Similar presentations:

Economic research on consumption and savings. Lecture 6

1.

Economic research on consumption and savingsLecture 6

2.

Before J.M.KeynesBefore Keynes households’ consumption was viewed as depended on the interest rate a key factor of saving behaviour.

However, "(t)here are not many people who will alter their way of living because the rate

of interest has fallen from 5 to 4 percent" (Keynes, 1936: 94)

Keynes (1936) identified eight different types of saving motives:

(1) “Precaution”, which implies building up a reserve against unforeseen contingencies;

(2) “Foresight”, which includes providing for anticipated future differences between

income and expenditure;

(3) “Calculation”, which refers to the wish to earn interest;

(4) “Improvement”, which means to enjoy a gradually improving standard of living over

time;

(5) “Independence”, which refers to the need to feel independent and to have the power

to do things;

(6) “Enterprise”, which means having the freedom to invest money if and when it is

favorable;

(7) “Pride”, which concerns leaving money to heirs (the bequest motive); and

(8) “Avarice” or pure miserliness.

Browning & Lusardi (1996) added one extra motive - the “down payment

motive”

3.

Absolute Income Hypothesis (AIH)The main psychological law of consumption:

“Men are disposable as a rule and on the average

to increases their consumption as their income

increases, but hot by as much as the increases

in their income.”

J.M.Keynes

Keynes’ model (AIH): C = c0 + c1 Yd

J.M Keynes

where

5 June 1883 - 21 April 1946

C = total consumption,

c0 = autonomous consumption (c0 > 0),

c1 is the marginal propensity to consume (MPC)

(0 < c1 < 1), and

Yd = disposable income (income after government intervention – benefits, taxes

and transfer payments – or Y + (G – T)).

For c1 = 0.75, if income increases by 100, consumption increases by 75 and

photo

savings increase by 25.

AIH - the MPC is less than the APC, and the APC declines as income rises.

4.

How can one test the Absolute Income Hypothesis (AIH)?photo

5.

Cross-section dataHouseholds with higher incomes:

consume more, -> MPC > 0

save more, -> MPC < 1

save a larger fraction of their income, -> APC as Y

Very strong correlation between income and

consumption -> income seemed to be the main

determinant of consumption

6.

Kuznets’ critique of AIHWhile early empirical work found support for the AIH and the proposition that

the APC falls as income rises, long-run data offered contrary evidence

(Kuznets 1946).

This indicated that the APC out of national disposable income appeared not

to vary with rising income over the relatively long run; in particular, it did

not fall as disposable income rose, as predicted by the linear AIH inclusive

of an intercept.

Rather, the apparent constancy of the APC suggested a long-run

proportional consumption function (C), such that the APC equals the MPC.

photo

7.

