Similar presentations:

Financial and Economic Analysis

1. Financial and Economic Analysis

FINANCIAL ANDECONOMIC ANALYSIS

Chapter 3

2.

■ Financial analysis is the study of the main indicators of the financial condition andfinancial performance of an organization in order to make management, investment

and other decisions by interested parties.

3.

■ Financial analysis includes analysis of the assets and liabilities of the organization,its solvency, liquidity, financial results and financial stability, analysis of asset

turnover (business activity). Financial analysis allows to identify such important

aspects as the possible probability of bankruptcy. Financial analysis is an integral

part of such specialists as auditors, appraisers

4. The main components of the financial - economic analysis of the enterprise are

The main components of the financial economic analysis of the enterprise are■ accounting analysis;

■ horizontal analysis;

■ vertical analysis;

■ trend analysis;

■ calculation of financial ratios.

5.

■ Horizontal analysis is comparing reporting indicators with indicators of previousperiods.

■ Vertical analysis is carried out in order to identify the proportion of individual

reporting items in the total final indicator and then compare the result with the data

of the previous period.

■ The trend analysis is based on the calculation of the relative deviations of the

reporting indicators for a number of years from the level of the base year.

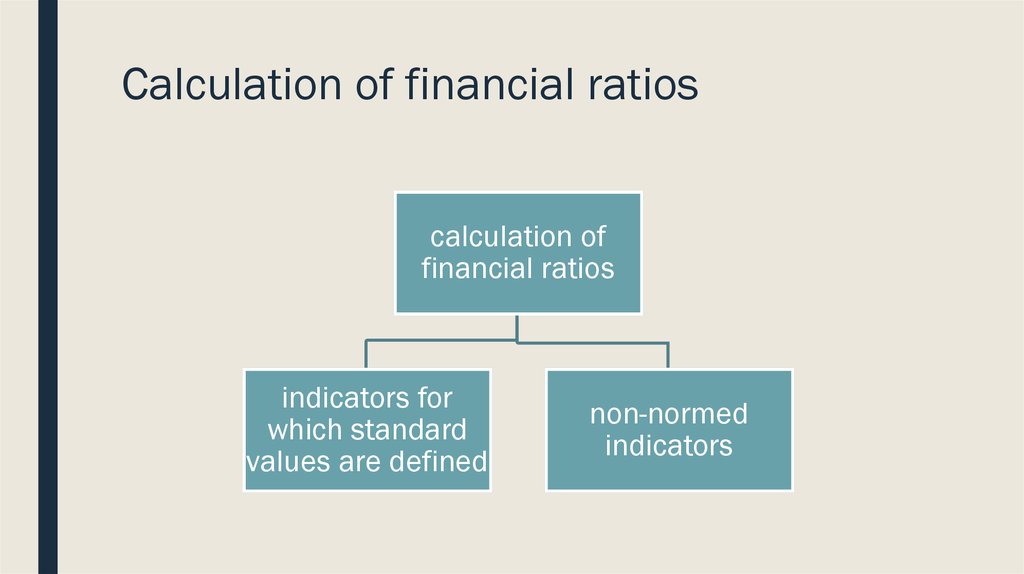

6. Calculation of financial ratios

calculation offinancial ratios

indicators for

which standard

values are defined

non-normed

indicators

7. Altman Z-score

■ The Z-score formula for predicting bankruptcy was published in 1968 by Edward I.Altman

■ The formula may be used to predict the probability that a firm will go

into bankruptcy within two years

8.

