Similar presentations:

Fundamentals of financial statement analysis. (Lecture 1)

1.

LECTURE 1. FUNDAMENTALS OFFINANCIAL STATEMENT ANALYSIS

Olga Uzhegova, DBA

2015

Brooks, Raymond. 2010. Financial management : core concepts. 1st ed, The

Prentice Hall series in finance. Boston: Prentice Hall. (Chapters 2, 14)

FIN 3121 Principles of Finance

2. LEARNING OBJECTIVES

Understand and conduct horizontal analysisCreate, understand, and interpret common-size

financial statements.

Calculate and interpret financial ratios.

Compare different company performances, using

financial ratios, historical financial ratio trends, and

industry ratios.

3.

I. Overview of Financial Statements3

4. TYPES OF FINANCIAL STATEMENTS

T Y P E S O F F I N A N C I A L S TAT E M E N T S• Balance Sheet

• Income Statement

• Statement of Cash Flows

• Statement of Changes in the Owner’s Equity

4

5. BALANCE SHEET

Statement of financial positionAssets

=

Statement of financial Condition

Liabilities

+

Equity

The balance sheet provides a snapshot of a firm’s

financial position at a particular date.

assets ≡ liabilities + owners’ equity

5

6. INCOME STATEMENT (P/L STATEMENT)

It is also known as Profit/Loss Statement, Operating Statement,

or Statement of Operations

It measures the results of firm’s operation over a specific period.

The bottom line of the income statement shows the firm’s

profit or loss for a period.

6

7. INCOME STATEMENT (P/L STATEMENT)

Total Sales / RevenuesCost of Goods Sold (COGS)

=

Gross Profit

Operating Expenses

=

Operating Income

+/Other Income/Other expenses

=

Earnings before Interest and Taxes ( EBIT)

+/Interest Income / Interest Expenses

=

Earnings Before Taxes (EBT) or Pre-Tax Income

Taxes

=

Net Income

7

8. CASH FLOWS STATEMENT

Cash flows from Operations+

Cash flows from Investments

+

Cash flows from Financing

=

Net change in cash

Cash Flows Statement shows:

how cash was generated, and

how it was used.

8

9. STATEMENT OF OWNER’S EQUITY

Statement of Changes in the Owner’s Equity is a financial statementthat presents a summary of the changes in owners’ equity accounts over

the reporting period. It reconciles the opening balances of equity accounts

with their closing balances.

Figures used to compile this statement are derived from previous and

current Balance Sheets and from the current Income Statement.

9

10.

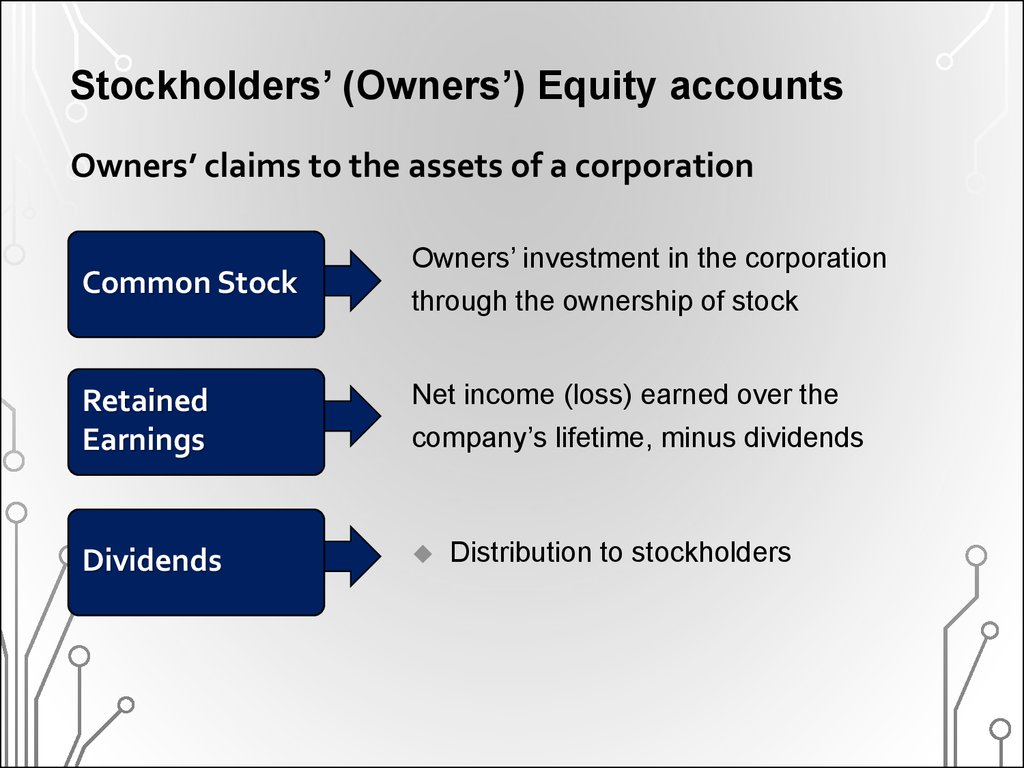

Stockholders’ (Owners’) Equity accountsOwners’ claims to the assets of a corporation

Common Stock

Owners’ investment in the corporation

through the ownership of stock

Retained

Earnings

Net income (loss) earned over the

company’s lifetime, minus dividends

Dividends

Distribution to stockholders

11.

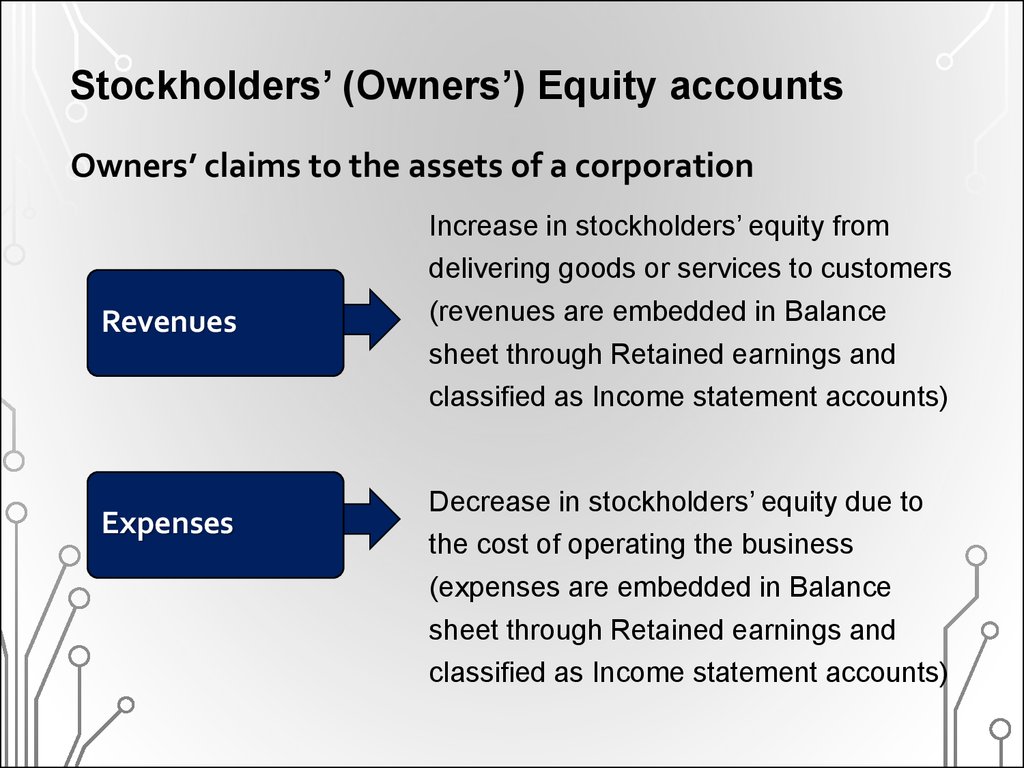

Stockholders’ (Owners’) Equity accountsOwners’ claims to the assets of a corporation

Revenues

Expenses

Increase in stockholders’ equity from

delivering goods or services to customers

(revenues are embedded in Balance

sheet through Retained earnings and

classified as Income statement accounts)

Decrease in stockholders’ equity due to

the cost of operating the business

(expenses are embedded in Balance

sheet through Retained earnings and

classified as Income statement accounts)

12.

(1) Increases in stockholders’ equity: Sale of stock and netincome (revenue greater than expenses).

(2) Decreases in stockholders’ equity: Dividends and net

loss (expenses greater than revenue).

13.

II. ANALYSIS OF FINANCIAL STATEMENTS13

14. APPROACHES TOWARDS FINANCIAL ANALYSIS

To conduct financial analysis it is possible to1.

Compare actual with budgeted values

2.

Compare a firm’s current performance against that of its own performance

(and/or of the performance of other companies in the industry) over a certain time

period by looking at the growth (decline) rate in various key items such as sales,

costs, and profits (trend analysis). Once trends are established, future

performance could be predicted.

3.

Recast the income statement and the balance sheet into common-size

statements by expressing each income statement item as a percent of sales and

each balance sheet item as a percent of total assets.

4.

Conduct ratio analysis. This allows for more in-depth diagnosis through

individual item analyses and comparisons

14

Setting up a standard of comparison is a benchmarking.

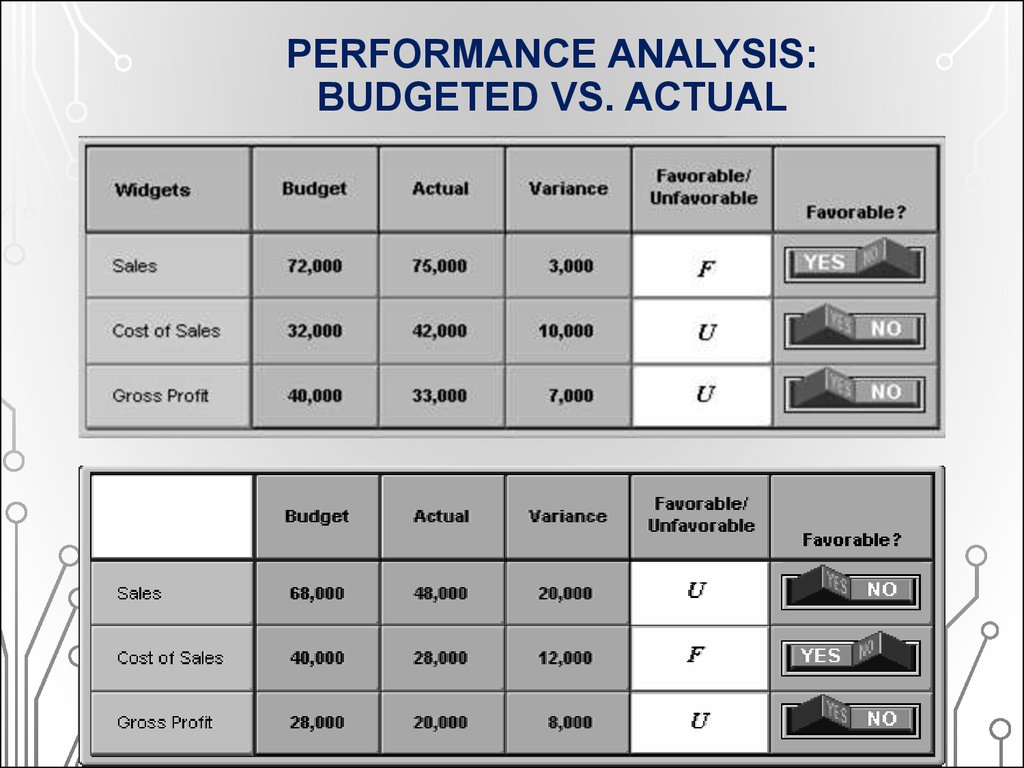

15. PERFORMANCE ANALYSIS: BUDGETED VS. ACTUAL

Favourable VarianceUnfavourable Variance

Budgeted

Actual

Budgeted

Actual

Revenue

$ nnn

$ NNN

$ NNN

$ nnn

Expenses

$ NNN

$ nnn

$ nnn

$ NNN

15

16. PERFORMANCE ANALYSIS: BUDGETED VS. ACTUAL

1617.

HORIZONTAL (TREND) ANALYSISType 1: Percentage changes from year-to-year

Two steps:

1. Compute dollar (or any currency) amount of change

from one period to the next

2. Divide dollar (or any currency) amount of change by

base-period amount

18.

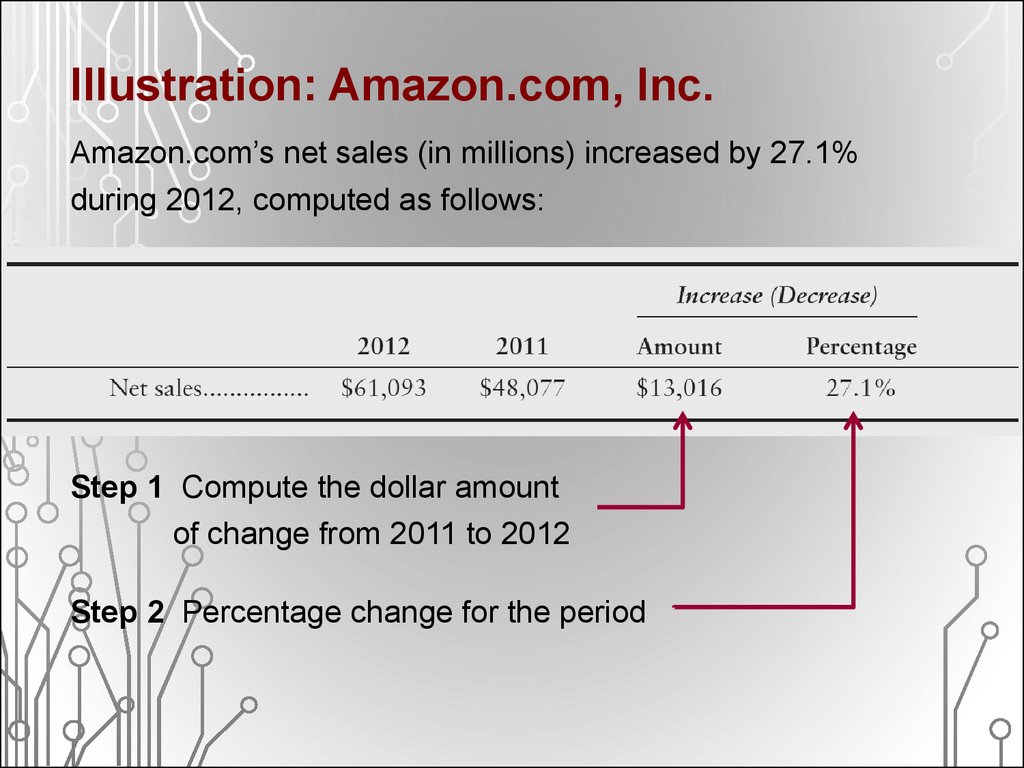

Illustration: Amazon.com, Inc.Amazon.com’s net sales (in millions) increased by 27.1%

during 2012, computed as follows:

Step 1 Compute the dollar amount

of change from 2011 to 2012

Step 2 Percentage change for the period

19.

