Similar presentations:

Finance Message Exchanging System

1.

2.

ContentsFinance Message Exchanging System

System Overview

Function Descriptions

Operate Guide

Memouandum

3.

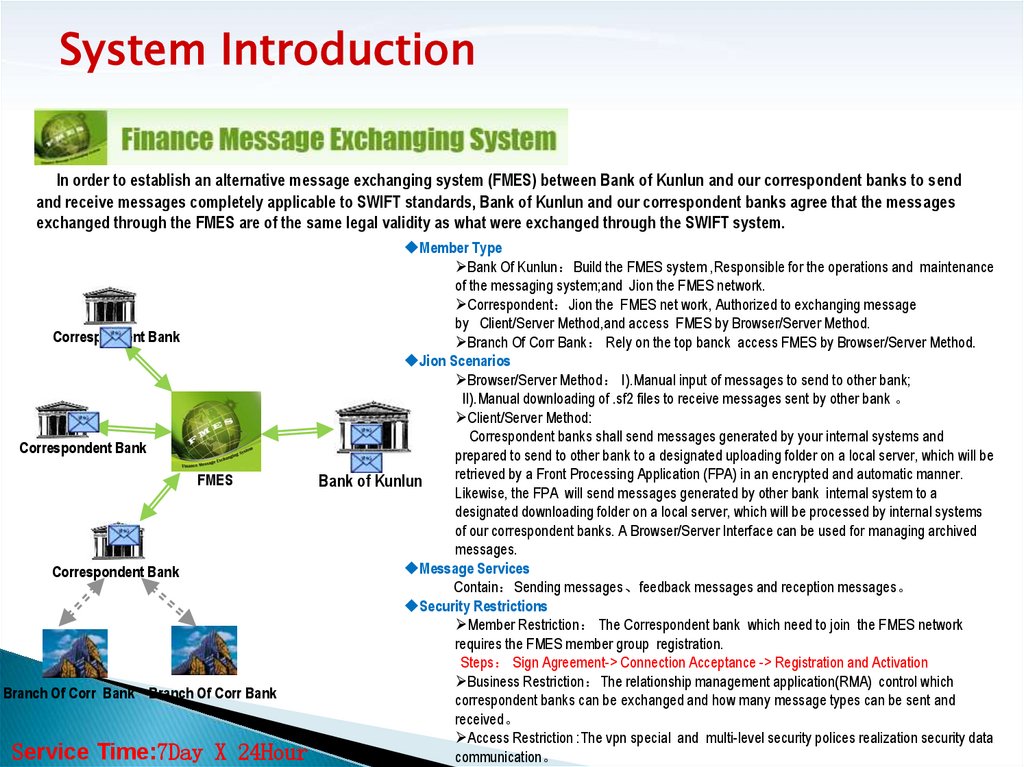

System IntroductionIn order to establish an alternative message exchanging system (FMES) between Bank of Kunlun and our correspondent banks to send

and receive messages completely applicable to SWIFT standards, Bank of Kunlun and our correspondent banks agree that the messages

exchanged through the FMES are of the same legal validity as what were exchanged through the SWIFT system.

Correspondent Bank

Correspondent Bank

FMES

Correspondent Bank

Branch Of Corr Bank Branch Of Corr Bank

Service Time:7Day X 24Hour

Member Type

Bank Of Kunlun Build the FMES system ,Responsible for the operations and maintenance

of the messaging system;and Jion the FMES network.

Correspondent Jion the FMES net work, Authorized to exchanging message

by Client/Server Method,and access FMES by Browser/Server Method.

Branch Of Corr Bank Rely on the top banck access FMES by Browser/Server Method.

Jion Scenarios

Browser/Server Method I).Manual input of messages to send to other bank;

II).Manual downloading of .sf2 files to receive messages sent by other bank 。

Client/Server Method:

Correspondent banks shall send messages generated by your internal systems and

prepared to send to other bank to a designated uploading folder on a local server, which will be

retrieved by a Front Processing Application (FPA) in an encrypted and automatic manner.

Bank of Kunlun

Likewise, the FPA will send messages generated by other bank internal system to a

designated downloading folder on a local server, which will be processed by internal systems

of our correspondent banks. A Browser/Server Interface can be used for managing archived

messages.

Message Services

Contain Sending messages、feedback messages and reception messages。

Security Restrictions

Member Restriction The Correspondent bank which need to join the FMES network

requires the FMES member group registration.

Steps Sign Agreement-> Connection Acceptance -> Registration and Activation

Business Restriction The relationship management application(RMA) control which

correspondent banks can be exchanged and how many message types can be sent and

received。

Access Restriction :The vpn special and multi-level security polices realization security data

communication。

4.

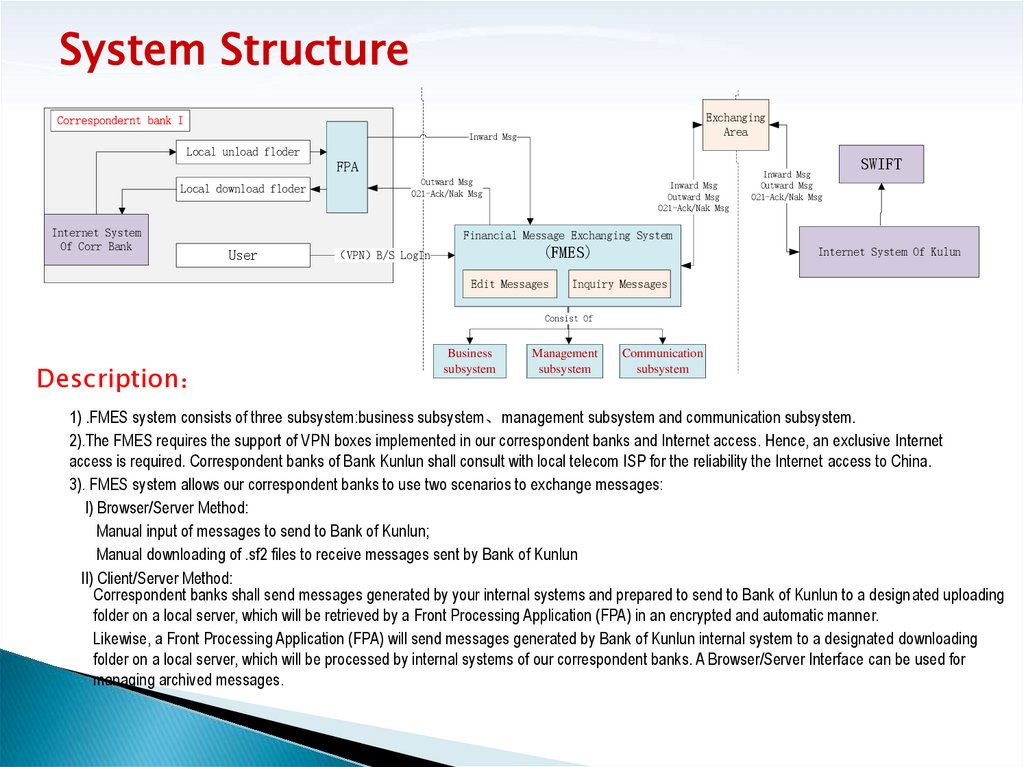

System StructureExchanging

Area

Correspondernt bank I

Inward Msg

Local unload floder

FPA

Local download floder

Internet System

Of Corr Bank

Outward Msg

021-Ack/Nak Msg

Inward Msg

Outward Msg

021-Ack/Nak Msg

Inward Msg

Outward Msg

021-Ack/Nak Msg

SWIFT

Financial Message Exchanging System

User

(FMES)

VPN B/S LogIn

Edit Messages

Internet System Of Kulun

Inquiry Messages

Consist Of

Description

Business

subsystem

Management

subsystem

Communication

subsystem

1) .FMES system consists of three subsystem:business subsystem、management subsystem and communication subsystem.

2).The FMES requires the support of VPN boxes implemented in our correspondent banks and Internet access. Hence, an exclusive Internet

access is required. Correspondent banks of Bank Kunlun shall consult with local telecom ISP for the reliability the Internet access to China.

3). FMES system allows our correspondent banks to use two scenarios to exchange messages:

I) Browser/Server Method:

Manual input of messages to send to Bank of Kunlun;

Manual downloading of .sf2 files to receive messages sent by Bank of Kunlun

II) Client/Server Method:

Correspondent banks shall send messages generated by your internal systems and prepared to send to Bank of Kunlun to a designated uploading

folder on a local server, which will be retrieved by a Front Processing Application (FPA) in an encrypted and automatic manner.

Likewise, a Front Processing Application (FPA) will send messages generated by Bank of Kunlun internal system to a designated downloading

folder on a local server, which will be processed by internal systems of our correspondent banks. A Browser/Server Interface can be used for

managing archived messages.

5.

ContentsFinance Message Exchanging System

System Overview

Function Descriptions

Operate Guide

Memouandum

6.

Business SubsystemMessage Creation

The institution which has joined in the FMES net can to login the system, then manual create message、modify the message and delete the

message.

Sending processing

The institution which has joined in the FMES can to review and authorization the messges in the system based on their business

requirements. And FMES system provide the emergency treatment and exception handling mechanism for users, the user can to urgent stop

or urgent sent the sending message at once, and mannully deal the sending message which has some exception in sending flow.

Receiving processing

The institution which has joined in the FMES can to mannully deal the receiving message,and re-distribute the receiving message which has

been distributed.

