Similar presentations:

Accounting Cycle

1.

Ho rn gren ’sAc co u ntin g

Lecture Ten

Lisa, Li

Accounting

1

2.

Learning Objectives – Chapter 41. Prepare the financial statements including the

classified balance sheet

2. Use the worksheet to prepare financial

statements

3. Explain the purpose of, journalize, and postclosing entries

Accounting

2

3.

Learning Objectives – Chapter 44. Prepare the post-closing trial balance

5. Describe the accounting cycle

6. Use the current ratio to evaluate business

performance

Accounting

3

4.

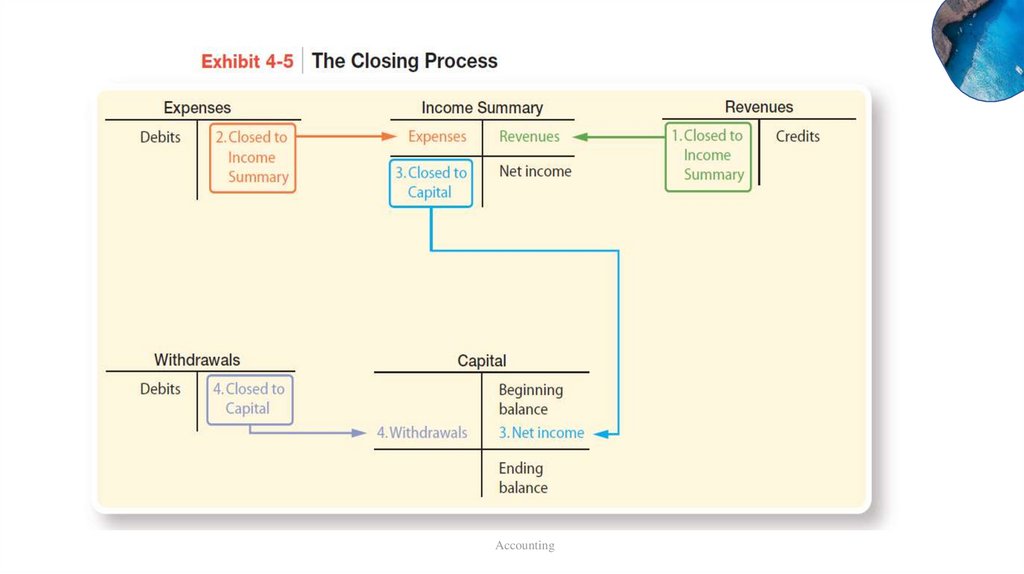

Review: Closing Process• Resets revenue, expense and

withdrawal account balances to

zero at the end of the period.

Identify accounts

for closing.

• Helps summarize a period’s

revenues and expenses in the

Income Summary account.

Record and post

closing entries.

• the process of closing the books

and getting ready for the next

accounting period.

Prepare post-closing

trial balance.

Accounting

5.

Accounting6.

Review: HomeworkAccounting

7.

Homework SolutionsMEL’S BOWLING ALLEY

Post-Closing Trial Balance

December 31, 2014

Date

Dec. 31

Accounts and Explanation

Service Revenue

Income Summary

To close revenue.

Debit

94,000

Credit

94,000

Account Title

Debit

Cash

31

Income Summary

Insurance Expense

Salaries Expense

Supplies Expense

Utilities Expense

Depreciation Expense—Equipment

Depreciated Expense—Building

To close expenses.

Balance

70,525

Accounts Receivable

20,000

36,000

800

12,000

1,500

225

Office Supplies

Prepaid Insurance

Equipment

$ 15,400

2,310

450

2,300

40,000

Accumulated Depreciation—Equipment

Building

$ 12,000

75,000

Accumulated Depreciation—Building

31

31

Income Summary

Turner, Capital

To close Income Summary.

Turner, Capital

Turner, Withdrawals

To close withdrawals.

23,475

Land

23,475

28,000

28,000

4,500

15,000

Accounts Payable

3,400

Utilities Payable

620

Salaries Payable

2,840

Unearned Revenue

1,300

Turner, Capital

Current Ratio = Total current assets / Total current liabilities

Total

= ($15,400 + $2,310 + $450 + $2,300) / ($3,400 + $620 + $2,840 + $1,300)

= $20,460 / $8,160 = 2.51

Accounting

Credit

125,800

$ 150,460

$ 150,460

7

8.

Review: Current Ratio•The most commonly used ratio is the Current Ratio.

•It is a measure of the company’s ability to quickly pay its debts.

•A company prefers to have a high current ratio because that means

it has plenty of current assets to pay its current liabilities.

A rule of thumb: A strong current ratio is 1.50,

A current ratio of 1.00 is considered low and somewhat risky.

Accounting

8

9.

Learning Objective 1Prepare the financial

statements including the

classified balance sheet

Accounting

9

10.

