Similar presentations:

Venture capital

1. Venture capital

Prof. R. Aernoudt1

2. Content

I. Not all the money is the sameII. Credits

III. Formal and informal vc

III. Formal VC

IV. Informal BA

2

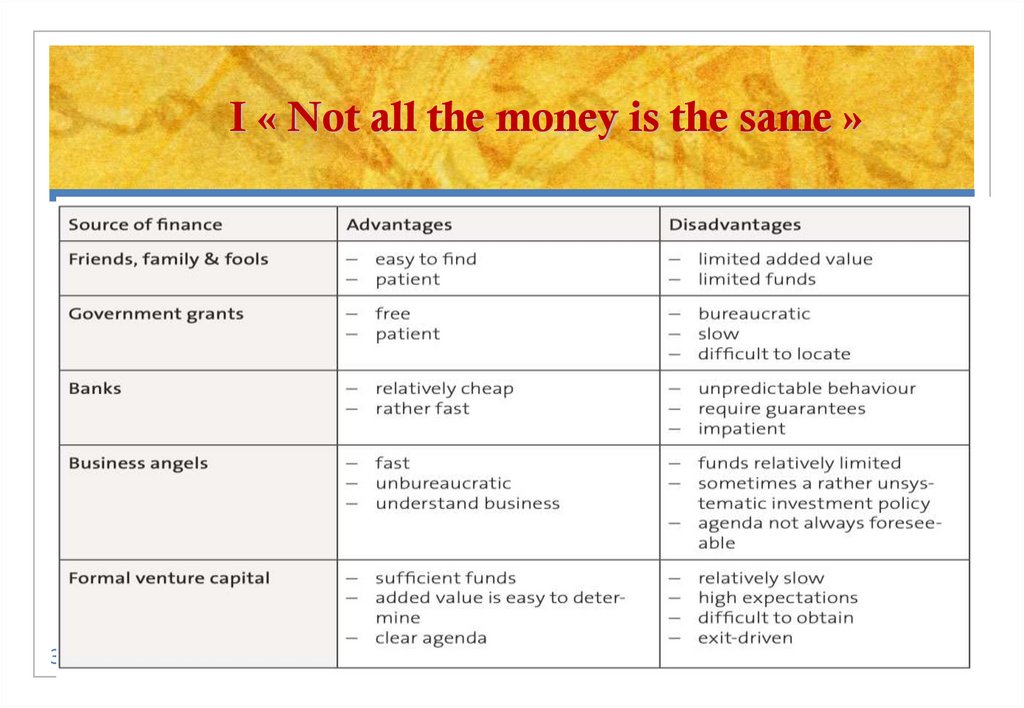

3. I « Not all the money is the same »

I « Not all the money is the same »3

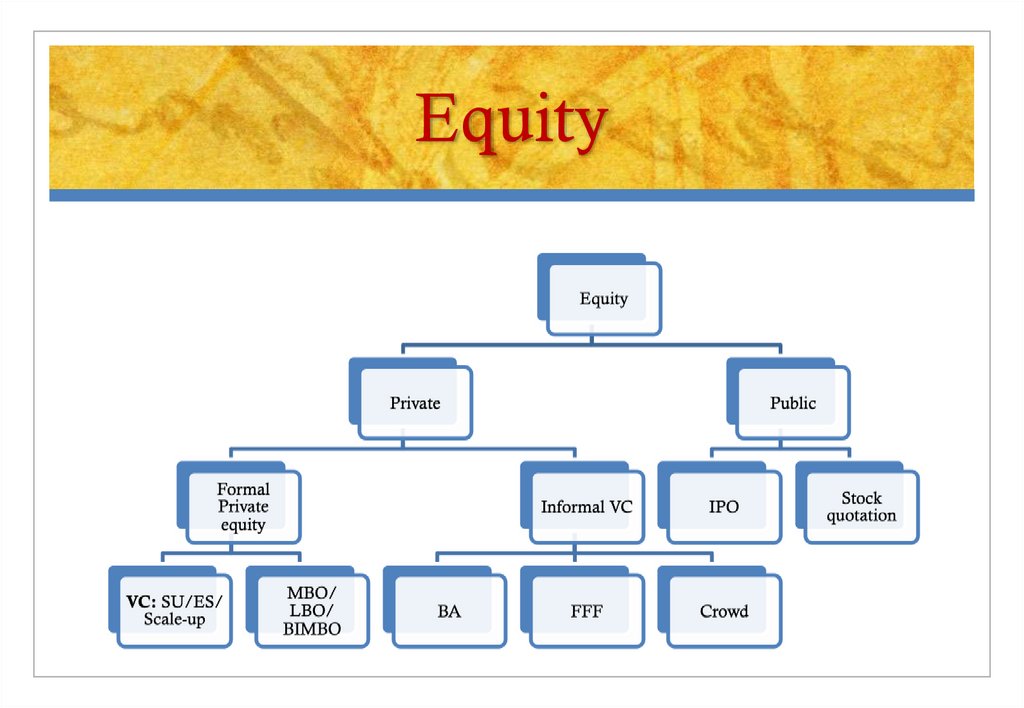

4. Equity

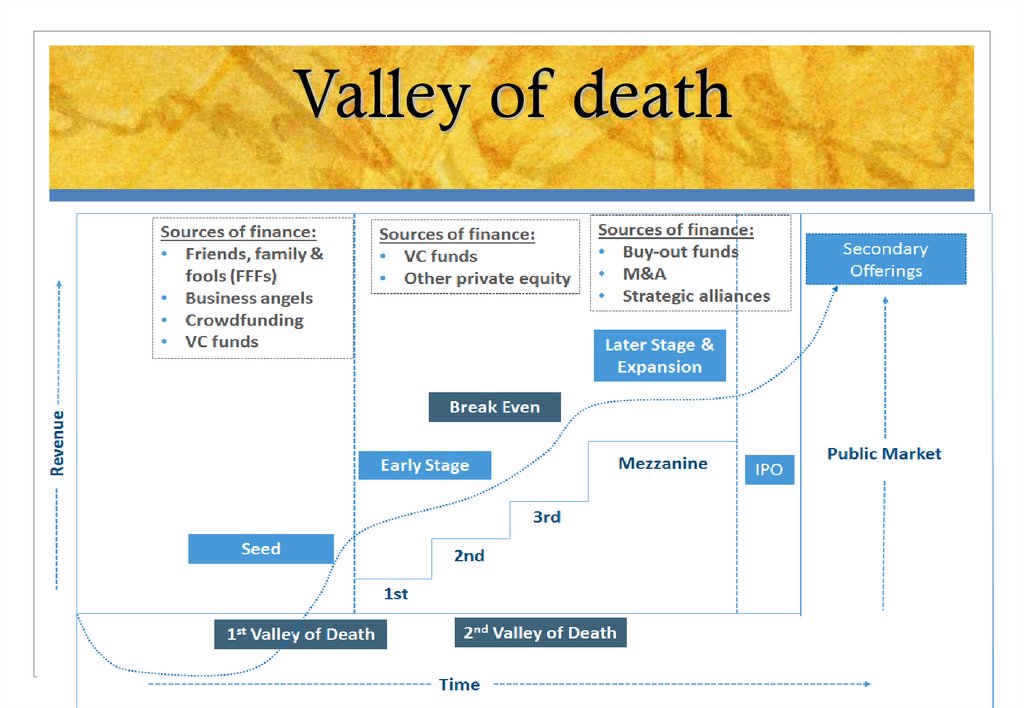

5. Valley of death

56. Definitions

6Private equity = equity capital to enterprises not quoted on a

stock market

Venture capital = equity investments made for the launch, early

development or expansion of a business

Seed money = financing provided to research, assess and develop

an initial concept before a business has reached the start-up

phase

Start-up = financing provided for product development and initial

marketing

7. Definitions

Expansion= financing provided for the growth and

expansion of a company which is breaking even or

trading profitably

Replacement

capital = purchase of existing shares in a

company from another private equity investment

organization, or from (an)other shareholder(s)

Buy-out

= management buy-out/-in : financing to enable

current operating management and investors to acquire

an existing product line or business

7

8.

