Similar presentations:

Financial Markets and Financial Instruments

1.

Financial Markets and FinancialInstruments

2.

Instructors for The CourseElena Merekina,

PhD

Grishunin

Sergei, PhD

Ella Fokina

(Khromova),

PhD

3.

The core books for this course4.

Core literature for this course– Saunders and Cornett “Financial Markets and

Institutions” (Fifth Edition and Later)

– Stephen Valdez and Philip Molyneux “Global

Financial Markets” (Eighth Edition and Later

edition)

– Darren Lau, Daryl Lau, Teh Sze Jin, Kristian Kho, Erina

Azmi, TM Lee, Bobby Ong «How to DeFi»

– Economics of Money, Banking, and Financial

Markets, The by Frederic S Mishkin | Jan 4, 2021

– Principles of Corporate Finance - 10th edition,

Brealey Myers Allen

– Capital Markets, Frank Fabozzi

5.

The Seminar ScheduleDate

Topic

Instructor

10.10.2023

Introduction to the course. Explanation of

the project

Grishunin, Fokina

24.10.2023

Seminar 2, prepare and present the first

results of the project (by groups)

Grishunin,

Fokina, Merekina

07.11.2023

Seminar 3, presenting the interim results

for the projects (by groups)

Grishunin,

Fokina, Merekina

21.11.2023

Seminar 4, pre-defense of the project (by

groups)

Grishunin,

Fokina, Merekina

28.11.2023

Final exam – defense of the projects (all

together)

Grishunin,

Fokina, Merekina

6.

Create The Telegram ChannelLet’s create the group in Telegram for instant

communication with the instructors

7.

The course final project8.

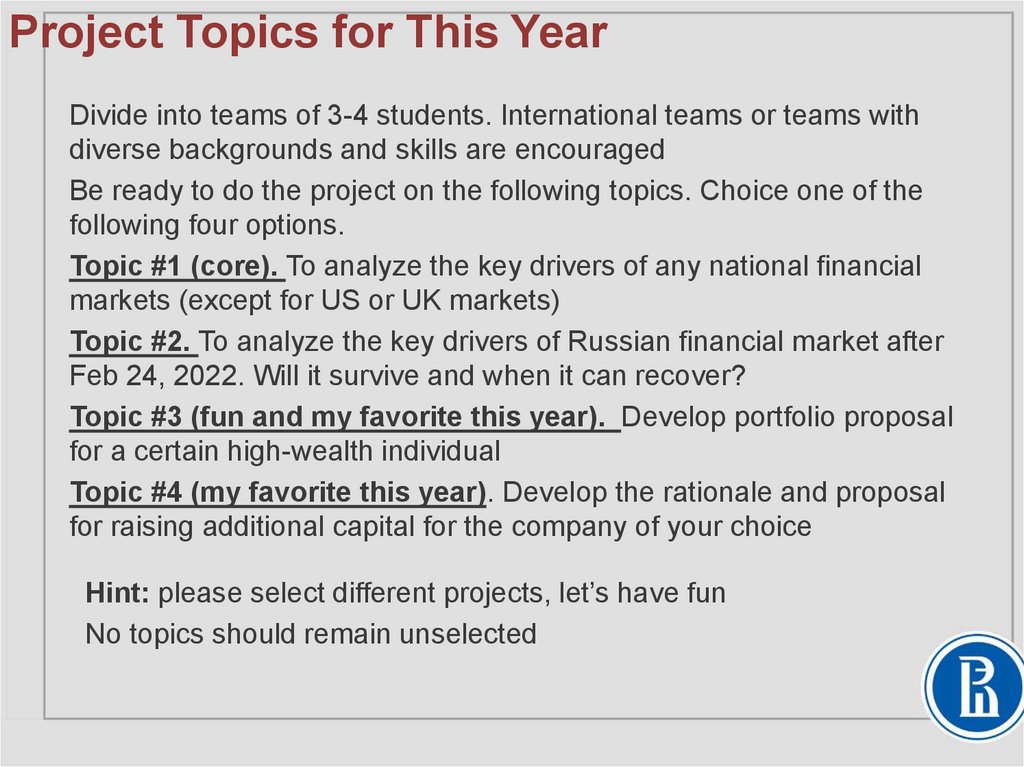

Project Topics for This YearDivide into teams of 3-4 students. International teams or teams with

diverse backgrounds and skills are encouraged

Be ready to do the project on the following topics. Choice one of the

following four options.

Topic #1 (core). To analyze the key drivers of any national financial

markets (except for US or UK markets)

Topic #2. To analyze the key drivers of Russian financial market after

Feb 24, 2022. Will it survive and when it can recover?

Topic #3 (fun and my favorite this year). Develop portfolio proposal

for a certain high-wealth individual

Topic #4 (my favorite this year). Develop the rationale and proposal

for raising additional capital for the company of your choice

Hint: please select different projects, let’s have fun

No topics should remain unselected

9.

The Objectives of The Project: topic 11. To analyze the key drivers of any national financial markets

(please do not take well-known markets such as UK or US)

1.

2.

3.

4.

5.

6.

Sub-markets (if any)

Key drivers of supply and demand

Market participants: investors, companies and intermediaries

Market infrastructure and regulation

Technological advances and future developments

Environmental, social and governance issues

2. To explain the distinguishing characteristics of financial

instruments traded on the market

1.

