Similar presentations:

Measures of risk and uncertainty. Portfolio theory

1. Measures of Risk and Uncertainty

Portfolio Theory2. Course Outline

1. Quantitative methods in decision making: goals, potentials and limits(1C)

2. Data collection and presentation (1C)

3. Use of descriptive statistics for describing the features of the data

(2C)

4. The role of financial mathematics in business decisions mathematical methods (2C)

5. Valuation of financial instruments and business decisions (2C)

Preparation for the inter-mediate assignment (1C)

6. Measures of risk and uncertainty (2C)

7. Statistical inference in business. Business planning on the basis of

predictions and assumptions. (3C)

8. Correlation and regression analysis for decision making (3C)

2

3. Grading

Quantitative Business DecisionGrading

20 points – Mid-term Exam

40 points – Final Exam

10 extra points – In-class performance

Seminars – EXCEL and SPSS

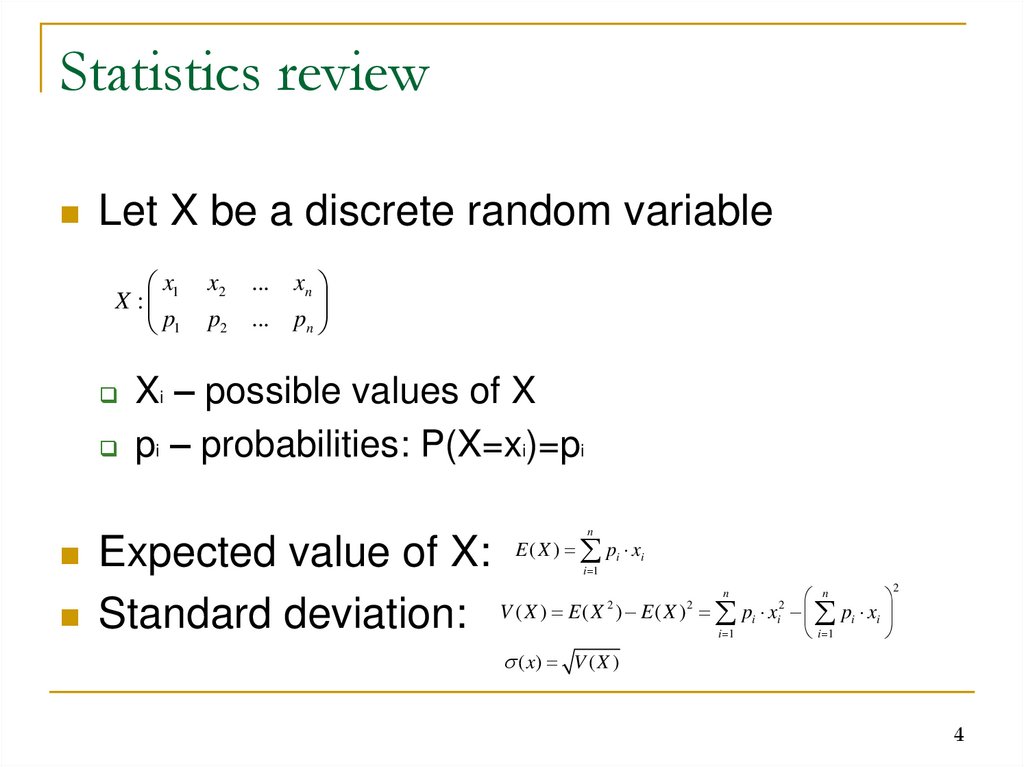

4. Statistics review

Let X be a discrete random variablex

X : 1

p1

x2 ...

p2 ...

xn

pn

Xi – possible values of X

pi – probabilities: P(X=xi)=pi

Expected value of X:

Standard deviation:

n

E ( X ) pi xi

i 1

n

V ( X ) E ( X ) E ( X ) pi x pi xi

i 1

i 1

n

2

2

2

2

i

( x) V ( X )

4

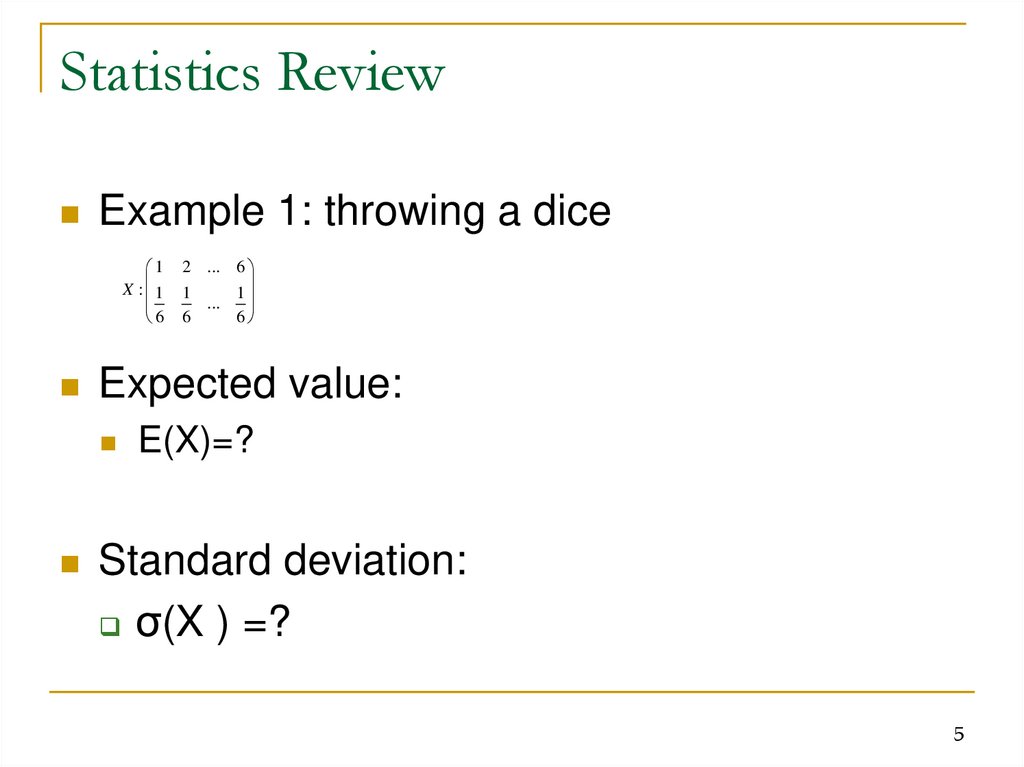

5. Statistics Review

Example 1: throwing a dice1

X : 1

6

2 ... 6

1

1

...

6

6

Expected value:

E(X)=?

Standard deviation:

σ(X ) =?

5

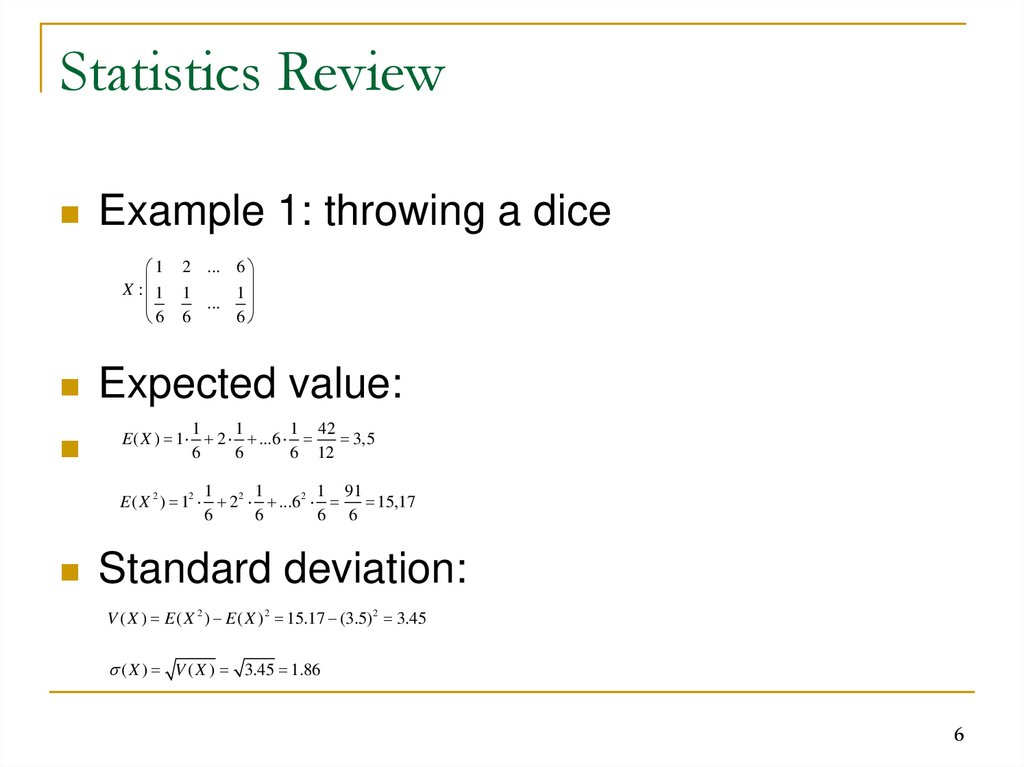

6. Statistics Review

Example 1: throwing a dice1

X : 1

6

2 ... 6

1

1

...

6

6

Expected value:

1

1

1 42

E ( X ) 1 2 ...6

3,5

6

6

6 12

1

1

1 91

E ( X 2 ) 12 22 ...62 15,17

6

6

6 6

Standard deviation:

V ( X ) E ( X 2 ) E ( X ) 2 15.17 (3.5) 2 3.45

( X ) V ( X ) 3.45 1.86

6

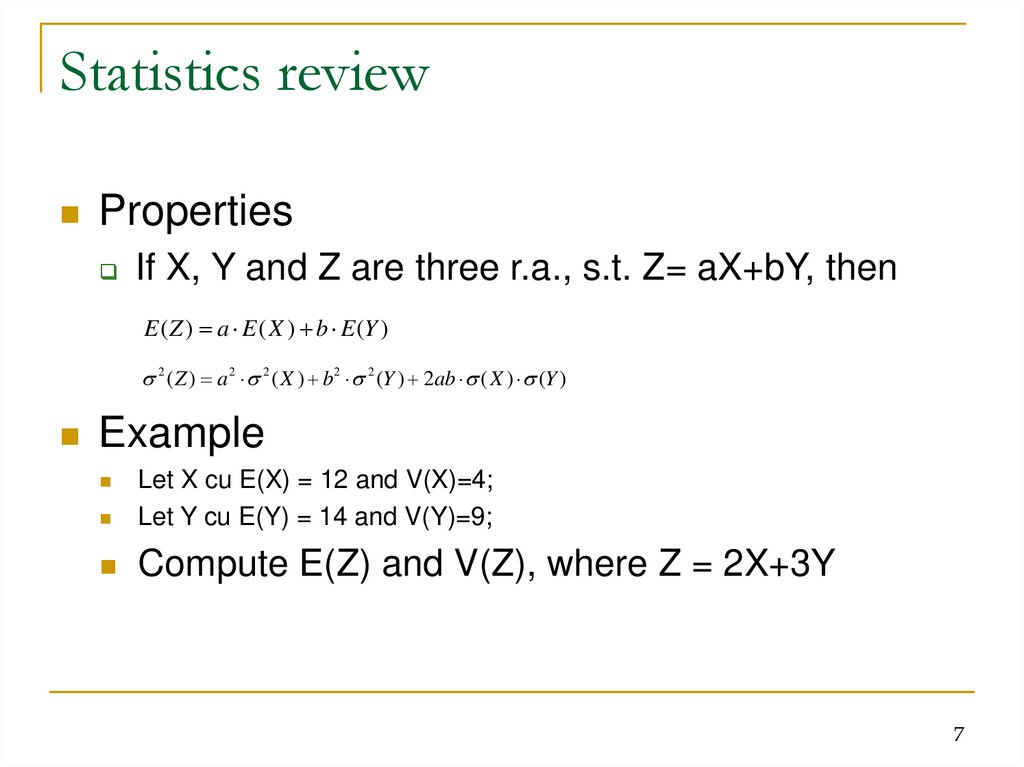

7. Statistics review

PropertiesIf X, Y and Z are three r.a., s.t. Z= aX+bY, then

E ( Z ) a E ( X ) b E (Y )