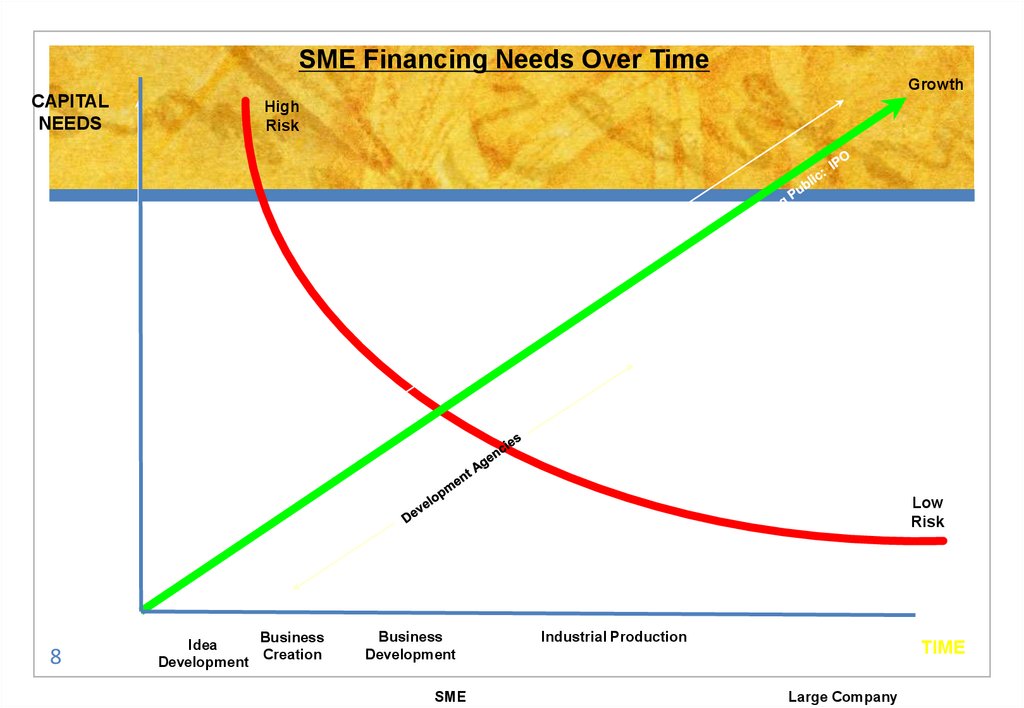

SME Financing Needs Over TimeGrowth

CAPITAL

NEEDS

High

Risk

Low

Risk

8

Business

Idea

Creation

Development

Business

Development

SME

Industrial Production

TIME

Large Company

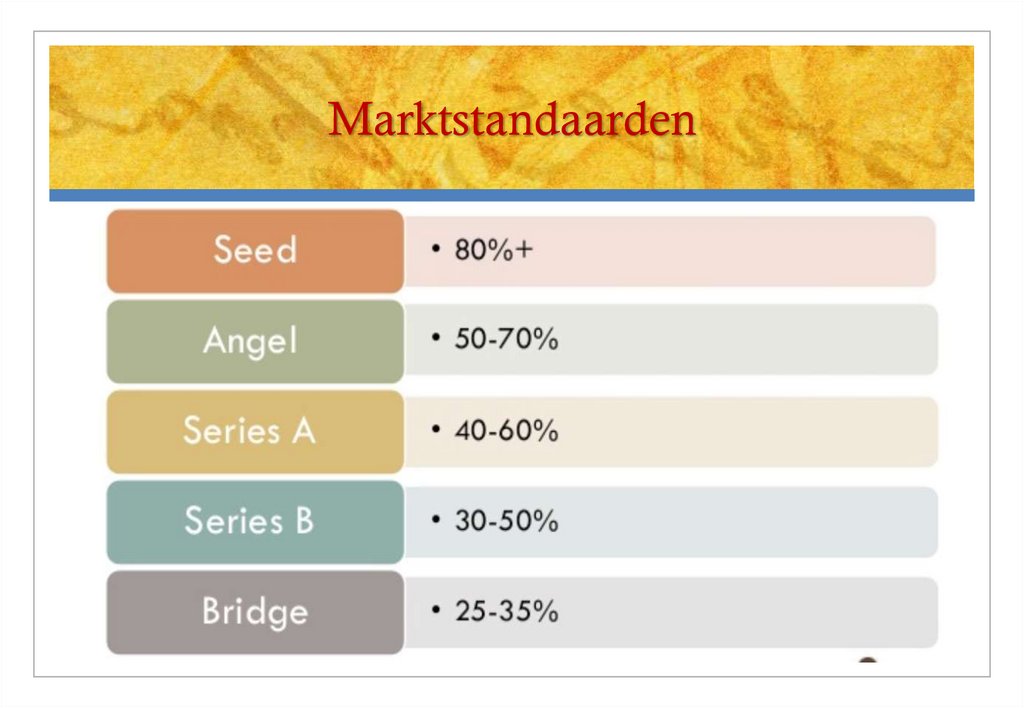

9. Marktstandaarden

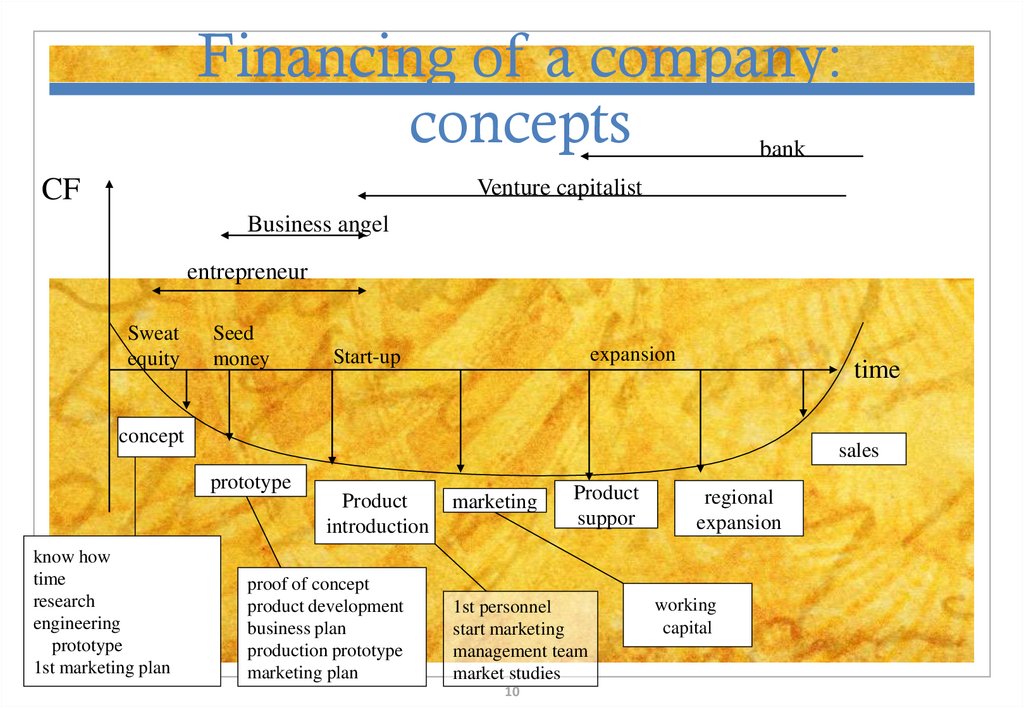

10. Financing of a company: concepts

bankCF

Venture capitalist

Business angel

entrepreneur

Sweat

equity

Seed

money

expansion

Start-up

time

concept

sales

prototype

Product

introduction

know how

time

research

engineering

prototype

1st marketing plan

proof of concept

product development

business plan

production prototype

marketing plan

marketing

Product

suppor

1st personnel

start marketing

management team

market studies

10

regional

expansion

