Similar presentations:

Financial plan

1.

FINANCIAL PLANB. ALIMZHAN, D. AUBAKIROVA,

V. KIM, Z. ABDUMANAP

United Buildings company

2.

Identify possiblesources of project

financing

Possible sources of funding. First of all it is

customers who will pay for the cost of repair

costs, with only a small difference to the

company's profits. The second option is large

construction companies that can offer a contract

for the construction of a residential facility and

repairs there.

3.

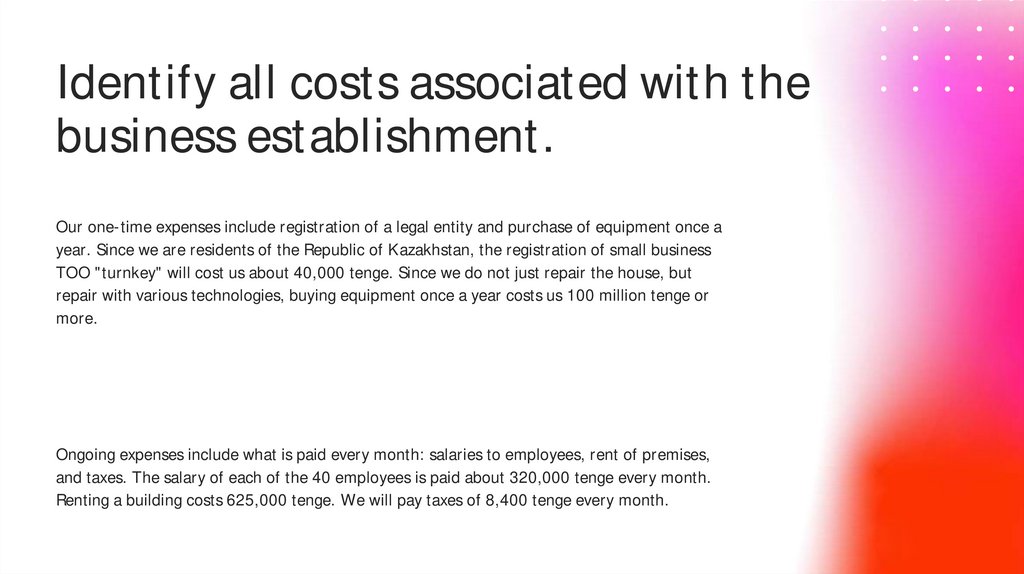

Identify all costs associated with thebusiness establishment.

Our one-time expenses include registration of a legal entity and purchase of equipment once a

year. Since we are residents of the Republic of Kazakhstan, the registration of small business

TOO "turnkey" will cost us about 40,000 tenge. Since we do not just repair the house, but

repair with various technologies, buying equipment once a year costs us 100 million tenge or

more.

Ongoing expenses include what is paid every month: salaries to employees, rent of premises,

and taxes. The salary of each of the 40 employees is paid about 320,000 tenge every month.

Renting a building costs 625,000 tenge. We will pay taxes of 8,400 tenge every month.

4.

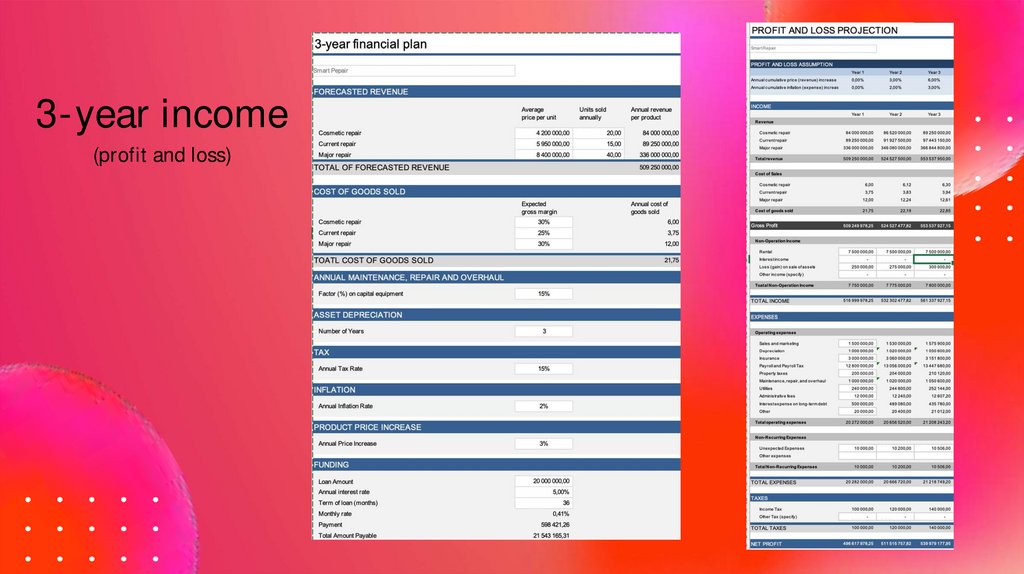

3-year income(profit and loss)

5.

-The cost of sales is the sum of all expenses made in the creation of a product or service that hasbeen sold.

Cost of Sales = Beginning Inventory + Raw Material Purchase + Cost of Direct Labor +

Overhead Manufacturing Cost – Ending Inventory

-Gross profit is the measurement of the efficiency of a company's labor and supplies in

creating goods or services.

Gross profit= revenue- cost of product

-Operating expenses of our business:

Cost of sales

Gross profit

Selling expenses

General and administrative expenses

-After all expenditures are deducted, net income/profit reveals how much money a

corporation makes.

Net income=Total revenue-Total expenses(Taxes+Operating cost+Depreciation+Other

expenses)

finance

finance