Bayesian rule states:

f ( y | , X ; 2 ) f ( ; 2 ) f ( | y , X ; 2 ) f ( y | X ; 2 )

f ( y | , X ; 2 ) f ( ; 2 )

f ( | y , X ; )

f ( y | X ; 2 )

2

i.e., the posterior of β is proportional to the product of the data

density of data and prior

f ( | y , X ; 2 ) f ( y | , X ; 2 ) f ( ; 2 )

21

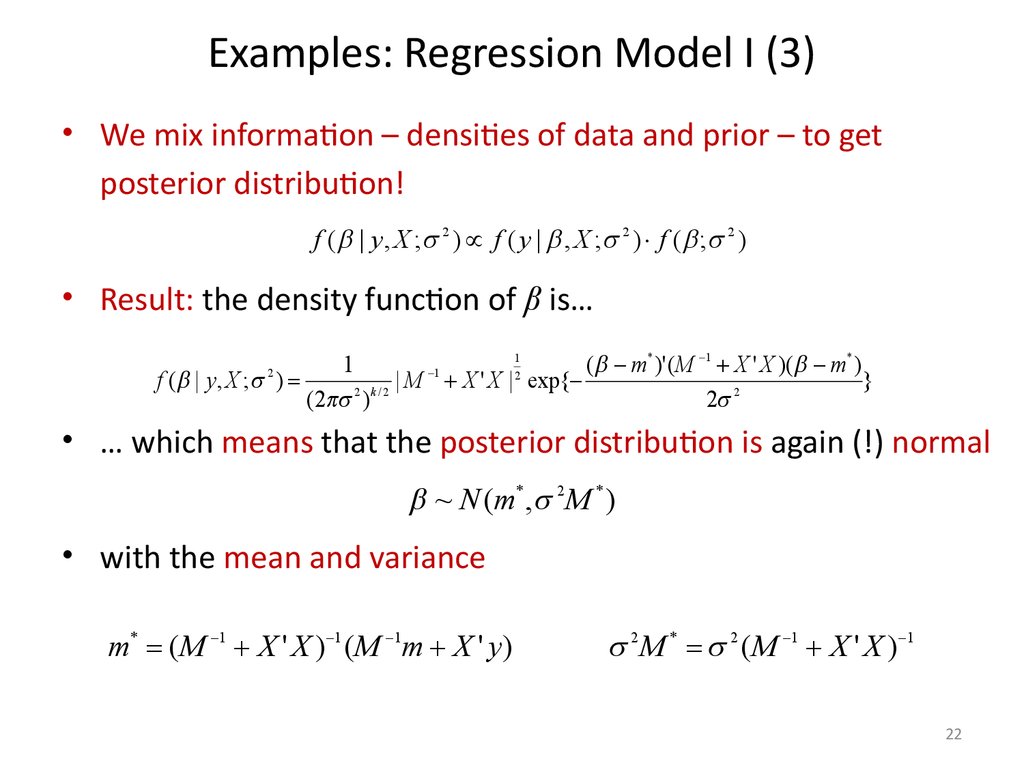

22. Examples: Regression Model I (3)

• We mix information – densities of data and prior – to getposterior distribution!

f ( | y , X ; 2 ) f ( y | , X ; 2 ) f ( ; 2 )

• Result: the density function of β is…

1

1

( m* )' ( M 1 X ' X )( m* )

1

2

f ( | y , X ; )

| M X ' X | exp{

}

(2 2 ) k / 2

2 2

2

• … which means that the posterior distribution is again (!) normal

~ N ( m* , 2 M * )

• with the mean and variance

m* ( M 1 X ' X ) 1 ( M 1m X ' y )

2 M * 2 ( M 1 X ' X ) 1

22

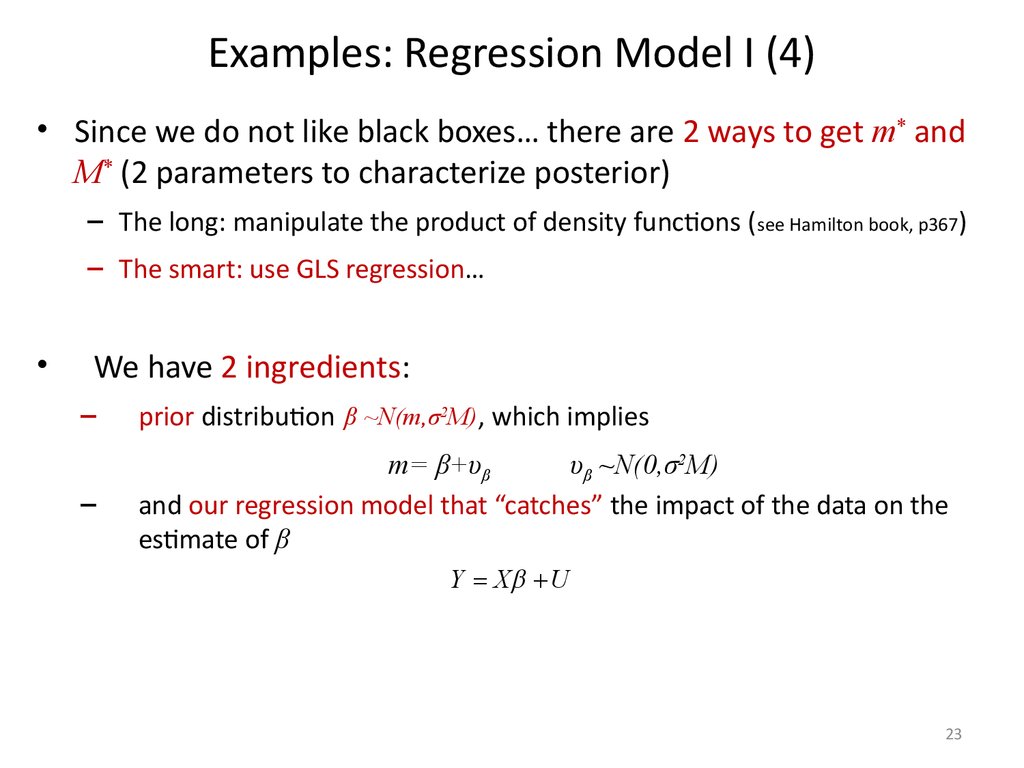

23.

Examples: Regression Model I (4)• Since we do not like black boxes… there are 2 ways to get m* and

M* (2 parameters to characterize posterior)

– The long: manipulate the product of density functions ( see Hamilton book, p367)

– The smart: use GLS regression…

We have 2 ingredients:

–

prior distribution β ~N(m,σ2M), which implies

–

m= β+υβ

υβ ~N(0,σ2M)

and our regression model that “catches” the impact of the data on the

estimate of β

Y X U

23

24.

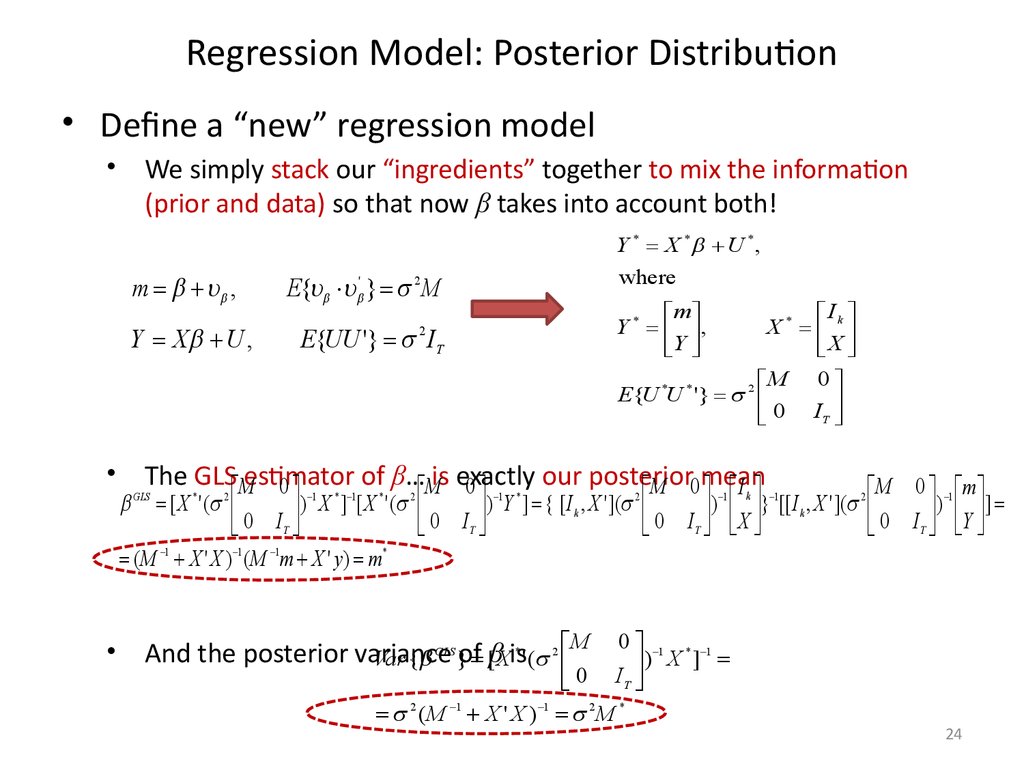

Regression Model: Posterior Distribution• Define a “new” regression model

We simply stack our “ingredients” together to mix the information

(prior and data) so that now β takes into account both!

m ,

Y X U ,

Y * X * U * ,

where

E{ ' } 2 M

m

Y * ,

Y

I

X* k

X

M 0

E{U *U * '} 2

0 IT

E{UU '} I T

2

The GLS Mestimator

of β… Mis exactly

our posterior

0

0

M 0mean

I

1

* 1

*

2

[ X * ' ( 2

)

X

]

[

X

'

(

0

0 IT

( M 1 X ' X ) 1 (M 1m X ' y ) m*

GLS

1 *

2

)

Y

]

{

[

I

,

X

'

](

k

0

IT

M 0 1 m

k

1

1

2

)

}

[[

I

,

X

'

](

k

0 I ) Y ]

IT X

T

M 0 1 * 1

0 I ) X ]

T

2

1

1

2

*

(M X ' X ) M

And the posterior variance

Var { }of [βXis' (

GLS

*

2

24

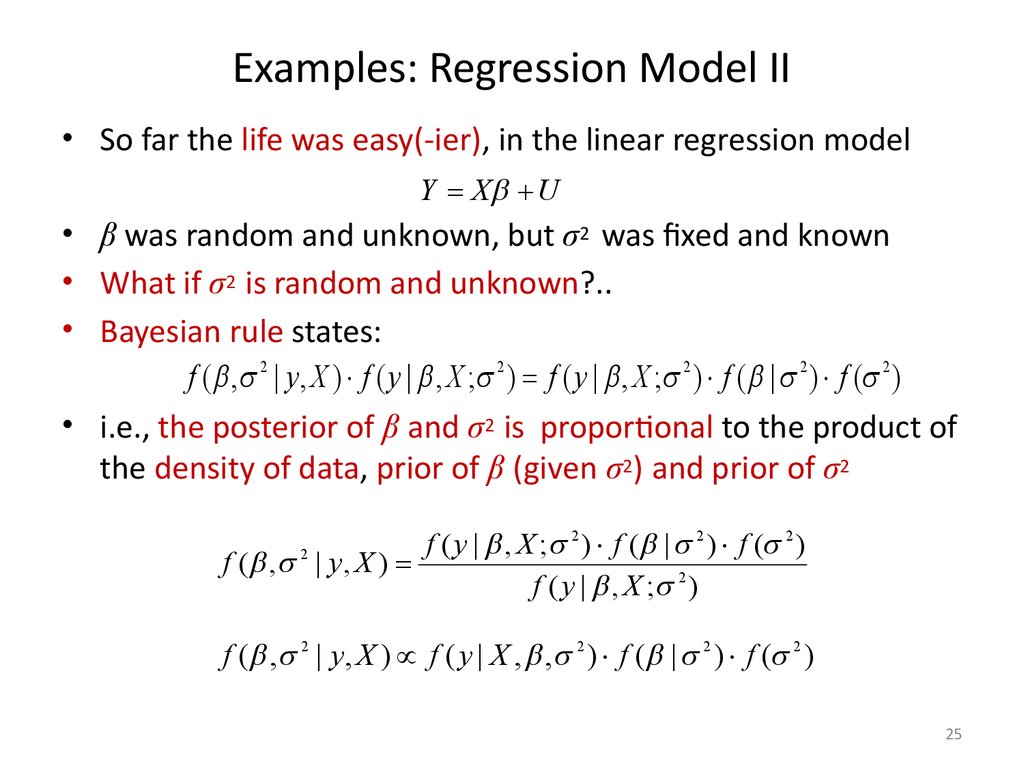

25. Examples: Regression Model II

• So far the life was easy(-ier), in the linear regression modelY X U

• β was random and unknown, but σ2 was fixed and known

• What if σ2 is random and unknown?..

• Bayesian rule states:

f ( , 2 | y, X ) f ( y | , X ; 2 ) f ( y | , X ; 2 ) f ( | 2 ) f ( 2 )

• i.e., the posterior of β and σ2 is proportional to the product of

the density of data, prior of β (given σ2) and prior of σ2

f ( y | , X ; 2 ) f ( | 2 ) f ( 2 )

f ( , | y , X )

f ( y | , X ; 2 )

2

f ( , 2 | y, X ) f ( y | X , , 2 ) f ( | 2 ) f ( 2 )

25

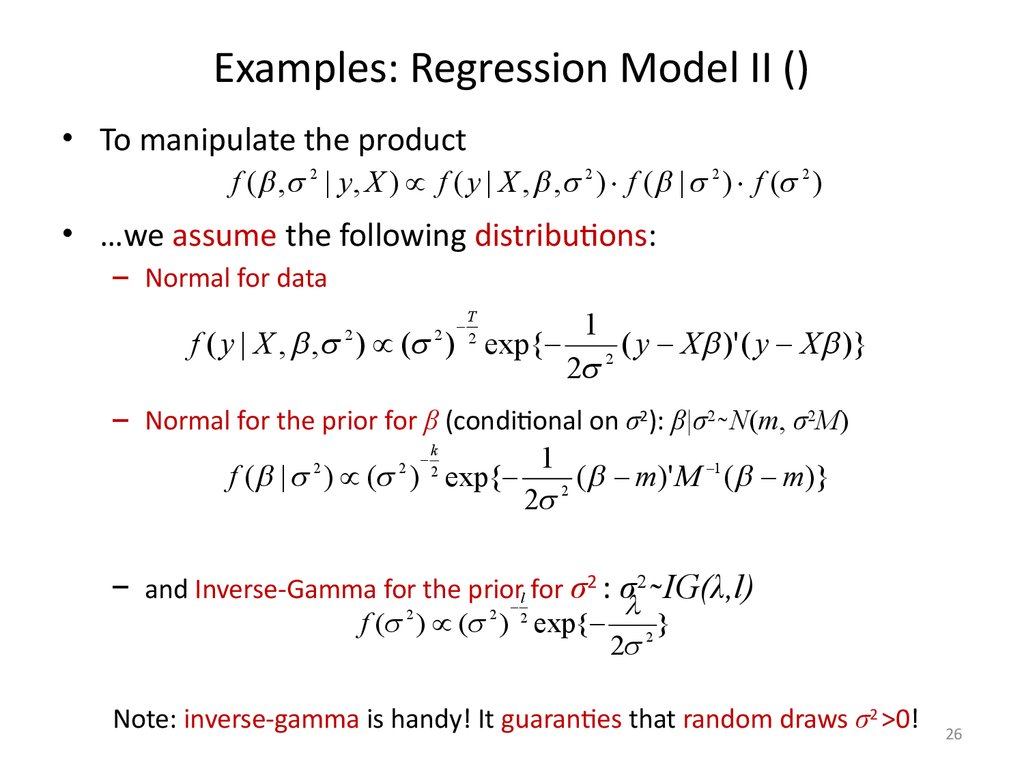

26. Examples: Regression Model II ()

• To manipulate the productf ( , 2 | y, X ) f ( y | X , , 2 ) f ( | 2 ) f ( 2 )

• …we assume the following distributions:

– Normal for data

1

f ( y | X , , ) ( ) exp{ 2 ( y X )' ( y X )}

2

2

2

T

2

– Normal for the prior for β (conditional on σ2): β|σ2 ̴ N(m, σ2M)

k

2

f ( | ) ( ) exp{

2

2

1

1

(

m

)'

M

( m)}

2

2

– and Inverse-Gamma for the priorl for σ2 : σ2 ̴ IG(λ,l)

2

2

2

f ( ) ( ) exp{ 2 }

2

Note: inverse-gamma is handy! It guaranties that random draws σ2 >0!