2.

3.

4.

5.

Description and key characteristics of the instruments

Available benchmarks for performance evaluation

Role in the investment portfolio

Risks and return characteristics

What will happen with the

3. What can change in the market in the current situation of raising

interest rates and diminishing government stimulus? Any signs of

crisis?

10.

The Objectives of The Project: topic 21. To analyze the key drivers of Russia’s financial markets (except

the countries covered in the lecture)

1.

2.

3.

4.

5.

6.

Sub-markets (if any)

Key drivers of supply and demand

Market participants: investors, companies and intermediaries

Market infrastructure and regulation. Key indicies

Technological advances and future developments

Environmental, social and governance issues

2. Ideal Storm. What happened in the market after Feb 24th, 2022

1.

2.

3.

4.

What happened with key drivers of supply and demand

How has the volumes changed? What happened with the prices, indices

and interest rates. Will the companies continue pay dividends? How the

number of defaults changed?

How the sanctions and “cancel culture” affected the market?

What sectors were the most affected? Prepare a case study

3. Will the Russian market survive and grow? What the main ways of

its development? What should be the conditions?

11.

Financial Market Analysis: Factors ToConsider

• Market history and historical performance

Size of the market

Organized venues and sub-markets

Macrostructure (role of the market in national economy)

Microstructure (investors, companies, securities,

intermediaries, indices)

Technological advances and external threats

Relationship with other markets, exposures to systemic

risks

Regulations

Access to investors from abroad

Other issues which may prevent investing (including

ESG)

12.

Financial Instruments: Factors To Consider• What types of instruments are available in the market,

and what are their most important differences for an

investor?

• What are their historical performance and risks metrics

• What benchmarks are available to evaluate the

performance of investors, and what are their

limitations?

• What investment strategies and portfolio roles are

characteristic of each instrument?

• What should due diligence cover

13.

Concerns to Address In Emerging Markets• Strength of the sovereign, government macroeconomic

and fiscal policies and their efficiency

• Linkages between sovereign and corporates

• Strength and volatility of the local currency

• Quality of country institutions and regulators

• Strength of domestic banking system

• Quality of financial market infrastructure

• Issues with the corporate governance

• Risks (e.g. demographics, productivity)

• Susceptibility to event risks

14.

The Objectives of The Project: topic 41. Select the company for the analysis (hint: take companies with high

level of financial and business transparency)

2. Using benchmarking/statistics and examples of specific companies

from different sectors in the financial markets, answer the following

questions:

o

o

o

o

o

o

What is the average amount of investment attracted by IPO/SPO/FPO/ICO by companies in the

market/industry?

What is the average cost of such financing (Who can act as an underwriter? At what rate? What is

the commission of the exchange, the state duty? Other costs?)

In what average period is an IPO/SPO/FPO/ICO being prepared and conducted (number of

days/months/years)?

How to choose the optimal moment to enter the stock exchange in the year/ in the company's life

cycle / stock market dynamics?

At which markets/exchanges the company should raise capital? Why

Who will be your investors? How will you pitch the capital raise? Domestic or international

investors? Private or institutional investors?

15.

The Objectives of The Project: topic 43. Specify the pros and cons of issuing bonds to raise capital for the

company

4. Using statistics and examples of specific companies from different

sectors in target financial markets, answer the following questions:

What is the average amount of investments attracted by issuing different types of bonds (according to

the website of the Moscow Exchange and CBonds: corporate, exchange, Eurobonds, replacement

bonds)?

What is the average cost of such financing (Who can act as an underwriter? At what rate? What is the

commission of the exchange, the state duty? Other costs?)

In what average period is the issue prepared and carried out (number of days/months/years)?

How to choose the optimal moment to enter the stock exchange in the year/ in the company's life cycle

/ stock market dynamics?

How to attract investors: choose zero-coupon, callable, puttable, convertible, other features?

Explain why to get a credit rating? What means debt services default and technical default?

Which companies can issue green bonds? Will the coupon for them be higher or lower?

Determine which investment method is the most suitable

and describe the conditions of such an issue in as much

detail sas possible for a COMPANY NAME

16.

Presentation of Key Finding and Grading1. The outcome for the project should include presentation

which answer all above questions. The presentation should

be prepared in MS PowerPoint. Please keep presentations

within maximum 15 slides (30 slides including appendices)

2. Each team should present their results – 15 minutes for

team plus 10 minutes for Q&A and discussion. I will restrict

each team to this schedule.

3. The total mark for the team project (maximum 10 marks)

should be provided with the feedback

4. In case of disputes, the instructor will conduct an

independent evaluation of the paper and correct the mark if

required

5. Plagiarism is strictly prohibited. Please work independently

17.

Use Trustworthy SourcesRecommended online sources:

1. International economic and financial institutions (IMF,

World Bank, OECD, BIS etc.) – include major statistics

covering almost all countries, good for key indicators of

national economies and financial markets;

2. National government institutions (central banks,

ministries of finance, securities commissions etc.);

3. National stock exchanges and trading systems;

4. Articles in science/research and business press

(published within the last 3 years);

5. Information databases: Cbonds, Yahoo Finance

Bloomberg, Thomson Reuters (Refinitive)

6. Trusted analytical reports (investment banks, sell-side

analyst)

18.

