Similar presentations:

Principles of corporate. Finance

1.

Principles ofCorporate

Finance

Chapter 10

A Project Is Not a Black Box

Seventh Edition

Richard A. Brealey

Stewart C. Myers

Slides by

Matthew Will

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

2. Topics Covered

10- 2Topics Covered

Sensitivity Analysis

Break Even Analysis

Monte Carlo Simulation

Decision Trees

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

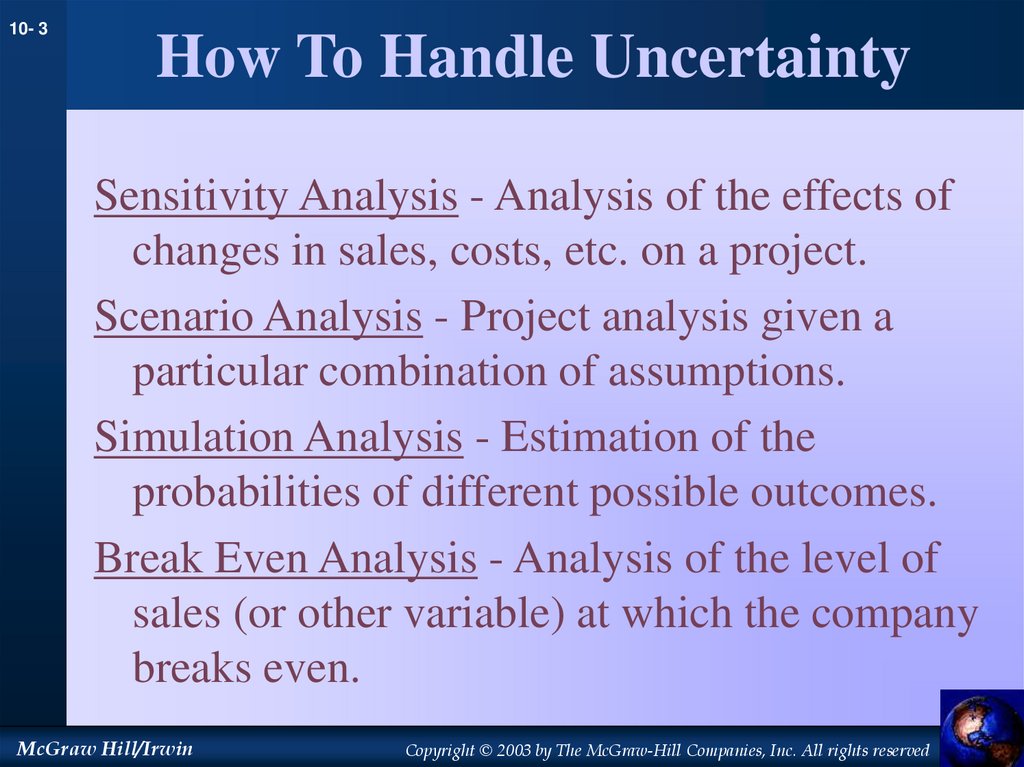

3. How To Handle Uncertainty

10- 3How To Handle Uncertainty

Sensitivity Analysis - Analysis of the effects of

changes in sales, costs, etc. on a project.

Scenario Analysis - Project analysis given a

particular combination of assumptions.

Simulation Analysis - Estimation of the

probabilities of different possible outcomes.

Break Even Analysis - Analysis of the level of

sales (or other variable) at which the company

breaks even.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

4. Sensitivity Analysis

10- 4Sensitivity Analysis

Example

Given the expected cash flow

forecasts for Otobai Company’s

Motor Scooter project, listed on

the next slide, determine the

NPV of the project given

changes in the cash flow

components using a 10% cost of

capital. Assume that all

variables remain constant, except

the one you are changing.

