Similar presentations:

Project comments. Project comments International finance and globalization

1. Project comments

Expected return and riskStock evaluation

Portfolio calculation

Project comments

International finance and globalization

Project

©Ella Khromova

2.

Expected return and riskStock evaluation

Portfolio calculation

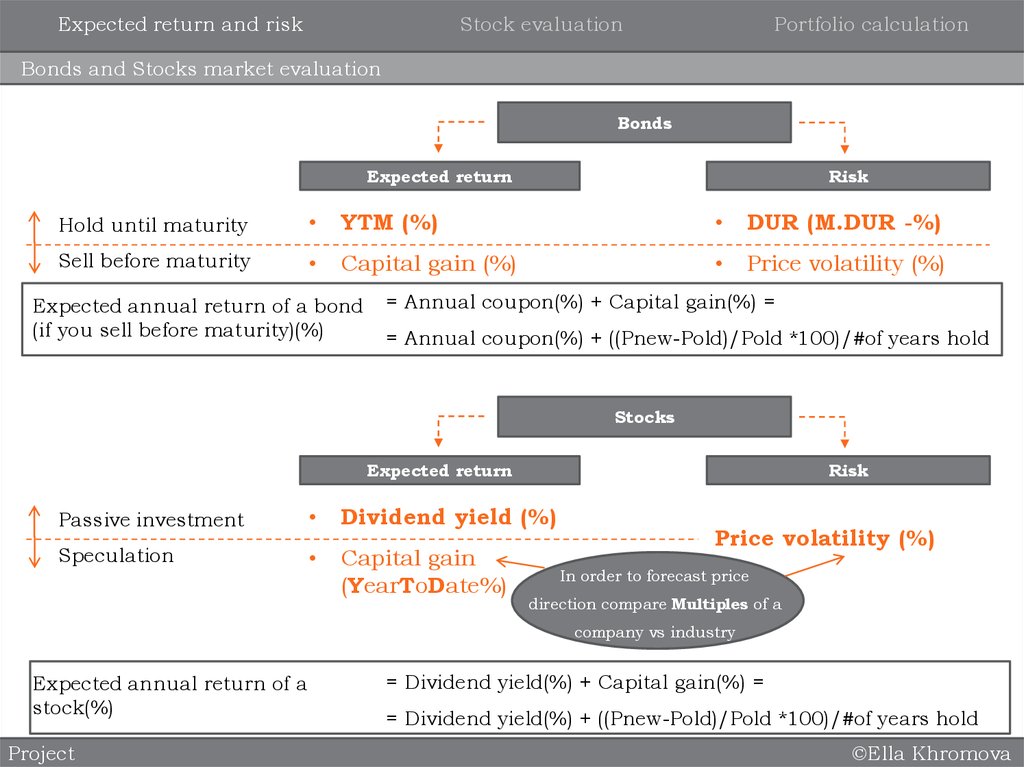

Bonds and Stocks market evaluation

Bonds

Expected return

Risk

Hold until maturity

YTM (%)

DUR (M.DUR -%)

Sell before maturity

Capital gain (%)

Price volatility (%)

Expected annual return of a bond

(if you sell before maturity)(%)

= Annual coupon(%) + Capital gain(%) =

= Annual coupon(%) + ((Pnew-Pold)/Pold *100)/#of years hold

Stocks

Expected return

Risk

Passive investment

Dividend yield (%)

Speculation

Capital gain

(YearToDate%)

Price volatility (%)

In order to forecast price

direction compare Multiples of a

company vs industry

Expected annual return of a

stock(%)

Project

= Dividend yield(%) + Capital gain(%) =

= Dividend yield(%) + ((Pnew-Pold)/Pold *100)/#of years hold

©Ella Khromova

3.

