Similar presentations:

Accounting for branches

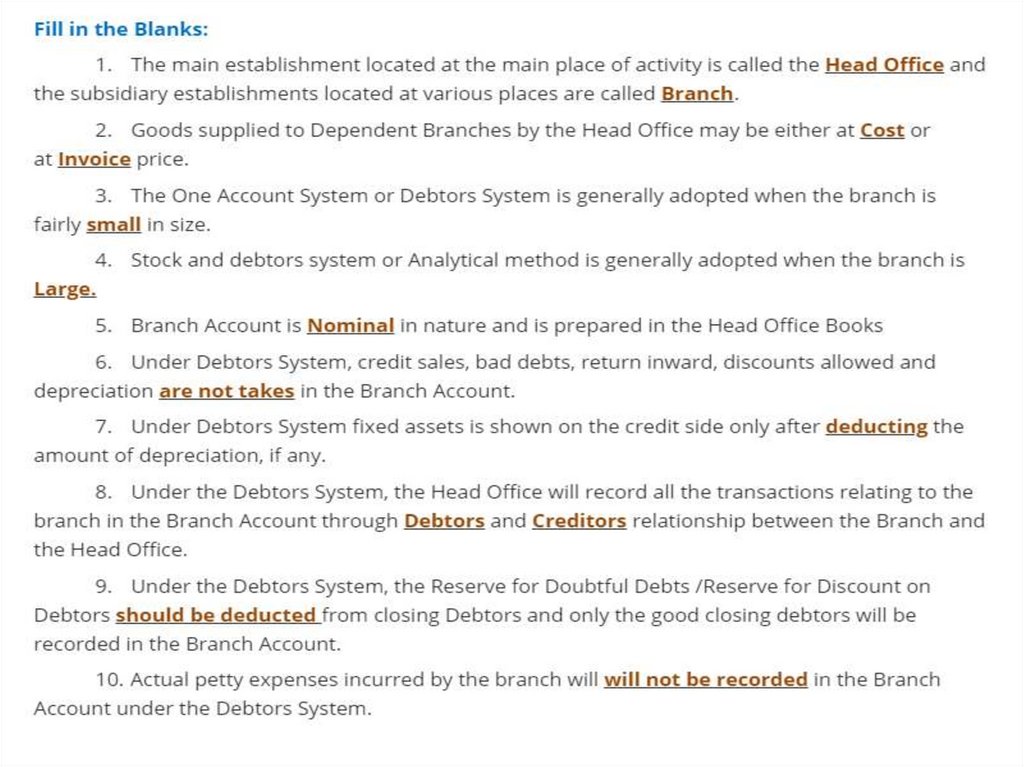

1.

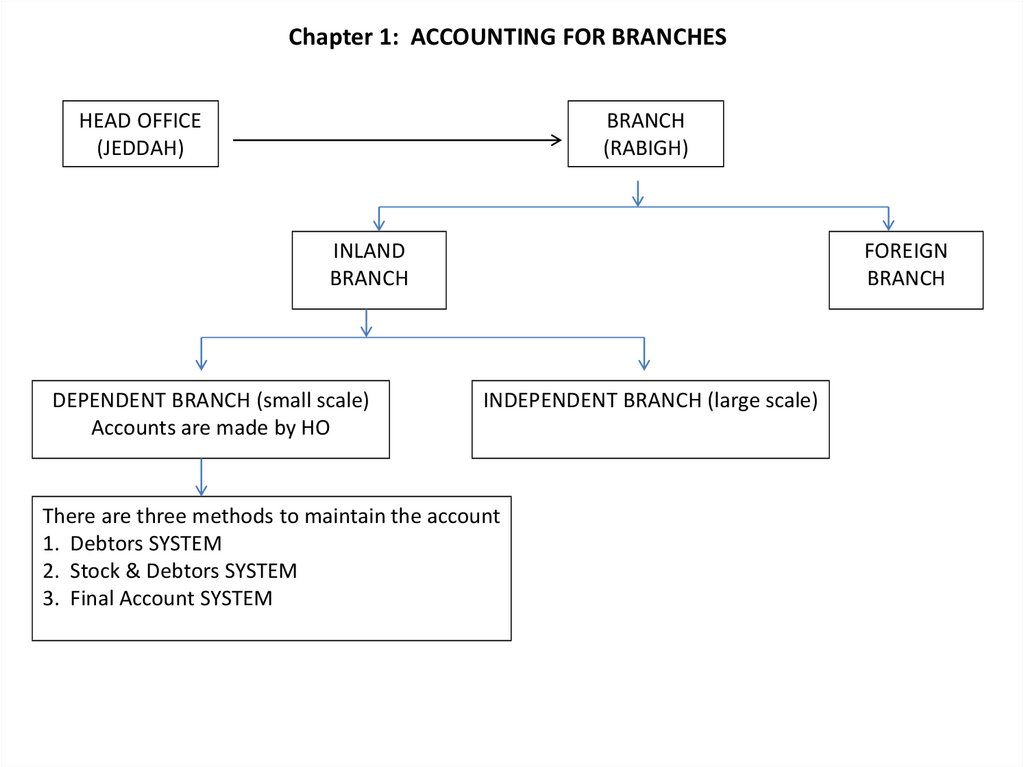

Chapter 1: ACCOUNTING FOR BRANCHESHEAD OFFICE

(JEDDAH)

BRANCH

(RABIGH)

INLAND

BRANCH

DEPENDENT BRANCH (small scale)

Accounts are made by HO

FOREIGN

BRANCH

INDEPENDENT BRANCH (large scale)

There are three methods to maintain the account

1. Debtors SYSTEM

2. Stock & Debtors SYSTEM

3. Final Account SYSTEM

2.

1st Method: Debtors SystemNOTES UNDER DEBBTORS SYSTEM:

1. Credit sales are not shown in branch account.

2. Expenses paid by branch are not shown in branch account b’coz they are adjusted

through cash account.

3. Non-cash expenses (dep., bad debts, loss by fire, and loss by theft) are also not

shown in branch account because they are adjusted through assets account.

3.

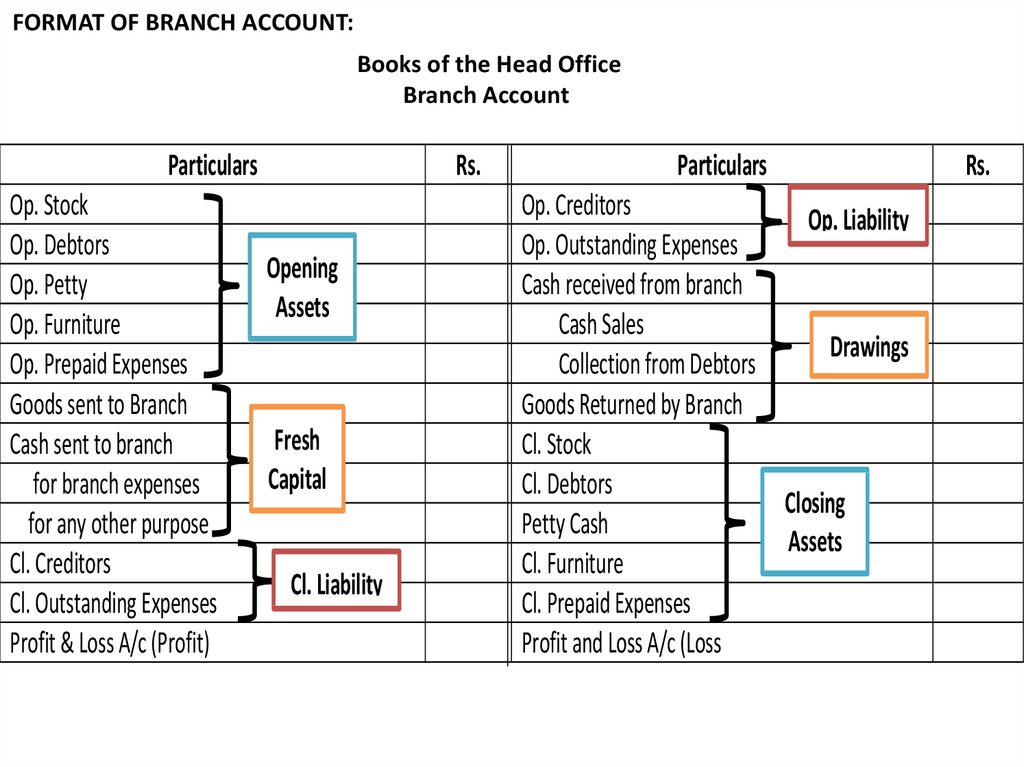

FORMAT OF BRANCH ACCOUNT:Books of the Head Office

Branch Account

Particulars

Op. Stock

Op. Debtors

Op. Petty

Op. Furniture

Op. Prepaid Expenses

Goods sent to Branch

Cash sent to branch

for branch expenses

for any other purpose

Cl. Creditors

Cl. Outstanding Expenses

Profit & Loss A/c (Profit)

Rs.

Opening

Assets

Fresh

Capital

Cl. Liability

Particulars

Op. Creditors

Op. Liability

Op. Outstanding Expenses

Cash received from branch

Cash Sales

Drawings

Collection from Debtors

Goods Returned by Branch

Cl. Stock

Cl. Debtors

Closing

Petty Cash

Assets

Cl. Furniture

Cl. Prepaid Expenses

Profit and Loss A/c (Loss

Rs.

4.

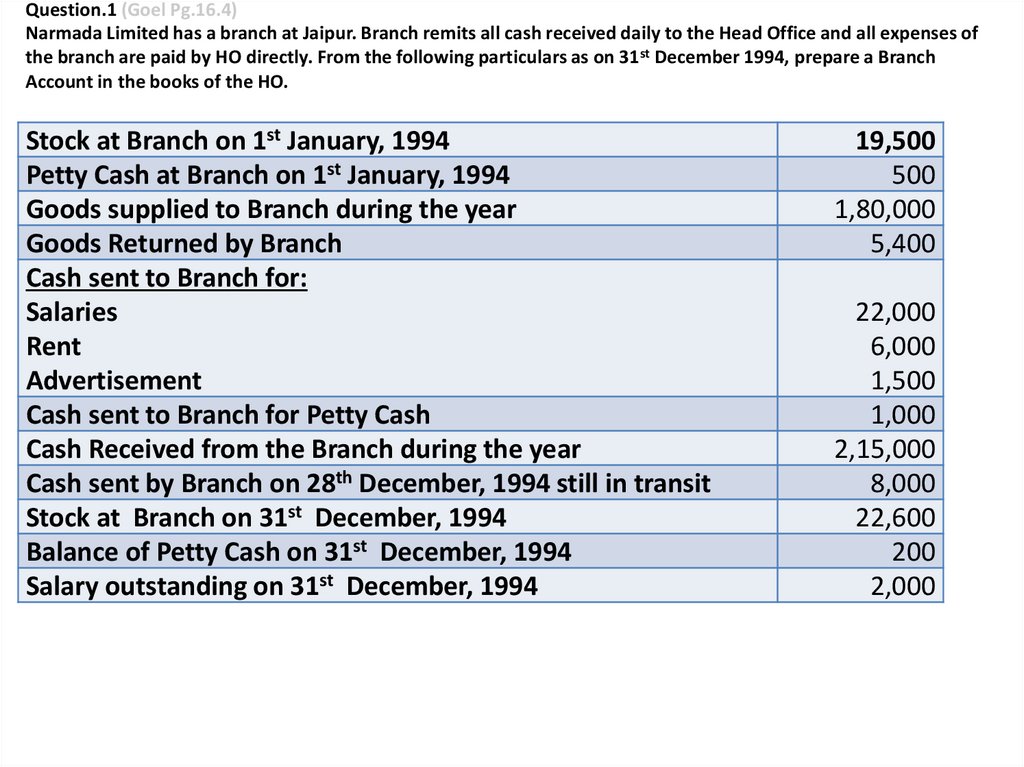

Question.1 (Goel Pg.16.4)Narmada Limited has a branch at Jaipur. Branch remits all cash received daily to the Head Office and all expenses of

the branch are paid by HO directly. From the following particulars as on 31st December 1994, prepare a Branch

Account in the books of the HO.