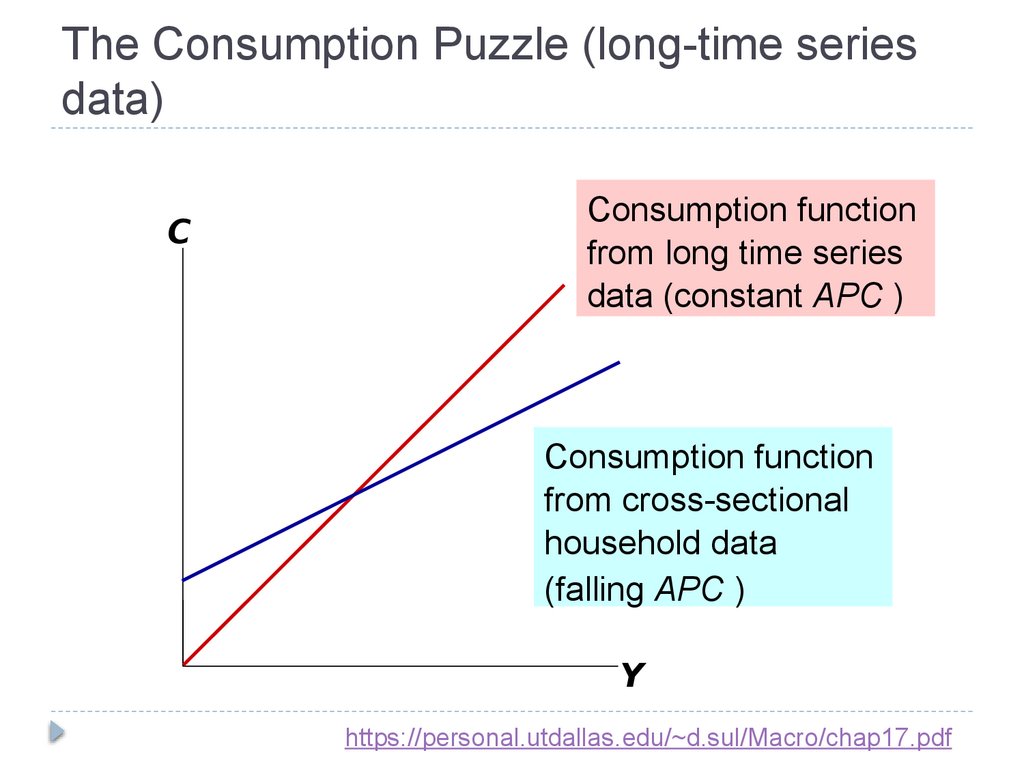

The Consumption Puzzle (long-time seriesdata)

C

Consumption function

from long time series

data (constant APC )

Consumption function

from cross-sectional

household data

(falling APC )

Y

https://personal.utdallas.edu/~d.sul/Macro/chap17.pdf

8.

Keynes vs. FisherKeynes:

Current consumption depends only on current income. Kuznets (1942) has

conducted a long-run consumption function using US’ time series data

from 1897 to 1938. He showed that in the long run, contrary to AIH

assumption APC and MPC are equal and not far from one.

Irving Fisher (1930):

Consumer is forward-looking and chooses consumption for the present

and future to maximize lifetime satisfaction.

Current consumption depends only on the present value of lifetime

income. The timing of income is irrelevant because the consumer can

borrow or lend between periods.

If consumer knows that her future income will increase, she can spread

the extra consumption over both periods by borrowing in the current

period.

However, if consumer faces borrowing constraints (‘liquidity constraints’),

then she may not be able to increase current consumption ...and her

consumption may behave as in the Keynesian theory even though she is

rational & forward-looking. https://personal.utdallas.edu/~d.sul/Macro/chap17.pdf

9.

Permanent income (PIH) & Life-cycle (LCH) hypothesesas a critical response to Absolute Income Hypothesis (AIH)

Keynes’ model (AIH) failed to explain

consumers’

behaviour accurately:

• econometric concerns including the problem of omitted

variables and autocorrelation;

• Keynes’ predictions about after-war consumption did not

come true.

I. Fisher (1930) – consumer is forward-looking and chooses

consumption for the present and future to maximize lifetime

satisfaction.

Milton Friedman

Milton Friedman

(1912-2006)

M. Friedman and F. Modigliani - theories of PIH and LCH,

both appeared in 1957.

They proposed that current income is not the major factor

influencing consumption/saving decision. Rather, it is the

person’s total life-time income – permanent income, as

Friedman puts it.

Higher School of Economics , Moscow, 2011

photo

Franco Modigliani

(1918-2003)

10.

Permanent Income HypothesisAccording to PIH, proposed by M.Friedman, one’s income has two

elements: permanent (anticipated or planned) and transitory (windfall).

Permanent component is determined by person’s long-term

expectations about the future income over the lifespan.

When we think of permanent income, both monetary assets (wages,

dividends) and human capital (education, experience) should be taken into

consideration.

Assumption that the correlation between the transitory components

of income and consumption is zero.

• What had been previously considered as an effect of other (social) variables

could be shown as the influence of income if instead of current measured

income the ‘permanent income’ had been introduced.

