Similar presentations:

Financial Statement Analysis

1. Financial Statement Analysis

1December 22

2. Financial Statement Analysis Contents

Overview and objective of financial statement analysis

Review and Re-formatting Statements for Financial Analysis

Income Statement – EBITDA and NOPLAT

Cash Flow Statement - Free Cash Flow and Equity Cash Flow

Financial ratio analysis

Management Performance

Valuation

Credit Analysis

Financial Model Drivers

Reference Slides

Financial Ratio Calculations

Discussion of Economic Profit

www.edbodmer.com

edbodmer@aol.com

2 December 22

3. Financial Statement Analysis - Introduction

• Financial Statement Analysis should tell a story about the company –How profitable is the company, what are the trends, how much risk is

there etc.

• You should be comfortable in reading various different financial

statements to be effective at financial modeling and financial analysis.

• Financial statement analysis is also important in:

Assessing management performance of a company and whether

projections of improvement or sustainability are reasonable.

Assessing the value of a company from historic performance.

Assessing the reasonableness of financial projections provided by a

company or the validity of earnings projections

Assessing whether the financial structure of a company is of

investment grade quality

www.edbodmer.com

edbodmer@aol.com

3 December 22

4. Objectives of Financial Statement Analysis

• Financial statement analysis is like detective work – How can we useinformation in financial statements to make assessments of various

issues. The financials should paint a picture of what has happened to

the company:

How can we quickly review the income statement, balance sheet

and cash flow statement to determine how the stock market value of

a company compares to inherent value.

How can we look the financial statements and assess risks

associated with a company and whether the company has sufficient

cash flow to pay off debt.

Finance and valuation are about projecting the future -- how can

financial statement analysis be used in making projections.

The problem in any financial analysis and valuation is that

measuring risk is very difficult

www.edbodmer.com

edbodmer@aol.com

4 December 22

5. Double Counting and Judgments in Financial Ratio Analysis

In analyzing financial statements judgments must be made in computing key data

such as EBITDA and in developing financial ratios.

Examples

Whether or not to include Other Income in EBITDA

o If other income not in EBITDA, then should not add non-consolidated

subsidiary companies in invested capital

Exploration Expenses taken out of EBITDA

o Make consistent between companies with different accounting policies

Goodwill (ROIC with or without goodwill depending on analysis issue)

Minority Interest (if include or exclude do for both income and balance)

o Total of minority interest is in EBITDA, therefore must include

financing of minority interest in invested capital

A key principle is that the financial data and the financial ratios are consistent and

logical – work through simple examples

www.edbodmer.com

edbodmer@aol.com

5 December 22

6. Income Statement

6December 22

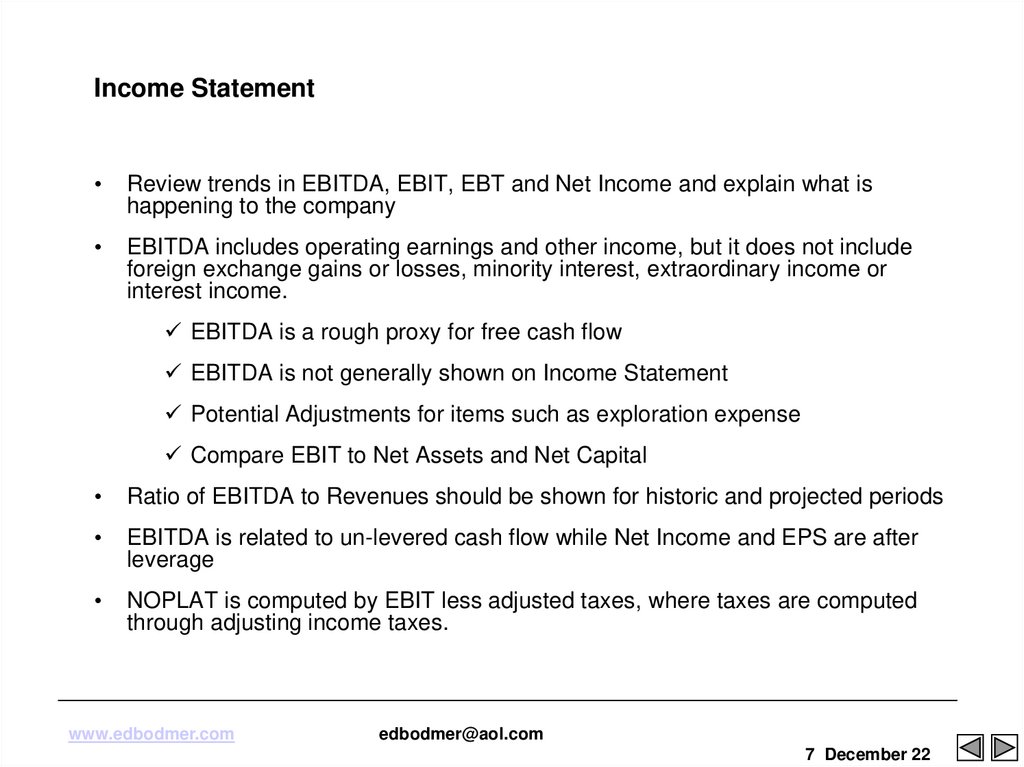

7. Income Statement

Review trends in EBITDA, EBIT, EBT and Net Income and explain what is

happening to the company

EBITDA includes operating earnings and other income, but it does not include

foreign exchange gains or losses, minority interest, extraordinary income or

interest income.

EBITDA is a rough proxy for free cash flow

EBITDA is not generally shown on Income Statement

Potential Adjustments for items such as exploration expense

Compare EBIT to Net Assets and Net Capital

Ratio of EBITDA to Revenues should be shown for historic and projected periods

EBITDA is related to un-levered cash flow while Net Income and EPS are after

leverage

NOPLAT is computed by EBIT less adjusted taxes, where taxes are computed

through adjusting income taxes.

www.edbodmer.com

edbodmer@aol.com

7 December 22

8. Standard Computation of EBITDA

www.edbodmer.comedbodmer@aol.com

8 December 22

9. Problems with EBITDA

• EBITDA is useful in its simplicity, and can be a good reference forcomparison of debt and value, but it has weaknesses:

EBIT is more important than DA, because must use cash for

replacing depreciation and amoritsation

In credit analysis, EBITDA works better for low rated credits than

high rated credits. (Moody’s)

EBITDA is a better measure for companies with long-lived assets

EBITDA can be manipulated through accounting policies (operating

expenses versus capital expenditures)

EBITDA ignores changes in working capital, does not consider

required re-investment, says nothing about the quality of earnings,

and it ignores unique attributes of industries.

www.edbodmer.com

edbodmer@aol.com

9 December 22

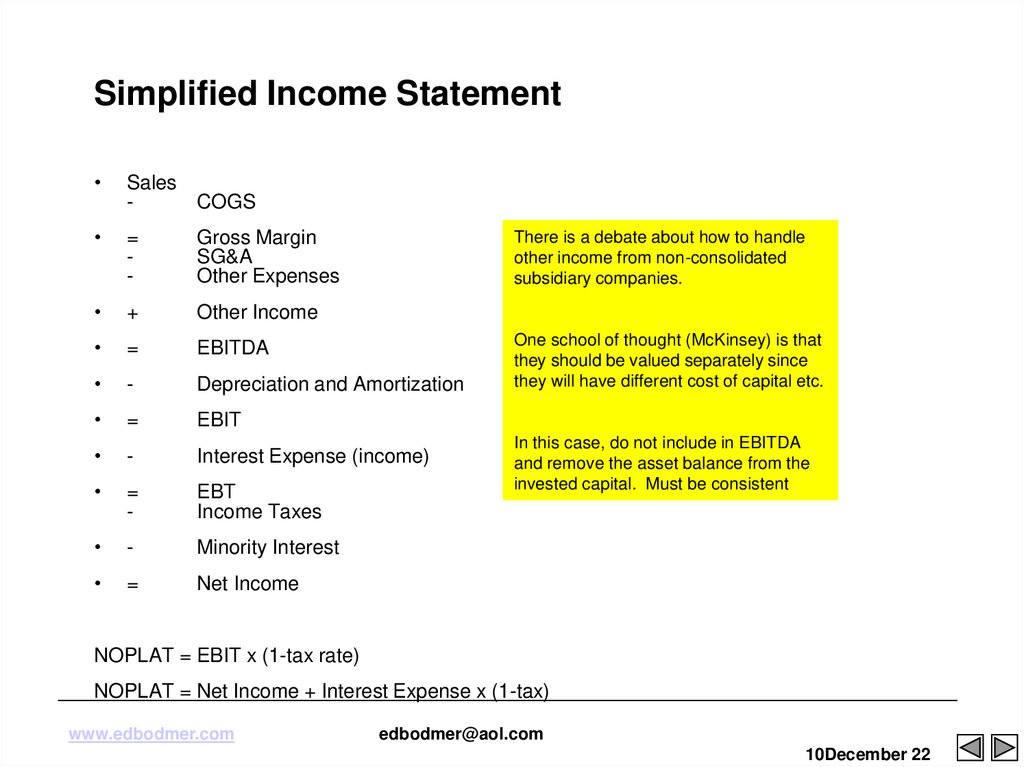

10. Simplified Income Statement

Sales

COGS

=

-

Gross Margin

SG&A

Other Expenses

+

Other Income

=

EBITDA

-

Depreciation and Amortization

=

EBIT

-

Interest Expense (income)

=

-

EBT

Income Taxes

-

Minority Interest

=

Net Income

There is a debate about how to handle

other income from non-consolidated

subsidiary companies.

One school of thought (McKinsey) is that

they should be valued separately since

they will have different cost of capital etc.

In this case, do not include in EBITDA

and remove the asset balance from the

invested capital. Must be consistent

NOPLAT = EBIT x (1-tax rate)

NOPLAT = Net Income + Interest Expense x (1-tax)

www.edbodmer.com

edbodmer@aol.com

10December 22

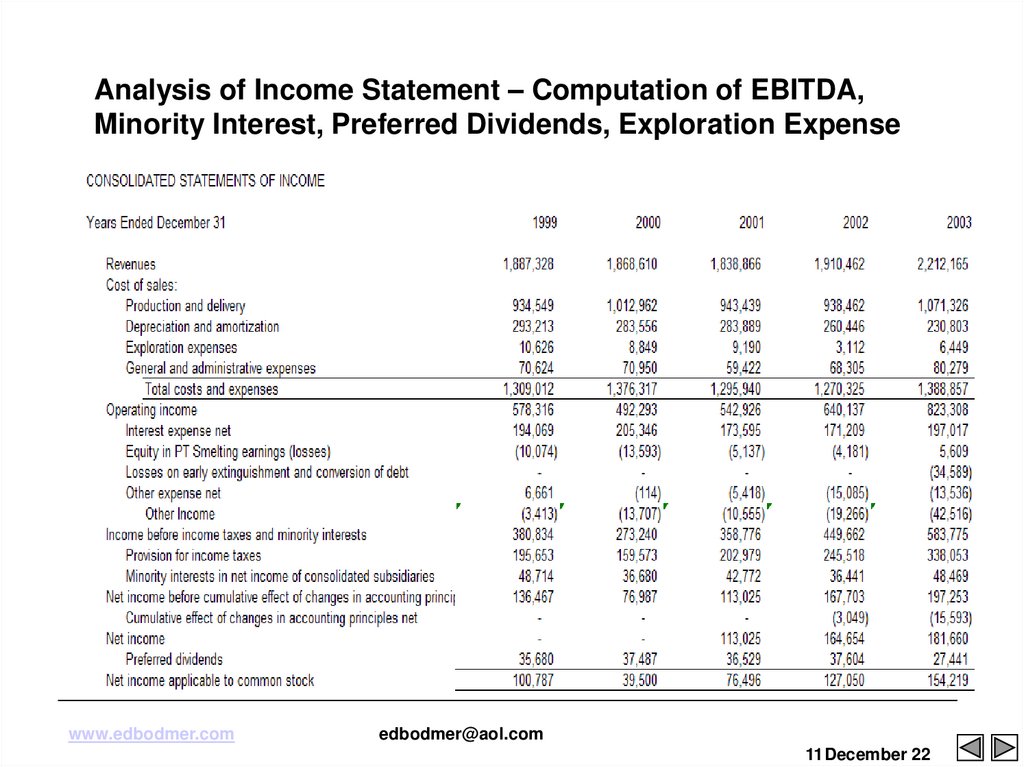

11. Analysis of Income Statement – Computation of EBITDA, Minority Interest, Preferred Dividends, Exploration Expense

www.edbodmer.comedbodmer@aol.com

11 December 22

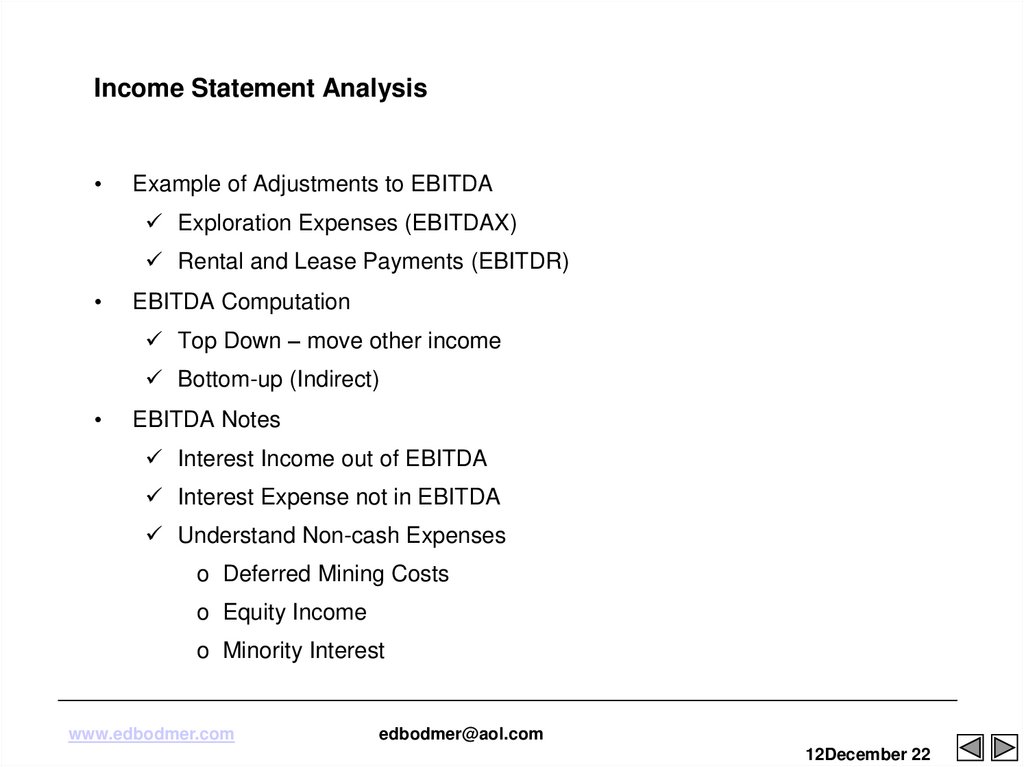

12. Income Statement Analysis

Example of Adjustments to EBITDA

Exploration Expenses (EBITDAX)

Rental and Lease Payments (EBITDR)

EBITDA Computation

Top Down – move other income

Bottom-up (Indirect)

EBITDA Notes

Interest Income out of EBITDA

Interest Expense not in EBITDA

Understand Non-cash Expenses

o Deferred Mining Costs

o Equity Income

o Minority Interest

www.edbodmer.com

edbodmer@aol.com

12December 22

13. Discounted Cash Flow Analysis – Real World Example

Credit Suisse First Boston estimated the present value of the stand-alone,

Unlevered, after-tax free cash flows that Texaco could produce over calendar

years 2001 through 2004 and that Chevron could produce over the same period.

The analysis was based on estimates of the managements of Texaco and

Chevron adjusted, as reviewed by or discussed with Texaco management, to

reflect, among other things, differing assumptions about future oil and gas prices.

Ranges of estimated terminal values were calculated by multiplying estimated

calendar year 2004 earnings before interest, taxes, depreciation, amortization and

exploration expense, commonly referred to as EBITDAX, by terminal EBITDAX

multiples of 6.5x to 7.5x in the case of both Texaco and Chevron.

The estimated un-levered after-tax free cash flows and estimated terminal values

were then discounted to present value using discount rates of 9.0 percent to

10.0 percent.

That analysis indicated an implied exchange ratio reference range of 0.56x to

0.80x.

www.edbodmer.com

edbodmer@aol.com

13December 22

14. Employee Stock Options

• One can debate the treatment of employee stock options for EBITDA,free cash flow and valuation.

• Think of options as giving stock to employees

If the treatment has changed over the years and it is a significant

expense, make adjustments to current or prior statements for

consistency.

