Similar presentations:

Plant and intangible assets. (Chapter 9)

1. Plant and Intangible Assets

Chapter 9McGraw-Hill/Irwin

Copyright © 2010 by The McGraw-Hill Companies, Inc. All

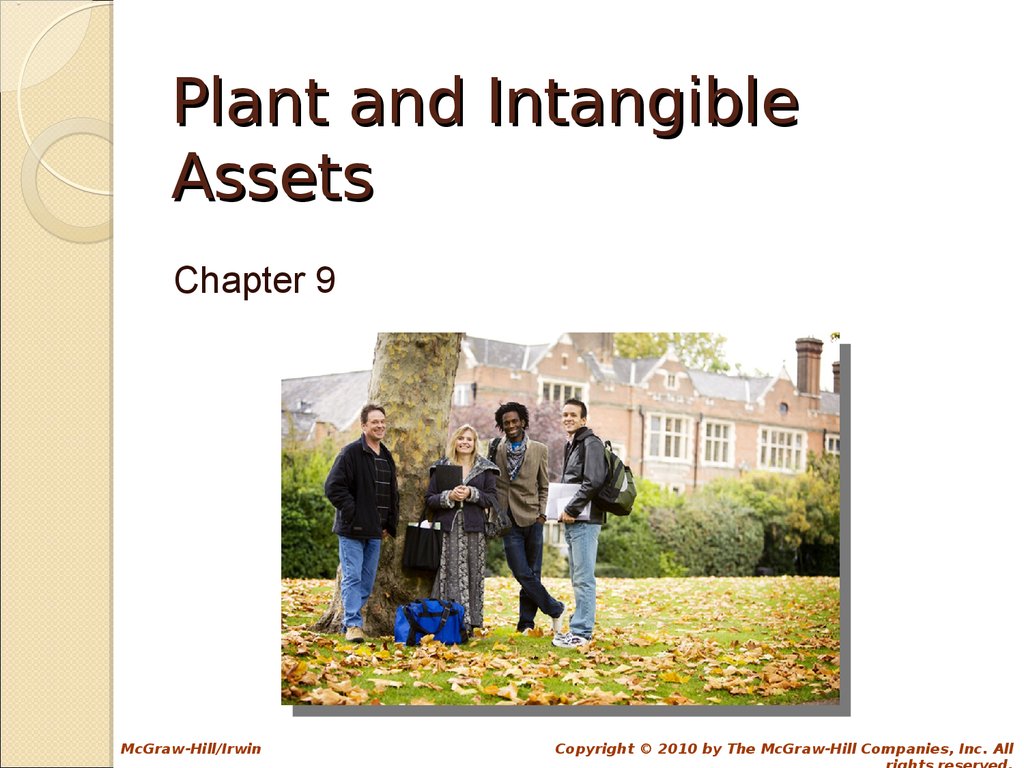

2. Plant Assets as a “Stream of Future Services”

Plant assets represent a bundle of futureservices, and can be thought of as longterm prepaid expenses.

The cost of plant assets is the

advance purchase of services.

As years pass, and the

services are used, the cost is

transferred to depreciation

expense.

9-2

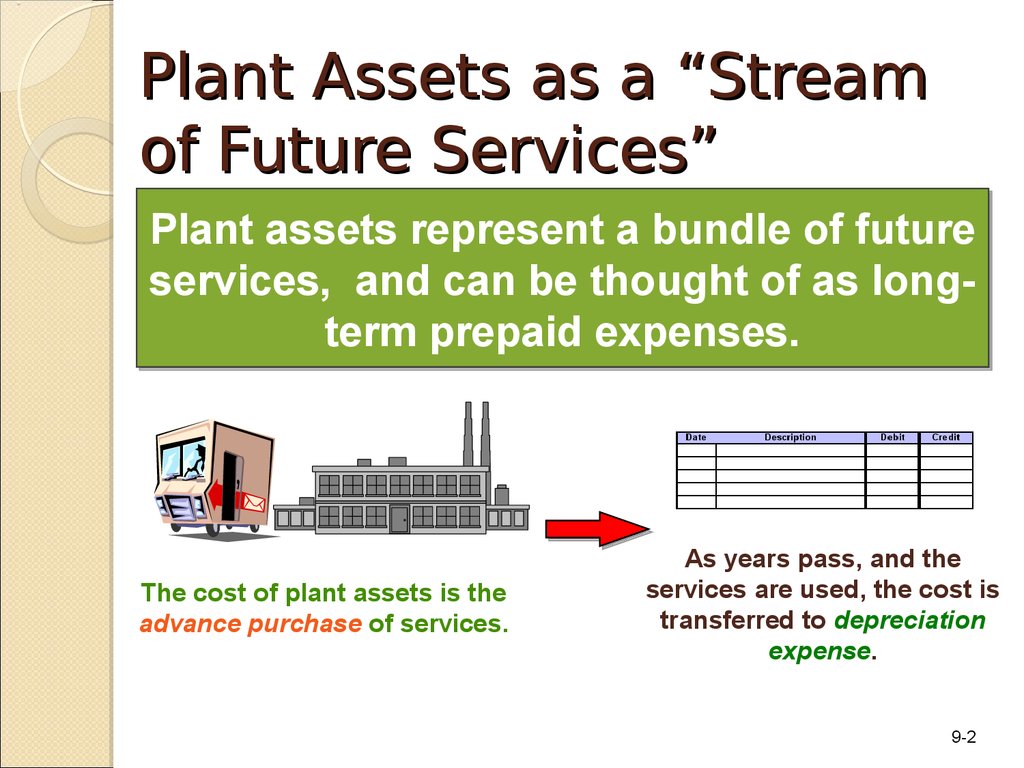

3. Major Categories of Plant Assets

T a n g ib le P la n tA s s e ts

In ta n g ib le

A s s e ts

N a tu ra l

R e so u rc e s

L o n g -te rm

a s s e t s h a v in g

p h y s ic a l s u b s t a n c e .

N o n c u rre n t a s s e ts

w it h n o p h y s ic a l

s u b s ta n c e .

S it e s a c q u ir e d fo r

e x t r a c t in g v a lu a b le

re s o u rc e s .

L a n d , b u ild in g s ,

e q u ip m e n t ,

fu r n it u r e , fix t u r e s .

P a t e n t s , c o p y r ig h t s ,

tra d e m a rk s ,

fr a n c h is e s , g o o d w ill.

O il r e s e r v e s ,

t im b e r , o t h e r

m in e r a ls .

9-3

4. Accountable Events in the Lives of Plant Assets

Acquisition.Allocation of the acquisition

cost to expense over the

asset’s useful life

(depreciation).

Sale or disposal.

9-4

5. Acquisition of Plant Assets

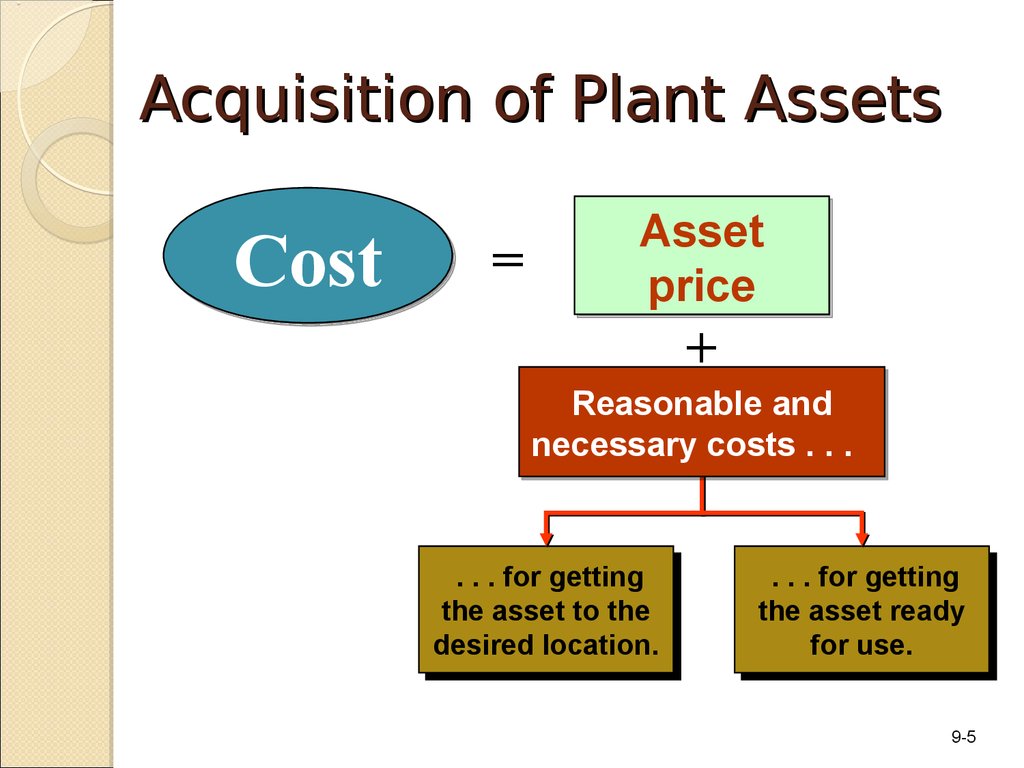

Cost=

Asset

price

+

Reasonable and

necessary costs . . .

......for

forgetting

getting

the

theasset

assetto

tothe

the

desired

desiredlocation.

location.

......for

forgetting

getting

the

theasset

asset ready

ready

for

foruse.

use.

9-5

6. Special Considerations

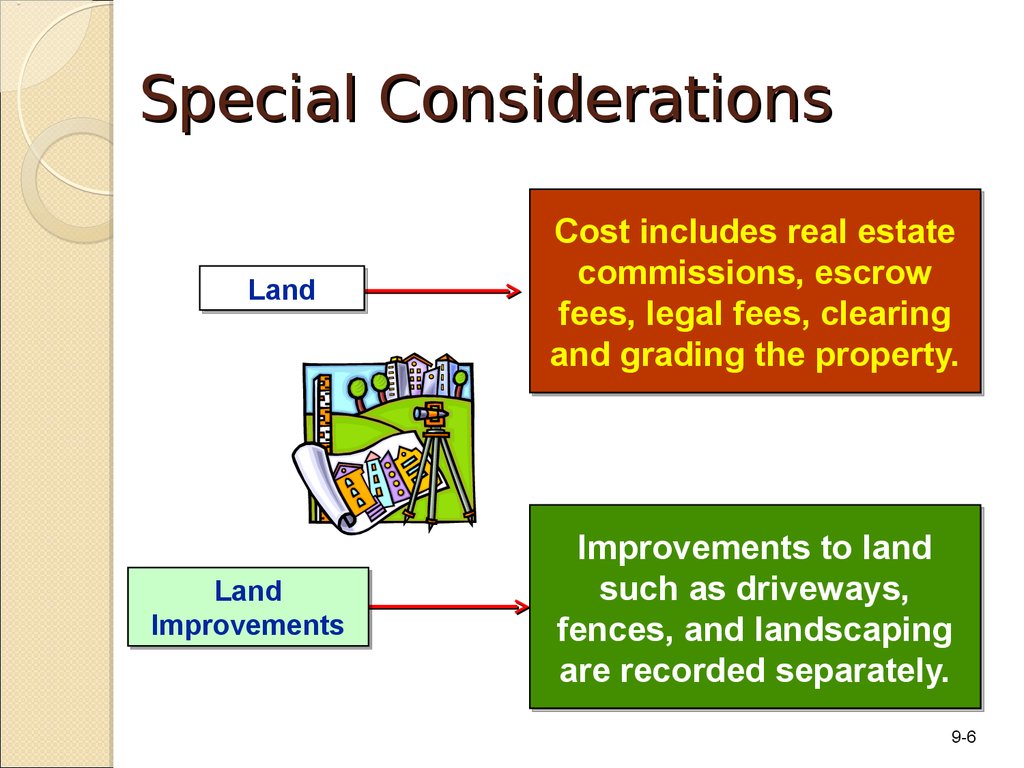

LandLand

Land

Land

Improvements

Improvements

Cost includes real estate

commissions, escrow

fees, legal fees, clearing

and grading the property.

