Similar presentations:

Introduction to Risk, Return, and the Opportunity Cost of Capital

1.

Principles ofCorporate

Finance

Seventh Edition

Richard A. Brealey

Chapter 7

Introduction to Risk, Return,

and the Opportunity Cost of

Capital

Stewart C. Myers

Slides by

Matthew Will

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

2. Topics Covered

7- 2Topics Covered

75 Years of Capital Market History

Measuring Risk

Portfolio Risk

Beta and Unique Risk

Diversification

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

3.

7- 3The Value of an Investment of $1 in 1926

1000

6402

S&P

Small Cap

Corp Bonds

Long Bond

T Bill

2587

64.1

Index

48.9

16.6

10

1

0.1

1925

1940

Source: Ibbotson Associates

McGraw Hill/Irwin

1955

1970

1985

2000

Year End

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

4.

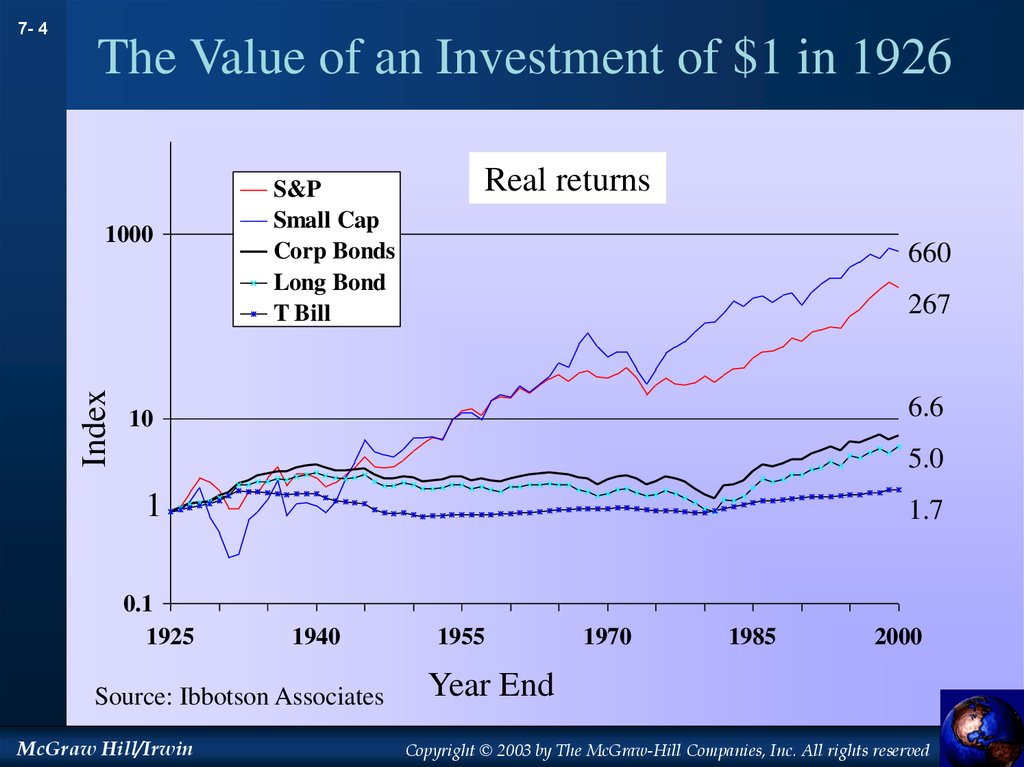

7- 4The Value of an Investment of $1 in 1926

Index

1000

S&P

Small Cap

Corp Bonds

Long Bond

T Bill

Real returns

660

267

6.6

10

5.0

1

0.1

1925

1.7

1940

Source: Ibbotson Associates

McGraw Hill/Irwin

1955

1970

1985

2000

Year End

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

5.

