Similar presentations:

Market performance report Business Excellence Russia

1.

Market performance reportBusiness Excellence Russia

Jul 2020

PAGE

1

2.

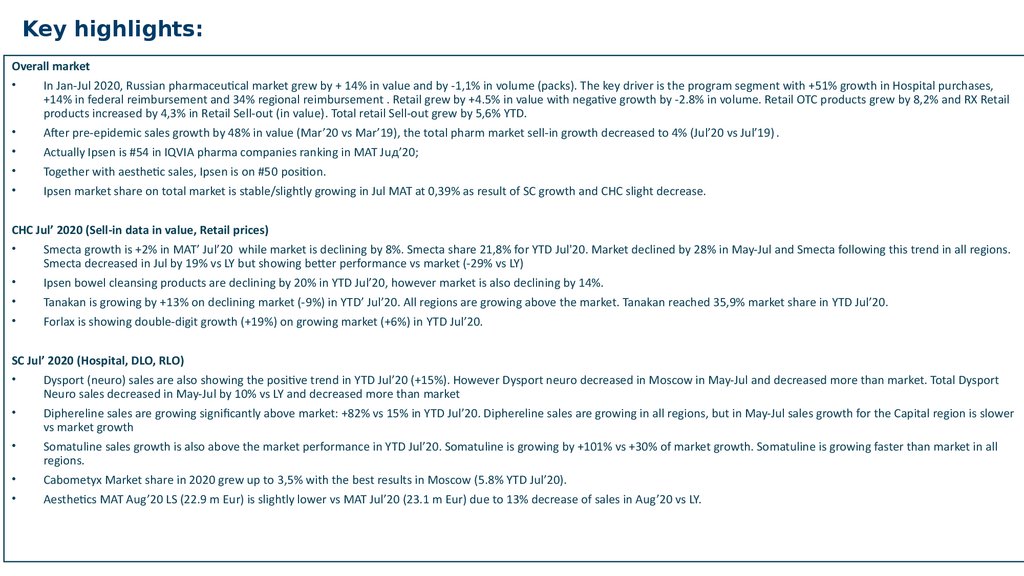

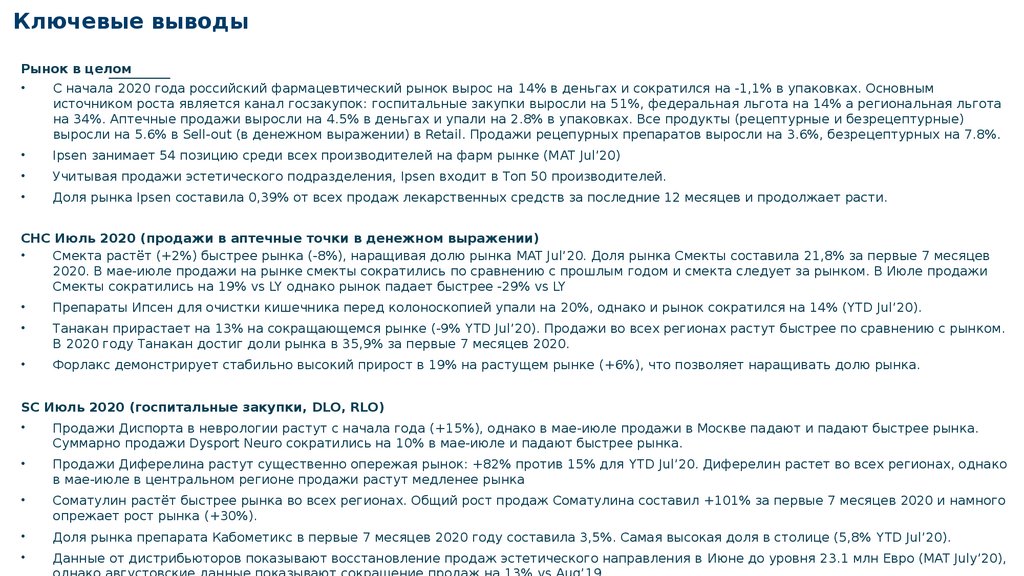

Key highlights:Overall market

In Jan-Jul 2020, Russian pharmaceutical market grew by + 14% in value and by -1,1% in volume (packs). The key driver is the program segment with +51% growth in Hospital purchases,

+14% in federal reimbursement and 34% regional reimbursement . Retail grew by +4.5% in value with negative growth by -2.8% in volume. Retail OTC products grew by 8,2% and RX Retail

products increased by 4,3% in Retail Sell-out (in value). Total retail Sell-out grew by 5,6% YTD.

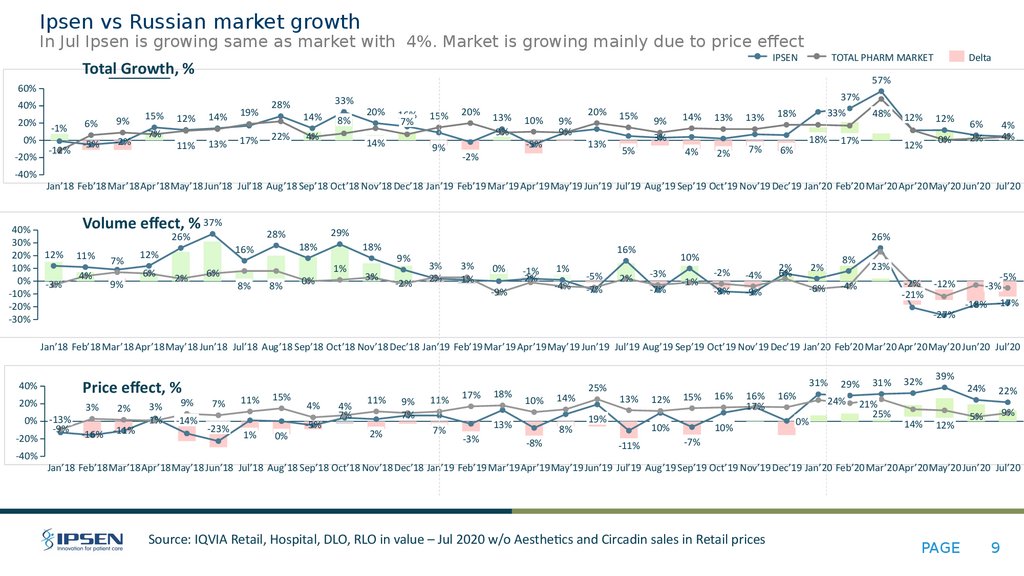

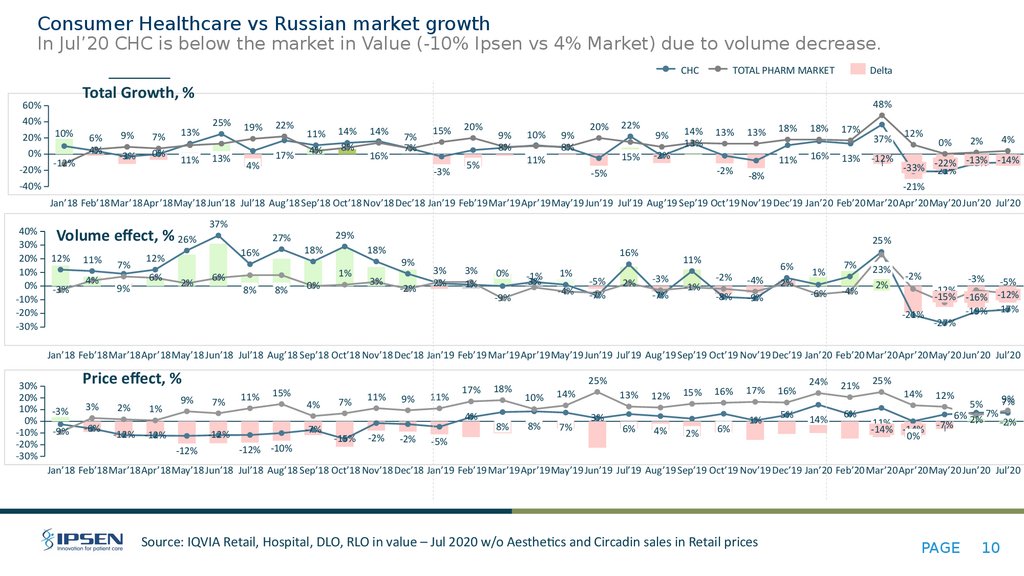

After pre-epidemic sales growth by 48% in value (Mar’20 vs Mar’19), the total pharm market sell-in growth decreased to 4% (Jul’20 vs Jul’19) .

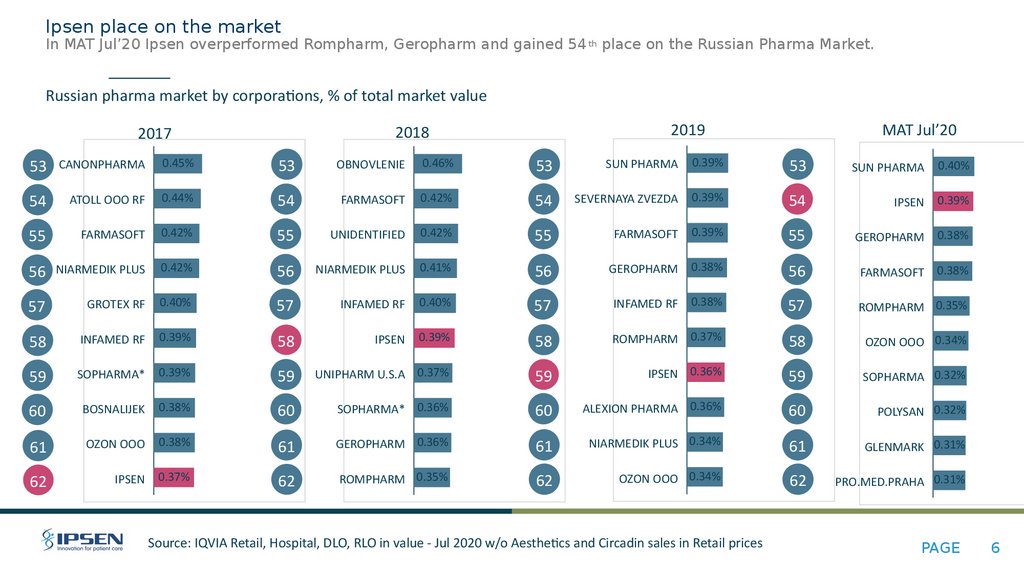

Actually Ipsen is #54 in IQVIA pharma companies ranking in MAT Juд’20;

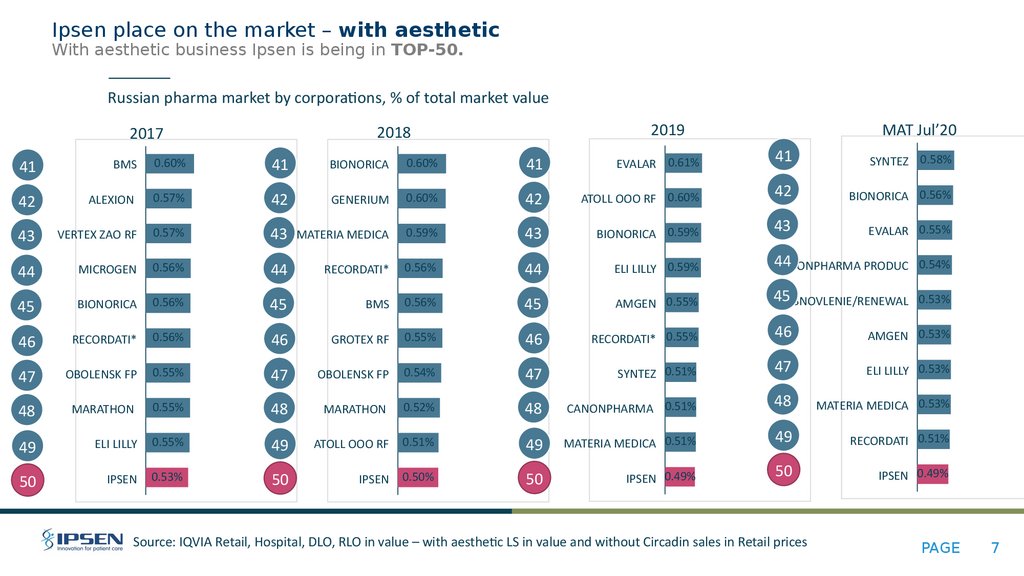

Together with aesthetic sales, Ipsen is on #50 position.

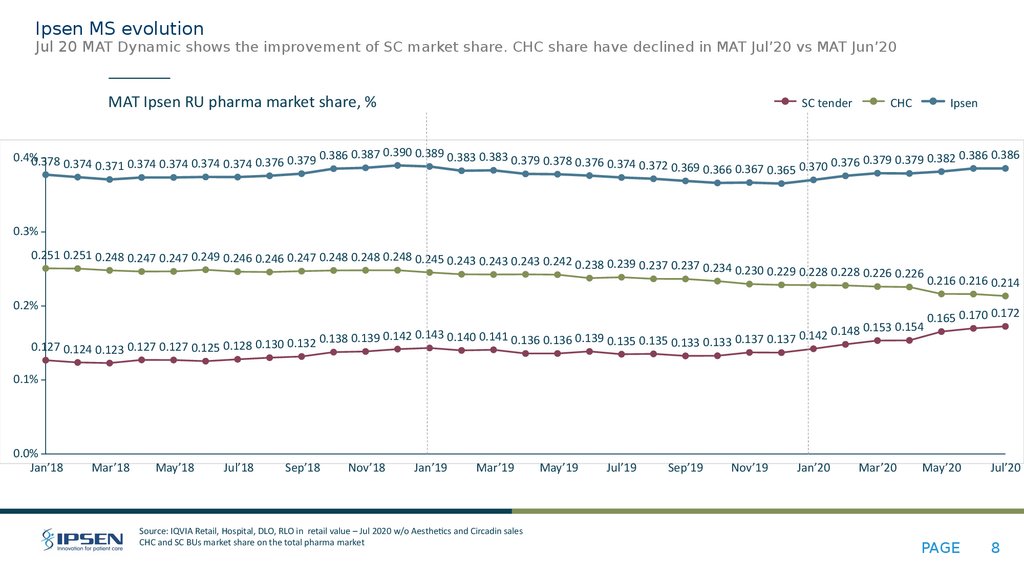

Ipsen market share on total market is stable/slightly growing in Jul MAT at 0,39% as result of SC growth and CHC slight decrease.

CHC Jul’ 2020 (Sell-in data in value, Retail prices)

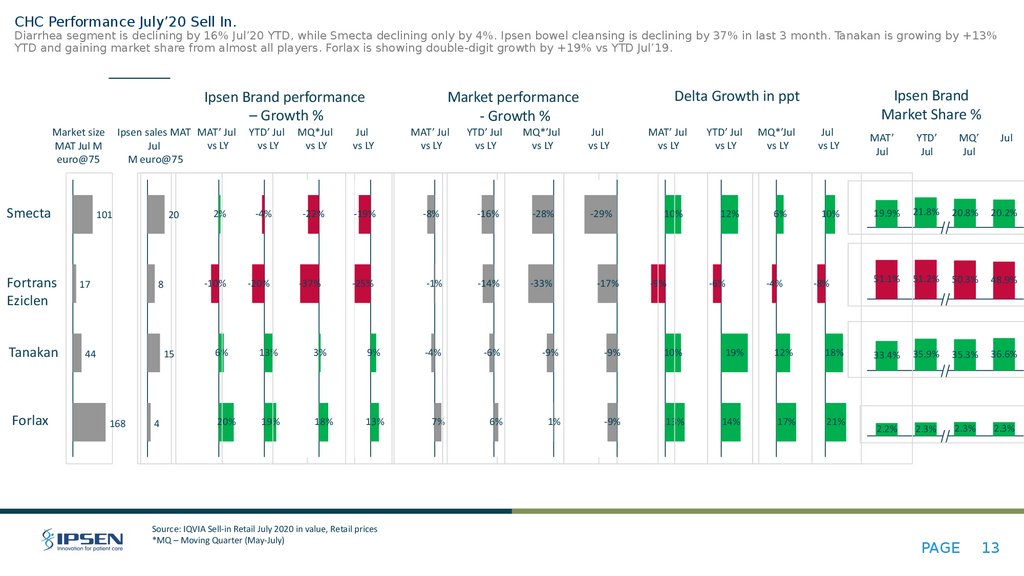

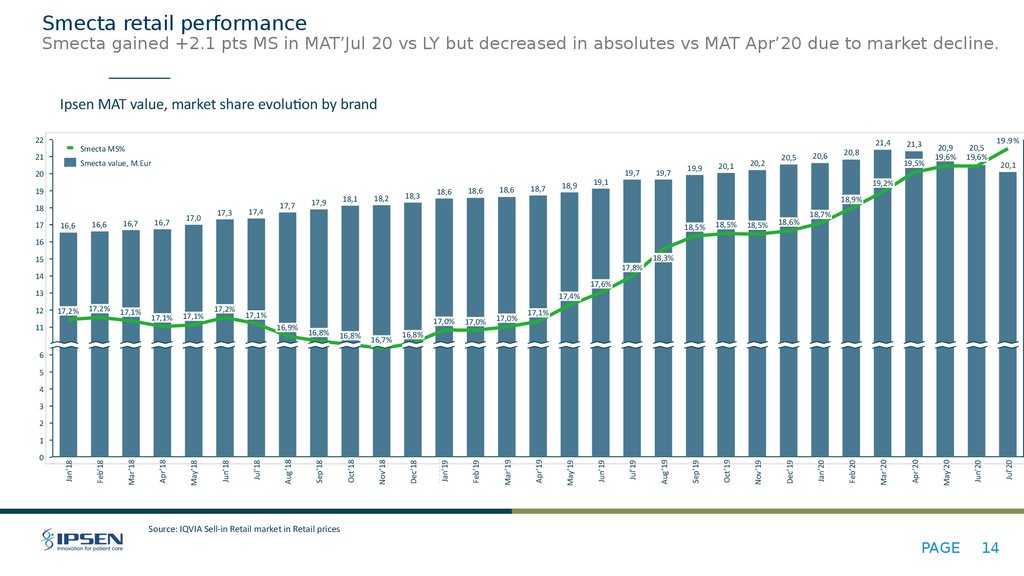

Smecta growth is +2% in MAT’ Jul’20 while market is declining by 8%. Smecta share 21,8% for YTD Jul'20. Market declined by 28% in May-Jul and Smecta following this trend in all regions.