2 ( Z ) a 2 2 ( X ) b 2 2 (Y ) 2ab ( X ) (Y )

Example

Let X cu E(X) = 12 and V(X)=4;

Let Y cu E(Y) = 14 and V(Y)=9;

Compute E(Z) and V(Z), where Z = 2X+3Y

7

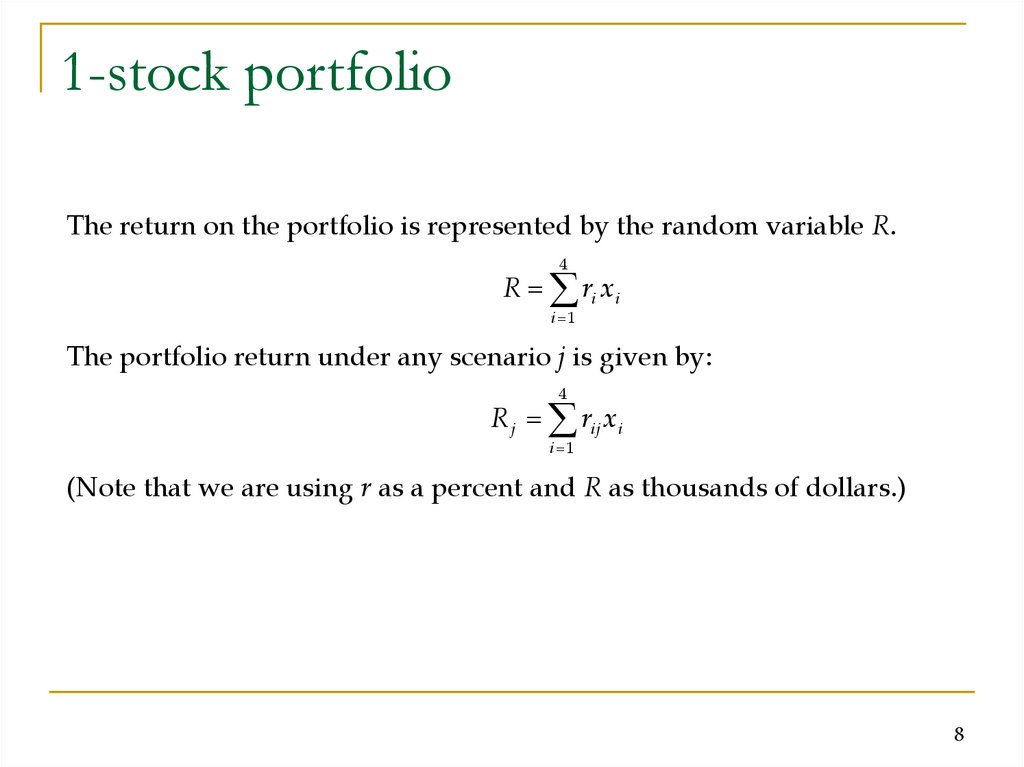

8. 1-stock portfolio

The return on the portfolio is represented by the random variable R.4

R ri x i

i 1

The portfolio return under any scenario j is given by:

4

R j rij x i

i 1

(Note that we are using r as a percent and R as thousands of dollars.)

8

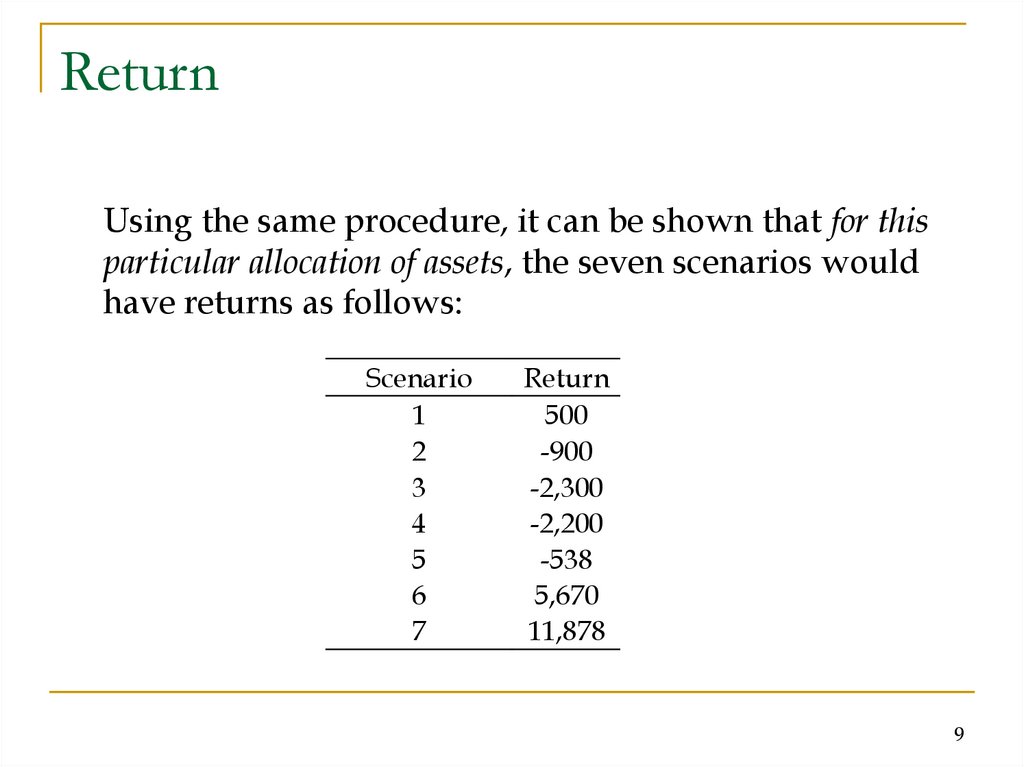

9. Return

Using the same procedure, it can be shown that for thisparticular allocation of assets, the seven scenarios would

have returns as follows:

Scenario

1

2

3

4

5

6

7

Return

500

-900

-2,300

-2,200

-538

5,670

11,878

9

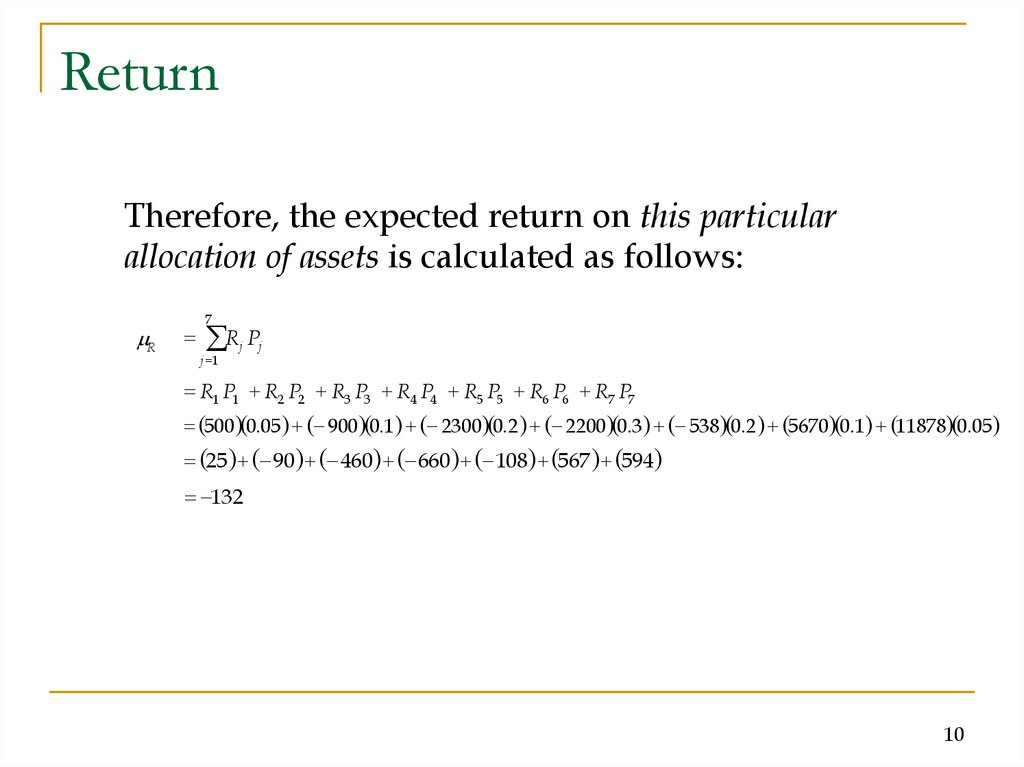

10. Return

Therefore, the expected return on this particularallocation of assets is calculated as follows:

mR

7

Rj Pj

j 1

R1 P1 R2 P2 R3 P3 R4 P4 R5 P5 R6 P6 R7 P7

(500 )(0.05 ) ( 900)(0.1 ) ( 2300)(0.2 ) ( 2200)(0.3 ) ( 538)(0.2 ) (5670)(0.1 ) (11878)(0.05 )

(25) ( 90 ) ( 460) ( 660) ( 108) (567 ) (594)

