Similar presentations:

Risk is part of all our lives

1. Risk assessment of investment projects by the Monte Carlo method using Oracle Crystal Ball

Elena Malyh2. Risk is part of all our lives

3.

TYPES OF RISK OF THE INVESTMENTPROJECT

continuous risks

discrete risks

(strategic decisions)

(risks fluctuations in market

factors)

4.

a high level of risklow risk

discrete risks

Decision Tree model

Real options method

The Discounted Cash

Flow Method

Monte Carlo model

low risk

a high level of risk

continuous risks

5. How does Crystal Ball work?

Crystal Ball is an easy-to-use simulation program that helps toanalyze the risks and uncertainties associated with Microsoft Excel

spreadsheet models.

6.

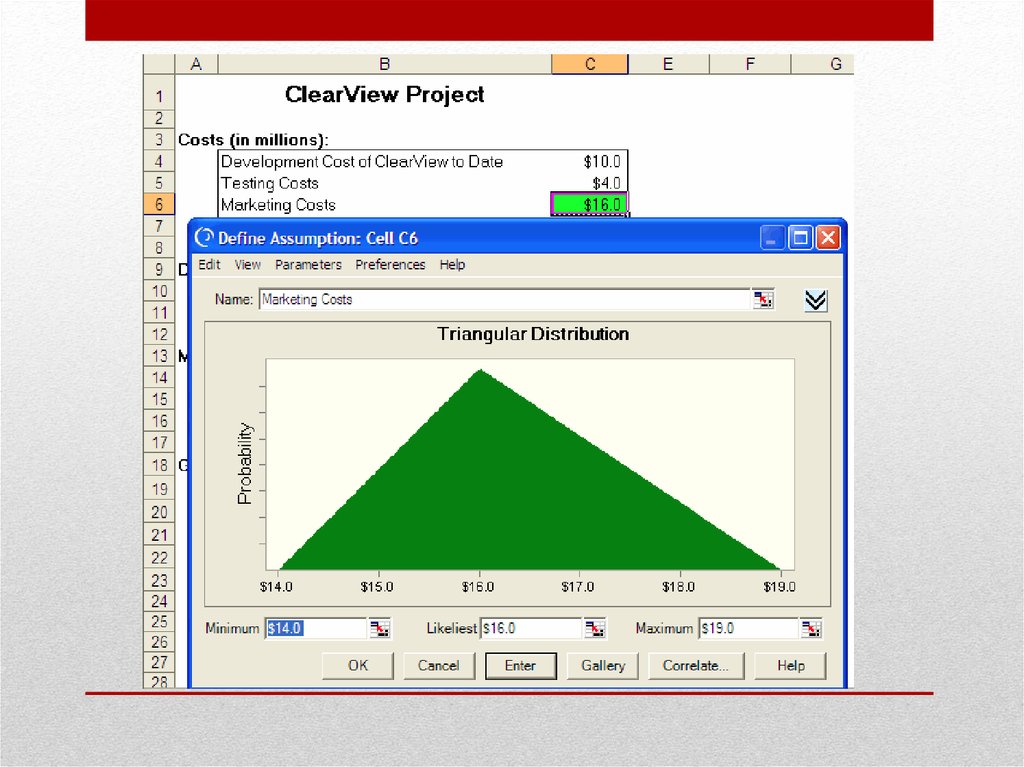

ClearView ProjectCosts (in millions U.S. dollars ):

Development Cost of ClearView to Date

Testing Costs

Marketing Costs

Total Costs

Drug Test (sample of 100 patients):

Patients Cured

10,00

4,00

16,00

30,00

100

Market Stady (in millions U.S. dollars):

Persons in U.S. with Nearsightedness Today

Growth Rate of Nearsightedness

Persons with Nearsightedness After One Year

40,00

0,02

40,80

Gross Profit on Dosages Sold:

Market Penetration

Profit Per Customer In Dollars

Gross Profit if Approved (MM)

0,08

12,00

39,20

Net Profit (MM)

9,20

7. Identifying Uncertainty and Defining Assumptions

There are many types of distribution,but the most used are normal and triangular distribution

8.

9.

10.

