Similar presentations:

Capital Budgeting and Risk

1.

Principles ofCorporate

Finance

Chapter 9

Capital Budgeting and Risk

Seventh Edition

Richard A. Brealey

Stewart C. Myers

Slides by

Matthew Will

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

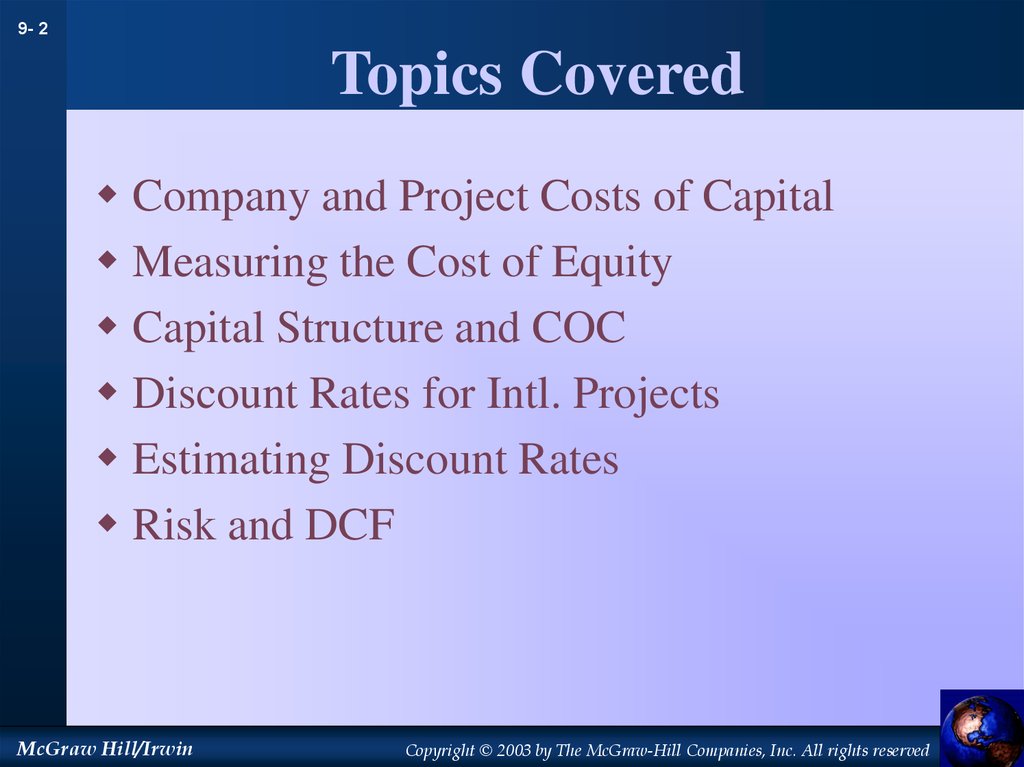

2. Topics Covered

9- 2Topics Covered

Company and Project Costs of Capital

Measuring the Cost of Equity

Capital Structure and COC

Discount Rates for Intl. Projects

Estimating Discount Rates

Risk and DCF

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

3. Company Cost of Capital

9- 3Company Cost of Capital

A firm’s value can be stated as the sum of the

value of its various assets

Firm value PV(AB) PV(A) PV(B)

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

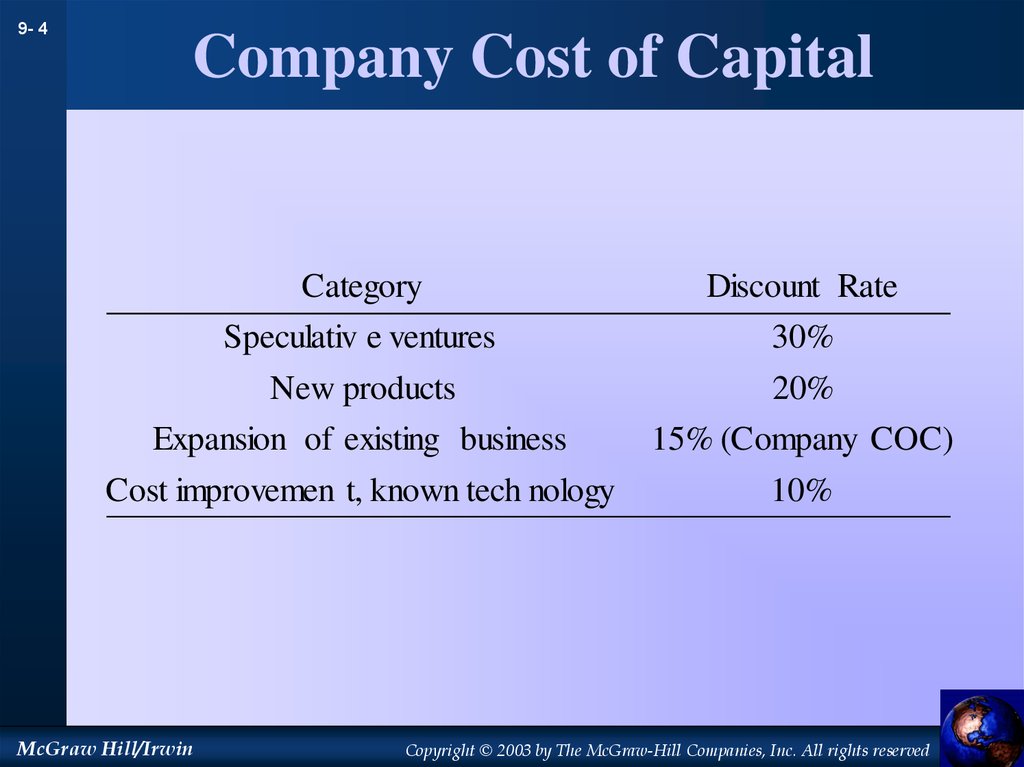

4. Company Cost of Capital

9- 4Company Cost of Capital

Category

Discount Rate

Speculativ e ventures

30%

New products

20%

Expansion of existing business

15% (Company COC)