132

10

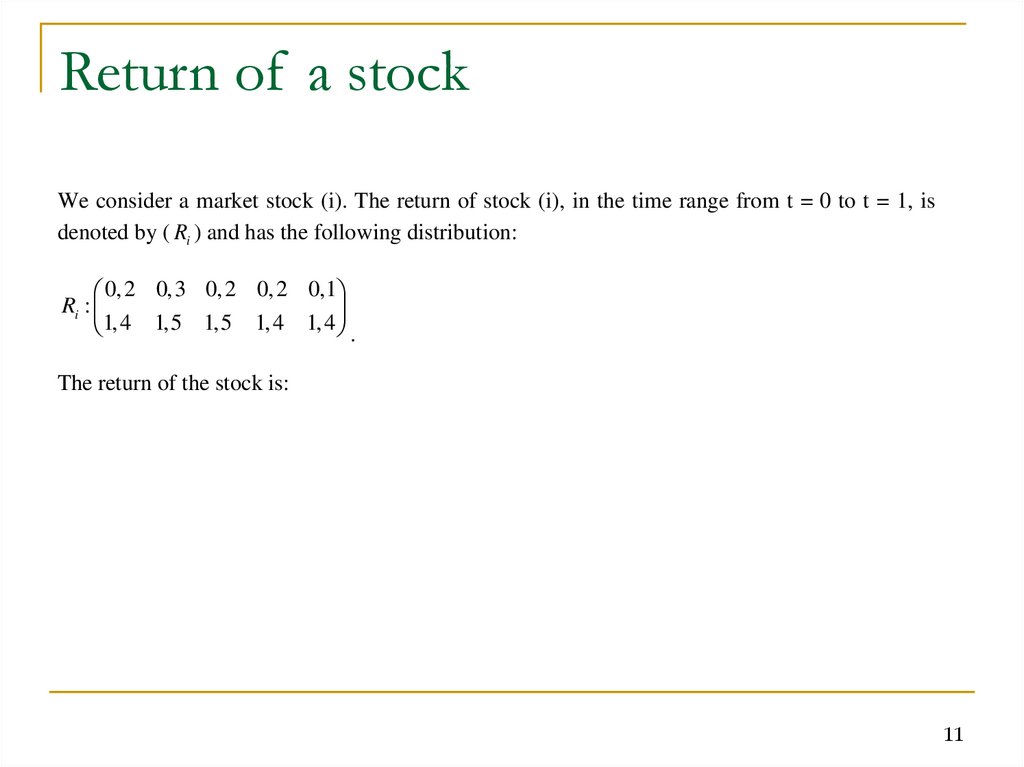

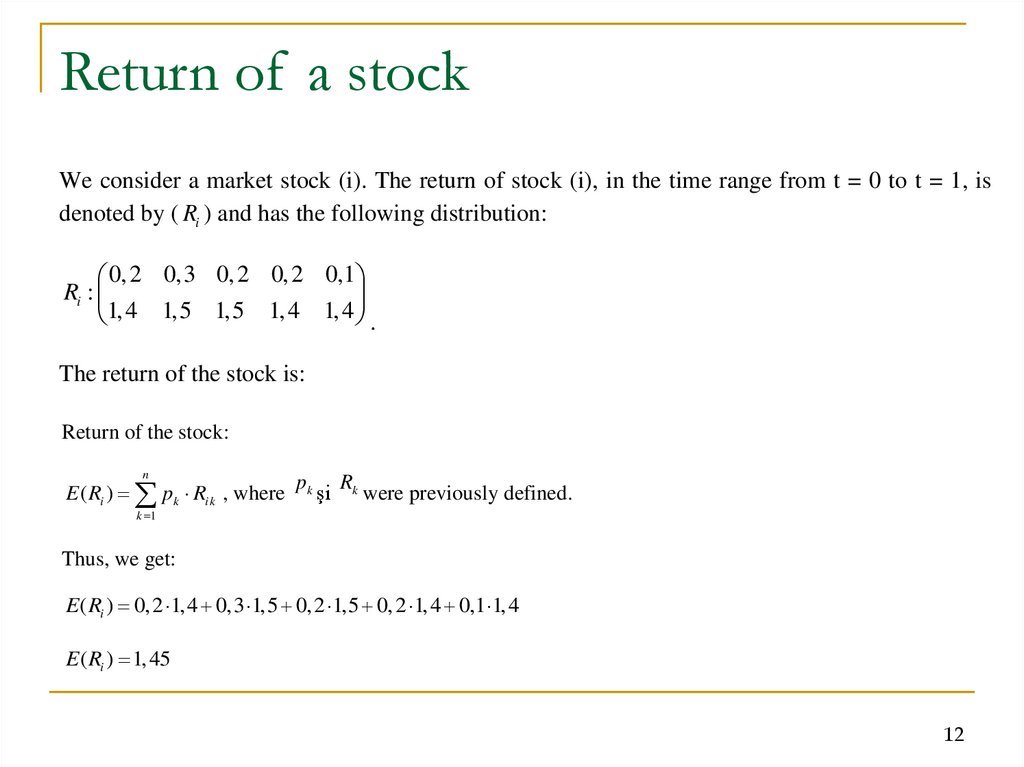

11. Return of a stock

We consider a market stock (i). The return of stock (i), in the time range from t = 0 to t = 1, isdenoted by ( Ri ) and has the following distribution:

0, 2 0,3 0, 2 0, 2 0,1

Ri :

1, 4 1,5 1,5 1, 4 1, 4 .

The return of the stock is:

11

12. Return of a stock

We consider a market stock (i). The return of stock (i), in the time range from t = 0 to t = 1, isdenoted by ( Ri ) and has the following distribution:

0, 2 0,3 0, 2 0, 2 0,1

Ri :

1, 4 1,5 1,5 1, 4 1, 4 .

The return of the stock is:

Return of the stock:

n

E ( Ri ) pk Ri k , where

pk

şi

Rk

were previously defined.

k 1

Thus, we get:

E ( Ri ) 0, 2 1, 4 0,3 1,5 0, 2 1,5 0, 2 1, 4 0,1 1, 4

E ( Ri ) 1, 45

12

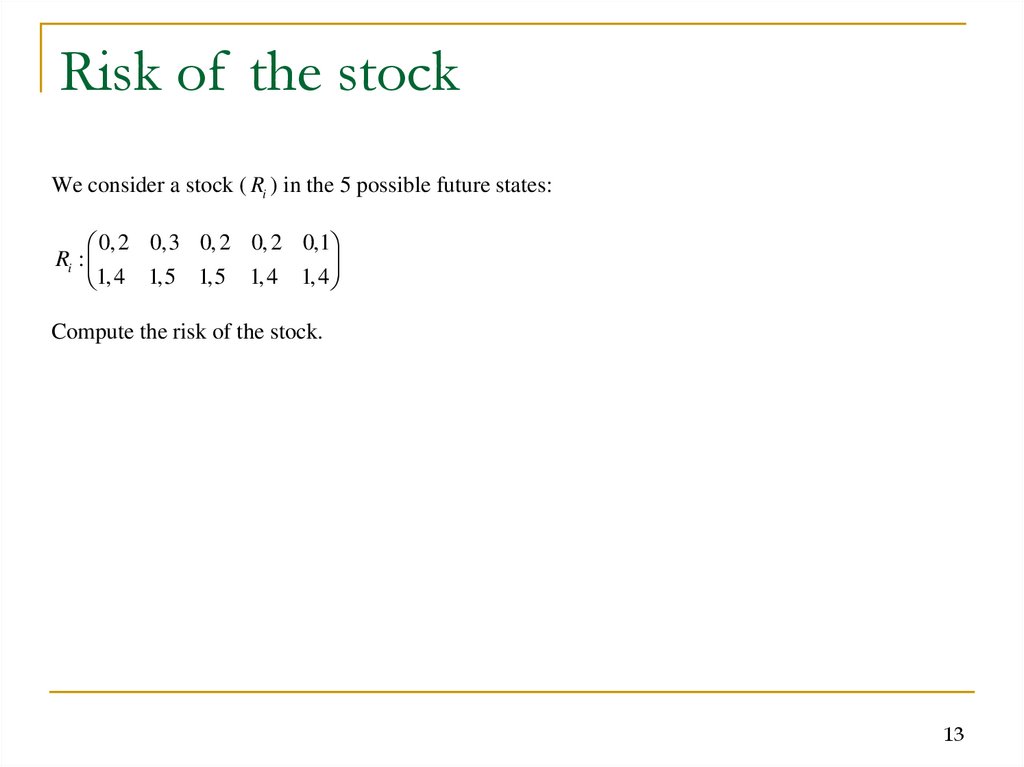

13. Risk of the stock

We consider a stock ( Ri ) in the 5 possible future states:0, 2 0,3 0, 2 0, 2 0,1

Ri :

1, 4 1,5 1,5 1, 4 1, 4

Compute the risk of the stock.

13

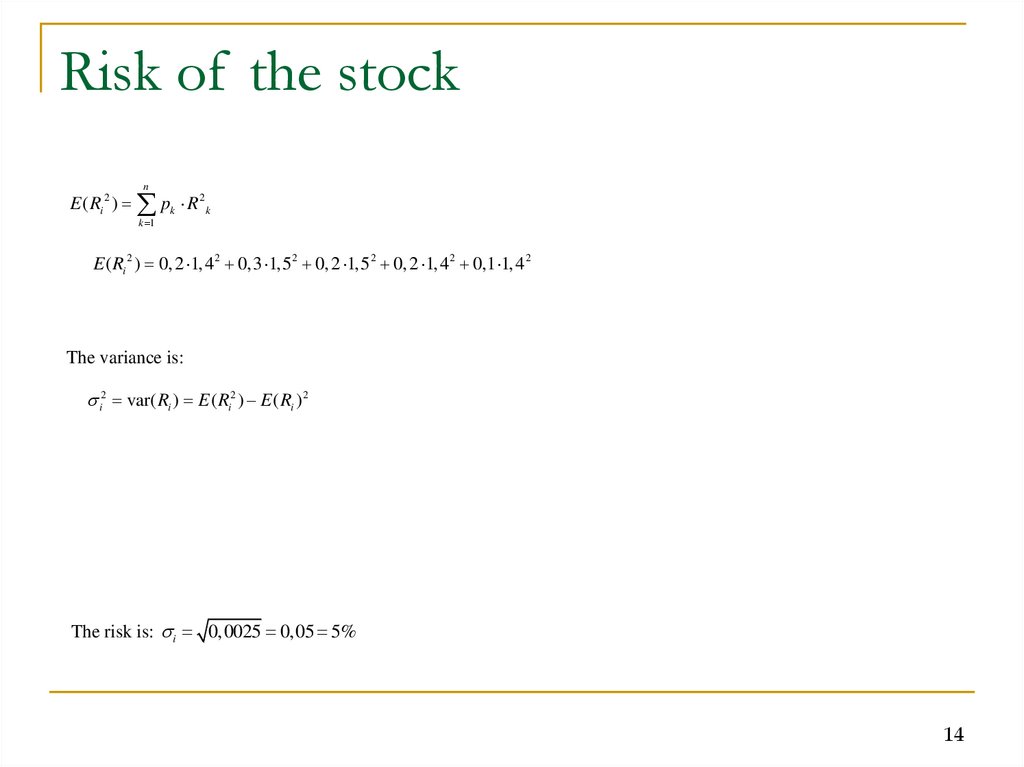

14. Risk of the stock

nE ( Ri 2 ) pk R 2 k

k 1

E ( Ri 2 ) 0, 2 1, 42 0,3 1,52 0, 2 1,52 0, 2 1, 4 2 0,1 1, 4 2

E ( Ri 2 ) 1,5562

The variance is:

