Similar presentations:

Financial reporting

1.

Financial reportingBy: Yurasova Irina Olegovna,

Associate Professor,

Department of Audit & Corporate Reporting

iyurasova@fa.ru

2.

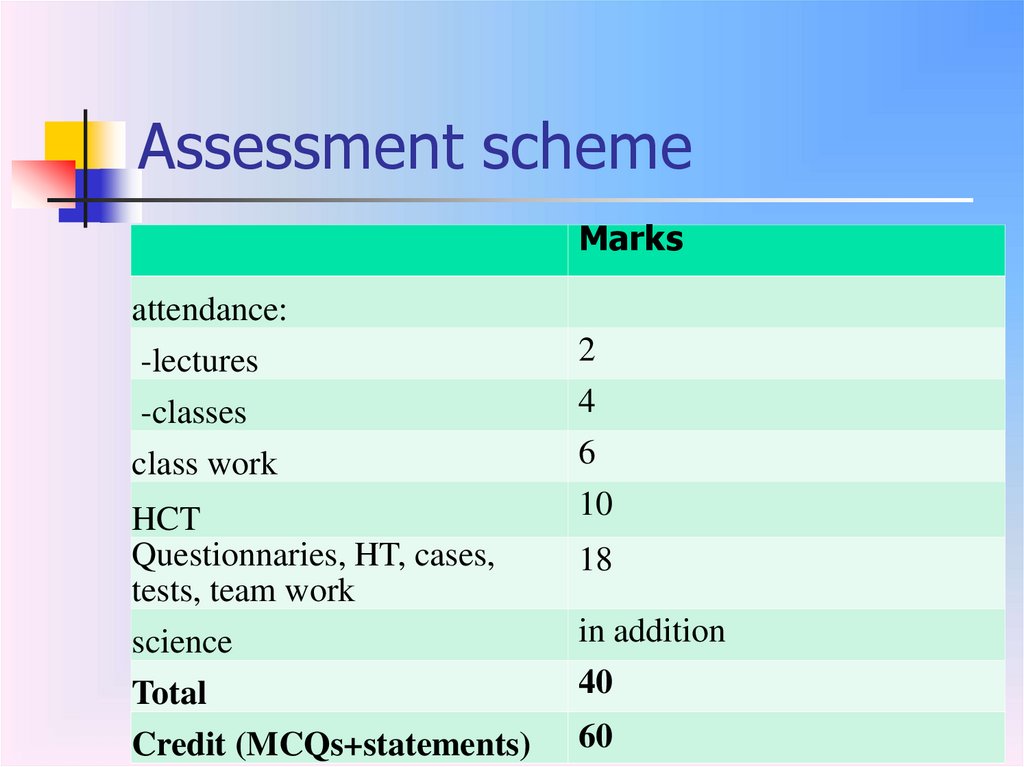

Assessment schemeMarks

attendance:

-lectures

2

-classes

class work

4

6

10

HCT

Questionnaries, HT, cases,

tests, team work

science

Total

Credit (MCQs+statements)

18

in addition

40

60

3.