Cost improvemen t, known tech nology

10%

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

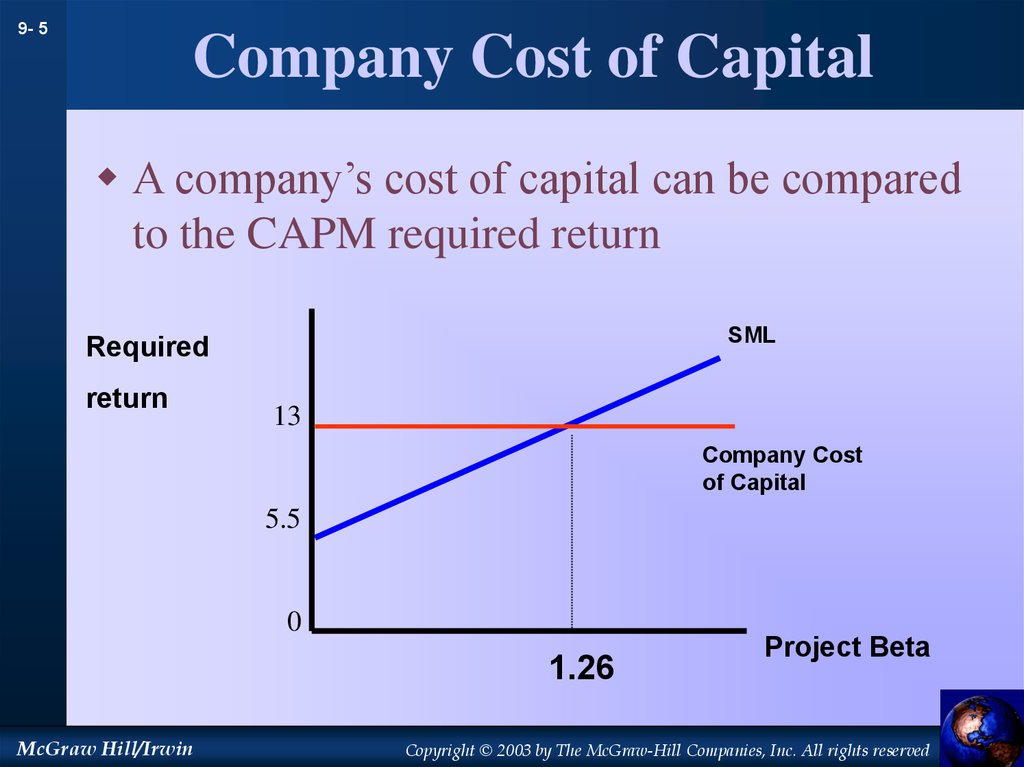

5. Company Cost of Capital

9- 5Company Cost of Capital

A company’s cost of capital can be compared

to the CAPM required return

SML

Required

return

13

Company Cost

of Capital

5.5

0

1.26

McGraw Hill/Irwin

Project Beta

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

6. Measuring Betas

9- 6Measuring Betas

The SML shows the relationship between

return and risk

CAPM uses Beta as a proxy for risk

Other methods can be employed to determine

the slope of the SML and thus Beta

Regression analysis can be used to find Beta

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

7. Measuring Betas

9- 7Measuring Betas

Dell Computer

Dell return (%)

Price data – Aug 88- Jan 95

R2 = .11

B = 1.62

Slope determined from plotting the

line of best fit.

McGraw Hill/Irwin

Market return (%)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

8. Measuring Betas

9- 8Measuring Betas

Dell Computer

Dell return (%)

Price data – Feb 95 – Jul 01

R2 = .27

B = 2.02

Slope determined from plotting the

line of best fit.

McGraw Hill/Irwin

Market return (%)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

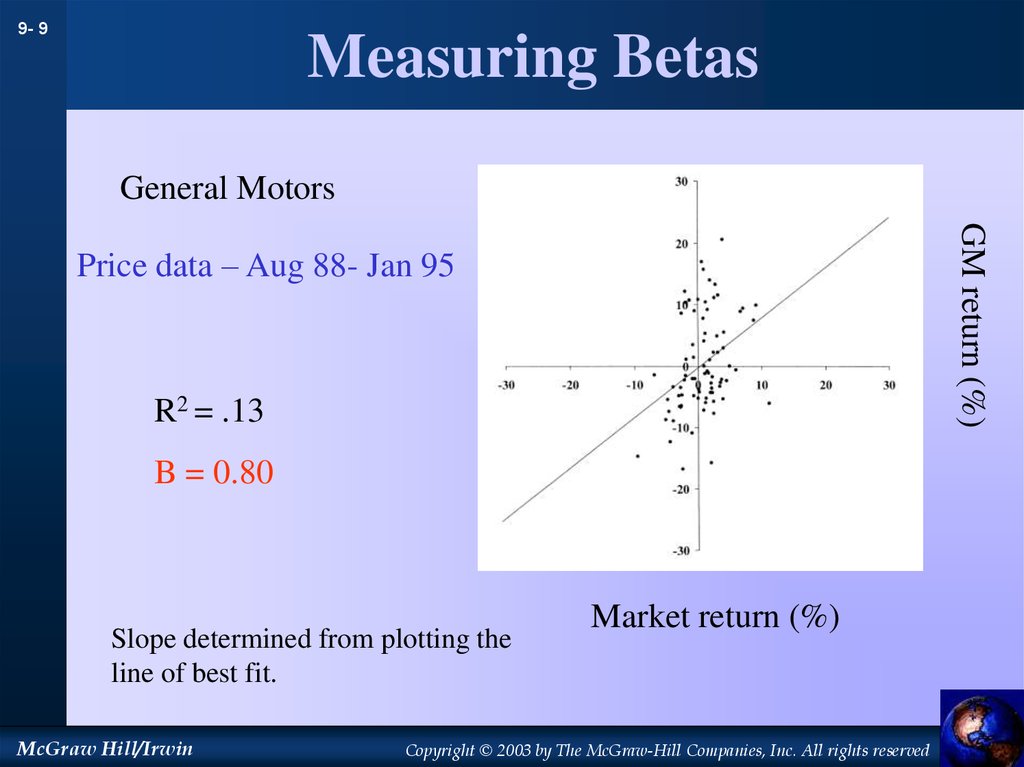

9. Measuring Betas

9- 9Measuring Betas

General Motors

GM return (%)

Price data – Aug 88- Jan 95

R2 = .13

B = 0.80

Slope determined from plotting the

line of best fit.

McGraw Hill/Irwin

Market return (%)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

10. Measuring Betas

9- 10Measuring Betas

General Motors

GM return (%)

Price data – Feb 95 – Jul 01

R2 = .25

B = 1.00

Slope determined from plotting the

line of best fit.

McGraw Hill/Irwin

Market return (%)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

11. Measuring Betas

9- 11Measuring Betas

Exxon Mobil

Exxon Mobil return (%)

Price data – Aug 88- Jan 95

R2 = .28

B = 0.52

Slope determined from plotting the

line of best fit.

McGraw Hill/Irwin

Market return (%)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

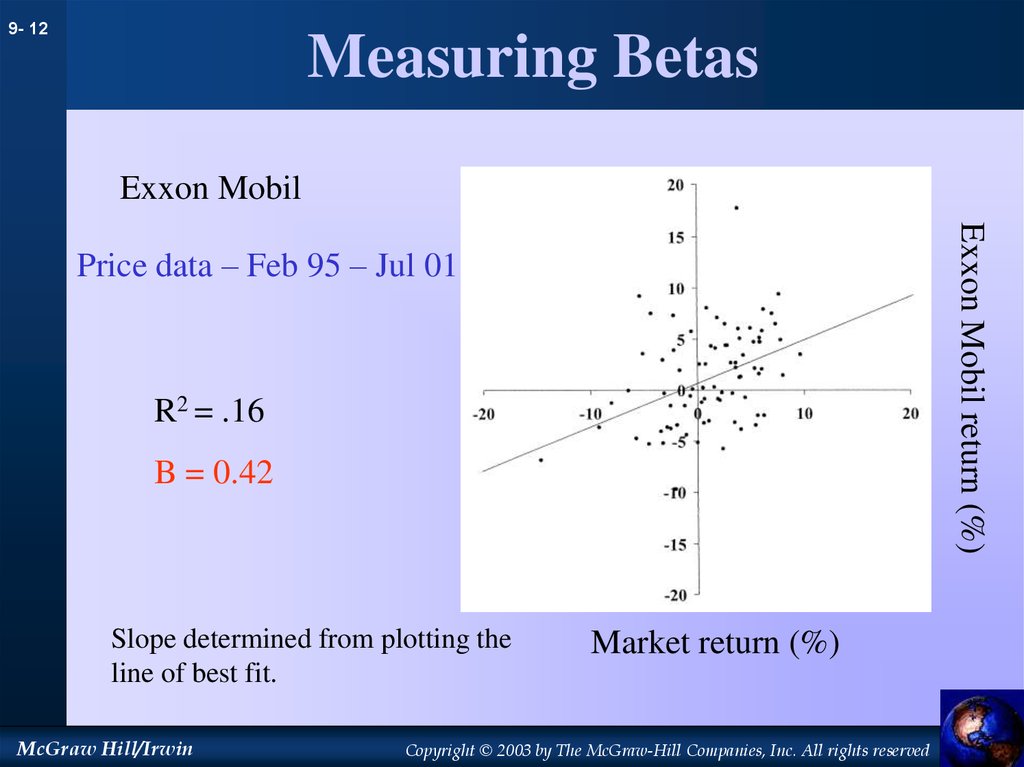

12. Measuring Betas

9- 12Measuring Betas

Exxon Mobil

Exxon Mobil return (%)

Price data – Feb 95 – Jul 01

R2 = .16

B = 0.42

Slope determined from plotting the

line of best fit.