Think of options as giving free shares to employees. The value of

existing shareholders is diluted.

o One can argue that this is two things

First, employees are compensated and the cash should be

accounted for

Second, invested capital is increased and the new equity

should be included in the capital base

www.edbodmer.com

edbodmer@aol.com

14December 22

15. Cash Flow Statement

15 December 2216. Cash Flow Statement

Modern Cash Flow Statement has separation between

Operations

Capital expenditures (to maintain and grow operations) and

Financing

Operating Cash Flow

Add back items from the income statement that do not use cash

(depreciation, dry hole costs etc)

Analyze how much cash flow the company generated and how it raised funds or

disposed funds

Use Cash Flow statement as a basis to compute free cash flow although cash flow

not presented on the statement

Problem: Interest Expense – related to financing and not operations – is in

the Net Income and is included in Cash From Operations

www.edbodmer.com

edbodmer@aol.com

16December 22

17. Cash Flow Statement

A. Operating Cash Flows

1) Net Income including interest expense, interest income and taxes

2) Depreciation

3) Deferred Taxes

4) Working Capital Changes

5) Minority Interest on Income Statement and Other Items

B. Investing Cash Flows

1) Capital Expenditure and Asset Purchases

3) Sale of Property, Plant, & Equipment

4) Inter-Corporate Investment

C. Financing Cash Flows

1) Dividend Payments

3) Proceeds from Equity or Debt Issuance

4) Equity Repurchased

5) Debt Principal Payments

www.edbodmer.com

edbodmer@aol.com

17December 22

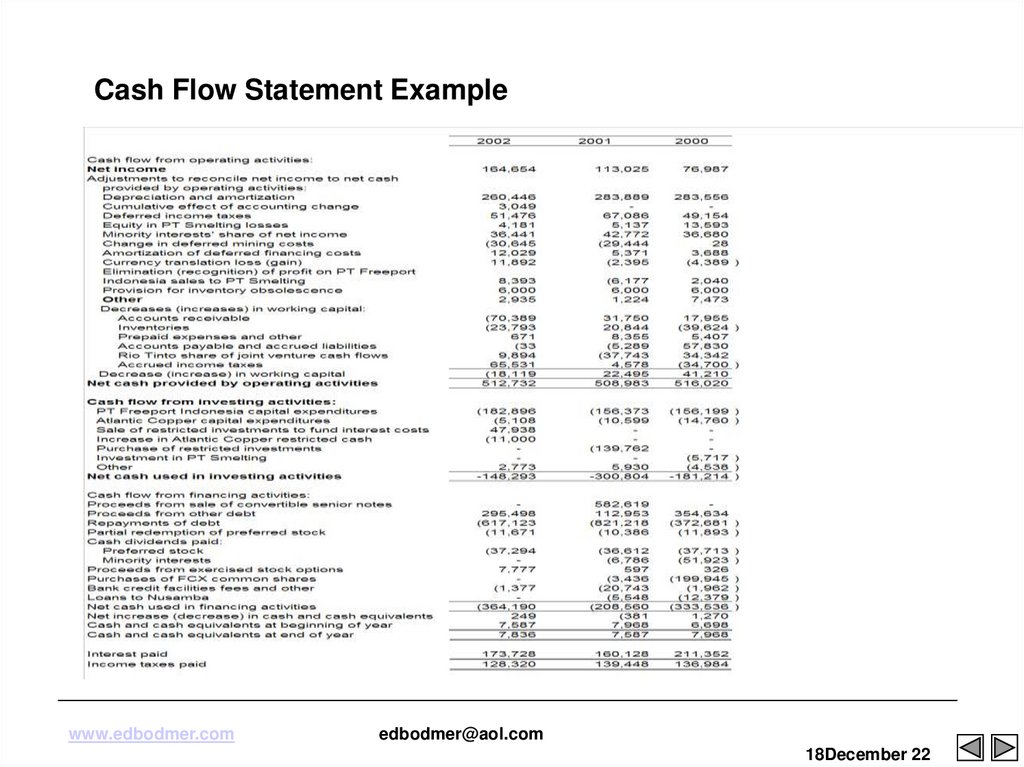

18. Cash Flow Statement Example

www.edbodmer.comedbodmer@aol.com

18December 22

19. The Notion of Free Cash Flow

• In practice the term cash flow has many uses. For example, operatingcash flow is net income plus depreciation.

• Free cash flow is the cash flow that is available to investors – FREE of

obligations such as capital expenditures and taxes -- to both debt and

equity investors – after re-investing in plant, and financing and paying

taxes.

• Accountants define cash flow from operations as net income plus

depreciation and other non-cash items less changes in working capital.

However, this cash flow is not available for distribution to equity holders

and debt holders. The free cash flow must account for capital

expenditures, repayments of debt, deferred items and other factors.

• Free cash flow consists of

Cash flow to equity holders

Cash flow to debt holders

www.edbodmer.com

edbodmer@aol.com

19December 22

20. Theoretical Context – Miller and Modigliani

• Theory that changed finance in 1958Value assets on fundamental operating characteristics such as the

capacity utilisation, the cost and the efficiency of assets and not the

manner in which assets are financed – debt versus equity or the

manner in which assets are hedged.

This has led to the discounted cash flow model that underlies most

valuations

The proof was based on a simple arbitrage idea that you could buy

stock in a company that has no debt and then borrow against the

stock. This will yield the same results as if the company borrowed

money instead of you.

The implication of this is that project finance is irrelevant

www.edbodmer.com

edbodmer@aol.com

20December 22

21. Fundamental Distinction in Financial Analysis – Free Cash Flow and Equity Cash Flow

• Free Cash flow that is independent from financingValuation

Performance in managing assets

Claims on free cash flow

Cash flow to pay debt obligations

Comparisons unbiased by capital structure policy

• Equity cash flow

Valuation of equity securities

Performance for shareholders

www.edbodmer.com

edbodmer@aol.com

21December 22

22. Importance of Free Cash Flow

Alternative Definitions, but one correct concept

Free Cash Flow Is Also Known As Unleveraged Cash Flow

Unleveraged Cash Flow Is Not Distorted By The Capital Structure

Free Cash Flow should not change when the capital structure changes

Free Cash Flow should be the same as equity cash flow if no debt is

outstanding and not cash balances are built up.

Free Cash Flow in Valuation

PV of Free Cash Flow Defines Enterprise Value

The Relevant Discount Rate Is The Unlevered Discount Rate or the

Weighted Average Cost of Capital

IRR on Free Cash Flow is the Project IRR

Free Cash Flow in Economic Value

FCF – Carrying Charge = Economic Profit

www.edbodmer.com

edbodmer@aol.com

22December 22

23. Cash Flow Statement in Financial Model

Analysis in Cash Flow Statements

Compute Cash Flow before Financing

o Operating Cash Flow minus Capital Expenditures

o Use Cash Flow Before Financing in Deriving Free Cash Flow

Equity Cash Flow

o Dividends less Cash Investments

o Cash Flow Before Financing less Maturities plus New Debt Issues

Last Line on Cash Flow Statement Includes

o Change in Cash Balance

o Change in Short-term Debt or Overdrafts

o Beginning Balance + Change = Ending Cash

o Beginning Balance of STD + Change = Ending Short-term Debt

www.edbodmer.com

edbodmer@aol.com

23December 22

24. Free Cash Flow Formulas

Free cash flow can be computed from the income statement or from the cash flow statement.

From the cash flow statement, the formula is:

Cash Before Financing

Plus: Interest Expense

Less: Tax Shield on Interest

From the income statement, the formula is:

EBITDA

Some argue that free cash flow

should not include non-operating

items. Here the non-consolidated

companies are treated in a similar

manner as liquid investments

Less: Taxes on EBIT

Less: Working Capital Investment

Less: Capital Expenditures

From Net Income

Net Income

Add: Net of Tax Interest

Add Depreciation, Deferred Taxes and Other Non-Cash Changes

Less: Changes in Working Capital

Less: Capital Expenditures

www.edbodmer.com

edbodmer@aol.com

24December 22

25. Free Cash Flow from NOPLAT

Free cash flow can be computed using the notion of net operating profit less

adjusted tax as follows (assuming no extraordinary income)

Step 1: Compute NOPLAT

Net Income

Plus Net Interest after Tax

Plus Deferred tax

Equals NOPLAT

Step 2: Compute Free Cash Flow

NOPLAT

Plus: Depreciation

Less: Change in Working Capital

Less: Capital Expenditures

Equals Free Cash Flow

www.edbodmer.com

edbodmer@aol.com

25December 22

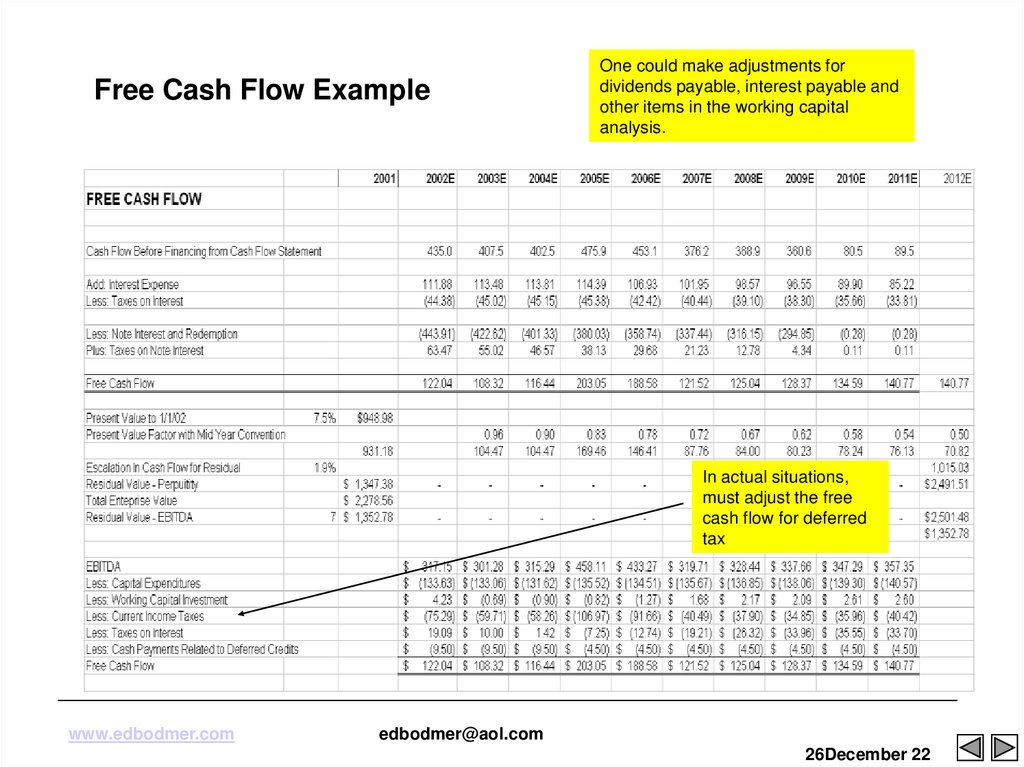

26. Free Cash Flow Example

One could make adjustments fordividends payable, interest payable and

other items in the working capital

analysis.

In actual situations,

must adjust the free

cash flow for deferred

tax

www.edbodmer.com

edbodmer@aol.com

26December 22

27. Balance Sheet

27 December 2228. Balance Sheet Adjustments

When analysing the balance sheet, various items should be adjusted and grouped

together:

Net Debt

o Total short and long term debt minus liquid investments held and

surplus cash

Cash Bucket

o For modelling, subtract short-term debt from surplus cash and liquid

investments

Surplus Cash

o Include temporary investments and also include long-term investments

Current Assets and Current Liabilities

o Separate the surplus cash from current assets and the debt from

current liabilities and relate remaining working capital items to revenue

and expense items

www.edbodmer.com

edbodmer@aol.com

28December 22

29. Balance Sheet Issues

• Treat surplus cash as negative debt and debt as negative cashRule of thumb – cash is 2% of revenues

Example – when developing a basic cash flow model, group the

cash and the debt as one account and then separate this account

on the balance sheet.

Unfunded pension expenses should be treated like debt – they

involve a fixed obligation and they can be replaced with debt when

they are funded.

Deferred taxes depend on the way deferred taxes are modelled for

cash flow purposes. If you model future changes in deferred taxes

and take account of these in projections, do not put deferred taxes

as a component of equity.

www.edbodmer.com

edbodmer@aol.com

29December 22

30. Problems with Equity Balance

• Would like the return on equity and the return on invested capital tomeasure equity invested by shareholders for return on investment and

return on equity

Problems with using equity balance on the balance sheet to

measure equity investment

o Write-offs of plant

o Accumulated Other Comprehensive Income

o Goodwill

o Re-structuring losses

o Employee Stock options

Can make adjustments to equity balance

www.edbodmer.com

edbodmer@aol.com

30December 22

31. Financial Ratio Analysis

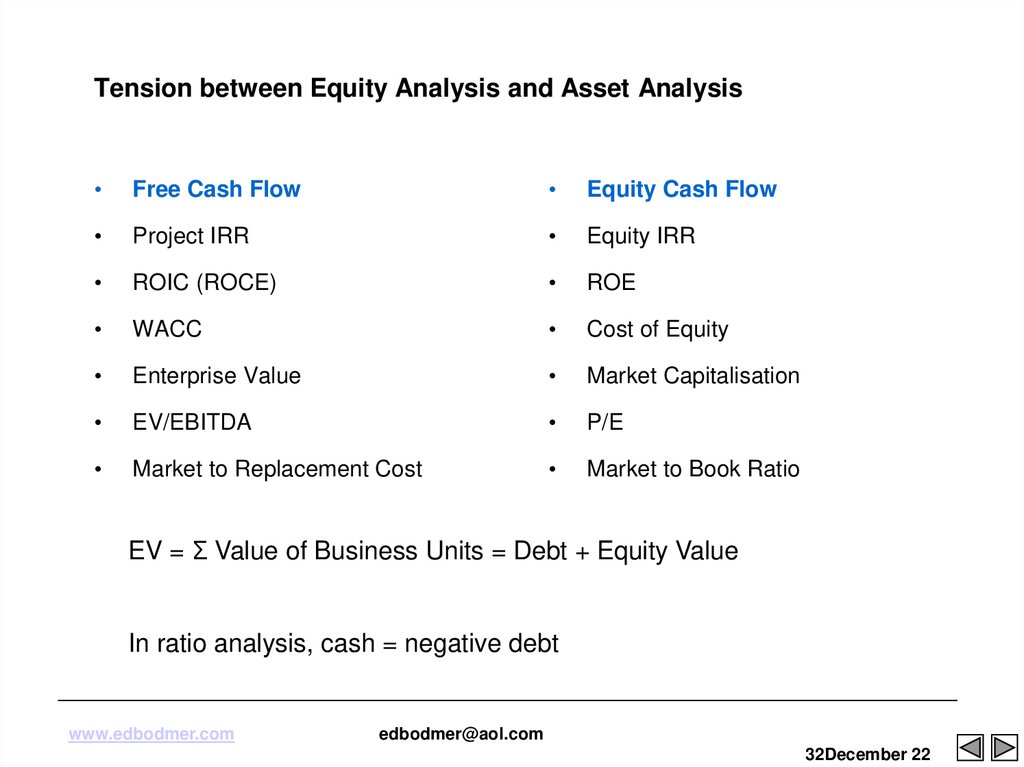

31 December 2232. Tension between Equity Analysis and Asset Analysis

Free Cash Flow

Equity Cash Flow

Project IRR

Equity IRR

ROIC (ROCE)

ROE

WACC

Cost of Equity

Enterprise Value

Market Capitalisation

EV/EBITDA

P/E

Market to Replacement Cost

Market to Book Ratio

EV = Σ Value of Business Units = Debt + Equity Value

In ratio analysis, cash = negative debt

www.edbodmer.com

edbodmer@aol.com

32December 22

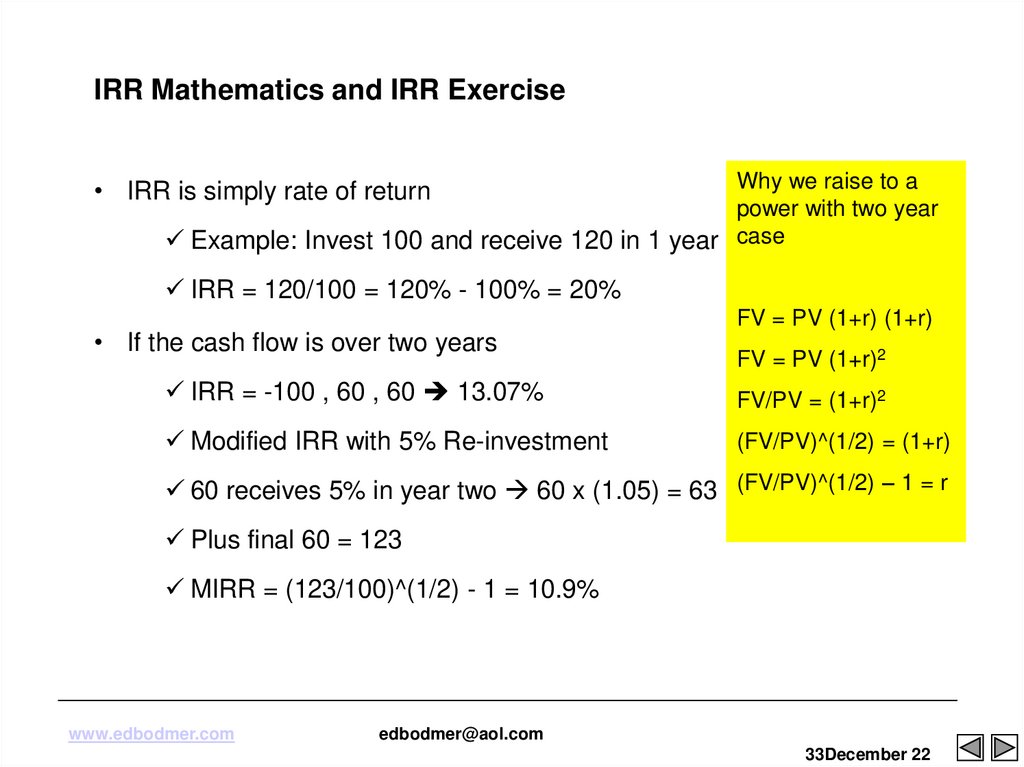

33. IRR Mathematics and IRR Exercise

Why we raise to apower with two year

Example: Invest 100 and receive 120 in 1 year case

• IRR is simply rate of return

IRR = 120/100 = 120% - 100% = 20%

• If the cash flow is over two years

FV = PV (1+r) (1+r)

FV = PV (1+r)2

IRR = -100 , 60 , 60 13.07%

FV/PV = (1+r)2

Modified IRR with 5% Re-investment

(FV/PV)^(1/2) = (1+r)

60 receives 5% in year two 60 x (1.05) = 63 (FV/PV)^(1/2) – 1 = r

Plus final 60 = 123

MIRR = (123/100)^(1/2) - 1 = 10.9%

www.edbodmer.com

edbodmer@aol.com

33December 22

34. Financial Ratio Analysis

Purpose :

Evaluate relation between two or more economically important items (one is

the starting point for further analysis)

Cautions:

Accounting analysis is important (deferred taxes etc.)