Target-settingClient Profile

Bonds

Stocks

Letter from your CEO

Dear financial analysts,

As you know we got 11 new clients this week and all of them are waiting for their portfolio proposal from our

Investment fund by Monday (24/04/2023). Please note that our clients are very busy, so you will have no more

than 12 minutes for your presentation and 5 minutes for Q&A session. Also note that all clients want to hear all

of the team members during presentation in order to get acquainted with their future investment consultants.

All our clients want a portfolio (that contains at least 5 securities) that is well-diversified in terms of different

financial instruments, countries and industries and that perfectly satisfies their needs. Clients' profiles with

detailed information can be seen below. If you cannot satisfy the requirements perfectly, provide the closest

estimate and explain why it was impossible to fulfill clients needs. If you can find better return under the risk

profile of your client – show it!

Our research team prepared some previous materials on bonds and stocks that will help you to construct a proper

portfolio. However, you are free to use any other sources to find out more information on these financial

instruments or even suggest investment in some other securities. Any current news about the companies that you

have decided to include in your portfolio is welcomed.

Good luck!

CEO of IR-INVEST Corp

Ella Khromova

Project

©Ella Khromova

19.

Target-settingClient Profile

Bonds

Stocks

Hints

1) Portfolio calculation

Expected return of a portfolio = Expected return of security A * weigh of security A in portfolio+ Expected return

of security B * weigh of security B in portfolio…

Portfolio risk=Portfolio volatility=

=

Volatility of security A2 ∗weigh of security A2 +Volatility of security B2 ∗ weigh of security B2

+2Covariance between returns of security A and B∗ weigh of A ∗ weigh of B …

You can assume during your calculations that Covariance between any securities is zero. However, you need

separately to comment whether your securities are correlated or not and whether it is good or bad in terms of

your portfolio risk. If you calculate Cov in the formula that would be a bonus.

2) Bond evaluation

Expected return of a bond can be approximated by YTM if you hold it until the maturity or YTS if you sell bond

before maturity

Bond risk can be approximated as Bond Duration (Mod DUR is calculated in %) + You need separately to discuss

Volatility of bonds prices (in case you are going to sell a bond before maturity) and Risk of default of a bond

(Rating)

3) Stock evaluation

First of all you need to compare Multipliers of a company with Industry Multipliers (Google them or calculate

from similar companies median) and find undervalued stocks.

Expected return of a stock can be approximated by Dividend Yield + You need separately discuss whether do

you expect to have capital gains or losses at the expected moment of sale (calculate ER in Excel)

Stock risk can be approximated as Volatility of stock prices (calculate st dev in Excel) and Risk of default of a

company (Rating)

4) Hedging

You can separately advise your client how to hedge his portfolio in terms of exchange rate risk, interest rate risk

or any other global events.

Project

©Ella Khromova

20.

Target-settingClient Profile

Bonds

Stocks

Client profile

Overall info

Amount of investment

and investment

horizon

Expected annual

return in USD

Attitude to risk

(max loss for 60

days)

1

Kanye West

•USA

•Singer and

future

president

•Ex-husband of

Kim

Kardashian

300 mln USD for 4

years

100% (thinks that

100% is the

biggest possible

return)

85% (thinks the

more the better)

2

Din

Winchester

•USA

•Demon killer

•Everything is

complicated

20 mln USD for 100

years (he will reborn

several times during

this period)

As much as you

can

100%

3

Spiderman

•Unknown

100 mln USD for 5

years (wants

somebody to SAVE his

money FROM

INFLATION while he

saves the planet)

6%

4%

Client №

Project

Client photo

©Ella Khromova

21.

Target-settingClient Profile

Bonds

Stocks

Client profile

Overall info

Amount of investment

and investment

horizon

Expected annual

return in USD

Attitude to risk(max

loss for 60 days)

