Similar presentations:

Financial statement analysis

1. Financial Statement Analysis

12ePRINCIPLES OF FINANCIAL ACCOUNTING

24e

PRINCIPLES OF ACCOUNTING

2e

Chapter 17

ACCOUNTING PRINCIPLES

Using excel for Success

Prepared by: C. Douglas Cloud

Prepared

Professorby:

Emeritus

C. Douglas

of Accounting

Cloud

Professor

Pepperdine

Emeritus

University

of Accounting

Pepperdine University

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted

in a license

distributed

with aReserved.

certain product

or be

service

or otherwise

onduplicated,

a password-protected

classroom

© 2012 Cengage

Learning.

All Rights

May not

copied,

scanned, or

in whole or website

in part, for

except

for use use.

as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Reeve Warren Duchac

2. Learning Objectives

1. Describe basic financial statementanalytical methods.

2. Use financial statement analysis to assess

the solvency of a business.

3. Use financial statement analysis to assess

the profitability of a business.

4. Describe the contents of corporate annual

reports.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3. Learning Objective 1

1. Describe basic financial statementanalytical methods.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

4. Basic Analytical Methods

LO 1Basic Analytical Methods

Users analyze a company’s financial

statements using a variety of analytical

methods. Three such methods are as

follows:

Horizontal analysis

Vertical analysis

Common-sized statements

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

5. Horizontal Analysis

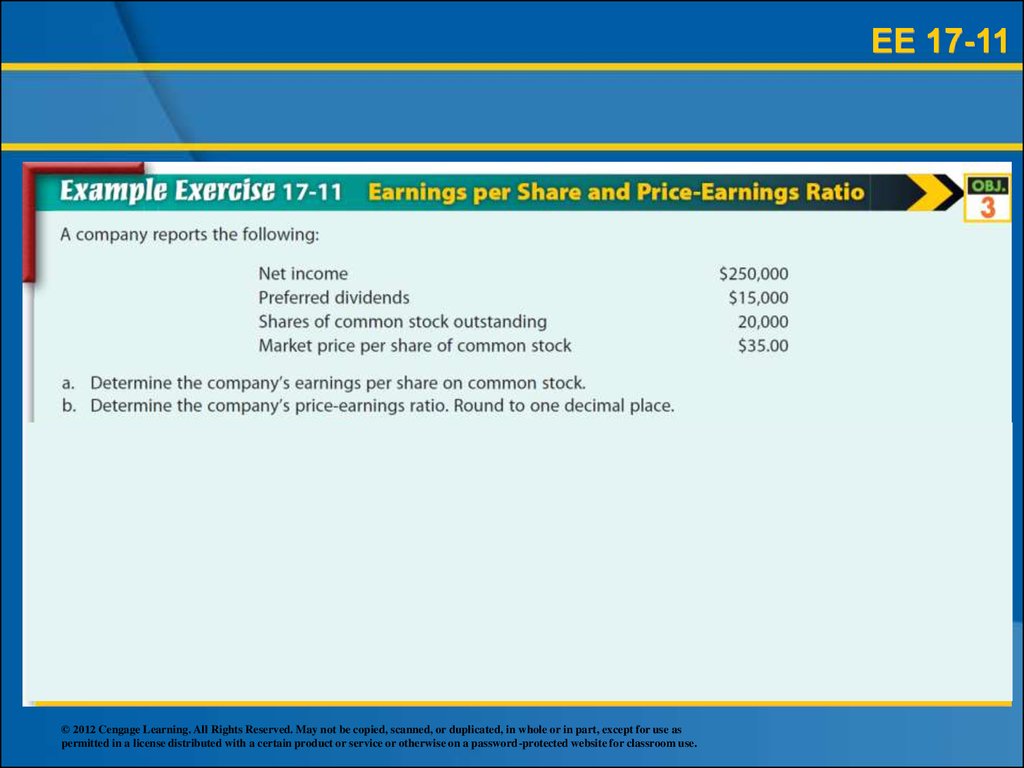

LO 1Horizontal Analysis

The percentage analysis of increases and

decreases in related items in comparative

financial statements is called horizontal

analysis.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

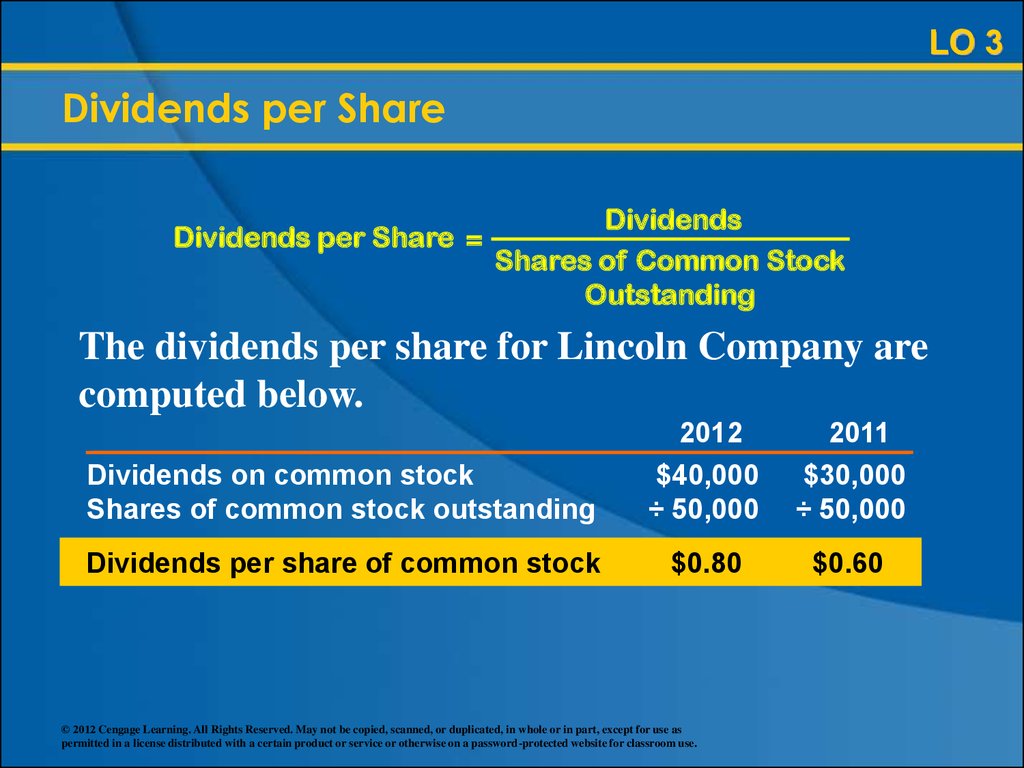

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

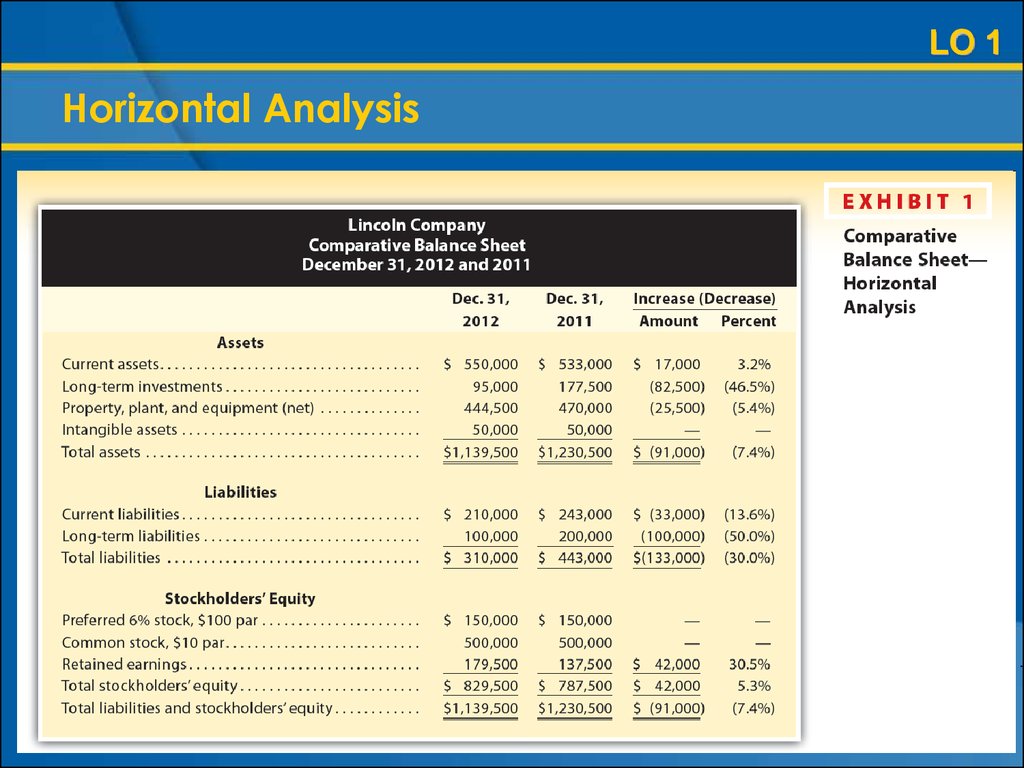

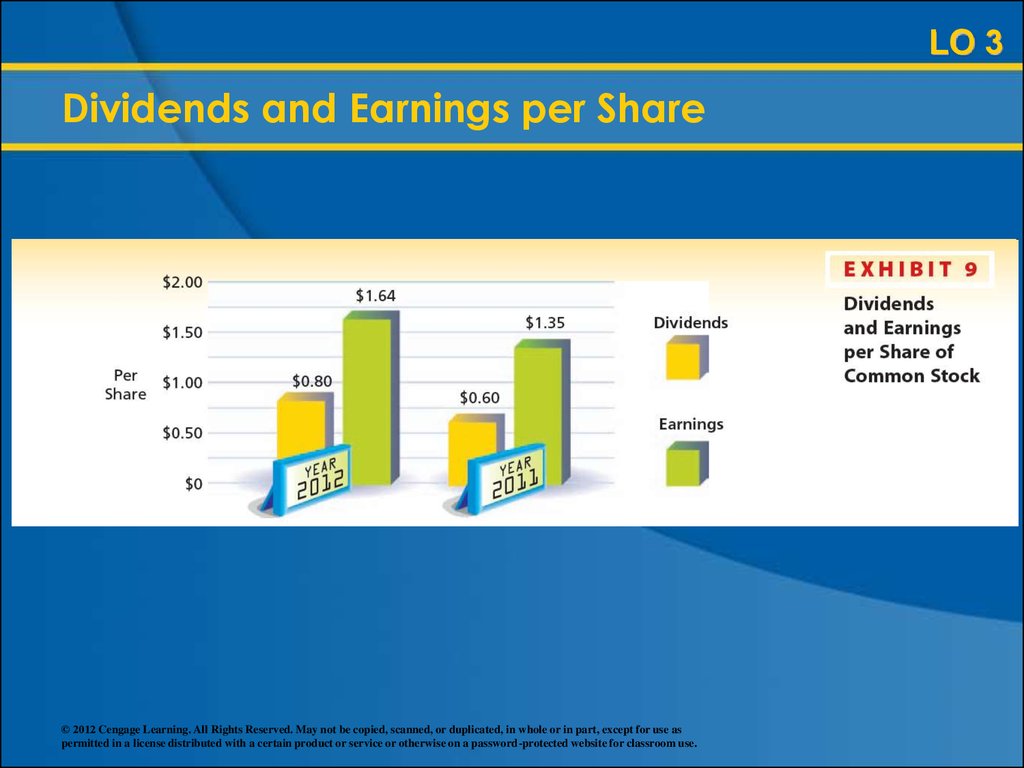

6. Horizontal Analysis

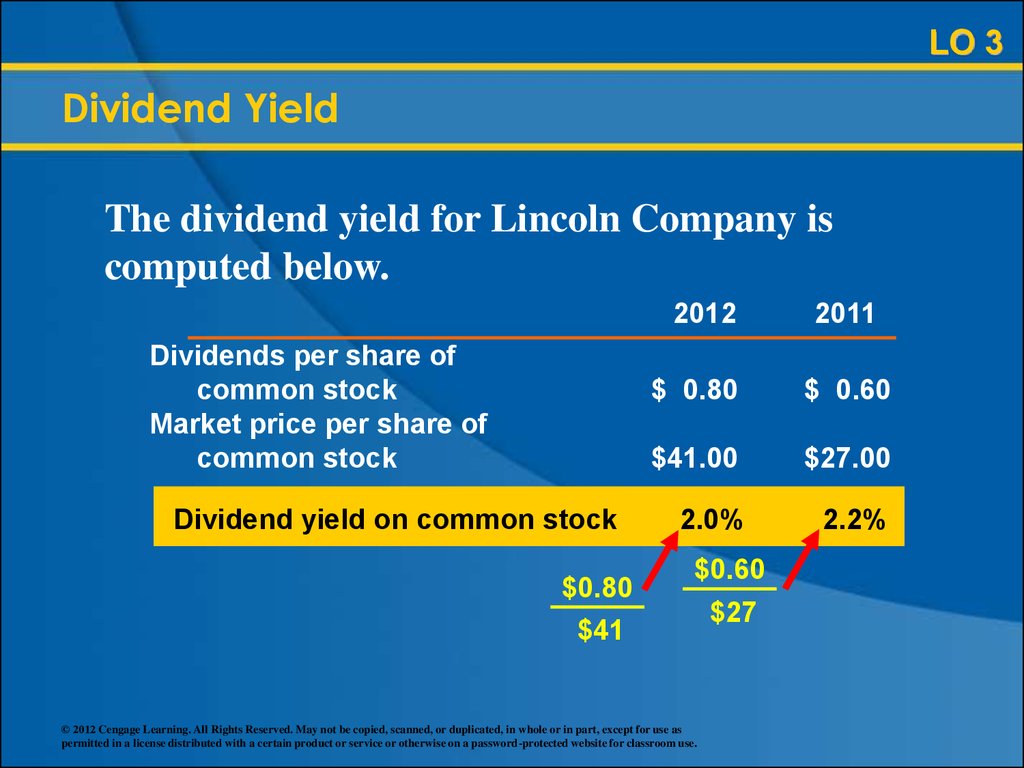

LO 1Horizontal Analysis

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

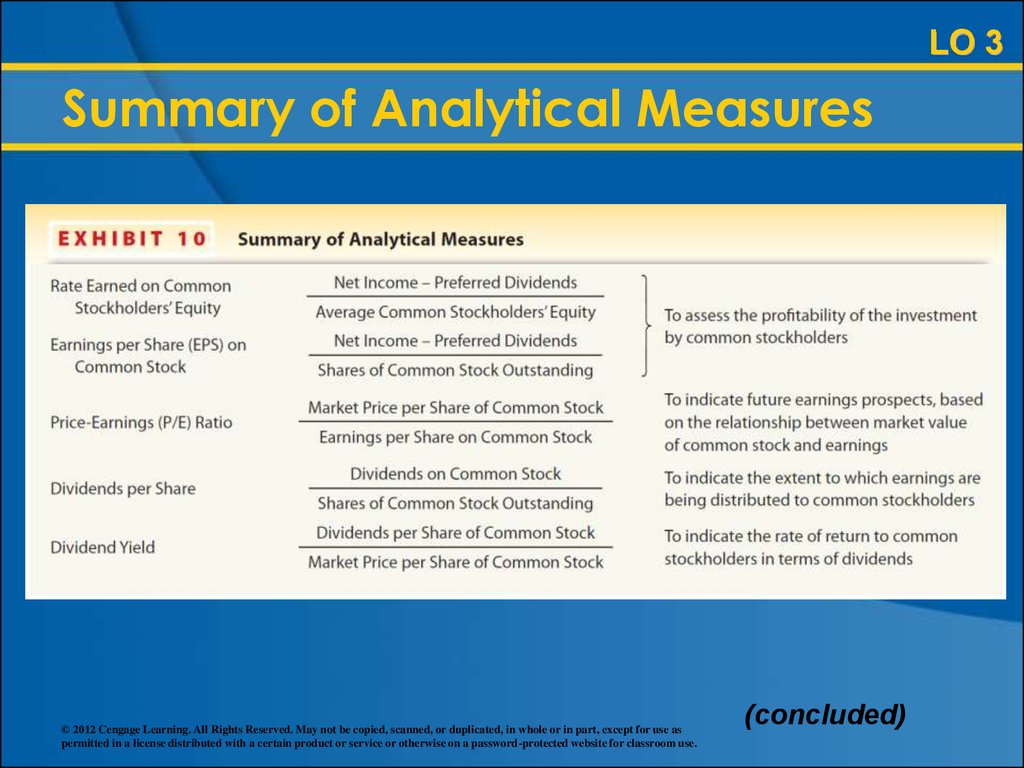

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

7.

LO 1Horizontal Analysis

Horizontal

Analysis:

Difference

Base year (2011)

$17,000

= 3.2%

$533,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

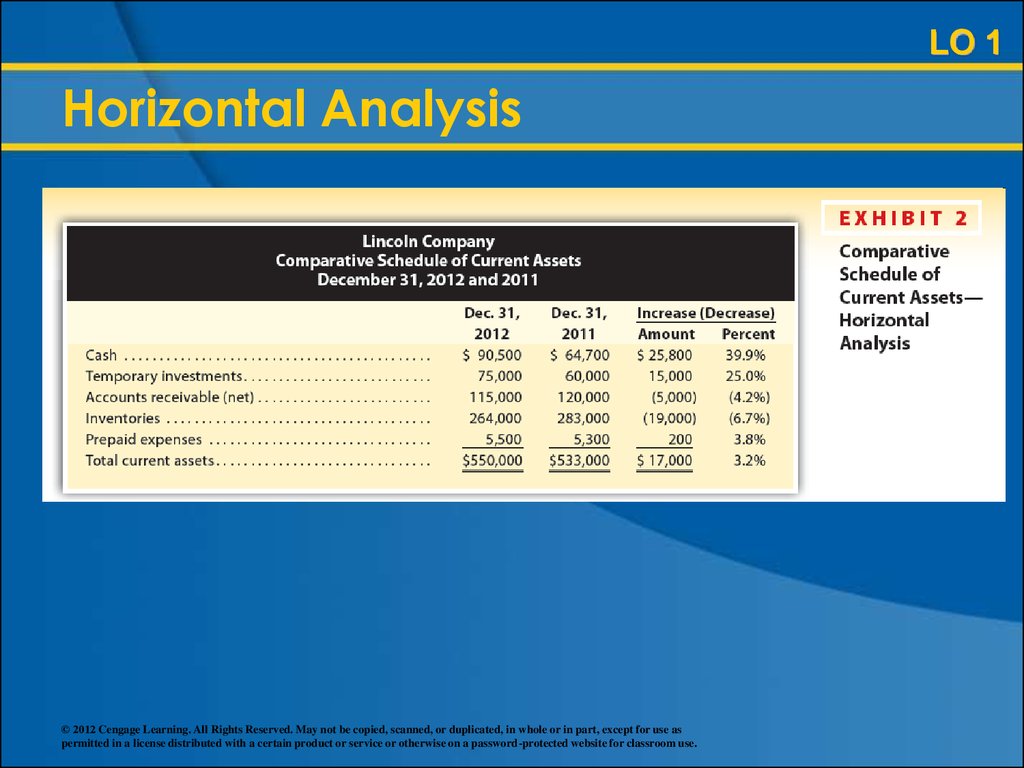

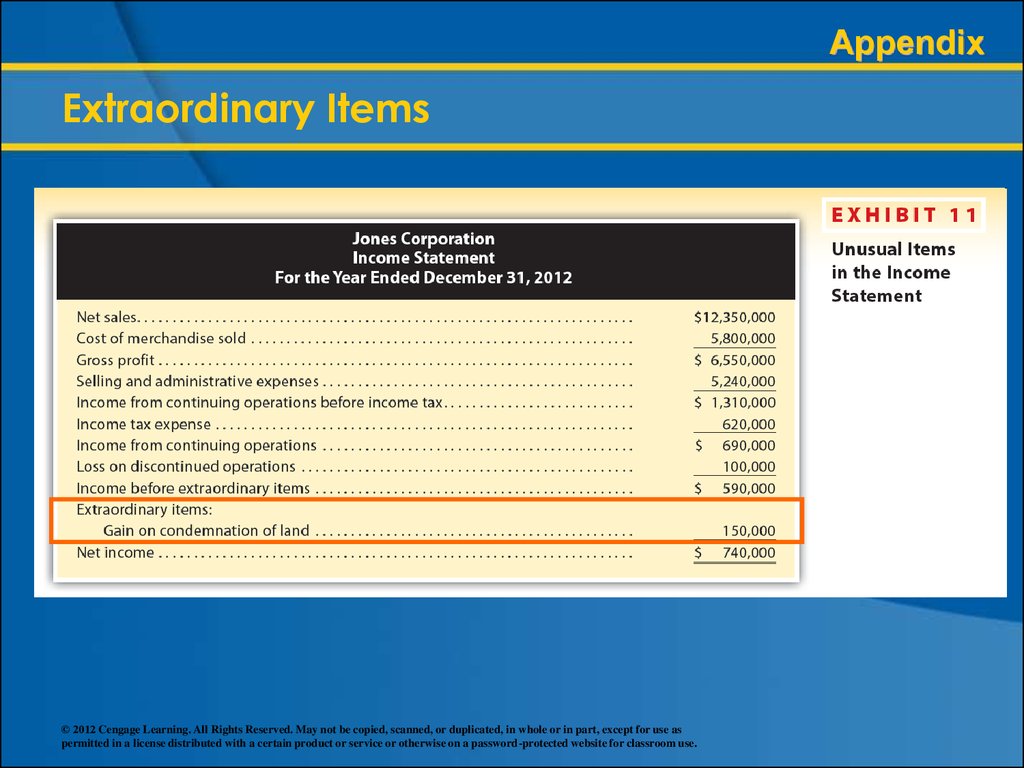

8.