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

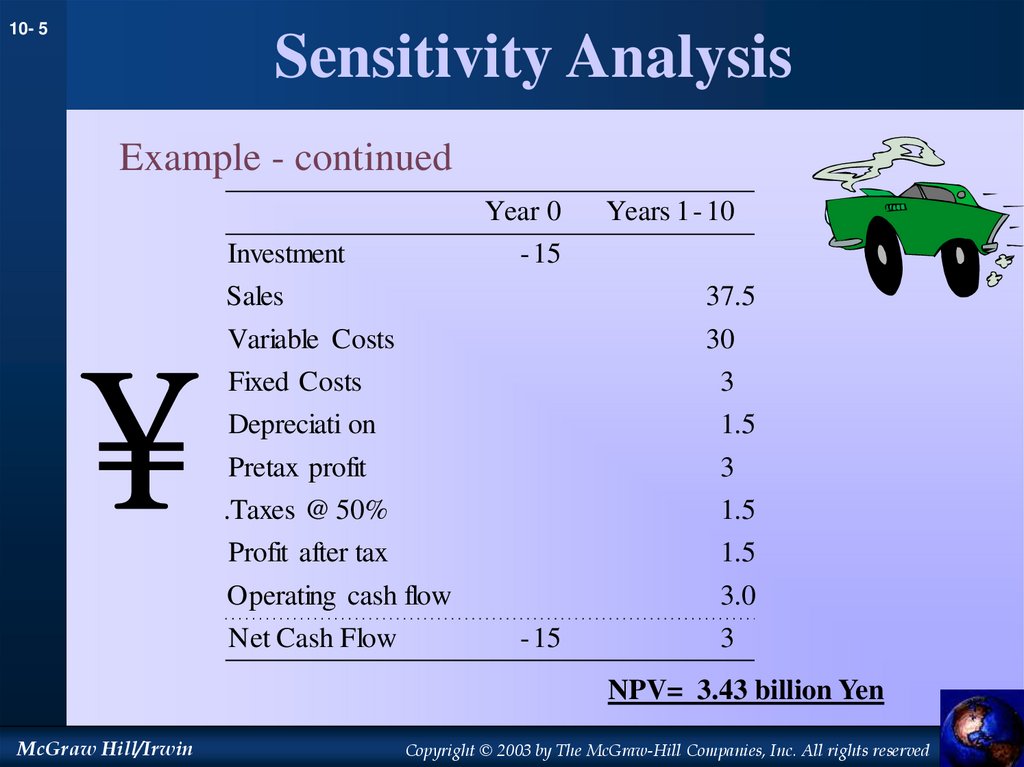

5. Sensitivity Analysis

10- 5Sensitivity Analysis

Example - continued

Investment

Sales

Variable Costs

Fixed Costs

Depreciati on

Pretax profit

.Taxes @ 50%

Profit after tax

Operating cash flow

Net Cash Flow

Year 0

- 15

- 15

Years 1 - 10

37.5

30

3

1.5

3

1.5

1.5

3.0

3

NPV= 3.43 billion Yen

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

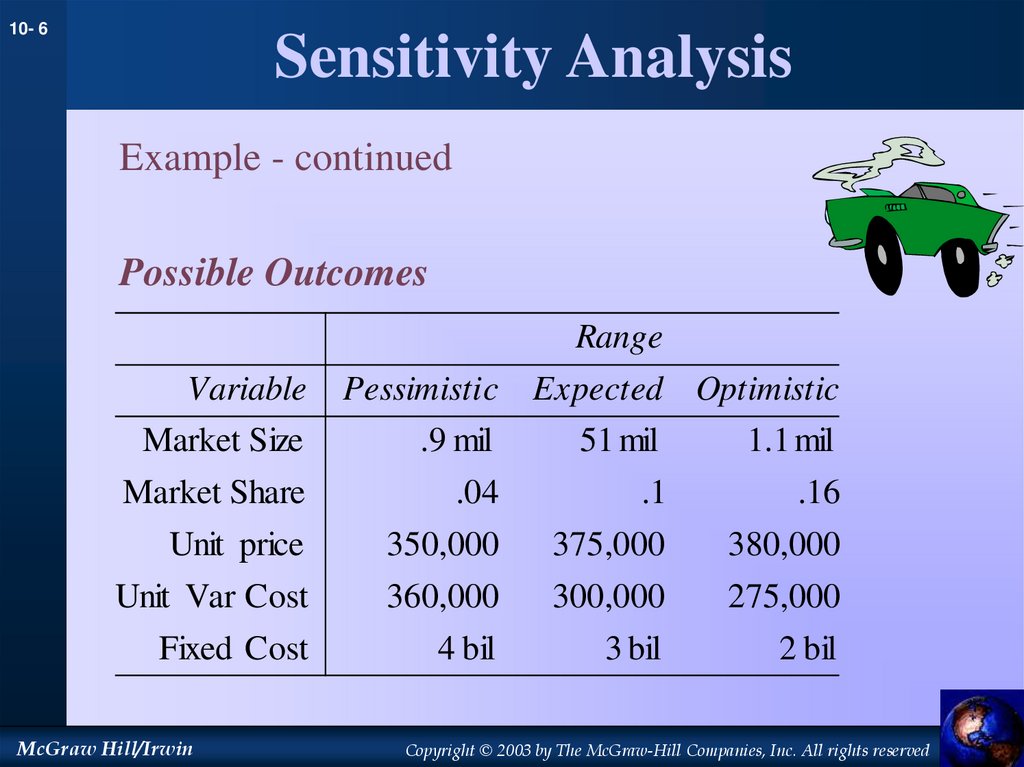

6. Sensitivity Analysis

10- 6Sensitivity Analysis

Example - continued

Possible Outcomes

Range

Variable

Pessimistic Expected Optimistic

Market Size

Market Share

.9 mil

.04

51 mil

.1

1.1 mil

.16

Unit price

350,000

375,000

380,000