i2 var( Ri ) E ( Ri2 ) E ( Ri ) 2

1,5562 1, 452

2, 22 1, 452

2,105 2.1025

0, 0025

The risk is: i 0,0025 0,05 5%

14

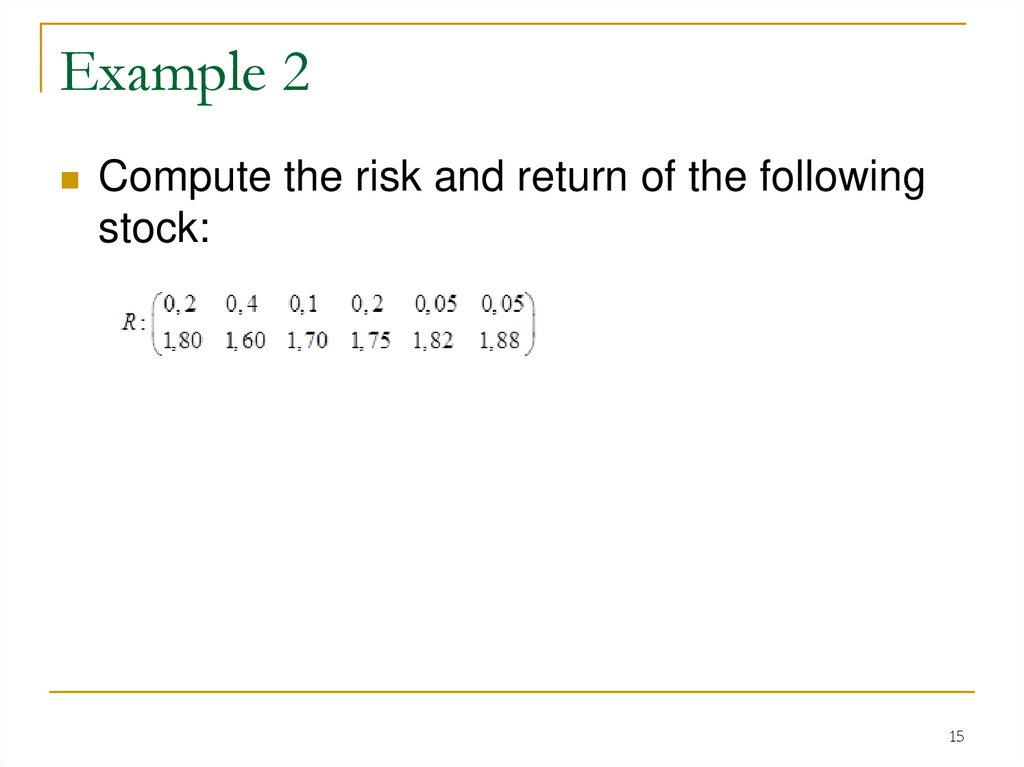

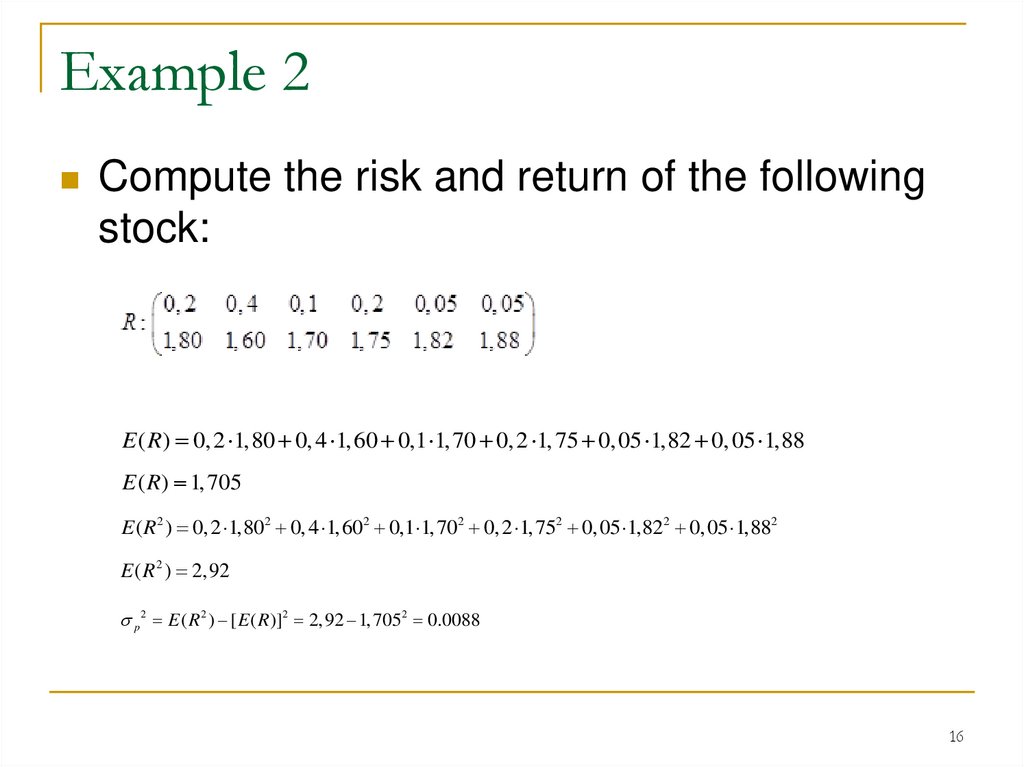

15. Example 2

Compute the risk and return of the followingstock:

15

16. Example 2

Compute the risk and return of the followingstock:

E ( R) 0, 2 1,80 0, 4 1, 60 0,1 1, 70 0, 2 1, 75 0, 05 1,82 0, 05 1,88

E ( R) 1, 705

E ( R2 ) 0, 2 1,802 0, 4 1,602 0,1 1,702 0, 2 1,752 0,05 1,822 0, 05 1,882

E ( R 2 ) 2,92

p 2 E ( R 2 ) [ E ( R)]2 2,92 1, 7052 0.0088

16

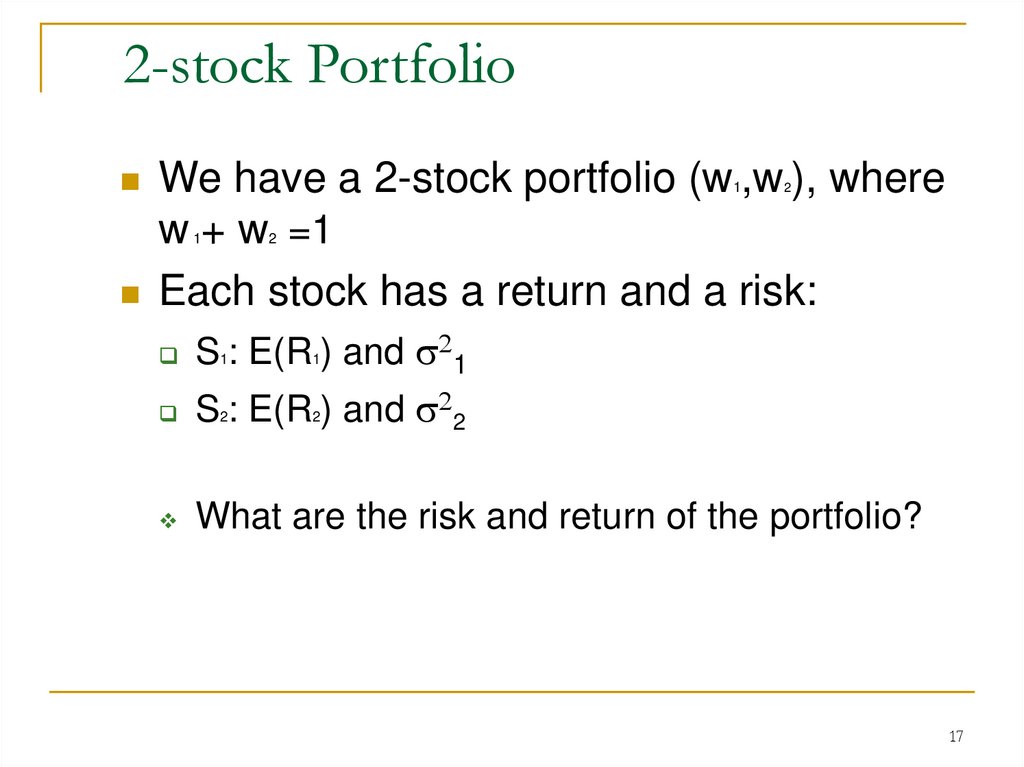

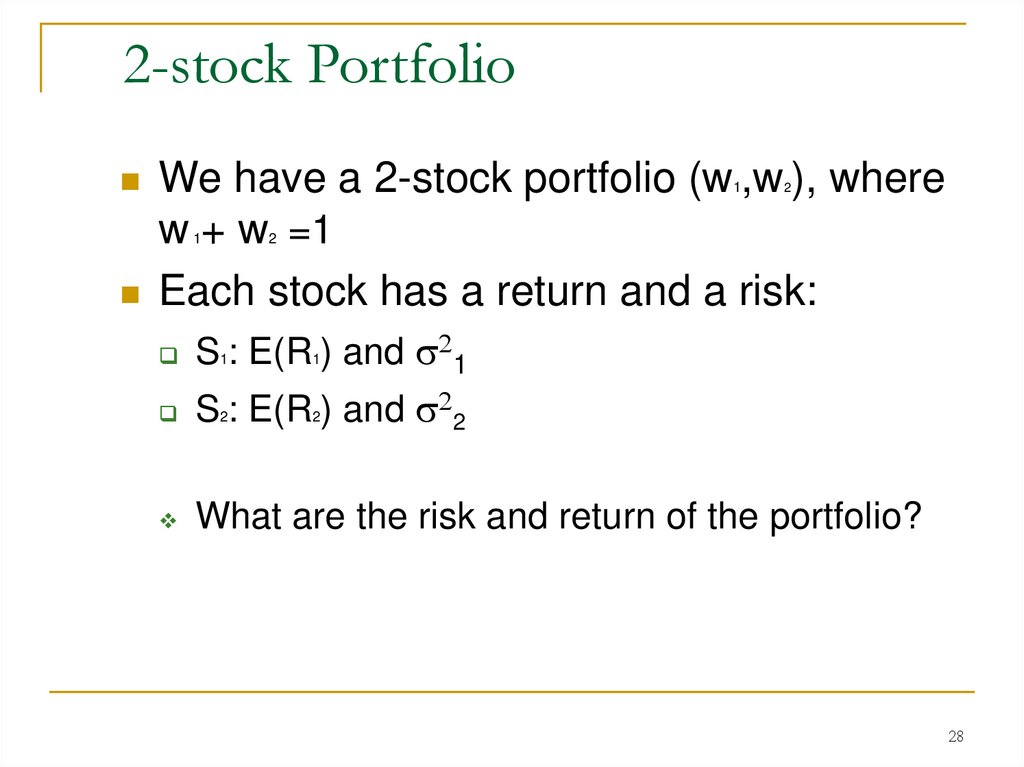

17. 2-stock Portfolio

We have a 2-stock portfolio (w1,w2), wherew + w =1

Each stock has a return and a risk:

1

2

S : E(R ) and 21

S : E(R ) and 22

What are the risk and return of the portfolio?