Smecta decreased in Jul by 19% vs LY but showing better performance vs market (-29% vs LY)

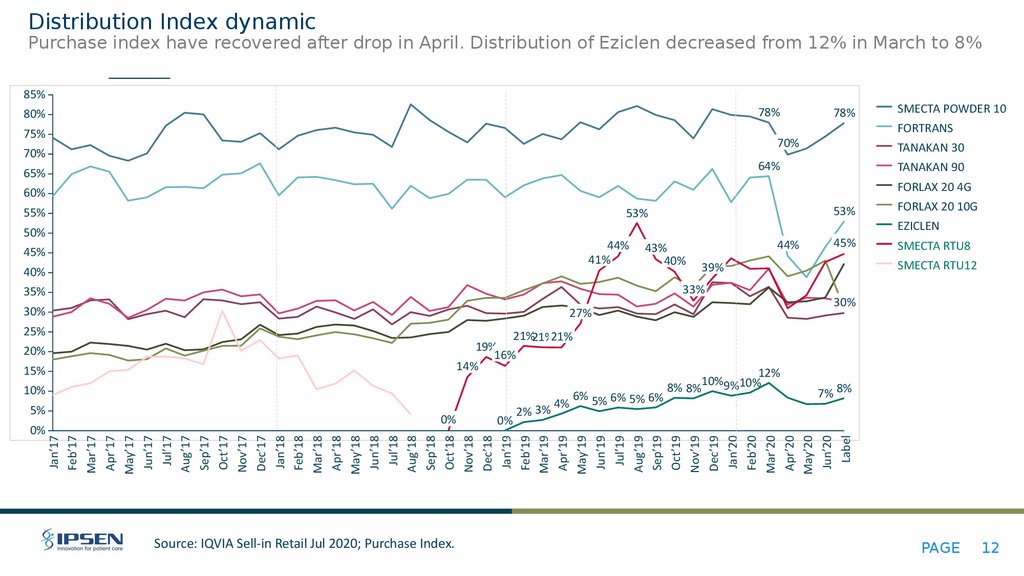

Ipsen bowel cleansing products are declining by 20% in YTD Jul’20, however market is also declining by 14%.

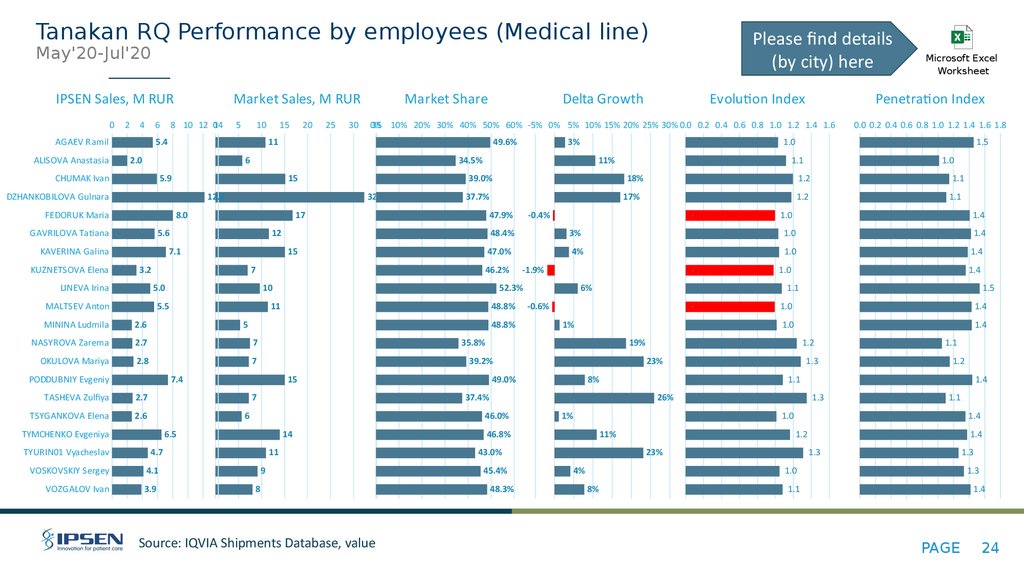

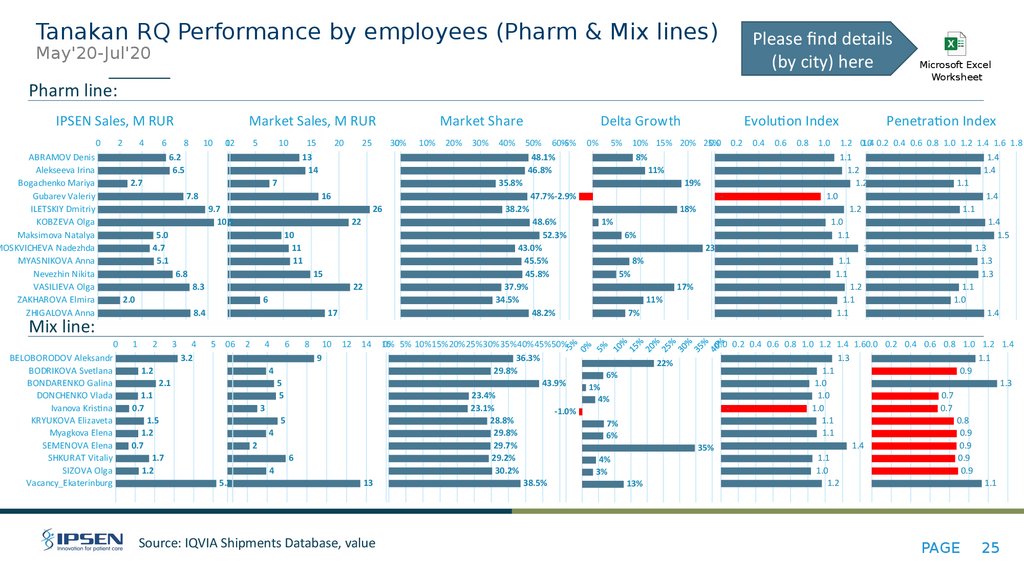

Tanakan is growing by +13% on declining market (-9%) in YTD’ Jul’20. All regions are growing above the market. Tanakan reached 35,9% market share in YTD Jul’20.

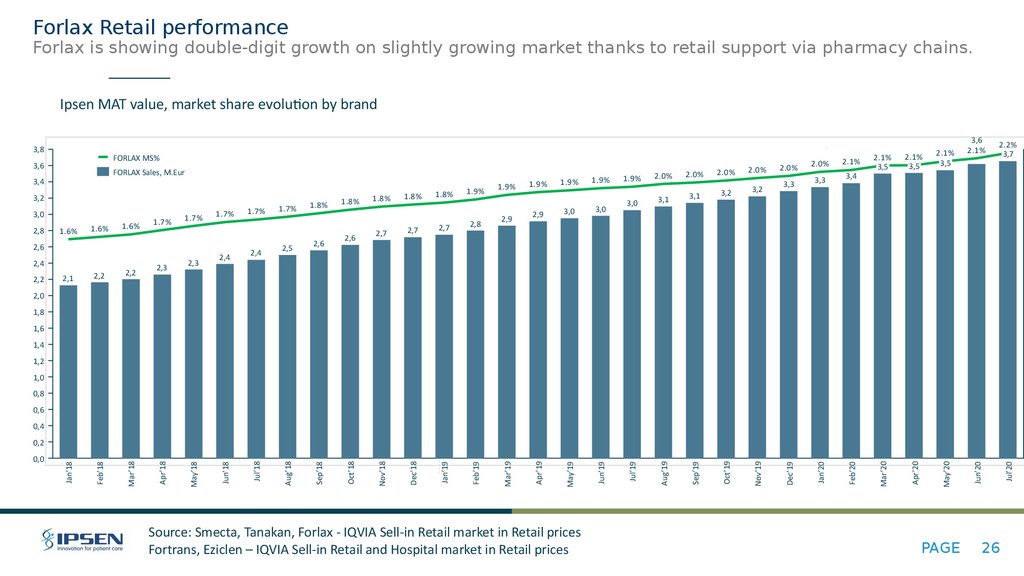

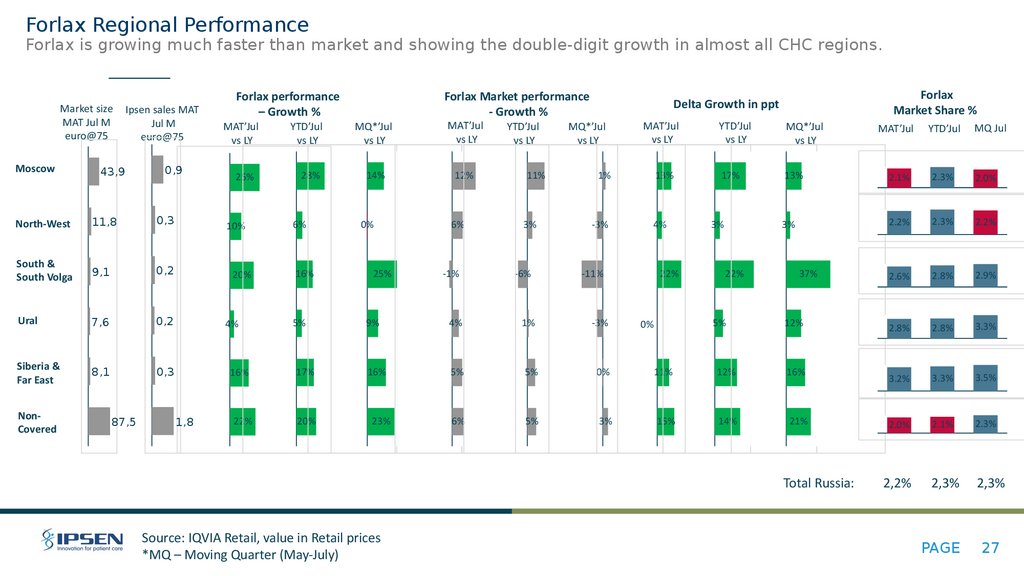

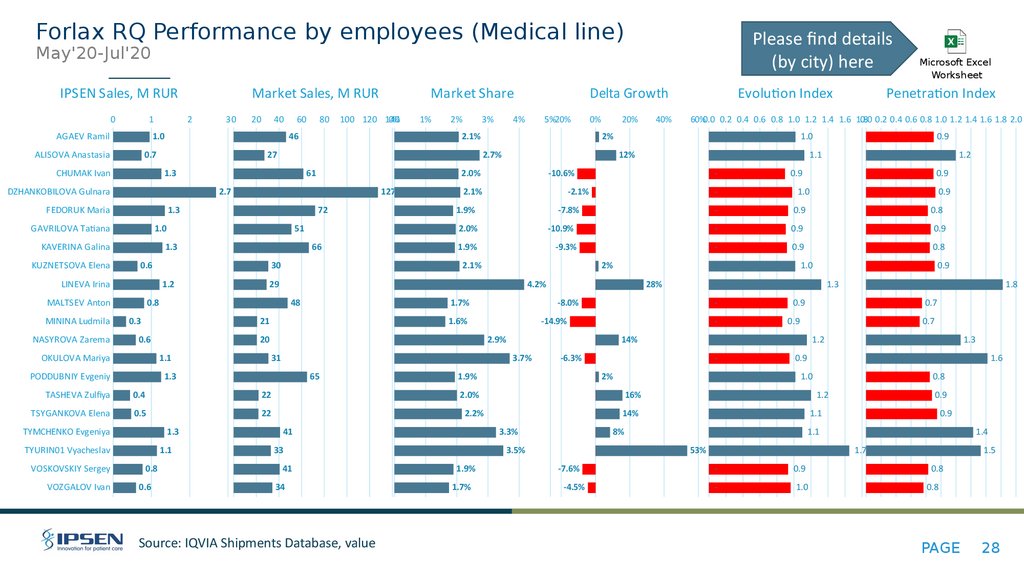

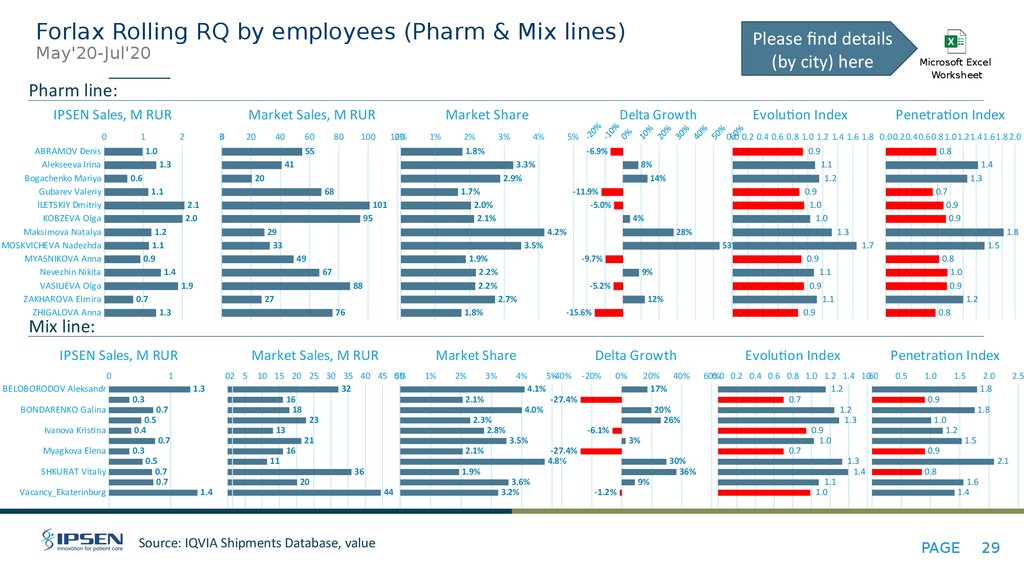

Forlax is showing double-digit growth (+19%) on growing market (+6%) in YTD Jul’20.

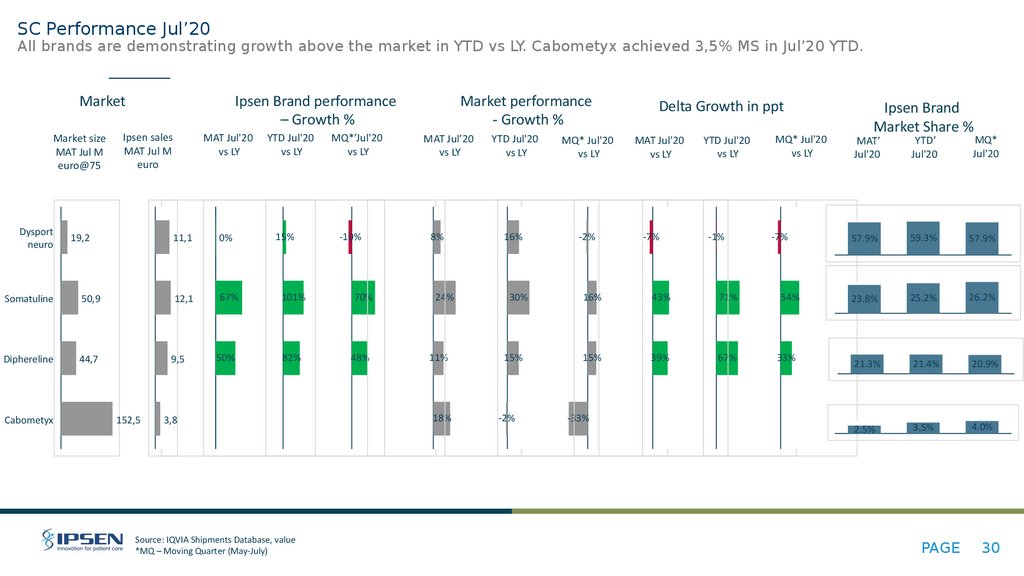

SC Jul’ 2020 (Hospital, DLO, RLO)

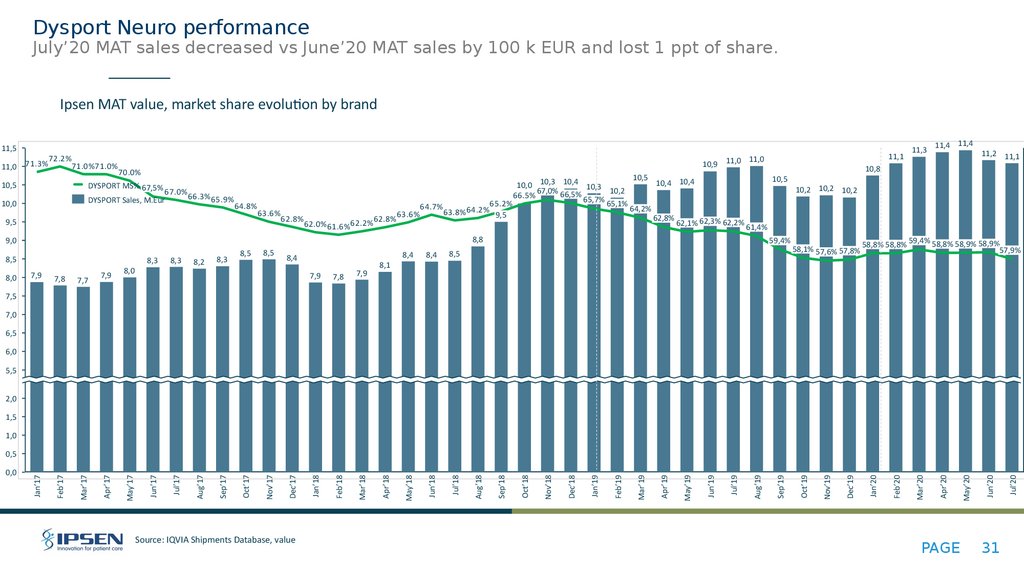

Dysport (neuro) sales are also showing the positive trend in YTD Jul’20 (+15%). However Dysport neuro decreased in Moscow in May-Jul and decreased more than market. Total Dysport