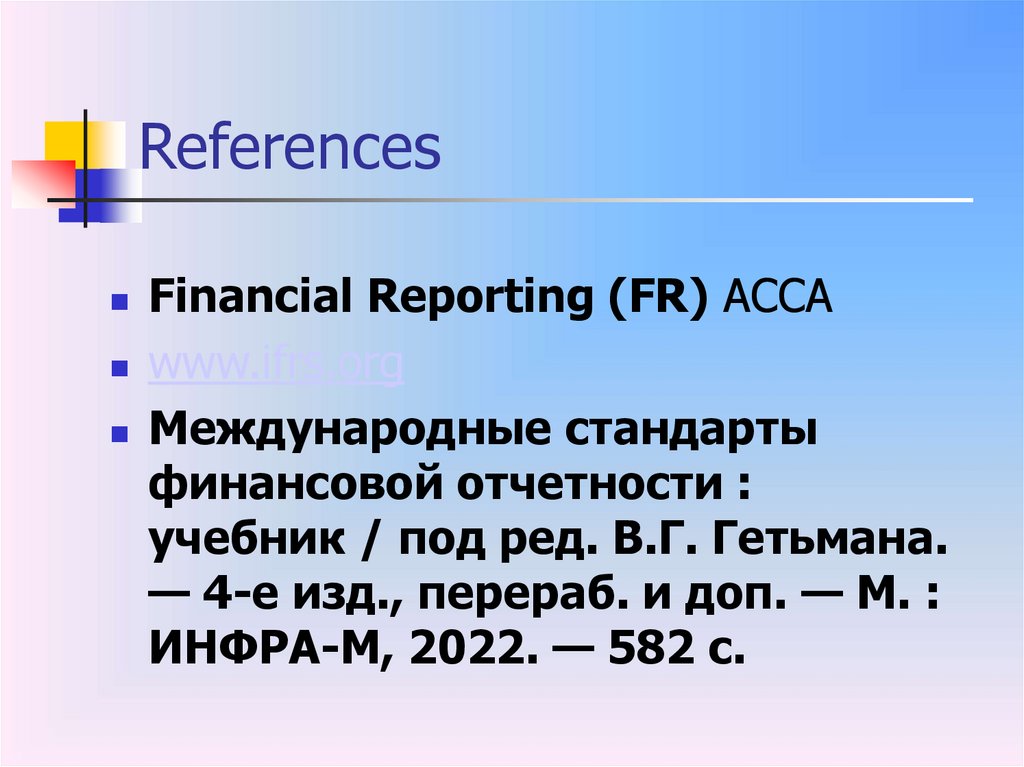

ReferencesFinancial Reporting (FR) ACCA

www.ifrs.org

Международные стандарты

финансовой отчетности :

учебник / под ред. В.Г. Гетьмана.

— 4-е изд., перераб. и доп. — М. :

ИНФРА-М, 2022. — 582 с.

4.

Conceptual frameworkis a statement of generally accepted

theoretical principles which form the

frame of reference for financial

reporting

5.

Conceptual framework andGAAP

Conceptual framework will form the

theoretical basis

Danger of not having a conceptual

framework:

contradictions and inconsistencies in

basic concepts

highly detailed standards

political pressure

6.

Advantages of a conceptualframework

standardising accounting practice

lower political interference

concentration on the same aspects

7.

Disadvantages of a conceptualframework

not certain that a single conceptual

framework can be devised which will

suit all users

may be a need for a variety of

accounting standards

not clear that a conceptual framework

makes the task of preparing and then

implementing standards any easier than

without a framework

8.

Sources of RegulationCompany Law

Accounting Standards

*Listing Rules

9.

GAAPInternational

National

IAS

UK GAAP

IFRS

US GAAP

10.

The objective of generalpurpose financial reporting

to provide information about the

reporting entity that is useful to existing

and potential investors, lenders and

other creditors in making decisions

about providing resources to the entity

11.

Types of economic decisionsBuying, selling or holding equity and

debt instruments;

Providing or settling loans and other

forms of credit; or

Exercising rights to vote on, or

otherwise influence, management's

actions that affect the use of the

entity's economic resources

12.

Review of the stewardshipto be able to review the financial

performance of the entity (effectively,

the income and expenses) as well as

other transactions (such as issuing

debt, the capital maintenance and

equity of the entity)

13.

Scope of the ConceptualFramework:

Chapter 1 The objective of general purpose financial reporting

Chapter 2 Qualitative characteristics of useful financial information

Chapter 3 Financial statements and the reporting entity

Chapter 4 The elements of financial statements

Chapter 5 Recognition and derecognition

Chapter 6 Measurement

Chapter 7 Presentation and disclosure

Chapter 8 Concepts of capital and capital maintenance

14.

Accrual accountingThe effects of transactions and other

events and circumstances on a

reporting entity's economic resources

and claims are recognised in the

periods in which they occur , even if the

resulting cash receipts and payments

occur in a different period

15.

The qualitative characteristicsidentify the types of information that are likely to

be most useful to the existing and potential

investors, lenders and other creditors for making

decisions about the reporting entity on the basis

of information in its financial report (financial

information).

16.

