Similar presentations:

The binomial model for option pricing

1. Option Pricing: The Multi Period Binomial Model

Henrik JönssonMälardalen University

Sweden

Gurzuf, Crimea, June

1

2. Contents

European Call Option

Geometric Brownian Motion

Black-Scholes Formula

Multi period Binomial Model

GBM as a limit

Black-Scholes Formula as a limit

Gurzuf, Crimea, June

2

3. European Call Option

C - Option PriceK - Strike price

T - Expiration day

Exercise only at T

Payoff function, e.g.

90

80

70

60

g(s)

100

50

40

30

20

10

0

400

420

440

g (s) [s K ] max 0, s K

460

480 K= 500

s

520

540

560

580

600

Gurzuf, Crimea, June

3

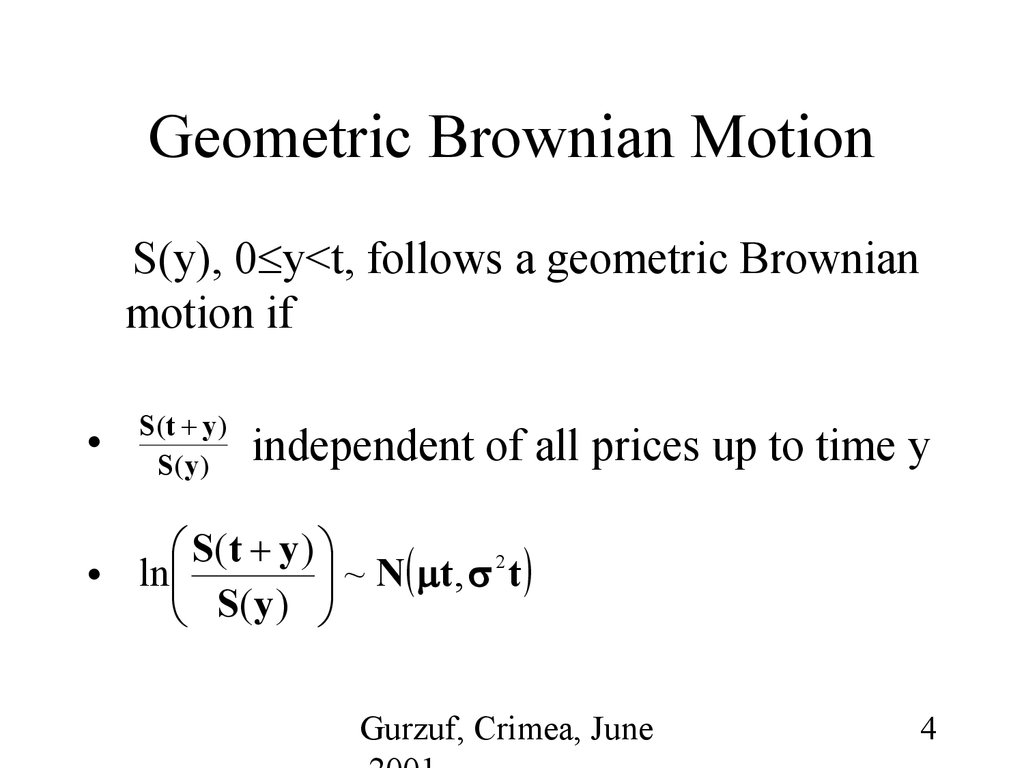

4. Geometric Brownian Motion

S(y), 0 y<t, follows a geometric Brownianmotion if

S (t y )

S(y )

independent of all prices up to time y

S (t y )

2

ln

~

N

t

,

t

•

S( y )

Gurzuf, Crimea, June

4

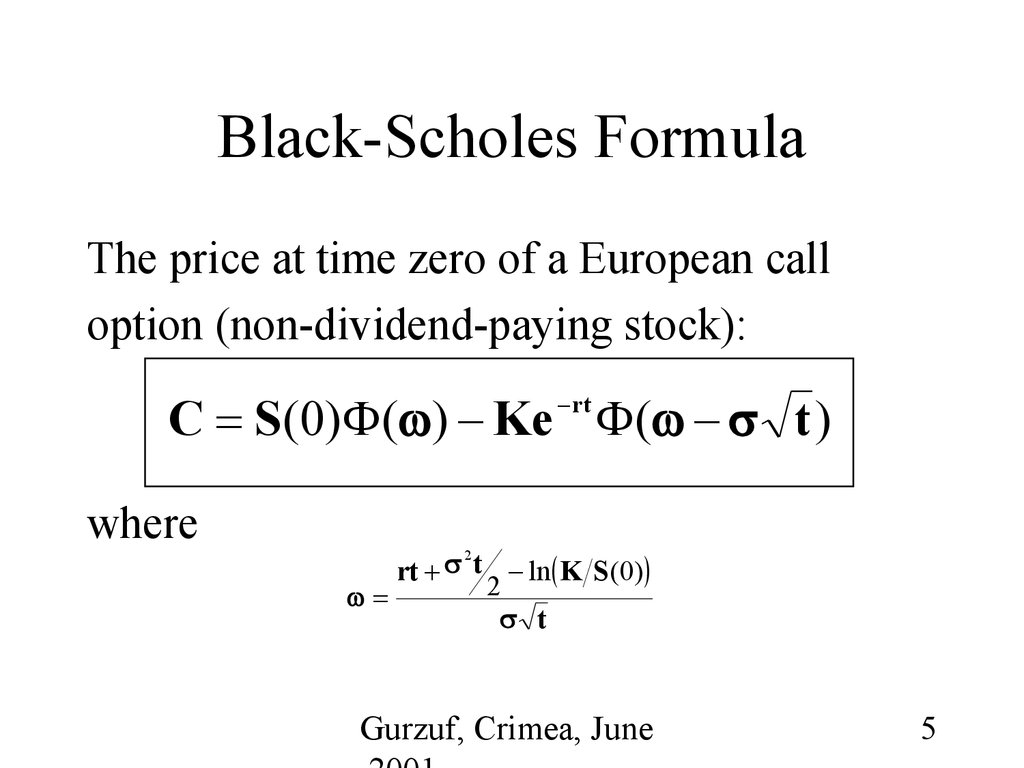

5. Black-Scholes Formula

The price at time zero of a European calloption (non-dividend-paying stock):

C S(0) ( ) Ke ( t )

rt

where

2

rt t ln K S(0)

2

t

Gurzuf, Crimea, June

5

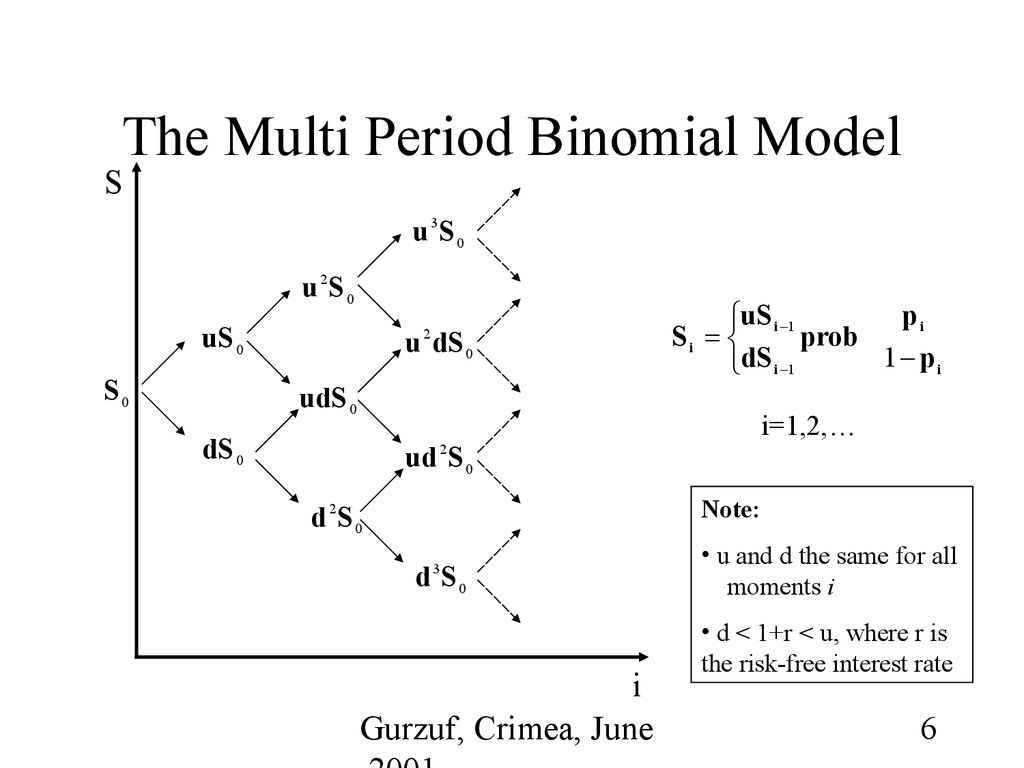

6. The Multi Period Binomial Model

Su 3S 0

u 2S 0

uS 0

S0

2

u dS 0

pi

uS i 1

Si

prob

1 pi

dS i 1

udS 0

i=1,2,…

dS 0

2

ud S 0

Note:

