Similar presentations:

Measures of Risk and Uncertainty Efficient portfolios consisting of two risky assets

1. Measures of Risk and Uncertainty

Efficient portfolios consisting of tworisky assets

2. Course Outline

1. Quantitative methods in decision making: goals, potentials and limits(1C)

2. Data collection and presentation (1C)

3. Use of descriptive statistics for describing the features of the data

(2C)

4. The role of financial mathematics in business decisions mathematical methods (2C)

5. Valuation of financial instruments and business decisions (2C)

Preparation for the inter-mediate assignment (1C)

6. Measures of risk and uncertainty (2C)

7. Statistical inference in business. Business planning on the basis of

predictions and assumptions. (3C)

8. Correlation and regression analysis for decision making (3C)

2

3. Grading

Quantitative Business DecisionGrading

20 points – Mid-term Exam

40 points – Final Exam

10 extra points – In-class performance

Seminars – EXCEL and SPSS

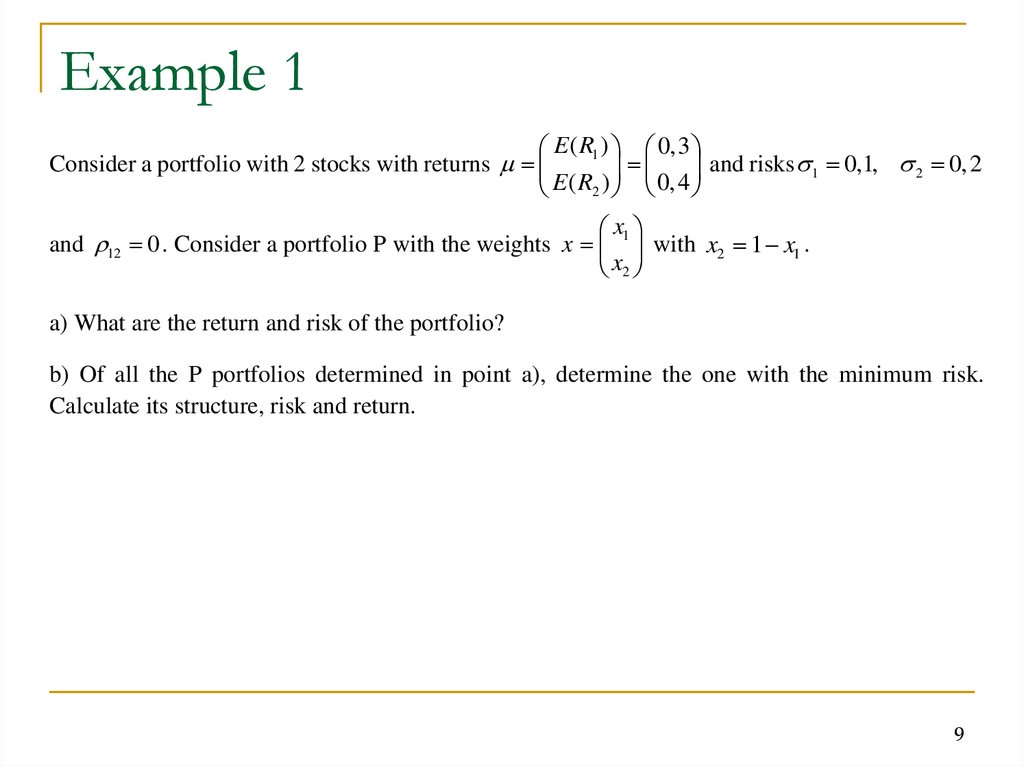

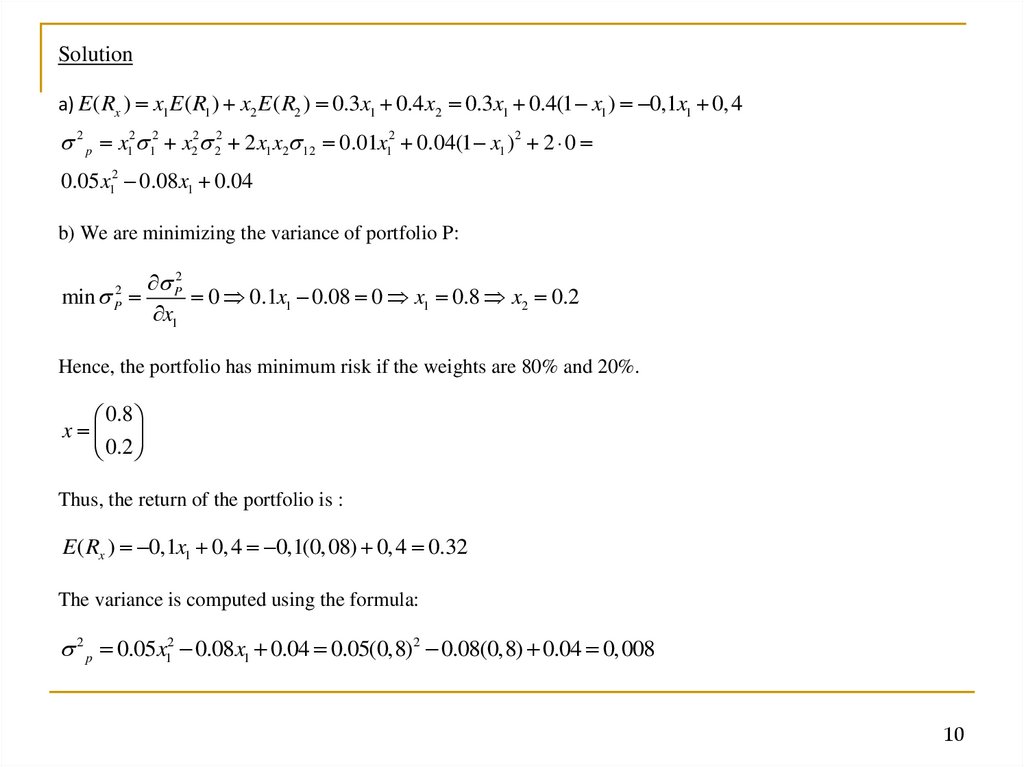

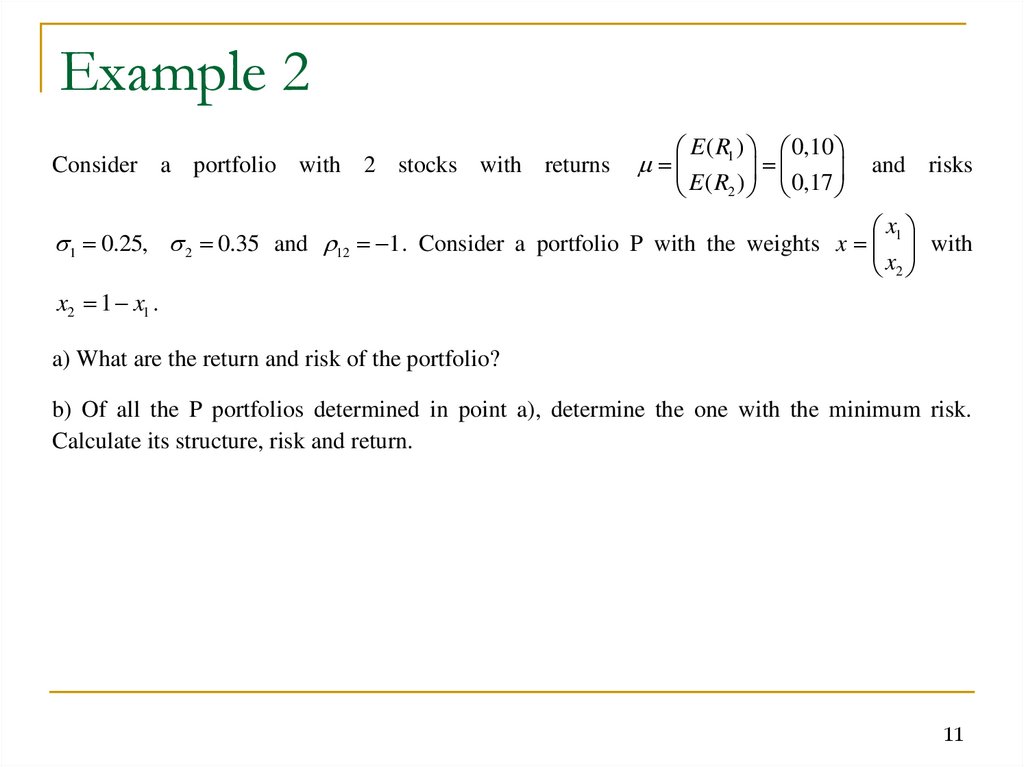

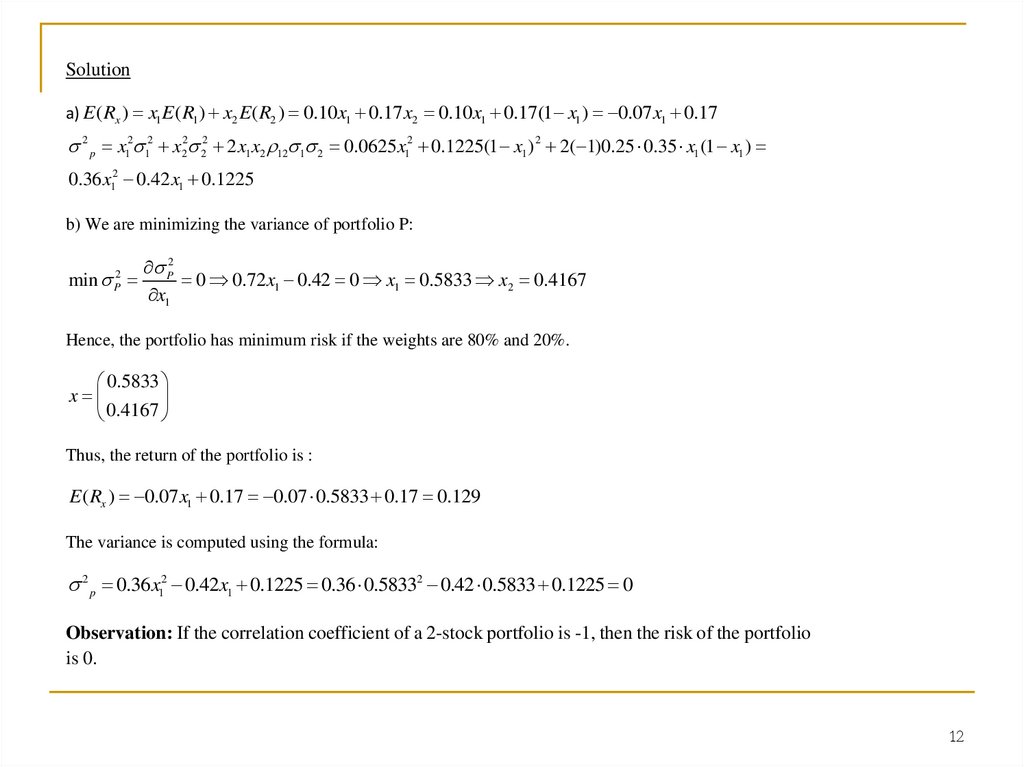

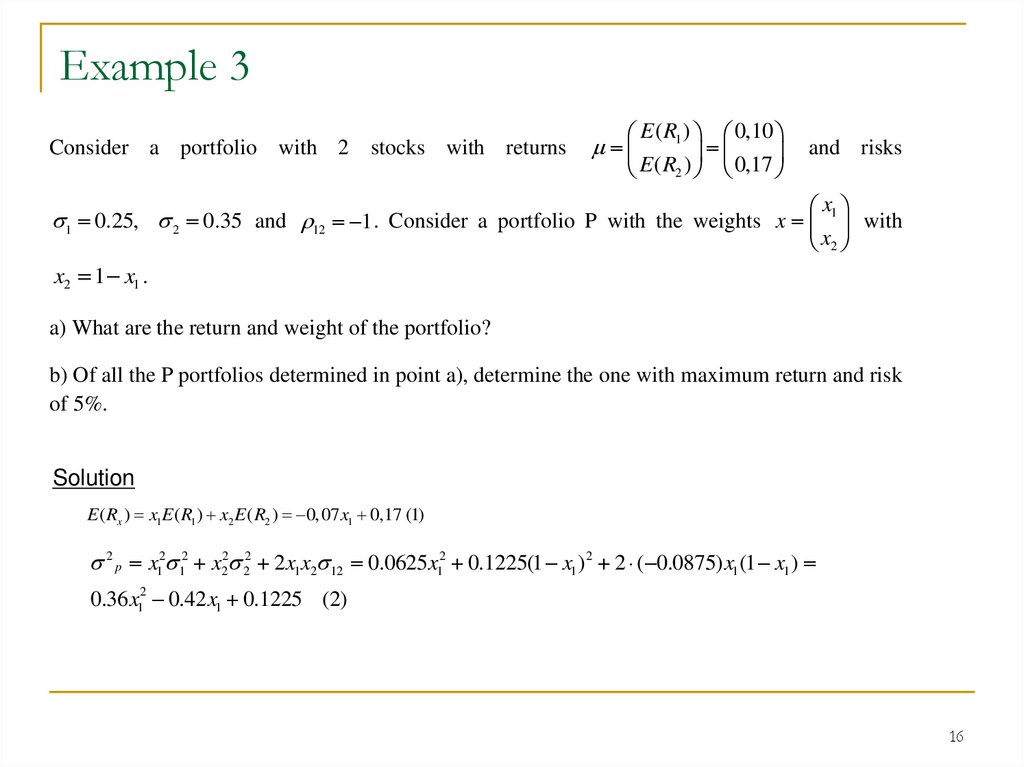

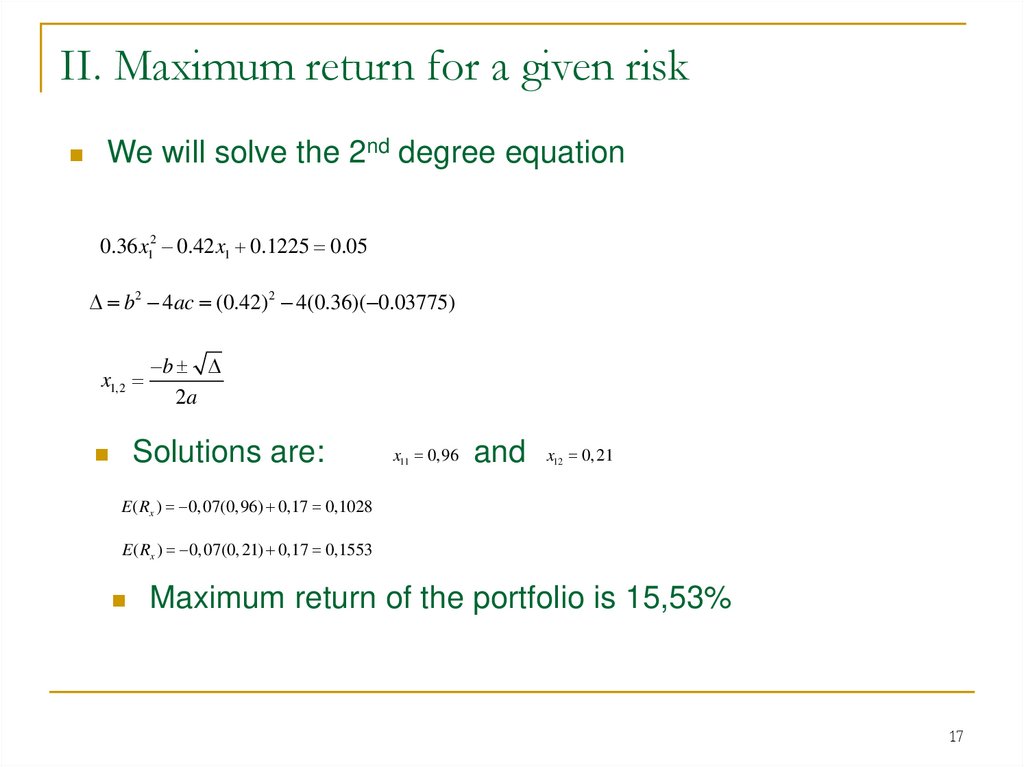

4. 2-stock Portfolio

For a portfolio of 2 shares, what are theweights chosen so that:

I. Minimum risk for a fixed return.

II. Maximum return for a fixed risk.

4

5. I. Minimum risk for a fixed return

Suppose we have a portfolio with two stocks(w1, w2), where w + w = 1

For each stock, the risk and return were

calculated:

1

S : E(R ) and s21

S : E(R ) and s22

1

2

2

1

2

What are the weights w and w so that the risk is

minimum for a fixed return?