McGraw Hill/Irwin

Market return (%)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

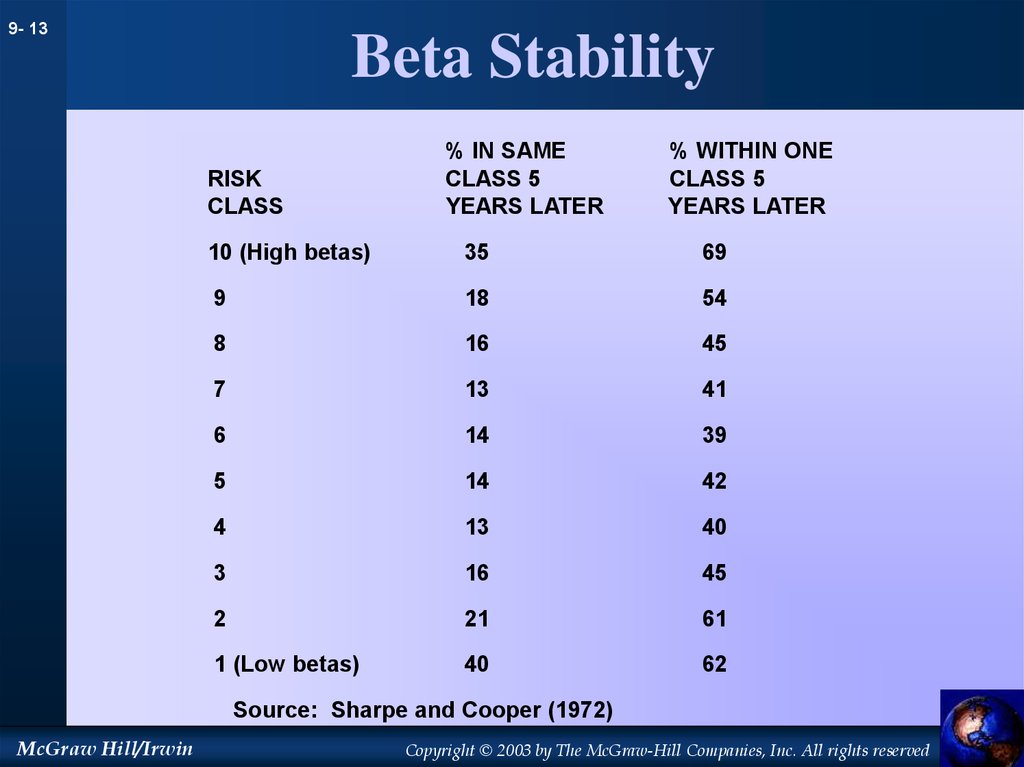

13. Beta Stability

9- 13Beta Stability

RISK

CLASS

% IN SAME

CLASS 5

YEARS LATER

% WITHIN ONE

CLASS 5

YEARS LATER

10 (High betas)

35

69

9

18

54

8

16

45

7

13

41

6

14

39

5

14

42

4

13

40

3

16

45

2

21

61

1 (Low betas)

40

62

Source: Sharpe and Cooper (1972)

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

14. Company Cost of Capital simple approach

9- 14Company Cost of Capital

simple approach

Company Cost of Capital (COC) is based on

the average beta of the assets

The average Beta of the assets is based on the

% of funds in each asset

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

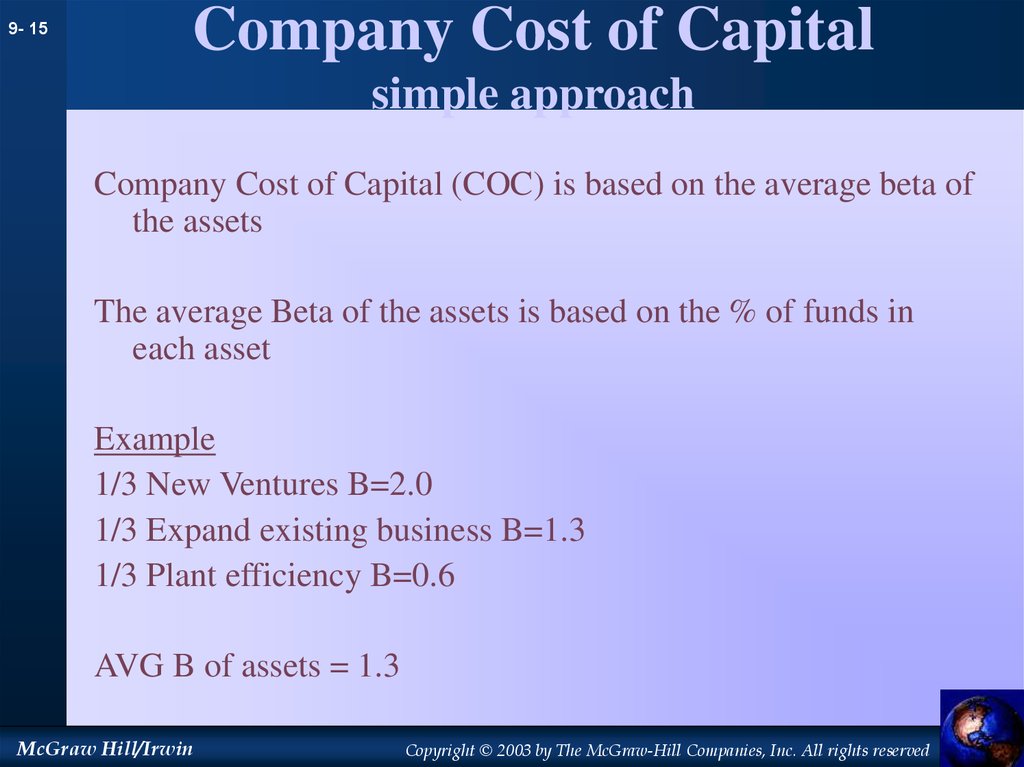

15. Company Cost of Capital simple approach

9- 15Company Cost of Capital

simple approach

Company Cost of Capital (COC) is based on the average beta of

the assets

The average Beta of the assets is based on the % of funds in

each asset

Example

1/3 New Ventures B=2.0

1/3 Expand existing business B=1.3

1/3 Plant efficiency B=0.6

AVG B of assets = 1.3

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

16. Capital Structure

9- 16Capital Structure

Capital Structure - the mix of debt & equity within a company

Expand CAPM to include CS

R = rf + B ( rm - rf )

becomes

Requity = rf + B ( rm - rf )

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

17. Capital Structure & COC

9- 17Capital Structure & COC

COC = rportfolio = rassets

rassets = WACC = rdebt (D) + requity (E)

(V)

(V)

Bassets = Bdebt (D) + Bequity (E)

(V)

(V)

requity = rf + Bequity ( rm - rf )

