Similar presentations:

Credit Risk Measurement Introduction GFIR

1.

Credit Risk Measurement IntroductionGFIR

2.

Risk introduction• Introduce risk-adjusted capital concepts

• Describe components of credit risk measurement

2

3.

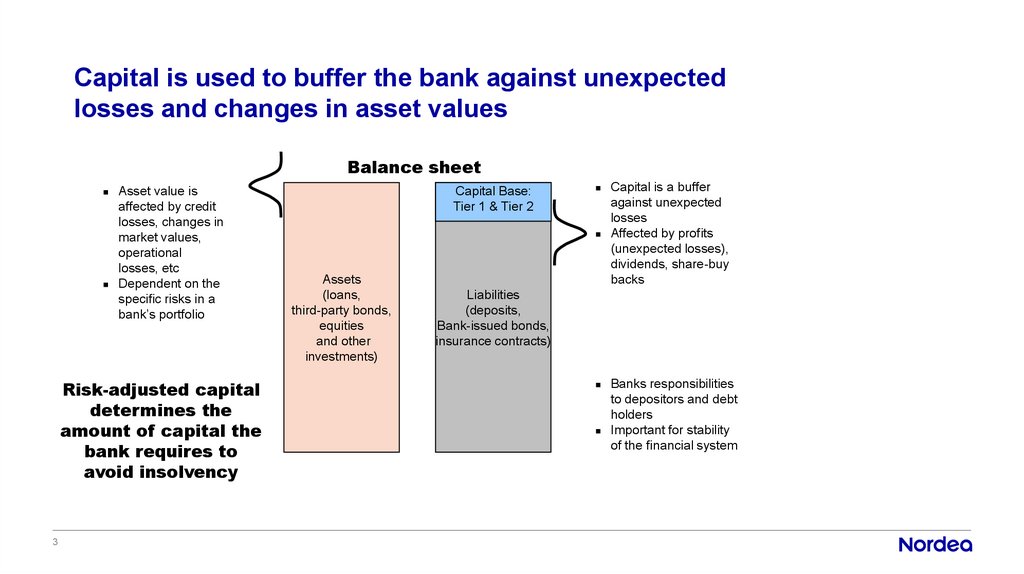

Capital is used to buffer the bank against unexpectedlosses and changes in asset values

Balance sheet

Asset value is

affected by credit

losses, changes in

market values,

operational

losses, etc

Dependent on the

specific risks in a

bank’s portfolio

Risk-adjusted capital

determines the

amount of capital the

bank requires to

avoid insolvency

3

Capital Base:

Tier 1 & Tier 2

Assets

(loans,

third-party bonds,

equities

and other

investments)

Capital is a buffer

against unexpected

losses

Affected by profits

(unexpected losses),

dividends, share-buy

backs

Liabilities

(deposits,

Bank-issued bonds,

insurance contracts)

Banks responsibilities

to depositors and debt

holders

Important for stability

of the financial system

4.