Receiving Message Exporting

The institution which has join in the FMES can to export the Receiving messages of their own.exporting the message has two mode:single

export and batch export.The one or more messages need to be exported will be exported to the single file (*.sf2).

Message Management

The institution which has joined in the FMES can to query and print the sending and receiving messages of their own.

Message Template

The institution which has joined in the FMES can create、modify and delete the customs sending message templates based on their

business requirements.The message template was created base on the FIN(MT) system message templates that apply to SWIFT

Standards,user can cut out the optional tag of the FIN(MT) system message templates to reduce the complexity of the page layout when

using templates to create message.On the other side,user can preset the ordinary message content to reduce the input operations and

improve the efficiency when using templates to create message.

Route Distribution

The institution which has joined in the FMES can to create、 modify and delete the distribute rules of the sending and receiving messages

based on their business requirements.

Business Monitor

Provide monitoring and processing for message in system.

7.

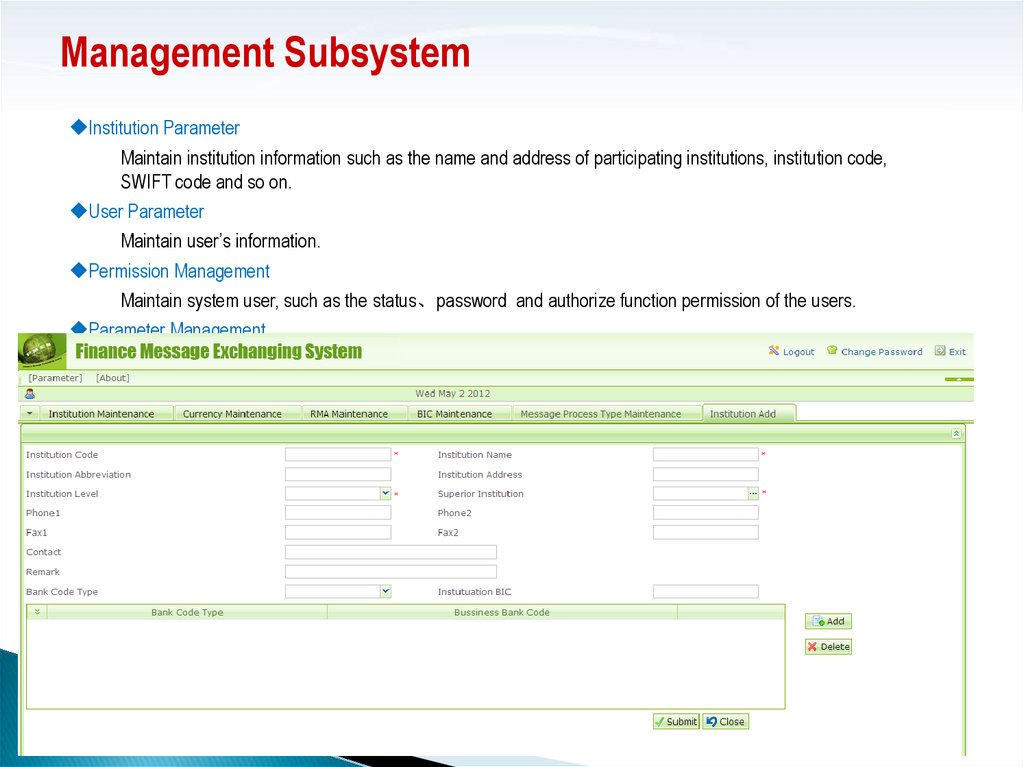

Management SubsystemInstitution Parameter

Maintain institution information such as the name and address of participating institutions, institution code,

SWIFT code and so on.

User Parameter

Maintain user’s information.

Permission Management

Maintain system user, such as the status、password and authorize function permission of the users.

Parameter Management

Maintain and manage system parameters.

Log Management

The user could Query the system log ont this module.

8.

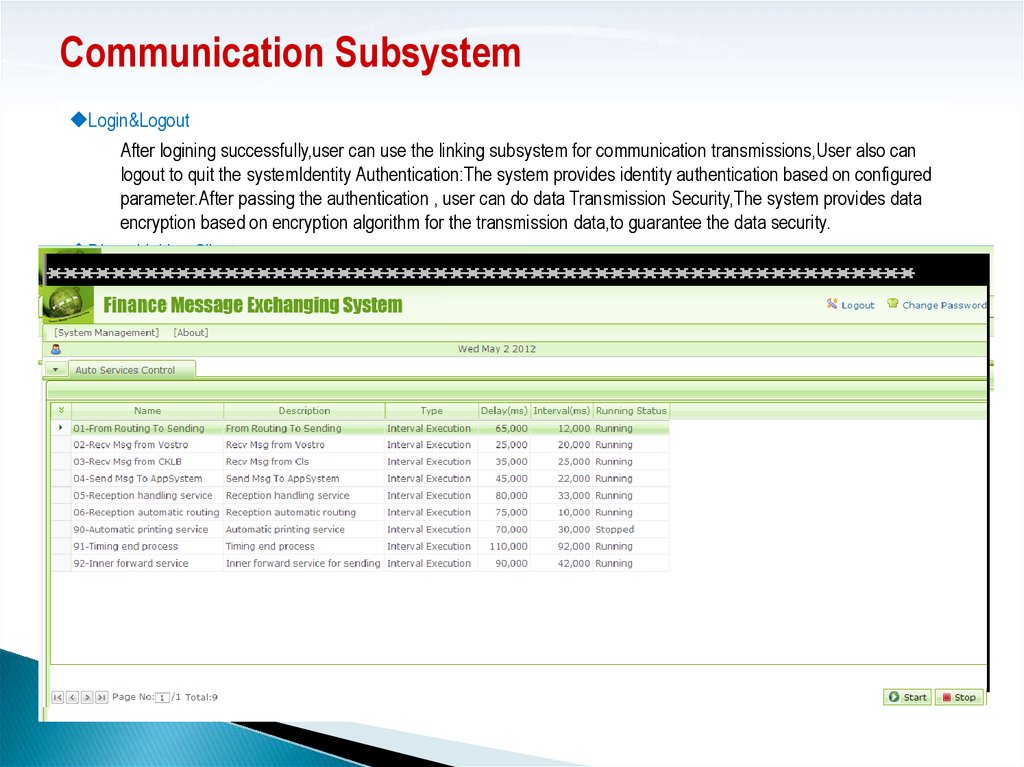

Communication SubsystemLogin&Logout

After logining successfully,user can use the linking subsystem for communication transmissions,User also can

logout to quit the systemIdentity Authentication:The system provides identity authentication based on configured

parameter.After passing the authentication , user can do data Transmission Security,The system provides data

encryption based on encryption algorithm for the transmission data,to guarantee the data security.

Direct-Linking Client

It’s the front-end of the participating institution.It transports the business messages to the financial message

exchanging system based on the participating instinution parameter configuration.

Direct-Linking Server

It’s the integrated services of the financial message exchanging system,provides response to the client

transmission,and receives the message from the financial message exchanging system then connects the

following flows.It also can transmit the received message from the participating institution to the client front-end.

Server Management

It manages the backstage service to start/stop, including automatic routing, sending service, receiving service

and other functions. It also manages the service of client to start/stop, including client sending service and client

receiving service.

9.

ContentsFinance Message Exchanging System

System Overview

Function Descriptions

Operate Guide

Browser/Server Method

Parameter settings

Business treatment

Client/Server Method

Memouandum

10.

Parameter settings-Organization Structure Introduction

Organization levels

Institution, group and role. The three are related to each other.

Institution:

The security officer of FMES center can maintain all institution information , include FMES center and

participating institutions.

Group:

The same word may have different meanings in different bank environments. Group can be seen as one department ,one

team or some specific persons.

Role:

Role can be divided into three types: security officer role, system manager role and business operator role.

Position:

Institution, group and role make up a position.

Position can be divided into three types: security officer position, system manager position and business operator position.

User:

User is the person who uses this system, and user must belong to an institution.

11.

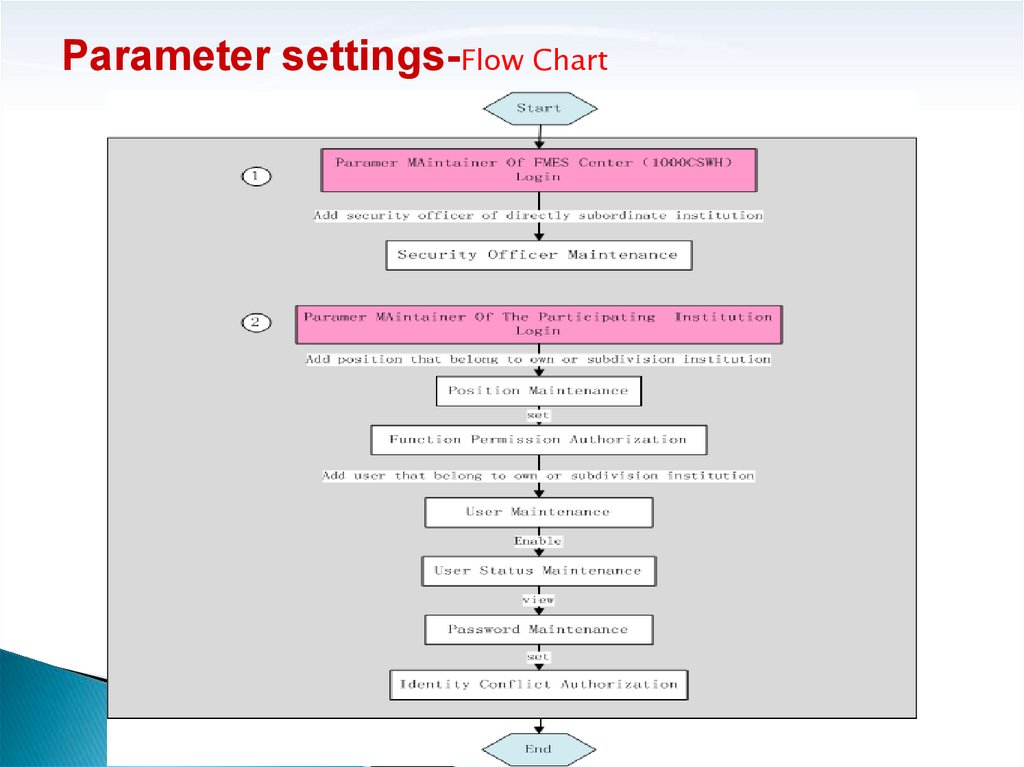

Parameter settings-Flow Chart12.