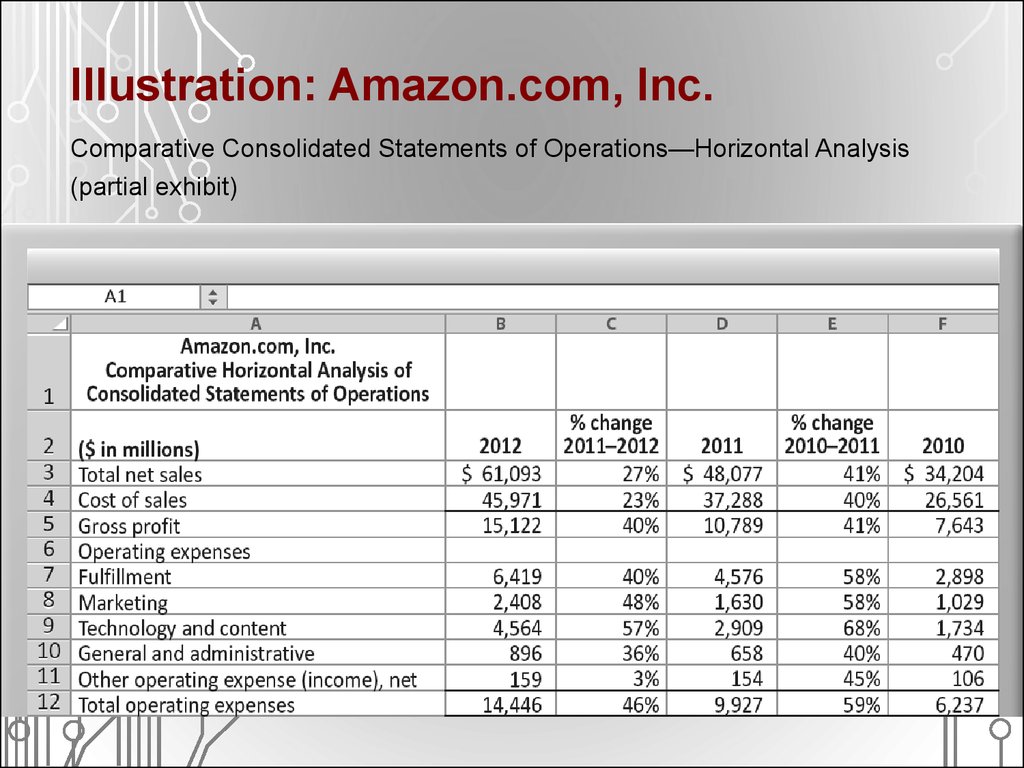

Illustration: Amazon.com, Inc.Comparative Consolidated Statements of Operations—Horizontal Analysis

(partial exhibit)

20.

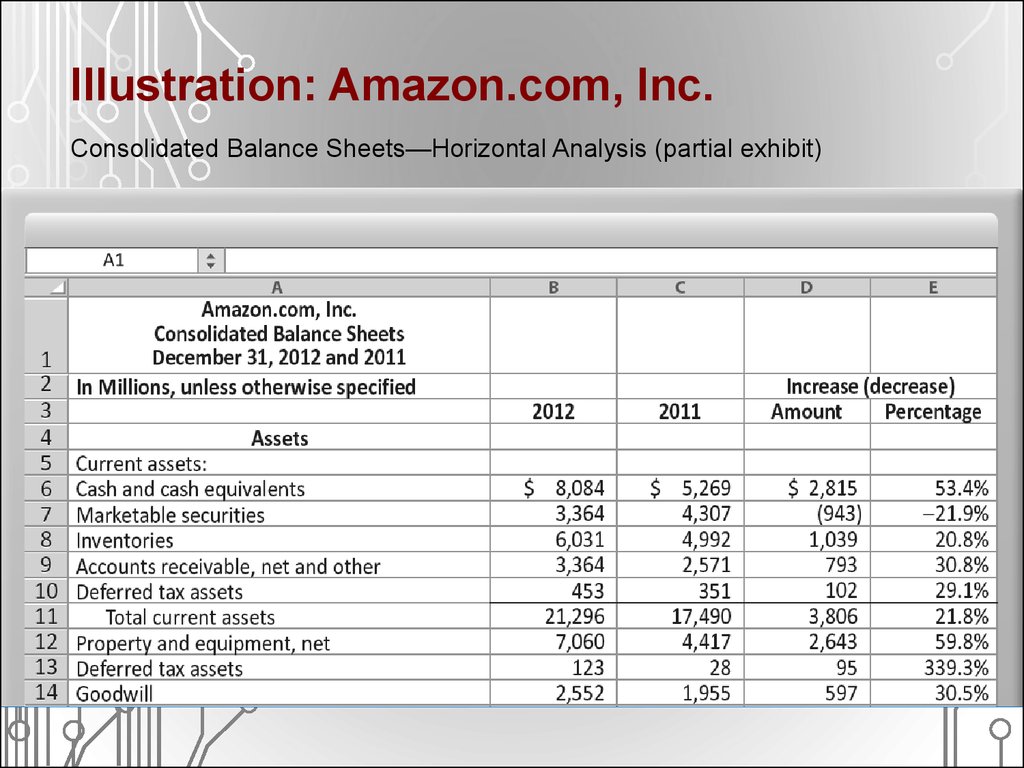

Illustration: Amazon.com, Inc.Consolidated Balance Sheets—Horizontal Analysis (partial exhibit)

21.

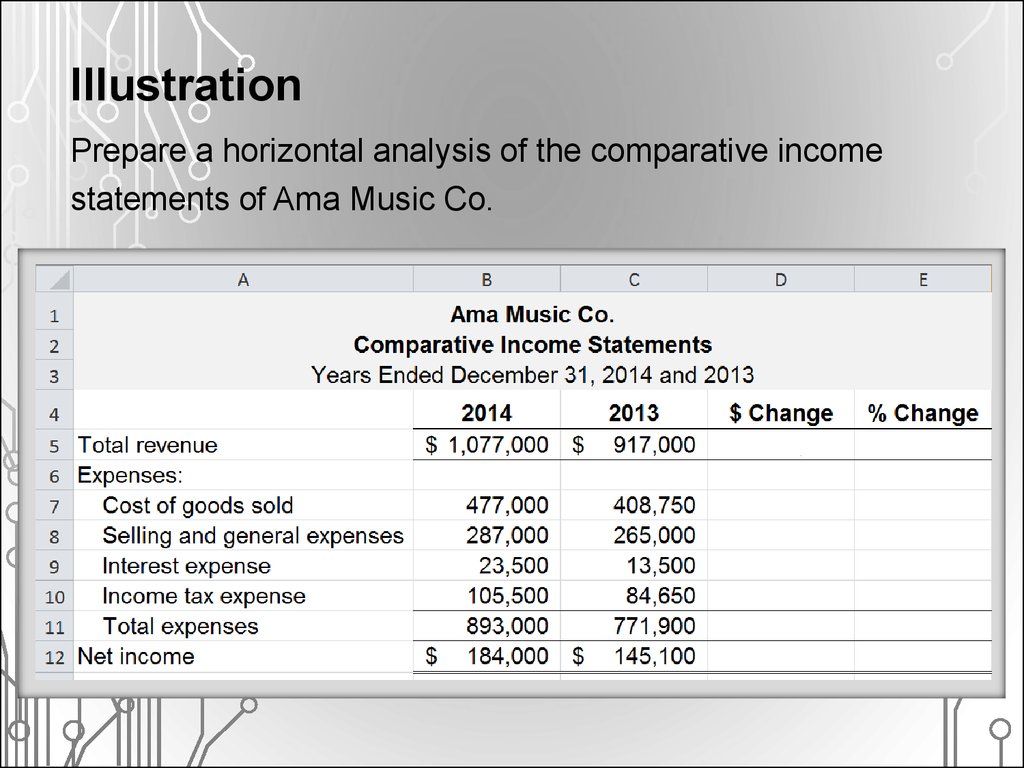

IllustrationPrepare a horizontal analysis of the comparative income

statements of Ama Music Co.

22.

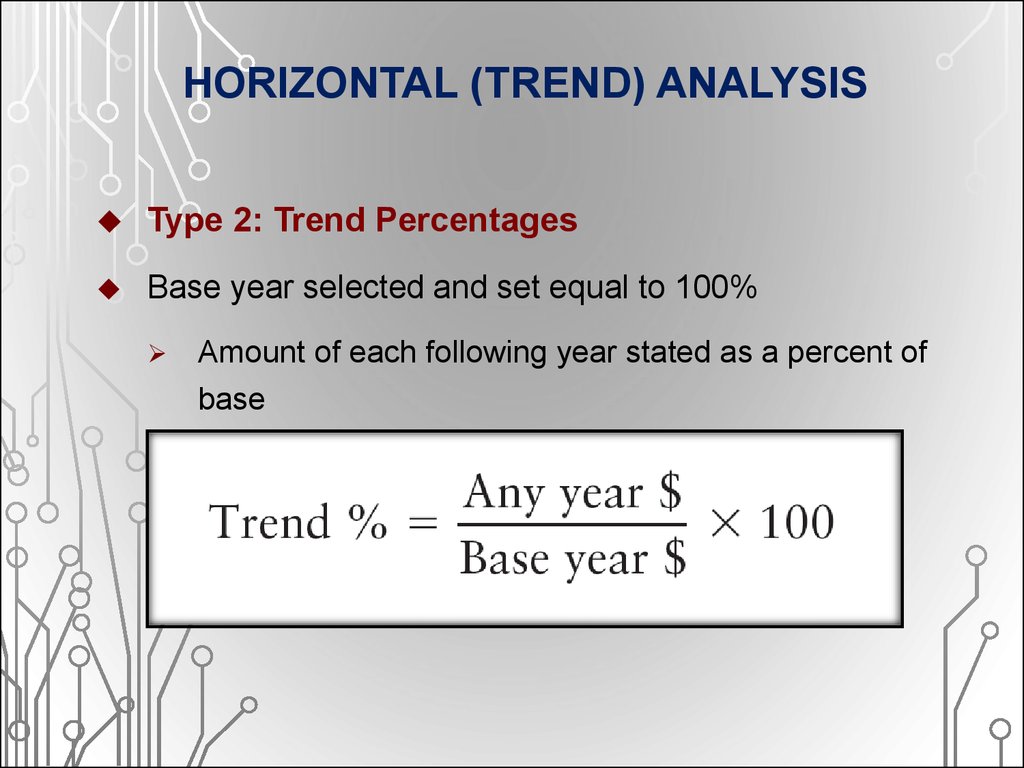

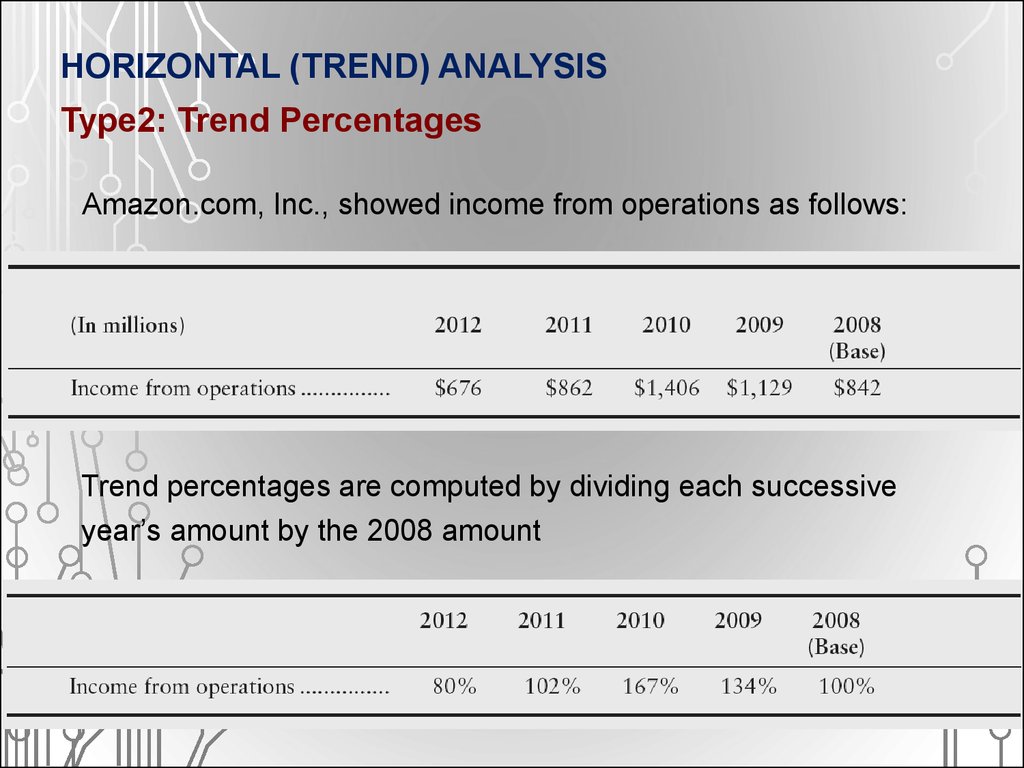

HORIZONTAL (TREND) ANALYSISType 2: Trend Percentages

Base year selected and set equal to 100%

Amount of each following year stated as a percent of

base

23.