LO 1Horizontal Analysis

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

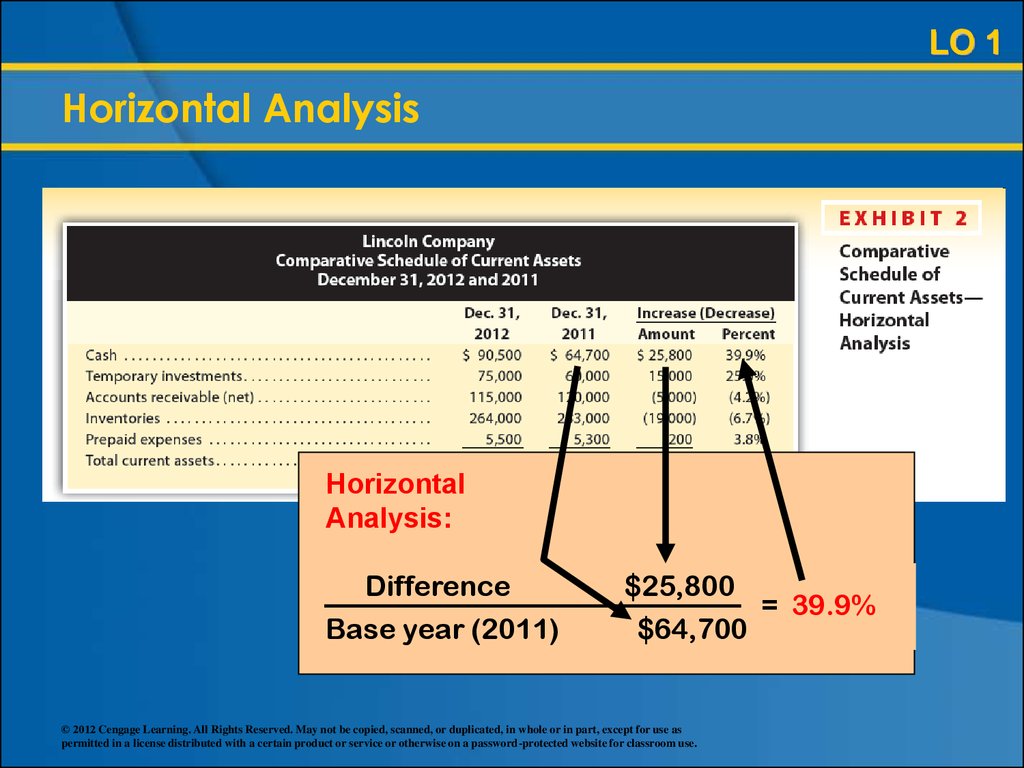

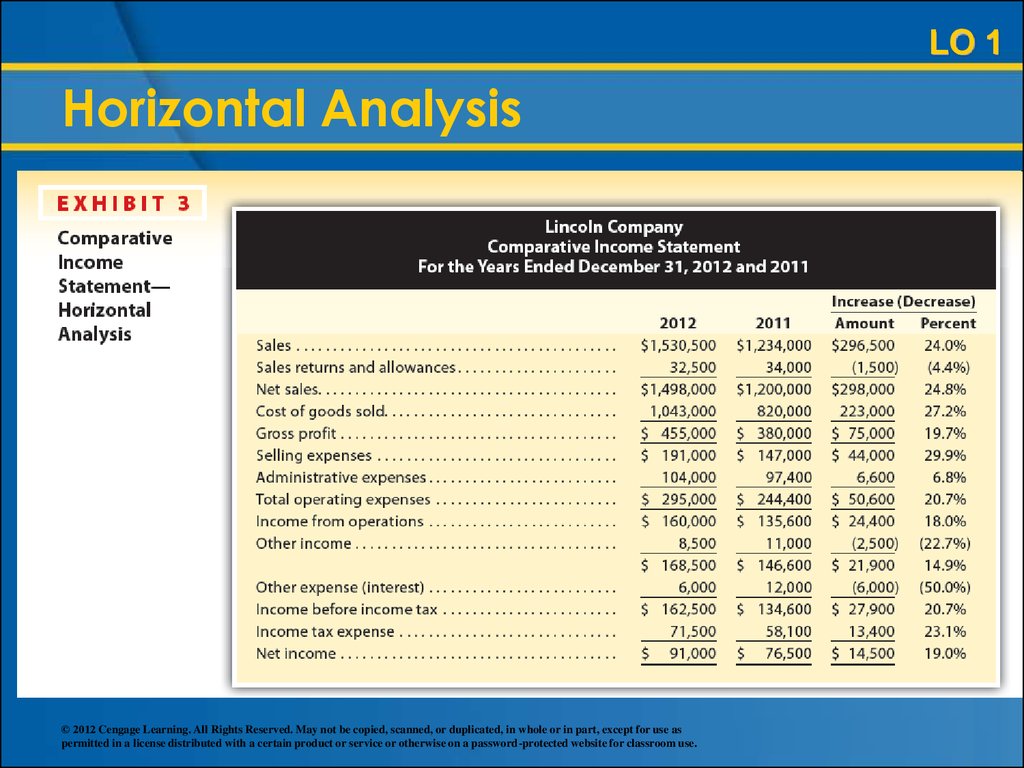

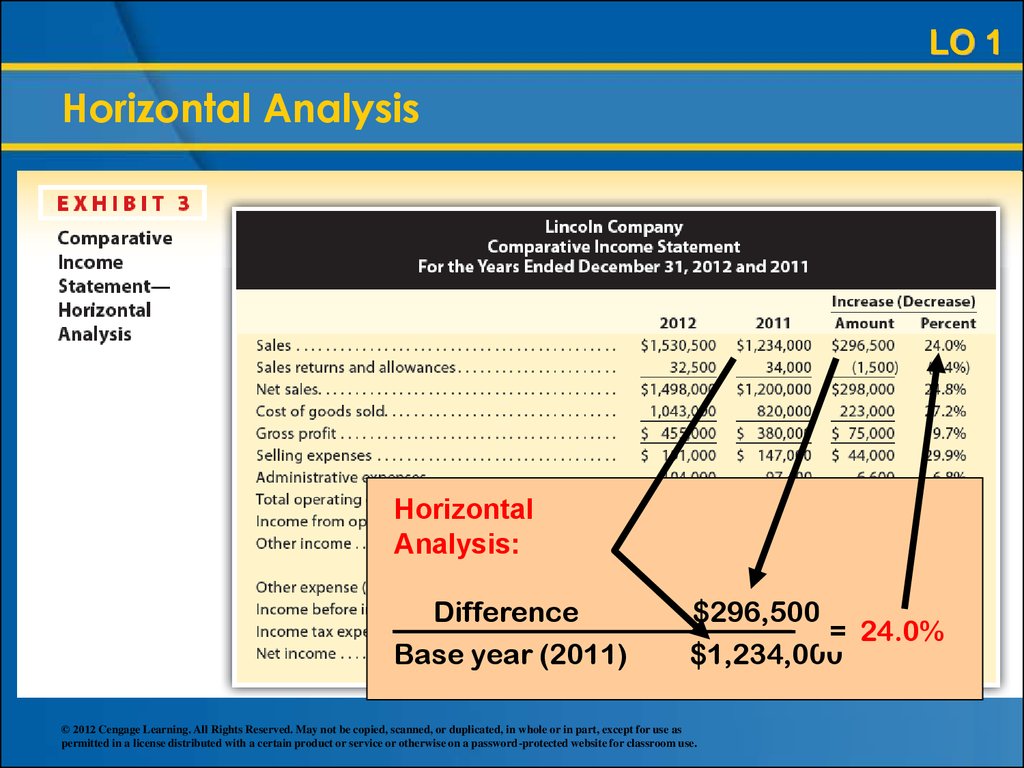

9. Horizontal Analysis

LO 1Horizontal Analysis

Horizontal

Analysis:

Difference

Base year (2011)

$25,800

= 39.9%

$64,700

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

10.

LO 1Horizontal Analysis

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

11. Horizontal Analysis

LO 1Horizontal Analysis

Horizontal

Analysis:

Difference

Base year (2011)

$296,500

= 24.0%

$1,234,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

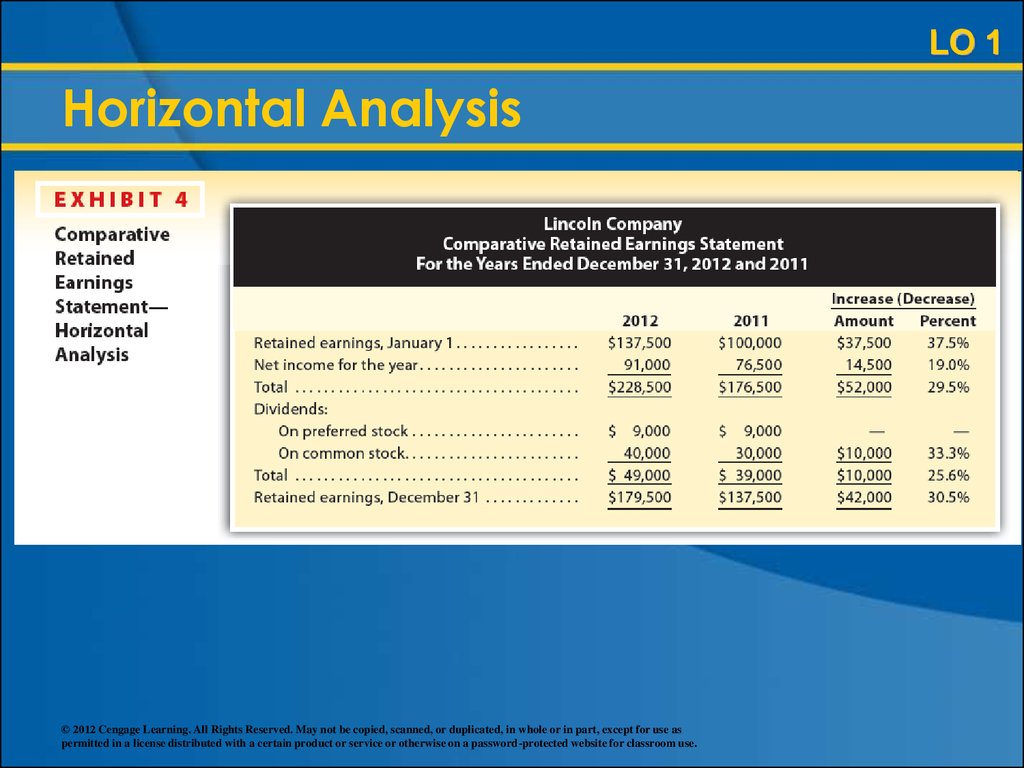

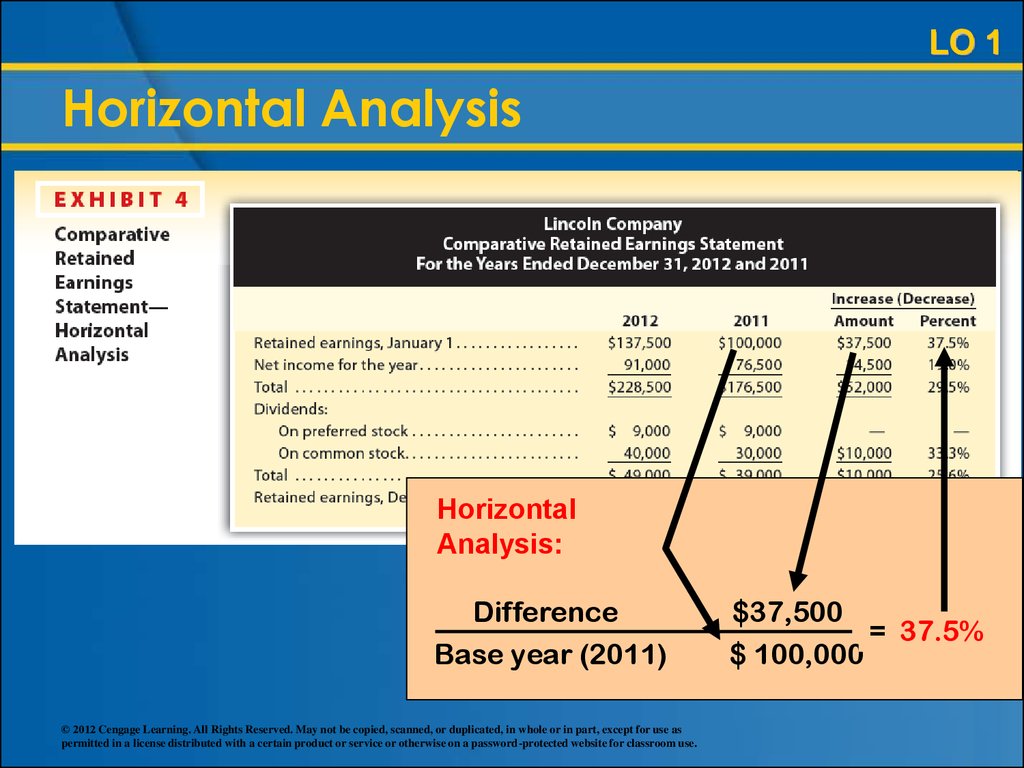

12.

LO 1Horizontal Analysis

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

13.

LO 1Horizontal Analysis

Horizontal

Analysis:

Difference

Base year (2011)

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

$37,500

= 37.5%

$ 100,000

14.

EE 17-1© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

15. Vertical Analysis

LO 1Vertical Analysis

A percentage analysis used to show the

relationship of each component to the total

within a single financial statement is called

vertical analysis.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

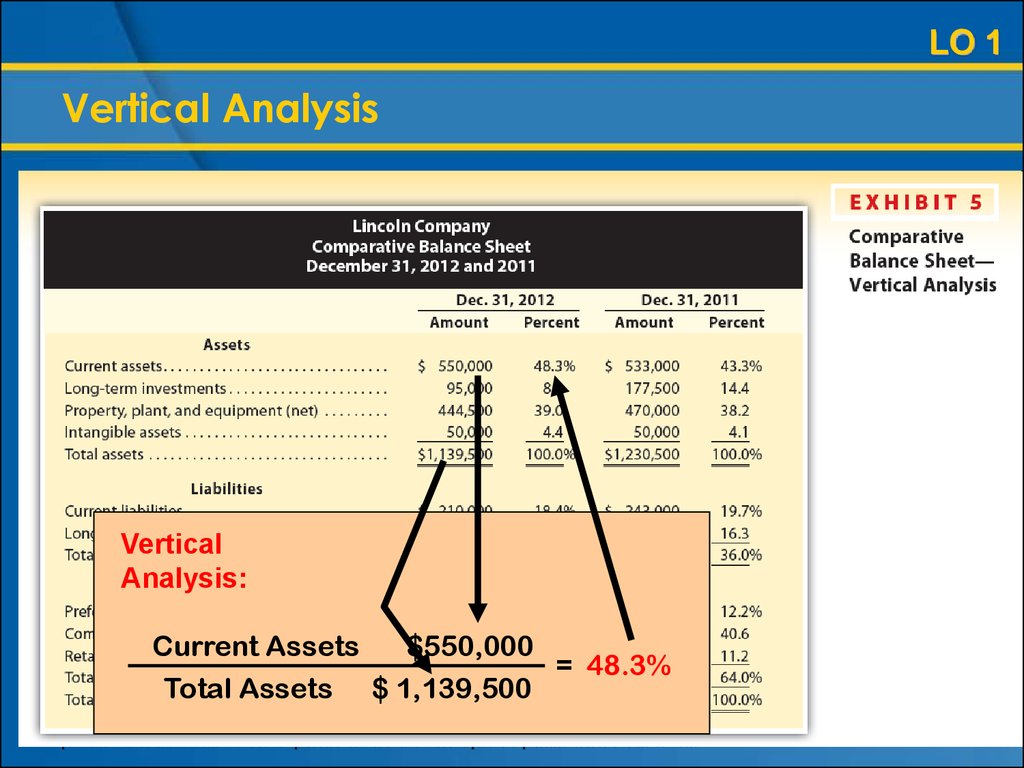

16. Vertical Analysis

LO 1Vertical Analysis

In a vertical analysis of the balance sheet,

each asset item is stated as a percent of the

total assets.

Each liability and stockholders’ equity item

is stated as a percent of the total liabilities

and stockholders’ equity.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

17. Vertical Analysis

LO 1Vertical Analysis

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

18. Vertical Analysis

LO 1Vertical Analysis

Vertical

Analysis:

Current Assets

$550,000

= 48.3%

Total Assets $ 1,139,500

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

19. Vertical Analysis

LO 1Vertical Analysis

In a vertical analysis of the income

statement, each item is stated as a percent

of net sales.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

20.

LO 1Vertical Analysis

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

21. Vertical Analysis

LO 1Vertical Analysis

Vertical Analysis:

Selling expenses $191,000

= 12.8%

Net sales

$1,498,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

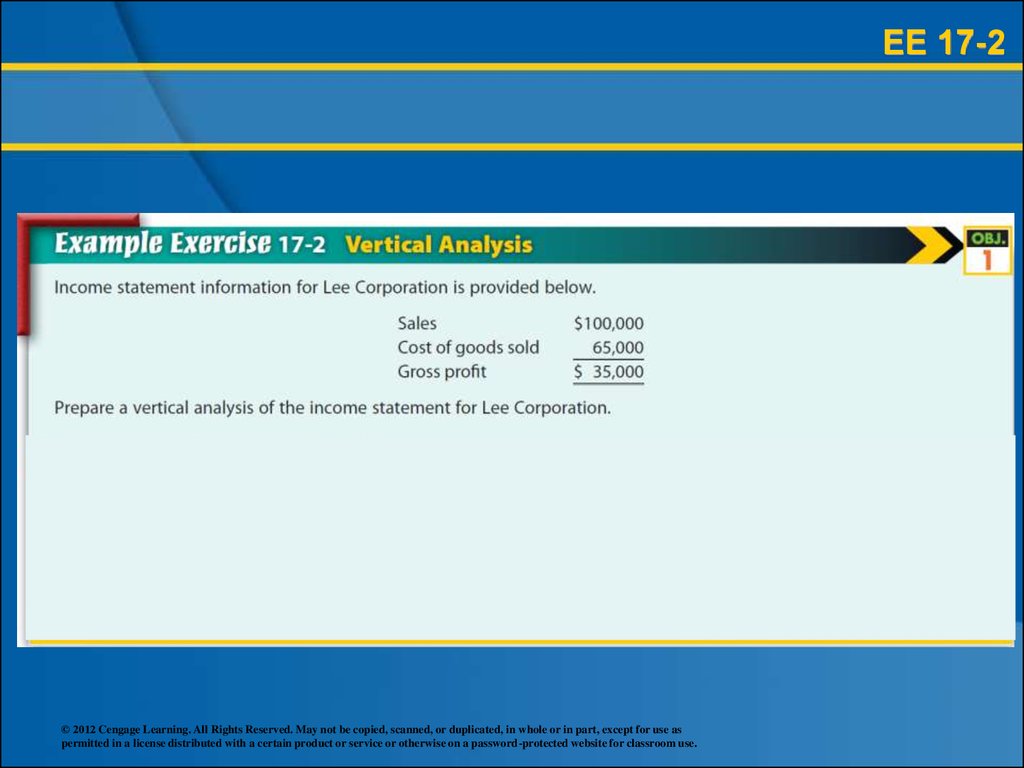

22.