Parameter settings-Parameter Setting Steps

1.

The security officer of the participating institution (Institution+LSO/RSO) login:

The security officer of the participating institution can maintain the position and user of own or subordinate institutions that

have no own security officer.

13.

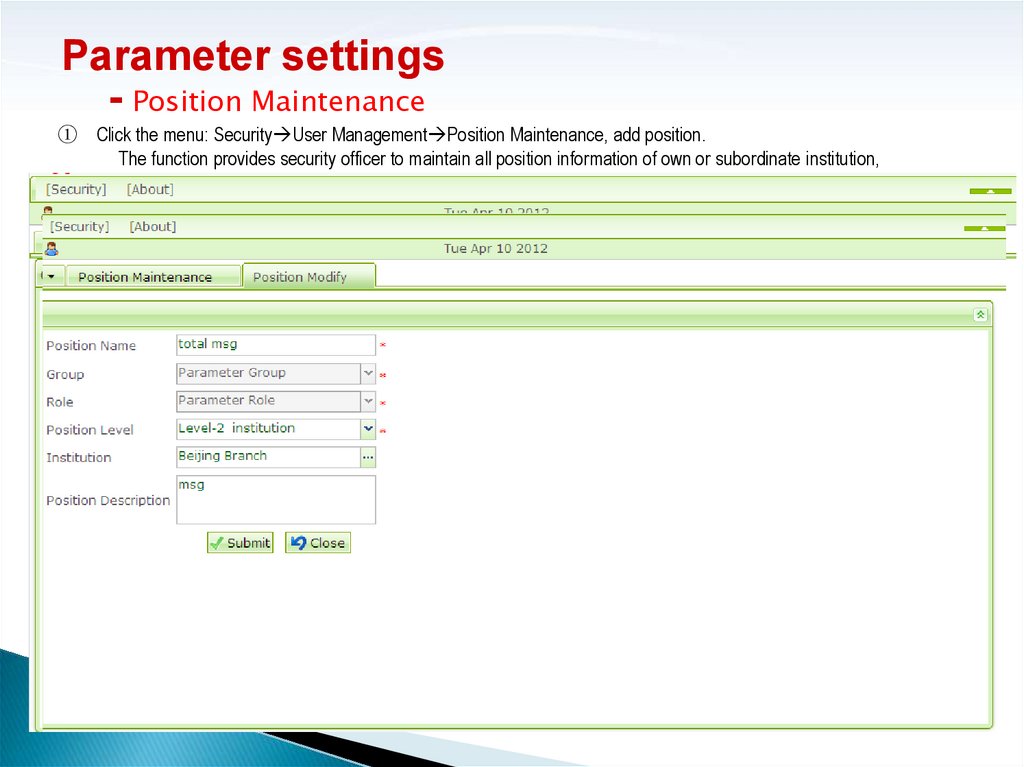

Parameter settings- Position Maintenance

① Click the menu: Security User Management Position Maintenance, add position.

The function provides security officer to maintain all position information of own or subordinate institution,

in addition to security officer position .

Security officer position has been set by the system, and can not be maintain.

Genaral parameter position and genaral message position have been also set by the system, and do not suggest to

be modified.

14.

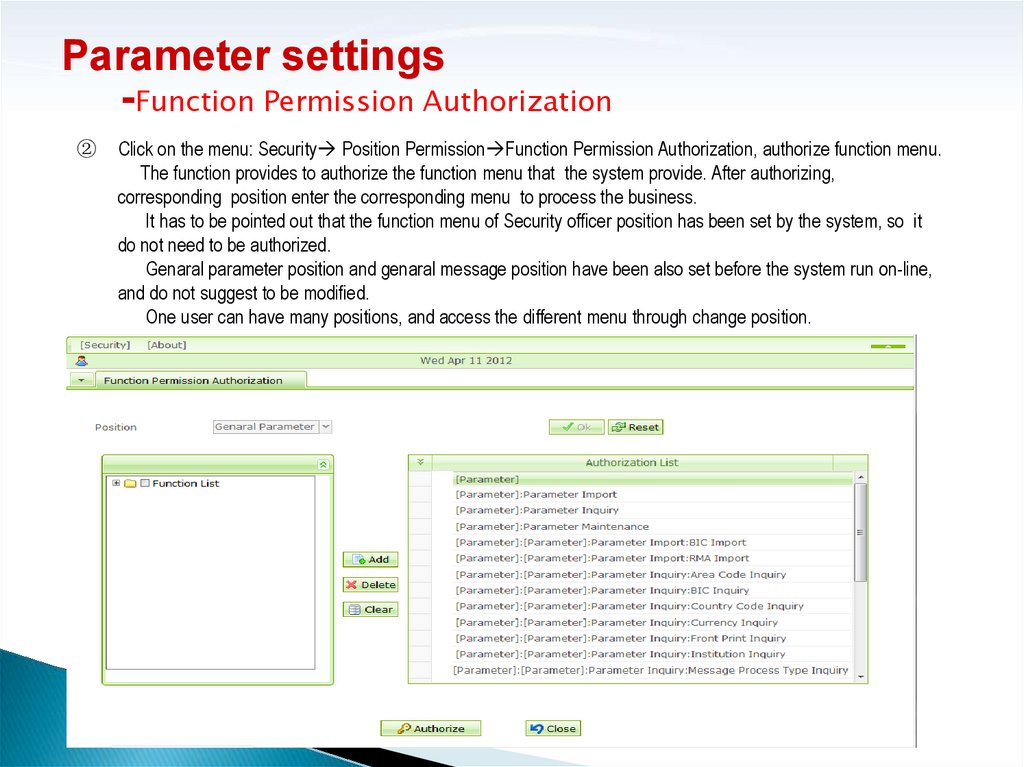

Parameter settings-Function Permission Authorization

②

Click on the menu: Security Position Permission Function Permission Authorization, authorize function menu.

The function provides to authorize the function menu that the system provide. After authorizing,

corresponding position enter the corresponding menu to process the business.

It has to be pointed out that the function menu of Security officer position has been set by the system, so it

do not need to be authorized.

Genaral parameter position and genaral message position have been also set before the system run on-line,

and do not suggest to be modified.

One user can have many positions, and access the different menu through change position.

15.

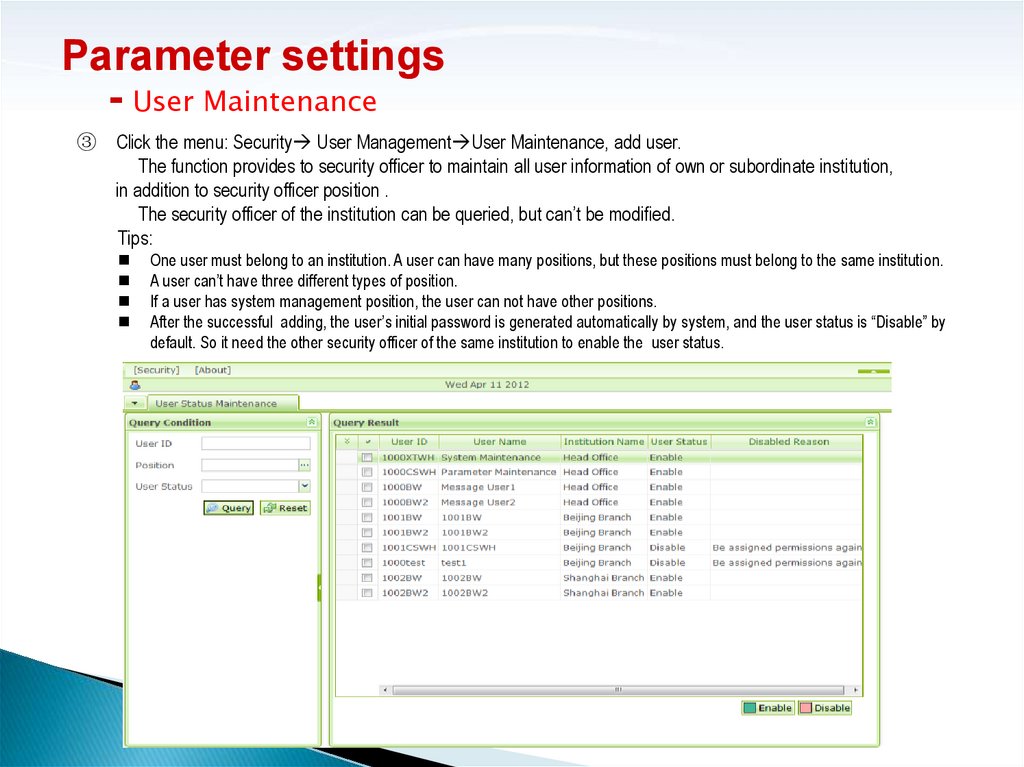

Parameter settings- User Maintenance

③ Click the menu: Security User Management User Maintenance, add user.