26

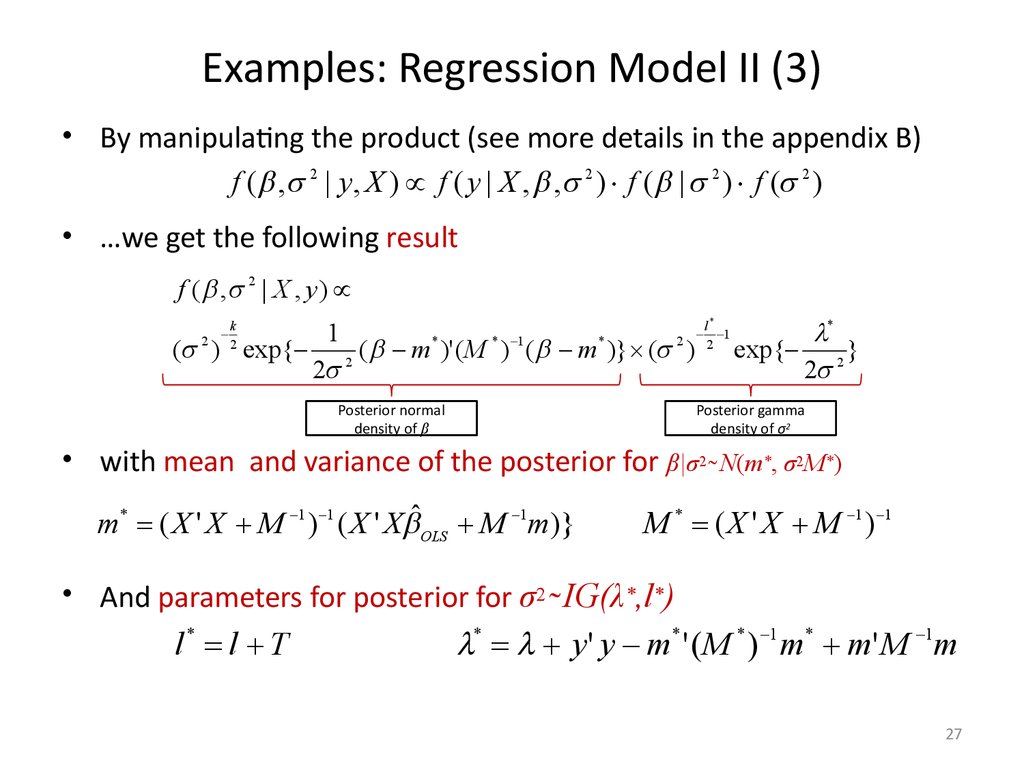

27. Examples: Regression Model II (3)

• By manipulating the product (see more details in the appendix B)f ( , 2 | y, X ) f ( y | X , , 2 ) f ( | 2 ) f ( 2 )

• …we get the following result

f ( , 2 | X , y )

*

l

1

1

*

* 1

*

2

( ) exp{ 2 ( m )' ( M ) ( m )} ( ) 2 exp{ 2 }

2

2

2

*

k

2

Posterior normal

density of β

Posterior gamma

density of σ2

• with mean and variance of the posterior for β|σ2 ̴ N(m*, σ2M*)

m* ( X ' X M 1 ) 1 ( X ' X ˆOLS M 1m)}

M * ( X ' X M 1 ) 1

• And parameters for posterior for σ2 ̴ IG(λ*,l*)

l* l T

* y ' y m* ' ( M * ) 1 m* m' M 1m

27

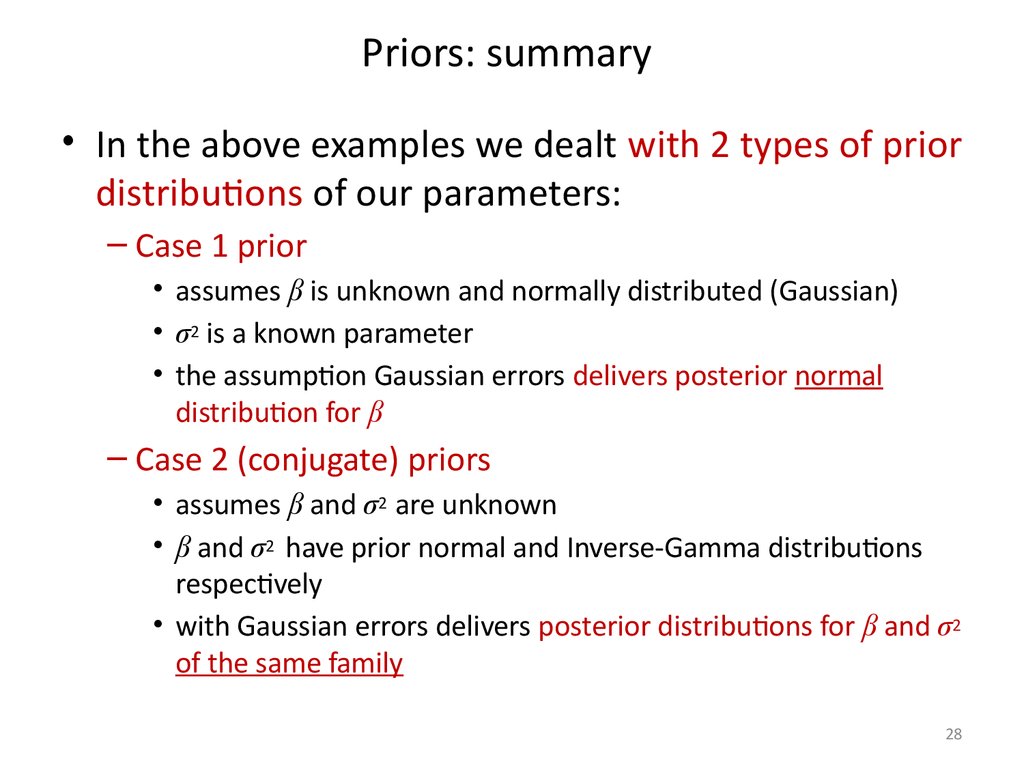

28. Priors: summary

• In the above examples we dealt with 2 types of priordistributions of our parameters:

– Case 1 prior

• assumes β is unknown and normally distributed (Gaussian)

• σ2 is a known parameter

• the assumption Gaussian errors delivers posterior normal

distribution for β

– Case 2 (conjugate) priors

• assumes β and σ2 are unknown

• β and σ2 have prior normal and Inverse-Gamma distributions

respectively

• with Gaussian errors delivers posterior distributions for β and σ2

of the same family

28

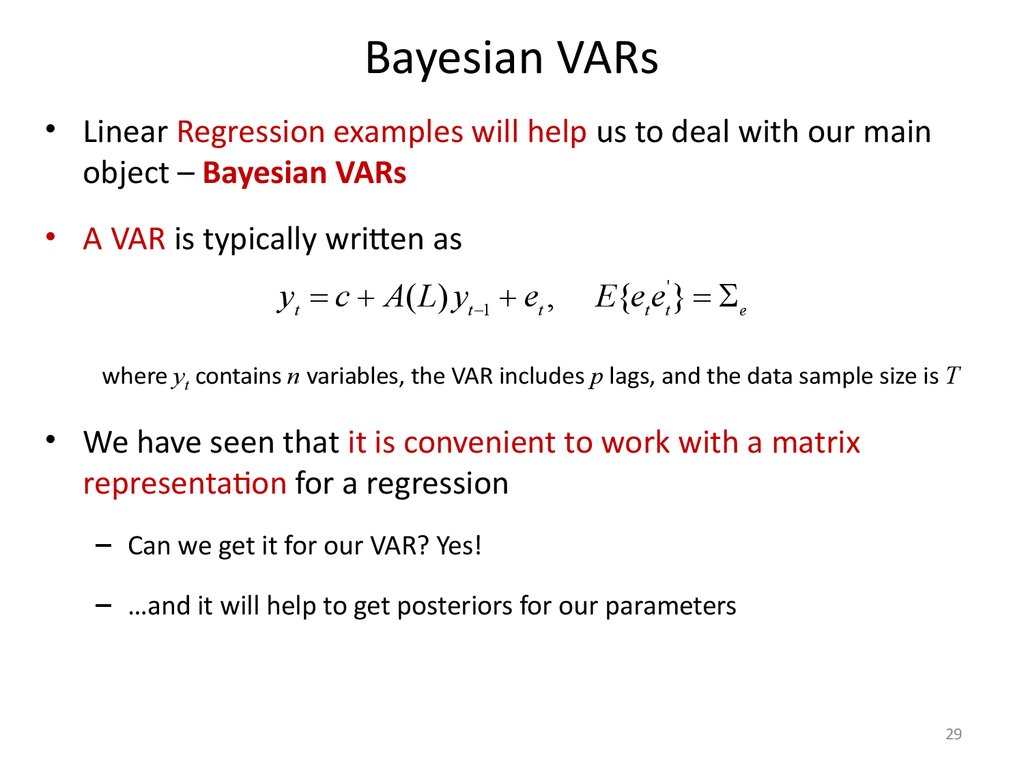

29. Bayesian VARs

• Linear Regression examples will help us to deal with our mainobject – Bayesian VARs

• A VAR is typically written as

yt c A( L) yt 1 et ,

E{et et' } e

where yt contains n variables, the VAR includes p lags, and the data sample size is T

• We have seen that it is convenient to work with a matrix

representation for a regression

– Can we get it for our VAR? Yes!

– …and it will help to get posteriors for our parameters

29

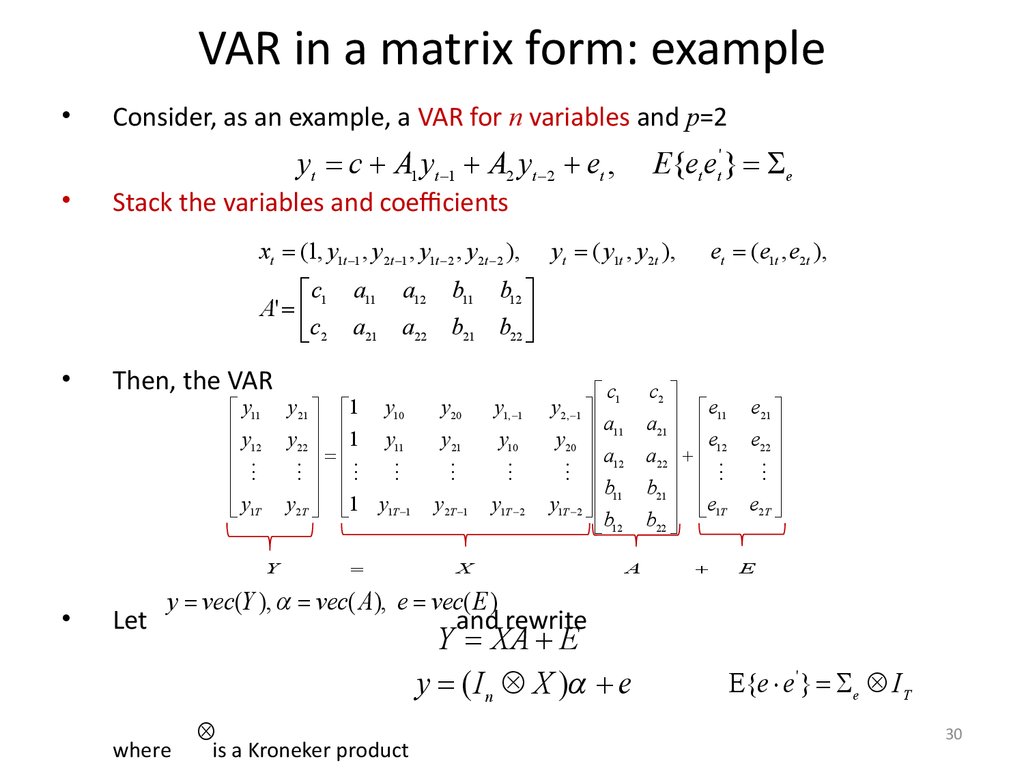

30. VAR in a matrix form: example

Consider, as an example, a VAR for n variables and p=2

yt c A1 yt 1 A2 yt 2 et ,

Stack the variables and coefficients

xt (1, y1t 1 , y2t 1 , y1t 2 , y2 t 2 ),

c

A' 1

c2

Then, the VAR

y11

y

12

y1T

Y

E{et et' } e

Let

a11

a12

b11

a21

a22

b21

y21 1 y10

y22 1 y11

y2T 1 y1T 1

yt ( y1t , y2 t ),

et (e1t , e2 t ),

b12

b22

y20

y21

y1, 1

y10

y2T 1

y1T 2

c

y2, 1 1

a

y20 11

a12

b11

y1T 2

b12

X

c2

e

a21 11

e12

a22

b21

e1T

b22

A

e21

e22

e2T

E

y vec(Y ), vec( A), e vec( E )

where

and rewrite

Y XA E

y ( I n X ) e

is a Kroneker product

E{e e'} e IT

30

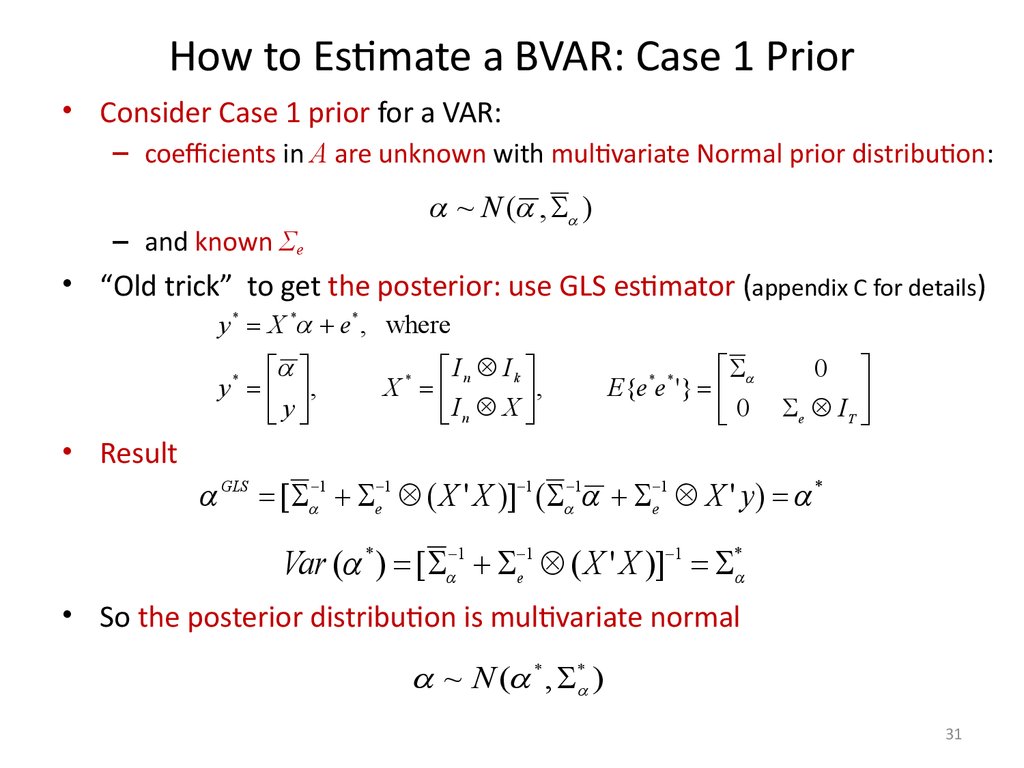

31. How to Estimate a BVAR: Case 1 Prior

• Consider Case 1 prior for a VAR:– coefficients in A are unknown with multivariate Normal prior distribution:

– and known Σe

~ N ( , )

• “Old trick” to get the posterior: use GLS estimator (appendix C for details)

y * X * e* , where

y * ,

y

I Ik

X* n

,

In X

E{e*e* '}

0

0

e IT

• Result

GLS [ 1 e 1 ( X ' X )] 1 ( 1 e 1 X ' y ) *

Var ( * ) [ 1 e 1 ( X ' X )] 1 *

• So the posterior distribution is multivariate normal

~ N ( * , * )

31

32. How to Estimate a BVAR: Case 2 (conjugate) Priors

Before we see the case of an unknown Σe

–

need to introduce a multivariate distribution to characterize the unknown

random error covariance matrix Σe

Consider a matrix

Each raw e (e ,..., e ) is a draw form N(0,S)

The nxn matrix

'

e ... e e ... e

i

1i

e10

e1 N

ni

10

e

e1 N

... en 0

... enN

n0

... enN

10

e1N

n0

... enN

has an Inverse Wishart distribution with k degrees of freedom: Σe~IWn(S,l)

If Σe ~ IWn(S,l), then Σe-1 follows a Wishart distribution: Σe-1~Wn(S-1,l)

Wishart distribution might be more convenient

– Σe-1 is a measure of precision (since Σe is a measure of dispersion)

32

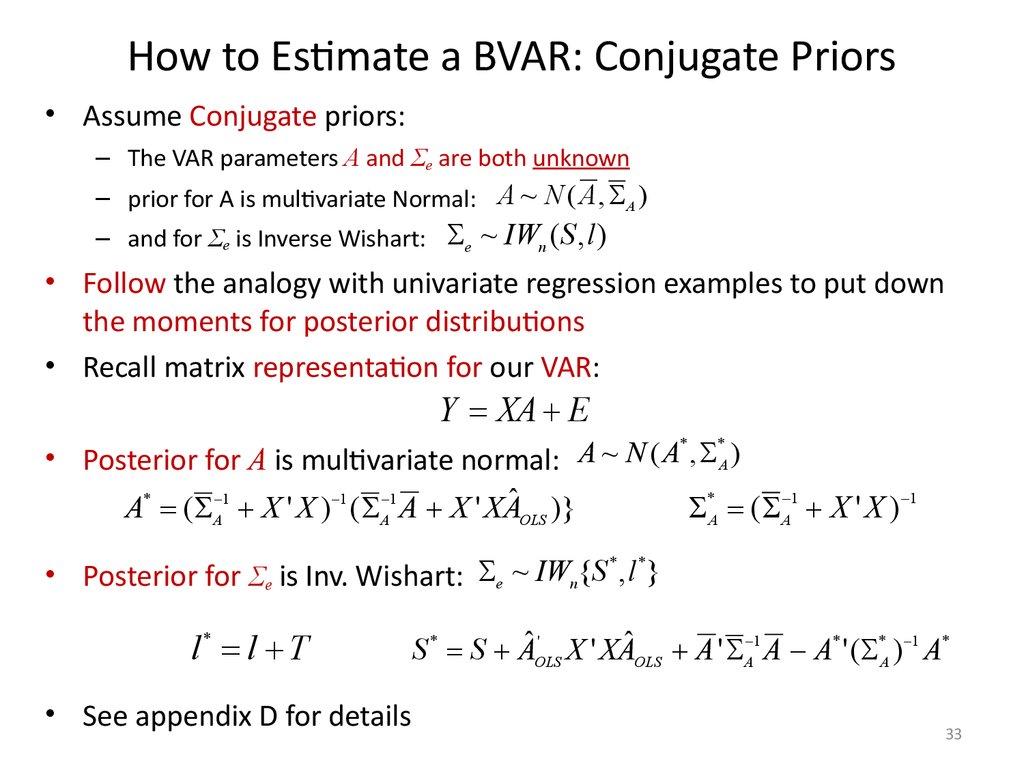

33. How to Estimate a BVAR: Conjugate Priors

• Assume Conjugate priors:– The VAR parameters A and Σe are both unknown

– prior for A is multivariate Normal: A ~ N ( A , A )

– and for Σe is Inverse Wishart: e ~ IWn ( S , l )

• Follow the analogy with univariate regression examples to put down

the moments for posterior distributions

• Recall matrix representation for our VAR:

Y XA E

*

*

A

~

N

(

A

,

• Posterior for A is multivariate normal:

A)

*A ( A 1 X ' X ) 1

A* ( A 1 X ' X ) 1 ( A 1 A X ' XAˆOLS )}

* *

• Posterior for Σe is Inv. Wishart: e ~ IWn {S , l }

l* l T

• See appendix D for details

'

S * S AˆOLS

X ' XAˆOLS A ' A 1 A A* ' ( *A ) 1 A*

33

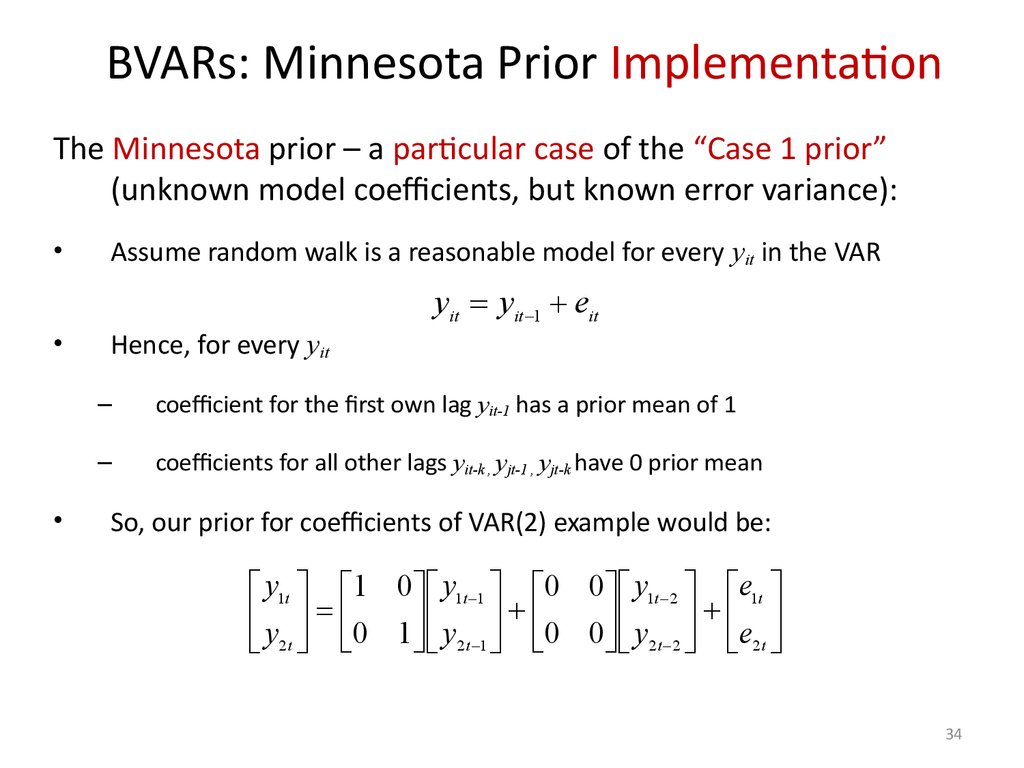

34. BVARs: Minnesota Prior Implementation

The Minnesota prior – a particular case of the “Case 1 prior”(unknown model coefficients, but known error variance):

Assume random walk is a reasonable model for every yit in the VAR

yit yit 1 eit

Hence, for every yit

–

coefficient for the first own lag yit-1 has a prior mean of 1

–

coefficients for all other lags yit-k , yjt-1 , yjt-k have 0 prior mean

So, our prior for coefficients of VAR(2) example would be:

y1t 1 0 y1t 1 0 0 y1t 2 e1t

y 0 1 y 0 0 y e

2 t 1

2t 2 2t

2t

34

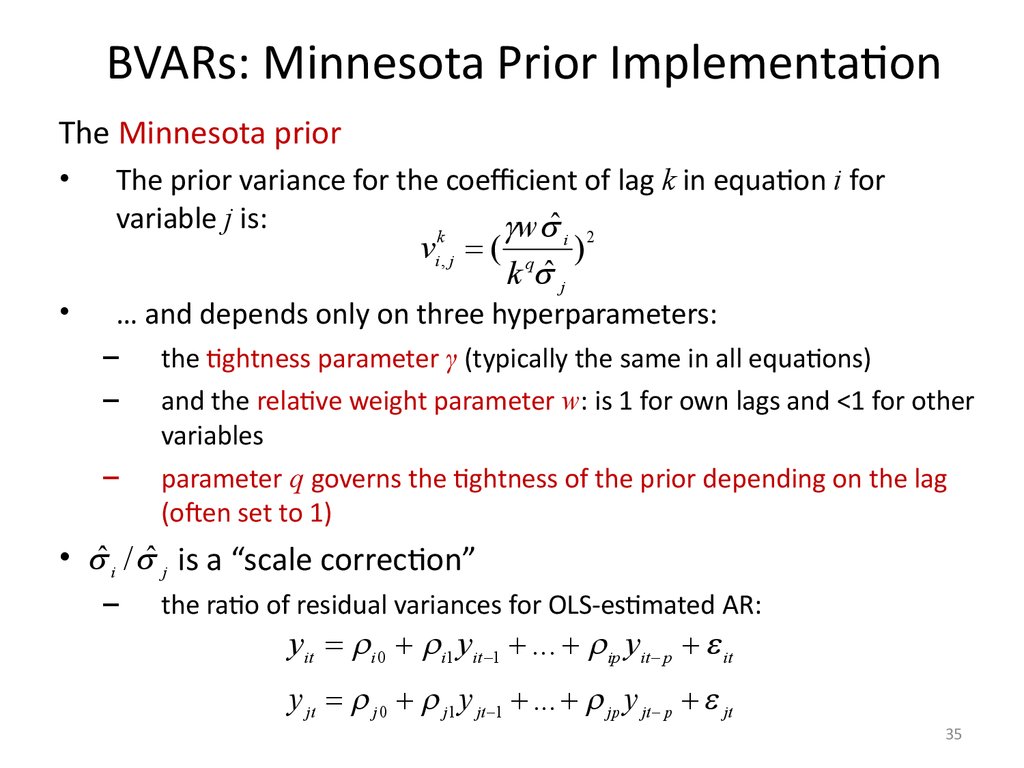

35. BVARs: Minnesota Prior Implementation

The Minnesota priorThe prior variance for the coefficient of lag k in equation i for

variable j is:

w ˆ 2

k

vi , j (

i

k ˆ j

q

)

… and depends only on three hyperparameters:

–

the tightness parameter γ (typically the same in all equations)

–

and the relative weight parameter w: is 1 for own lags and <1 for other

variables

–

parameter q governs the tightness of the prior depending on the lag

(often set to 1)

• ˆ i / ˆ j is a “scale correction”

–

the ratio of residual variances for OLS-estimated AR:

yit i 0 i1 yit 1 ... ip yit p it

y jt j 0 j1 y jt 1 ... jp y jt p jt

35

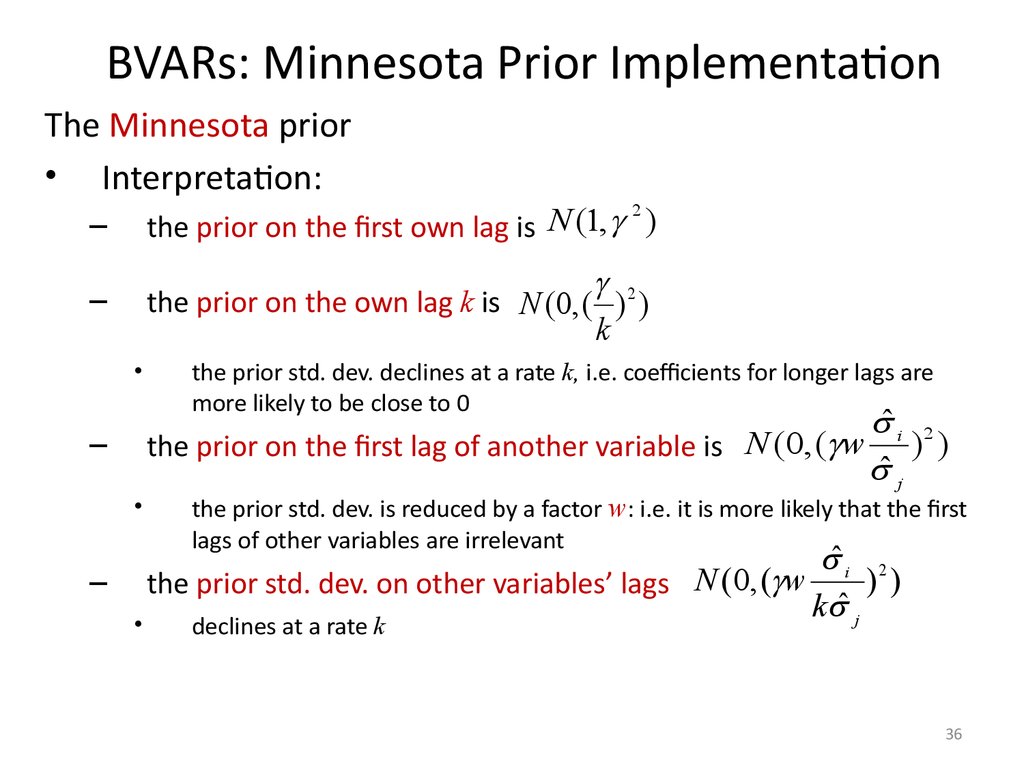

36. BVARs: Minnesota Prior Implementation

The Minnesota prior• Interpretation:

–

2

N

(

1

,

)

the prior on the first own lag is

–

the prior on the own lag k is N (0, ( ) 2 )

k

–

the prior std. dev. declines at a rate k, i.e. coefficients for longer lags are

more likely to be close to 0

ˆ i 2

the prior on the first lag of another variable is N (0, ( w ) )

ˆ j

the prior std. dev. is reduced by a factor w: i.e. it is more likely that the first

lags of other variables are irrelevant

ˆ i 2

))

– the prior std. dev. on other variables’ lags N (0, ( w

k ˆ j

declines at a rate k

36

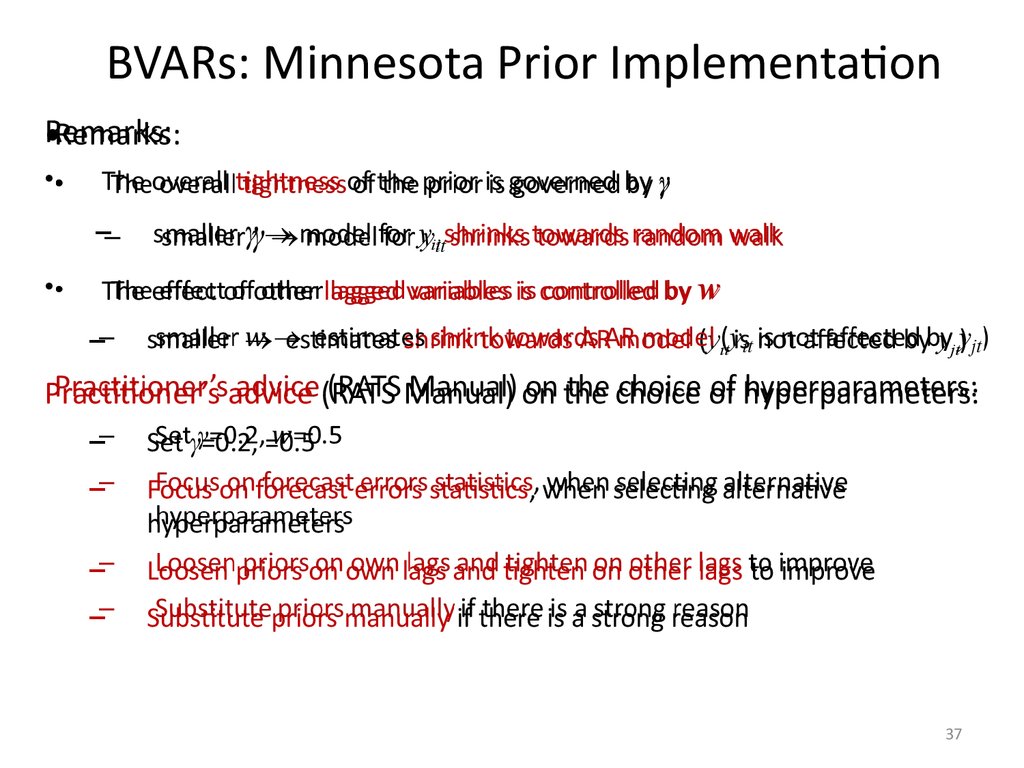

37.

BVARs: Minnesota Prior ImplementationRemarks:

The overall tightness of the prior is governed by γ

–

smaller γ model for yit shrinks towards random walk

The effect of other lagged variables is controlled by w

–

smaller estimates shrink towards AR model (yit is not affected by yjt)

Practitioner’s advice (RATS Manual) on the choice of hyperparameters:

–

Set γ=0.2, =0.5

–

Focus on forecast errors statistics, when selecting alternative

hyperparameters

–

Loosen priors on own lags and tighten on other lags to improve

–

Substitute priors manually if there is a strong reason

37

38. BVARs: Prior Selection

Minnesota and conjugate priors are useful (e.g., to obtain

closed-form solutions), but can be too restrictive:

–

Independence across equations

–

Symmetry in the prior can sometimes be a problem

Increased computer power allows to simulate more general

prior distributions using numerical methods

Three examples:

–

DSGE-VAR approach: Del Negro and Schorfheide (IER, 2004)

–

Explore different prior distributions and hyperparameters: Kadiyala and

Karlsson (1997)

–

Choosing the hyperparameters to maximize the marginal likelihood:

Giannone, Lenza and Primiceri (2011)

38

39. Del Negro and Schorfheide (2004): DSGE-VAR Approach

Del Negro and Schorfheide (2004)

We want to estimate a BVAR model

We also have a DSGE model for the same variables

–

It can be solved and linearized: approximated with a RF VAR

–

Then, we can use coefficients from the DSGE-based VAR as prior means to

estimate the BVAR

• Several advantages:

–

DSGE-VAR may improve forecasts by restricting parameter values

–

At the same time, can improve empirical performance of DSGE relaxing its

restrictions

–

Our priors (from DSGE) are based on deep structural parameters consistent

with economic theory

39

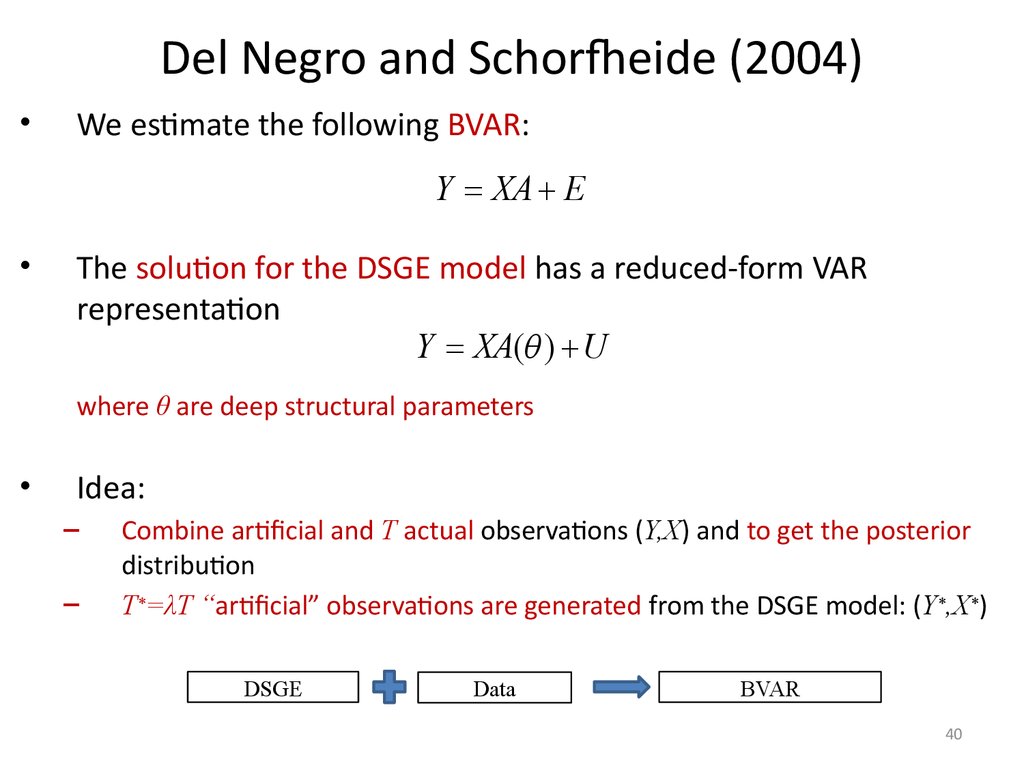

40. Del Negro and Schorfheide (2004)

We estimate the following BVAR:

Y XA E

The solution for the DSGE model has a reduced-form VAR

representation

Y XA( ) U

where θ are deep structural parameters

Idea:

–

–

Combine artificial and T actual observations (Y,X) and to get the posterior

distribution

T*=λT “artificial” observations are generated from the DSGE model: (Y*,X*)

DSGE

Data

BVAR

40

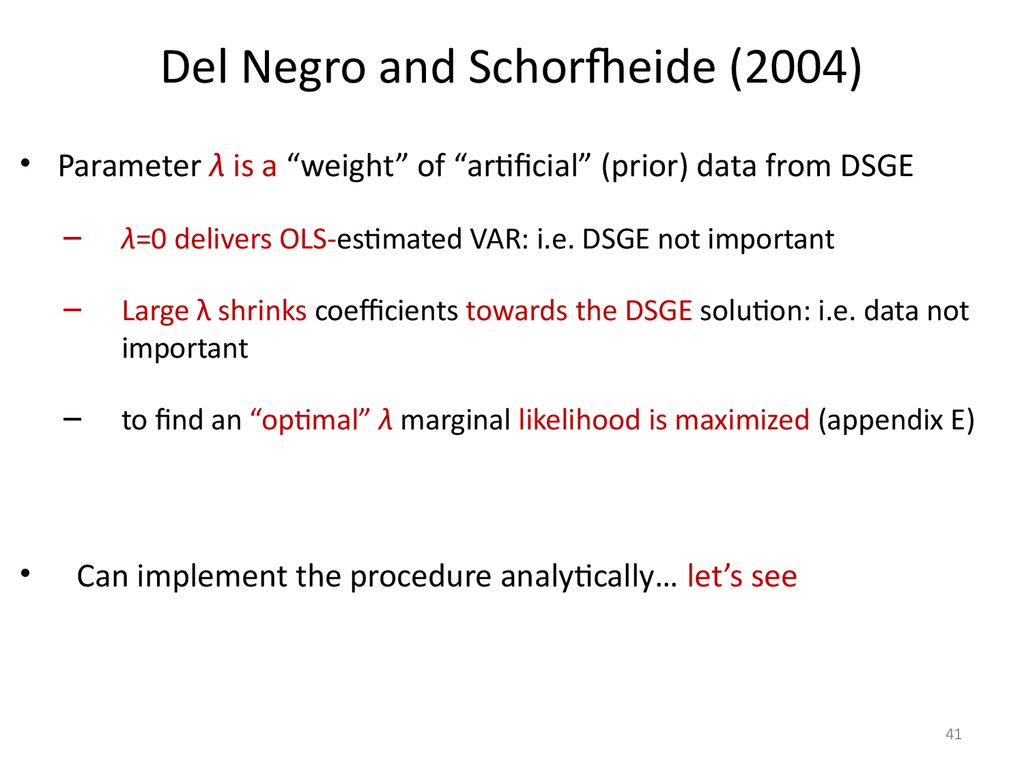

41. Del Negro and Schorfheide (2004)

• Parameter λ is a “weight” of “artificial” (prior) data from DSGE–

λ=0 delivers OLS-estimated VAR: i.e. DSGE not important

–

Large λ shrinks coefficients towards the DSGE solution: i.e. data not

important

–

to find an “optimal” λ marginal likelihood is maximized (appendix E)

Can implement the procedure analytically… let’s see

41

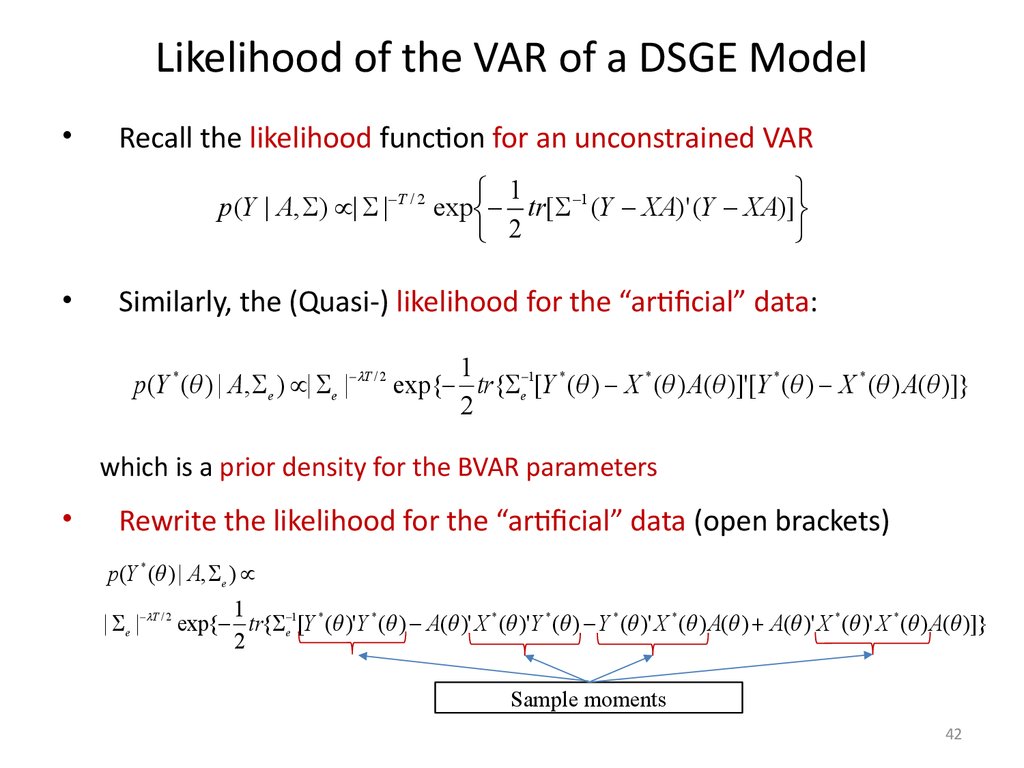

42. Likelihood of the VAR of a DSGE Model

Recall the likelihood function for an unconstrained VAR

1

p (Y | A, ) | | T / 2 exp tr[ 1 (Y XA)' (Y XA)]

2

Similarly, the (Quasi-) likelihood for the “artificial” data:

1

p(Y * ( ) | A, e ) | e | T / 2 exp{ tr{ e 1[Y * ( ) X * ( ) A( )]'[Y * ( ) X * ( ) A( )]}

2

which is a prior density for the BVAR parameters

Rewrite the likelihood for the “artificial” data (open brackets)

p(Y * ( ) | A, e )

1

| e | T / 2 exp{ tr{ e 1[Y * ( )'Y * ( ) A( )' X * ( )'Y * ( ) Y * ( )' X * ( ) A( ) A( )' X * ( )' X * ( ) A( )]}

