Similar presentations:

Accounting

1.

Ho rn gren ’sAc co u ntin g

Lecture Eight

Lisa, Li

Accounting

1

2.

Learning Objectives – Chapter 31.

2.

3.

4.

5.

6.

Cash Basis vs Accrual Basis Accounting

Apply the time period concept, revenue recognition, and matching principles

Explain the purpose of and journalize and post adjusting entries

Prepare an adjusted trial balance

Identify the impact of adjusting entries on the financial statements

use a worksheet to prepare the adjusted trial balance

Accounting

Accounting

2

3.

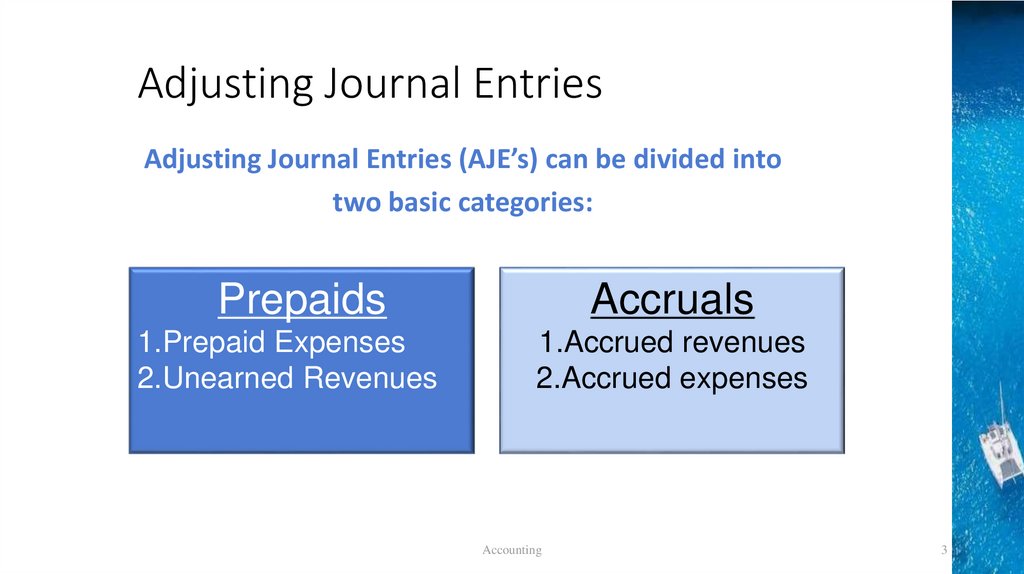

Adjusting Journal EntriesAdjusting Journal Entries (AJE’s) can be divided into

two basic categories:

Prepaids

1.Prepaid Expenses

2.Unearned Revenues

Accruals

1.Accrued revenues

2.Accrued expenses

Accounting

3

4.

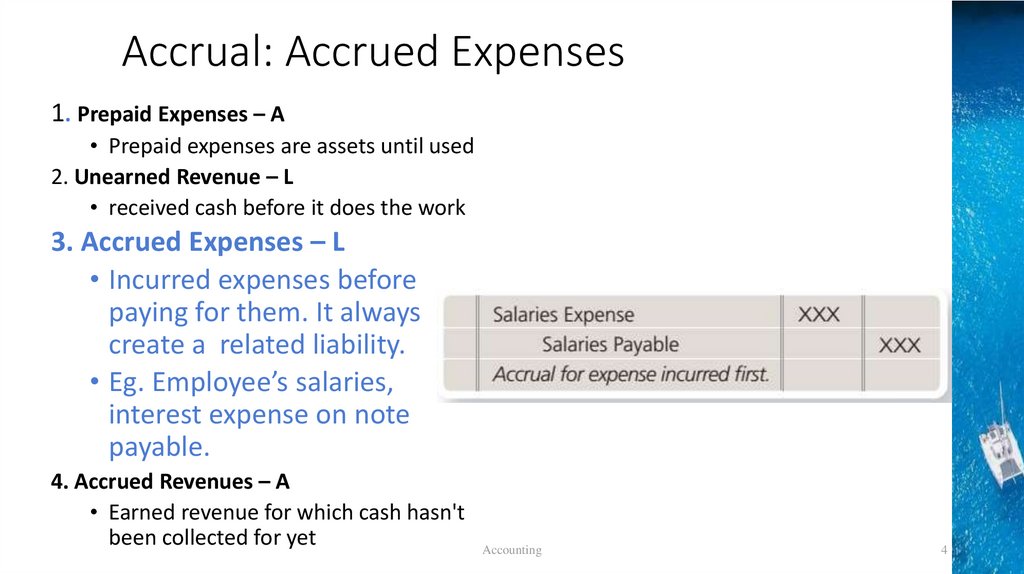

Accrual: Accrued Expenses1. Prepaid Expenses – A

• Prepaid expenses are assets until used

2. Unearned Revenue – L

• received cash before it does the work

3. Accrued Expenses – L

• Incurred expenses before

paying for them. It always

create a related liability.

• Eg. Employee’s salaries,

interest expense on note

payable.

4. Accrued Revenues – A

• Earned revenue for which cash hasn't

been collected for yet

Accounting

4

5.

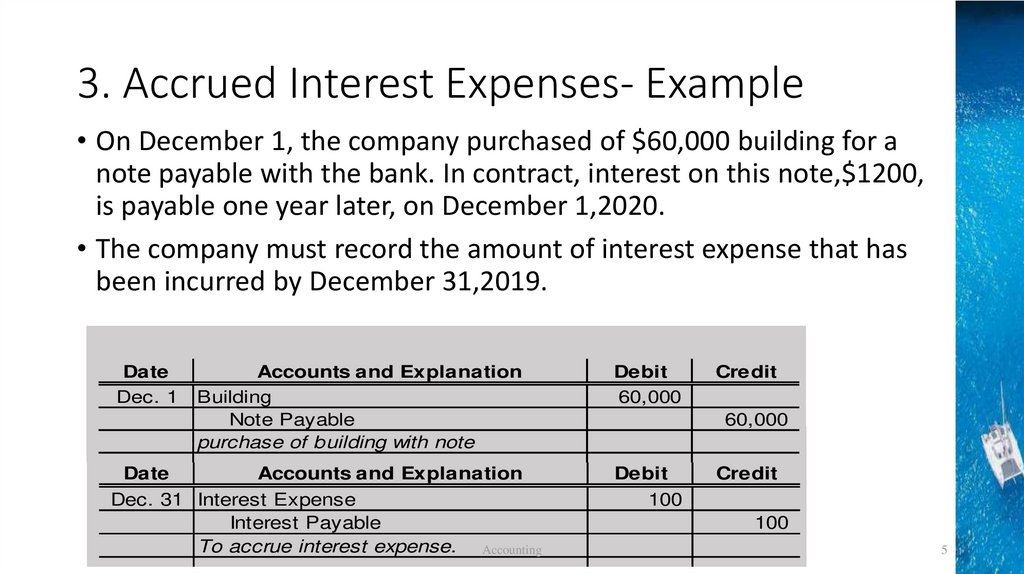

3. Accrued Interest Expenses- Example• On December 1, the company purchased of $60,000 building for a

note payable with the bank. In contract, interest on this note,$1200,

is payable one year later, on December 1,2020.

• The company must record the amount of interest expense that has

been incurred by December 31,2019.

Date

Dec. 1

Accounts and Explanation

Building

Note Payable

purchase of building with note

Date

Accounts and Explanation

Dec. 31 Interest Expense

Interest Payable

To accrue interest expense. Accounting

Debit

60,000

Credit

60,000

Debit

100

Credit

100

5

6.

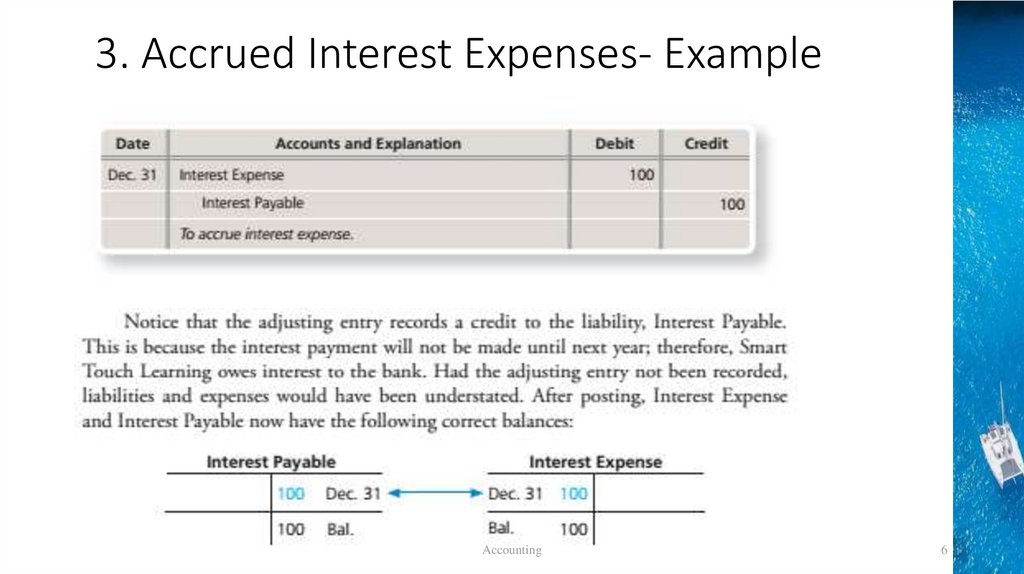

3. Accrued Interest Expenses- ExampleAccounting

6

7.