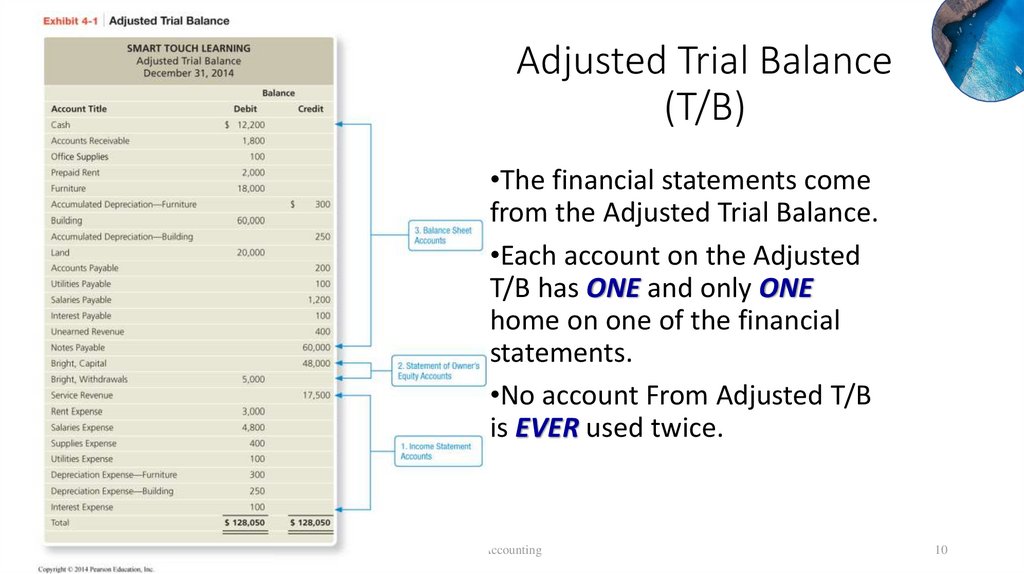

Adjusted Trial Balance(T/B)

•The financial statements come

from the Adjusted Trial Balance.

•Each account on the Adjusted

T/B has ONE and only ONE

home on one of the financial

statements.

•No account From Adjusted T/B

is EVER used twice.

Accounting

10

11.

How do we prepare Financial Statements?The financial statements should be prepared in the

following order:

1.Income statement —reports revenues and expenses

and calculates net income or net loss for the time

period.

2.Statement of owner’s equity —shows how capital

changed during the period due to owner contributions,

net income (or net loss), and owner withdrawals.

3.Balance sheet —reports assets, liabilities, and owner’s

equity as of the last day of the period.

Accounting

11

12.

SMART TOUCH LEARNINGIncome Statement

Two Months Ended December 31, 2014

Revenues

Service Revenue

$ 17,500

Expenses

Rent Expense

$ 3,000

Salaries Expense

4,800

Supplies Expense

400

Utilities Expense

100

Depr Exp - Furniture

300

Depr Exp - Building

250

Interest Expense

100

Total expenses

8,950

Net income

$ 8,550

Income Statement Amounts

Accounting

12

13.

SMART TOUCH LEARNINGIncome Statement

Two Months Ended December 31, 2014

Revenues

Service Revenue

$ 17,500

Expenses

Rent Expense

$ 3,000

Salaries Expense

4,800

Supplies Expense

400

Utilities Expense

100

Depr Exp - Furniture

300

Depr Exp - Building

250

Interest Expense

100

Total expenses

8,950

Net income

$ 8,550

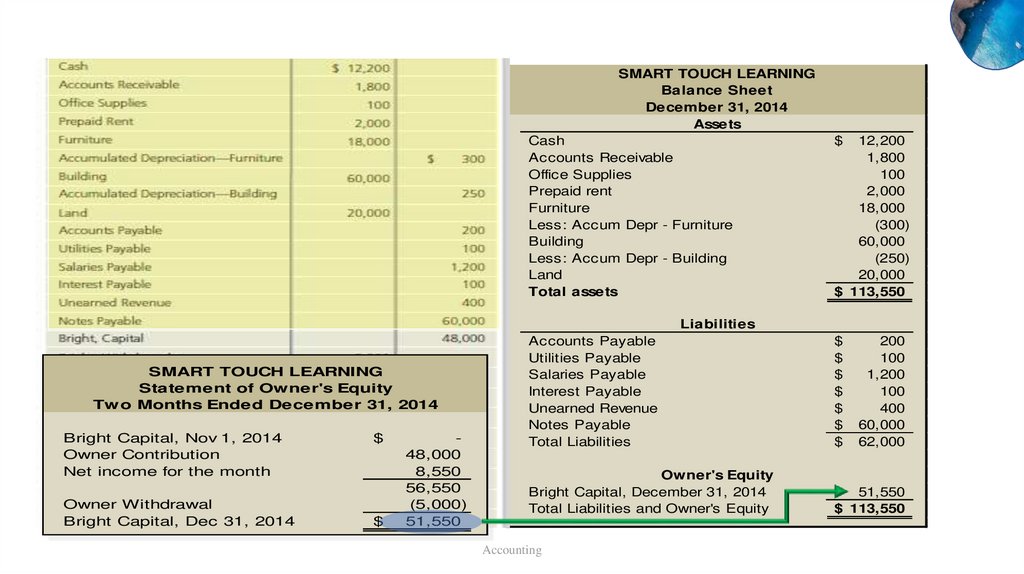

SMART TOUCH LEARNING

Statement of Owner's Equity

Two Months Ended December 31, 2014

Bright Capital, Nov 1, 2014

Owner Contribution

Net income for the month

Owner Withdrawal

Bright Capital, Dec 31, 2014

Accounting

$

$

48,000

8,550

56,550

(5,000)

51,550

13

14.