The function provides to security officer to maintain all user information of own or subordinate institution,

in addition to security officer position .

The security officer of the institution can be queried, but can’t be modified.

Tips:

One user must belong to an institution. A user can have many positions, but these positions must belong to the same institution.

A user can’t have three different types of position.

If a user has system management position, the user can not have other positions.

After the successful adding, the user’s initial password is generated automatically by system, and the user status is “Disable” by

default. So it need the other security officer of the same institution to enable the user status.

16.

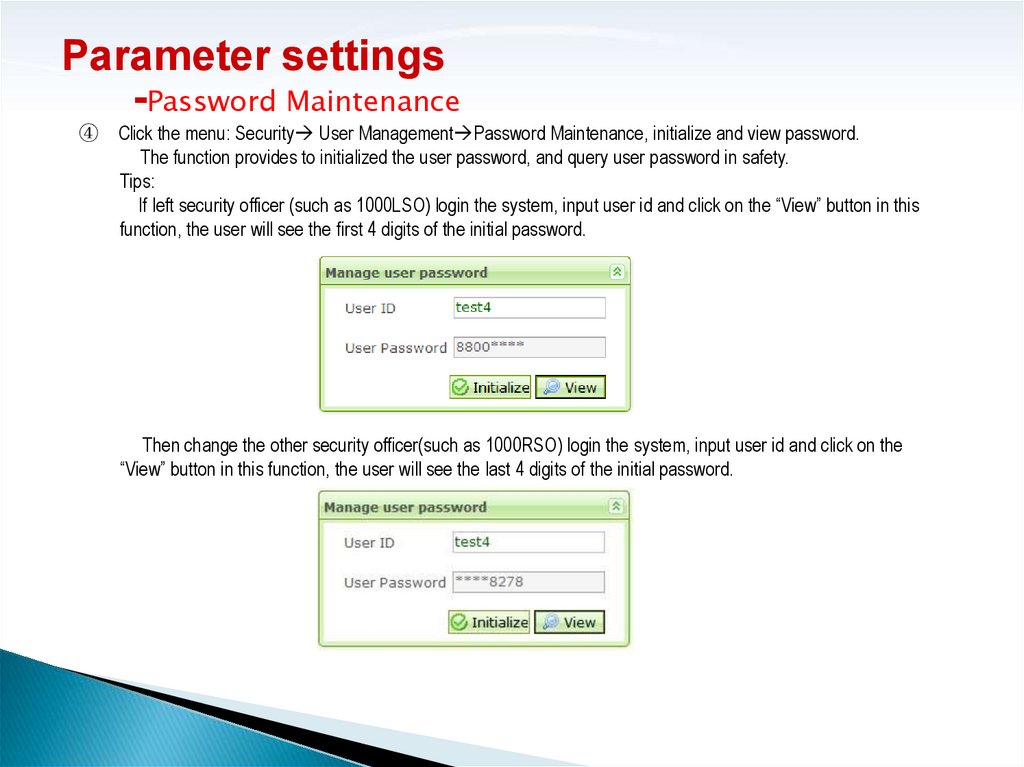

Parameter settings-Password Maintenance

④ Click the menu: Security User Management Password Maintenance, initialize and view password.

The function provides to initialized the user password, and query user password in safety.

Tips:

If left security officer (such as 1000LSO) login the system, input user id and click on the “View” button in this

function, the user will see the first 4 digits of the initial password.

Then change the other security officer(such as 1000RSO) login the system, input user id and click on the

“View” button in this function, the user will see the last 4 digits of the initial password.

17.

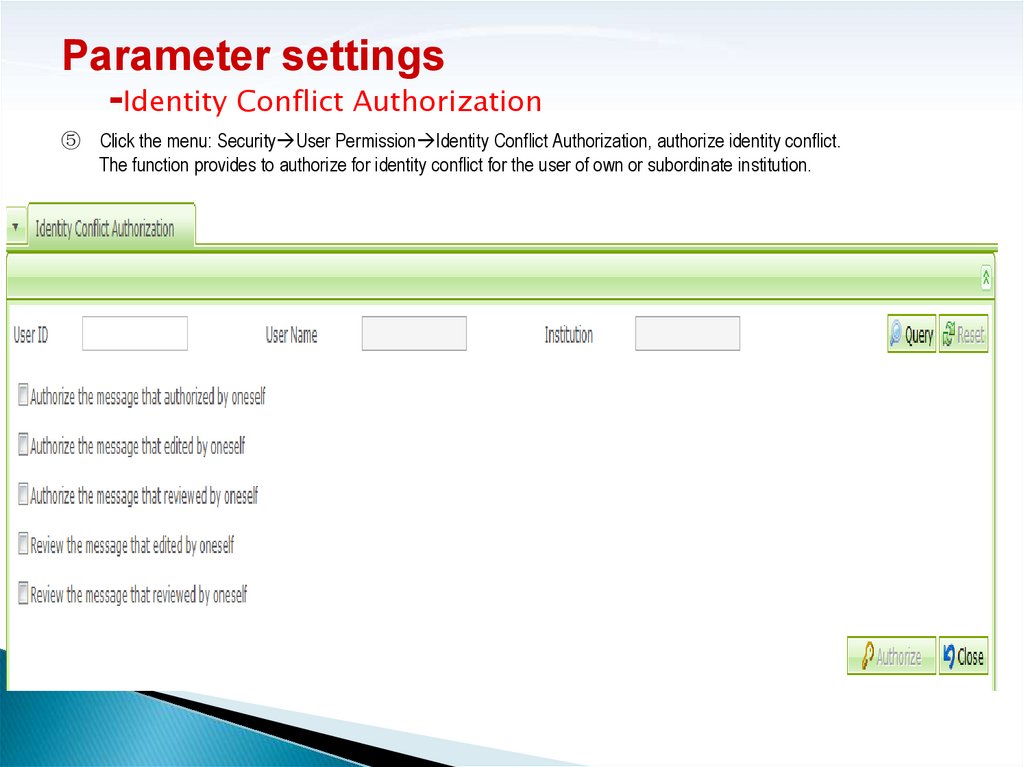

Parameter settings-Identity Conflict Authorization

⑤ Click the menu: Security User Permission Identity Conflict Authorization, authorize identity conflict.

The function provides to authorize for identity conflict for the user of own or subordinate institution.

18.

ContentsFinance Message Exchanging System

System Overview

Function Descriptions

Operate Guide

Browser/Server Method

Parameter settings

Business treatment

Client/Server Method

Memouandum

19.

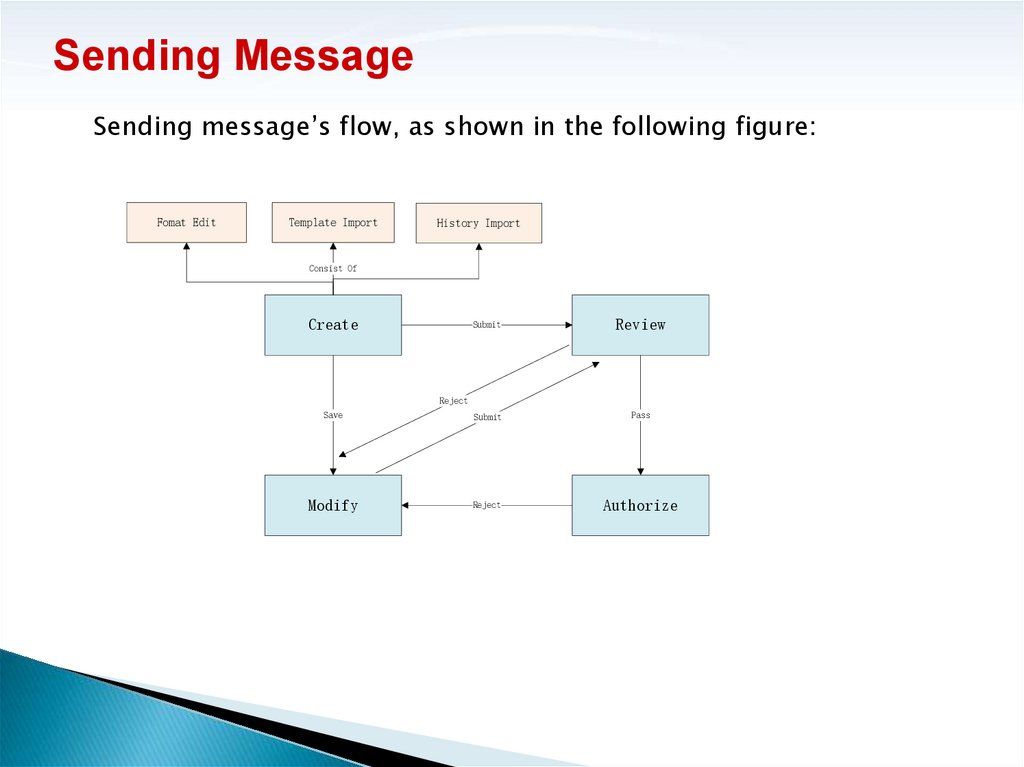

Sending MessageSending message’s flow, as shown in the following figure:

Fomat Edit

Template Import

History Import

Consist Of

Create

Submit

Review

Save

Submit

Pass

Modify

Reject

Authorize

Reject

20.