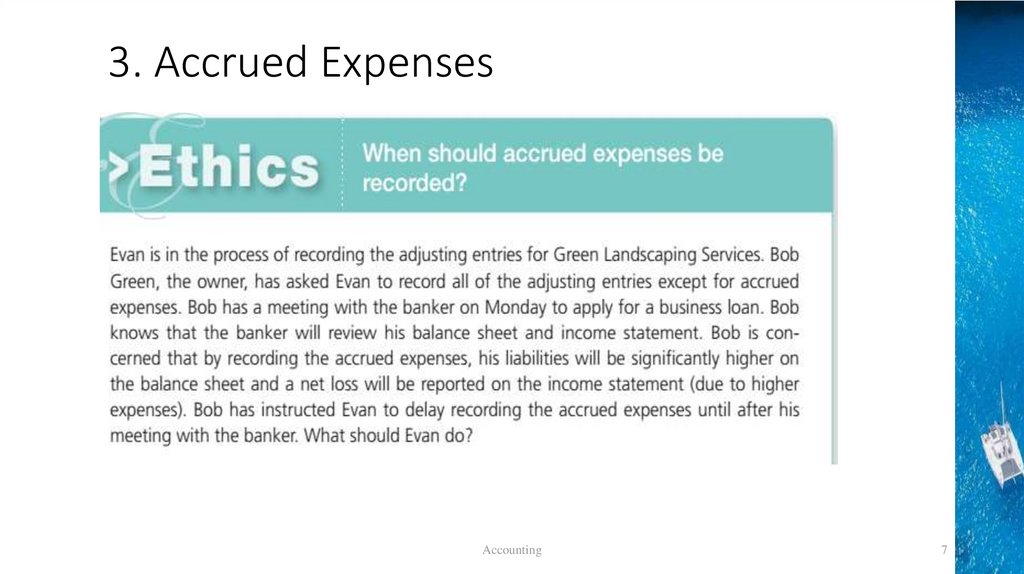

3. Accrued ExpensesAccounting

7

8.

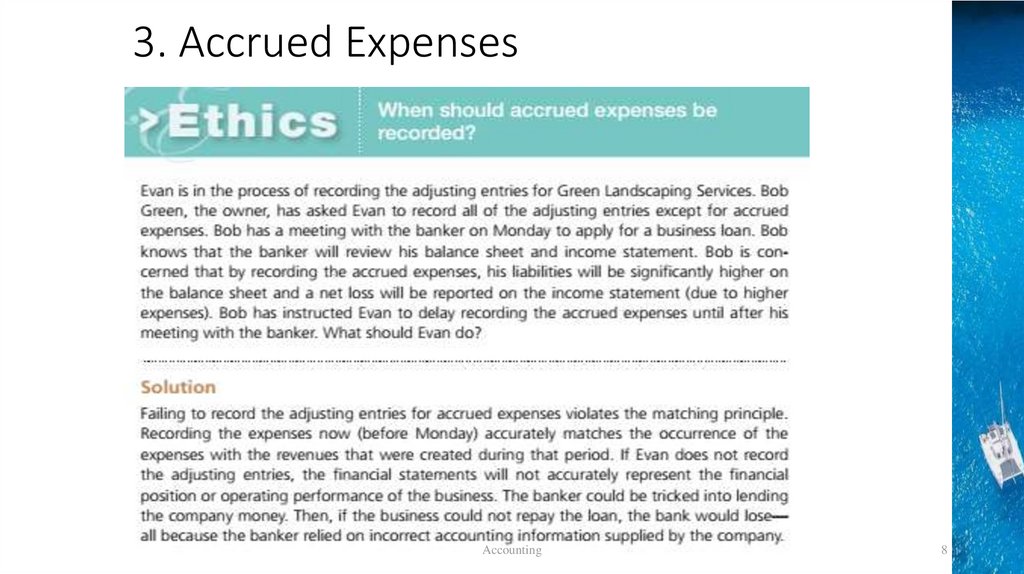

3. Accrued ExpensesAccounting

8

9.

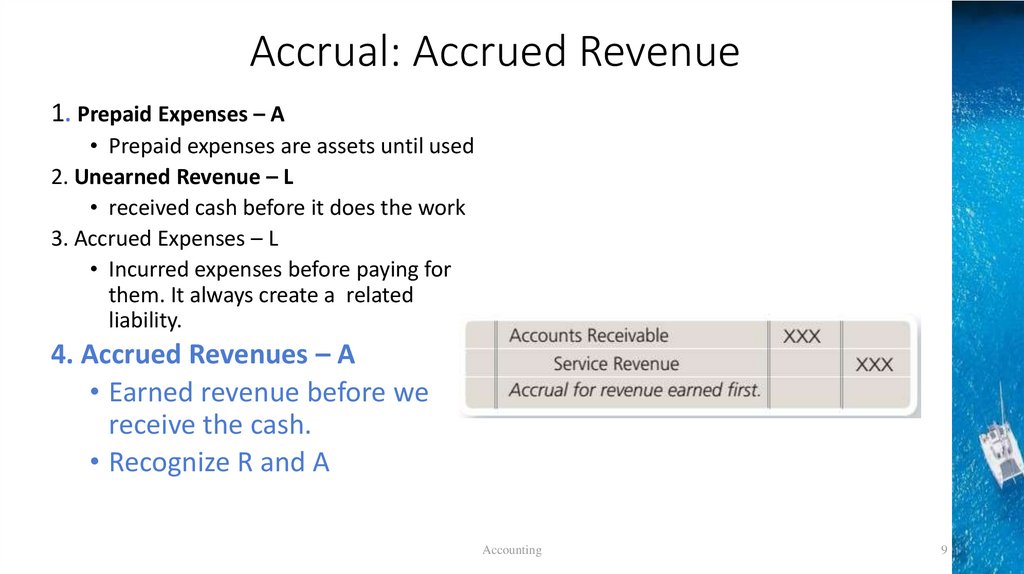

Accrual: Accrued Revenue1. Prepaid Expenses – A

• Prepaid expenses are assets until used

2. Unearned Revenue – L

• received cash before it does the work

3. Accrued Expenses – L

• Incurred expenses before paying for

them. It always create a related

liability.

4. Accrued Revenues – A

• Earned revenue before we

receive the cash.

• Recognize R and A

Accounting

9

10.

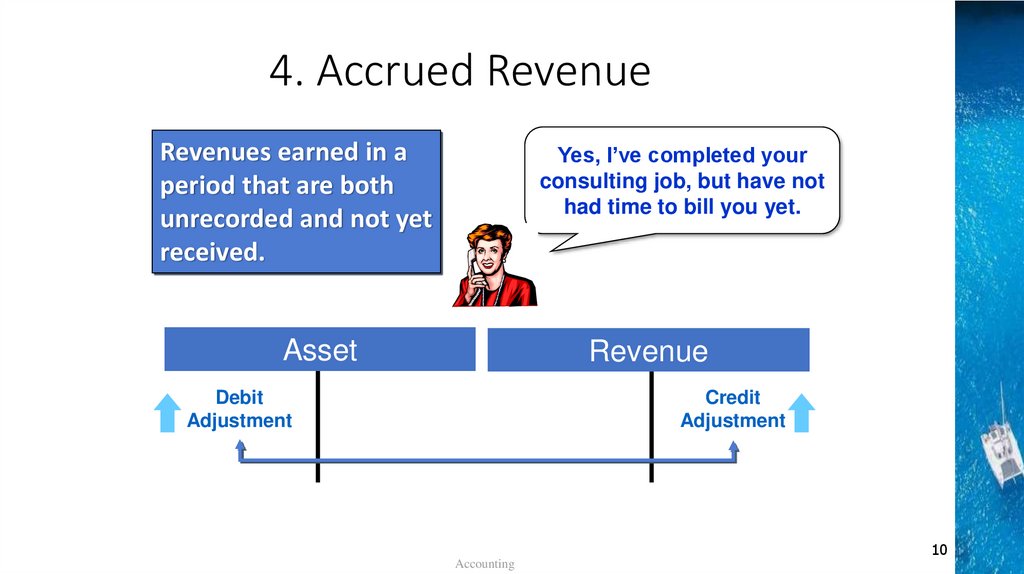

4. Accrued RevenueRevenues earned in a

period that are both

unrecorded and not yet

received.