Interpretation is key

What does the P/E mean

Is an interest coverage of 3.5 good

Why is the ROIC low

Should we use MB, PE or EV/EBITDA

Document financial ratios (numerator and denominator) with footnotes and

comments

Show components of numerator and denominator in rows above the ratio

calculation

www.edbodmer.com

edbodmer@aol.com

34December 22

35. General Discussion of Financial Ratios

Financial Ratios Often Compares Income Statement or Cash Flow with Balance

Sheet

In developing ratios, understand why the formula is developed (e.g. other

income and other investments in return on invested capital)

There is Not Necessarily One Single Correct Formula

For example, pre-tax or after-tax return on assets.

Keep the numerator consistent with the denominator

Financial Ratios should be evaluated in the context of benchmarks

Credit ratios and bond rating standards

Returns and cost of capital

Operating ratios and history

www.edbodmer.com

edbodmer@aol.com

35December 22

36. Classes of Financial Ratios

Management Performance

Ratios that measure the historic economic performance of management and

evaluate whether the economic performance can be maintained (e.g. ROIC)

Valuation

Ratios that are used to give an indication of the value of the company (e.g.

P/E)

Credit Analysis

Ratios that gauge the credit quality and liquidity of the company (e.g.

Interest coverage and current ratio)

Model Evaluation

Ratios used to evaluate the assumptions and mechanics of financial

forecasts

www.edbodmer.com

edbodmer@aol.com

36December 22

37. Ratios that Measure Management Performance

37 December 2238. Class 1: Financial Indicators of Management Performance

Evaluate Whether Management is Doing a Good Job with Investor Funds (Not if

the company is appropriately valued)

Return on Invested Capital

Return on Assets

Return on Equity

Market/Book Ratio

Market Value/Replacement Cost

Key Issue

Evaluate relative to risk

o ROE versus Cost of Equity

o ROIC versus WACC

www.edbodmer.com

edbodmer@aol.com

38December 22

39. ROIC, WACC and Growth

• ROIC is before interest and the return covers both debt and equityfinancing – EBIT is before interest and investment includes both debt and

equity investment

• WACC is the blended average of debt and equity required returns

• ROIC versus WACC measures the ability to make true economic profit

• Once have economic profit, should grow the business as much as

possible.

www.edbodmer.com

edbodmer@aol.com

39December 22

40. Basic Economic Principles, ROIC and Financial Analysis

• When you measure value, you are gauging the ability of a firm to realizeeconomic profit. For example, when you compare the equity IRR with the

equity cost of capital.

• When you assess assumptions in a financial forecast, you must assess

whether economic profit implicit in the assumptions can in fact be

realized. For example, if the financial forecast has a very high ROE, is

that reasonable.

• When you interpret financial statistics, you are gauging the strategy of the

company in terms of whether economic profit is being realized. In

reviewing the return on invested capital, does this demonstrate that the

company has the potential to earn economic profit.

www.edbodmer.com

edbodmer@aol.com

40December 22

41. Return on Invested Capital Analysis

• ROIC is not distorted by the leverage of the company• ROIC can be used to gauge economic profit and whether the company

should grow operations

• ROIC can be used to assess the reasonableness of projections

For example, if ROIC is very high and the company is in a

competitive business with few barriers to entry, the forecast is

probably not realistic.

• ROIC can be computed on a division basis EBIT and allocation of capital

to divisions from net assets to gauge the profit of parts of the company

• ROIC comes from sustainable competitive advantage and high market

share

www.edbodmer.com

edbodmer@aol.com

41December 22

42. Formula for Return on Invested Capital

The return in invested capital formula can be for a division or an entire corporation. It is after

tax and after depreciation. Cash balances should be excluded from the denominator and

interest income from the numerator. Goodwill and goodwill amortization should be excluded.

Formula:

ROIC = EBITAT/Invested Capital

Where:

o EBITAT: Earnings before Interest Taxes and Goodwill Amortization less taxes on

EBITAT

o Taxes on EBITAT: Cash Income Taxes Less Tax on Interest Expense and

Interest Income and Tax on Non-operating Income

o Invested Capital less cash balance

Adjustments

Other Assets

Cash Balances

Goodwill

Other

www.edbodmer.com

edbodmer@aol.com

42December 22

43. Issues in Management Performance Evaluation

Basic Formula: ROIC versus WACC

How to compute ROIC

o NOPLAT/Average Invested Capital

o May or may not include goodwill – If goodwill is not included, compute

NOPLAT without subtracting goodwill write-off and subtract net

goodwill from invested capital

o Reduce the invested capital by surplus cash balances

o Some don’t include other income – then the invested capital should be

reduced by other investments

o Can compute with ratios

EBIT Margin x (1-t) * Asset Turn

Asset Turn = Sales/Assets; EBIT Margin = EBIT/Sales

ROCE vs ROIC

o ROCE is generally computed in an indirect way by starting with net

income, and adding net of tax interest and adding minorities

www.edbodmer.com

edbodmer@aol.com

43December 22

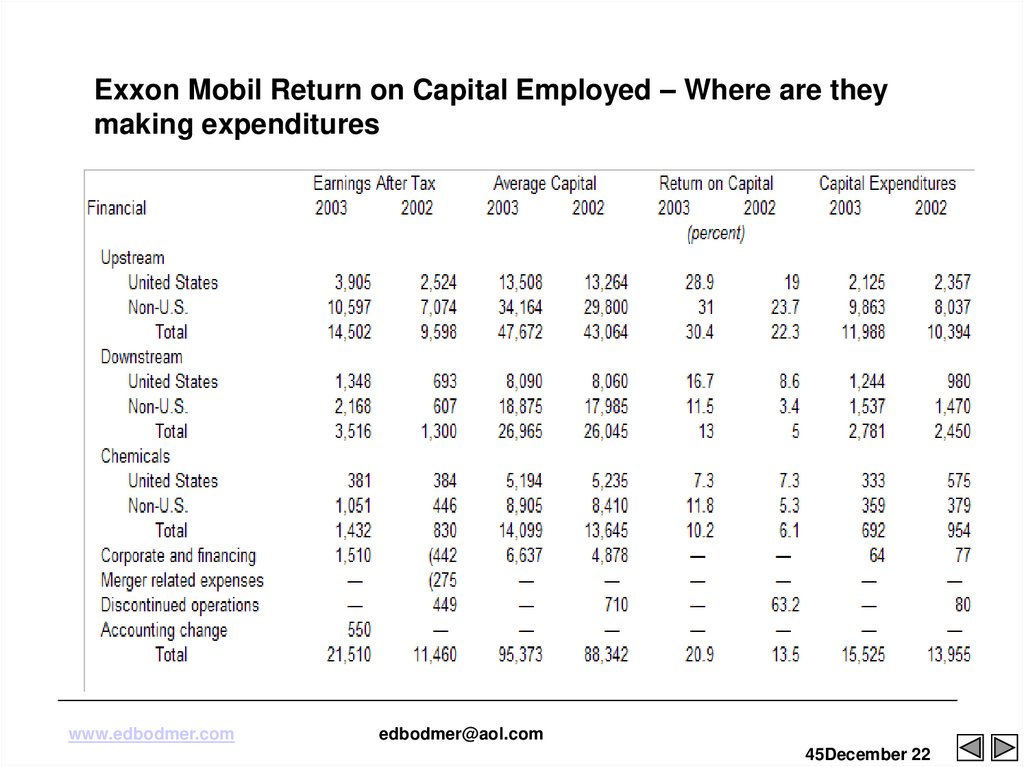

44. Exxon Mobil Return on Average Capital Employed

Return on average capital employed (ROCE) is a performance measure ratio.

From the perspective of the business segments, ROCE is annual business

segment earnings divided by average business segment capital employed

(average of beginning and end-of-year amounts).

These segment earnings include ExxonMobil’s share of segment earnings of

equity companies, consistent with our capital employed definition, and exclude

the cost of financing.

The corporation’s total ROCE is net income excluding the after-tax cost of

financing, divided by total corporate average capital employed. The corporation

has consistently applied its ROCE definition for many years and views it as the

best measure of historical capital productivity in our capital intensive longterm industry, both to evaluate management’s performance and to

demonstrate to shareholders that capital has been used wisely over the long

term. Additional measures, which tend to be more cash flow based, are used for

future investment decisions.

www.edbodmer.com

edbodmer@aol.com

44December 22

45. Exxon Mobil Return on Capital Employed – Where are they making expenditures

www.edbodmer.comedbodmer@aol.com

45December 22

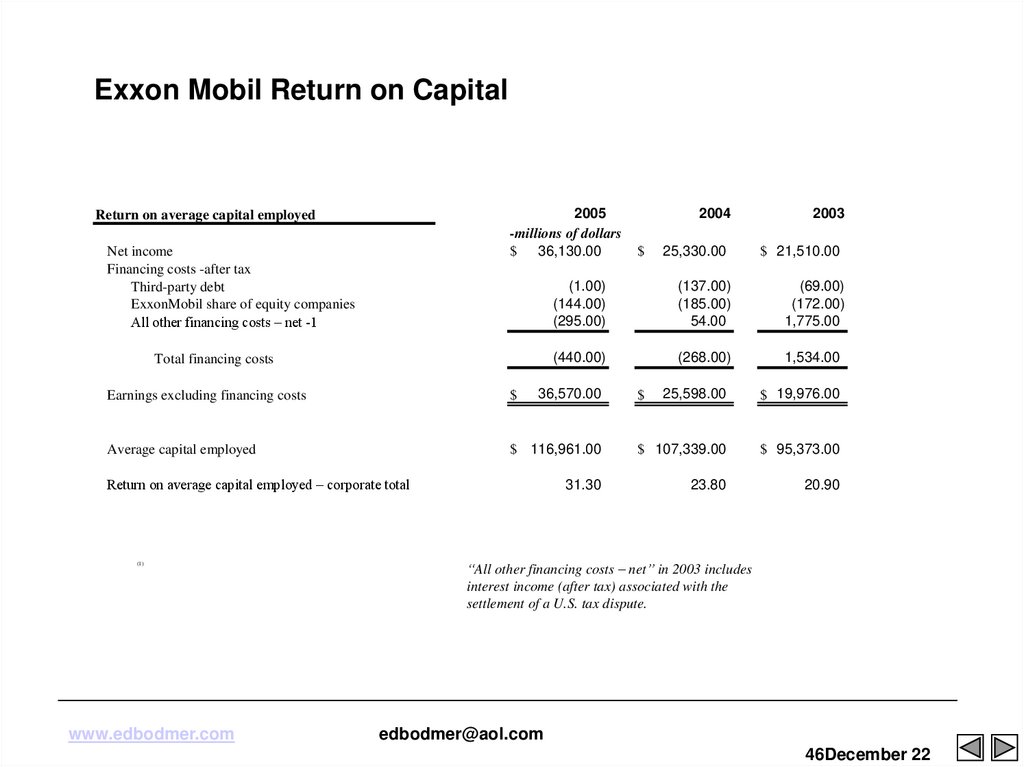

46. Exxon Mobil Return on Capital

2005-millions of dollars

$ 36,130.00

Return on average capital employed

Net income

Financing costs -after tax

Third-party debt

ExxonMobil share of equity companies

All other financing costs – net -1

Total financing costs

2004

2003

25,330.00

$ 21,510.00

(1.00)

(144.00)

(295.00)

(137.00)

(185.00)

54.00

(69.00)

(172.00)

1,775.00

(440.00)

(268.00)

1,534.00

25,598.00

$ 19,976.00

36,570.00

$

Earnings excluding financing costs

$

Average capital employed

$ 116,961.00

$ 107,339.00

$ 95,373.00

31.30

23.80

20.90

Return on average capital employed – corporate total

(1)

www.edbodmer.com

$

“All other financing costs – net” in 2003 includes

interest income (after tax) associated with the

settlement of a U.S. tax dispute.

edbodmer@aol.com

46December 22

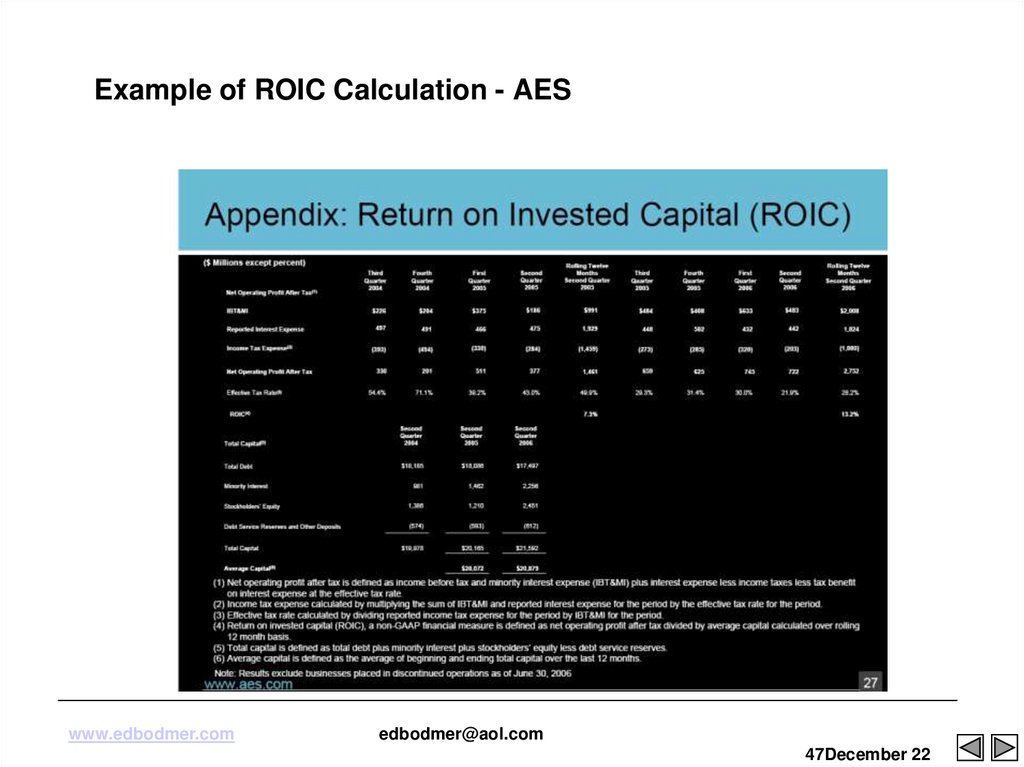

47. Example of ROIC Calculation - AES

www.edbodmer.comedbodmer@aol.com

47December 22

48. Illustration of Invested Capital Computation

www.edbodmer.comedbodmer@aol.com

48December 22

49. ROE and ROIC – Note how to compute growth rates from ROE and Retention

www.edbodmer.comedbodmer@aol.com

49December 22

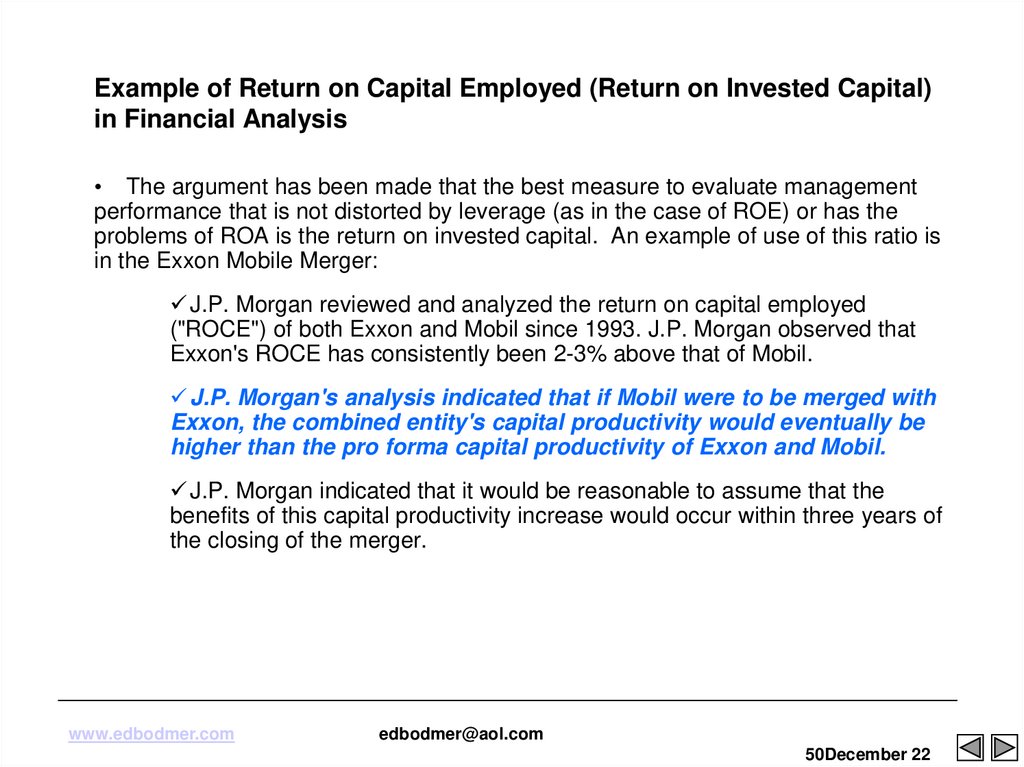

50. Example of Return on Capital Employed (Return on Invested Capital) in Financial Analysis

• The argument has been made that the best measure to evaluate managementperformance that is not distorted by leverage (as in the case of ROE) or has the

problems of ROA is the return on invested capital. An example of use of this ratio is

in the Exxon Mobile Merger:

J.P. Morgan reviewed and analyzed the return on capital employed

("ROCE") of both Exxon and Mobil since 1993. J.P. Morgan observed that

Exxon's ROCE has consistently been 2-3% above that of Mobil.

J.P. Morgan's analysis indicated that if Mobil were to be merged with

Exxon, the combined entity's capital productivity would eventually be

higher than the pro forma capital productivity of Exxon and Mobil.