McGraw Hill/Irwin

IMPORTANT

E, D, and V are

all market values

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

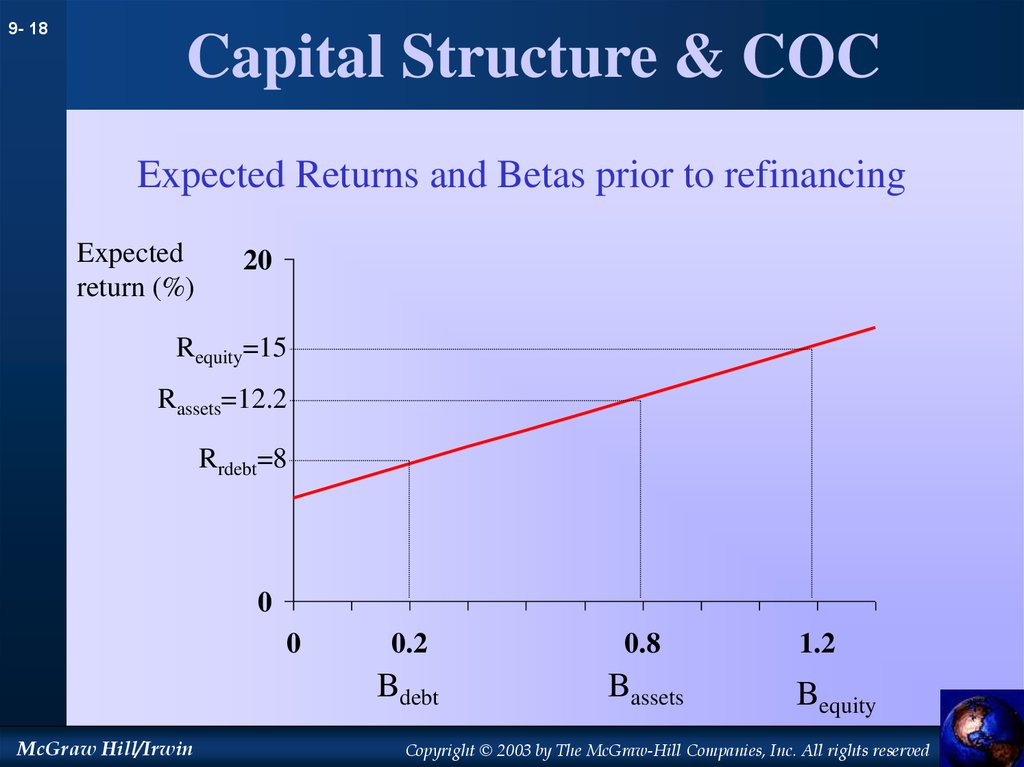

18. Capital Structure & COC

9- 18Capital Structure & COC

Expected Returns and Betas prior to refinancing

Expected

return (%)

20

Requity=15

Rassets=12.2

Rrdebt=8

0

0

McGraw Hill/Irwin

0.2

0.8

Bdebt

Bassets

1.2

Bequity

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

19. Union Pacific Corp.

9- 19Union Pacific Corp.

Requity = Return on Stock

= 15%

Rdebt = YTM on bonds

= 7.5 %

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

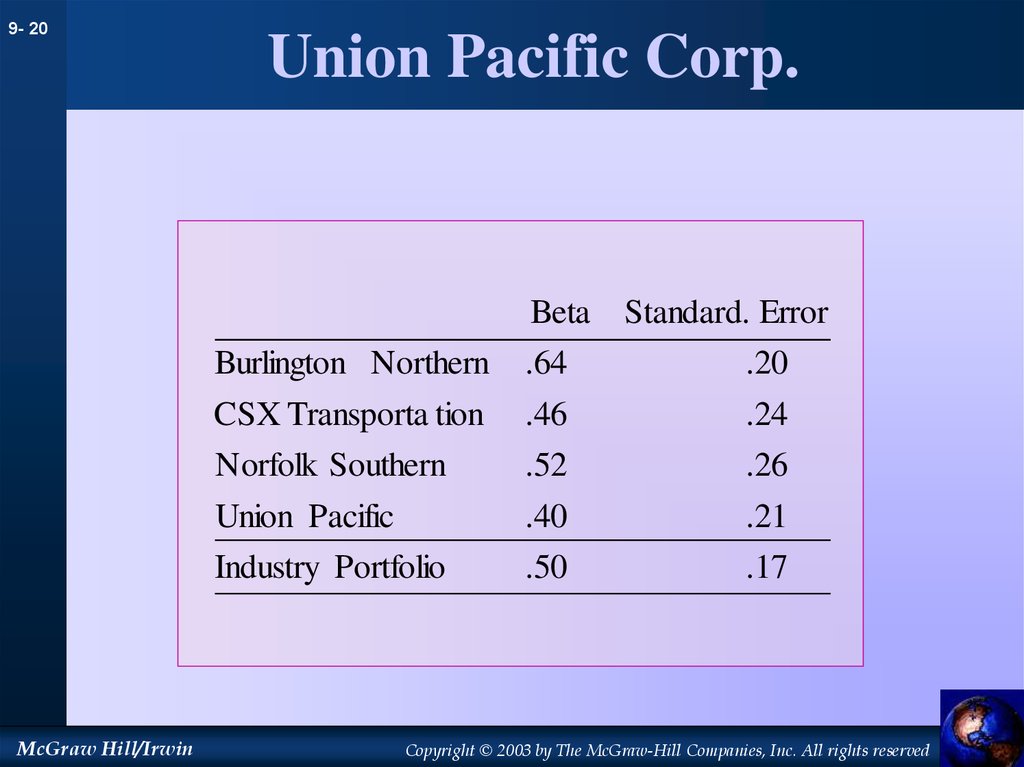

20. Union Pacific Corp.

9- 20Union Pacific Corp.

Beta

McGraw Hill/Irwin

Standard. Error

Burlington Northern

.64

.20

CSX Transporta tion

.46

.24

Norfolk Southern

.52

.26

Union Pacific

.40

.21

Industry Portfolio

.50

.17

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

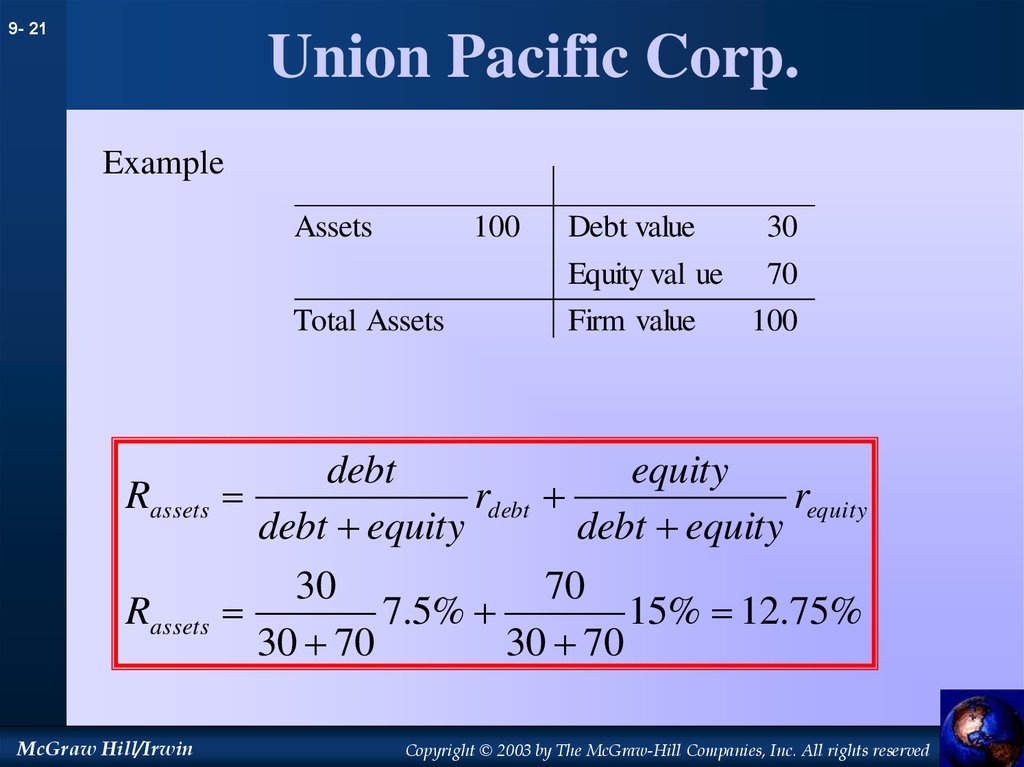

21. Union Pacific Corp.

9- 21Union Pacific Corp.