d 2S 0

3

d S0

i

Gurzuf, Crimea, June

• u and d the same for all

moments i

• d < 1+r < u, where r is

the risk-free interest rate

6

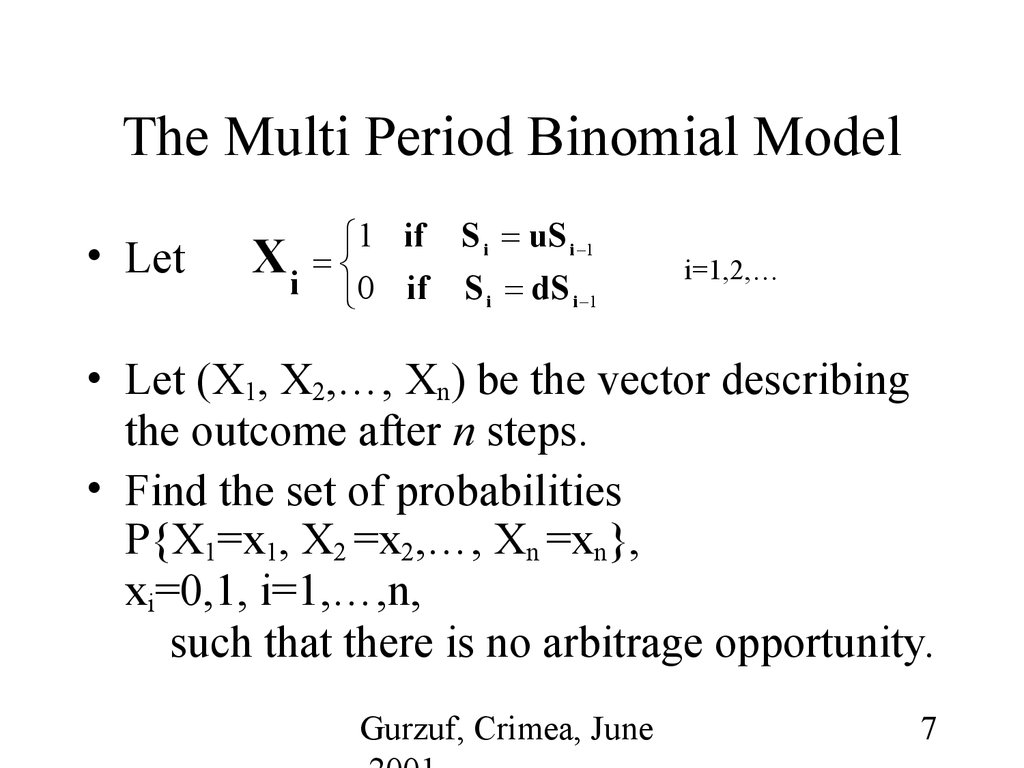

7. The Multi Period Binomial Model

• Let1 if S i uS i 1

Xi

0 if S i dS i 1

i=1,2,…

• Let (X1, X2,…, Xn) be the vector describing

the outcome after n steps.

• Find the set of probabilities

P{X1=x1, X2 =x2,…, Xn =xn},

xi=0,1, i=1,…,n,

such that there is no arbitrage opportunity.

Gurzuf, Crimea, June

7

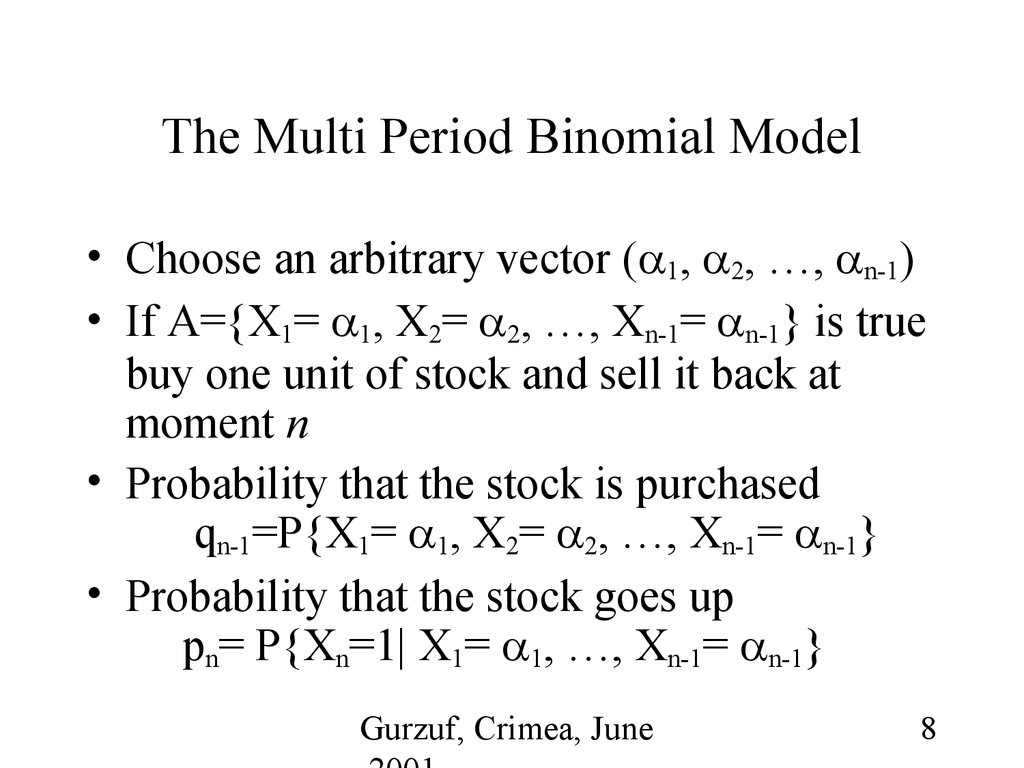

8. The Multi Period Binomial Model

• Choose an arbitrary vector ( 1, 2, …, n-1)• If A={X1= 1, X2= 2, …, Xn-1= n-1} is true

buy one unit of stock and sell it back at

moment n

• Probability that the stock is purchased

qn-1=P{X1= 1, X2= 2, …, Xn-1= n-1}

• Probability that the stock goes up

pn= P{Xn=1| X1= 1, …, Xn-1= n-1}

Gurzuf, Crimea, June

8

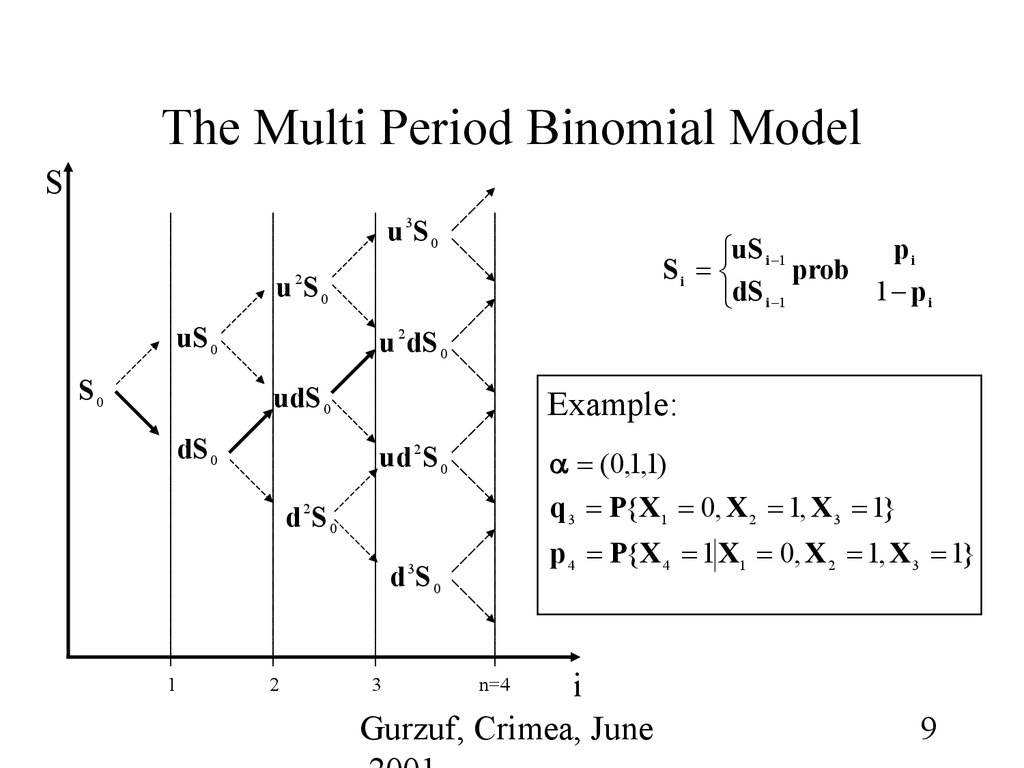

9. The Multi Period Binomial Model

Su 3S 0

pi

uS i 1

Si

prob

dS

1 pi

i 1

u 2S 0

uS 0

S0

u 2 dS 0

udS 0

dS 0

Example:

ud 2 S 0

(0,1,1)

q 3 P{X1 0, X 2 1, X 3 1}

d 2S 0

p 4 P{X 4 1 X1 0, X 2 1, X 3 1}

3

d S0

1

2

i

Gurzuf, Crimea, June

3

n=4

9

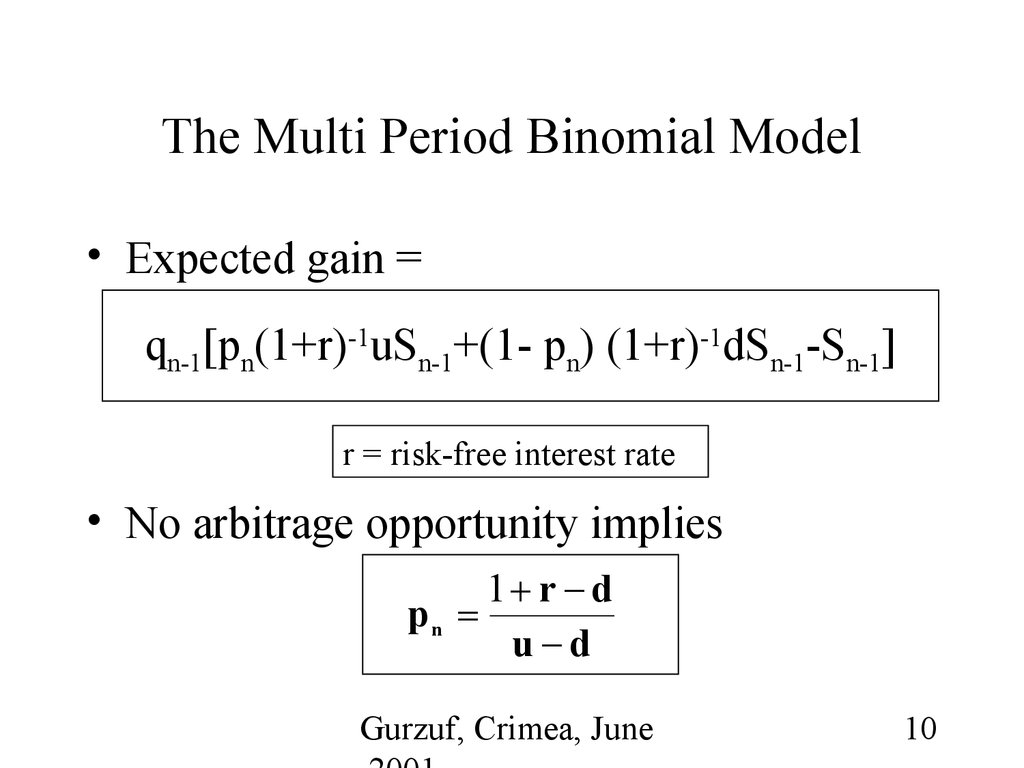

10. The Multi Period Binomial Model

• Expected gain =qn-1[pn(1+r)-1uSn-1+(1- pn) (1+r)-1dSn-1-Sn-1]

r = risk-free interest rate

• No arbitrage opportunity implies

1 r d

pn

u d

Gurzuf, Crimea, June

10

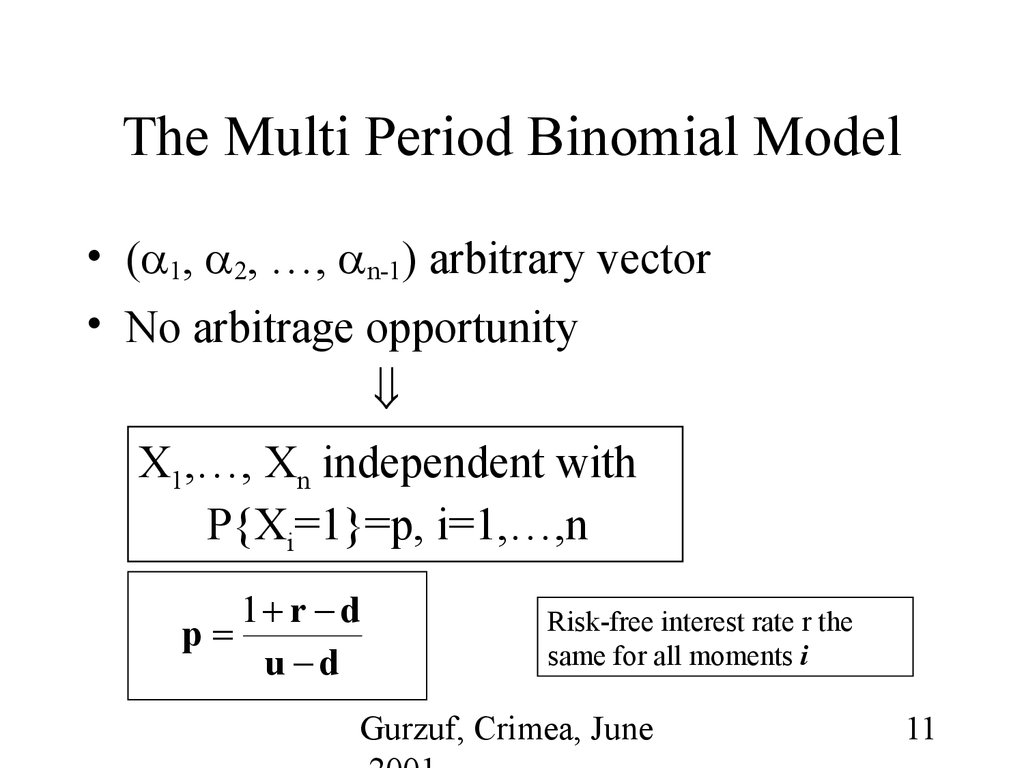

11. The Multi Period Binomial Model

• ( 1, 2, …, n-1) arbitrary vector• No arbitrage opportunity

X1,…, Xn independent with

P{Xi=1}=p, i=1,…,n

1 r d

p

u d

Risk-free interest rate r the

same for all moments i

Gurzuf, Crimea, June

11

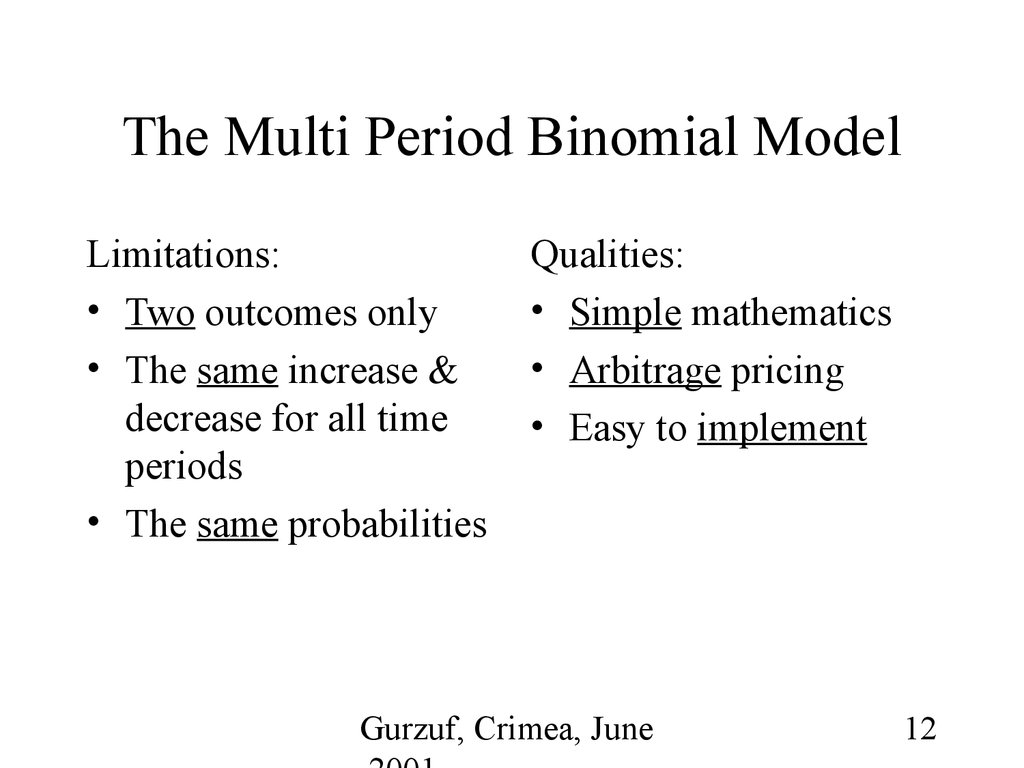

12. The Multi Period Binomial Model

Limitations:• Two outcomes only

• The same increase &

decrease for all time

periods

• The same probabilities

Qualities:

• Simple mathematics

• Arbitrage pricing

• Easy to implement

Gurzuf, Crimea, June

12

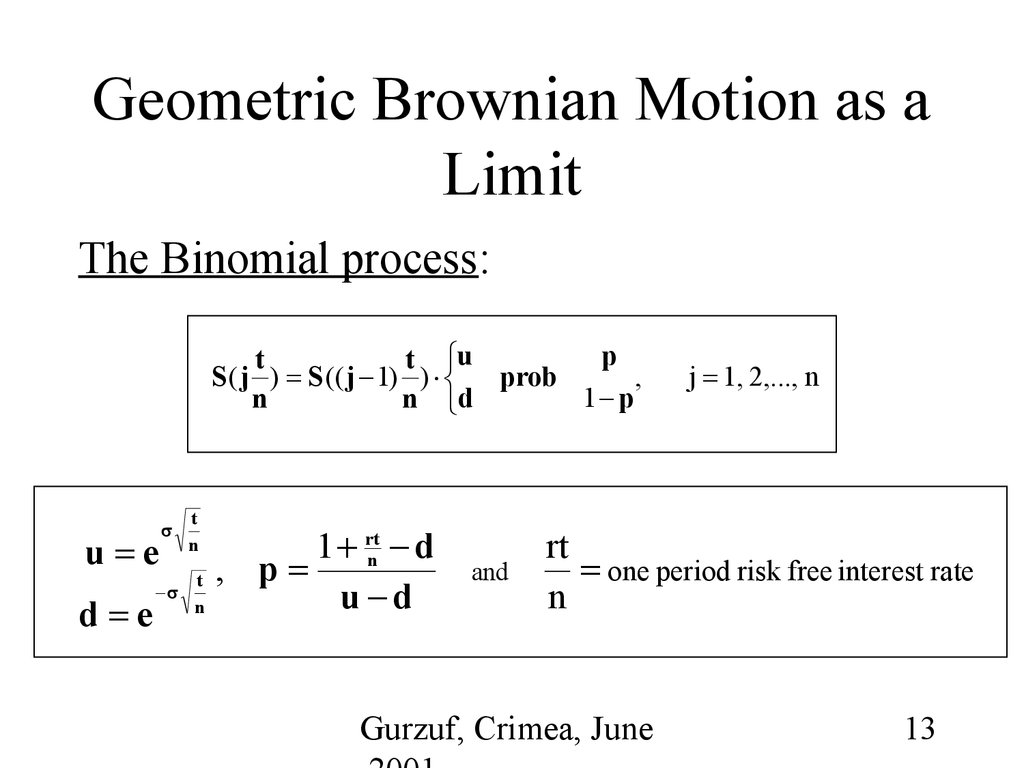

13. Geometric Brownian Motion as a Limit

The Binomial process:p

t

t u

S( j ) S(( j 1) ) prob

,

1 p

n

n d

t

n

rt

1

u e

n d

p

t ,

u

d

n

d e

and

j 1, 2,..., n

rt

one period risk free interest rate

n

Gurzuf, Crimea, June

13

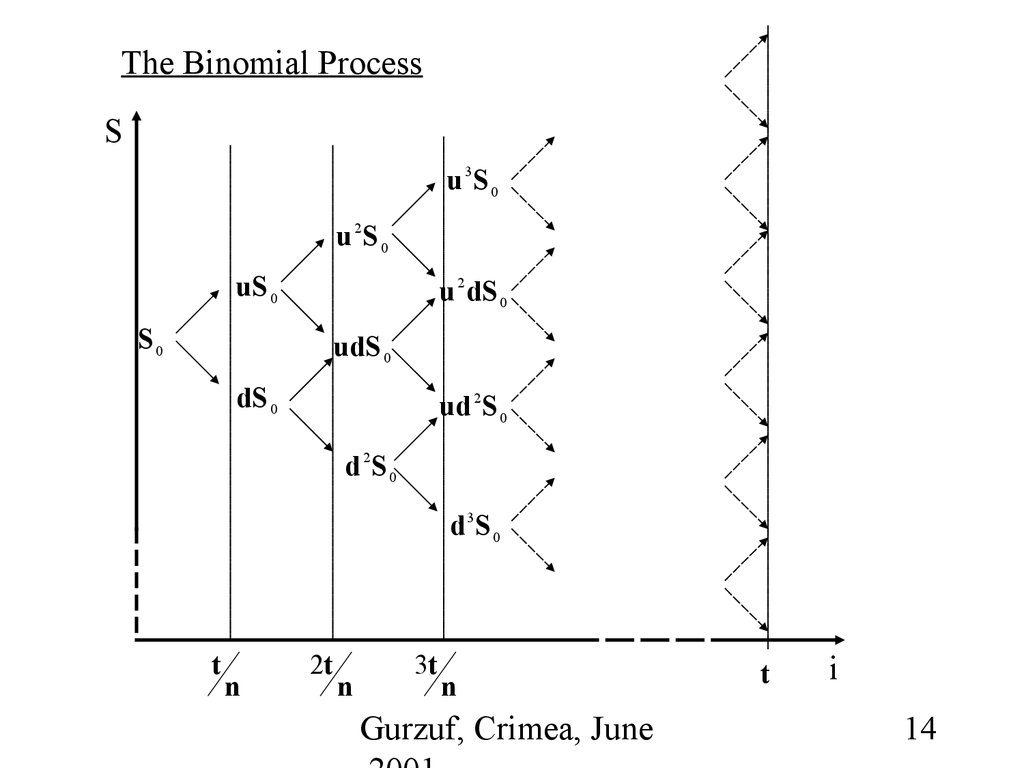

14.

The Binomial ProcessS

u 3S 0

u 2S 0

uS 0

u 2 dS 0

S0

udS 0

dS 0

ud 2 S 0

d 2S 0

d 3S 0

t

n

2t

n

3t

n

Gurzuf, Crimea, June

t

i

14

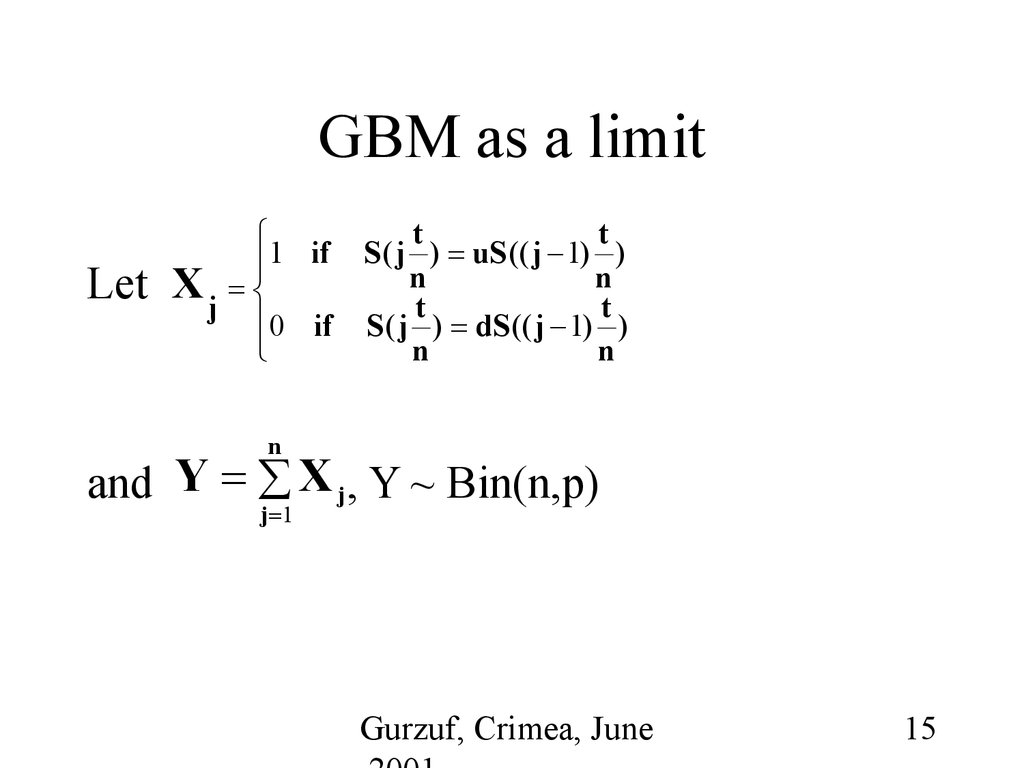

15. GBM as a limit

Lett

t

1 if S( j n ) uS (( j 1) n )