Yes, I’ve completed your

consulting job, but have not

had time to bill you yet.

Asset

Revenue

Debit

Adjustment

Credit

Adjustment

10

Accounting

11.

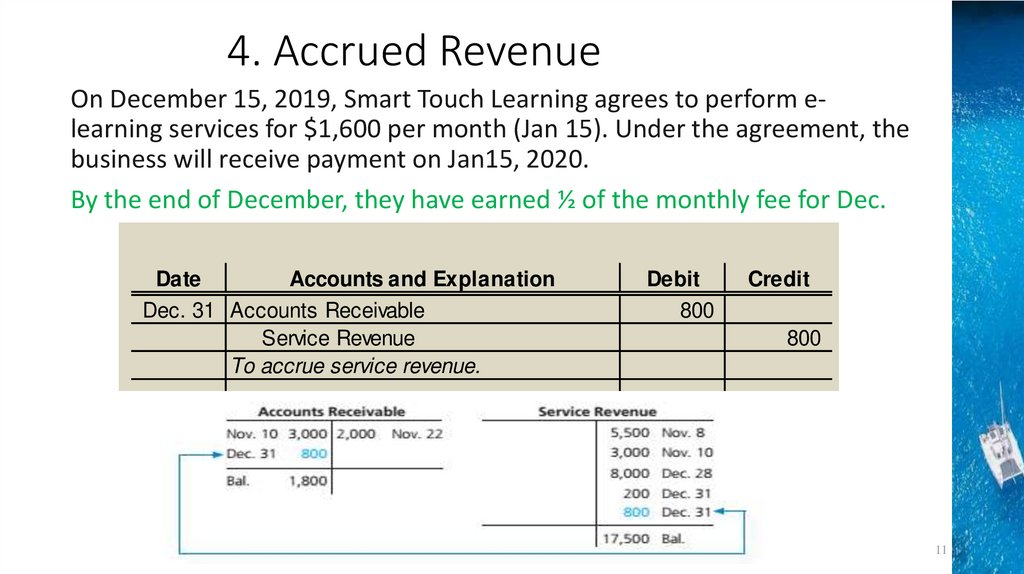

4. Accrued RevenueOn December 15, 2019, Smart Touch Learning agrees to perform elearning services for $1,600 per month (Jan 15). Under the agreement, the

business will receive payment on Jan15, 2020.

By the end of December, they have earned ½ of the monthly fee for Dec.

Date

Accounts and Explanation

Dec. 31 Accounts Receivable

Service Revenue

To accrue service revenue.

Accounting

Debit

800

Credit

800

11

12.

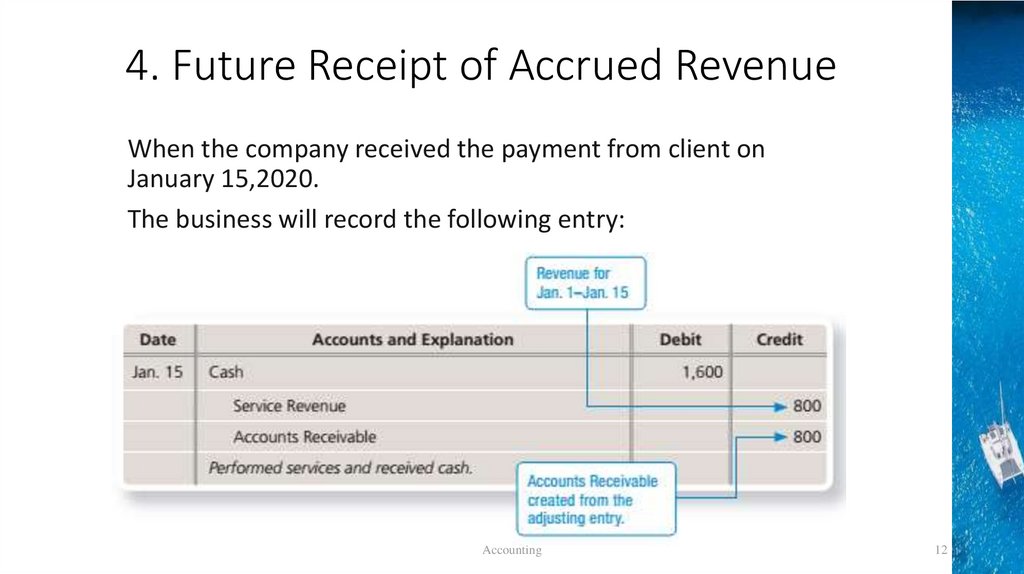

4. Future Receipt of Accrued RevenueWhen the company received the payment from client on

January 15,2020.

The business will record the following entry:

Accounting

12

13.

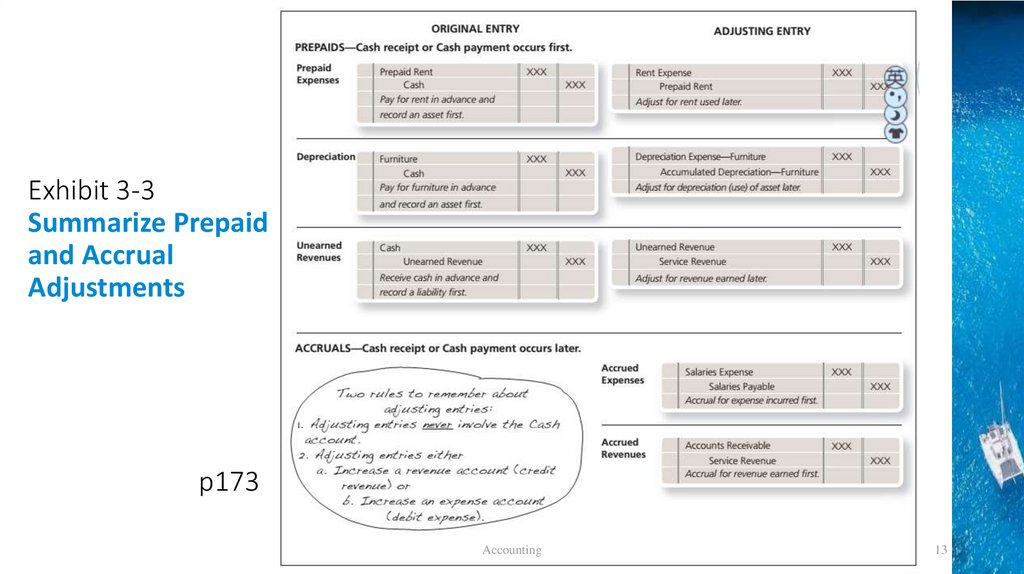

Exhibit 3-3Summarize Prepaid

and Accrual

Adjustments

p173

Accounting

13

14.

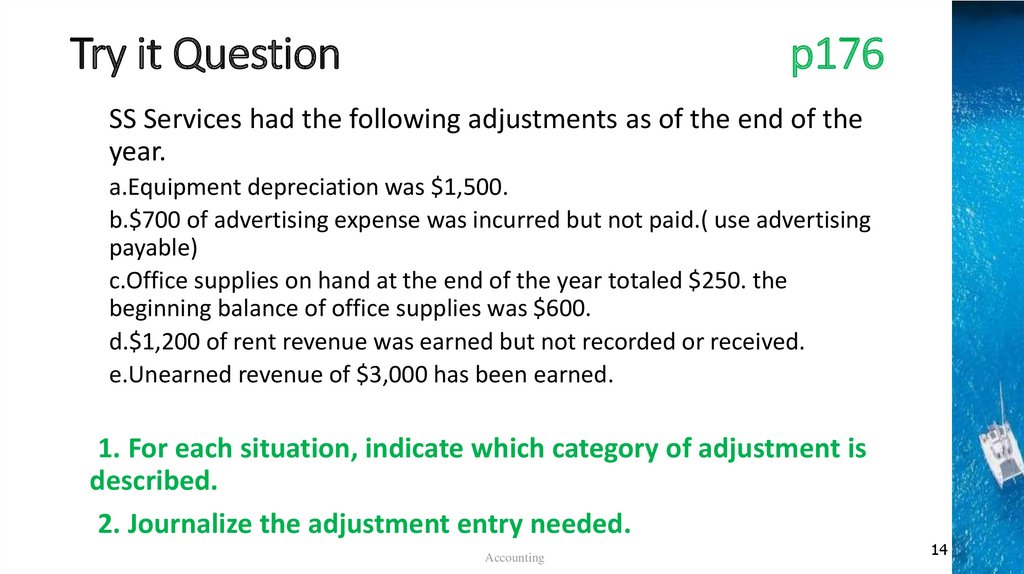

Try it Questionp176

SS Services had the following adjustments as of the end of the

year.

a.Equipment depreciation was $1,500.

b.$700 of advertising expense was incurred but not paid.( use advertising

payable)

c.Office supplies on hand at the end of the year totaled $250. the

beginning balance of office supplies was $600.

d.$1,200 of rent revenue was earned but not recorded or received.

e.Unearned revenue of $3,000 has been earned.