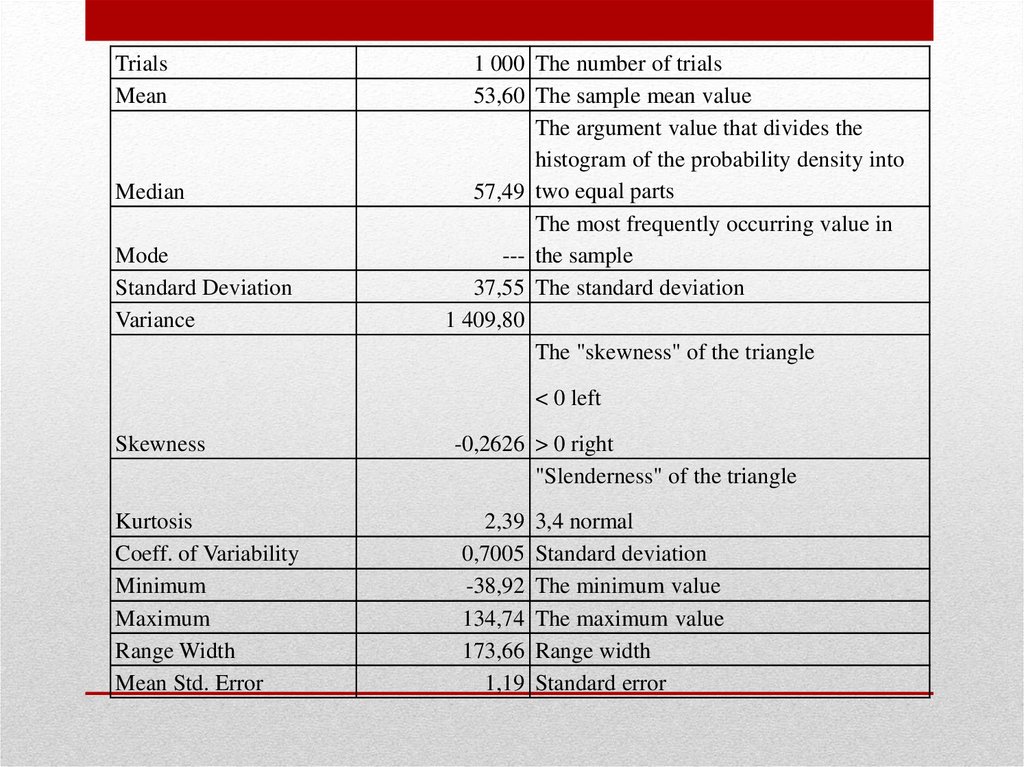

Analyzing Simulation Results11.

Analyzing Simulation Results12.

TrialsMean

Median

Mode

Standard Deviation

Variance

1 000 The number of trials

53,60 The sample mean value

The argument value that divides the

histogram of the probability density into

57,49 two equal parts

The most frequently occurring value in

--- the sample

37,55 The standard deviation

1 409,80

The "skewness" of the triangle

< 0 left

Skewness

Kurtosis

Coeff. of Variability

Minimum

Maximum

Range Width

Mean Std. Error

-0,2626 > 0 right

"Slenderness" of the triangle

2,39

0,7005

-38,92

134,74

173,66

1,19

3,4 normal

Standard deviation

The minimum value

The maximum value

Range width

Standard error

13.

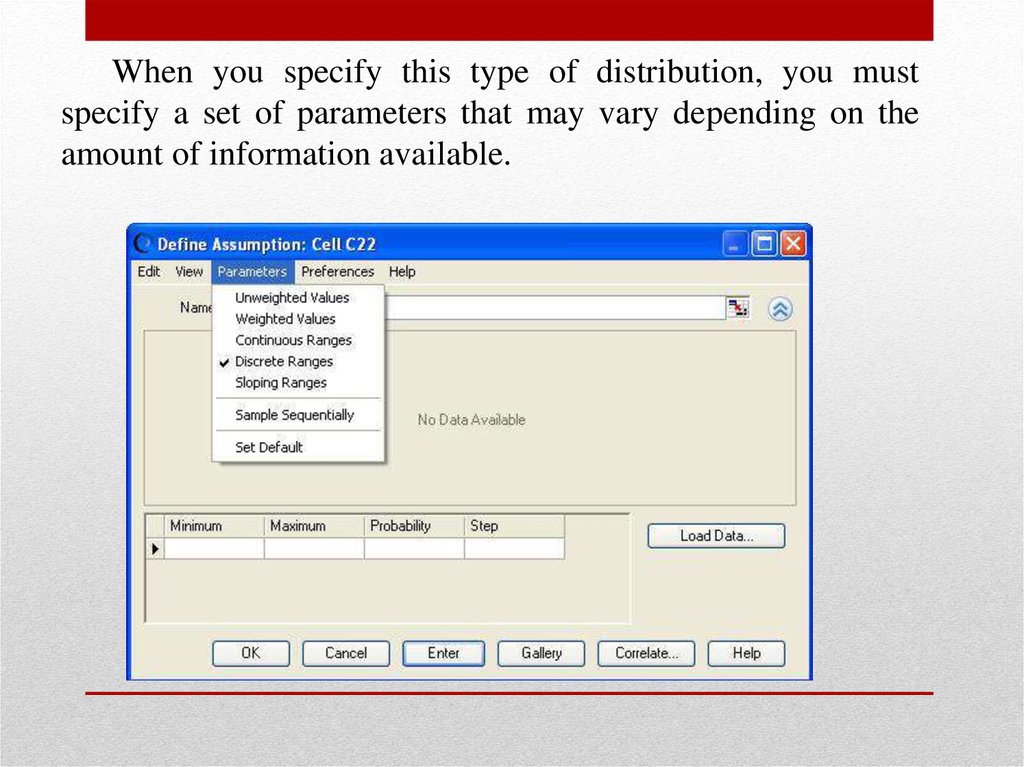

When you specify this type of distribution, you mustspecify a set of parameters that may vary depending on the

amount of information available.

14.

The definitionof custom continuous distribution

15.

The definition ofa discrete custom distribution

16.

The definition of a custom distributionbased on available data

17.

18.

0 year1 year

Price

The number of sold

2 year

3 year

6

6,05

6,1

802000

967000

1132000

4812000

5850350

6905200

2646600

3217693

3797860

2165400

2632658

3107340

324810

394899

466101

1840590

2237759

2641239

588989

716083

845196

1251601

1521676

1796043

Revenue

Cost, % of sales

The cost

55%

Gross profit

Transaction costs

Net income before taxes

Taxes (32%)

Initial investment

Net income

NPV

-3400000

344796

finance

finance