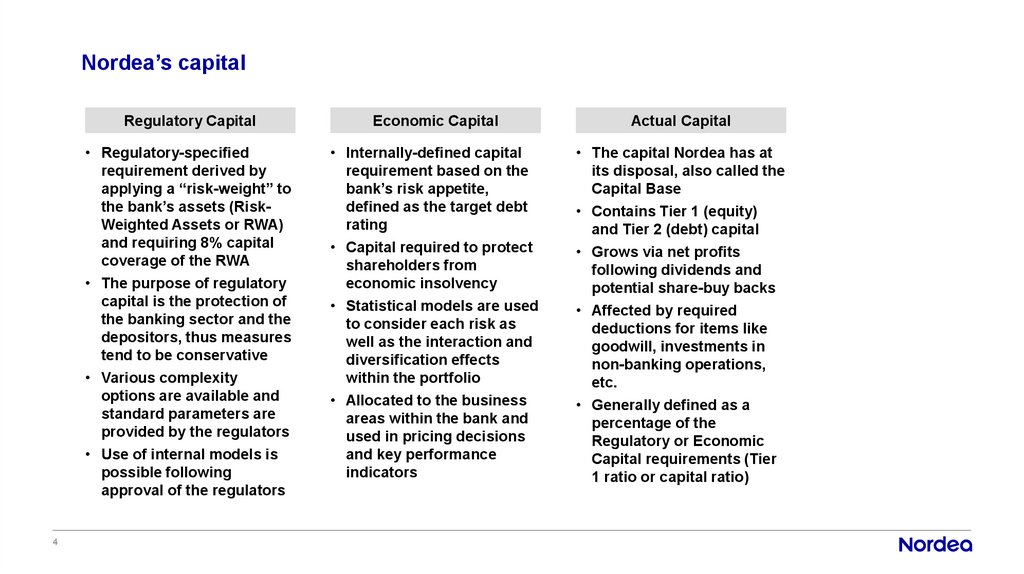

Nordea’s capital4

Regulatory Capital

Economic Capital

Actual Capital

• Regulatory-specified

requirement derived by

applying a “risk-weight” to

the bank’s assets (RiskWeighted Assets or RWA)

and requiring 8% capital

coverage of the RWA

• The purpose of regulatory

capital is the protection of

the banking sector and the

depositors, thus measures

tend to be conservative

• Various complexity

options are available and

standard parameters are

provided by the regulators

• Use of internal models is

possible following

approval of the regulators

• Internally-defined capital

requirement based on the

bank’s risk appetite,

defined as the target debt

rating

• Capital required to protect

shareholders from

economic insolvency

• Statistical models are used

to consider each risk as

well as the interaction and

diversification effects

within the portfolio

• Allocated to the business

areas within the bank and

used in pricing decisions

and key performance

indicators

• The capital Nordea has at

its disposal, also called the

Capital Base

• Contains Tier 1 (equity)

and Tier 2 (debt) capital

• Grows via net profits

following dividends and

potential share-buy backs

• Affected by required

deductions for items like

goodwill, investments in

non-banking operations,

etc.

• Generally defined as a

percentage of the

Regulatory or Economic

Capital requirements (Tier

1 ratio or capital ratio)

5.

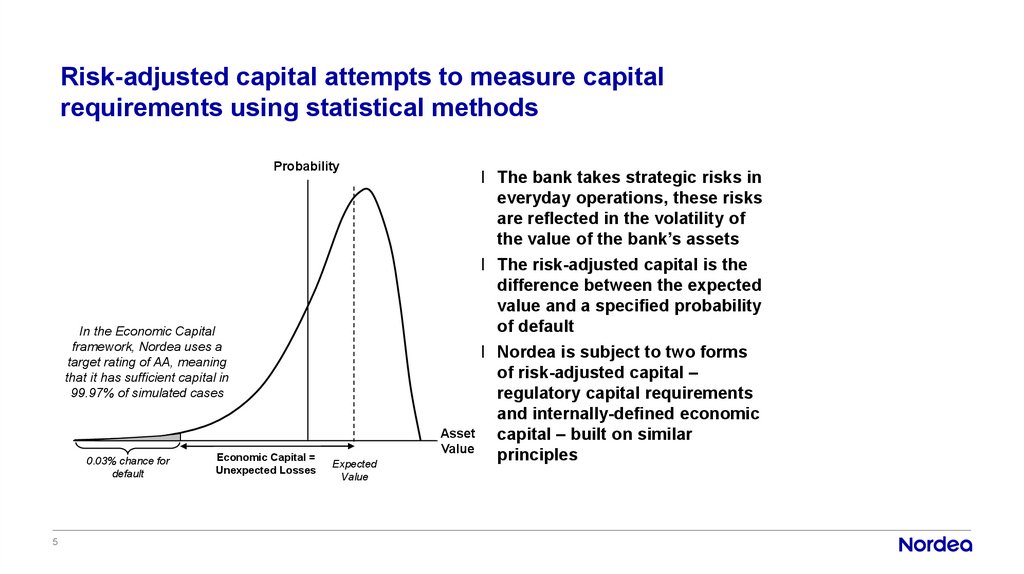

Risk-adjusted capital attempts to measure capitalrequirements using statistical methods

Probability

l The bank takes strategic risks in

everyday operations, these risks

are reflected in the volatility of

the value of the bank’s assets

l The risk-adjusted capital is the

difference between the expected

value and a specified probability

of default

In the Economic Capital

framework, Nordea uses a

target rating of AA, meaning

that it has sufficient capital in

99.97% of simulated cases

0.03% chance for

default

5

Economic Capital =

Unexpected Losses

Asset

Value

Expected

Value

l Nordea is subject to two forms

of risk-adjusted capital –

regulatory capital requirements

and internally-defined economic

capital – built on similar

principles

6.