1. For each situation, indicate which category of adjustment is

described.

2. Journalize the adjustment entry needed.

Accounting

14

15.

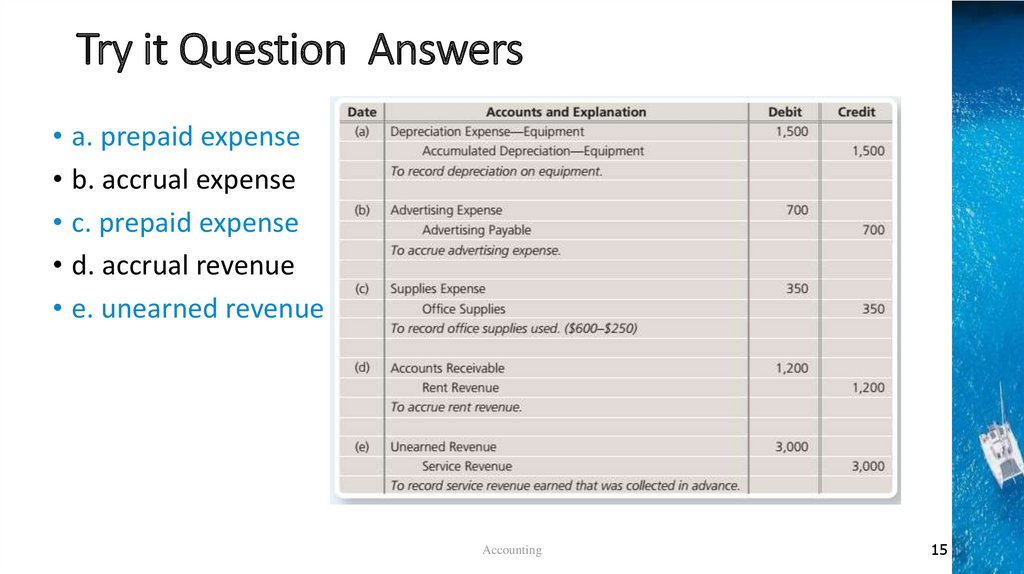

Try it Question Answers• a. prepaid expense

• b. accrual expense

• c. prepaid expense

• d. accrual revenue

• e. unearned revenue

Accounting

15

16.

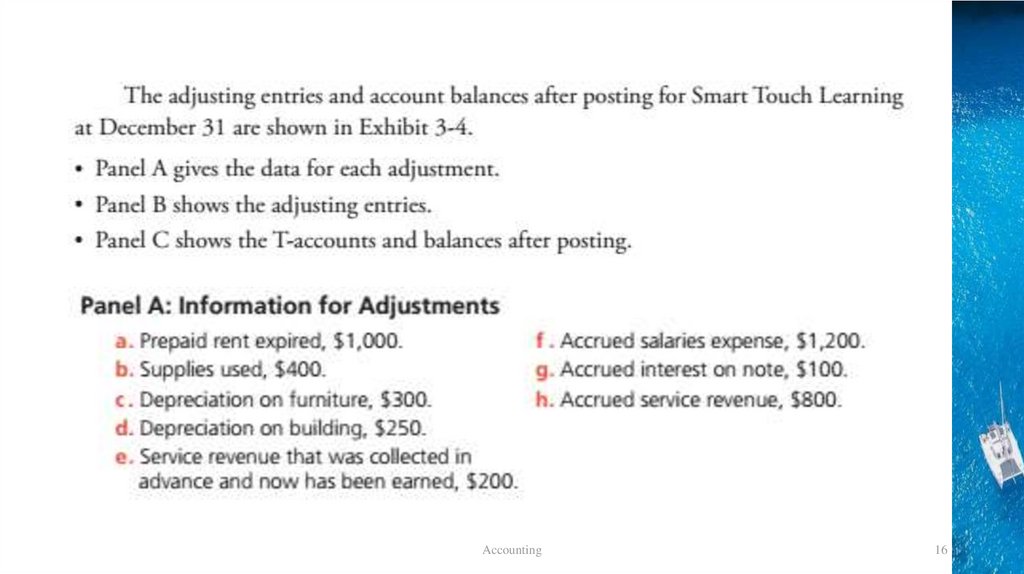

Accounting16

17.

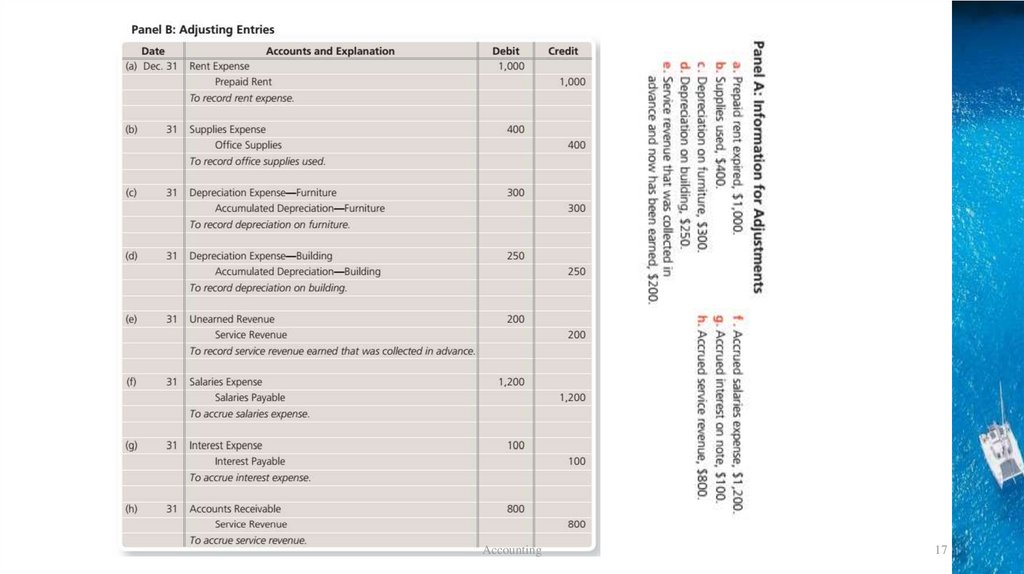

Accounting17

18.

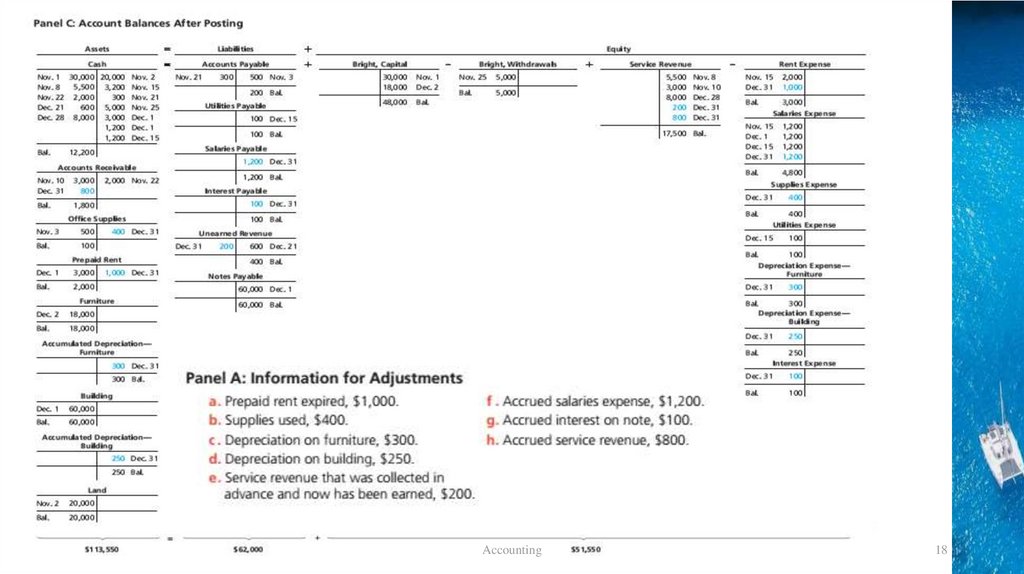

截图p175CAccounting

18

19.

Learning Objective 4Explain the purpose of and

prepare an adjusted trial

balance

Accounting

19

20.