HORIZONTAL (TREND) ANALYSISType2: Trend Percentages

Amazon.com, Inc., showed income from operations as follows:

Trend percentages are computed by dividing each successive

year’s amount by the 2008 amount

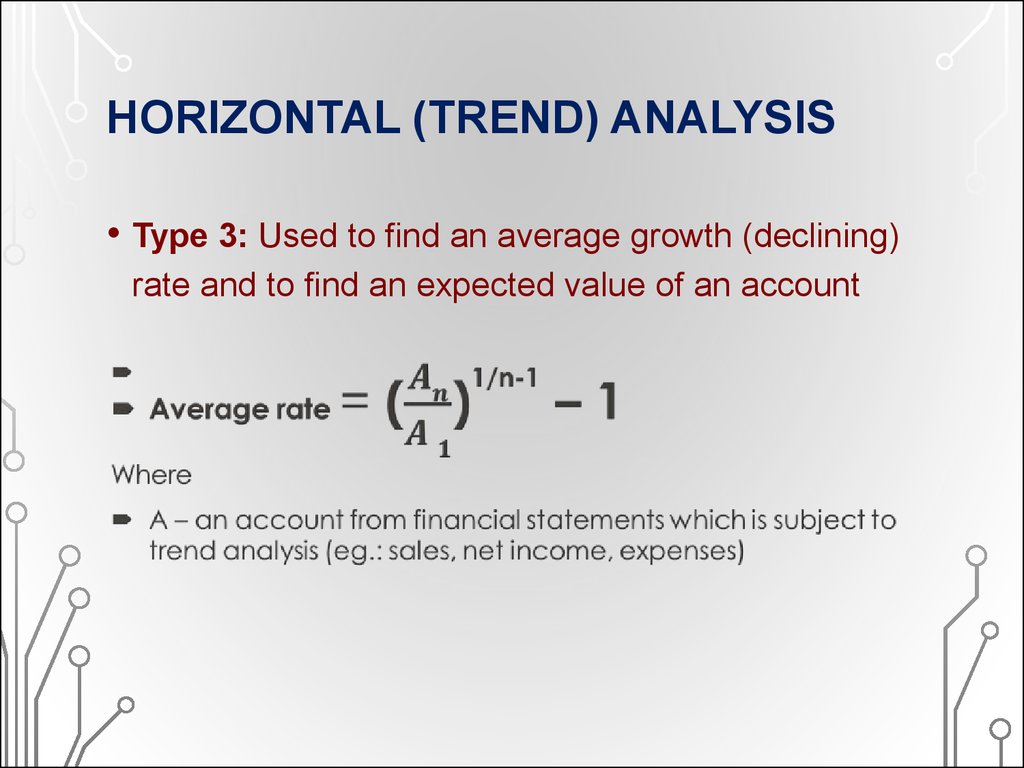

24. HORIZONTAL (TREND) ANALYSIS

• Type 3: Used to find an average growth (declining)rate and to find an expected value of an account

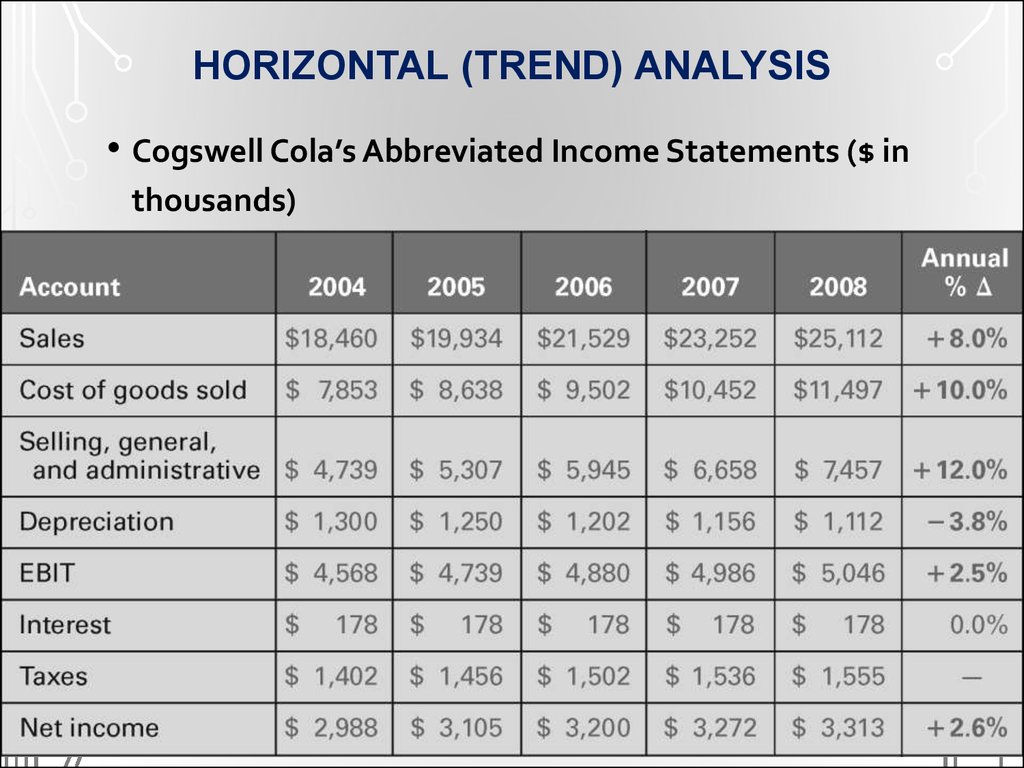

25. HORIZONTAL (TREND) ANALYSIS

• Cogswell Cola’s Abbreviated Income Statements ($ inthousands)

26.

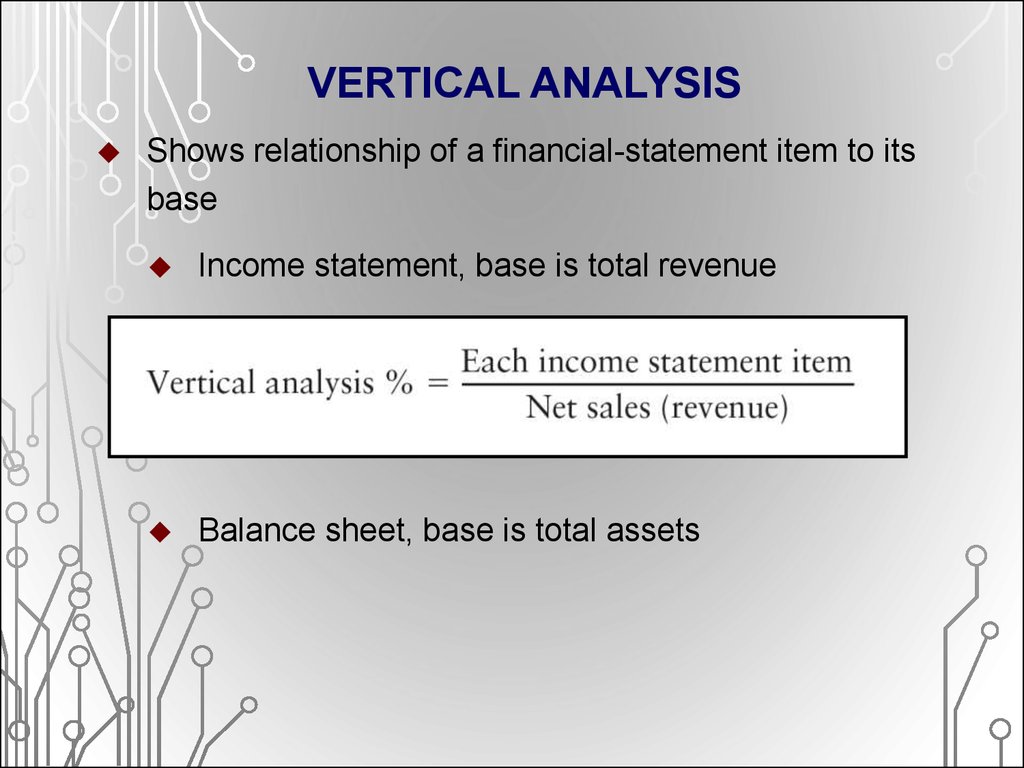

VERTICAL ANALYSISShows relationship of a financial-statement item to its

base

Income statement, base is total revenue

Balance sheet, base is total assets

27.

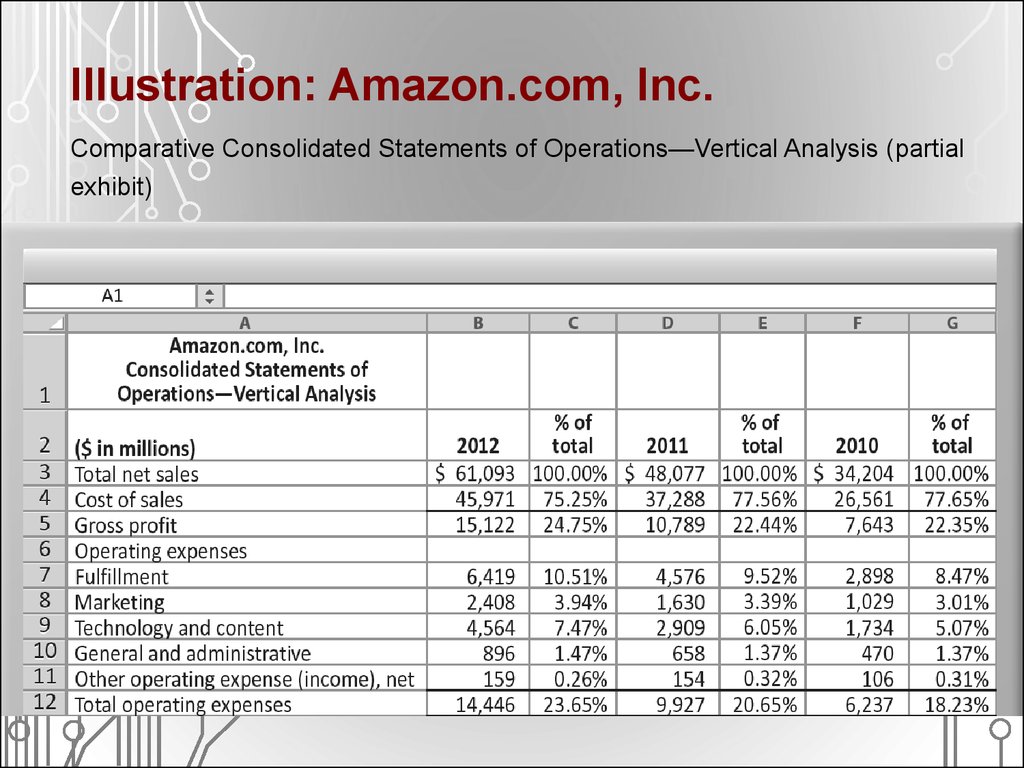

Illustration: Amazon.com, Inc.Comparative Consolidated Statements of Operations—Vertical Analysis (partial

exhibit)

28.

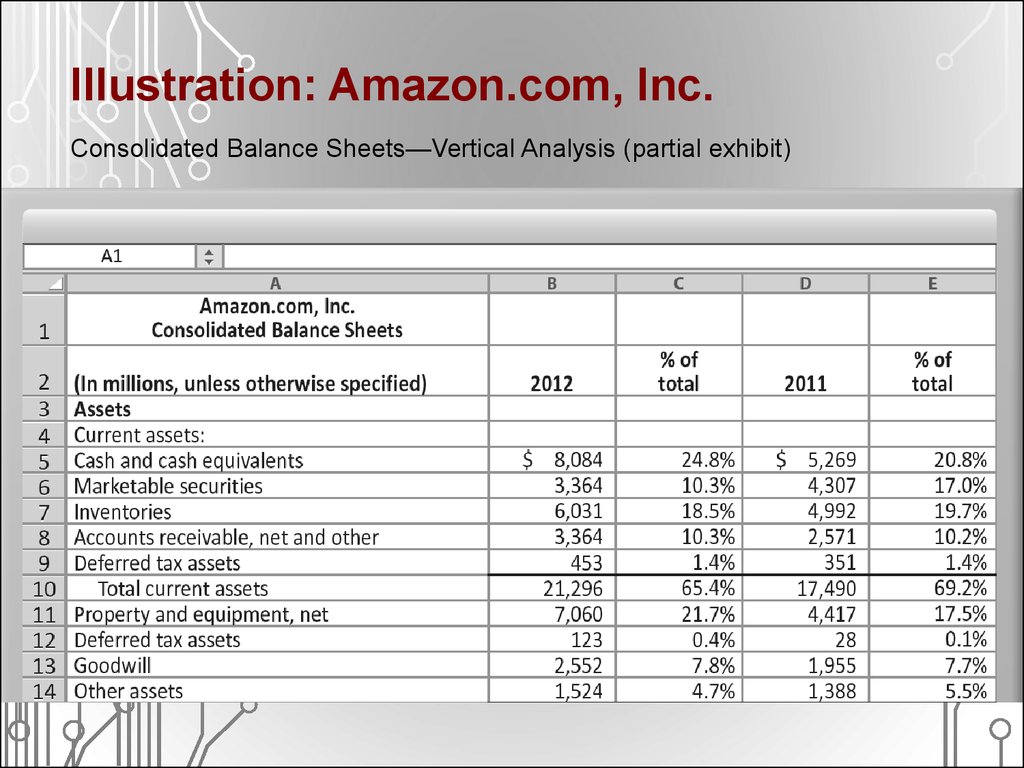

Illustration: Amazon.com, Inc.Consolidated Balance Sheets—Vertical Analysis (partial exhibit)

29.

COMMON-SIZE FINANCIAL STATEMENTSType of vertical analysis

Report only percentages (no dollar amounts)

Assists in the comparison of different companies

Expresses financial results in terms of a common

denominator

30.

