Similar presentations:

Recording business transactions. Accounting

1.

Ho rn gren ’sAc co u ntin g

Lecture Six

Lisa, Li

1

2.

Review• Define and apply Revenue recognition and matching principle

• Record transactions into journals

• and post journal entries to the Ledger Accounts

• Prepare a trial balance

• Discover errors in recording transactions and correct them.

Accounting

2

3.

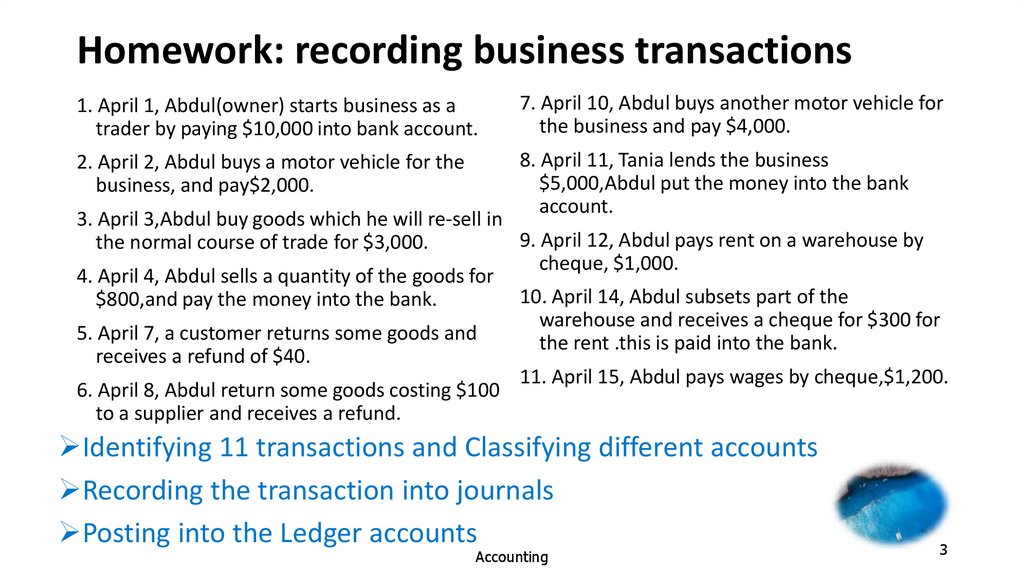

Homework: recording business transactions1. April 1, Abdul(owner) starts business as a

trader by paying $10,000 into bank account.

7. April 10, Abdul buys another motor vehicle for

the business and pay $4,000.

2. April 2, Abdul buys a motor vehicle for the

business, and pay$2,000.

8. April 11, Tania lends the business

$5,000,Abdul put the money into the bank

account.

3. April 3,Abdul buy goods which he will re-sell in

9. April 12, Abdul pays rent on a warehouse by

the normal course of trade for $3,000.

cheque, $1,000.

4. April 4, Abdul sells a quantity of the goods for

10. April 14, Abdul subsets part of the

$800,and pay the money into the bank.

warehouse and receives a cheque for $300 for

5. April 7, a customer returns some goods and

the rent .this is paid into the bank.

receives a refund of $40.

11. April 15, Abdul pays wages by cheque,$1,200.

6. April 8, Abdul return some goods costing $100

to a supplier and receives a refund.

Identifying 11 transactions and Classifying different accounts

Recording the transaction into journals

Posting into the Ledger accounts

Accounting

3

4.

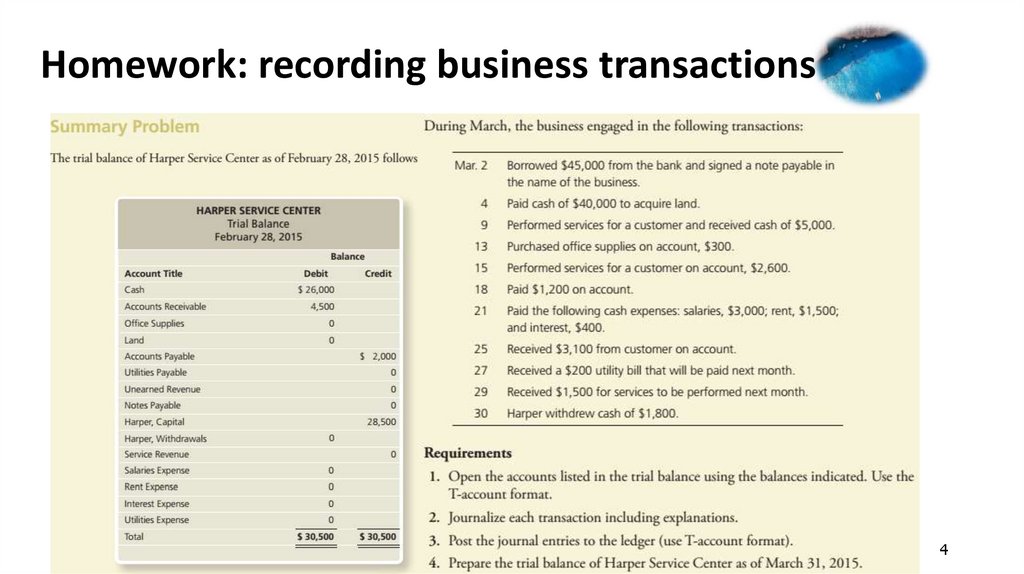

Homework: recording business transactionsAccounting

4

4

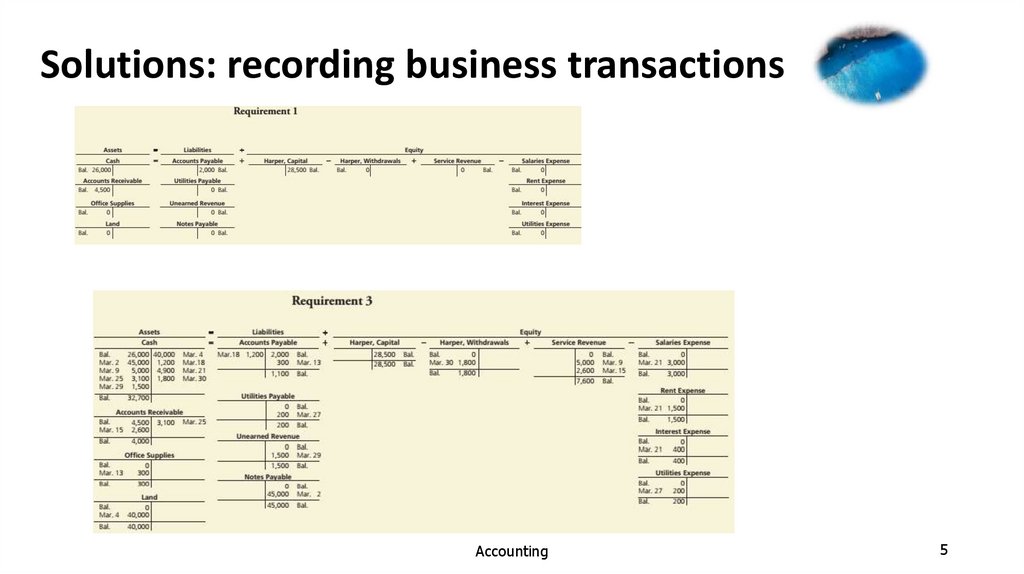

5.

Solutions: recording business transactionsAccounting

5

6.

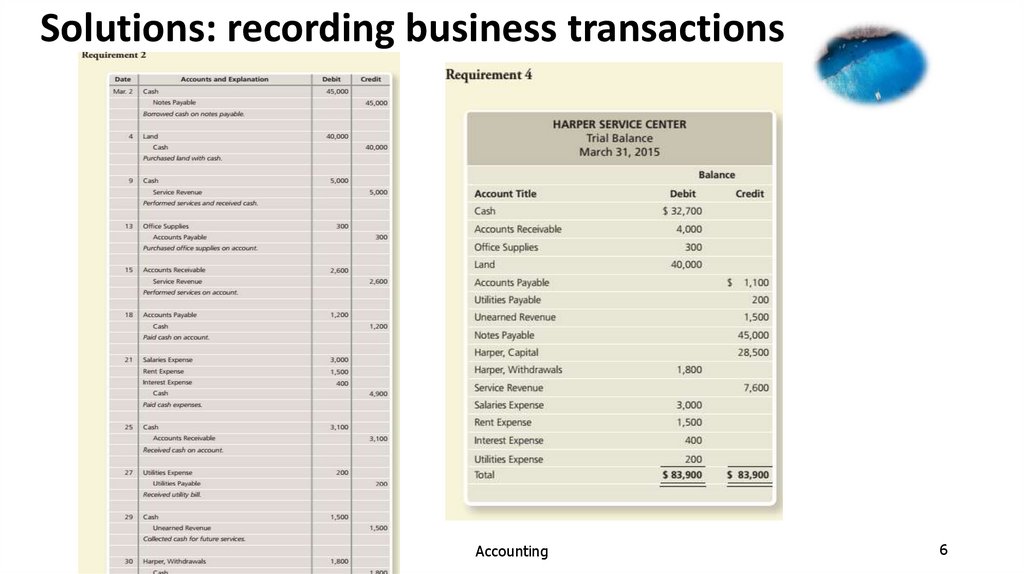

Solutions: recording business transactionsAccounting

6

7.