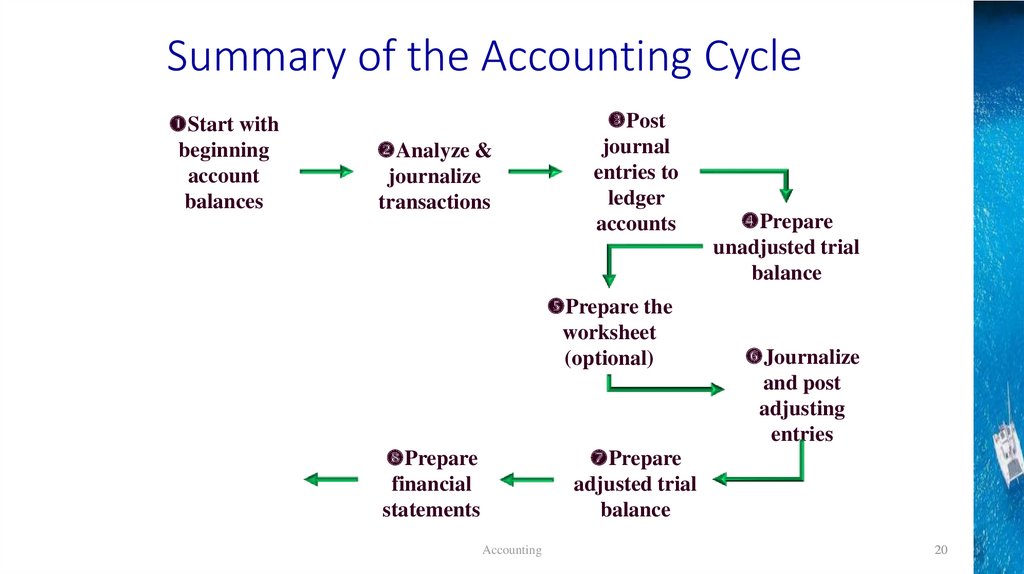

Summary of the Accounting CycleStart with

beginning

account

balances

Analyze &

journalize

transactions

Post

journal

entries to

ledger

accounts

Prepare the

worksheet

(optional)

Prepare

financial

statements

Prepare

unadjusted trial

balance

Journalize

and post

adjusting

entries

Prepare

adjusted trial

balance

Accounting

20

21.

The Adjusted Trial Balance• After journalizing and posting all the adjusting journal

entries at the end of the fiscal period, a new adjusted

trial balance is prepared.

– List all accounts

– List debit balances in the debit column

– List credit balance in the credit column

• If it balances, financial statements can be prepared.

Accounting

21

22.

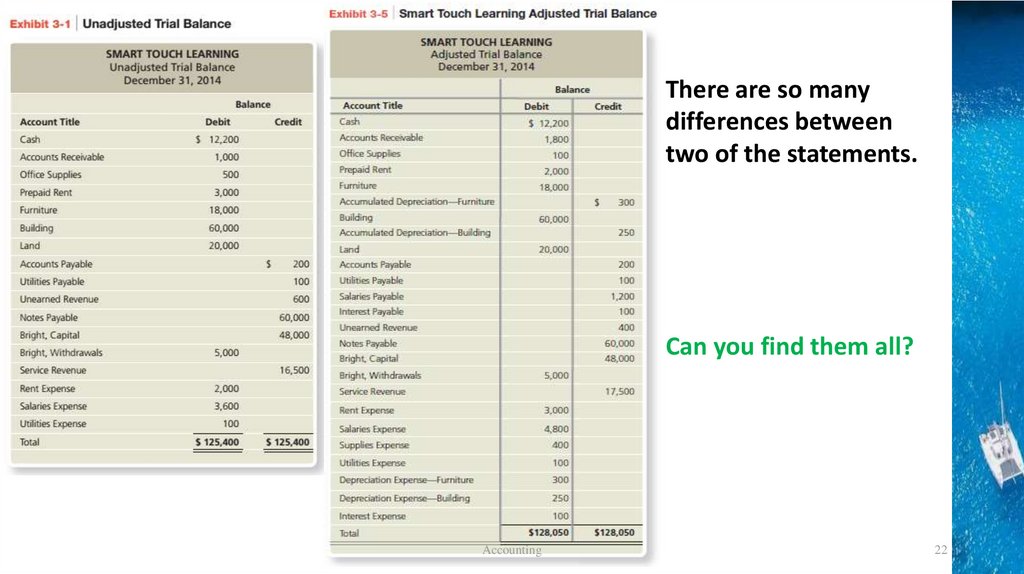

There are so manydifferences between

two of the statements.

Can you find them all?

Accounting

22

23.

Learning Objective 5Identify the impact of

adjusting entries on the

financial statements

Accounting

23

24.

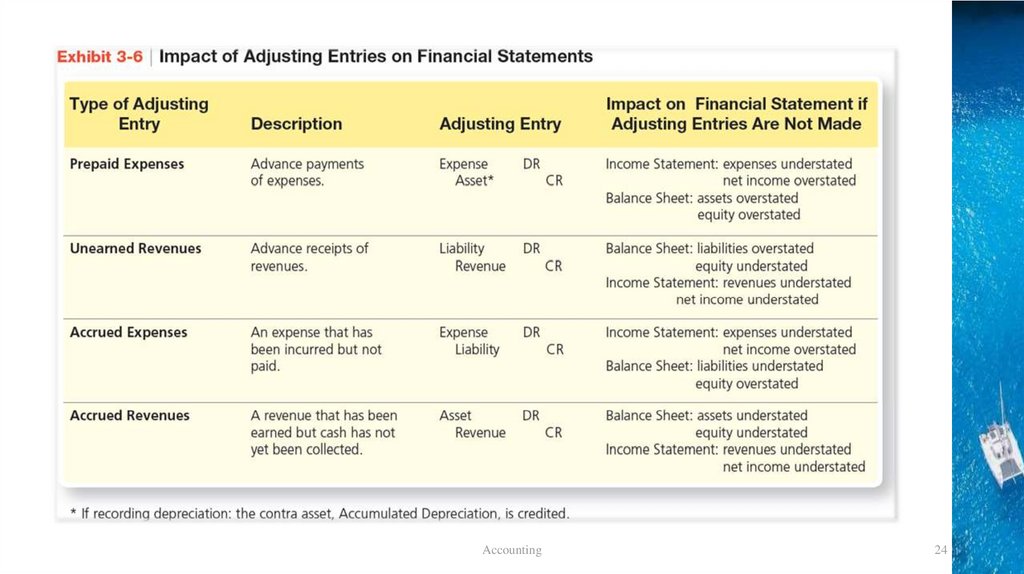

Accounting24

25.