SMART TOUCH LEARNINGBalance Sheet

December 31, 2014

Assets

Cash

Accounts Receivable

Office Supplies

Prepaid rent

Furniture

Less: Accum Depr - Furniture

Building

Less: Accum Depr - Building

Land

Total assets

$

12,200

1,800

100

2,000

18,000

(300)

60,000

(250)

20,000

$ 113,550

Liabilities

SMART TOUCH LEARNING

Statement of Owner's Equity

Two Months Ended December 31, 2014

Bright Capital, Nov 1, 2014

Owner Contribution

Net income for the month

Owner Withdrawal

Bright Capital, Dec 31, 2014

$

$

48,000

8,550

56,550

(5,000)

51,550

Accounts Payable

Utilities Payable

Salaries Payable

Interest Payable

Unearned Revenue

Notes Payable

Total Liabilities

$

$

$

$

$

$

$

Owner's Equity

Bright Capital, December 31, 2014

Total Liabilities and Owner's Equity

51,550

$ 113,550

Accounting

200

100

1,200

100

400

60,000

62,000

15.

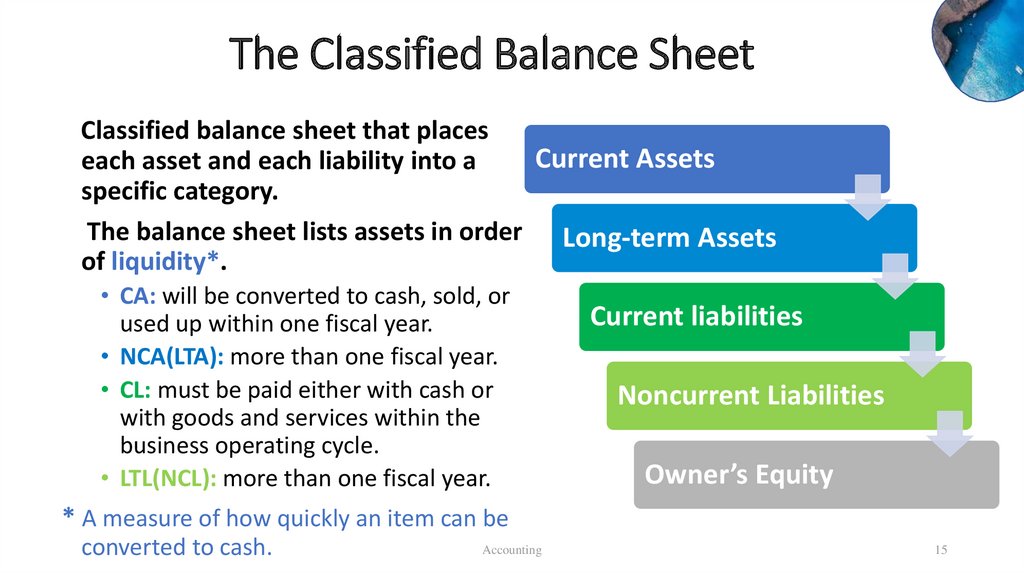

The Classified Balance SheetClassified balance sheet that places

Current Assets

each asset and each liability into a

specific category.

The balance sheet lists assets in order Long-term Assets

of liquidity*.

• CA: will be converted to cash, sold, or

used up within one fiscal year.

• NCA(LTA): more than one fiscal year.

• CL: must be paid either with cash or

with goods and services within the

business operating cycle.

• LTL(NCL): more than one fiscal year.

Current liabilities

Noncurrent Liabilities

Owner’s Equity

* A measure of how quickly an item can be

converted to cash.

Accounting

15

16.

SMART TOUCH LEARNINGBalance Sheet

December 31, 2014

Assets

Current Assets:

Cash

Accounts Receivable

Office Supplies

Prepaid rent

Total Current Assets

Plant Assets:

Furniture

Less: Accum Depr - Furniture

Building

Less: Accum Depr - Building

Land

Total Plant Assets

Total assets

The Classified

Balance Sheet

$

12,200

1,800

100

2,000

16,100

18,000

(300)

60,000

(250)

20,000

97,450

$ 113,550

Liabilities

Current Liabilities:

Accounts Payable

Utilities Payable

Salaries Payable

Interest Payable

Unearned Revenue

Total Current Assets

Long-term Liabilities

Notes Payable

Total Liabilities

Owner's Equity

Bright, Capital, Dec. 31, 2014

Total Liabilities & Owner's Equity

Accounting

$

200

100

1,200

100

400

2,000

60,000

62,000

51,550

$ 113,550

16

17.

SMART TOUCH LEARNINGBalance Sheet

December 31, 2014

Assets

Current Assets:

Cash

Accounts Receivable

Office Supplies

Prepaid rent

Total Current Assets

Plant Assets:

Furniture

Less: Accum Depr - Furniture

Building

Less: Accum Depr - Building

Land

Total Plant Assets

Total assets

$

12,200

1,800

100

2,000

16,100

18,000

(300)

60,000

(250)

20,000

97,450

$ 113,550

• The Asset section is sub-divided

into current and long-term groups.