Stock at Branch on 1st January, 1994

Petty Cash at Branch on 1st January, 1994

Goods supplied to Branch during the year

Goods Returned by Branch

Cash sent to Branch for:

Salaries

Rent

Advertisement

Cash sent to Branch for Petty Cash

Cash Received from the Branch during the year

Cash sent by Branch on 28th December, 1994 still in transit

Stock at Branch on 31st December, 1994

Balance of Petty Cash on 31st December, 1994

Salary outstanding on 31st December, 1994

19,500

500

1,80,000

5,400

22,000

6,000

1,500

1,000

2,15,000

8,000

22,600

200

2,000

5.

SOLUTION: 1IN THE BOOKS OF HO. (MULTAN)

LAHORE BRANCH ACCOUNT

PARTICULARS

AMOUNT

PARTICULARS

AMOUNT

6.

SOLUTION: 1IN THE BOOKS OF HO. (MULTAN)

LAHORE BRANCH ACCOUNT

PARTICULARS

AMOUNT

BALANCE B/D:

OPENING STOCK

Petty cash

PARTICULARS

AMOUNT

Goods Returned by Branch

By Bank A/C ( From Branch)

19,500

500

1,80,000 Cash in transit

8,000

To Bank (exp.)

(22000+6000+1500)

To Bank (Petty exp.)

29,500 Closing stock

22,600

To Profit & Loss A/C

2,15,000

20,000 By Closing Balance :

Goods sent to Branch

Balance c/d O/S Salary

5,400

1,000 Petty Cash

200

30,800

2,000

18,700

2,51,200

2,51,200

7.

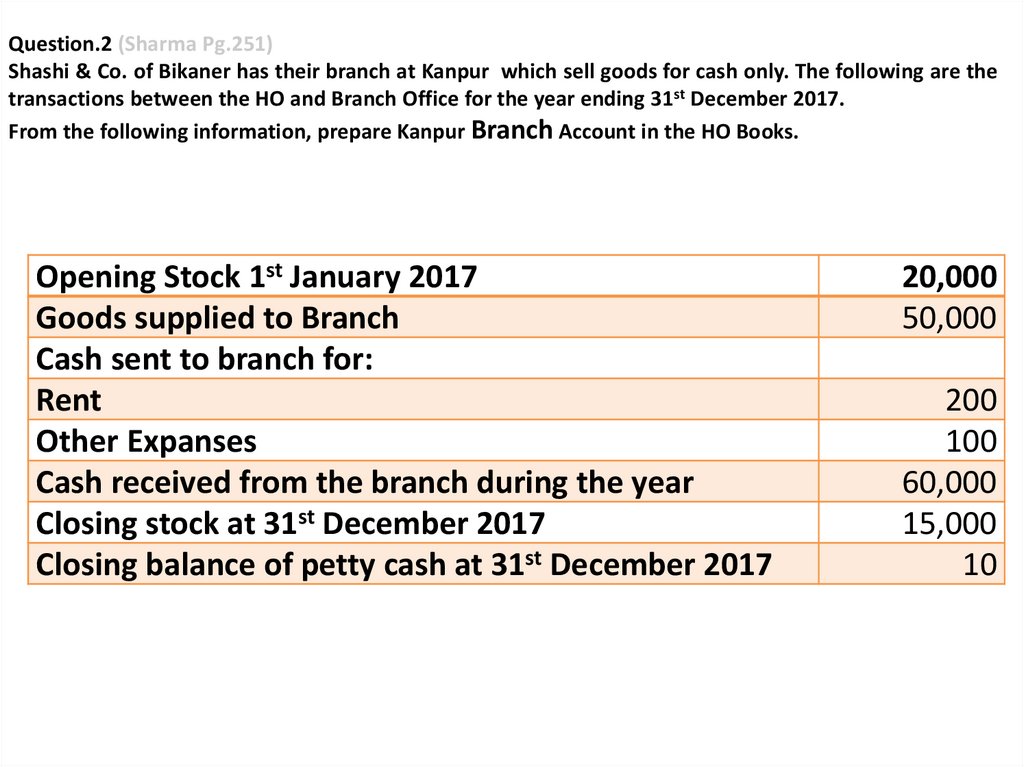

Question.2 (Sharma Pg.251)Shashi & Co. of Bikaner has their branch at Kanpur which sell goods for cash only. The following are the

transactions between the HO and Branch Office for the year ending 31st December 2017.

From the following information, prepare Kanpur Branch Account in the HO Books.

Opening Stock 1st January 2017

Goods supplied to Branch

Cash sent to branch for:

Rent

Other Expanses

Cash received from the branch during the year

Closing stock at 31st December 2017

Closing balance of petty cash at 31st December 2017

20,000

50,000

200

100

60,000

15,000

10

8.

SOLUTION: 2Opening Stock 1st January 2017

Goods supplied to Branch

Cash sent to branch for:

Rent

Other Expanses

Cash received from the branch during the year

Closing stock at 31st December 2017

Closing balance of petty cash at 31st December 2017

20,000

50,000

200

100

60,000

15,000

10

IN THE BOOKS OF Shashi & Co. of Bikaner

KANPUR BRANCH ACCOUNT

PARTICULARS

BALANCE B/D:

STOCK

To Goods Supplied to Branch A/C

To Cash A/C:

Rent

200

Other Exp.

100

To N.Profit Transfd to General P & L A/C

AMOUNT

PARTICULARS

AMOUNT

20,000 By Cash A/C

50,000 By Balance c/d:

Closing stock

300 Petty Cash

4,710

75,010

60,000

15,000

10

15,010

75,010

9.

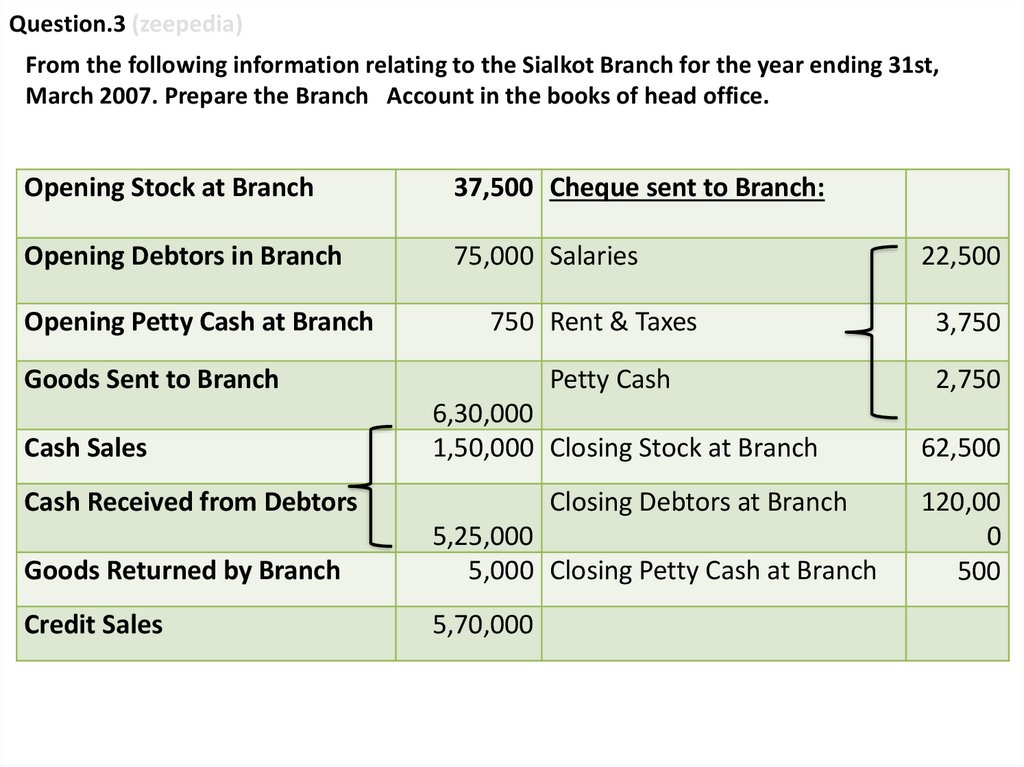

Question.3 (zeepedia)From the following information relating to the Sialkot Branch for the year ending 31st,

March 2007. Prepare the Branch Account in the books of head office.

Opening Stock at Branch

37,500 Cheque sent to Branch:

Opening Debtors in Branch

75,000 Salaries

Opening Petty Cash at Branch

750 Rent & Taxes

Goods Sent to Branch

Cash Sales

Petty Cash

6,30,000

1,50,000 Closing Stock at Branch

Cash Received from Debtors

Closing Debtors at Branch

Goods Returned by Branch

5,25,000

5,000 Closing Petty Cash at Branch

Credit Sales

5,70,000

22,500

3,750

2,750

62,500

120,00

0

500

10.

Solution.3 (zeepediaBRANCH ACCOUNT

Particulars

Opening Stock at Branch

Opening Debtors in Branch

Opening Petty Cash at Branch

Amount

Particulars

($)

37,500 Cash Received from Branch:

75,000 Cash Sales

750 Cash Recv. from Debtors

Cheque sent to Branch:

Goods Returned by Branch

Salaries

22500

Closing Stock at Branch

Rent & Taxes

3750

Closing Debtors at Branch

Petty Cash

2750

Goods Sent to Branch

Profit & Loss A/c (Profit)

29,000 Closing Petty Cash at Branch

Amount

($)

1,50,000

5,25,000

6,75,000

5,000

62,500

120,000

500

6,30,000

90,750

8,63,000

8,63,000

11.

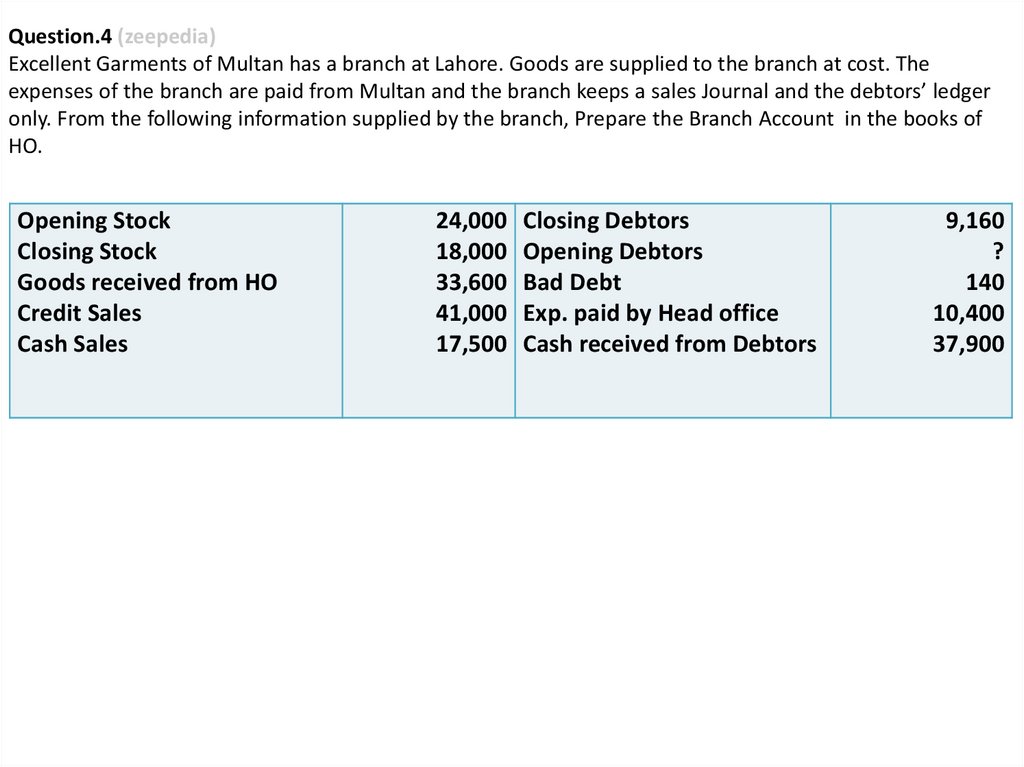

Question.4 (zeepedia)Excellent Garments of Multan has a branch at Lahore. Goods are supplied to the branch at cost. The

expenses of the branch are paid from Multan and the branch keeps a sales Journal and the debtors’ ledger

only. From the following information supplied by the branch, Prepare the Branch Account in the books of

HO.