2

Sample moments

42

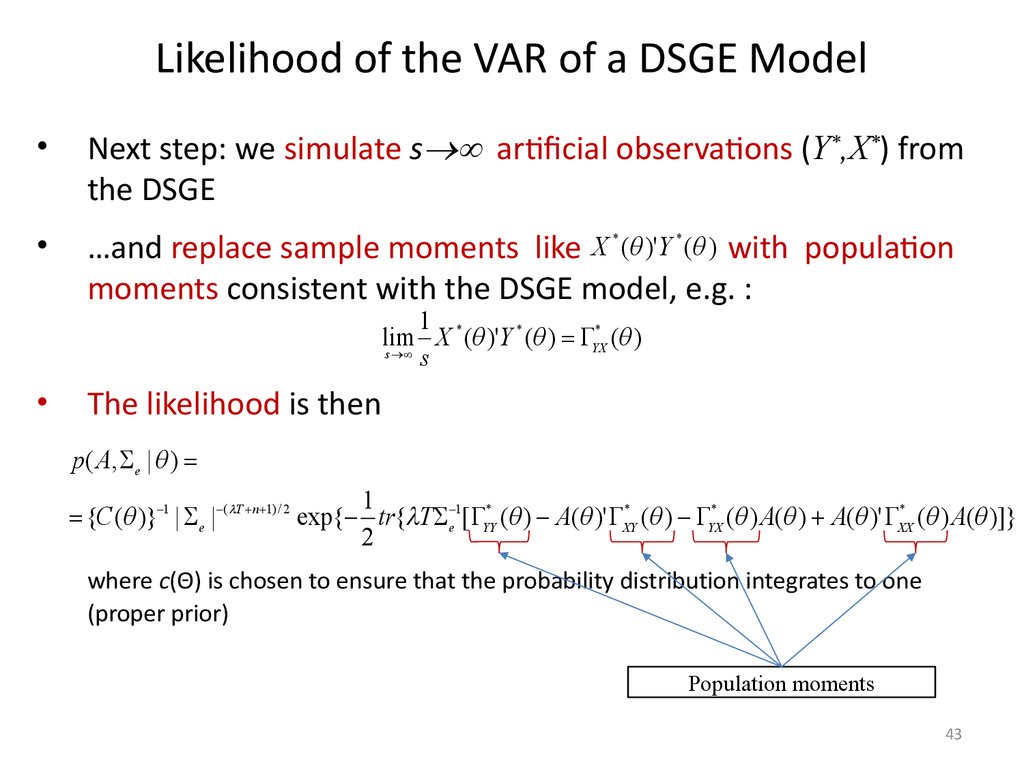

43. Likelihood of the VAR of a DSGE Model

Next step: we simulate s artificial observations (Y*,X*) from

the DSGE

…and replace sample moments like X ( )'Y ( ) with population

moments consistent with the DSGE model, e.g. :

*

*

1

lim X * ( )'Y * ( ) YX* ( )

s

s

The likelihood is then

p( A, e | )

1

*

{C ( )} 1 | e | ( T n 1) / 2 exp{ tr{ T e 1[ YY* ( ) A( )' XY* ( ) YX* ( ) A( ) A( )' XX

( ) A( )]}

2

where c(Θ) is chosen to ensure that the probability distribution integrates to one

(proper prior)

Population moments

43

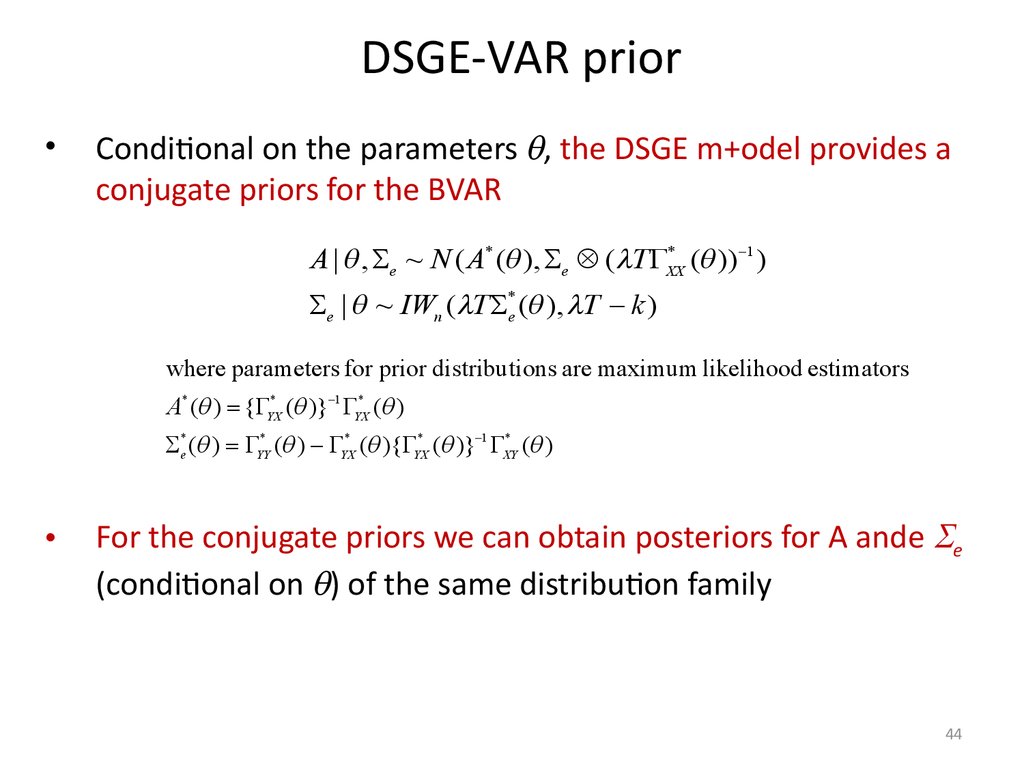

44. DSGE-VAR prior

Conditional on the parameters , the DSGE m+odel provides a

conjugate priors for the BVAR

*

A | , e ~ N ( A* ( ), e ( T XX

( )) 1 )

e | ~ IWn ( T *e ( ), T k )

where parameters for prior distributions are maximum likelihood estimators

A* ( ) { YX* ( )} 1 YX* ( )

*

*e ( ) YY* ( ) YX* ( ){ YX* ( )} 1 XY

( )

For the conjugate priors we can obtain posteriors for A ande e

(conditional on ) of the same distribution family

44

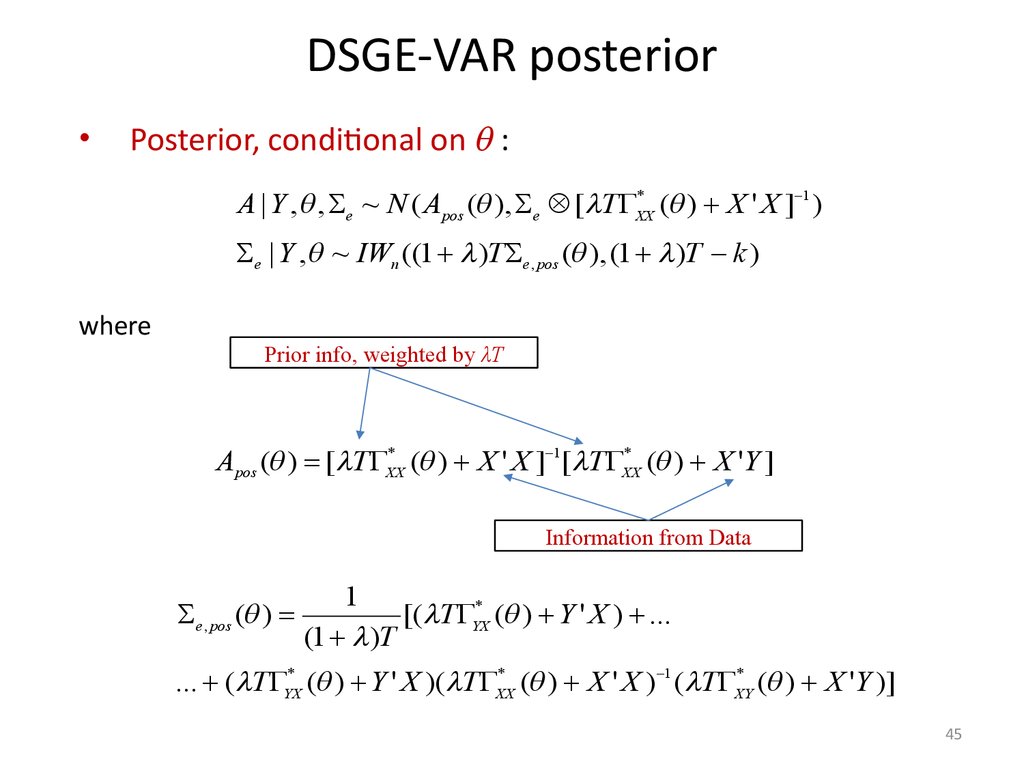

45. DSGE-VAR posterior

Posterior, conditional on :

*

A | Y , , e ~ N ( Apos ( ), e [ T XX

( ) X ' X ] 1 )

e | Y , ~ IWn ((1 )T e , pos ( ), (1 )T k )

where

Prior info, weighted by λT

*

*

Apos ( ) [ T XX

( ) X ' X ] 1[ T XX

( ) X 'Y ]

Information from Data

e , pos ( )

1

[( T YX* ( ) Y ' X ) ...

(1 )T

*

*

... ( T YX* ( ) Y ' X )( T XX

( ) X ' X ) 1 ( T XY

( ) X 'Y )]

45

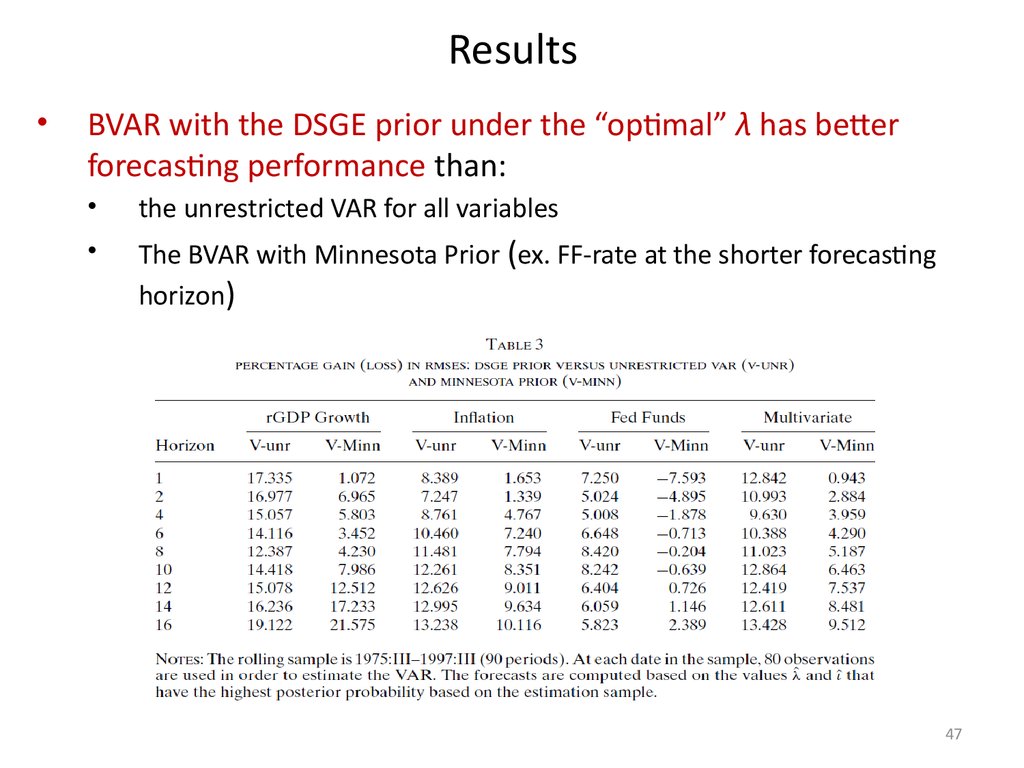

46. Results

BVARs (under different λ’s) have advantage in forecasting

performance (RMSE) vis-à-vis the unrestricted VAR

The “optimal” λ is about 0.6. It also delivers the best ex-post

forecasting performance for 1 quarter horizon

46

47. Results

BVAR with the DSGE prior under the “optimal” λ has better

forecasting performance than:

the unrestricted VAR for all variables

The BVAR with Minnesota Prior (ex. FF-rate at the shorter forecasting

horizon)

47

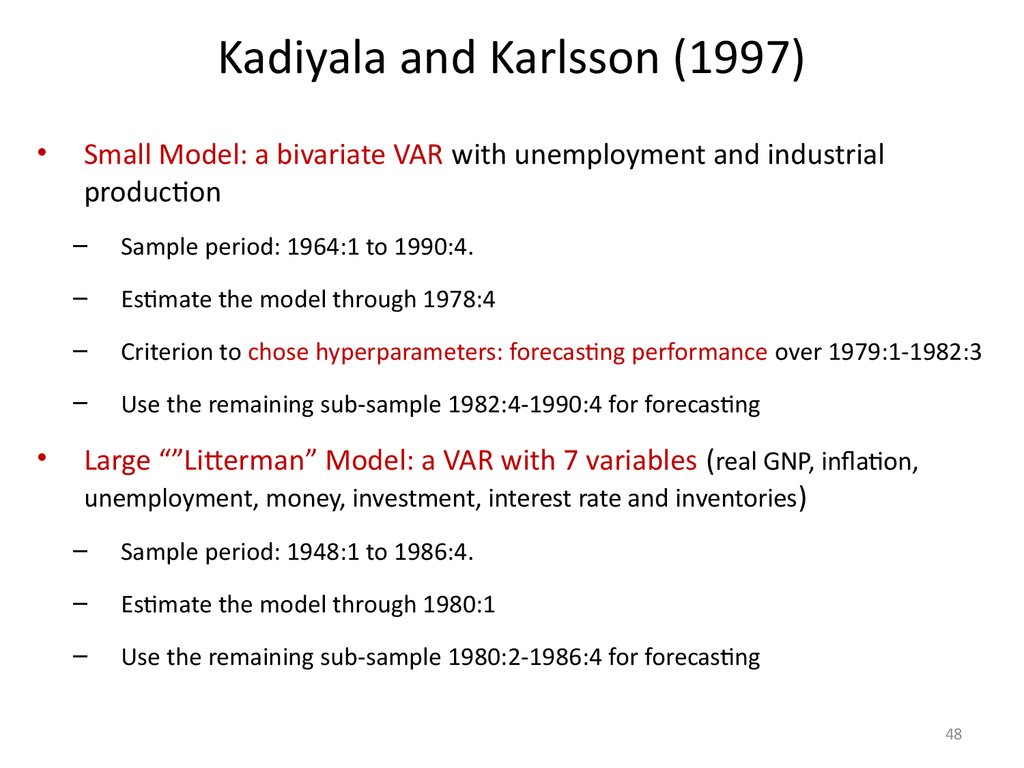

48. Kadiyala and Karlsson (1997)

Small Model: a bivariate VAR with unemployment and industrial

production

–

Sample period: 1964:1 to 1990:4.

–

Estimate the model through 1978:4

–

Criterion to chose hyperparameters: forecasting performance over 1979:1-1982:3

–

Use the remaining sub-sample 1982:4-1990:4 for forecasting

Large “”Litterman” Model: a VAR with 7 variables (real GNP, inflation,

unemployment, money, investment, interest rate and inventories)

–

Sample period: 1948:1 to 1986:4.