Xj

t

t

0 if S( j ) dS (( j 1) )

n

n

n

and Y X j , Y ~ Bin(n,p)

j 1

Gurzuf, Crimea, June

15

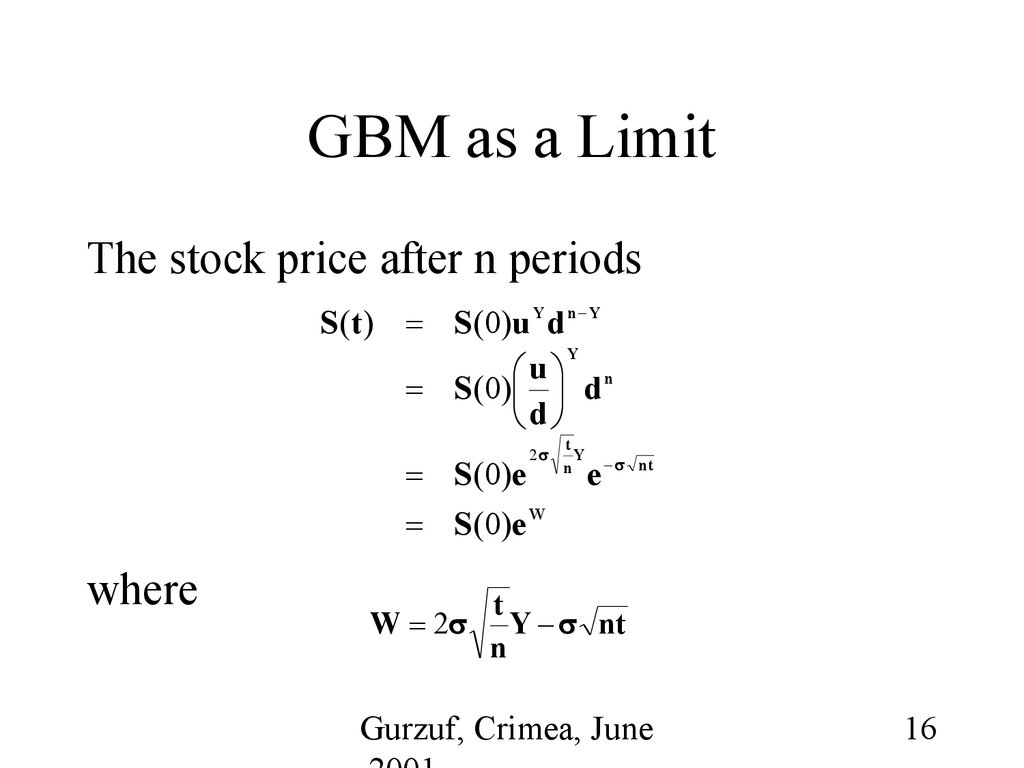

16. GBM as a Limit

The stock price after n periodsS(t ) S(0)u Y d n Y

Y

u

S(0) d n

d

2

S(0)e

S(0)e W

where

W 2

t

Y

n

e

nt

t

Y nt

n

Gurzuf, Crimea, June

16

17. GBM as a Limit

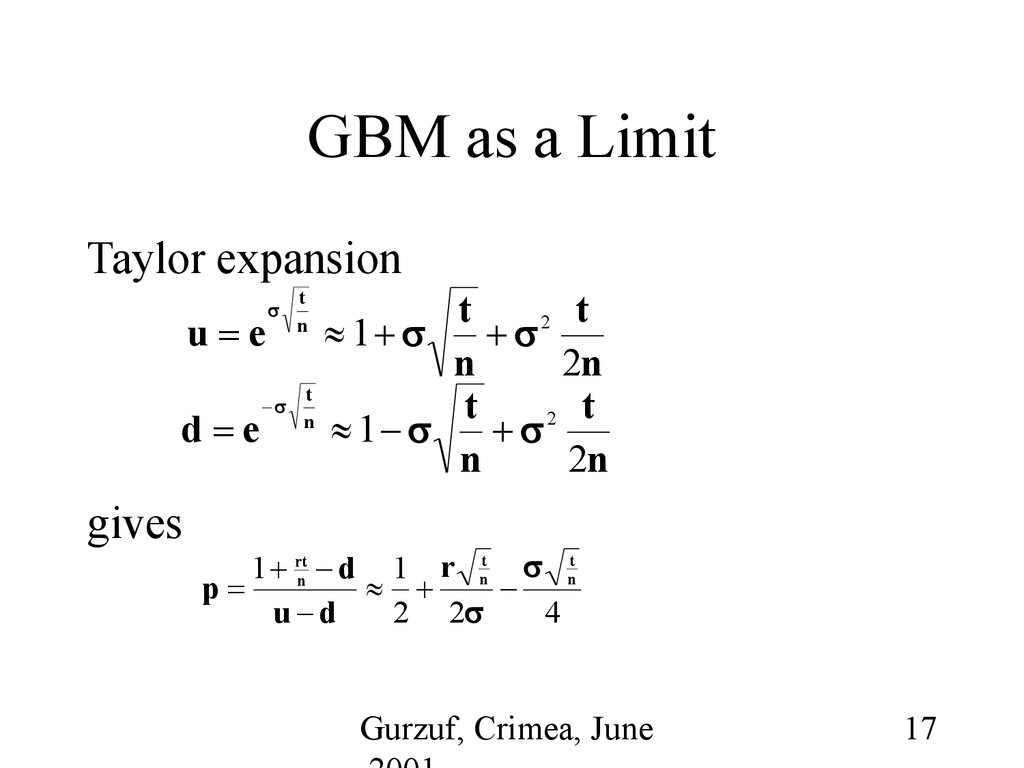

Taylor expansiont

n

t

2 t

u e

1

n

2n

t

t

2 t

n

d e

1

n

2n

gives

1 rtn d 1 r nt nt

p

u d

2 2

4

Gurzuf, Crimea, June

17

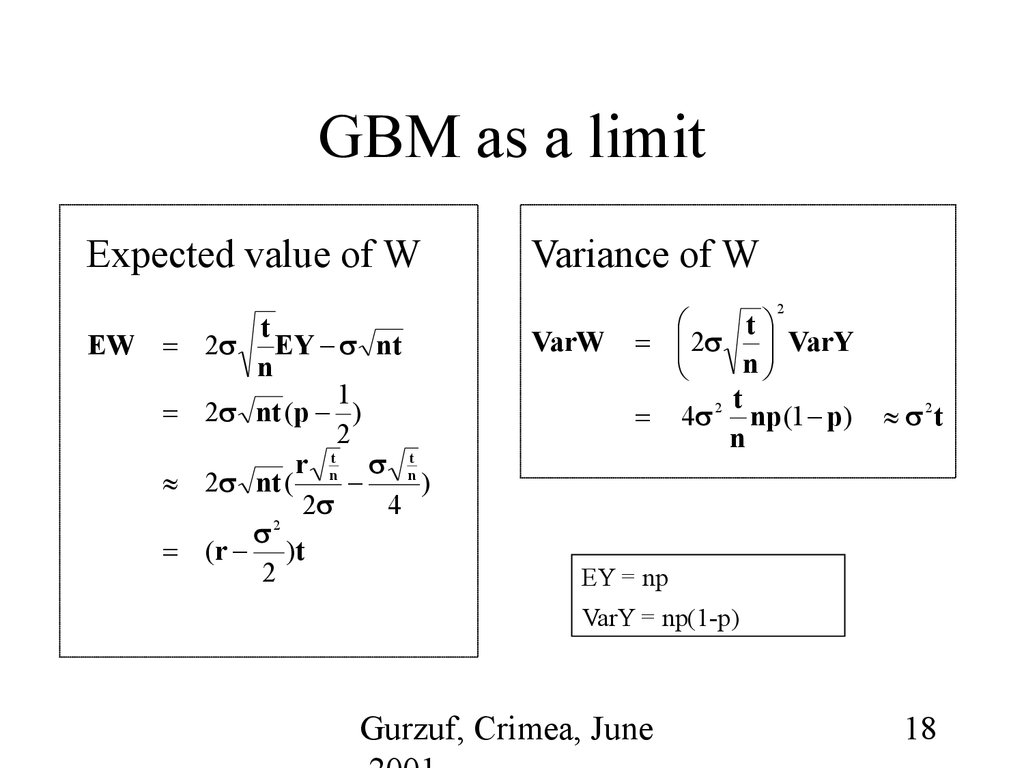

18. GBM as a limit

Expected value of Wt

EY nt

n

1

2 nt (p )