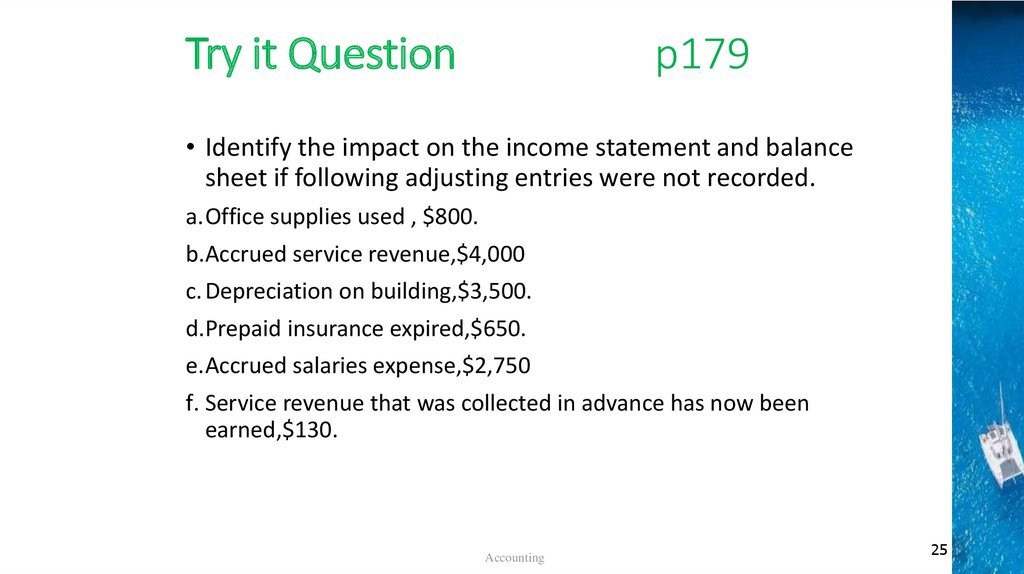

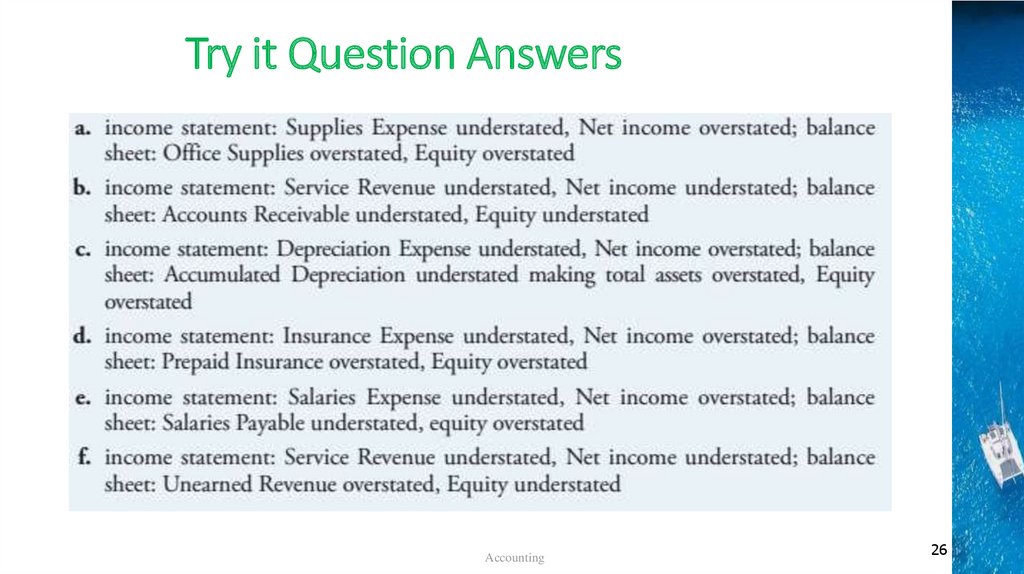

Try it Questionp179

• Identify the impact on the income statement and balance

sheet if following adjusting entries were not recorded.

a.Office supplies used , $800.

b.Accrued service revenue,$4,000

c. Depreciation on building,$3,500.

d.Prepaid insurance expired,$650.

e.Accrued salaries expense,$2,750

f. Service revenue that was collected in advance has now been

earned,$130.

Accounting

25

26.

Try it Question AnswersAccounting

26

27.

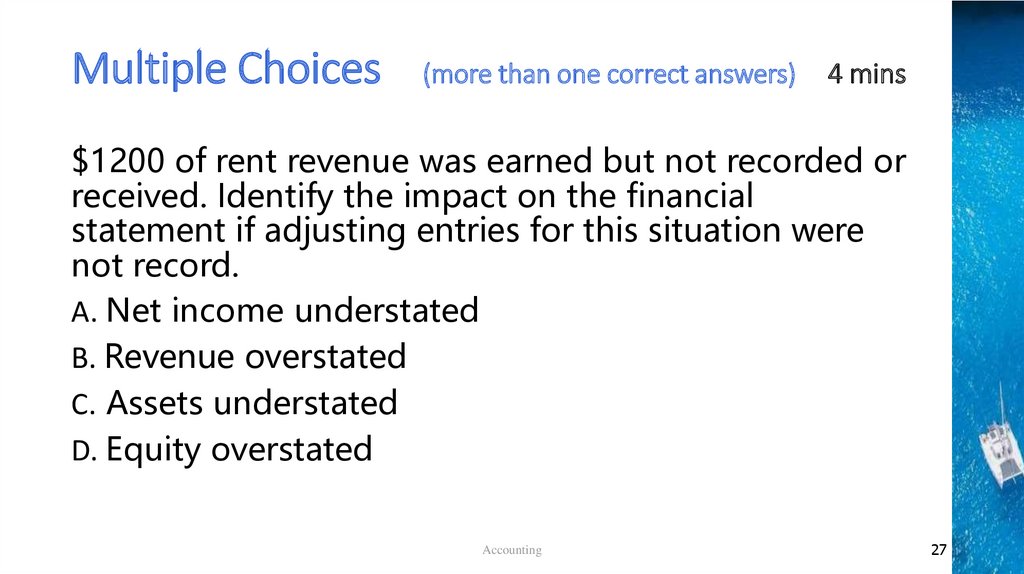

Multiple Choices(more than one correct answers)

4 mins

$1200 of rent revenue was earned but not recorded or

received. Identify the impact on the financial

statement if adjusting entries for this situation were

not record.

A. Net income understated

B. Revenue overstated

C. Assets understated

D. Equity overstated

Accounting

27

28.

Learning Objective 6Explain the worksheet and

use it to prepare adjusting

entries and the adjusted

trial balance

P179-181

Accounting

28

29.

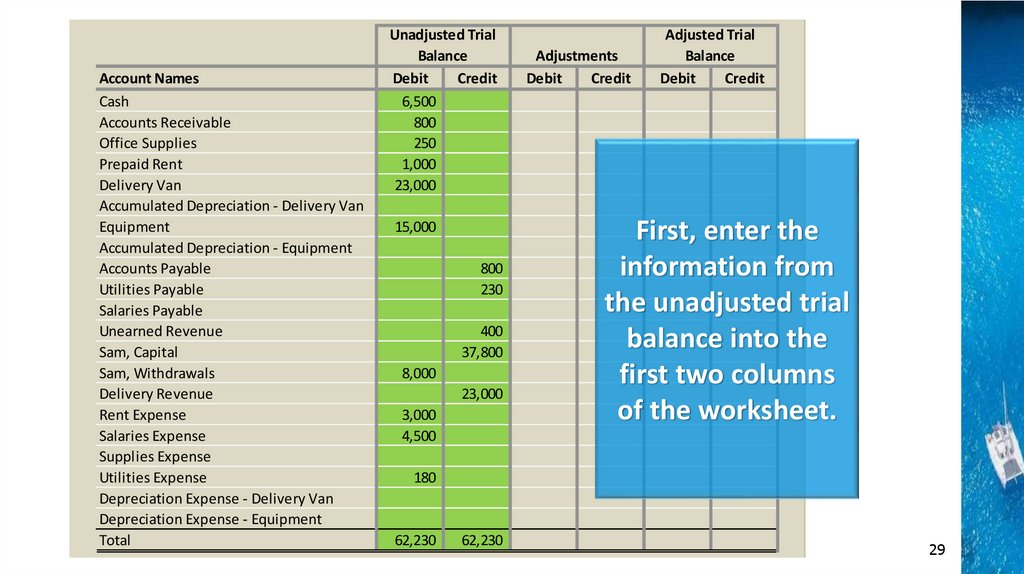

Account NamesCash

Accounts Receivable

Office Supplies

Prepaid Rent

Delivery Van

Accumulated Depreciation - Delivery Van

Equipment

Accumulated Depreciation - Equipment

Accounts Payable

Utilities Payable

Salaries Payable

Unearned Revenue

Sam, Capital

Sam, Withdrawals

Delivery Revenue

Rent Expense

Salaries Expense

Supplies Expense

Utilities Expense

Depreciation Expense - Delivery Van

Depreciation Expense - Equipment

Total

3-29

Unadjusted Trial

Balance

Debit

Credit

6,500

800

250

1,000

23,000

Adjustments

Debit

Credit

15,000

800

230

400

37,800

8,000

23,000

3,000

4,500

Adjusted Trial

Balance

Debit

Credit

First, enter the

information from

the unadjusted trial

balance into the

first two columns

of the worksheet.

180

62,230

62,230

Accounting

29

30.

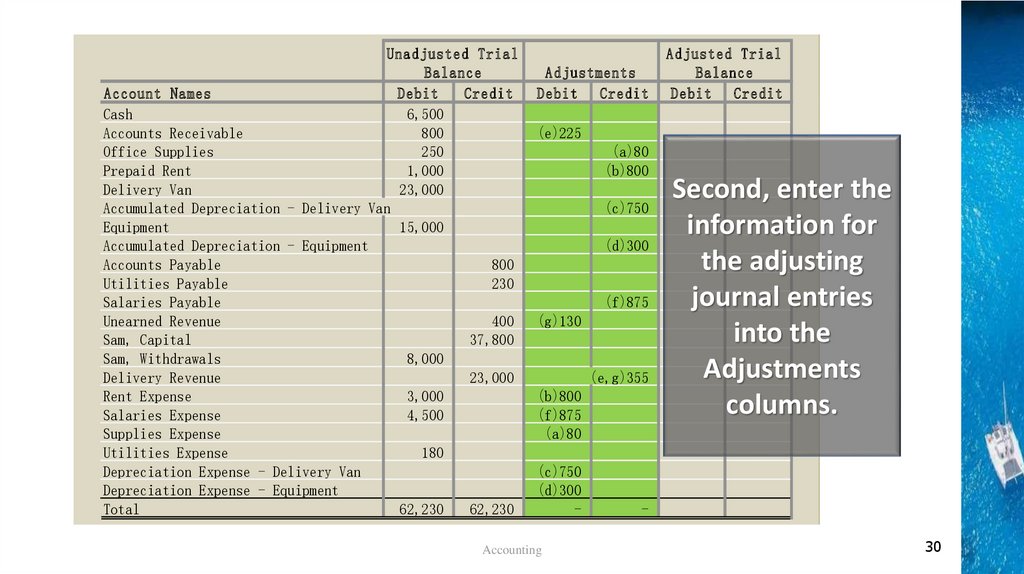

Unadjusted TrialBalance

Account Names

Debit

Credit

Cash

6,500

Accounts Receivable

800

Office Supplies

250

Prepaid Rent

1,000

Delivery Van

23,000

Accumulated Depreciation - Delivery Van

Equipment

15,000

Accumulated Depreciation - Equipment

Accounts Payable

800

Utilities Payable

230

Salaries Payable

Unearned Revenue

400

Sam, Capital

37,800

Sam, Withdrawals

8,000

Delivery Revenue

23,000

Rent Expense

3,000

Salaries Expense

4,500

Supplies Expense

Utilities Expense

180

Depreciation Expense - Delivery Van

Depreciation Expense - Equipment

Total

62,230

62,230

Adjustments

Debit Credit

Adjusted Trial

Balance

Debit Credit

(e)225

(a)80

(b)800

(c)750

(d)300

(f)875

(g)130

(e,g)355

(b)800

(f)875

(a)80

(c)750

(d)300

-

Accounting

Second, enter the

information for

the adjusting

journal entries

into the

Adjustments

columns.