Opening Stock

Closing Stock

Goods received from HO

Credit Sales

Cash Sales

24,000

18,000

33,600

41,000

17,500

Closing Debtors

Opening Debtors

Bad Debt

Exp. paid by Head office

Cash received from Debtors

9,160

?

140

10,400

37,900

12.

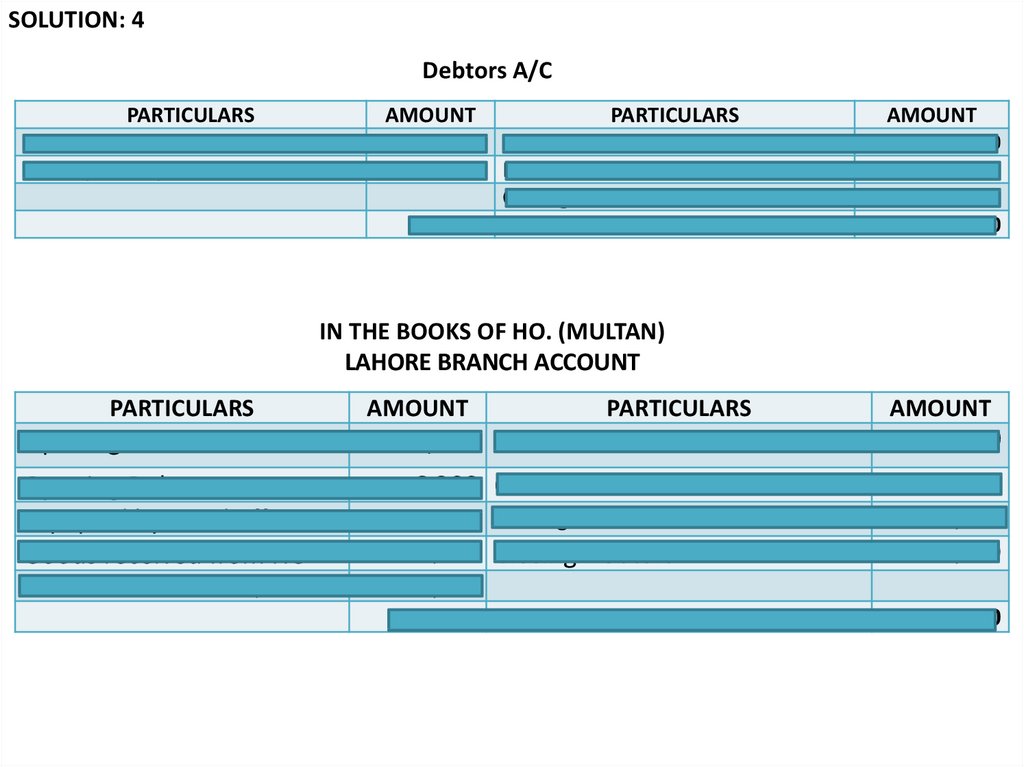

SOLUTION: 4Debtors A/C

PARTICULARS

OPENING DEBTORS (BALANCE ????)

SALES (CREDIT)

AMOUNT

PARTICULARS

6,200 Cash received from Debtors

41,000 Bad Debt

Closing Debtors C/F

47,200

AMOUNT

37,900

140

9,160

47,200

IN THE BOOKS OF HO. (MULTAN)

LAHORE BRANCH ACCOUNT

PARTICULARS

Opening Stock

24,000 Cash received from BRANCH

AMOUNT

17,500

Opening Debtors

Exp. paid by Head office

Goods received from HO

6,200 Cash received from Debtors

10,400 Closing Stock

33,600 Closing Debtors

37,900

18,000

9,160

GEN. PROFIT & LOSS A/C

AMOUNT

8,360

82,560

PARTICULARS

82,560

13.

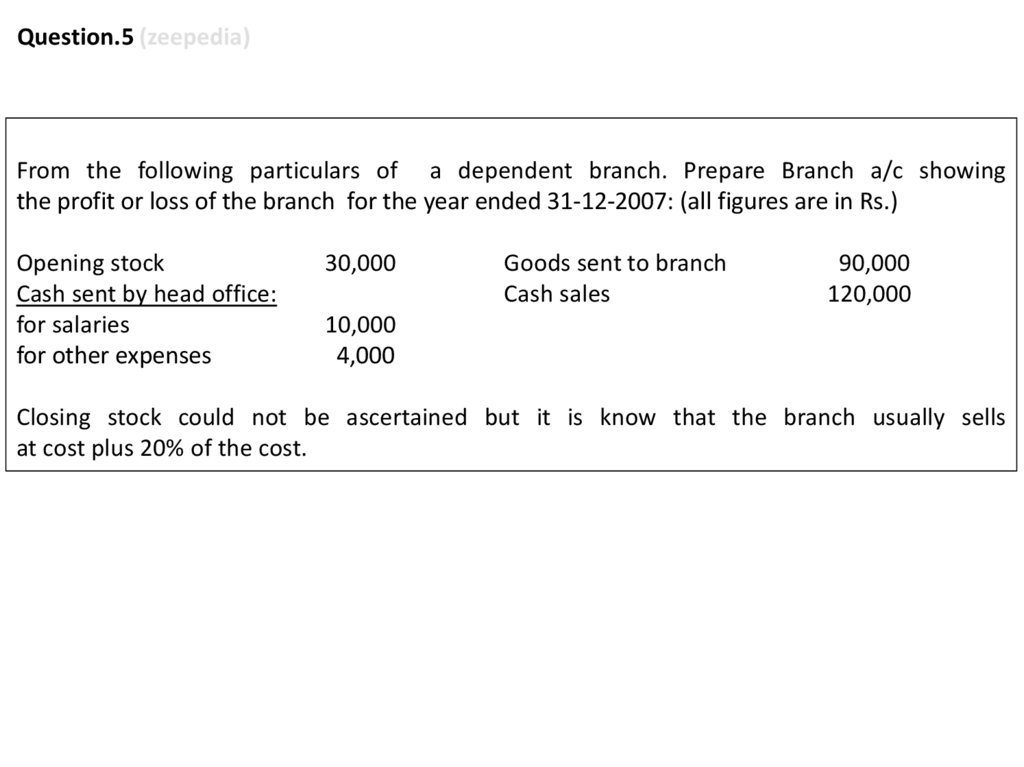

Question.5 (zeepedia)From the following particulars of a dependent branch. Prepare Branch a/c showing

the profit or loss of the branch for the year ended 31-12-2007: (all figures are in Rs.)

Opening stock

Cash sent by head office:

for salaries

for other expenses

30,000

Goods sent to branch

Cash sales

90,000

120,000

10,000

4,000

Closing stock could not be ascertained but it is know that the branch usually sells

at cost plus 20% of the cost.

14.

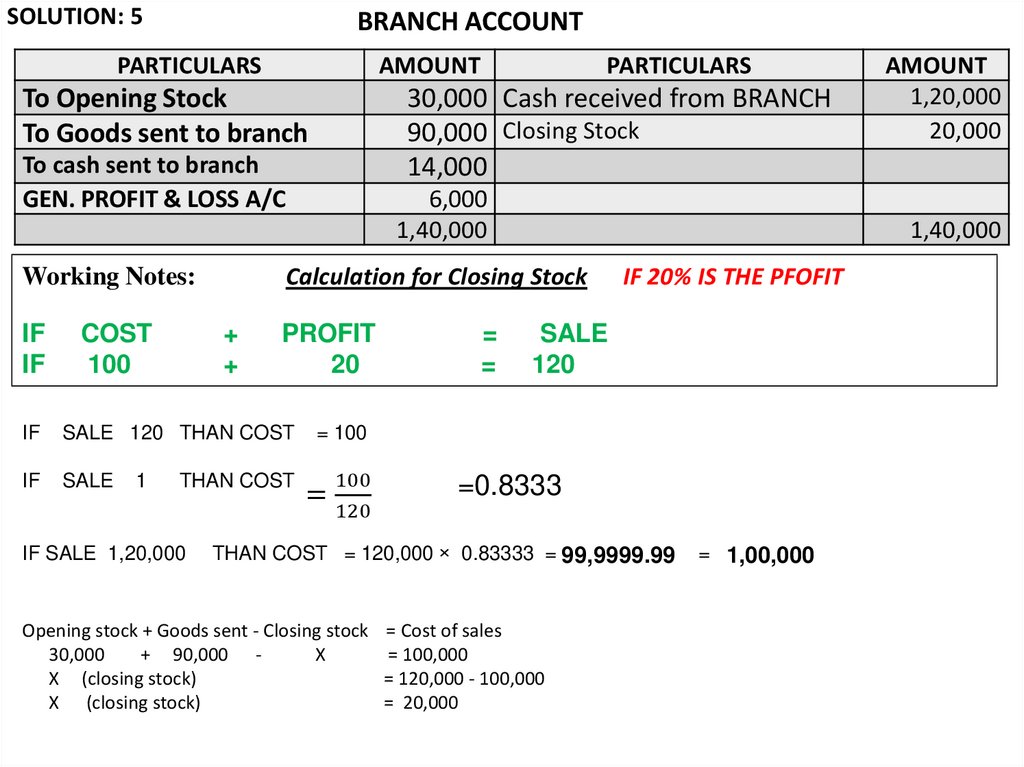

SOLUTION: 5BRANCH ACCOUNT

PARTICULARS

AMOUNT

To Opening Stock

To Goods sent to branch

30,000 Cash received from BRANCH

90,000 Closing Stock

14,000

To cash sent to branch

GEN. PROFIT & LOSS A/C

COST

100

6,000

1,40,000

+

+

PROFIT

20

IF

SALE 120 THAN COST

IF

SALE

1

THAN COST

IF SALE 1,20,000

=

=

IF 20% IS THE PFOFIT

SALE

120

= 100

=

100

120

=0.8333

THAN COST = 120,000 × 0.83333 = 99,999.99

Opening stock + Goods sent - Closing stock

30,000

+ 90,000 X

X (closing stock)

X (closing stock)

AMOUNT

1,20,000

20,000

1,40,000

Calculation for Closing Stock

Working Notes:

IF

IF

PARTICULARS

= Cost of sales

= 100,000

= 120,000 - 100,000

= 20,000

= 1,00,000

15.

SOLUTION: 5BRANCH ACCOUNT

PARTICULARS

AMOUNT

To Opening Stock

To Goods sent to branch

30,000 Cash received from BRANCH

90,000 Closing Stock

14,000

To cash sent to branch

GEN. PROFIT & LOSS A/C

COST

100

6,000

1,40,000

+

+

PROFIT

20

IF

SALE 120 THAN COST

IF

SALE

1

THAN COST

IF SALE 1,20,000

=

=

IF 20% IS THE PFOFIT

SALE

120

= 100

=

100

120

=0.8333

THAN COST = 120,000 × 0.83333 = 99,9999.99

Opening stock + Goods sent - Closing stock

30,000

+ 90,000 X

X (closing stock)

X (closing stock)

AMOUNT

1,20,000

20,000

1,40,000

Calculation for Closing Stock

Working Notes:

IF

IF

PARTICULARS

= Cost of sales

= 100,000

= 120,000 - 100,000

= 20,000

= 1,00,000

16.