working

capital

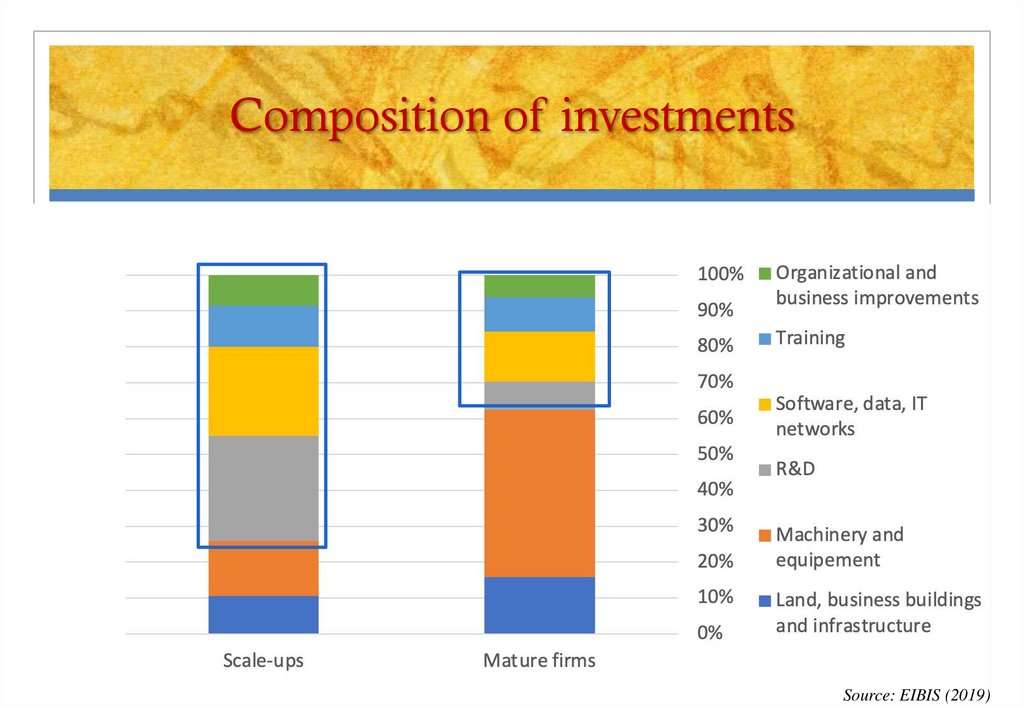

11. Composition of investments

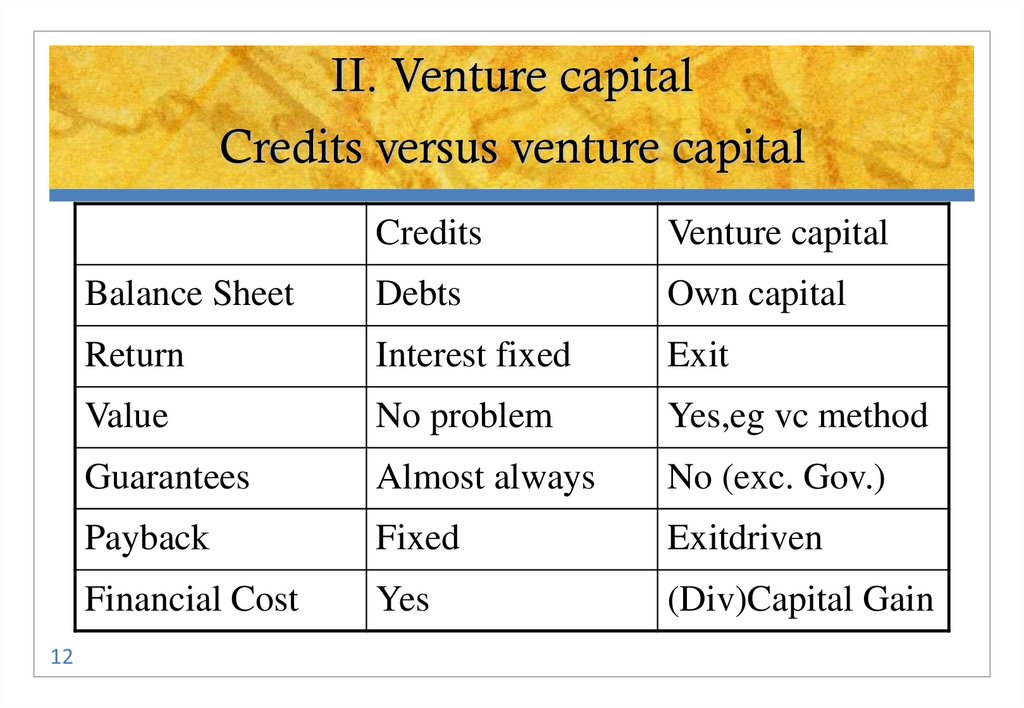

Source: EIBIS (2019)12. II. Venture capital Credits versus venture capital

12Credits

Venture capital

Balance Sheet

Debts

Own capital

Return

Interest fixed

Exit

Value

No problem

Yes,eg vc method

Guarantees

Almost always

No (exc. Gov.)

Payback

Fixed

Exitdriven

Financial Cost

Yes

(Div)Capital Gain

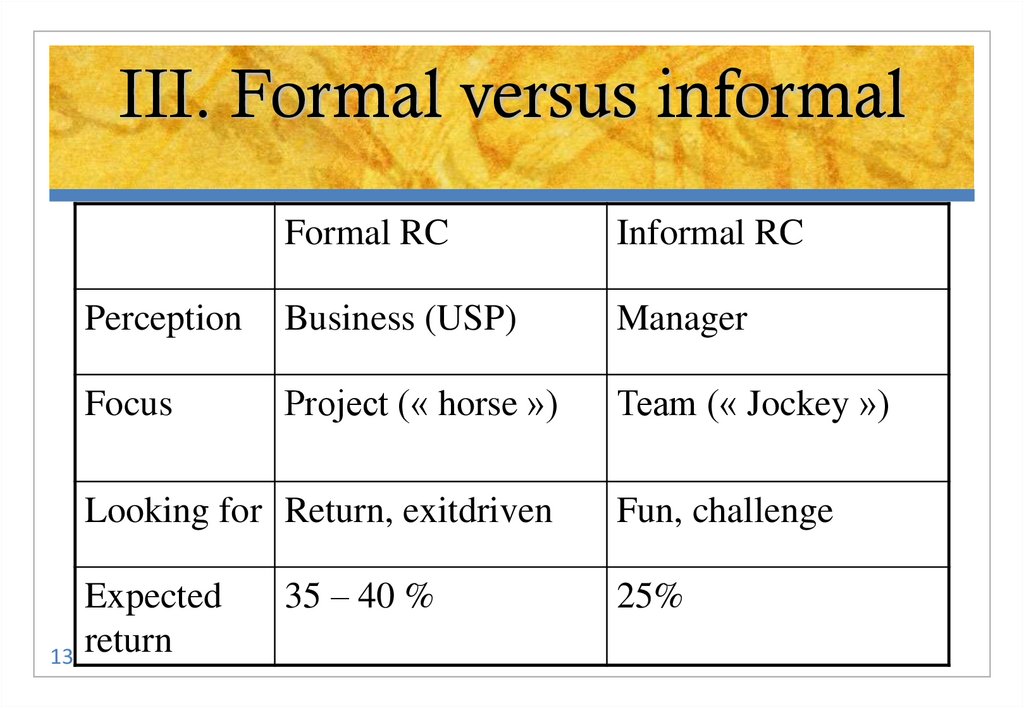

13. III. Formal versus informal

Formal RCInformal RC

Perception

Business (USP)

Manager

Focus

Project (« horse »)

Team (« Jockey »)

Looking for Return, exitdriven

Expected

13 return

35 – 40 %

Fun, challenge

25%

14.

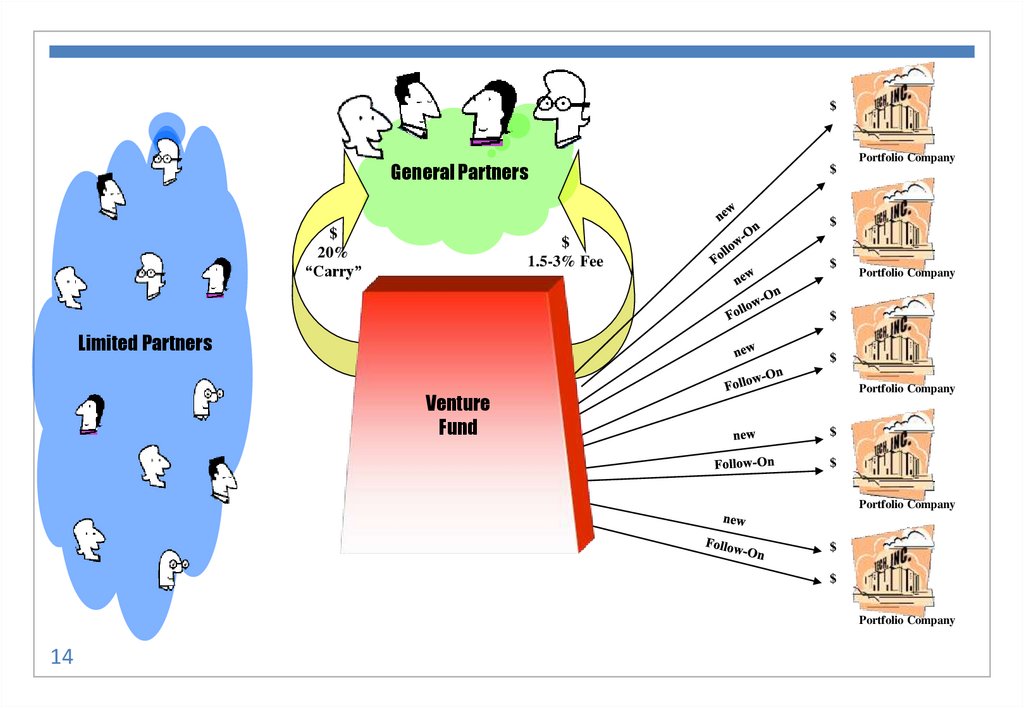

$General Partners

Portfolio Company

$

$

$

20%

“Carry”