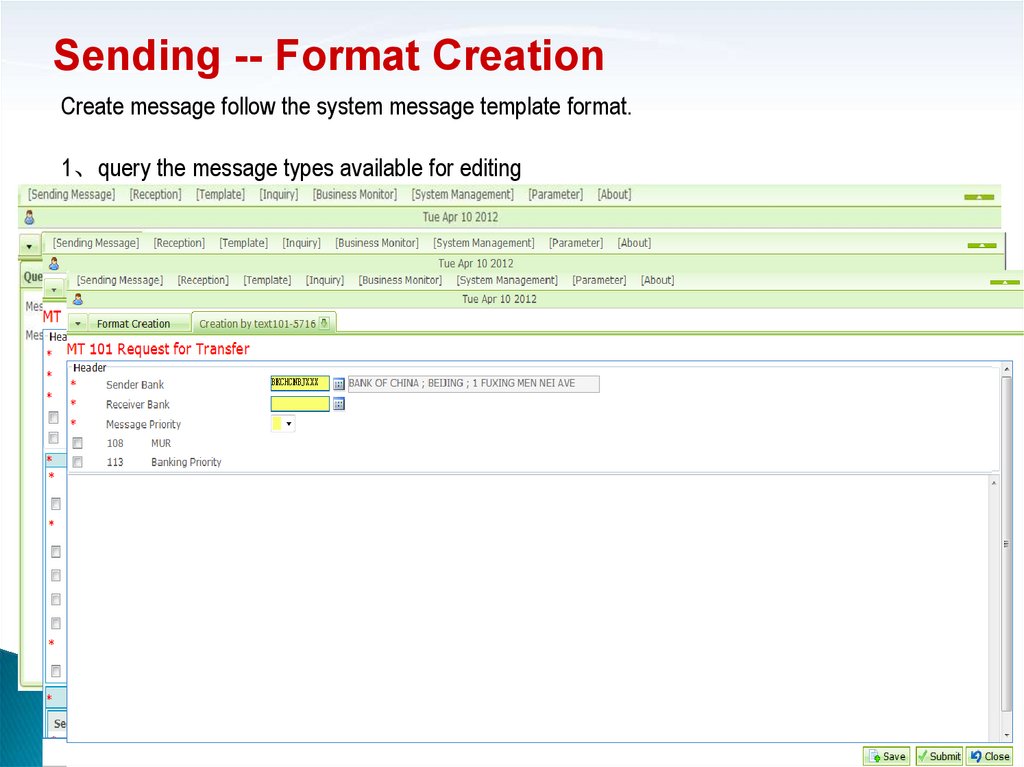

Sending -- Format CreationCreate message follow the system message template format.

1、query the message types available for editing

2、 Click on the“Format Edit”button,enter the format edit page of the seleced

message type

3、 Click on the“Text Edit”button,enter the text edit page of the seleced message

type

21.

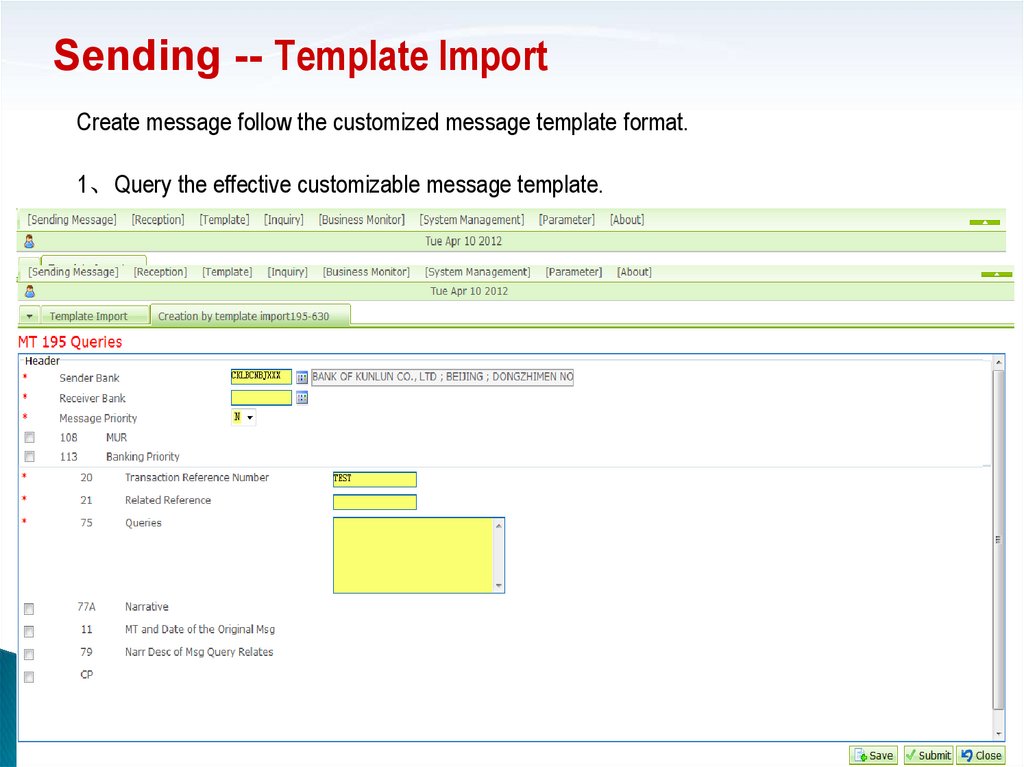

Sending -- Template ImportCreate message follow the customized message template format.

1、Query the effective customizable message template.

2、 Click on the “Import” button, enter the edit page of the selected message template.

22.

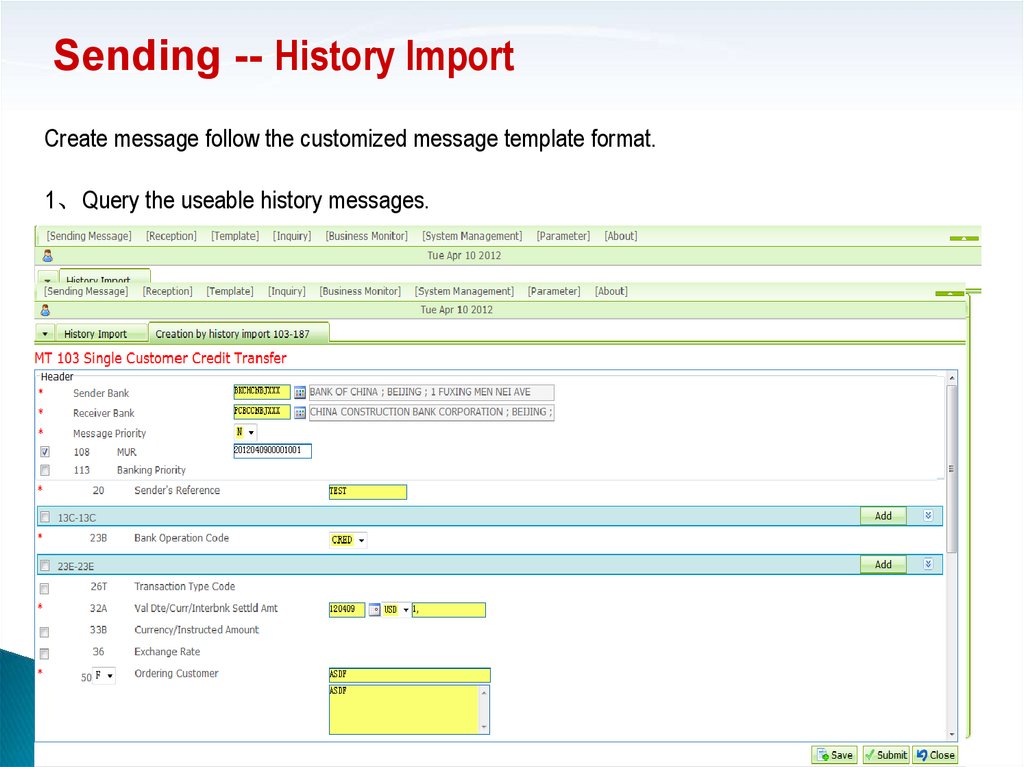

Sending -- History ImportCreate message follow the customized message template format.

1、Query the useable history messages.

2、 Click on the “Import” button, enter the edit page of the selected history message.

23.