J.P. Morgan indicated that it would be reasonable to assume that the

benefits of this capital productivity increase would occur within three years of

the closing of the merger.

www.edbodmer.com

edbodmer@aol.com

50December 22

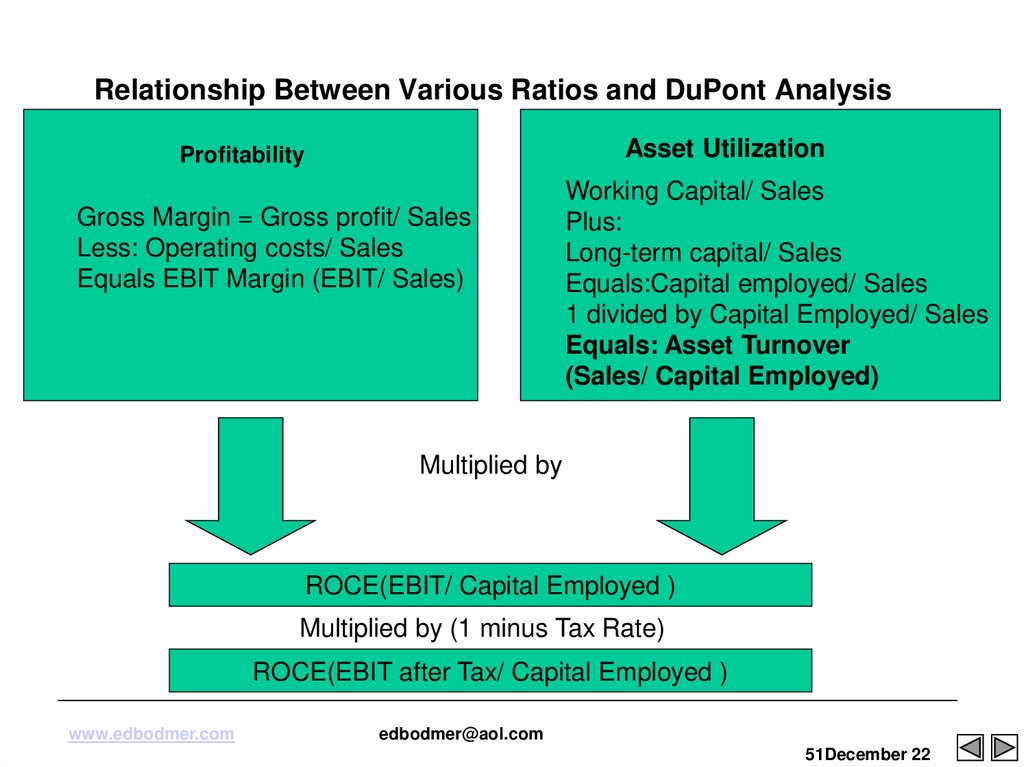

51. Relationship Between Various Ratios and DuPont Analysis

Asset UtilizationProfitability

Gross Margin = Gross profit/ Sales

Less: Operating costs/ Sales

Equals EBIT Margin (EBIT/ Sales)

Working Capital/ Sales

Plus:

Long-term capital/ Sales

Equals:Capital employed/ Sales

1 divided by Capital Employed/ Sales

Equals: Asset Turnover

(Sales/ Capital Employed)

Multiplied by

ROCE(EBIT/ Capital Employed )

Multiplied by (1 minus Tax Rate)

ROCE(EBIT after Tax/ Capital Employed )

www.edbodmer.com

edbodmer@aol.com

51December 22

52. Class 2: Financial Indicators of Market Value

Financial Ratios can be used to analyze whether the valuation of a company is

appropriate. Analysts should understand the drivers of different ratios. Valuation

Ratios include:

Universal Financial Ratios

o Price to Earnings Ratio

o Enterprise Value/EBITDA

o PEG (P/E to Earnings Growth) Ratio

o Market to Book Ratio

Industry Specific Financial Ratios

o Value/Reserve

o Value/Customer

o Value/Plane Seat

www.edbodmer.com

edbodmer@aol.com

52December 22

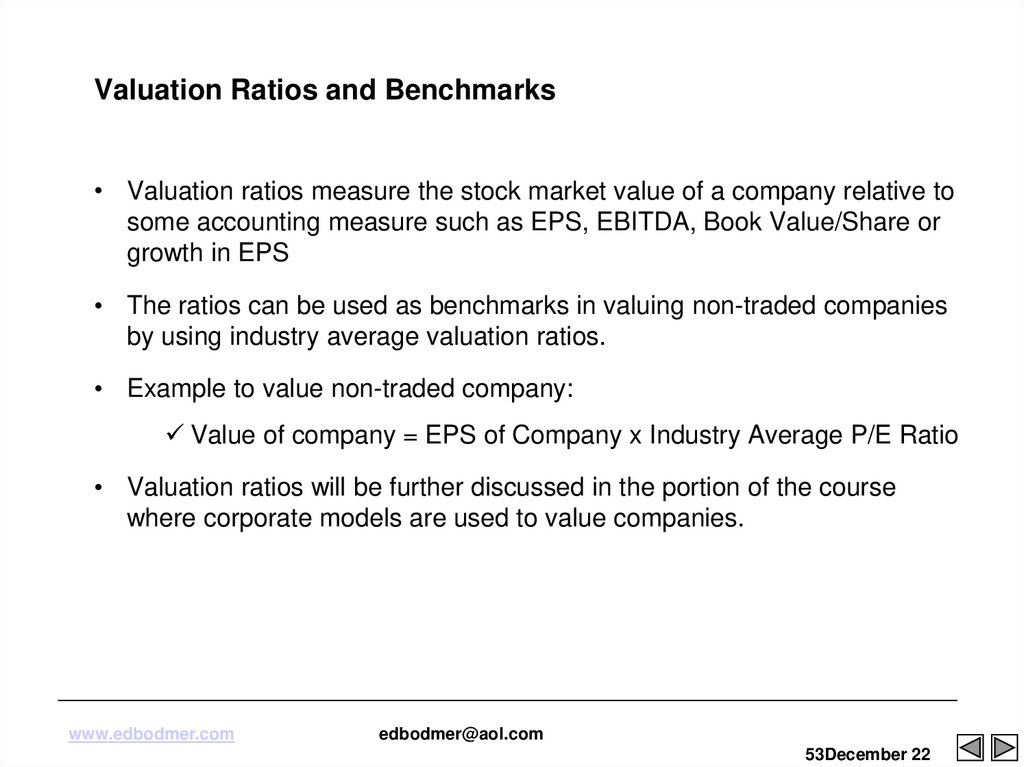

53. Valuation Ratios and Benchmarks

• Valuation ratios measure the stock market value of a company relative tosome accounting measure such as EPS, EBITDA, Book Value/Share or

growth in EPS

• The ratios can be used as benchmarks in valuing non-traded companies

by using industry average valuation ratios.

• Example to value non-traded company:

Value of company = EPS of Company x Industry Average P/E Ratio

• Valuation ratios will be further discussed in the portion of the course

where corporate models are used to value companies.

www.edbodmer.com

edbodmer@aol.com

53December 22

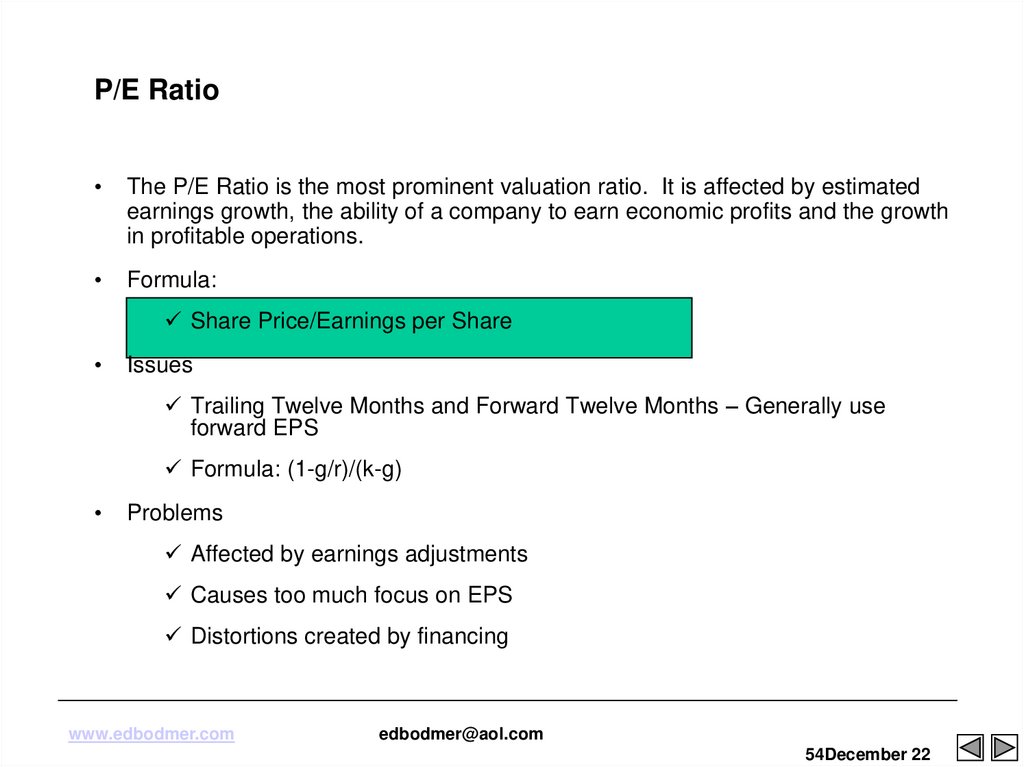

54. P/E Ratio

The P/E Ratio is the most prominent valuation ratio. It is affected by estimated

earnings growth, the ability of a company to earn economic profits and the growth

in profitable operations.

Formula:

Share Price/Earnings per Share

Issues

Trailing Twelve Months and Forward Twelve Months – Generally use

forward EPS

Formula: (1-g/r)/(k-g)

Problems

Affected by earnings adjustments

Causes too much focus on EPS

Distortions created by financing

www.edbodmer.com

edbodmer@aol.com

54December 22

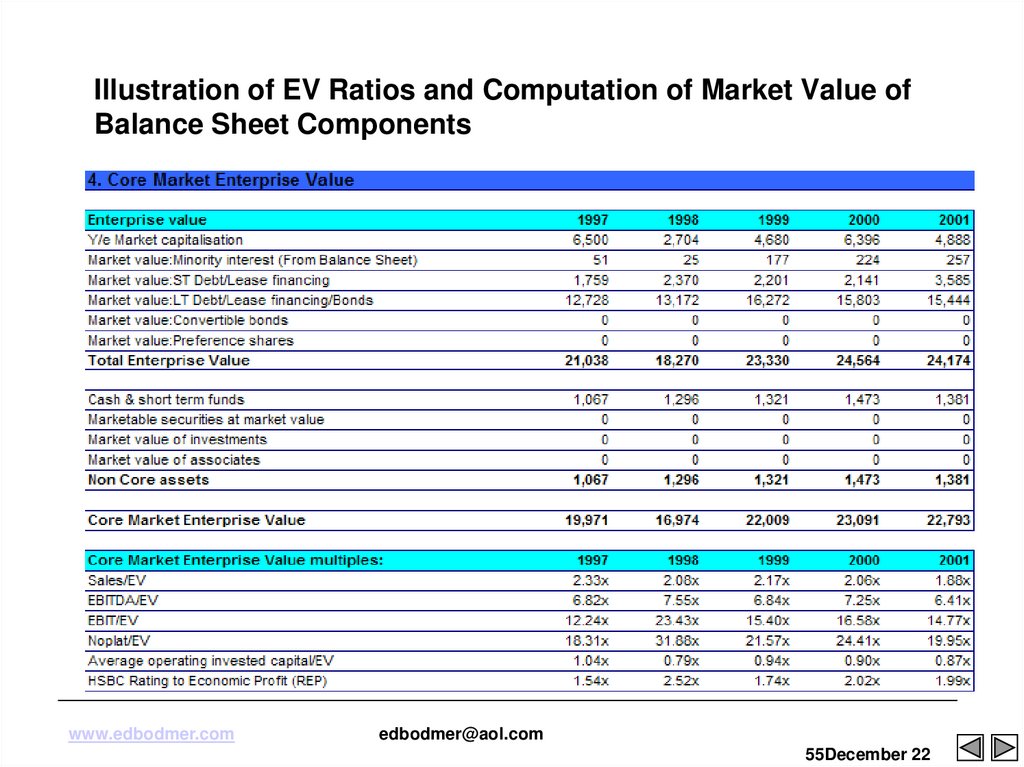

55. Illustration of EV Ratios and Computation of Market Value of Balance Sheet Components

www.edbodmer.comedbodmer@aol.com

55December 22

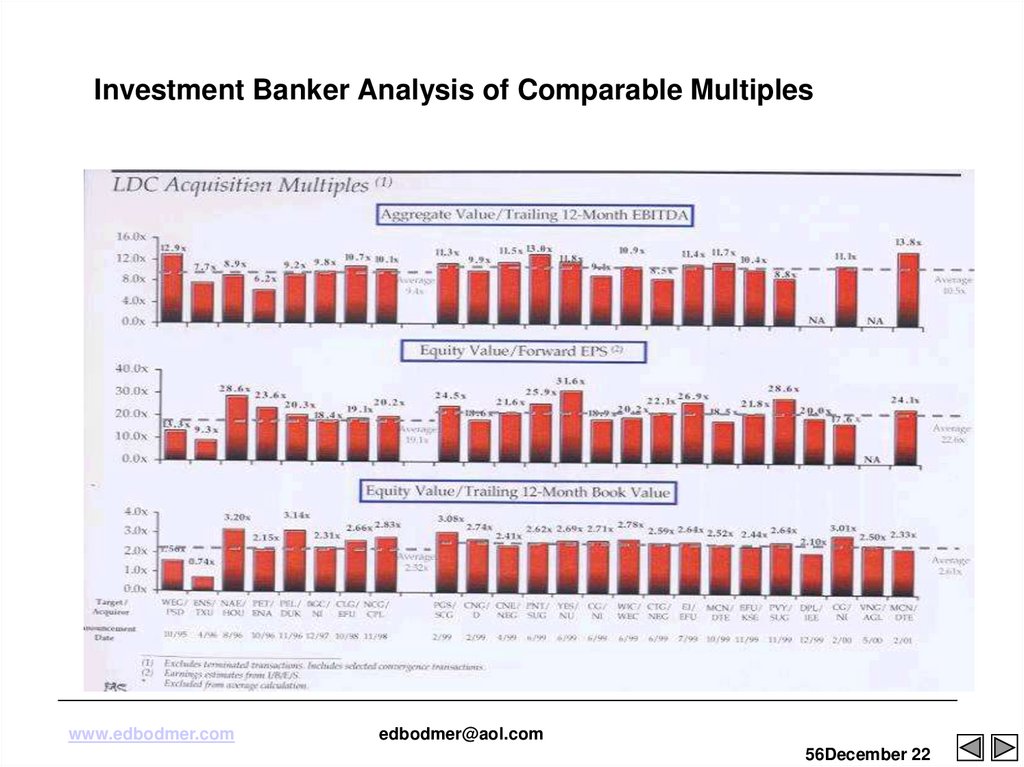

56. Investment Banker Analysis of Comparable Multiples

www.edbodmer.comedbodmer@aol.com

56December 22

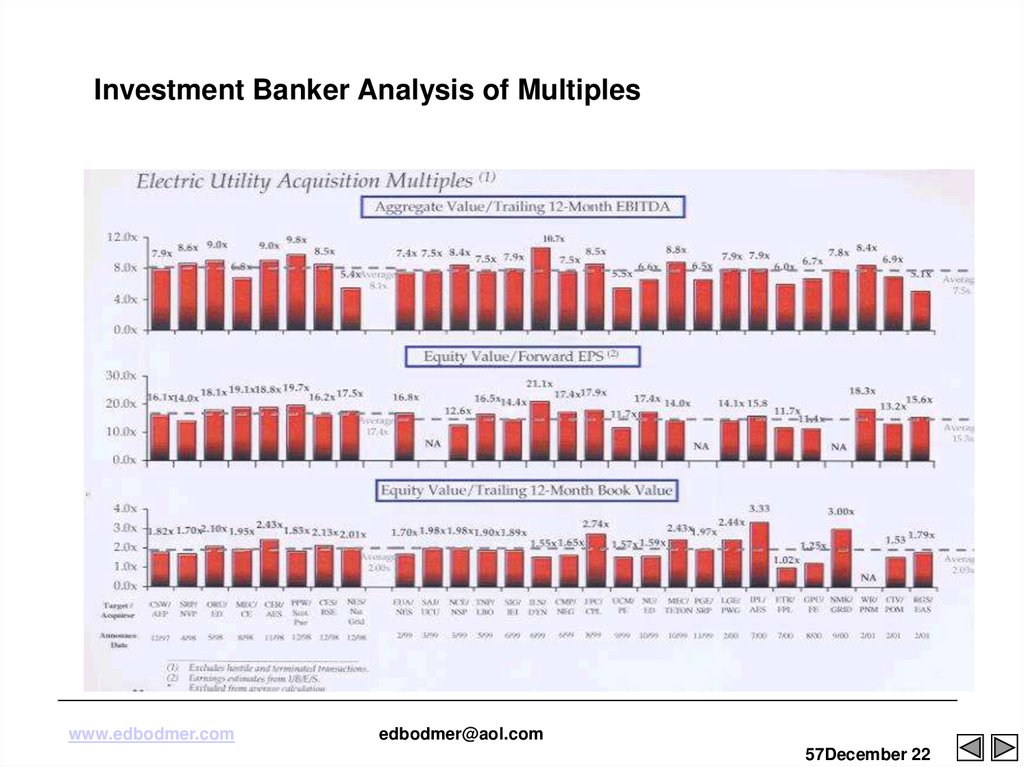

57. Investment Banker Analysis of Multiples

www.edbodmer.comedbodmer@aol.com

57December 22

58. Use of PE in Valuation

• The long-run P/E ratio is often used in valuation. This process involves:Project EPS

Compute Stable EPS

Compute P/E Ratio using formula

o P/E = (1-g/r)/(k-g)

o g – growth in EPS or Net Income

o r – rate of return earned on equity

o k – cost of equity capital

Related Formula for terminal value with NOPLAT (EBITAT)

o (1-g/ROIC)/(WACC – g)