The different risk types in Nordea6

Credit Risk

Credit risk is defined as the risk that counterparties of Nordea fail to fulfil

their agreed obligations and that the pledged collateral does not cover

Nordea’s claims.

Market Risk

Market price risk is defined as the risk of loss in market value as a result

of movements in financial market variables such as interest rates, foreign

exchange rates, equity prices and commodity prices.

Operational

Risk

Operational risk is defined as the risk of direct or indirect loss, or

damaged reputation resulting from inadequate or failed internal

processes, people and systems or from external events.

Business Risk

Business risk is the risk of loss in value due to fluctuations in volumes,

margins and costs.

Life Insurance

Risk

The Life insurance risk is the risk of unexpected losses due to changes in

mortality rates, longevity rates, disability rates and selection effects.

7.

Credit risk can be described as expected loss andeconomic capital

Actual

Credit

Losses

Expected Loss (EL)

Simulated

Credit

Losses

Economic Capital

Economic Capital (EC)

Volatility

Expected

Loss

Time (Years)

7

Frequency

Estimate of average annual loss rate

over an economic cycle

Considered a cost of doing business

Compared to actual provisions to

determine capital base

Possible to include in pricing

Based on the anticipated volatility of

the annual loss rate

The estimated loss of value over a

one-year time horizon given a

specific confidence interval

Requires extra capital in the balance

sheet to cover the risk

8.

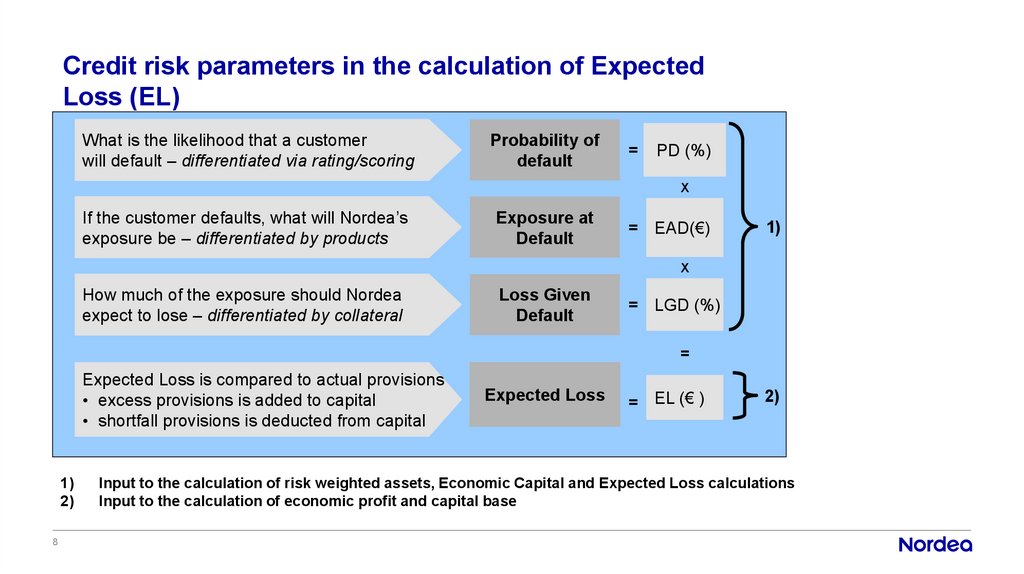

Credit risk parameters in the calculation of ExpectedLoss (EL)

What is the likelihood that a customer

will default – differentiated via rating/scoring

Probability of

default

=

PD (%)

X

If the customer defaults, what will Nordea’s

exposure be – differentiated by products

Exposure at

Default

= EAD(€)

1)

X

How much of the exposure should Nordea

expect to lose – differentiated by collateral

Loss Given

Default

= LGD (%)

=

Expected Loss is compared to actual provisions

• excess provisions is added to capital

• shortfall provisions is deducted from capital

1)

2)

8

Expected Loss

= EL (€ )

2)

Input to the calculation of risk weighted assets, Economic Capital and Expected Loss calculations

Input to the calculation of economic profit and capital base

9.

Credit risk parameters in the calculation of EconomicCapital (EC)

If the customer defaults, what will Nordea’s

exposure be?

Exposure at

Default

=

EAD (€)

X

How much capital is allocated to a certain

exposure, based on its PD, LGD, maturity

and single name concentration?