1

2

1

2

17

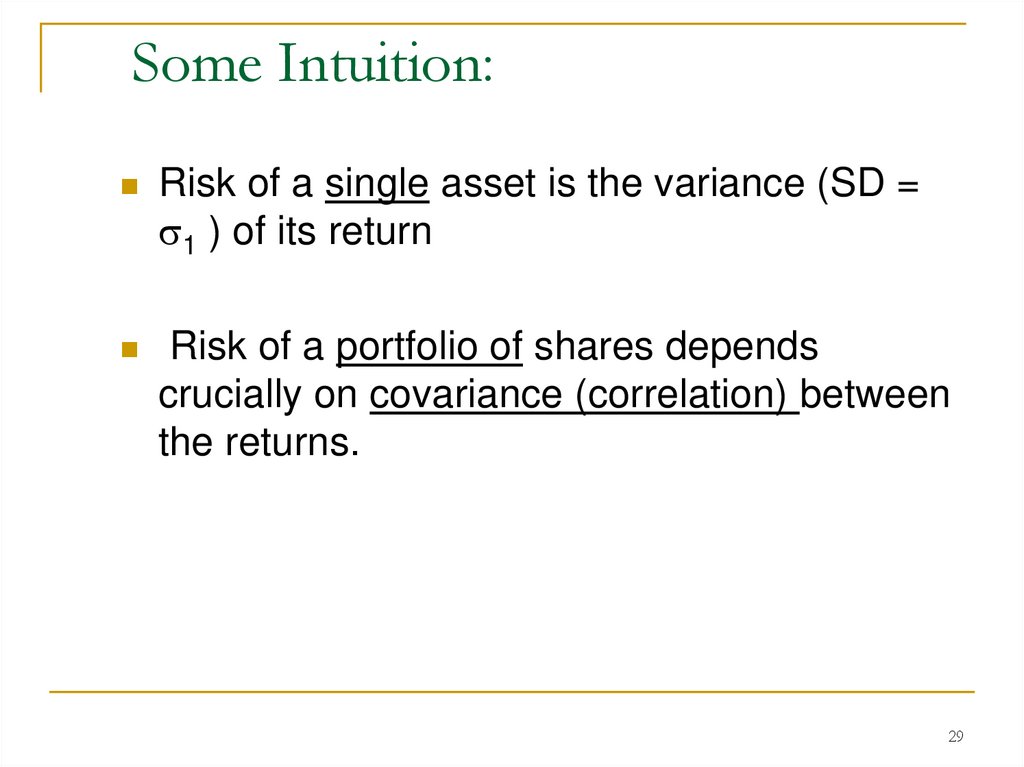

18. Some Intuition:

Risk of a single asset is the variance (SD =1 ) of its return

Risk of a portfolio of shares depends

crucially on (correlation) between the assets.

18

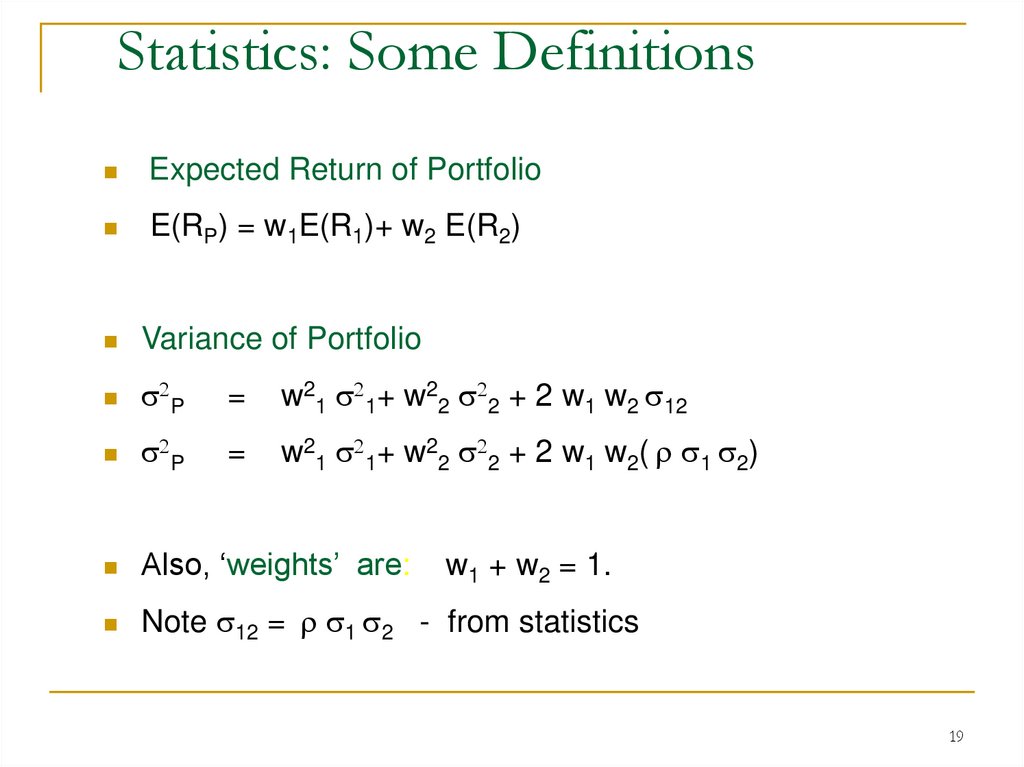

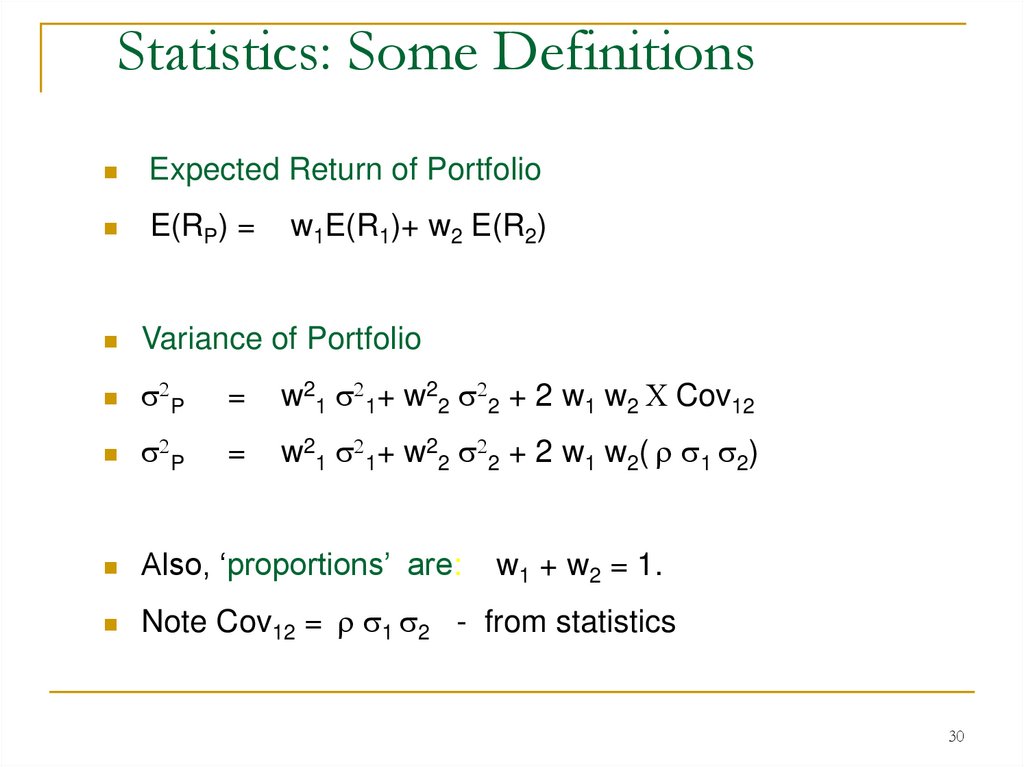

19. Statistics: Some Definitions

Expected Return of PortfolioE(RP) = w1E(R1)+ w2 E(R2)

Variance of Portfolio

2P

=

w21 21+ w22 22 + 2 w1 w2 12

2P

=

w21 21+ w22 22 + 2 w1 w2( 1 2)

Also, ‘weights’ are:

Note 12 = 1 2 - from statistics

w1 + w2 = 1.

19

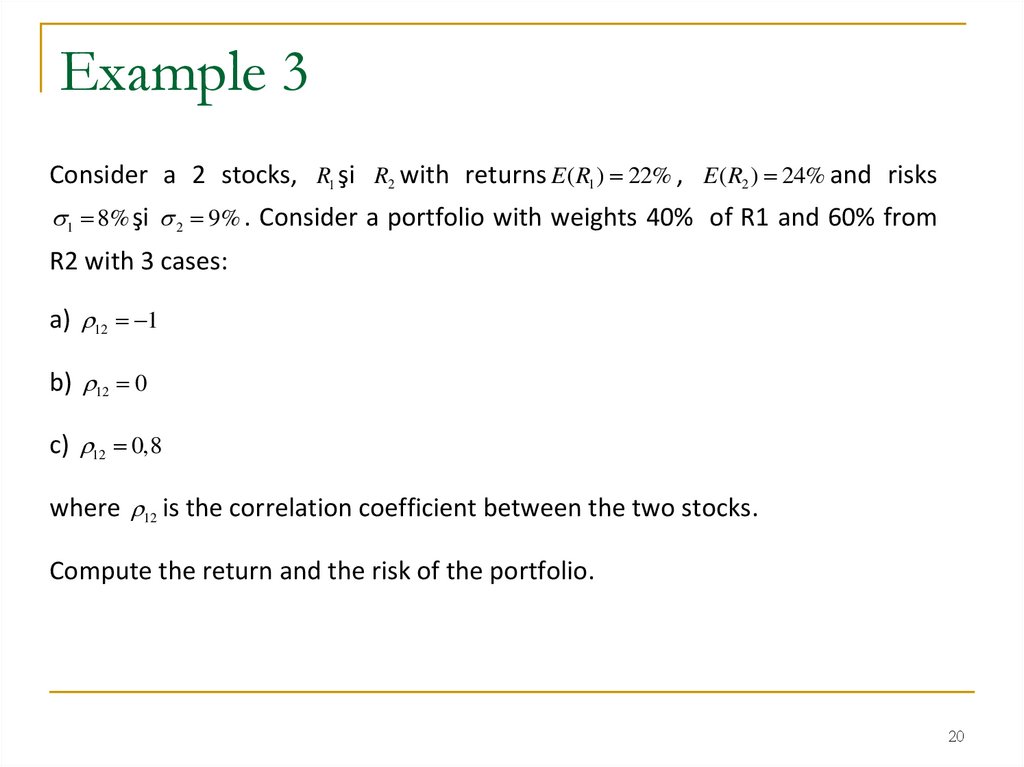

20. Example 3

Consider a 2 stocks, R1 şi R2 with returns E ( R1 ) 22% , E ( R2 ) 24% and risks1 8% şi 2 9% . Consider a portfolio with weights 40% of R1 and 60% from

R2 with 3 cases:

a) 12 1

b) 12 0

c) 12 0,8

where 12 is the correlation coefficient between the two stocks.

Compute the return and the risk of the portfolio.