EE 17-2© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

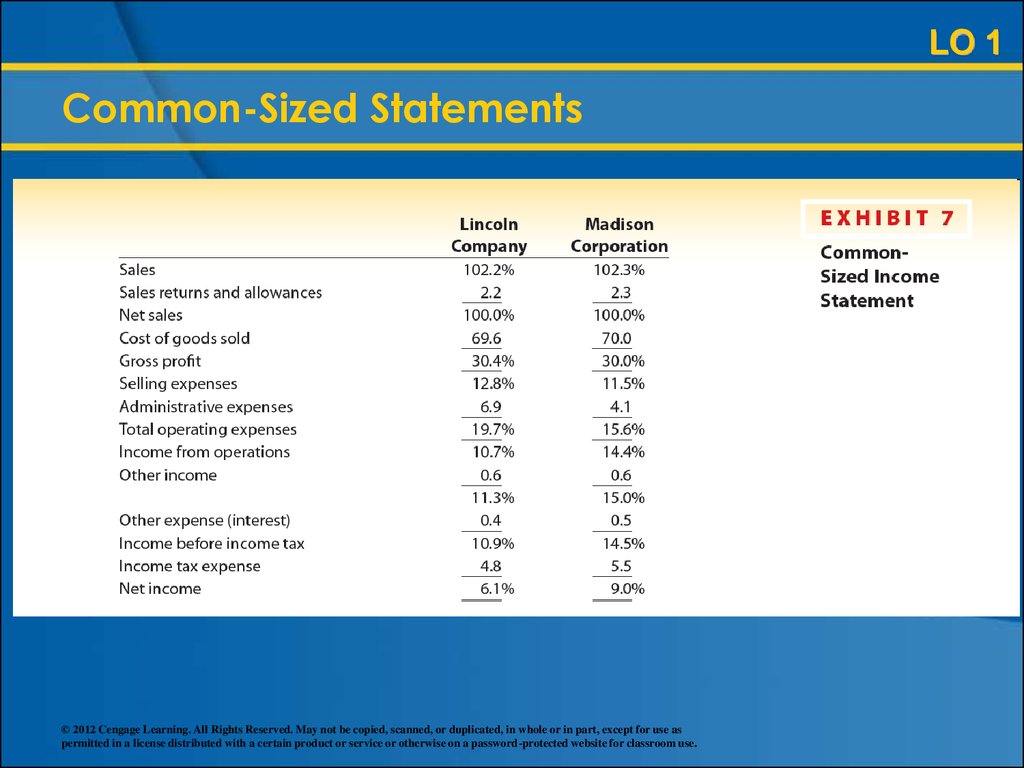

23. Common-Sized Statements

LO 1Common-Sized Statements

In a common-sized statement, all items are

expressed as percentages with no dollar

amounts shown.

Common-sized statements are useful for

comparing the current period with prior

periods, individual businesses with one

another, or one business with industry

averages.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

24. Common-Sized Statements

LO 1Common-Sized Statements

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

25. Learning Objective 2

1. Describe basic financial statementanalytical methods.

2. Use financial statement analysis to assess

the solvency of a business.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

26. Solvency Analysis

LO 2Solvency Analysis

All users of financial statements are

interested in the ability of a company to do

the following:

Meet its financial obligations (debts),

called solvency.

Earn income, called profitability.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

27. Solvency Analysis

LO 2Solvency Analysis

Solvency analysis focuses on the ability of a

business to pay its current and noncurrent

liabilities.

Solvency and profitability are interrelated. A

company that cannot pay its debts will have

difficulty obtaining credit, which can

decrease its profitability.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

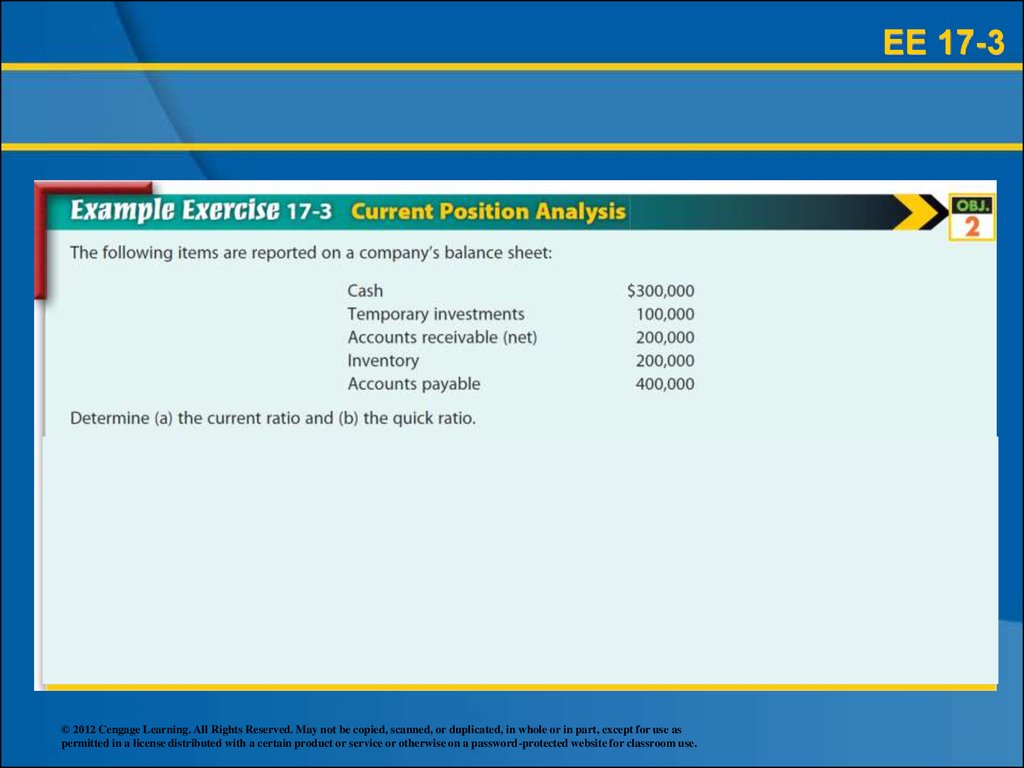

28. Current Position Analysis

LO 2Current Position Analysis

A company’s ability to pay its current

liabilities is called current position analysis. It

is of special interest to short-term creditors.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

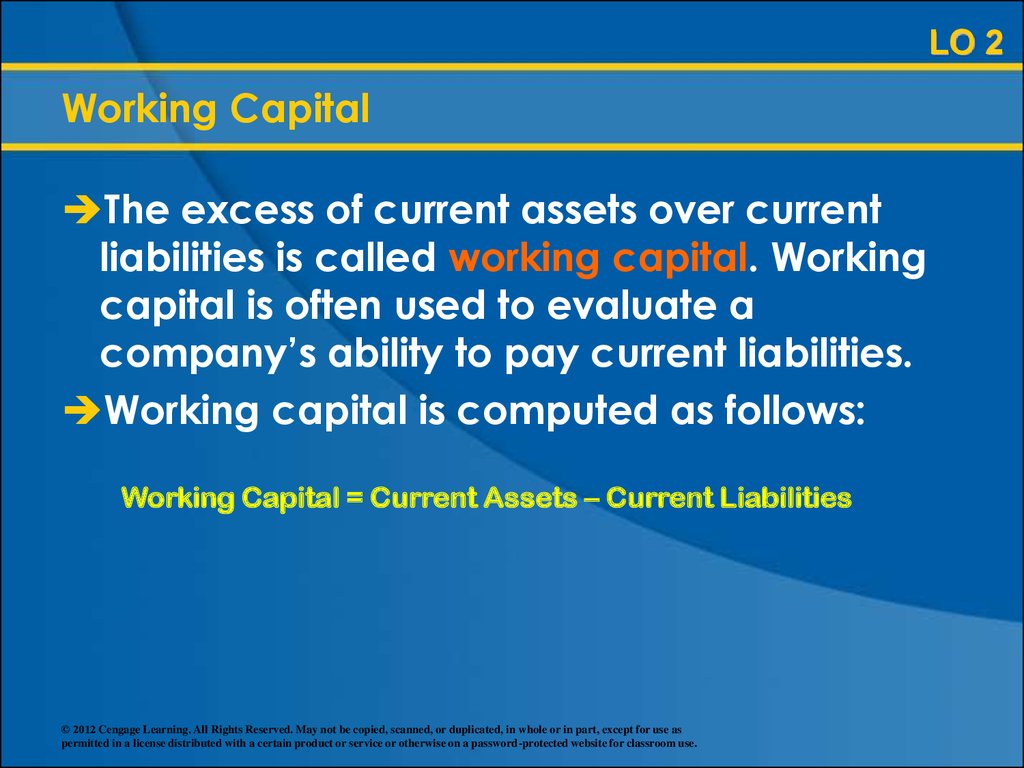

29. Working Capital

LO 2Working Capital

The excess of current assets over current

liabilities is called working capital. Working

capital is often used to evaluate a

company’s ability to pay current liabilities.

Working capital is computed as follows:

Working Capital = Current Assets – Current Liabilities

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

30. Current Ratio

LO 2Current Ratio

The current ratio, sometimes called the

working capital ratio or bankers’ ratio, also

measures a company’s ability to pay its

current liabilities.

The current ratio is computed as follows:

Current Ratio =

Current Assets

Current Liabilities

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

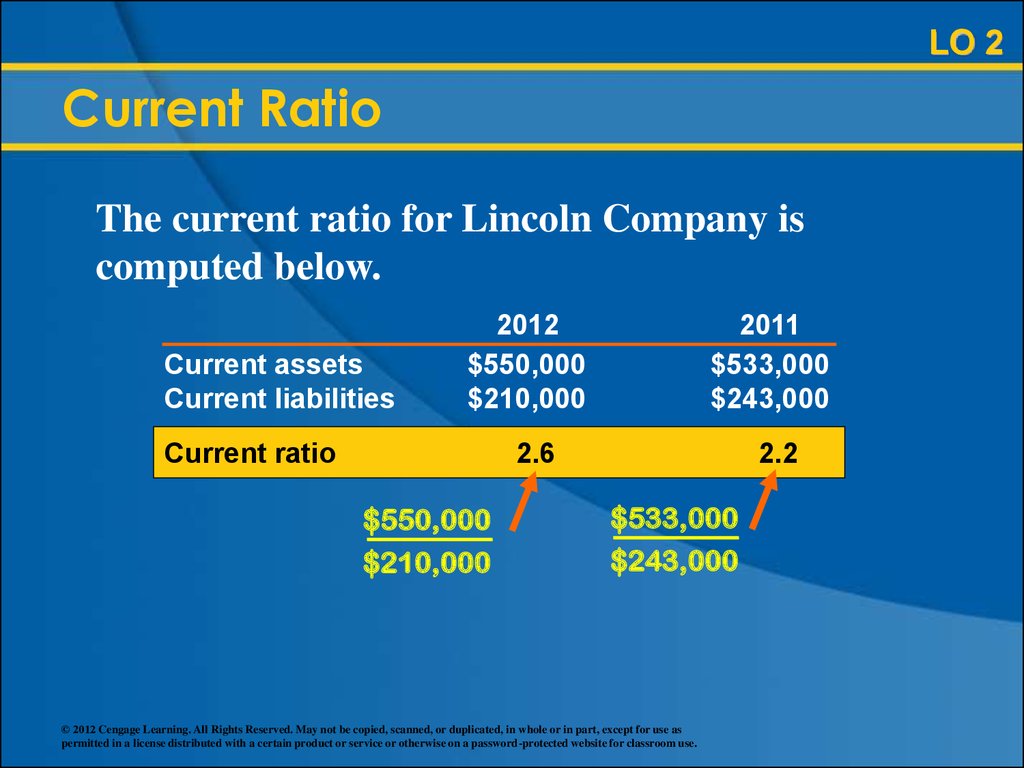

31.

LO 2Current Ratio

The current ratio for Lincoln Company is

computed below.

Current assets

Current liabilities

2012

$550,000

$210,000

Current ratio

2011

$533,000

$243,000

2.6

$550,000

$210,000

2.2

$533,000

$243,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

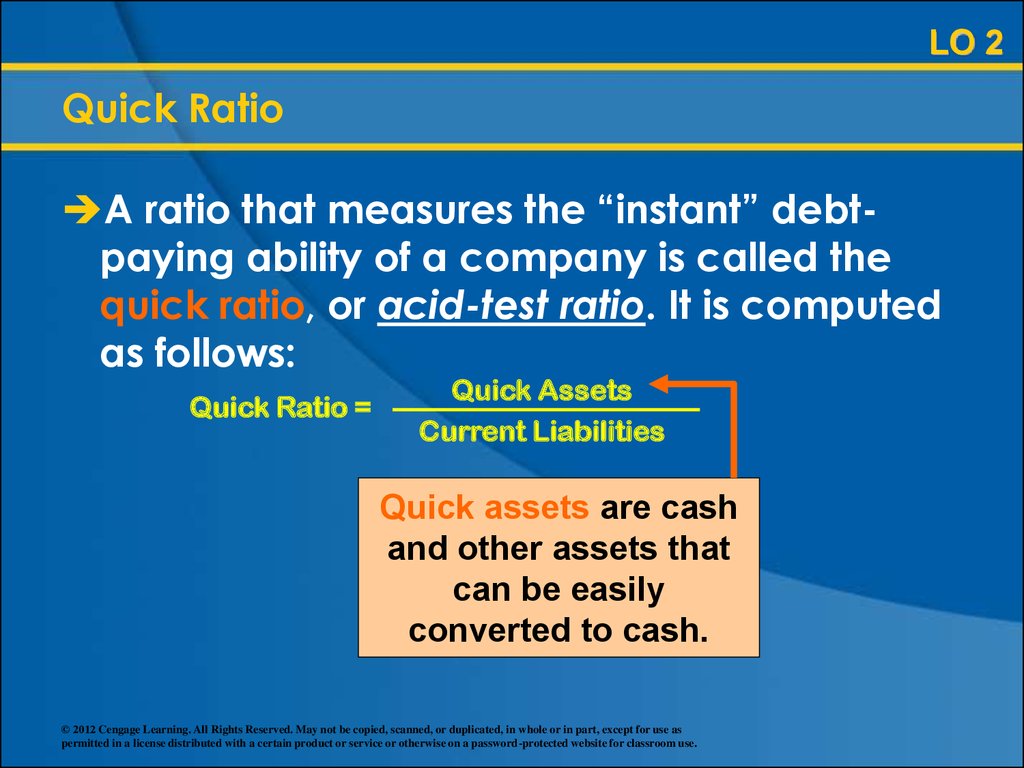

32. Quick Ratio

LO 2Quick Ratio

A ratio that measures the “instant” debtpaying ability of a company is called the

quick ratio, or acid-test ratio. It is computed

as follows:

Quick Ratio =

Quick Assets

Current Liabilities

Quick assets are cash

and other assets that

can be easily

converted to cash.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

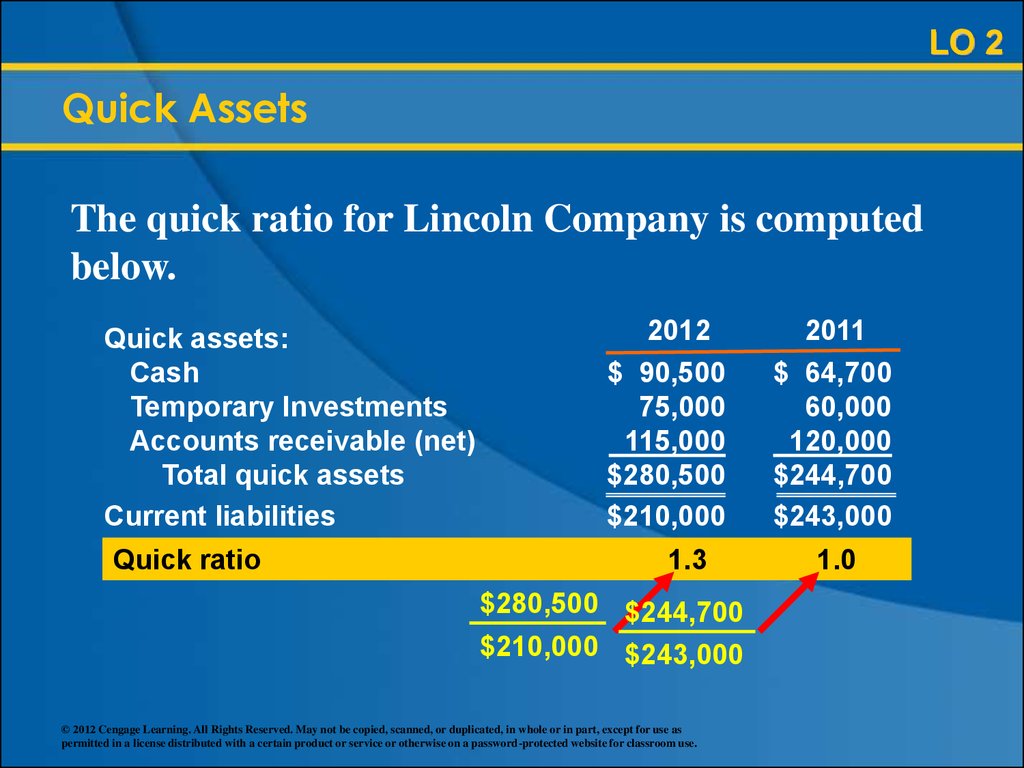

33. Quick Assets

LO 2Quick Assets

The quick ratio for Lincoln Company is computed

below.

Quick assets:

Cash

Temporary Investments

Accounts receivable (net)

Total quick assets

Current liabilities

Quick ratio

2012

$ 90,500

75,000

115,000

$280,500

$210,000

1.3

$280,500 $244,700

$210,000 $243,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

2011

$ 64,700

60,000

120,000

$244,700

$243,000

1.0

34.