$

1.5-3% Fee

$

Portfolio Company

$

Limited Partners

$

Venture

Fund

Portfolio Company

$

$

Portfolio Company

$

$

Portfolio Company

14

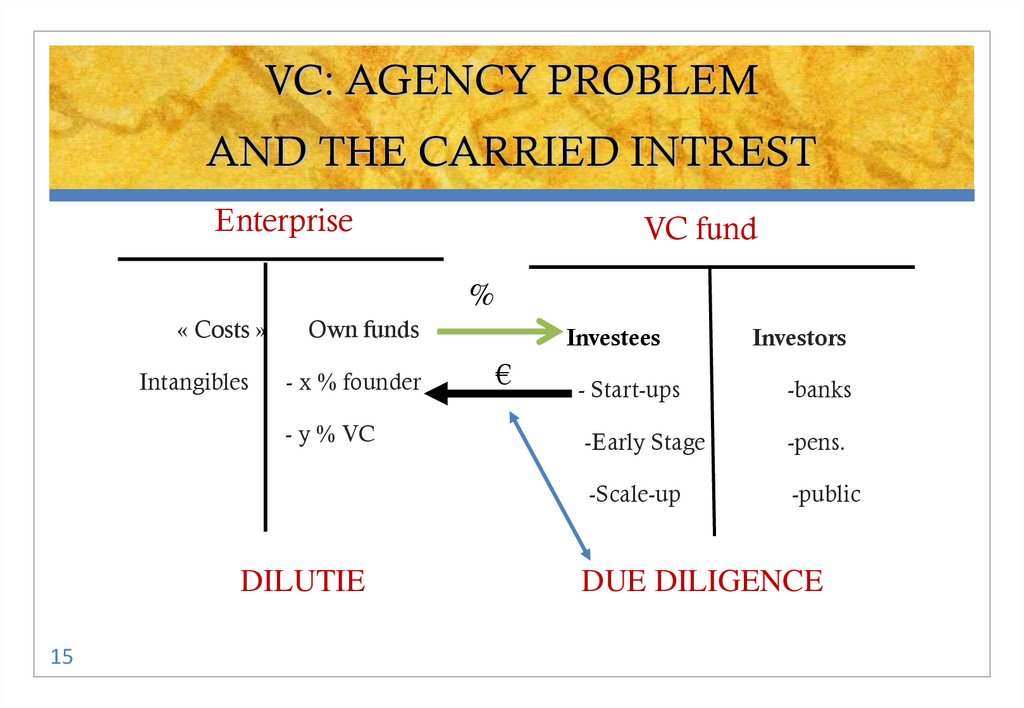

15. VC: AGENCY PROBLEM AND THE CARRIED INTREST

EnterpriseVC fund

%

« Costs »

Intangibles

Own funds

- x % founder

- y % VC

DILUTIE

15

Investees

€

Investors

- Start-ups

-banks

-Early Stage

-pens.

-Scale-up

-public

DUE DILIGENCE

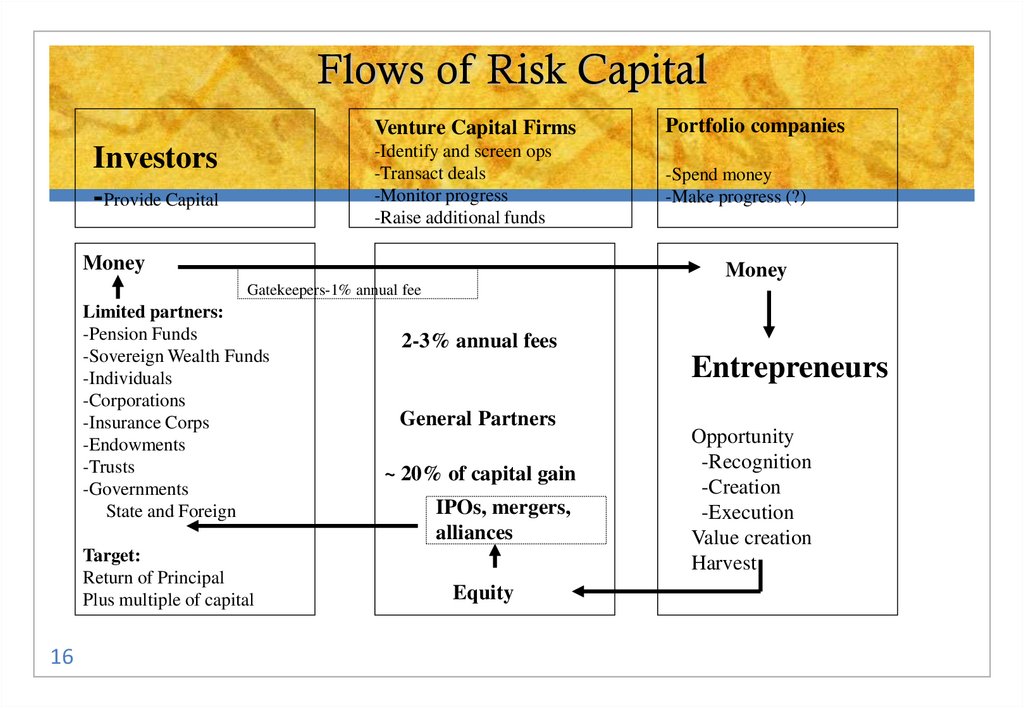

16. Flows of Risk Capital

Investors-Provide Capital

Venture Capital Firms

Portfolio companies

-Identify and screen ops

-Transact deals

-Monitor progress

-Raise additional funds

-Spend money

-Make progress (?)

Money

Money

Gatekeepers-1% annual fee

Limited partners:

-Pension Funds

-Sovereign Wealth Funds

-Individuals

-Corporations

-Insurance Corps

-Endowments

-Trusts

-Governments

State and Foreign

Target:

Return of Principal

Plus multiple of capital

16

2-3% annual fees

Entrepreneurs

General Partners

~ 20% of capital gain

IPOs, mergers,

alliances

Equity

Opportunity

-Recognition

-Creation

-Execution

Value creation

Harvest

17.