Example

Assets

100

Total Assets

Rassets

Rassets

McGraw Hill/Irwin

Debt value

30

Equity val ue

70

Firm value

100

debt

equity

rdebt

requity

debt equity

debt equity

30

70

7.5%

15% 12.75%

30 70

30 70

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

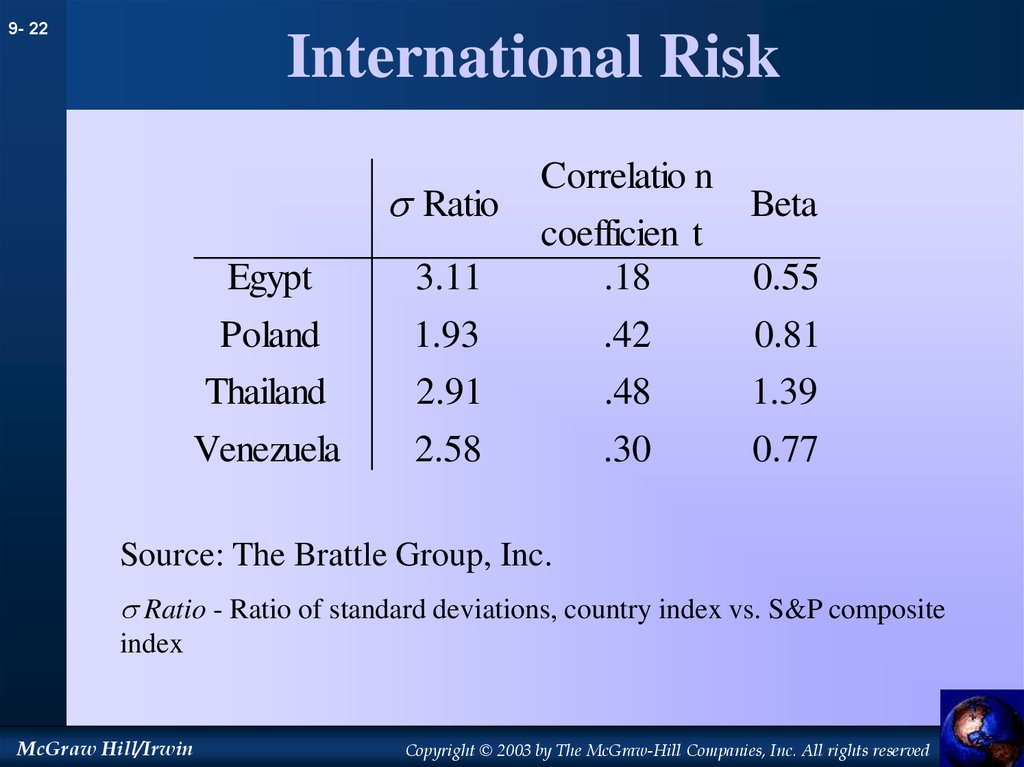

22. International Risk

9- 22International Risk

Ratio

Correlatio n

Beta

Egypt

3.11

coefficien t

.18

Poland

1.93

.42

0.81

Thailand

2.91

.48

1.39

Venezuela

2.58

.30

0.77

0.55

Source: The Brattle Group, Inc.

Ratio - Ratio of standard deviations, country index vs. S&P composite

index

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

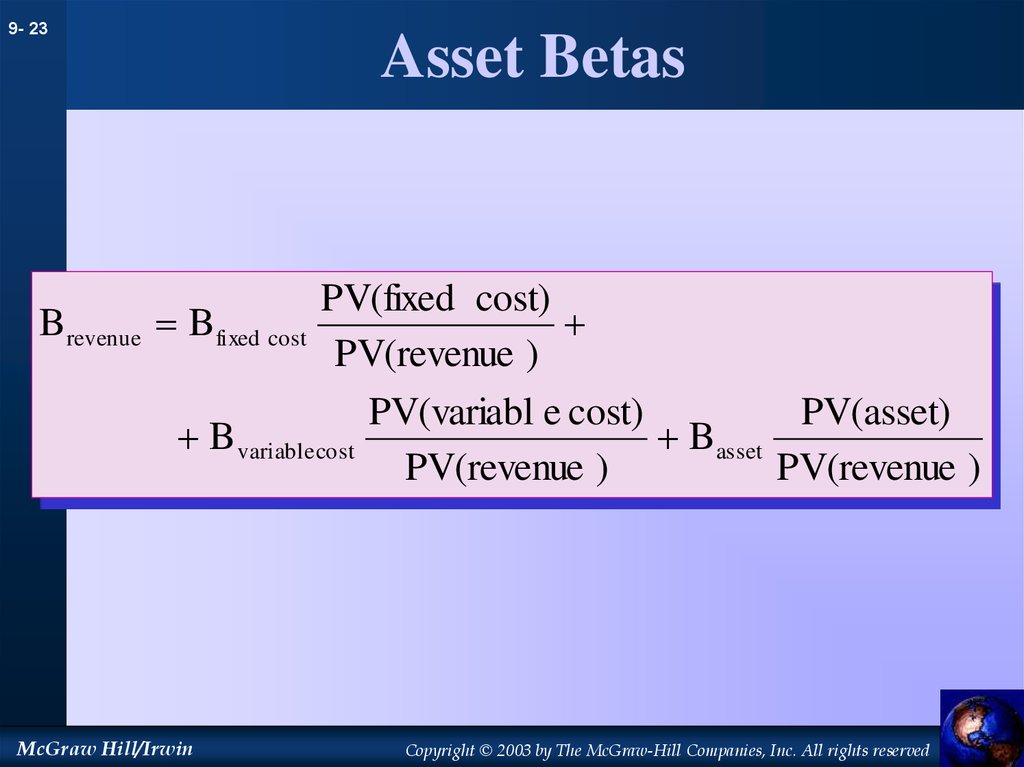

23. Asset Betas

9- 23B revenue

Asset Betas

PV(fixed cost)

Bfixed cost

PV(revenue )

PV(variabl e cost)

PV(asset)

B variable cost

Basset

PV(revenue )

PV(revenue )

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

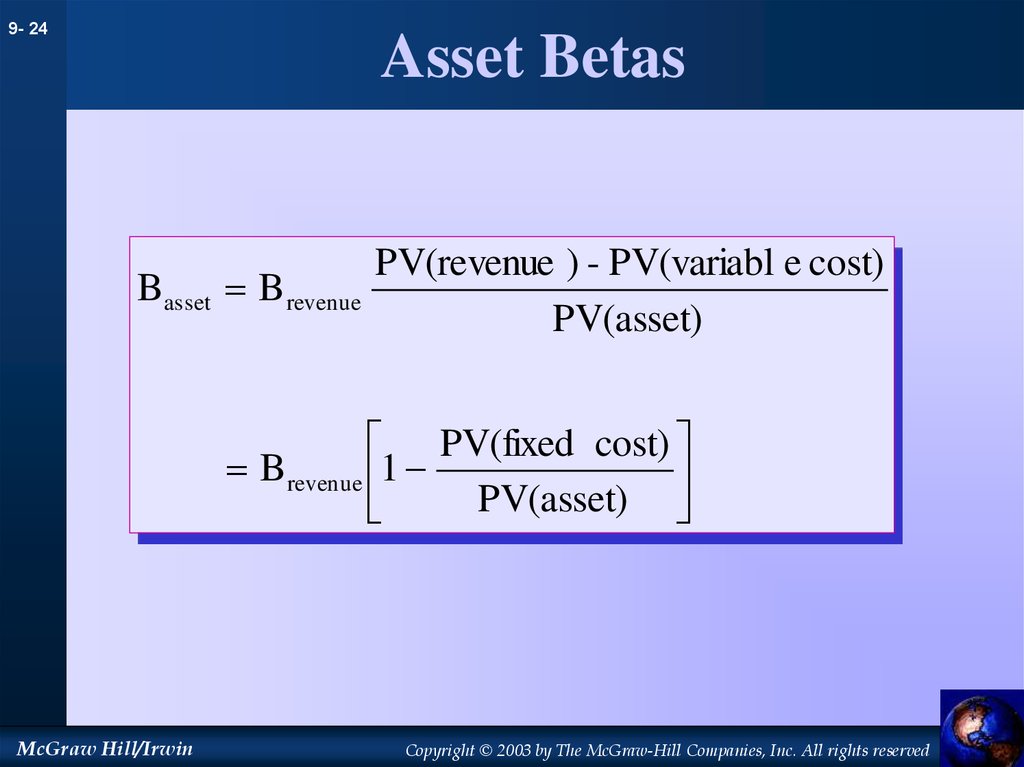

24. Asset Betas

9- 24Asset Betas

Basset B revenue

PV(revenue ) - PV(variabl e cost)

