Similar presentations:

Buy-to-let in the United Kingdom

1. Buy-to-let in the United Kingdom

BUY-TO-LET IN THEUNITED KINGDOM

2.

The United Kingdom is a verybeautiful country with a

fascinating history, culture

and traditions.

It has high-quality

infrastructure and medicine,

beautiful architecture and

nature, large sports and

music events so many people

will want to live or rent an

apartment there.

3. bank

We recommend you a UKbank with a huge amount

of assets. It is the HSBC (The

Hongkong and Shanghai

Banking Corporation). The

bank is very reliable.

BANK

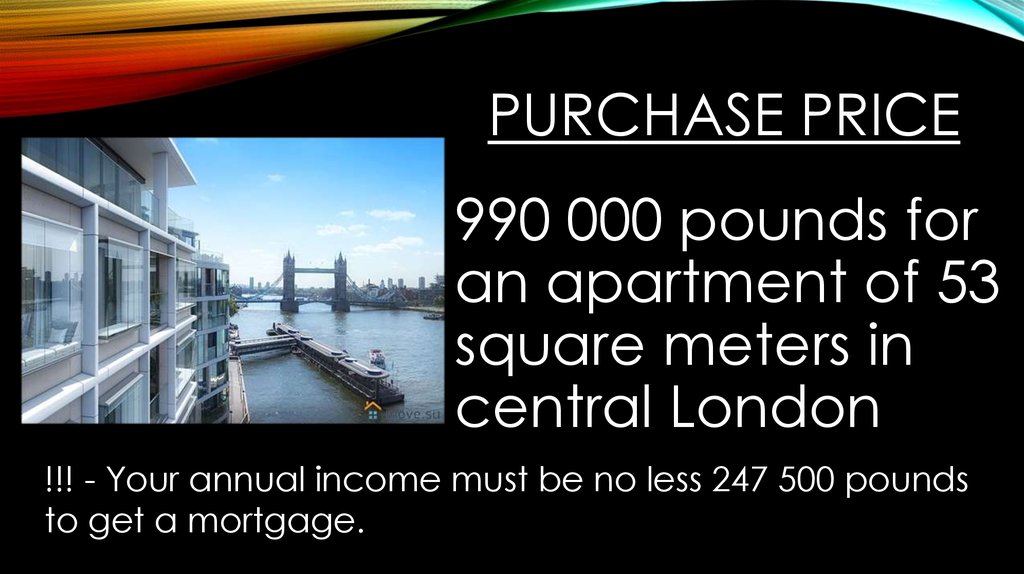

4. Purchase price

PURCHASE PRICE990 000 pounds for

an apartment of 53

square meters in

central London

!!! - Your annual income must be no less 247 500 pounds

to get a mortgage.

5. Deposit (40%)

DEPOSIT (40%)396 000 pounds for non-resident.

Non-resident is a person who is constantly

registered and lives in another state.

If you were a resident, you would pay 10%

of the purchase price.

6. Mortgage (60%)

MORTGAGE (60%)594 000 pounds for non-resident.

If you were a resident, you would pay 90%

of the purchase price.

7. monthly mortgage payment

MONTHLY MORTGAGE PAYMENT4 310 pounds

4,5% 20-year repayment

8. rental income

RENTAL INCOME5 200 pounds per month

@ 9% per annum

9. rent as a % of mortgage

RENT AS A % OF MORTGAGE130%

10. risks

RISKSWith any property investment, there are risks:

tourism reduction, property values and rents could

fall.

It is important to consider the risks as well as the

potential rewards.

11.

Purchase price£ 990 000

Deposit (40%)

£ 396 000

Mortgage (60%)

£ 594 000

Monthly mortgage payment

£ 4 310

4,5% 20-year

repayment

Rental income

£ 5 200 per month

@ 9% per annum

Rent as a % of mortgage

130%

12. Thanks for attention!

THANKS FOR ATTENTION!We hope you take a mortgage

«buy-to-let» in our country.

business

business