30

31.

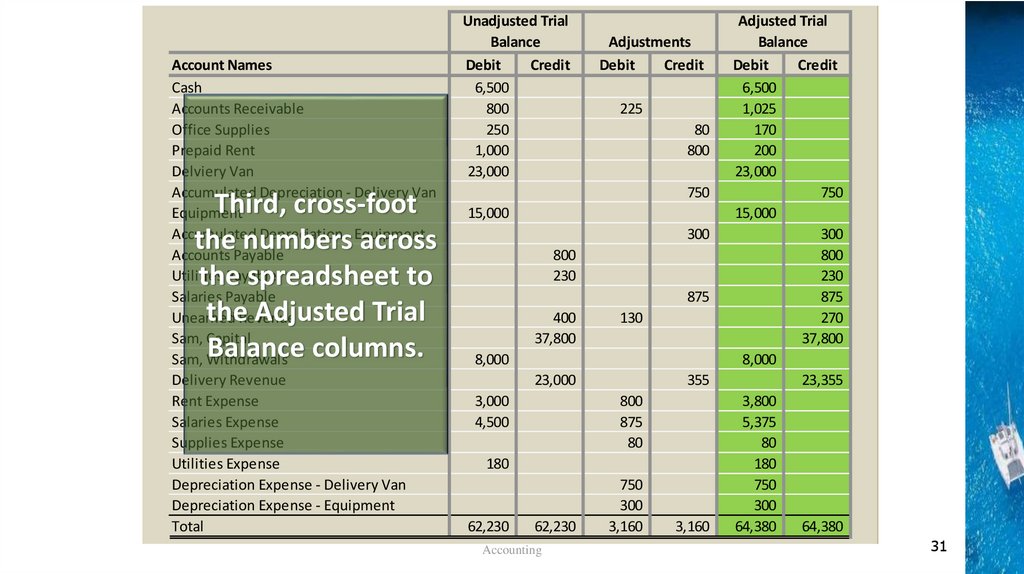

Account NamesCash

Accounts Receivable

Office Supplies

Prepaid Rent

Delviery Van

Accumulated Depreciation - Delivery Van

Equipment

Accumulated Depreciation - Equipment

Accounts Payable

Utilities Payable

Salaries Payable

Unearned Revenue

Sam, Capital

Sam, Withdrawals

Delivery Revenue

Rent Expense

Salaries Expense

Supplies Expense

Utilities Expense

Depreciation Expense - Delivery Van

Depreciation Expense - Equipment

Total

Third, cross-foot

the numbers across

the spreadsheet to

the Adjusted Trial

Balance columns.

Unadjusted Trial

Balance

Debit

Credit

6,500

800

250

1,000

23,000

Adjustments

Debit

Credit

225

80

800

750

15,000

300

800

230

875

400

37,800

130

8,000

23,000

3,000

4,500

355

800

875

80

180

62,230

62,230

Accounting

750

300

3,160

3,160

Adjusted Trial

Balance

Debit

Credit

6,500

1,025

170

200

23,000

750

15,000

300

800

230

875

270

37,800

8,000

23,355

3,800

5,375

80

180

750

300

64,380

64,380

31

32.

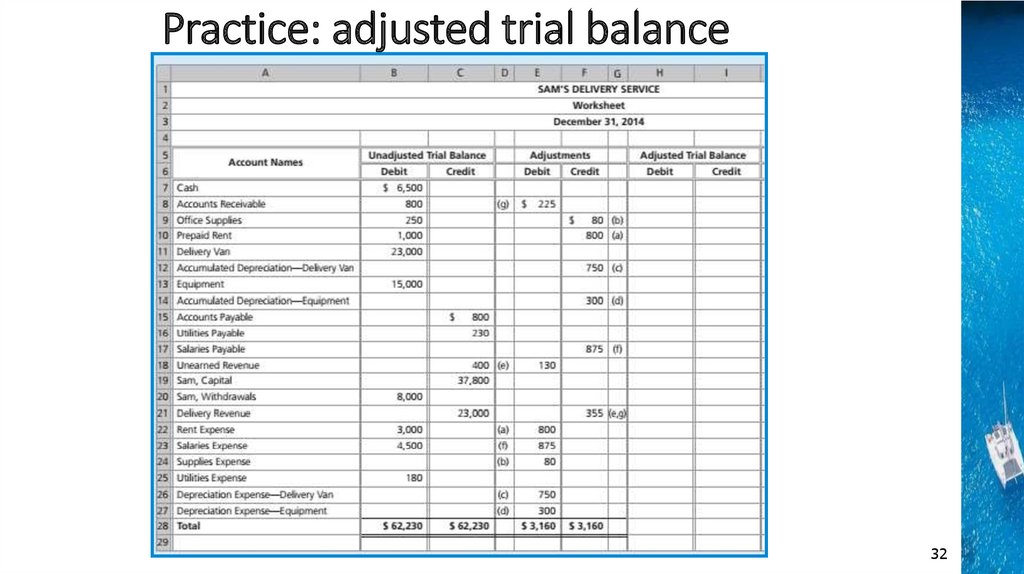

Practice: adjusted trial balanceAccounting

32

33.

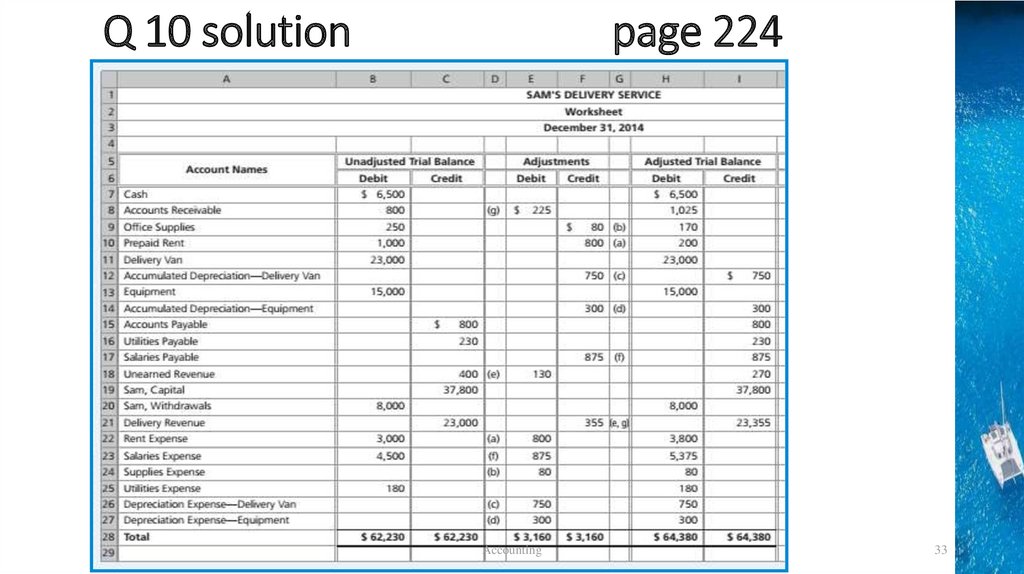

Q 10 solutionpage 224

Accounting

33

34.

Multiple Choices2mins

An internal document that helps summarize data for the

preparation of financial statements is called a:

A.

B.

C.

D.

ledger.

journal.

worksheet.

chart of accounts.

© 2015 Pearson Education, Limited.

34

35.

Multiple Choices2mins

An internal document that helps summarize data for the

preparation of financial statements is called a:

A.

B.

C.

D.

ledger.

journal.

worksheet.

chart of accounts.

© 2015 Pearson Education, Limited.

35

36.

Multiple Choices2mins

The adjusted trial balance shows:

A. amounts that are out of balance and ways to rectify

them.

B. amounts that are to be used to prepare the financial

statements.

C. amounts of assets and liabilities only.

D. amounts of revenues and expenses only.

© 2015 Pearson Education, Limited.