PV(asset)

PV(fixed cost)

B revenue 1

PV(asset)

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

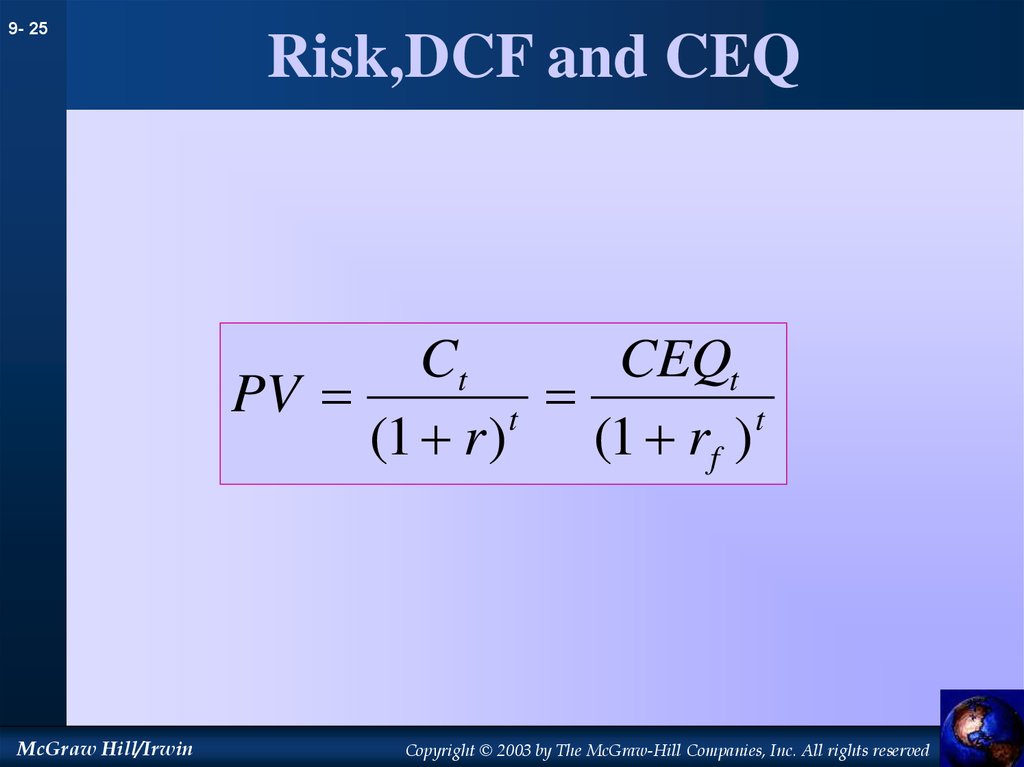

25. Risk,DCF and CEQ

9- 25Risk,DCF and CEQ

Ct

CEQt

PV

t

t

(1 r )

(1 rf )

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

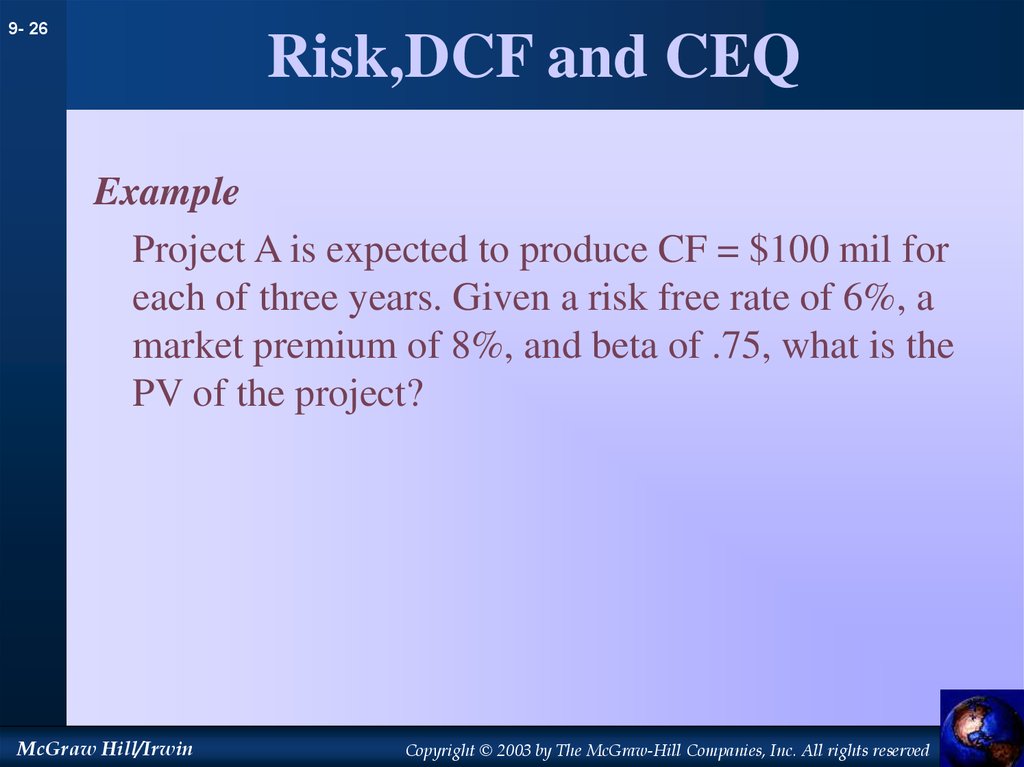

26. Risk,DCF and CEQ

9- 26Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for

each of three years. Given a risk free rate of 6%, a

market premium of 8%, and beta of .75, what is the

PV of the project?

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

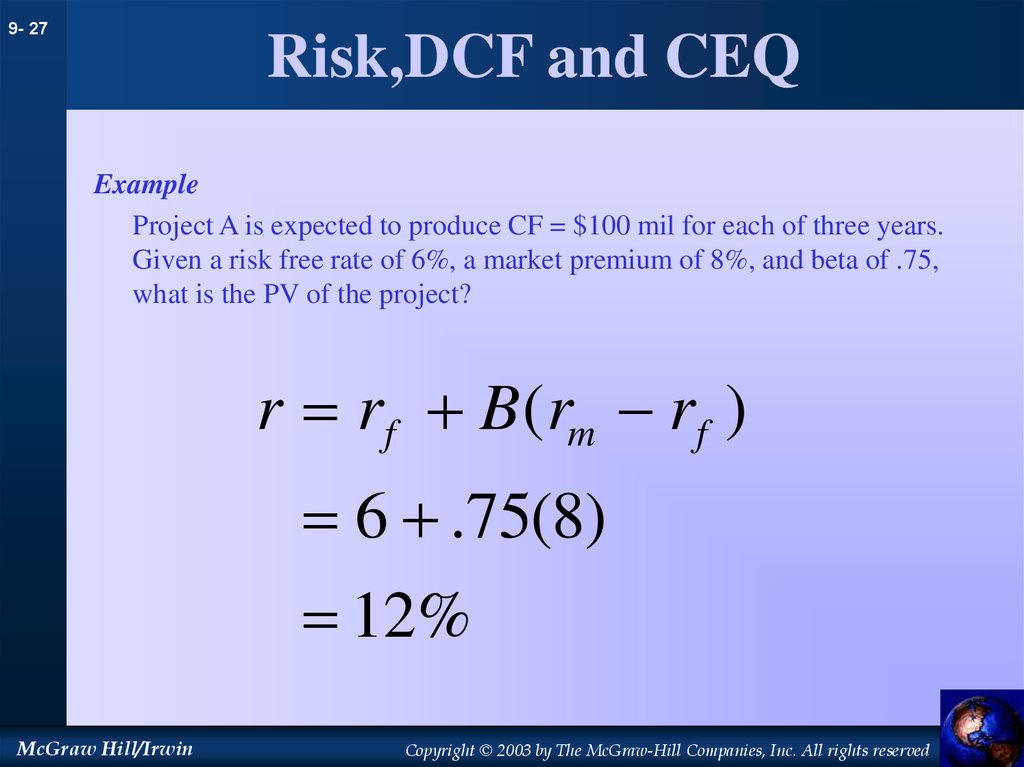

27. Risk,DCF and CEQ

9- 27Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?