EE 17-3© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

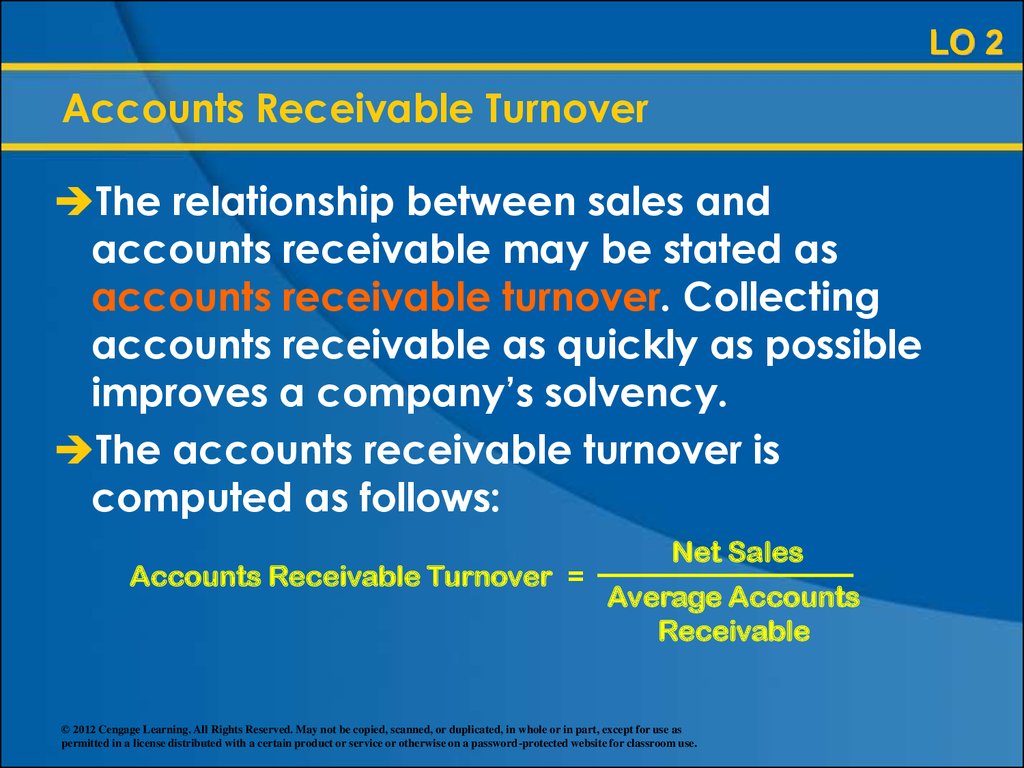

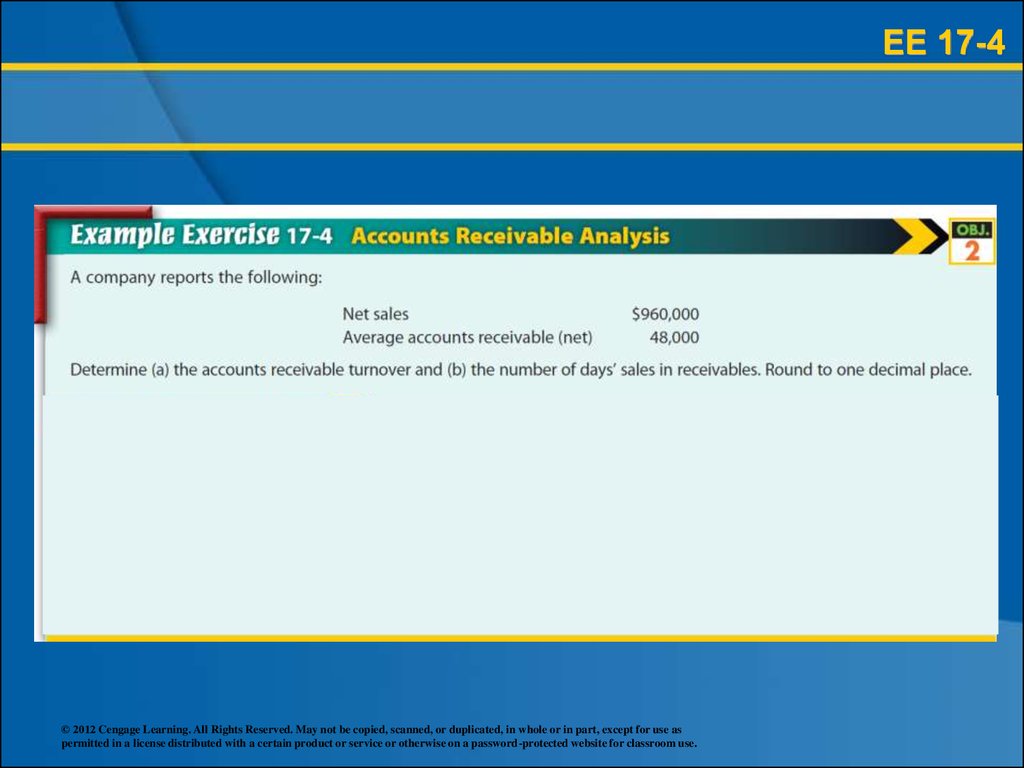

35. Accounts Receivable Turnover

LO 2Accounts Receivable Turnover

The relationship between sales and

accounts receivable may be stated as

accounts receivable turnover. Collecting

accounts receivable as quickly as possible

improves a company’s solvency.

The accounts receivable turnover is

computed as follows:

Accounts Receivable Turnover =

Net Sales

Average Accounts

Receivable

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

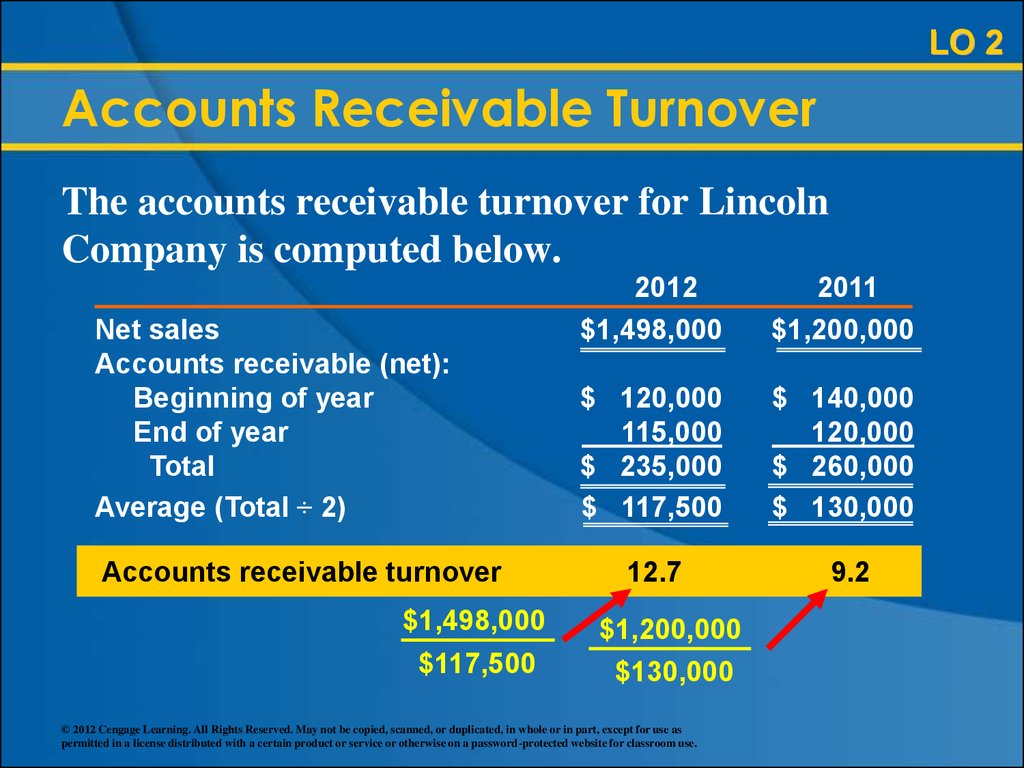

36.

LO 2Accounts Receivable Turnover

The accounts receivable turnover for Lincoln

Company is computed below.

Net sales

Accounts receivable (net):

Beginning of year

End of year

Total

Average (Total ÷ 2)

Accounts receivable turnover

$1,498,000

$117,500

2012

$1,498,000

2011

$1,200,000

$ 120,000

115,000

$ 235,000

$ 117,500

$ 140,000

120,000

$ 260,000

$ 130,000

12.7

9.2

$1,200,000

$130,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

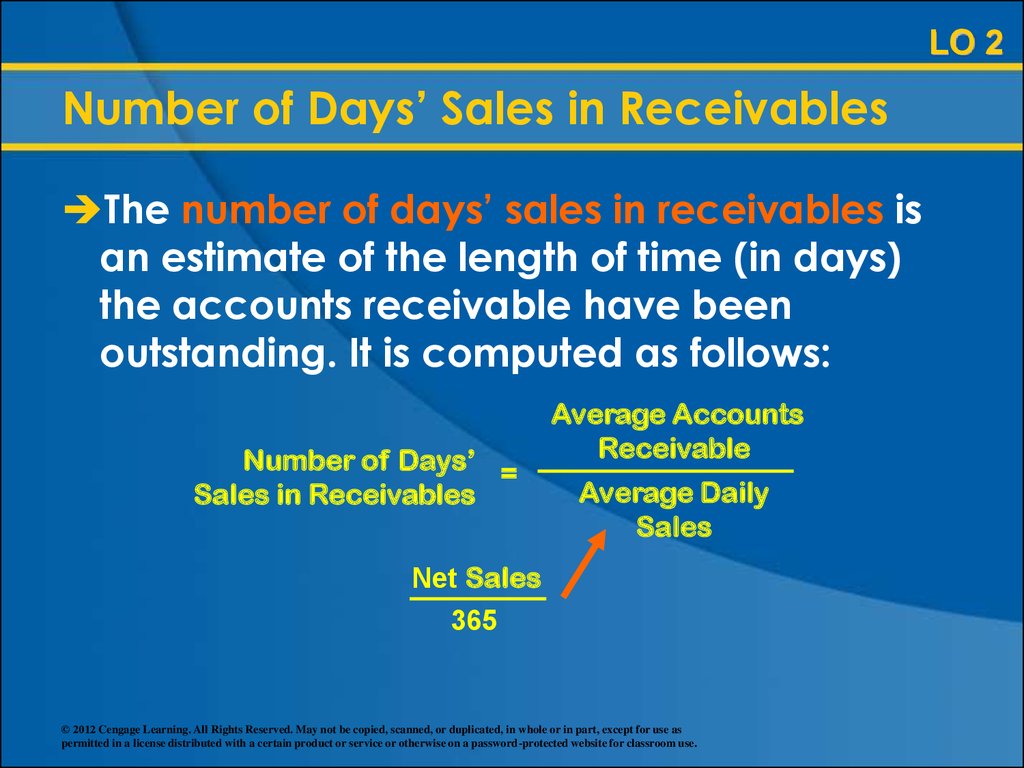

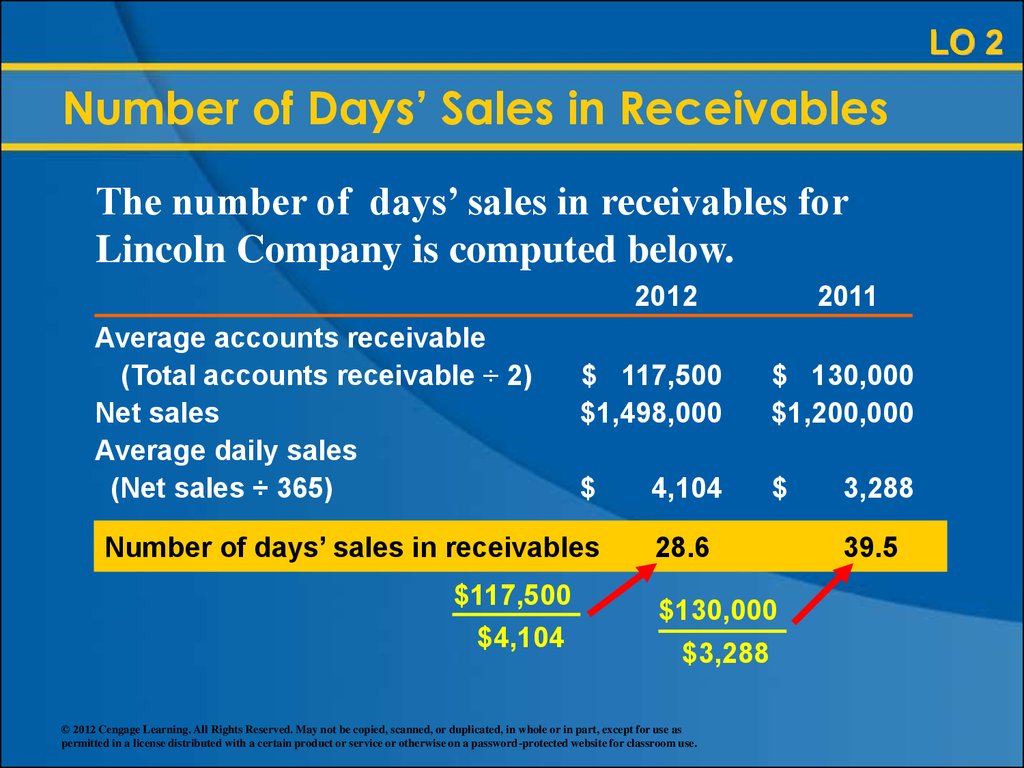

37. Number of Days’ Sales in Receivables

LO 2Number of Days’ Sales in Receivables

The number of days’ sales in receivables is

an estimate of the length of time (in days)

the accounts receivable have been

outstanding. It is computed as follows:

Number of Days’ =

Sales in Receivables

Average Accounts

Receivable

Average Daily

Sales

Net Sales

365

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

38. Number of Days’ Sales in Receivables

LO 2Number of Days’ Sales in Receivables

The number of days’ sales in receivables for

Lincoln Company is computed below.

2012

Average accounts receivable

(Total accounts receivable ÷ 2)

Net sales

Average daily sales

(Net sales ÷ 365)

$ 117,500

$1,498,000

$ 130,000

$1,200,000

$

$

Number of days’ sales in receivables

$117,500

$4,104

2011

4,104

28.6

$130,000

$3,288

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3,288

39.5

39.

EE 17-4© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

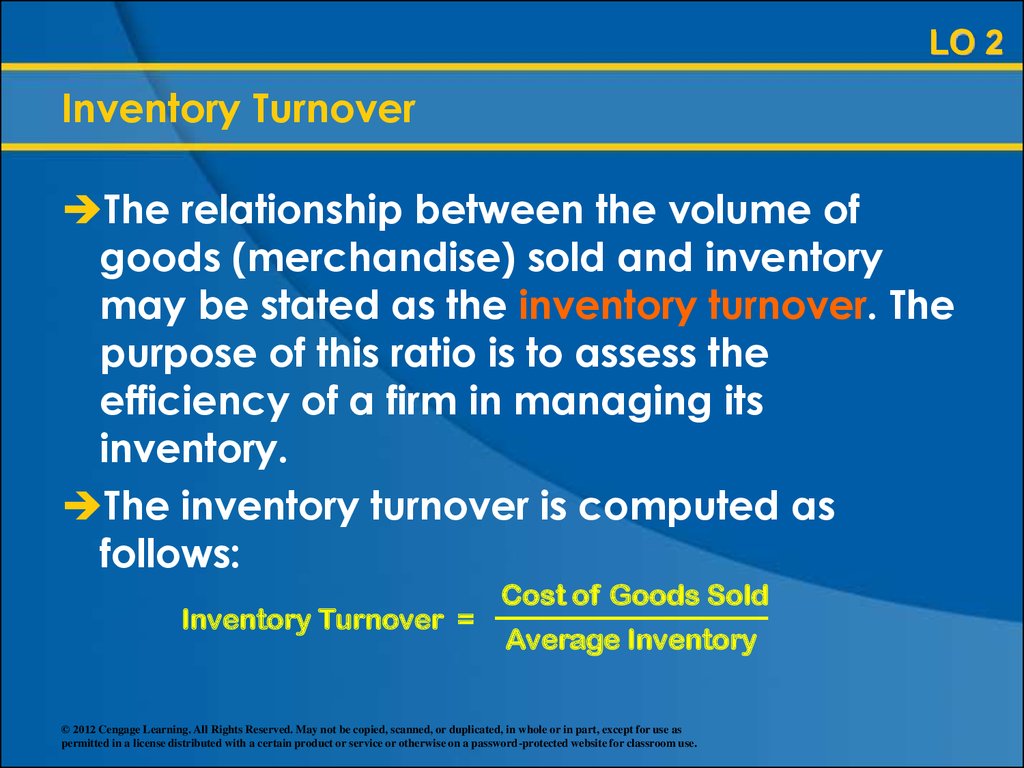

40. Inventory Turnover

LO 2Inventory Turnover

The relationship between the volume of

goods (merchandise) sold and inventory

may be stated as the inventory turnover. The

purpose of this ratio is to assess the

efficiency of a firm in managing its

inventory.

The inventory turnover is computed as

follows:

Inventory Turnover =

Cost of Goods Sold

Average Inventory

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

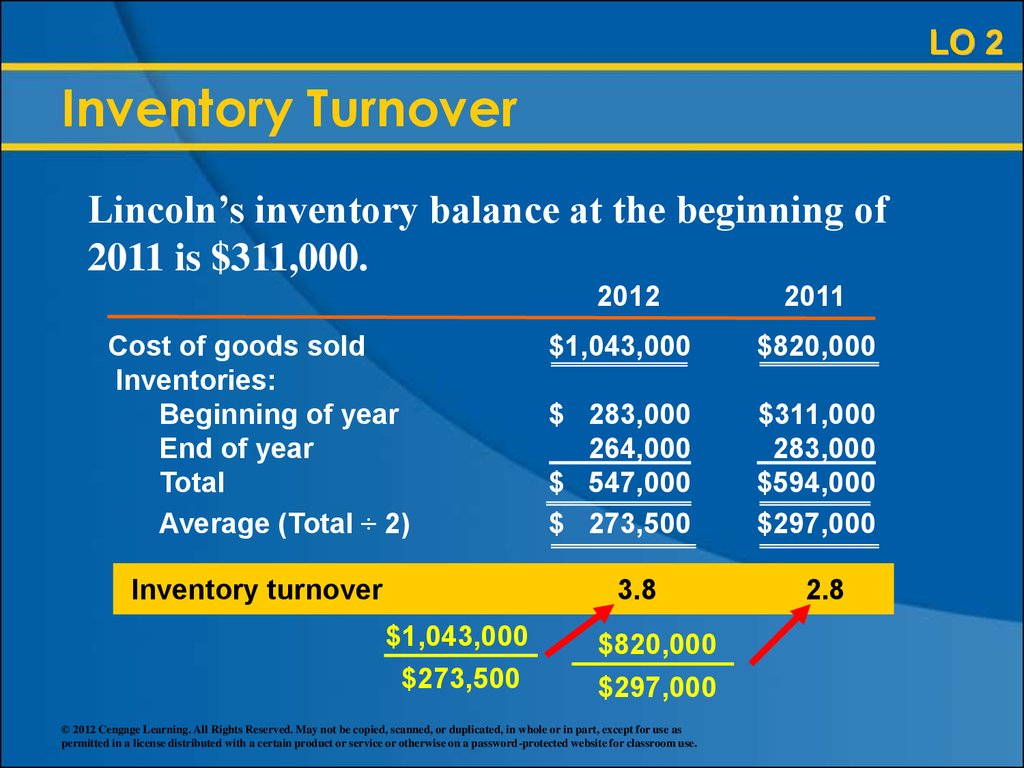

41.

LO 2Inventory Turnover

Lincoln’s inventory balance at the beginning of

2011 is $311,000.