Neuro sales decreased in May-Jul by 10% vs LY and decreased more than market

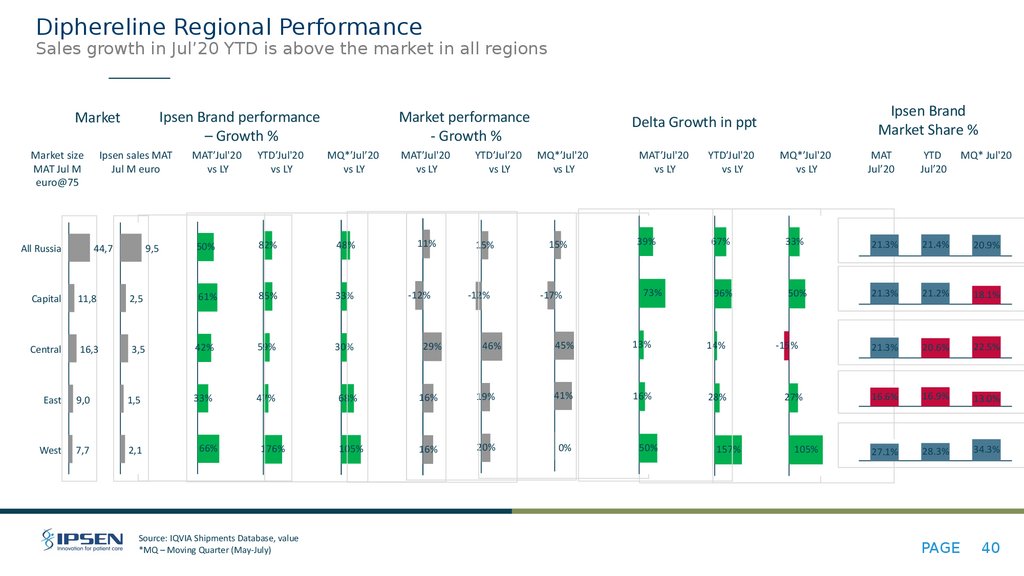

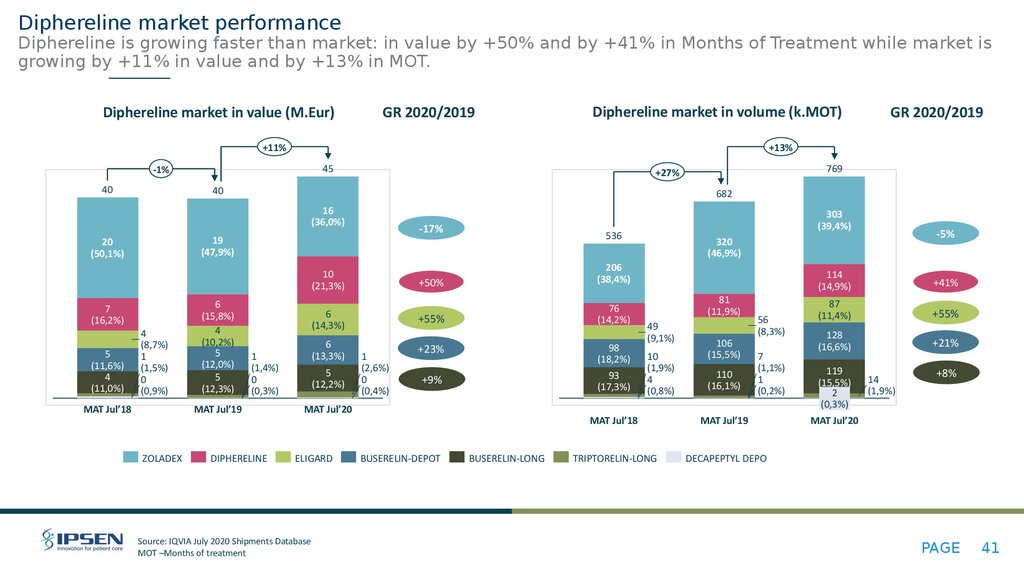

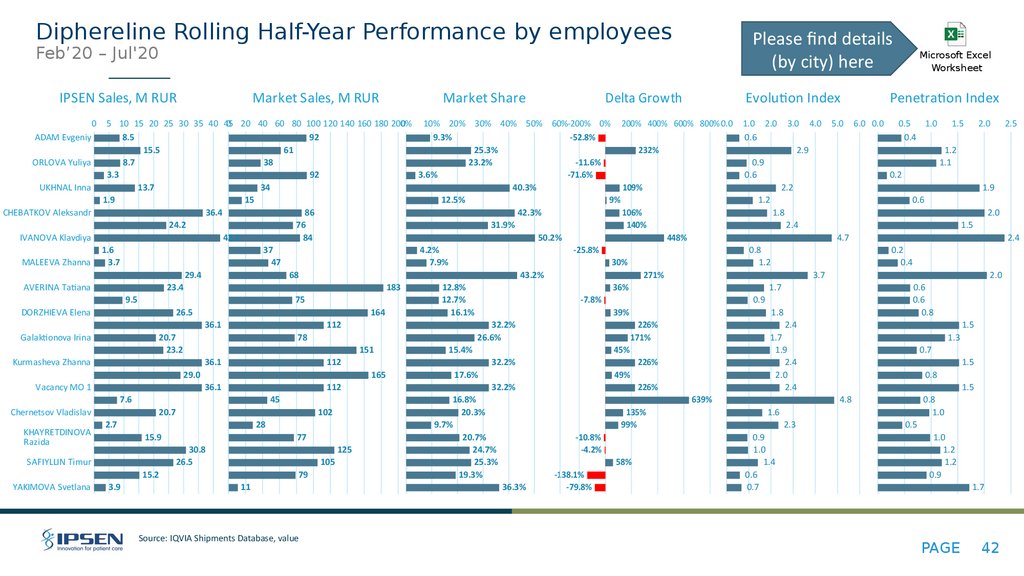

Diphereline sales are growing significantly above market: +82% vs 15% in YTD Jul’20. Diphereline sales are growing in all regions, but in May-Jul sales growth for the Capital region is slower

vs market growth

Somatuline sales growth is also above the market performance in YTD Jul’20. Somatuline is growing by +101% vs +30% of market growth. Somatuline is growing faster than market in all

regions.

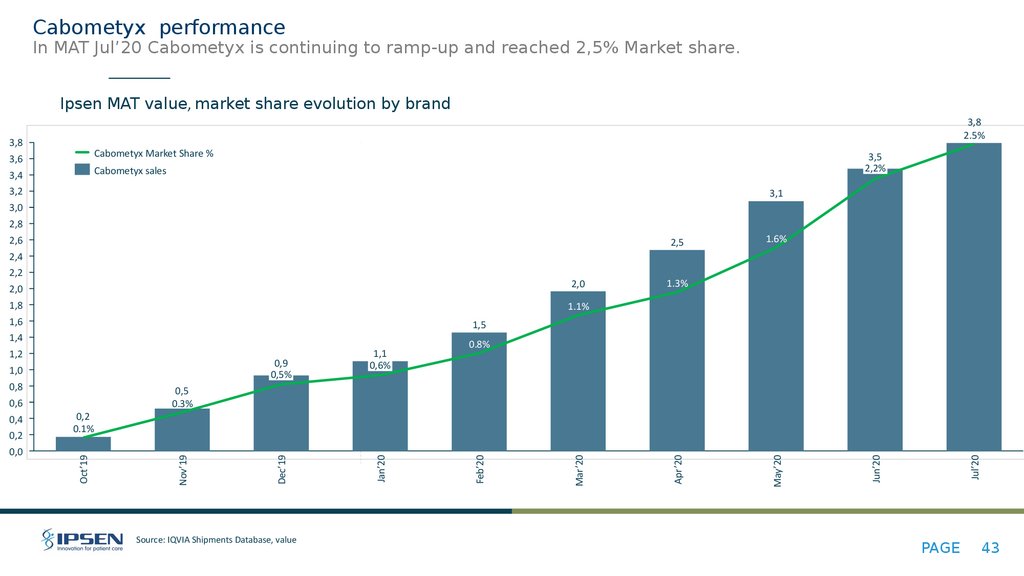

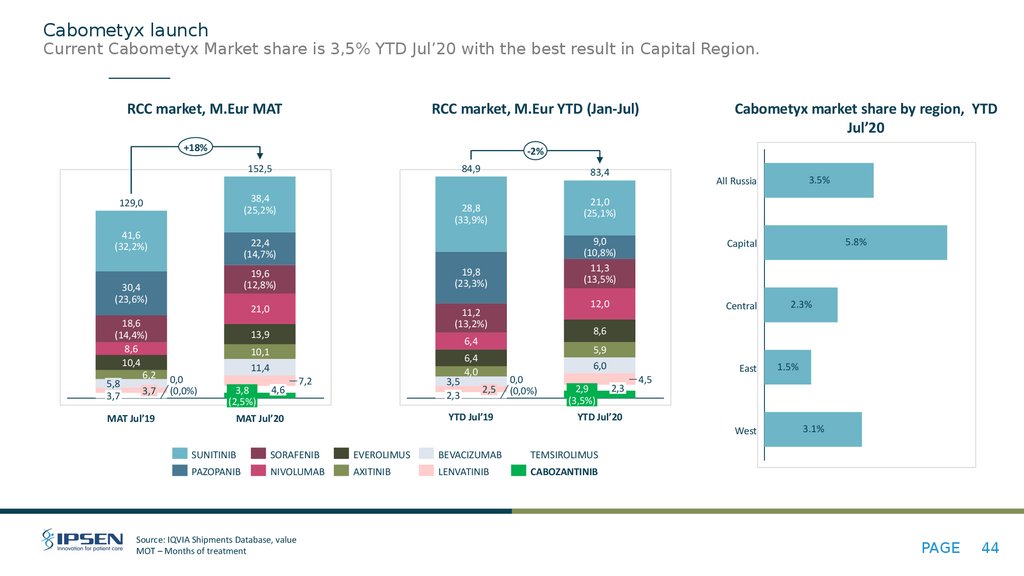

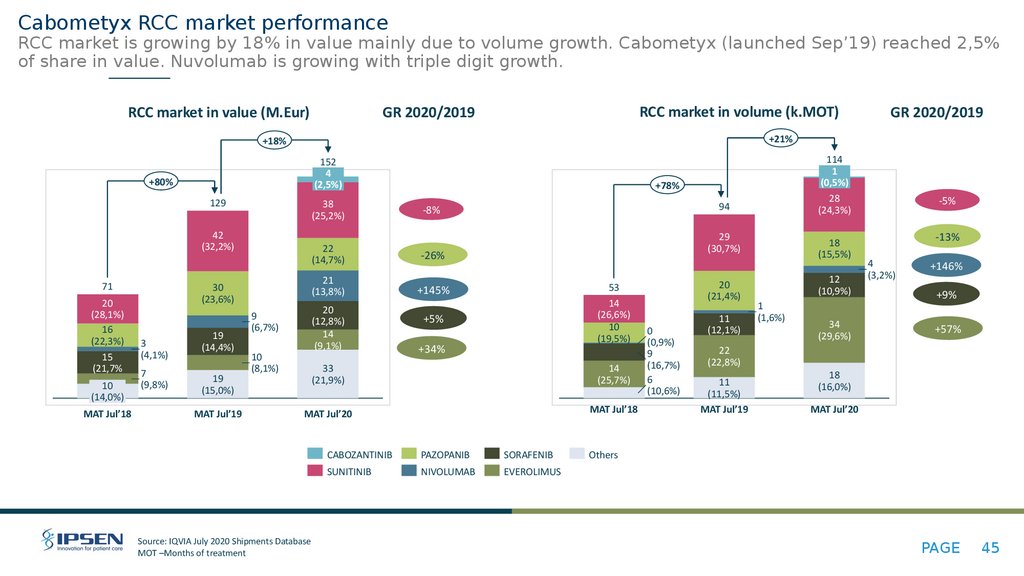

Cabometyx Market share in 2020 grew up to 3,5% with the best results in Moscow (5.8% YTD Jul’20).

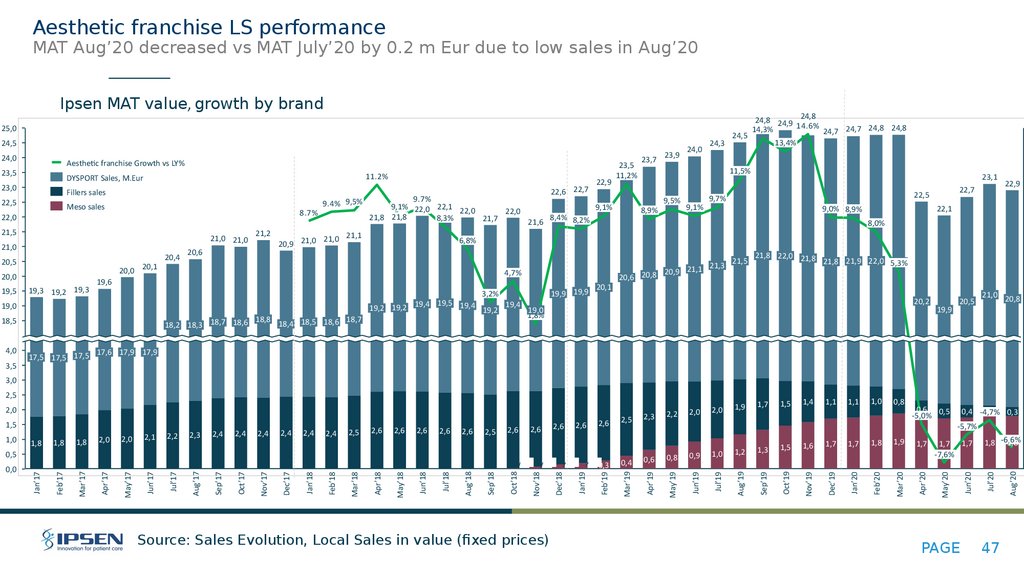

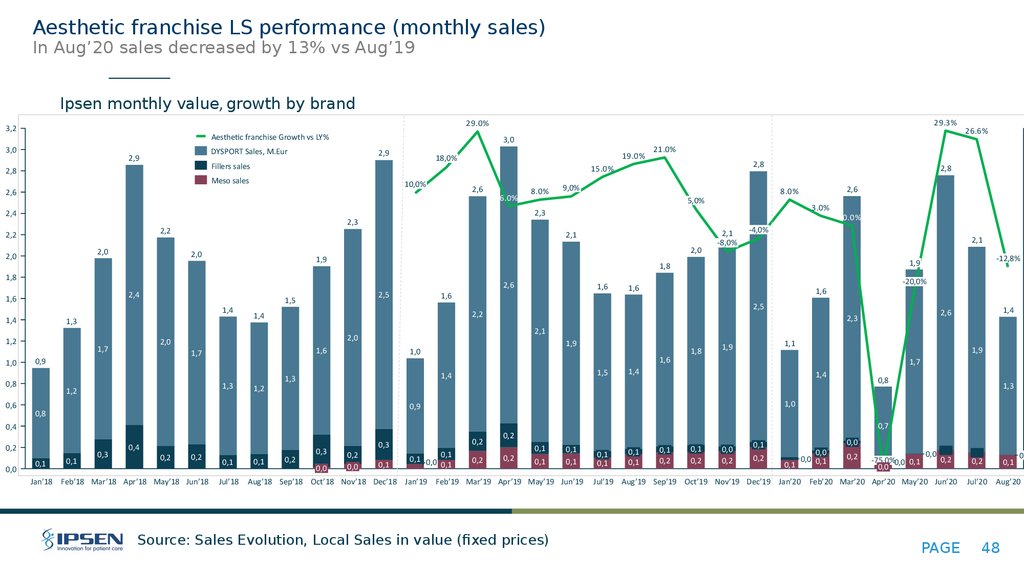

Aesthetics MAT Aug’20 LS (22.9 m Eur) is slightly lower vs MAT Jul’20 (23.1 m Eur) due to 13% decrease of sales in Aug’20 vs LY.

PAGE

2

3.

Ключевые выводыРынок в целом

С начала 2020 года российский фармацевтический рынок вырос на 14% в деньгах и сократился на -1,1% в упаковках. Основным

источником роста является канал госзакупок: госпитальные закупки выросли на 51%, федеральная льгота на 14% а региональная льгота

на 34%. Аптечные продажи выросли на 4.5% в деньгах и упали на 2.8% в упаковках. Все продукты (рецептурные и безрецептурные)

выросли на 5.6% в Sell-out (в денежном выражении) в Retail. Продажи рецепурных препаратов выросли на 3.6%, безрецептурных на 7.8%.

Ipsen занимает 54 позицию среди всех производителей на фарм рынке (МAT Jul’20)

Учитывая продажи эстетического подразделения, Ipsen входит в Топ 50 производителей.

Доля рынка Ipsen составила 0,39% от всех продаж лекарственных средств за последние 12 месяцев и продолжает расти.

CHC Июль 2020 (продажи в аптечные точки в денежном выражении)

Смекта растёт (+2%) быстрее рынка (-8%), наращивая долю рынка MAT Jul’20. Доля рынка Смекты составила 21,8% за первые 7 месяцев

2020. В мае-июле продажи на рынке смекты сократились по сравнению с прошлым годом и смекта следует за рынком. В Июле продажи

Смекты сократились на 19% vs LY однако рынок падает быстрее -29% vs LY

Препараты Ипсен для очистки кишечника перед колоноскопией упали на 20%, однако и рынок сократился на 14% (YTD Jul’20).

Танакан прирастает на 13% на сокращающемся рынке (-9% YTD Jul’20). Продажи во всех регионах растут быстрее по сравнению с рынком.

В 2020 году Танакан достиг доли рынка в 35,9% за первые 7 месяцев 2020.

Форлакс демонстрирует стабильно высокий прирост в 19% на растущем рынке (+6%), что позволяет наращивать долю рынка.

SC Июль 2020 (госпитальные закупки, DLO, RLO)

Продажи Диспорта в неврологии растут с начала года (+15%), однако в мае-июле продажи в Москве падают и падают быстрее рынка.

Суммарно продажи Dysport Neuro сократились на 10% в мае-июле и падают быстрее рынка.

Продажи Диферелина растут существенно опережая рынок: +82% против 15% для YTD Jul’20. Диферелин растет во всех регионах, однако

в мае-июле в центральном регионе продажи растут медленее рынка

Соматулин растёт быстрее рынка во всех регионах. Общий рост продаж Соматулина составил +101% за первые 7 месяцев 2020 и намного

опрежает рост рынка (+30%).

Доля рынка препарата Кабометикс в первые 7 месяцев 2020 году составила 3,5%. Самая высокая доля в столице (5,8% YTD Jul’20).

Данные от дистрибьюторов показывают восстановление продаж эстетического направления в Июне до уровня 23.1 млн Евро (MAT July’20),

PAGE

3

4.

Source: IQVIA highlights report July’20PAGE

4

5.

Source: IQVIA highlights report Jul’20PAGE

5

6.

Ipsen place on the marketIn MAT Jul’20 Ipsen overperformed Rompharm, Geropharm and gained 54 th place on the Russian Pharma Market.

Russian pharma market by corporations, % of total market value

2019

2018

2017

MAT Jul’20

53

CANONPHARMA

0.45%

53

OBNOVLENIE

0.46%

53

SUN PHARMA

0.39%

53

SUN PHARMA

0.40%

54

ATOLL OOO RF

0.44%

54

FARMASOFT

0.42%

54

SEVERNAYA ZVEZDA

0.39%

54

IPSEN

0.39%

55

FARMASOFT

0.42%

55

UNIDENTIFIED

0.42%

55

FARMASOFT

0.39%

55

GEROPHARM

0.38%

56

NIARMEDIK PLUS

0.42%

56

NIARMEDIK PLUS

0.41%

56

GEROPHARM

0.38%

56

FARMASOFT

0.38%

57

GROTEX RF

0.40%

57

INFAMED RF

0.40%

57

INFAMED RF 0.38%

57

ROMPHARM 0.35%

58

INFAMED RF

0.39%

58

IPSEN

0.39%

58

ROMPHARM 0.37%

58

OZON OOO 0.34%

59

SOPHARMA*

0.39%

59

UNIPHARM U.S.A 0.37%

59

IPSEN 0.36%

59

SOPHARMA 0.32%

60

BOSNALIJEK

0.38%

60

SOPHARMA* 0.36%

60

ALEXION PHARMA 0.36%

60

POLYSAN 0.32%

61

OZON OOO

0.38%

61

GEROPHARM 0.36%

61

NIARMEDIK PLUS 0.34%

61

GLENMARK 0.31%

62

IPSEN

0.37%

62

ROMPHARM 0.35%

62

OZON OOO 0.34%

62

PRO.MED.PRAHA 0.31%

Source: IQVIA Retail, Hospital, DLO, RLO in value - Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

PAGE

6

7.