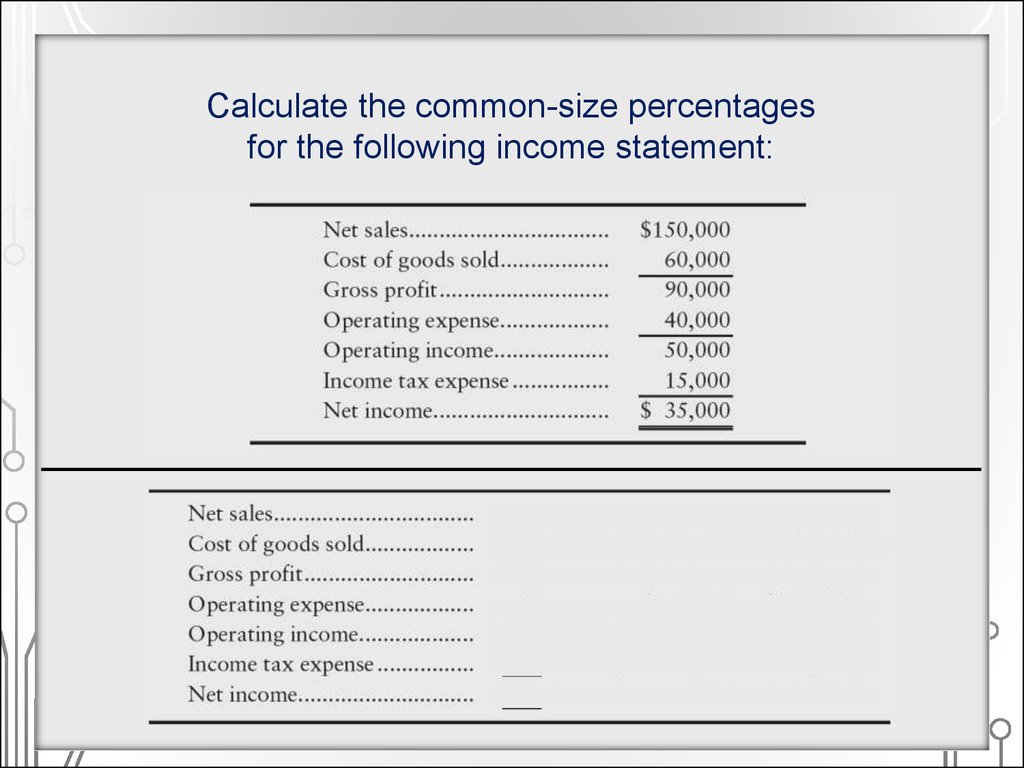

Calculate the common-size percentagesfor the following income statement:

31. FINANCIAL RATIO ANALYSIS

F I N A N C I A L R AT I O A N A LY S I SFinancial ratios are relationships between different

accounts from financial statements (due to this they are

relative values)

Financial ratios allow for meaningful comparisons across

time, between competitors, and with industry averages.

31

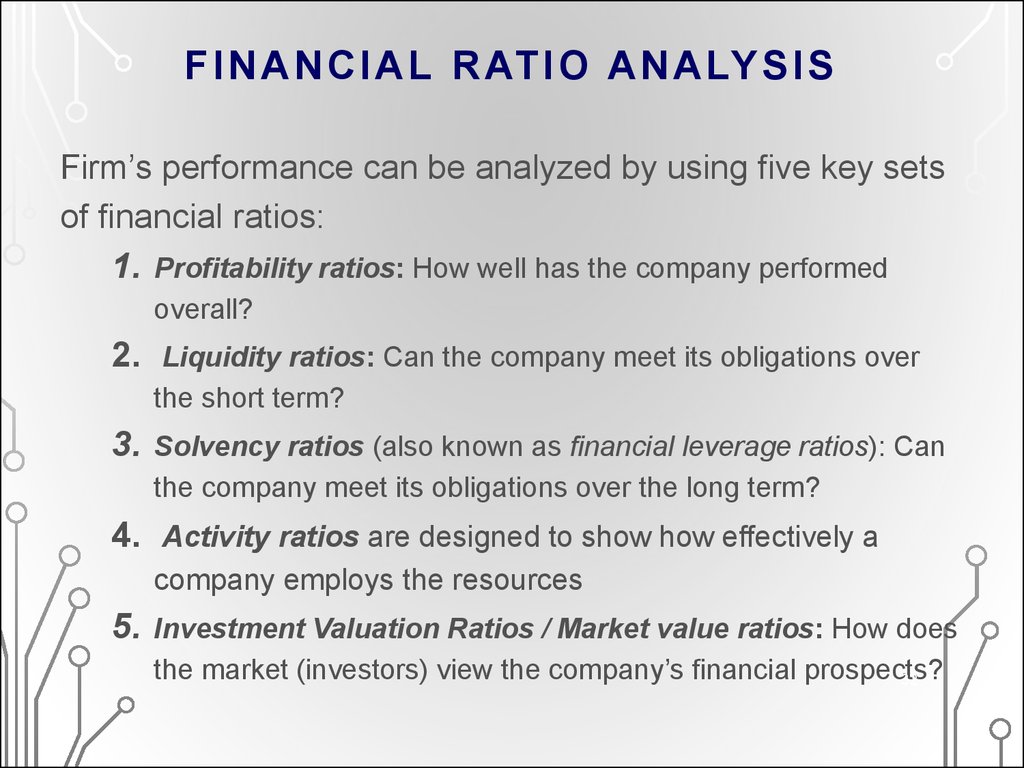

32. FINANCIAL RATIO ANALYSIS

F I N A N C I A L R AT I O A N A LY S I SFirm’s performance can be analyzed by using five key sets

of financial ratios:

1. Profitability ratios: How well has the company performed

overall?

2. Liquidity ratios: Can the company meet its obligations over

the short term?

3. Solvency ratios (also known as financial leverage ratios): Can

the company meet its obligations over the long term?

4. Activity ratios are designed to show how effectively a

company employs the resources

5. Investment Valuation Ratios / Market value ratios: How does

the market (investors) view the company’s financial prospects?