–

Estimate the model through 1980:1

–

Use the remaining sub-sample 1980:2-1986:4 for forecasting

48

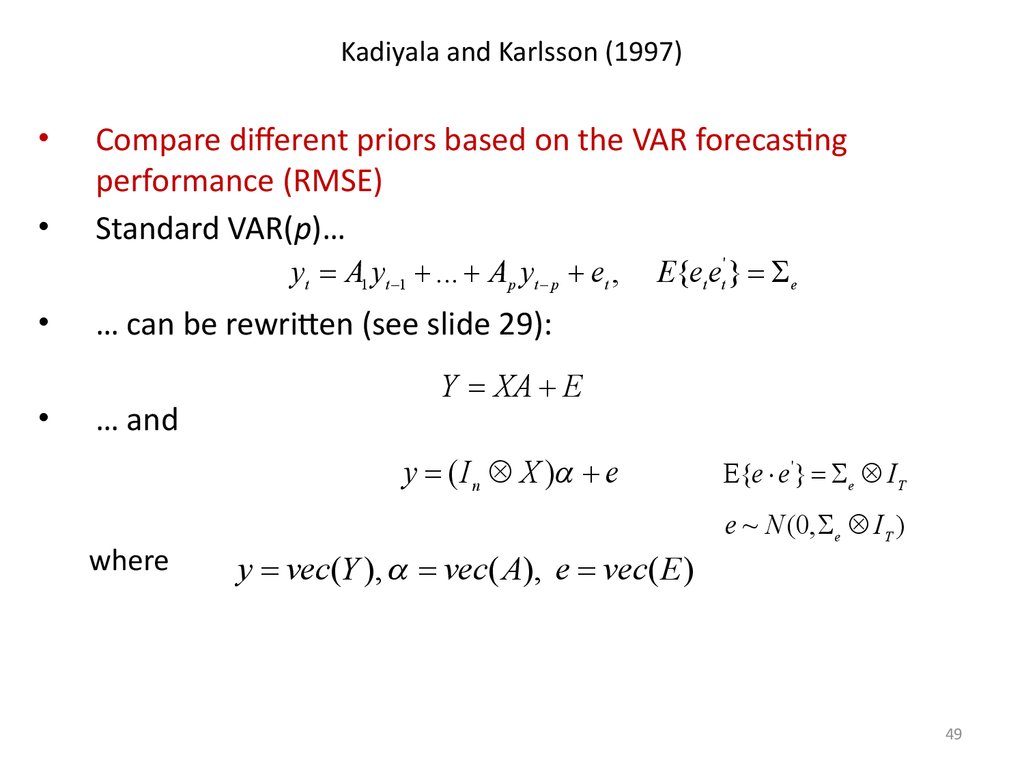

49. Kadiyala and Karlsson (1997)

Compare different priors based on the VAR forecasting

performance (RMSE)

Standard VAR(p)…

yt A1 yt 1 ... Ap yt p et ,

E{et et' } e

… can be rewritten (see slide 29):

… and

Y XA E

y ( I n X ) e

where

E{e e'} e IT

e ~ N (0, e IT )

y vec(Y ), vec( A), e vec( E )

49

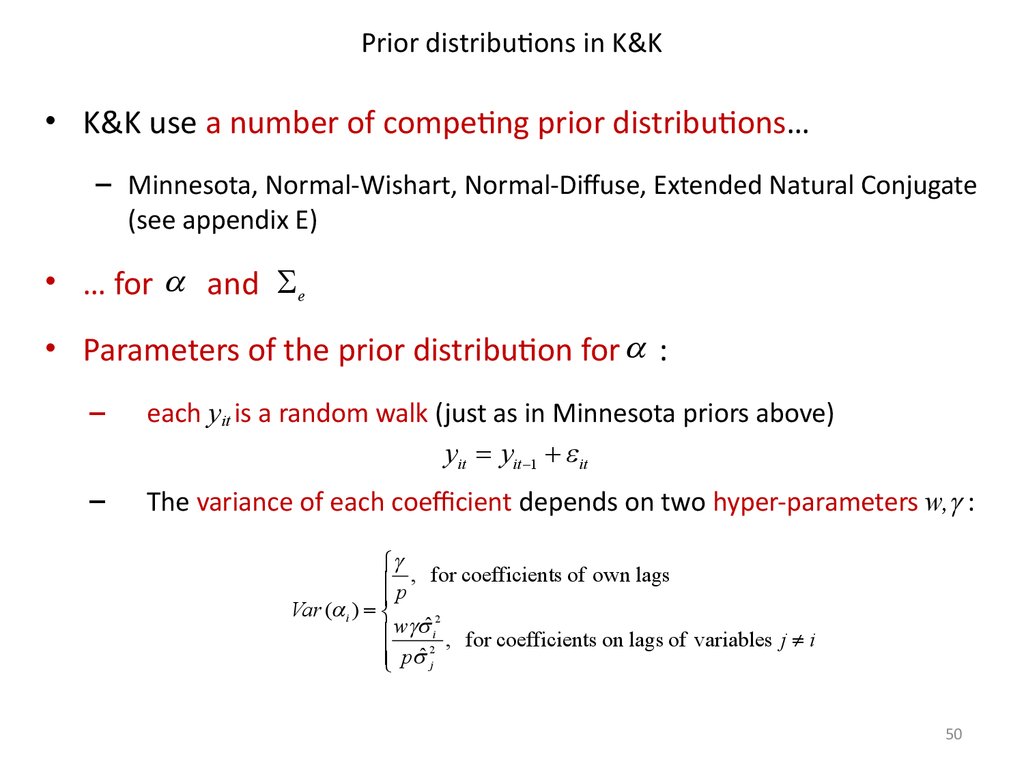

50. Prior distributions in K&K

Prior distributions in K&K• K&K use a number of competing prior distributions…

– Minnesota, Normal-Wishart, Normal-Diffuse, Extended Natural Conjugate

(see appendix E)

• … for and e

• Parameters of the prior distribution for :

–

each yit is a random walk (just as in Minnesota priors above)

yit yit 1 it

–

The variance of each coefficient depends on two hyper-parameters w, :

ï p , for coefficients of own lags

ï

Var ( i )

2

ï w ˆ i , for coefficients on lags of variables j i

ï p ˆ 2j

50

51. Prior distributions in K&K

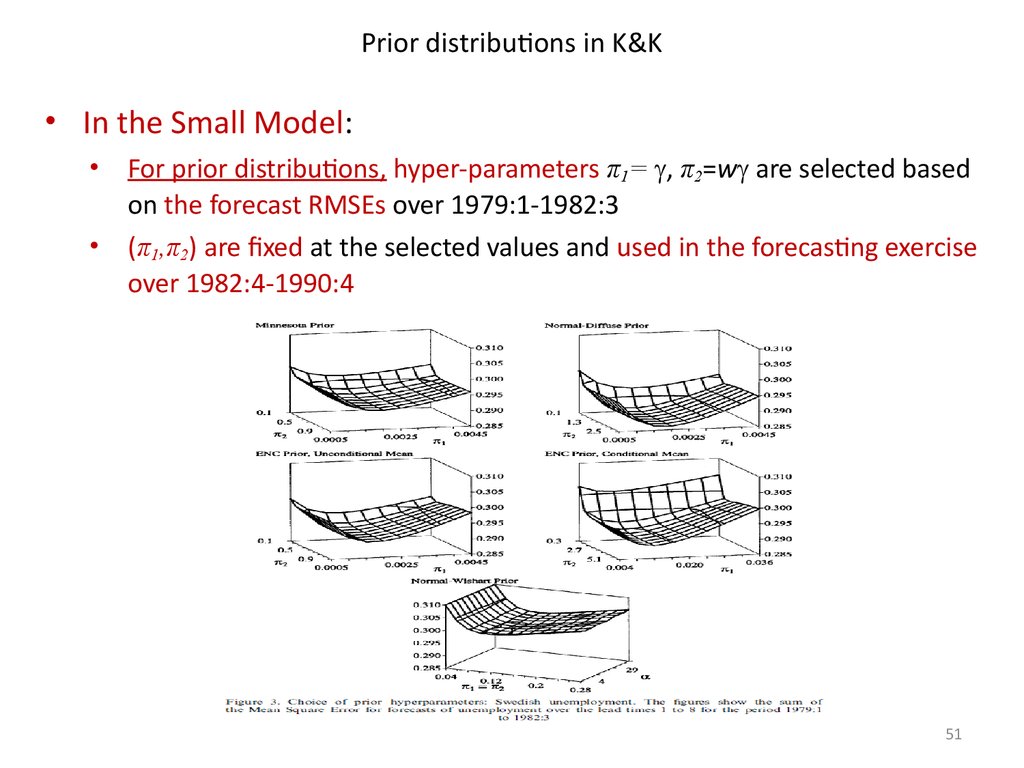

Prior distributions in K&K• In the Small Model:

For prior distributions, hyper-parameters π1= , π2=w are selected based

on the forecast RMSEs over 1979:1-1982:3

(π1,π2) are fixed at the selected values and used in the forecasting exercise

over 1982:4-1990:4

51

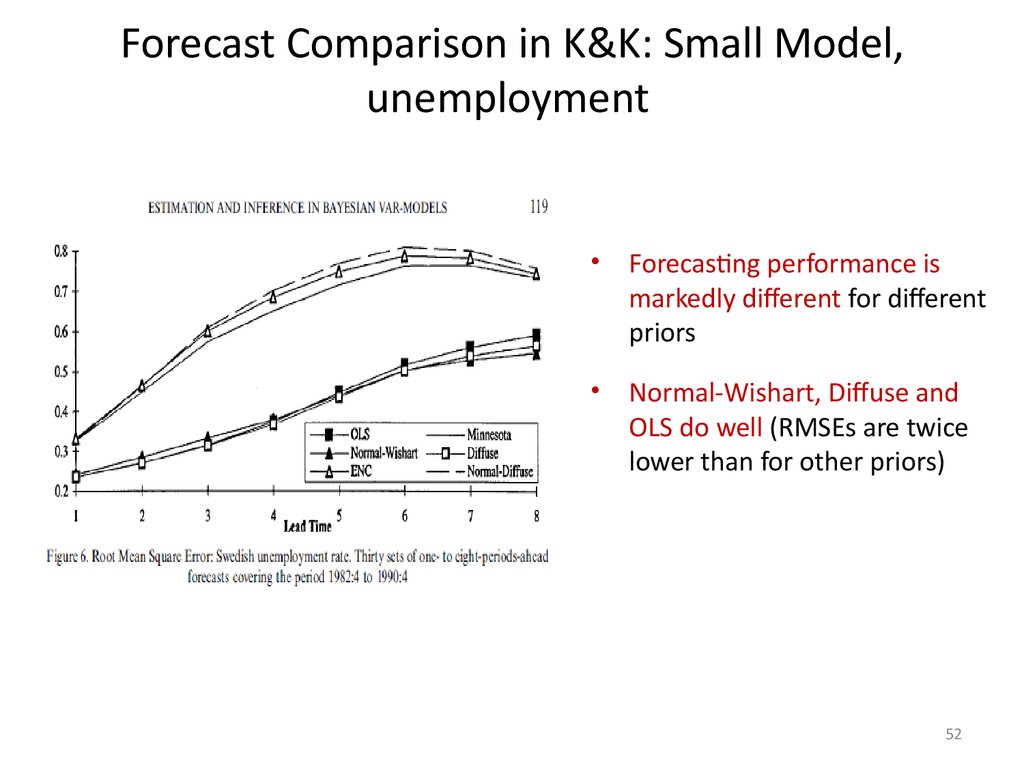

52. Forecast Comparison in K&K: Small Model, unemployment

Forecast Comparison in K&K: Small Model,unemployment

Forecasting performance is

markedly different for different

priors

Normal-Wishart, Diffuse and

OLS do well (RMSEs are twice

lower than for other priors)

52

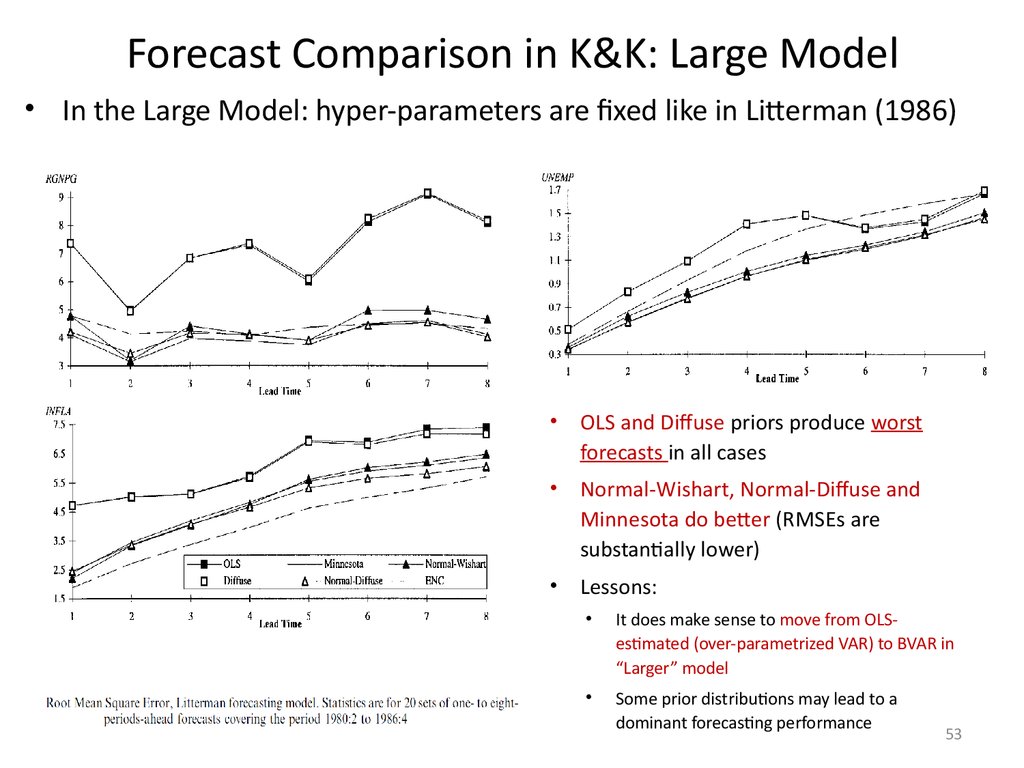

53. Forecast Comparison in K&K: Large Model

Forecast Comparison in K&K: Large Model• In the Large Model: hyper-parameters are fixed like in Litterman (1986)

OLS and Diffuse priors produce worst

forecasts in all cases

Normal-Wishart, Normal-Diffuse and

Minnesota do better (RMSEs are

substantially lower)

Lessons:

It does make sense to move from OLSestimated (over-parametrized VAR) to BVAR in

“Larger” model

Some prior distributions may lead to a

dominant forecasting performance

53

54. Giannone, Lenza and Primiceri (2011)

Use three VARs to compare forecasting performance

– Small VAR: GDP, GDP deflator, Federal Funds rate for the U.S

– Medium VAR: includes small VAR plus consumption, investment, hours

worked and wages

– Large VAR: expand the medium VAR with up to 22 variables

The prior distributions of the VAR parameters ϴ={ , Σ , Σe} depend

on a small number of hyperparameters

The hyperparameters are themselves uncertain and follow either

gamma or inverse gamma distributions

–

This is to the contrast of Minnesota priors where hyperparameters are

fixed!