Cost of goods sold

Inventories:

Beginning of year

End of year

Total

Average (Total ÷ 2)

Inventory turnover

2012

2011

$1,043,000

$820,000

$ 283,000

264,000

$ 547,000

$ 273,500

$311,000

283,000

$594,000

$297,000

3.8

$1,043,000

$273,500

$820,000

$297,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

2.8

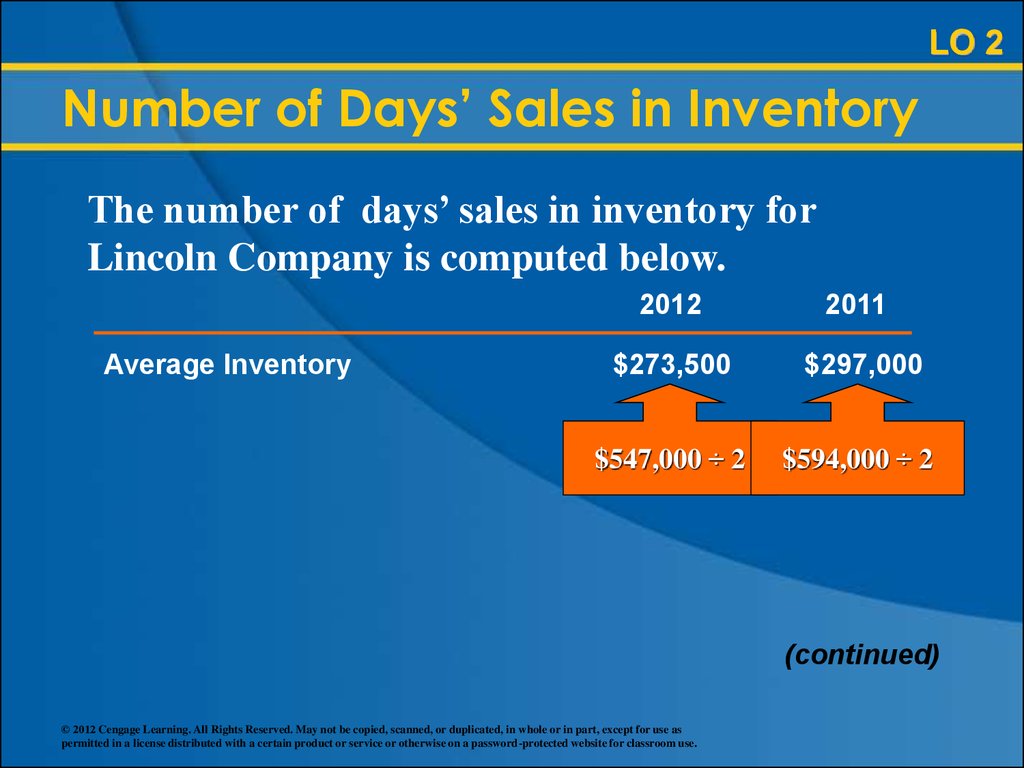

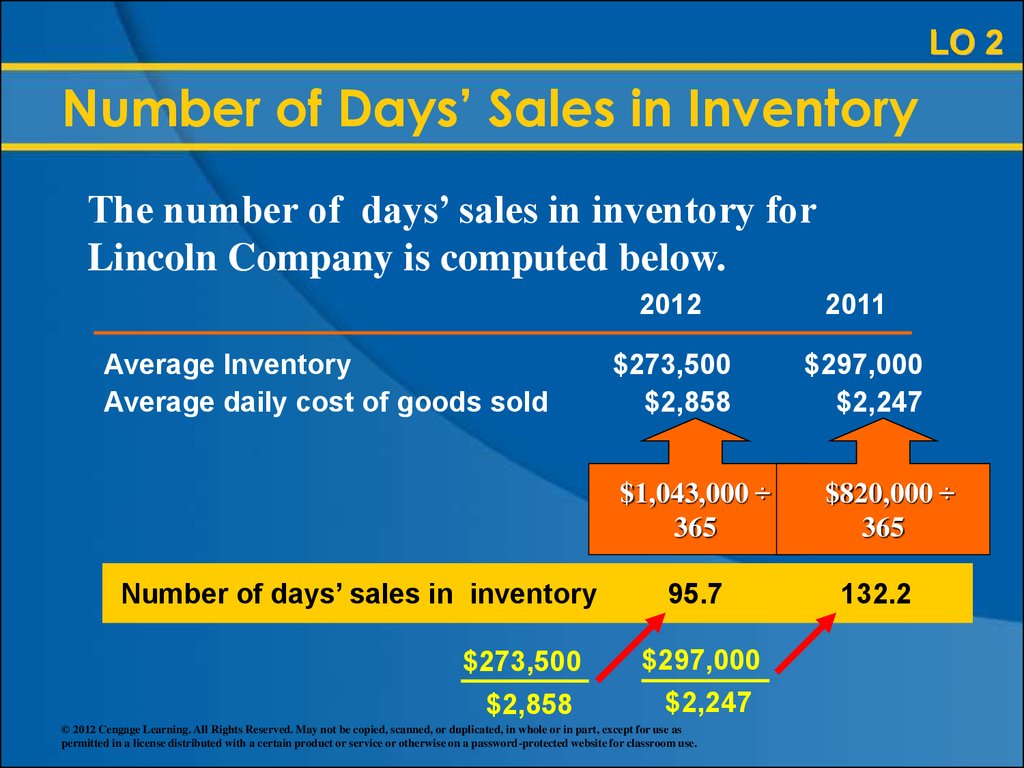

42. Number of Days’ Sales in Inventory

LO 2Number of Days’ Sales in Inventory

The number of days’ sales in inventory is a

rough measure of the length of time it takes

to purchase, sell, and replace the inventory.

The number of days’ sales in inventory is

computed as follows:

Average Inventory

Number of Days’

=

Sales in Inventory

Average Daily Cost of

Goods Sold

Cost of Goods Sold

365

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

43.

LO 2Number of Days’ Sales in Inventory

The number of days’ sales in inventory for

Lincoln Company is computed below.

Average Inventory

2012

2011

$273,500

$297,000

$547,000 ÷ 2

$594,000 ÷ 2

(continued)

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

44.

LO 2Number of Days’ Sales in Inventory

The number of days’ sales in inventory for

Lincoln Company is computed below.

Average Inventory

Average daily cost of goods sold

2012

2011

$273,500

$2,858

$297,000

$2,247

$1,043,000 ÷

365

Number of days’ sales in inventory

$273,500

$2,858

95.7

$297,000

$2,247

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

$820,000 ÷

365

132.2

45.

EE 17-5© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

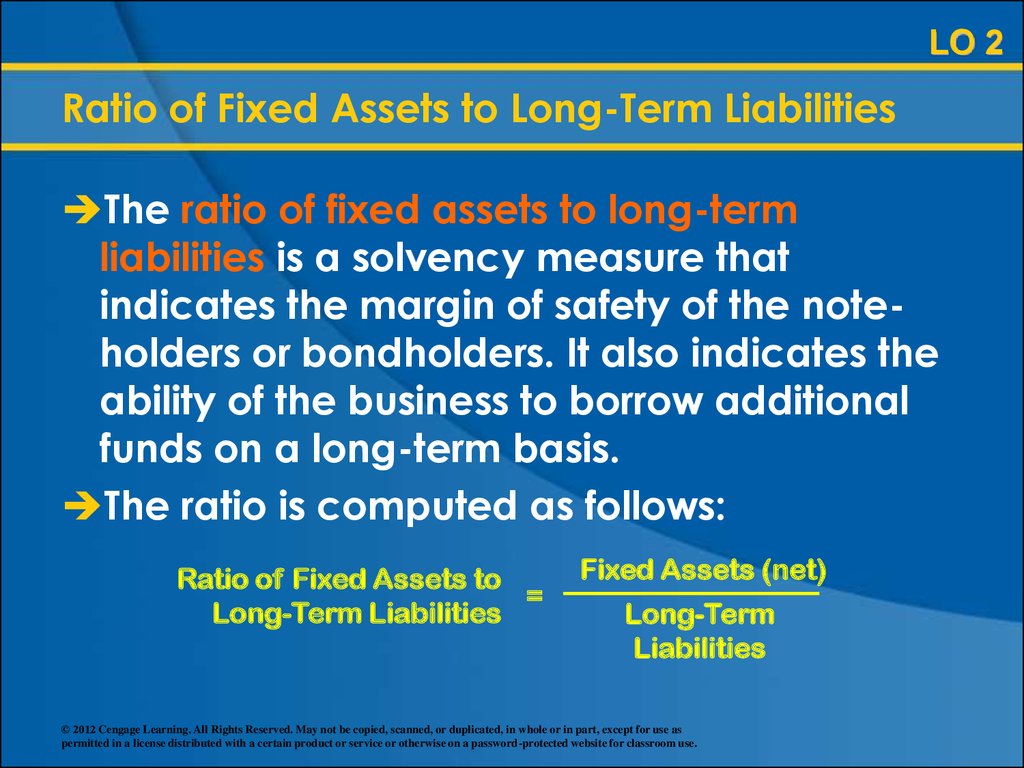

46. Ratio of Fixed Assets to Long-Term Liabilities

LO 2Ratio of Fixed Assets to Long-Term Liabilities

The ratio of fixed assets to long-term

liabilities is a solvency measure that

indicates the margin of safety of the noteholders or bondholders. It also indicates the

ability of the business to borrow additional

funds on a long-term basis.

The ratio is computed as follows:

Ratio of Fixed Assets to

=

Long-Term Liabilities

Fixed Assets (net)

Long-Term

Liabilities

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

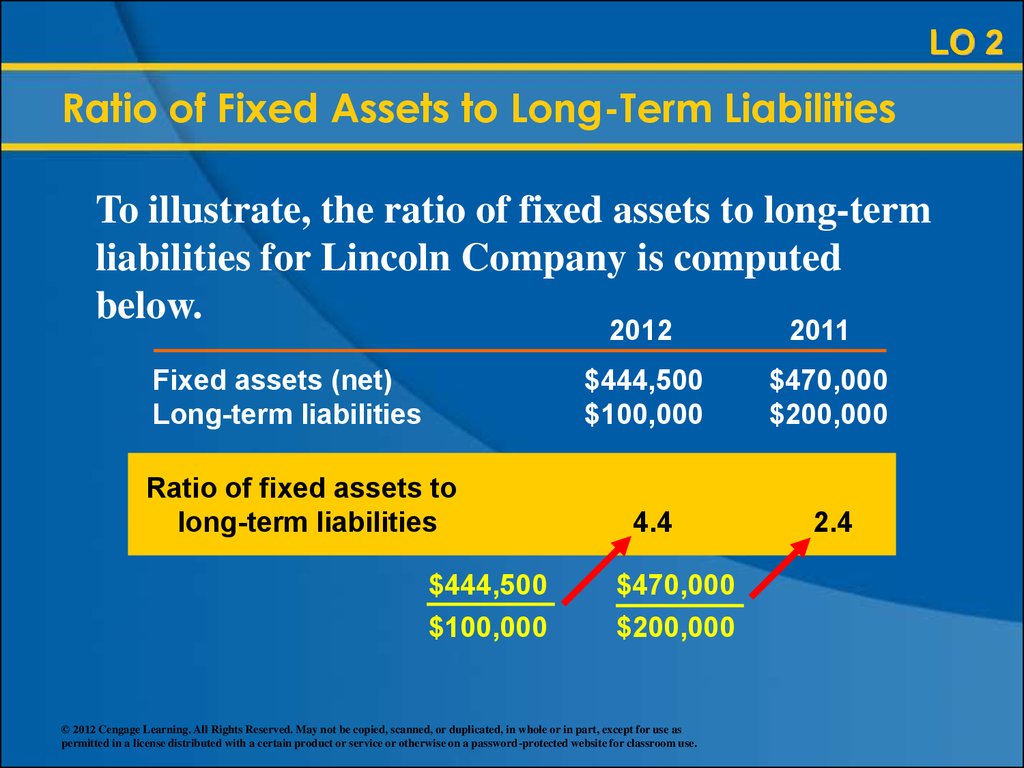

47.

LO 2Ratio of Fixed Assets to Long-Term Liabilities

To illustrate, the ratio of fixed assets to long-term

liabilities for Lincoln Company is computed

below.

2012

Fixed assets (net)

Long-term liabilities

$444,500

$100,000

Ratio of fixed assets to

long-term liabilities

$444,500

$100,000

4.4

$470,000

$200,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

2011

$470,000

$200,000

2.4

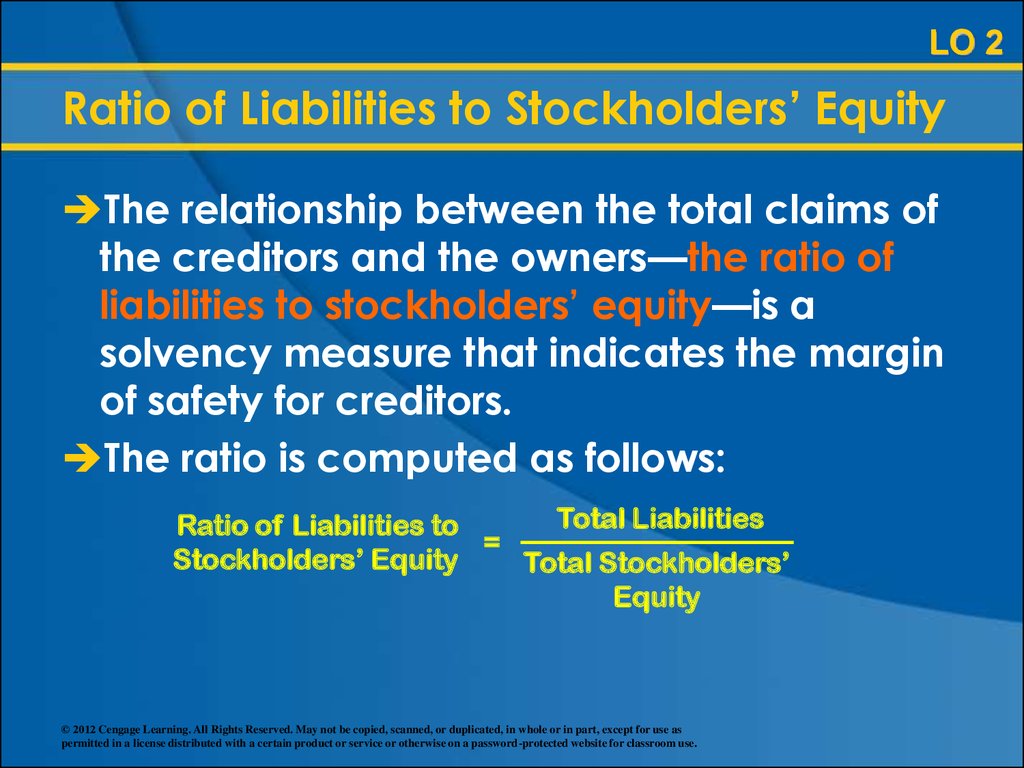

48. Ratio of Liabilities to Stockholders’ Equity

LO 2Ratio of Liabilities to Stockholders’ Equity

The relationship between the total claims of

the creditors and the owners—the ratio of

liabilities to stockholders’ equity—is a

solvency measure that indicates the margin

of safety for creditors.

The ratio is computed as follows:

Total Liabilities

Ratio of Liabilities to

=

Stockholders’ Equity

Total Stockholders’

Equity

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

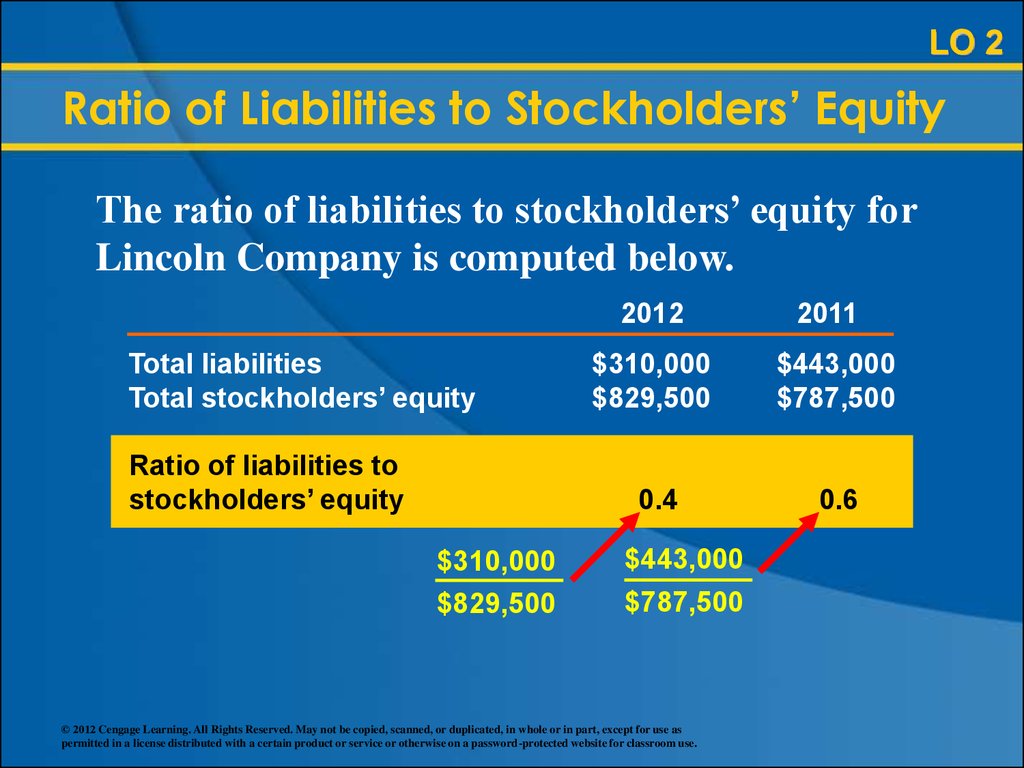

49. Ratio of Liabilities to Stockholders’ Equity

LO 2Ratio of Liabilities to Stockholders’ Equity

The ratio of liabilities to stockholders’ equity for

Lincoln Company is computed below.

2012

Total liabilities

Total stockholders’ equity

Ratio of liabilities to

stockholders’ equity

$310,000

$829,500

2011

$310,000

$829,500

$443,000

$787,500

0.4

0.6

$443,000

$787,500

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

50.

EE 17-6© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

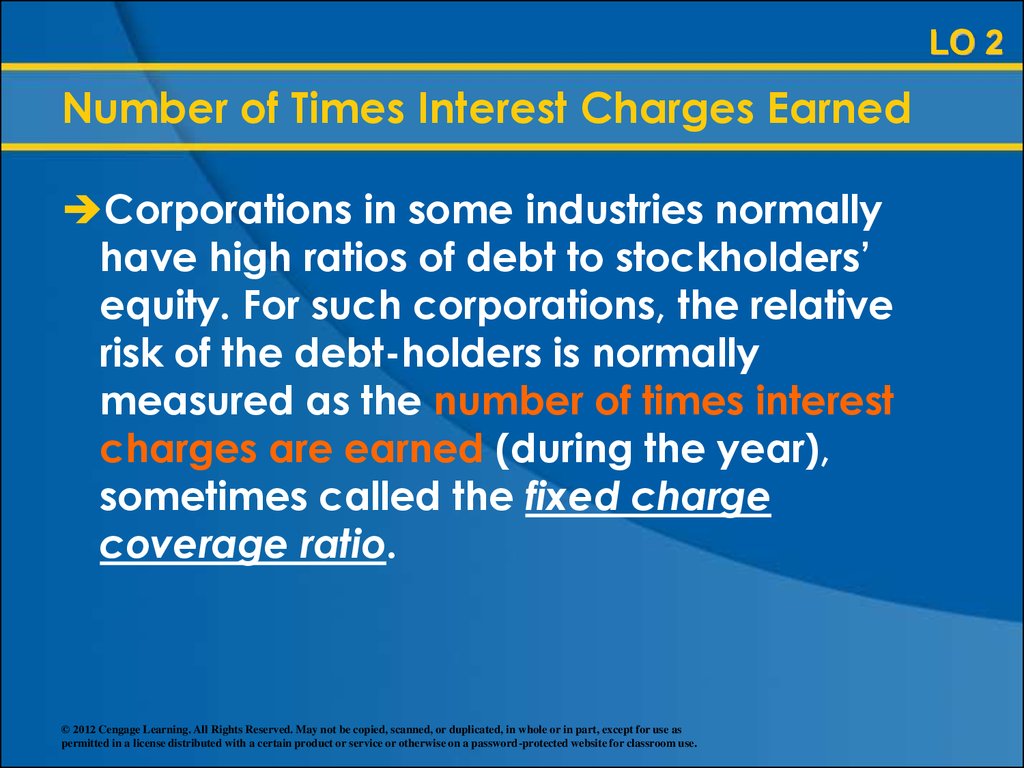

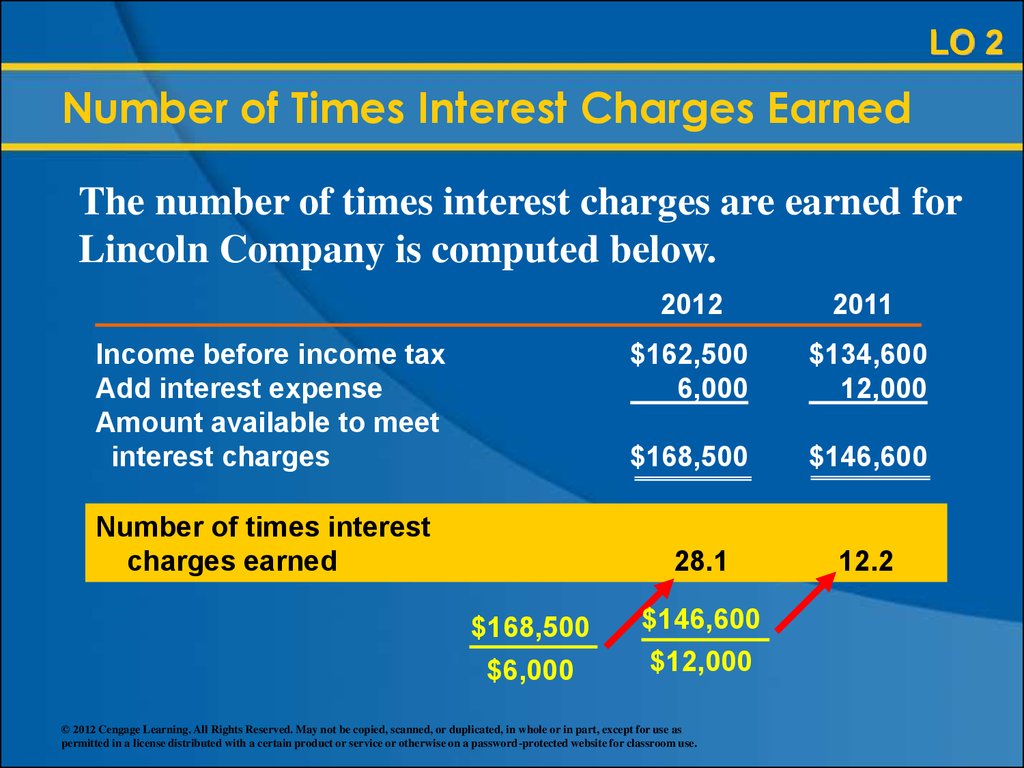

51. Number of Times Interest Charges Earned

LO 2Number of Times Interest Charges Earned

Corporations in some industries normally

have high ratios of debt to stockholders’