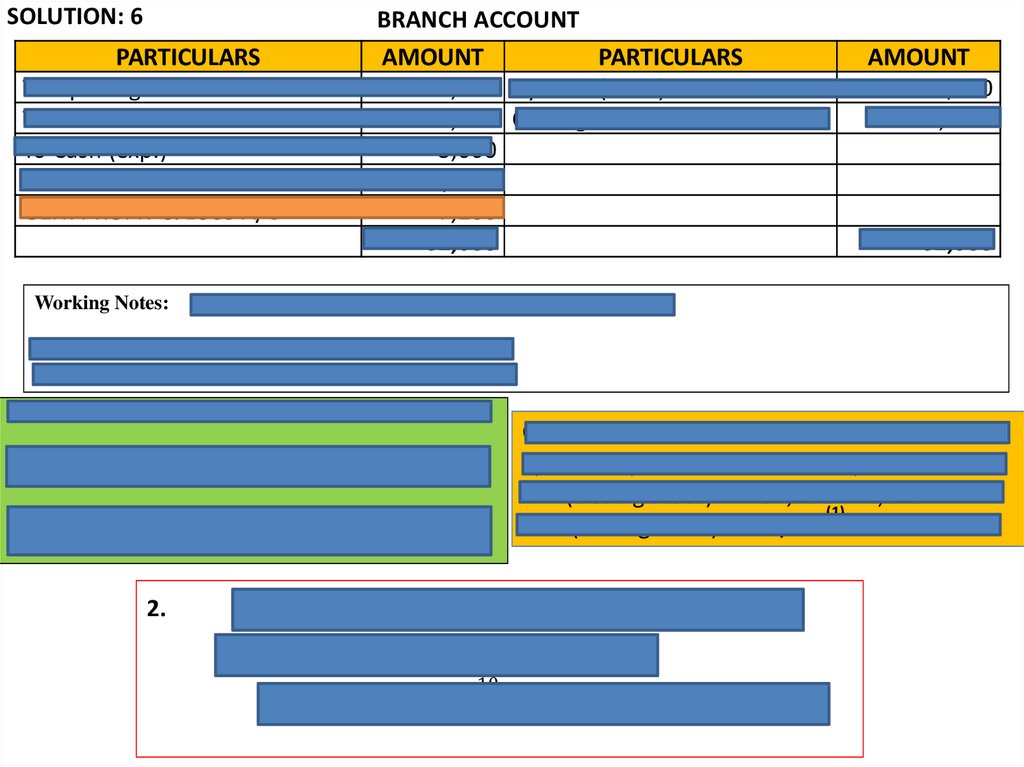

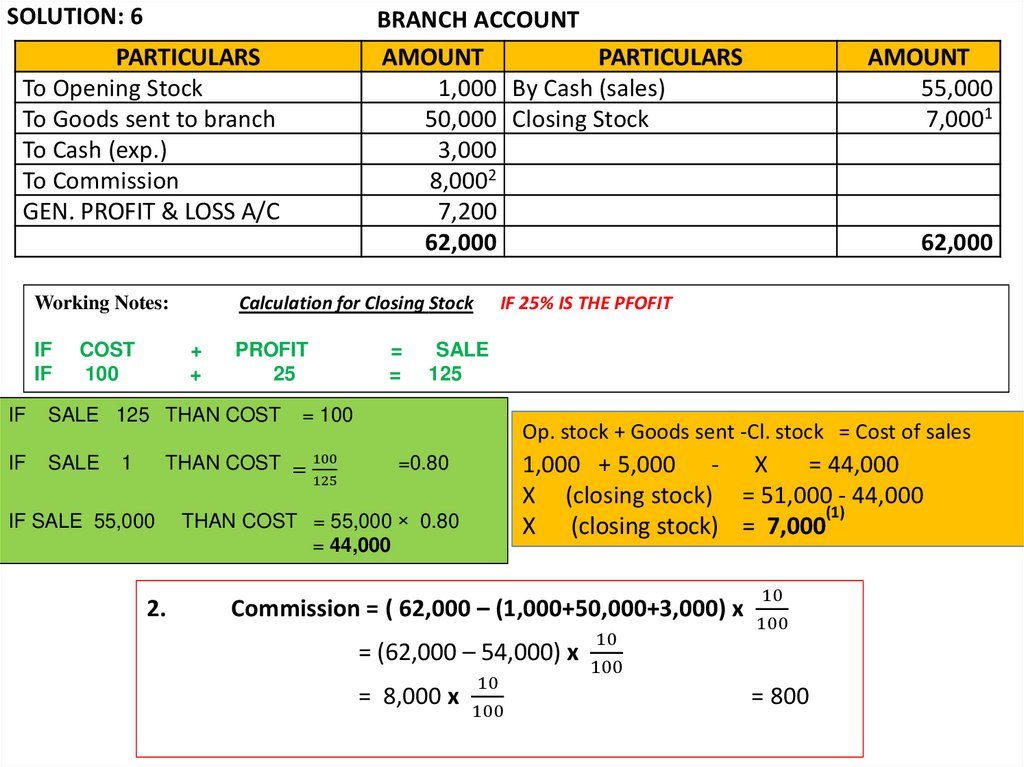

Question.6)(Sharma Pg 252

Prepare Branch a/c from the following particulars. Branch makes only cash sales.

Goods supplied to branch

Expenses

Cash Sales

Opening stock

50,000

3,000

55,000

1,000

Closing stock has not been ascertained. Manager gets commission @ 10% on net profit

before charging such commission.

Branch sells goods at cost + 25%.

17.

SOLUTION: 6BRANCH ACCOUNT

AMOUNT

PARTICULARS

1,000 By Cash (sales)

50,000 Closing Stock

3,000

8,0002

7,200

62,000

PARTICULARS

To Opening Stock

To Goods sent to branch

To Cash (exp.)

To Commission

GEN. PROFIT & LOSS A/C

Calculation for Closing Stock

Working Notes:

IF

IF

COST

100

+

+

PROFIT

25

IF

SALE 125 THAN COST

IF

SALE

=

=

SALE

125

Op. stock + Goods sent -Cl. stock = Cost of sales

1,000 + 5,000 - X

= 44,000

X (closing stock) = 51,000 - 44,000

(1)

X (closing stock) = 7,000

=0.80

125

IF SALE 55,000

2.

62,000

IF 25% IS THE PFOFIT

= 100

THAN COST = 100

1

AMOUNT

55,000

7,0001

THAN COST = 55,000 × 0.80

= 44,000

Commission = ( 62,000 – (1,000+50,000+3,000) x

= (62,000 – 54,000) x

= 8,000 x

10

100

10

100

10

100

= 800

18.

SOLUTION: 6BRANCH ACCOUNT

AMOUNT

PARTICULARS

1,000 By Cash (sales)

50,000 Closing Stock

3,000

8,0002

7,200

62,000

PARTICULARS

To Opening Stock

To Goods sent to branch

To Cash (exp.)

To Commission

GEN. PROFIT & LOSS A/C

Calculation for Closing Stock

Working Notes:

IF

IF

COST

100

+

+

PROFIT

25

IF

SALE 125 THAN COST

IF

SALE

=

=

SALE

125

Op. stock + Goods sent -Cl. stock = Cost of sales

1,000 + 5,000 - X

= 44,000

X (closing stock) = 51,000 - 44,000

(1)

X (closing stock) = 7,000

=0.80

125

IF SALE 55,000

2.

62,000

IF 25% IS THE PFOFIT

= 100

THAN COST = 100

1

AMOUNT

55,000

7,0001

THAN COST = 55,000 × 0.80

= 44,000

Commission = ( 62,000 – (1,000+50,000+3,000) x

= (62,000 – 54,000) x

= 8,000 x

10

100

10

100

10

100

= 800

19.

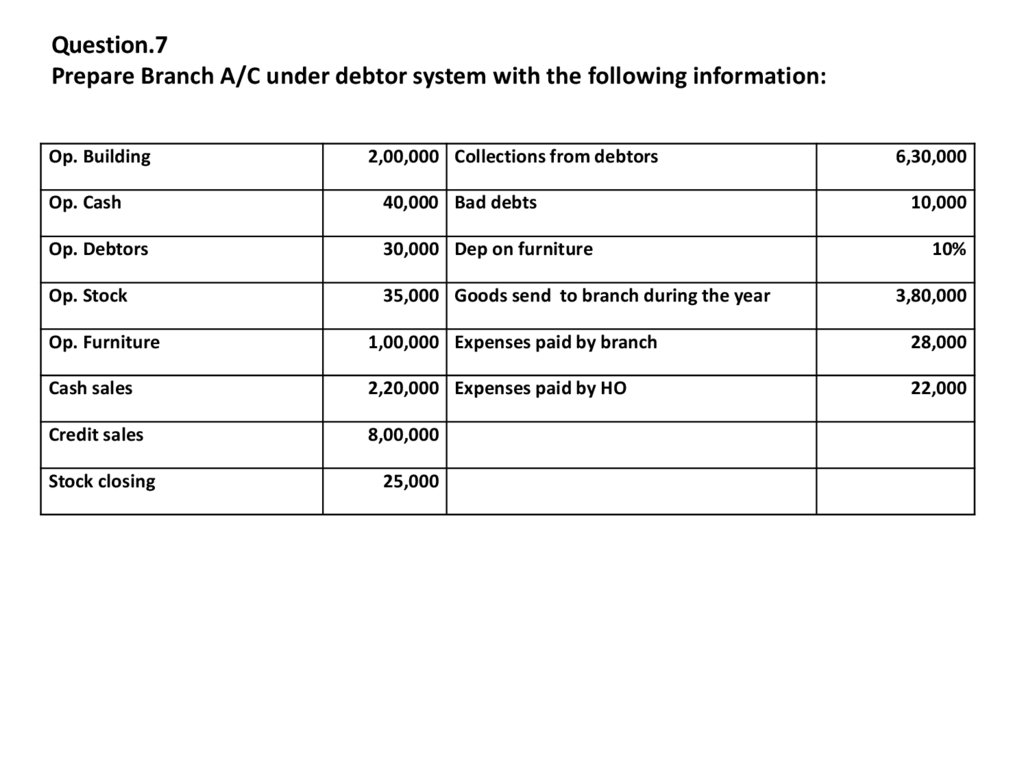

Question.7Prepare Branch A/C under debtor system with the following information:

Op. Building

2,00,000 Collections from debtors

Op. Cash

40,000 Bad debts

Op. Debtors

30,000 Dep on furniture

Op. Stock

35,000 Goods send to branch during the year

6,30,000

10,000

10%

3,80,000

Op. Furniture

1,00,000 Expenses paid by branch

28,000

Cash sales

2,20,000 Expenses paid by HO

22,000

Credit sales

8,00,000

Stock closing

25,000

20.

Structure.7Debtors Account

Branch A/C

21.