• Sometimes, there is also a subgrouping for plant assets

intangible assets and long-term

investments.

Liabilities

Current Liabilities:

Accounts Payable

Utilities Payable

Salaries Payable

Interest Payable

Unearned Revenue

Total Current Assets

Long-term Liabilities

Notes Payable

Total Liabilities

Owner's Equity

Bright, Capital, Dec. 31, 2014

Total Liabilities & Owner's Equity

Accounting

$

200

100

1,200

100

400

2,000

60,000

62,000

51,550

$ 113,550

17

18.

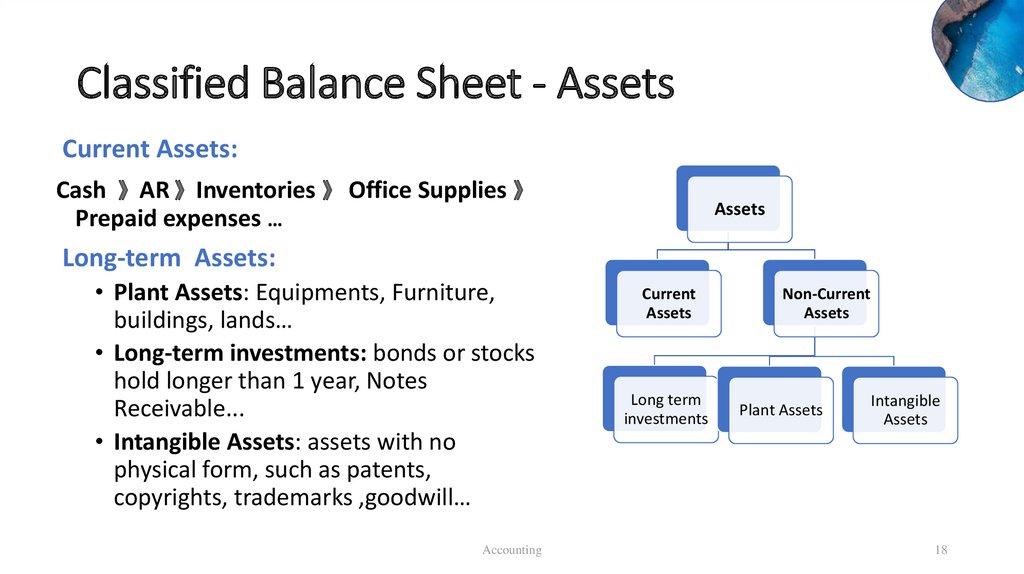

Classified Balance Sheet - AssetsCurrent Assets:

Cash 》AR 》Inventories 》 Office Supplies 》

Prepaid expenses …

Assets

Long-term Assets:

• Plant Assets: Equipments, Furniture,

buildings, lands…

• Long-term investments: bonds or stocks

hold longer than 1 year, Notes

Receivable...

• Intangible Assets: assets with no

physical form, such as patents,

copyrights, trademarks ,goodwill…

Accounting

Current

Assets

Long term

investments

Non-Current

Assets

Plant Assets

Intangible

Assets

18

19.

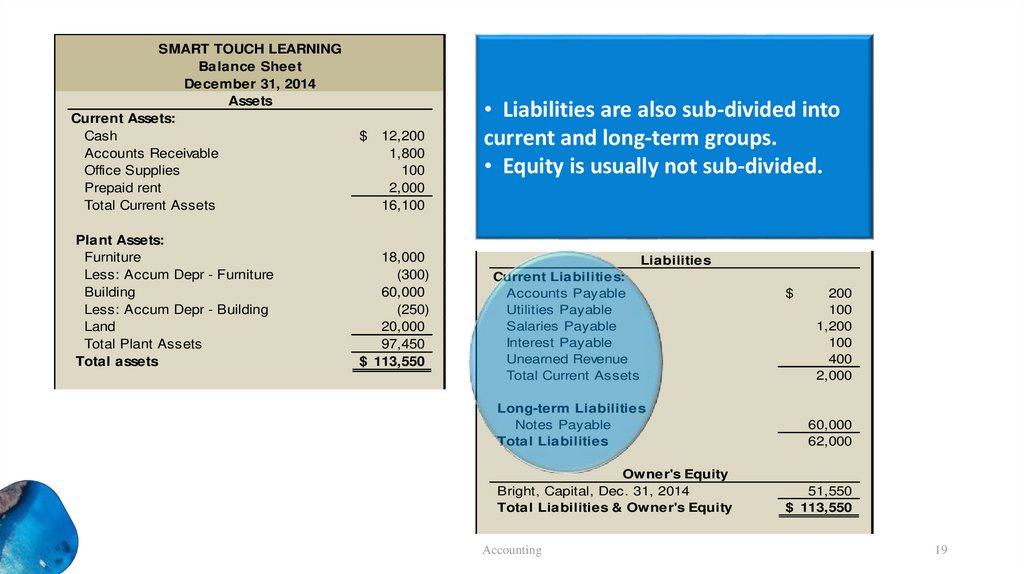

SMART TOUCH LEARNINGBalance Sheet

December 31, 2014

Assets

Current Assets:

Cash

Accounts Receivable

Office Supplies

Prepaid rent

Total Current Assets

Plant Assets:

Furniture

Less: Accum Depr - Furniture

Building

Less: Accum Depr - Building

Land

Total Plant Assets

Total assets

$

12,200

1,800

100

2,000

16,100

18,000

(300)

60,000

(250)

20,000

97,450

$ 113,550

• Liabilities are also sub-divided into

current and long-term groups.