Improvements to land

such as driveways,

fences, and landscaping

are recorded separately.

9-6

7. Special Considerations

BuildingsRepairs made prior to the

building being put in use

are considered part of the

building’s cost.

Equipment

Related interest,

insurance, and property

taxes are treated as

expenses of the current

period.

9-7

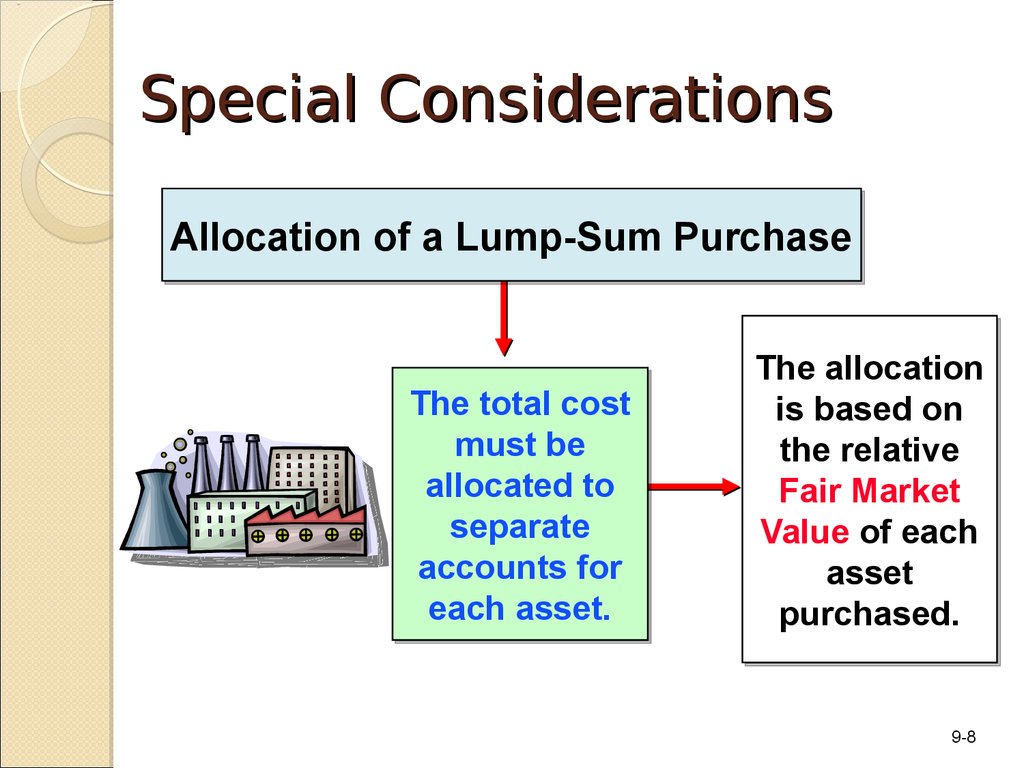

8. Special Considerations

Allocation of a Lump-Sum PurchaseThe total cost

must be

allocated to

separate

accounts for

each asset.

The allocation

is based on

the relative

Fair Market

Value of each

asset

purchased.

9-8

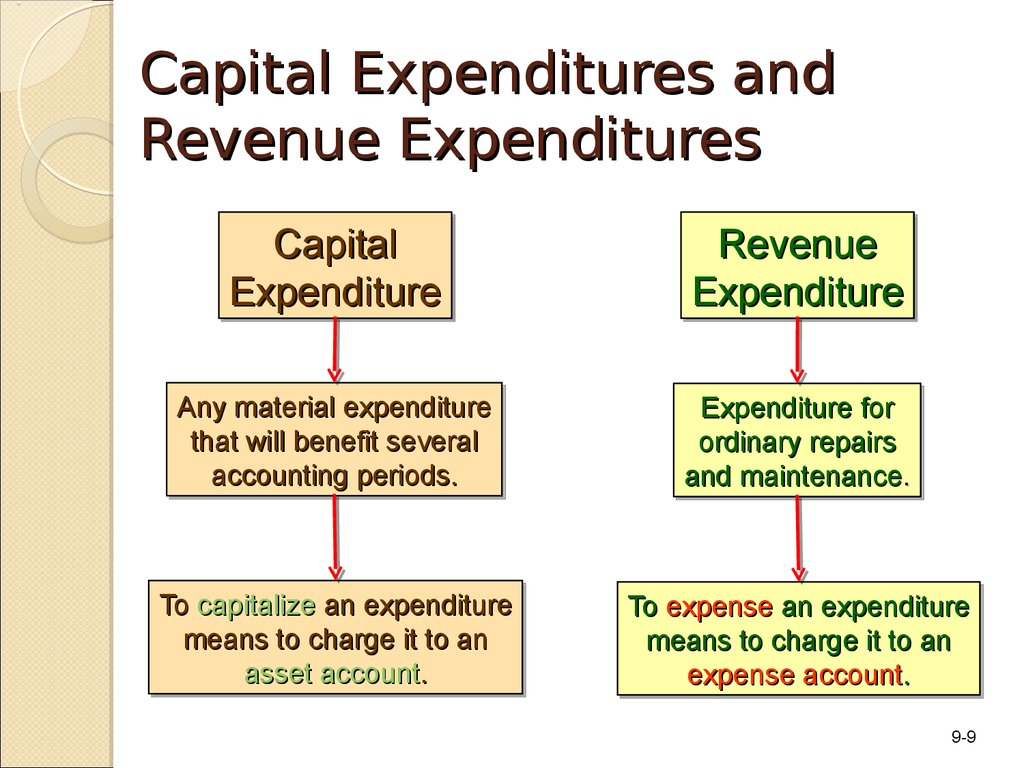

9. Capital Expenditures and Revenue Expenditures

CapitalCapital

Expenditure

Expenditure

Revenue

Revenue

Expenditure

Expenditure

Any

Any material

material expenditure

expenditure

that

that will

will benefit

benefit several

several

accounting

accounting periods.

periods.

Expenditure

Expenditure for

for

ordinary

ordinary repairs

repairs

and

and maintenance

maintenance..

To

To capitalize

capitalize an

an expenditure

expenditure

means

means to

to charge

charge itit to

to an

an

asset

asset account

account..

To

To expense

expense an

an expenditure

expenditure

means

means to

to charge

charge itit to

to an

an

expense

expense account

account..

9-9

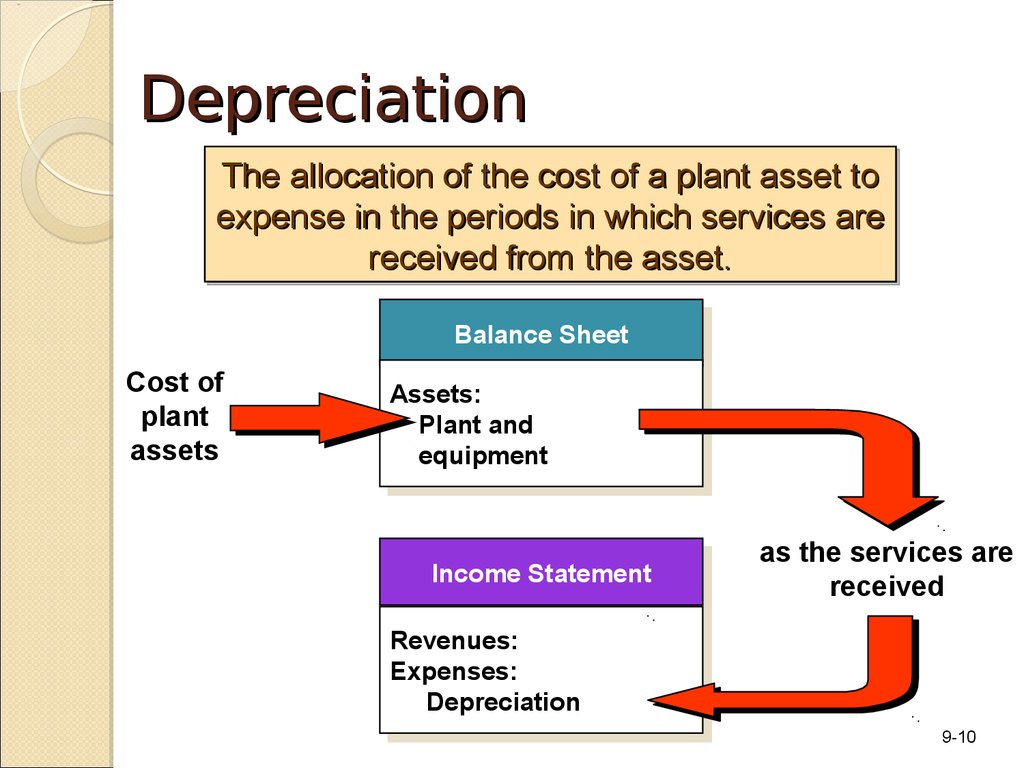

10. Depreciation

TheThe allocation

allocation of

of the

the cost

cost of

of aa plant

plant asset

asset to

to

expense

expense in

in the

the periods

periods in

in which

which services

services are

are

received

received from

from the

the asset.

asset.

Balance

BalanceSheet

Sheet

Cost of

plant

assets

Assets:

Assets:

Plant

Plantand

and

equipment

equipment

Income

IncomeStatement

Statement

as the services are

received

Revenues:

Revenues:

Expenses:

Expenses:

Depreciation

Depreciation

9-10

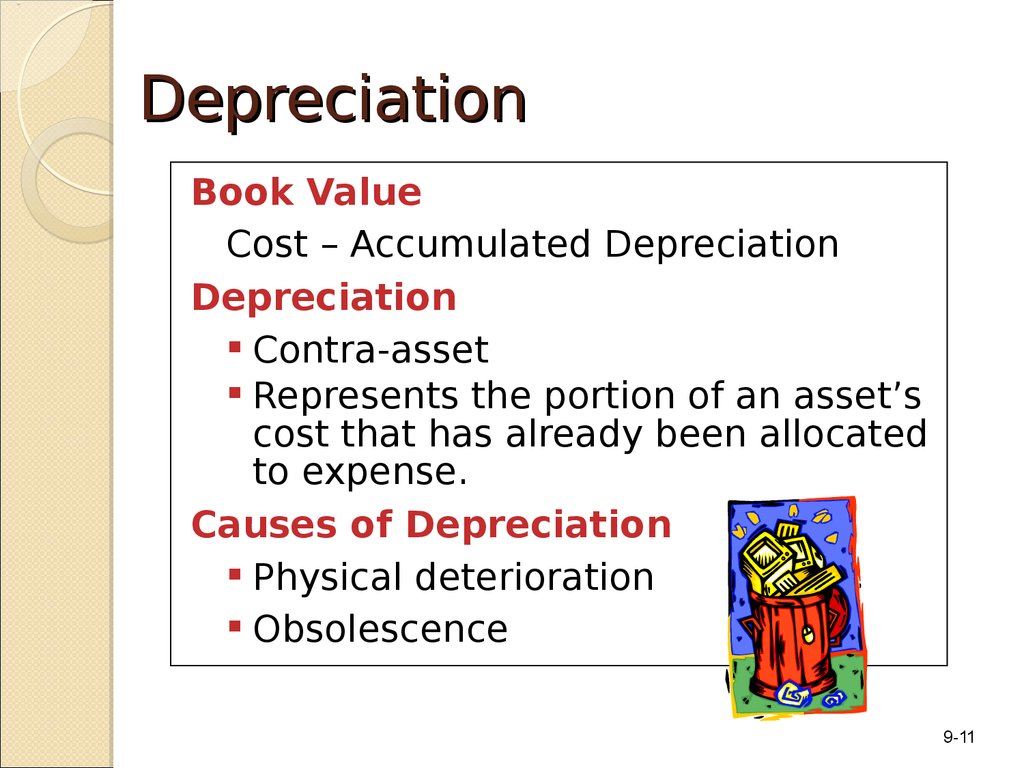

11. Depreciation

Book ValueCost – Accumulated Depreciation

Depreciation

Contra-asset

Represents the portion of an asset’s

cost that has already been allocated

to expense.