32

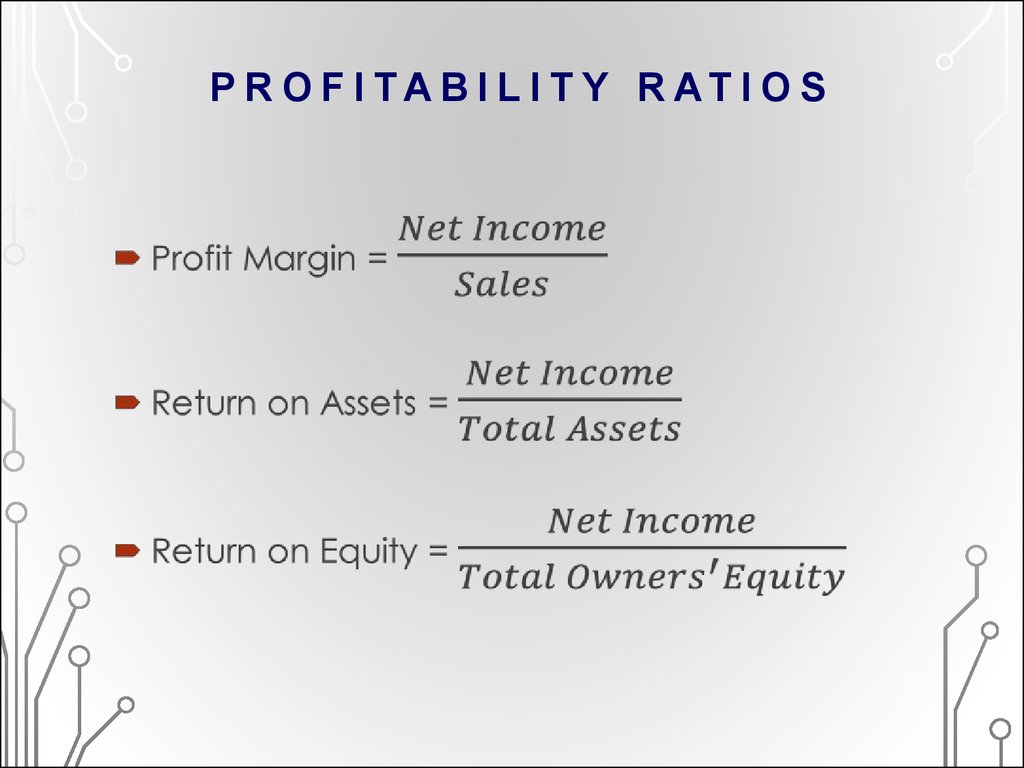

33. PROFITABILITY RATIOS

P R O F I TA B I L I T Y R AT I O S33

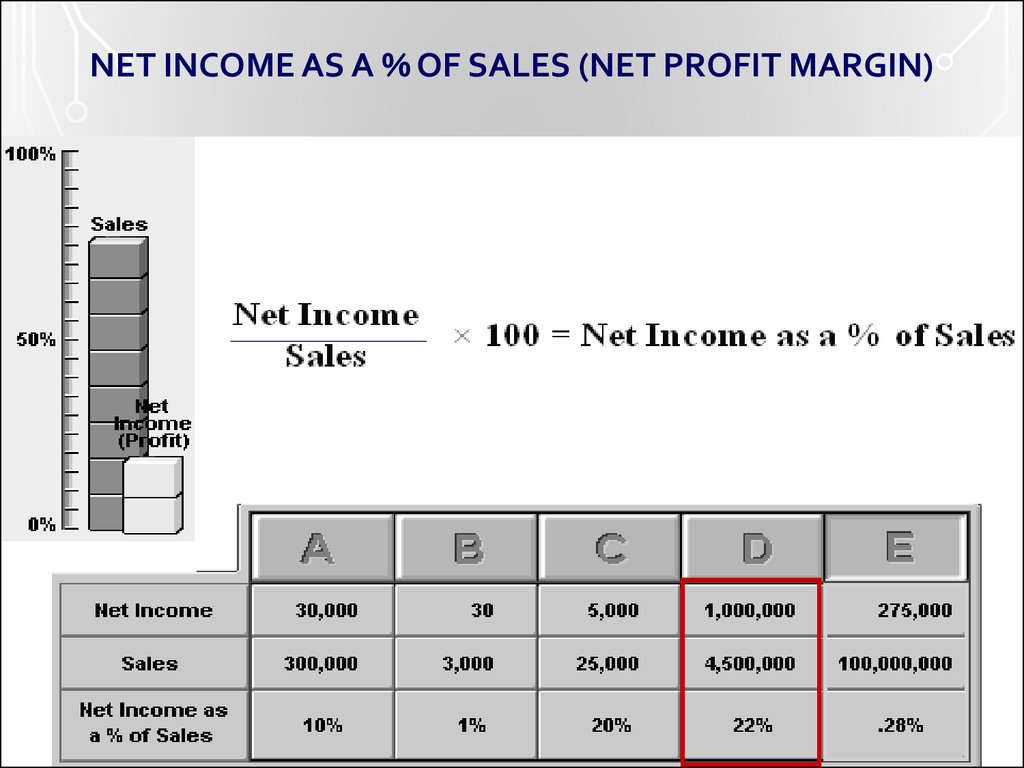

34. NET INCOME AS A % OF SALES (NET PROFIT MARGIN)

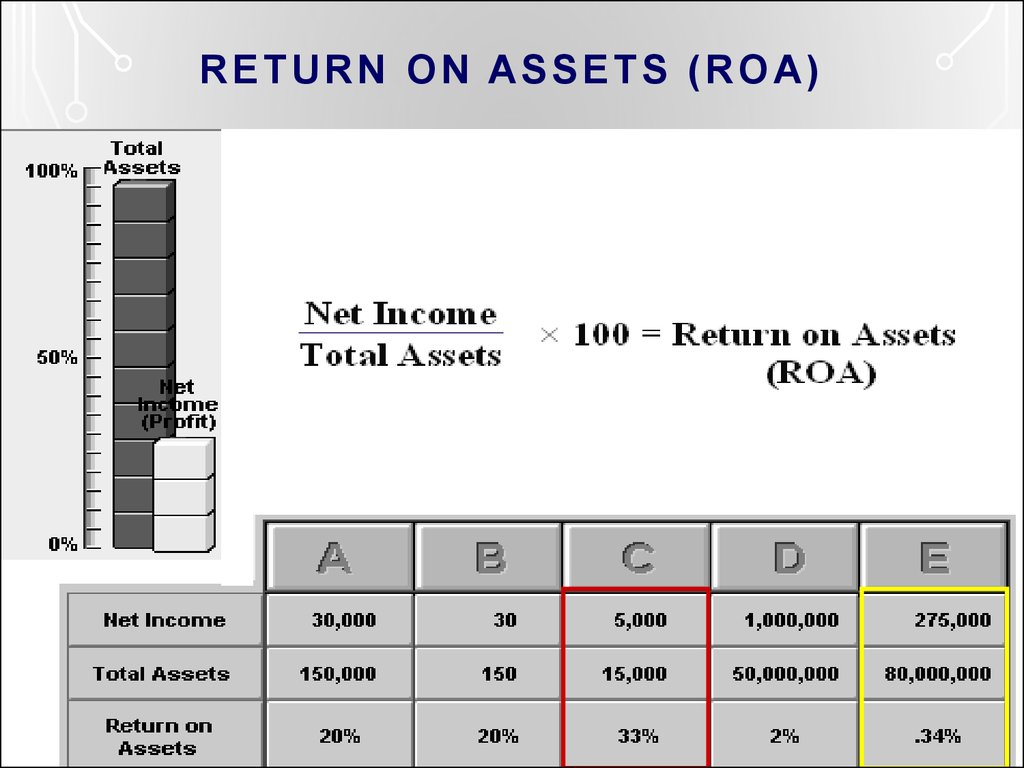

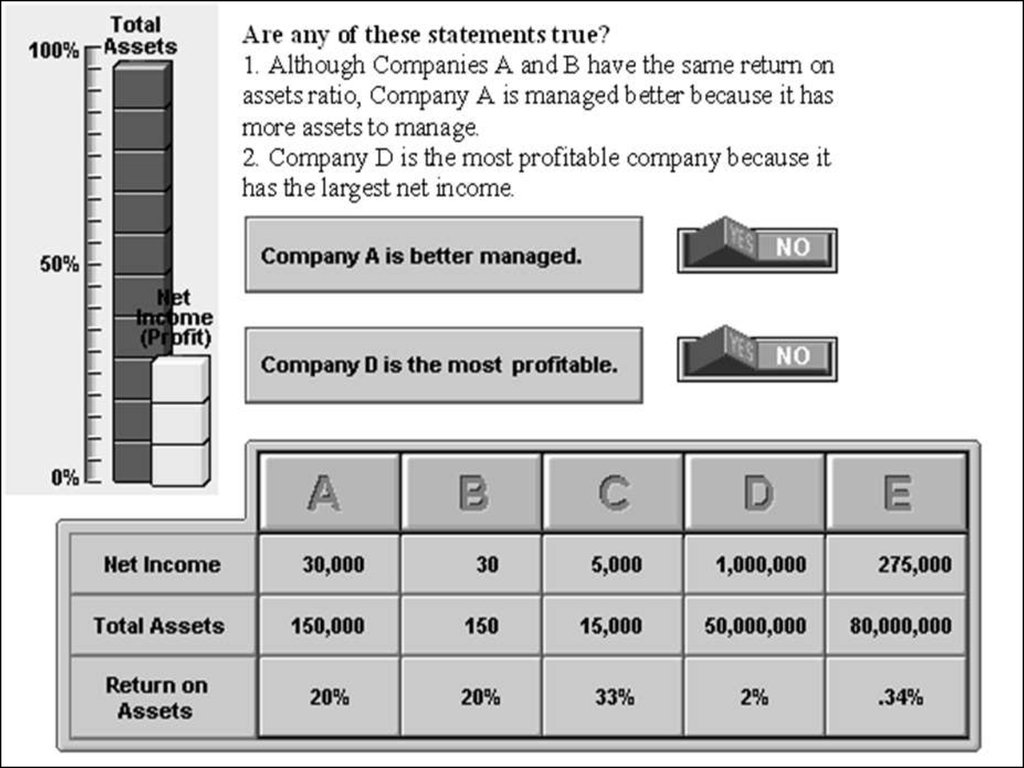

3435. RETURN ON ASSETS (ROA)

3536.

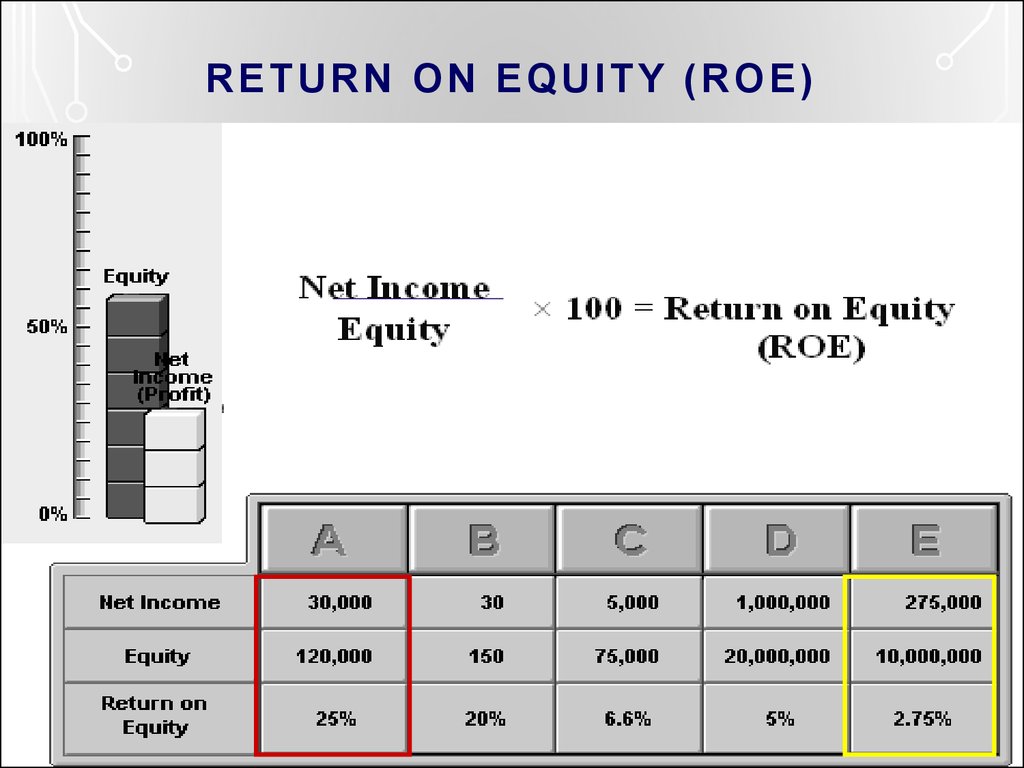

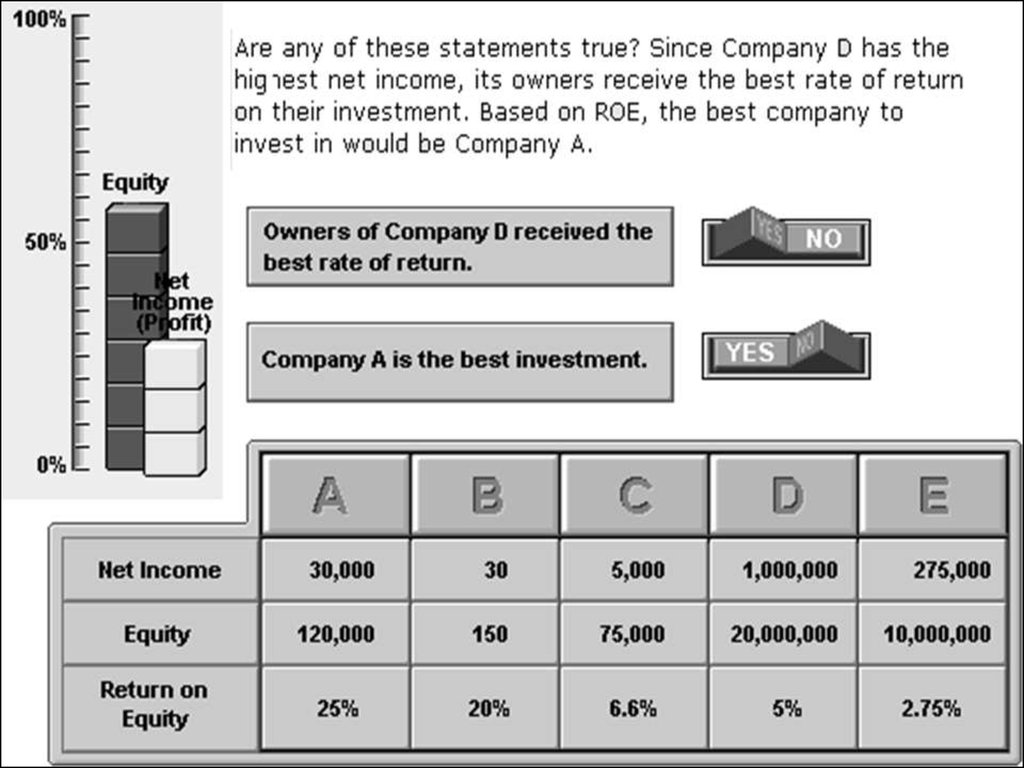

3637. RETURN ON EQUITY (ROE)

3738.