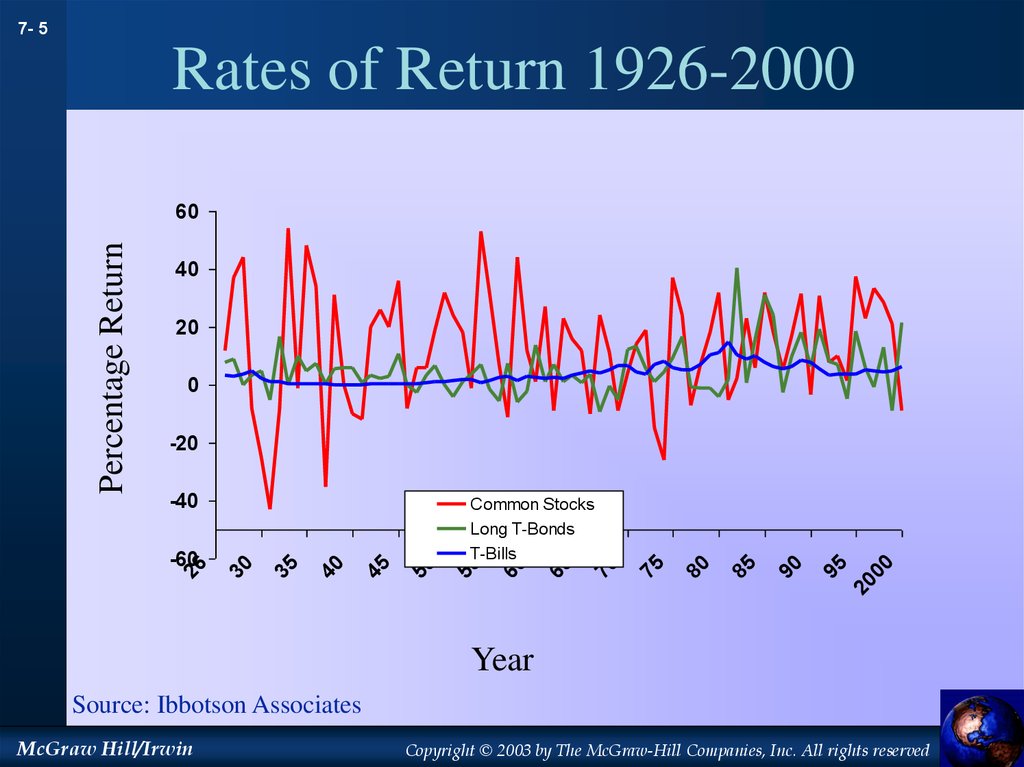

7- 5Rates of Return 1926-2000

40

20

0

95

90

85

80

75

70

65

60

55

50

45

40

35

26

-60

Common Stocks

Long T-Bonds

T-Bills

20

-40

00

-20

30

Percentage Return

60

Year

Source: Ibbotson Associates

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

6. Average Market Risk Premia (1999-2000)

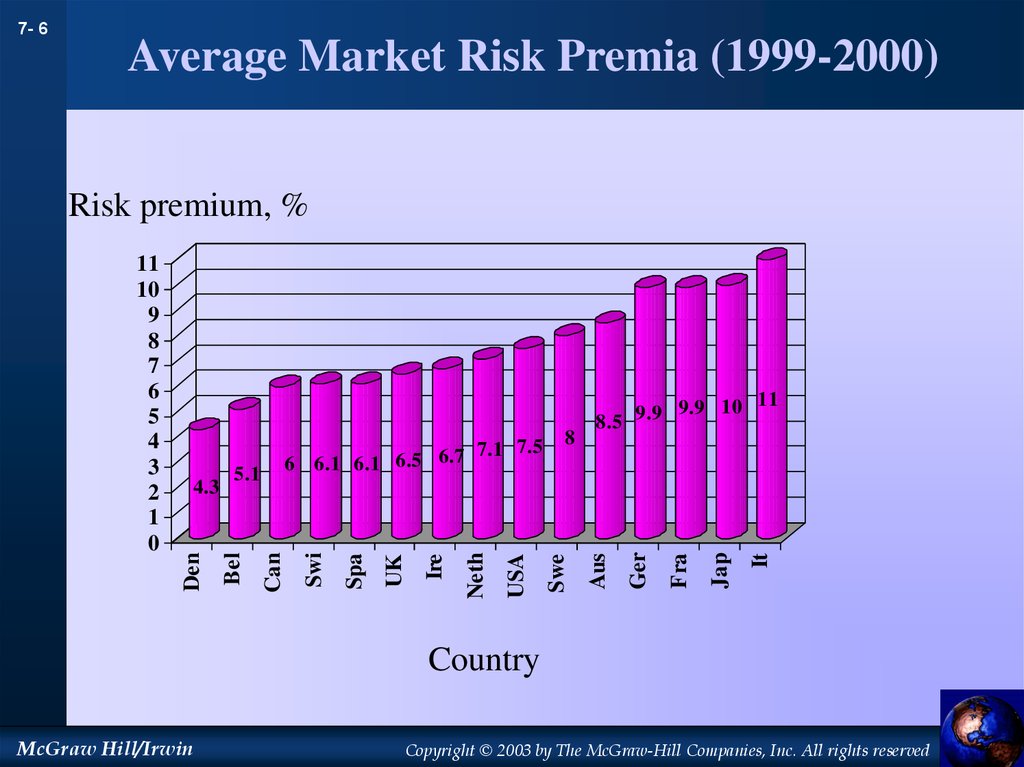

7- 6Average Market Risk Premia (1999-2000)

Risk premium, %

It

Jap

Fra

Ger

9.9 10 11

9.9

8.5

Aus

8

Swe

USA

Neth

Ire

UK

Spa

Swi

7.1 7.5

6 6.1 6.1 6.5 6.7

Can

5.1

Bel

4.3

Den

11

10

9

8

7

6

5

4

3

2

1

0

Country

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

7. Measuring Risk

7- 7Measuring Risk

Variance - Average value of squared deviations from

mean. A measure of volatility.