Example - black families spent less on consumption and saved more than their

white counterparts, if their level of current income is considered equal. However,

black families are not more ‘thrifty’ - because the level of permanent income was

photo

lower for black households, the same level of measured current income meant

different financial circumstances under which white and black families had to

function.

11.

The Life-Cycle HypothesisLifetime resources = W + RY

To achieve smooth consumption, consumer divides her

resources equally over time: C = (W + RY )/T , or

C = aW + bY

where

a = (1/T ) is the marginal propensity to consume out of wealth

b = (R/T ) is the marginal propensity to consume out of income

W = initial wealth

Y = annual income until retirement (assumed constant)

R = number of years until retirement

T = lifetime in years

https://personal.utdallas.edu/~d.sul/Macro/chap17.pdf

12.

Life-Cycle Hypothesisphoto

13.

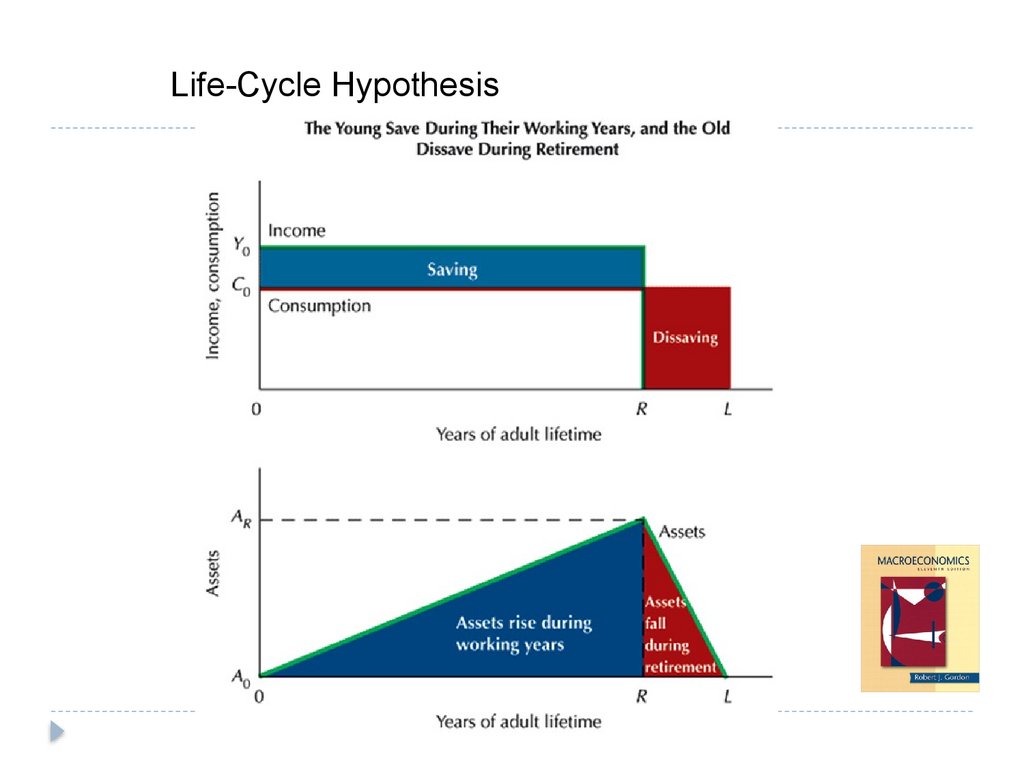

The LCH can solve the consumption puzzleThe life-cycle consumption function implies

Across households, income varies more than

wealth, so high-income households should have a

lower APC than low-income households.

Over time, aggregate wealth and income grow

together, causing APC to remain stable.

https://personal.utdallas.edu/~d.sul/Macro/chap17.pdf

14.