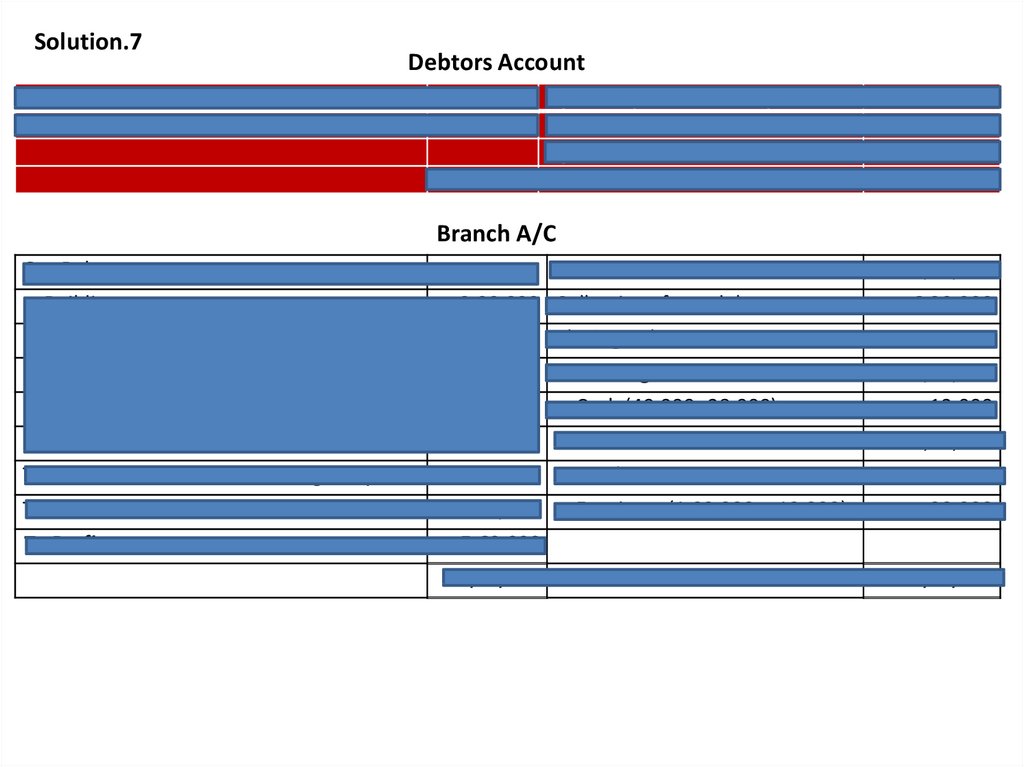

Solution.7Op. Debtors

Credit sales

Debtors Account

30,000 By Cash (from debtors)

8,00,000 Bad debts

By Bal C/D

8,30,000

6,30,000

10,000

1,90,000

8,30,000

Branch A/C

Op. Balance:

Building

Cash sales

2,00,000 Collections from debtors

Cash

40,000 Closing Bal:

Debtors

30,000

Building

Stock

35,000

Cash (40,000- 28,000)

Furniture

To Goods send to branch during the year

To Cash

To Profit

2,20,000

6,30,000

2,00,000

12,000

1,00,000

Debtors

3,80,000

Stock

25,000

Furniture (1,00,000 – 10,000)

90,000

22,000

1,90,000

5,60,000

13,67,000

13,67,000

22.

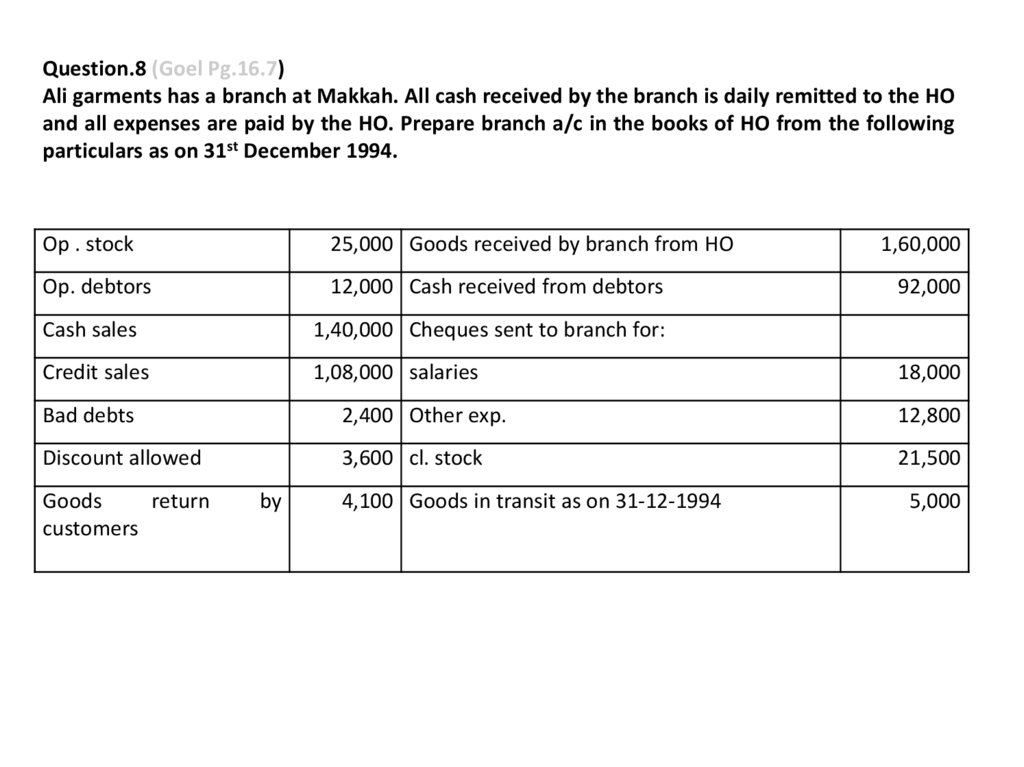

Question.8 (Goel Pg.16.7)Ali garments has a branch at Makkah. All cash received by the branch is daily remitted to the HO

and all expenses are paid by the HO. Prepare branch a/c in the books of HO from the following

particulars as on 31st December 1994.

Op . stock

25,000 Goods received by branch from HO

Op. debtors

12,000 Cash received from debtors

Cash sales

1,40,000 Cheques sent to branch for:

Credit sales

1,08,000 salaries

1,60,000

92,000

18,000

Bad debts

2,400 Other exp.

12,800

Discount allowed

3,600 cl. stock

21,500

Goods

return

customers

by

4,100 Goods in transit as on 31-12-1994

5,000

23.

STRUCTURE: 8Debtors Account

Makkah Branch A/C

for the year ending 31st December, 1994

24.

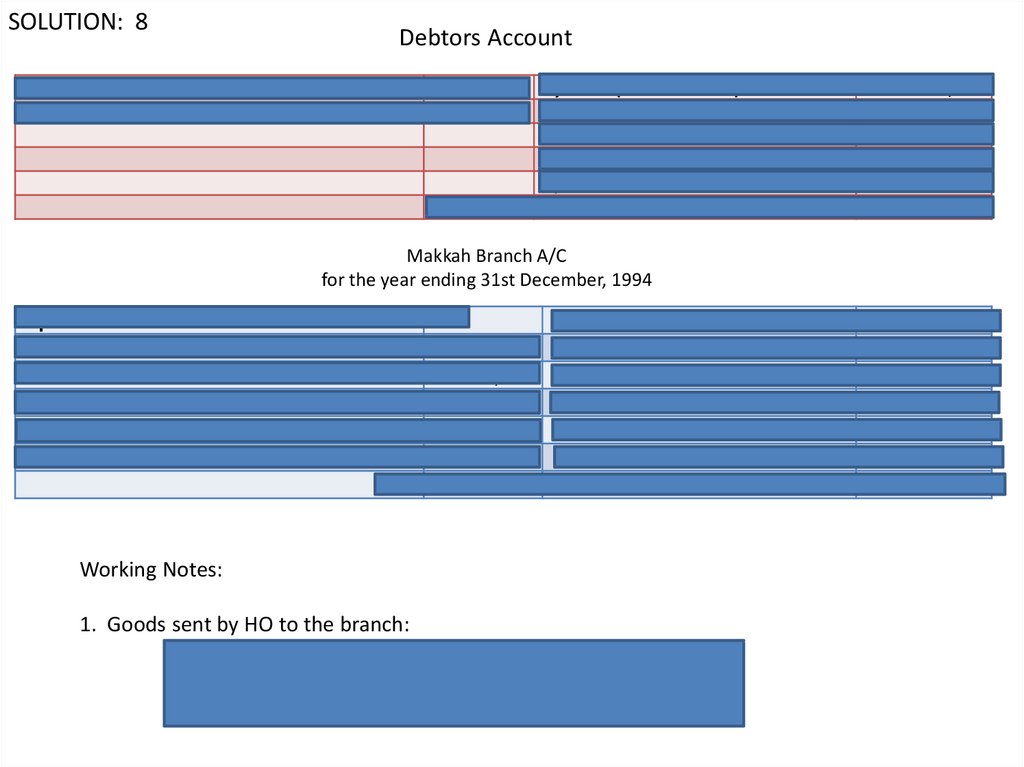

SOLUTION: 8Debtors Account

Op. Debtors

Credit sales

12,000 By Cash (from debtors)

1,08,000 Bad debts

Disc. allowed

Sales return

By balance c/d

1,20,000

92,000

2,400

3,600

4,100

17,900

1,20,000

Makkah Branch A/C

for the year ending 31st December, 1994

Op. Balance:

stock

Debtors

To Goods send to branch during the year

To Bank (Exp)

To P/ L A/C

25,000

12,000

1,65,000

30,800

43,600

2,76,400

Cash sales

Collections from debtors

Closing Bal:

Debtors

17,900

Stock

21,500

Goods in transit

5,000

Working Notes:

1. Goods sent by HO to the branch:

Goods received by branch

Add: Goods in transit

160000

5,000

1,65,000

1,40,000

92,000

44,400

2,76,400

25.

Revision1st Method: Debtors System

NOTES UNDER DEBBTORS SYSTEM:

1. Credit sales are not shown in branch account.

2. Expenses paid by branch are not shown in branch account because they are adjusted

through cash account.

3. Non-cash expenses (dep., bad debts, loss by fire, and loss by theft) are also not shown

in branch account because they are adjusted through assets account.

26.

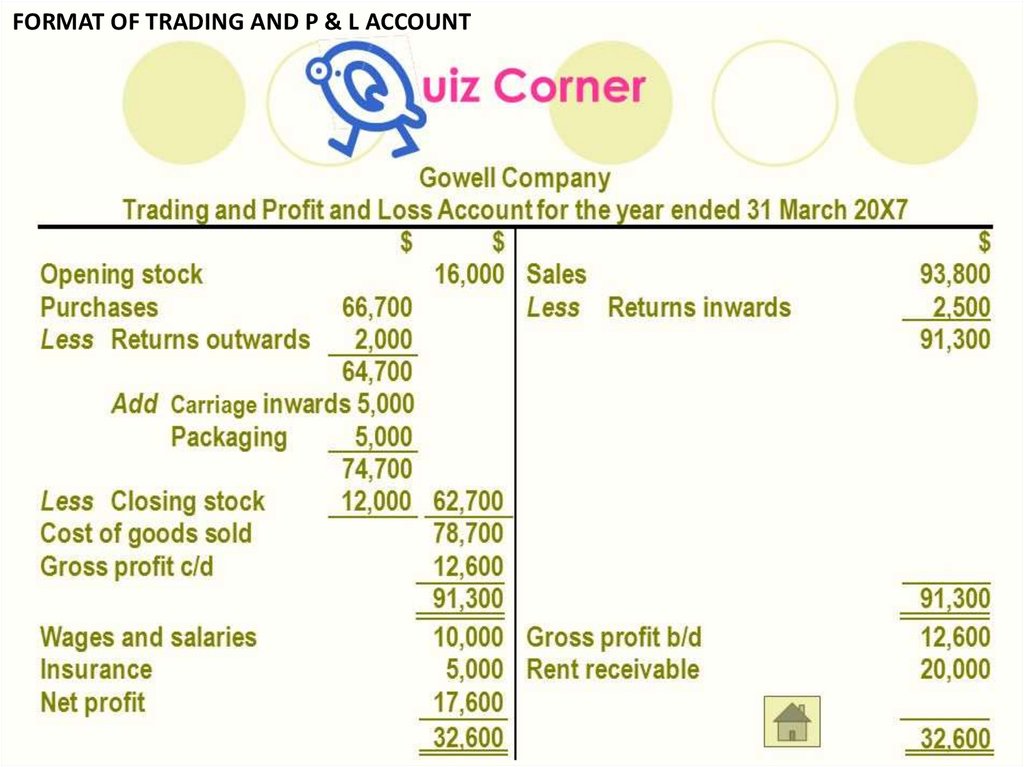

FORMAT OF TRADING AND P & L ACCOUNT27.