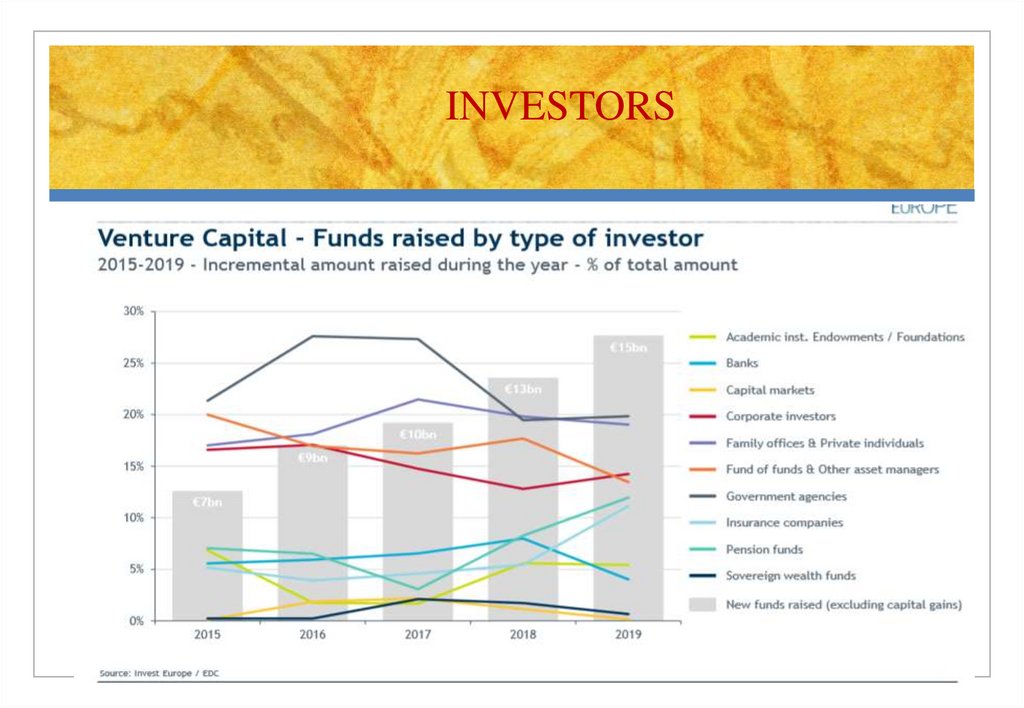

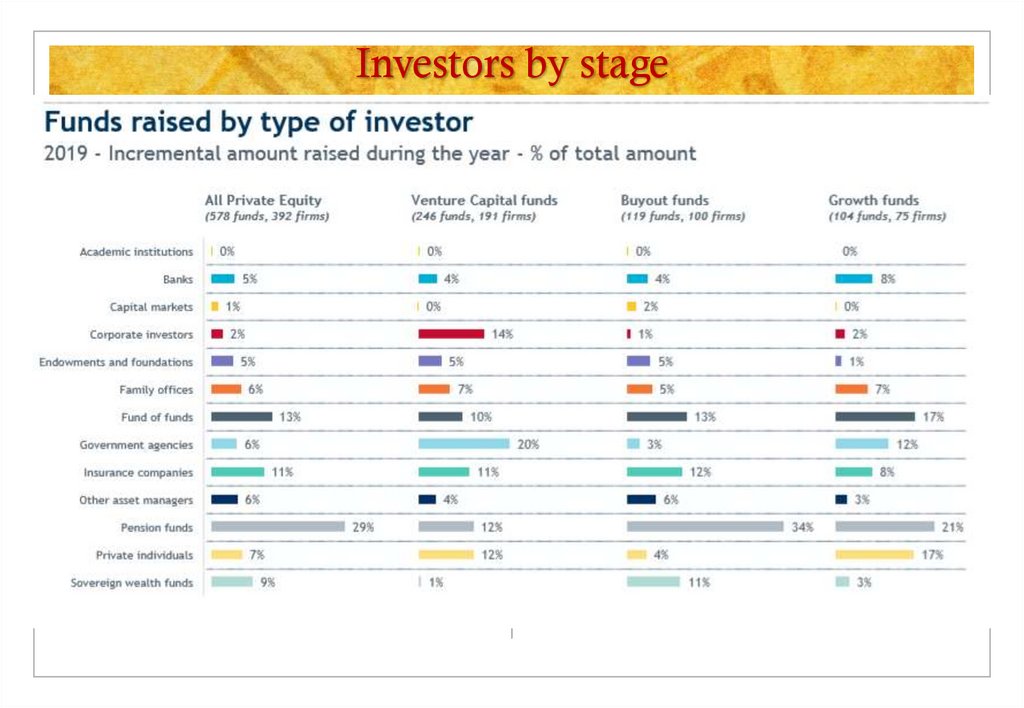

INVESTORS18. Investors by stage

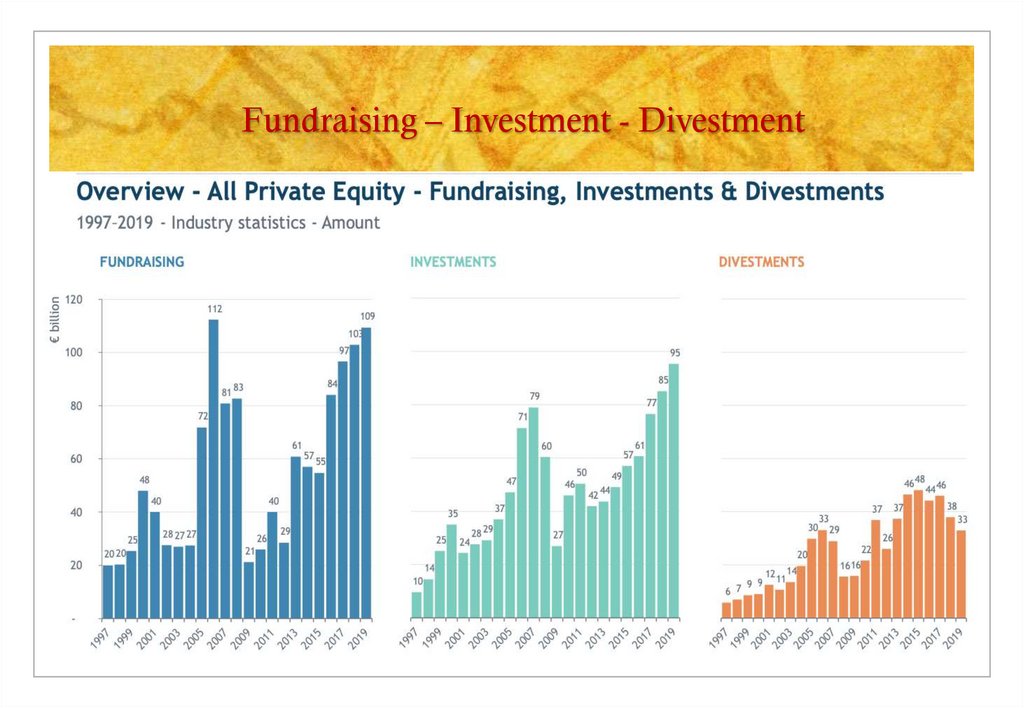

19. Fundraising – Investment - Divestment

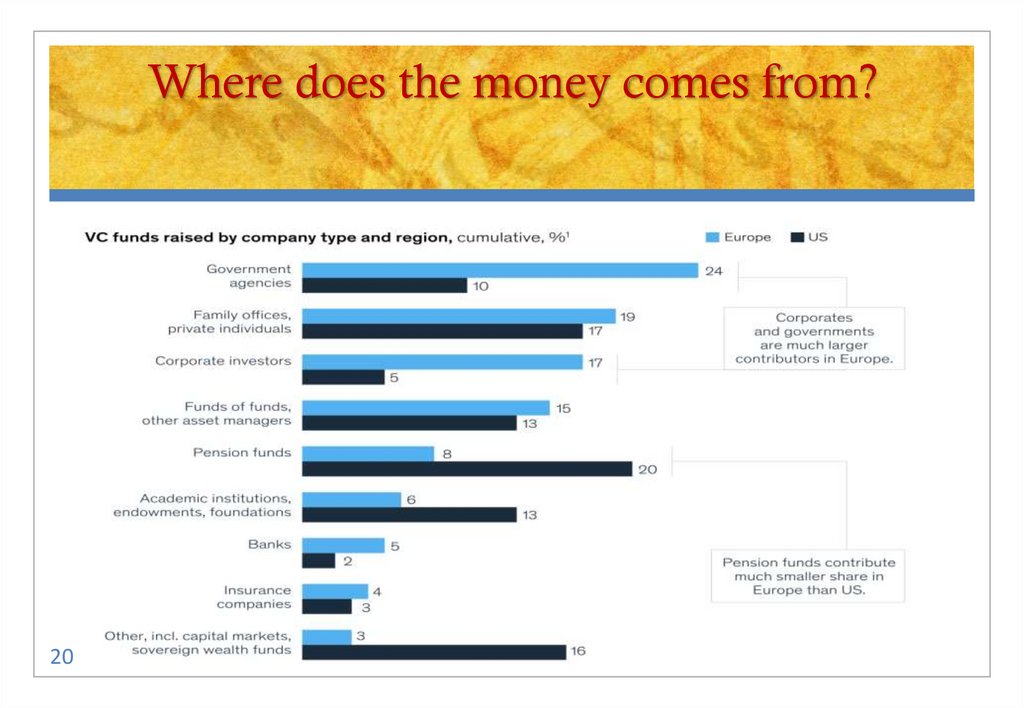

20. Where does the money comes from?

2021. Success is easier in US

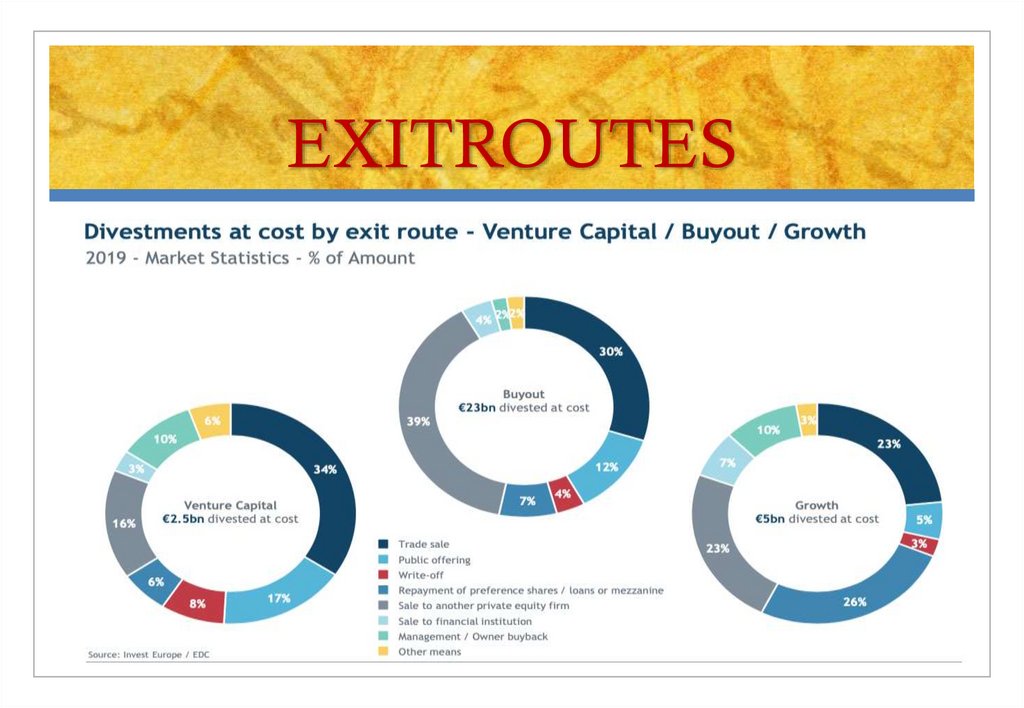

raernoudt@gmail.com22. EXITROUTES

23. What does a vc want?

231.

Management capacity and track record

2.

Market and growth potential

3.

Market niche

4.

Return (liquidity/exit)

5.

Market is more important than technology

24.

What does a VC offersbefore investment?

24

1.

Due diligence (analysis of business

plan/market/technology/competition/...)

2.

Analysis of gaps

3.

Optimal financial structure

4.

Valuation

5.

Stock option plan (milestones)

25.

What does VC offersduring investment?

choice

of distribution channels

product/marketing strategy

fixing priorities

networks:

financial advice (next rounds)

25

26. What does VC offers after the investment??

R&D,fiscal advice

M&A

Exit

Organisation (IPO, trade sale, …)

International

26

experience

Smart money

27. VC Market

27Supply

Venture capitalist avoid risk (MBO preference)

Pervert risk – return relation

Demand

Lack of investment readiness (pecking order

theory)