r rf B( rm rf )

6 .75(8)

12%

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

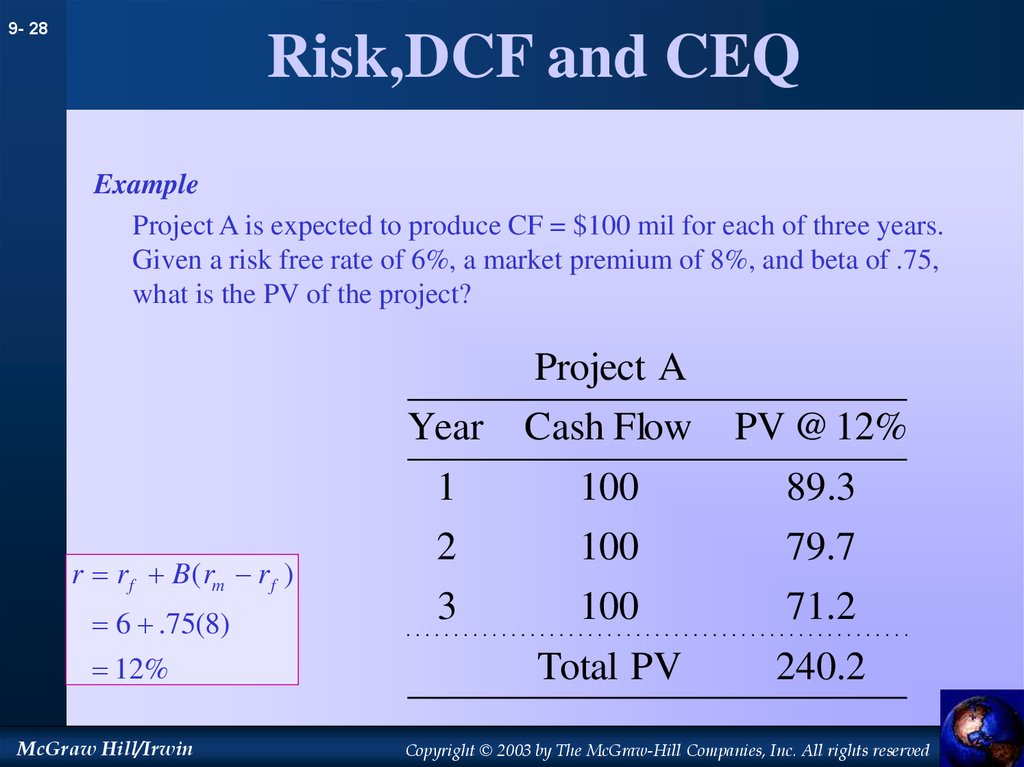

28. Risk,DCF and CEQ

9- 28Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?

Project A

r rf B( rm rf )

6 .75(8)

12%

McGraw Hill/Irwin

Year

Cash Flow

PV @ 12%

1

100

89.3

2

100

79.7

3

100

71.2

Total PV

240.2

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

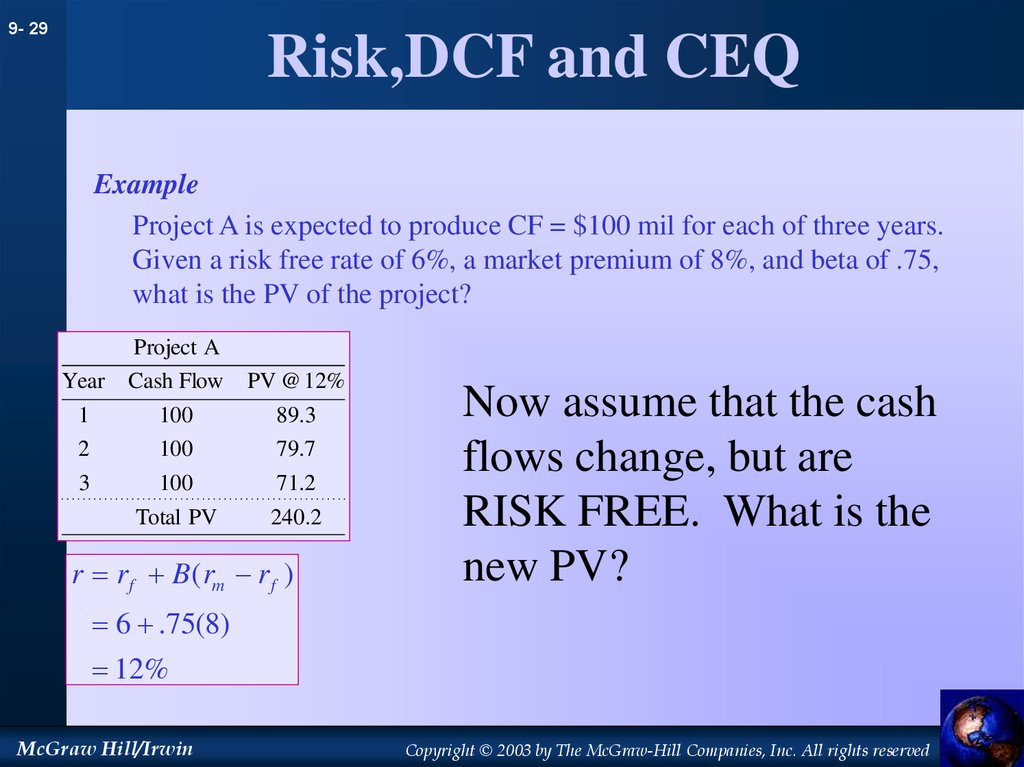

29. Risk,DCF and CEQ

9- 29Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?

Project A

Year

Cash Flow

PV @ 12%

1

100

89.3

2

100

79.7

3

100

71.2

Total PV

240.2

r rf B( rm rf )

Now assume that the cash

flows change, but are

RISK FREE. What is the

new PV?

6 .75(8)

12%

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

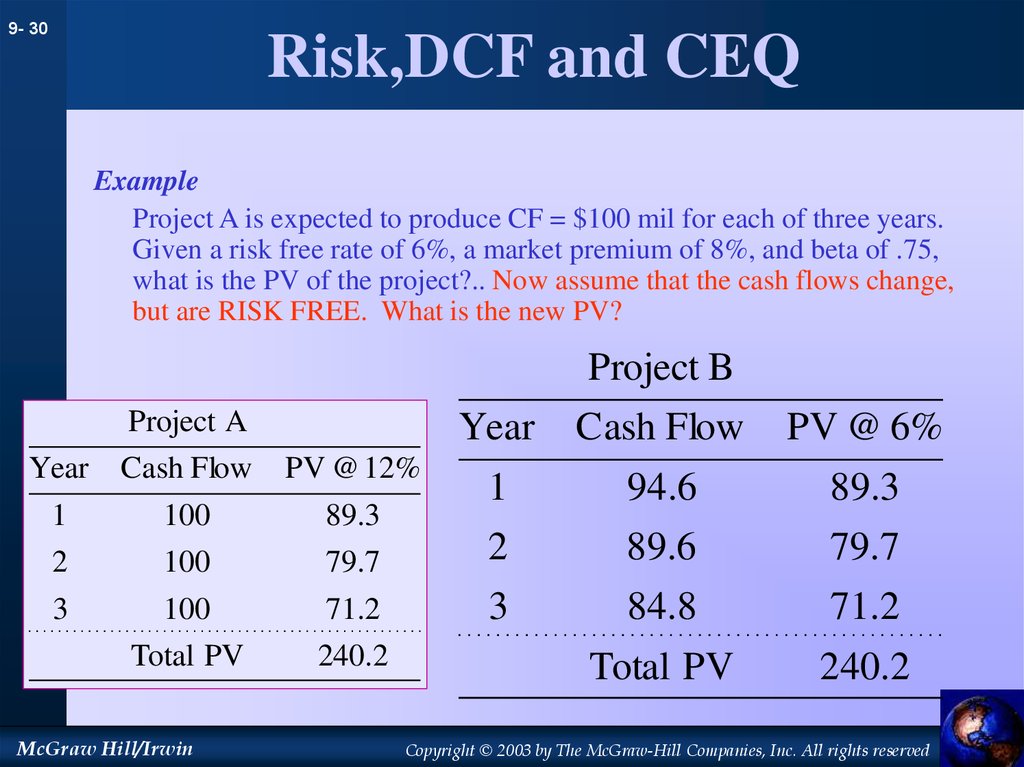

30. Risk,DCF and CEQ

9- 30Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?.. Now assume that the cash flows change,

but are RISK FREE. What is the new PV?