• Equity is usually not sub-divided.

Liabilities

Current Liabilities:

Accounts Payable

Utilities Payable

Salaries Payable

Interest Payable

Unearned Revenue

Total Current Assets

Long-term Liabilities

Notes Payable

Total Liabilities

Owner's Equity

Bright, Capital, Dec. 31, 2014

Total Liabilities & Owner's Equity

Accounting

$

200

100

1,200

100

400

2,000

60,000

62,000

51,550

$ 113,550

19

20.

Accounting20

21.

Accounting21

22.

Learning Objective 2Use the worksheet to prepare

financial statements

Accounting

22

23.

Accounting23

24.

Accounting24

25.

4-25Accounting

26.

Accounting26

27.

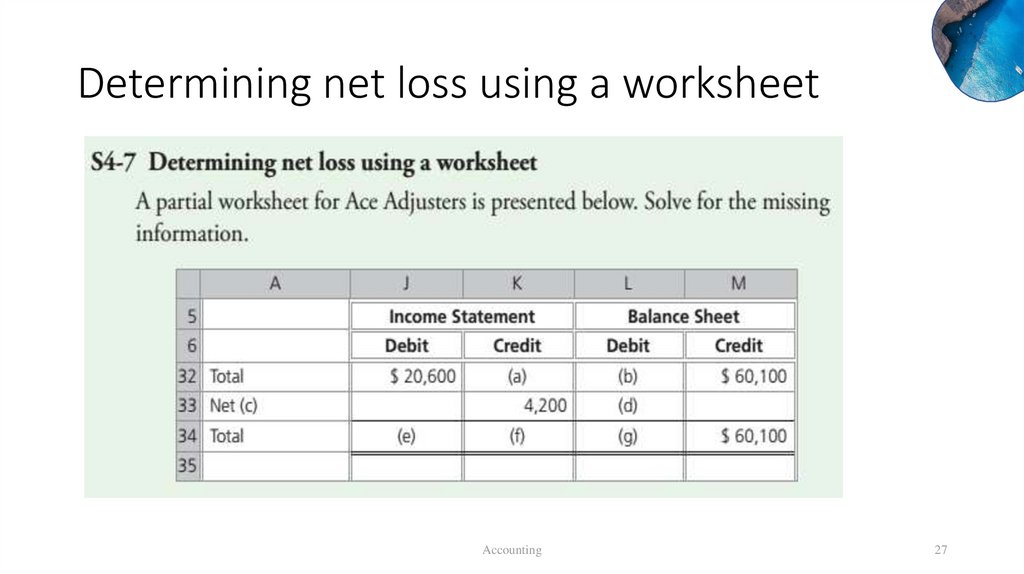

Determining net loss using a worksheetAccounting

27

28.

Determining net loss using a worksheeta. $16,400 ($20,600 – $4,200)

c. Loss

d. $4,200

f. $20,600 ($16,400 + $4,200)

b. $55,900 ($60,100 – $4,200)

e. $20,600

g. $60,100 ($55,900 + $4,200)

Accounting

28

29.

Learning Objective 5Describe the

accounting cycle

Accounting

30.