Market lacks transparancy

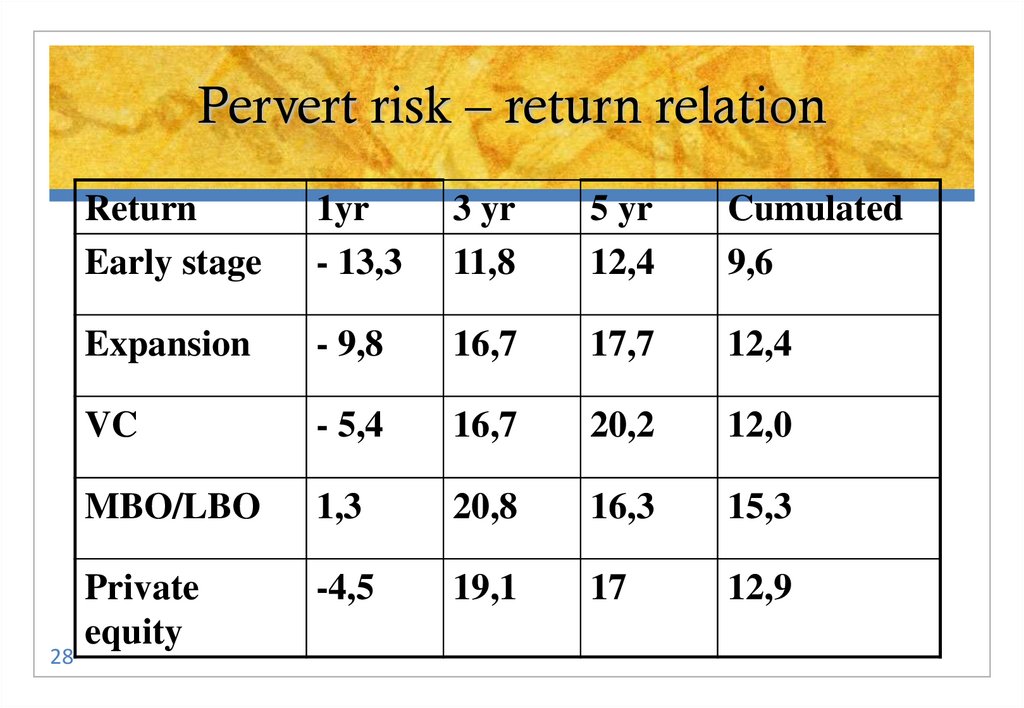

28. Pervert risk – return relation

28Return

Early stage

1yr

- 13,3

3 yr

11,8

5 yr

12,4

Cumulated

9,6

Expansion

- 9,8

16,7

17,7

12,4

VC

- 5,4

16,7

20,2

12,0

MBO/LBO

1,3

20,8

16,3

15,3

Private

equity

-4,5

19,1

17

12,9

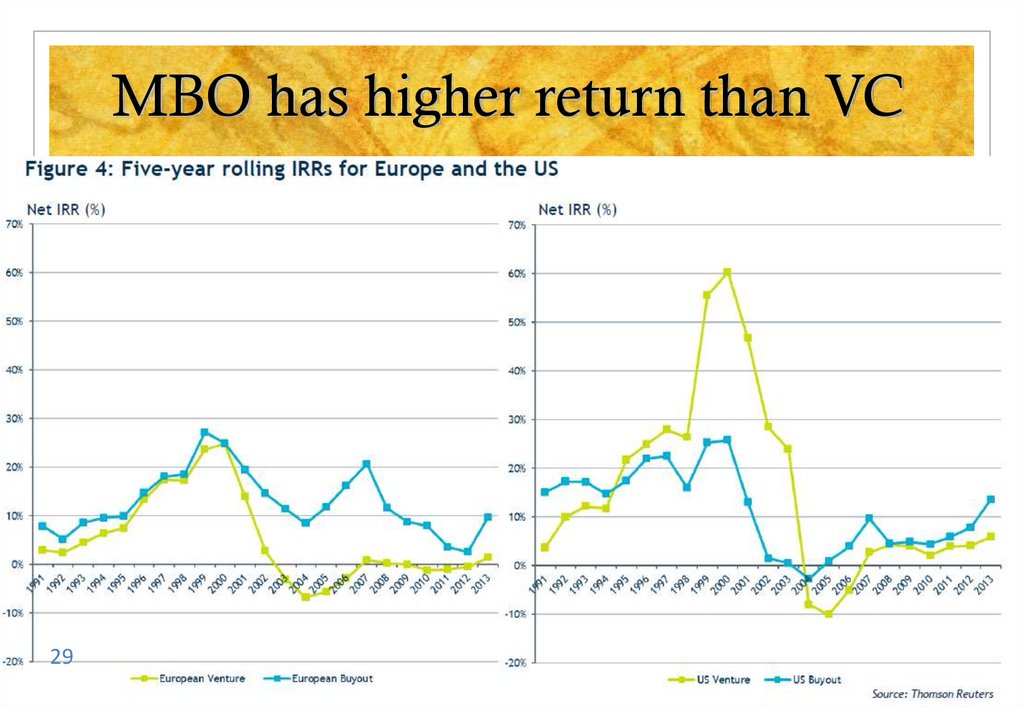

29. MBO has higher return than VC

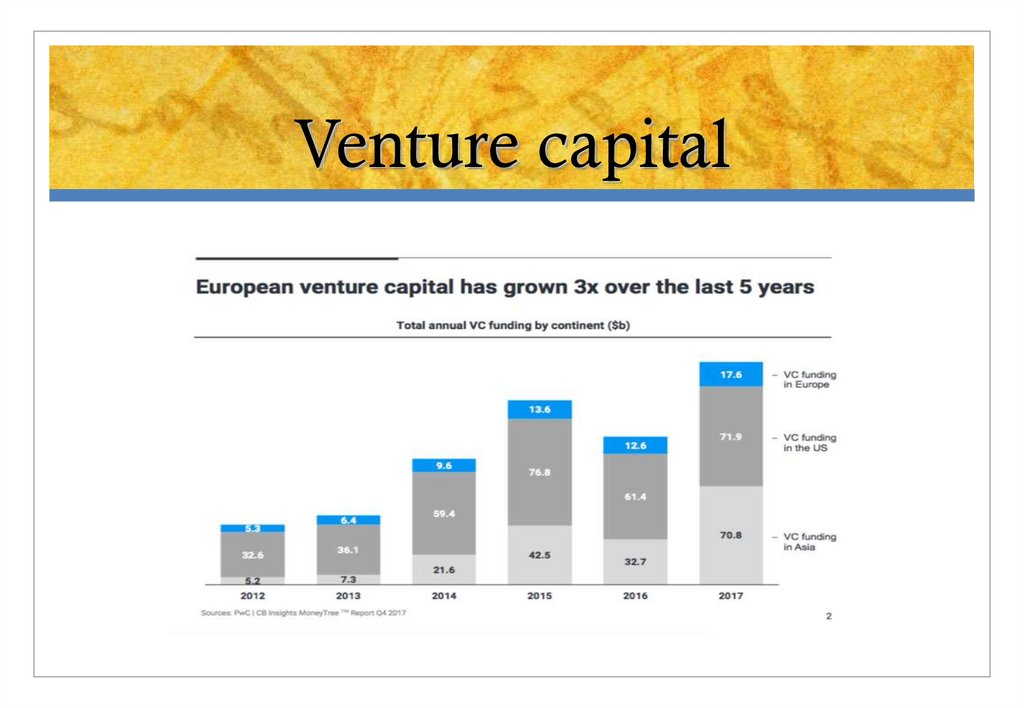

2930. Venture capital

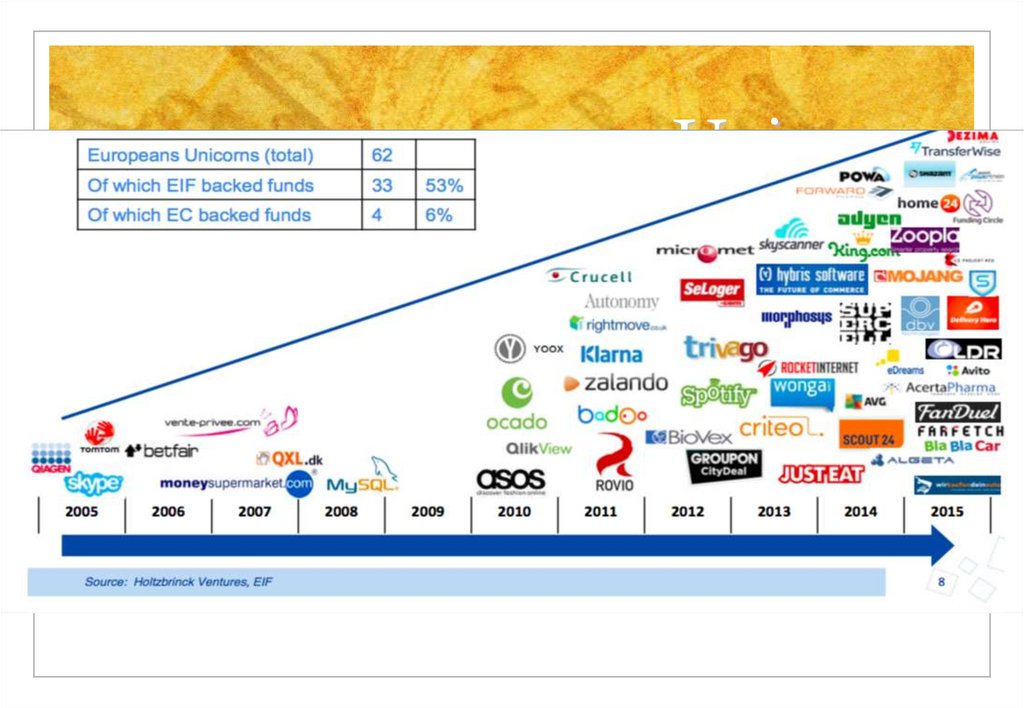

31. Unicorns

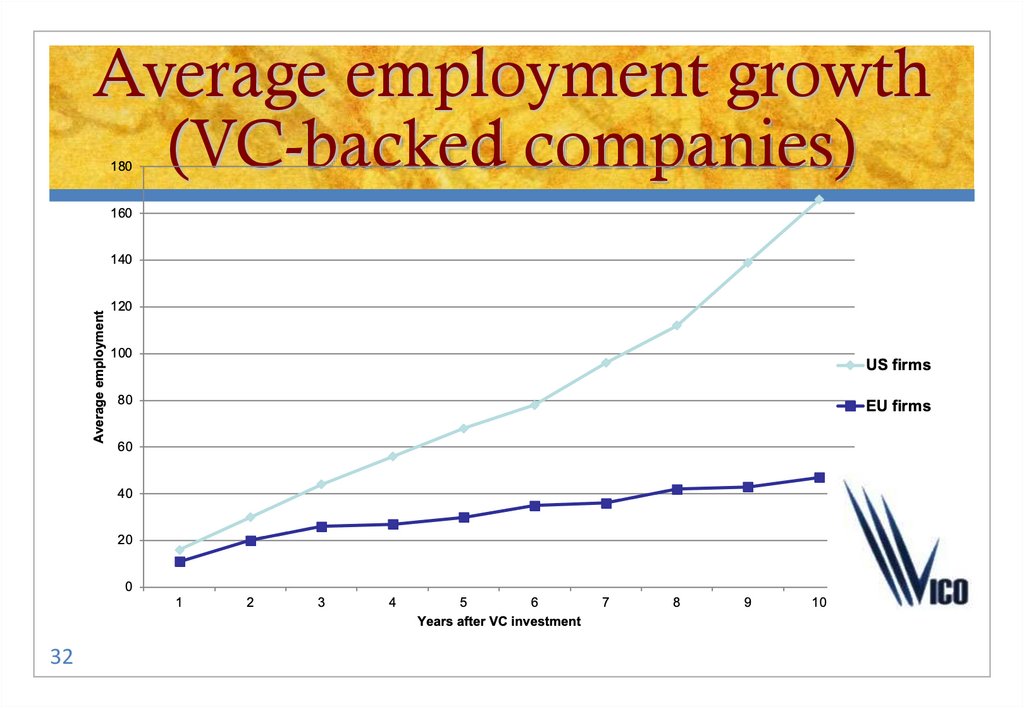

32. Average employment growth (VC-backed companies)

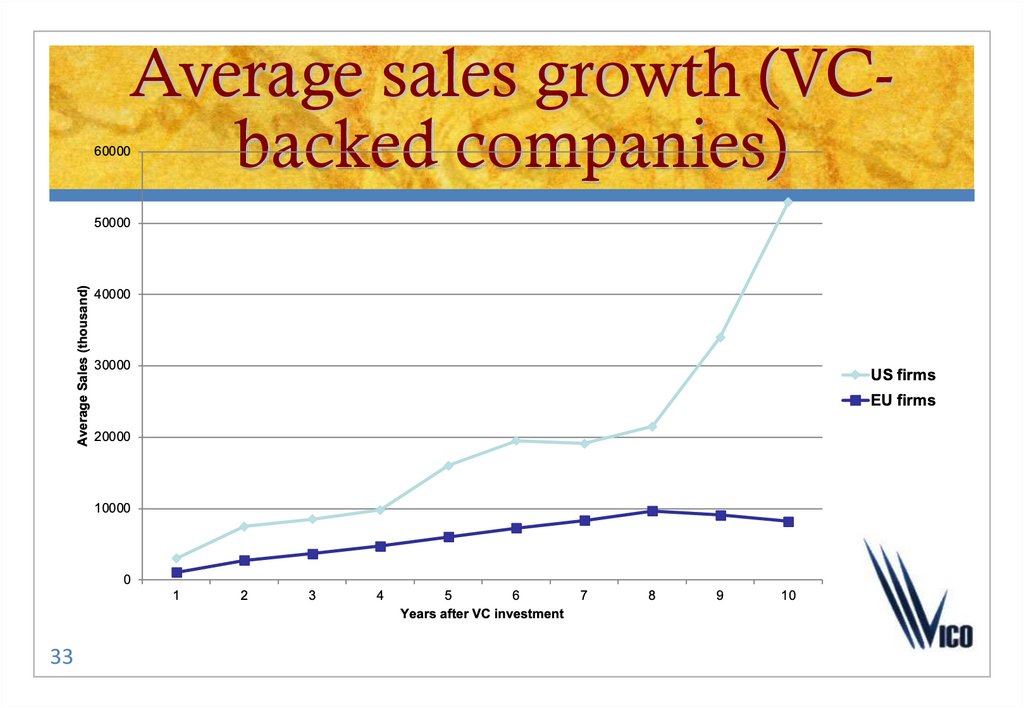

3233. Average sales growth (VC-backed companies)

Average sales growth (VCbacked companies)33

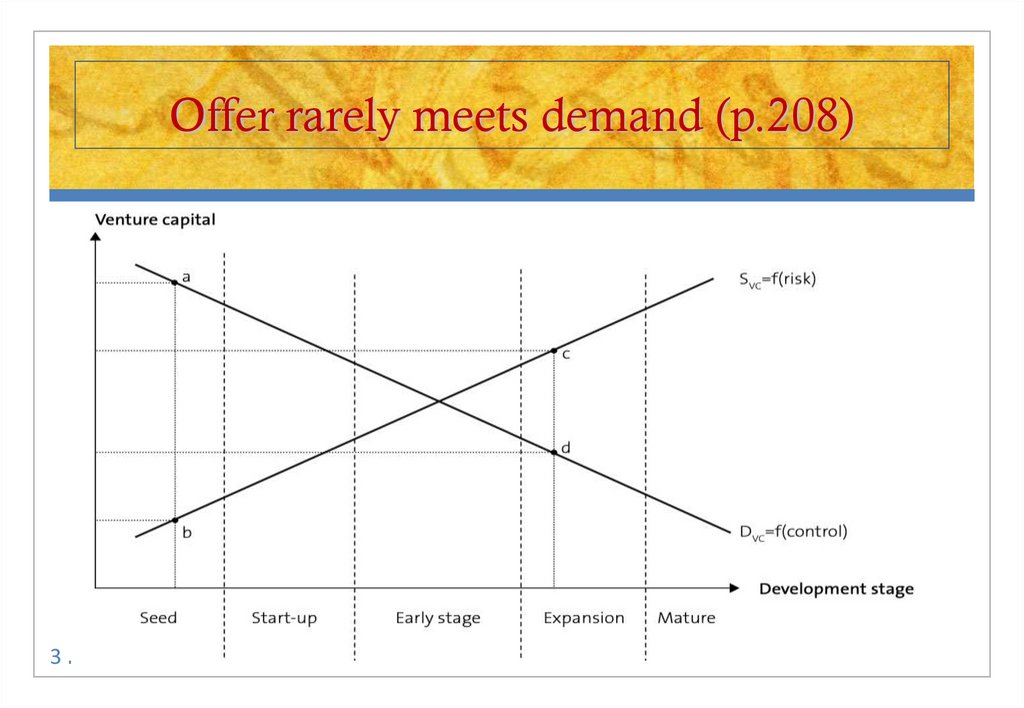

34. Offer rarely meets demand (p.208)