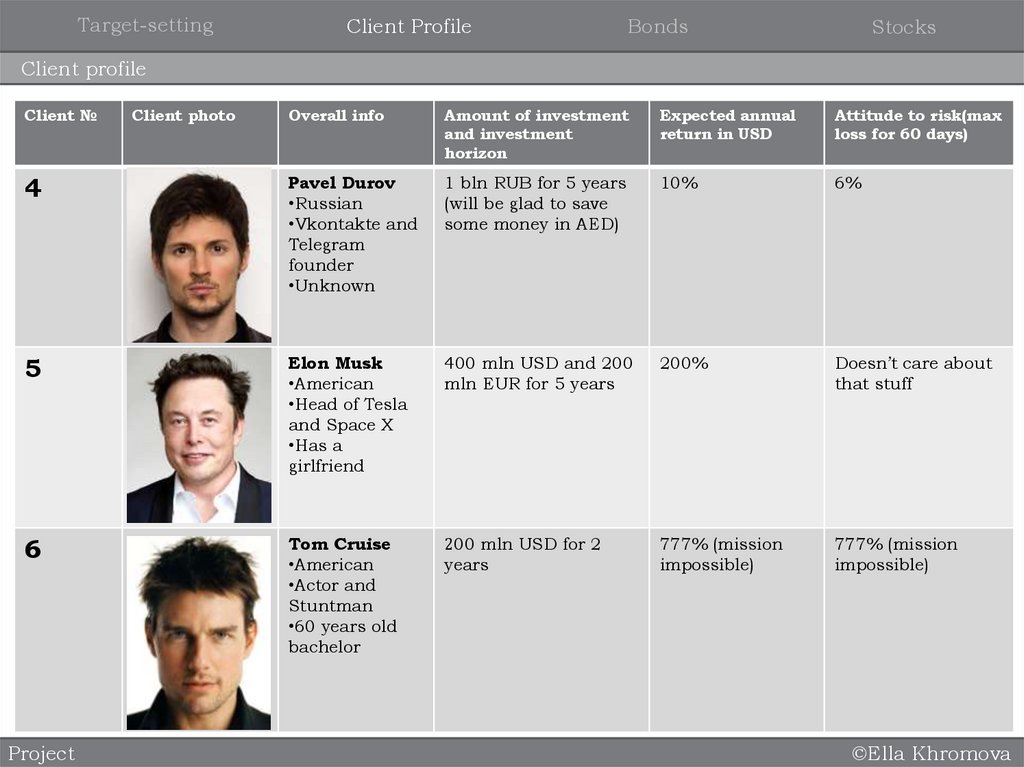

4

Pavel Durov

•Russian

•Vkontakte and

Telegram

founder

•Unknown

1 bln RUB for 5 years

(will be glad to save

some money in AED)

10%

6%

5

Elon Musk

•American

•Head of Tesla

and Space X

•Has a

girlfriend

400 mln USD and 200

mln EUR for 5 years

200%

Doesn’t care about

that stuff

6

Tom Cruise

•American

•Actor and

Stuntman

•60 years old

bachelor

200 mln USD for 2

years

777% (mission

impossible)

777% (mission

impossible)

Client №

Project

Client photo

©Ella Khromova

22.

Target-settingClient Profile

Bonds

Stocks

Client profile

Overall info

Amount of

investment and

investment horizon

Expected annual

return in USD

Attitude to risk(max

loss for 60 days)

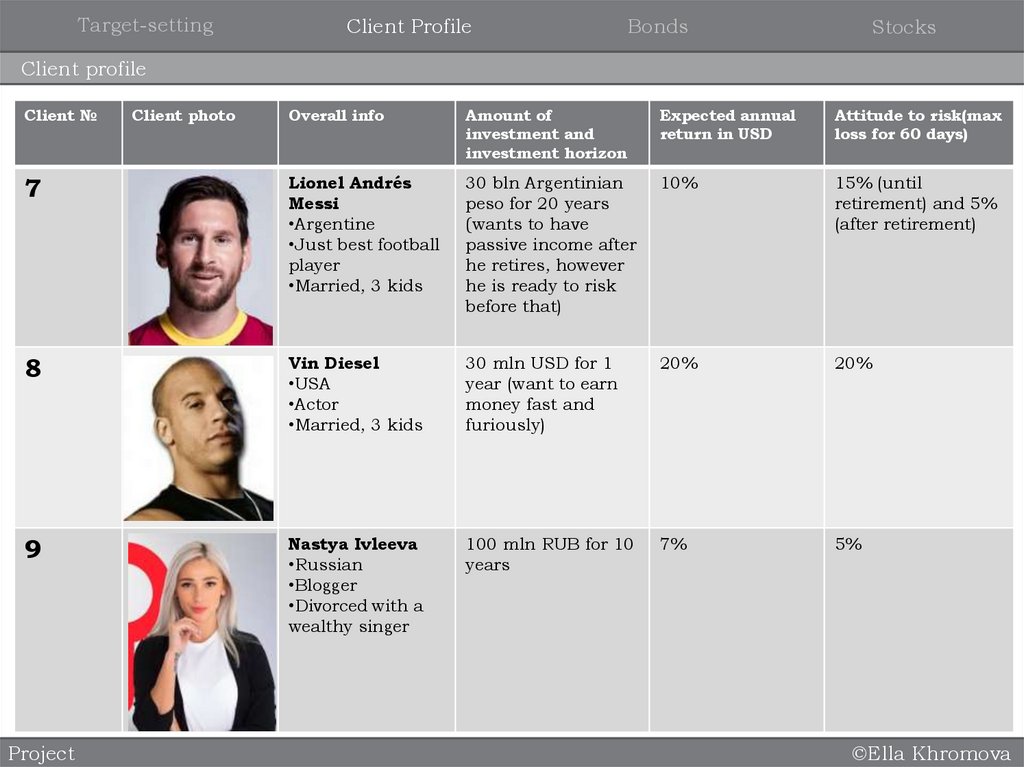

7

Lionel Andrés

Messi

•Argentine

•Just best football

player

•Married, 3 kids

30 bln Argentinian

peso for 20 years

(wants to have

passive income after

he retires, however

he is ready to risk

before that)

10%

15% (until

retirement) and 5%

(after retirement)

8

Vin Diesel

•USA

•Actor

•Married, 3 kids

30 mln USD for 1

year (want to earn

money fast and

furiously)

20%

20%

9

Nastya Ivleeva

•Russian

•Blogger

•Divorced with a

wealthy singer

100 mln RUB for 10

years

7%

5%

Client №

Project

Client photo

©Ella Khromova

23.