20

21. Solution

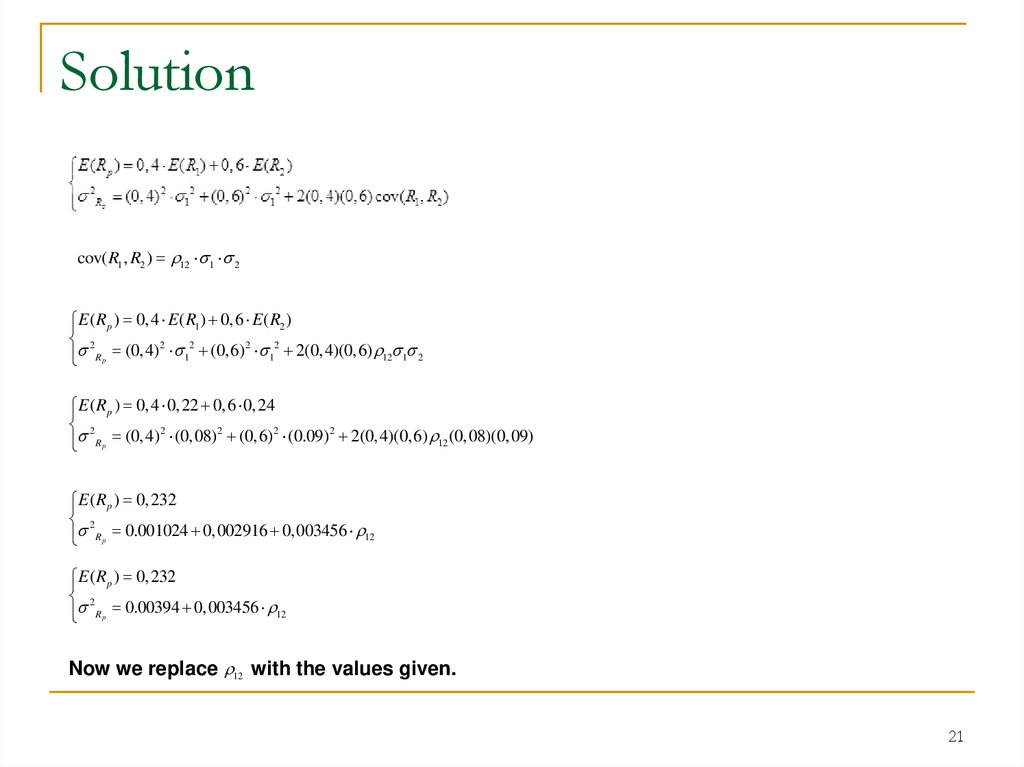

cov( R1 , R2 ) 12 1 2E ( Rp ) 0, 4 E ( R1 ) 0,6 E ( R2 )

2

2

2

2

2

Rp (0, 4) 1 (0,6) 1 2(0, 4)(0,6) 12 1 2

E ( Rp ) 0, 4 0, 22 0,6 0, 24

2

2

2

2

2

Rp (0, 4) (0,08) (0,6) (0.09) 2(0, 4)(0,6) 12 (0,08)(0,09)

E ( Rp ) 0, 232

2

Rp 0.001024 0,002916 0,003456 12

E ( Rp ) 0, 232

2

Rp 0.00394 0,003456 12

Now we replace 12 with the values given.

21

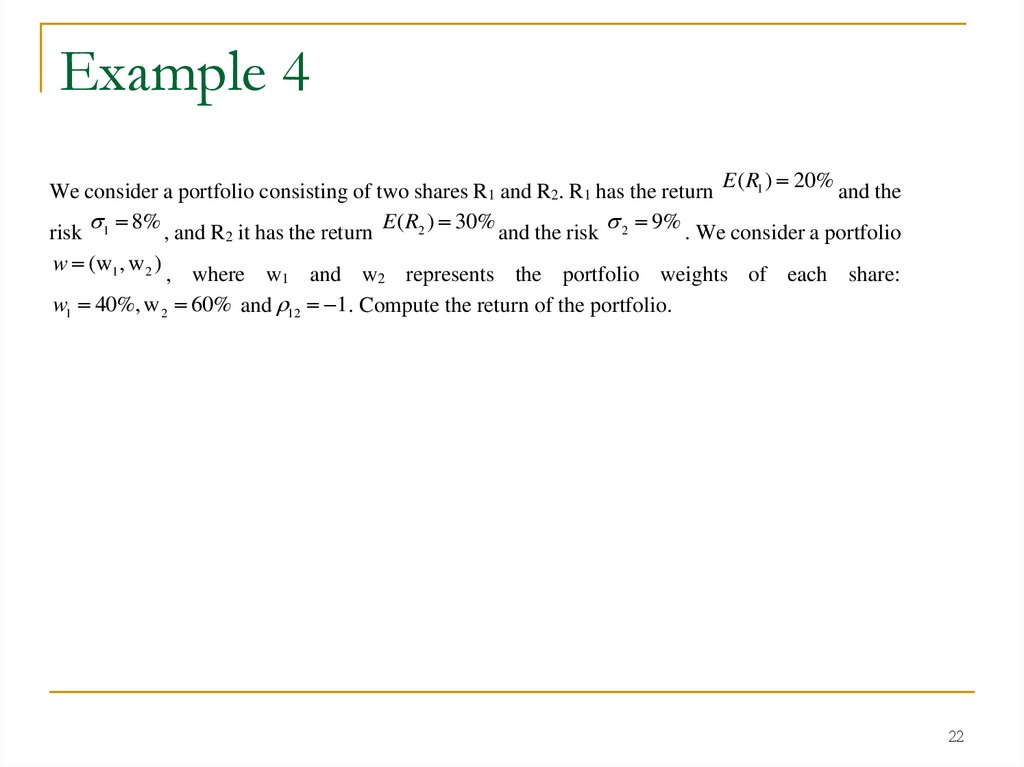

22. Example 4

E ( R1 ) 20% and theWe consider a portfolio consisting of two shares R1 and R2. R1 has the return

8% , and R it has the return E ( R2 ) 30% and the risk 2 9% . We consider a portfolio

risk 1

2

w (w1 , w 2 ) , where w and w represents the portfolio weights of each share:

1

2

w1 40%, w 2 60% and 12 1 . Compute the return of the portfolio.

22

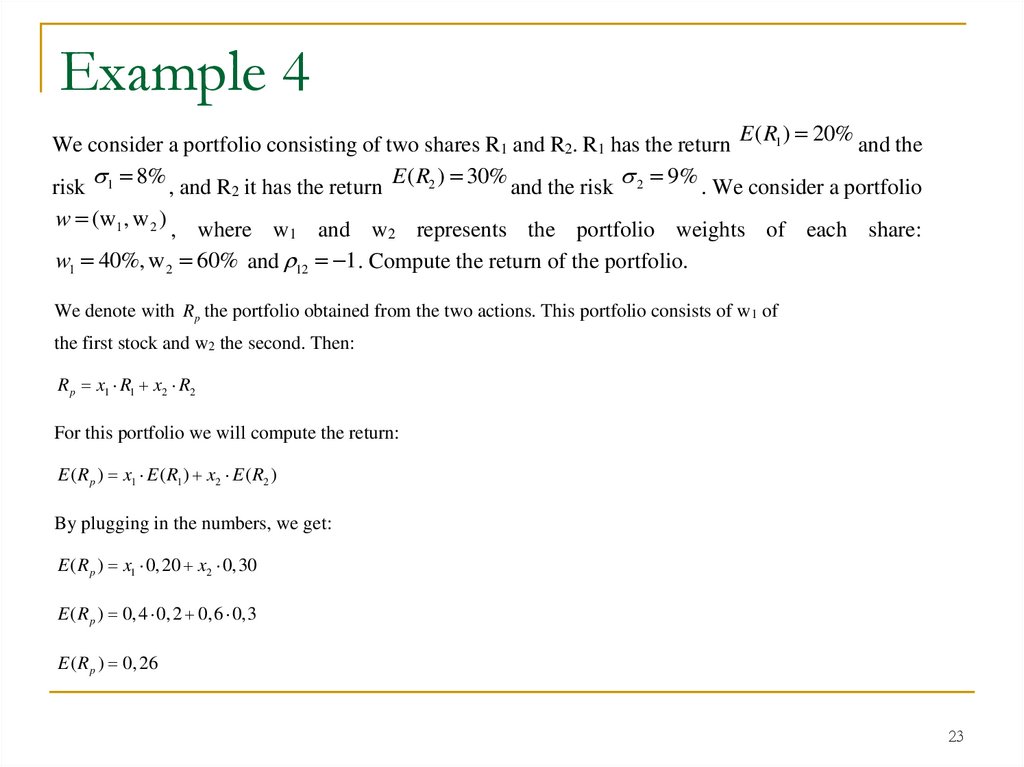

23. Example 4

E ( R1 ) 20% and theWe consider a portfolio consisting of two shares R1 and R2. R1 has the return

8% , and R it has the return E ( R2 ) 30% and the risk 2 9% . We consider a portfolio

risk 1

2

w (w1 , w 2 ) , where w and w represents the portfolio weights of each share:

1

2

w1 40%, w 2 60% and 12 1 . Compute the return of the portfolio.

We denote with R p the portfolio obtained from the two actions. This portfolio consists of w1 of

the first stock and w2 the second. Then:

R p x1 R1 x2 R2

For this portfolio we will compute the return:

E ( R p ) x1 E ( R1 ) x2 E ( R2 )

By plugging in the numbers, we get:

E ( R p ) x1 0, 20 x2 0,30

E ( R p ) 0, 4 0, 2 0, 6 0,3

E ( R p ) 0, 26

23

24. Example 5

E ( R1 ) 20% and theWe consider a portfolio consisting of two shares R1 and R2. R1 has the return

8% , and R it has the return E ( R2 ) 30% and the risk 2 9% . We consider a portfolio

risk 1

2

w (w1 , w 2 ) , where w and w represents the portfolio weights of each share:

1

2

w1 40%, w 2 60% and 12 1 . Compute the risk of the portfolio.