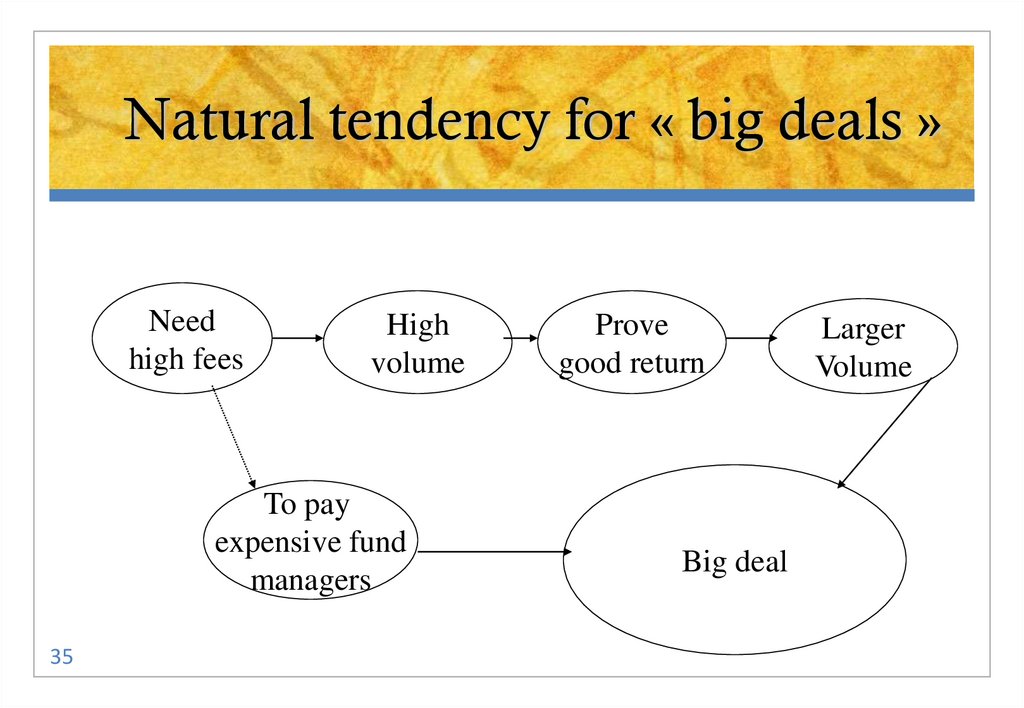

3435. Natural tendency for « big deals »

Natural tendency for « big deals »Need

high fees

High

volume

To pay

expensive fund

managers

35

Prove

good return

Big deal

Larger

Volume

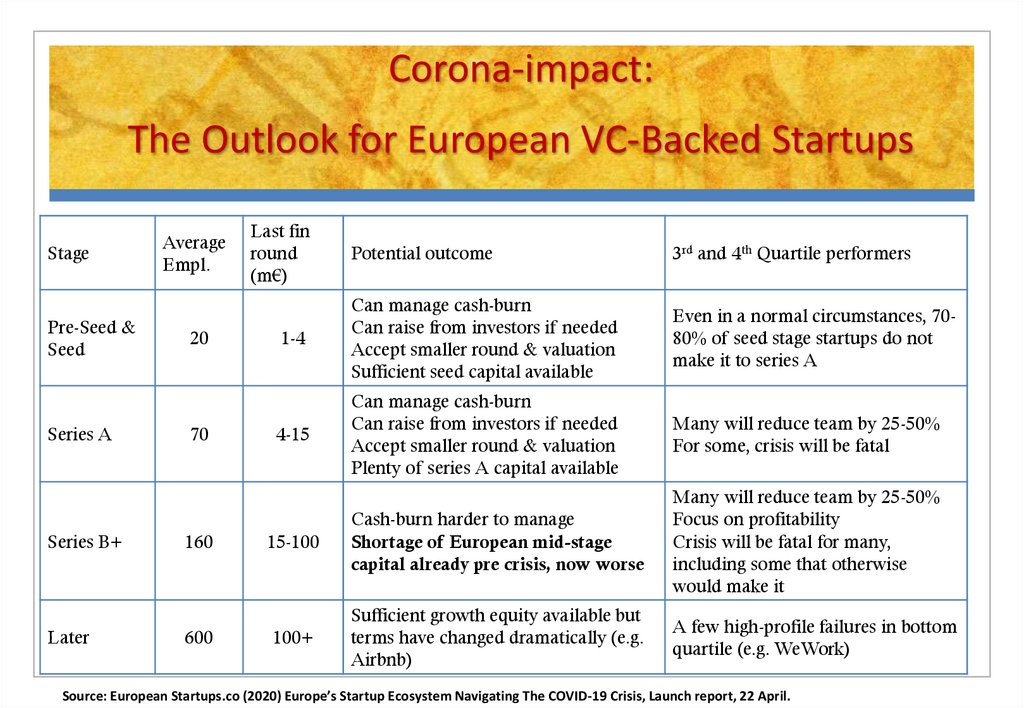

36. Corona-impact: The Outlook for European VC-Backed Startups

StagePre-Seed &

Seed

Series A

Series B+

Later

Average

Empl.

20

70

160

600

Last fin

round

(m€)

Potential outcome

3rd and 4th Quartile performers

1-4

Can manage cash-burn

Can raise from investors if needed

Accept smaller round & valuation

Sufficient seed capital available

Even in a normal circumstances, 7080% of seed stage startups do not

make it to series A

4-15

Can manage cash-burn

Can raise from investors if needed

Accept smaller round & valuation

Plenty of series A capital available

Many will reduce team by 25-50%

For some, crisis will be fatal

15-100

Cash-burn harder to manage

Shortage of European mid-stage

capital already pre crisis, now worse

Many will reduce team by 25-50%

Focus on profitability

Crisis will be fatal for many,

including some that otherwise

would make it

100+

Sufficient growth equity available but

terms have changed dramatically (e.g.

Airbnb)

A few high-profile failures in bottom

quartile (e.g. WeWork)

Source: European Startups.co (2020) Europe’s Startup Ecosystem Navigating The COVID-19 Crisis, Launch report, 22 April.

37. Conclusion on formal VC

Forthe « happy few »

Big

deals

Smart

money versus investment readiness

Exitdriven

Hard

37

versus (family) continuity

for starters

finance

finance