Target-settingClient Profile

Bonds

Stocks

Client profile

Overall info

Amount of

investment and

investment horizon

Expected annual

return in USD

Attitude to risk(max

loss for 60 days)

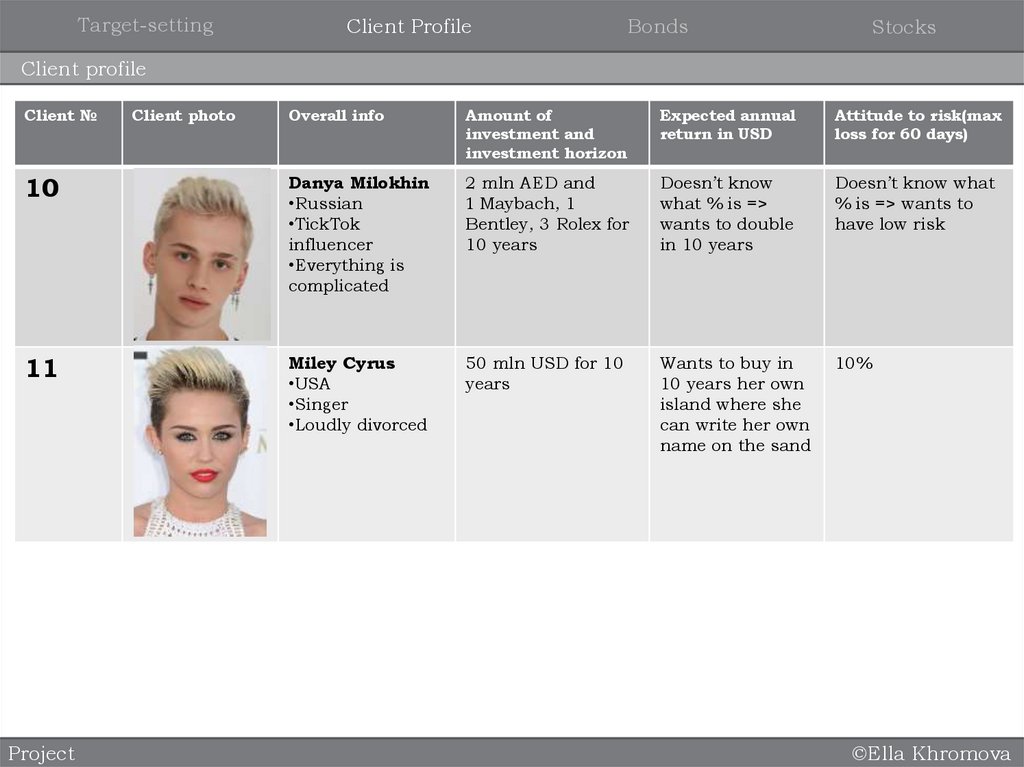

10

Danya Milokhin

•Russian

•TickTok

influencer

•Everything is

complicated

2 mln AED and

1 Maybach, 1

Bentley, 3 Rolex for

10 years

Doesn’t know

what % is =>

wants to double

in 10 years

Doesn’t know what

% is => wants to

have low risk

11

Miley Cyrus

•USA

•Singer

•Loudly divorced

50 mln USD for 10

years

Wants to buy in

10 years her own

island where she

can write her own

name on the sand

10%

Client №

Project

Client photo

©Ella Khromova

24.

Target-settingClient Profile

Bonds

Stocks

Italy government bond

Project

©Ella Khromova

25.

Target-settingClient Profile

Bonds

Stocks

Turkey government bond

Project

©Ella Khromova

26.

Target-settingClient Profile

Bonds

Stocks

US Treasury bond

Project

©Ella Khromova

27.

Target-settingClient Profile

Bonds

Stocks

Societe Generale bond

Project

©Ella Khromova

28.

Target-settingClient Profile

Bonds

Stocks

Volkswagen bond

Project

©Ella Khromova

29.