Capital factors

=

EC (%)

=

Economic capital

=

EC (€)

After full Basel II implementation Nordea will use the same parameters PD, LGD and EAD

when calculating credit risk RWA as is used in the estimation of Economic Capital.

9

10.

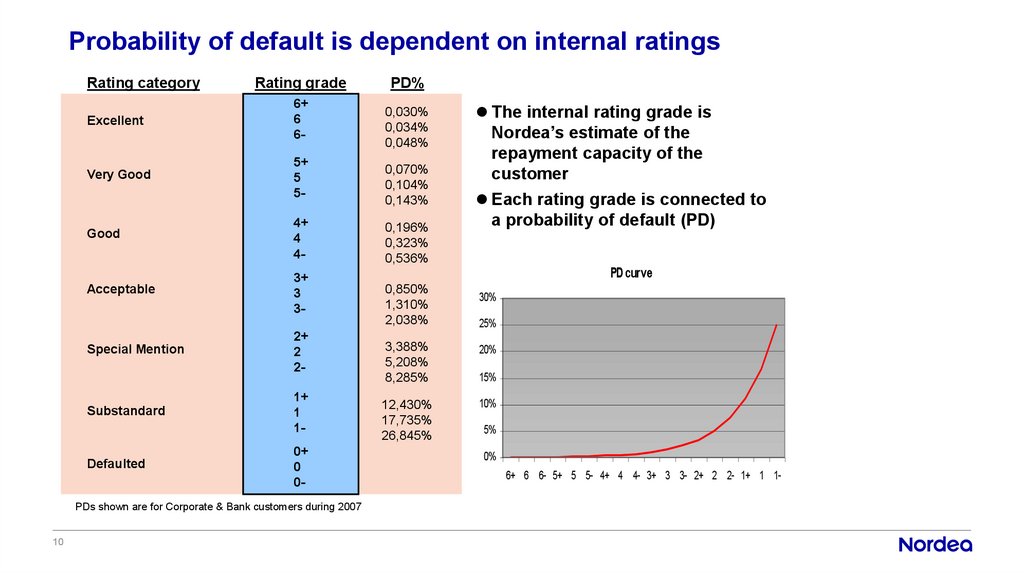

Probability of default is dependent on internal ratingsRating category

Rating grade

Excellent

6+

6

6-

Very Good

5+

5

5-

Good

4+

4

4-

Acceptable

3+

3

3-

Special Mention

Substandard

Defaulted

2+

2

21+

1

10+

0

0-

PDs shown are for Corporate & Bank customers during 2007

10

PD%

0,030%

0,034%

0,048%

0,070%

0,104%

0,143%

0,196%

0,323%

0,536%

The internal rating grade is

Nordea’s estimate of the

repayment capacity of the

customer

Each rating grade is connected to

a probability of default (PD)

PD curve

0,850%

1,310%

2,038%

30%

25%

3,388%

5,208%

8,285%

20%

12,430%

17,735%

26,845%

10%

15%

5%

0%

6+ 6 6- 5+ 5 5- 4+ 4 4- 3+ 3 3- 2+ 2 2- 1+ 1 1-

11.