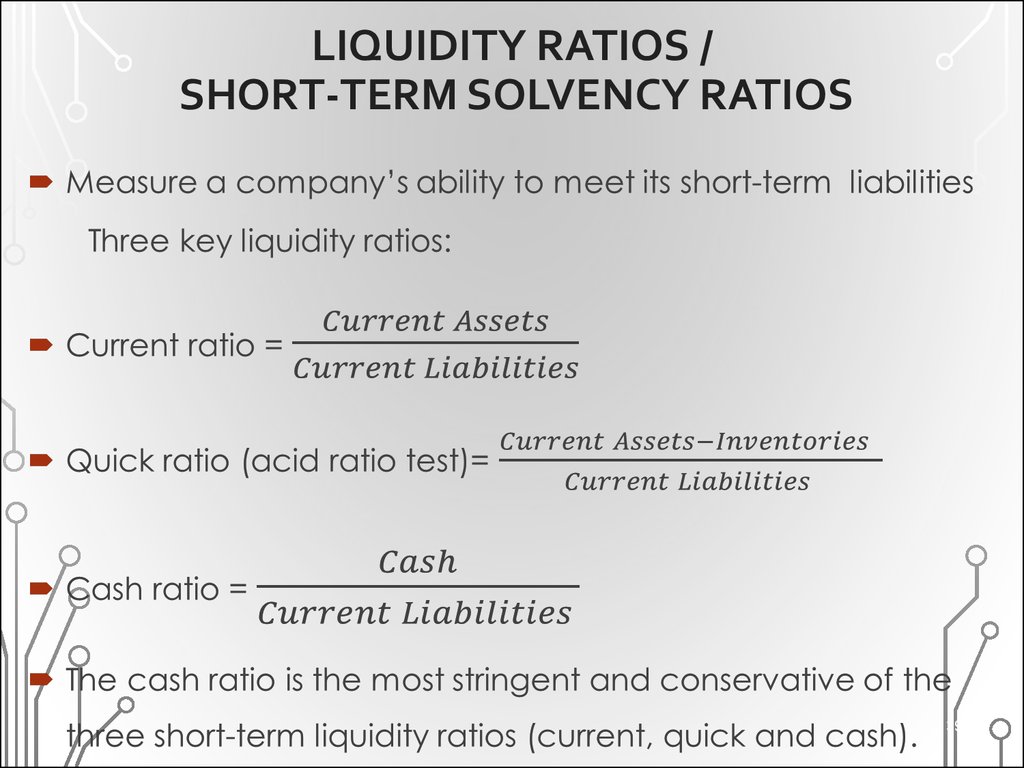

3839. LIQUIDITY RATIOS / SHORT-TERM SOLVENCY RATIOS

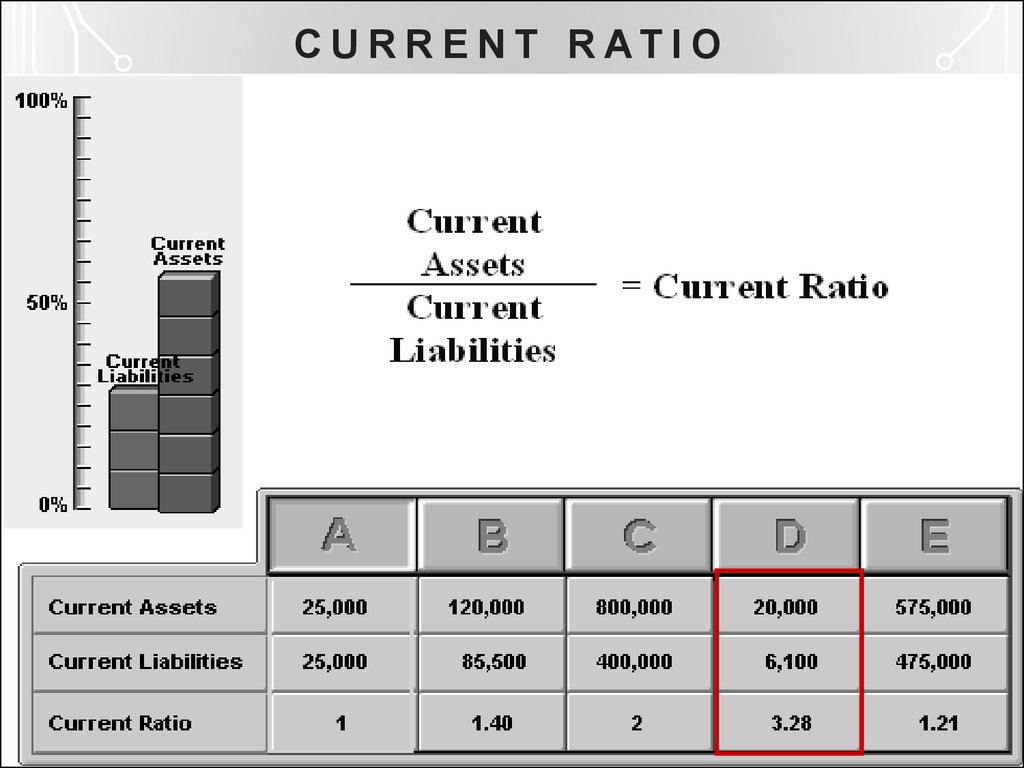

3940. CURRENT RATIO

C U R R E N T R AT I O40

41. QUICK RATIO OR ACID RATIO TEST

Q U I C K R AT I O O R AC I D R AT I O T E S T41

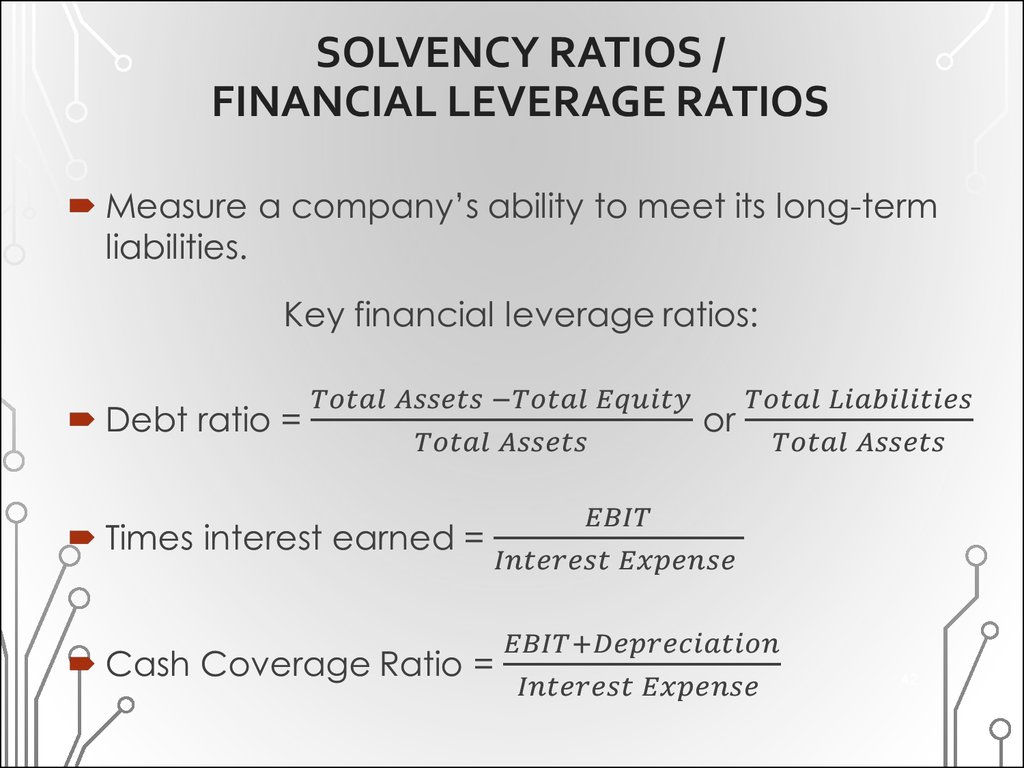

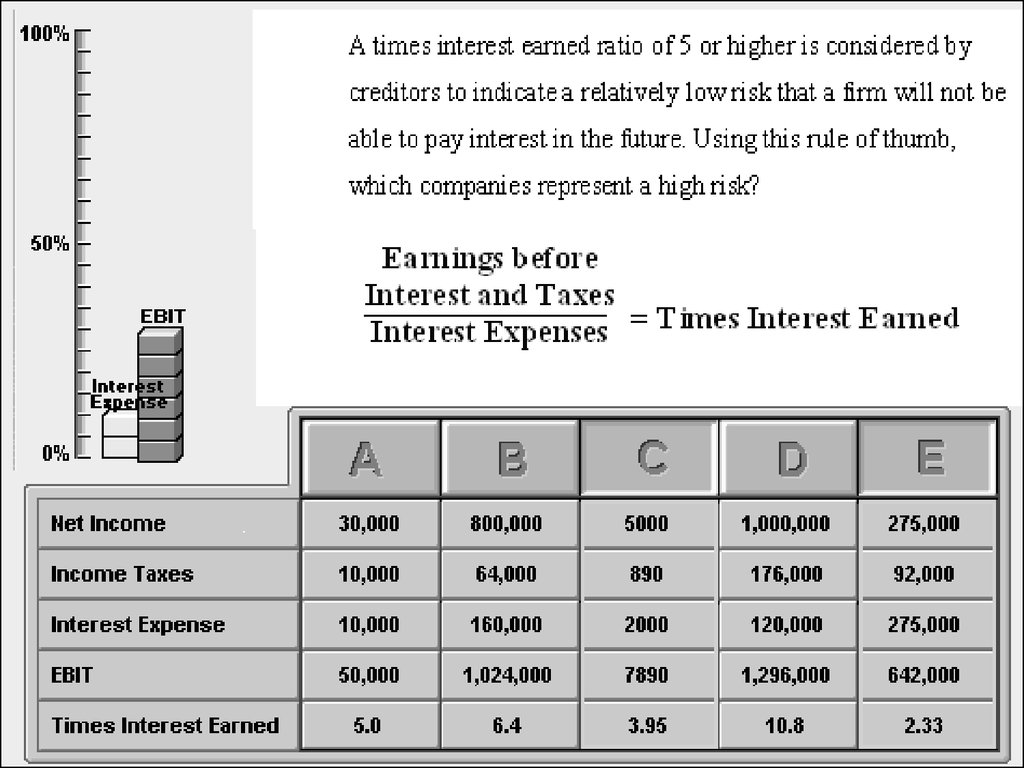

42. SOLVENCY RATIOS / FINANCIAL LEVERAGE RATIOS

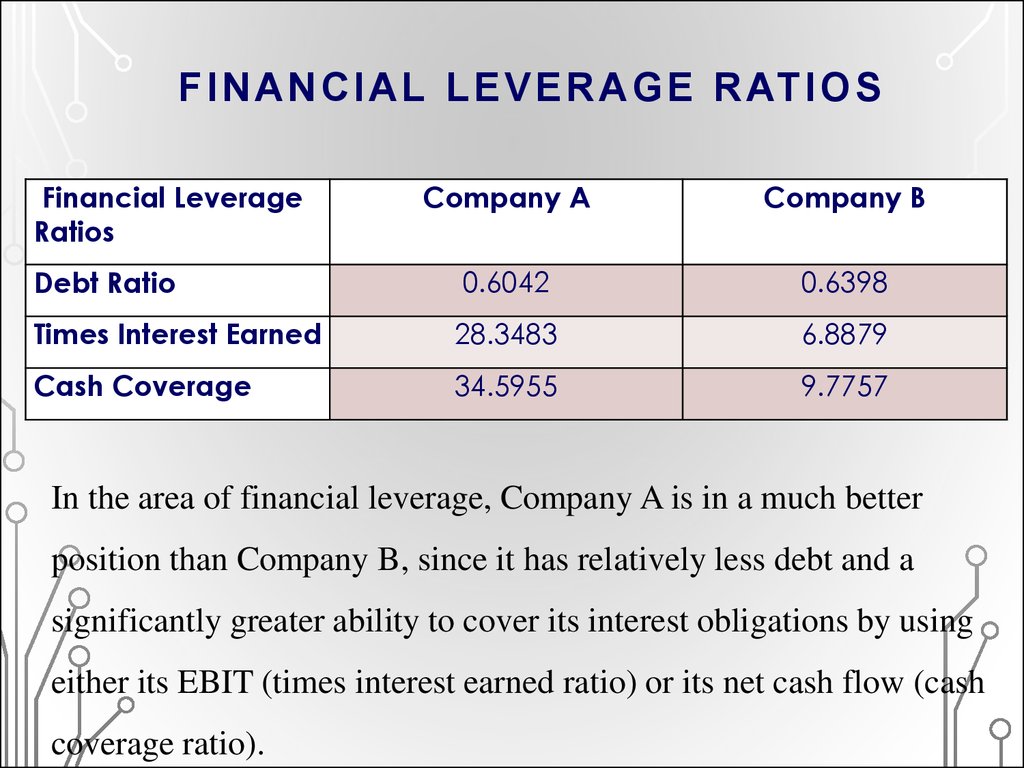

4243. FINANCIAL LEVERAGE RATIOS

F I N A N C I A L L E V E R A G E R AT I O SFinancial Leverage

Ratios

Company A

Company B

Debt Ratio

0.6042

0.6398

Times Interest Earned

28.3483

6.8879

Cash Coverage

34.5955

9.7757

In the area of financial leverage, Company A is in a much better

position than Company B, since it has relatively less debt and a

significantly greater ability to cover its interest obligations by using

either its EBIT (times interest earned ratio) or its net cash flow43(cash

coverage ratio).

44.

4445. ACTIVITY / ASSET MANAGEMENT RATIOS

These ratios measure how efficiently a firm is using itsassets to generate revenues or how much cash is being

tied up in other assets such as receivables and inventory.