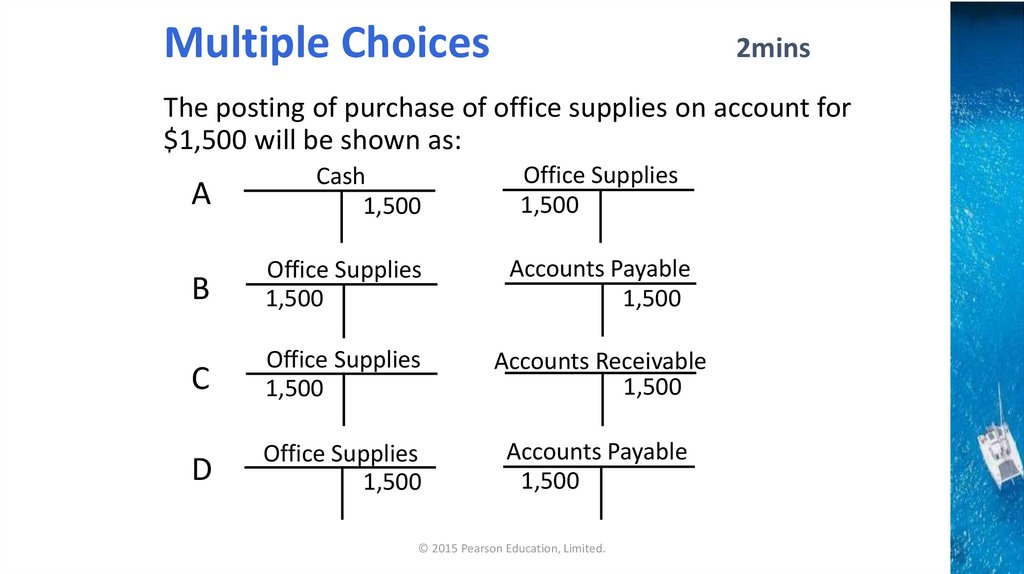

Multiple Choices2mins

The posting of purchase of office supplies on account for

$1,500 will be shown as:

Office Supplies

1,500

A

Cash

1,500

B

Office Supplies

1,500

Accounts Payable

1,500

C

Office Supplies

1,500

Accounts Receivable

1,500

D

Office Supplies

1,500

Accounts Payable

1,500

© 2015 Pearson Education, Limited.

8.

Multiple Choices2mins

The detailed record of all increases and decreases that

have occurred in an individual asset, liability, or equity

during a specific period is called a(n):

A. balance sheet.

B. journal.

C. account.

D. trial balance.

© 2015 Pearson Education, Limited.

9.

Multiple Choices2mins

8. Kevin Copies recorded a cash collection on account by

debiting Cash and crediting Accounts Payable. How will

this error affect the trial balance?

A. Assets will be understated

B. Liabilities will be overstated

C. Profits will be overstated

D. Equity will be understated

© 2015 Pearson Education, Limited.

10.

Learning Objectives – Chapter 31.

2.

3.

4.

5.

6.

Cash Basis vs Accrual Basis Accounting

Apply the time period concept, revenue recognition, and matching principles

Explain the purpose of and journalize and post adjusting entries

Prepare an adjusted trial balance

Identify the impact of adjusting entries on the financial statements

use a worksheet to prepare the adjusted trial balance

Accounting

10

11.

Learning Objective 1Differentiate between cash

basis accounting and accrual

basis accounting

11

12.

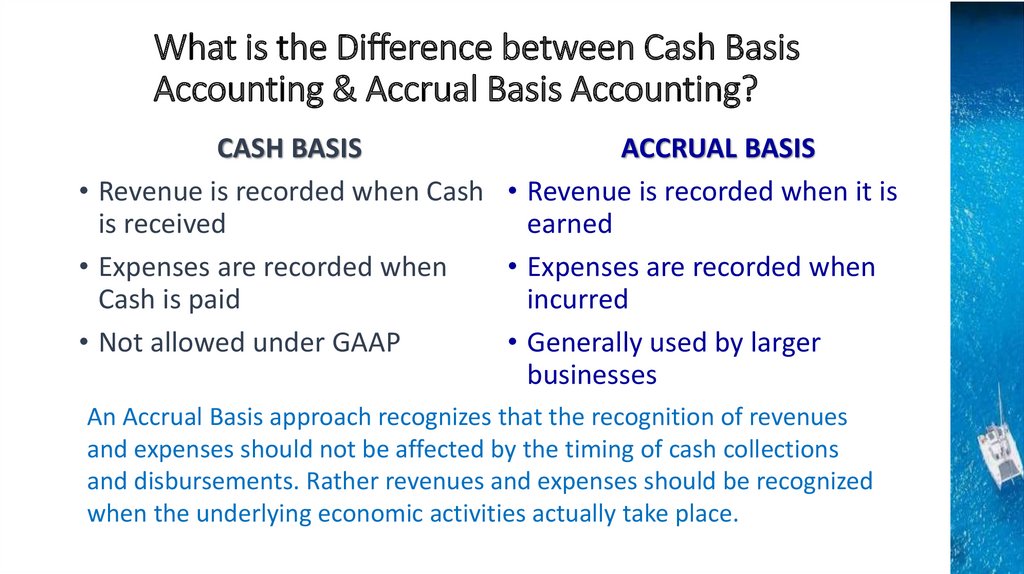

What is the Difference between Cash BasisAccounting & Accrual Basis Accounting?

CASH BASIS

ACCRUAL BASIS

• Revenue is recorded when Cash • Revenue is recorded when it is

is received

earned

• Expenses are recorded when

• Expenses are recorded when

Cash is paid

incurred

• Not allowed under GAAP

• Generally used by larger

businesses

An Accrual Basis approach recognizes that the recognition of revenues

and expenses should not be affected by the timing of cash collections

and disbursements. Rather revenues and expenses should be recognized

when the underlying economic activities actually take place.

13.

Learning Objective 2Define and apply the time

period concept, revenue

recognition, and matching

principles

13

14.

Review The Time Period Concept• Assumes that a business’s activities can be sliced

into small

OCTOBER 2012

segments and that

Su Mo Tu We Th Fr Sa

financial statements

1

2

3

4

5

6

can be prepared for

7

8

9 10 11 12 13

14 15 16 17 18 19 20

specific time periods,

21 22 23 24 25 26 27

such as a month,

28 29 30 31

quarter, or year.

• Any twelve month period is referred to as a fiscal

year.

Accounting

14

15.

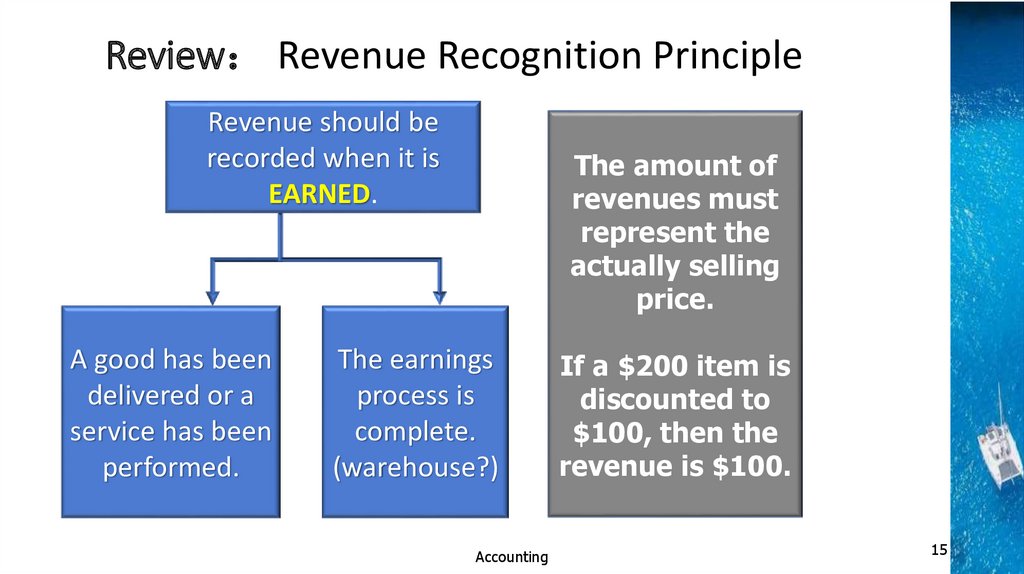

Review Revenue Recognition PrincipleRevenue should be

recorded when it is

EARNED.

A good has been

delivered or a

service has been

performed.

The amount of

revenues must

represent the

actually selling

price.

The earnings

process is

complete.

(warehouse?)

Accounting

If a $200 item is

discounted to

$100, then the

revenue is $100.

15

16.

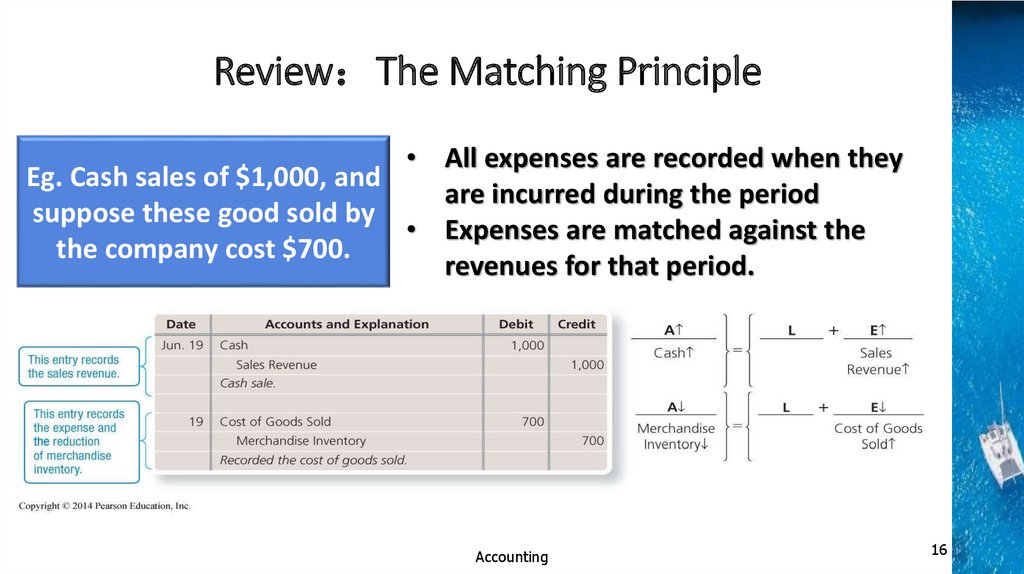

Review The Matching Principle• All expenses are recorded when they

Eg. Cash sales of $1,000, and

are incurred during the period

suppose these good sold by

• Expenses are matched against the

the company cost $700.

revenues for that period.

Accounting

16

17.

Learning Objective 3Explain the purpose of and

journalize and post

adjusting entries

17

18.