1

2

5

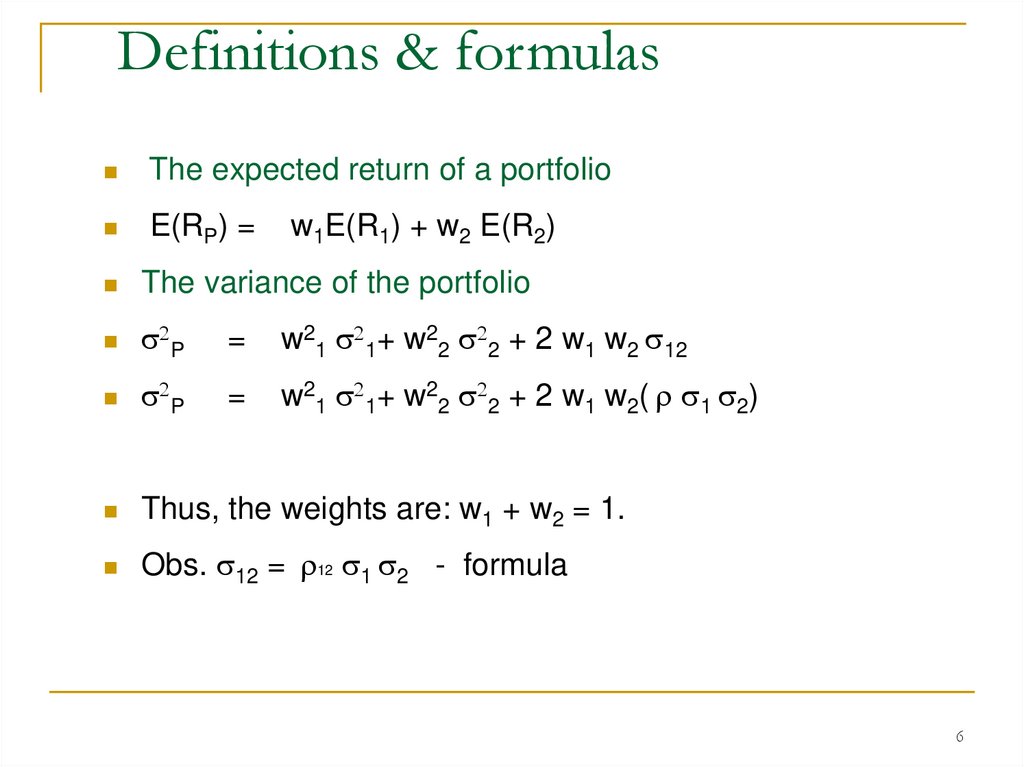

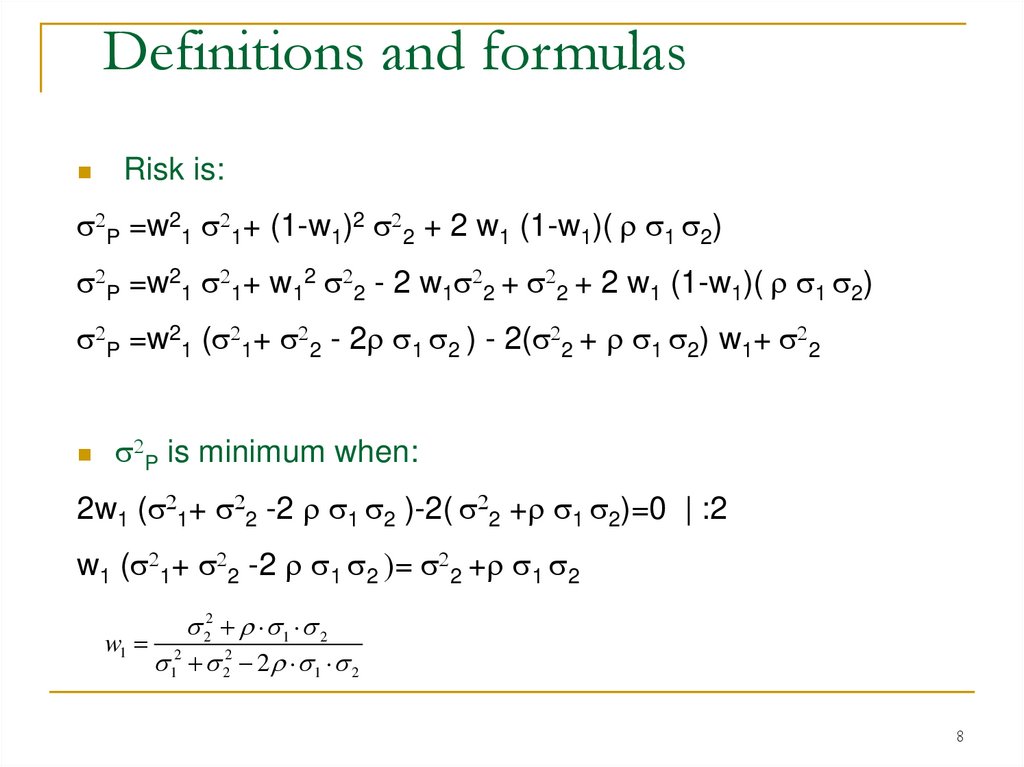

6. Definitions & formulas

Definitions & formulasThe expected return of a portfolio

E(RP) =

The variance of the portfolio

s2P

=

w21 s21+ w22 s22 + 2 w1 w2 s12

s2P

=

w21 s21+ w22 s22 + 2 w1 w2( s1 s2)

Thus, the weights are: w1 + w2 = 1.