Standard Deviation - Average value of squared

deviations from mean. A measure of volatility.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

8. Measuring Risk

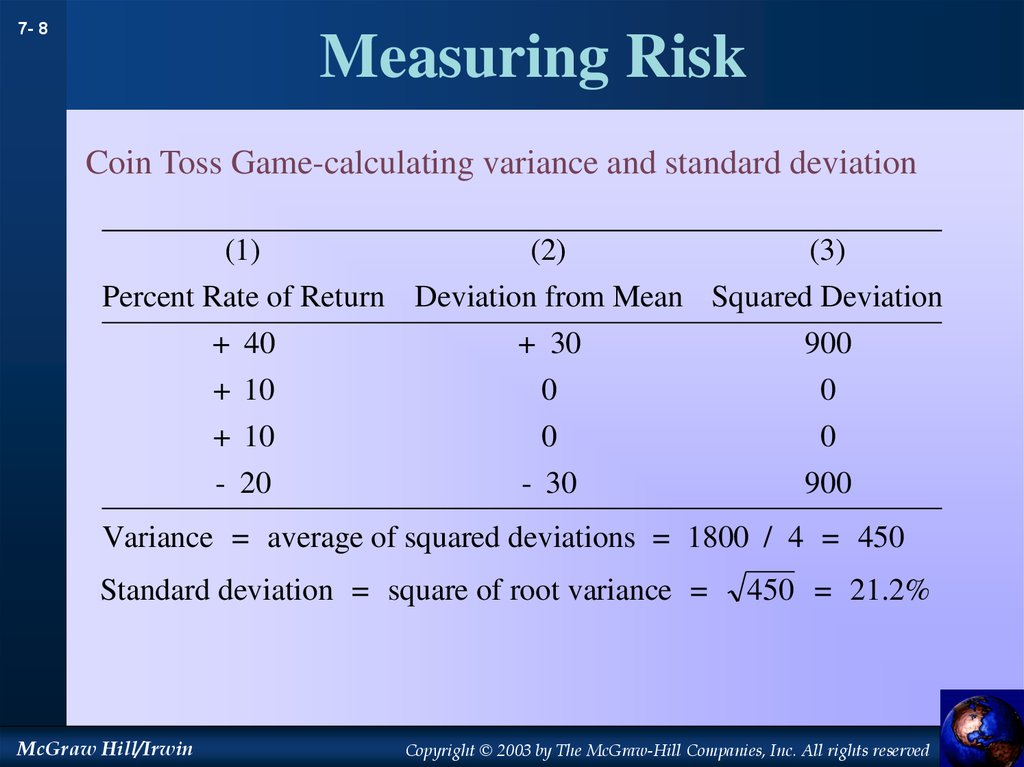

7- 8Measuring Risk

Coin Toss Game-calculating variance and standard deviation

(1)

(2)

(3)

Percent Rate of Return Deviation from Mean Squared Deviation

+ 40

+ 30

900

+ 10

0

0

+ 10

0

0

- 20

- 30

900

Variance = average of squared deviations = 1800 / 4 = 450

Standard deviation = square of root variance =

McGraw Hill/Irwin

450 = 21.2%

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

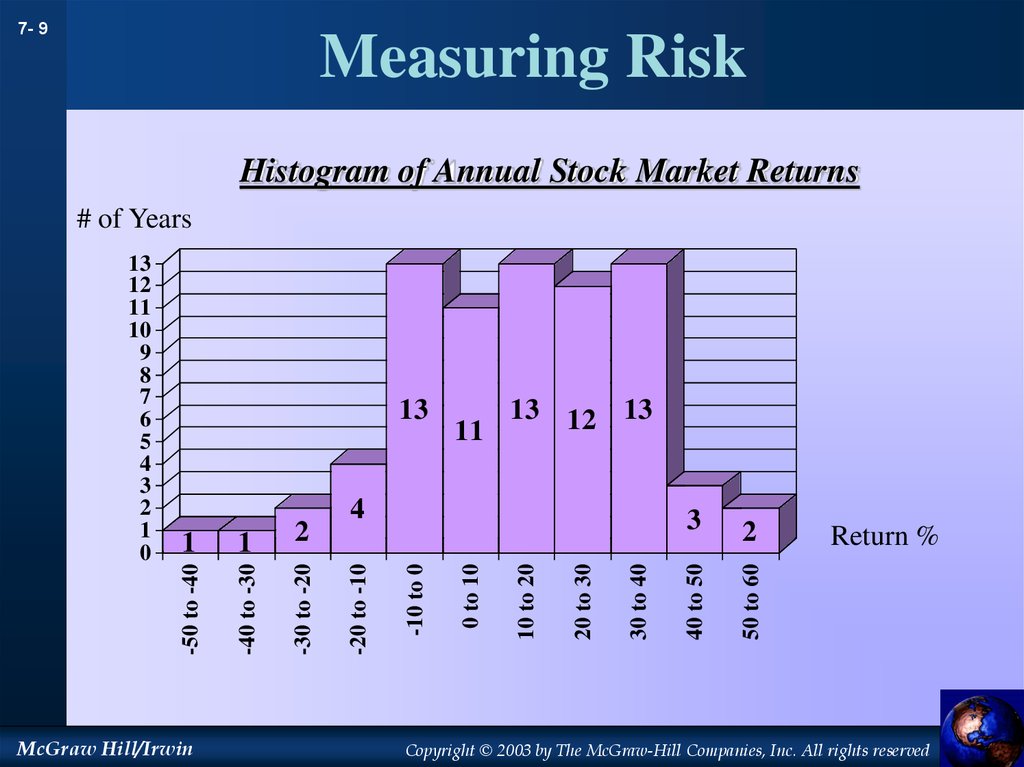

9. Measuring Risk

7- 9Measuring Risk

Histogram of Annual Stock Market Returns

# of Years

2

Return %

50 to 60

40 to 50

30 to 40

20 to 30

10 to 20

0 to 10

-30 to -20

McGraw Hill/Irwin

3

-10 to 0

1

13 12 13

11

4

-20 to -10

1

2

-40 to -30

13

-50 to -40

13

12

11

10

9

8

7

6

5

4

3

2

1

0

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

10. Measuring Risk

7- 10Measuring Risk

Diversification - Strategy designed to reduce risk by

spreading the portfolio across many investments.