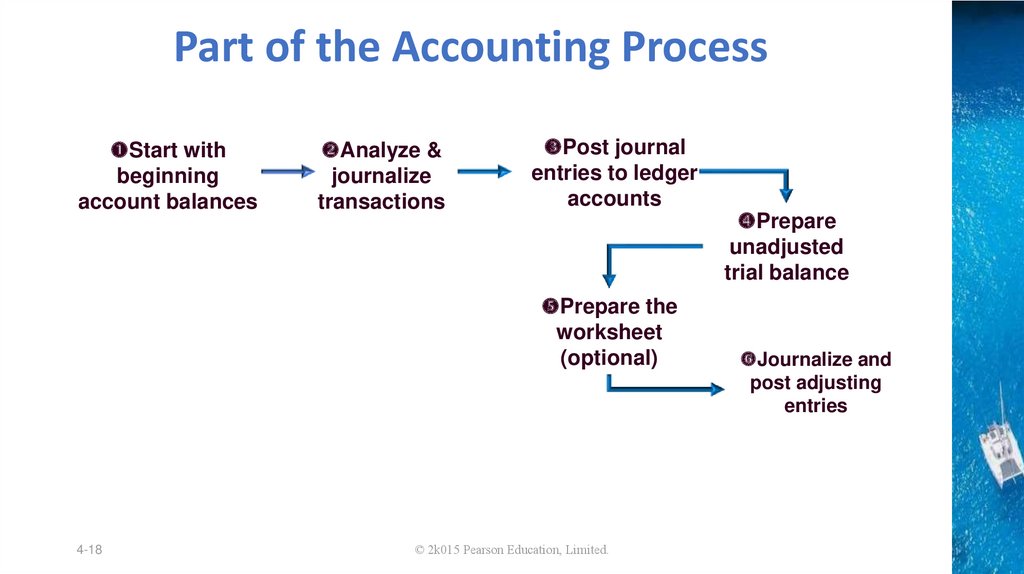

Part of the Accounting ProcessStart with

beginning

account balances

Analyze &

journalize

transactions

Post journal

entries to ledger

accounts

Prepare the

worksheet

(optional)

4-18

© 2k015 Pearson Education, Limited.

Prepare

unadjusted

trial balance

Journalize and

post adjusting

entries

19.

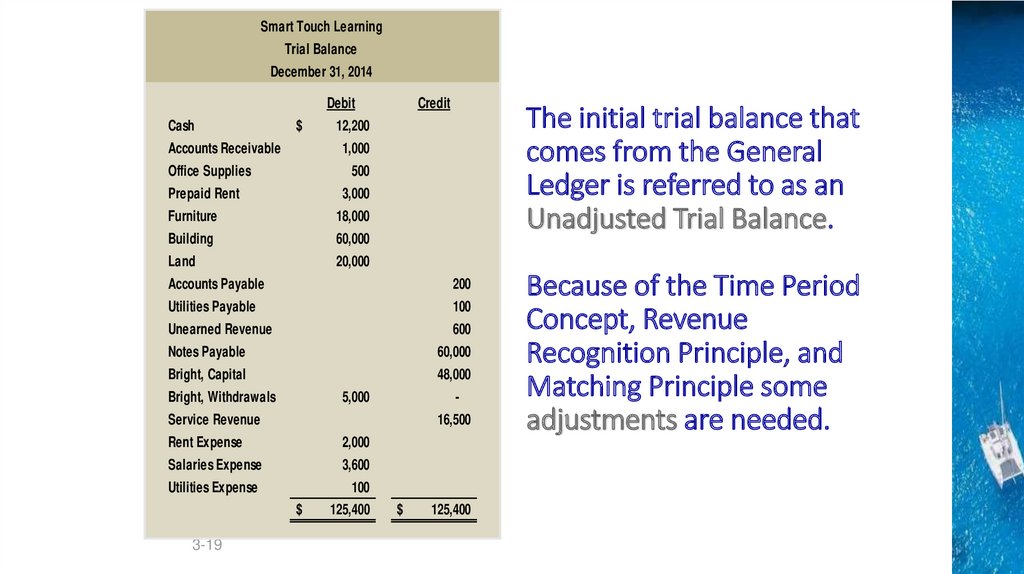

Smart Touch LearningTrial Balance

December 31, 2014

Debit

Cash

$

Accounts Receivable

Credit

The initial trial balance that

comes from the General

Ledger is referred to as an

Unadjusted Trial Balance.

12,200

1,000

Office Supplies

500

Prepaid Rent

3,000

Furniture

18,000

Building

60,000

Land

20,000

Accounts Payable

200

Utilities Payable

100

Unearned Revenue

600

Notes Payable

60,000

Bright, Capital

48,000

Bright, Withdrawals

5,000

-

Service Revenue

16,500

Rent Expense

2,000

Salaries Expense

3,600

Utilities Expense

100

$

3-19

125,400

$

125,400

Because of the Time Period

Concept, Revenue

Recognition Principle, and

Matching Principle some

adjustments are needed.

20.

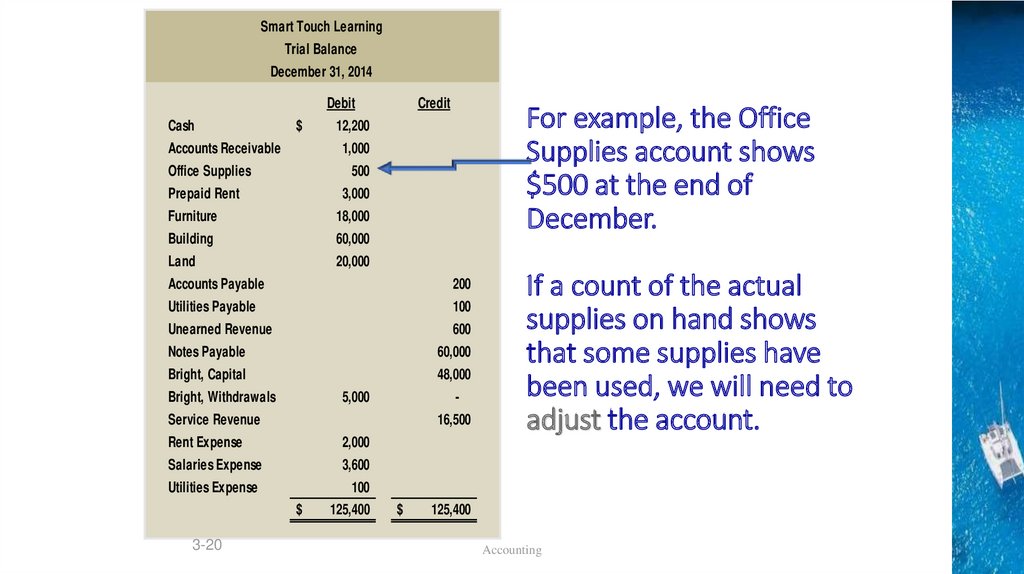

Smart Touch LearningTrial Balance

December 31, 2014

Debit

Cash

$

Accounts Receivable

Credit

For example, the Office

Supplies account shows

$500 at the end of

December.

12,200

1,000

Office Supplies

500

Prepaid Rent

3,000

Furniture

18,000

Building

60,000

Land

20,000

Accounts Payable

200

Utilities Payable

100

Unearned Revenue

600

Notes Payable

60,000

Bright, Capital

48,000

Bright, Withdrawals

5,000

-

Service Revenue

16,500

Rent Expense

2,000

Salaries Expense

3,600

Utilities Expense

100

$

3-20

125,400

$

If a count of the actual

supplies on hand shows

that some supplies have

been used, we will need to

adjust the account.

125,400

Accounting

21.

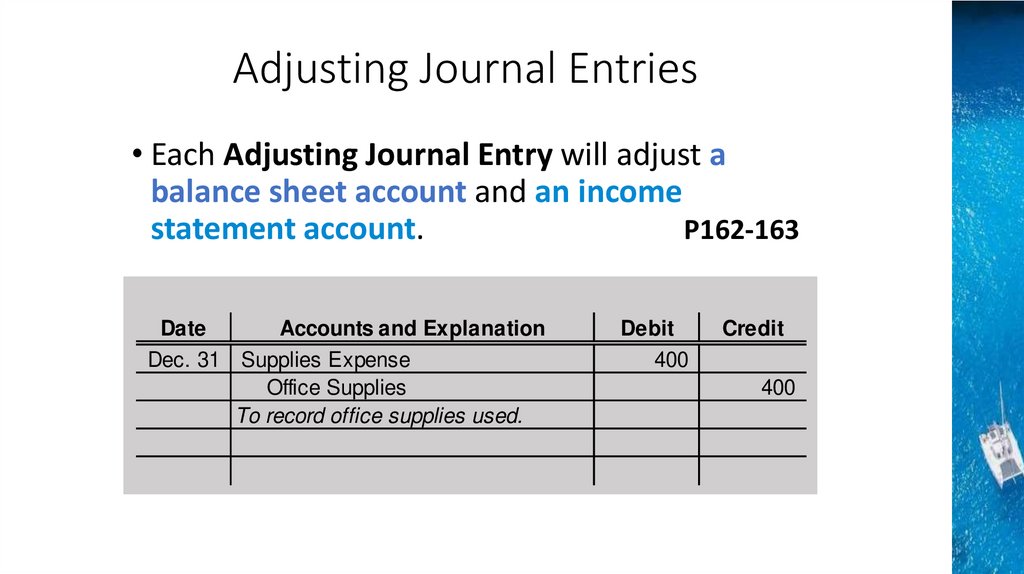

Adjusting Journal Entries• Each Adjusting Journal Entry will adjust a

balance sheet account and an income

statement account.

P162-163

Date

Accounts and Explanation

Dec. 31 Supplies Expense

Office Supplies

To record office supplies used.

Debit

400

Credit

400

22.

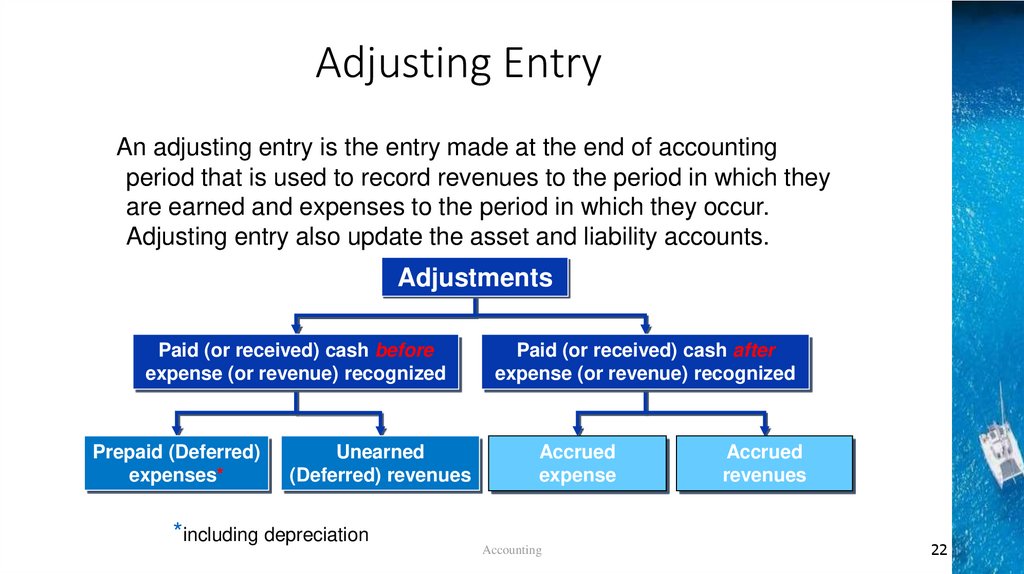

Adjusting EntryAn adjusting entry is the entry made at the end of accounting

period that is used to record revenues to the period in which they

are earned and expenses to the period in which they occur.