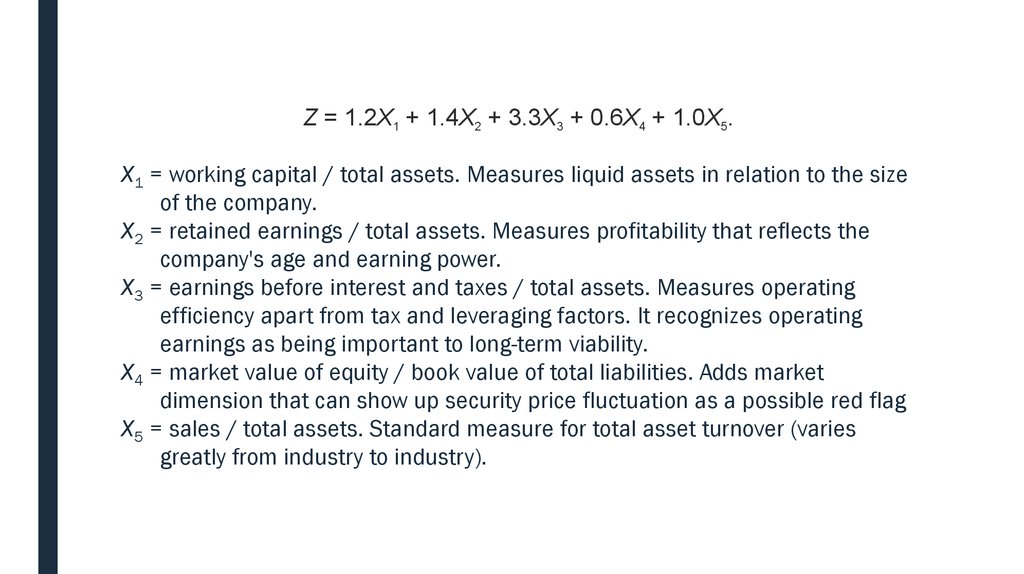

Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5.X1 = working capital / total assets. Measures liquid assets in relation to the size

of the company.

X2 = retained earnings / total assets. Measures profitability that reflects the

company's age and earning power.

X3 = earnings before interest and taxes / total assets. Measures operating

efficiency apart from tax and leveraging factors. It recognizes operating

earnings as being important to long-term viability.

X4 = market value of equity / book value of total liabilities. Adds market

dimension that can show up security price fluctuation as a possible red flag

X5 = sales / total assets. Standard measure for total asset turnover (varies

greatly from industry to industry).

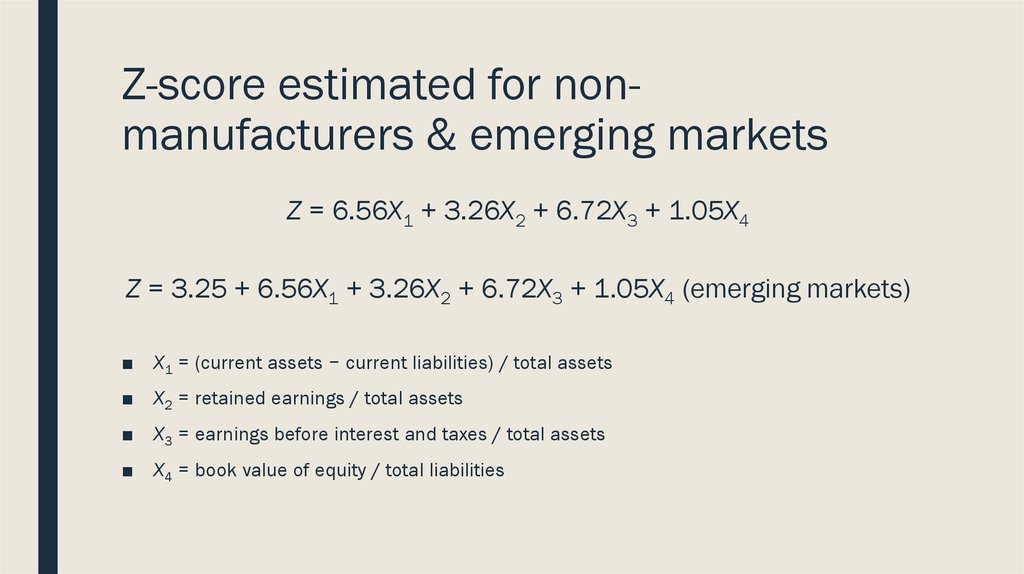

9. Z-score estimated for non-manufacturers & emerging markets

Z-score estimated for nonmanufacturers & emerging marketsZ = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4