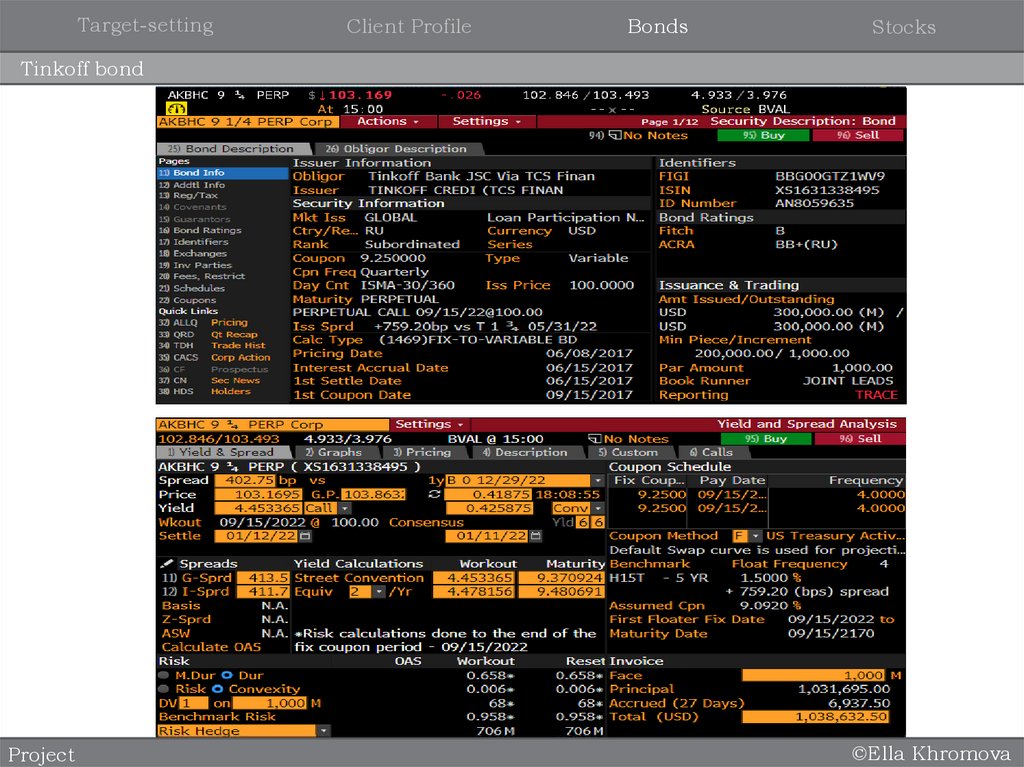

Target-settingClient Profile

Bonds

Stocks

Tinkoff bond

Project

©Ella Khromova

30.

Target-settingClient Profile

Bonds

Stocks

PETROLEOS MEXICANOS bond

Project

©Ella Khromova

31.

Target-settingClient Profile

Bonds

Stocks

Amazon bond

Project

©Ella Khromova

32.

Target-settingClient Profile

Bonds

Stocks

Gamestop bond

Project

©Ella Khromova

33.

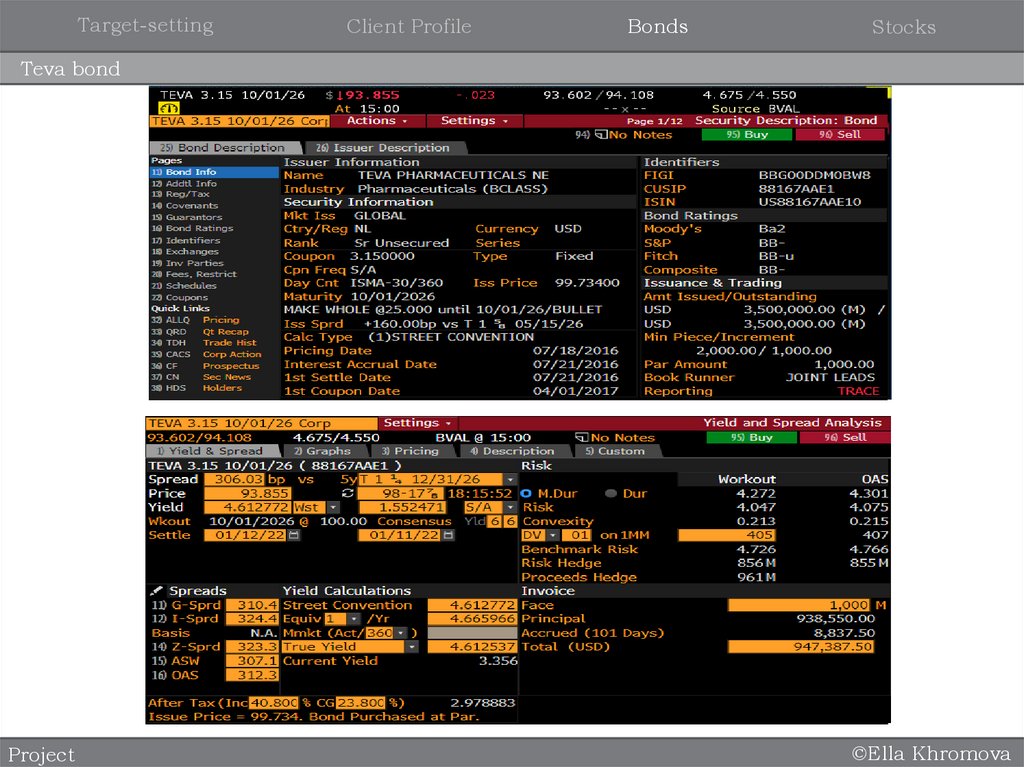

Target-settingClient Profile

Bonds

Stocks

Teva bond

Project

©Ella Khromova

34.

