Similar presentations:

Investment Basics

1. Chapter 11

PART 4:MANAGING YOUR INVESTMENTS

Chapter 11

Investment Basics

2. Learning Objectives

Set your goals and be ready to invest.Understand how taxes affect your

investments.

Calculate interest rates and real rates of

return.

Manage risk in your investments.

Allocate your assets in the manner that is

best for you.

11-2

3. Investing Versus Speculating

When you buy an investment, you put moneyin an asset that generates a return.

–

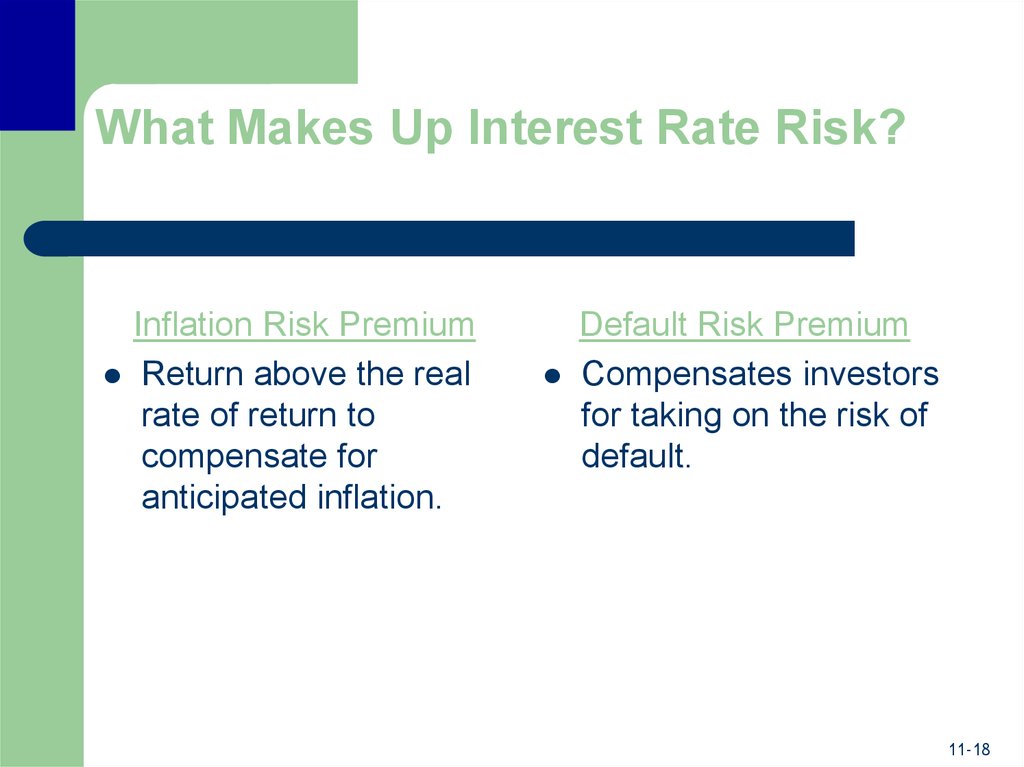

Part of that is income:

–

Rent on real estate

Dividends on stock

Interest on bonds

Even if the stock or bond does not pay income

now, in the future it may.