Question.9 (Same question No.7)Prepare Branch A/C under Final Account system with the following information:

Op. Building

Op. Cash

Op. Debtors

Op. Stock

Op. Furniture

Cash sales

Credit sales

Stock closing

2,00,000

40,000

30,000

35,000

1,00,000

2,20,000

8,00,000

25,000

Collections from debtors

Bad debts

Dep on furniture

Goods send to branch during the year

Expenses paid by branch

Expenses paid by HO

SOLUTION 9 (Final Account Methods)

Branch Trading & Profit and Loss A/C

6,30,000

10,000

10%

3,80,000

28,000

22,000

28.

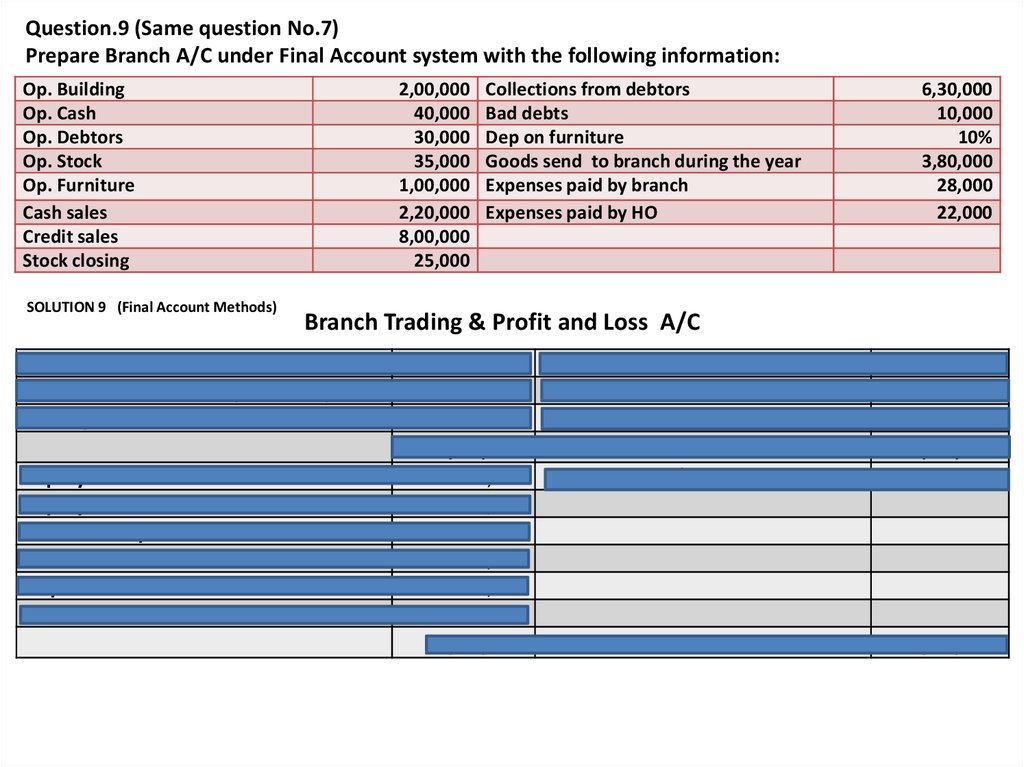

Question.9 (Same question No.7)Prepare Branch A/C under Final Account system with the following information:

Op. Building

Op. Cash

Op. Debtors

Op. Stock

Op. Furniture

Cash sales

Credit sales

Stock closing

SOLUTION 9 (Final Account Methods)

2,00,000

40,000

30,000

35,000

1,00,000

2,20,000

8,00,000

25,000

Collections from debtors

Bad debts

Dep on furniture

Goods send to branch during the year

Expenses paid by branch

Expenses paid by HO

Branch Trading & Profit and Loss A/C

Op. stock

Goods sent to branch (Purchase)

Gross profit

35,000 Sales cash

3,80,000 Sales credit

6,30,000 C. Stock

10,45,000

Exp by HO

Exp by branch

Non cash exp:

Bad debts

Depreciation

Net Profit

6,30,000

10,000

10%

3,80,000

28,000

22,000

22,000 Gross Profit B/D

28,000

2,20,000

8,00,000

25,000

10,45,000

6,30,000

10,000

10,000

5,60,000

6,30,000

6,30,000

29.

SOLUTION 10: HOME ASSIGNMENT (1)IN THE BOOKS OF HO. (JEDDAH)

MADINA BRANCH ACCOUNT

(for the year 1987)

TO Opening stock

STOCK

10,000

DEBTORS

5,000

PETTYCASH

30

TO Goods supplied to branch

TO Cash - expenses

To P &L A/C ( Balancing Figure)

BY CASH:

CASH SALES

20,000

RECEIVED FROM DEBTORS

10,000

BY Goods returned by branch a/c

Closing balance:

Debtor

Stock

Cash goods in transit

SOLUTION OF

HOME

ASSIGNMENT (1)

15,030

35,000

2,000

5,470

57,500

30,000

500

20,000

6,000

1,000

57,500

BRANCH DEBTORS ACCOUNT

(to calculate the closing balance of debtors)

To Op. debtors

To Credit sales

5,000 By Cash (received from debtors)

30,000 By return inward (Goods returned by the customers)

By Disc.

Bad debts

By balance b/d

35,000

10,000

3,000

500

1,500

20,000

35,000

30.

Question 10(HOME ASSIGNMENT No.1)

Almarai company has its HO at Jeddah and branch at Madina. The branch sells for cash as well as

credit. With the help of the following transactions which took place between HO and Branch Office in

the year 2017: Prepare Branch Account and Debtors Account in the books of HO.

Opening stock

10,000 Cash received from debtors

Closing stock

6,000 Cash sent to branch for expenses

Op. debtors

5,000 Goods returned by the branch

Op. petty cash

30 Goods returned by the customers

10,000

2,000

500

3,000

Goods supplied to branch

35,000 Allowed discount to customers

500

Credit sales

30,000 Bad debts

1,500

Cash sales

20,000 Goods in transit from HO on 31st

December 2017

1,000

31.

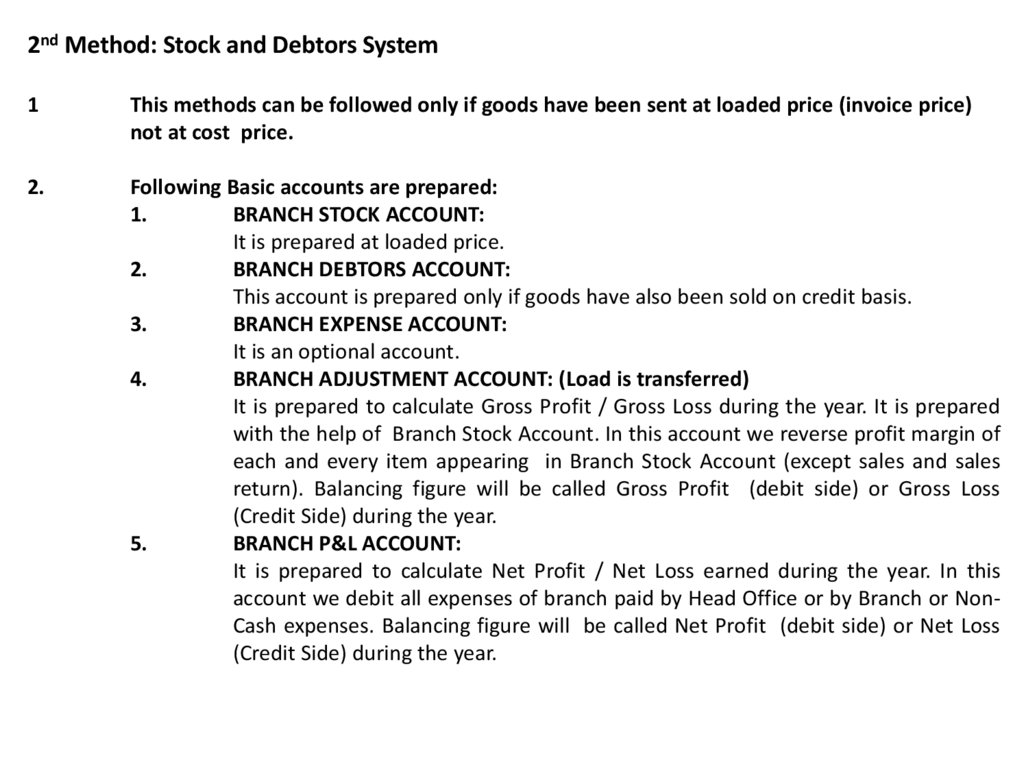

2nd Method: Stock and Debtors System1

This methods can be followed only if goods have been sent at loaded price (invoice price)

not at cost price.

2.

Following Basic accounts are prepared:

1.

BRANCH STOCK ACCOUNT:

It is prepared at loaded price.

2.

BRANCH DEBTORS ACCOUNT:

This account is prepared only if goods have also been sold on credit basis.

3.

BRANCH EXPENSE ACCOUNT:

It is an optional account.

4.

BRANCH ADJUSTMENT ACCOUNT: (Load is transferred)

It is prepared to calculate Gross Profit / Gross Loss during the year. It is prepared

with the help of Branch Stock Account. In this account we reverse profit margin of

each and every item appearing in Branch Stock Account (except sales and sales

return). Balancing figure will be called Gross Profit (debit side) or Gross Loss

(Credit Side) during the year.

5.

BRANCH P&L ACCOUNT:

It is prepared to calculate Net Profit / Net Loss earned during the year. In this

account we debit all expenses of branch paid by Head Office or by Branch or NonCash expenses. Balancing figure will be called Net Profit (debit side) or Net Loss

(Credit Side) during the year.

32.

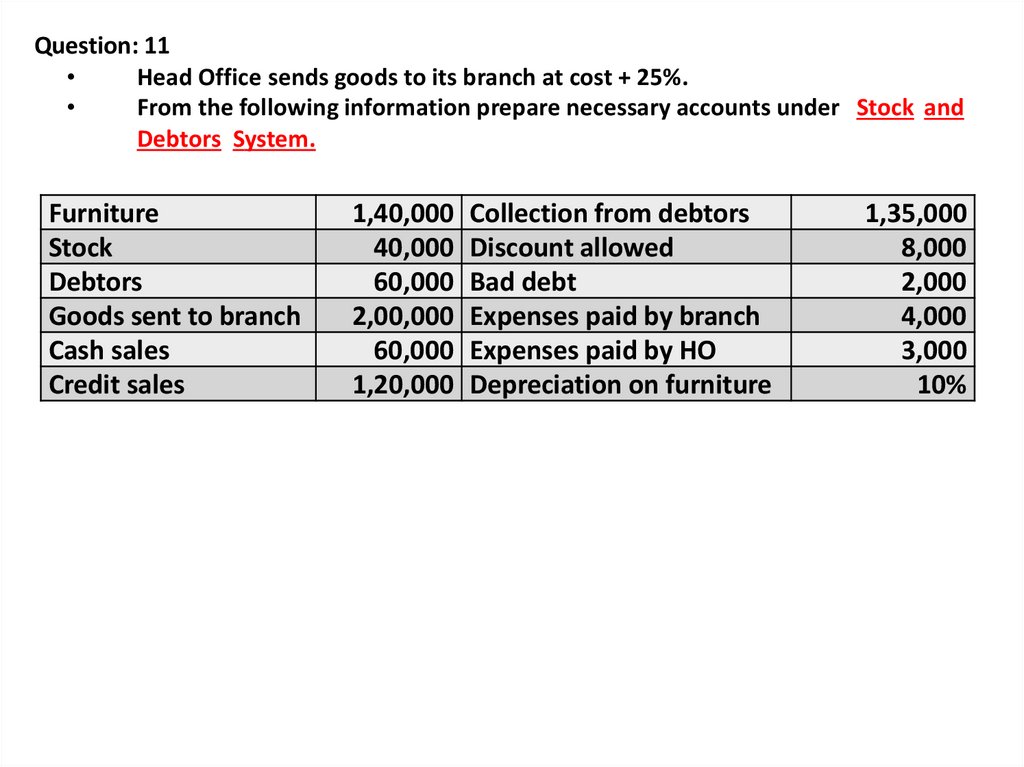

Question: 11Head Office sends goods to its branch at cost + 25%.