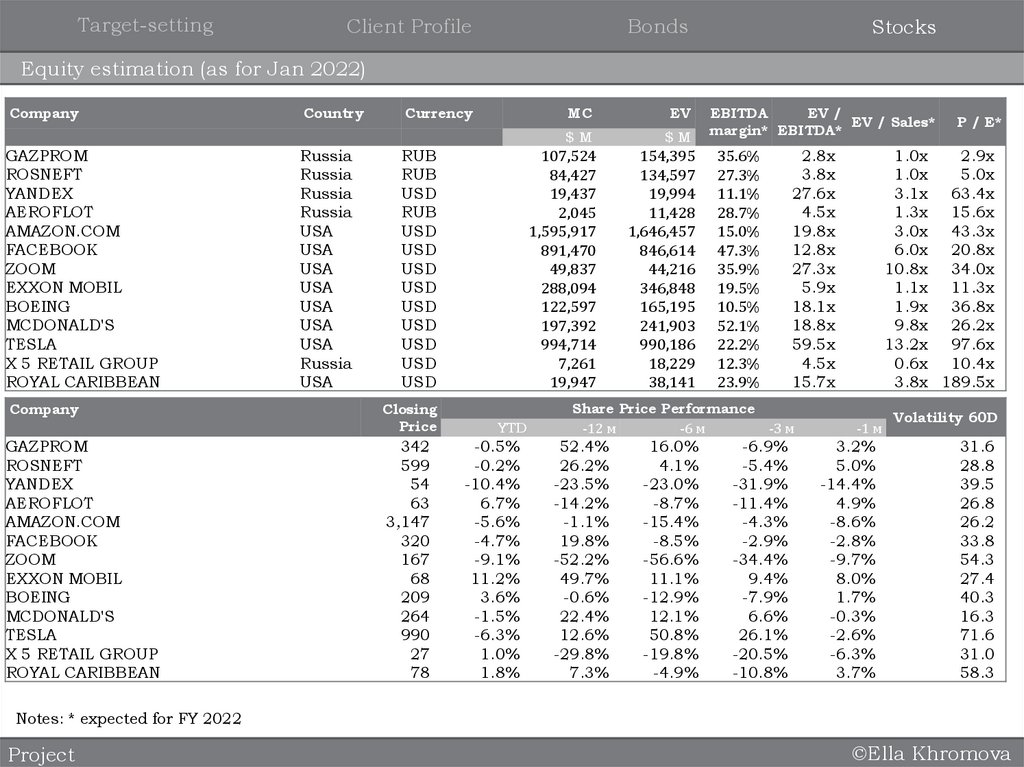

Target-settingBonds

Stocks

MC

EV

$M

$M

EBITDA

EV /

EV / Sales*

margin* EBITDA*

107,524

84,427

19,437

2,045

1,595,917

891,470

49,837

288,094

122,597

197,392

994,714

7,261

19,947

154,395

134,597

19,994

11,428

1,646,457

846,614

44,216

346,848

165,195

241,903

990,186

18,229

38,141

Client Profile

Equity estimation (as for Jan 2022)

Company

GAZPROM

ROSNEFT

YANDEX

AEROFLOT

AMAZON.COM

ZOOM

EXXON MOBIL

BOEING

MCDONALD'S

TESLA

X 5 RETAIL GROUP

ROYAL CARIBBEAN

Company

GAZPROM

ROSNEFT

YANDEX

AEROFLOT

AMAZON.COM

ZOOM

EXXON MOBIL

BOEING

MCDONALD'S

TESLA

X 5 RETAIL GROUP

ROYAL CARIBBEAN

Country

Russia

Russia

Russia

Russia

USA

USA

USA

USA

USA

USA

USA

Russia

USA

Currency

RUB

RUB

USD

RUB

USD

USD

USD

USD

USD

USD

USD

USD

USD

Closing

Price

YTD

342

599

54

63

3,147

320

167

68

209

264

990

27

78

-0.5%

-0.2%

-10.4%

6.7%

-5.6%

-4.7%

-9.1%

11.2%

3.6%

-1.5%

-6.3%

1.0%

1.8%

35.6%

27.3%

11.1%

28.7%

15.0%

47.3%

35.9%

19.5%

10.5%

52.1%

22.2%

12.3%

23.9%

2.8x

3.8x

27.6x

4.5x

19.8x

12.8x

27.3x

5.9x

18.1x

18.8x

59.5x

4.5x

15.7x

Share Price Performance

-12 м

-6 м

-3 м

52.4%

26.2%

-23.5%

-14.2%

-1.1%

19.8%

-52.2%

49.7%

-0.6%

22.4%

12.6%

-29.8%

7.3%

16.0%

4.1%

-23.0%

-8.7%

-15.4%

-8.5%

-56.6%

11.1%

-12.9%

12.1%

50.8%

-19.8%

-4.9%

-6.9%

-5.4%

-31.9%

-11.4%

-4.3%

-2.9%

-34.4%

9.4%

-7.9%

6.6%

26.1%

-20.5%

-10.8%

P / E*

1.0x

2.9x

1.0x

5.0x

3.1x 63.4x

1.3x 15.6x

3.0x 43.3x

6.0x 20.8x

10.8x 34.0x

1.1x 11.3x

1.9x 36.8x

9.8x 26.2x

13.2x 97.6x

0.6x 10.4x

3.8x 189.5x

-1 м

3.2%

5.0%

-14.4%

4.9%

-8.6%

-2.8%

-9.7%

8.0%

1.7%

-0.3%

-2.6%

-6.3%

3.7%

Volatility 60D

31.6

28.8

39.5

26.8

26.2

33.8

54.3

27.4

40.3

16.3

71.6

31.0

58.3

Notes: * expected for FY 2022

Project

©Ella Khromova

35.