equity. For such corporations, the relative

risk of the debt-holders is normally

measured as the number of times interest

charges are earned (during the year),

sometimes called the fixed charge

coverage ratio.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

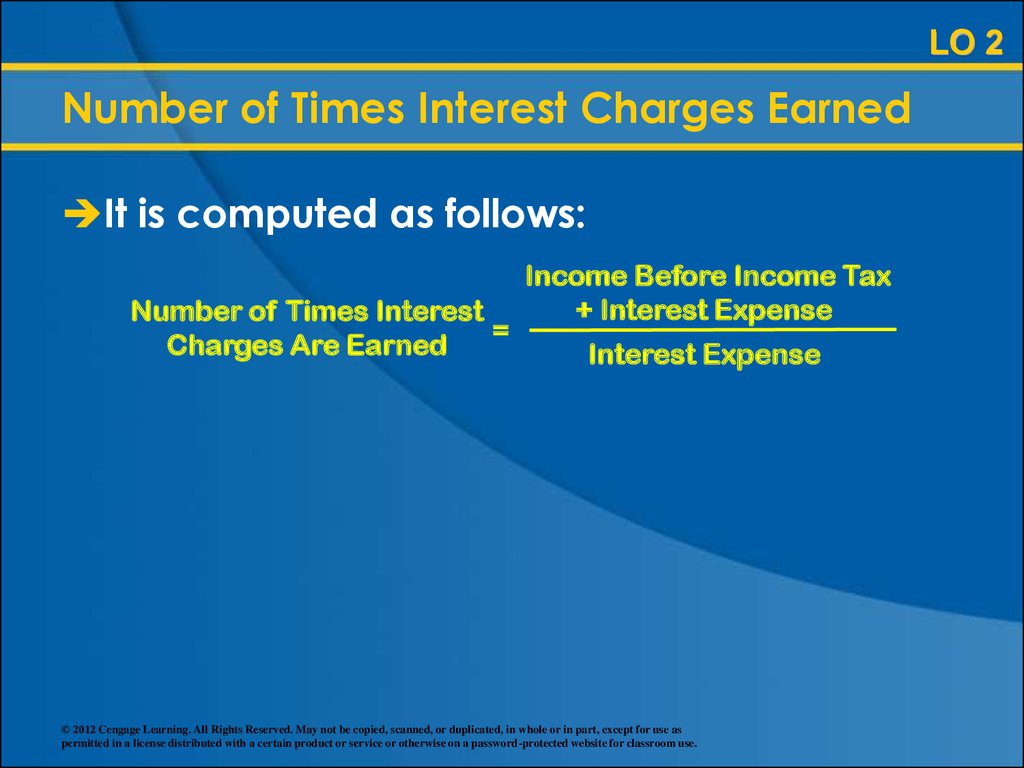

52. Number of Times Interest Charges Earned

LO 2Number of Times Interest Charges Earned

It is computed as follows:

Number of Times Interest

=

Charges Are Earned

Income Before Income Tax

+ Interest Expense

Interest Expense

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

53.

LO 2Number of Times Interest Charges Earned

The number of times interest charges are earned for

Lincoln Company is computed below.

Income before income tax

Add interest expense

Amount available to meet

interest charges

Number of times interest

charges earned

2012

2011

$162,500

6,000

$134,600

12,000

$168,500

$146,600

28.1

$168,500

$6,000

$146,600

$12,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

12.2

54.

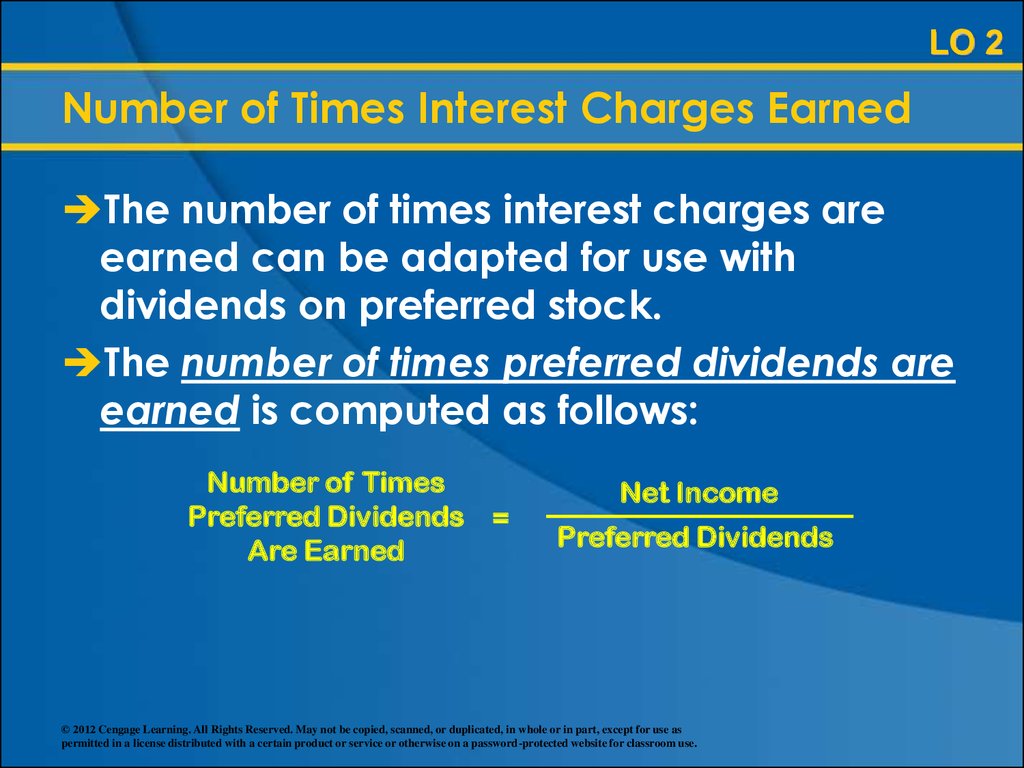

LO 2Number of Times Interest Charges Earned

The number of times interest charges are

earned can be adapted for use with

dividends on preferred stock.

The number of times preferred dividends are

earned is computed as follows:

Number of Times

Preferred Dividends =

Are Earned

Net Income

Preferred Dividends

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

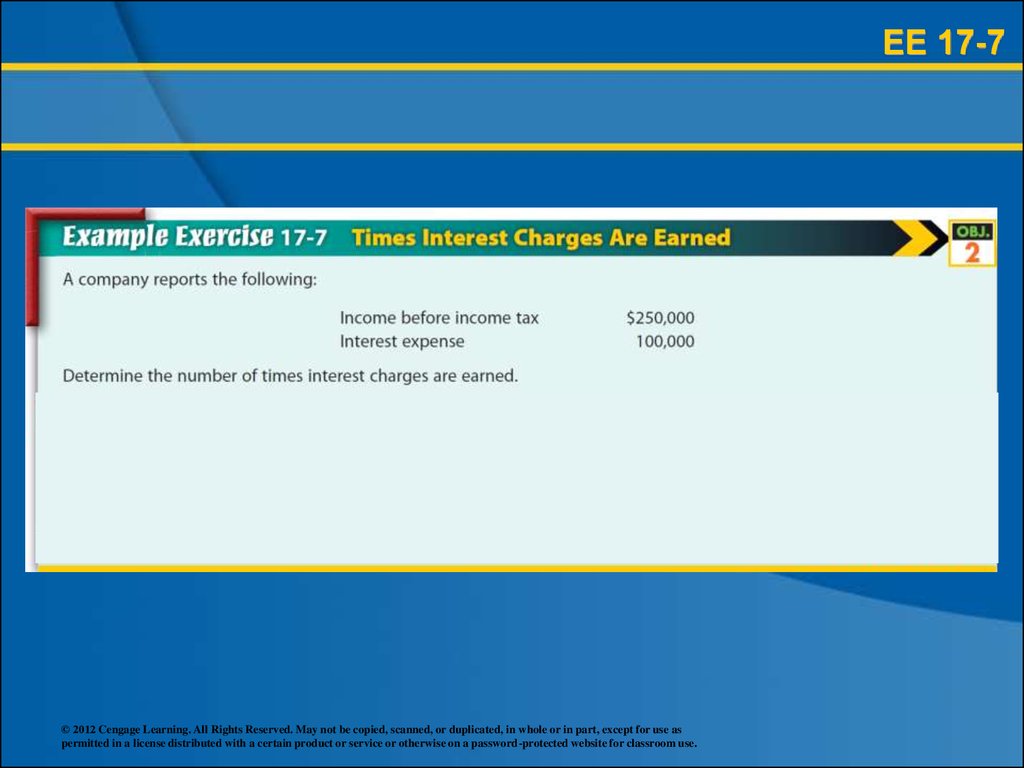

55.

EE 17-7© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

56. Learning Objective 3

1. Describe basic financial statementanalytical methods.

2. Use financial statement analysis to assess

the solvency of a business.

3. Use financial statement analysis to assess

the profitability of a business.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

57. Profitability Analysis

LO 3Profitability Analysis

Profitability analysis focuses primarily on the

relationship between operating results and

the resources available to a business.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

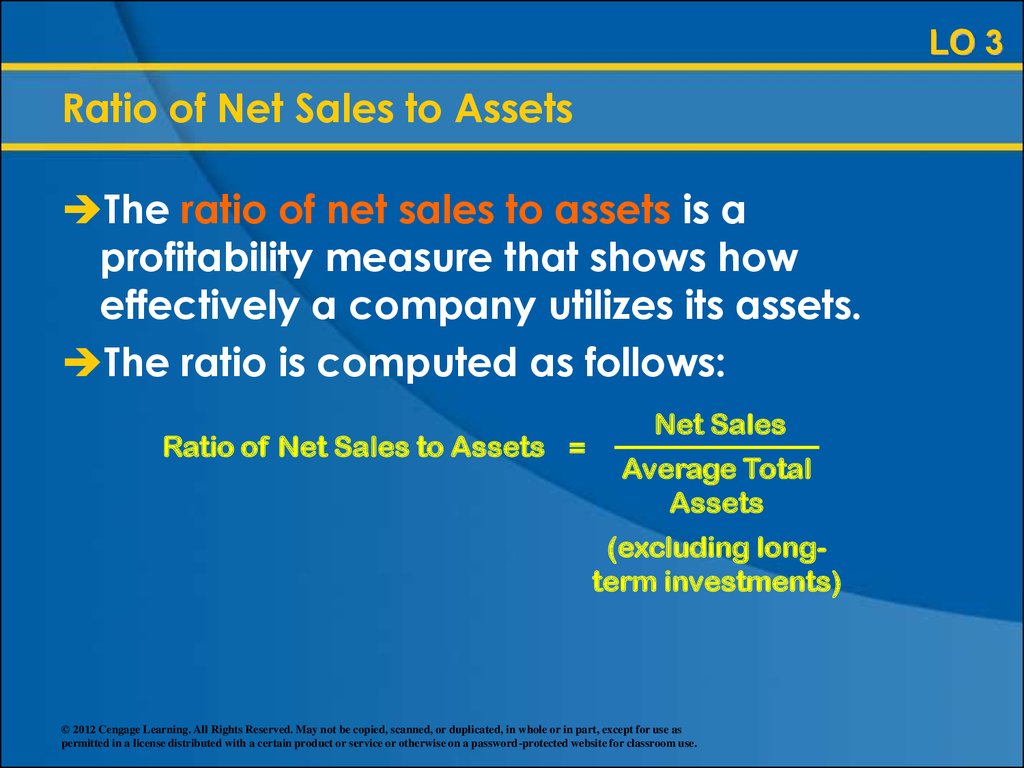

58. Ratio of Net Sales to Assets

LO 3Ratio of Net Sales to Assets

The ratio of net sales to assets is a

profitability measure that shows how

effectively a company utilizes its assets.

The ratio is computed as follows:

Ratio of Net Sales to Assets =

Net Sales

Average Total

Assets

(excluding longterm investments)

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

59.

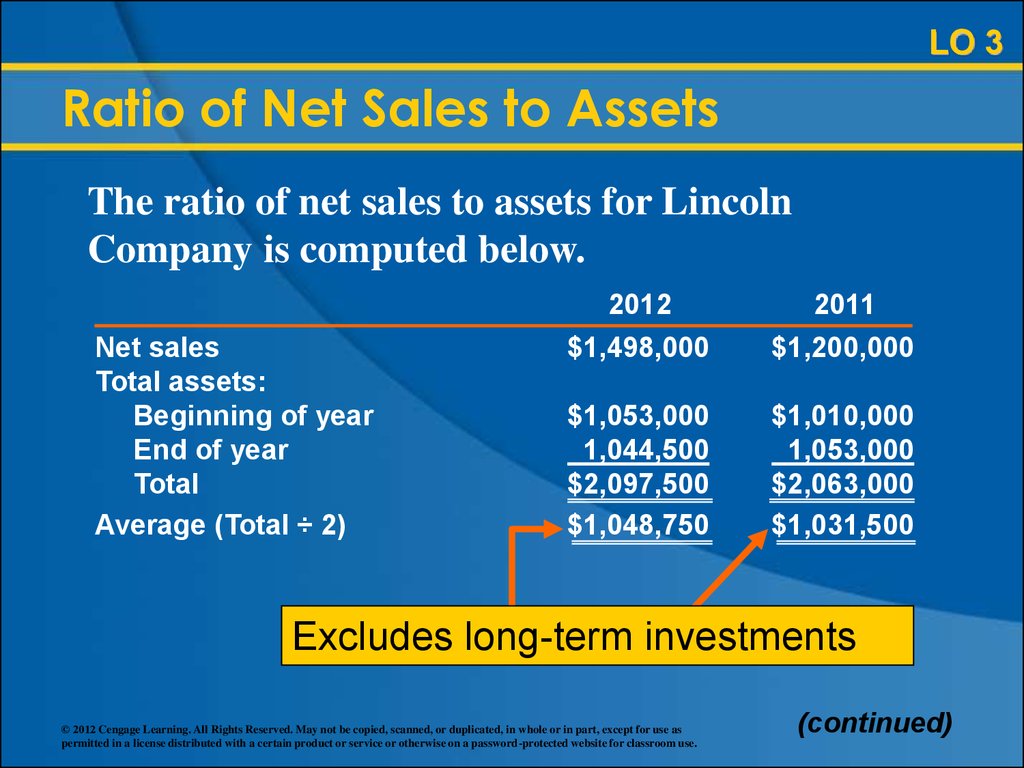

LO 3Ratio of Net Sales to Assets

The ratio of net sales to assets for Lincoln

Company is computed below.

Net sales

Total assets:

Beginning of year

End of year

Total

Average (Total ÷ 2)

2012

$1,498,000

2011

$1,200,000

$1,053,000

1,044,500

$2,097,500

$1,048,750

$1,010,000

1,053,000

$2,063,000

$1,031,500

Excludes long-term investments

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

(continued)

60.

LO 3Ratio of Net Sales to Assets

The ratio of net sales to assets for Lincoln

Company is computed below.

Net sales

Total assets:

Beginning of year

End of year

Total

Average (Total ÷ 2)

Ratio of net sales to assets

$1,498,000

$1,048,750

2012

$1,498,000

2011

$1,200,000

$1,053,000

1,044,500

$2,097,500

$1,048,750

$1,010,000

1,053,000

$2,063,000

$1,031,500

1.4

$1,200,000

$1,031,500

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

1.2

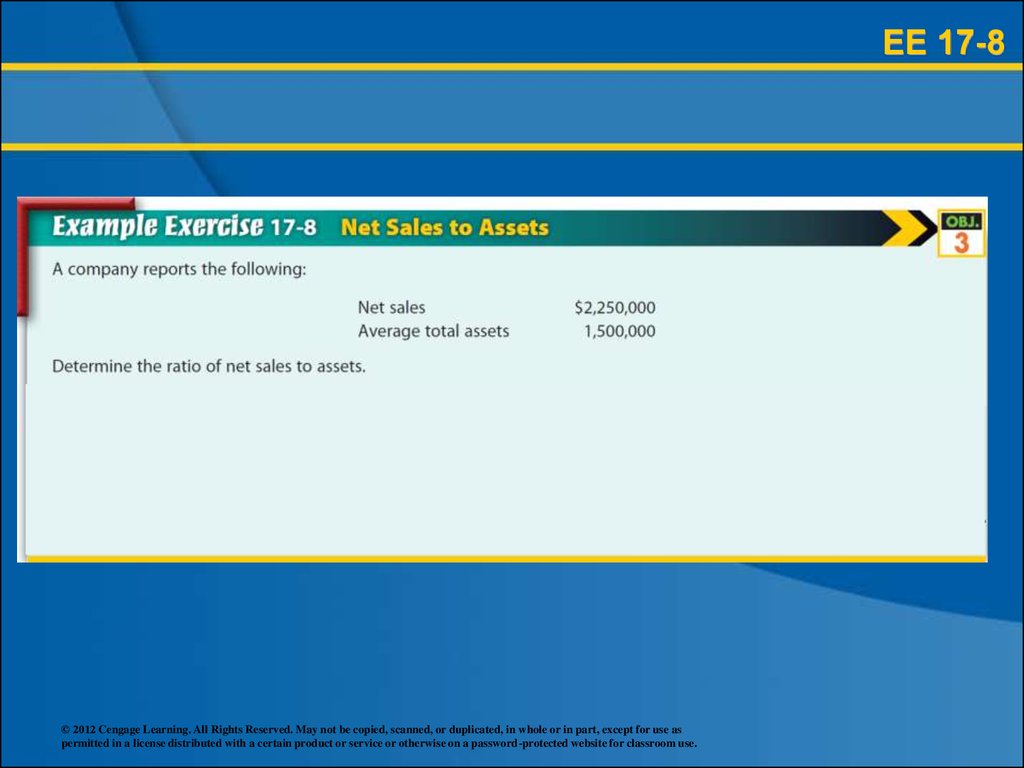

61.