Causes of Depreciation

Physical deterioration

Obsolescence

9-11

12. Straight-Line Depreciation

Depreciation=

Expense per Year

Cost - Residual Value

Years of Useful Life

9-12

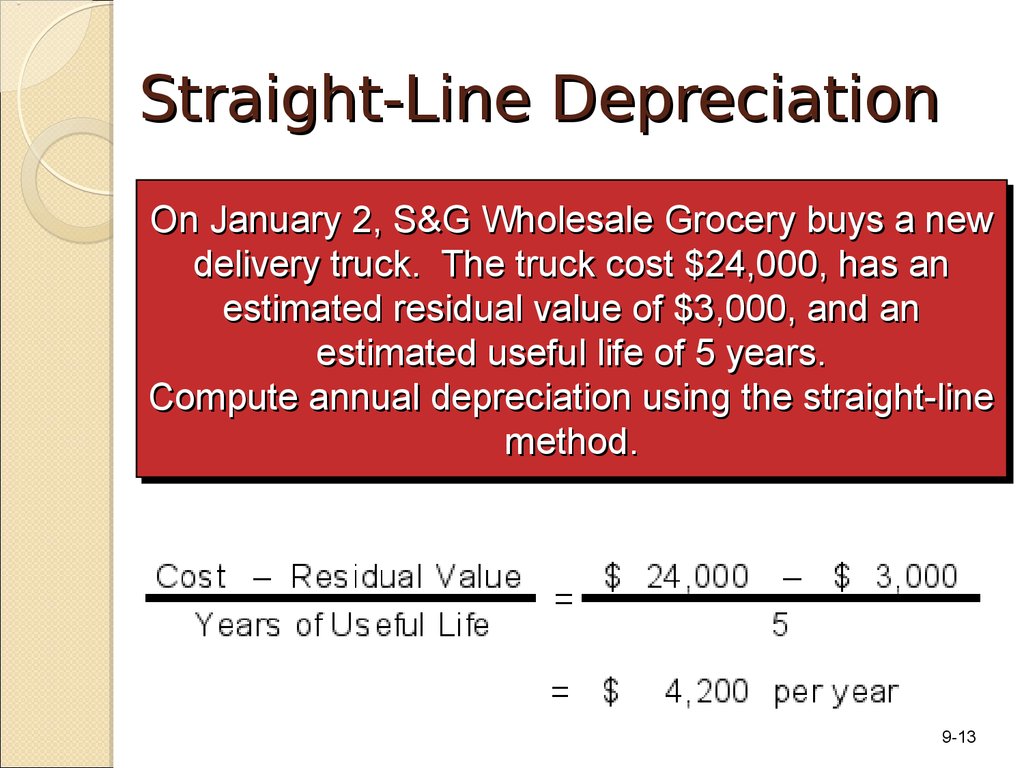

13. Straight-Line Depreciation

OnOn January

January 2,

2, S&G

S&G Wholesale

Wholesale Grocery

Grocery buys

buys aa new

new

delivery

delivery truck.

truck. The

The truck

truck cost

cost $24,000,

$24,000, has

has an

an

estimated

estimated residual

residual value

value of

of $3,000,

$3,000, and

and an

an

estimated

estimated useful

useful life

life of

of 55 years.

years.

Compute

Compute annual

annual depreciation

depreciation using

using the

the straight-line

straight-line

method.

method.

9-13

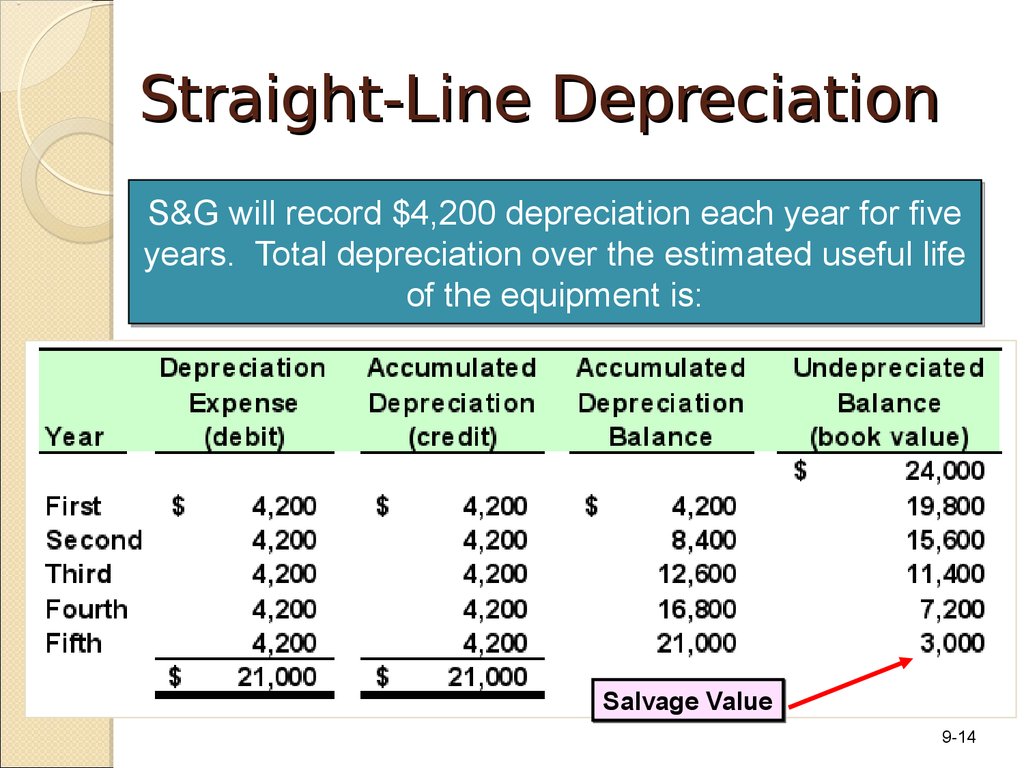

14. Straight-Line Depreciation

S&G will record $4,200 depreciation each year for fiveyears. Total depreciation over the estimated useful life

of the equipment is:

Salvage Value

9-14

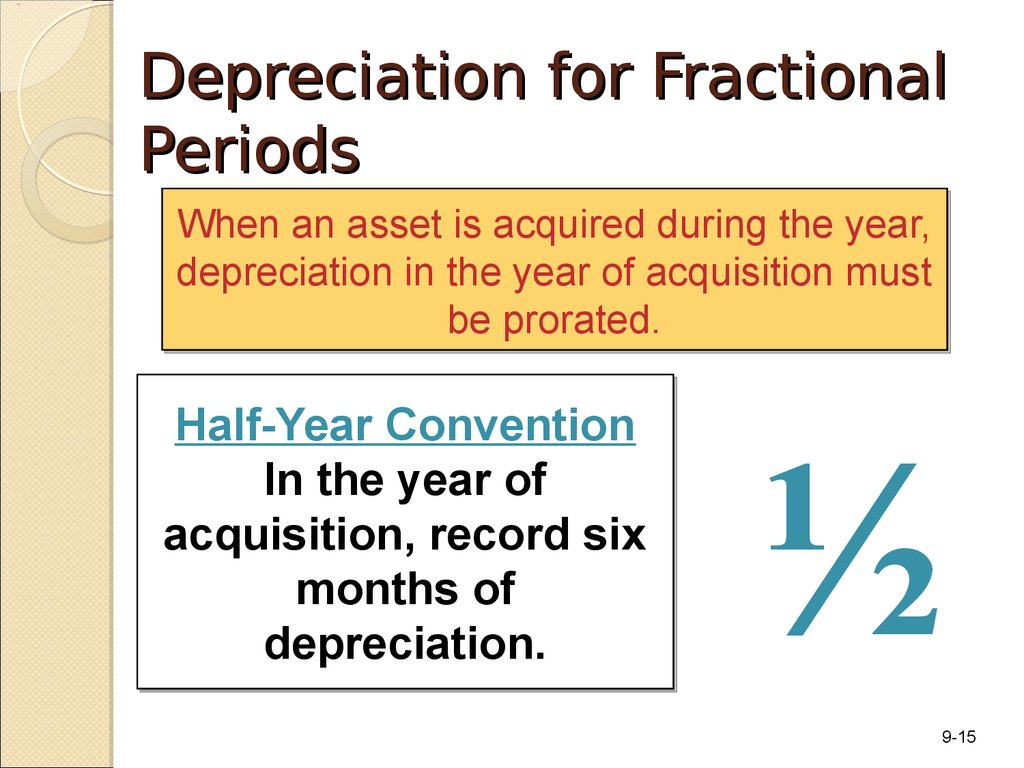

15. Depreciation for Fractional Periods

When an asset is acquired during the year,depreciation in the year of acquisition must

be prorated.

Half-Year Convention

In the year of

acquisition, record six

months of

depreciation.

½

9-15

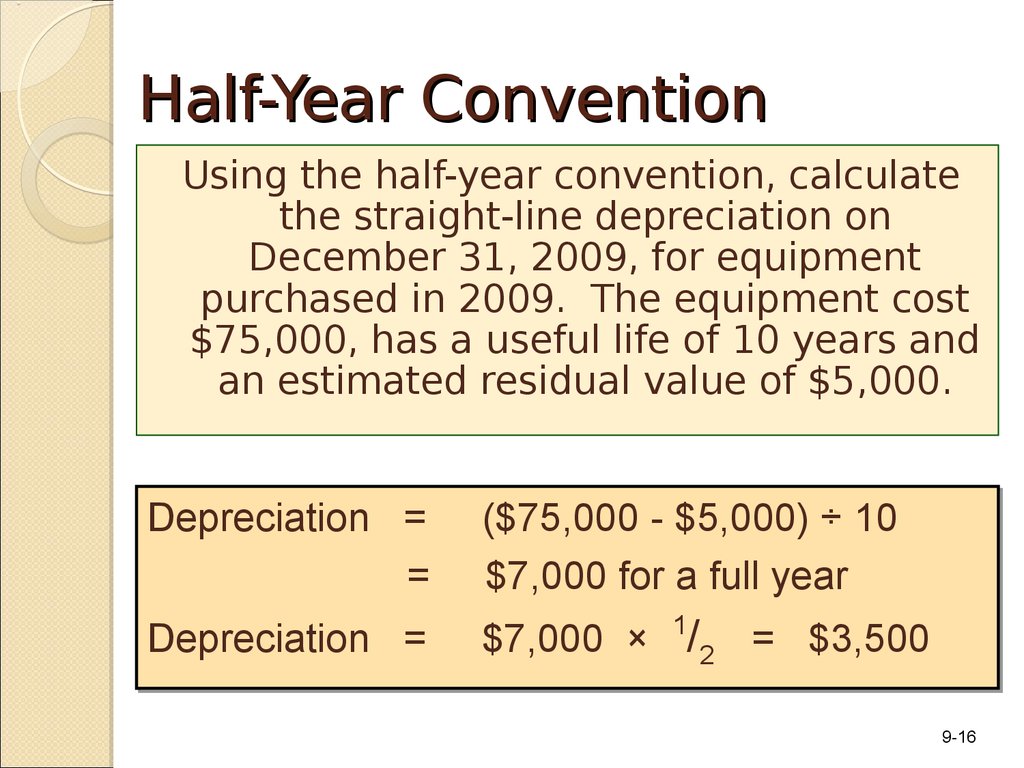

16. Half-Year Convention

Using the half-year convention, calculatethe straight-line depreciation on

December 31, 2009, for equipment

purchased in 2009. The equipment cost

$75,000, has a useful life of 10 years and

an estimated residual value of $5,000.