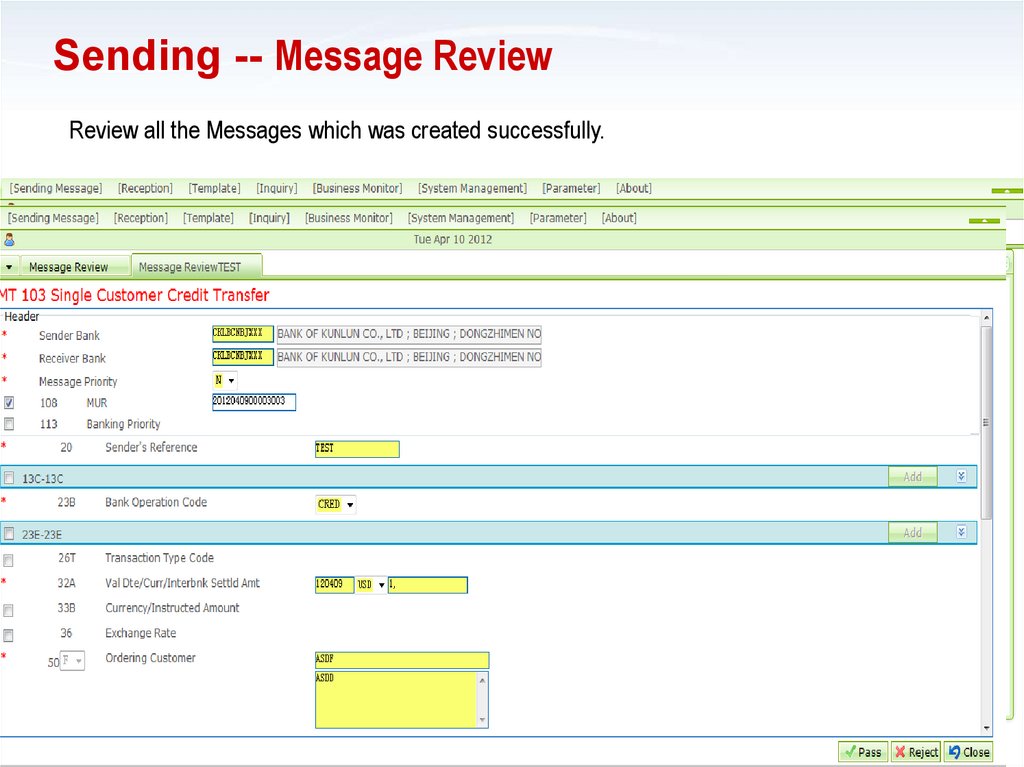

Sending -- Message ReviewReview all the Messages which was created successfully.

24.

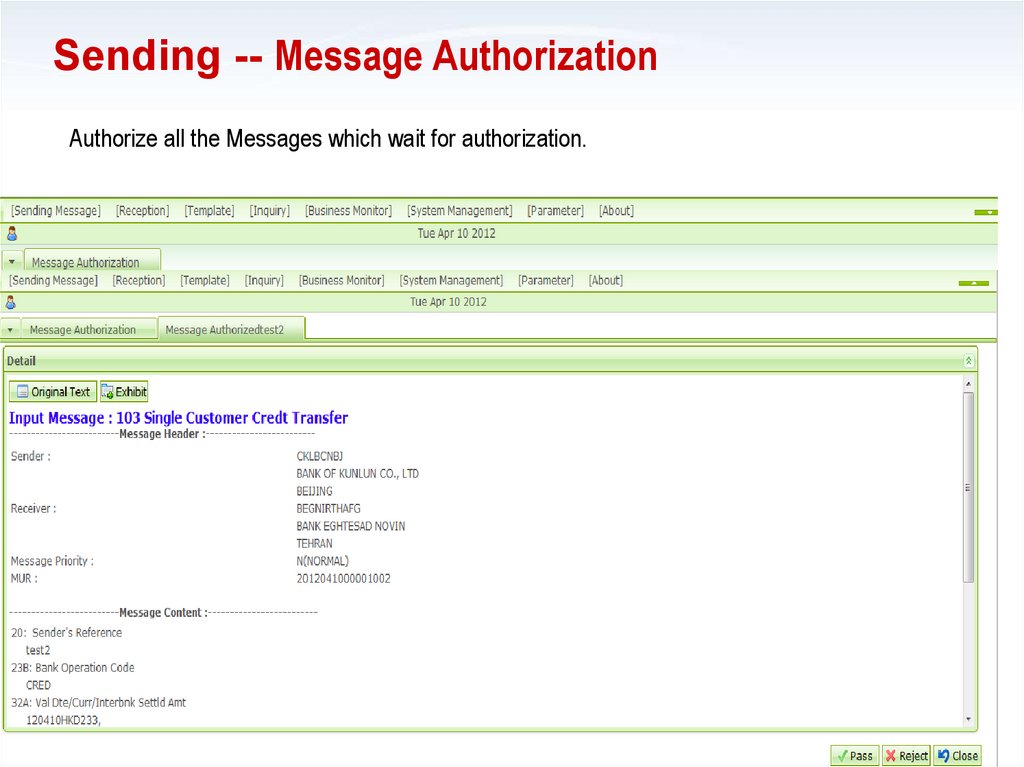

Sending -- Message AuthorizationAuthorize all the Messages which wait for authorization.

25.

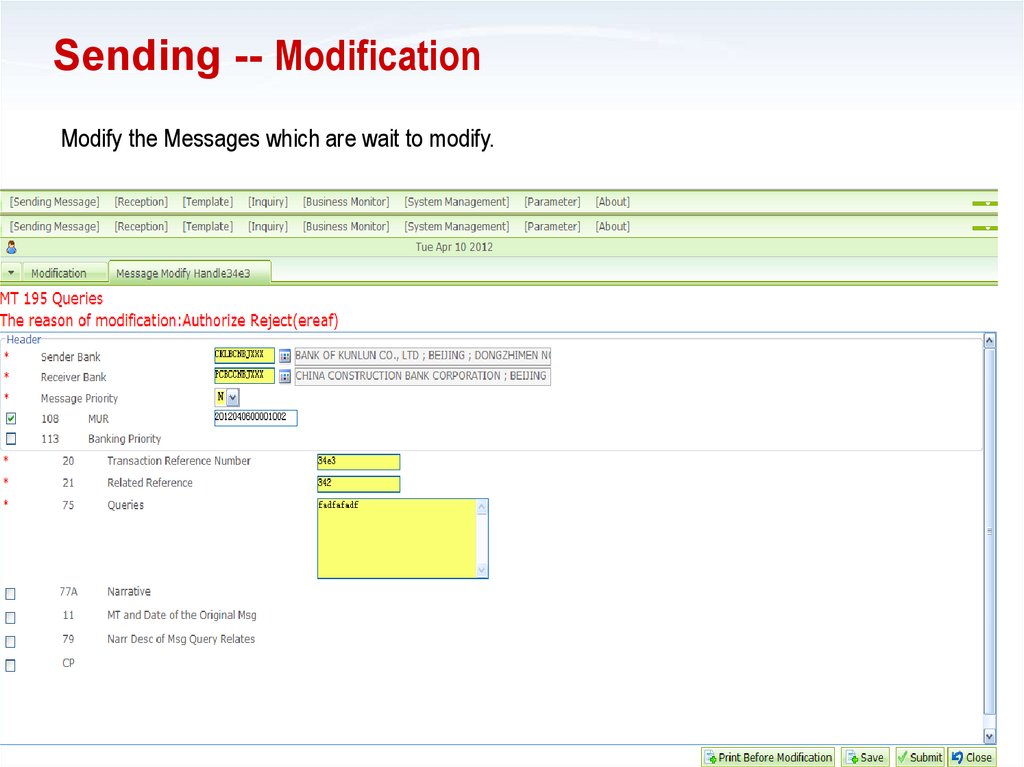

Sending -- ModificationModify the Messages which are wait to modify.

26.

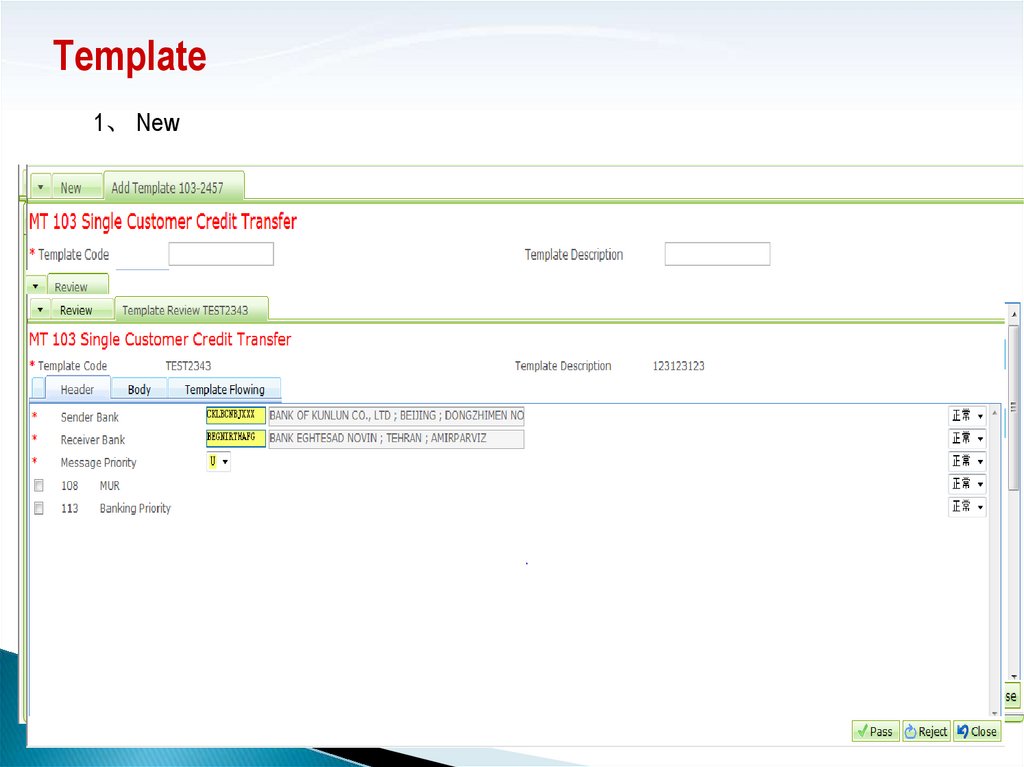

Template1、 New

Click the menu: Template New to customize the message template

for the function of creating message

2、 Review

Click the menu: Template Review to review the new edited message

template, then you can use the valid reviewed message template

in the function of creating message .