Target-settingBonds

Client Profile

Stocks

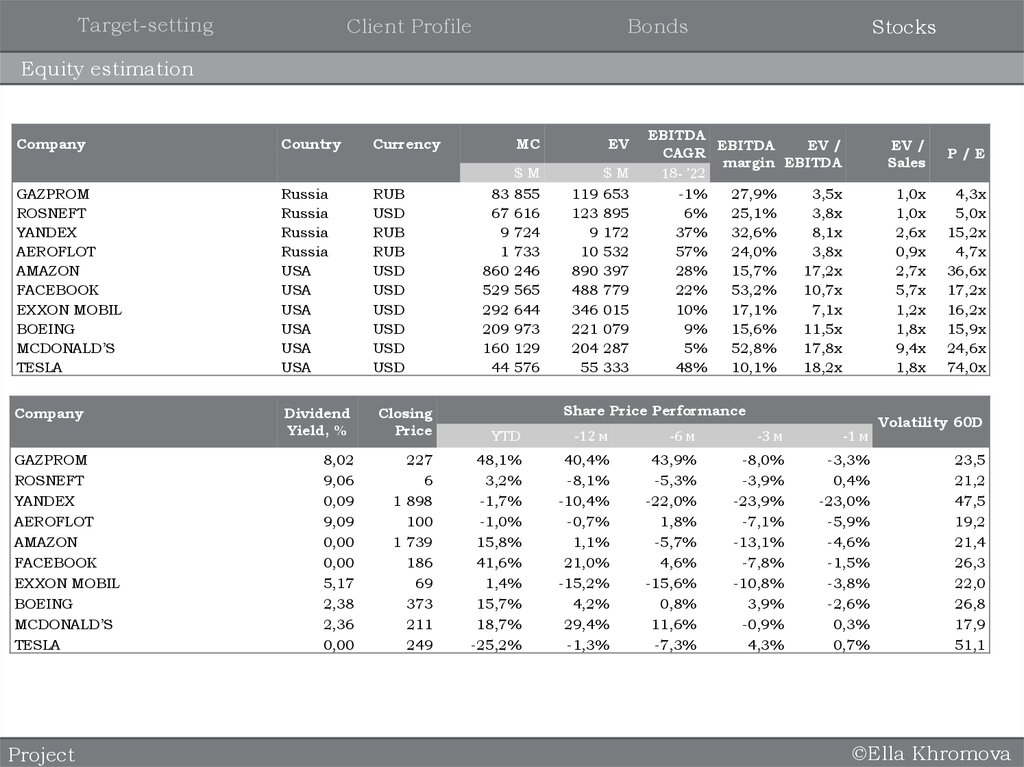

Equity estimation

Company

Country

Currency

MC

EV

RUB

USD

RUB

RUB

USD

USD

USD

USD

USD

USD

$M

855

616

724

733

246

565

644

973

129

576

$M

653

895

172

532

397

779

015

079

287

333

GAZPROM

ROSNEFT

YANDEX

AEROFLOT

AMAZON

EXXON MOBIL

BOEING

MCDONALD’S

TESLA

Russia

Russia

Russia

Russia

USA

USA

USA

USA

USA

USA

Company

Dividend

Yield, %

Closing

Price

YTD

-12 м

-6 м

-3 м

-1 м

8,02

9,06

0,09

9,09

0,00

0,00

5,17

2,38

2,36

0,00

227

6

1 898

100

1 739

186

69

373

211

249

48,1%

3,2%

-1,7%

-1,0%

15,8%

41,6%

1,4%

15,7%

18,7%

-25,2%

40,4%

-8,1%

-10,4%

-0,7%

1,1%

21,0%

-15,2%

4,2%

29,4%

-1,3%

43,9%

-5,3%

-22,0%

1,8%

-5,7%

4,6%

-15,6%

0,8%

11,6%

-7,3%

-8,0%

-3,9%

-23,9%

-7,1%

-13,1%

-7,8%

-10,8%

3,9%

-0,9%

4,3%

-3,3%

0,4%

-23,0%

-5,9%

-4,6%

-1,5%

-3,8%

-2,6%

0,3%

0,7%

GAZPROM

ROSNEFT

YANDEX

AEROFLOT

AMAZON

EXXON MOBIL

BOEING

MCDONALD’S

TESLA

Project

83

67

9

1

860

529

292

209

160

44

119

123

9

10

890

488

346

221

204

55

EBITDA

EBITDA

EV /

CAGR

margin EBITDA

18- '22

-1%

27,9%

3,5x

6%

25,1%

3,8x

37%

32,6%

8,1x

57%

24,0%

3,8x

28%

15,7%

17,2x

22%

53,2%

10,7x

10%

17,1%

7,1x

9%

15,6%

11,5x

5%

52,8%

17,8x

48%

10,1%

18,2x

Share Price Performance

EV /

Sales

P/E

1,0x

1,0x

2,6x

0,9x

2,7x

5,7x

1,2x

1,8x

9,4x

1,8x

4,3x

5,0x

15,2x

4,7x

36,6x

17,2x

16,2x

15,9x

24,6x

74,0x

Volatility 60D

23,5

21,2

47,5

19,2

21,4

26,3

22,0

26,8

17,9

51,1

©Ella Khromova

4.

Financial InstrumentsEquity

Relative Valuation: Most Commonly used Multiples

Multiples

Attributable to all stakeholders:

debtors and shareholders

(based on enterprise value)

EV/Sales

EV/EBITDA

Lecture 7

Attributable to shareholders

only

(based on equity value)

P/E=Price to Earnings=

(Equity Value aka Market

Capitalization / Net Income)

©Ella Khromova

5.