Unit Var Cost

Fixed Cost

360,000

4 bil

300,000

3 bil

275,000

2 bil

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

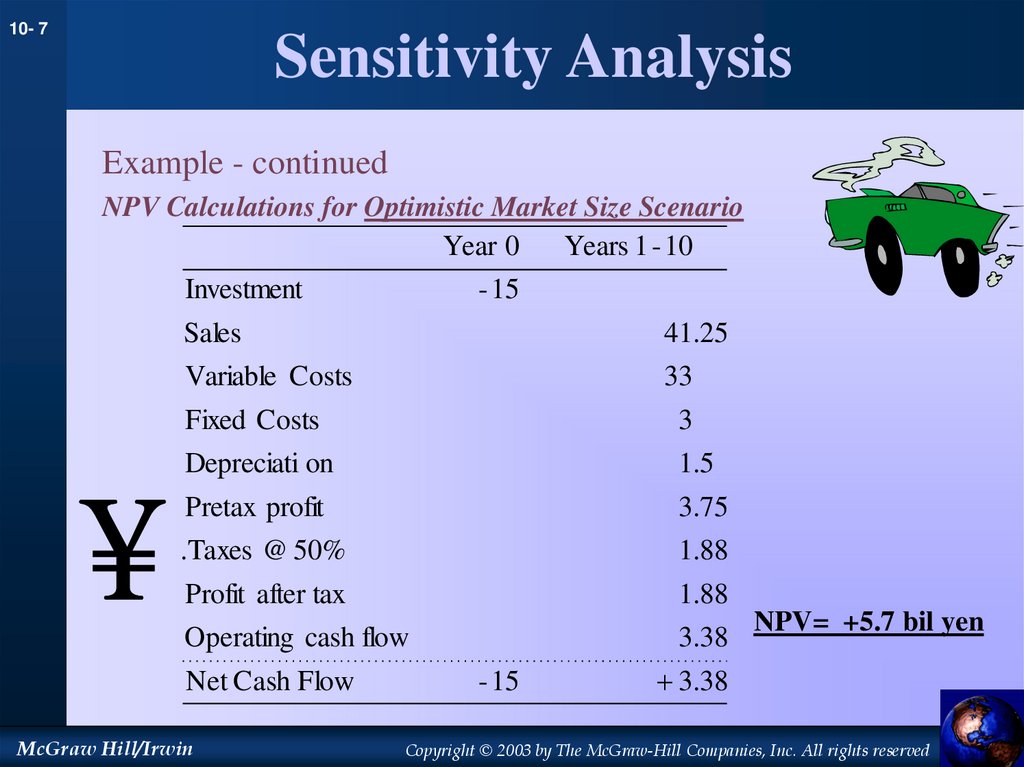

7. Sensitivity Analysis

10- 7Sensitivity Analysis

Example - continued

NPV Calculations for Optimistic Market Size Scenario

Year 0

Years 1 - 10

Investment

Sales

Variable Costs

Fixed Costs

Depreciati on

Pretax profit

.Taxes @ 50%

Profit after tax

Operating cash flow

Net Cash Flow

McGraw Hill/Irwin

- 15

- 15

41.25

33

3

1.5

3.75

1.88

1.88

NPV= +5.7 bil yen

3.38

3.38

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

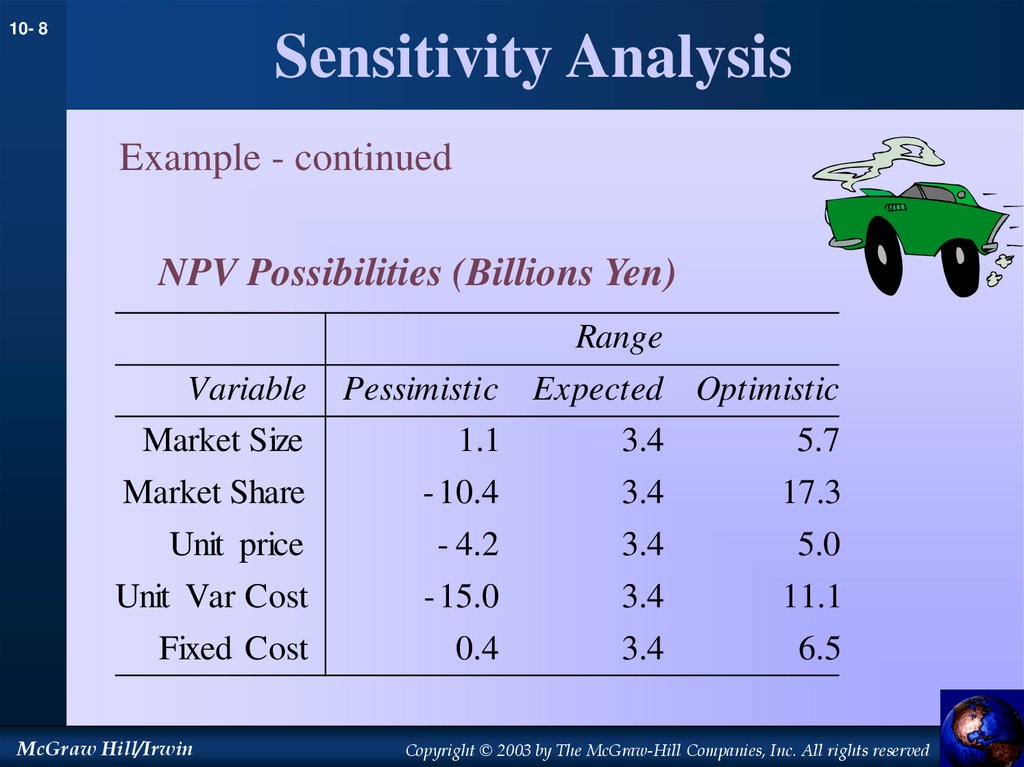

8. Sensitivity Analysis

10- 8Sensitivity Analysis

Example - continued

NPV Possibilities (Billions Yen)