The formula demonstrates where value really comes from

www.edbodmer.com

edbodmer@aol.com

58December 22

59. Risk Assessment of Debt and Analysis of Credit Spreads

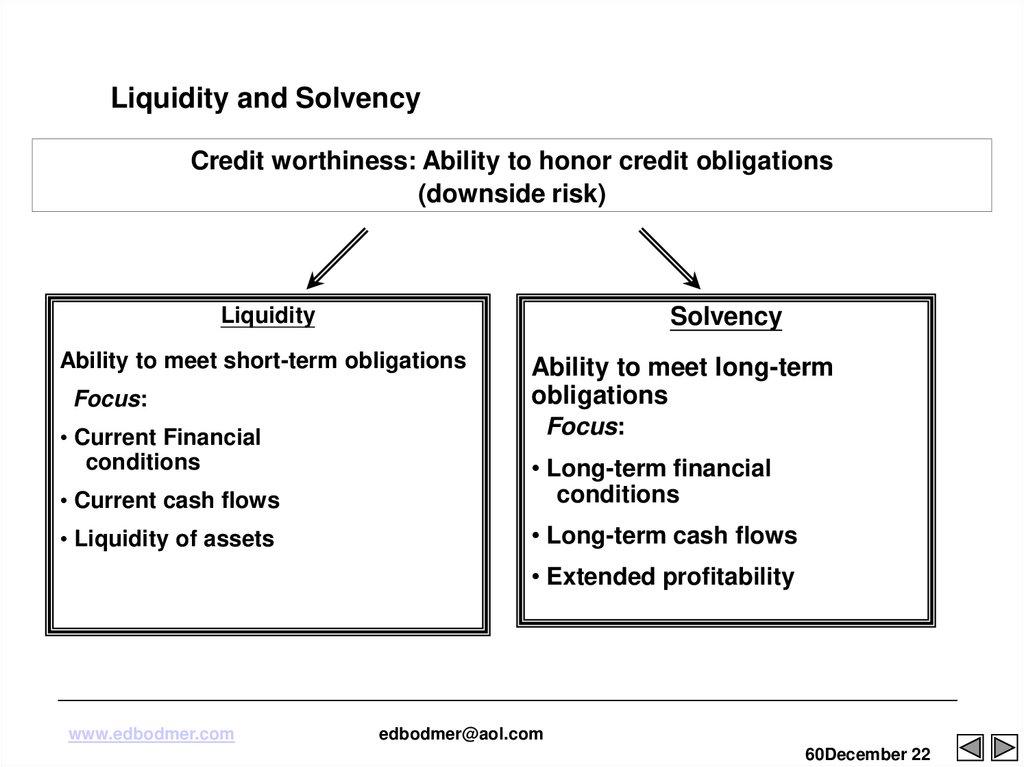

59 December 2260. Liquidity and Solvency

Credit worthiness: Ability to honor credit obligations(downside risk)

Liquidity

Solvency

Ability to meet short-term obligations

Focus:

• Current Financial

conditions

Ability to meet long-term

obligations

Focus:

• Current cash flows

• Long-term financial

conditions

• Liquidity of assets

• Long-term cash flows

• Extended profitability

www.edbodmer.com

edbodmer@aol.com

60December 22

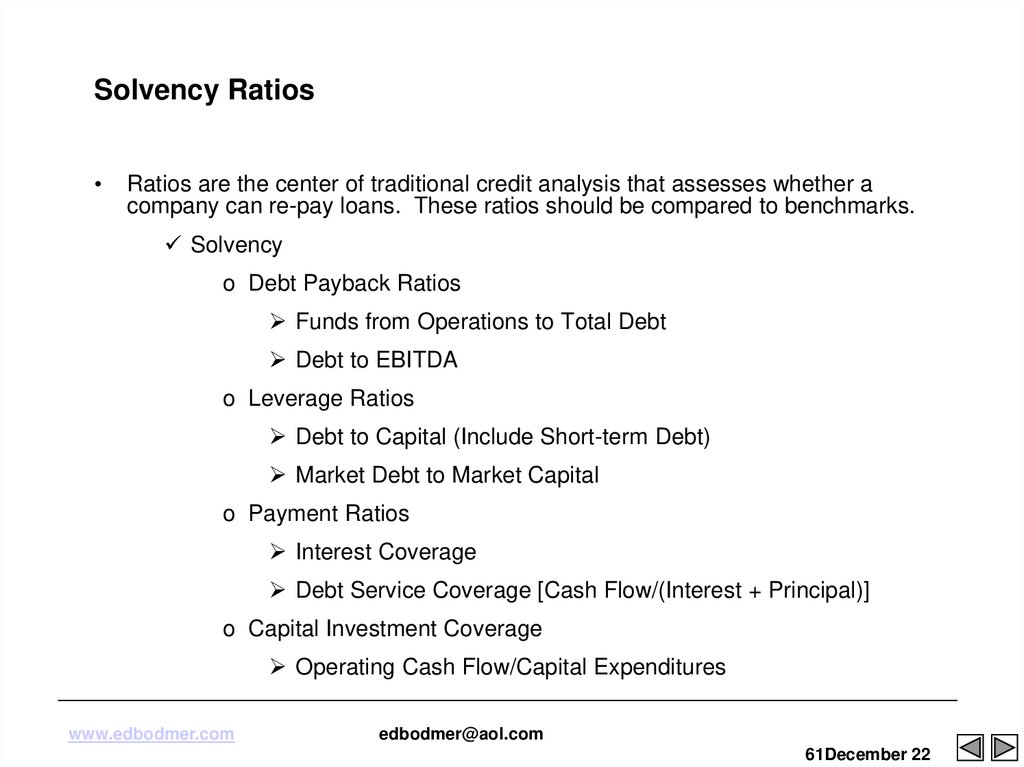

61. Solvency Ratios

Ratios are the center of traditional credit analysis that assesses whether a

company can re-pay loans. These ratios should be compared to benchmarks.

Solvency

o Debt Payback Ratios

Funds from Operations to Total Debt

Debt to EBITDA

o Leverage Ratios

Debt to Capital (Include Short-term Debt)

Market Debt to Market Capital

o Payment Ratios

Interest Coverage

Debt Service Coverage [Cash Flow/(Interest + Principal)]

o Capital Investment Coverage

Operating Cash Flow/Capital Expenditures

www.edbodmer.com

edbodmer@aol.com

61December 22

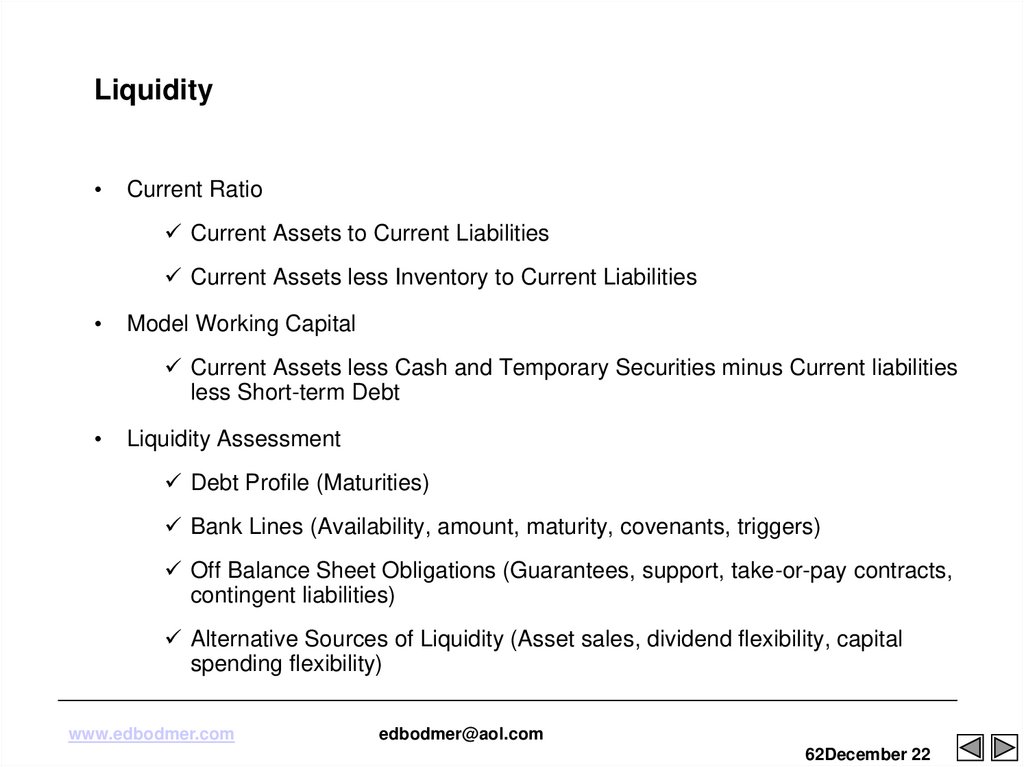

62. Liquidity

Current Ratio

Current Assets to Current Liabilities

Current Assets less Inventory to Current Liabilities

Model Working Capital

Current Assets less Cash and Temporary Securities minus Current liabilities

less Short-term Debt

Liquidity Assessment

Debt Profile (Maturities)

Bank Lines (Availability, amount, maturity, covenants, triggers)

Off Balance Sheet Obligations (Guarantees, support, take-or-pay contracts,

contingent liabilities)

Alternative Sources of Liquidity (Asset sales, dividend flexibility, capital

spending flexibility)

www.edbodmer.com

edbodmer@aol.com

62December 22

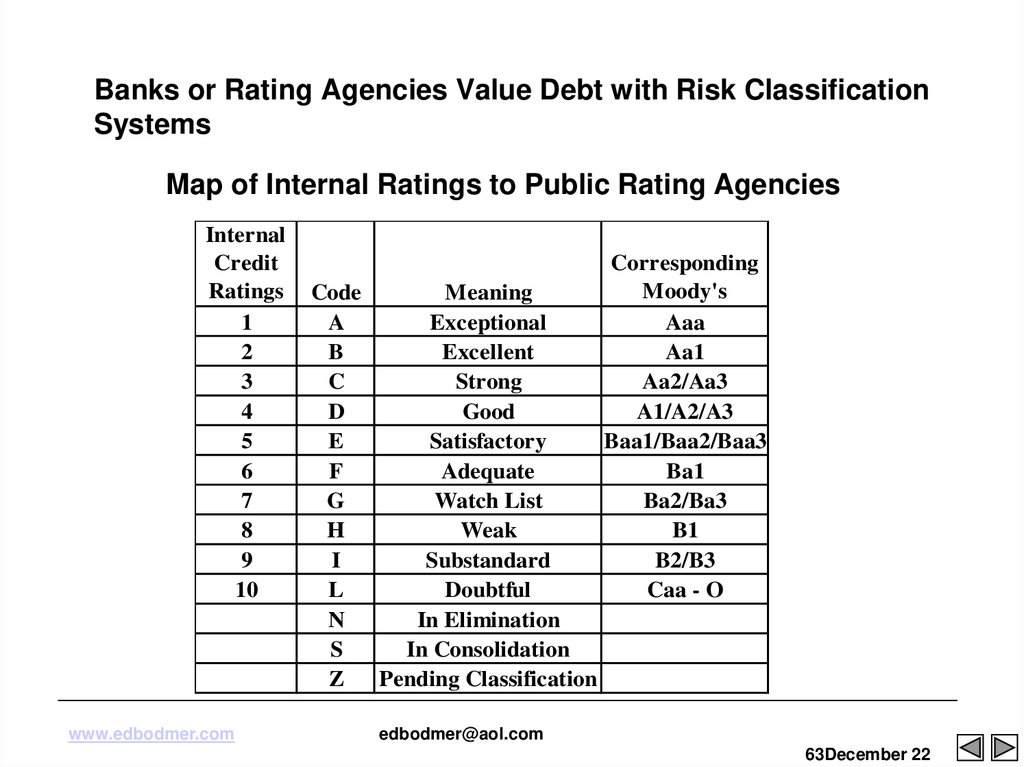

63. Banks or Rating Agencies Value Debt with Risk Classification Systems

Map of Internal Ratings to Public Rating AgenciesInternal

Credit

Ratings

1

2

3

4

5

6

7

8

9

10

www.edbodmer.com

Code

Meaning

A

Exceptional

B

Excellent

C

Strong

D

Good

E

Satisfactory

F

Adequate

G

Watch List

H

Weak

I

Substandard

L

Doubtful

N

In Elimination

S

In Consolidation

Z

Pending Classification

Corresponding

Moody's

Aaa

Aa1

Aa2/Aa3

A1/A2/A3

Baa1/Baa2/Baa3

Ba1

Ba2/Ba3

B1

B2/B3

Caa - O

edbodmer@aol.com

63December 22

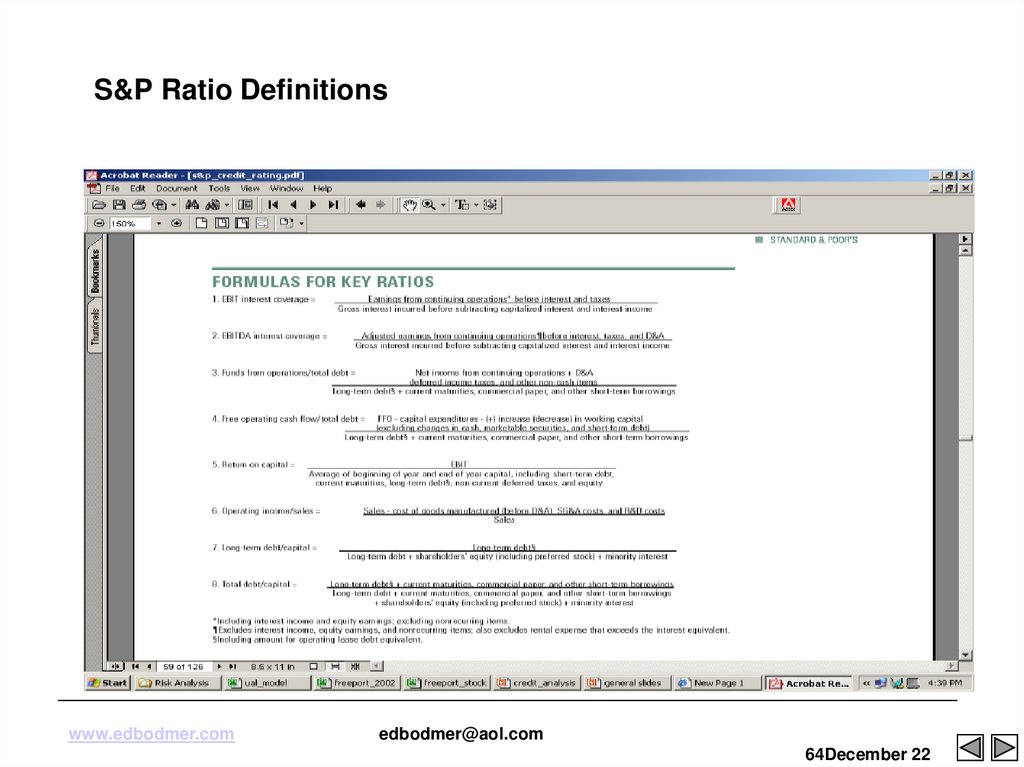

64. S&P Ratio Definitions

S&P Ratio Definitionswww.edbodmer.com

edbodmer@aol.com

64December 22

65. S&P Benchmarks

S&P Benchmarkswww.edbodmer.com

edbodmer@aol.com

65December 22

66. Example of Using Ratios to Gauge Credit Rating

• The credit ratios are shown next to the achieved ratios. Concentrate onFunds from operations ratios.

Note that based on business

profile scores published by

S&P

www.edbodmer.com

edbodmer@aol.com

66December 22

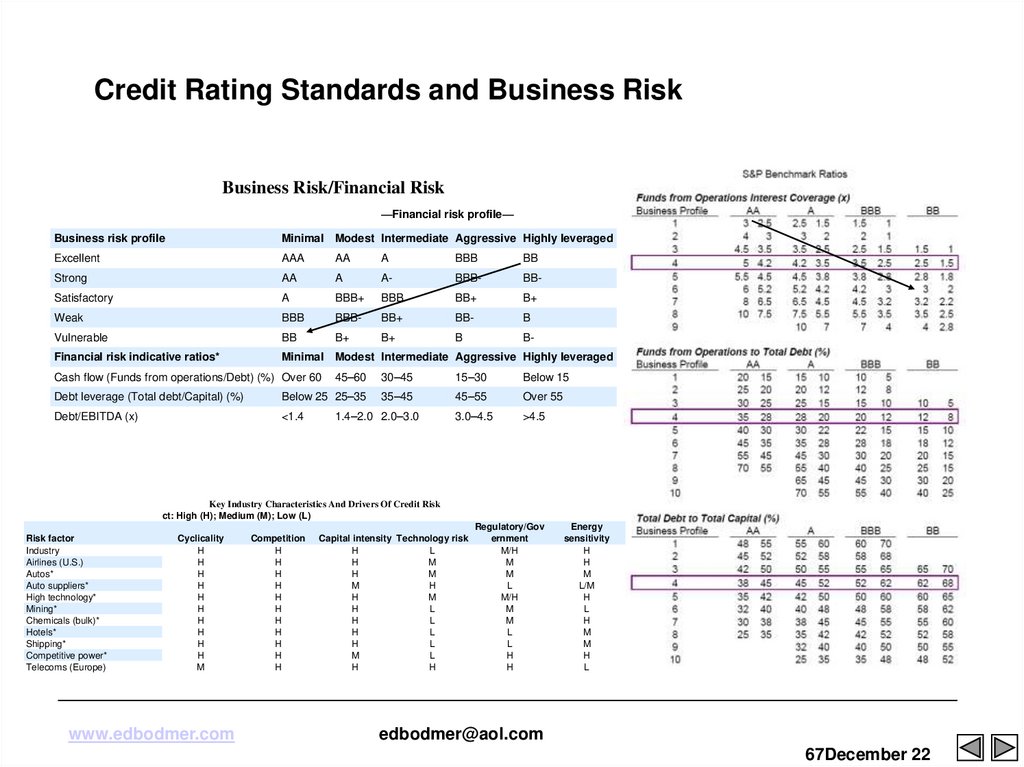

67. Credit Rating Standards and Business Risk

Business Risk/Financial Risk—Financial risk profile—

Business risk profile

Minimal Modest Intermediate Aggressive Highly leveraged

Excellent

AAA

AA

A

BBB

BB

Strong

AA

A

A-

BBB-

BB-

Satisfactory

A

BBB+

BBB

BB+

B+

Weak

BBB

BBB-

BB+

BB-

B

Vulnerable

BB

B+

B+

B

B-

Financial risk indicative ratios*

Minimal Modest Intermediate Aggressive Highly leveraged

Cash flow (Funds from operations/Debt) (%) Over 60

45–60

30–45

15–30

Below 15

Debt leverage (Total debt/Capital) (%)

Below 25 25–35

35–45

45–55

Over 55

Debt/EBITDA (x)

<1.4

1.4–2.0 2.0–3.0

3.0–4.5

>4.5

Key Industry Characteristics And Drivers Of Credit Risk

Credit risk impact: High (H); Medium (M); Low (L)

Risk factor

Industry

Airlines (U.S.)