24

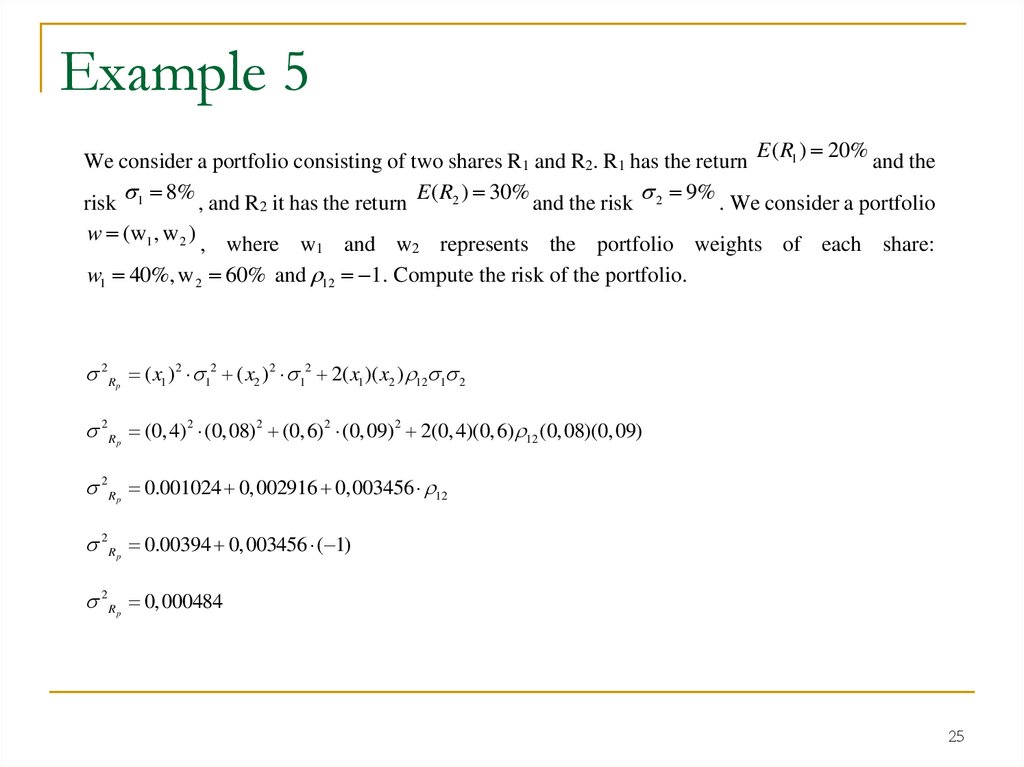

25. Example 5

E ( R1 ) 20% and theWe consider a portfolio consisting of two shares R1 and R2. R1 has the return

8% , and R it has the return E ( R2 ) 30% and the risk 2 9% . We consider a portfolio

risk 1

2

w (w1 , w 2 ) , where w and w represents the portfolio weights of each share:

1

2

w1 40%, w 2 60% and 12 1 . Compute the risk of the portfolio.

2 R ( x1 )2 12 ( x2 )2 12 2( x1 )( x2 ) 12 1 2

p

2 R (0, 4)2 (0,08)2 (0,6)2 (0,09)2 2(0, 4)(0,6) 12 (0,08)(0,09)

p

2 R 0.001024 0,002916 0,003456 12

p

2 R 0.00394 0,003456 ( 1)

p

2 R 0, 000484

p

25

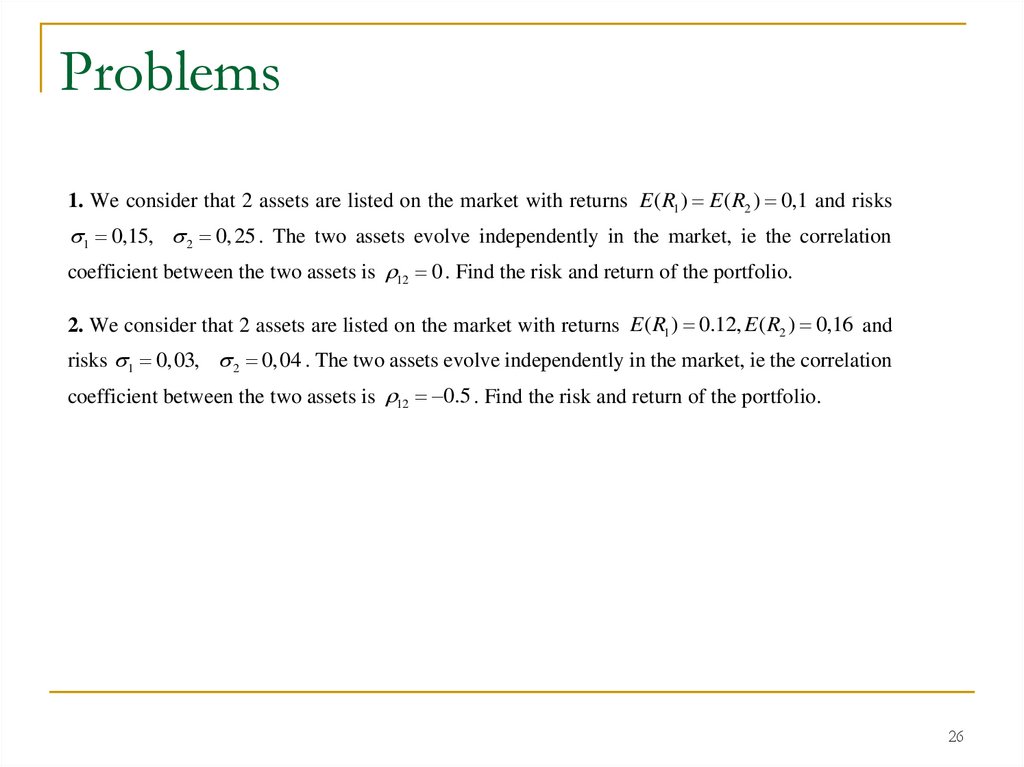

26. Problems

1. We consider that 2 assets are listed on the market with returns E ( R1 ) E ( R2 ) 0,1 and risks1 0,15, 2 0, 25 . The two assets evolve independently in the market, ie the correlation

coefficient between the two assets is 12 0 . Find the risk and return of the portfolio.

2. We consider that 2 assets are listed on the market with returns E ( R1 ) 0.12, E ( R2 ) 0,16 and

risks 1 0,03, 2 0,04 . The two assets evolve independently in the market, ie the correlation

coefficient between the two assets is 12 0.5 . Find the risk and return of the portfolio.

26

27. Portfolio Theory

3- Stock Portfolio28. 2-stock Portfolio

We have a 2-stock portfolio (w1,w2), wherew + w =1

Each stock has a return and a risk:

1

2

S : E(R ) and 21

S : E(R ) and 22

What are the risk and return of the portfolio?

1

2

1

2

28

29. Some Intuition:

Risk of a single asset is the variance (SD =1 ) of its return

Risk of a portfolio of shares depends

crucially on covariance (correlation) between

the returns.

29

30. Statistics: Some Definitions

Expected Return of PortfolioE(RP) =

Variance of Portfolio

2P

=

w21 21+ w22 22 + 2 w1 w2 C Cov12

2P

=

w21 21+ w22 22 + 2 w1 w2( 1 2)

Also, ‘proportions’ are:

Note Cov12 = 1 2 - from statistics

w1E(R1)+ w2 E(R2)

w1 + w2 = 1.

30

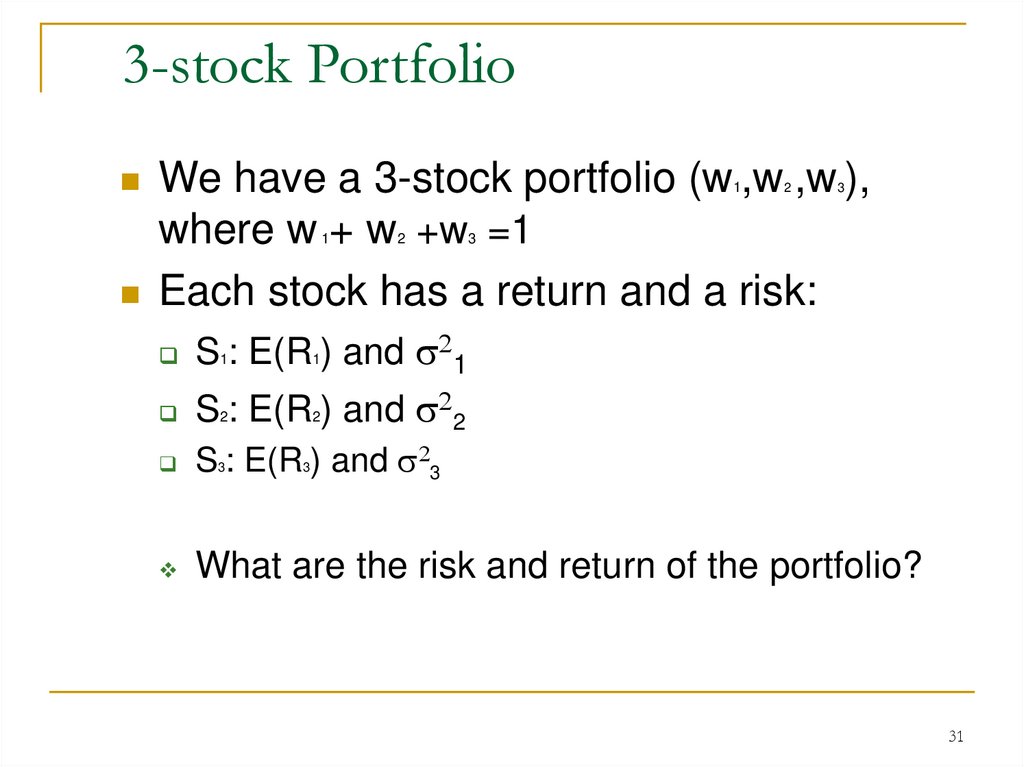

31. 3-stock Portfolio

We have a 3-stock portfolio (w1,w2 ,w3),where w + w +w =1

Each stock has a return and a risk:

1

2

3

S : E(R ) and 21

S : E(R ) and 22

S : E(R ) and 23

What are the risk and return of the portfolio?