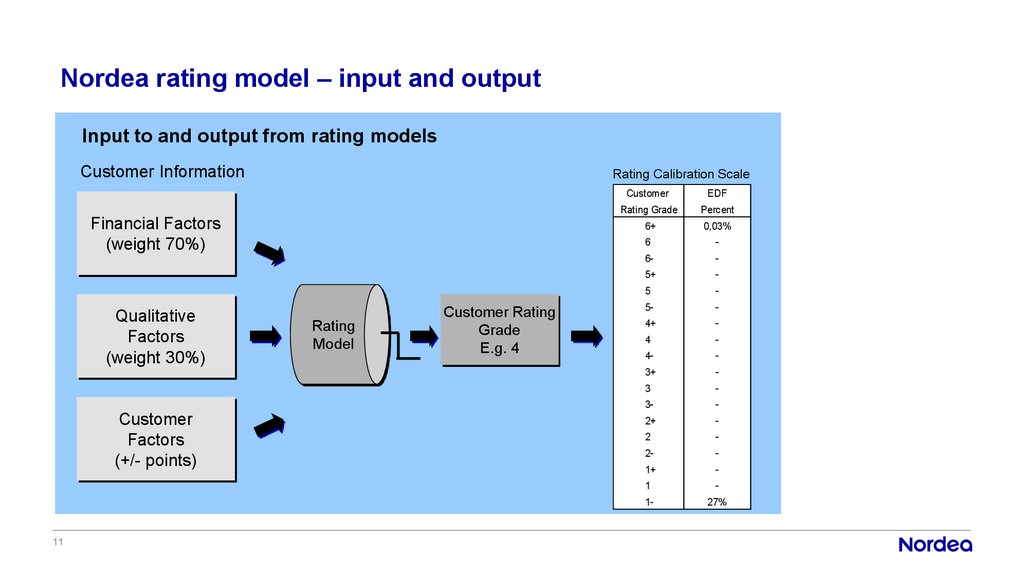

Nordea rating model – input and outputInput to and output from rating models

Customer Information

Rating Calibration Scale

Financial Factors

(weight 70%)

Qualitative

Factors

(weight 30%)

Customer

Factors

(+/- points)

11

Rating

Model

Customer Rating

Grade

E.g. 4

Customer

EDF

Rating Grade

Percent

6+

0,03%

6

-

6-

-

5+

-

5

-

5-

-

4+

-

4

-

4-

-

3+

-

3

-

3-

-

2+

-

2

-

2-

-

1+

-

1

-

1-

27%

30,00%

25,00%

20,00%

15,00%

10,00%

5,00%

0,00%

6+ 6 6- 5+ 5 5- 4+ 4 4- 3+

12.

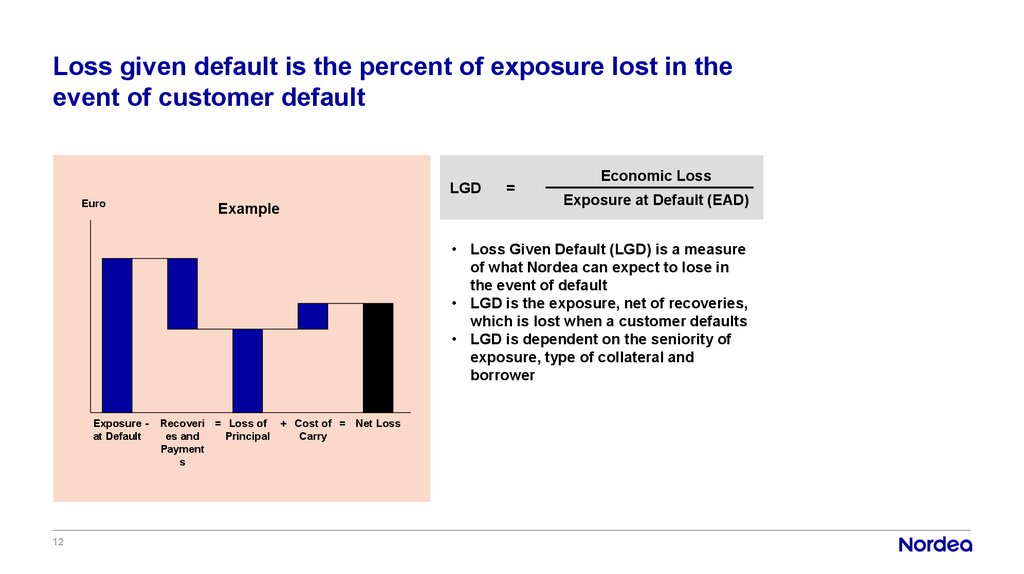

Loss given default is the percent of exposure lost in theevent of customer default

LGD

Euro

Example

=

Economic Loss

Exposure at Default (EAD)

• Loss Given Default (LGD) is a measure

of what Nordea can expect to lose in

the event of default

• LGD is the exposure, net of recoveries,

which is lost when a customer defaults

• LGD is dependent on the seniority of

exposure, type of collateral and

borrower

Exposure at Default

12

Recoveri = Loss of + Cost of = Net Loss

es and

Principal

Carry

Payment

s

13.