Unique Risk - Risk factors affecting only that firm.

Also called “diversifiable risk.”

Market Risk - Economy-wide sources of risk that

affect the overall stock market. Also called

“systematic risk.”

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

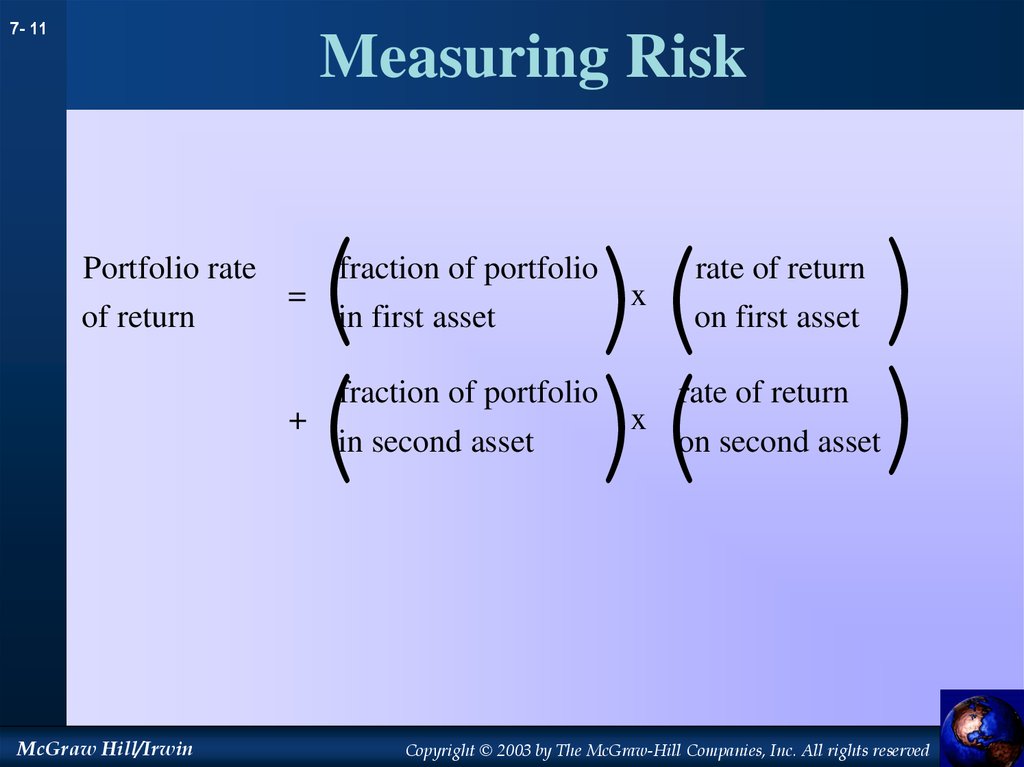

11. Measuring Risk

7- 11Measuring Risk

Portfolio rate

of return

(

(

=

+

McGraw Hill/Irwin

)(

)(

fraction of portfolio

in first asset

fraction of portfolio

in second asset

x

x

rate of return

on first asset

rate of return

)

)