Ipsen place on the market – with aestheticWith aesthetic business Ipsen is being in TOP-50.

Russian pharma market by corporations, % of total market value

2019

2018

2017

MAT Jul’20

41

BMS

0.60%

41

BIONORICA

0.60%

41

EVALAR 0.61%

41

SYNTEZ 0.58%

42

ALEXION

0.57%

42

GENERIUM

0.60%

42

ATOLL OOO RF 0.60%

42

BIONORICA 0.56%

43

VERTEX ZAO RF

0.57%

43

MATERIA MEDICA

0.59%

43

BIONORICA 0.59%

43

EVALAR 0.55%

44

MICROGEN

0.56%

44

RECORDATI*

0.56%

44

ELI LILLY 0.59%

44

CANONPHARMA PRODUC

0.54%

45

BIONORICA

0.56%

45

BMS

0.56%

45

AMGEN 0.55%

45OBNOVLENIE/RENEWAL

0.53%

46

RECORDATI*

0.56%

46

GROTEX RF

0.55%

46

RECORDATI* 0.55%

46

AMGEN 0.53%

47

OBOLENSK FP

0.55%

47

OBOLENSK FP

0.54%

47

SYNTEZ 0.51%

47

ELI LILLY 0.53%

48

MARATHON

0.55%

48

MARATHON

0.52%

48

CANONPHARMA 0.51%

48

MATERIA MEDICA 0.53%

49

ELI LILLY

0.55%

49

ATOLL OOO RF

0.51%

49

MATERIA MEDICA 0.51%

49

RECORDATI 0.51%

50

IPSEN

0.53%

50

IPSEN

0.50%

50

IPSEN 0.49%

50

IPSEN 0.49%

Source: IQVIA Retail, Hospital, DLO, RLO in value – with aesthetic LS in value and without Circadin sales in Retail prices

PAGE

7

8.

Ipsen MS evolutionJul 20 MAT Dynamic shows the improvement of SC market share. CHC share have declined in MAT Jul’20 vs MAT Jun’20

MAT Ipsen RU pharma market share, %

SC tender

0.387 0.390 0.389 0.383 0.383 0.379 0.378

0.4%

0.378 0.374 0.371 0.374 0.374 0.374 0.374 0.376 0.379 0.386

0.376 0.374 0.372 0.369

0.366 0.367 0.365 0.370

CHC

Ipsen

0.376 0.379 0.379 0.382

0.386 0.386

0.3%

0.251 0.251 0.248 0.247 0.247 0.249 0.246 0.246 0.247 0.248 0.248 0.248 0.245 0.243 0.243 0.243 0.242

0.238 0.239 0.237 0.237 0.234 0.230

0.229 0.228 0.228 0.226 0.226

0.2%

0.127 0.124 0.123 0.127 0.127 0.125 0.128 0.130 0.132

0.138 0.139 0.142 0.143 0.140 0.141 0.136 0.136 0.139 0.135 0.135 0.133 0.133 0.137 0.137 0.142

0.148 0.153 0.154

0.216 0.216 0.214

0.165 0.170 0.172

0.1%

0.0%

Jan’18

Mar’18

May’18

Jul’18

Sep’18

Nov’18

Jan’19

Mar’19

Source: IQVIA Retail, Hospital, DLO, RLO in retail value – Jul 2020 w/o Aesthetics and Circadin sales

CHC and SC BUs market share on the total pharma market

May’19

Jul’19

Sep’19

Nov’19

Jan’20

Mar’20

May’20

Jul’20

PAGE

8

9.

Ipsen vs Russian market growthIn Jul Ipsen is growing same as market with 4%. Market is growing mainly due to price effect

IPSEN

Total Growth, %

TOTAL PHARM MARKET

57%

60%

40%

20%

0%

-20%

-1%

-12%

6%

-5%

9%

-2%

15%

12%

7%

11%

Delta

14%

13%

19%

17%

14%

22%

37%

33%

33%

28%

8%

4%

20%

16%

7%

14%

15%

9%

20%

13%

9%

10%

9%

9%

20%

13%

-5%

-2%

15%

9%

14%

13%

13%

18%

3%

5%

4%

2%

7%

18%

6%

48%

17%

12%

12%

12%

0%

6%

2%

4%

4%

-40%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

40%

30%

20%

10%

0%

-10%

-20%

-30%

Volume effect, % 37%

12%

-3%

11%

4%

7%

6%

9%

18%

16%

12%

2%

29%

28%

26%

1%

6%

8%

8%

26%

18%

0%

9%

3%

-2%

16%

3%

2%

3%

1%

0%

-1%

2%

-9%

1%

-4%

-5%

-7%

2%

10%

-3%

-7%

-1%

-2%

-8%

-4%

2%

6%

8%

2%

-2% -12%

-21%

-4%

-6%

-9%

23%

-27%

-5%

-3%

-18% -17%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20May’20 Jun’20 Jul’20

Price effect, %

40%

20%

0%

-20%

-40%

3%

-13%

-9%

2%

-16% -11%

3%

1%

9%

-14%

7%

-23%

11%

1%

15%

4%

-5%

0%

4%

7%

11%

2%

9%

7%

11%

7%

17%

18%

10%

13%

-3%

14%

8%

-8%

31%

25%

13%

19%

12%

15%

16%

17%

10%

10%

-11%

16%

16%

0%

29%

24%

31%

21%

25%

32%

14%

39%

12%

24%

22%

5%

9%

-7%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

Source: IQVIA Retail, Hospital, DLO, RLO in value – Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

PAGE

9

10.

Consumer Healthcare vs Russian market growthIn Jul’20 CHC is below the market in Value (-10% Ipsen vs 4% Market) due to volume decrease.

CHC

40%

0%

-20%

Delta

Total Growth, %

60%

20%

TOTAL PHARM MARKET

10%

6%

4%

-12%

9%

7%

-3%

0%

13%

11%

48%

25%

13%

19%

4%

22%

17%

11%

4%

14%

8%

14%

16%

7%

7%

15%

-3%

20%

9%

8%

10%

9%

8%

20%

15%

11%

5%

22%

9%

14%

13%

13%

13%

-2%

-2%

-5%

-40%

18%

11%

18%

16%

17%

13%

37%

-12%

-8%

12%

0%

2%

4%

-13% -10%

-14%

-22% -11%

-33% -21%

-21%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

40%

30%

20%

10%

0%

-10%

-20%

-30%

Volume effect, % 26%

12%

-3%

11%

4%

7%

37%

9%

18%

16%

12%

6%

2%

29%

27%

9%

1%

6%

8%

25%

18%

8%

0%

3%

-2%

16%

3%

2%

3%

1%

0%

-1%

3%

-9%

1%

-4%

-5%

-7%

2%

11%

-3%

-7%

-1%

6%

-2%

-8%

-4%

1%

2%

-6%

-9%

7%

-4%

23%

2%

-2%

-3% -5%

-12%

-15% -16% -12%

-19% -17%

-21%

-27%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

30%

20%

10%

0%

-10%

-20%

-30%

Price effect, %

-3%

3%

-9%

-6%

2%

1%

9%

7%

11%

15%

4%

7%

11%

9%

11%

17%

4%

-12% -12%

-7%

-12%

-12%

-12% -10%

-15%

-2%

-2%

-5%

18%

8%

25%

10%

8%

14%

7%

13%

12%

15%

16%

3%

6%

4%

2%

6%

17%

1%

16%

5%

24%

14%

21%

6%

25%

14%

11%

-14% -14%

0%

12%

9%

7%

5%

7%

6% 2%

-2%

-7%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

Source: IQVIA Retail, Hospital, DLO, RLO in value – Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

PAGE

10

11.

Specialty Care vs Russian market growthIn Jul’20 SC is higher than market performance.

SC

Total Growth, %

125%

100%

75%

50%

25%

0%

-25%

-50%

TOTAL PHARM MARKET

112% 105%

50%

6%

-18%

-12% -22%

9%

1%

7%

40%

9%

11%

19%

13%

-3%

19%

75%

55%

22%

8%

4%

29%

14%

32%

7%

33%

20%

15%

27%

46%

10%

9%

9%

10%

-29%

-18%

39%

15%

20%

13%

9%

-17%

14%

-11%

6%

68%

18%

17%

13%

13%

86%

60%

-1%

48%

12%

18%

Delta

0%

28%

32%

2%

4%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20May’20 Jun’20 Jul’20

100%

75%

50%

25%

0%

-25%

-50%

Volume effect, %

-14%

-3%

-2%

4%

7%

6%

29%

24%

6%

2%

79%

75%

55%

-6%

8%

48%

8%

39%

1%

0%

20%

10%

3%

-2%

21%

3%

6%

50%

32%

3%

-11%

-1%

-9%

-25%

10%

-4%

-5%

7%

2%

11%

-3%

-1% -2%

-10% -18%

16%

-4%

2%

-2%

71%

82%

47%

23%

-6%

-4%

23%

-2%

-12%

-1%

-3%

-11%

-5%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

60%

40%

20%

0%

-20%

-40%

-60%

Price effect, %

41%

-5%

-9%

3%

-21%

2%

-5%

1%

-4%

9%

-15%

7%

4%

11%

11%

15%

7%

4%

-20%

0%

7%

11%

9%

22%

9%

12%

11%

17%

18%

10%

14%

25%

13%

-5%

15%

2%

-4%

-7%

12%

0%

24%

22%

16%

17%

-1%

-33%

16%

2%

24%

10%

39%

45%

14%

12%

23%

21%

25%

44%

29%

5%

9%

-24%

Jan’18 Feb’18 Mar’18 Apr’18 May’18 Jun’18 Jul’18 Aug’18 Sep’18 Oct’18 Nov’18 Dec’18 Jan’19 Feb’19 Mar’19 Apr’19 May’19 Jun’19 Jul’19 Aug’19 Sep’19 Oct’19 Nov’19 Dec’19 Jan’20 Feb’20 Mar’20 Apr’20 May’20 Jun’20 Jul’20

Source: IQVIA Retail, Hospital, DLO, RLO in value – Jul 2020 w/o Aesthetics and Circadin sales in Retail prices

PAGE

11

12.

Distribution Index dynamicPurchase index have recovered after drop in April. Distribution of Eziclen decreased from 12% in March to 8%

85%

78%

80%

78%

FORTRANS

75%

70%

70%

TANAKAN 30

64%

65%

TANAKAN 90

FORLAX 20 4G

60%

55%

FORLAX 20 10G

EZICLEN

44%

41%

45%

40%

43%

40%

44%

30%

27%

25%

21%21%21%

19%

16%

14%

20%

15%

10%

0%

4%

12%

10%9%10%

SMECTA RTU8

SMECTA RTU12

30%

7% 8%

Jan’17

Feb’17

Mar’17

Apr’17

May’17

Jun’17

Jul’17

Aug’17

Sep’17

Oct’17

Nov’17

Dec’17

Jan’18

Feb’18

Mar’18

Apr’18

May’18

Jun’18

Jul’18

Aug’18

Sep’18

Oct’18

Nov’18

Dec’18

Jan’19

Feb’19

Mar’19

Apr’19

May’19

Jun’19

Jul’19

Aug’19

Sep’19

Oct’19

Nov’19

Dec’19

Jan’20

Feb’20

Mar’20

Apr’20

May’20

Jun’20

Label

0%

2% 3%

6% 5% 6% 5% 6%

8% 8%

45%

39%

33%

35%

0%

53%

53%

50%

5%

SMECTA POWDER 10

Source: IQVIA Sell-in Retail Jul 2020; Purchase Index.

PAGE

12

13.

CHC Performance July’20 Sell In.Diarrhea segment is declining by 16% Jul’20 YTD, while Smecta declining only by 4%. Ipsen bowel cleansing is declining by 37% in last 3 month. Tanakan is growing by +13%

YTD and gaining market share from almost all players. Forlax is showing double-digit growth by +19% vs YTD Jul’19.

Ipsen Brand performance

– Growth %

Market size

MAT Jul M

euro@75

Smecta

Fortrans

Eziclen

Tanakan

Forlax

Ipsen sales MAT MAT’ Jul

vs LY

Jul

M euro@75

101

17

20

8

44

15

168

4

YTD’ Jul

vs LY

2%

-4%

-10%

-20%

MQ*Jul

vs LY

Jul

vs LY

MAT’ Jul

vs LY

-22%

-19%

-8%

-25%

-37%

6%

13%

3%

9%

20%

19%

18%

13%

Source: IQVIA Sell-in Retail July 2020 in value, Retail prices

*MQ – Moving Quarter (May-July)

MQ*’Jul

vs LY

Jul

vs LY

-16%

-28%

-29%

-1%

-14%

-33%

-4%

-6%

-9%

-9%

10%

6%

1%

-9%

13%

7%

YTD’ Jul

vs LY

Ipsen Brand

Market Share %

Delta Growth in ppt

Market performance

- Growth %

-17%

MAT’ Jul

vs LY

10%

-9%

YTD’ Jul

vs LY

12%

-6%

19%

14%

MQ*’Jul

vs LY

6%

-4%

Jul

vs LY

10%

-8%

12%

18%

17%

21%

MAT’

Jul

YTD’

Jul

MQ’

Jul

19.9%

21.8%

20.8%

20.2%

51.1%

51.2%

50.3%

48.9%

33.4%

35.9%

35.3%

36.6%

2.2%

2.3%

2.3%

2.3%

PAGE

Jul

13

14.

Smecta retail performanceSmecta gained +2.1 pts MS in MAT’Jul 20 vs LY but decreased in absolutes vs MAT Apr’20 due to market decline.

21,4

Smecta MS%

Smecta value, M.Eur

19,7

20

16,6

16,6

16,7

16,7

17,0

17,4

17,7

18,1

17,9

18,2

18,6

18,6

18,7

18,9

20,5

20,6

21,3

19,5%

19,1

20,9

19,6%

20,5

19,6%

19.9%

20,1

19,2%

18,9%

18,5%

18,5%

18,5%

18,6%

Dec’19

17

17,3

18,6

20,2

Nov’19

18

18,3

20,1

Oct’19

19

19,7

19,9

Sep’19

21

20,8

Jun’20

22

May’20

Ipsen MAT value, market share evolution by brand

18,7%

16

18,3%

15

17,8%

14

17,6%

13

17,2%

17,1%

11

16,9%

16,8%

16,8%

16,7%

17,0%

17,0%

17,0%

Mar’19

17,1%

Feb’19

17,1%

Jan’19

17,1%

Nov’18

17,2%

Oct’18

17,2%

Sep’18

12

17,4%

17,1%

16,8%

6

5

4

3

2

Source: IQVIA Sell-in Retail market in Retail prices

PAGE

14

Jul’20

Apr’20

Mar’20

Feb’20

Jan’20

Aug’19

Jul’19

Jun’19

May’19

Apr’19

Dec’18

Aug’18

Jul’18

Jun’18

May’18

Apr’18

Mar’18

Feb’18

0

Jan’18

1

15.

Smecta regional performance.In last 3 month sales of Smecta have decreased by 18%-30% decline, following the market. But delta growth are

positive for all regions.

Market size

MAT Jul M

euro@75

Moscow

Ipsen sales MAT

Jul M euro@75

5,0

28,7

Smecta performance

– Growth %

MAT’Jul

vs LY

4%

YTD’Jul

vs LY

5%

Diarrhea Market performance

- Growth %

MQ*’Jul

vs LY

-27%

MAT’Jul

vs LY

-5%

YTD’Jul

vs LY

MQ*’Jul

vs LY

Smecta

Market Share %

Delta Growth in ppt

MAT’Jul

vs LY

YTD’Jul

vs LY

-16%

-34%

9%

21%

-11%

-19%

-31%

12%

8%

MQ*’Jul

vs LY

7%

MAT’

Jul

YTD’

Jul

MQ*’

Jul

17.4%

21.2%

18.6%

19.9%

21.4%

20.6%

20.2%

22.3%

22.9%

North-West

8,0

1,6

South &

South Volga

4,9

1,0

5%

-6%

-19%

-10%

-21%

-34%

15%

15%

Ural

4,6

0,9

5%

-10%

-24%

-9%

-18%

-26%

14%

8%

2%

20.4%

20.7%

20.7%

Siberia &

Far East

4,4

0,9

0%

-10%

-21%

-15%

-23%

6%

5%

2%

21.3%

21.9%

22.2%

1%

-5%

-18%

-15%

-24%

11%

9%

21.1%

22.2%

21.5%

NonCovered

50,7

1%

10,7

-11%

-32%

-6%

-9%

-1%

15%

6%

Total Russia:

Source: IQVIA Retail Jul 2020 in value in Retail prices

*MQ – Moving Quarter (May-July)

19,9% 21,8% 20,8%

PAGE

15

16.