1

1

2

3

2

3

31

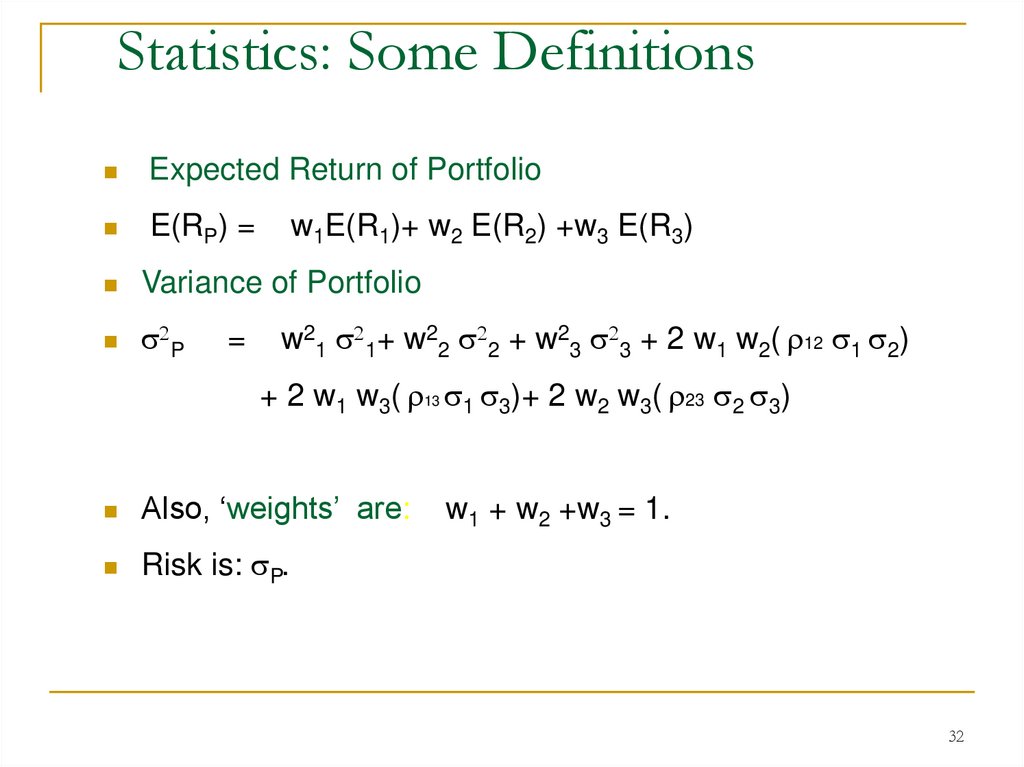

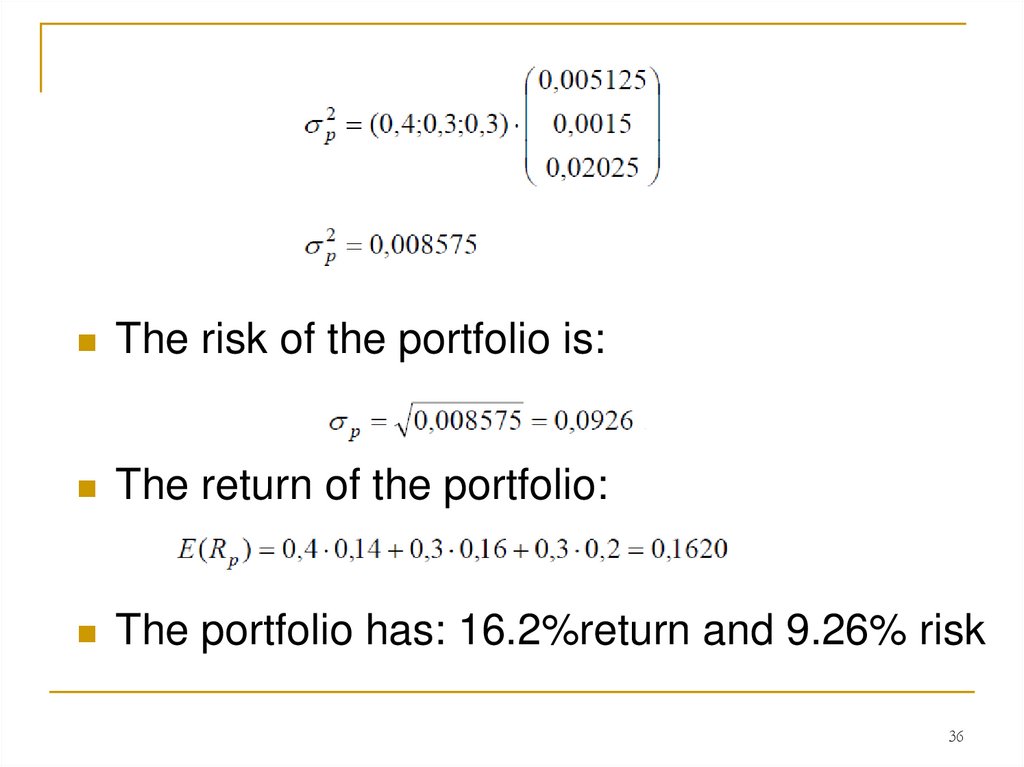

32. Statistics: Some Definitions

Expected Return of PortfolioE(RP) =

Variance of Portfolio

2P

=

w1E(R1)+ w2 E(R2) +w3 E(R3)

w21 21+ w22 22 + w23 23 + 2 w1 w2( 12 1 2)

+ 2 w1 w3( 13 1 3)+ 2 w2 w3( 23 2 3)

Also, ‘weights’ are:

Risk is: P.

w1 + w2 +w3 = 1.

32

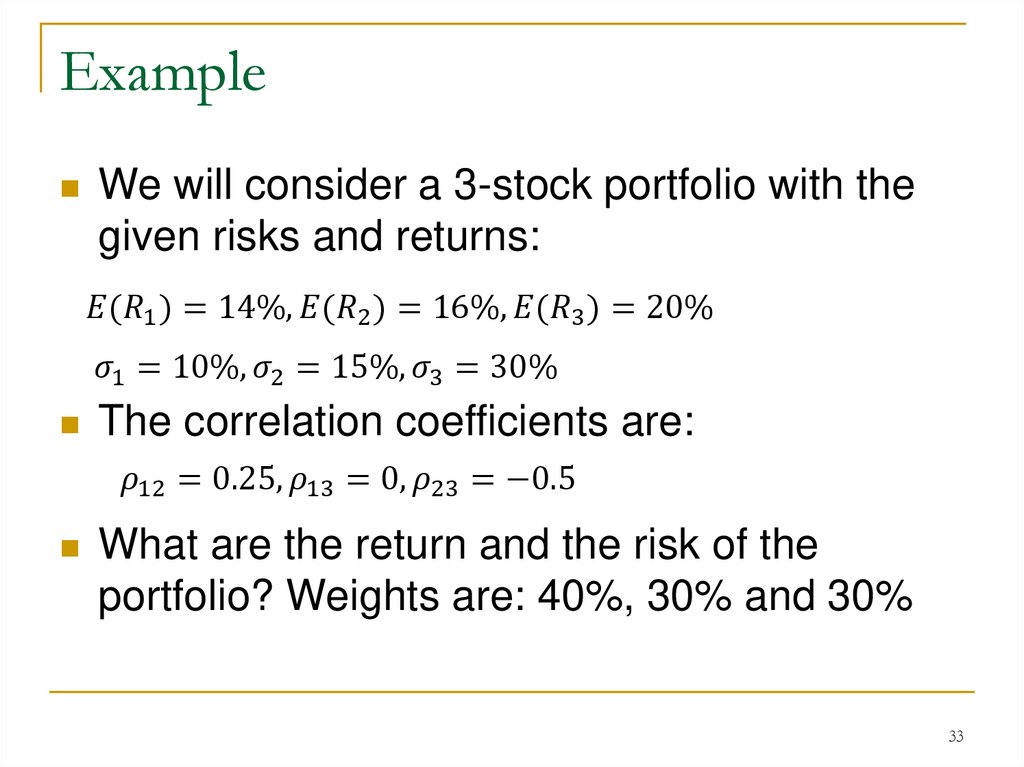

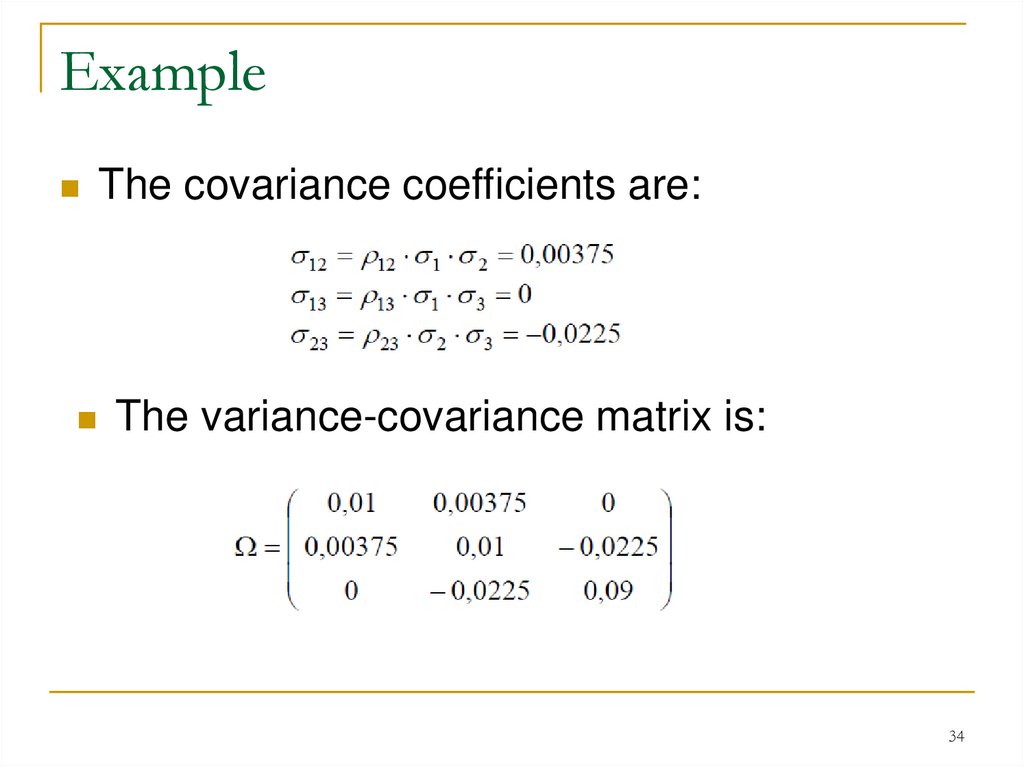

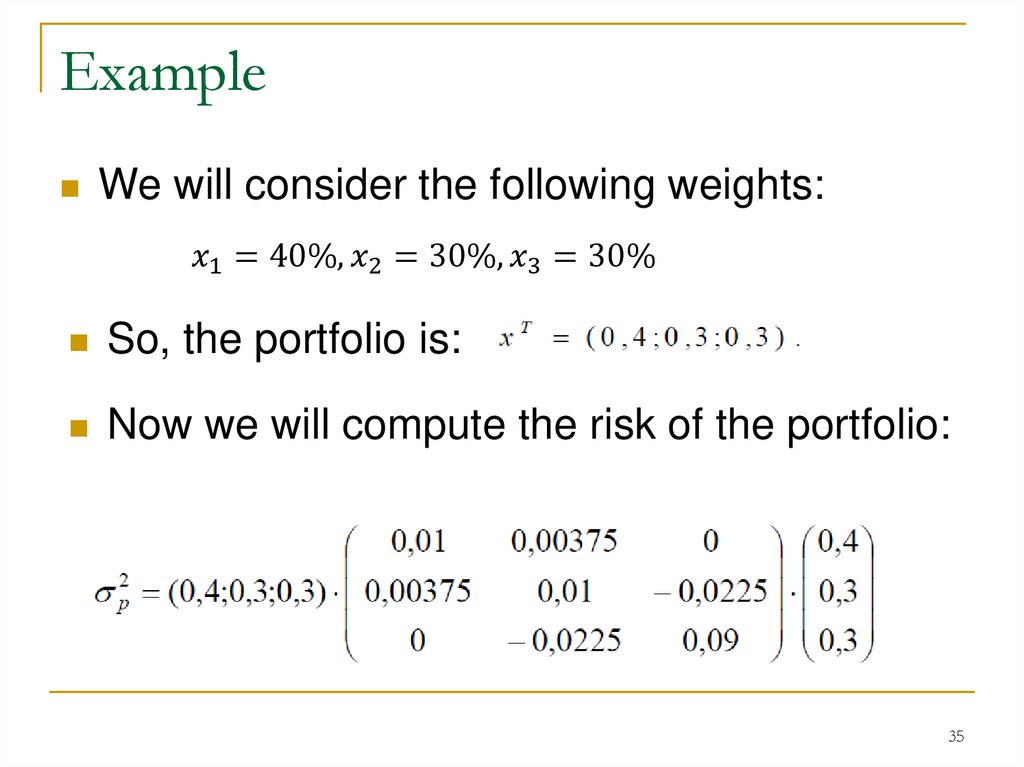

33. Example

We will consider a 3-stock portfolio with thegiven risks and returns:

business

business