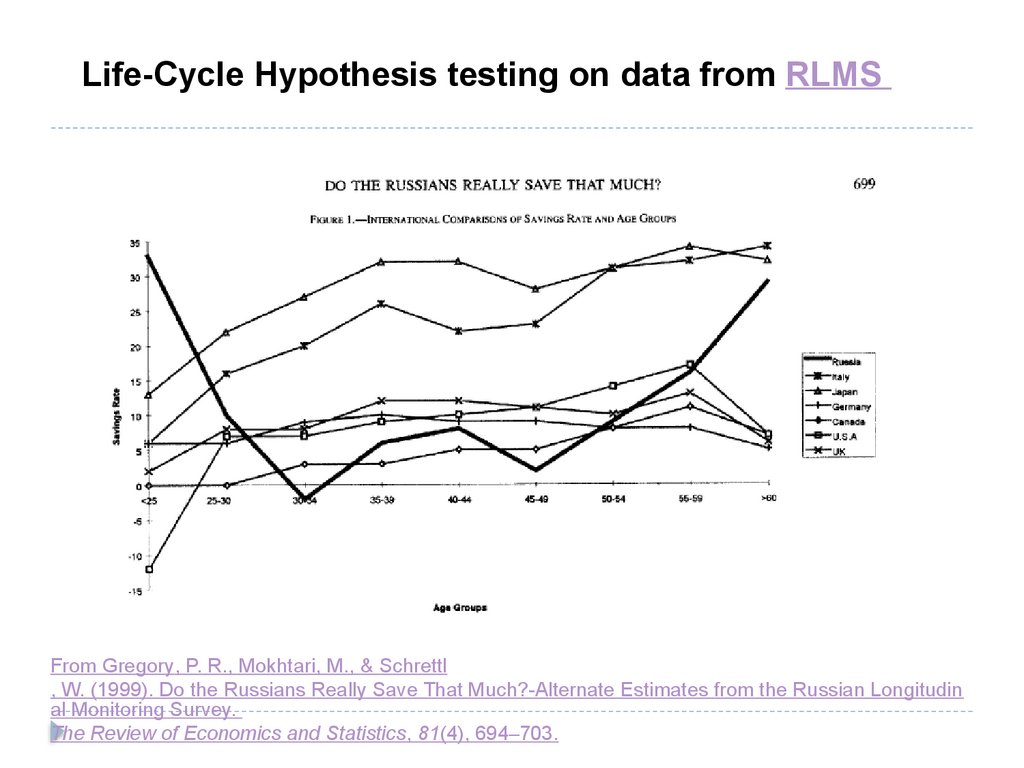

Life-Cycle Hypothesis testing on data from RLMSphoto

From Gregory, P. R., Mokhtari, M., & Schrettl

, W. (1999). Do the Russians Really Save That Much?-Alternate Estimates from the Russian Longitudin

al Monitoring Survey.

The Review of Economics and Statistics, 81(4), 694–703.

15.

Income uncertainty - the main challenge to theneoclassical consumption and savings models (PIH & LCH)

Why income uncertainty is a big problem?

In PI-LC framework consumption increases with current

income only if that increase is a permanent one

In case of uncertainty individuals can not estimate the

permanent (life-cycle) level of consumption and as a result

are unable to smooth out the fluctuations of income

So, one needs to introduce assumptions about the nature of

uncertainty and preferences, otherwise it is not possible to

obtain a closed form solution for consumption.

Excess sensitivity of consumption to income: consumption

responds too much to predictable changes in income.

The best candidate explanation is the existence of borrowing

(liquidity) constraints.

16.

Consumer response to the Reagan tax cuts - Paper by Nicholas S.

Souleles

, Journal of Public Economics 85 (2002), pp.99-120

Research question

Reagan tax cut – tax reform. While its second and third stage the reform

was announced in advance.

Phases of Reagan tax cut

1. 5% decrease – October 1981;

10% decrease - July 1982;

3. 10% deacrease – July 1983

the PIH model - consumers should respond to news about their future tax

liability, not to previously expected actual changes in withholding cash

flows.

However, as Souleles noticed, consumption is found to be excessively

sensitive to the tax cuts, counter to the model. Liquidity constraints and

other standard explanations do not appear to explain this excess

sensitivity.