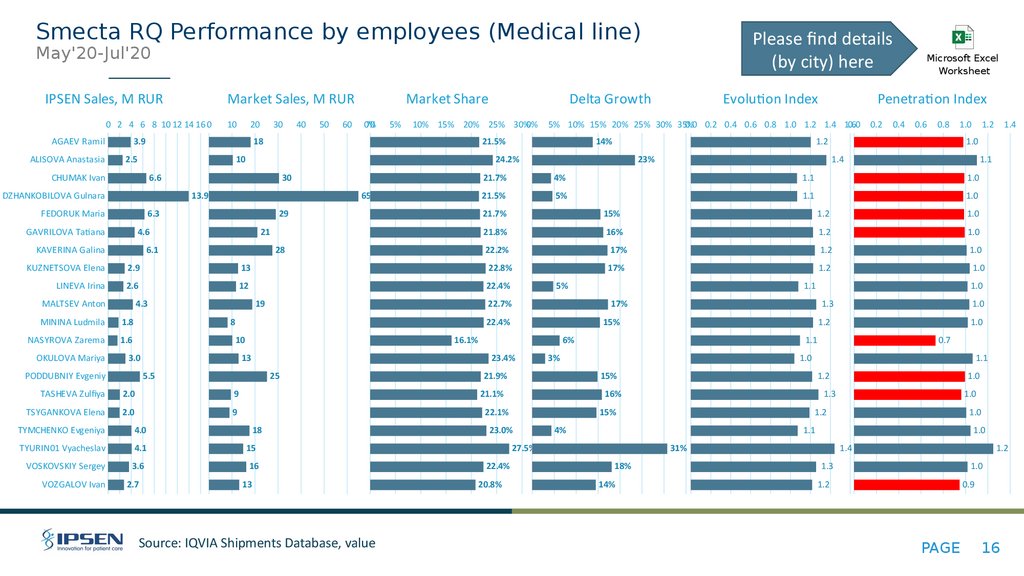

Smecta RQ Performance by employees (Medical line)Please find details

(by city) here

May'20-Jul'20

IPSEN Sales, M RUR

Market Sales, M RUR

0 2 4 6 8 10 12 14 16 0

AGAEV Ramil

ALISOVA Anastasia

10

20

3.9

30

50

60

0%

70

5%

DZHANKOBILOVA Gulnara

30

13.9

FEDORUK Maria

65

6.3

29

4.6

KAVERINA Galina

21

6.1

28

OKULOVA Mariya

3.0

PODDUBNIY Evgeniy

21.7%

15%

-

1.2

1.0

21.8%

16%

-

1.2

1.0

17%

-

1.2

1.0

17%

-

1.2

2.0

9

TSYGANKOVA Elena

2.0

9

TYMCHENKO Evgeniya

4.0

TYURIN01 Vyacheslav

4.1

VOSKOVSKIY Sergey

3.6

VOZGALOV Ivan

2.7

15%

6%

23.4%

21.9%

15%

16%

22.1%

23.0%

15

16

13

Source: IQVIA Shipments Database, value

15%

4%

27.5%

22.4%

20.8%

0.7

1.0

1.1

1.2

14%

-

1.0

1.3

1.0

1.2

1.0

1.1

1.0

31% 18%

1.0

1.1

-

-

1.0

1.2

-

-

1.0

1.3

-

-

1.0

1.1

-

-

3%

21.1%

18

17%

16.1%

25

TASHEVA Zulfiya

5%

22.4%

5.5

1.1

1.0

22.7%

13

1.4

1.1

22.4%

10

-

1.4

1.0

-

12

1.6

1.2

1.2

5%

2.6

NASYROVA Zarema

1.0

21.5%

LINEVA Irina

8

0.8

1.0

22.2%

19

0.6

1.1

22.8%

1.8

23%

0.4

-

13

MININA Ludmila

-

0.2

4%

2.9

4.3

Penetration Index

21.7%

KUZNETSOVA Elena

MALTSEV Anton

14%

24.2%

6.6

Evolution Index

5% 10% 15% 20% 25% 30% 35%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6

0.0

21.5%

10

CHUMAK Ivan

Delta Growth

10% 15% 20% 25% 30%0%

18

2.5

GAVRILOVA Tatiana

40

Market Share

Microsoft Excel

Worksheet

1.4

1.2

1.3

1.0

1.2

0.9

PAGE

16

17.

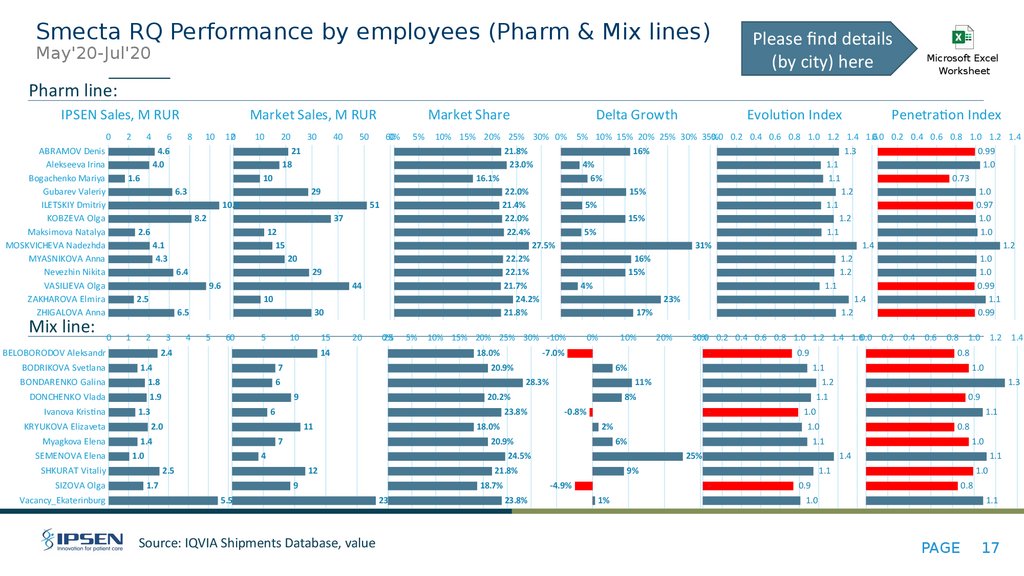

Smecta RQ Performance by employees (Pharm & Mix lines)Please find details

(by city) here

May'20-Jul'20

Microsoft Excel

Worksheet

Pharm line:

IPSEN Sales, M RUR

0

ABRAMOV Denis

Alekseeva Irina

Bogachenko Mariya

Gubarev Valeriy

ILETSKIY Dmitriy

KOBZEVA Olga

Maksimova Natalya

MOSKVICHEVA Nadezhda

MYASNIKOVA Anna

Nevezhin Nikita

VASILIEVA Olga

ZAKHAROVA Elmira

ZHIGALOVA Anna

Mix line:

2

4

6

30

40

50

5%

21.8%

23.0%

12

15

44

10

6.5

2

3

4

30

5

60

5

10

15

2.4

20

0%

25

14

1.4

5%

4%

23%

17%

0%

10%

-7.0%

7

11%

-0.8%

12

6%

5.5

Source: IQVIA Shipments Database, value

18.7%

23

9%

-4.9%

23.8%

0.73

1.0

0.97

1.0

1.0

1.1

1.2

1.1

1.4

1.2

1.2

1.2

1.0

1.0

0.99

1.1

0.99

1.1

1.4

1.2

0.9

0.8

1.0

1.2

1.3

1.1

0.9

1.0

1.1

1.0

-

0.8

1.1

1.0

1.4

-

0.8 1.0 1.2 1.4

1.1

-

1%

0.99

1.0

1.2

25% -

21.8%

9

1.3

1.1

1.1

-

-

24.5%

2.5

Penetration Index

30%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.60.0 0.2 0.4 0.6

2%

20.9%

-

-

8%

18.0%

4

20%

6%

23.8%

11

1.7

16%

15%

20.2%

6

2.0

SHKURAT Vitaliy

31%

28.3%

9

1.4

5%

20.9%

6

1.0

15%

10% 15% 20% 25% 30% -10%

18.0%

7

1.3

5%

22.2%

22.1%

21.7%

24.2%

21.8%

29

9.6

1

15%

27.5%

20

2.5

16%

22.0%

21.4%

22.0%

22.4%

37

6.4

Evolution Index

4%

6%

16.1%

51

4.1

4.3

Delta Growth

10% 15% 20% 25% 30% 0% 5% 10% 15% 20% 25% 30% 35%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4

29

2.6

0

60

0%

21

18

8.2

KRYUKOVA Elizaveta

Vacancy_Ekaterinburg

20

10.9

1.9

SIZOVA Olga

10

Market Share

10

1.8

Myagkova Elena

120

6.3

DONCHENKO Vlada

SEMENOVA Elena

10

1.6

BONDARENKO Galina

Ivanova Kristina

8

4.6

4.0

BELOBORODOV Aleksandr

BODRIKOVA Svetlana

Market Sales, M RUR

1.1

1.1

1.0

0.9

0.8

1.0

1.1

PAGE

17

18.

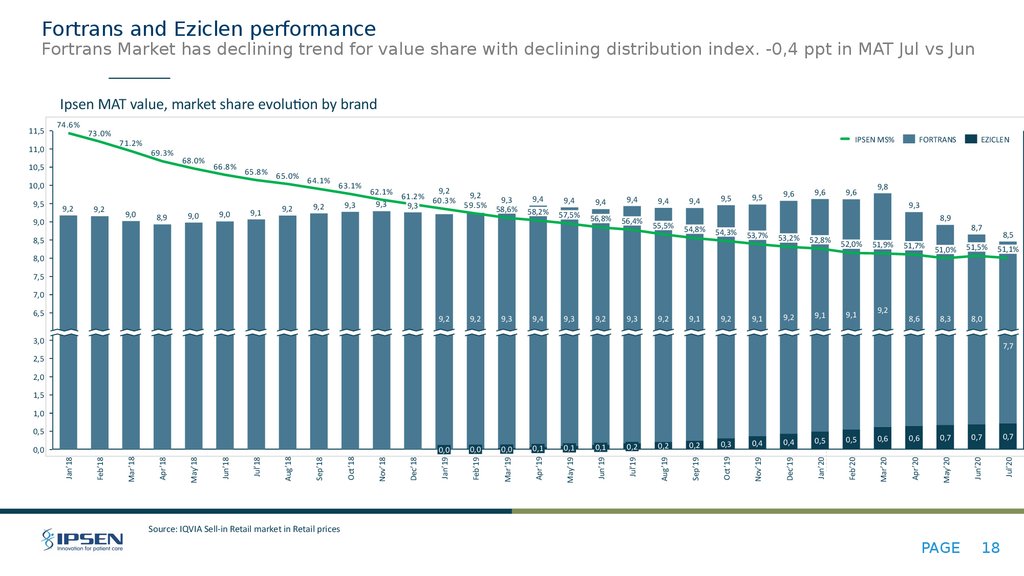

Fortrans and Eziclen performanceFortrans Market has declining trend for value share with declining distribution index. -0,4 ppt in MAT Jul vs Jun

Ipsen MAT value, market share evolution by brand

11,5

74.6%

73.0%

IPSEN MS%

71.2%

11,0

69.3%

10,5

68.0%

66.8%

65.8% 65.0%

10,0

9,5

9,2

9,2

9,0

9,0

8,9

9,0

9,0

9,1

9,2

64.1%

63.1%

9,2

9,3

9,2

62.1%

9,2

61.2%

60.3%

9,3

59.5%

9,3

9,3

58,6%

9,4

58,2%

9,4

9,4

9,4

57,5%

56,8%

56,4%

9,4

9,4

55,5%

54,8%

9,5

9,5

9,6

9,6

9,6

FORTRANS

EZICLEN

9,8

9,3

8,9

8,5

54,3%

53,7%

8,7

53,2%

52,8%

52,0%

51,9%

51,7%

51,0%

51,5%

8,6

8,3

8,0

8,5

51,1%

8,0

7,5

7,0

6,5

9,2

9,2

9,3

9,4

9,3

9,2

9,3

9,2

9,1

9,2

9,1

9,2

9,1

9,1

9,2

3,0

7,7

2,5

2,0

1,5

0,4

0,4

Mar’19

Apr’19

May’19

Jun’19

Jul’19

Aug’19

Sep’19

Oct’19

Nov’19

Dec’19

Jan’20

Feb’20

Mar’20

Apr’20

0,7

0,7

0,7

Jul’20

0,3

Jun’20

0,0

0,2

Feb’19

Dec’18

Nov’18

Oct’18

Sep’18

Aug’18

Jul’18

Jun’18

May’18

Apr’18

Mar’18

Feb’18

Jan’18

0,0

0,2

0,6

0,1

0,2

0,6

0,1

0,1

0,5

0,0

0,5

0,0

Jan’19

0,5

May’20

1,0

Source: IQVIA Sell-in Retail market in Retail prices

PAGE

18

19.

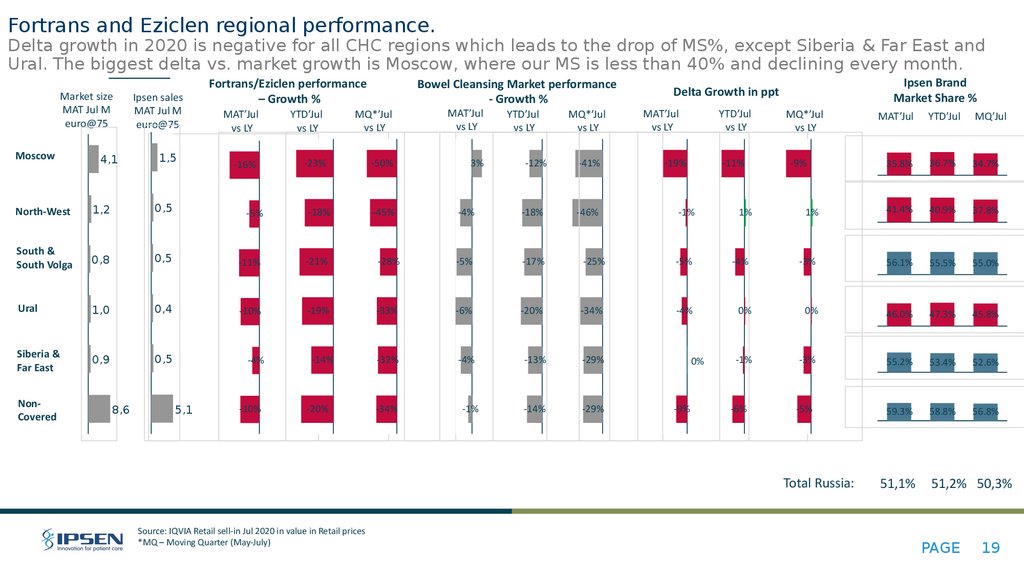

Fortrans and Eziclen regional performance.Delta growth in 2020 is negative for all CHC regions which leads to the drop of MS%, except Siberia & Far East and

Ural. The biggest delta vs. market growth is Moscow, where our MS is less than 40% and declining every month.

Market size

MAT Jul M

euro@75

Moscow

4,1

Ipsen sales

MAT Jul M

euro@75

1,5

Fortrans/Eziclen performance

– Growth %

MAT’Jul

vs LY

-16%

YTD’Jul

vs LY

1,2

0,5

-5%

-18%

South &

South Volga

0,8

0,5

-11%

-21%

Ural

1,0

0,4

-10%

-19%

Siberia &

Far East

0,9

0,5

-4%

NonCovered

8,6

5,1

-10%

MQ*’Jul

vs LY

MAT’Jul

vs LY

-50%

3%

-23%

North-West

Bowel Cleansing Market performance

- Growth %

-14%

-20%

-45%

YTD’Jul

vs LY

-12%

MQ*’Jul

vs LY

-41%

MAT’Jul

vs LY

YTD’Jul

vs LY

-19%

-18%

-28%

-5%

-17%

-25%

-5%

-33%

-6%

-20%

-34%

-4%

-32%

-4%

-1%

-13%

-29%

-14%

-29%

-1%

0%

-9%

MQ*’Jul

vs LY

YTD’Jul

MQ’Jul

35.8%

36.7%

34.7%

1%

41.4%

40.9%

37.8%

-3%

56.1%

55.5%

55.0%

0%

0%

46.0%

47.3%

45.8%

-1%

-3%

55.2%

53.4%

52.6%

-5%

59.3%

58.8%

56.8%

-11%

-4%

-34%

-46%

Ipsen Brand

Market Share %

Delta Growth in ppt

1%

-4%

-6%

-9%

Total Russia:

Source: IQVIA Retail sell-in Jul 2020 in value in Retail prices

*MQ – Moving Quarter (May-July)

MAT’Jul

51,1%

51,2% 50,3%

PAGE

19

20.

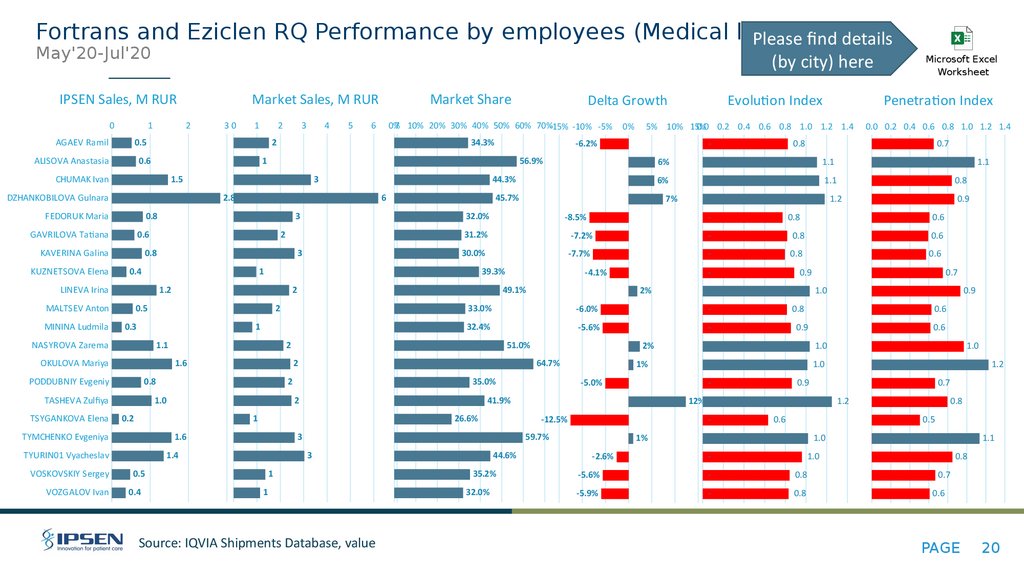

Fortrans and Eziclen RQ Performance by employees (Medical line)Please find details

May'20-Jul'20

(by city) here

IPSEN Sales, M RUR

0

1

AGAEV Ramil

Market Sales, M RUR

2

0.6

5

6

3

3

0.8

3

1

1.1

OKULOVA Mariya

PODDUBNIY Evgeniy

TASHEVA Zulfiya

1.0

TYMCHENKO Evgeniya

TYURIN01 Vyacheslav

0.4

-4.1%

2%

-6.0%

-

32.4%

-5.6%

2%

1%

-5.0%

35.2%

32.0%

0.7

1.0

0.6

0.9

0.6

-

1.0

-

1.0

1%

-2.6%

1.0

1.2

0.9

0.7

12% -

0.9

0.8

-

-12.5%

44.6%

0.9

-

33.0%

59.7%

Source: IQVIA Shipments Database, value

0.6

0.6

41.9%

1

0.8

0.9

0.8

35.0%

1

1.2

-

3

0.5

-

0.8

-7.7%

3

1.4

1.1

30.0%

26.6%

1.6

-

0.6

64.7%

1

6%

1.1

0.8

2

0.2

1.1

-

51.0%

2

-

-7.2%

2

0.8

0.7

31.2%

2

1.6

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4

0.8

-

49.1%

2

NASYROVA Zarema

-8.5%

2

0.5

Penetration Index

6%

7%

39.3%

1.2

0.3

-

45.7%

1

LINEVA Irina

Evolution Index

5% 10% 15%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4

-6.2%

32.0%

2

0.4

0%

44.3%

6

0.6

MALTSEV Anton

0%

7 10% 20% 30% 40% 50% 60% 70%-15% -10% -5%

56.9%

0.8

KAVERINA Galina

Delta Growth

34.3%

2.8

GAVRILOVA Tatiana

VOZGALOV Ivan

4

1.5

FEDORUK Maria

VOSKOVSKIY Sergey

3

1

DZHANKOBILOVA Gulnara

TSYGANKOVA Elena

2

2

CHUMAK Ivan

MININA Ludmila

1

0.5

ALISOVA Anastasia

KUZNETSOVA Elena

30

Market Share

Microsoft Excel

Worksheet

1.2

0.6

0.8

0.5

-

1.0

-

1.1

1.0

-5.6%

-

0.8

-5.9%

-

0.8

0.8

0.7

0.6

PAGE

20

21.