54

55. Giannone, Lenza and Primiceri (2011)

The marginal likelihood is obtained by integrating

out the parameters of the model:

f ( y)

f ( y | )d f ( y | ) p ( )d

But the prior distribution of is itself a function of

the hyperparameters of the model i.e. p(θ)=p (θ|γ)

55

56. Giannone, Lenza and Primiceri (2011)

We interpret the model as a hierarchical model by replacing

pγ(θ)=p(θ|γ) and evaluate the marginal likelihood:

f ({ yt } | )

f ({ y }, ) p ( | )d

t

The hyperparameters γ are uncertain

Informativeness of their prior distribution is chosen via maximizing

the posterior distribution

p ( | y ) p ( y | ) p ( y )

Maximizing the posterior of γ corresponds to maximizing the onestep ahead forecasting accuracy of the model

56

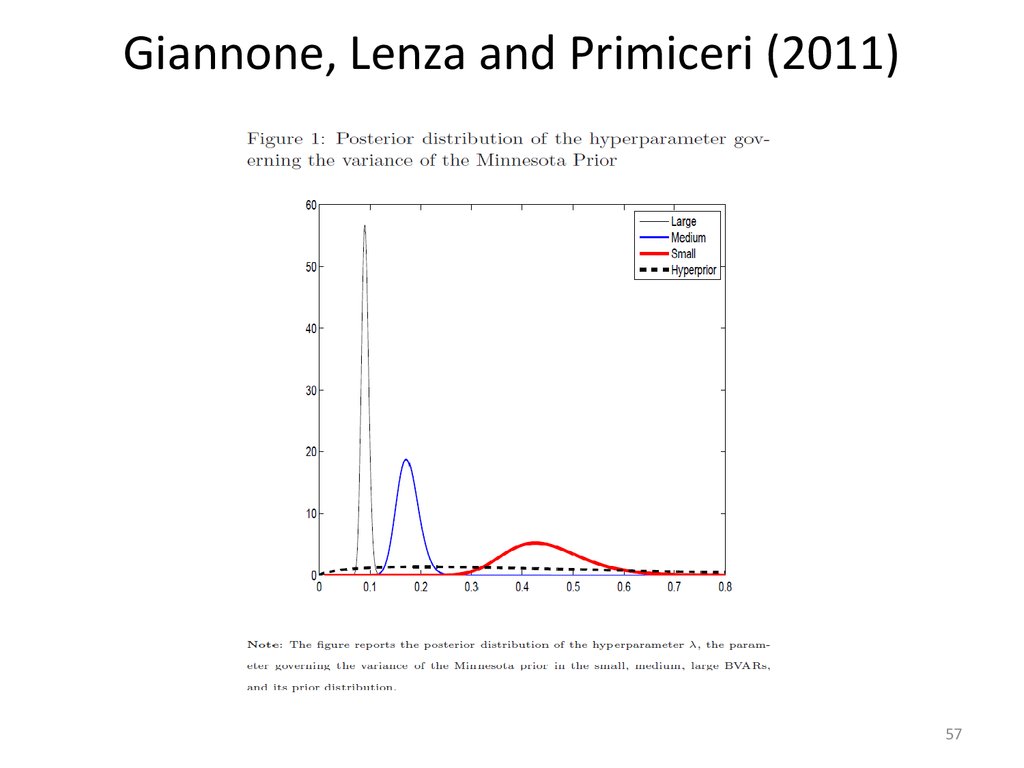

57. Giannone, Lenza and Primiceri (2011)

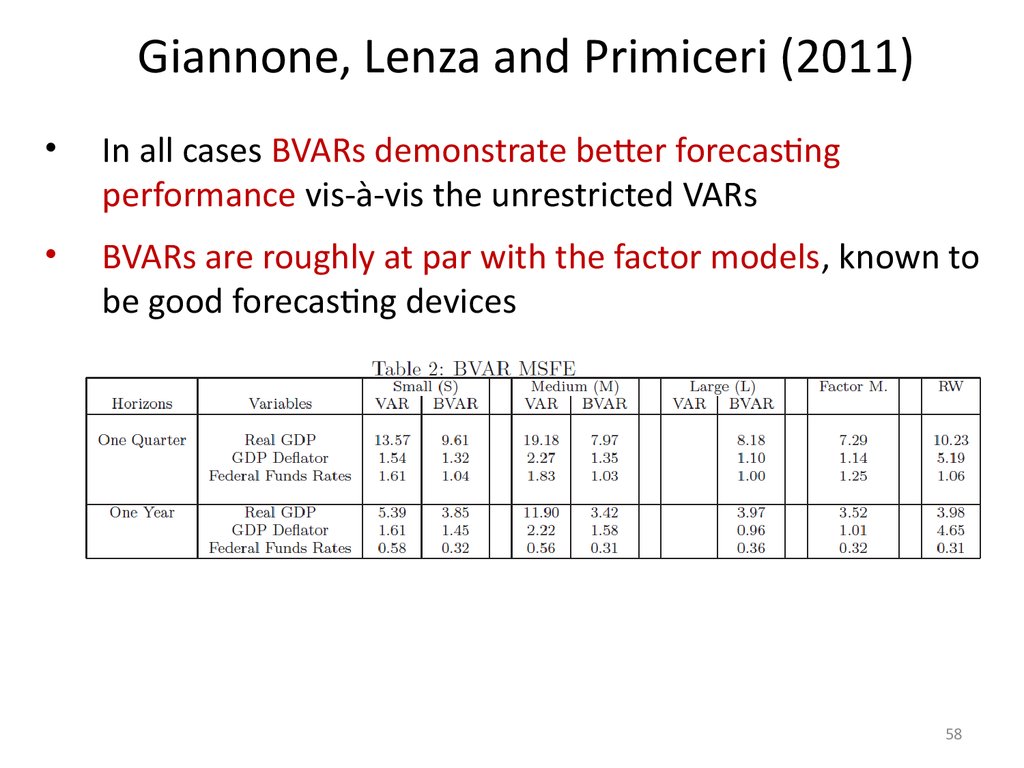

5758.

Giannone, Lenza and Primiceri (2011)In all cases BVARs demonstrate better forecasting

performance vis-à-vis the unrestricted VARs

BVARs are roughly at par with the factor models, known to

be good forecasting devices

58

59. Conclusions

BVARs is a useful tool to improve forecasts

This is not a “black box”

–

posterior distribution parameters are typically functions of prior

parameters and data

Choice of priors can go:

–

from a simple Minnesota prior (that is convenient for analytical results)

–

…to a full-fledged DSGE model that incorporates theory-consistent

structural parameters

The choice of hyperparameters for the prior depends on the

nature of the time series we want to forecast

–

No “one size fits all approach”

59

60.

Thank You!60

61. Appendix A: Remarks about the marginal likelihood

Remarks about the marginal likelihood:

– If we have M1,….MN competing models, the marginal

likelihood of model Mj, f({yt}|Mj) can be seen as:

1.

2.

–

The update on the weight of model M j after observing the data

The out-of-sample prediction record of model j.

Model comparison between two models is performed

with the posterior odds ratio:

P(M1 |{yt}) P(M1 ) f ({ y }|M1 )

P(M2 |{ yt}) P(M2 ) f ({ y }|M2 )

–

Favor’s parsimonious modeling: in-built “Occam’s Razor.”

61

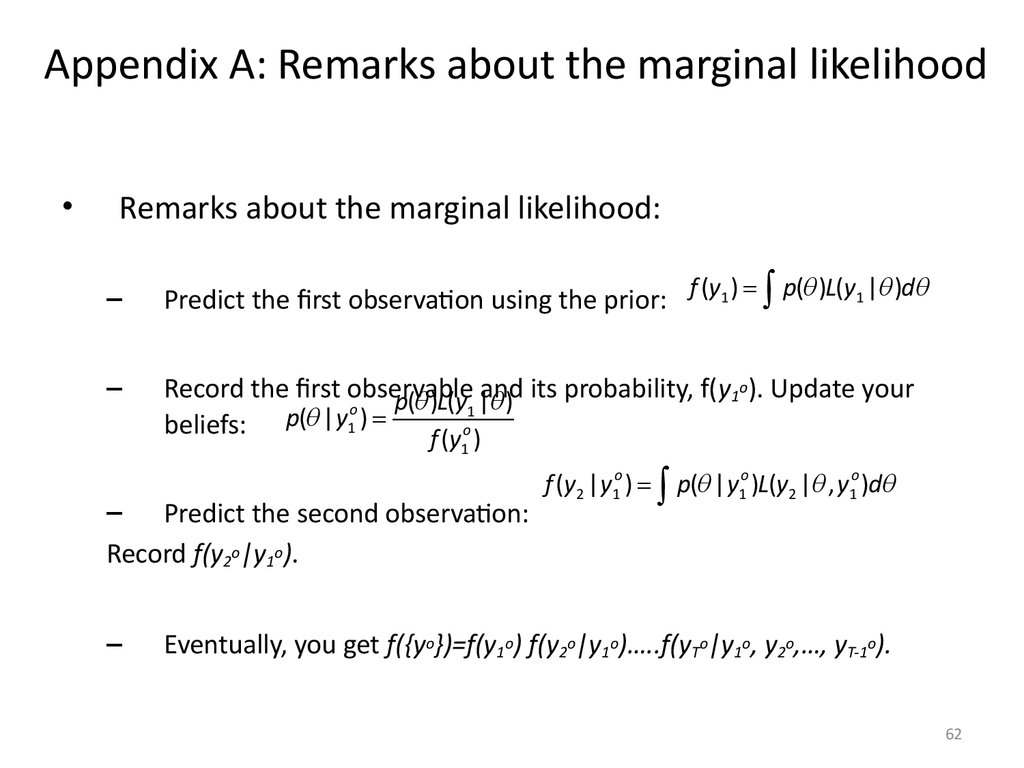

62. Appendix A: Remarks about the marginal likelihood

Remarks about the marginal likelihood:

–

–

Predict the first observation using the prior: f (y1 ) p( )L(y1 | )d

o

Record the first observable

p( )L(y1 |and

) its probability, f(y1 ). Update your

o

beliefs: p( | y1 )

f (y o )

1

– Predict the second observation:

Record f(y2o|y1o).

–

f (y2 | y1o ) p( | y1o )L(y2 | , y1o )d

Eventually, you get f({yo})=f(y1o) f(y2o|y1o)…..f(yTo|y1o, y2o,…, yT-1o).

62

63. Appendix B: Linear Regression with conjugate priors

• To calculate the posterior distribution for parametersf ( , 2 | y, X ) f ( y | X , , 2 ) f ( | 2 ) f ( 2 )

• …we assume the following for distributions:

– Normal for data

f ( y | X , , ) ( )

2

2

T

2

exp{

1

2 2

( y X )' ( y X )}

– Normal for the prior for β (conditional on σ2): β|σ2 ̴ N(m, σ2M)

k

2

f ( | ) ( ) exp{

2

2

1

( m)' M 1 ( m)}

2

2

– and Inverse-gamma for the prior for σ2 : σ2 ̴ IΓ(λ,k)

k

2

f ( ) ( ) exp{

2

2

}

2

2

• Next consider the product

f ( y | X , , 2 ) f ( | 2 )

63

64.

Appendix B: Linear Regression with conjugate priors• Rearranging the expressions under the exponents we have the

following:

( y X )' ( y X ) ( m)' M 1 ( m) ...

... ( y X ˆ )' ( y X ˆ ) ( ˆ )' X ' X ( ˆ ) ( m)' M 1 ( m) ...

... ( m* )' ( X ' X M 1 )( m* ) y ' y m* ' ( X ' X M 1 ) m* m' M 1m

where

ˆ ( X ' X ) 1 X ' y

is an OLS estimator of

m* ( X ' X M 1 ) 1 ( X ' X ˆ M 1m)}

Further denote

M * ( X ' X M 1 ) 1 ( X ' X M 1 ) ( M * ) 1

… and rewrite the

f ( , 2 | X , y )

1

( m* )' ( M * ) 1 ( m* )}

2

2

N T

1

y ' y m* ' ( M * ) 1 m* m' M 1m

2

2

( )

exp{

}

2 2

k

2

( ) exp{

2

65

65.

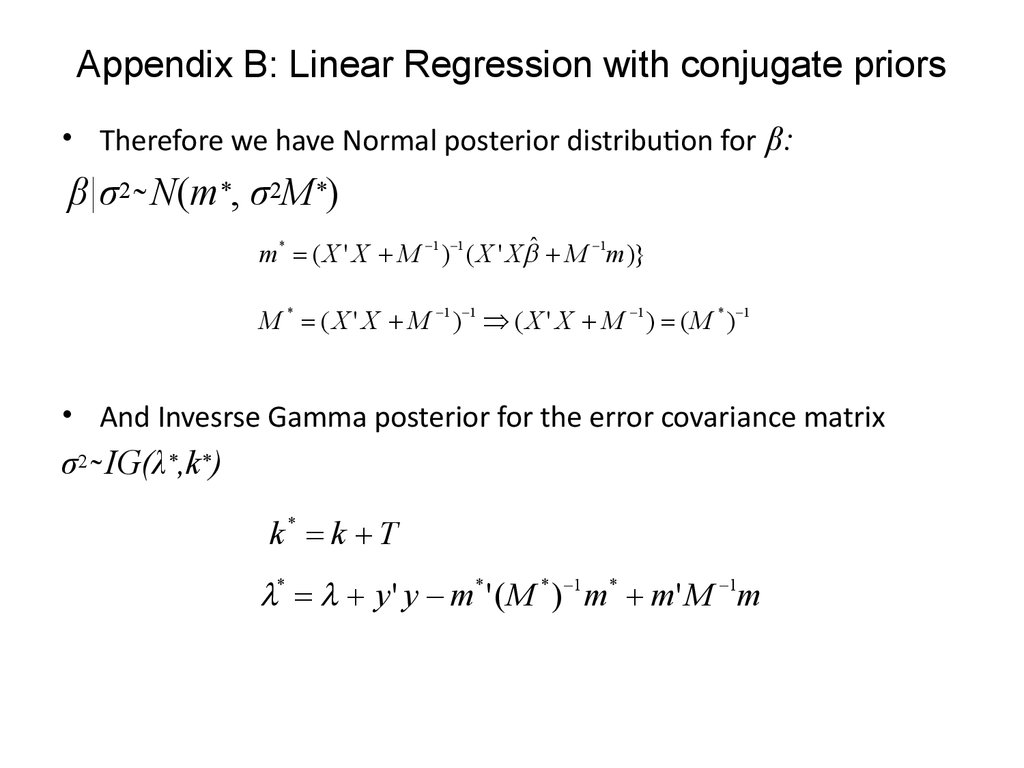

Appendix B: Linear Regression with conjugate priors• Therefore we have Normal posterior distribution for β:

β|σ2 ̴ N(m*, σ2M*)

m* ( X ' X M 1 ) 1 ( X ' X ˆ M 1m)}

M * ( X ' X M 1 ) 1 ( X ' X M 1 ) ( M * ) 1

• And Invesrse Gamma posterior for the error covariance matrix

σ2 ̴ IG(λ*,k*)

k* k T

* y ' y m* ' ( M * ) 1 m* m' M 1m

66. Appendix C: How to Estimate a BVAR, Case 1 prior

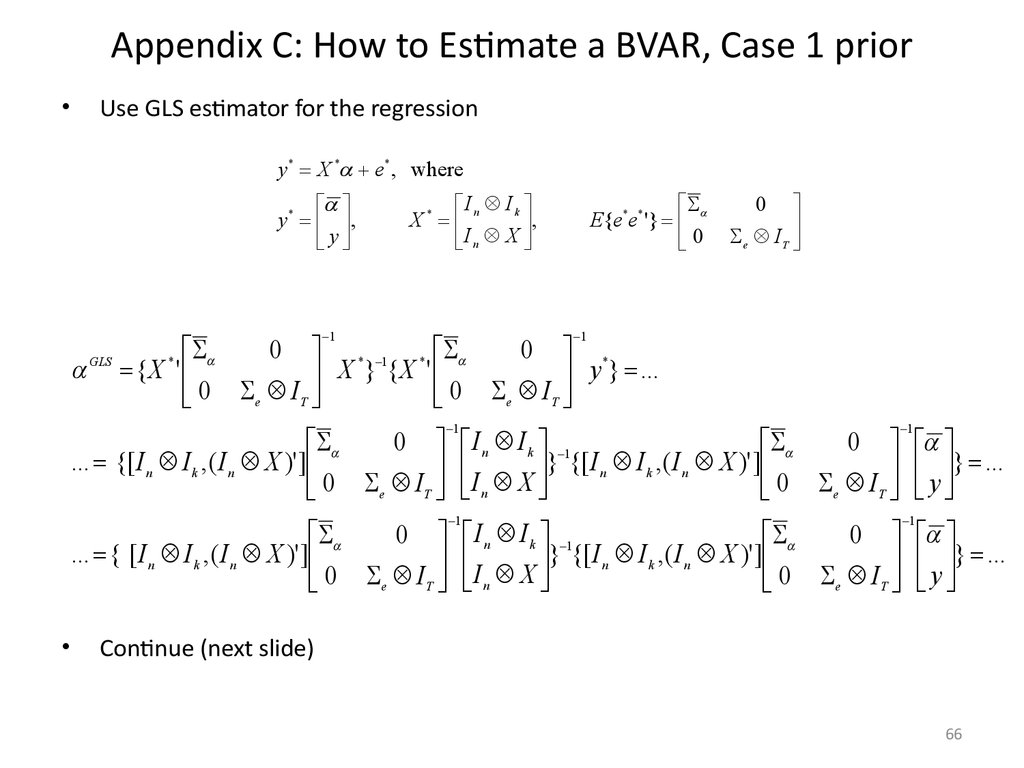

Use GLS estimator for the regression

y * X * e* , where

y * ,

y

I Ik

X* n

,

I

X

n

1

E{e*e* '}

0

0

e IT

1

0 * 1 *

0 *

GLS { X * '

X

}

{

X

'

y } ...