Z = 3.25 + 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4 (emerging markets)

■ X1 = (current assets − current liabilities) / total assets

■ X2 = retained earnings / total assets

■ X3 = earnings before interest and taxes / total assets

■ X4 = book value of equity / total liabilities

10. Zones of discriminations

■ Z > 2.6 – “Safe” Zone, low probability of bankruptcy■ 1.1 < Z < 2.6 – “Grey” Zone, border state, the probability of bankruptcy is not high,

but not excluded;

■ Z < 1.1 – “Distress” Zone, there is a probability of bankruptcy of the enterprise

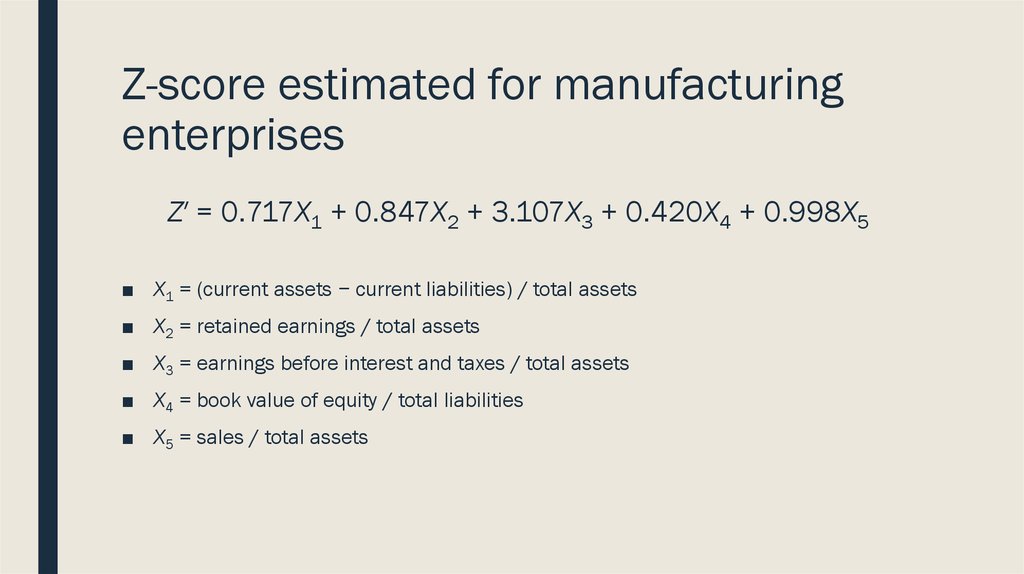

11. Z-score estimated for manufacturing enterprises

Z′ = 0.717X1 + 0.847X2 + 3.107X3 + 0.420X4 + 0.998X5■ X1 = (current assets − current liabilities) / total assets

■ X2 = retained earnings / total assets

■ X3 = earnings before interest and taxes / total assets

■ X4 = book value of equity / total liabilities

■ X5 = sales / total assets

12. Zones of discrimination:

■ Z′ > 2.9 – “Safe” Zone■ 1.23 < Z′ < 2.9 – “Grey” Zone

■ Z′ < 1.23 – “Distress” Zone

13. Commonly-used financial ratios can be divided into the following five categories.

Commonly-used financial ratios can bedivided into the following five categories.