on second asset

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

12. Measuring Risk

7- 12Portfolio standard deviation

Measuring Risk

0

5

10

15

Number of Securities

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

13. Measuring Risk

7- 13Portfolio standard deviation

Measuring Risk

Unique

risk

Market risk

0

5

10

15

Number of Securities

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

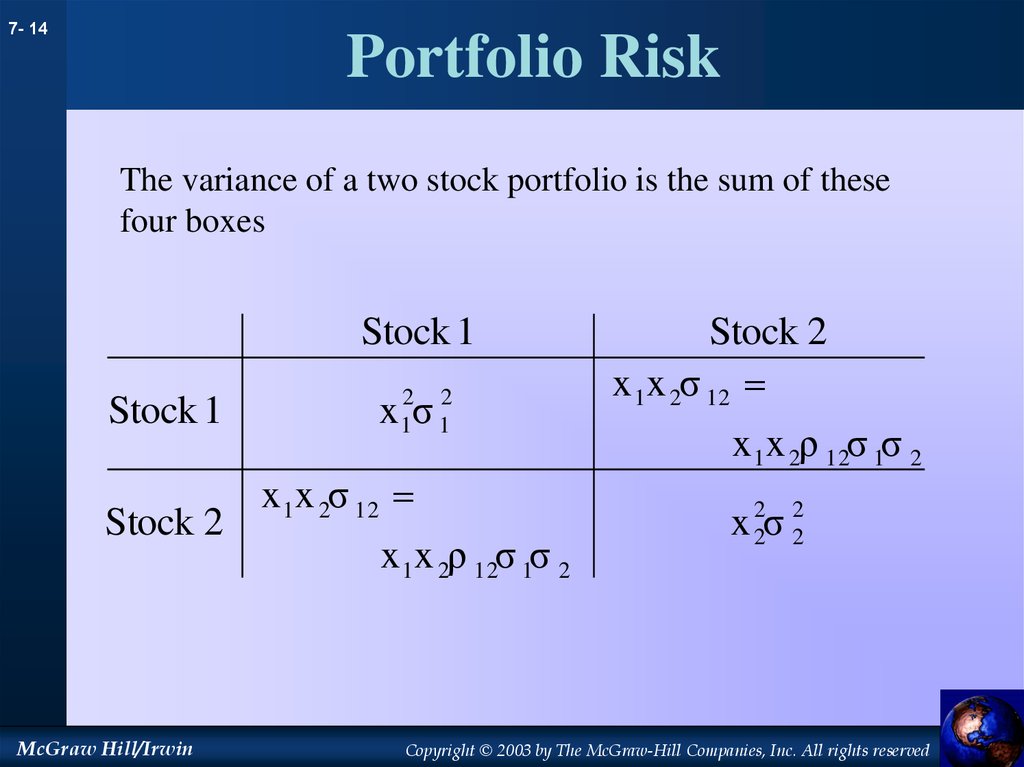

14. Portfolio Risk

7- 14Portfolio Risk

The variance of a two stock portfolio is the sum of these

four boxes

Stock 1

Stock 1

Stock 2

McGraw Hill/Irwin

x 12σ 12

x 1x 2σ 12

x 1x 2ρ 12σ 1σ 2

Stock 2

x 1x 2σ 12

x 1x 2ρ 12σ 1σ 2

x 22σ 22

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

15. Portfolio Risk

7- 15Portfolio Risk

Example

Suppose you invest 65% of your portfolio in CocaCola and 35% in Reebok. The expected dollar

return on your CC is 10% x 65% = 6.5% and on

Reebok it is 20% x 35% = 7.0%. The expected

return on your portfolio is 6.5 + 7.0 = 13.50%.

Assume a correlation coefficient of 1.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

16. Portfolio Risk

7- 16Portfolio Risk

Example

Suppose you invest 65% of your portfolio in Coca-Cola and 35% in

Reebok. The expected dollar return on your CC is 10% x 65% = 6.5%

and on Reebok it is 20% x 35% = 7.0%. The expected return on your

portfolio is 6.5 + 7.0 = 13.50%. Assume a correlation coefficient of 1.