27.

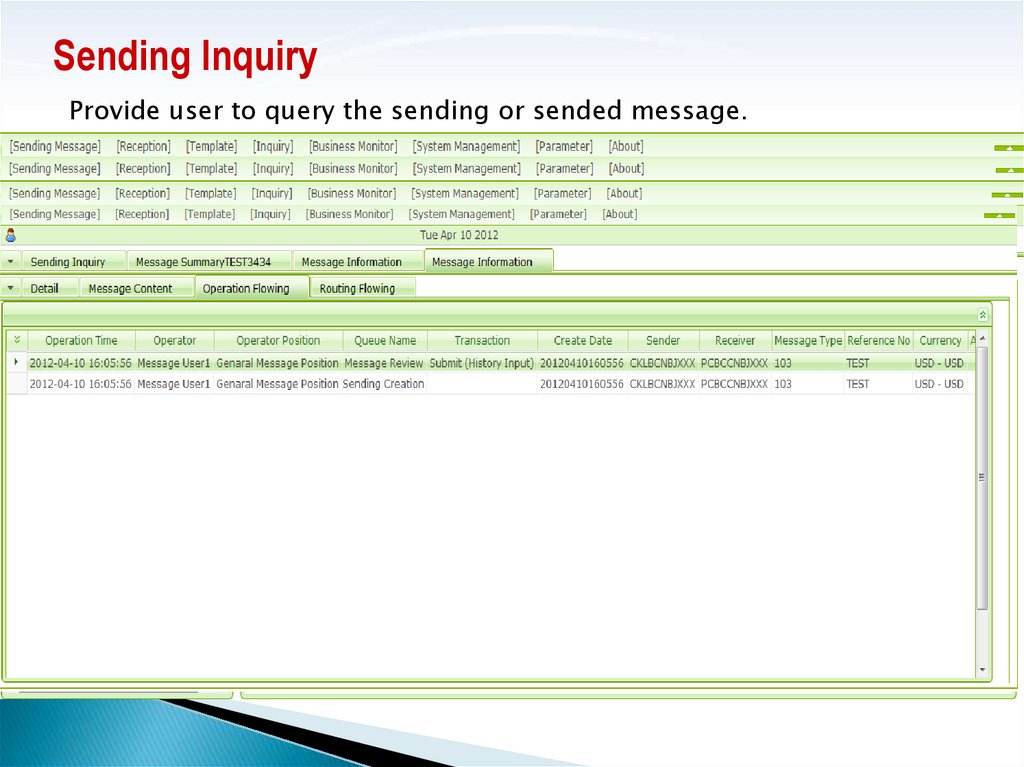

Sending InquiryProvide user to query the sending or sended message.

28.

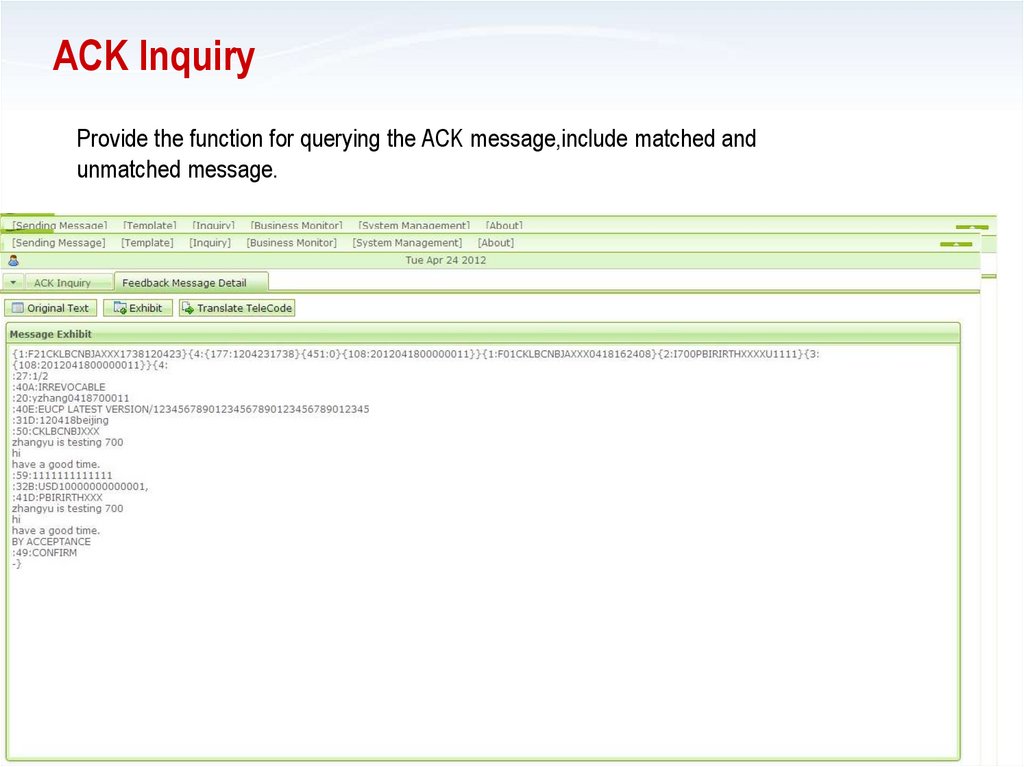

ACK InquiryProvide the function for querying the ACK message,include matched and

unmatched message.

29.

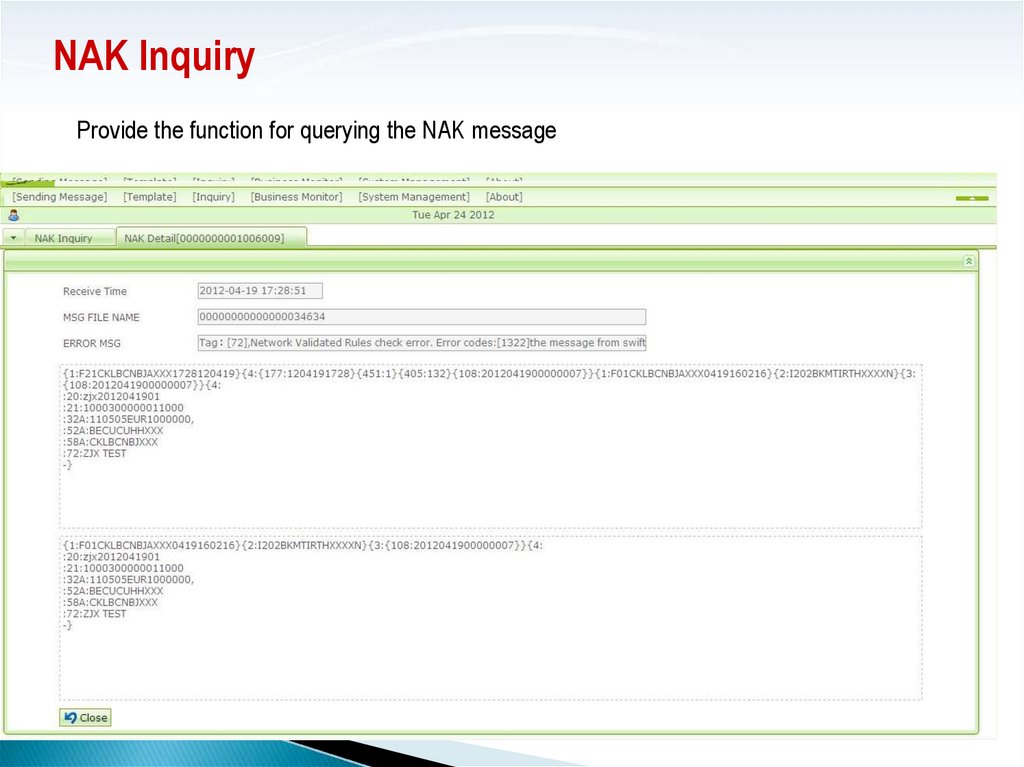

NAK InquiryProvide the function for querying the NAK message

30.