0 e IT

0 e IT

0

... {[ I n I k , ( I n X )' ]

0 e IT

1

0

I n I k 1

}

{[

I

I

,

(

I

X

)'

]

n

k

n

y } ...

I X

n

0 e IT

1

0

I n I k 1

}

{[

I

I

,

(

I

X

)'

]

n

k

n

y } ...

I X

n

0 e IT

0

... { [ I n I k , ( I n X )' ]

0 e IT

1

1

Continue (next slide)

66

67. Appendix C: How to Estimate a BVAR, Case 1 Prior

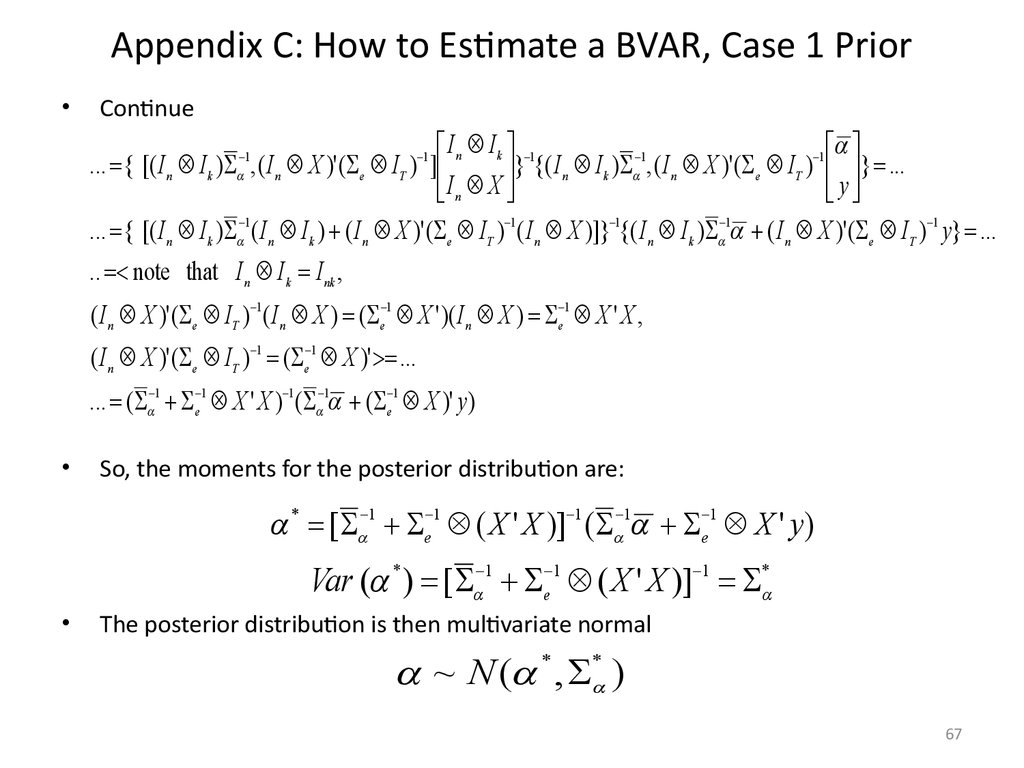

Continue

I n I k 1

1

1

... { [( I n I k ) , ( I n X )' ( e IT ) ]

} {( I n I k ) , ( I n X )' ( e IT ) } ...

y

In X

... { [( I n I k ) 1 ( I n I k ) ( I n X )' ( e IT ) 1 ( I n X )]} 1{( I n I k ) 1 ( I n X )' ( e I T ) 1 y} ...

1

1

.. note that I n I k I nk ,

( I n X )' ( e IT ) 1 ( I n X ) ( e 1 X ' )( I n X ) e 1 X ' X ,

( I n X )' ( e IT ) 1 ( e 1 X )' ...

... ( 1 e 1 X ' X ) 1 ( 1 ( e 1 X )' y )

So, the moments for the posterior distribution are:

* [ 1 e 1 ( X ' X )] 1 ( 1 e 1 X ' y )

Var ( * ) [ 1 e 1 ( X ' X )] 1 *

The posterior distribution is then multivariate normal

~ N ( * , * )

67

68. Appendix D: How to Estimate a BVAR: Conjugate Priors

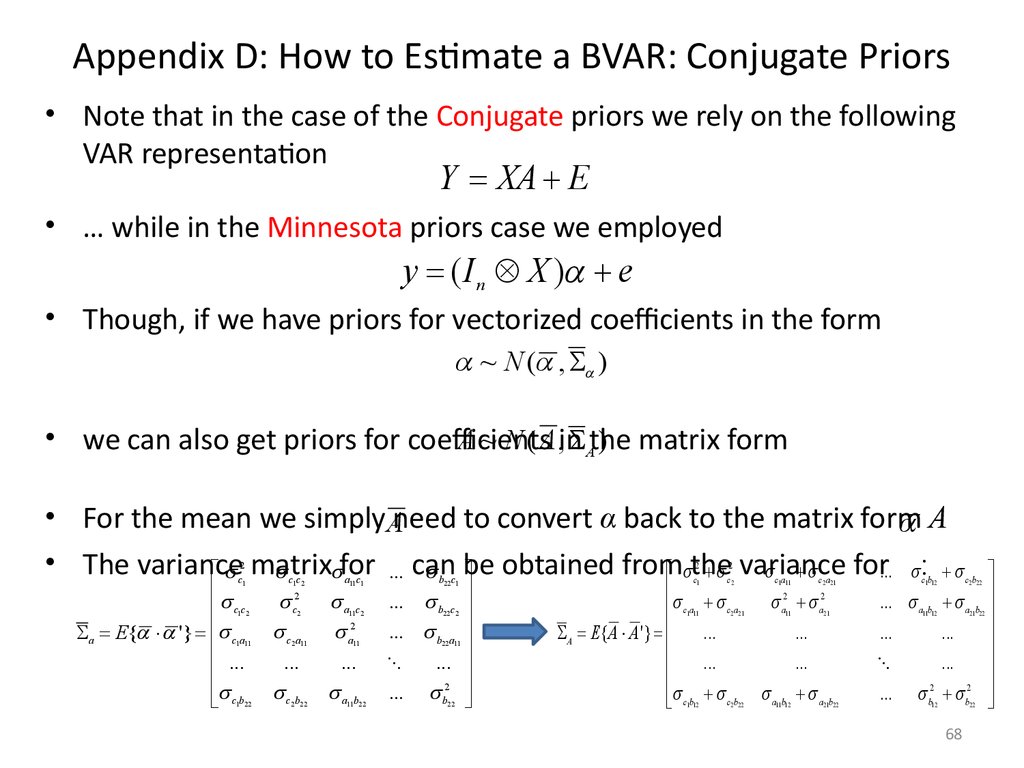

• Note that in the case of the Conjugate priors we rely on the followingVAR representation

Y XA E

• … while in the Minnesota priors case we employed

y ( I n X ) e

• Though, if we have priors for vectorized coefficients in the form

~ N ( , )

• we can also get priors for coefficients

A ~ N ( A ,in Athe

) matrix form

• For the mean we simply Aneed to convert α back to the matrix form

A

• The variance

for... :

variance

for ... can

be

the

matrix

obtained from

2

c1

c c

a E{ '} c a

...

c b

1 2

1 11

1 22

c1c2

c2

c a

...

c b

2

2 11

2 22

a11c1

a c

a2

...

a b

11 2

11

11 22

b22 c1

... b c

... b a

...

... b2

22 2

22 11

22

2

c1

c a

A E{ A A '}

c b

1 11

1 12

2

c2

c a

2 21

...

...

c b

2 22

c1a11

c2 a21

a2 a2

...

...

a b a b

11

11 12

21

21 22

c1b12

c2b22

... a b a b

11 12

21 22

...

...

...

...

b2 b2

12

22

68

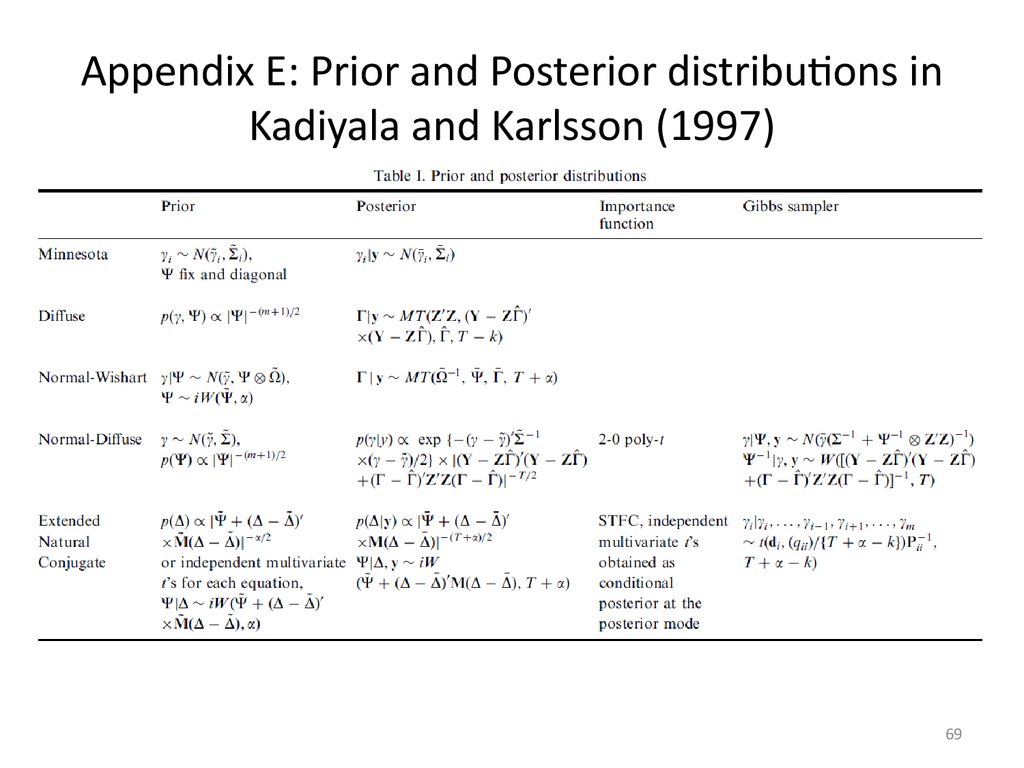

69. Appendix E: Prior and Posterior distributions in Kadiyala and Karlsson (1997)

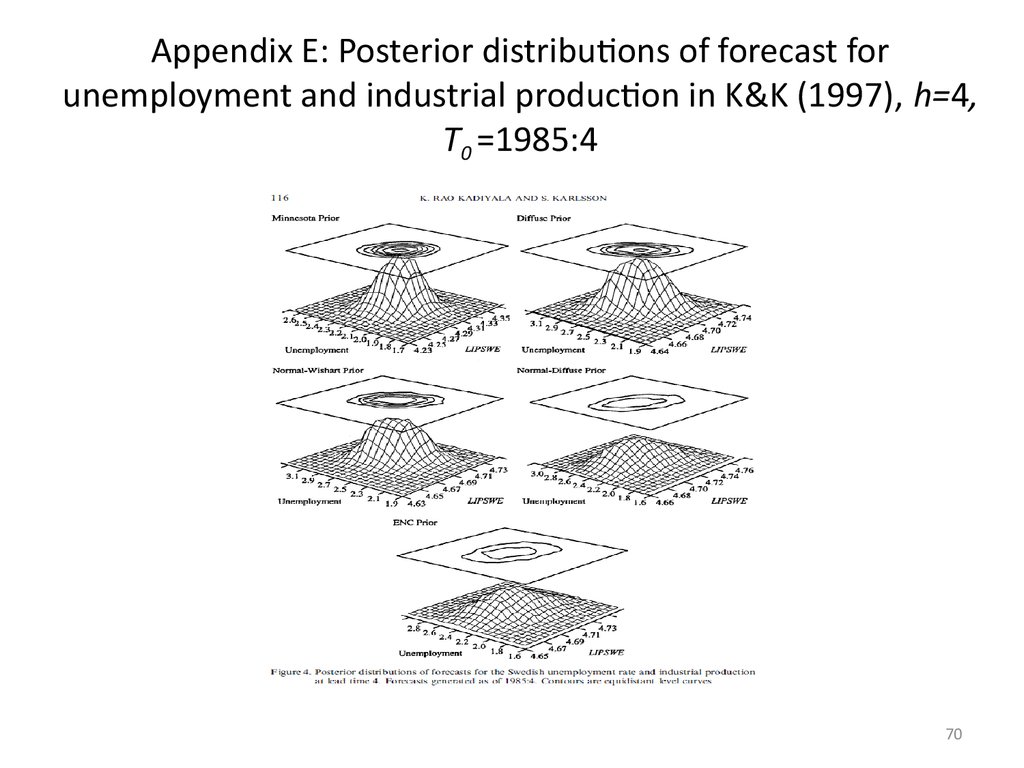

6970. Appendix E: Posterior distributions of forecast for unemployment and industrial production in K&K (1997), h=4, T0 =1985:4

Appendix E: Posterior distributions of forecast forunemployment and industrial production in K&K (1997), h=4,

T0 =1985:4

70

71. Appendix E: Posterior distribution of the unemployment rate forecast in K&K (1997)

Appendix E: Posterior distribution of theunemployment rate forecast in K&K (1997)

71

72. Appendix E: Choosing λ

• Choosing in order to maximize the “empirical performance”of the DSGE-VAR

• Use the marginal data density:

p ( Y ) p ( Y | ) p( )d

• This can be interpreted as posterior probabilities for

• High posterior for large values of indicates that a lot of

weight should be placed in the DSGE model

• High posterior for low values of indicates information

about the degree of misspecification of the DSGE model

• Choose :

ˆ argmax p ( Y )

L

72

mathematics

mathematics economics

economics