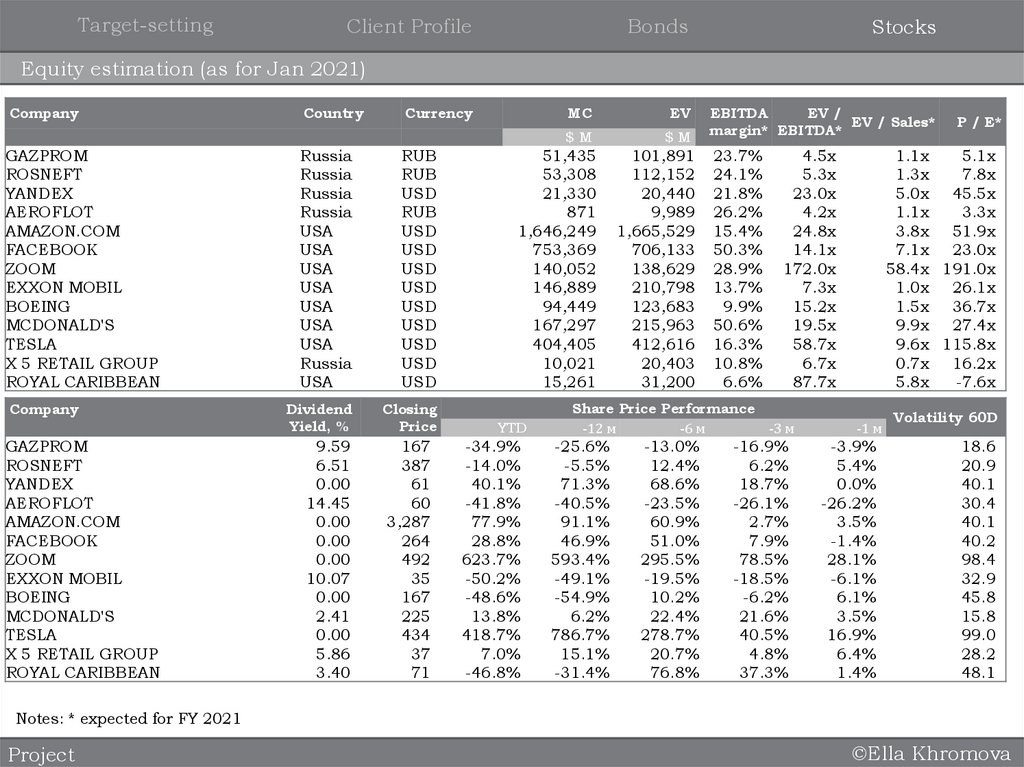

Target-settingBonds

Stocks

MC

EV

$M

$M

EBITDA

EV /

EV / Sales*

margin* EBITDA*

51,435

53,308

21,330

871

1,646,249

753,369

140,052

146,889

94,449

167,297

404,405

10,021

15,261

101,891

112,152

20,440

9,989

1,665,529

706,133

138,629

210,798

123,683

215,963

412,616

20,403

31,200

Client Profile

Equity estimation (as for Jan 2021)

Company

GAZPROM

ROSNEFT

YANDEX

AEROFLOT

AMAZON.COM

ZOOM

EXXON MOBIL

BOEING

MCDONALD'S

TESLA

X 5 RETAIL GROUP

ROYAL CARIBBEAN

Company

GAZPROM

ROSNEFT

YANDEX

AEROFLOT

AMAZON.COM

ZOOM

EXXON MOBIL

BOEING

MCDONALD'S

TESLA

X 5 RETAIL GROUP

ROYAL CARIBBEAN

Country

Currency

Russia

Russia

Russia

Russia

USA

USA

USA

USA

USA

USA

USA

Russia

USA

RUB

RUB

USD

RUB

USD

USD

USD

USD

USD

USD

USD

USD

USD

Dividend

Yield, %

Closing

Price

YTD

9.59

6.51

0.00

14.45

0.00

0.00

0.00

10.07

0.00

2.41

0.00

5.86

3.40

167

387

61

60

3,287

264

492

35

167

225

434

37

71

-34.9%

-14.0%

40.1%

-41.8%

77.9%

28.8%

623.7%

-50.2%

-48.6%

13.8%

418.7%

7.0%

-46.8%

23.7%

24.1%

21.8%

26.2%

15.4%

50.3%

28.9%

13.7%

9.9%

50.6%

16.3%

10.8%

6.6%

4.5x

5.3x

23.0x

4.2x

24.8x

14.1x

172.0x

7.3x

15.2x

19.5x

58.7x

6.7x

87.7x

Share Price Performance

-12 м

-6 м

-3 м

-25.6%

-5.5%

71.3%

-40.5%

91.1%

46.9%

593.4%

-49.1%

-54.9%

6.2%

786.7%

15.1%

-31.4%

-13.0%

12.4%

68.6%

-23.5%

60.9%

51.0%

295.5%

-19.5%

10.2%

22.4%

278.7%

20.7%

76.8%

-16.9%

6.2%

18.7%

-26.1%

2.7%

7.9%

78.5%

-18.5%

-6.2%

21.6%

40.5%

4.8%

37.3%

P / E*

1.1x

5.1x

1.3x

7.8x

5.0x 45.5x

1.1x

3.3x

3.8x 51.9x

7.1x 23.0x

58.4x 191.0x

1.0x 26.1x

1.5x 36.7x

9.9x 27.4x

9.6x 115.8x

0.7x 16.2x

5.8x

-7.6x

-1 м

-3.9%

5.4%

0.0%

-26.2%

3.5%

-1.4%

28.1%

-6.1%

6.1%

3.5%

16.9%

6.4%

1.4%

Volatility 60D

18.6

20.9

40.1

30.4

40.1

40.2

98.4

32.9

45.8

15.8

99.0

28.2

48.1

Notes: * expected for FY 2021

Project

©Ella Khromova

36.

Good Luck with Your Projectshttps://media.istockphoto.com/vectors/balance-between-finance-andeducation-cost-of-education-is-expensive-vectorid1178234506?s=612x612

finance

finance