Financial InstrumentsEquity

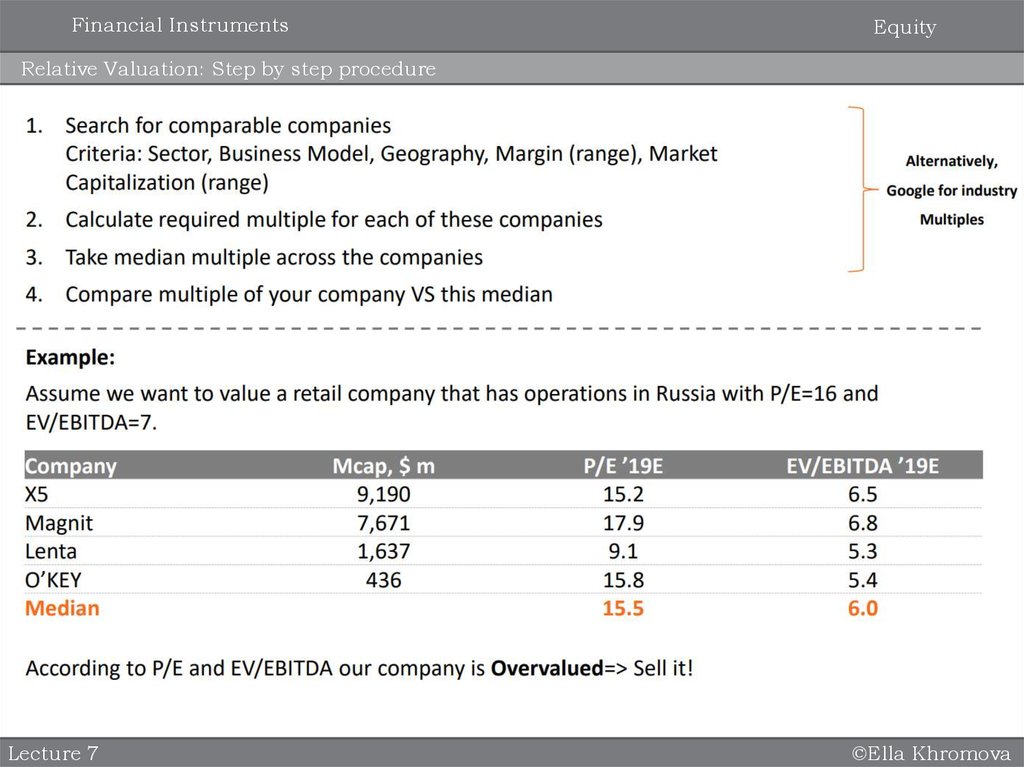

Relative Valuation: Step by step procedure

Lecture 7

©Ella Khromova

6.

Expected return and riskStock evaluation

Portfolio calculation

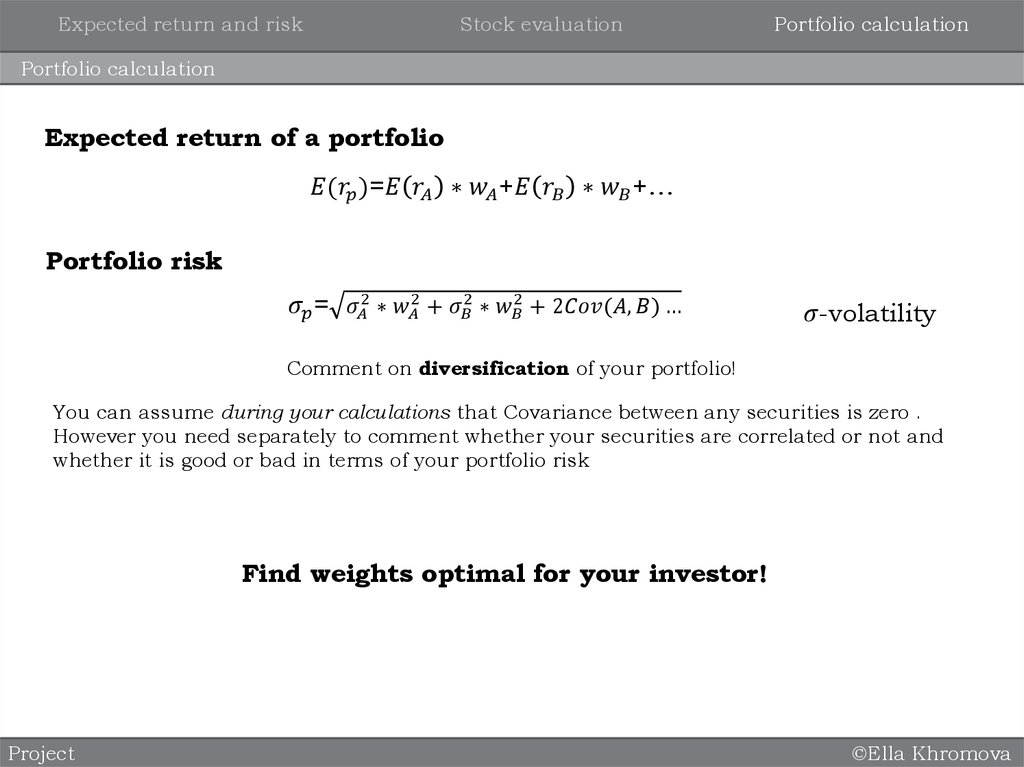

Portfolio calculation

Expected return of a portfolio

finance

finance business

business