Obs. s12 = 12 s1 s2 - formula

w1E(R1) + w2 E(R2)

6

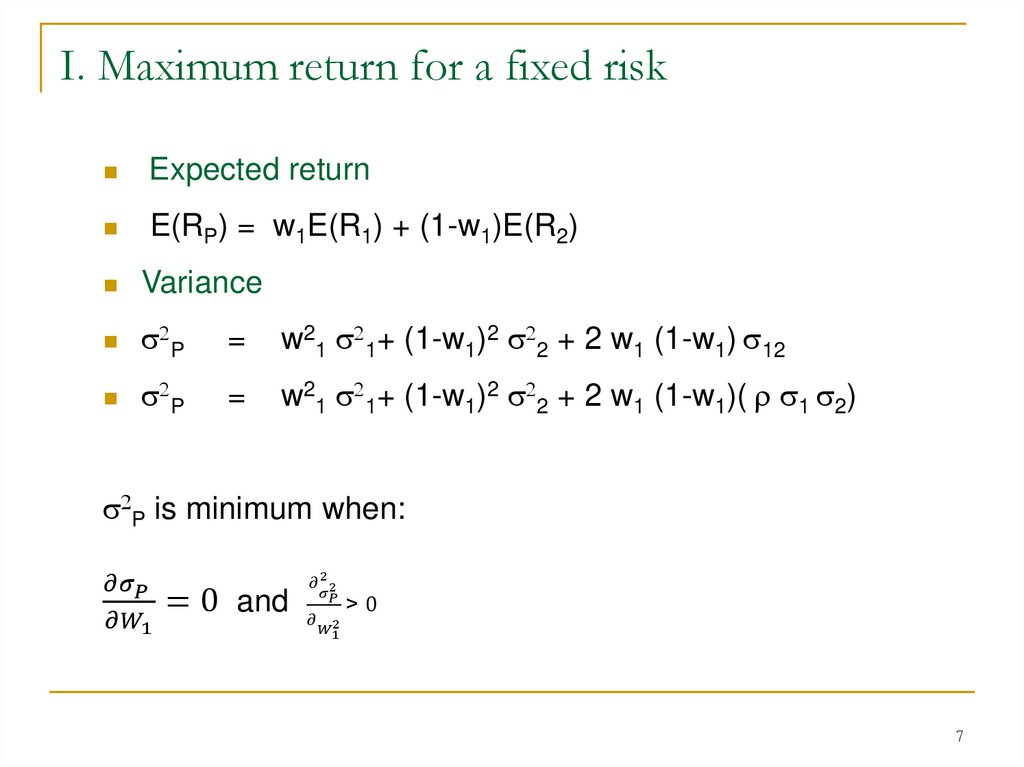

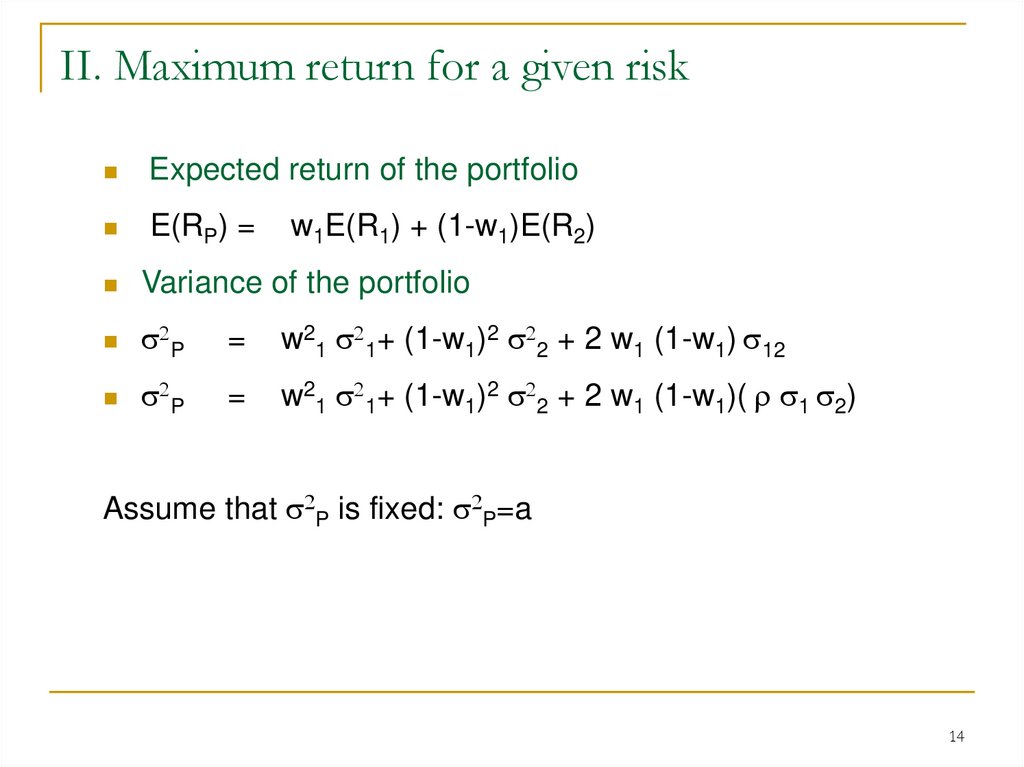

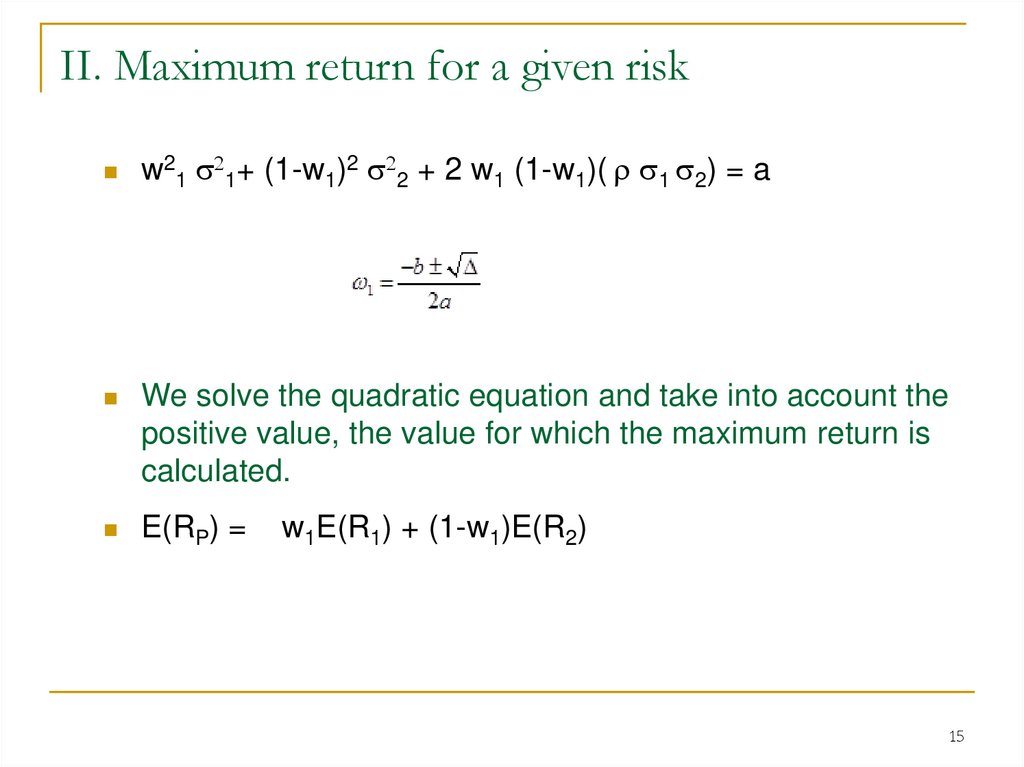

7. I. Maximum return for a fixed risk

Expected returnE(RP) = w1E(R1) + (1-w1)E(R2)

Variance

s2P

=

w21 s21+ (1-w1)2 s22 + 2 w1 (1-w1) s12

s2P

=

w21 s21+ (1-w1)2 s22 + 2 w1 (1-w1)( s1 s2)

s2P is minimum when:

finance

finance