Autos*

Auto suppliers*

High technology*

Mining*

Chemicals (bulk)*

Hotels*

Shipping*

Competitive power*

Telecoms (Europe)

Cyclicality

H

H

H

H

H

H

H

H

H

H

M

www.edbodmer.com

Competition

H

H

H

H

H

H

H

H

H

H

H

Capital intensity Technology risk

H

L

H

M

H

M

M

H

H

M

H

L

H

L

H

L

H

L

M

L

H

H

Regulatory/Gov

ernment

M/H

M

M

L

M/H

M

M

L

L

H

H

Energy

sensitivity

H

H

M

L/M

H

L

H

M

M

H

L

edbodmer@aol.com

67December 22

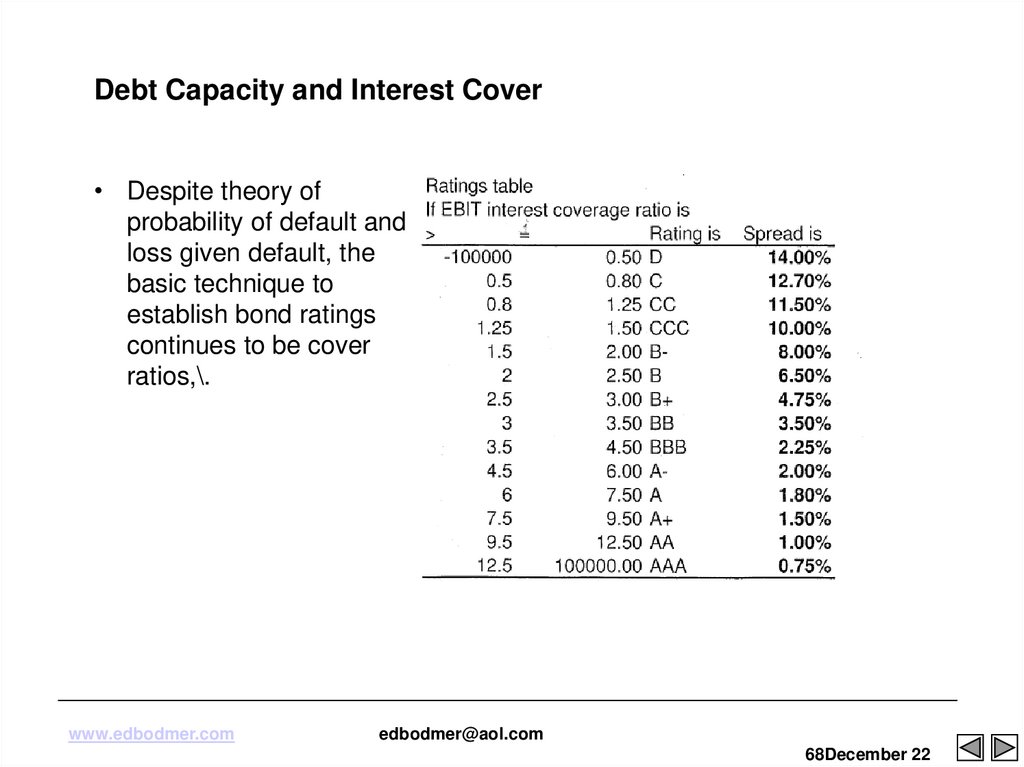

68. Debt Capacity and Interest Cover

• Despite theory ofprobability of default and

loss given default, the

basic technique to

establish bond ratings

continues to be cover

ratios,\.

www.edbodmer.com

edbodmer@aol.com

68December 22

69. Default Rates and Credit Spreads

www.edbodmer.comedbodmer@aol.com

69December 22

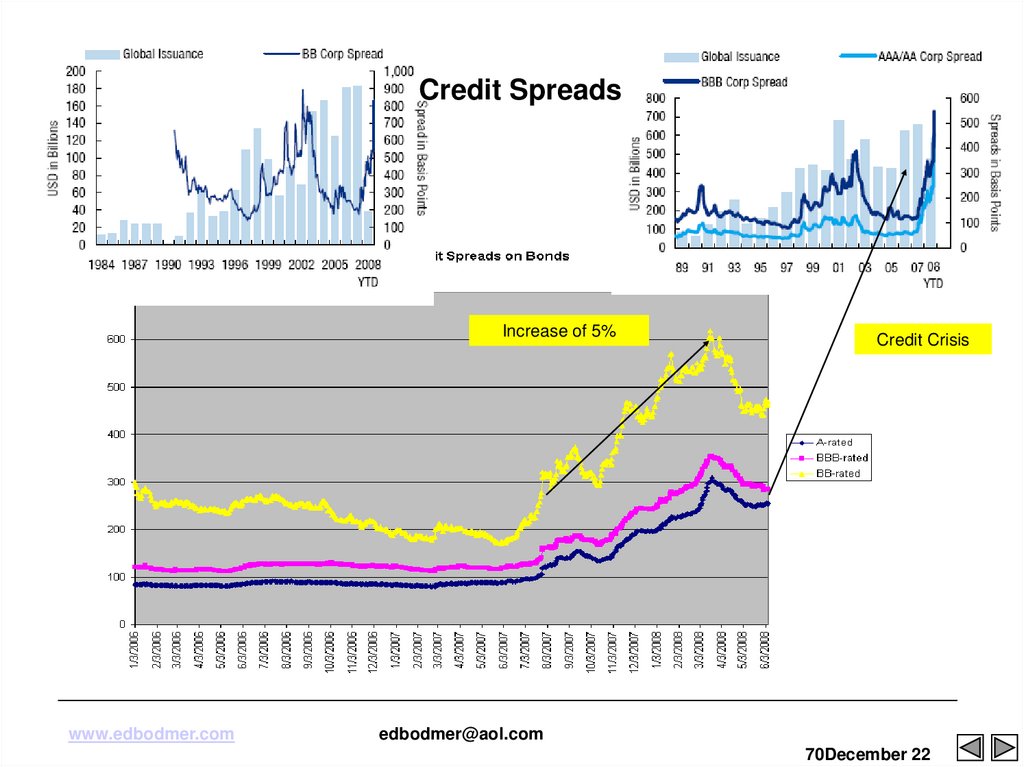

70. Credit Spreads

Increase of 5%www.edbodmer.com

Credit Crisis

edbodmer@aol.com

70December 22

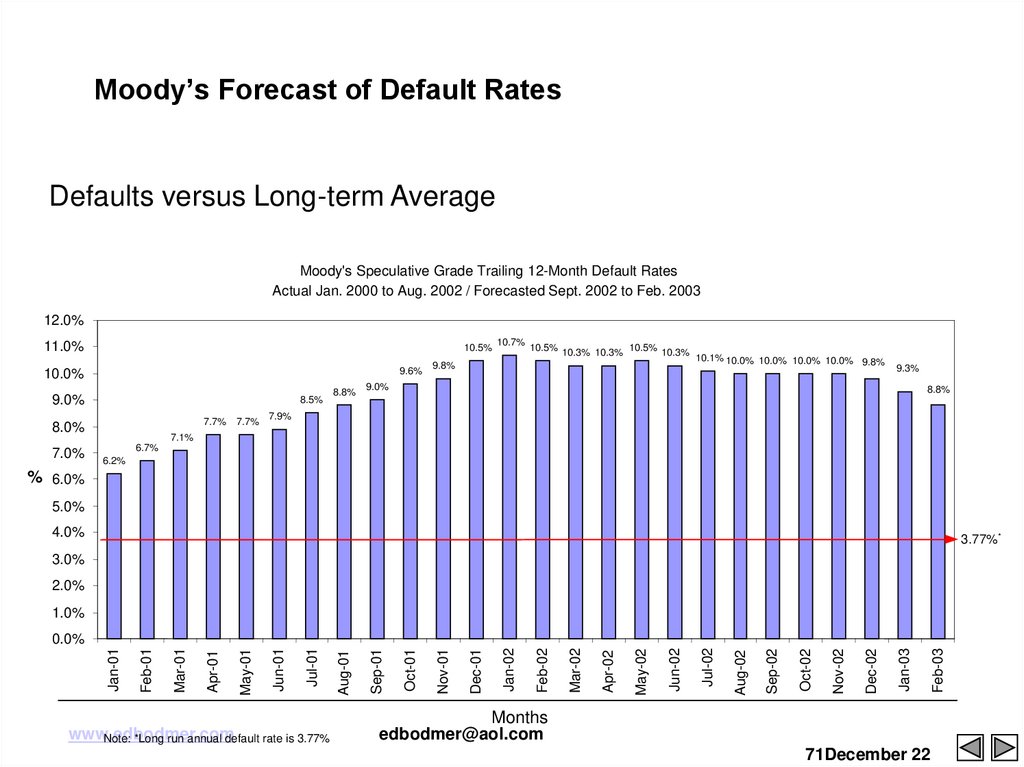

71. Moody’s Forecast of Default Rates

Defaults versus Long-term AverageMoody's Speculative Grade Trailing 12-Month Default Rates

Actual Jan. 2000 to Aug. 2002 / Forecasted Sept. 2002 to Feb. 2003

12.0%

11.0%

10.5%

9.6%

10.0%

9.0%

8.5%

7.7%

8.0%

7.0%

7.7%

8.8%

10.7%

10.5%

10.3% 10.3%

10.5%

10.3%

9.8%

10.1% 10.0% 10.0% 10.0% 10.0% 9.8%

9.3%

9.0%

8.8%

7.9%

7.1%

6.7%

6.2%

% 6.0%

5.0%

4.0%

3.77%*

3.0%

2.0%

1.0%

www.edbodmer.com

Note: *Long run annual default rate is 3.77%

Months

edbodmer@aol.com

71December 22

Feb-03

Jan-03

Dec-02

Nov-02

Oct-02

Sep-02

Aug-02

Jul-02

Jun-02

May-02

Apr-02

Mar-02

Feb-02

Jan-02

Dec-01

Nov-01

Oct-01

Sep-01

Aug-01

Jul-01

Jun-01

May-01

Apr-01

Mar-01

Feb-01

Jan-01

0.0%

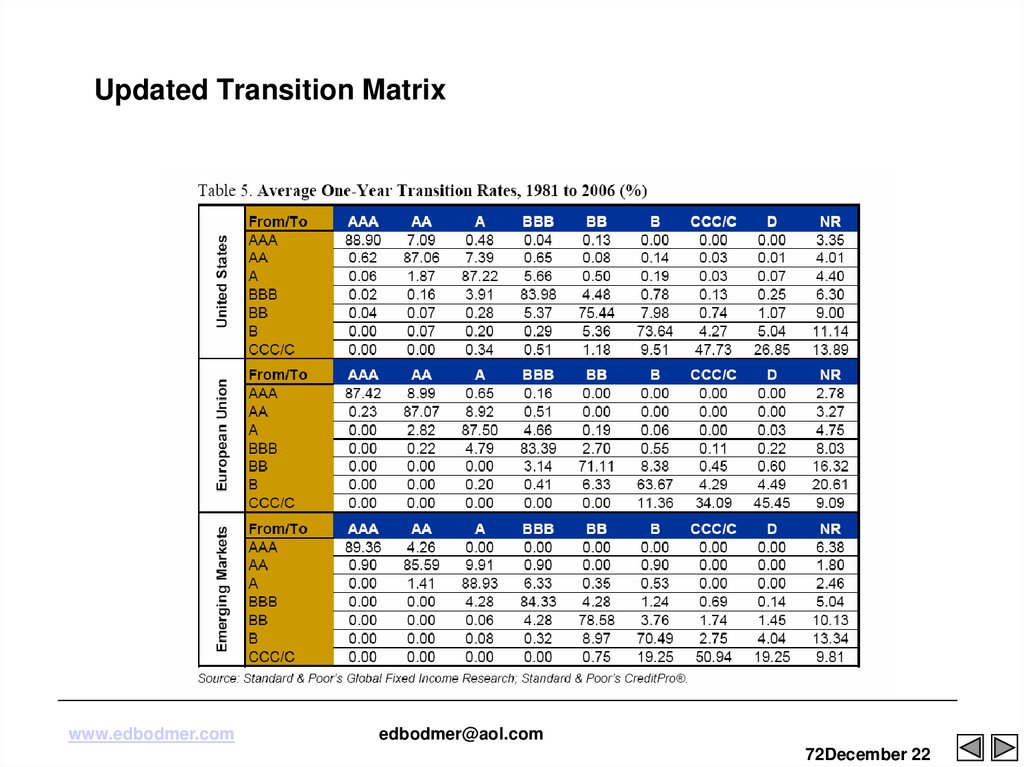

72. Updated Transition Matrix

www.edbodmer.comedbodmer@aol.com

72December 22

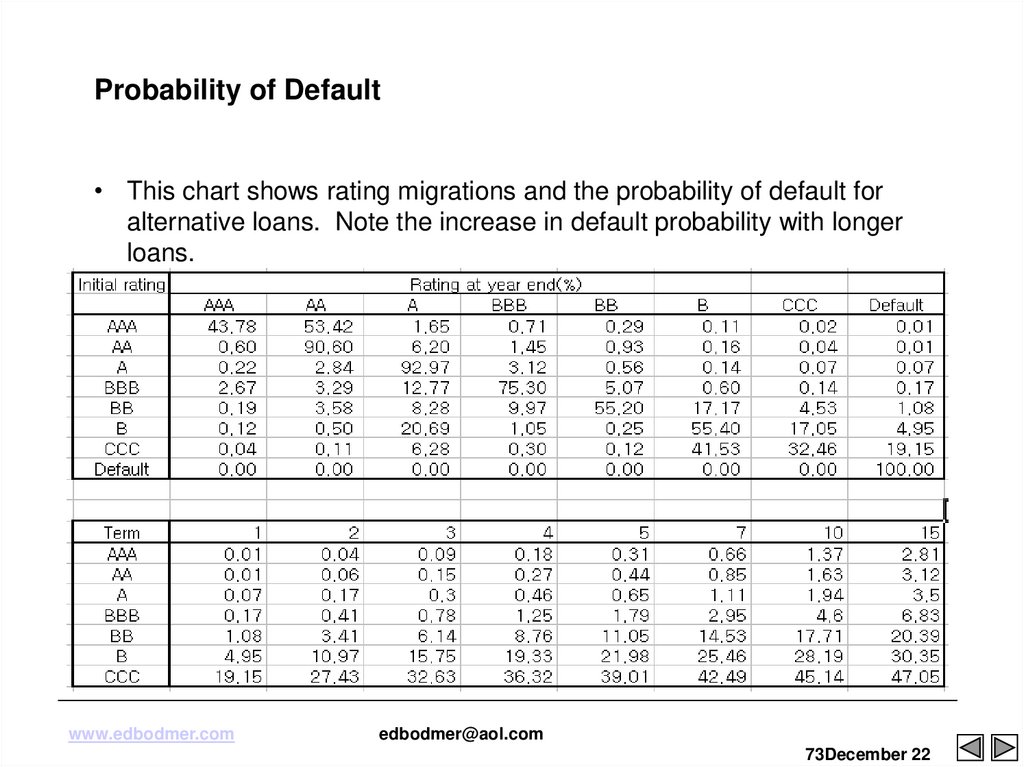

73. Probability of Default

• This chart shows rating migrations and the probability of default foralternative loans. Note the increase in default probability with longer

loans.