Adjusting entry also update the asset and liability accounts.

Adjustments

Paid (or received) cash before

expense (or revenue) recognized

Prepaid (Deferred)

expenses*

Unearned

(Deferred) revenues

*including depreciation

Paid (or received) cash after

expense (or revenue) recognized

Accrued

expense

Accounting

Accrued

revenues

22

23.

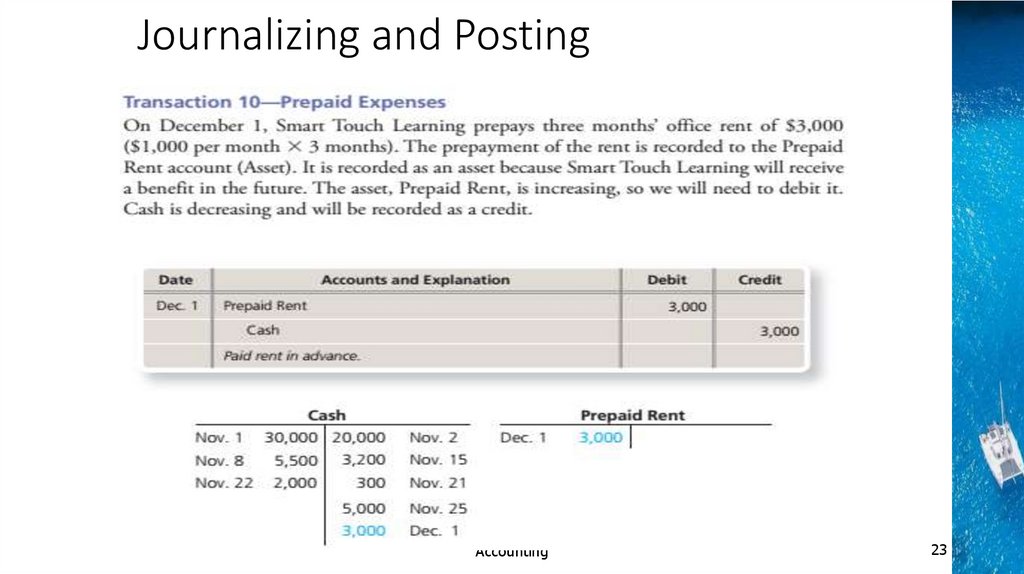

Journalizing and PostingAccounting

23

24.

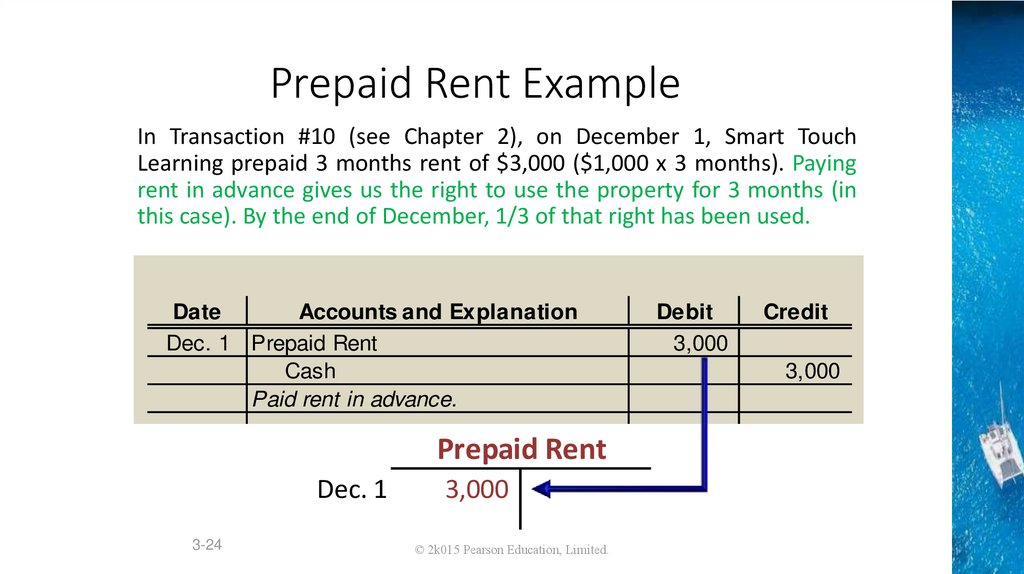

Prepaid Rent ExampleIn Transaction #10 (see Chapter 2), on December 1, Smart Touch

Learning prepaid 3 months rent of $3,000 ($1,000 x 3 months). Paying

rent in advance gives us the right to use the property for 3 months (in

this case). By the end of December, 1/3 of that right has been used.

Date

Accounts and Explanation

Dec. 1 Prepaid Rent

Cash

Paid rent in advance.

Prepaid Rent

Dec. 1

3-24

3,000

© 2k015 Pearson Education, Limited.

Debit

3,000

Credit

3,000

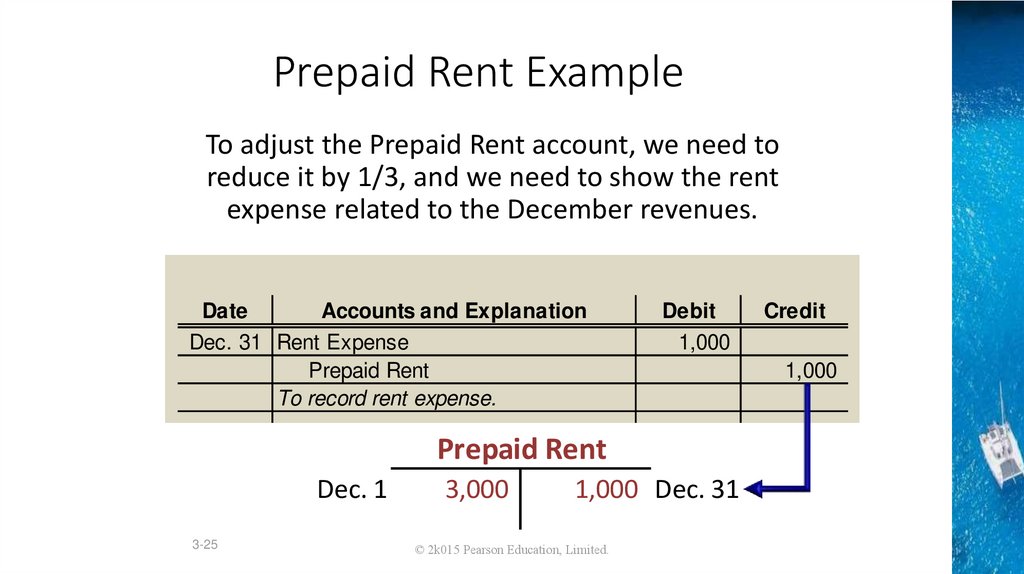

25.

Prepaid Rent ExampleTo adjust the Prepaid Rent account, we need to

reduce it by 1/3, and we need to show the rent

expense related to the December revenues.

Date

Accounts and Explanation

Dec. 31 Rent Expense

Prepaid Rent

To record rent expense.

Debit

1,000

Prepaid Rent

Dec. 1

3-25

3,000

1,000 Dec. 31

© 2k015 Pearson Education, Limited.

Credit

1,000

26.

Prepaid InsuranceOn 12/1/2019, FastForward paid $2,400 for insurance

for 2-years (24-months, December 2019 through

November 2021). FastForward recorded the expenditure

as Prepaid Insurance on 12/31/2019.

What adjustment is required?

Accounting

26

27.

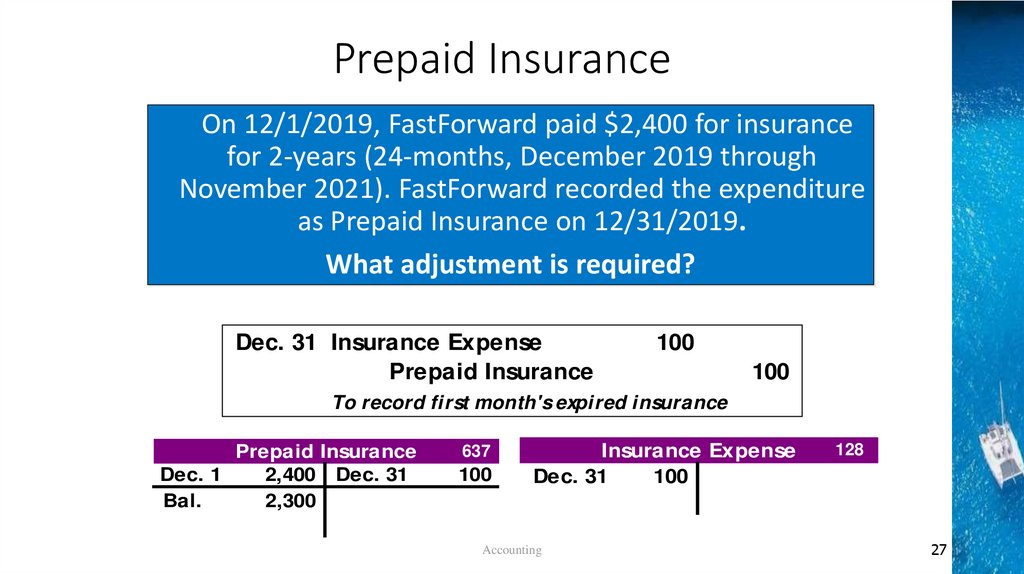

Prepaid InsuranceOn 12/1/2019, FastForward paid $2,400 for insurance

for 2-years (24-months, December 2019 through

November 2021). FastForward recorded the expenditure

as Prepaid Insurance on 12/31/2019.

What adjustment is required?