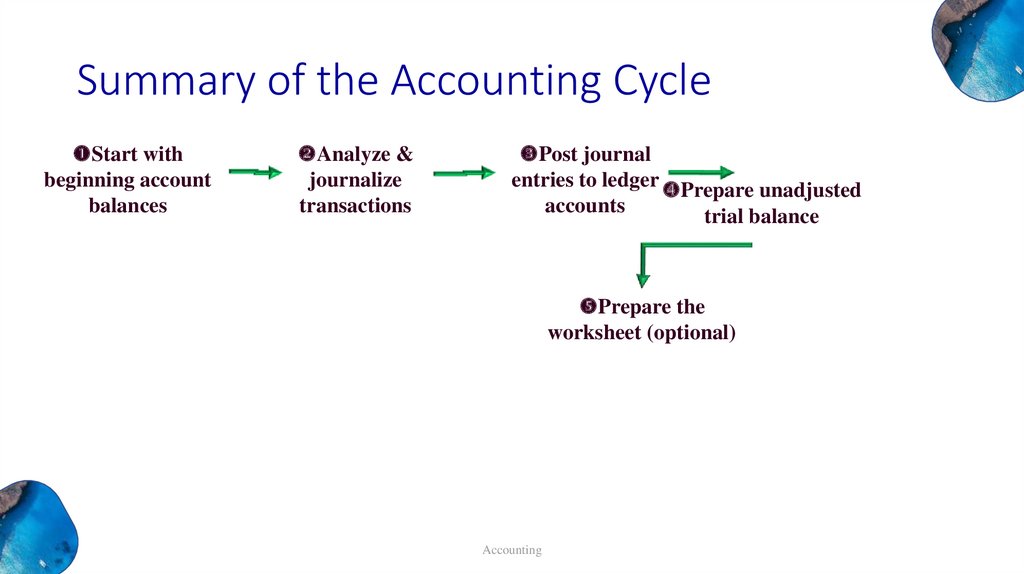

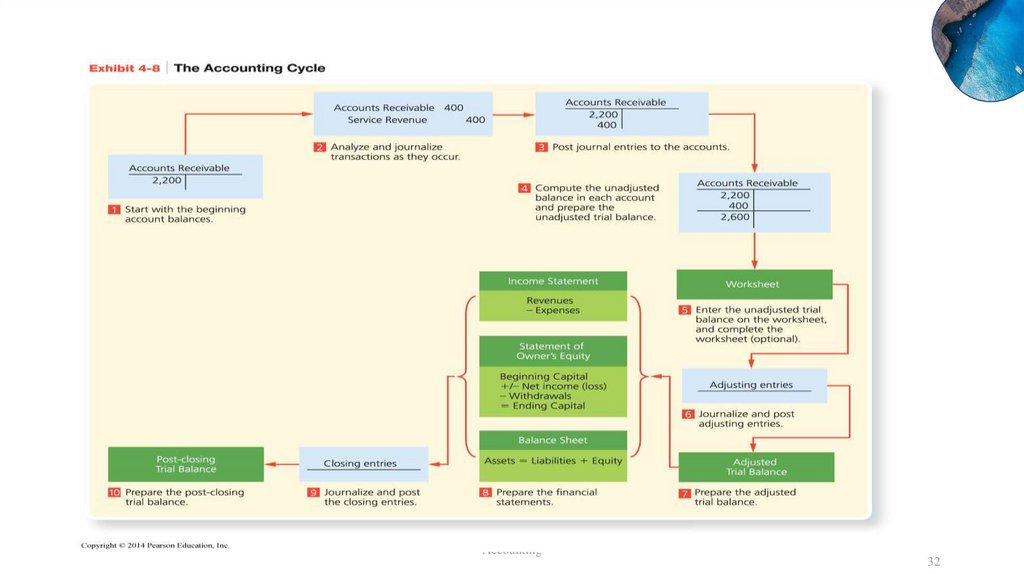

Summary of the Accounting CycleStart with

beginning account

balances

Analyze &

journalize

transactions

Post journal

entries to ledger Prepare unadjusted

accounts

trial balance

Prepare the

worksheet (optional)

Accounting

31.

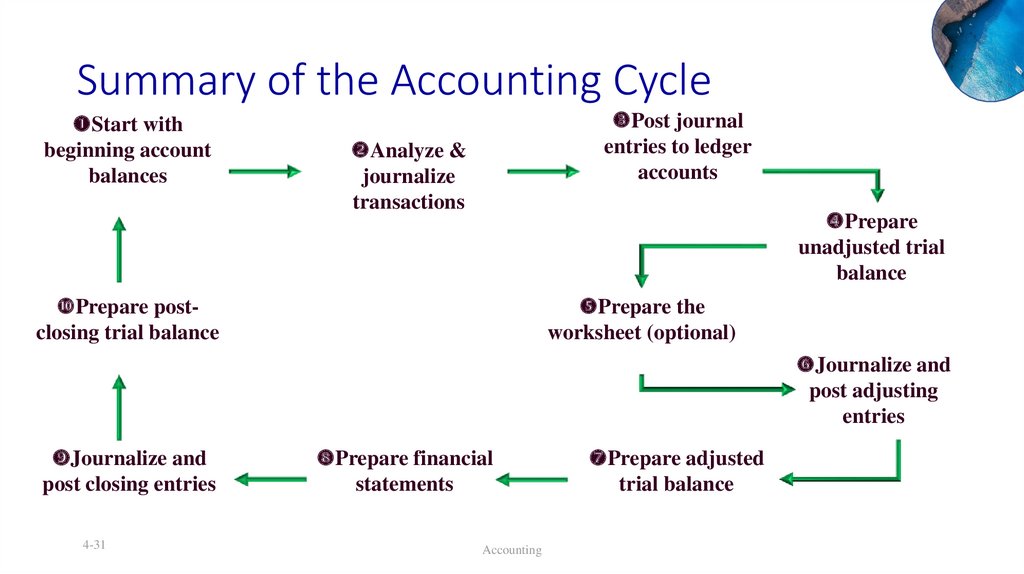

Summary of the Accounting CycleStart with

beginning account

balances

Post journal

entries to ledger

accounts

Analyze &

journalize

transactions

Prepare

unadjusted trial

balance

Prepare postclosing trial balance

Prepare the

worksheet (optional)

Journalize and

post adjusting

entries

Journalize and

post closing entries

4-31

Prepare financial

statements

Accounting

Prepare adjusted

trial balance

32.

Accounting32

33.