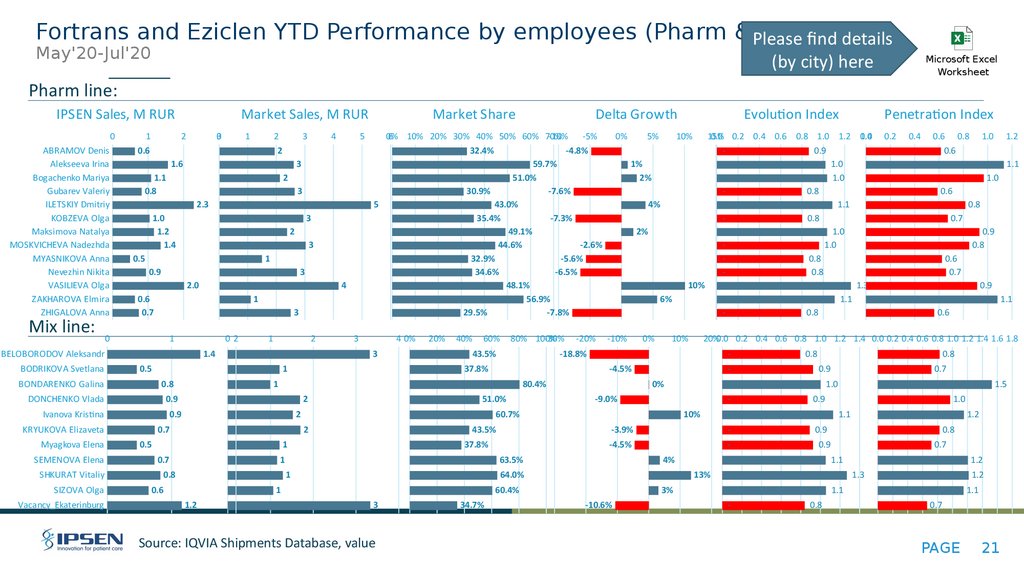

Fortrans and Eziclen YTD Performance by employees (Pharm & PleaseMix lines)

find details

May'20-Jul'20

(by city) here

Microsoft Excel

Worksheet

Pharm line:

IPSEN Sales, M RUR

0

ABRAMOV Denis

Alekseeva Irina

Bogachenko Mariya

Gubarev Valeriy

ILETSKIY Dmitriy

KOBZEVA Olga

Maksimova Natalya

MOSKVICHEVA Nadezhda

MYASNIKOVA Anna

Nevezhin Nikita

VASILIEVA Olga

ZAKHAROVA Elmira

ZHIGALOVA Anna

Mix line:

1

Market Sales, M RUR

2

0

3

Vacancy_Ekaterinburg

0%

6 10% 20% 30% 40% 50% 60% 70%

-10%

3

5

1.0

1.2

1.4

3

2

3

1

0.9

3

2.0

4

0.6

0.7

1

3

0

1

02

1

2

1.4

3

4 0%

3

0.5

1

0.8

20%

40%

60%

80% 100%

-30%

43.5%

37.8%

2

0.9

0.7

-20%

4%

2%

10%

6%

-10%

43.5%

1

37.8%

1

0.8

0%

10%

3

Source: IQVIA Shipments Database, value

34.7%

0.8

1.0

1.2

0.6

1.1

1.0

0.8

0.6

1.1

0.8

0.8

0.7

1.0

1.0

0.9

0.8

0.8

0.8

0.6

0.7

1.3

0.9

1.1

1.1

0.8

-

0.6

0.8

0.8

0.9

-3.9%

4%

1.5

0.9

1.0

1.1

0.8

0.9

0.7

1.1

-

1.2

1.3

-

1.2

0.9

13%

0.7

1.0

-

-4.5%

-10.6%

0.6

1.0

1.0

10%

3%

0.4

0.9

-

-9.0%

60.4%

0.2

20%0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8

0%

64.0%

1

-

-

63.5%

1

Penetration Index

15%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4

0.0

1%

2%

60.7%

2

0.5

10%

-4.5%

51.0%

2

1.2

5%

80.4%

0.9

0.6

0%

Evolution Index

-18.8%

1

0.7

-5%

-4.8%

59.7%

51.0%

30.9%

-7.6%

43.0%

35.4%

-7.3%

49.1%

44.6%

-2.6%

32.9%

-5.6%

34.6%

-6.5%

48.1%

56.9%

29.5%

-7.8%

2

0.5

Delta Growth

32.4%

2.3

KRYUKOVA Elizaveta

SIZOVA Olga

5

3

1.1

0.8

Ivanova Kristina

SHKURAT Vitaliy

4

2

DONCHENKO Vlada

SEMENOVA Elena

3

1.6

BONDARENKO Galina

Myagkova Elena

2

0.6

BELOBORODOV Aleksandr

BODRIKOVA Svetlana

1

Market Share

1.2

1.1

0.8

1.1

0.7

PAGE

21

22.

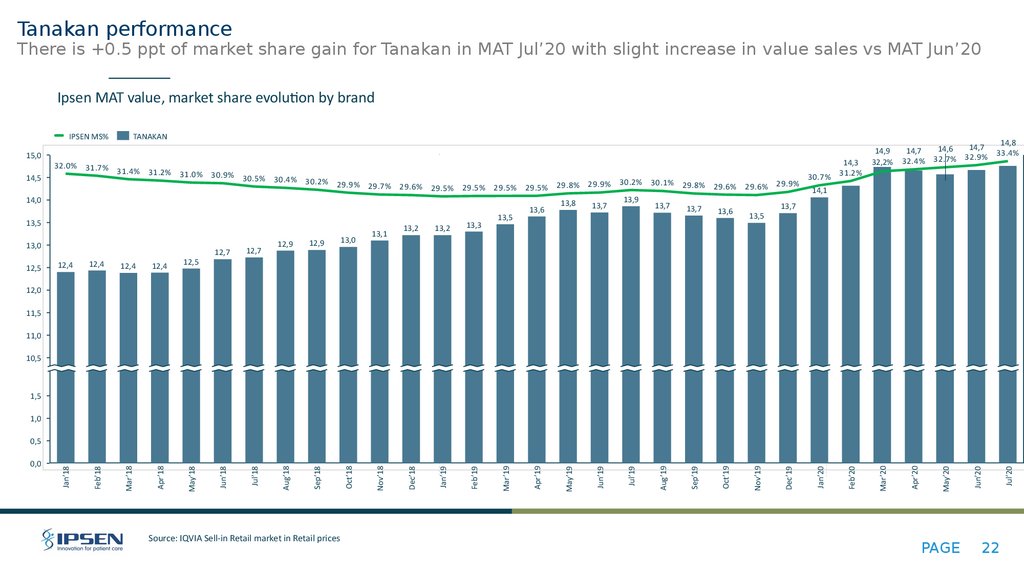

Tanakan performanceThere is +0.5 ppt of market share gain for Tanakan in MAT Jul’20 with slight increase in value sales vs MAT Jun’20

Ipsen MAT value, market share evolution by brand

15,0

14,5

31.4%

31.2%

31.0%

30.9% 30.5%

30.4% 30.2%

29.9% 29.7%

29.6%

29.5% 29.5%

29.5%

29.5%

Oct’18

13,1

13,2

Feb’19

13,0

13,2

13,3

Jan’19

12,9

Sep’18

12,7

12,9

Aug’18

12,7

Jul’18

Mar’18

12,4

May’18

12,4

12,5

Apr’18

12,4

Feb’18

12,5

12,4

Jan’18

13,0

Jun’18

13,5

Dec’18

14,0

13,5

13,6

29.8% 29.9%

13,8

13,7

30.2%

13,9

30.1%

13,7

29.8%

29.6%

13,7

13,6

Oct’19

31.7%

Sep’19

32.0%

29.6%

29.9%

30.7%

14,3

31.2%

14,9

32,2%

14,7

32.4%

Apr’20

TANAKAN

Mar’20

IPSEN MS%

14,7

14,6

32.7% 32.9%

14,8

33.4%

14,1

13,7

13,5

12,0

11,5

11,0

10,5

1,5

1,0

Source: IQVIA Sell-in Retail market in Retail prices

PAGE

22

Jul’20

Jun’20

May’20

Feb’20

Jan’20

Dec’19

Nov’19

Aug’19

Jul’19

Jun’19

May’19

Apr’19

Mar’19

0,0

Nov’18

0,5

23.

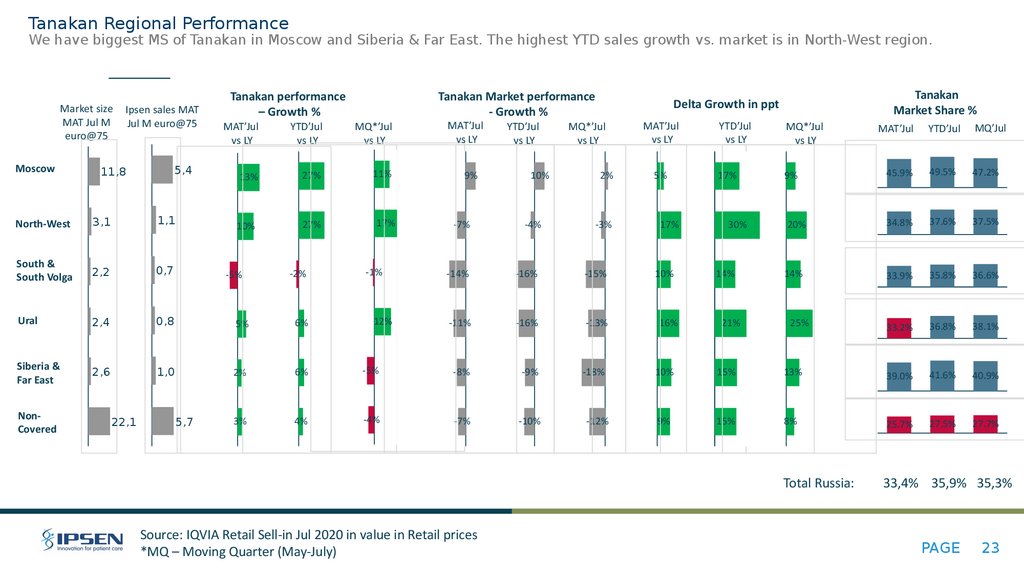

Tanakan Regional PerformanceWe have biggest MS of Tanakan in Moscow and Siberia & Far East. The highest YTD sales growth vs. market is in North-West region.

Market size

MAT Jul M

euro@75

Moscow

Ipsen sales MAT

Jul M euro@75

5,4

11,8

Tanakan performance

– Growth %

MAT’Jul

vs LY

YTD’Jul

vs LY

MQ*’Jul

vs LY

13%

27%

11%

10%

27%

North-West

3,1

1,1

South &

South Volga

2,2

0,7

Ural

2,4

0,8

5%

6%

Siberia &

Far East

2,6

1,0

2%

6%

3%

4%

NonCovered

22,1

-5%

5,7

Tanakan Market performance

- Growth %

-2%

17%

-1%

MAT’Jul

vs LY

9%

-7%

YTD’Jul

vs LY

10%

-4%

MQ*’Jul

vs LY

2%

-3%

-14%

-16%

-15%

-11%

-16%

-13%

-5%

-8%

-9%

-18%

-4%

-7%

-10%

12%

Source: IQVIA Retail Sell-in Jul 2020 in value in Retail prices

*MQ – Moving Quarter (May-July)

Tanakan

Market Share %

Delta Growth in ppt

-12%

MAT’Jul

vs LY

5%

17%

10%

16%

YTD’Jul

vs LY

MQ*’Jul

vs LY

17%

9%

30%

14%

21%

YTD’Jul

MQ’Jul

45.9%

49.5%

47.2%

20%

34.8%

37.6%

37.5%

14%

33.9%

35.8%

36.6%

33.2%

36.8%

38.1%

25%

MAT’Jul

10%

15%

13%

39.0%

41.6%

40.9%

9%

15%

8%

25.7%

27.5%

27.7%

Total Russia:

33,4% 35,9% 35,3%

PAGE

23

24.

Tanakan RQ Performance by employees (Medical line)Please find details

(by city) here

May'20-Jul'20

IPSEN Sales, M RUR

0

2

4

6

AGAEV Ramil

ALISOVA Anastasia

Market Sales, M RUR

8 10 12 014

10

5.4

20

25

30

49.6%

15

12.2

FEDORUK Maria

MALTSEV Anton

10

2.6

NASYROVA Zarema

2.7

7

OKULOVA Mariya

2.8

7

5

PODDUBNIY Evgeniy

48.8%

TSYGANKOVA Elena

2.6

TYMCHENKO Evgeniya

6.5

14

4.7

VOSKOVSKIY Sergey

4.1

VOZGALOV Ivan

3.9

-

-0.6%

1%

11

9

8%

8

Source: IQVIA Shipments Database, value

1%

11%

43.0%

4%

1.0

1.4

1.1

1.5

-

1.0

1.4

1.2

-

1.3

1.2

1.4

1.3

1.1

1.0

1.4

1.2

-

-

1.1

1.1

-

8%

1.4

1.4

23%

1.4

1.0

-

46.8%

48.3%

1.4

-

26%

45.4%

1.0

23%

49.0%

46.0%

1.1

1.0

37.4%

6

1.2

-

39.2%

7

-

4%

19%

15

1.1

1.0

35.8%

7.4

2.7

48.8%

1.0

1.2

-

6%

1.5

1.1

3%

-1.9%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8

-

-

52.3%

11

MININA Ludmila

TASHEVA Zulfiya

47.0%

46.2%

5.5

-0.4%

48.4%

7

5.0

17%

47.9%

15

3.2

Penetration Index

1.0

18%

37.7%

12

7.1

LINEVA Irina

11%

17

5.6

KAVERINA Galina

-

39.0%

32

8.0

GAVRILOVA Tatiana

3%

34.5%

5.9

Evolution Index

0%

35 10% 20% 30% 40% 50% 60% -5% 0% 5% 10% 15% 20% 25% 30% 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6

6

DZHANKOBILOVA Gulnara

TYURIN01 Vyacheslav

15

Delta Growth

11

2.0

CHUMAK Ivan

KUZNETSOVA Elena

5

Market Share

Microsoft Excel

Worksheet

1.4

1.3

1.3

1.0

1.3

1.1

1.4

PAGE

24

25.

Tanakan RQ Performance by employees (Pharm & Mix lines)May'20-Jul'20

Please find details

(by city) here

Pharm line:

IPSEN Sales, M RUR

0

2

ABRAMOV Denis

Alekseeva Irina

Bogachenko Mariya

Gubarev Valeriy

ILETSKIY Dmitriy

KOBZEVA Olga

Maksimova Natalya

MOSKVICHEVA Nadezhda

MYASNIKOVA Anna

Nevezhin Nikita

VASILIEVA Olga

ZAKHAROVA Elmira

ZHIGALOVA Anna

4

6

Market Sales, M RUR

8

6.2

6.5

12

0

5

10

2.7

15

13

14

20

22

15

8.3

22

2.0

6

8.4

4

3.2

30%

40%

50% 60%

-5%

48.1%

46.8%

17

5 06

2

4

1.2

6

4

2.1

1.1

0.7

1.5

1.2

0.7

1.7

1.2

5

5

3

5

4

2

6

4

5.2

8

10

9

12

38.2%

48.6%

52.3%

43.0%

45.5%

45.8%

37.9%

34.5%

48.2%

10

11

11

3

20%

47.7%-2.9%

26

6.8

2

10%

35.8%

5.0

4.7

5.1

1

30

0%

Delta Growth

16

9.7

10.5

0

25

7

7.8

Mix line:

BELOBORODOV Aleksandr

BODRIKOVA Svetlana

BONDARENKO Galina

DONCHENKO Vlada

Ivanova Kristina

KRYUKOVA Elizaveta

Myagkova Elena

SEMENOVA Elena

SHKURAT Vitaliy

SIZOVA Olga

Vacancy_Ekaterinburg

10

Market Share

16

0% 5% 10%15%20%25%30%35%40%45%50%

36.3%

29.8%

43.9%

23.4%

23.1%

-1.0%

28.8%

29.8%

29.7%

29.2%

30.2%

13

38.5%

0%

5%

10% 15% 20% 25%

0.0 0.2

8%

11%

19%

18%

1%

6%

23%8%

5%

17%

11%

7%

-

14

Source: IQVIA Shipments Database, value

Evolution Index

22%

6%

1%

4%

7%

6%

4%

3%

13%

0.4

0.6

0.8

Microsoft Excel

Worksheet

Penetration Index

1.0

1.2 0.0

1.4 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8

1.1

1.4

1.2

1.4

1.2

1.1

1.0

1.4

1.2

1.1

1.0

1.4

1.1

1.5

1.3

1.3

1.1

1.3

1.1

1.3

1.2

1.1

1.1

1.0

1.1

1.4

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.60.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4

1.3

1.1

1.1

0.9

1.0

1.3

1.0

0.7

1.0

0.7

1.1

0.8

1.1

0.9

1.4

0.9

35% 1.1

0.9

1.0

0.9

1.2

1.1

PAGE

25

26.

Forlax Retail performanceForlax is showing double-digit growth on slightly growing market thanks to retail support via pharmacy chains.