2.

17.

More research on the excess sensitivity ofconsumption to income

Wilcox (1989) found that social security recipients

respond not to the announcement of increases in their

benefits, but only later on actually receiving the

increases.

Poterba (1988) concluded that consumption did not

react to news of policy changes, counter to the LC/PI

model.

Fisher et al. (2020) the MPC is lower at higher wealth

quintiles, indicating that low wealth households cannot

smooth consumption as much as other households.

This implies that increasing wealth inequality likely

reduces aggregate consumption, which, in turn, could

limit economic growth

18.

Borrowing (liquidity) constraintsIt has now become customary to interpret evidence of 'excess

sensitivity' of consumption growth to labour income as an indication

of 'liquidity constraints', by which it is usually meant the presence of

some imperfection in financial markets that prevents people from

borrowing.

Deaton (1991) estimated the effect of liquidity constraints on the

level of consumption. His conclusion was that the behaviour induced

by the presence of liquidity constraints is similar to that associated

with a precautionary motive for saving. As in the precautionary

motive for saving, people will accumulate a buffer stock to avoid

the possibility of needing a loan that they cannot obtain.

Furthermore, the liquidity constraint will be binding only occasionally

as during most periods, individuals avoid, by their optimal behaviour,

to find themselves constrained.

19.

Buffer-stock saving modelWhen consumers are both impatient and prudent there will be

a target level of wealth (`cash' for short) such that if actual

cash exceeds the target, the consumer will spend freely

and cash will fall, while if actual cash is below the target the

consumer will save and cash will rise.

Gourinchas and Parker (2002) estimate the model and

conclude that the buffer-stock saving phase of life lasts from

age 25 until around age 40-45.

Carroll (1992) - it can be optimal for average household

spending patterns to mirror average household income

profiles over much of the life cycle.

20.

Bequest motivesOne of the implications of the simplest version of the life cycle

model is that wealth is decumulated in the last part of the life

cycle.

While the rate at which wealth is decumulated depends on the

parameters of the model and in particular about beliefs about

longevity, the result that wealth should decline seems to be

robust.

The evidence on this point is mixed, in that several studies do not

find strong evidence of decumulation of wealth by the elderly.

21.

Measuring cohort effectsAs the data sets are not panels, to estimate age profiles, researchers

forced to use grouping techniques. These techniques were first used

within life cycle models by Browning, Deaton and Irish (1985).

Rather than following the same individual over time, one can follow tile

average behaviour of a group of individuals as they age. Groups can

be defined in different ways, as long as the membership of the group

is constant over time.

To compute the life cycle profile of a given variable, say log

consumption, one splits the households interviewed in each

individual cross section in groups defined on the basis of the

household head's year of birth.

Their big advantage is that they allow to study the dynamic behaviour

of the variables of interest even in the absence of panel data.

Indeed, in many respects, their use might be superior to that of panel

data! For example, time series of cross sections are probably

less affected by non-random attrition than panel data.

22.