Range

Variable

Pessimistic Expected Optimistic

Market Size

Market Share

1.1

- 10.4

3.4

3.4

5.7

17.3

Unit price

- 4.2

3.4

5.0

Unit Var Cost

Fixed Cost

- 15.0

0.4

3.4

3.4

11.1

6.5

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

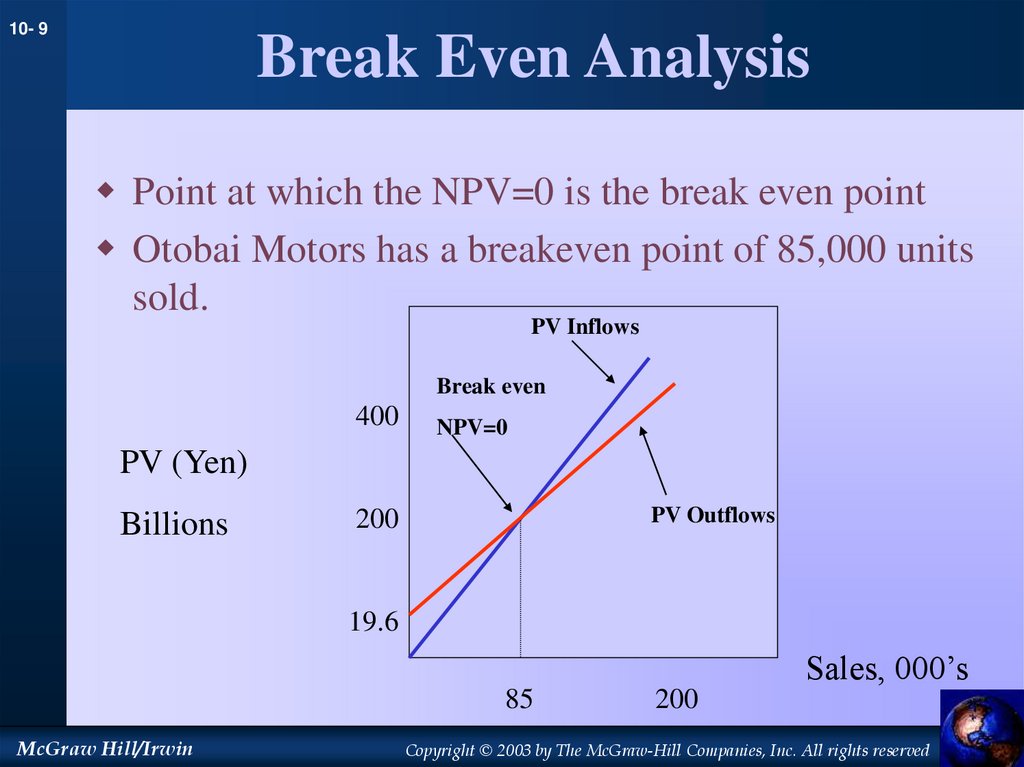

9. Break Even Analysis

10- 9Break Even Analysis

Point at which the NPV=0 is the break even point

Otobai Motors has a breakeven point of 85,000 units

sold.

PV Inflows

Break even

400

NPV=0

PV (Yen)

Billions

PV Outflows

200

19.6

Sales, 000’s

85

McGraw Hill/Irwin

200

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

10. Monte Carlo Simulation

10- 10Monte Carlo Simulation

Modeling Process

Step 1: Modeling the Project

Step 2: Specifying Probabilities

Step 3: Simulate the Cash Flows

McGraw Hill/Irwin

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

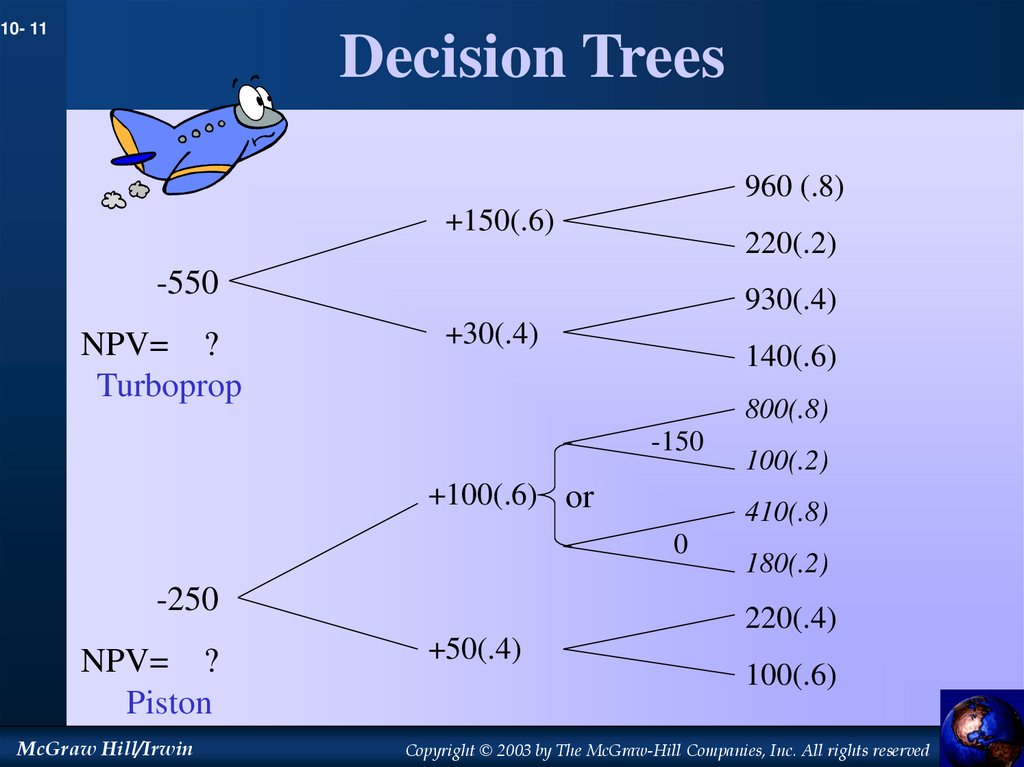

11. Decision Trees

10- 11Decision Trees

960 (.8)

+150(.6)

220(.2)

-550

NPV= ?

Turboprop

930(.4)

+30(.4)

140(.6)

800(.8)

-150

+100(.6) or

410(.8)

0

-250

NPV= ?