EE 17-8© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

62. Rate Earned on Total Assets

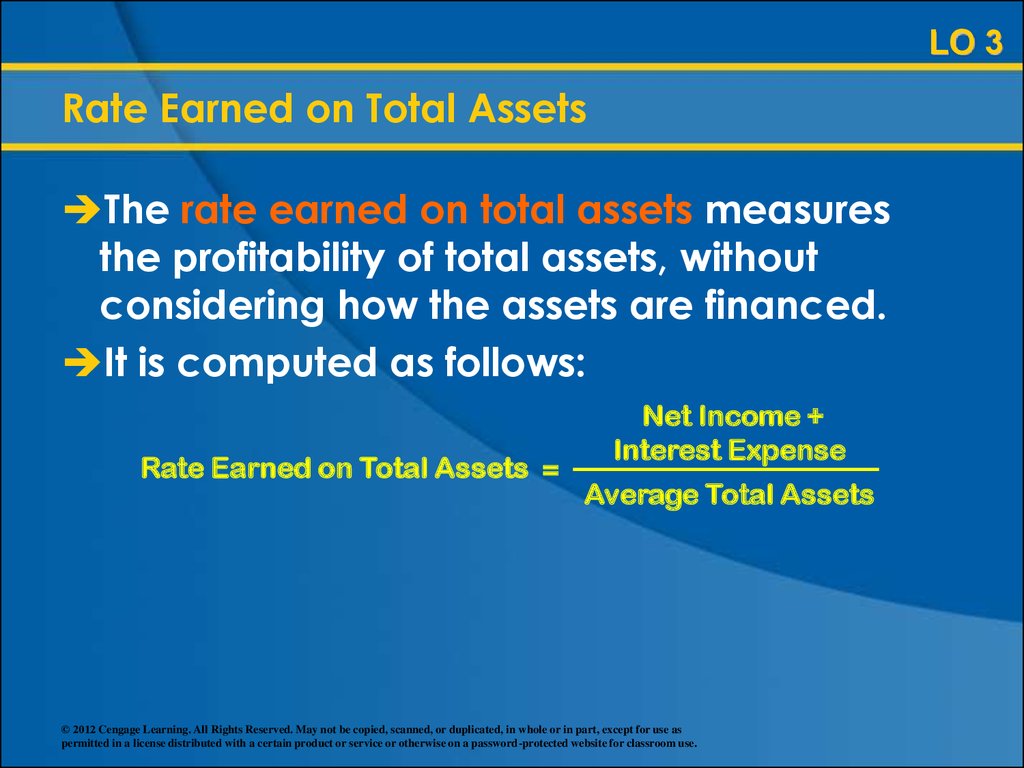

LO 3Rate Earned on Total Assets

The rate earned on total assets measures

the profitability of total assets, without

considering how the assets are financed.

It is computed as follows:

Rate Earned on Total Assets =

Net Income +

Interest Expense

Average Total Assets

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

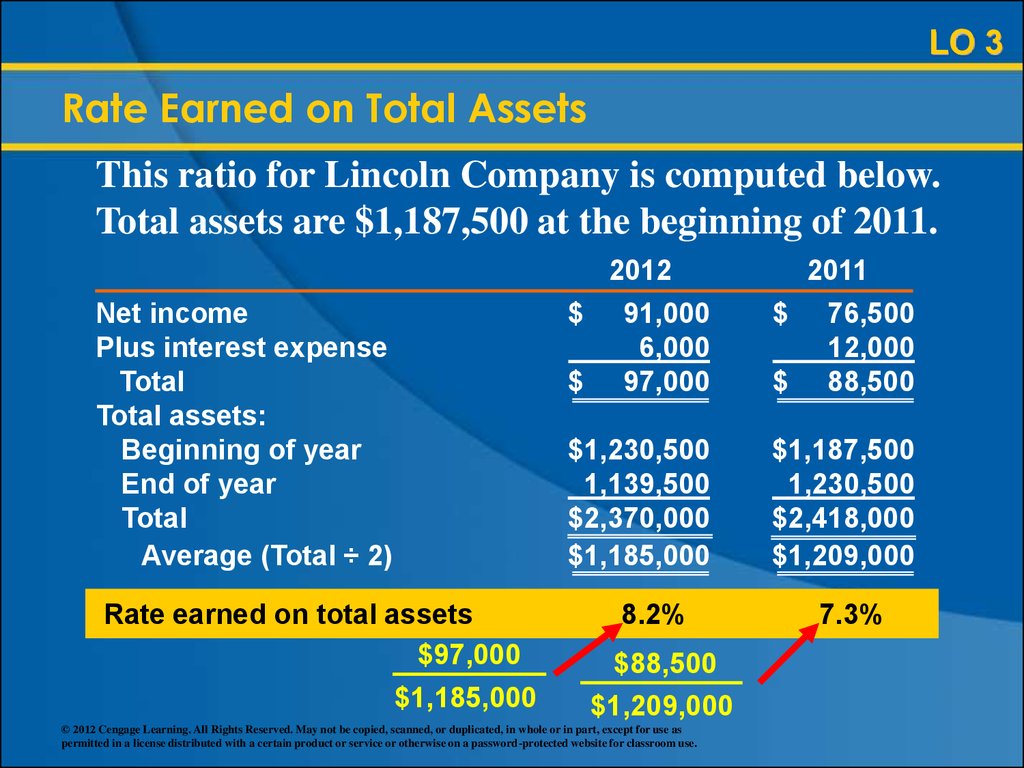

63. Rate Earned on Total Assets

LO 3Rate Earned on Total Assets

This ratio for Lincoln Company is computed below.

Total assets are $1,187,500 at the beginning of 2011.

Net income

Plus interest expense

Total

Total assets:

Beginning of year

End of year

Total

Average (Total ÷ 2)

Rate earned on total assets

$97,000

$1,185,000

2012

$ 91,000

6,000

$ 97,000

2011

$ 76,500

12,000

$ 88,500

$1,230,500

1,139,500

$2,370,000

$1,185,000

$1,187,500

1,230,500

$2,418,000

$1,209,000

8.2%

$88,500

$1,209,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

7.3%

64.

EE 17-9© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

65. Rate Earned on Stockholders’ Equity

LO 3Rate Earned on Stockholders’ Equity

The rate earned on stockholders’ equity

measures the rate of income earned on the

amount invested by the stockholders.

It is computed as follows:

Rate Earned on

=

Stockholders’ Equity

Net Income

Average Total

Stockholders’ Equity

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

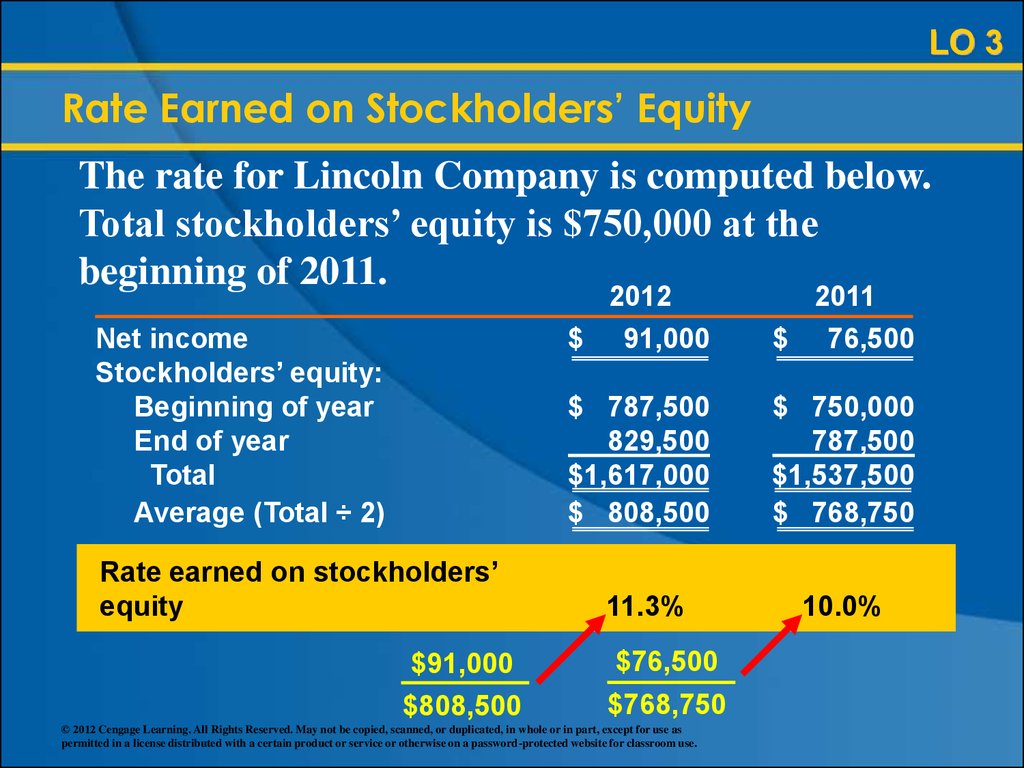

66. Rate Earned on Stockholders’ Equity

LO 3Rate Earned on Stockholders’ Equity

The rate for Lincoln Company is computed below.

Total stockholders’ equity is $750,000 at the

beginning of 2011.

Net income

Stockholders’ equity:

Beginning of year

End of year

Total

Average (Total ÷ 2)

Rate earned on stockholders’

equity

$91,000

$808,500

2012

$ 91,000

2011

$ 76,500

$ 787,500

829,500

$1,617,000

$ 808,500

$ 750,000

787,500

$1,537,500

$ 768,750

11.3%

10.0%

$76,500

$768,750

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

67. Rate Earned on Stockholders’ Equity

LO 3Rate Earned on Stockholders’ Equity

The difference between the rate earned on

stockholders’ equity and the rate earned on

total assets is called leverage.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

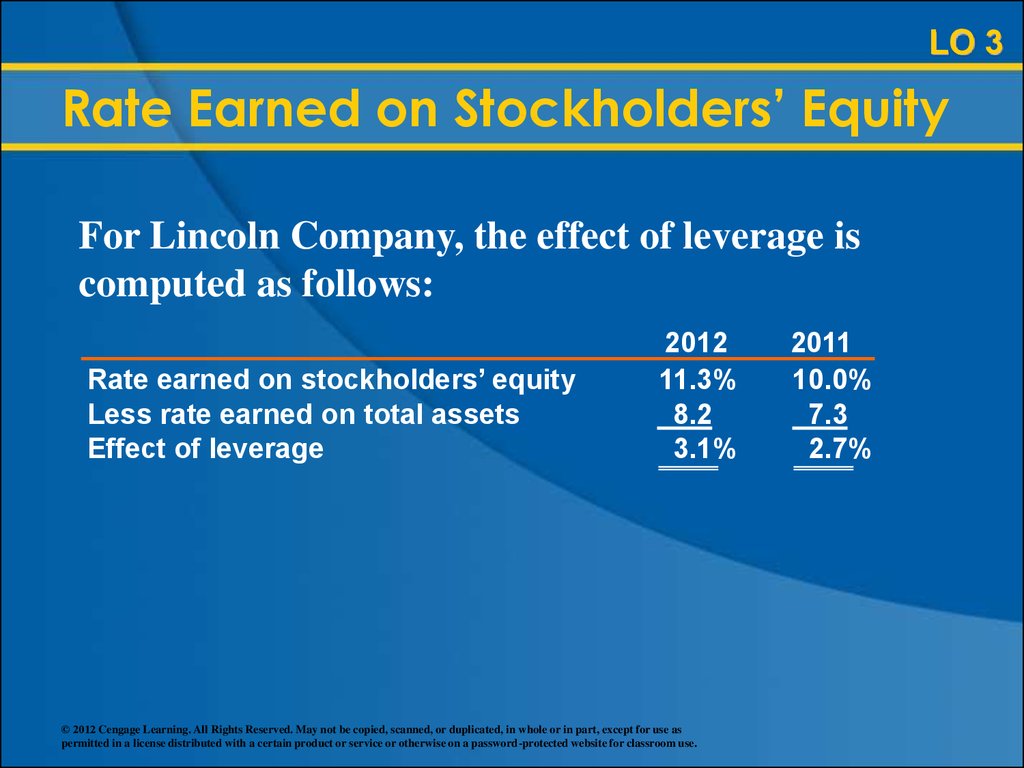

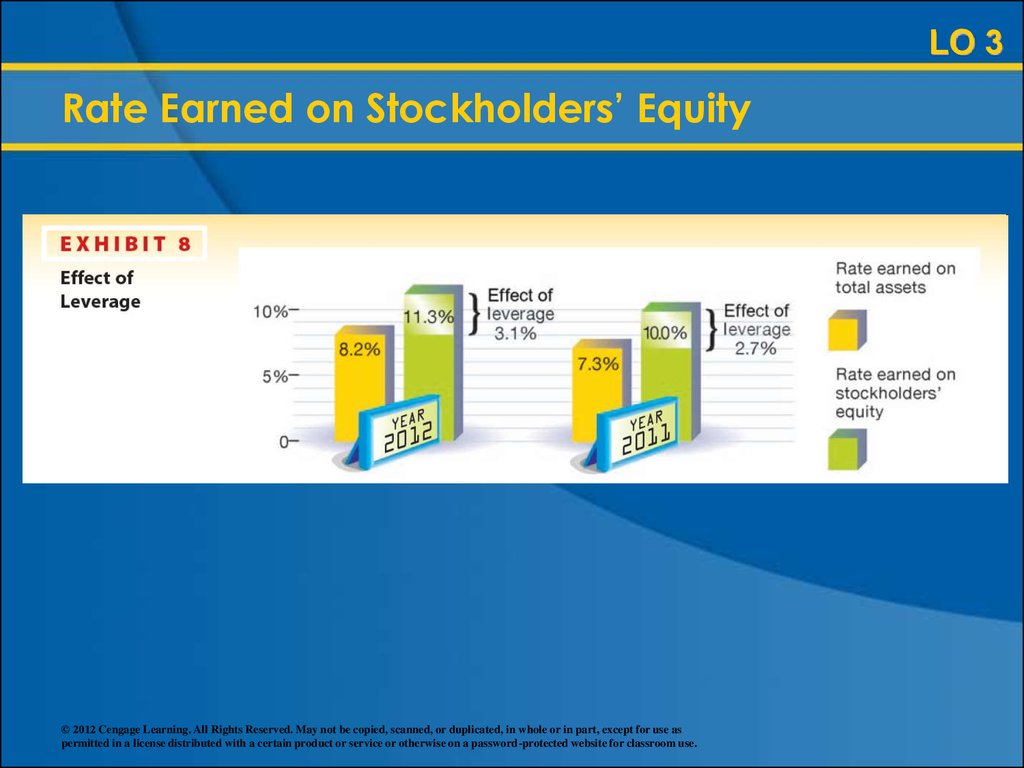

68.

LO 3Rate Earned on Stockholders’ Equity

For Lincoln Company, the effect of leverage is

computed as follows:

Rate earned on stockholders’ equity

Less rate earned on total assets

Effect of leverage

2012

11.3%

8.2

3.1%

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

2011

10.0%

7.3

2.7%

69. Rate Earned on Stockholders’ Equity

LO 3Rate Earned on Stockholders’ Equity

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

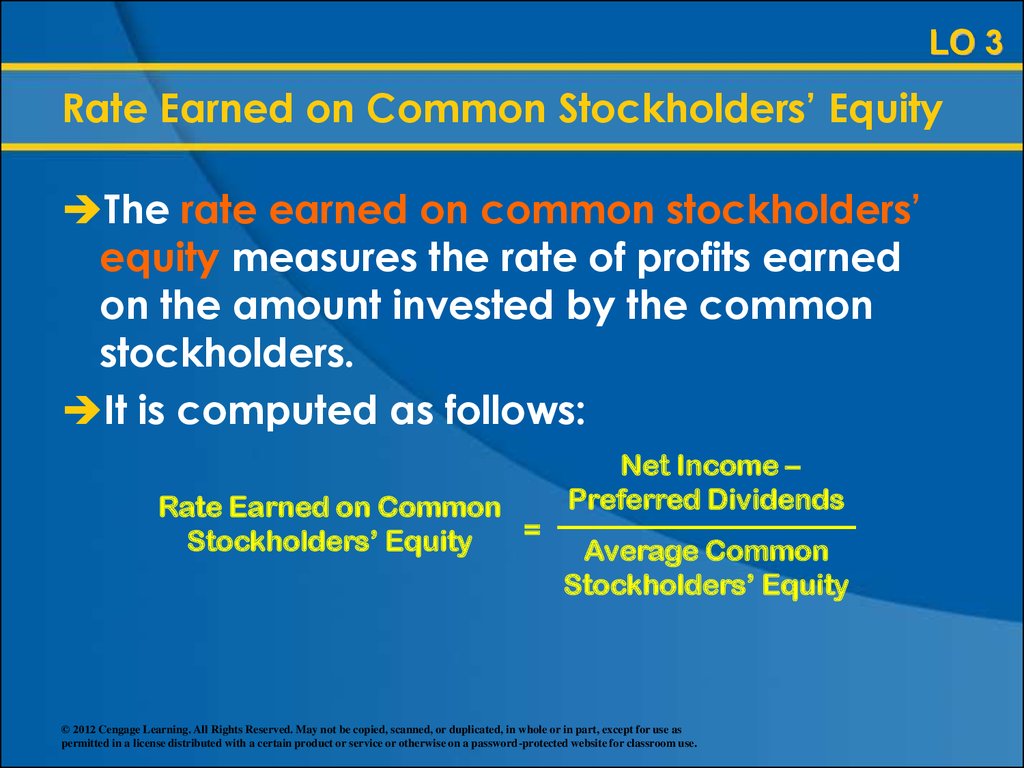

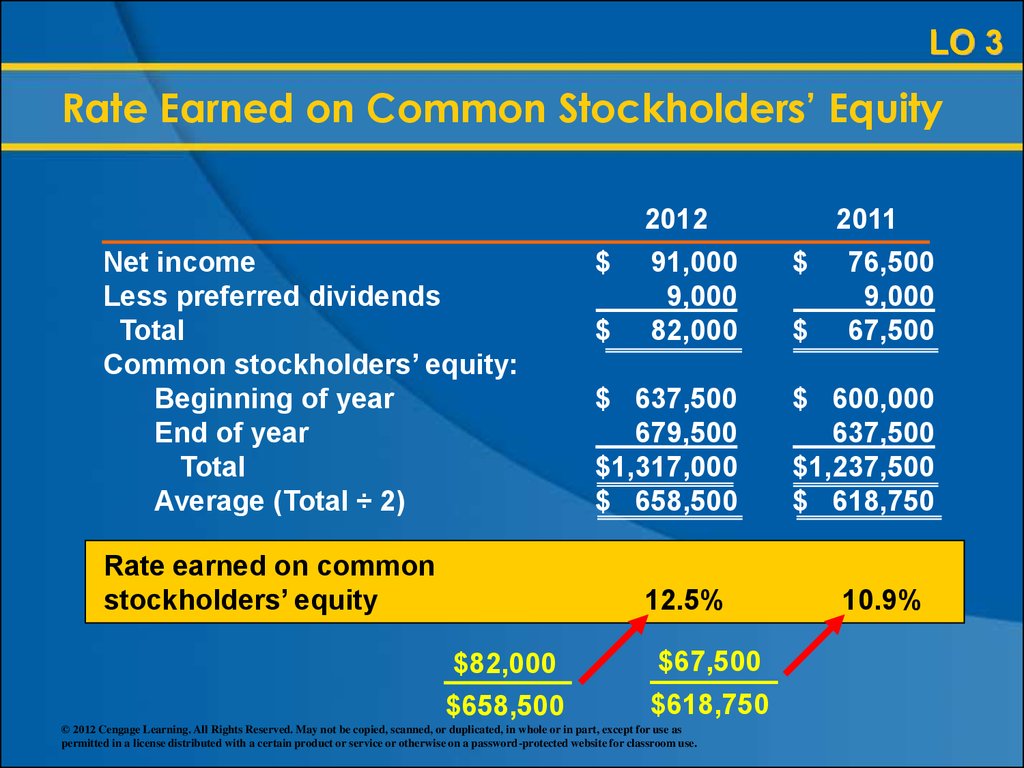

70. Rate Earned on Common Stockholders’ Equity

LO 3Rate Earned on Common Stockholders’ Equity

The rate earned on common stockholders’

equity measures the rate of profits earned

on the amount invested by the common

stockholders.