36

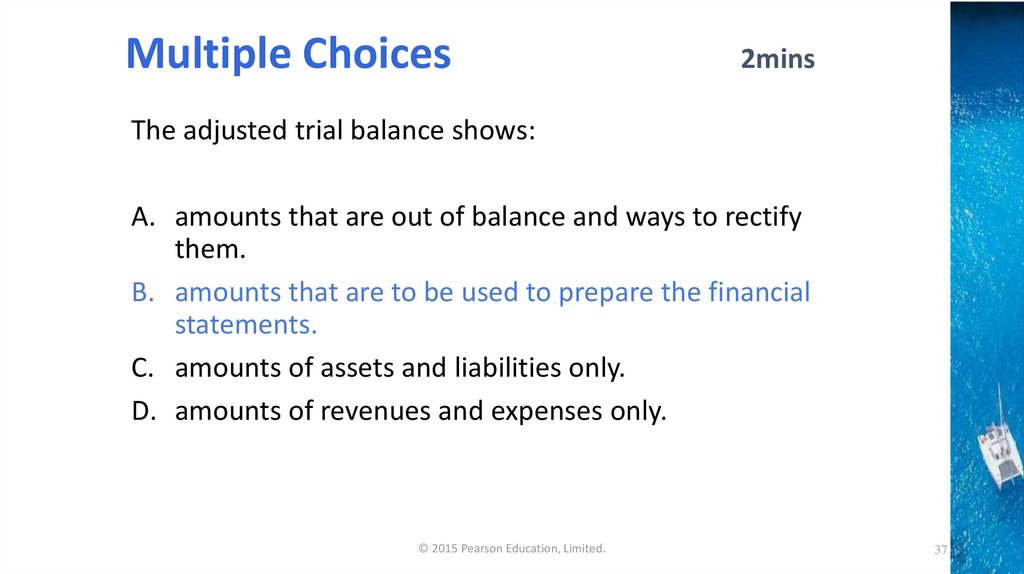

37.

Multiple Choices2mins

The adjusted trial balance shows:

A. amounts that are out of balance and ways to rectify

them.

B. amounts that are to be used to prepare the financial

statements.

C. amounts of assets and liabilities only.

D. amounts of revenues and expenses only.

© 2015 Pearson Education, Limited.

37

38.

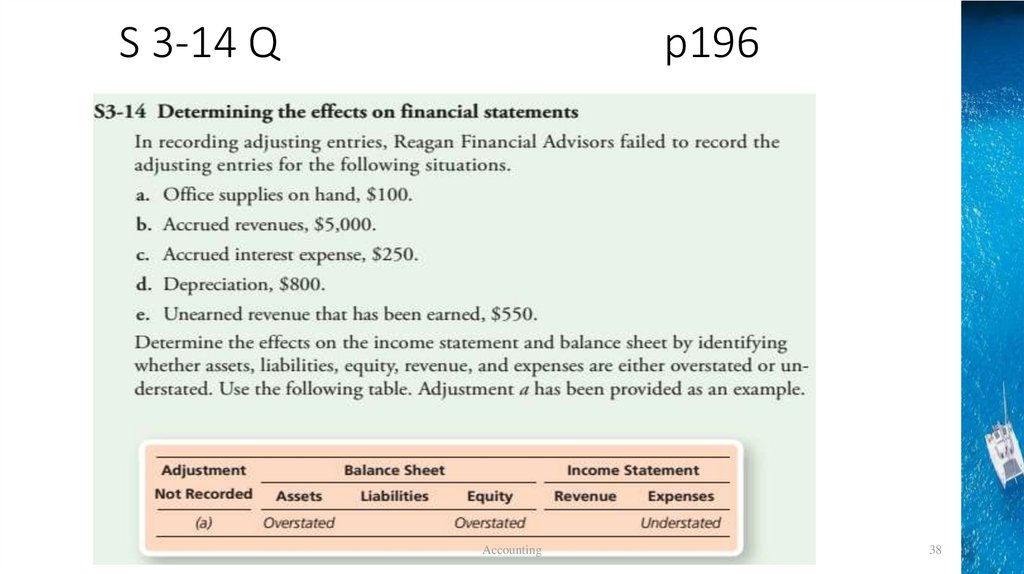

S 3-14 Qp196

Accounting

38

39.

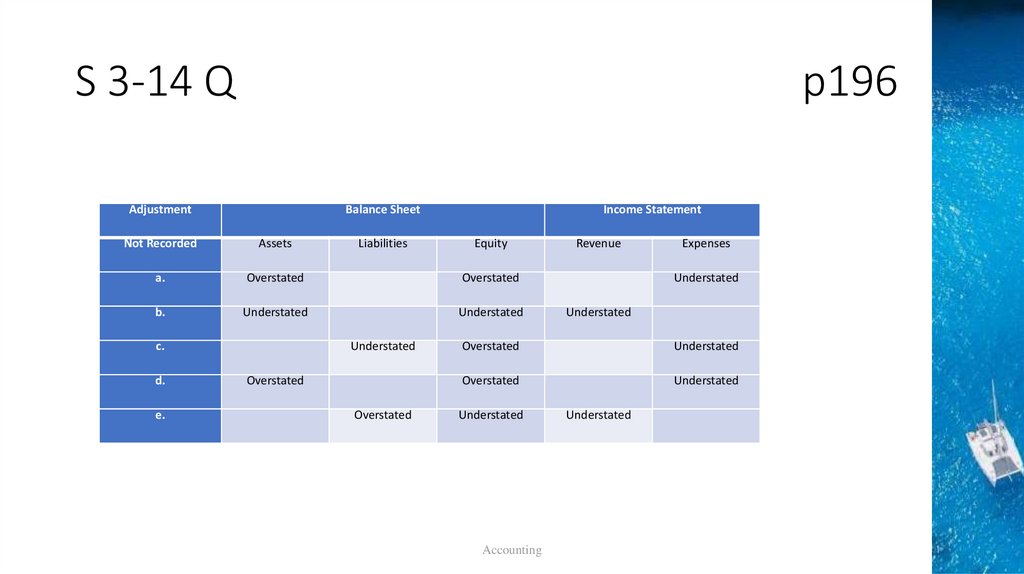

S 3-14 Qp196

Adjustment

Balance Sheet

Not Recorded

Assets

a.

Overstated

Overstated

b.

Understated

Understated

c.

d.

e.

Liabilities

Income Statement

Understated

Overstated

Overstated

Equity

Revenue

Expenses

Understated

Understated

Overstated

Understated

Overstated

Understated

Understated

Accounting

Understated

39

40.

Unit Assessment Task• Homework

30%

- three times, each time account for 10%

• Final Individual Assignment

70%

- accounting cases

More than 60% of total marks will pass

Accounting

40

40

41.

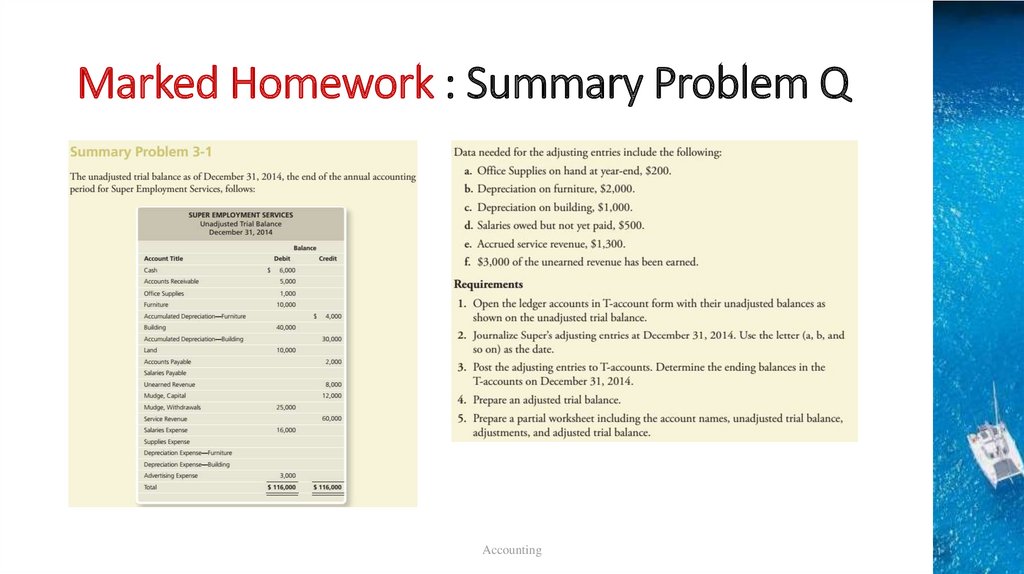

Marked Homework : Summary Problem QAccounting

41

42.

Enjoy yourSpring Break !

See you

th

on May 12 !

Accounting

42

finance

finance