From the following information prepare necessary accounts under Stock and

Debtors System.

Furniture

Stock

Debtors

Goods sent to branch

Cash sales

Credit sales

1,40,000

40,000

60,000

2,00,000

60,000

1,20,000

Collection from debtors

Discount allowed

Bad debt

Expenses paid by branch

Expenses paid by HO

Depreciation on furniture

1,35,000

8,000

2,000

4,000

3,000

10%

33.

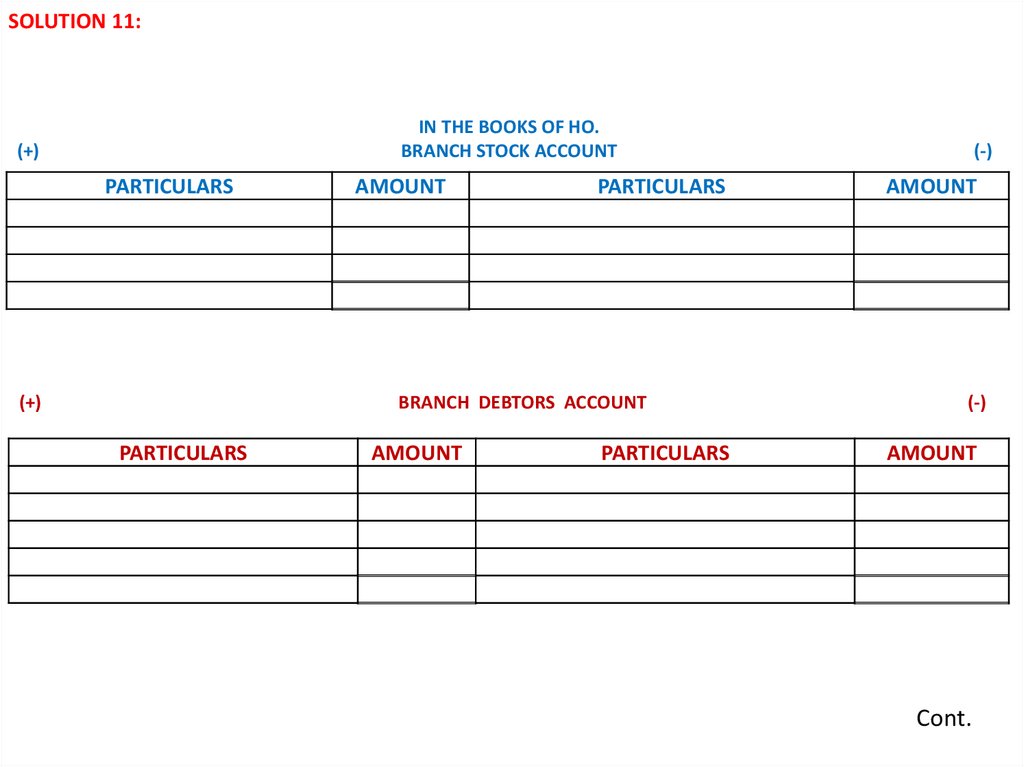

SOLUTION 11:IN THE BOOKS OF HO.

BRANCH STOCK ACCOUNT

(+)

PARTICULARS

(+)

AMOUNT

PARTICULARS

BRANCH DEBTORS ACCOUNT

PARTICULARS

AMOUNT

PARTICULARS

(-)

AMOUNT

(-)

AMOUNT

Cont.

34.

SOLUTION 11:Under Stock and Debtors System, we have to make following accounts:

1.

BRANCH STOCK ACCOUNT (for Stock)

2.

BRANCH DEBTORS ACCOUNT (for Load of Profit)

3.

BRANCH ADJUSTMENT ACCOUNT (for Gross Profit)

4.

BRANCH P & L ACCOUNT (for Net Profit)

5.

BRANCH EXPENSE ACCOUNT ( Optional)

(+)

PARTICULARS

TO Balance B/D

To Goods Sent To Branch A/C

(+)

PARTICULARS

TO Balance B/D

To Branch Stock A/C (Credit Sales)

Cost

= 100

Load

= 25

Invoice Price =125

IN THE BOOKS OF HO.

BRANCH STOCK ACCOUNT

AMOUNT

PARTICULARS

40,000 By Branch Cash A/C (Cash Sales)

2,00,000 By Branch Debtors A/C (Credit Sales)

By Balance C/D (Balancing Figure)

2,40,000

BRANCH DEBTORS ACCOUNT

AMOUNT

PARTICULARS

60,000 By Branch Cash A/C (Cash Sales)

1,20,000 By Disc. A/C

By bad debts

By Balance C/D (Balancing Figure)

1,80,000

(-)

AMOUNT

60,000

1,20,000

60,000

2,40,000

(-)

AMOUNT

1,35,000

8,000

2,000

35,000

1,80,000

Cont.

35.

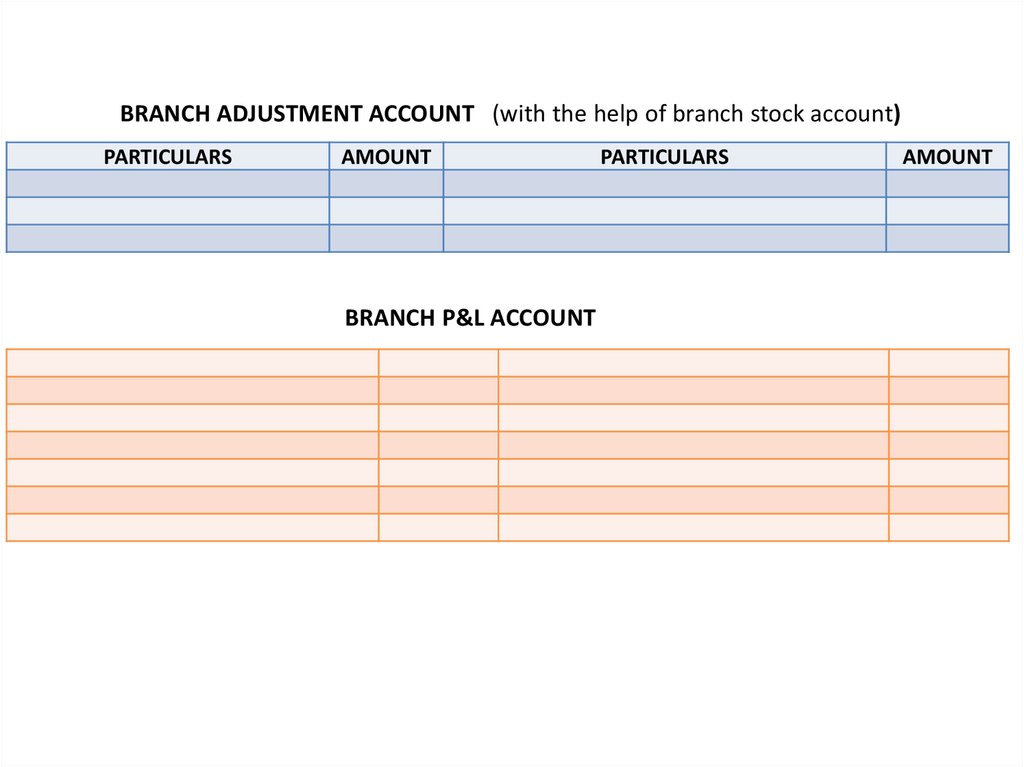

BRANCH ADJUSTMENT ACCOUNT (with the help of branch stock account)PARTICULARS

AMOUNT

BRANCH P&L ACCOUNT

PARTICULARS

AMOUNT

36.

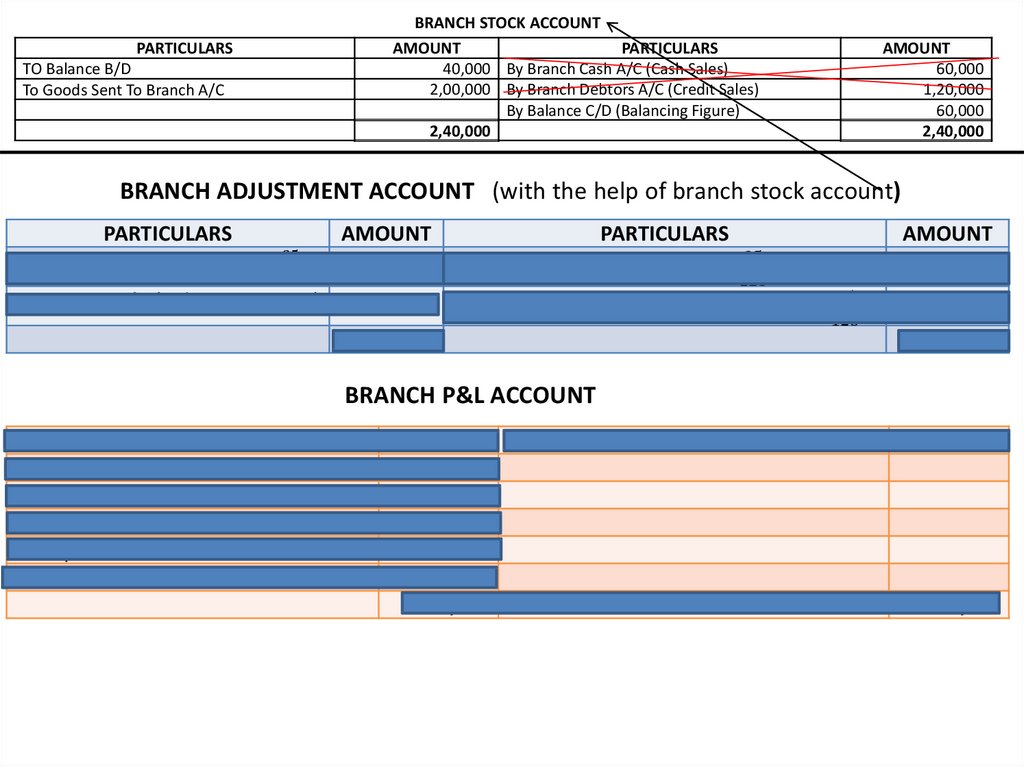

BRANCH STOCK ACCOUNTPARTICULARS

TO Balance B/D

To Goods Sent To Branch A/C

AMOUNT

PARTICULARS

40,000 By Branch Cash A/C (Cash Sales)

2,00,000 By Branch Debtors A/C (Credit Sales)

By Balance C/D (Balancing Figure)

2,40,000

AMOUNT

60,000

1,20,000

60,000

2,40,000

BRANCH ADJUSTMENT ACCOUNT (with the help of branch stock account)

PARTICULARS

25

TO stock reserve a/c (60000× 125 )

AMOUNT

PARTICULARS

12,000 By Stock Reserve a/c (40,000× 25 )

125

36,000 By Goods sent to branch A/C (2,00,000×

To Gross Profit (Balancing Figure)

48,000

AMOUNT

8,000

25

125

)

40,000

48,000

BRANCH P&L ACCOUNT

To Expenses paid by HO

To Expenses paid by branch

To disc. allowed

To bad debts

To depreciation on furniture

To Net Profit

3,000 By Gross Profit

4,000

8,000

2,000

14,000

5,000

36,000

36000

36,000

37.