■ Liquidity or Solvency Ratios

■ Financial Leverage or Debt Ratios

■ Asset Efficiency or Turnover Ratios

■ Profitability Ratios

■ Market Value Ratios

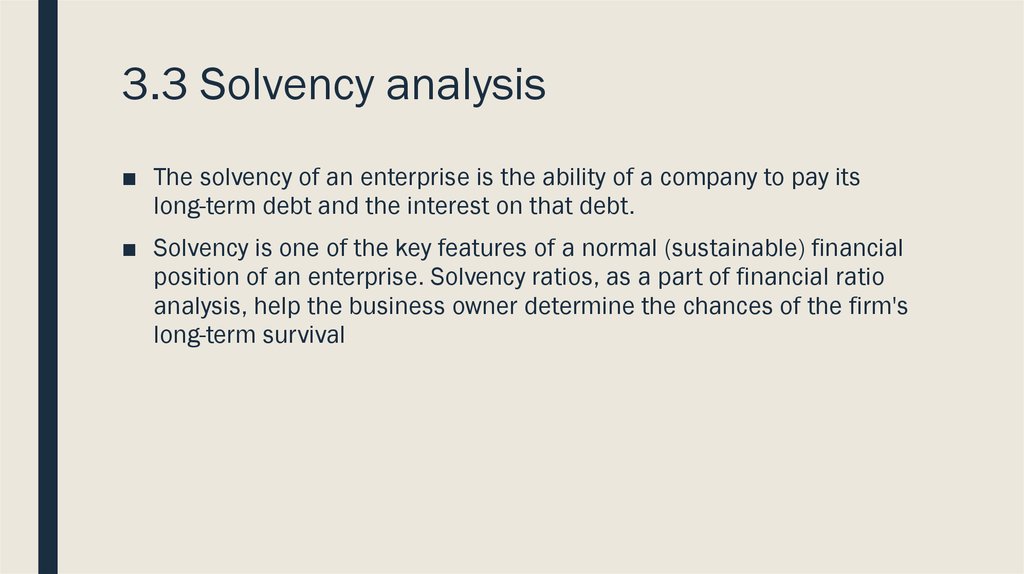

14. 3.3 Solvency analysis

■ The solvency of an enterprise is the ability of a company to pay itslong-term debt and the interest on that debt.

■ Solvency is one of the key features of a normal (sustainable) financial

position of an enterprise. Solvency ratios, as a part of financial ratio

analysis, help the business owner determine the chances of the firm's

long-term survival

15. The solvency of the company consists of two factors:

1. Availability ofassets

2. The degree of

liquidity of assets

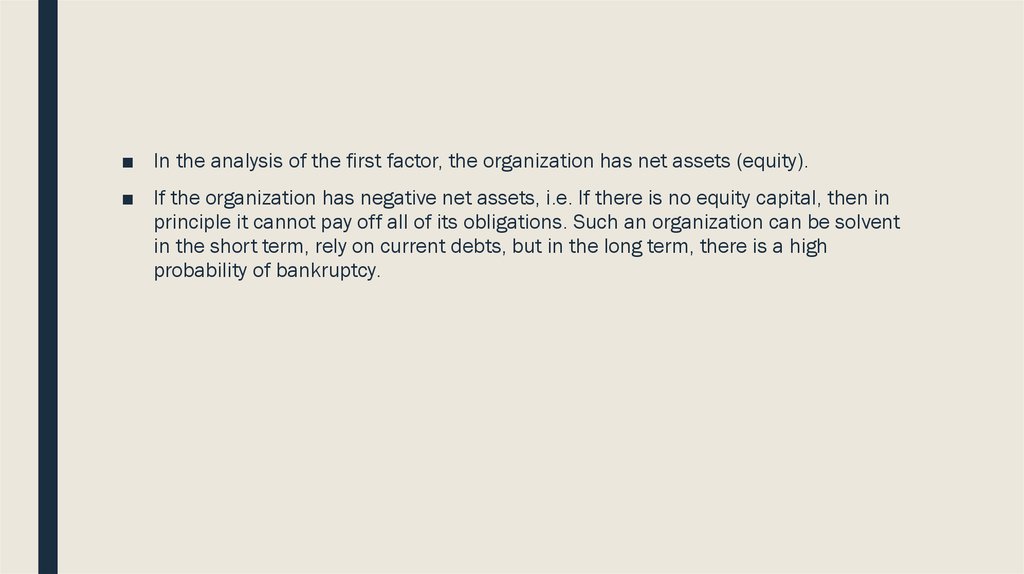

16.