Total Assets Turnover Ratio

Fixed Asset Turnover Ratio

Inventory Turnover

Account Receivable Turnover

45

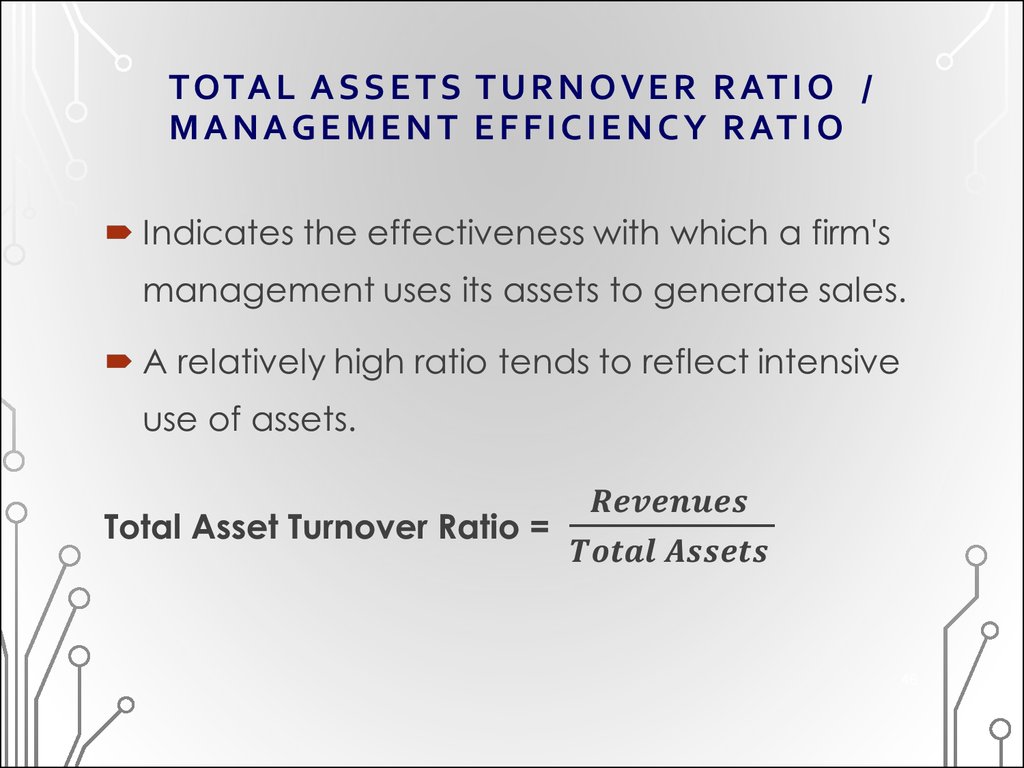

46. TOTAL ASSETS TURNOVER RATIO / MANAGEMENT EFFICIENCY RATIO

TOTA L A S S E T S T U R N O V E R R AT I O /M A N A G E M E N T E F F I C I E N C Y R AT I O

46

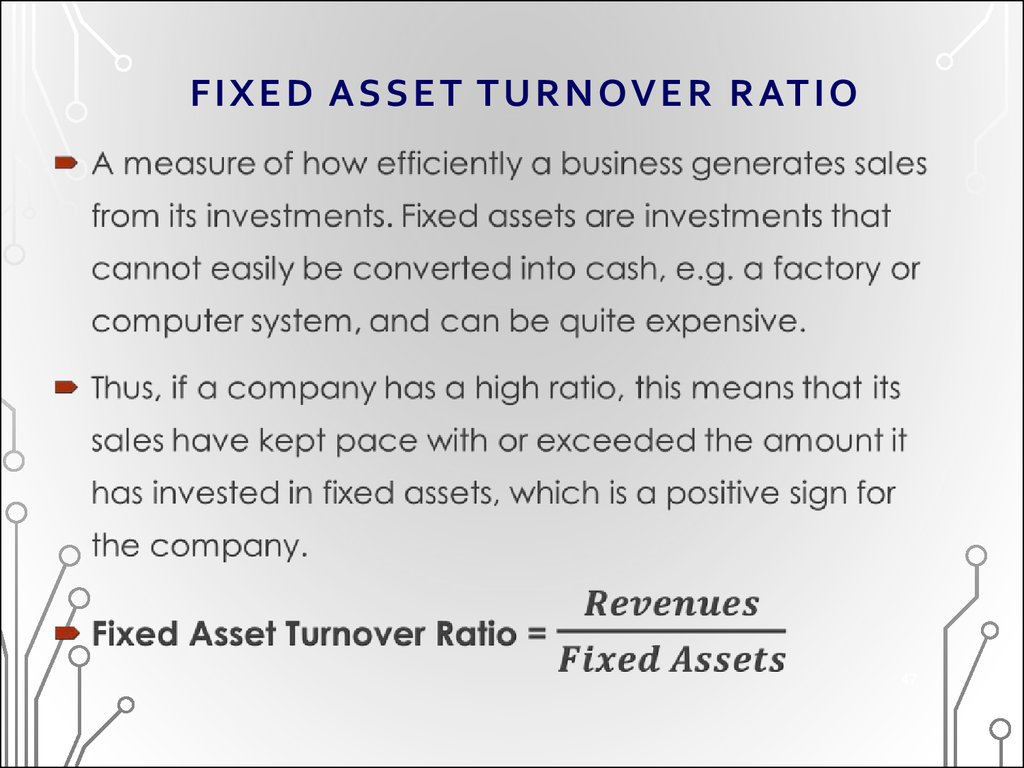

47. FIXED ASSET TURNOVER RATIO

F I X E D A S S E T T U R N OV E R R AT I O47

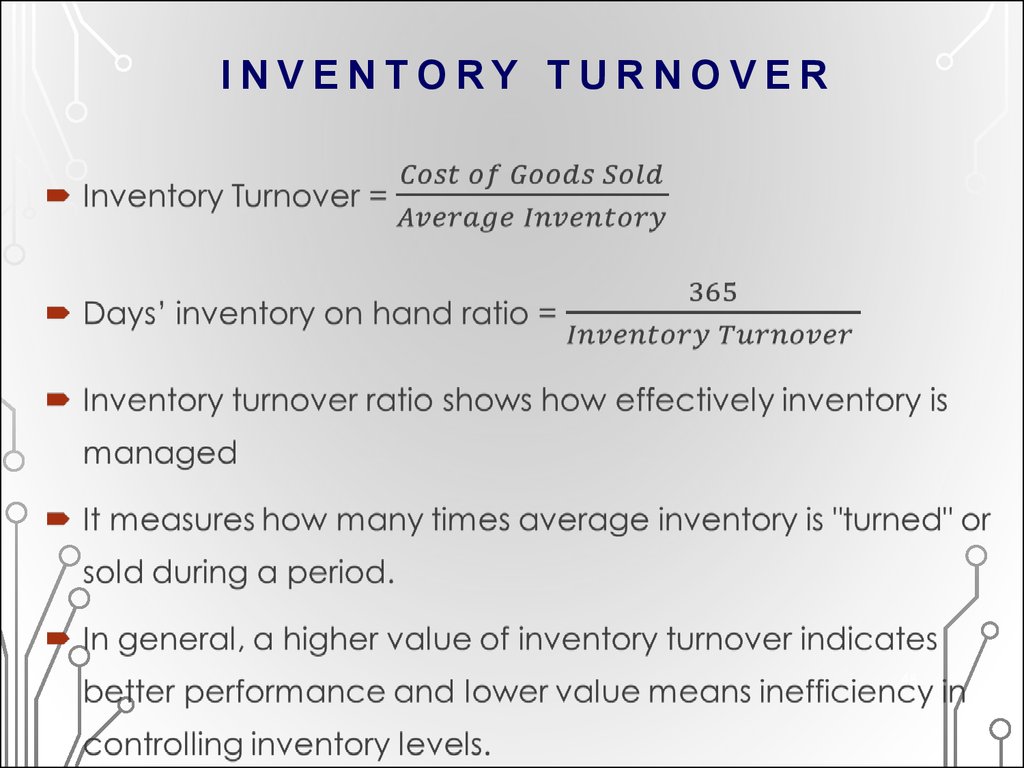

48. INVENTORY TURNOVER

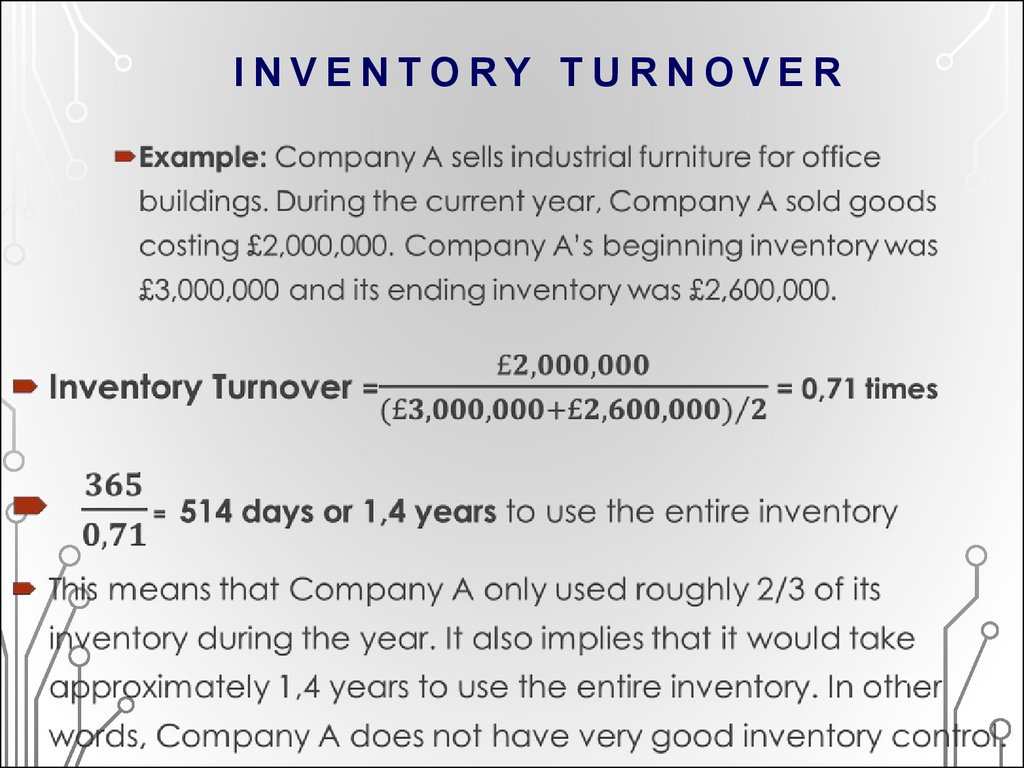

4849. INVENTORY TURNOVER

A lower inventory turnover ratio may be an indication of over-stocking

which may pose risk of obsolescence and increased inventory holding

costs.

A very high value of this ratio may be accompanied by loss of sales due to

inventory shortage.

Inventory turnover is different for different industries. Businesses which

trade perishable goods have very higher turnover compared to those

dealing in durables. Hence a comparison would only be fair if made

between businesses of same industry.

49

50. INVENTORY TURNOVER

5051. INVENTORY TURNOVER

A low turnover is usually a bad sign because products tend todeteriorate as they sit in a warehouse.

Companies selling perishable items have very high turnover.

For more accurate inventory turnover figures due to fluctuation

in the level of inventory throughout the year, the average

inventory figure [(beginning inventory + ending inventory)/2] is

used when computing inventory turnover. Average inventory

accounts for any seasonality effects on the ratio.

51

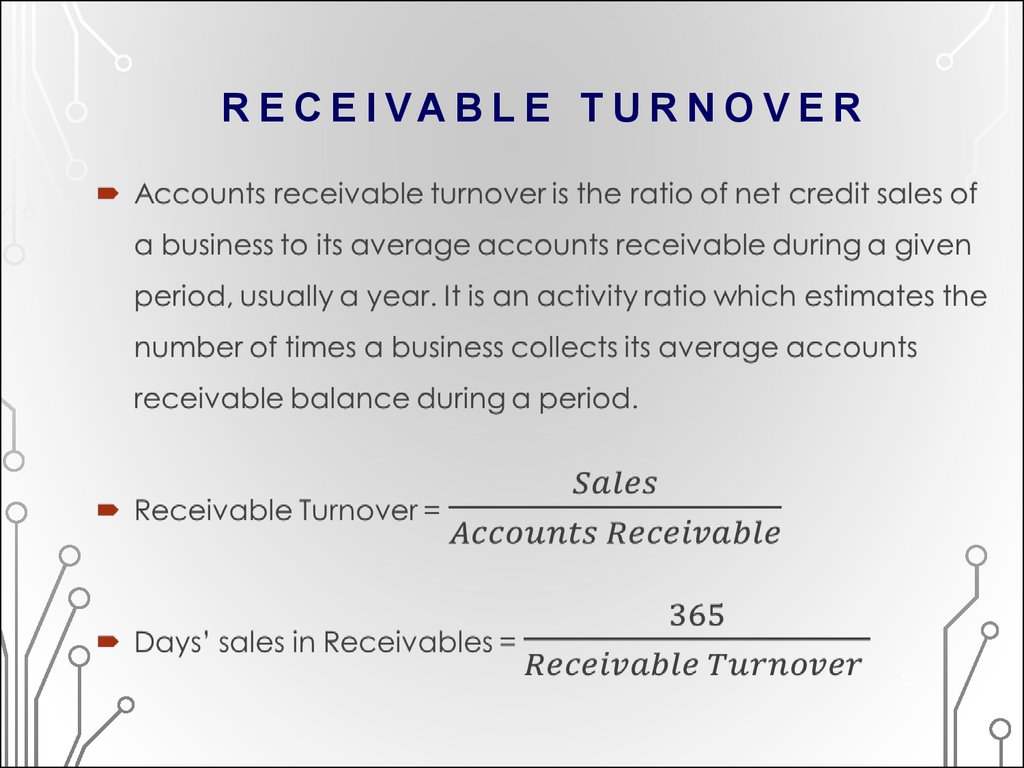

52. RECEIVABLE TURNOVER

R E C E I VA B L E T U R N O V E R52

53. RECEIVABLE TURNOVER

R E C E I VA B L E T U R N O V E RAccounts receivable turnover measures the efficiency of a business in

collecting its credit sales. Generally a high value of accounts receivable

turnover is favorable and lower figure may indicate inefficiency in

collecting outstanding sales. Increase in accounts receivable turnover

overtime generally indicates improvement in the process of cash

collection on credit sales.

However, a normal level of receivables turnover is different for different

industries. Also, very high values of this ratio may not be favourable, if

achieved by extremely strict credit terms since such policies may repel

potential buyers.

53

54. RECEIVABLE TURNOVER

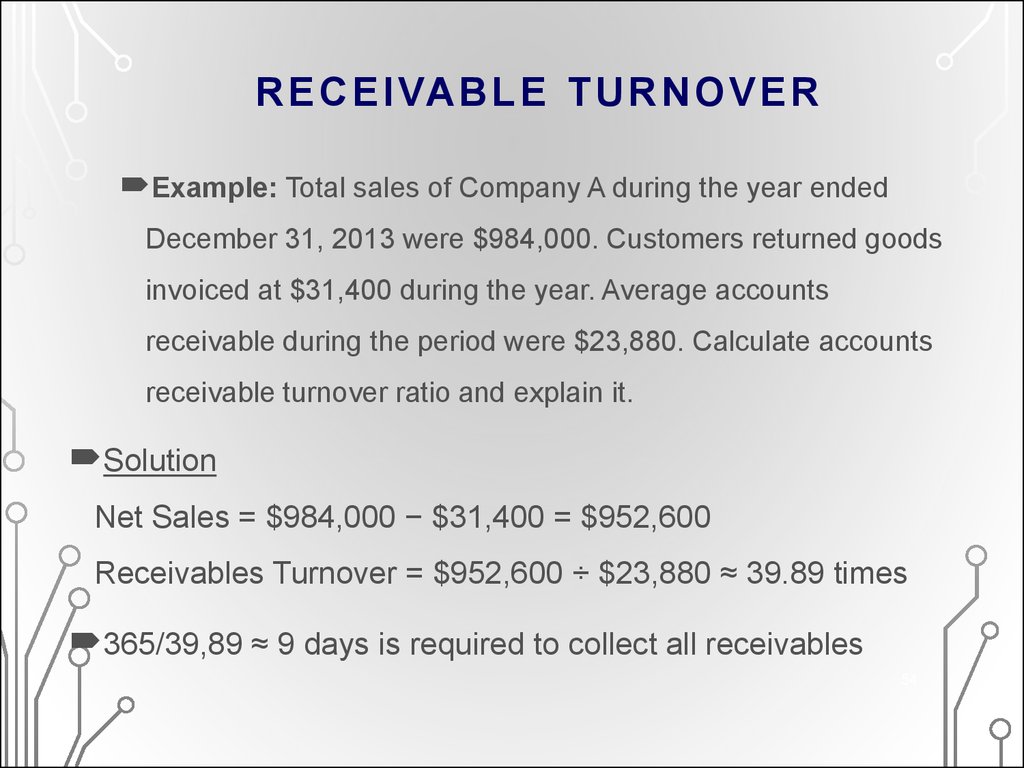

R E C E I VA B L E T U R N O V E RExample: Total sales of Company A during the year ended

December 31, 2013 were $984,000. Customers returned goods

invoiced at $31,400 during the year. Average accounts

receivable during the period were $23,880. Calculate accounts

receivable turnover ratio and explain it.

Solution

Net Sales = $984,000 − $31,400 = $952,600

Receivables Turnover = $952,600 ÷ $23,880 ≈ 39.89 times

365/39,89 ≈ 9 days is required to collect all receivables

54

55. INVESTMENT VALUATION RATIOS / MARKET VALUE RATIOS

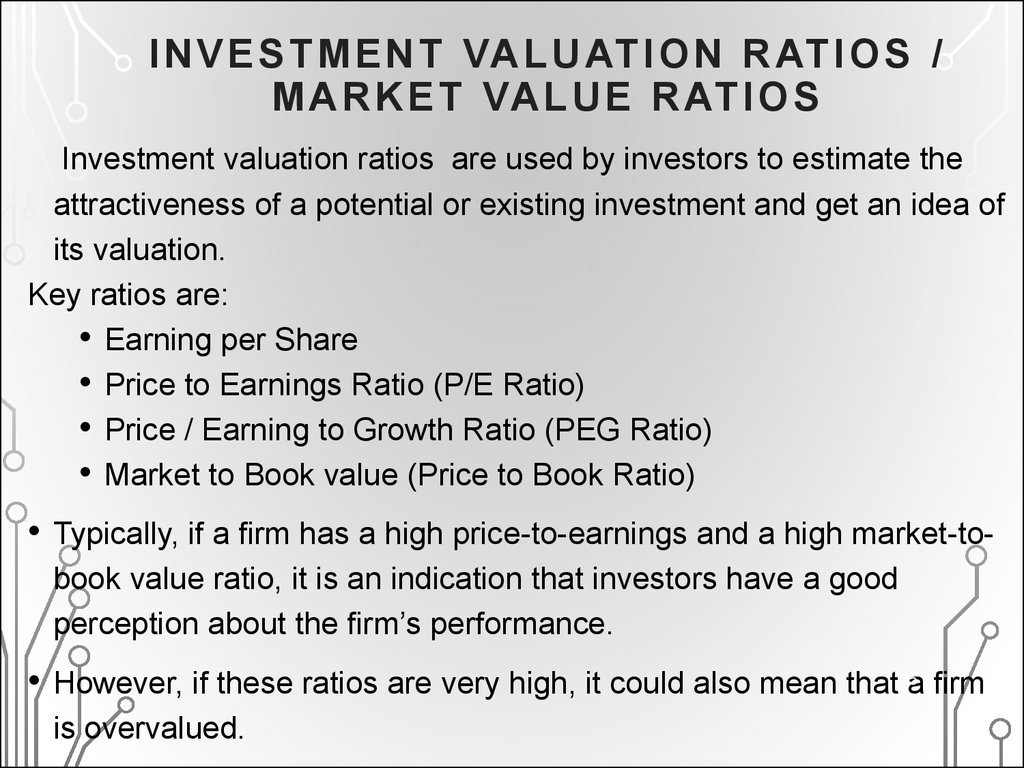

I N V E S T M E N T VA L U AT I O N R AT I O S /M A R K E T VA L U E R AT I O S

Investment valuation ratios are used by investors to estimate the

attractiveness of a potential or existing investment and get an idea of

its valuation.

Key ratios are:

• Earning per Share

• Price to Earnings Ratio (P/E Ratio)

• Price / Earning to Growth Ratio (PEG Ratio)

• Market to Book value (Price to Book Ratio)

Typically, if a firm has a high price-to-earnings and a high market-tobook value ratio, it is an indication that investors have a good

perception about the firm’s performance.

However, if these ratios are very high, it could also mean that 55a firm

is overvalued.