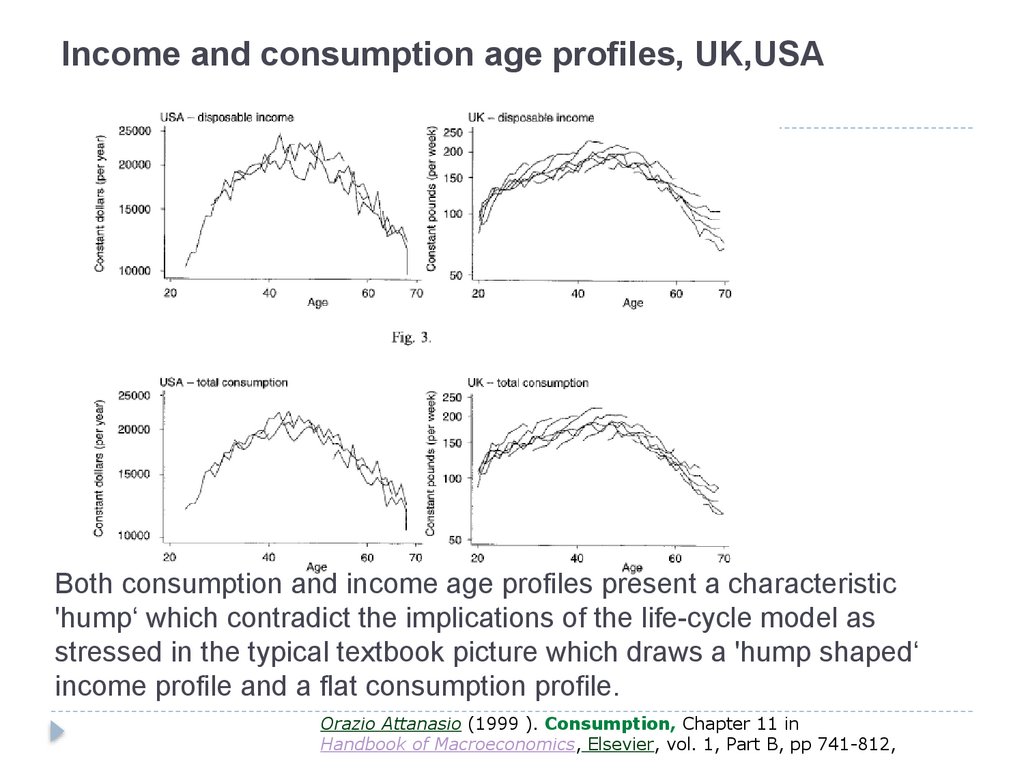

Income and consumption age profiles, UK,USABoth consumption and income age profiles present a characteristic

'hump‘ which contradict the implications of the life-cycle model as

stressed in the typical textbook picture which draws a 'hump shaped‘

income profile and a flat consumption profile.

Orazio Attanasio (1999 ). Consumption, Chapter 11 in

Handbook of Macroeconomics, Elsevier, vol. 1, Part B, pp 741-812,

23.