Piston

McGraw Hill/Irwin

100(.2)

180(.2)

220(.4)

+50(.4)

100(.6)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

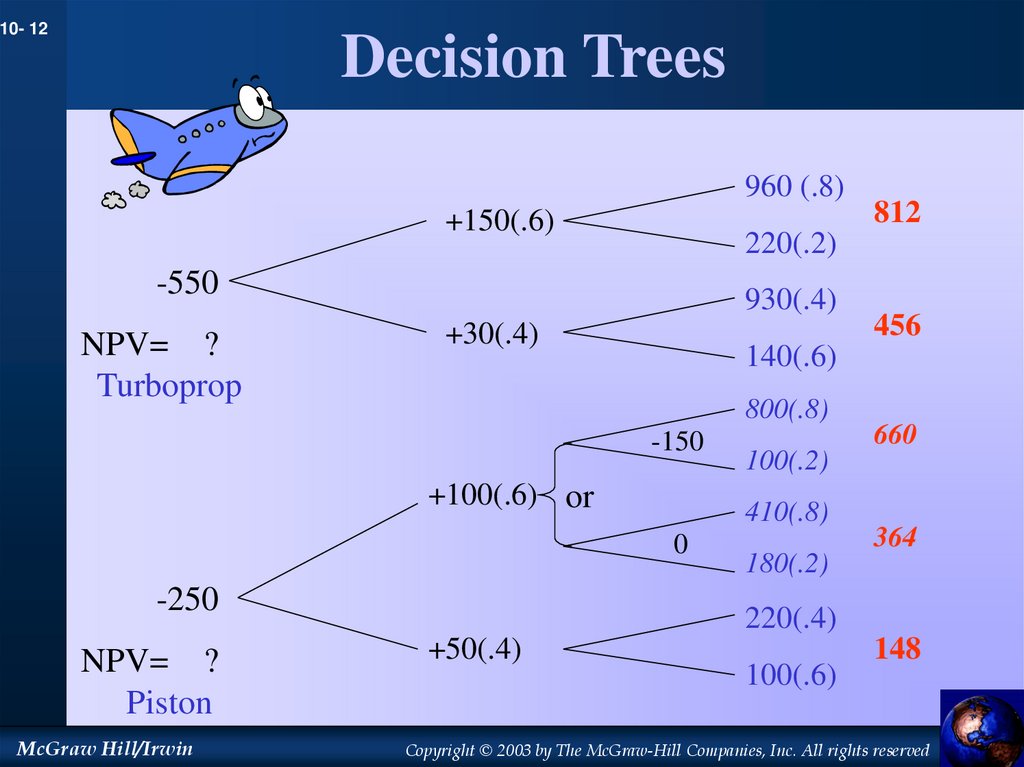

12. Decision Trees

10- 12Decision Trees

960 (.8)

+150(.6)

220(.2)

-550

NPV= ?

Turboprop

930(.4)

+30(.4)

-150

+100(.6) or

McGraw Hill/Irwin

100(.2)

410(.8)

0

NPV= ?

Piston

456

140(.6)

800(.8)

-250

812

180(.2)

660

364

220(.4)

+50(.4)

100(.6)

148

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

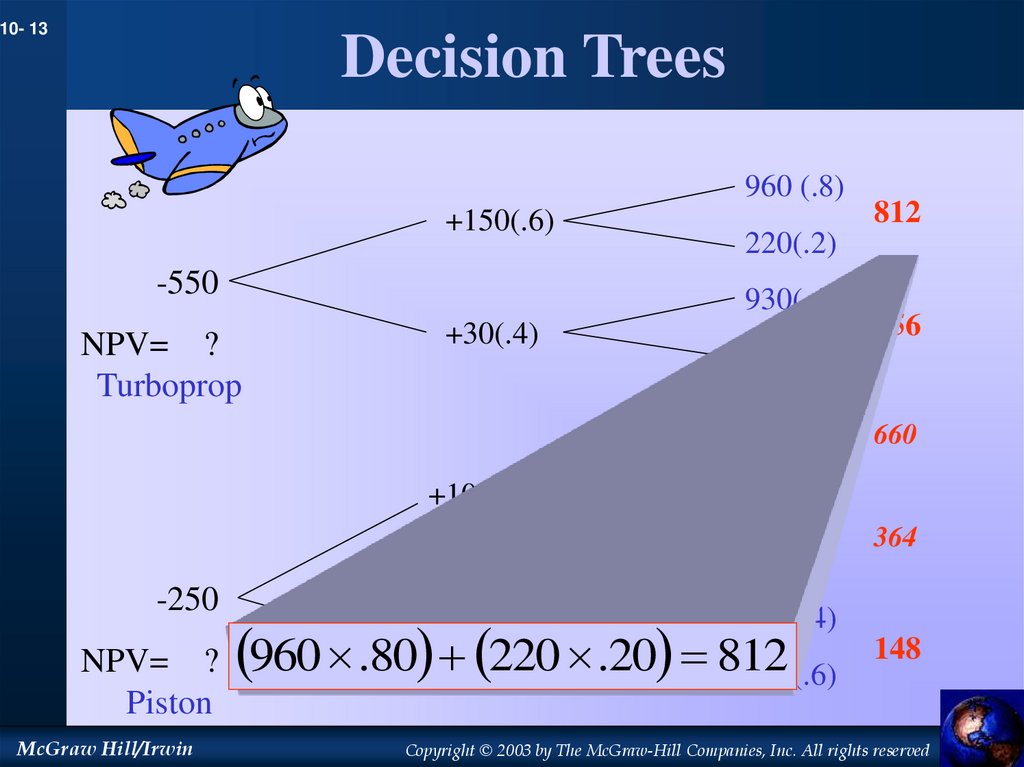

13. Decision Trees

10- 13Decision Trees

960 (.8)

+150(.6)

220(.2)

-550

930(.4)

NPV= ?