Dec. 31 Insurance Expense

Prepaid Insurance

100

100

To record first month's expired insurance

Prepaid Insurance

Dec. 1

2,400 Dec. 31

Bal.

2,300

637

100

Insurance Expense

Dec. 31

100

Accounting

128

27

28.

Depreciation (plant Assets)• plant assets are long-lived, tangible assets used in the

operation of a business. As a business uses these assets,

their value and usefulness decline.

• Plant Assets need to depreciates, such as buildings

equipment, furniture, and automobiles. The contra asset

account used is Accumulated Depreciation—(asset’s name)

• Land has an infinite life; Under Generally Accepted

Accounting Principles, we never depreciate Land. (p163)

Plant assets, with the exception of land, are depreciated

over their useful lives.

Accounting

28

29.

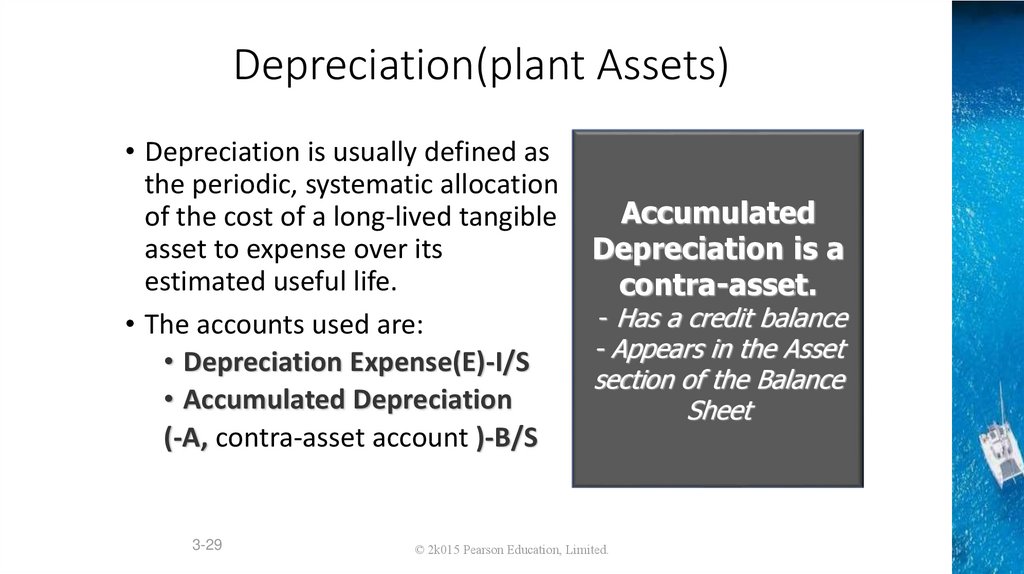

Depreciation(plant Assets)• Depreciation is usually defined as

the periodic, systematic allocation

of the cost of a long-lived tangible

asset to expense over its

estimated useful life.

• The accounts used are:

• Depreciation Expense(E)-I/S

• Accumulated Depreciation

(-A, contra-asset account )-B/S

3-29

Accumulated

Depreciation is a

contra-asset.

- Has a credit balance

- Appears in the Asset

section of the Balance

Sheet

© 2k015 Pearson Education, Limited.

30.

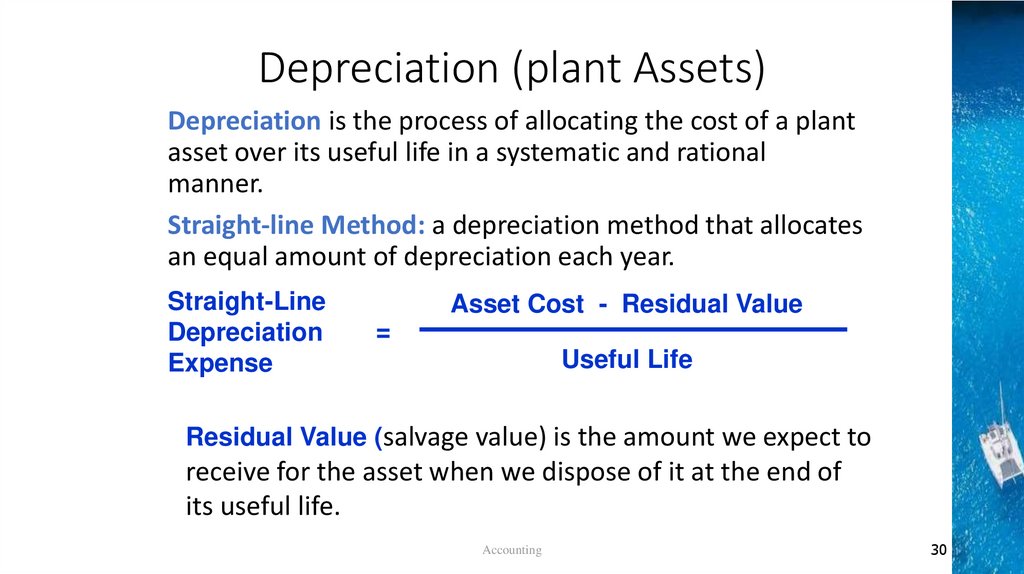

Depreciation (plant Assets)Depreciation is the process of allocating the cost of a plant

asset over its useful life in a systematic and rational

manner.

Straight-line Method: a depreciation method that allocates

an equal amount of depreciation each year.

Straight-Line

Depreciation

Expense

Asset Cost - Residual Value

=

Useful Life

Residual Value (salvage value) is the amount we expect to

receive for the asset when we dispose of it at the end of

its useful life.

Accounting

30

31.

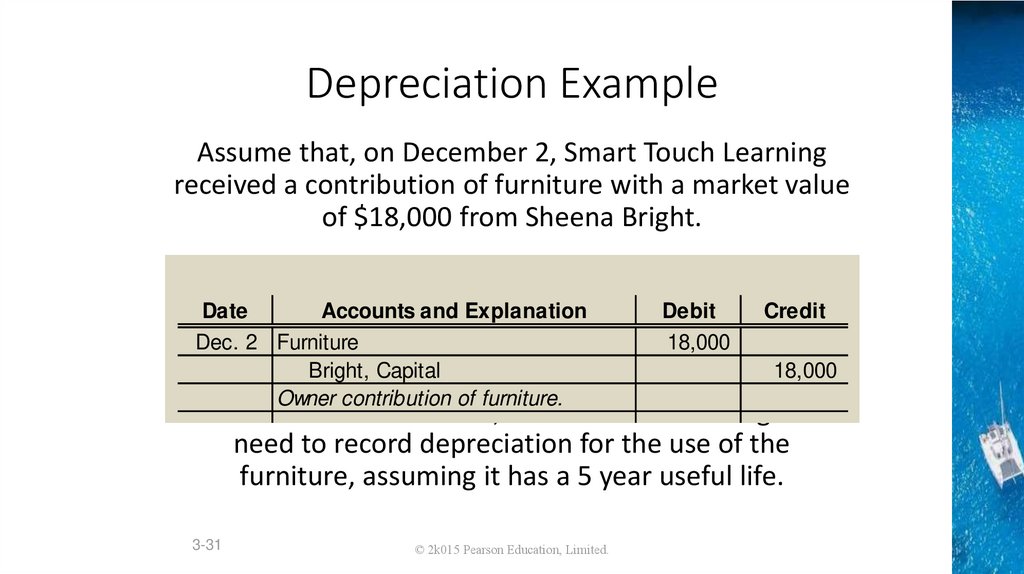

Depreciation ExampleAssume that, on December 2, Smart Touch Learning

received a contribution of furniture with a market value

of $18,000 from Sheena Bright.

Date

Accounts and Explanation

Dec. 2 Furniture

Bright, Capital

Owner contribution of furniture.

Debit

18,000

Credit

18,000

At the end of December, Smart Touch Learning will

need to record depreciation for the use of the

furniture, assuming it has a 5 year useful life.

3-31

© 2k015 Pearson Education, Limited.

32.

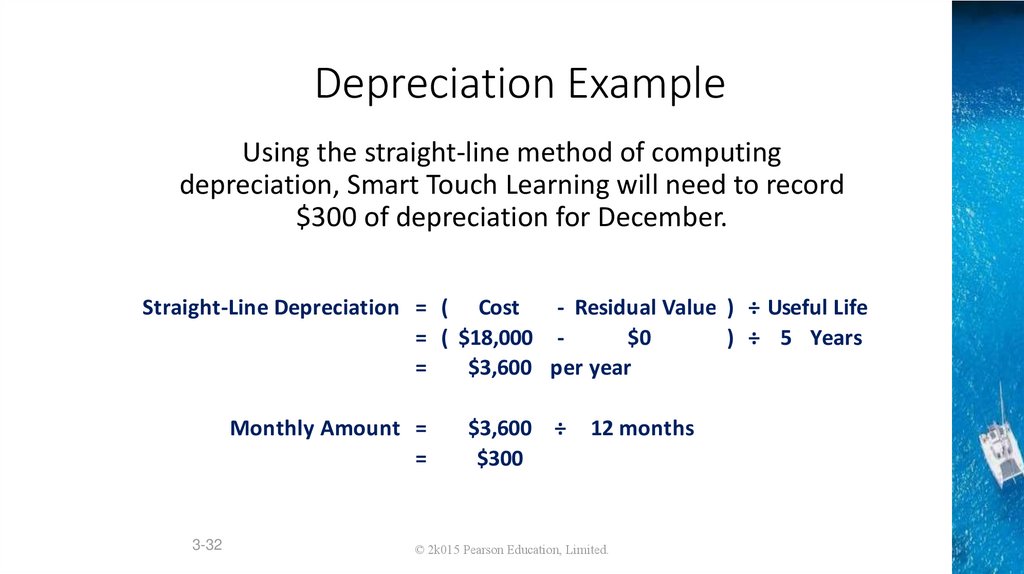

Depreciation ExampleUsing the straight-line method of computing

depreciation, Smart Touch Learning will need to record

$300 of depreciation for December.

Straight-Line Depreciation = ( Cost

- Residual Value ) ÷ Useful Life

= ( $18,000 $0

) ÷ 5 Years

=

$3,600 per year

Monthly Amount =

=

3-32

$3,600 ÷

$300

12 months

© 2k015 Pearson Education, Limited.

33.