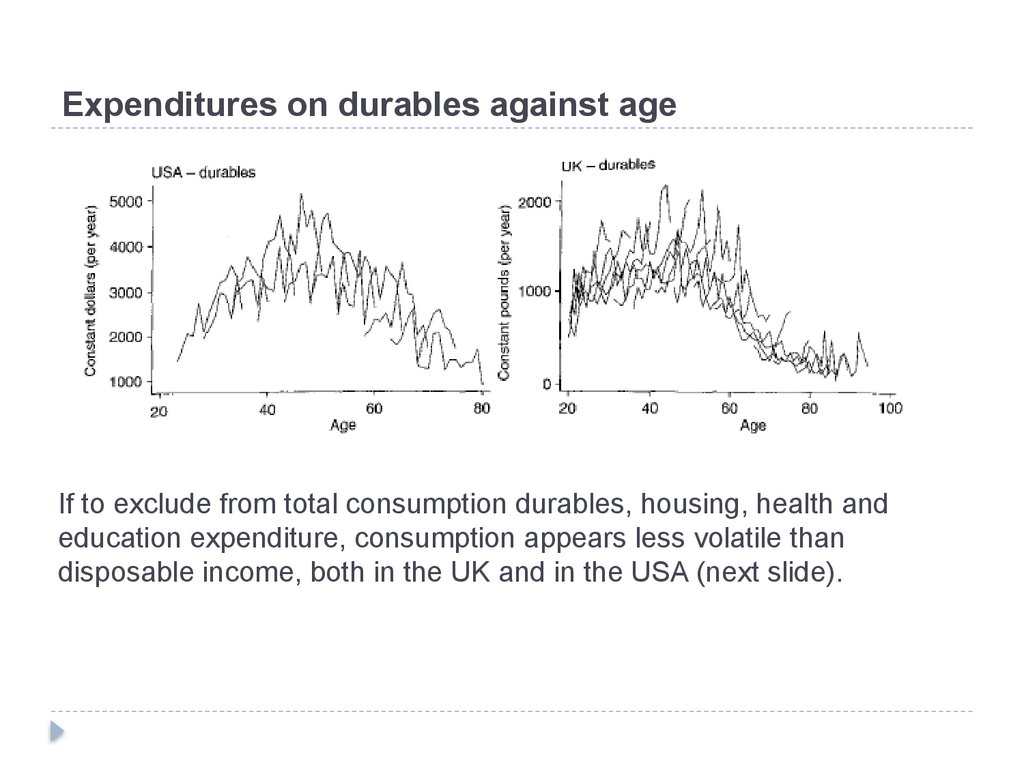

Expenditures on durables against ageIf to exclude from total consumption durables, housing, health and

education expenditure, consumption appears less volatile than

disposable income, both in the UK and in the USA (next slide).

24.

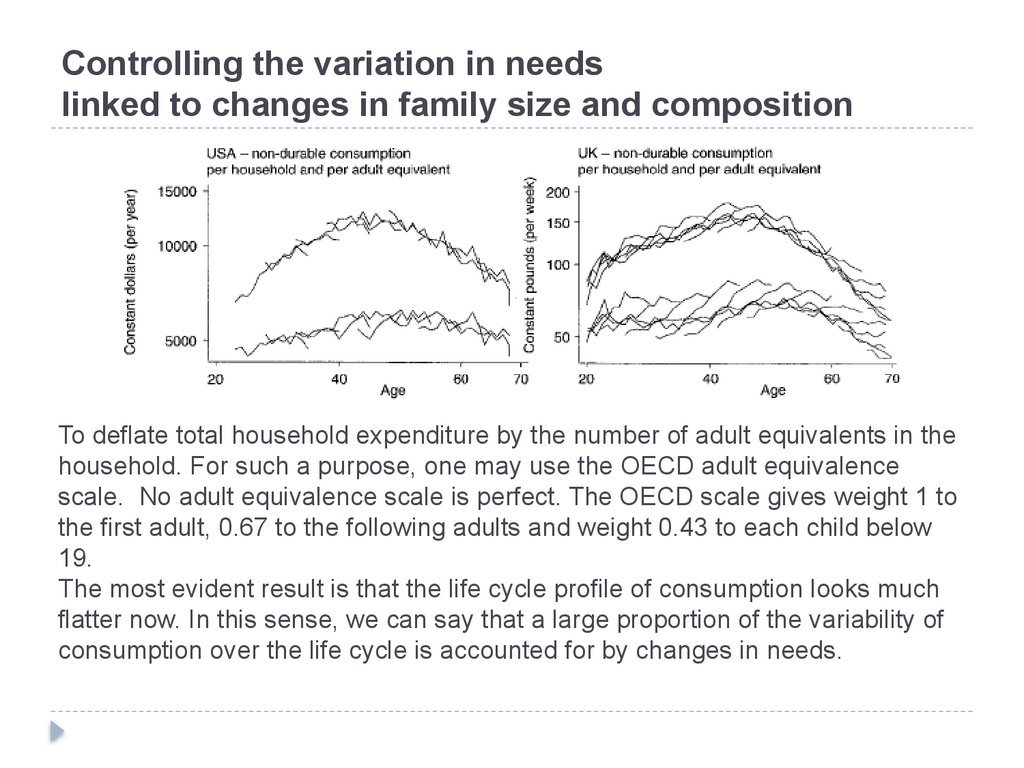

Controlling the variation in needslinked to changes in family size and composition

To deflate total household expenditure by the number of adult equivalents in the

household. For such a purpose, one may use the OECD adult equivalence

scale. No adult equivalence scale is perfect. The OECD scale gives weight 1 to

the first adult, 0.67 to the following adults and weight 0.43 to each child below

19.

The most evident result is that the life cycle profile of consumption looks much

flatter now. In this sense, we can say that a large proportion of the variability of

consumption over the life cycle is accounted for by changes in needs.

economics

economics