Turboprop

+30(.4)

800(.8)

+100(.6) or

McGraw Hill/Irwin

100(.2)

410(.8)

0

NPV= ?

Piston

456

140(.6)

-150

-250

812

180(.2)

660

364

220(.4)

148

960 .80 +50(.4)

220 .20 812

100(.6)

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

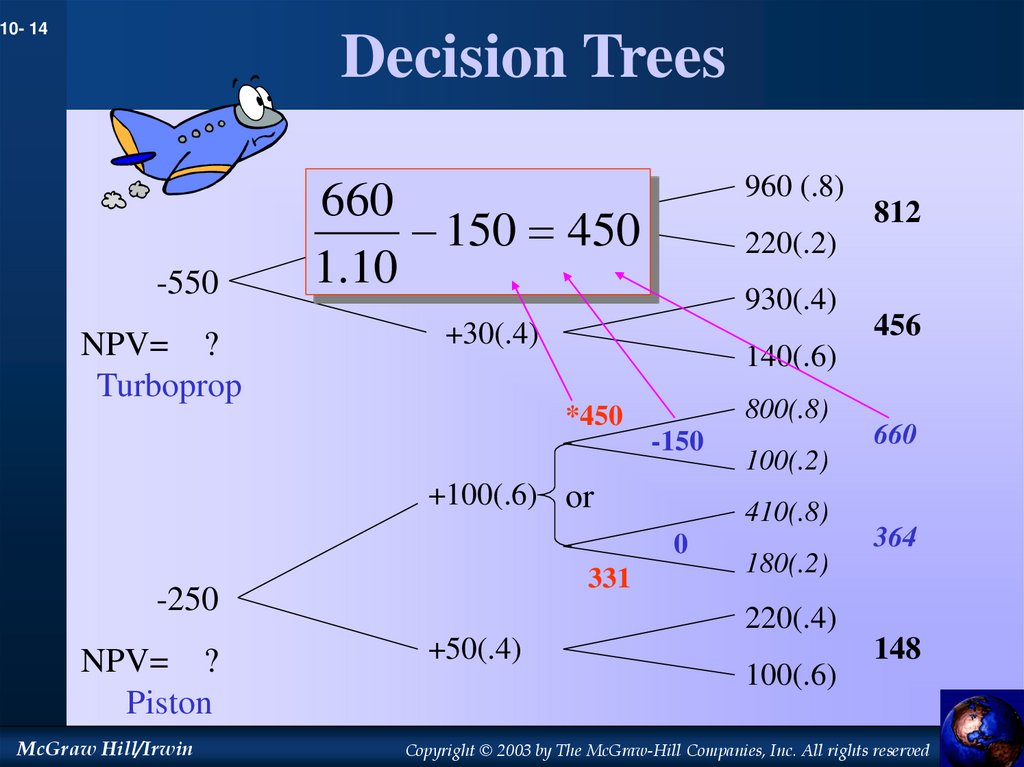

14. Decision Trees

10- 14Decision Trees

-550

NPV= ?

Turboprop

960 (.8)

660 +150(.6)

150 450

1.10

220(.2)

930(.4)

+30(.4)

800(.8)

-150

+100(.6) or

331

McGraw Hill/Irwin

100(.2)

410(.8)

0

NPV= ?

Piston

456

140(.6)

*450

-250

812

180(.2)

660

364

220(.4)

+50(.4)

100(.6)