Depreciation =

=

($75,000 - $5,000) ÷ 10

$7,000 for a full year

Depreciation =

$7,000 × 11/22 = $3,500

9-16

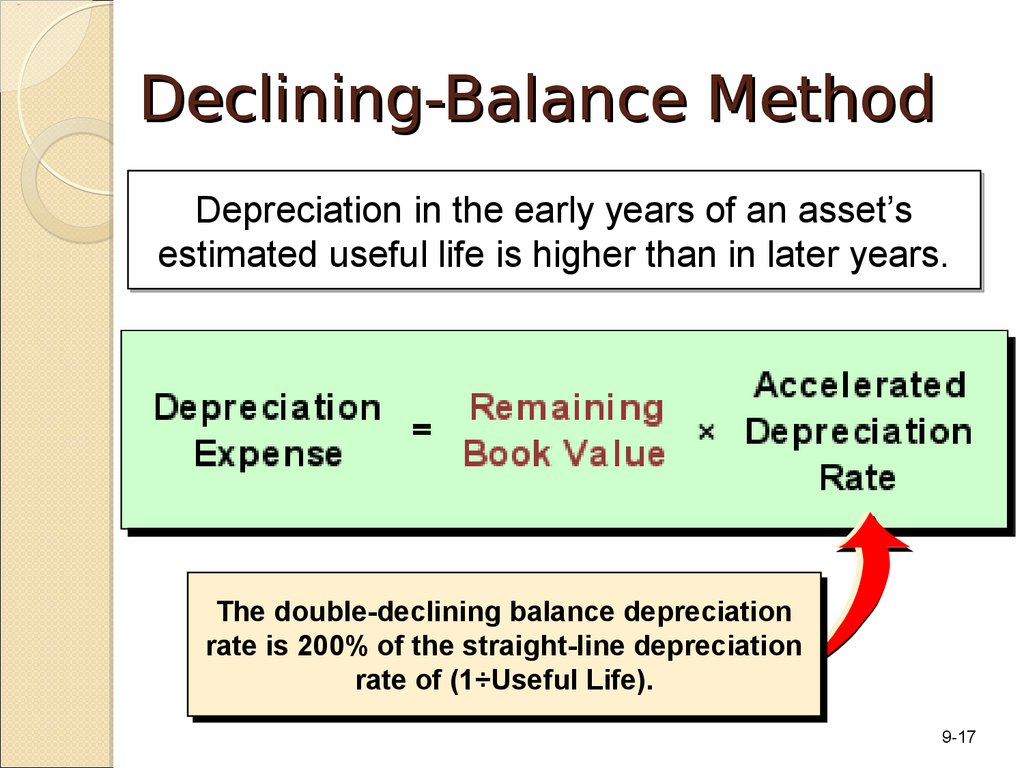

17. Declining-Balance Method

Depreciation in the early years of an asset’sestimated useful life is higher than in later years.

The

The double-declining

double-declining balance

balance depreciation

depreciation

rate

rate is

is 200%

200% of

of the

the straight-line

straight-line depreciation

depreciation

rate

rate of

of (1÷Useful

(1÷Useful Life).

Life).

9-17

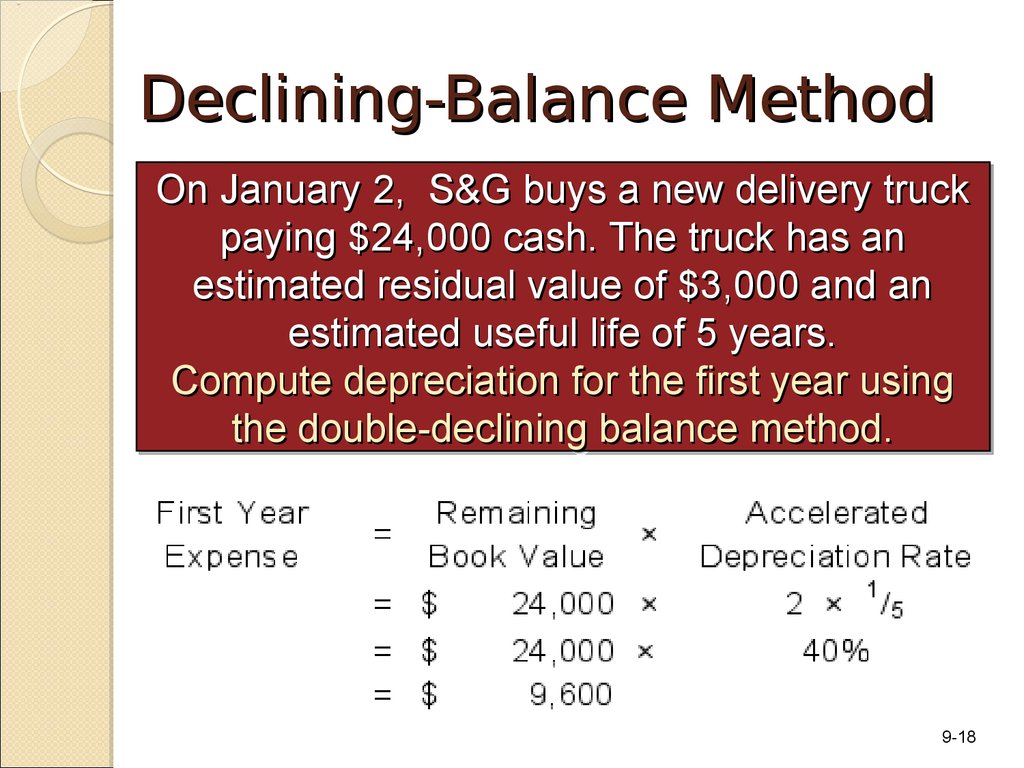

18. Declining-Balance Method

OnOn January

January 2,

2, S&G

S&G buys

buys aa new

new delivery

delivery truck

truck

paying

paying $24,000

$24,000 cash.

cash. The

The truck

truck has

has an

an

estimated

estimated residual

residual value

value of

of $3,000

$3,000 and

and an

an

estimated

estimated useful

useful life

life of

of 55 years.

years.

Compute

Compute depreciation

depreciation for

for the

the first

first year

year using

using

the

the double-declining

double-declining balance

balance method.

method.

9-18

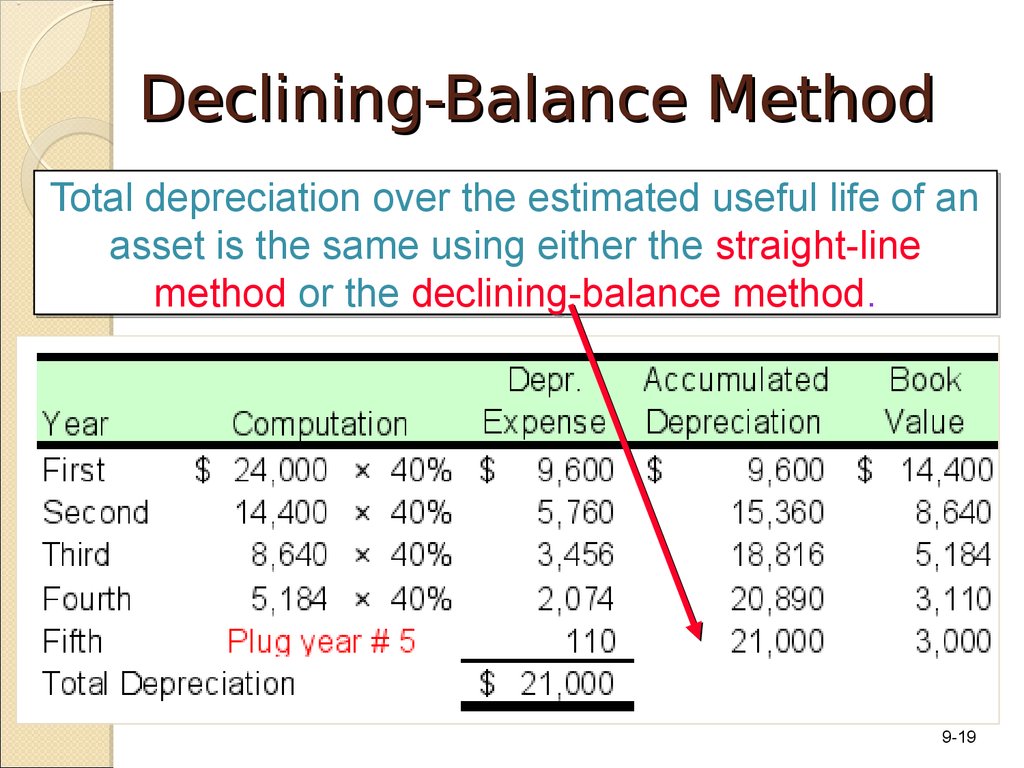

19. Declining-Balance Method

Total depreciation over the estimated useful life of anCompute

depreciation

for

the

rest

of

the

Compute

depreciation

for

the

rest

of

the

asset is the same using either the straight-line

truck’s

life.

truck’s

estimated useful

usefulmethod.

life.

method

or the estimated

declining-balance

9-19

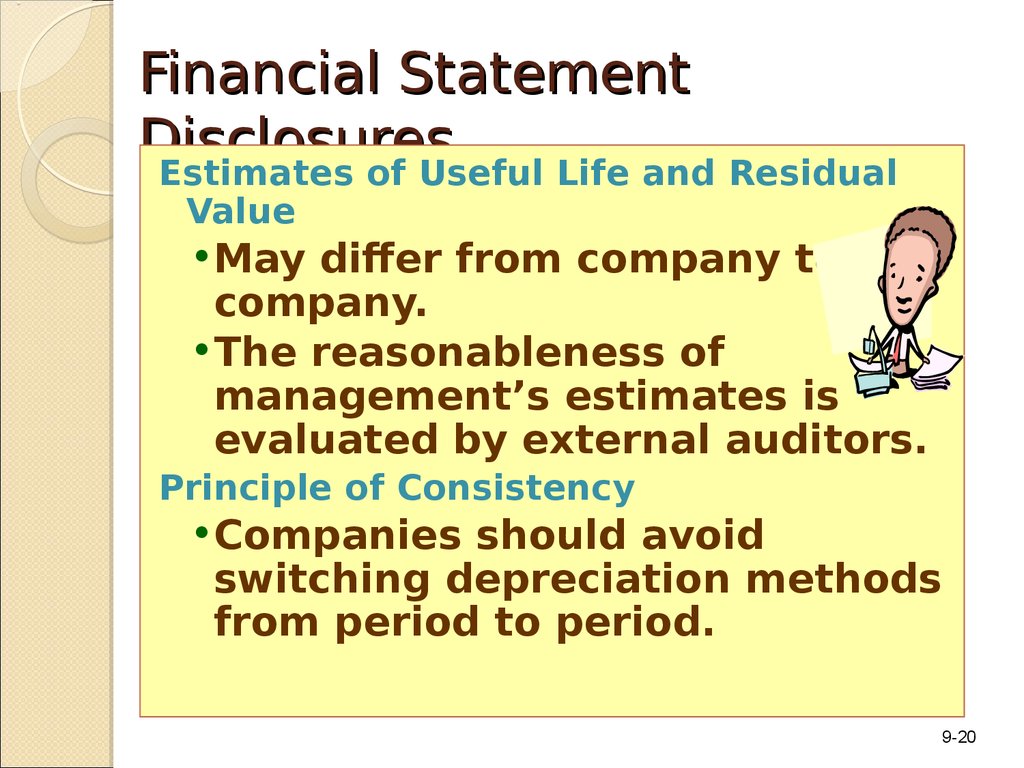

20. Financial Statement Disclosures

Estimates of Useful Life and ResidualValue

•May differ from company to

company.