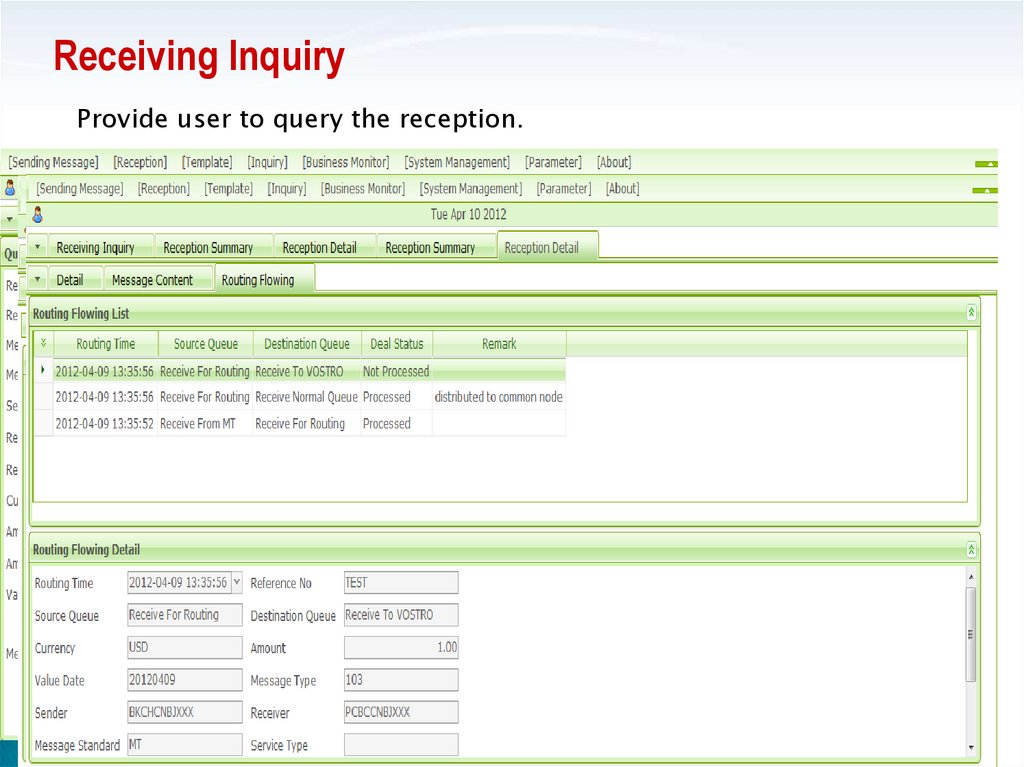

Receiving InquiryProvide user to query the reception.

31.

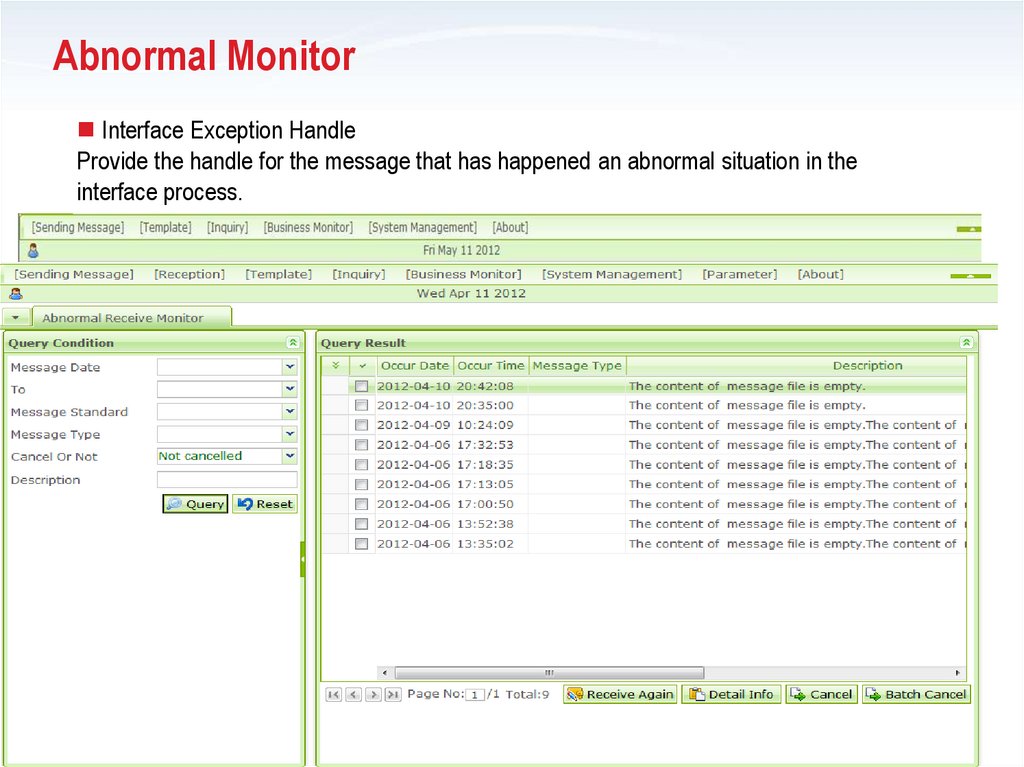

Abnormal MonitorInterface Exception Handle

Provide the handle for the message that has happened an abnormal situation in the

interface process.

Abnormal Task Monitor

Provide the handle for the message that has happened an abnormal situation in the

sending or receiving routing process.

Abnormal Receive Monitor

Provide the handle for the message that has happened an abnormal situation

while reception handling service was running.

32.

ContentsFinance Message Exchanging System

System Overview

Function Descriptions

Operate Guide

Browser/Server Method

Client/Server Method

Memouandum

33.

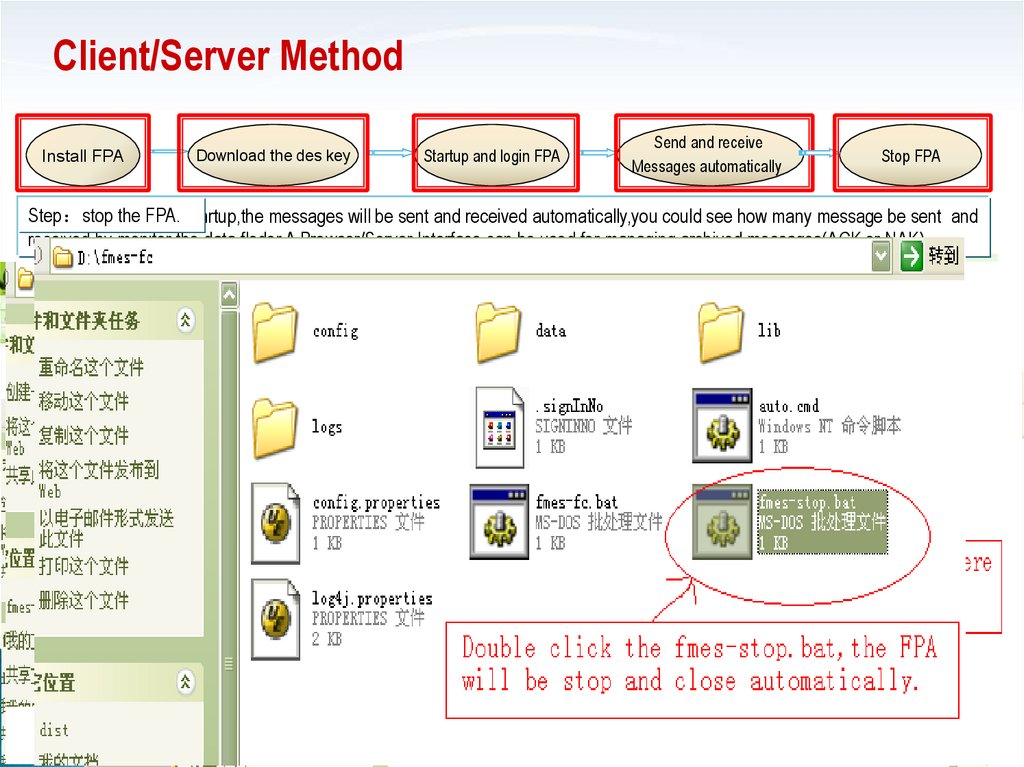

Client/Server MethodInstall FPA

Download the des key

Startup and login FPA

Send and receive

Messages automatically

Stop FPA

Step stop

Step you

Step startup

the

and

FPA.

totime

login

uncompress

check

thetobe

into

login

your

status

local

by

machine.and

the system

logs.

you can

some

files

in the

Step If youhave

Step after

first

FPA

startup,the

tothe

useFPA.and

thethe

messages

FPAfmes-fc.zip

or want

will

exchange

sent

and

the

received

des

file,you

automatically,you

must

loginfind

the

could

FMES

see

systenm

how

many

,directory.

generate

messageand

bedownload

sent and

the des key

received

by monitor

to your local

the data

machine,then

floder.A Browser/Server

you must rename

Interface

the new

candes

be file

used

to for

“des”

managing

and replace

archived

the old

messages(ACK

des key file. or NAK).

34.

ContentsFinance Message Exchanging System

System Overview

Function Descriptions

Operate Guide

Memouandum

35.

Questions shall be answeredThe following questions shall be answered by correspondent banks of Bank of Kunlun before we design and

implement the Client/Sever scenario of Financial Message Exchanging System (FMES):

(1) Whether your esteemed bank is capable of uploading messages generated by your internal system and prepared

to send to Bank of Kunlun to a designated folder on a local server.

(2) Whether your esteemed bank is capable of downloading messages generated by Bank of Kunlun internal system

and prepared to send to you from a designated folder on a local server.

(3) In order to demonstrate the feasibility of the Financial Message Exchanging System (FMES), both Bank of

Kunlun and our correspondent banks shall prepare sample messages generated by internal system and provide them to

the other party in order for either party to use these sample messages to conduct pilot experiments on the Front

Processing Application (FPA).

software

software