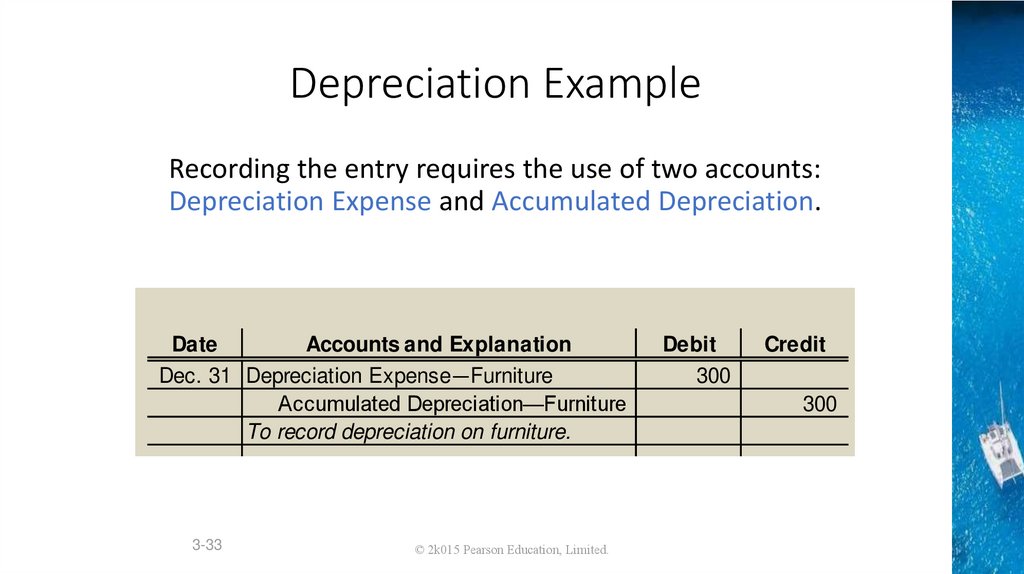

Depreciation ExampleRecording the entry requires the use of two accounts:

Depreciation Expense and Accumulated Depreciation.

Date

Accounts and Explanation

Dec. 31 Depreciation Expense—Furniture

Accumulated Depreciation—Furniture

To record depreciation on furniture.

3-33

© 2k015 Pearson Education, Limited.

Debit

300

Credit

300

34.

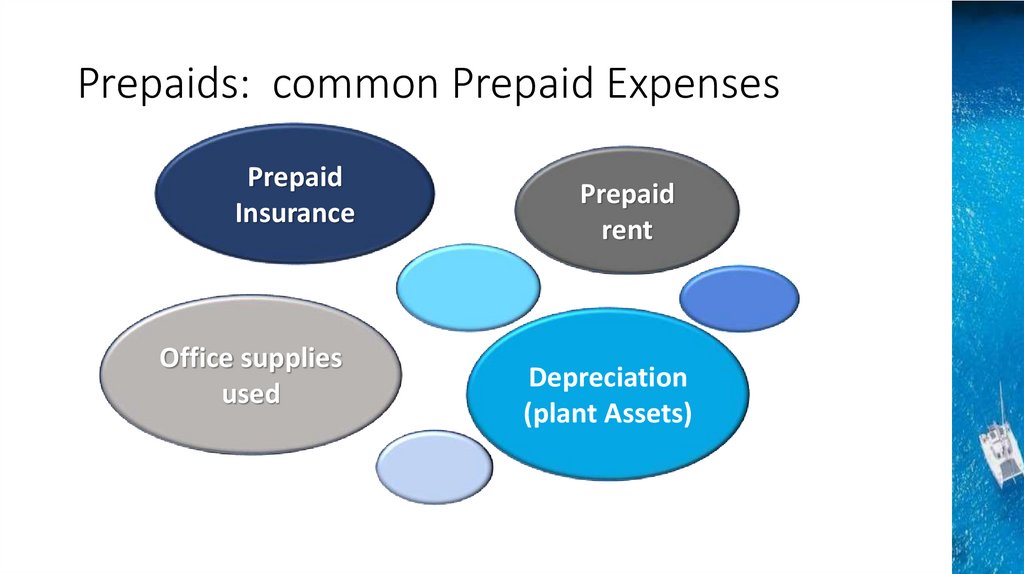

Prepaids: common Prepaid ExpensesPrepaid

Insurance

Office supplies

used

Prepaid

rent

Depreciation

(plant Assets)

35.

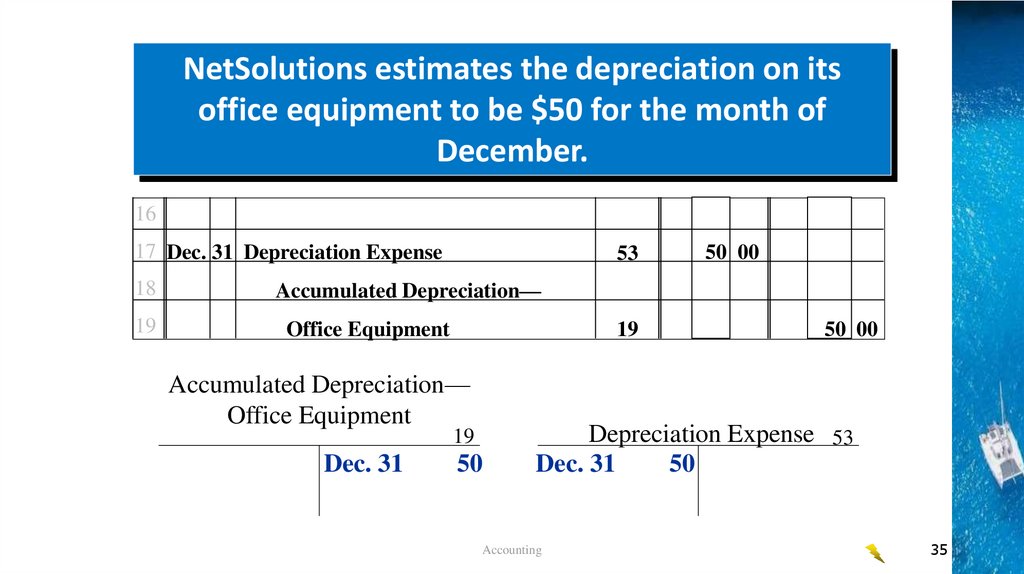

NetSolutions estimates the depreciation on itsoffice equipment to be $50 for the month of

December.

16

17 Dec. 31 Depreciation Expense

18

19

53

50 00

Accumulated Depreciation—

19

Office Equipment

Accumulated Depreciation—

Office Equipment

19

Dec. 31

50

50 00

Depreciation Expense 53

Dec. 31

50

Accounting

35

36.

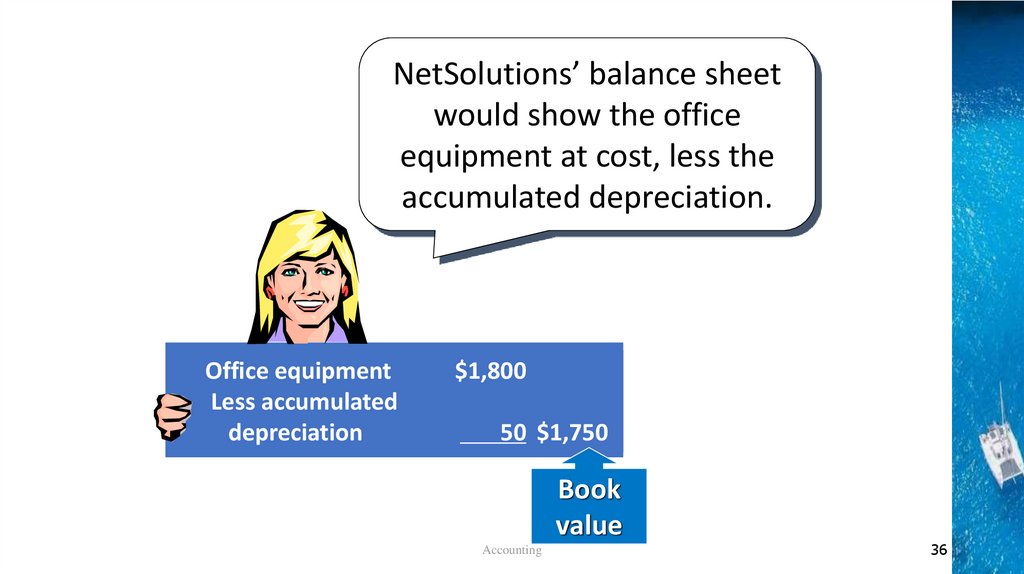

NetSolutions’ balance sheetwould show the office

equipment at cost, less the

accumulated depreciation.

Office equipment

Less accumulated

depreciation

$1,800

50 $1,750

Book

value

Accounting

36

37.

Multiple Choices2mins

Fitness First has a new client who prepays $600 for a package

of six training sessions. Fitness First had provided four training

sessions as of year end. Which of the following amounts

should Fitness First report on its income statement?

A. Service Revenue of $400

B. Service Revenue of $600

C. Unearned service revenue of $400

D. Unearned service revenue of $600

© 2015 Pearson Education, Limited.

38.

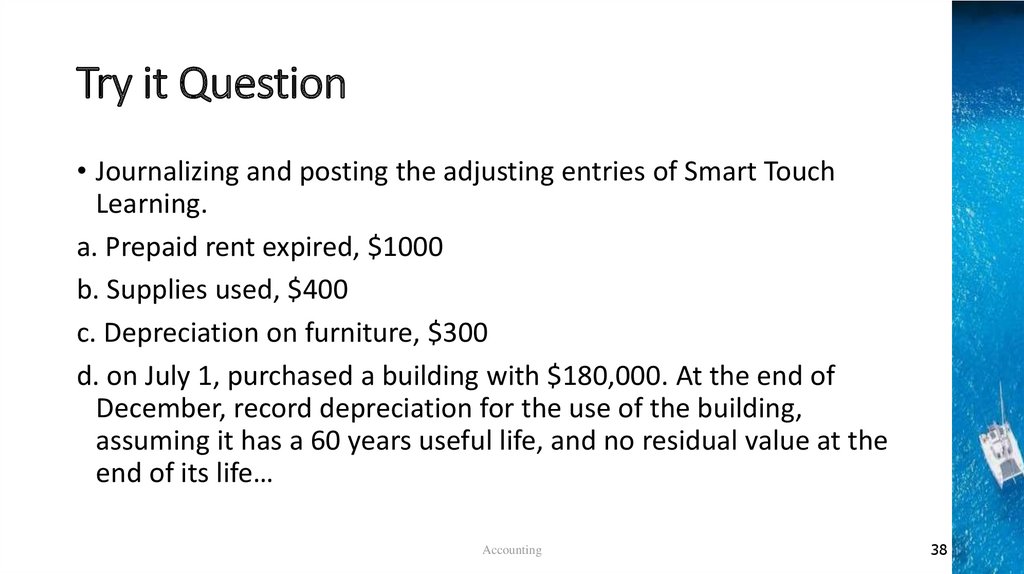

Try it Question• Journalizing and posting the adjusting entries of Smart Touch

Learning.

a. Prepaid rent expired, $1000

b. Supplies used, $400

c. Depreciation on furniture, $300

d. on July 1, purchased a building with $180,000. At the end of

December, record depreciation for the use of the building,

assuming it has a 60 years useful life, and no residual value at the

end of its life…

Accounting

38

39.