•The reasonableness of

management’s estimates is

evaluated by external auditors.

Principle of Consistency

•Companies should avoid

switching depreciation methods

from period to period.

9-20

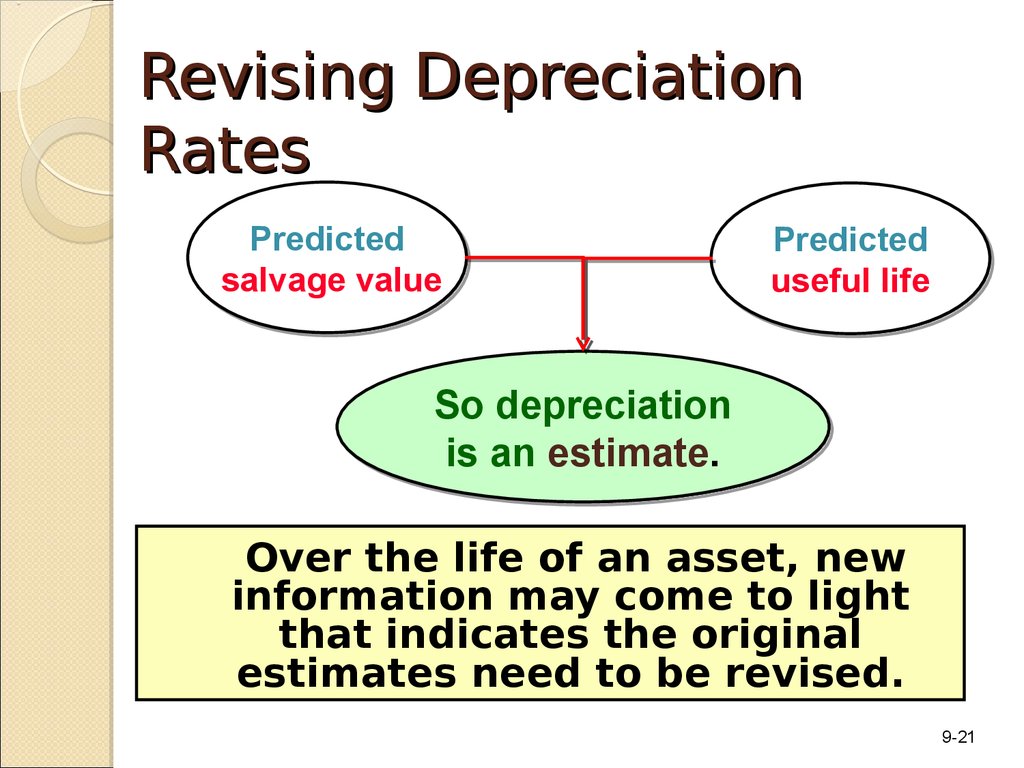

21. Revising Depreciation Rates

Predictedsalvage value

Predicted

useful life

So depreciation

is an estimate.

Over the life of an asset, new

information may come to light

that indicates the original

estimates need to be revised.

9-21

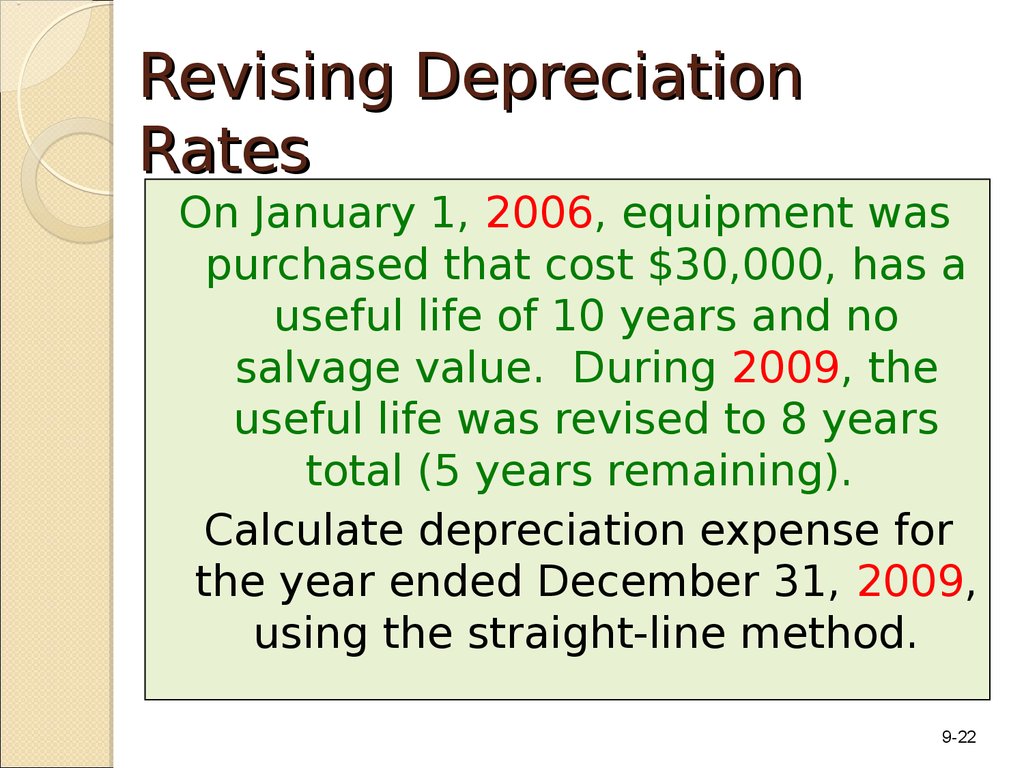

22. Revising Depreciation Rates

On January 1, 2006, equipment waspurchased that cost $30,000, has a

useful life of 10 years and no

salvage value. During 2009, the

useful life was revised to 8 years

total (5 years remaining).

Calculate depreciation expense for

the year ended December 31, 2009,

using the straight-line method.

9-22

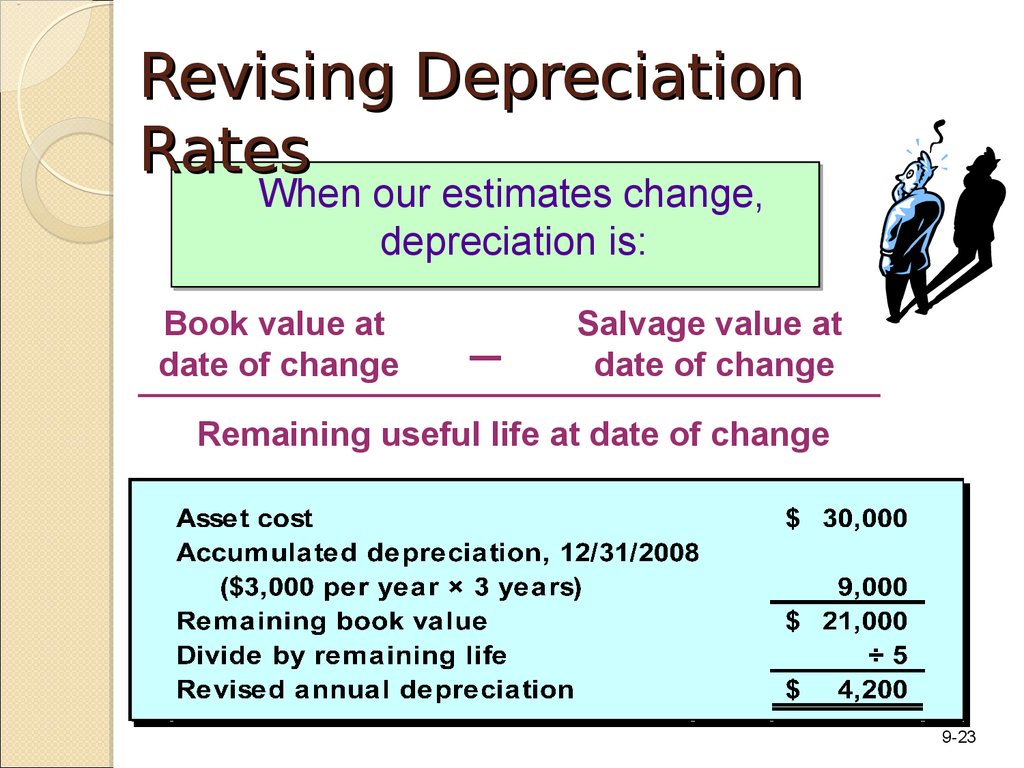

23. Revising Depreciation Rates

When our estimates change,depreciation is:

Book value at

date of change

–

Salvage value at

date of change

Remaining useful life at date of change

9-23

24. Impairment of Plant Assets

IfIf thethe cost

cost of

of an

an asset

asset

cannot

cannot be

be recovered

recovered

through

through future

future use

use or

or

sale,

sale, the

the asset

asset should

should

be

be written

written down

down to

to its

its

net

net realizable

realizable value.

value.

9-24

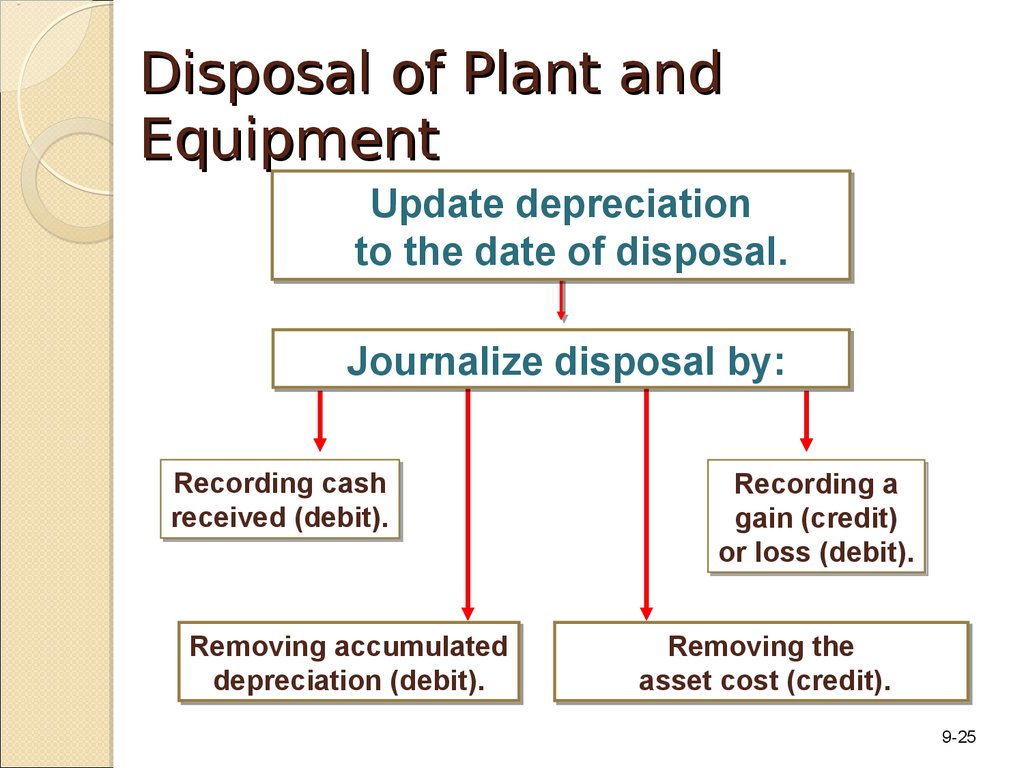

25. Disposal of Plant and Equipment

Update depreciationto the date of disposal.

Journalize disposal by:

Recording

Recording cash

cash

received

received (debit).

(debit).

Removing

Removing accumulated

accumulated

depreciation

depreciation (debit).