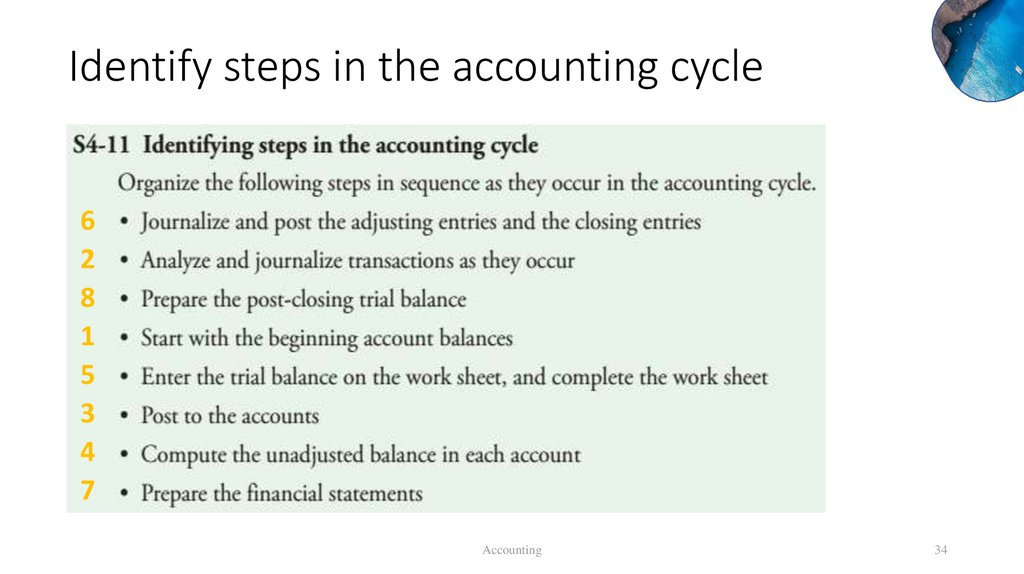

Identify steps in the accounting cycleAccounting

33

34.

Identify steps in the accounting cycle6

2

8

1

5

3

4

7

Accounting

34

35.

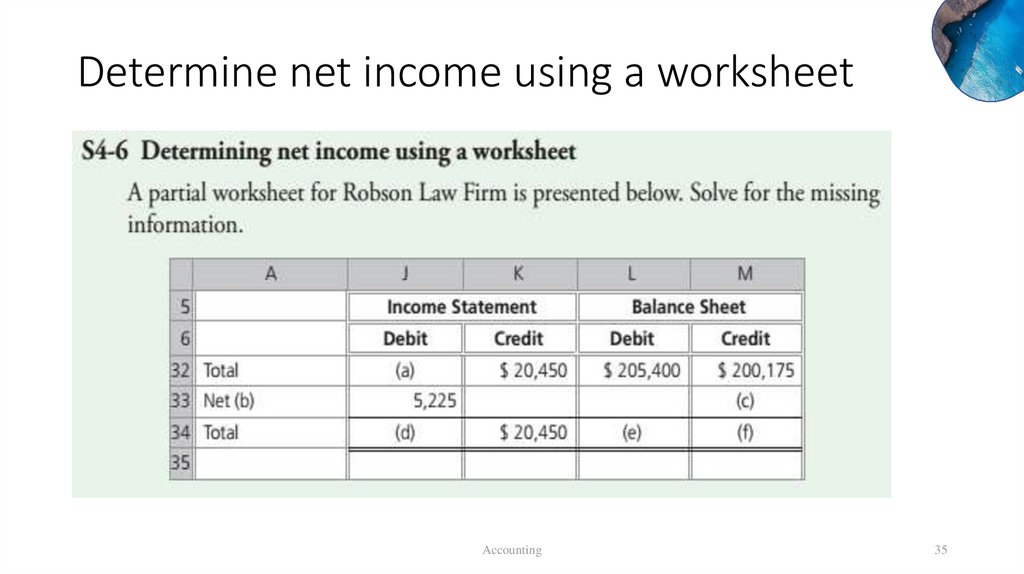

Determine net income using a worksheetAccounting

35

36.

Determine net income using a worksheeta. $15,225 ($20,450 – $5,225)

d. $20,450 ($15,225 + $5,225)

f. $205,400 ($200,175 + $5,225)

b. Income

e. $205,400

Accounting

c. $5,225

36

37.