www.edbodmer.com

edbodmer@aol.com

73December 22

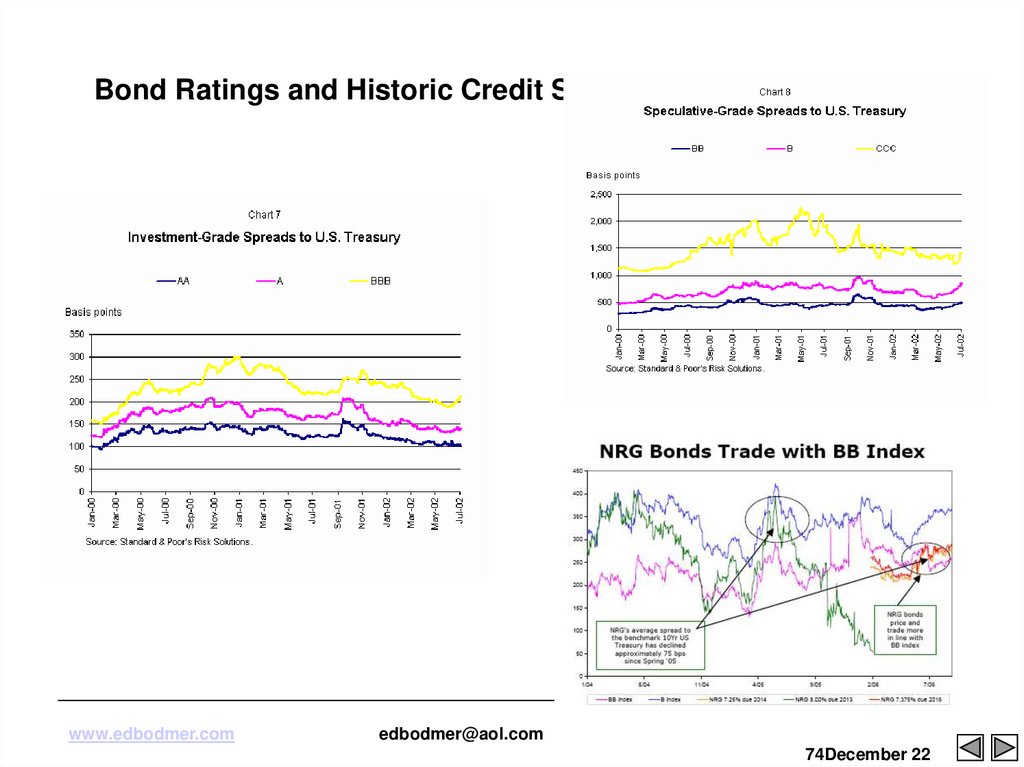

74. Bond Ratings and Historic Credit Spreads

www.edbodmer.comedbodmer@aol.com

74December 22

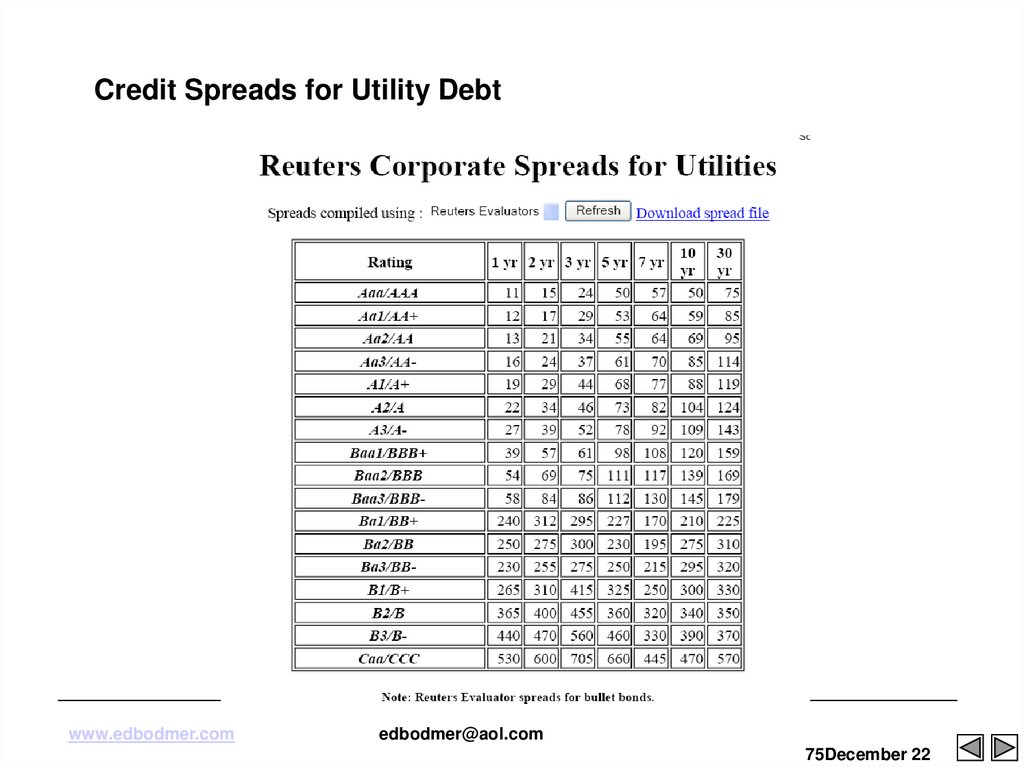

75. Credit Spreads for Utility Debt

www.edbodmer.comedbodmer@aol.com

75December 22

76. DSCR Criteria in Different Industries in Project Finance

Electric Power:

1.3-1.4

Resources:

1.5-2.0

Telecoms:

1.5-2.0

Infrastructure:

1.2-1.6

Minimum ratio could dip to 1.5

At a minimum, investment-grade merchant projects probably will have to exceed a

2.0x annual DSCR through debt maturity, but also show steadily increasing ratios.

Even with 2.0x coverage levels, Standard & Poor's will need to be satisfied that

the scenarios behind such forecasts are defensible. Hence, Standard & Poor's

may rely on more conservative scenarios when determining its rating levels.

For more traditional contract revenue driven projects, minimum base case

coverage levels should exceed 1.3x to 1.5x levels for investment-grade.

www.edbodmer.com

edbodmer@aol.com

76December 22

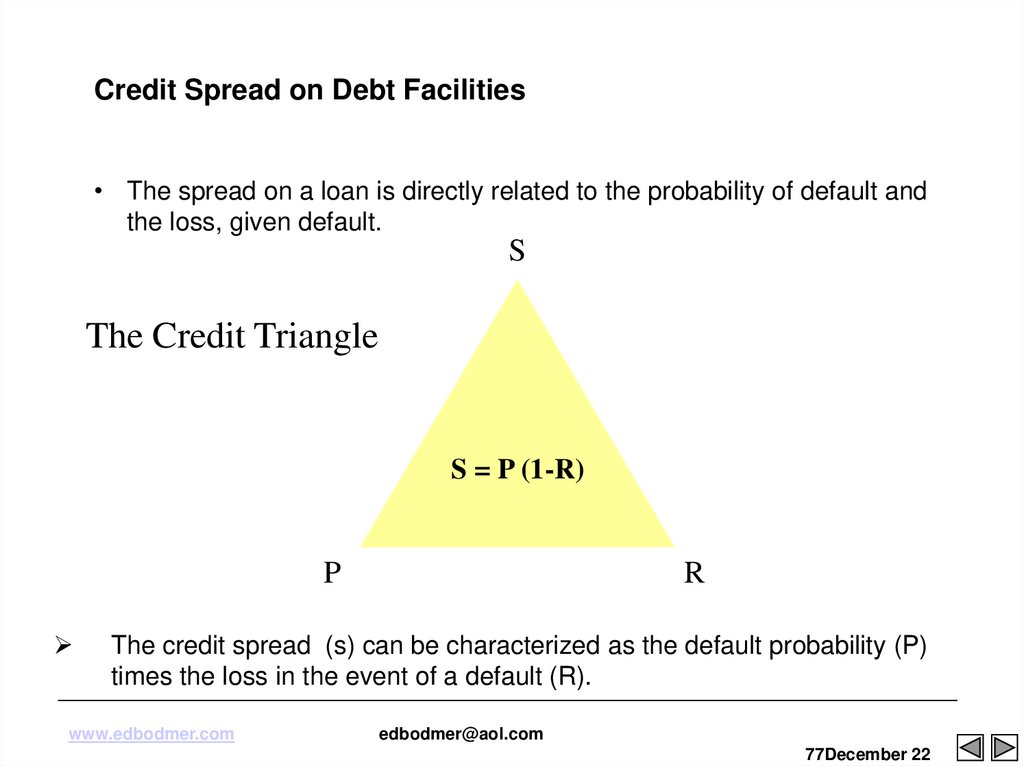

77. Credit Spread on Debt Facilities

• The spread on a loan is directly related to the probability of default andthe loss, given default.

S

The Credit Triangle

S = P (1-R)

P

R

The credit spread (s) can be characterized as the default probability (P)

times the loss in the event of a default (R).

www.edbodmer.com

edbodmer@aol.com

77December 22

78. Expected Loss Can Be Broken Down Into Three Components

Borrower RiskEXPECTED

LOSS

$$

=

Probability of

Default

Facility Risk Related

Loss Severity

x

Given Default

Loan Equivalent

x

Exposure

(PD)

(Severity)

(Exposure)

%

%

$$

What is the probability

of the counterparty

defaulting?

If default occurs, how

much of this do we

expect to lose?

If default occurs, how

much exposure do we

expect to have?