(debit).

Recording

Recording aa

gain

gain (credit)

(credit)

or

or loss

loss (debit).

(debit).

Removing

Removing the

the

asset

asset cost

cost (credit).

(credit).

9-25

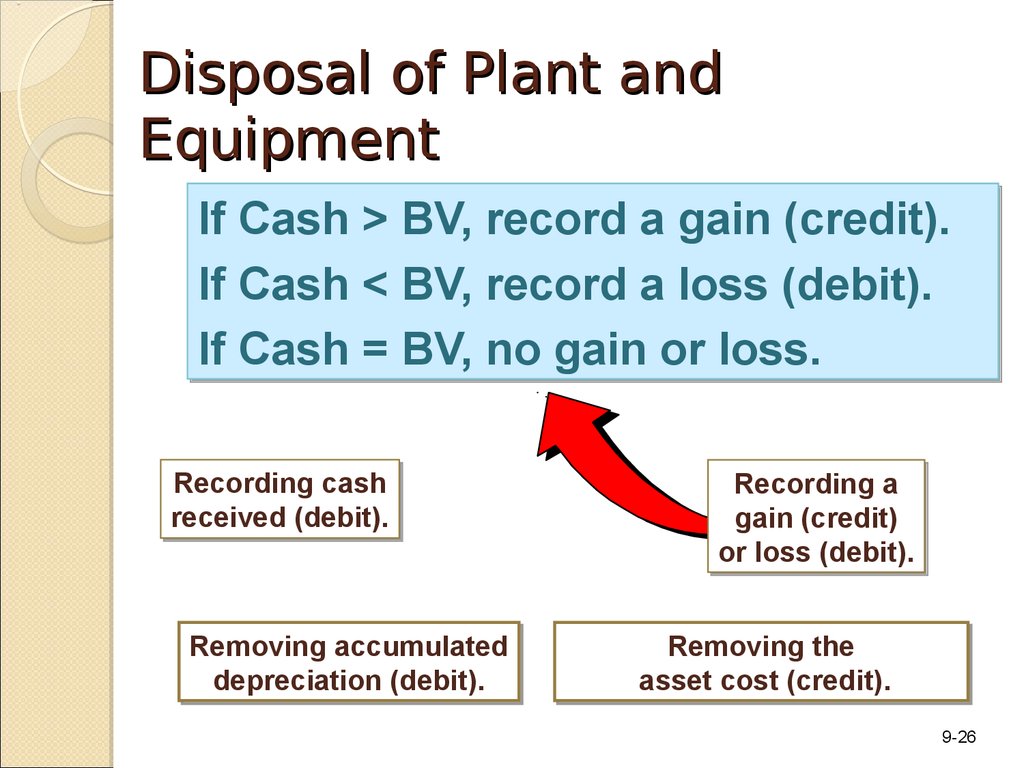

26. Disposal of Plant and Equipment

If Cash > BV, record a gain (credit).If Cash < BV, record a loss (debit).

If Cash = BV, no gain or loss.

Recording

Recording cash

cash

received

received (debit).

(debit).

Removing

Removing accumulated

accumulated

depreciation

depreciation (debit).

(debit).

Recording

Recording aa

gain

gain (credit)

(credit)

or

or loss

loss (debit).

(debit).

Removing

Removing the

the

asset

asset cost

cost (credit).

(credit).

9-26

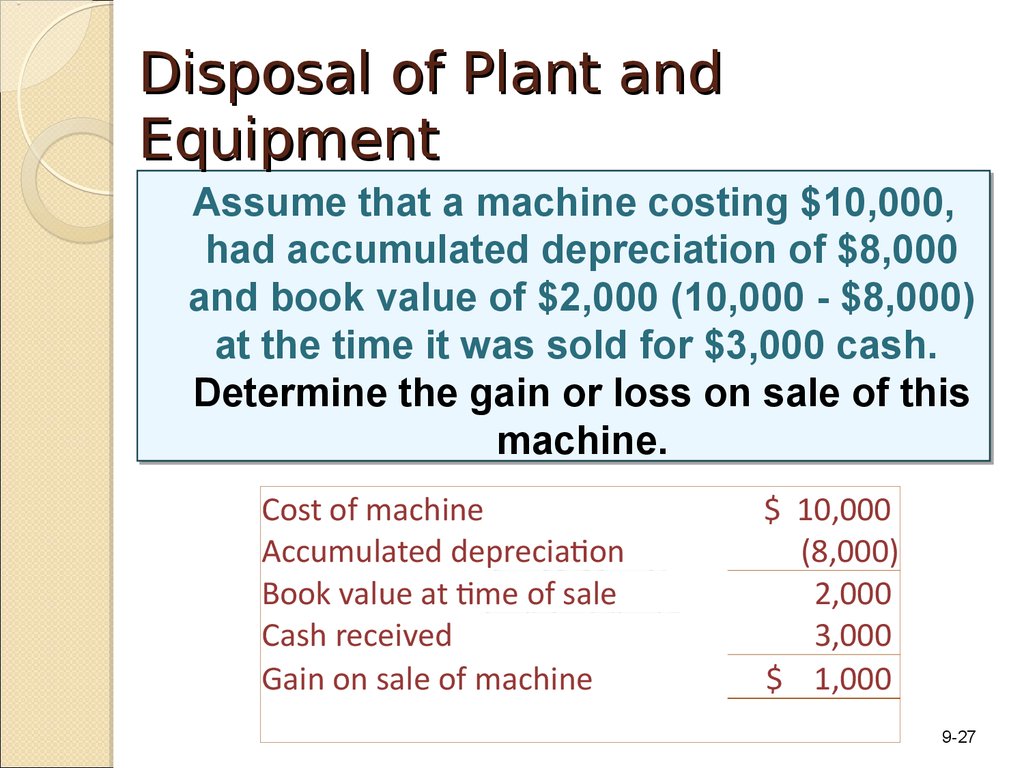

27. Disposal of Plant and Equipment

Assume that a machine costing $10,000,had accumulated depreciation of $8,000

and book value of $2,000 (10,000 - $8,000)

at the time it was sold for $3,000 cash.

Determine the gain or loss on sale of this

machine.

Cost of machine

Accumulated depreciation

Book value at time of sale

Cash received

Gain on sale of machine

$ 10,000

(8,000)

2,000

3,000

$ 1,000

9-27

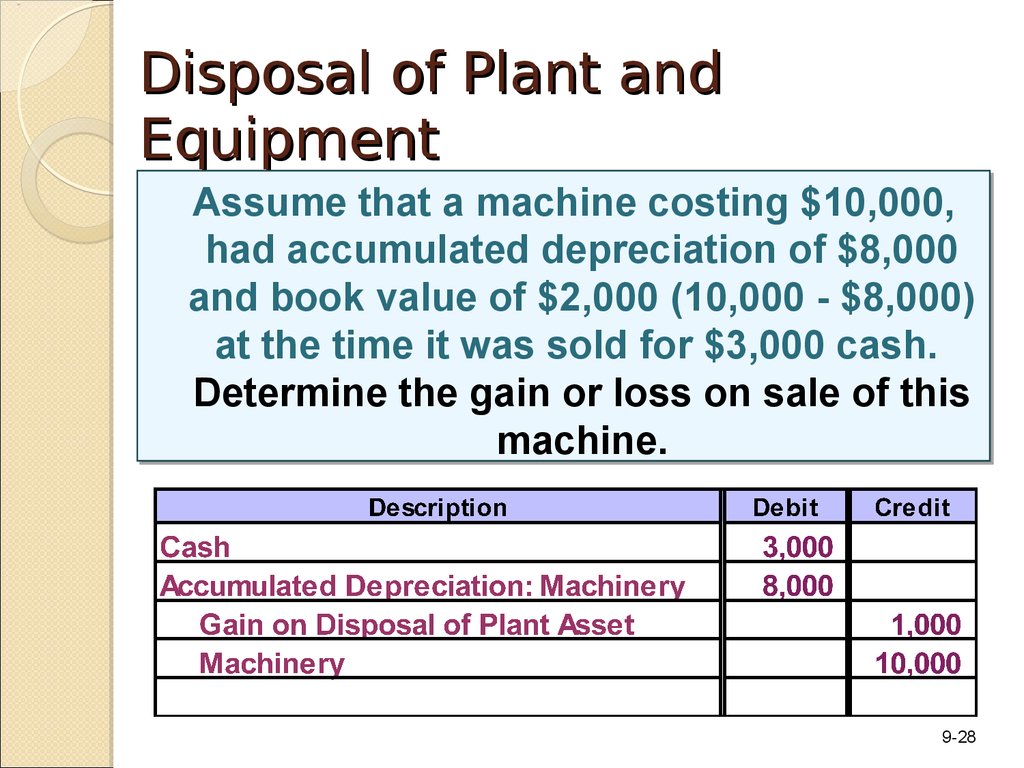

28. Disposal of Plant and Equipment

Assume that a machine costing $10,000,had accumulated depreciation of $8,000

and book value of $2,000 (10,000 - $8,000)

at the time it was sold for $3,000 cash.

Determine the gain or loss on sale of this

machine.