Coca - Cola

Coca - Cola

Reebok

McGraw Hill/Irwin

x 12 σ12 (.65) 2 (31.5) 2

x 1 x 2 ρ12 σ1σ 2 .65 .35

1 31.5 58.5

Reebok

x 1 x 2 ρ12 σ1σ 2 .65 .35

1 31.5 58.5

x 22 σ 22 (.35) 2 (58.5) 2

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

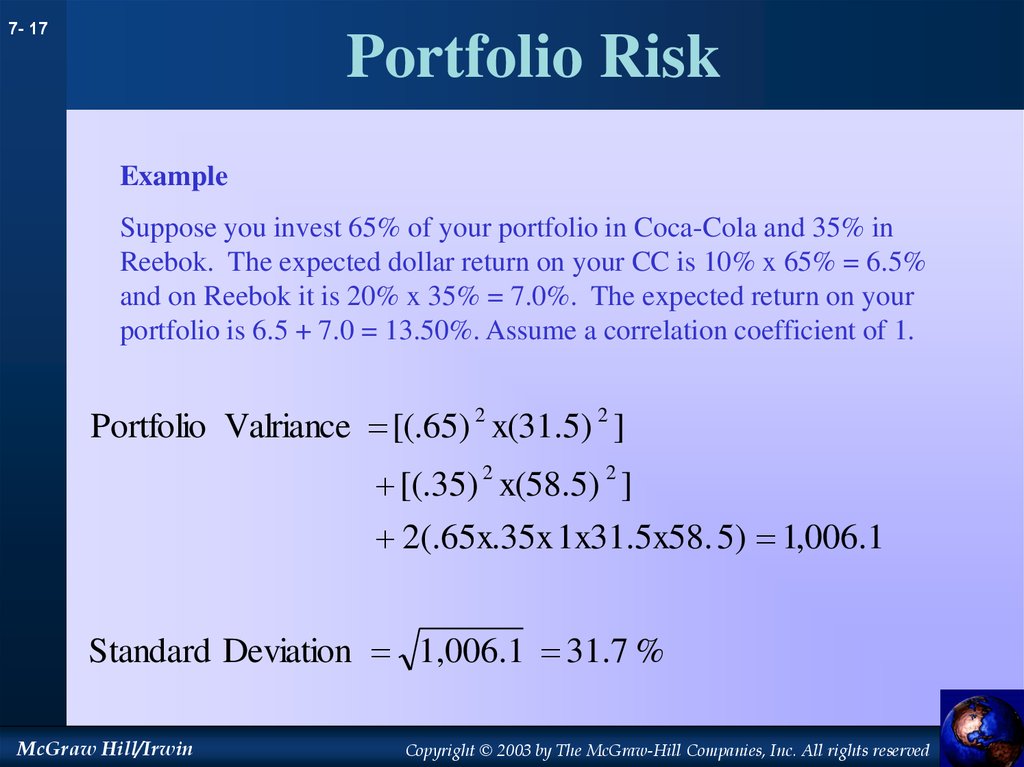

17. Portfolio Risk

7- 17Portfolio Risk

Example

Suppose you invest 65% of your portfolio in Coca-Cola and 35% in

Reebok. The expected dollar return on your CC is 10% x 65% = 6.5%

and on Reebok it is 20% x 35% = 7.0%. The expected return on your

portfolio is 6.5 + 7.0 = 13.50%. Assume a correlation coefficient of 1.

Portfolio Valriance [(.65) 2 x(31.5) 2 ]

[(.35) 2 x(58.5) 2 ]

2(.65x.35x 1x31.5x58. 5) 1,006.1

Standard Deviation 1,006.1 31.7 %

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

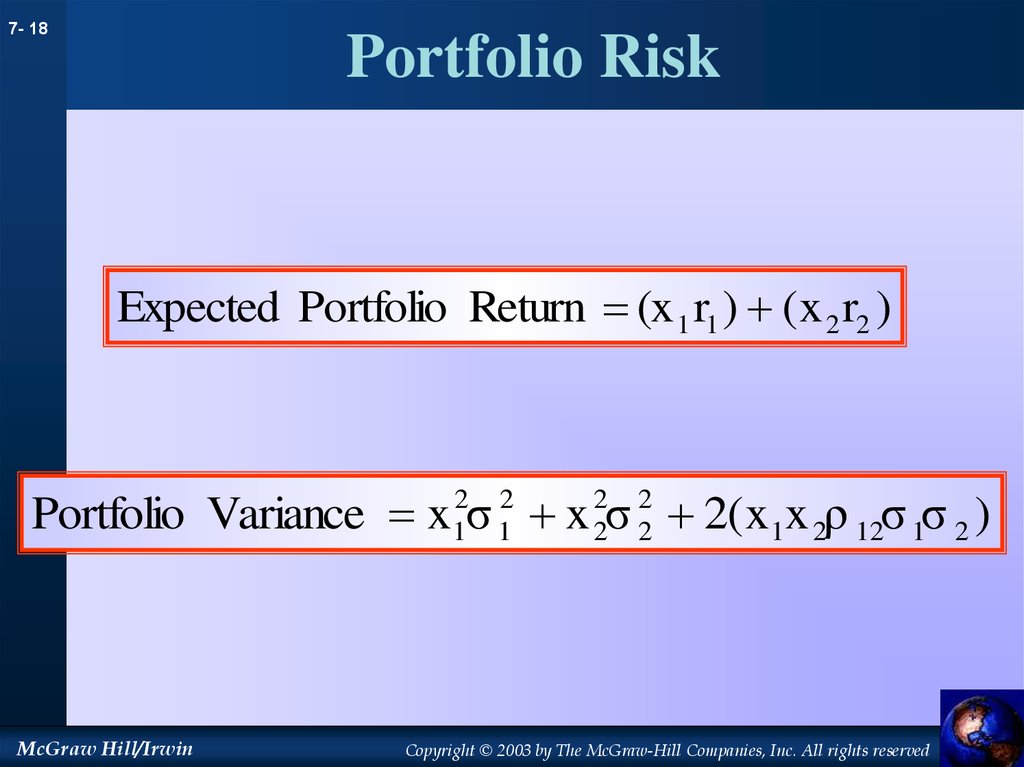

18. Portfolio Risk

7- 18Portfolio Risk

Expected Portfolio Return (x 1 r1 ) ( x 2 r2 )

Portfolio Variance x12σ 12 x 22σ 22 2( x1x 2ρ 12σ 1σ 2 )

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

19. Portfolio Risk

7- 19Portfolio Risk

The shaded boxes contain variance terms; the remainder

contain covariance terms.