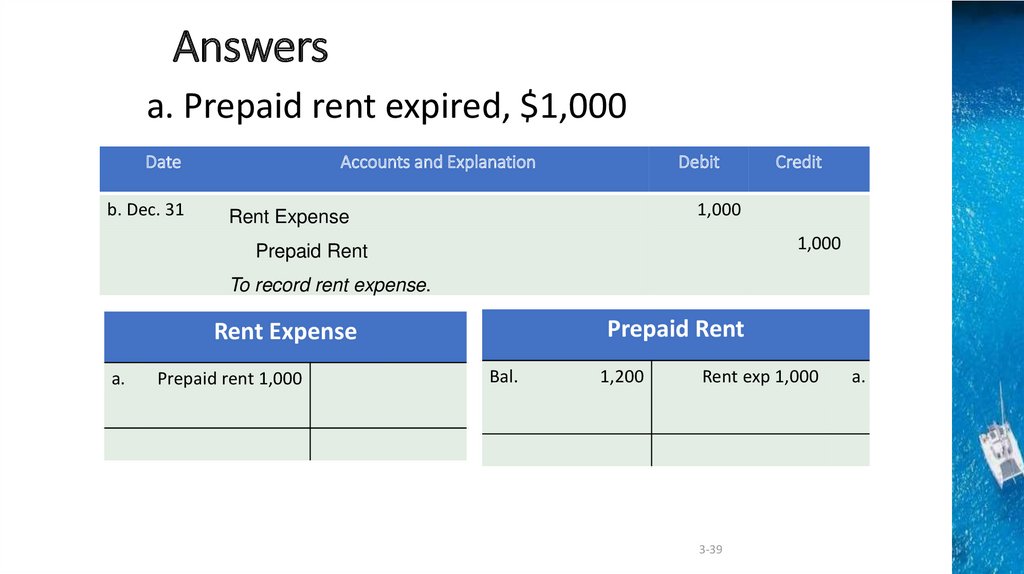

Answersa. Prepaid rent expired, $1,000

Date

b. Dec. 31

Accounts and Explanation

Debit

Credit

1,000

Rent Expense

1,000

Prepaid Rent

To record rent expense.

Prepaid Rent

Rent Expense

a.

Prepaid rent 1,000

Bal.

1,200

Rent exp 1,000

3-39

a.

40.

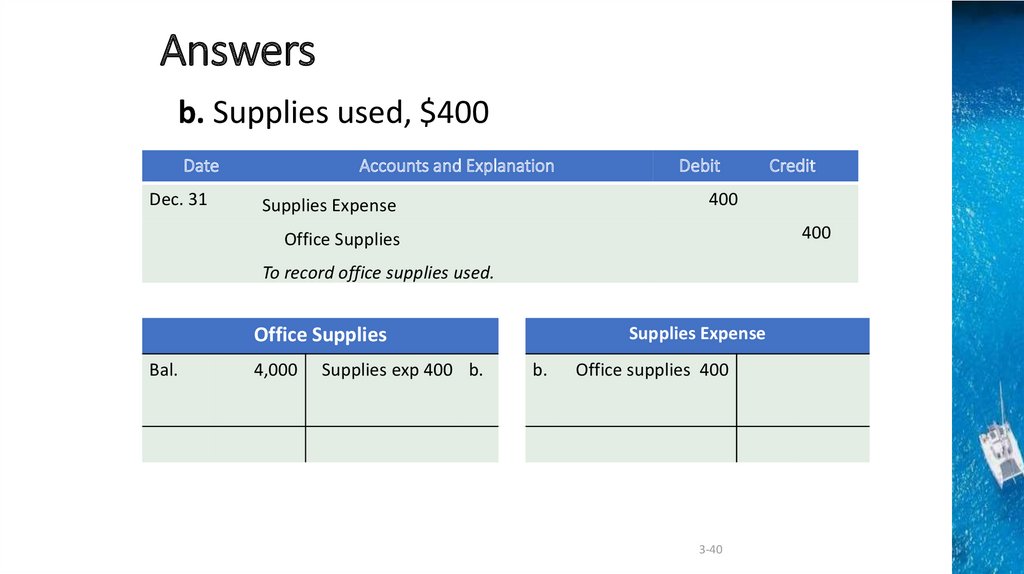

Answersb. Supplies used, $400

Date

Dec. 31

Accounts and Explanation

Debit

400

Supplies Expense

400

Office Supplies

To record office supplies used.

Supplies Expense

Office Supplies

Bal.

4,000

Supplies exp 400 b.

Credit

b.

Office supplies 400

3-40

41.

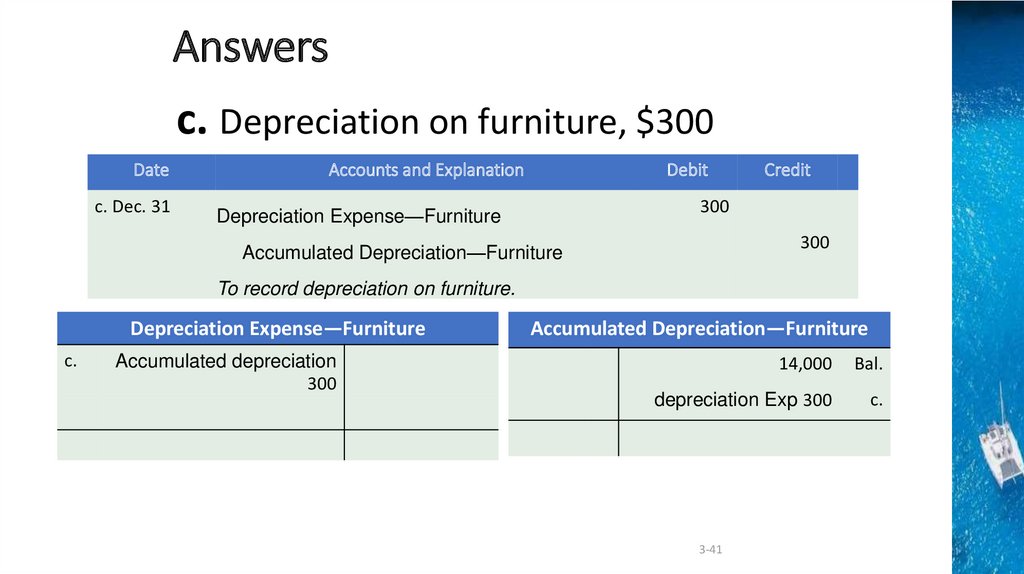

Answersc. Depreciation on furniture, $300

Date

c. Dec. 31

Accounts and Explanation

Debit

Credit

300

Depreciation Expense—Furniture

300

Accumulated Depreciation—Furniture

To record depreciation on furniture.

Depreciation Expense—Furniture

c.

Accumulated depreciation

300

Accumulated Depreciation—Furniture

14,000

Bal.

depreciation Exp 300

c.

3-41

42.

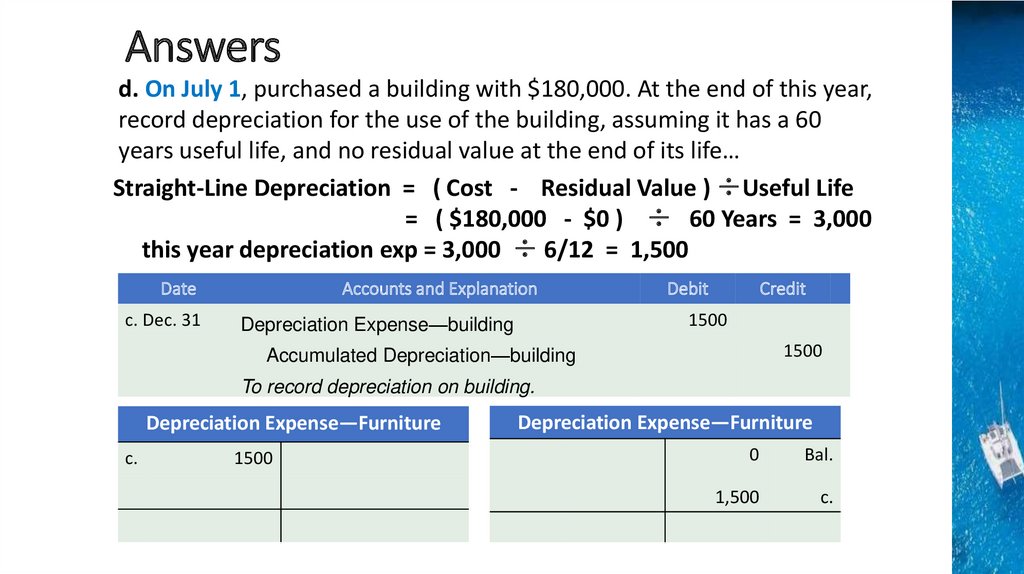

Answersd. On July 1, purchased a building with $180,000. At the end of this year,

record depreciation for the use of the building, assuming it has a 60

years useful life, and no residual value at the end of its life…

Straight-Line Depreciation = ( Cost - Residual Value ) ÷Useful Life

= ( $180,000 - $0 ) ÷ 60 Years = 3,000

this year depreciation exp = 3,000 ÷ 6/12 = 1,500

Date

c. Dec. 31

Accounts and Explanation

Debit

Credit

1500

Depreciation Expense—building

1500

Accumulated Depreciation—building

To record depreciation on building.

Depreciation Expense—Furniture

c.

1500

Depreciation Expense—Furniture

0

Bal.

1,500

c.

43.

Prepaid Expenses(A) or Expense ?1. Other prepaid expenses, such as Prepaid Rent, are

accounted for exactly as Insurance and Supplies.