3,3

3,4

2.2%

3,7

Jul’20

3,3

2.1%

3,5

3,6

2.1%

Jun’20

2.1%

2.1%

3,5

May’20

2.0%

Feb’20

3,0

2.0%

Jan’20

2,7

3,0

3,1

3,2

3,1

3,2

3,0

Nov’19

2,3

2,6

2,7

2,8

2,7

2,9

1.9%

Oct’19

Mar’18

2,3

2,5

2,6

2,9

1.9%

2.0%

2.0%

Sep’19

2,2

2,4

Jul’18

2,2

Feb’18

2,2

2,1

Jan’18

2,4

2,4

Jun’18

2,6

1.7%

1.9%

1.9%

Jun’19

1.6%

1.7%

1.8%

1.9%

May’19

1.6%

1.7%

1.8%

Feb’19

1.6%

1.7%

1.8%

Jan’19

2,8

1.7%

1.8%

Dec’18

3,0

1.8%

Nov’18

3,2

1.9%

Apr’19

3,4

2.0%

2.0%

Aug’19

FORLAX Sales, M.Eur

Jul’19

3,6

Dec’19

FORLAX MS%

2.1%

3,5

Apr’20

3,8

Mar’20

Ipsen MAT value, market share evolution by brand

2,0

1,8

1,6

1,4

1,2

1,0

0,8

0,6

0,4

Mar’19

Oct’18

Sep’18

Aug’18

May’18

0,0

Apr’18

0,2

Source: Smecta, Tanakan, Forlax - IQVIA Sell-in Retail market in Retail prices

Fortrans, Eziclen – IQVIA Sell-in Retail and Hospital market in Retail prices

PAGE

26

27.

Forlax Regional PerformanceForlax is growing much faster than market and showing the double-digit growth in almost all CHC regions.

Market size

MAT Jul M

euro@75

Moscow

Ipsen sales MAT

Jul M

euro@75

43,9

0,9

North-West

11,8

0,3

South &

South Volga

9,1

0,2

Ural

7,6

0,2

Siberia &

Far East

8,1

0,3

NonCovered

87,5

Forlax performance

– Growth %

MAT’Jul

vs LY

25%

10%

20%

4%

16%

1,8

22%

YTD’Jul

vs LY

28%

6%

16%

5%

17%

20%

Forlax Market performance

- Growth %

MQ*’Jul

vs LY

MAT’Jul

vs LY

14%

12%

0%

25%

6%

-1%

YTD’Jul

vs LY

11%

3%

-6%

MQ*’Jul

vs LY

MAT’Jul

vs LY

1%

-3%

13%

4%

-11%

-3%

22%

YTD’Jul

vs LY

MQ*’Jul

vs LY

17%

13%

2.1%

2.3%

2.0%

3%

2.2%

2.3%

2.2%

2.6%

2.8%

2.9%

2.8%

2.8%

3.3%

3.2%

3.3%

3.5%

2.0%

2.1%

2.3%

2,2%

2,3%

2,3%

3%

22%

5%

37%

9%

4%

16%

5%

5%

0%

11%

12%

16%

6%

5%

3%

15%

14%

21%

23%

1%

Forlax

Market Share %

Delta Growth in ppt

0%

12%

Total Russia:

Source: IQVIA Retail, value in Retail prices

*MQ – Moving Quarter (May-July)

MAT’Jul

YTD’Jul

PAGE

MQ Jul

27

28.

Forlax RQ Performance by employees (Medical line)Please find details

(by city) here

May'20-Jul'20

IPSEN Sales, M RUR

0

1

AGAEV Ramil

2

40

100 120 140

0%

61

72

1.0

51

1.3

30

1.2

MALTSEV Anton

PODDUBNIY Evgeniy

22

TSYGANKOVA Elena

0.5

22

TYMCHENKO Evgeniya

1.3

TYURIN01 Vyacheslav

1.1

0.8

0.6

-

-9.3%

2%

1.7%

28%

-8.0%

-6.3%

1.9%

41

3.3%

33

41

34

Source: IQVIA Shipments Database, value

1.9%

1.7%

0.9

1.0

0.9

0.9

-

0.9

0.8

1.0

-4.5%

0.9

-

1.3

1.8

0.9

0.7

0.9

0.7

-

1.2

1.3

0.9

1.6

1.0

0.8

-

1.2

14%

-

1.1

-

1.1

53% -7.6%

0.9

16%

8%

3.5%

0.9

-

-

2.0%

1.2

0.8

2%

2.2%

1.1

0.9

14%

0.9

-

-

-14.9%

3.7%

1.0

-

2.9%

65

0.4

-

-10.9%

Penetration Index

60%0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0

-

-7.8%

1.9%

Evolution Index

-

-2.1%

1.6%

1.3

40%

-10.6%

1.9%

31

TASHEVA Zulfiya

20%

12%

2.1%

20

1.1

0%

4.2%

21

0.6

5%-20%

2%

29

48

0.3

4%

2.1%

0.8

OKULOVA Mariya

3%

2.0%

66

0.6

LINEVA Irina

2%

2.0%

127

1.3

KAVERINA Galina

1%

2.1%

2.7

GAVRILOVA Tatiana

VOZGALOV Ivan

80

Delta Growth

2.7%

1.3

FEDORUK Maria

VOSKOVSKIY Sergey

60

27

DZHANKOBILOVA Gulnara

NASYROVA Zarema

20

Market Share

46

0.7

CHUMAK Ivan

MININA Ludmila

30

1.0

ALISOVA Anastasia

KUZNETSOVA Elena

Market Sales, M RUR

Microsoft Excel

Worksheet

0.9

0.9

1.4

1.7

-

0.9

-

1.0

1.5

0.8

0.8

PAGE

28

29.

Forlax Rolling RQ by employees (Pharm & Mix lines)Please find details

(by city) here

May'20-Jul'20

Microsoft Excel

Worksheet

Pharm line:

IPSEN Sales, M RUR

0

ABRAMOV Denis

Alekseeva Irina

Bogachenko Mariya

Gubarev Valeriy

ILETSKIY Dmitriy

KOBZEVA Olga

Maksimova Natalya

MOSKVICHEVA Nadezhda

MYASNIKOVA Anna

Nevezhin Nikita

VASILIEVA Olga

ZAKHAROVA Elmira

ZHIGALOVA Anna

1

Market Sales, M RUR

2

30

20

40

1.0

60

80

100

Market Share

120

0%

1%

55

1.3

2%

3%

1.1

68

2.1

2.0

4%

4.2%

28%

3.5%

49

1.9%

2.2%

2.2%

67

1.9

88

27

1.3

8%

14%

-11.9%

-5.0%

29

33

-9.7%

9%

-5.2%

2.7%

76

12%

1.8%

Evolution Index

Penetration Index

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 0.00.20.40.60.81.01.21.41.61.82.0

-6.9%

1.7%

2.0%

2.1%

101

95

0.7

5%

3.3%

2.9%

20

1.2

1.1

0.9

1.4

4%

1.8%

41

0.6

Delta Growth

-15.6%

53%-

0.9

0.8

1.1

1.2

1.4

1.3

0.9

1.0

1.0

0.7

0.9

0.9

1.3

1.8

1.7

1.5

0.9

0.8

1.0

0.9

1.1

0.9

1.1

0.9

1.2

0.8

Mix line:

IPSEN Sales, M RUR

0

Market Sales, M RUR

1

BELOBORODOV Aleksandr

02 5

1.3

0.3

BONDARENKO Galina

Ivanova Kristina

Myagkova Elena

SHKURAT Vitaliy

Vacancy_Ekaterinburg

0.7

0.5

0.4

0.7

0.3

0.5

0.7

0.7

1.4

10 15 20 25 30 35 40 45 0%

50

32

16

18

23

13

21

16

11

36

20

44

Source: IQVIA Shipments Database, value

Market Share

1%

2%

3%

Delta Growth

4%

5%

-40%

-20%

0%

4.1%

2.1%

-27.4%

4.0%

2.3%

2.8%

-6.1%

3.5%

2.1%

-27.4%

4.8%

1.9%

3.6%

3.2%

-1.2%

20% 40%

17%

Evolution Index

60%

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6

0.0

1.2

0.7

20%

1.2

26%

1.3

0.9

3%

1.0

0.7

30%

1.3

36%

1.4

9%

1.1

1.0

Penetration Index

0.5

1.0

1.5

2.0

1.8

2.5

0.9

1.8

1.0

1.2

1.5

0.9

2.1

0.8

1.6

1.4

PAGE

29

30.

SC Performance Jul’20All brands are demonstrating growth above the market in YTD vs LY. Cabometyx achieved 3,5% MS in Jul’20 YTD.

Market

Market size

MAT Jul M

euro@75

Dysport

neuro

Ipsen sales

MAT Jul M

euro

19,2

Somatuline

50,9

Diphereline

44,7

Cabometyx

Ipsen Brand performance

– Growth %

MAT Jul'20

vs LY

11,1

0%

12,1

67%

9,5

152,5

50%

YTD Jul'20

vs LY

15%

101%

82%

3,8

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

MQ*’Jul'20

vs LY

-10%

70%

48%

Market performance

- Growth %

MAT Jul’20

vs LY

8%

24%

11%

18%

YTD Jul'20

vs LY

MQ* Jul'20

vs LY

16%

-2%

30%

15%

-2%

Delta Growth in ppt

MAT Jul'20

vs LY

-7%

YTD Jul'20

vs LY

-1%

16%

43%

71%

15%

39%

67%

MQ* Jul'20

vs LY

-7%

54%

33%

Ipsen Brand

Market Share %

MQ*

Jul'20

MAT’

Jul'20

YTD’

Jul'20

57.9%

59.3%

57.9%

23.8%

25.2%

26.2%

21.3%

21.4%

20.9%

2.5%

3.5%

4.0%

-33%

PAGE

30

31.

Dysport Neuro performanceJuly’20 MAT sales decreased vs June’20 MAT sales by 100 k EUR and lost 1 ppt of share.

Ipsen MAT value, market share evolution by brand

11,5

11,0

71.3%

72.2%

71.0%71.0%

70.0%

11,3

11,4 11,4

11,2 11,1

10,8

10,5

10,5

10,4 10,4

10,0 10,3 10,4 10,3

DYSPORT MS% 67,5%

10,2 10,2 10,2

10,2

67,0% 66,5%

67.0%

66.5%

66.3% 65.9%

65,7%

DYSPORT Sales, M.Eur

65.2%

65,1%

64.8%

64.7%

64,2%

63.8% 64.2% 9,5

63.6%

63.6%

62,8%

62.8%

62.8%

62,1% 62,3% 62,2% 61,4%

62.2%

62.0% 61.6%

10,5

10,0

9,5

8,8

Mar’17

8,4

7,9

7,8

7,9

8,4

8,5

Jul’18

Feb’17

8,3

8,4

Jun’18

7,7

7,9

8,2

Mar’18

7,8

8,3

8,0

Feb’18

7,9

Jan’17

8,3

8,5

Jan’18

8,5

8,5

May’18

9,0

8,0

11,1

11,0

10,9 11,0

59,4%

58,1% 57,6% 57,8%

58,8% 58,8% 59,4% 58,8% 58,9% 58,9%

57,9%

8,1

7,5

7,0

6,5

6,0

5,5

2,0

1,5

1,0

Source: IQVIA Shipments Database, value

PAGE

31

Jul’20

Jun’20

May’20

Apr’20

Mar’20

Feb’20

Jan’20

Dec’19

Nov’19

Oct’19

Sep’19

Aug’19

Jul’19

Jun’19

May’19

Apr’19

Mar’19

Feb’19

Jan’19

Dec’18

Nov’18

Oct’18

Sep’18

Aug’18

Apr’18

Dec’17

Nov’17

Oct’17

Sep’17

Aug’17

Jul’17

Jun’17

May’17

0,0

Apr’17

0,5

32.

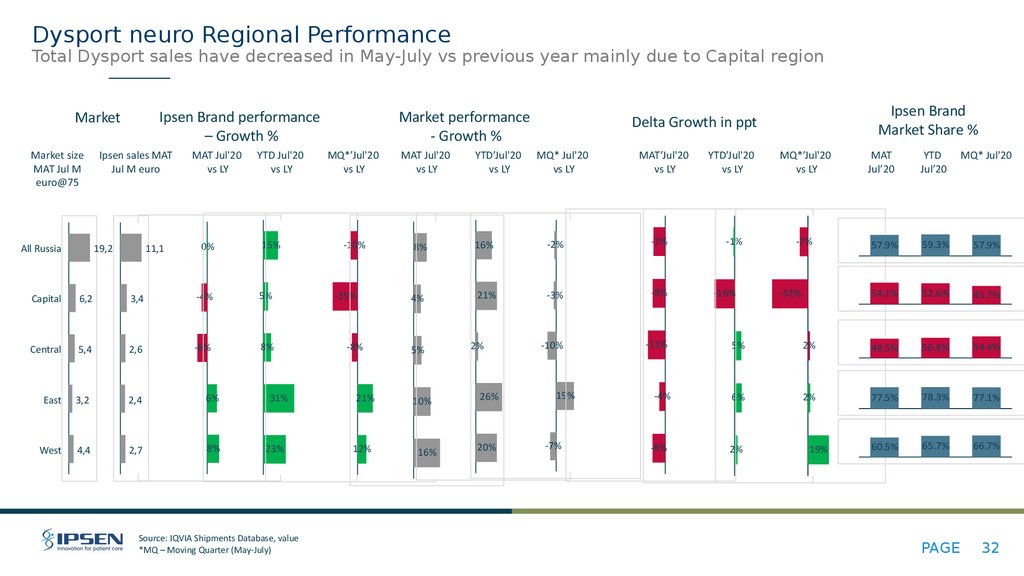

Dysport neuro Regional PerformanceTotal Dysport sales have decreased in May-July vs previous year mainly due to Capital region

Ipsen Brand performance

– Growth %

Market

Market size

MAT Jul M

euro@75

All Russia

Ipsen sales MAT

Jul M euro

19,2

11,1

MAT Jul'20

vs LY

0%

YTD Jul'20

vs LY

15%

Capital

6,2

3,4

-4%

5%

Central

5,4

2,6

-6%

8%

East

3,2

2,4

6%

West

4,4

2,7

8%

31%

23%

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

Market performance

- Growth %

MQ*’Jul'20

vs LY

-10%

-35%

-8%

21%

12%

MAT Jul'20

vs LY

YTD’Jul'20

vs LY

Ipsen Brand

Market Share %

Delta Growth in ppt

MQ* Jul'20

vs LY

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

MQ*’Jul'20

vs LY

-1%

-7%

MAT

Jul’20

YTD

Jul’20

MQ* Jul'20

57.9%

59.3%

57.9%

54.1%

52.6%

45.7%

8%

16%

-2%

-7%

4%

21%

-3%

-8%

-10%

-11%

5%

2%

48.5%

50.8%

54.4%

-4%

6%

2%

77.5%

78.3%

77.1%

60.5%

65.7%

66.7%

5%

10%

16%

2%

26%

20%

19%

-7%

-8%

-16%

2%

-32%

19%

PAGE

32

33.

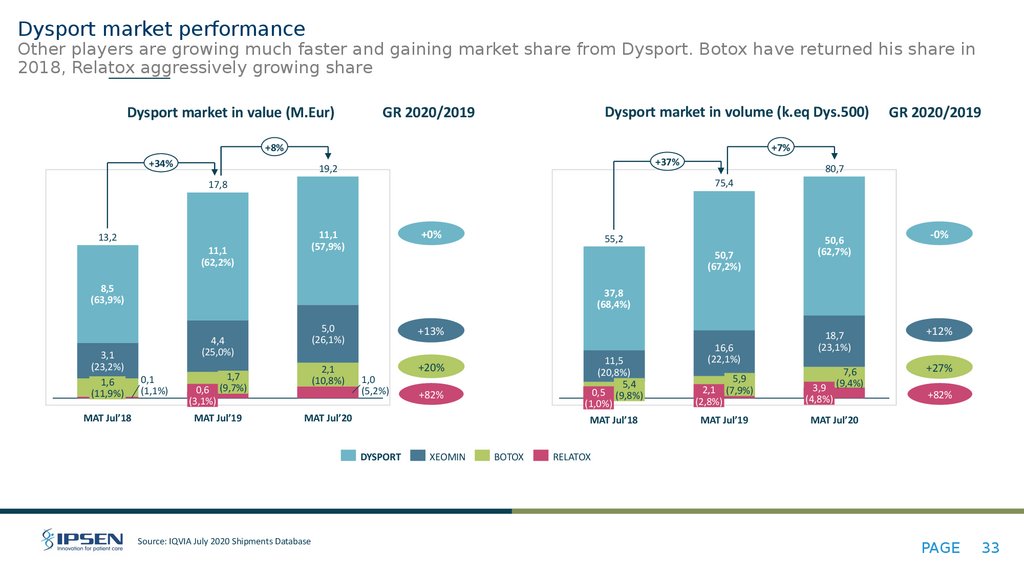

Dysport market performanceOther players are growing much faster and gaining market share from Dysport. Botox have returned his share in

2018, Relatox aggressively growing share

Dysport market in value (M.Eur)

Dysport market in volume (k.eq Dys.500)

GR 2020/2019

+8%

+7%

+34%

+37%

19,2

+0%

11,1

(57,9%)

13,2

11,1

(62,2%)

55,2

50,7

(67,2%)

8,5

(63,9%)

MAT Jul’18

80,7

75,4

17,8

3,1

(23,2%)

1,6

(11,9%)

GR 2020/2019

50,6

(62,7%)

-0%

37,8

(68,4%)

5,0

(26,1%)

4,4

(25,0%)

0,1

(1,1%)

2,1

(10,8%)

1,7

0,6 (9,7%)

(3,1%)

MAT Jul’19

+13%

+20%

1,0

(5,2%)

+82%

MAT Jul’20

DYSPORT

Source: IQVIA July 2020 Shipments Database

XEOMIN

BOTOX

16,6

(22,1%)

18,7

(23,1%)

+12%

+27%

11,5

(20,8%)

5,4

0,5 (9,8%)

(1,0%)

5,9

2,1 (7,9%)

(2,8%)

7,6

(9,4%)

3,9

(4,8%)

MAT Jul’18

MAT Jul’19

MAT Jul’20

+82%

RELATOX

PAGE

33

34.