2

r nt nt

2 nt (

)

2

4

2

(r )t

2

EW 2

Variance of W

2

VarW

t

2 VarY

n

t

4 2 np (1 p)

n

2t

EY = np

VarY = np(1-p)

Gurzuf, Crimea, June

18

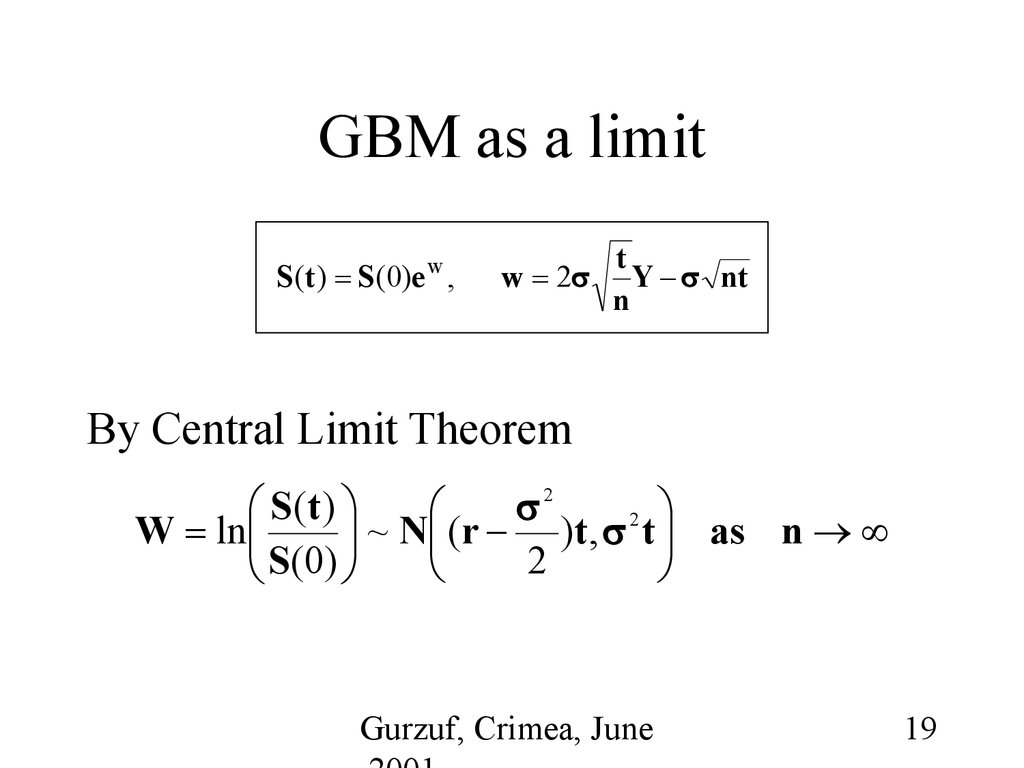

19. GBM as a limit

S(t ) S(0)e W ,w 2

t

Y nt

n

By Central Limit Theorem

S (t )

2

2

W ln

~ N (r )t, t as n

2

S ( 0)

Gurzuf, Crimea, June

19

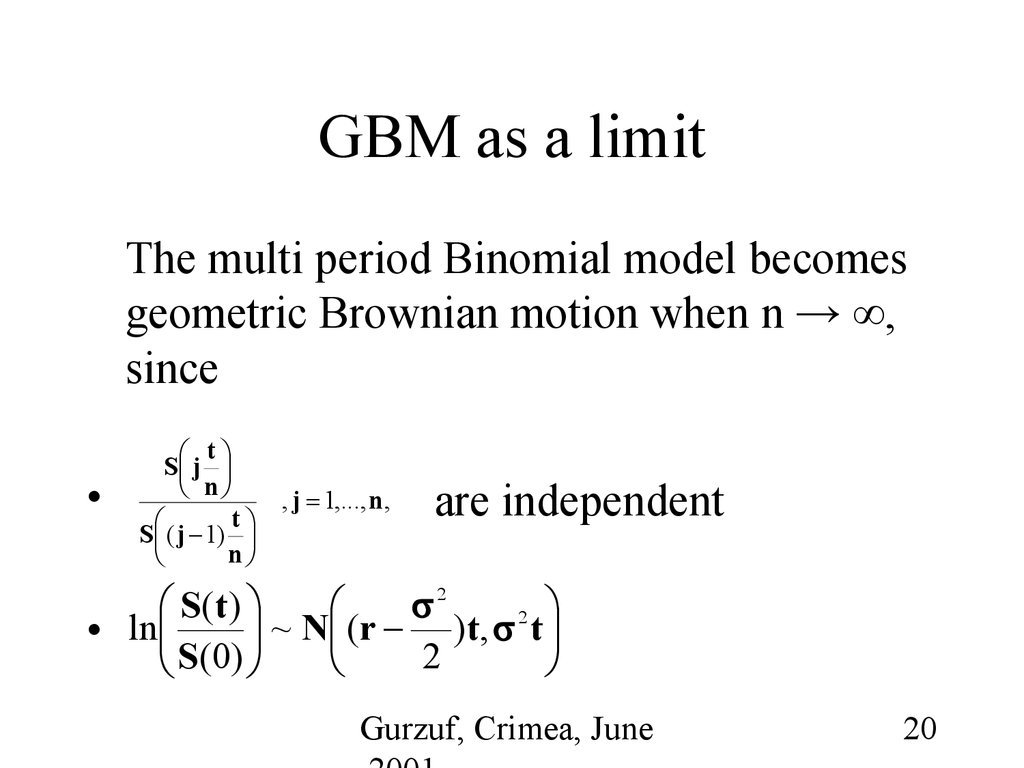

20. GBM as a limit

The multi period Binomial model becomesgeometric Brownian motion when n → ∞,

since

t

S j

n

, j 1,..., n,

t

S ( j 1)

n

are independent

2

S (t )

2

ln

~ N (r )t, t

2

S(0)

Gurzuf, Crimea, June

20

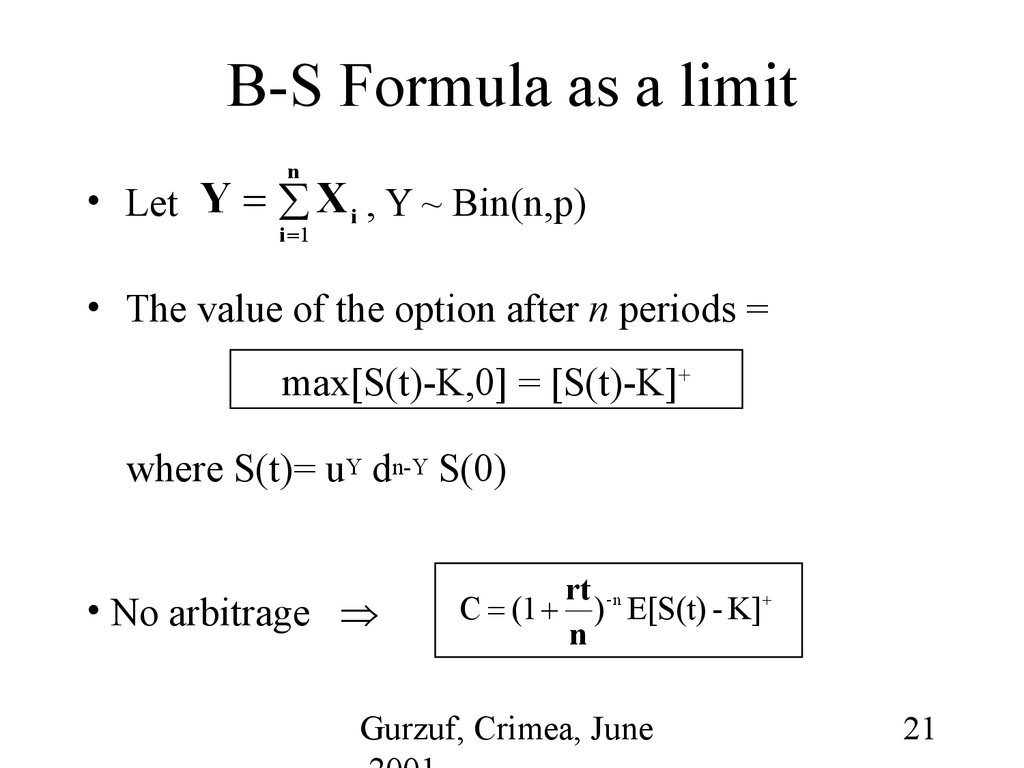

21. B-S Formula as a limit

n• Let Y X i , Y ~ Bin(n,p)

i 1

• The value of the option after n periods =

max[S(t)-K,0] = [S(t)-K]+

where S(t)= uY dn-Y S(0)