9-28

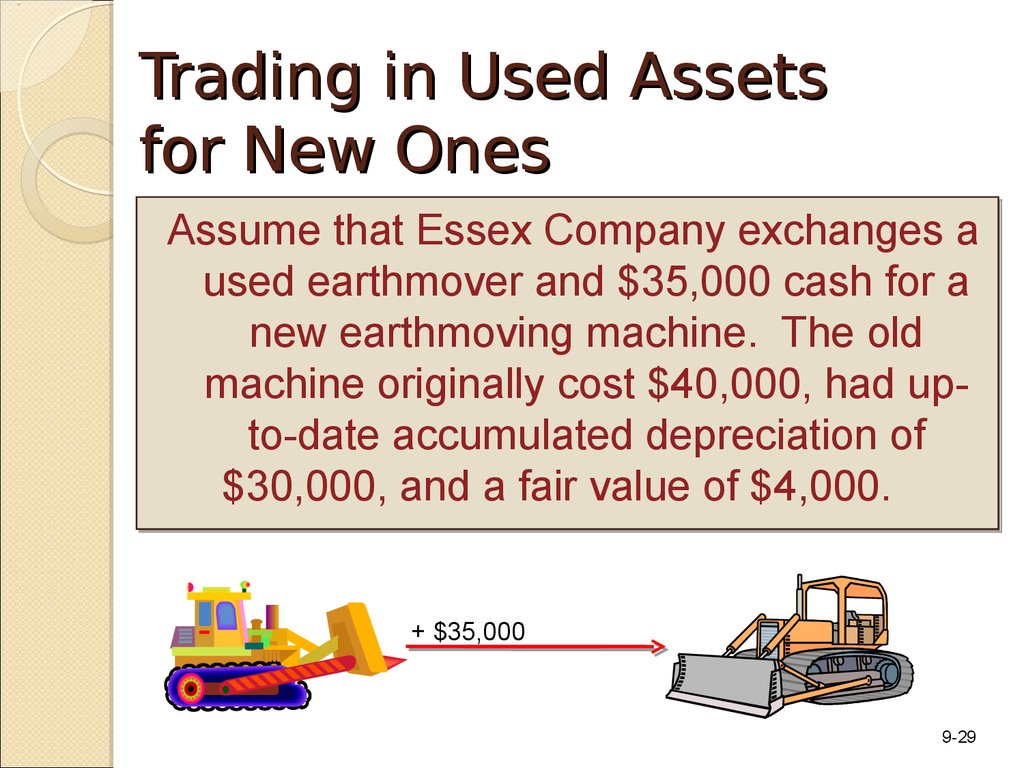

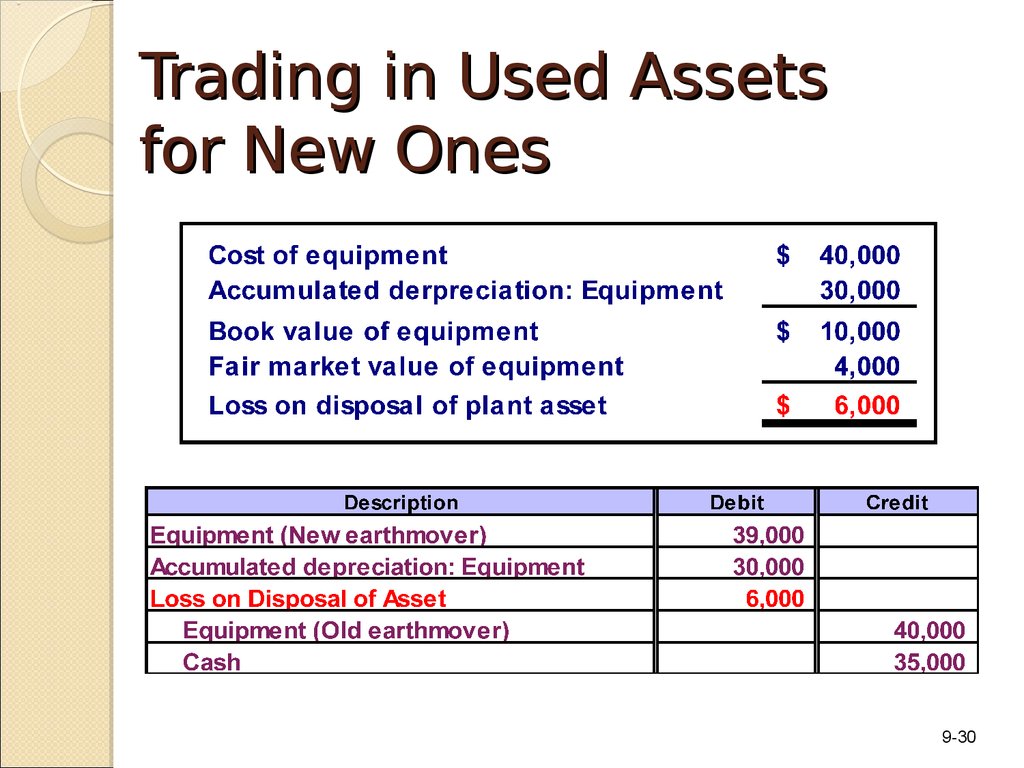

29. Trading in Used Assets for New Ones

Assume that Essex Company exchanges aused earthmover and $35,000 cash for a

new earthmoving machine. The old

machine originally cost $40,000, had upto-date accumulated depreciation of

$30,000, and a fair value of $4,000.

+ $35,000

9-29

30. Trading in Used Assets for New Ones

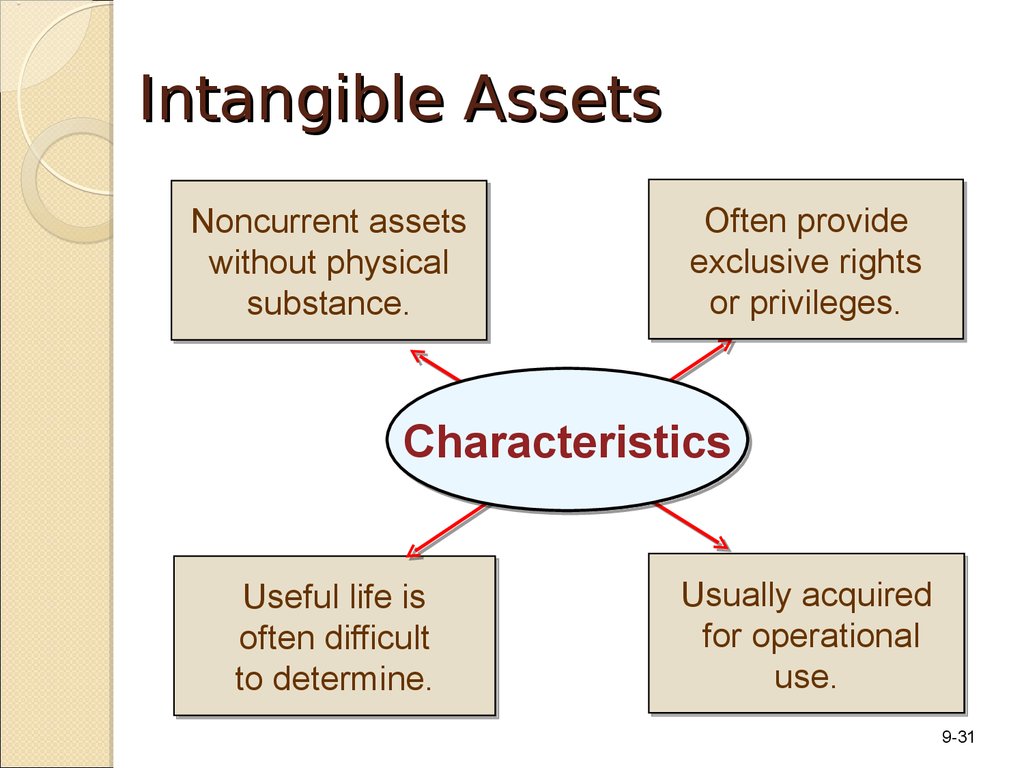

9-3031. Intangible Assets

Noncurrent assetswithout physical

substance.

Often provide

exclusive rights

or privileges.

Characteristics

Useful life is

often difficult

to determine.

Usually acquired

for operational

use.

9-31

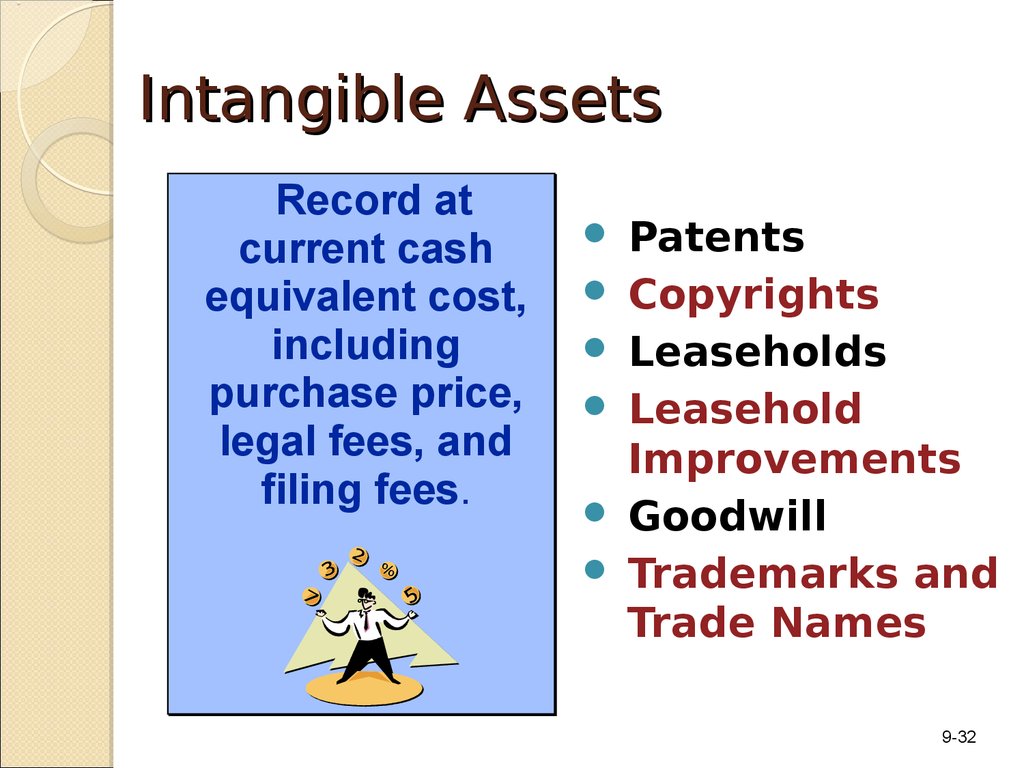

32. Intangible Assets

Record atcurrent cash

equivalent cost,

including

purchase price,

legal fees, and

filing fees.

Patents

Copyrights

Leaseholds

Leasehold

Improvements

Goodwill

Trademarks and

Trade Names

9-32

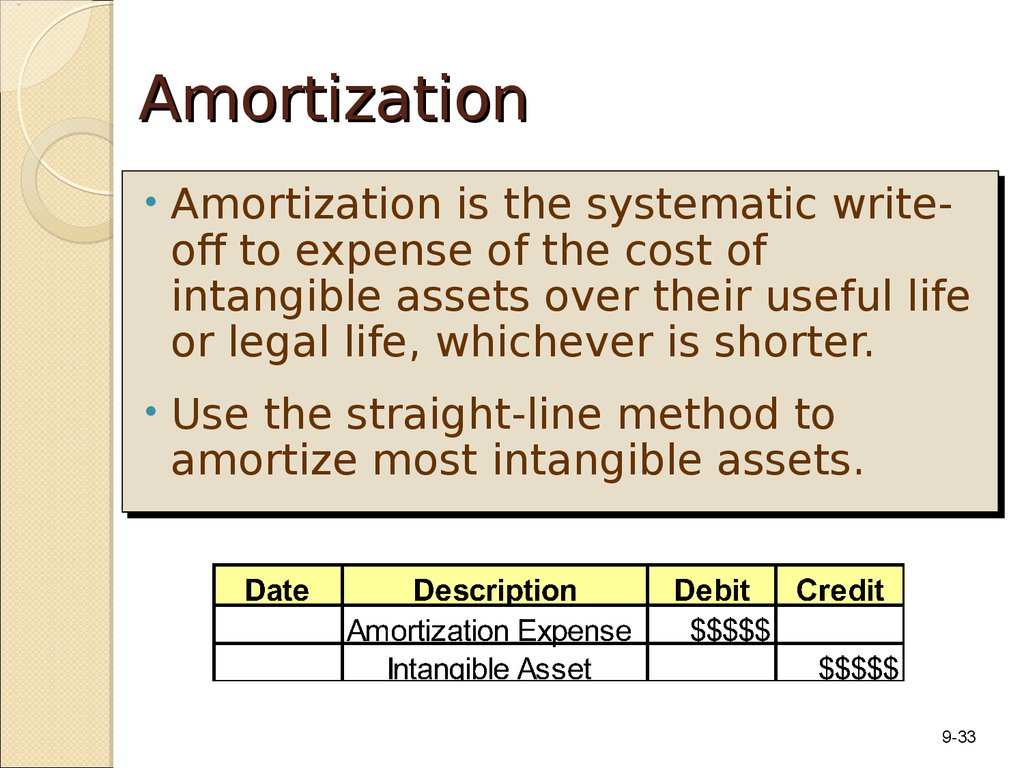

33. Amortization

•• AmortizationAmortization is

is the

the systematic

systematic writewrite-

off

off to

to expense

expense of

of the

the cost

cost of

of

intangible

intangible assets

assets over

over their

their useful

useful life

life

or

or legal

legal life,

life, whichever

whichever is

is shorter.

shorter.

•• Use

Use the

the straight-line

straight-line method

method to

to

amortize

amortize most

most intangible

intangible assets.

assets.