Dysport Rolling Half-Year Performance by employeesPlease find details

(by city) here

Feb’20 – Jul'20

IPSEN Sales, M RUR

0

5

10 15 20 25 30 35

0

AKIMOV Dmitry

CHUBAROV Sergey

Market Sales, M RUR

11.5

14.3

50

GULOYANTS Vasiliy

KALASHNIKOVA Elena

SAVCHUK Oksana

80% 100%

-50%

78.3%

48

35

KOROVKINA Anastasiya

21.0

KUDINOV Sergey

45

19.2

MAGLAKELIDZE Khatuna

62

21.6

46

13.4

19.3

76.5%

36

24

19.0

15.8

48.5%

27.2%

35

37

Source: IQVIA Shipments Database, value

27%

-9.2%

-1.8%

-19.2%

54.5%

42.9%

-0.6%

1.3

0.8

0.9

0.8

0.7

0.9

0.8

1.1

139%-

0.8

1.2

1.4

0.9

-

0.9

0.8

-

-

1.0

0.9

-

1.2

0.7

11%

1.3

0.9

0.7

-

1.4

1.2

-

80.3%

25

-

-30.9%

-26.1%

1.5

1.3

-

-10.2%

1.2

1.2

-

0.7

47.4%

21

17.5

6.5

0.9

-

46.6%

28

16.6

-

-26.5%

52.6%

1.2

1.0

-8.1%

-

2.5 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6

1.0

0.9

-

2.0

1.1

-

-14.1%

43.2%

1.5

Penetration Index

0.9

-

-24.2%

46.7%

45

32.3

Melnikov Valeriy

-2.0%

-11.7%

54.0%

1.0

-8.6%

16%

47.2%

43

0.5

-

48%

75.1%

150%

0.0

-

3%

57.0%

32

100%

Evolution Index

-

69.0%

39

23.1

50%

17%

82.0%

16.7

Konyukhov Sergey

0%

-12.0%

72.6%

29

24.1

KOBZAREVA Olga

60%

33

22.4

BUTRINA Lada

40%

27

33.3

KARMATSKAYA Tatiana

20%

86.2%

22.6

BOGDANOVA Polina

70

0%

72.4%

24.0

SOLOVIEVA Lidiya

60

70.6%

22.4

GUDOSHNIKOVA Olga

Yusupova Elvira

40

Delta Growth

17

ZVEREVA Alla

TYURIN Vyacheslav

30

12

KRUGLOVA Olga

MODINA Ekaterina

20

16

9.0

KOROBTSOVA Ekaterina

10

Market Share

Microsoft Excel

Worksheet

1.3

1.0

0.8

0.7

0.5

1.0

0.9

2.1

0.7

PAGE

34

35.

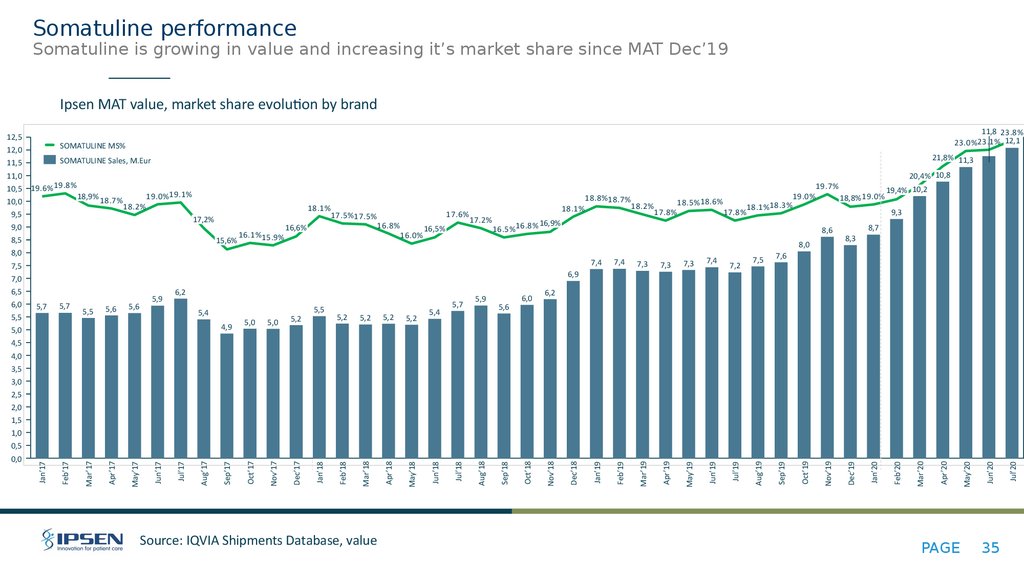

Somatuline performanceSomatuline is growing in value and increasing it’s market share since MAT Dec’19

Ipsen MAT value, market share evolution by brand

11,8 23.8%

23.0%23.1% 12,1

12,5

SOMATULINE MS%

12,0

11,5

20,4% 10,8

10,0

9,5

18,9% 18.7%

19.7%

19.0%19.1%

18.2%

18.1%

17,2%

9,0

8,5

15,6%

16.1%15.9%

18.8% 18.7%

17.6%

17.5%17.5%

16.8%

16,6%

16.0%

18.1%

17.2%

16,5%

16.5%

18.2%

17.8%

17.8%

18,8% 19.0%

18.1%18.3%

8,6

8,0

7,4

7,4

7,3

7,3

7,3

7,4

Jan’19

Feb’19

Mar’19

Apr’19

May’19

Jun’19

7,5

7,0

7,2

7,5

7,6

19,4% 10,2

9,3

16.8% 16,9%

8,0

8,7

8,3

6,9

4,9

5,0

5,0

5,2

5,2

5,2

5,2

5,2

May’18

5,5

5,4

Apr’18

5,6

6,2

Mar’18

5,5

5,9

Feb’18

5,5

5,0

5,6

Dec’17

5,7

Nov’17

5,7

Oct’17

6,5

6,0

19.0%

18.5%18.6%

Sep’19

19.6%19.8%

Aug’19

11,0

10,5

21,8% 11,3

SOMATULINE Sales, M.Eur

5,4

5,7

5,9

6,0

6,2

5,6

4,5

4,0

3,5

3,0

2,5

2,0

1,5

1,0

Source: IQVIA Shipments Database, value

PAGE

35

Jul’20

Jun’20

May’20

Apr’20

Mar’20

Feb’20

Jan’20

Dec’19

Nov’19

Oct’19

Jul’19

Dec’18

Nov’18

Oct’18

Sep’18

Aug’18

Jul’18

Jun’18

Jan’18

Sep’17

Aug’17

Jul’17

Jun’17

May’17

Apr’17

Mar’17

Feb’17

0,0

Jan’17

0,5

36.

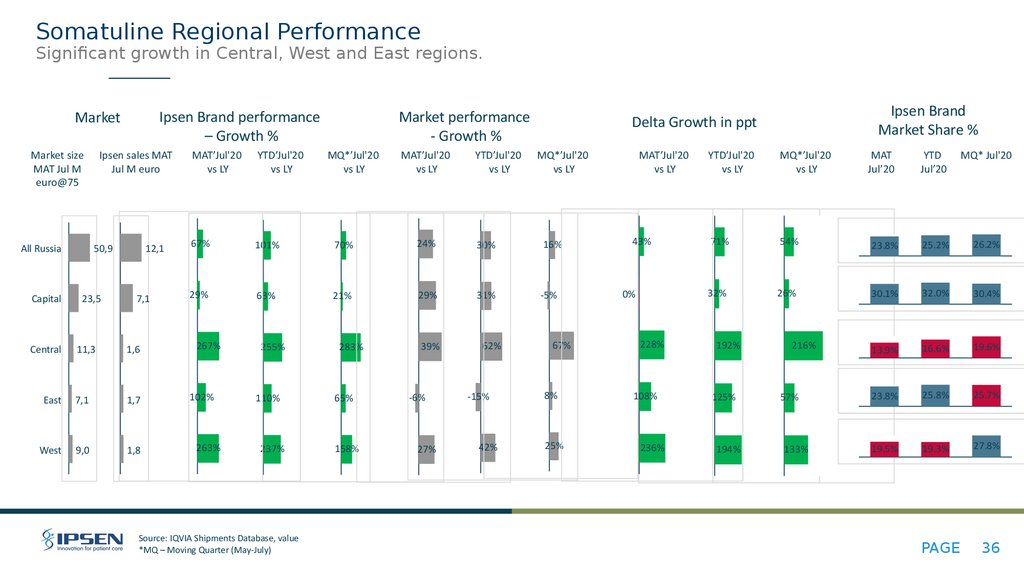

Somatuline Regional PerformanceSignificant growth in Central, West and East regions.

Ipsen Brand performance

– Growth %

Market

Ipsen sales MAT

Jul M euro

Market size

MAT Jul M

euro@75

All Russia

Capital

Central

50,9

23,5

12,1

7,1

11,3

1,6

East

7,1

1,7

West

9,0

1,8

Market performance

- Growth %

MAT’Jul'20

vs LY

YTD’Jul'20

vs LY

67%

101%

70%

24%

30%

16%

29%

63%

21%

29%

31%

-5%

267%

102%

263%

255%

110%

237%

Source: IQVIA Shipments Database, value

*MQ – Moving Quarter (May-July)

MQ*’Jul'20

vs LY

283%

65%

158%

MAT’Jul'20

vs LY

39%

-6%

27%

YTD’Jul'20

vs LY

62%

-15%

42%

Ipsen Brand

Market Share %

Delta Growth in ppt

MQ*’Jul'20

vs LY

67%

8%

25%

MAT’Jul'20

vs LY

43%

0%

228%

108%

236%

YTD’Jul'20

vs LY

MQ*’Jul'20

vs LY

71%

54%

32%

26%

192%

125%

194%

216%

57%

133%

MAT

Jul’20

YTD

Jul’20

MQ* Jul'20

23.8%

25.2%

26.2%

30.1%

32.0%

30.4%

13.9%

16.6%

19.6%

23.8%

25.8%

25.7%

19.5%

19.3%

27.8%

PAGE

36

37.

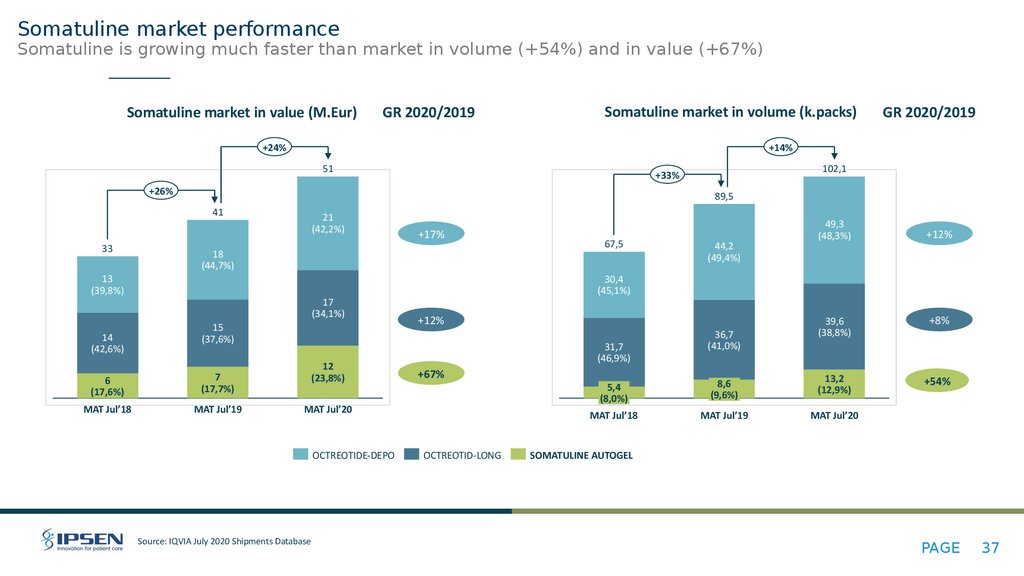

Somatuline market performanceSomatuline is growing much faster than market in volume (+54%) and in value (+67%)

Somatuline market in value (M.Eur)

GR 2020/2019

Somatuline market in volume (k.packs)

+24%

+14%

51

89,5

41

21

(42,2%)

+17%

18

(44,7%)

13

(39,8%)

67,5

44,2

(49,4%)

49,3

(48,3%)

+12%

30,4

(45,1%)

17

(34,1%)

14

(42,6%)

102,1

+33%

+26%

33

GR 2020/2019

15

(37,6%)

6

(17,6%)

7

(17,7%)

MAT Jul’18

MAT Jul’19

12

(23,8%)

+12%

31,7

(46,9%)

+67%

MAT Jul’20

OCTREOTIDE-DEPO

Source: IQVIA July 2020 Shipments Database

OCTREOTID-LONG

36,7

(41,0%)

39,6

(38,8%)

+8%

+54%

5,4

(8,0%)

8,6

(9,6%)

13,2

(12,9%)

MAT Jul’18

MAT Jul’19

MAT Jul’20

SOMATULINE AUTOGEL

PAGE

37

38.

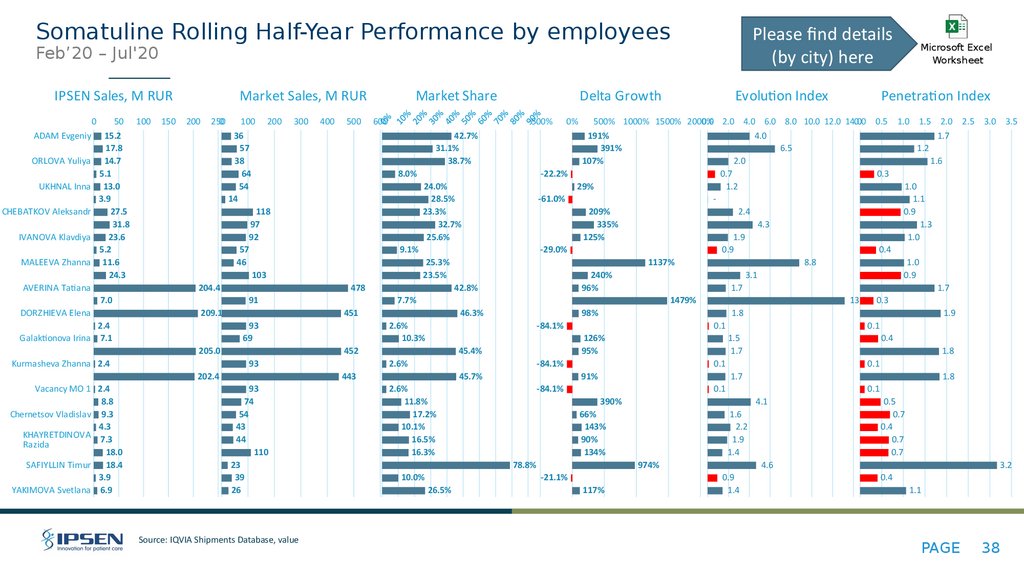

Somatuline Rolling Half-Year Performance by employeesFeb’20 – Jul'20

IPSEN Sales, M RUR

0

ADAM Evgeniy

ORLOVA Yuliya

UKHNAL Inna

CHEBATKOV Aleksandr

IVANOVA Klavdiya

MALEEVA Zhanna

50 100

15.2

17.8

14.7

5.1

13.0

3.9

27.5

31.8

23.6

5.2

11.6

24.3

AVERINA Tatiana

150

Market Sales, M RUR

200

250

0

100

36

57

38

64

54

14

200

300

204.4

8.0%

24.0%

28.5%

23.3%

32.7%

25.6%

9.1%

25.3%

23.5%

42.8%

7.7%

451

93

69

205.0

46.3%

2.6%

10.3%

452

93

202.4

45.4%

2.6%

443

93

74

54

43

44

110

23

39

26

Source: IQVIA Shipments Database, value

Delta Growth

-500%

478

209.1

Kurmasheva Zhanna 2.4

600

42.7%

31.1%

38.7%

91

2.4

Galaktionova Irina 7.1

Vacancy MO 1 2.4

8.8

Chernetsov Vladislav 9.3

4.3

KHAYRETDINOVA 7.3

Razida

18.0

SAFIYLLIN Timur

18.4

3.9

YAKIMOVA Svetlana 6.9

500

118

97

92

57

46

103

7.0

DORZHIEVA Elena

400

Market Share

45.7%

2.6%

11.8%

17.2%

10.1%

16.5%

16.3%

10.0%

26.5%

Please find details

(by city) here

Evolution Index

Microsoft Excel

Worksheet

Penetration Index

0%

500% 1000% 1500% 2000%

0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5

191%

4.0

1.7

391%

6.5

1.2

107%

2.0

1.6

-22.2%

0.7

0.3

29%

1.2

1.0

-61.0%

1.1

209%

2.4

0.9

335%

4.3

1.3

125%

1.9

1.0

-29.0%

0.9

0.4

1137%

8.8

1.0

240%

3.1

0.9

96%

1.7

1.7

1479%

13.2 0.3

98%

1.8

1.9

-84.1%

0.1

0.1

126%

1.5

0.4

95%

1.7

1.8

-84.1%

0.1

0.1

91%

1.7

1.8

-84.1%

0.1

0.1

390%

4.1

0.5

66%

1.6

0.7

143%

2.2

0.4

90%

1.9

0.7

134%

1.4

0.7

78.8%

974%

4.6

3.2

-21.1%

0.9

0.4

117%

1.4

1.1

PAGE

38

39.

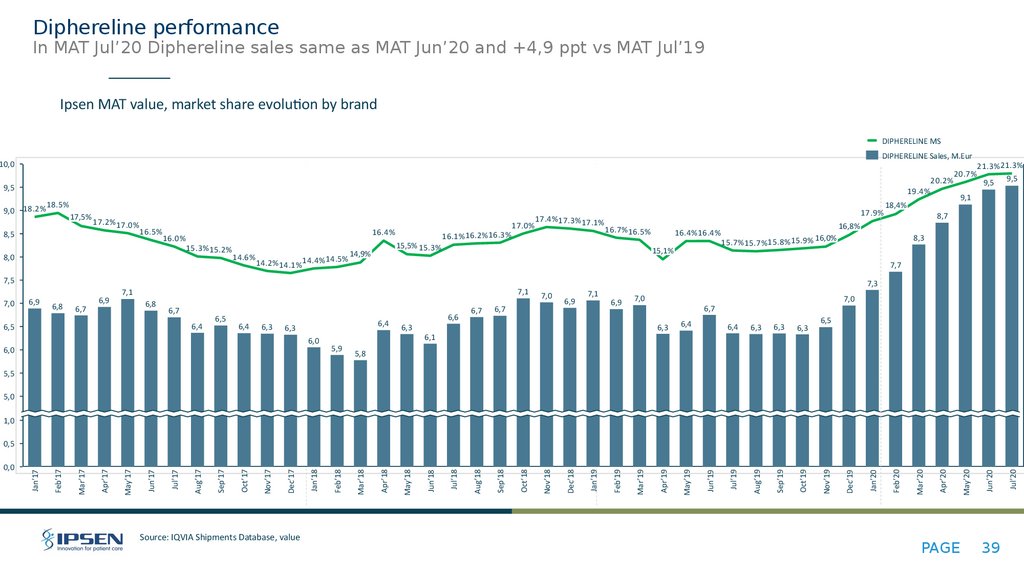

Diphereline performanceIn MAT Jul’20 Diphereline sales same as MAT Jun’20 and +4,9 ppt vs MAT Jul’19

Ipsen MAT value, market share evolution by brand

DIPHERELINE MS

DIPHERELINE Sales, M.Eur

10,0

20.2%

9,5

9,0

19.4%

18.2% 18.5%

17,5%

17.2% 17.0%

8,5

16.5%

16.4%

16.0%

15.3% 15.2%

8,0

17.0%

14.6%

14.2% 14.1% 14.4% 14.5%

17.4% 17.3% 17.1%