148

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

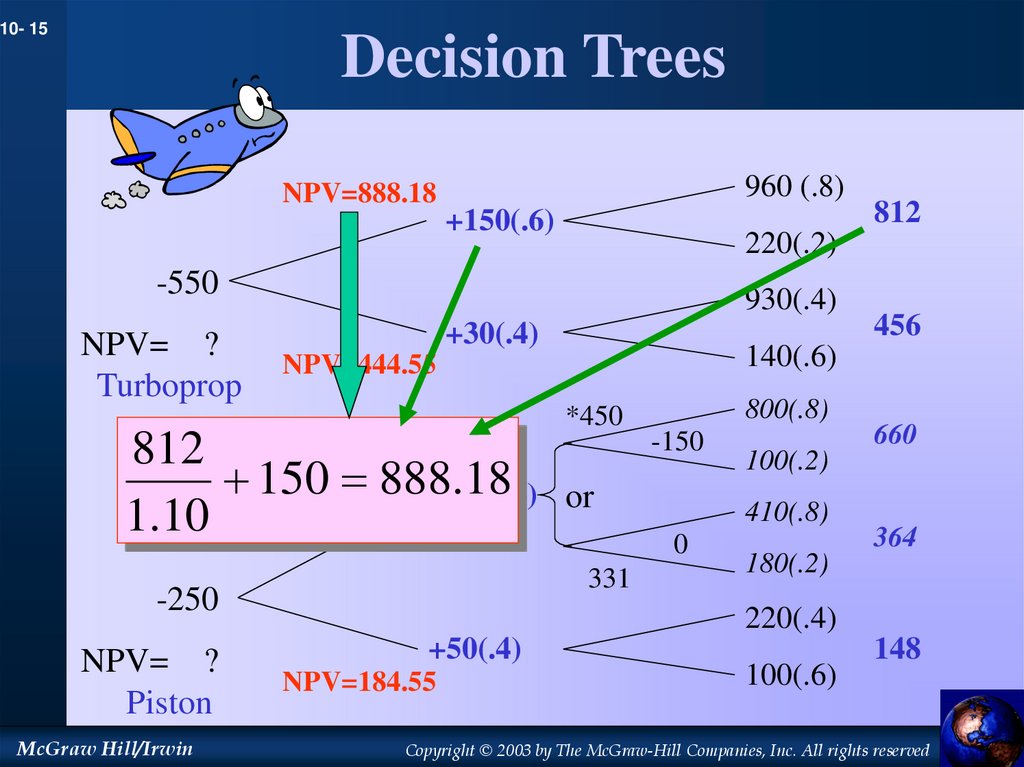

15. Decision Trees

10- 15Decision Trees

960 (.8)

NPV=888.18

+150(.6)

220(.2)

-550

NPV= ?

Turboprop

930(.4)

+30(.4)

*450

812 NPV=550.00

150 888+100(.6)

.18 or

1.10

NPV= ?

Piston

McGraw Hill/Irwin

456

140(.6)

NPV=444.55

331

-250

812

800(.8)

-150

100(.2)

410(.8)

0

180(.2)

660

364

220(.4)

+50(.4)

NPV=184.55

100(.6)

148

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

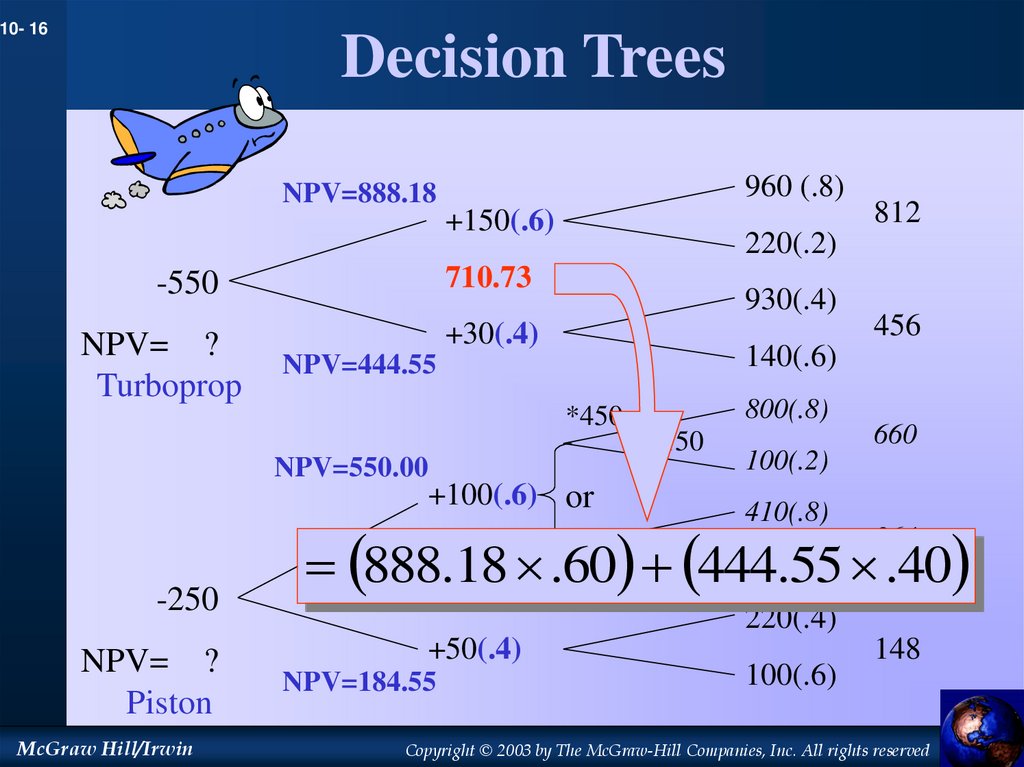

16. Decision Trees

10- 16Decision Trees

960 (.8)

NPV=888.18

+150(.6)

NPV= ?

Turboprop

220(.2)

710.73

-550

930(.4)

+30(.4)

NPV=550.00

800(.8)

-150

+100(.6) or

100(.2)

410(.8)

McGraw Hill/Irwin

660

180(.2)

888403.82

.18 .60

331 444.55 .40

0

NPV= ?

Piston

456

140(.6)

NPV=444.55

*450

-250

812

364

220(.4)

+50(.4)

NPV=184.55

100(.6)