It is computed as follows:

Rate Earned on Common

=

Stockholders’ Equity

Net Income –

Preferred Dividends

Average Common

Stockholders’ Equity

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

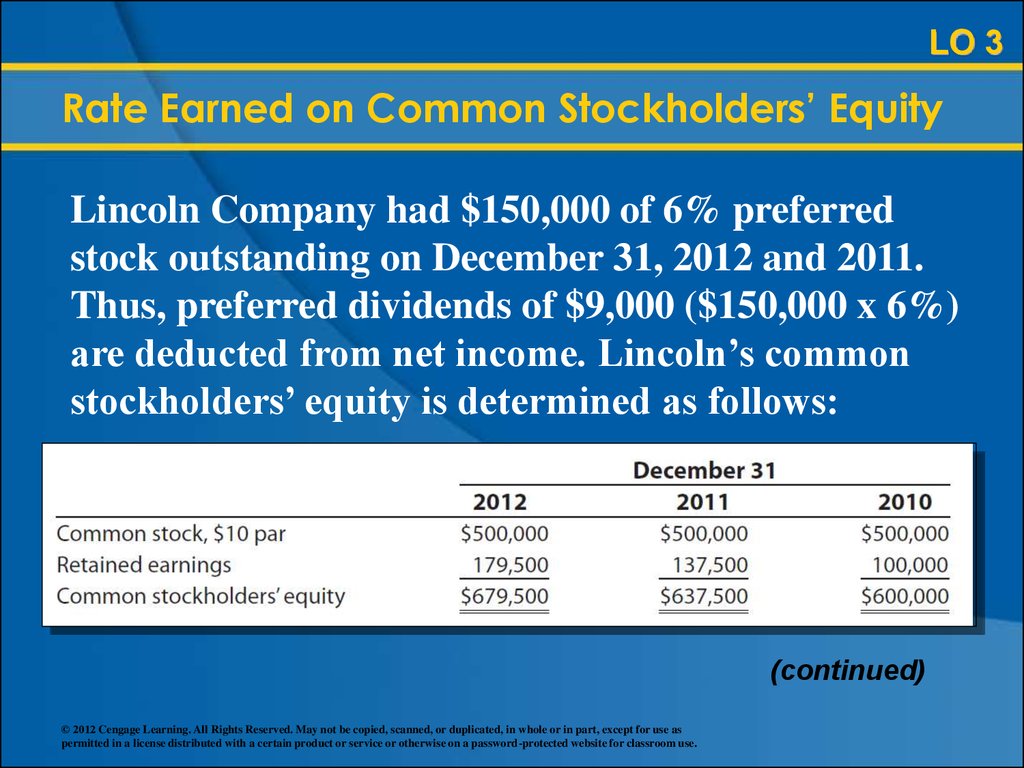

71.

LO 3Rate Earned on Common Stockholders’ Equity

Lincoln Company had $150,000 of 6% preferred

stock outstanding on December 31, 2012 and 2011.

Thus, preferred dividends of $9,000 ($150,000 x 6%)

are deducted from net income. Lincoln’s common

stockholders’ equity is determined as follows:

(continued)

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

72.

LO 3Rate Earned on Common Stockholders’ Equity

Net income

Less preferred dividends

Total

Common stockholders’ equity:

Beginning of year

End of year

Total

Average (Total ÷ 2)

Rate earned on common

stockholders’ equity

2012

91,000

9,000

82,000

2011

$ 76,500

9,000

$ 67,500

$ 637,500

679,500

$1,317,000

$ 658,500

$ 600,000

637,500

$1,237,500

$ 618,750

$

$

12.5%

$82,000

$658,500

$67,500

$618,750

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

10.9%

73.

EE 17-10© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

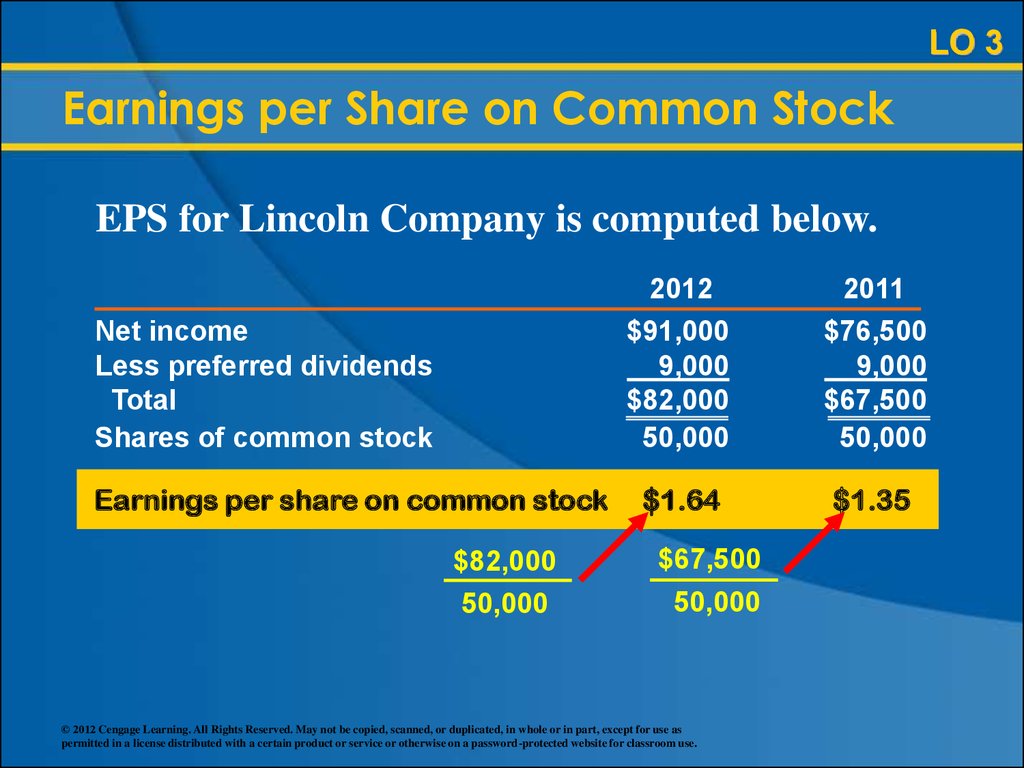

74. Earnings per Share on Common Stock

LO 3Earnings per Share on Common Stock

Earnings per share (EPS) on common stock

measures the share of profits that are earned

by a share of common stock. GAAP

requires the reporting of earnings per share

in the income statement.

It is computed as follows:

Net Income –

Preferred Dividends

Earnings per Share (EPS)

=

on Common Stock

Shares of Common Stock

Outstanding

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

75. Earnings per Share on Common Stock

LO 3Earnings per Share on Common Stock

EPS for Lincoln Company is computed below.

Net income

Less preferred dividends

Total

Shares of common stock

Earnings per share on common stock

$82,000

50,000

2012

$91,000

9,000

$82,000

50,000

2011

$76,500

9,000

$67,500

50,000

$1.64

$1.35

$67,500

50,000

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

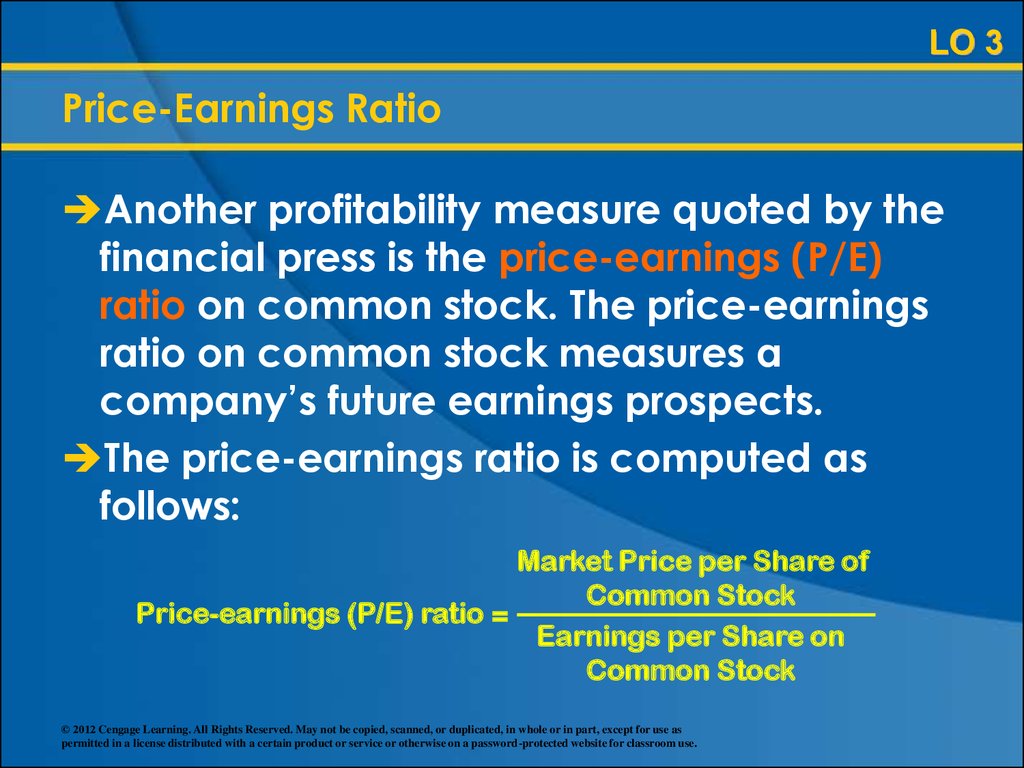

76. Price-Earnings Ratio

LO 3Price-Earnings Ratio

Another profitability measure quoted by the

financial press is the price-earnings (P/E)

ratio on common stock. The price-earnings

ratio on common stock measures a

company’s future earnings prospects.

The price-earnings ratio is computed as

follows:

Market Price per Share of

Common Stock

Price-earnings (P/E) ratio =

Earnings per Share on

Common Stock

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

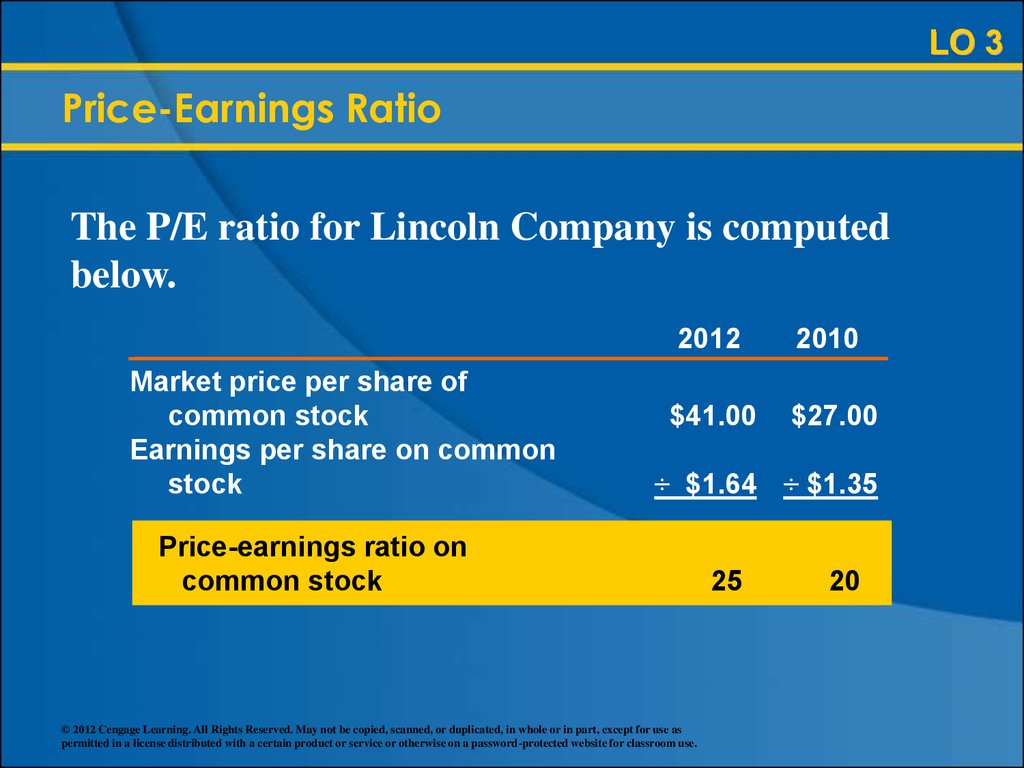

77. Price-Earnings Ratio

LO 3Price-Earnings Ratio

The P/E ratio for Lincoln Company is computed

below.

Market price per share of

common stock

Earnings per share on common

stock

2012

2010

$41.00

$27.00

÷ $1.64 ÷ $1.35

Price-earnings ratio on

common stock

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

25

20

78.

EE 17-11© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

79. Dividends per Share

LO 3Dividends per Share

Dividends per share can be reported with

earnings per share to indicate the

relationship between dividends and

earnings.

Comparing these two per-share amounts

measures the extent to which earnings are

being distributed to common shareholders.

The ratio for dividends per share is at the top

of the next slide.

(continued)

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

80. Dividends per Share

LO 3Dividends per Share

Dividends per Share =

Dividends

Shares of Common Stock

Outstanding

The dividends per share for Lincoln Company are

computed below.

Dividends on common stock

Shares of common stock outstanding

2012

$40,000

÷ 50,000

2011

$30,000

÷ 50,000

Dividends per share of common stock

$0.80

$0.60

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

81. Dividends and Earnings per Share

LO 3Dividends and Earnings per Share

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

82. Dividend Yield

LO 3Dividend Yield

The dividend yield on common stock

measures the rate of return to common

stockholders from cash dividends.

It is of special interest to investors whose

objective is to earn dividends from their

investment. It is computed as follows:

Dividends per Share of

Common Stock

Dividend Yield =

Market Price per Share of

Common Stock

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

83. Dividend Yield

LO 3Dividend Yield

The dividend yield for Lincoln Company is

computed below.

2012

Dividends per share of

common stock

Market price per share of

common stock

Dividend yield on common stock

$0.80

$41

2011

$ 0.80

$ 0.60

$41.00

$27.00

2.0%

2.2%

$0.60

$27

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

84. Summary of Analytical Measures

LO 3Summary of Analytical Measures

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

(continued)

85.

LO 3Summary of Analytical Measures

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

(continued)

86.

LO 3Summary of Analytical Measures

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

(concluded)

87. Learning Objective 4

1. Describe basic financial statementanalytical methods.

2. Use financial statement analysis to assess

the solvency of a business.

3. Use financial statement analysis to assess

the profitability of a business.

4. Describe the contents of corporate annual

reports.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

88. Corporate Annual Reports

LO 4Corporate Annual Reports

In addition to the financial statements and

the accompanying notes, corporate annual

reports usually include the following

sections:

Management discussion and analysis

Report on internal control

Report on fairness of the financial

statements

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

89. Management Discussion and Analysis

LO 4Management Discussion and Analysis

Management’s Discussion and Analysis

(MD&A) is required in annual reports filed with

the SEC.

It contains management’s analysis of current

operations and its plans for the future.

Typical items included in the MD&A are:

Management’s analysis and explanations

of any significant changes between the

current and prior year’s financial

statements.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

(continued)

90.

LO 4Management Discussion and Analysis

Important accounting principles or

policies that could affect interpretation

of the financial statements.

Management’s assessment of the

company’s liquidity and the availability

of capital to the company.

Significant risk exposures that might

affect the company.

Any “off-balance-sheet” arrangements

such as leases not included directly in the

financial statements.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

91. Report on Internal Control

LO 4Report on Internal Control

The Sarbanes-Oxley Act of 2002 requires a

report stating management’s responsibility

for establishing and maintaining internal

control. In addition, management’s

assessment of the effectiveness of internal

controls over financial reporting is included

in the report.

It also requires a public accounting firm to

verify management’s conclusions on internal

control.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

92. Report on Fairness of Financial Statements

LO 4Report on Fairness of Financial Statements

All publicly held corporations are required

by the Sarbanes-Oxley Act of 2002 to have

an independent audit (examination) of their

financial statements. The CPA firm that

conducts the audit renders an opinion on

the fairness of the statements.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

93. Appendix

Unusual Itemson the Income

Statement

Prepared by: C. Douglas Cloud

Professor Emeritus of Accounting

Pepperdine University

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

94. Unusual Items on the Income Statement

AppendixUnusual Items on the Income Statement

Unusual items affecting the current period’s

income statement include the following:

Discontinued operations

Extraordinary items

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

95. Discontinued Operations

AppendixDiscontinued Operations

A company may discontinue a segment of

its operations by selling or abandoning the

segment’s operations.

A note accompanying the income

statement should describe the operations

sold, including such details as the date

operations were discontinued, the assets

sold, and the effect (if any) on current and

future operations.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

96. Discontinued Operations

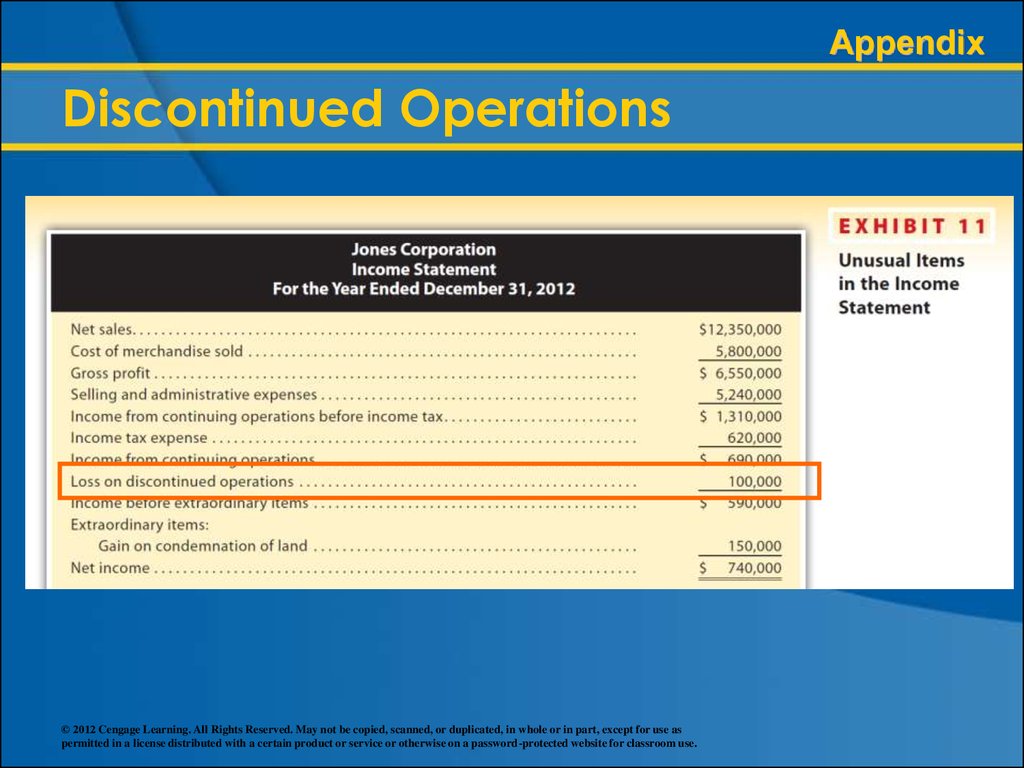

AppendixDiscontinued Operations

Jones Corporation produces and sells electrical

products, hardware supplies, and lawn equipment.

Because of lack of profits, Jones discontinues its

electrical products operation and sells the remaining

inventory and other assets at a loss of $100,000.

Exhibit 11 (next slide) illustrates the reporting of the

loss on the discontinued operations.

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

97.

AppendixDiscontinued Operations

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

98. Extraordinary Items

AppendixExtraordinary Items

An extraordinary item is defined as an event

or transaction with both of the following

characteristics:

Unusual in nature

Infrequent in occurrence

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

99. Extraordinary Items

AppendixExtraordinary Items

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

100. Reporting Earnings per Share

AppendixReporting Earnings per Share

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

101. Financial Statement Analysis

The EndPrepared by: C. Douglas Cloud

Professor Emeritus of Accounting

Pepperdine University

© 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

finance

finance