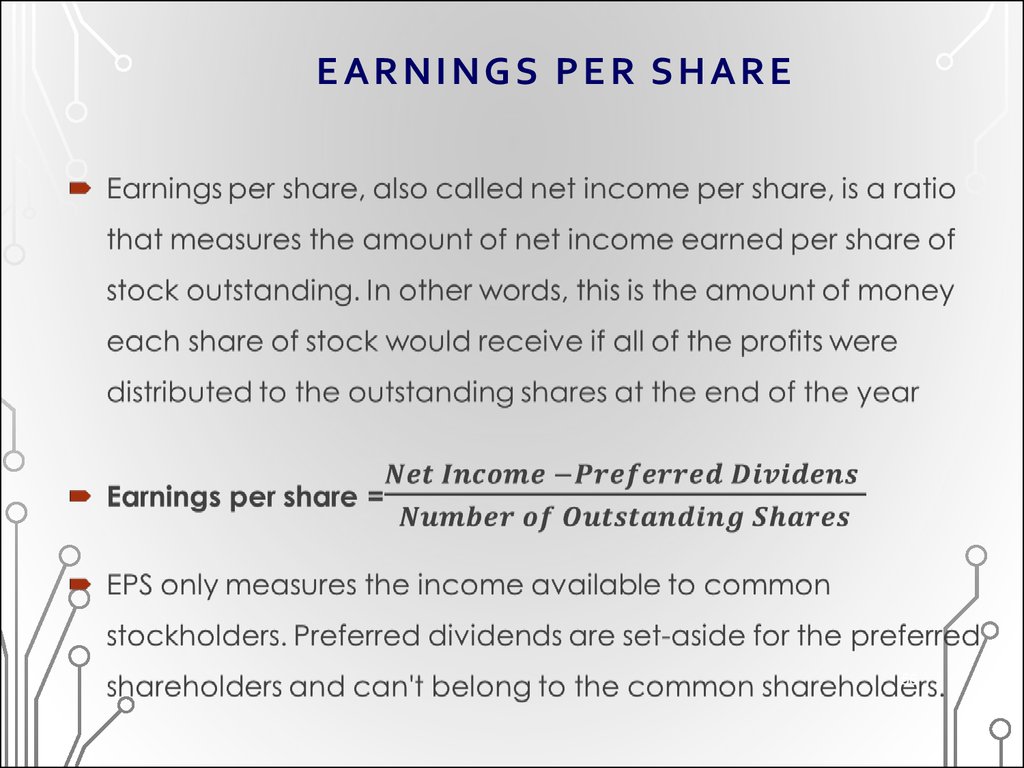

56. EARNINGS PER SHARE

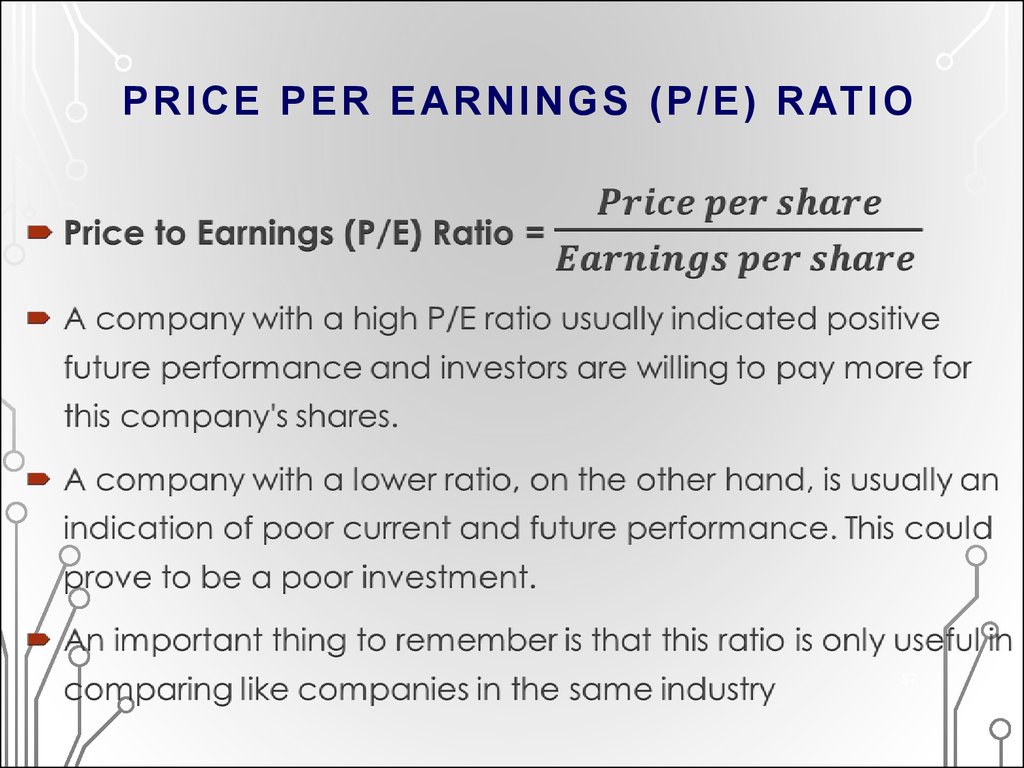

5657. PRICE PER EARNINGS (P/E) RATIO

P R I C E P E R E A R N I N G S ( P / E ) R AT I O57

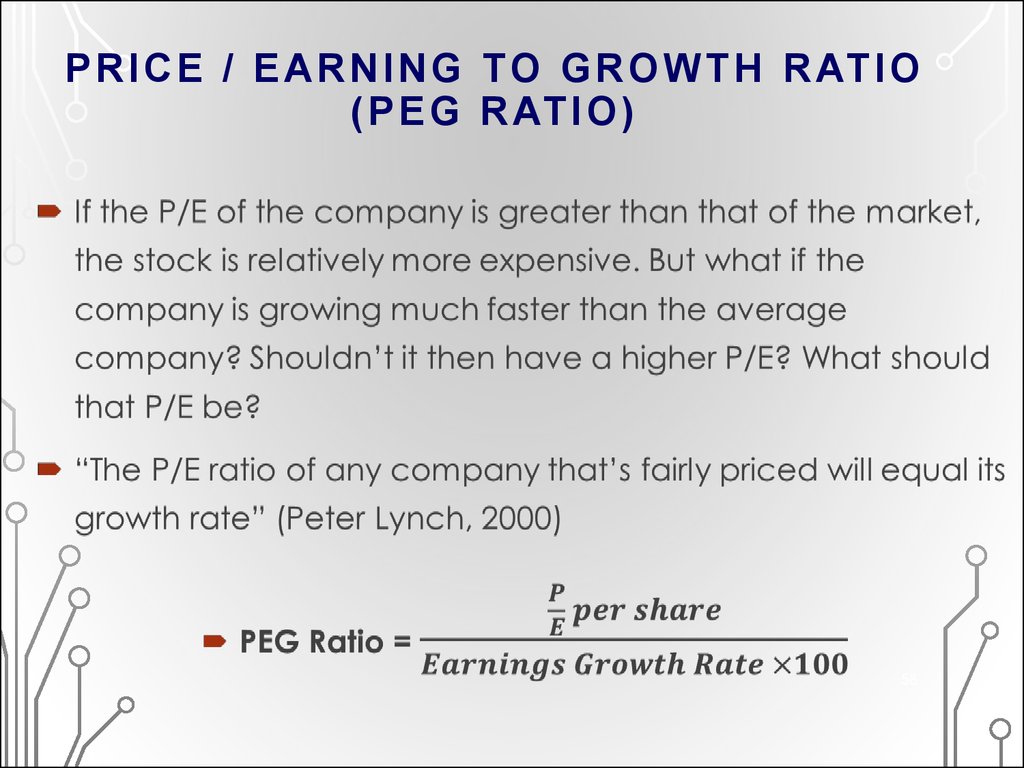

58. PRICE / EARNING TO GROWTH RATIO (PEG RATIO)

P R I C E / E A R N I N G TO G R O W T H R AT I O( P E G R AT I O )

58

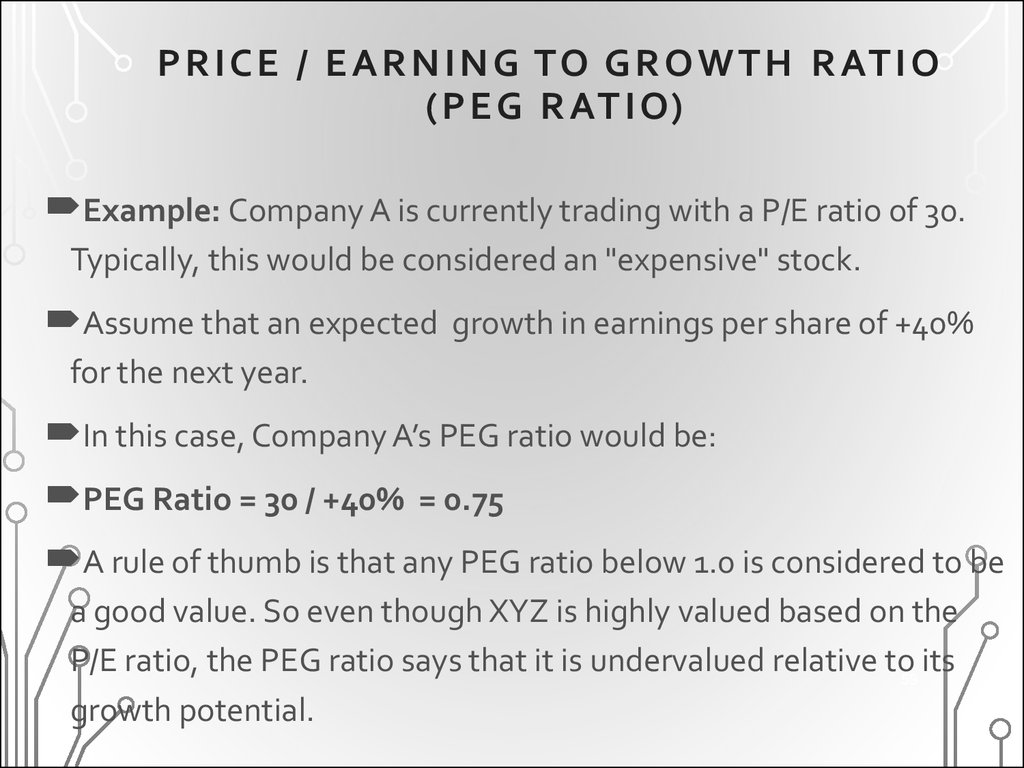

59. PRICE / EARNING TO GROWTH RATIO (PEG RATIO)

P R I C E / E A R N I N G TO G R O W T H R AT I O( P E G R AT I O)

Example: Company A is currently trading with a P/E ratio of 30.

Typically, this would be considered an "expensive" stock.

Assume that an expected

growth in earnings per share of +40%

for the next year.

In this case, Company A’s PEG ratio would be:

PEG Ratio = 30 / +40% = 0.75

A rule of thumb is that any PEG ratio below 1.0 is considered to be

a good value. So even though XYZ is highly valued based on the

P/E ratio, the PEG ratio says that it is undervalued relative to59 its

growth potential.

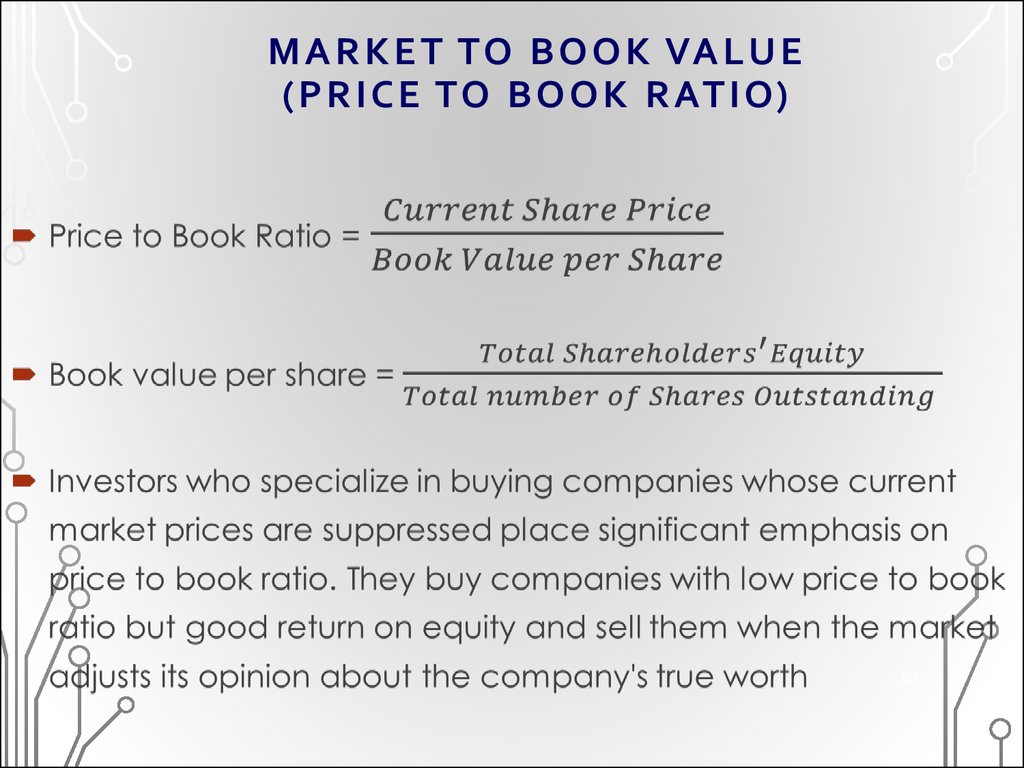

60. MARKET TO BOOK VALUE (PRICE TO BOOK RATIO)

M A R K E T TO B O O K VA L U E( P R I C E TO B O O K R AT I O)

60

61.

Limitations of Ratio AnalysisTo be useful, ratios should be analyzed over a period of

years to consider all relevant factors

Any one year, or even any two years, may not represent

the company’s performance over the long term

finance

finance