• No arbitrage

C (1

rt - n

) E[S(t) - K]

n

Gurzuf, Crimea, June

21

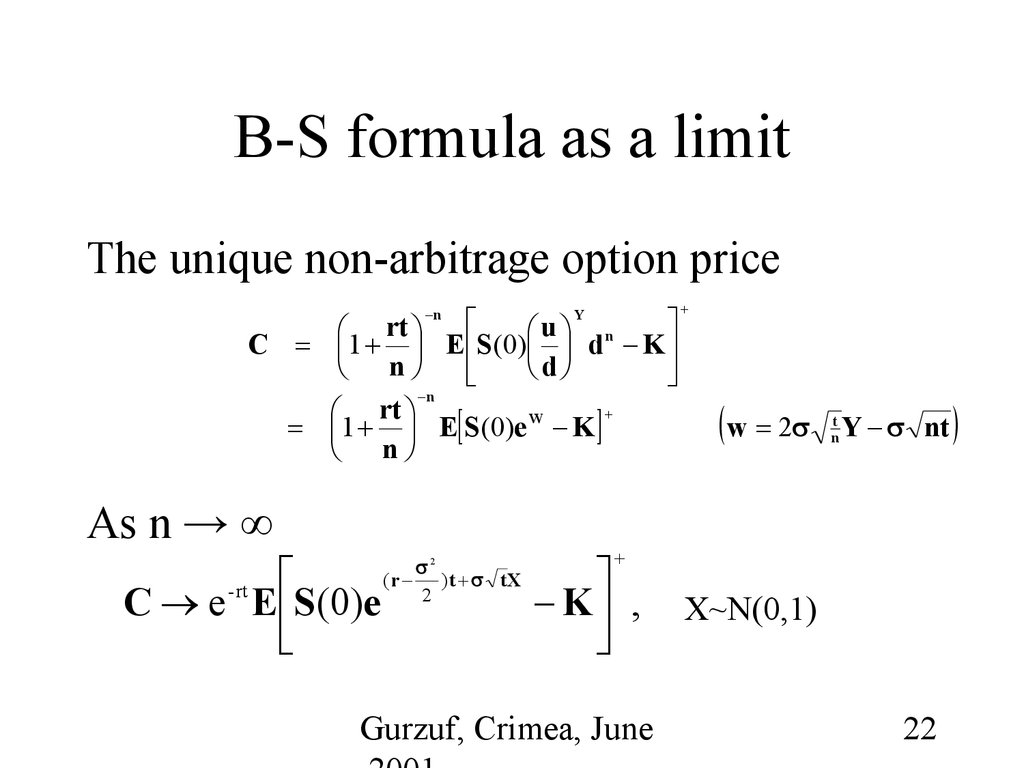

22. B-S formula as a limit

The unique non-arbitrage option priceY

rt

u n

C 1 E S(0) d K

n

d

n

rt

1 E S(0)e W K

n

n

As n → ∞

C e E S(0)e

- rt

2

( r ) t tX

2

w 2

t

n

Y nt

K ,

Gurzuf, Crimea, June

X~N(0,1)

22

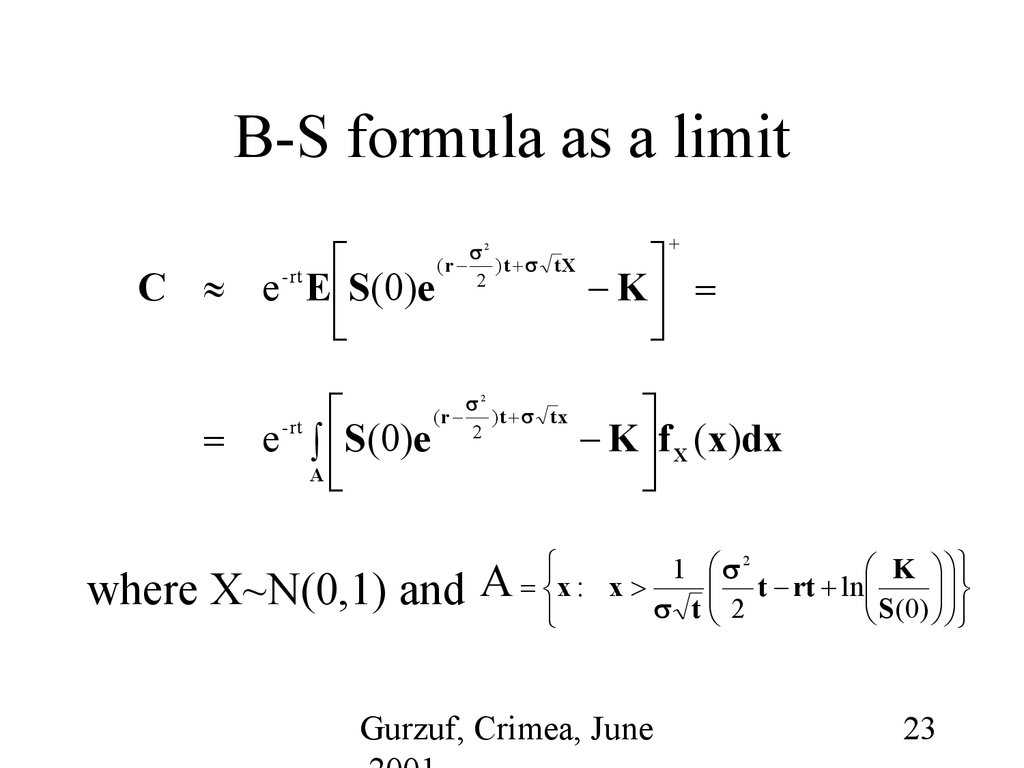

23. B-S formula as a limit

C e E S(0)e- rt

e S(0)e

A

- rt

2

( r ) t tX

2

2

( r ) t tx

2

where X~N(0,1) and A

K

K f X (x)dx

1 2

K

t rt ln

x : x

t 2

S(0)