1

2

3

STOCK

To calculate

portfolio

variance add

up the boxes

4

5

6

N

1

2

3

4

5

6

N

STOCK

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

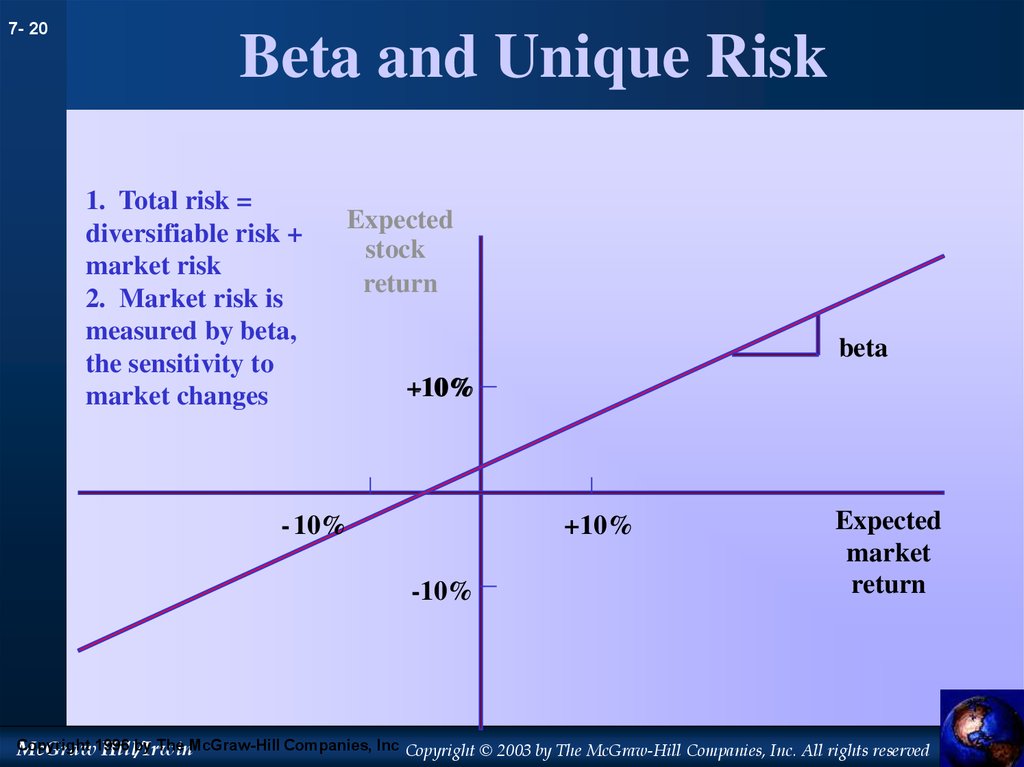

20. Beta and Unique Risk

7- 20Beta and Unique Risk

1. Total risk =

diversifiable risk +

market risk

2. Market risk is

measured by beta,

the sensitivity to

market changes

Expected

stock

return

beta

+10%

-10%

- 10%

+10%

-10%

Expected

market

return

Copyright

by The McGraw-Hill Companies, Inc Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

McGraw1996

Hill/Irwin

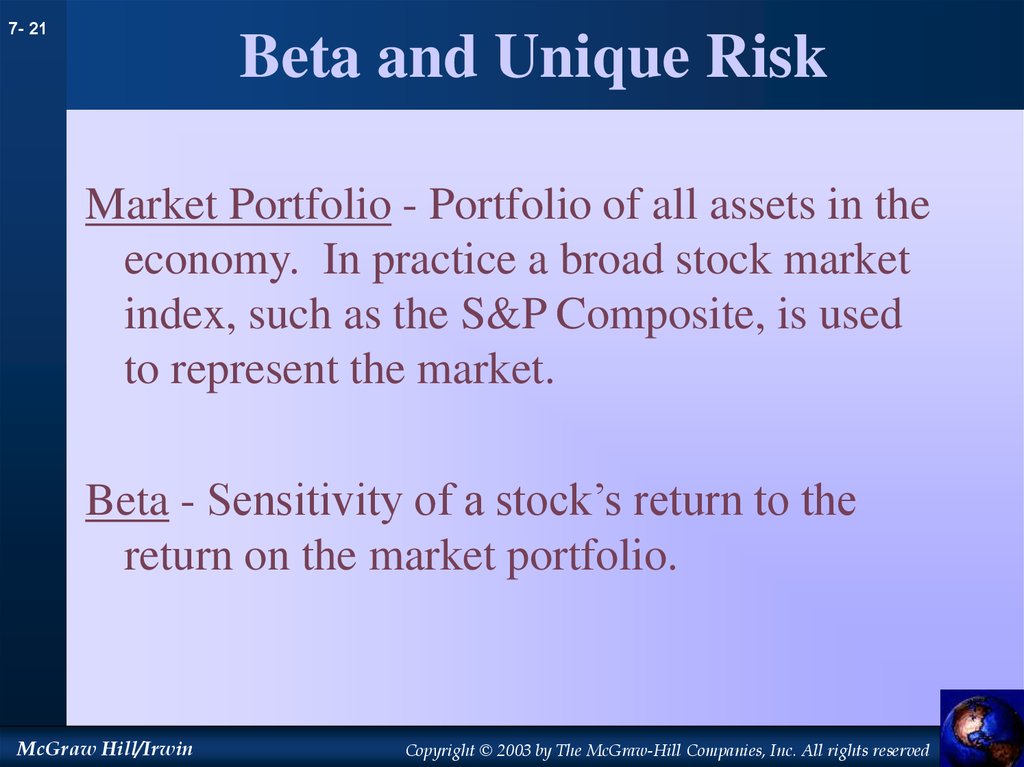

21. Beta and Unique Risk

7- 21Beta and Unique Risk

Market Portfolio - Portfolio of all assets in the

economy. In practice a broad stock market

index, such as the S&P Composite, is used

to represent the market.