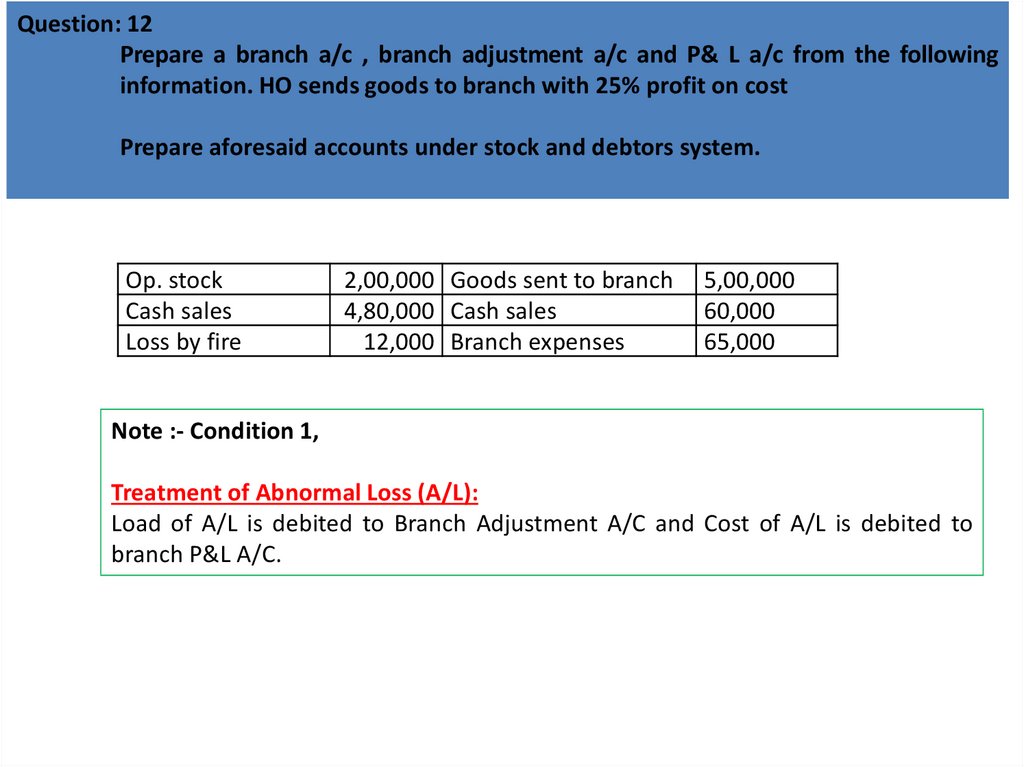

Question: 12Prepare a branch a/c , branch adjustment a/c and P& L a/c from the following

information. HO sends goods to branch with 25% profit on cost

Prepare aforesaid accounts under stock and debtors system.

Op. stock

Cash sales

Loss by fire

2,00,000 Goods sent to branch

4,80,000 Cash sales

12,000 Branch expenses

5,00,000

60,000

65,000

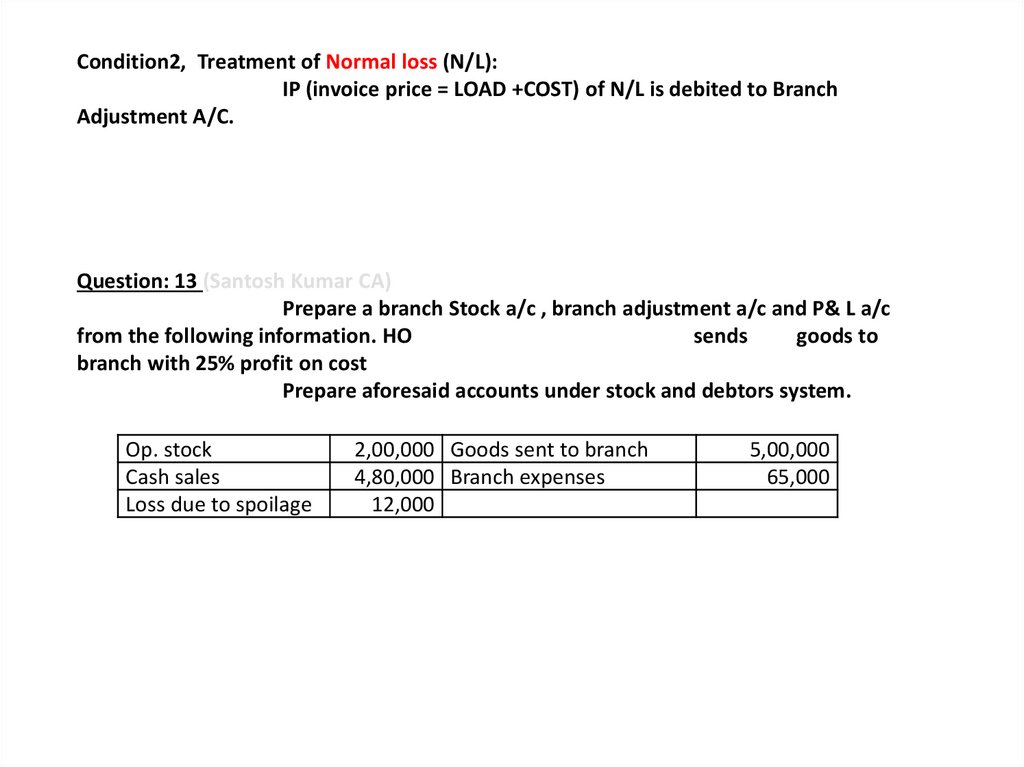

Note :- Condition 1,

Treatment of Abnormal Loss (A/L):

Load of A/L is debited to Branch Adjustment A/C and Cost of A/L is debited to

branch P&L A/C.

38.

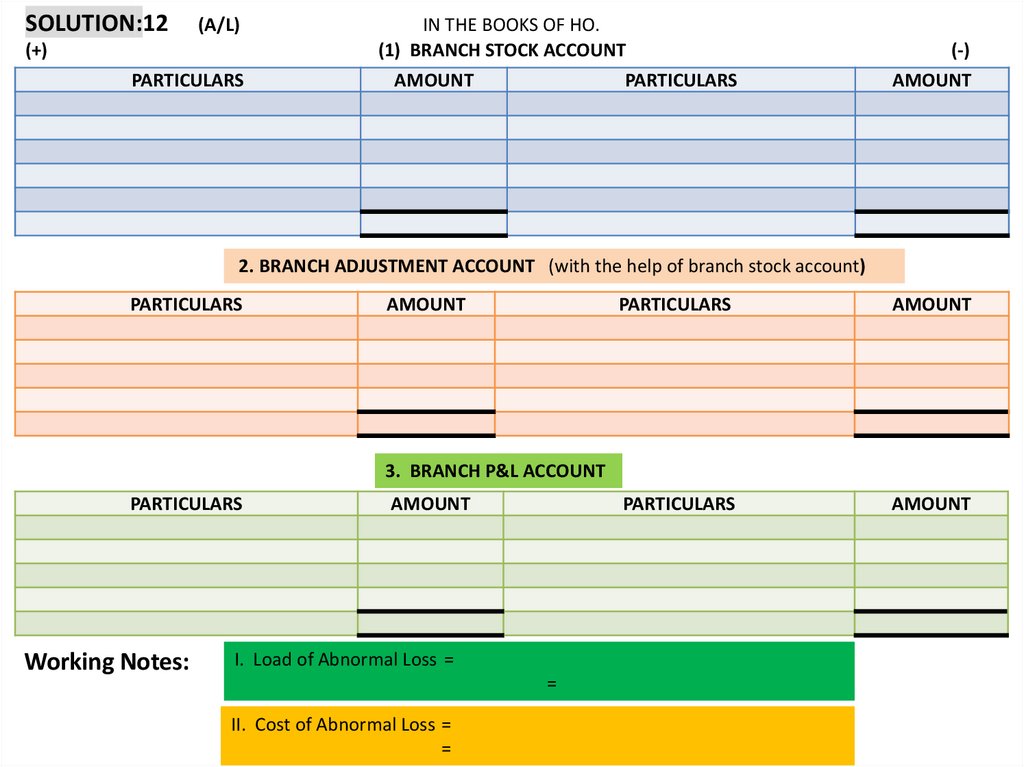

SOLUTION:12(A/L)

(+)

PARTICULARS

IN THE BOOKS OF HO.

(1) BRANCH STOCK ACCOUNT

AMOUNT

PARTICULARS

(-)

AMOUNT

2. BRANCH ADJUSTMENT ACCOUNT (with the help of branch stock account)

PARTICULARS

AMOUNT

PARTICULARS

AMOUNT

PARTICULARS

AMOUNT

3. BRANCH P&L ACCOUNT

PARTICULARS

Working Notes:

AMOUNT

I. Load of Abnormal Loss =

=

II. Cost of Abnormal Loss =

=

39.

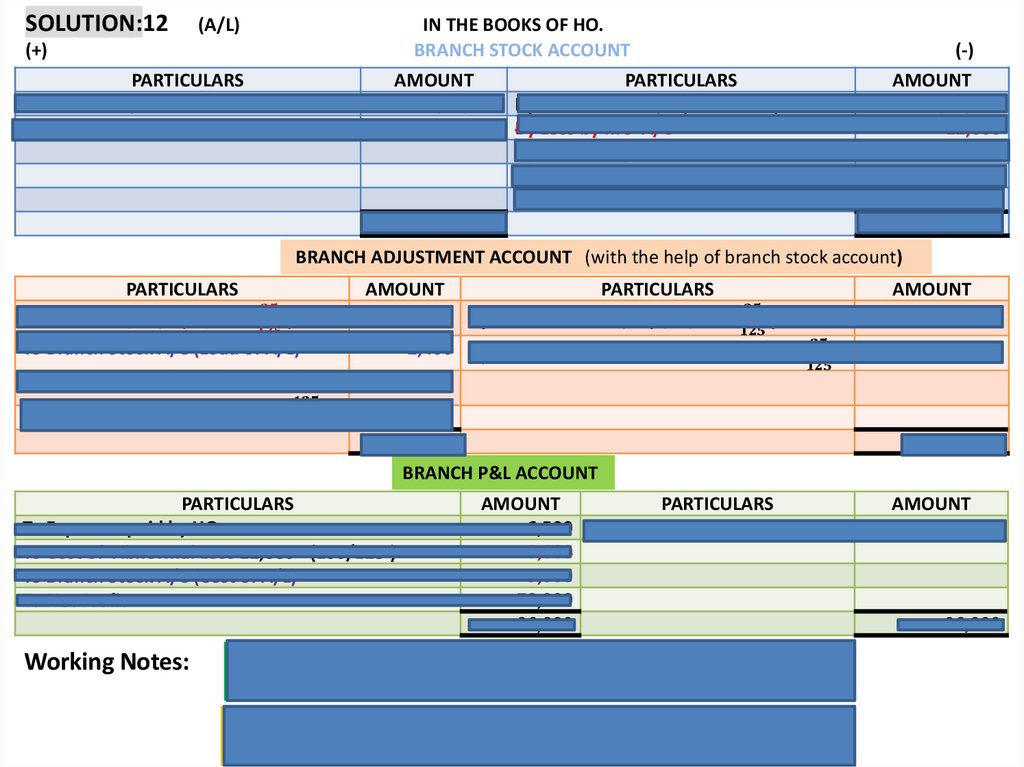

SOLUTION:12(A/L)

IN THE BOOKS OF HO.

BRANCH STOCK ACCOUNT

(+)

PARTICULARS

TO Balance B/D

To Goods Sent To Branch A/C

(-)

AMOUNT

PARTICULARS

2,00,000 By Branch Cash A/C (Cash Sales)

5,00,000 By Loss by fire A/C

By Branch Adj. A/C (Load of A/L)

By Branch P&L A/C (Loss of A/L)

By Balance C/D (Balancing Figure)

7,00,000

AMOUNT

4,80,000

12,000

2,400

9,600

2,08,000

7,00,000

BRANCH ADJUSTMENT ACCOUNT (with the help of branch stock account)

PARTICULARS

AMOUNT

PARTICULARS

2,400 By Stock Reserve a/c (2,00,000×

finance

finance