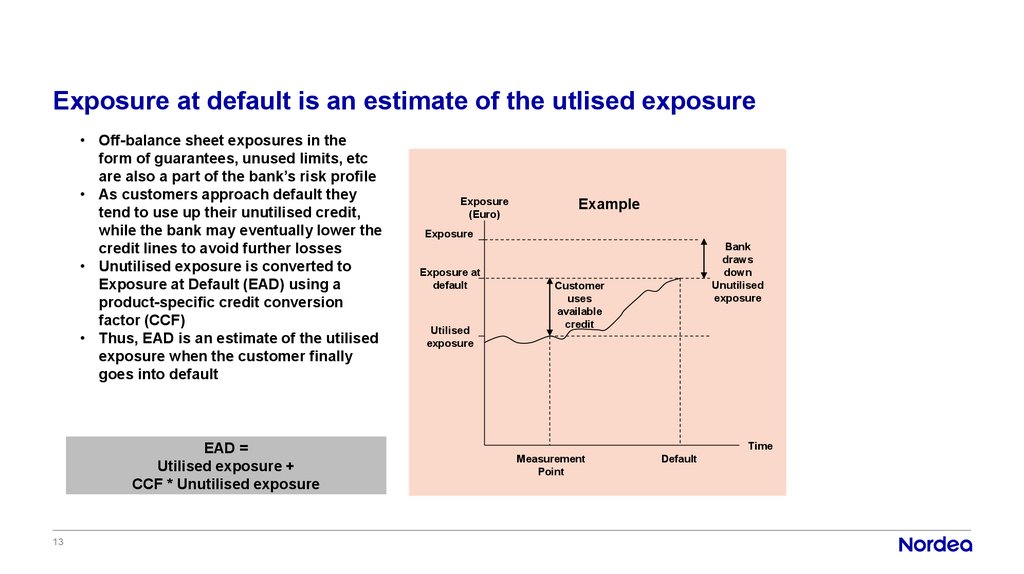

Exposure at default is an estimate of the utlised exposure• Off-balance sheet exposures in the

form of guarantees, unused limits, etc

are also a part of the bank’s risk profile

• As customers approach default they

tend to use up their unutilised credit,

while the bank may eventually lower the

credit lines to avoid further losses

• Unutilised exposure is converted to

Exposure at Default (EAD) using a

product-specific credit conversion

factor (CCF)

• Thus, EAD is an estimate of the utilised

exposure when the customer finally

goes into default

EAD =

Utilised exposure +

CCF * Unutilised exposure

13

Exposure

(Euro)

Example

Exposure

Exposure at

default

Utilised

exposure

Bank

draws

down

Unutilised

exposure

Customer

uses

available

credit

Time

Measurement

Point

Default

14.

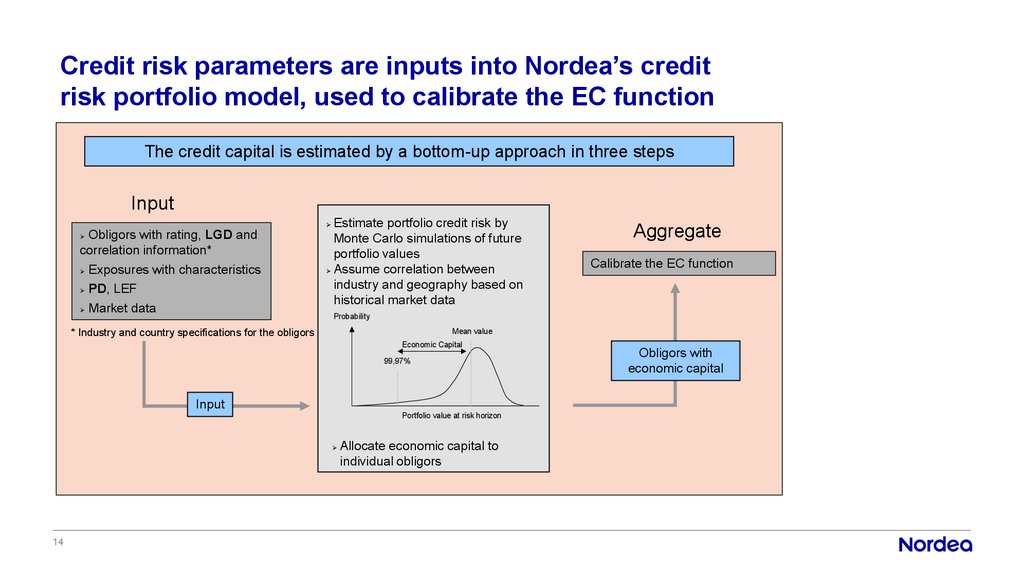

Credit risk parameters are inputs into Nordea’s creditrisk portfolio model, used to calibrate the EC function