The focus of grading tools is on modeling PD

www.edbodmer.com

edbodmer@aol.com

78December 22

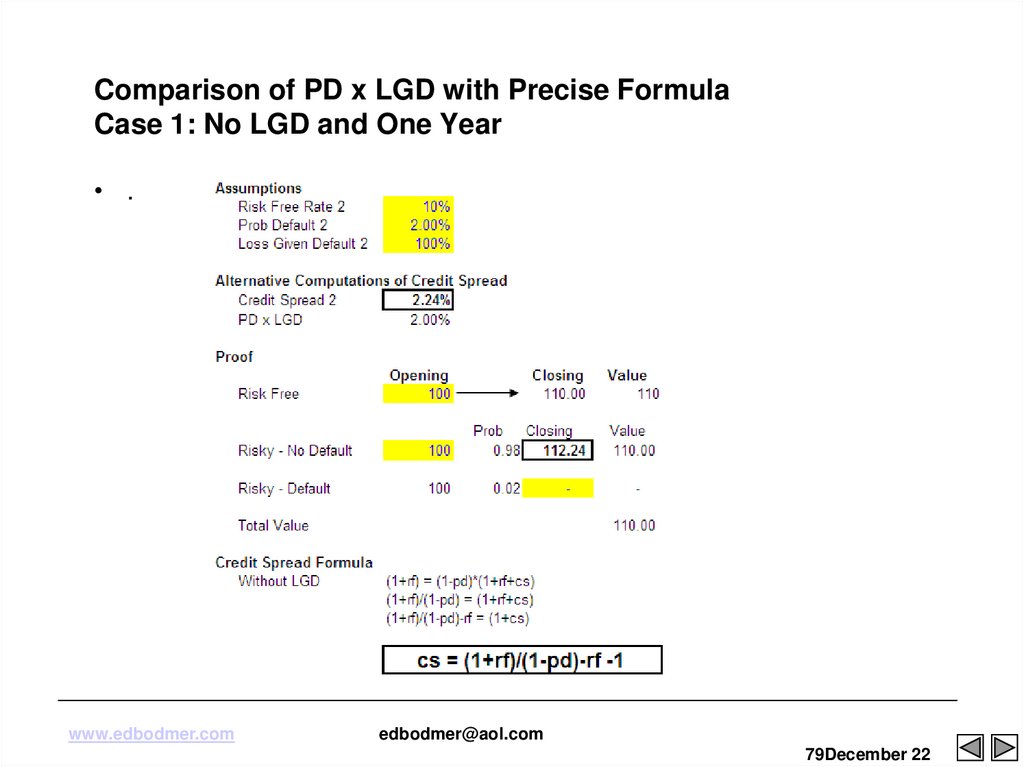

79. Comparison of PD x LGD with Precise Formula Case 1: No LGD and One Year

• .www.edbodmer.com

edbodmer@aol.com

79December 22

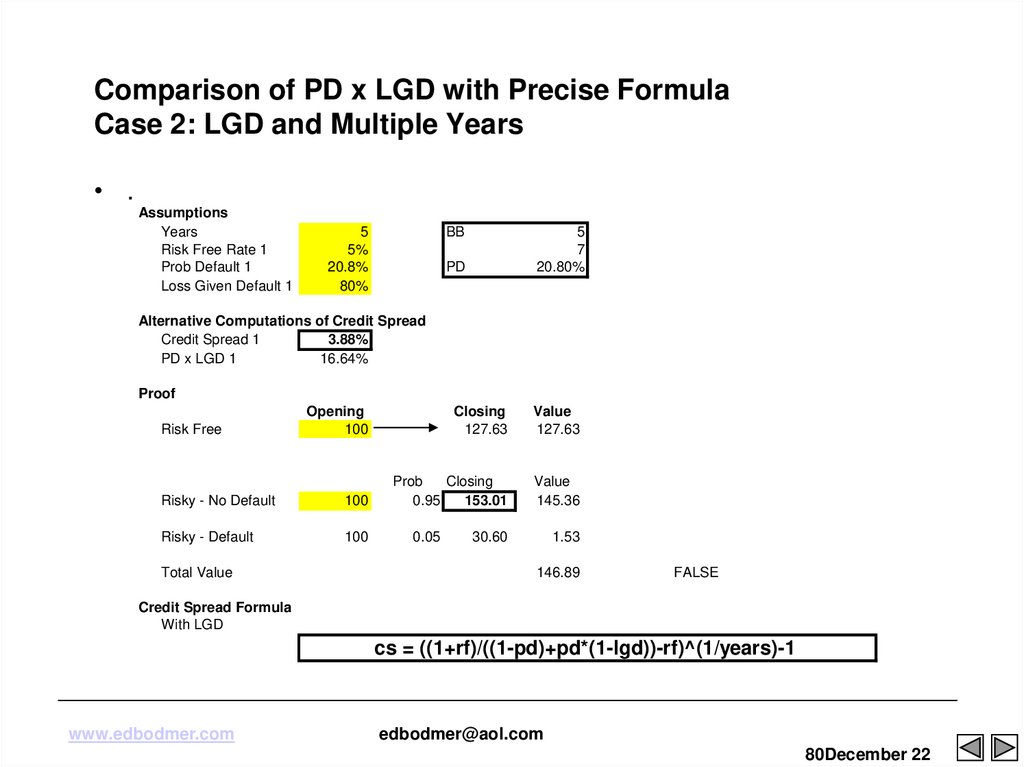

80. Comparison of PD x LGD with Precise Formula Case 2: LGD and Multiple Years

• .Assumptions

Years

Risk Free Rate 1

Prob Default 1

Loss Given Default 1

5

5%

20.8%

80%

BB

PD

5

7

20.80%

Opening

100

Closing

127.63

Value

127.63

Risky - No Default

100

Prob

Closing

0.95

153.01

Value

145.36

Risky - Default

100

Alternative Computations of Credit Spread

Credit Spread 1

3.88%

PD x LGD 1

16.64%

Proof

Risk Free

Total Value

0.05

30.60

1.53

146.89

FALSE

Credit Spread Formula

With LGD

cs = ((1+rf)/((1-pd)+pd*(1-lgd))-rf)^(1/years)-1

www.edbodmer.com

edbodmer@aol.com

80December 22

81. Default Rates by Industry

www.edbodmer.comedbodmer@aol.com

81December 22

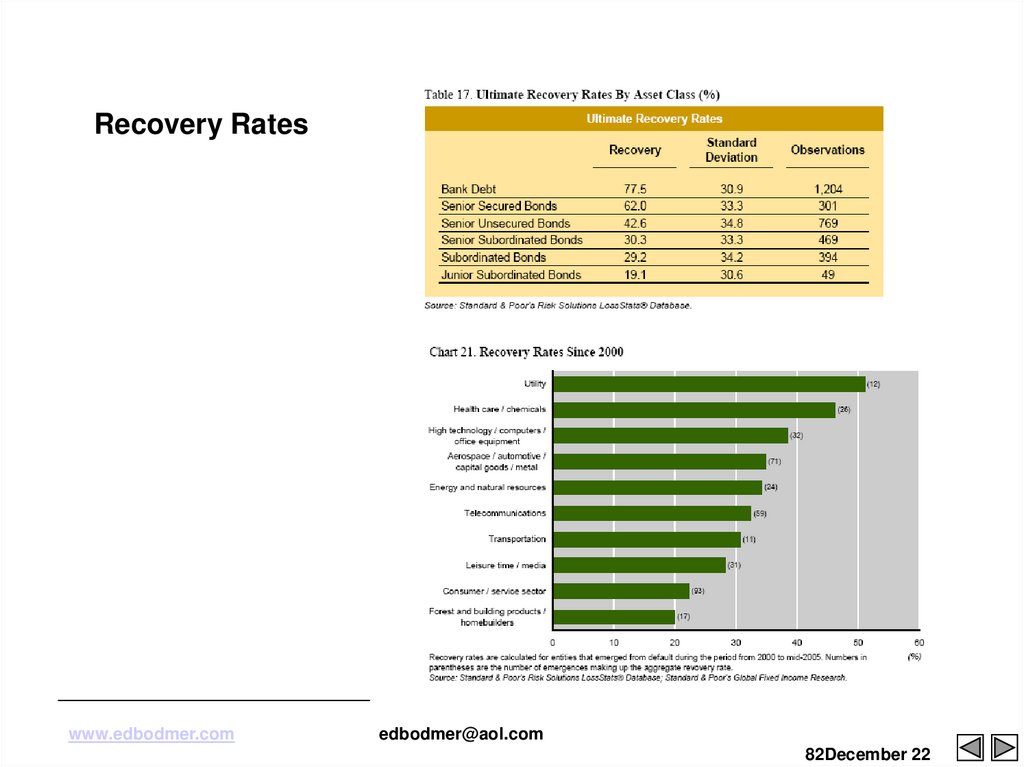

82. Recovery Rates

www.edbodmer.comedbodmer@aol.com

82December 22

83. Mathematical Credit Analysis

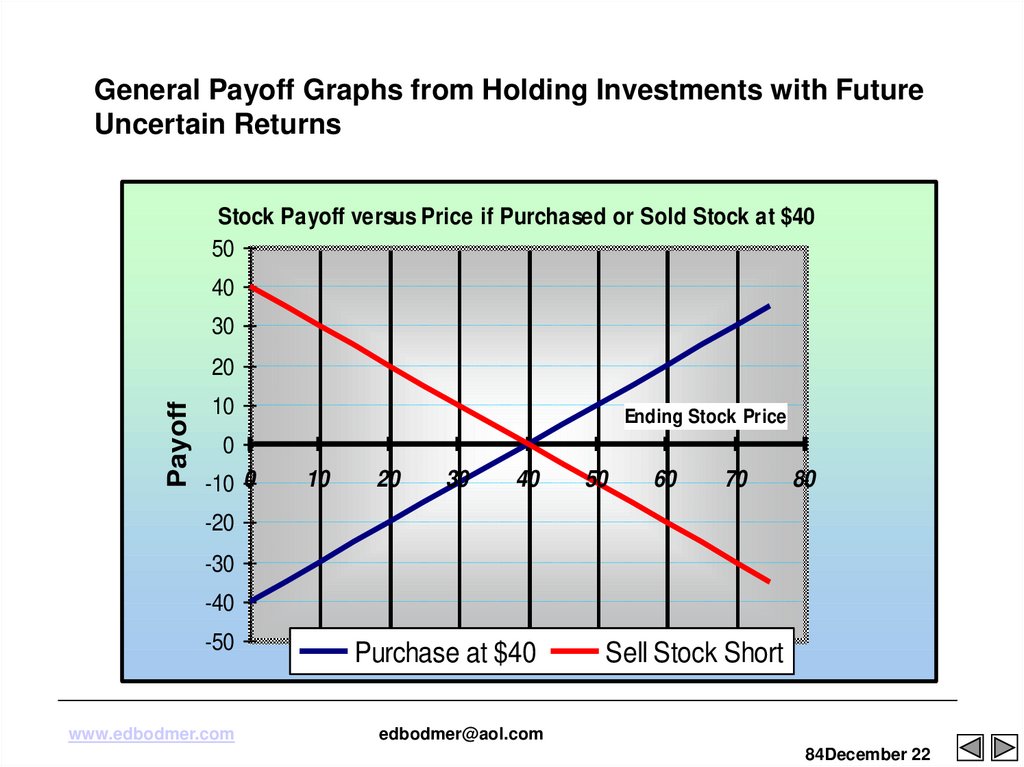

83 December 2284. General Payoff Graphs from Holding Investments with Future Uncertain Returns

Stock Payoff versus Price if Purchased or Sold Stock at $4050

40

30

Payoff

20

10

Ending Stock Price

0

-10 0

10

20

30

40

50

60

70

80

-20

-30

-40

-50

www.edbodmer.com

Purchase at $40

Sell Stock Short

edbodmer@aol.com

84December 22

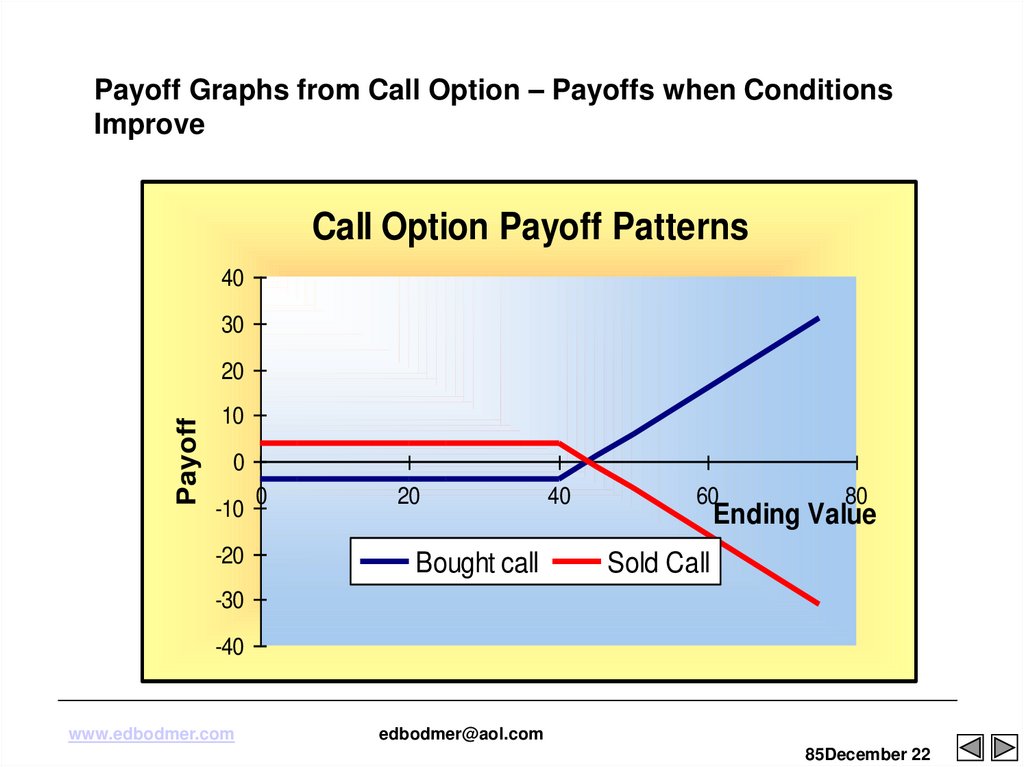

85. Payoff Graphs from Call Option – Payoffs when Conditions Improve

Call Option Payoff Patterns40

30

Payoff

20

10

0

-10

-20

0

20

Bought call

40

60

80

Ending Value

Sold Call

-30

-40

www.edbodmer.com

edbodmer@aol.com

85December 22

86. Payoff Graphs from Buying Put Option – Returns are realized to buyer when the value declines

www.edbodmer.comedbodmer@aol.com

86December 22

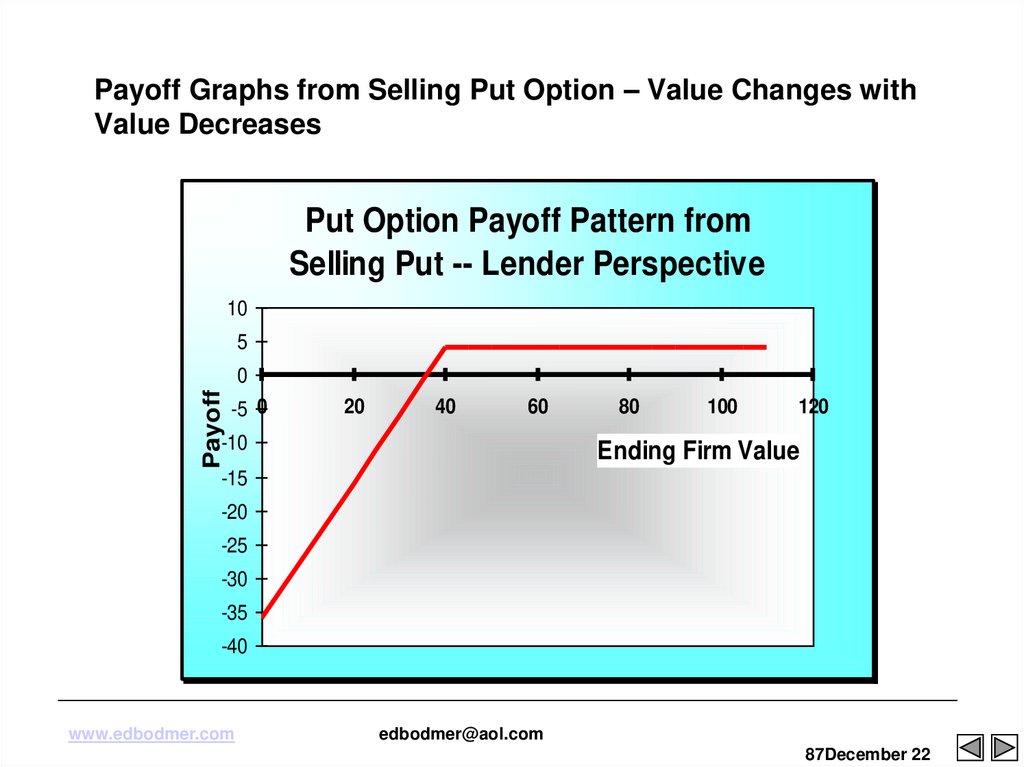

87. Payoff Graphs from Selling Put Option – Value Changes with Value Decreases

Put Option Payoff Pattern fromSelling Put -- Lender Perspective

10

5

Payoff

0

-5 0

20

40

60

-10

80

100

120

Ending Firm Value

-15

-20

-25

-30

-35

-40

www.edbodmer.com

edbodmer@aol.com

87December 22

88. The Black-Scholes/Merton Approach

Consider a firm with equity and one debt issue.

The debt issue matures at date T and has principal F.

It is a zero coupon bond for simplicity.

Value of the firm is V(t).

Value of equity is E(t).

Current value of debt is D(t).

www.edbodmer.com

edbodmer@aol.com

88December 22

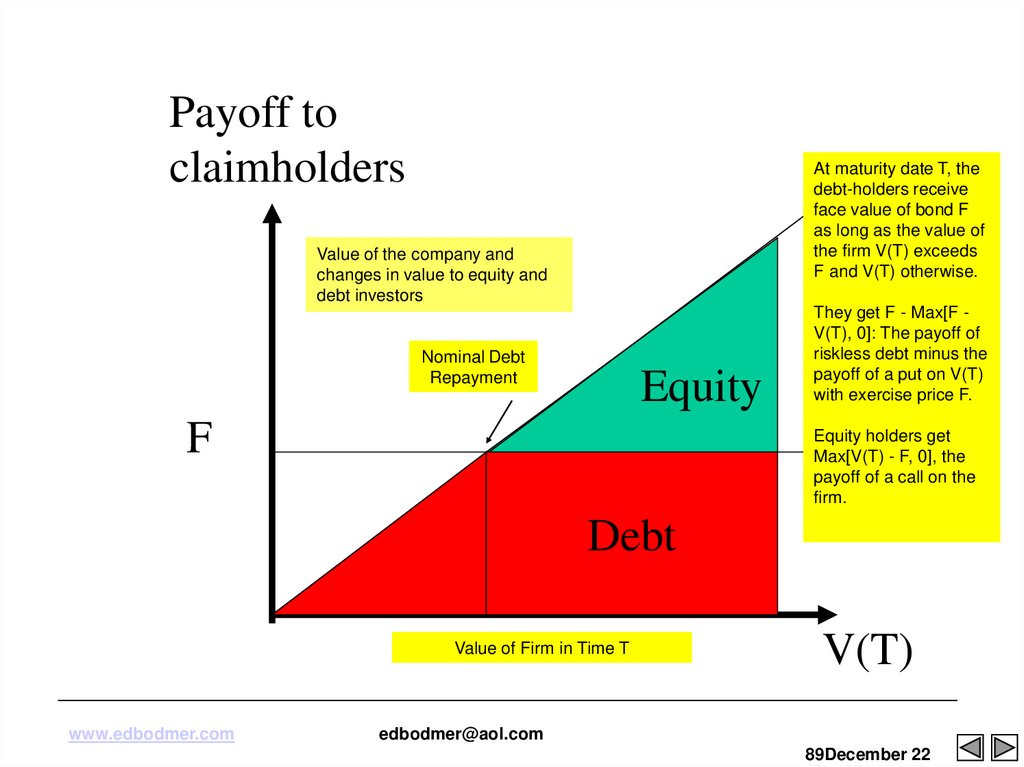

89.

Payoff toclaimholders

At maturity date T, the

debt-holders receive

face value of bond F

as long as the value of

the firm V(T) exceeds

F and V(T) otherwise.

Value of the company and

changes in value to equity and

debt investors

Nominal Debt

Repayment

Equity

F

They get F - Max[F V(T), 0]: The payoff of

riskless debt minus the

payoff of a put on V(T)

with exercise price F.

Equity holders get

Max[V(T) - F, 0], the

payoff of a call on the

firm.

Debt

Value of Firm in Time T

www.edbodmer.com

V(T)

edbodmer@aol.com

89December 22

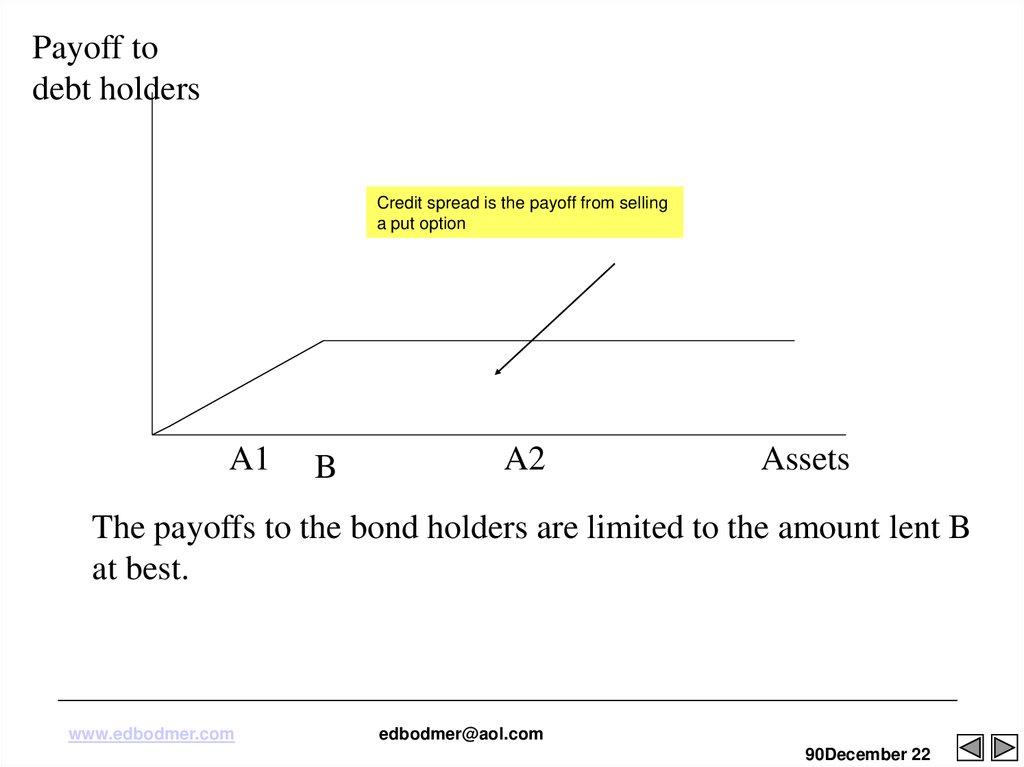

90.

Payoff todebt holders

Credit spread is the payoff from selling

a put option

A1

B

A2

Assets

The payoffs to the bond holders are limited to the amount lent B

at best.

www.edbodmer.com

edbodmer@aol.com

90December 22

91. Merton’s Model

Merton’s model regards the equity as an option on the assets of the firm

In a simple situation the equity value is

max(VT -D, 0)

where VT is the value of the firm and D is the debt repayment required

Assumptions

Markets are frictionless, there is no difference between borrowing and

lending rates

Market value of the assets of a company follow Brownian Motion Process

with constant volatility

No cash flow payouts during the life of the debt contract – no debt repayments and no dividend payments

APR is not violated

www.edbodmer.com

edbodmer@aol.com

91December 22

92. Merton‘s Structural Model (1974)

• Assumes a simple capital structure with all debt represented by one zerocoupon bond – problem in project finance because of amortization of

bonds.

• We will derive the loss rates endogenously, together with the default

probability

• Risky asset V, equity S, one zero bond B maturing at T and face value

(incl. Accrued interest) F

• Default risk on the loan to the firm is tantamount to the firm‘s assets VT

falling below the obligations to the debt holders F

• Credit risk exists as long as probability (V<F)>0

• This naturally implies that at t=0, B0<Fe-rT; yT>rf, where πT=yT-rf is the

default spread which compensates the bond holder for taking the default

risk

www.edbodmer.com

edbodmer@aol.com

92December 22

93. Merton Model Propositions

Face value of zero coupon debt is strike price

Can use the Black-Scholes model with equity as a call or debt as a put option to directly

measure the value of risky debt

Can use to compute the required yield on a risky bond:

PV of Debt = Face x (1+y)^t

or

(1+y)^t = PV/Face

(1+y) = (PV/Face)^(1/t)

y = (PV/Face)^(1/t) – 1

With continual compounding = - Ln(PV/Face)/t

Computation of the yield allows computation of the required credit spread and computation of

debt value

Borrower always holds a valuable default or repayment option. If things go well repayment

takes place, borrower pays interest and principal keeps the remaining upside, If things go bad,

limited liability allows the borrower to default and walk away losing his/her equity.

www.edbodmer.com

edbodmer@aol.com

93December 22

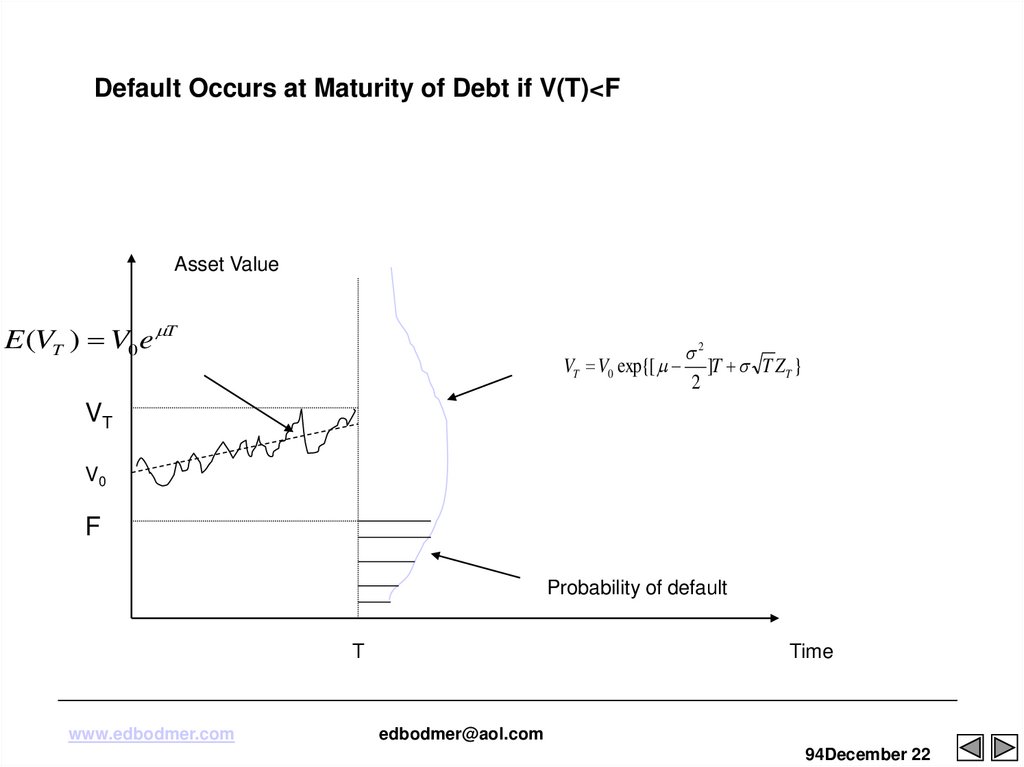

94. Default Occurs at Maturity of Debt if V(T)<F

Default Occurs at Maturity of Debt if V(T)<FAsset Value

E (VT ) V0 e T

2

VT V0 exp{[ ]T T ZT }

2

VT

V0

F

Probability of default

T

www.edbodmer.com

Time

edbodmer@aol.com

94December 22

95. Resources and Contacts

• My contactsEd Bodmer

Phone: +001-630-886-2754

E-mail: edbodmer@aol.com

• Other Sources

Financial Library – project finance case studies including Eurotunnel

and Dabhol

Financial Library – Monte Carlo simulation analysis

www.edbodmer.com

edbodmer@aol.com

95December 22

finance

finance