Gurzuf, Crimea, June

23

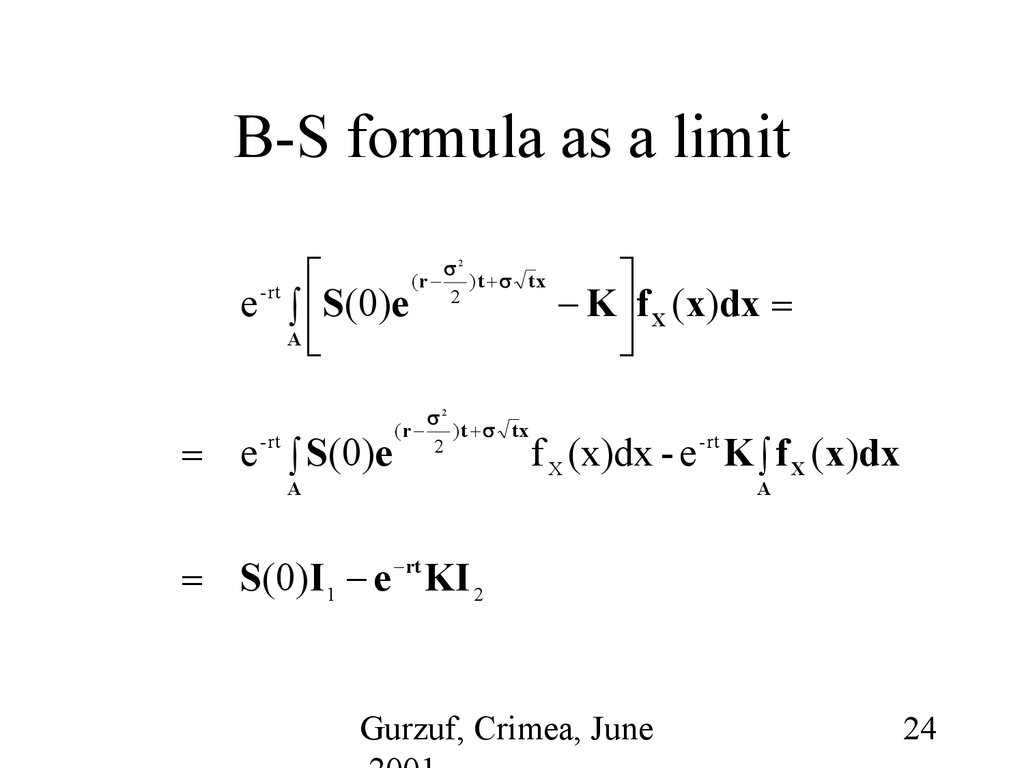

24. B-S formula as a limit

e S(0)eA

- rt

e - rt S(0)e

2

( r ) t tx

2

(r

2

) t tx

2

A

K f X (x)dx

f X (x)dx - e - rt K f X (x)dx

A

S(0)I 1 e rt KI 2

Gurzuf, Crimea, June

24

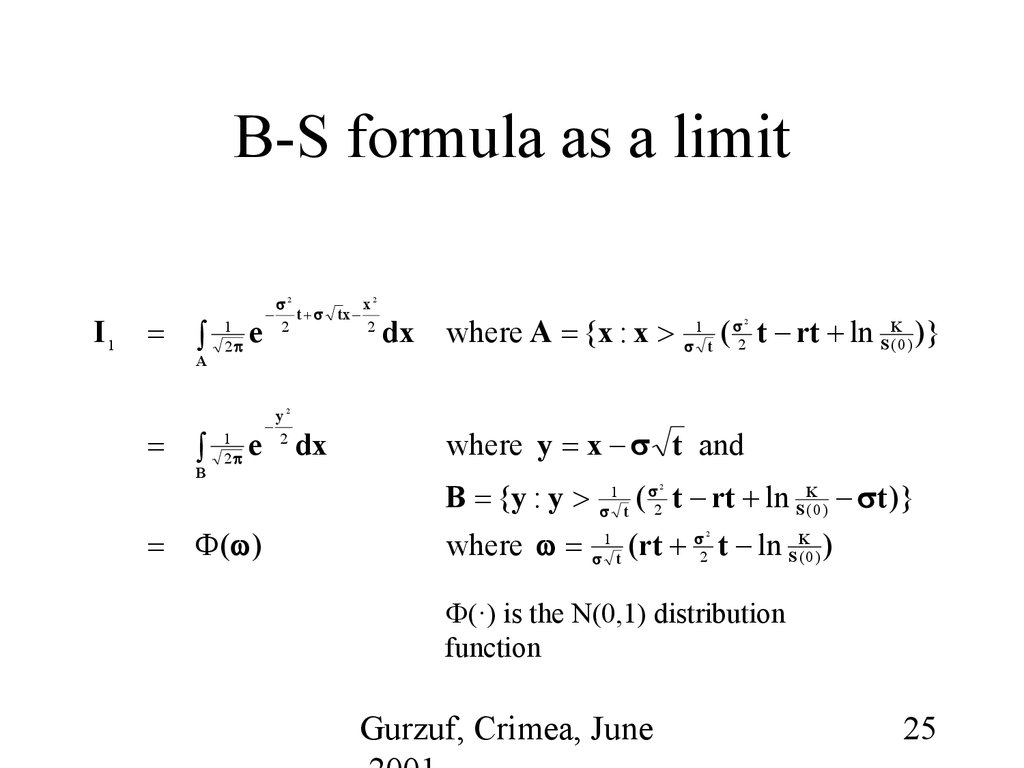

25. B-S formula as a limit

I1A

B

1

2

1

2

e

e

2

x2

t tx

2

2

y2

2

dx

dx where A {x : x t ( t rt ln SK( 0 ) )}

2

2

1

where y x t and

B {y : y 1 t ( 2 t rt ln SK( 0 ) t )}

where 1 t (rt 2 t ln SK( 0 ) )

2

( )

2

(·) is the N(0,1) distribution

function

Gurzuf, Crimea, June

25

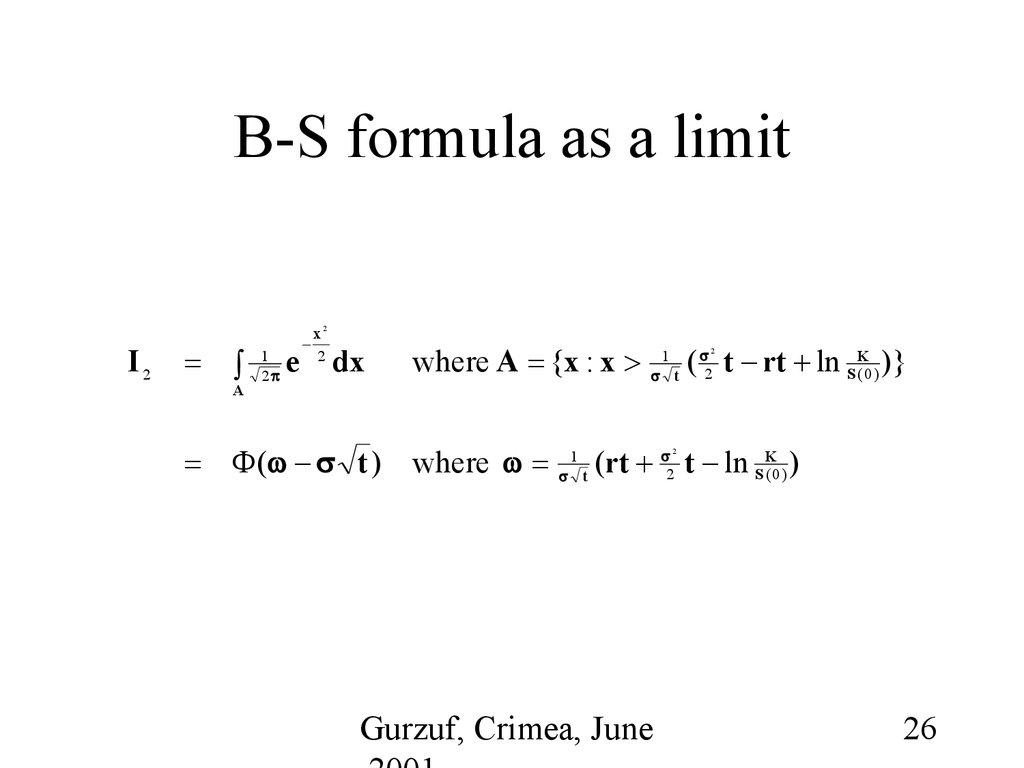

26. B-S formula as a limit

I2A

1

2

e

x2

2

dx

where A {x : x 1 t ( 2 t rt ln SK( 0 ) )}

2

( t ) where t (rt t ln SK( 0 ) )

1

Gurzuf, Crimea, June

2

2

26

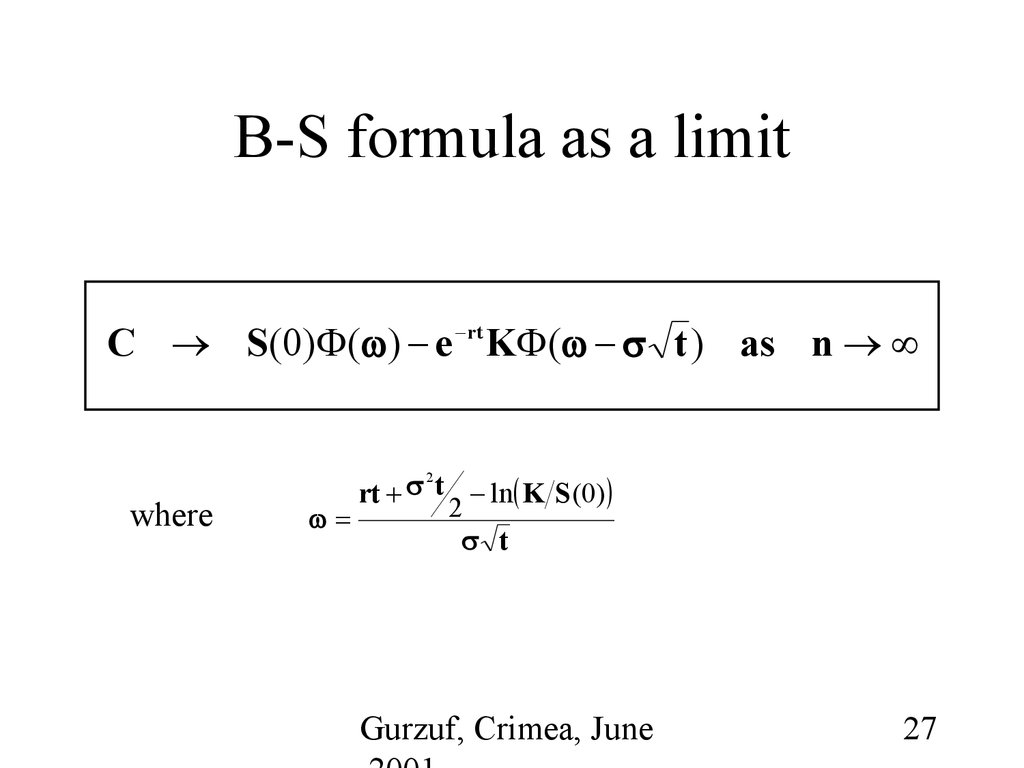

27. B-S formula as a limit

C S(0) ( ) e rt K ( t ) as nwhere

2

rt t ln K S(0)

2

t

Gurzuf, Crimea, June

27

mathematics

mathematics