Project B

Project A

Year

Cash Flow

PV @ 6%

1

94.6

89.3

Year

Cash Flow

PV @ 12%

1

100

89.3

2

100

79.7

2

89.6

79.7

3

100

71.2

3

84.8

71.2

Total PV

240.2

Total PV

240.2

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

31. Risk,DCF and CEQ

9- 31Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?.. Now assume that the cash flows change,

but are RISK FREE. What is the new PV?

Project B

Project A

Year

Cash Flow

PV @ 12%

Year

Cash Flow

PV @ 6%

1

100

89.3

1

94.6

89.3

2

100

79.7

2

89.6

79.7

3

100

71.2

3

84.8

71.2

Total PV

240.2

Total PV

240.2

Since the 94.6 is risk free, we call it a Certainty Equivalent

of the 100.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

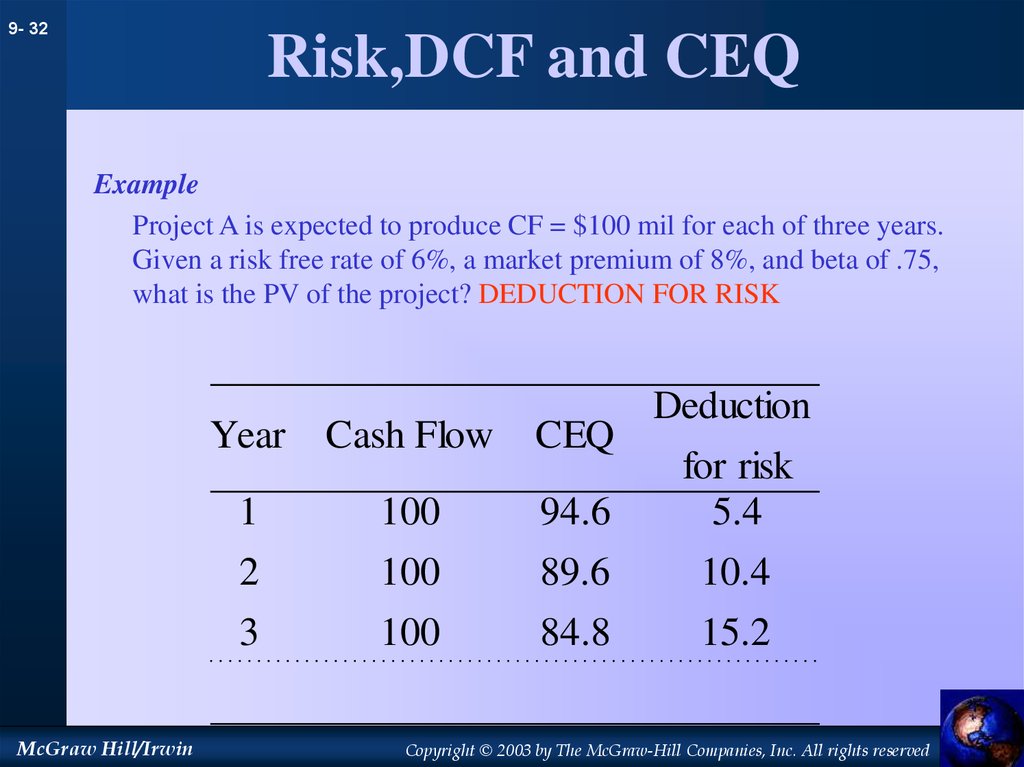

32. Risk,DCF and CEQ

9- 32Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project? DEDUCTION FOR RISK

Year Cash Flow

McGraw Hill/Irwin

CEQ

Deduction

1

100

94.6

for risk

5.4

2

100

89.6

10.4

3

100

84.8

15.2

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

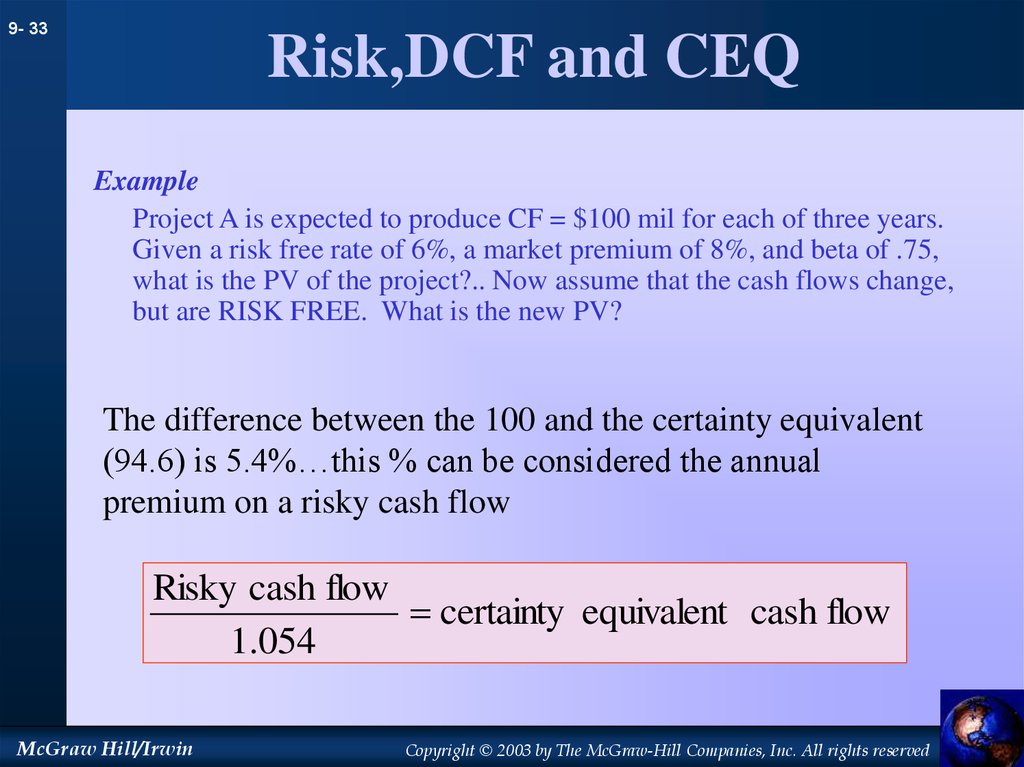

33. Risk,DCF and CEQ

9- 33Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?.. Now assume that the cash flows change,

but are RISK FREE. What is the new PV?

The difference between the 100 and the certainty equivalent

(94.6) is 5.4%…this % can be considered the annual

premium on a risky cash flow

Risky cash flow

certainty equivalent cash flow

1.054

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

34. Risk,DCF and CEQ

9- 34Risk,DCF and CEQ

Example

Project A is expected to produce CF = $100 mil for each of three years.

Given a risk free rate of 6%, a market premium of 8%, and beta of .75,

what is the PV of the project?.. Now assume that the cash flows change,

but are RISK FREE. What is the new PV?

100

Year 1

94.6

1.054

Year 2

100

89.6

2

1.054

100

Year 3

84.8

3

1.054

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

finance

finance