9-33

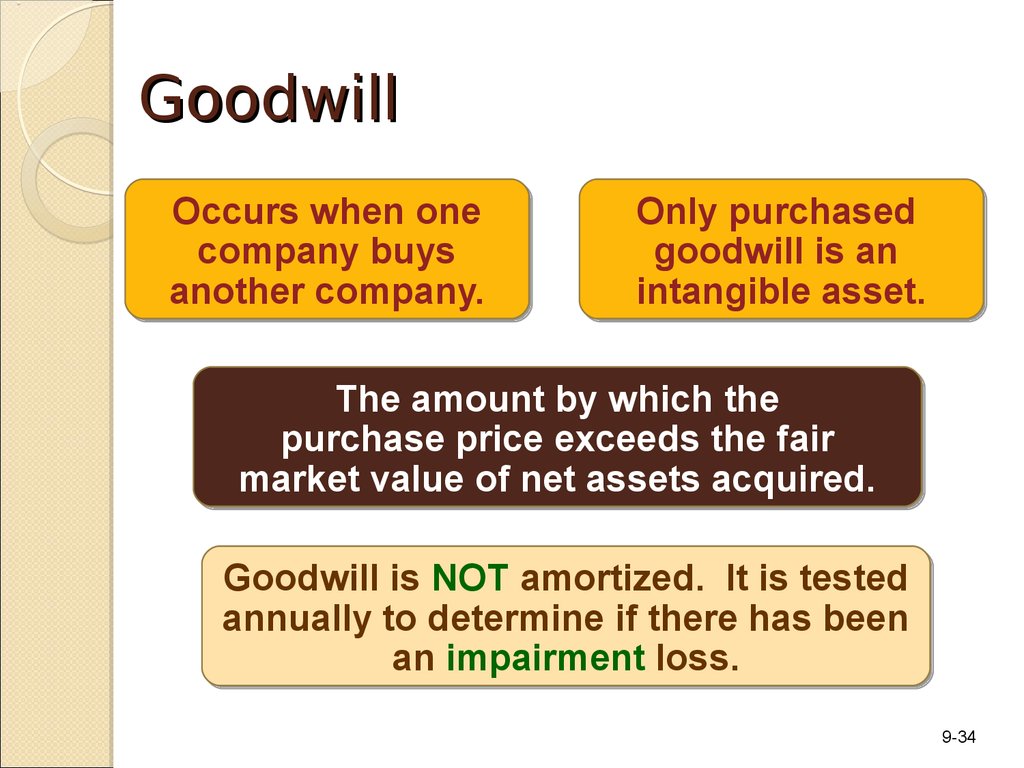

34. Goodwill

Occurs when onecompany buys

another company.

Only purchased

goodwill is an

intangible asset.

The amount by which the

purchase price exceeds the fair

market value of net assets acquired.

Goodwill is NOT amortized. It is tested

annually to determine if there has been

an impairment loss.

9-34

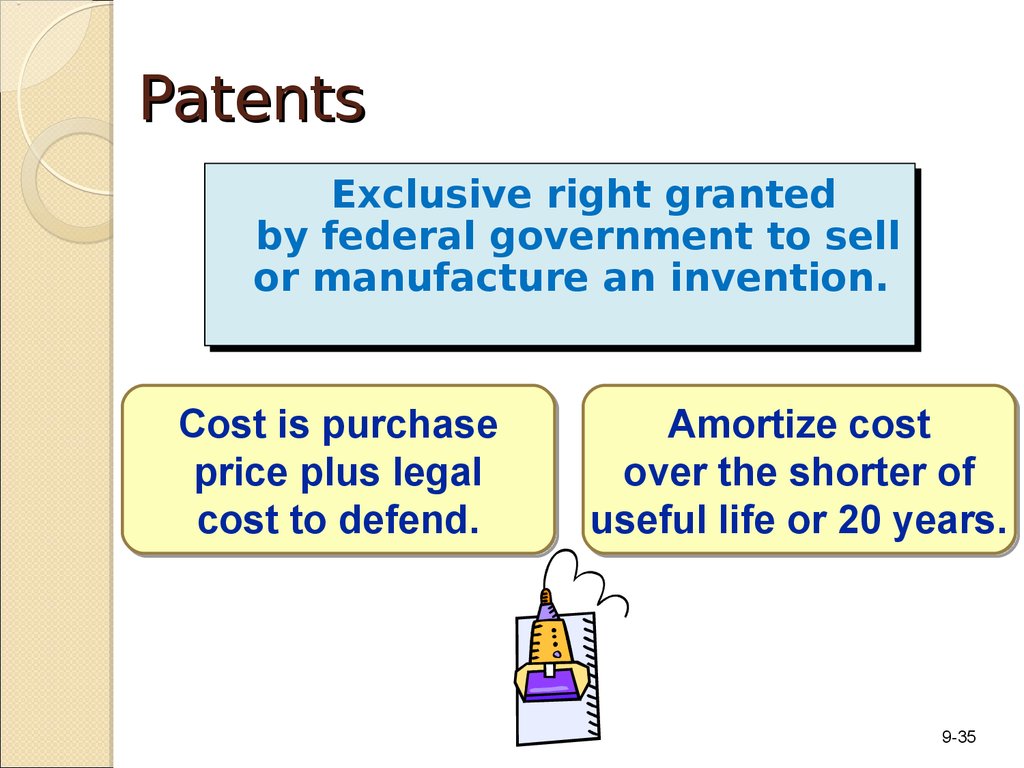

35. Patents

ExclusiveExclusive right

right granted

granted

by

by federal

federal government

government to

to sell

sell

or

or manufacture

manufacture an

an invention.

invention.

Cost is purchase

price plus legal

cost to defend.

Amortize cost

over the shorter of

useful life or 20 years.

9-35

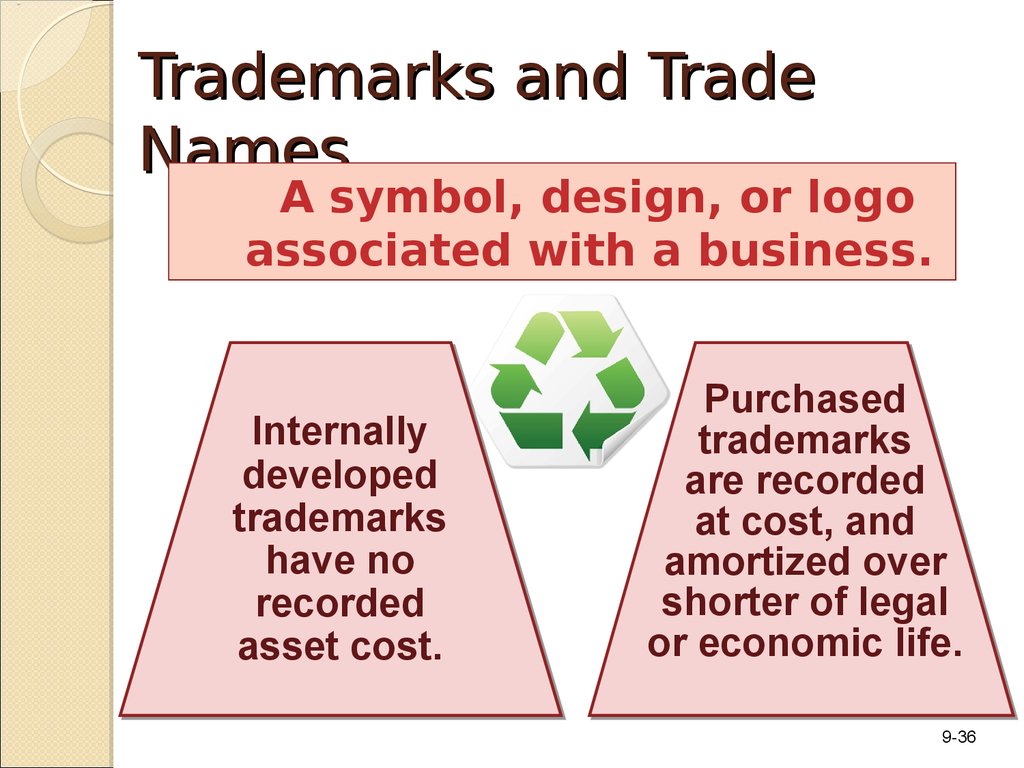

36. Trademarks and Trade Names

A symbol, design, or logoassociated with a business.

Internally

developed

trademarks

have no

recorded

asset cost.

Purchased

trademarks

are recorded

at cost, and

amortized over

shorter of legal

or economic life.

9-36

37. Franchises

Legally protected right to sell products orprovide services purchased by franchisee

from franchisor.

Purchase price is intangible

asset which is amortized over

the shorter of the protected

right or useful life.

9-37

38. Copyrights

Exclusive right granted by thefederal government to protect

artistic or intellectual

properties.

Legal life is

life of creator

plus 70 years.

Amortize cost

over period

benefited.

9-38

39. Research and Development Costs

All expenditures classified as researchand development should be charged

to expense when incurred.

All

All of

of these

these R&D

R&D costs

costs

will

will really

really reduce

reduce our

our

net

net income

income this

this year!

year!

9-39

40. Natural Resources

Total cost,including

exploration and

development,

is charged to

depletion expense

over periods

benefited.

Extracted from

the natural

environment

and reported

at cost less

accumulated

depletion.

Examples: oil, coal, gold

9-40

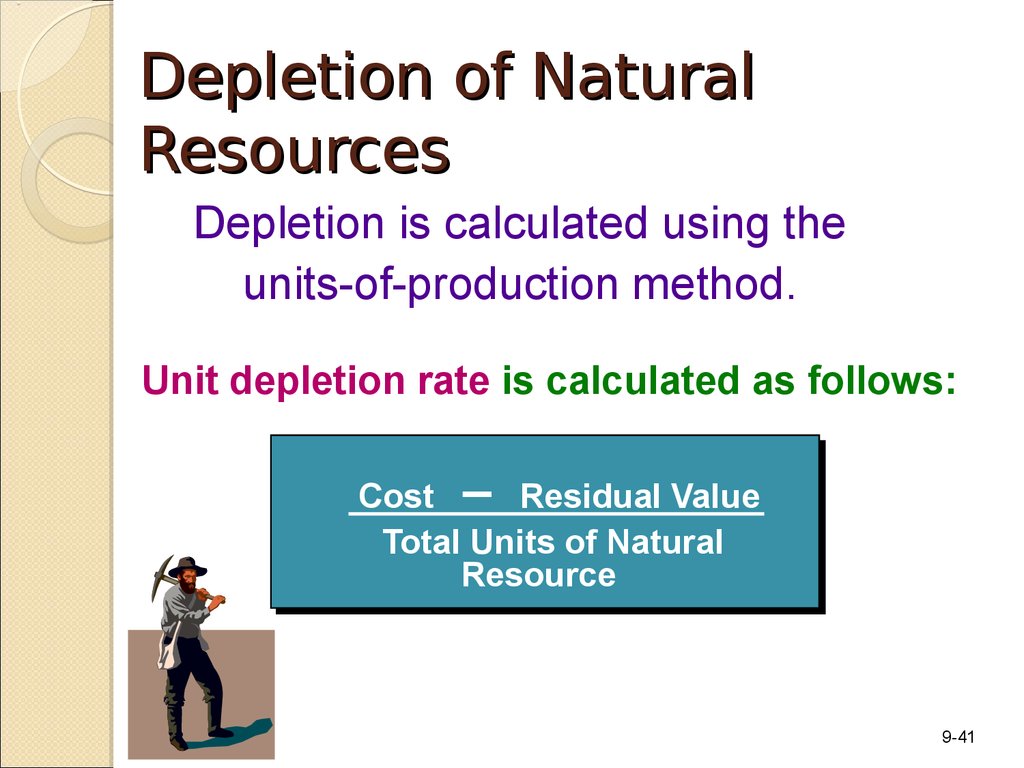

41. Depletion of Natural Resources

Depletion is calculated using theunits-of-production method.

Unit depletion rate is calculated as follows:

Cost – Residual Value

Total Units of Natural

Resource

9-41

42. Plant Transactions and the Statement of Cash Flows

Cash payments for plant assets represent acash outflow for investing activities on the

statement of cash flows. A disposal of a plant

asset for cash results in a cash inflow to the

company.

Depreciation is a

non-cash charge to

income and has no

effect on cash flows.

9-42

finance

finance industry

industry