■ In the analysis of the first factor, the organization has net assets (equity).■ If the organization has negative net assets, i.e. If there is no equity capital, then in

principle it cannot pay off all of its obligations. Such an organization can be solvent

in the short term, rely on current debts, but in the long term, there is a high

probability of bankruptcy.

17.

■ If an organization has positive net assets, this does not indicate its good solvency.■ It is necessary to analyze the second factor - liquidity of assets.

■ A situation may arise where there is a discrepancy between the liquidity of the

assets and the forthcoming maturity of the liability.

■ For example, an enterprise, on the one hand, has a large share of non-current

assets that are more difficult to realize (low-liquid assets), on the other, a large

proportion of short-term liabilities. In this scenario, there may come a time when the

organization does not have enough money to pay off current liabilities.

18.

■ There are several different solvency ratios, some of them technicaland of use primarily to auditors or corporate analysts, others easily

assessed and of interest to professional accountants, business

owners and shareholders alike. A few of these basic solvency ratios

are:

■ 1) The Total Debt/Total Assets Ratio measures how much of the firm's

asset base is financed using debt.

19.

2) The Equity Ratio explains how much of the company is owned by itsinvestors.

The Equity Ratio = total equity / total assets.

It answers a basic, but very important question: if the company goes out

of business after it pays all liabilities how much will be left for its

investors.

In general, higher equity ratios are typically favorable for companies. This

is usually the case for several reasons.

-

Higher investment levels by shareholders shows potential

shareholders that the company is worth investing in since so many

investors are willing to finance the company.

-

A higher ratio also shows potential creditors that the company is more

sustainable and less risky to lend future loans.

20.

■ The Equity Ratio = 100000/150000 = 0,67■ As you can see, ratio is .67. This means that investors rather than debt

are currently funding more assets. 67 percent of the company’s

assets are owned by shareholders and not creditors. Depending on

the industry, this is a healthy ratio.

21.

3) Interest Earned measures a company's ability meet its long-term debtobligations. It's calculated by dividing corporate income before interest

and income taxes (commonly abbreviated EBIT) by interest expense

related to long-term debt.

■ Earnings before interest and taxes ÷ Interest expense = Times interest

earned

The ratio is commonly used by lenders to ascertain whether a

prospective borrower can afford to take on any additional debt. The ratio

is calculated by comparing the earnings of a business that are available

for use in paying down the interest expense on debt, divided by the

amount of interest expense.

22.

■ A ratio of less than one indicates that a business may not be in aposition to pay its interest obligations, and so is more likely to default

on its debt. A much higher ratio is a strong indicator that the ability to

service debt is not a problem for a borrower.

23.

■ The solvency of the company in terms of asset liquidity is analyzed by means ofspecial financial ratios - liquidity ratios:

■ Cash ratio. Compares the amount of cash and investments to short-term liabilities.

This ratio excludes any assets that might not be immediately convertible into cash,

especially inventory.

■ Quick ratio. Same as the cash ratio, but includes accounts receivable as an asset.

This ratio explicitly avoids inventory, which may be difficult to convert into cash.

■ Current ratio. Compares all current assets to all current liabilities. This ratio includes

inventory, which is not especially liquid, and which can therefore mis-represent the

liquidity of a business.

24. 3.4 Financial Leverage Ratios to Measure the Solvency of the Business

■ These ratios compare the overall debt load of a company to its assetsor equity, showing how much of the company assets below to

shareholders vs. creditors.

■ If shareholders own more assets, the company is said to be less

leveraged.

■ If creditors own a majority of assets, the company is said to be highly

leveraged.

■ Clearly, financial leverage ratios help management and investors to

understand how risk level of the capital structure of a company.

finance

finance