The credit capital is estimated by a bottom-up approach in three steps

Input

Estimate portfolio credit risk by

Monte Carlo simulations of future

portfolio values

Portfolio

model

Assume correlation

between

industry and geography based on

historical market data

Obligors with rating, LGD and

correlation information*

Exposures with characteristics

PD, LEF

Market data

Calibrate the EC function

Probability

Mean value

* Industry and country specifications for the obligors

Economic Capital

99,97%

Input

Portfolio value at risk horizon

14

Aggregate

Allocate economic capital to

individual obligors

Obligors with

economic capital

15.

Credit risk formulasBasel Capital for Corporates and Institutions

Basel_capi tal EADFIRB Basel LGDFIRB f PD, conf_inter val Basel f ( PD, maturity

FIRB

• Basel formula for Corporates and Institutions is specified in the Basel II Capital

Requirements Directive and stipulates Alpha (1.06) and confidence interval (99.9%)

• Formula above is multiplied by 12.5 (divided by 8%) to get Risk-Weighted Assets

f PD, conf_inter val Basel N [(1 R )^ 0.5 G ( PD) ( R /(1 R ))^ 0.5 G (0.999)] PD

Where,

R 0.12 [1 EXP( 50 PD)) /(1 EXP( 50)) 0.24 [1 (1 EXP( 50 PD)) /(1 EXP( 50))]

f ( PD, maturity

FIRB

) (1 ( M 2.5) b)

where,

b (0.11852 0.05478 ln( PD))^ 2

M is fixed at 2.5 years in FIRB

15

(1 1.5 b)

)

16.

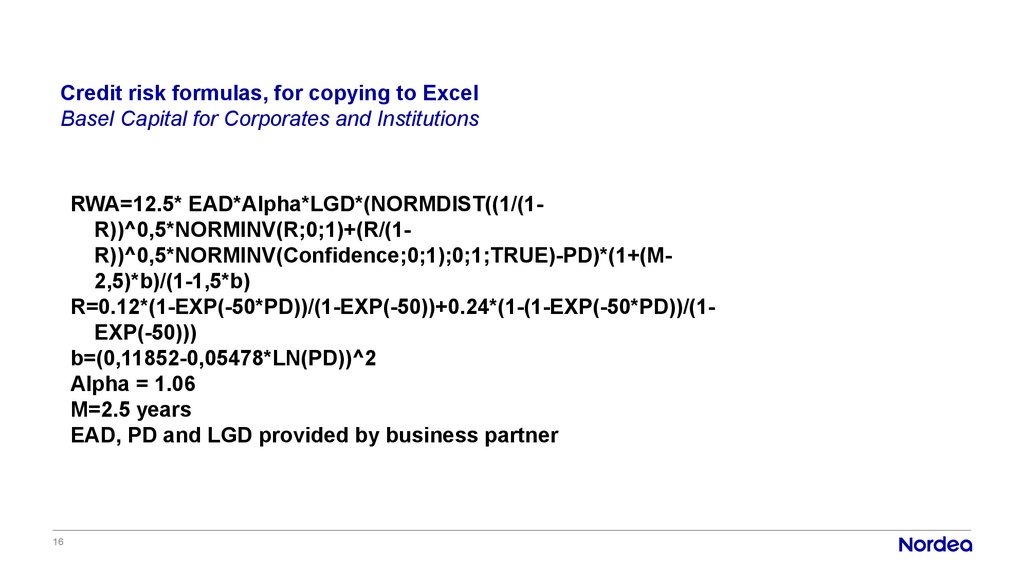

Credit risk formulas, for copying to ExcelBasel Capital for Corporates and Institutions

RWA=12.5* EAD*Alpha*LGD*(NORMDIST((1/(1R))^0,5*NORMINV(R;0;1)+(R/(1R))^0,5*NORMINV(Confidence;0;1);0;1;TRUE)-PD)*(1+(M2,5)*b)/(1-1,5*b)

R=0.12*(1-EXP(-50*PD))/(1-EXP(-50))+0.24*(1-(1-EXP(-50*PD))/(1EXP(-50)))

b=(0,11852-0,05478*LN(PD))^2

Alpha = 1.06

M=2.5 years

EAD, PD and LGD provided by business partner

16

finance

finance