Practice closing entriesAccounting

37

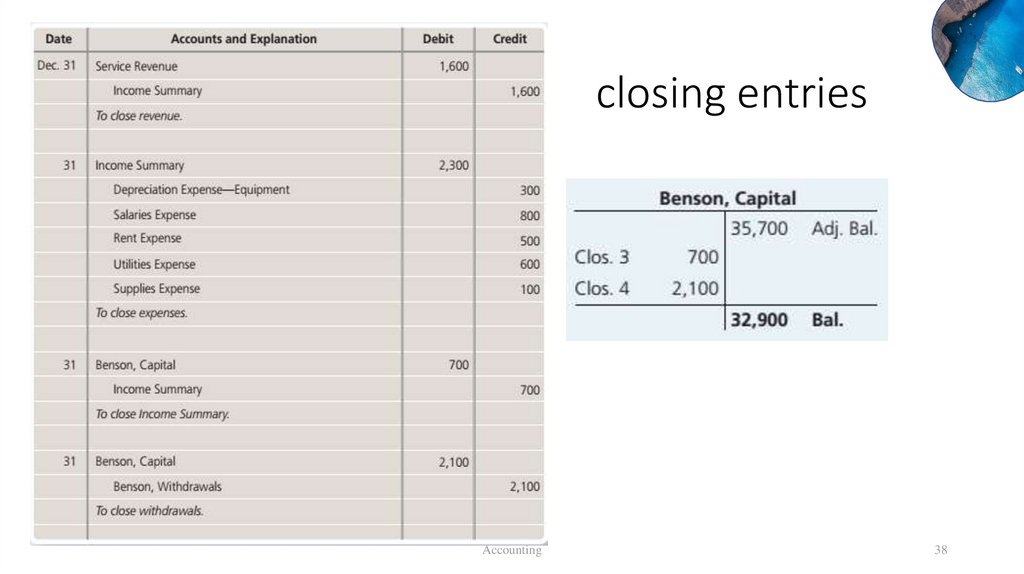

38.

closing entriesAccounting

38

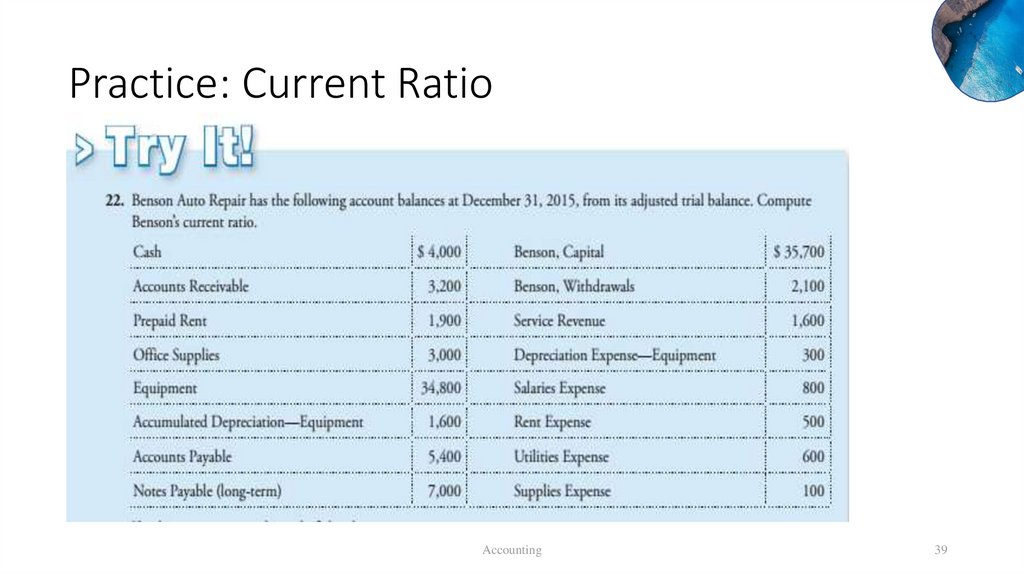

39.

Practice: Current RatioAccounting

39

40.

Current RatioAccounting

40

41.

Summary problemAccounting

41

42.

SolutionAccounting

42

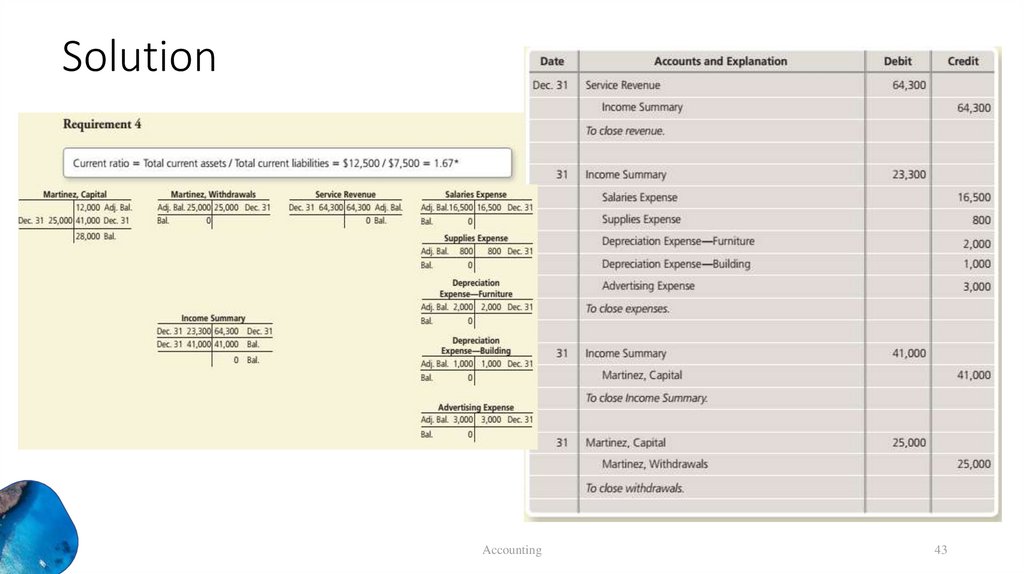

43.

SolutionAccounting

43

finance

finance