2. We should note that some prepaid expenses are both

paid for and fully used up within a single period.

3. For example, a company may pay monthly rent on the

first day of each month. This payment creates a prepaid

expense on the first day of the month that fully expires

by the end of the month.

4. In these special cases, we can record the cash paid with

a debit to the expense account instead of an asset

account.

Accounting

43

44.

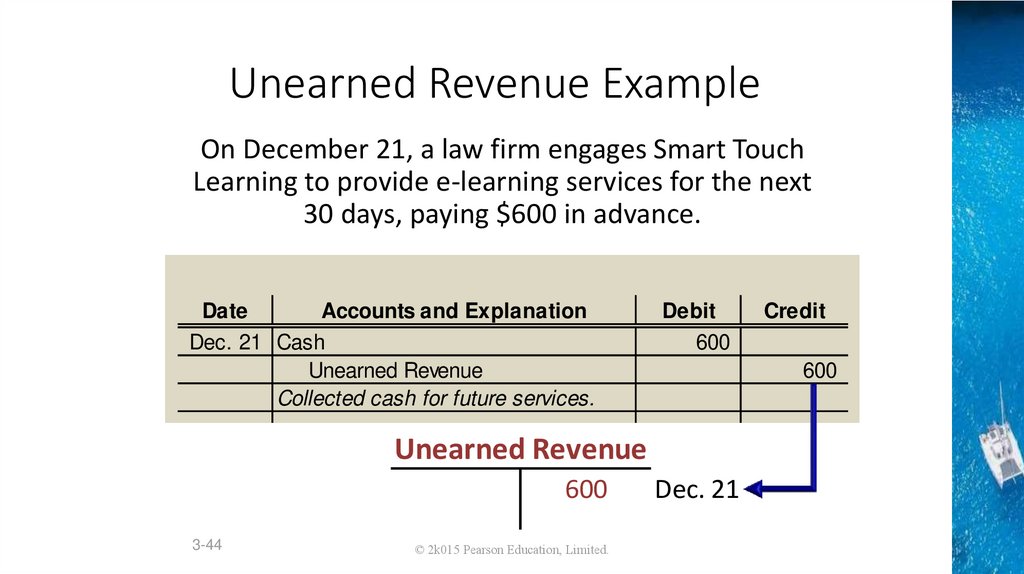

Unearned Revenue ExampleOn December 21, a law firm engages Smart Touch

Learning to provide e-learning services for the next

30 days, paying $600 in advance.

Date

Accounts and Explanation

Dec. 21 Cash

Unearned Revenue

Collected cash for future services.

Debit

600

600

Unearned Revenue

600

3-44

© 2k015 Pearson Education, Limited.

Credit

Dec. 21

45.

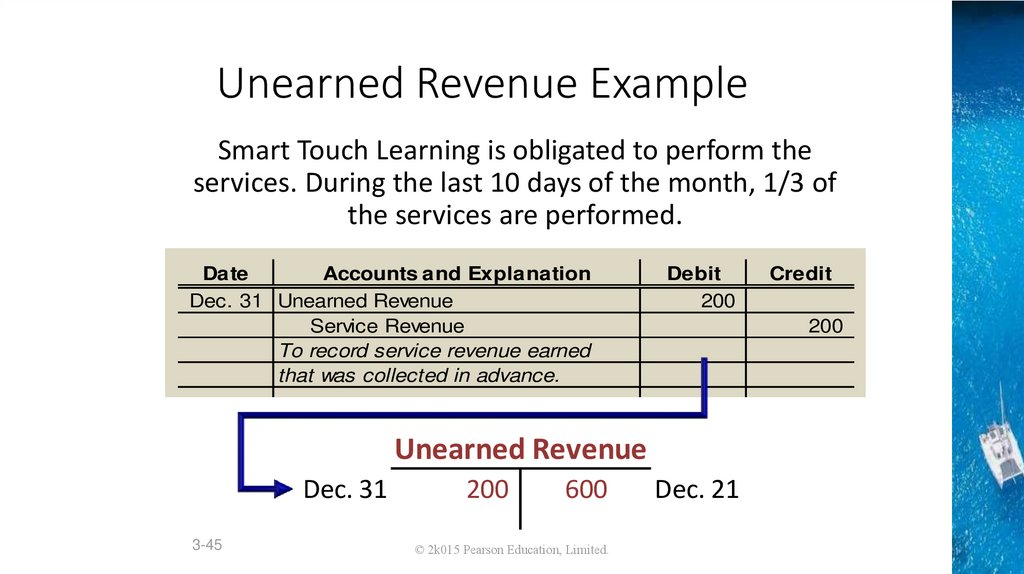

Unearned Revenue ExampleSmart Touch Learning is obligated to perform the

services. During the last 10 days of the month, 1/3 of

the services are performed.

Date

Accounts and Explanation

Dec. 31 Unearned Revenue

Service Revenue

To record service revenue earned

that was collected in advance.

Debit

200

200

Unearned Revenue

Dec. 31

3-45

200

600

© 2k015 Pearson Education, Limited.

Credit

Dec. 21

46.

Unearned RevenuesOn December 26, 2009, FastForward agrees to provide

consulting services to a client for a fixed fee of $3,000

for 60 days. On this date, the client pays the entire

consulting fee in advance. FastForward makes the

following entry:

Accounting

46

47.

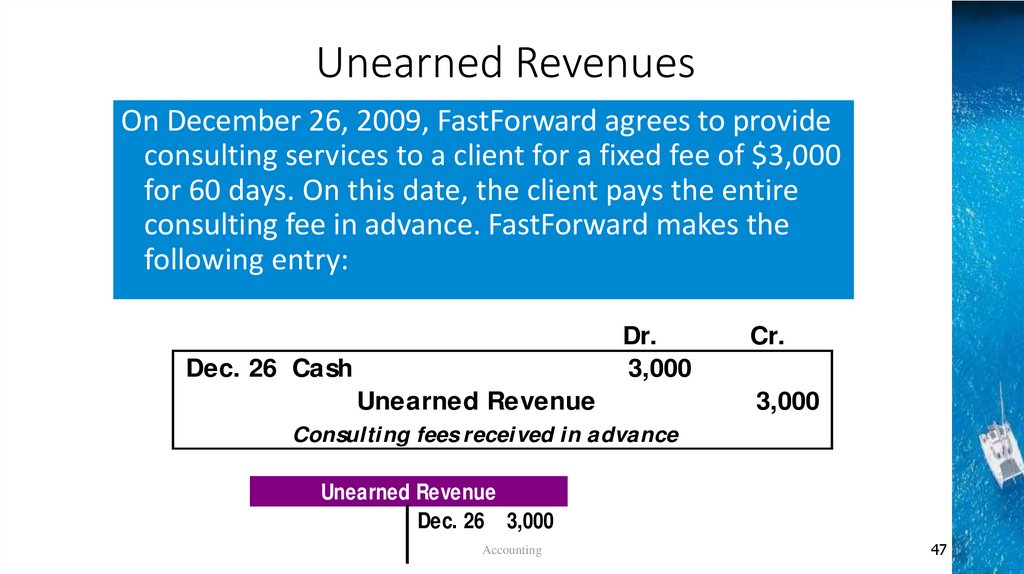

Unearned RevenuesOn December 26, 2009, FastForward agrees to provide

consulting services to a client for a fixed fee of $3,000

for 60 days. On this date, the client pays the entire

consulting fee in advance. FastForward makes the

following entry:

Dr.

3,000

Dec. 26 Cash

Unearned Revenue

Cr.

3,000

Consulting fees received in advance

Unearned Revenue

Dec. 26 3,000

Accounting

47

48.

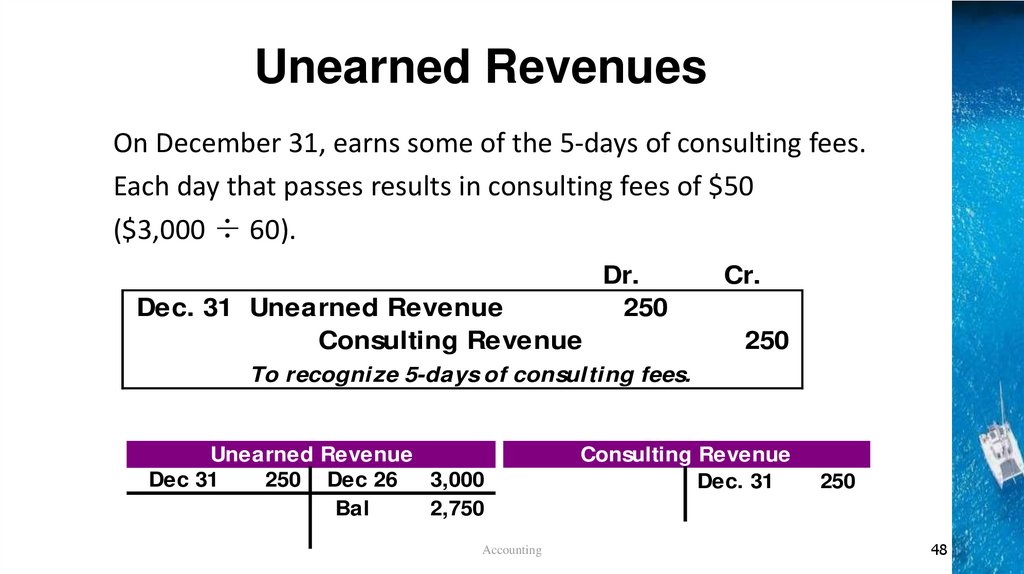

Unearned RevenuesOn December 31, earns some of the 5-days of consulting fees.

Each day that passes results in consulting fees of $50

($3,000 ÷ 60).

Dec. 31 Unearned Revenue

Consulting Revenue

Dr.

250

Cr.

250

To recognize 5-days of consulting fees.

Unearned Revenue

Dec 31

250 Dec 26

3,000

Bal

2,750

Accounting

Consulting Revenue

Dec. 31

250

48

49.

Multiple ChoicesUnearned revenue is essentially a(n):

A.

B.

C.

D.

net income.

net loss.

liability.

asset.

© 2015 Pearson Education, Limited.

2mins

50.

Multiple Choices2mins

Which of the following are the two basic categories

of adjusting entries?

A.

B.

C.

D.

Net income and net loss

Expenses and revenues

Prepaids and accruals

Cash and noncash

© 2015 Pearson Education, Limited.

51.

Keep up the good work !C U next Tuesday!

51

finance

finance