11-3

4. Investing Versus Speculating

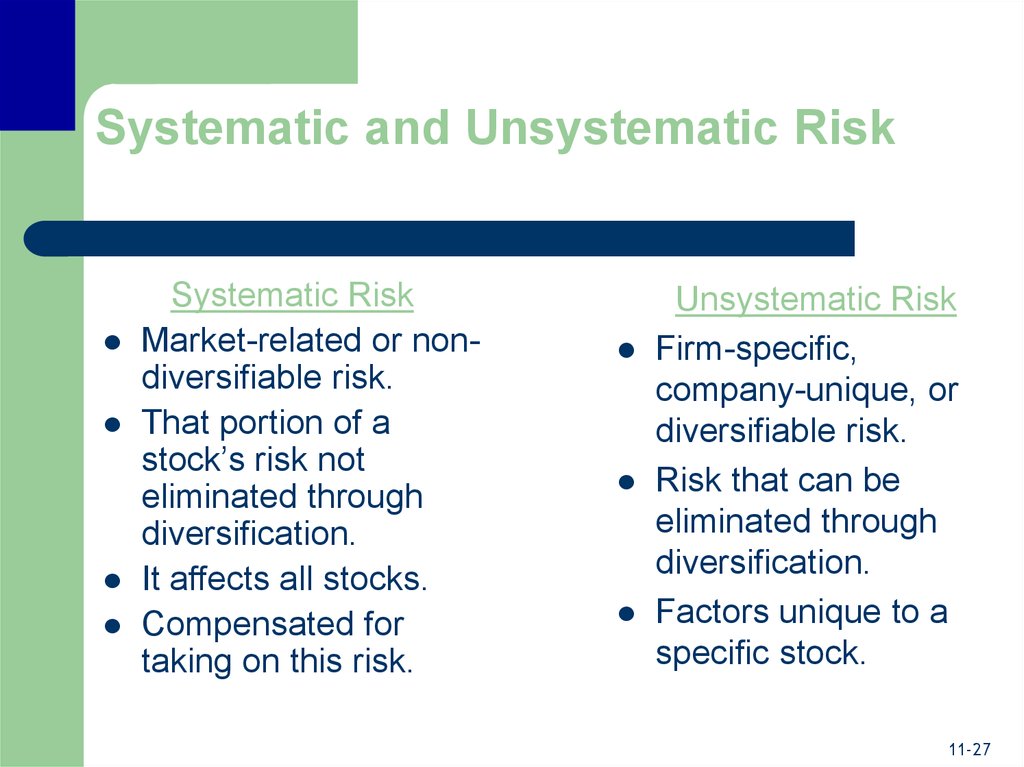

With speculation, assets don’t generate an incomereturn and their value depends entirely on supply

and demand.

Examples include:

–

–

–

–

–

Gold coins

Baseball cards

Non-income producing real estate

Gems

Derivative securities

11-4

5. Investing Versus Speculating

Derivative securities derive their value fromthe value of another asset.

–

–

Futures - a written contract to buy or sell a

commodity in the future.

Options - the right to buy or sell an asset at a set

price on or before maturity date.

Call option – right to buy

Put option – right to sell

11-5

6. Investing Versus Speculating

Futures contracts deal with commodities such as oil,soybeans, or corn.

It requires the holder to buy or sell the asset,

regardless of what happens to its value in the

interim.

Contract sets a price and a future time at which you

will buy or sell the asset.

With futures, it is possible to lose more than you

invested.

11-6

7. Investing Versus Speculating

Options markets and futures markets are a“zero sum game.”

If someone makes money, then someone

must lose money.

If profits and losses are added up, the total

would be zero.

Can lose more than invested.

11-7

8. Setting Investment Goals

When you make a plan, you must:–

–

–

–

Write down your goals and prioritize them.

Attach costs to them.

Determine when the money for those goals will be

needed.

Periodically reevaluate your goals.

11-8

9. Setting Investment Goals

Formalize goals into:–

–

–

Short-term – within 1 year

Intermediate-term – 1-10 years

Long-term – over 10 years

11-9

10. Setting Investment Goals

Focus on which goals are important by asking:–

–

–

–

If I don’t accomplish this goal, what are the

consequences?

Am I willing to make the financial sacrifices necessary

to meet this goal?

How much money do I need to accomplish this goal?

When do I need this money?

11-10

11. Fitting Taxes into Investing

Compare returns on an after-tax basis:–

–

–

Marginal tax is the rate you pay on the next dollar

of earnings.

Make investments on a tax-deferred basis so no

taxes are paid until liquidation.

Capital gains and dividend income are better than

ordinary income.

11-11

12. Starting Your Investment Program

Tips to Get Started–

–

–

–

–

Pay yourself first – set aside savings, so spending

remains.

Make investing automatic – use automatic withholding.

Take advantage of Uncle Sam and your employer – try

matching investments.

Windfalls – invest some or all.

Make 2 months a year investment months – reduce

spending.

11-12

13. Investment Choices

Lending Investments–

Savings accounts

Ownership Investments

and bonds.

–

Debt instruments

issued by

corporations and

the government.

Preferred stocks and

common stocks which

represent ownership in

a corporation.

Income-producing real

estate.

11-13

14. Lending Investments

A savings account pays interest on thebalance held in the account.

With a bond, the return is usually fixed and

known ahead of time.

–

–

–

–

Principal returned on maturity date.

Corporate bonds issued in $1000 units.

Pay semiannual interest.

Coupon rate is the annual interest rate.

11-14

15. Ownership Investments

Real estate investments in income-producingproperties are illiquid.

Stocks, or equities, are the most popular

ownership investment.

–

–

–

–

Stocks may pay a quarterly dividend.

Preferred stock dividends are fixed.

Common stock has voting rights.

Bond interest is paid prior to stock dividends.

11-15

16. Market Interest Rates

Interest rates affect the value of stocks,bonds, and real estate.