Beta - Sensitivity of a stock’s return to the

return on the market portfolio.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

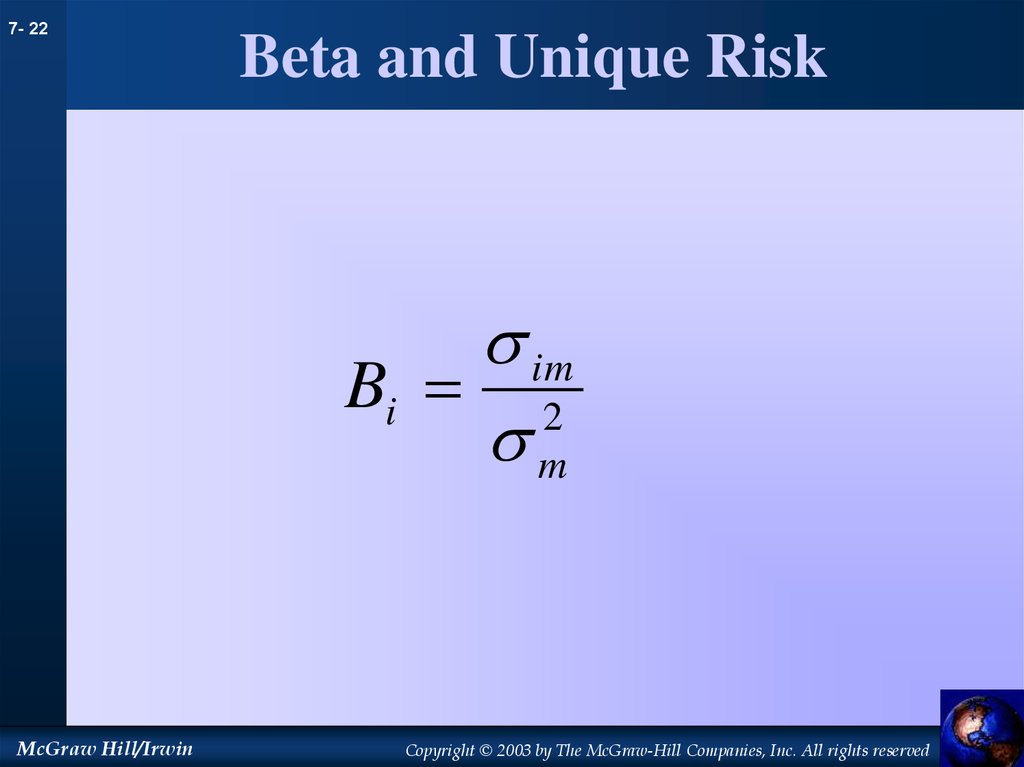

22. Beta and Unique Risk

7- 22Beta and Unique Risk

im

Bi 2

m

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

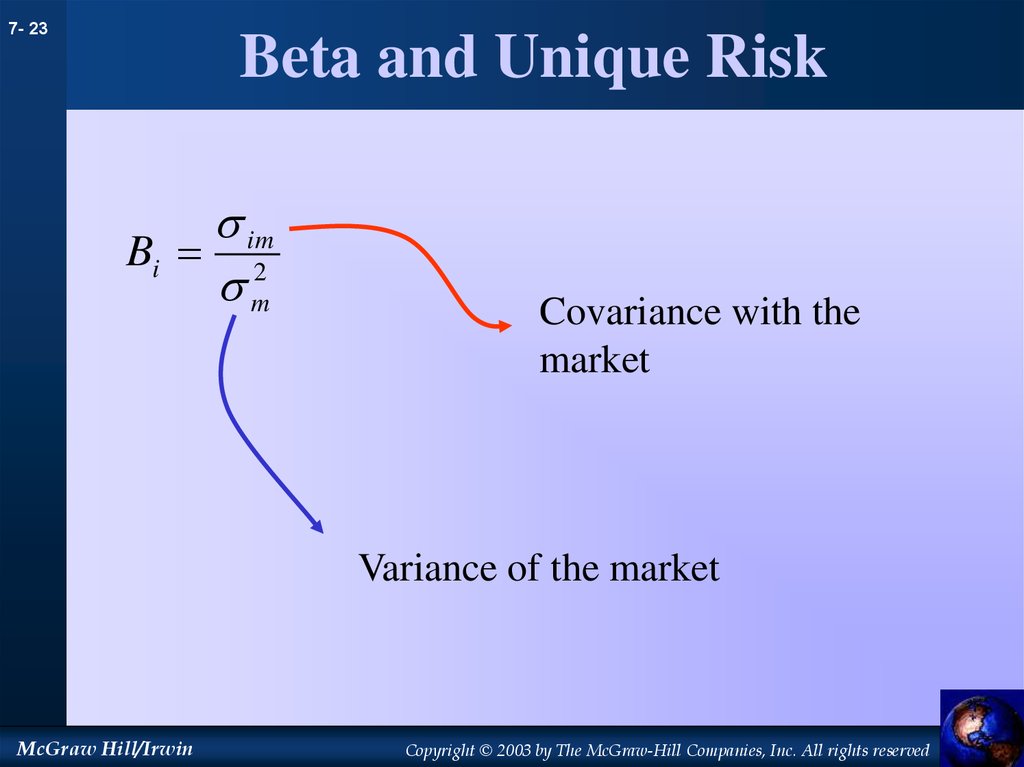

23. Beta and Unique Risk

7- 23Beta and Unique Risk

im

Bi 2

m

Covariance with the

market

Variance of the market

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

finance

finance