148

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

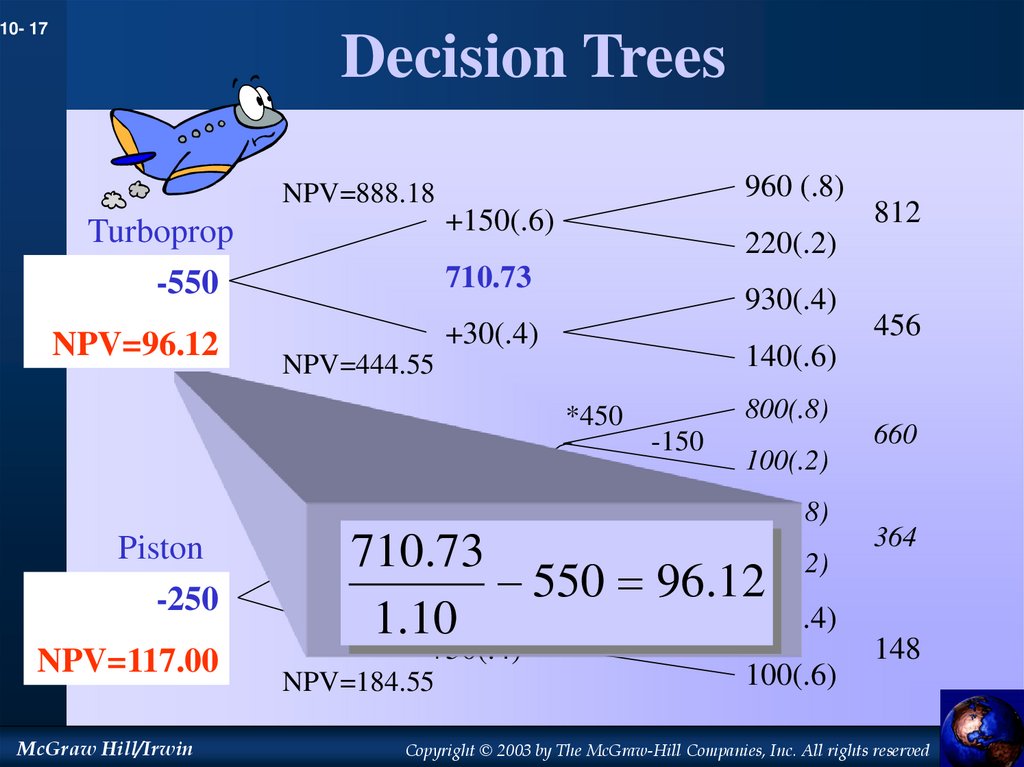

17. Decision Trees

10- 17Decision Trees

960 (.8)

NPV=888.18

Turboprop

-550

+150(.6)

NPV=96.12

+30(.4)

220(.2)

710.73

930(.4)

NPV=550.00

+100(.6) or

NPV=117.00

McGraw Hill/Irwin

800(.8)

-150

100(.2)

410(.8)

0

710.73

180(.2)

331

550 96.12

403.82

220(.4)

1.10

+50(.4)

NPV=184.55

456

140(.6)

NPV=444.55

*450

Piston

-250

812

100(.6)

660

364

148

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

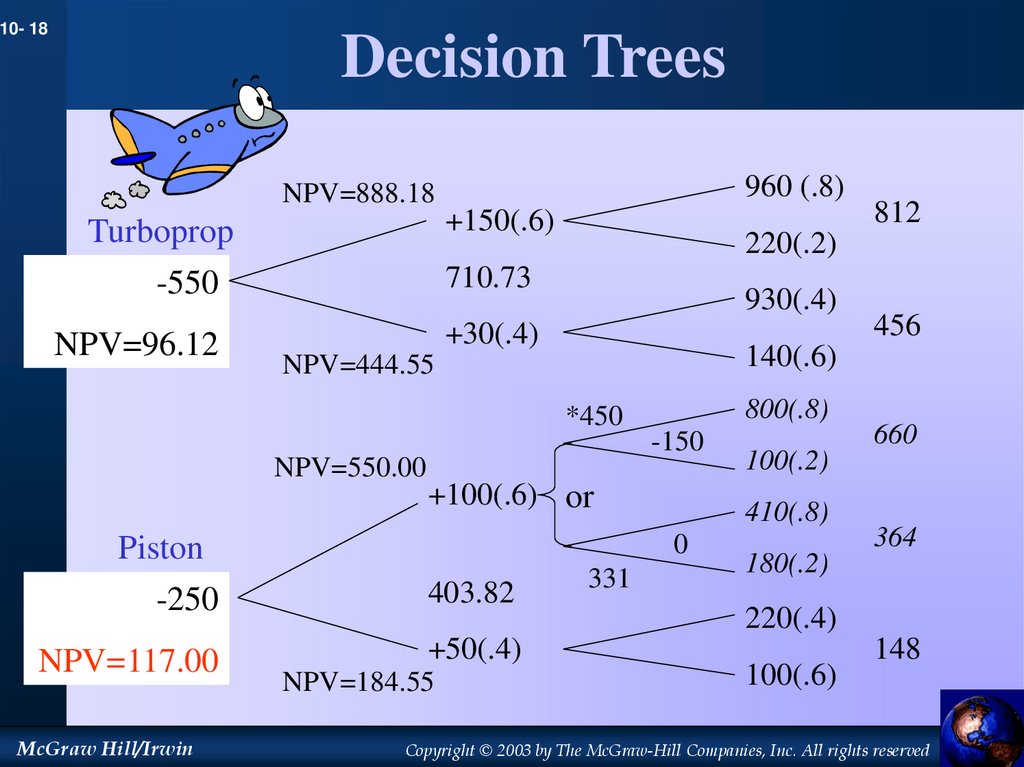

18. Decision Trees

10- 18Decision Trees

960 (.8)

NPV=888.18

Turboprop

-550

+150(.6)

NPV=96.12

+30(.4)

220(.2)

710.73

930(.4)

*450

NPV=550.00

800(.8)

-150

+100(.6) or

NPV=117.00

+50(.4)

McGraw Hill/Irwin

NPV=184.55

331

100(.2)

410(.8)

0

403.82

456

140(.6)

NPV=444.55

Piston

-250

812

180(.2)

660

364

220(.4)

100(.6)

148

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

finance

finance