Nominal rate of return is not adjusted for

inflation.

Real rate of return adjusts for inflation.

–

Real rate = nominal rate - inflation rate

11-16

17. What Makes Up Interest Rate Risk?

Real risk-free rate of return is what investorsreceive for delaying consumption.

Short-term Treasury bills are virtually riskfree. Their interest rate is considered to be

the risk-free rate.

11-17

18. What Makes Up Interest Rate Risk?

Inflation Risk PremiumReturn above the real

rate of return to

compensate for

anticipated inflation.

Default Risk Premium

Compensates investors

for taking on the risk of

default.

11-18

19. What Makes Up Interest Rate Risk?

Maturity Risk PremiumAdditional return

demanded by investors

on longer-term bonds.

Liquidity Risk Premium

For bonds that cannot

be converted into cash

quickly at a fair market

price.

11-19

20. How Interest Rates Affect Returns on Other Investments

Expected returns on all investments are related.What you can earn on one investment determines

what you can earn on another.

Interest rates act as a “base” return. When

interest rates go up, investors demand a higher

return on other investments.

11-20

21. Look at Risk-Return Trade-Offs

Risk is related to potential return.The more risk you assume, the greater the

potential reward – but also the greater possibility

of losing your money.

You must eliminate risk without affecting potential

return.

11-21

22. Sources of Risk in the Risk-Return Trade-Off

Interest Rate Risk – the higher the interestrate, the less a bond is worth.

Inflation Risk – rising prices will erode

purchasing power.

Business Risk – effects of good and bad

management decisions.

11-22

23. Sources of Risk in the Risk-Return Trade-Off

Financial Risk – associated with the use ofdebt by the firm.

Liquidity Risk – inability to liquidate a security

quickly and at a fair market price.

11-23

24. Sources of Risk in the Risk-Return Trade-Off

Market Rate Risk – associated with overallmarket movements.

–

–

Bull markets – stocks appreciate in value

Bear markets – stocks decline in price

11-24

25. Diversification

“Don’t put all your eggs in one basket.”Extreme good and bad returns cancel out, resulting in

a reduction of the total variability or risk without

affecting expected return.

Not only eliminates risk but also helps us understand

what risk is relevant to investors.

11-25

26. Systematic and Unsystematic Risk

As you diversify, the variability or risk of the portfolioshould decline.

Not all risk can be eliminated by diversification.

The risk in returns common to all stocks isn’t

eliminated through diversification.

Risk unique to one stock can be countered and

cancelled out by the variability of another stock in the

portfolio.

11-26

27. Systematic and Unsystematic Risk

Systematic RiskMarket-related or nondiversifiable risk.

That portion of a

stock’s risk not

eliminated through

diversification.

It affects all stocks.

Compensated for

taking on this risk.

Unsystematic Risk

Firm-specific,

company-unique, or

diversifiable risk.

Risk that can be

eliminated through

diversification.

Factors unique to a

specific stock.

11-27

28. How to Measure the Ultimate Risk on Your Portfolio

For risk associated with investment returns,look at:

–

–

–

Variability of the average annual return on your

investment.

Uncertainty associated with the ultimate dollar

value of the investment.

How the ultimate dollar return on the investment

compares to that of another investment.

11-28

29. How to Measure the Ultimate Risk on Your Portfolio

If investment time horizon is long and you investin stocks, there is uncertainty about the ultimate

value of investment, so take on additional risk.

Take on more risk as time horizon lengthens.

No place to hide in a crash, both stocks and

bonds are affected.

11-29

30. Asset Allocation

How your money should be divided amongstocks, bonds and other investments.

Investors should be diversified, holding

different classes of investments.

Common stocks more appropriate for the

long-term horizon.

Asset allocation is the most important

investing task.

11-30

31. Asset Allocation and Approaching Retirement

The Golden Years (Age 55-64)Preserve level of wealth and allow it to grow.

Start moving into bonds.

Maintain a diversified portfolio.

Own 60% stocks and 40% bonds.

11-31

32. Asset Allocation and Approaching Retirement

The Retirement Years (Over Age 65)Spending more than saving.

Income is primary, capital appreciation secondary.

Safety through diversification and movement away from

common stocks.

Early on, own 40% stocks, 40% bonds, 20% T-bills. Later

own 20% common, 60% bonds, and 20% T-bills.

11-32

33. What You Should Know About Efficient Markets

Deals with the speed at which newinformation is reflected in prices.

–

The more efficient the market, the faster prices

react to new information.

If the stock market were truly efficient, then

there would be no benefit from stock

analysts.

11-33

finance

finance