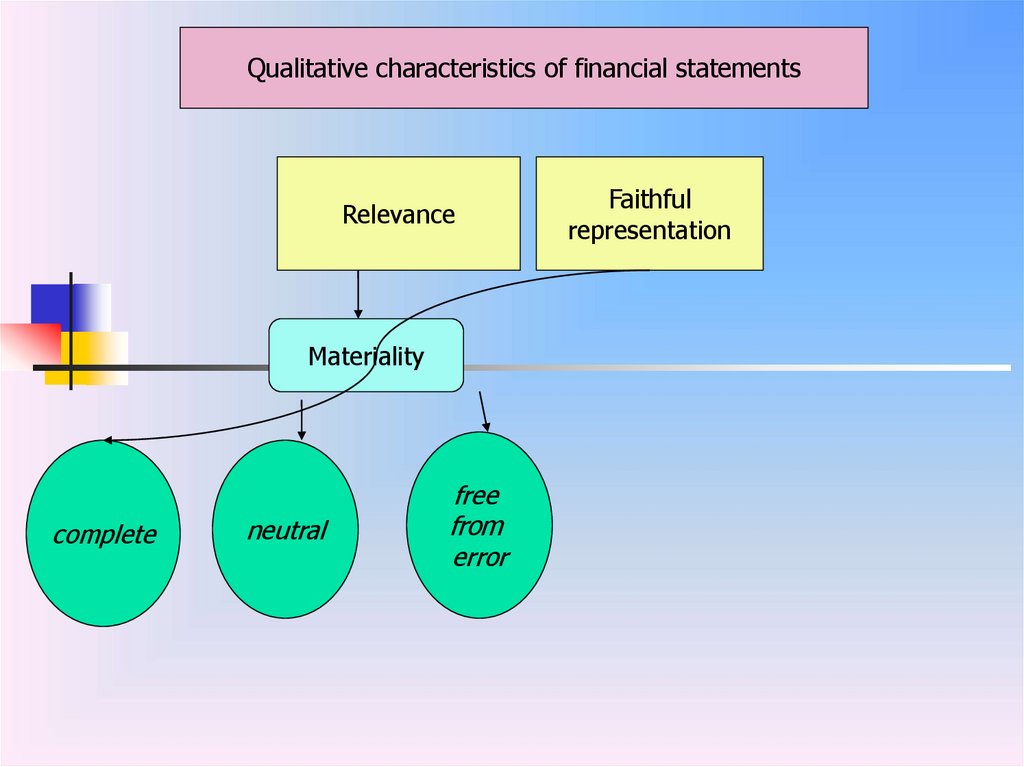

Qualitative characteristics of financial statementsRelevance

Materiality

complete

neutral

free

from

error

Faithful

representation

17.

RelevanceRelevant financial information is capable of making a difference in the decisions

made by users.

Information may be capable of making a difference in a decision even if some

users choose not to take advantage of it or are already aware of it from

other sources.

Predictive value

Confirmatory

value

17

18.

Faithful representationfinancial information must faithfully represent the

phenomena that it purports to represent

19.

completeA complete depiction includes all information necessary

for a user to understand the phenomenon being

depicted, including all necessary descriptions and

explanations

19

20.

neutralA neutral depiction is without bias in the selection or

presentation of financial information

20

21.

freefrom

error

there are no errors or omissions in the description of the

phenomenon, and the process used to produce the

reported information has been selected and applied

with no errors in the process

21

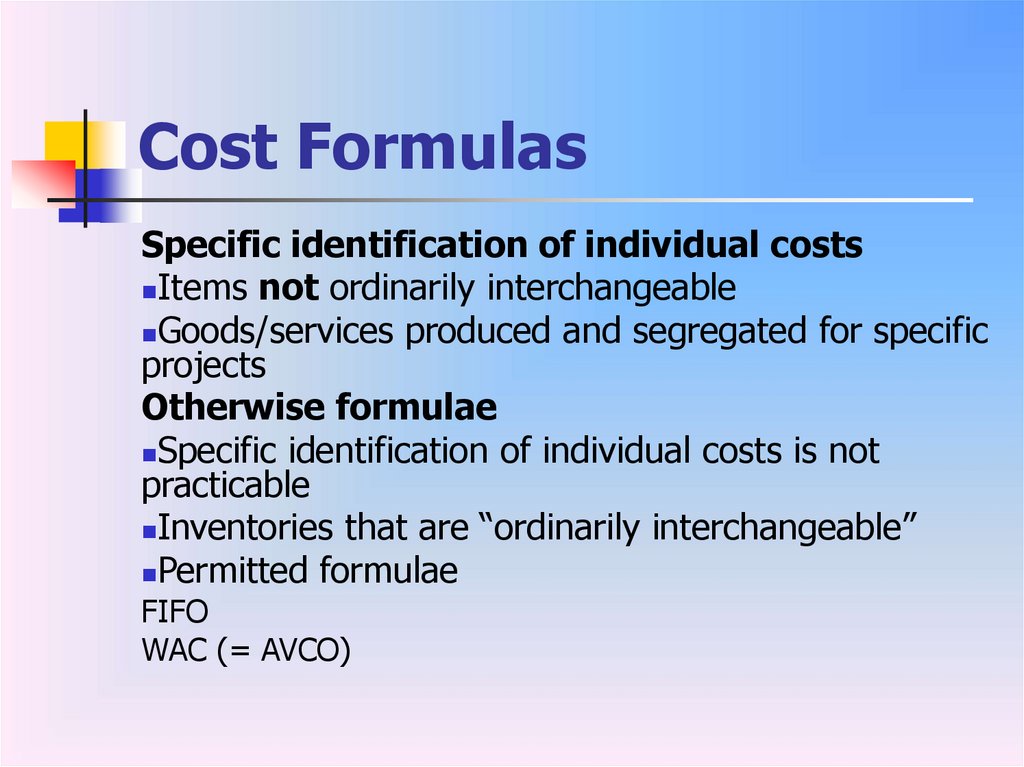

22.

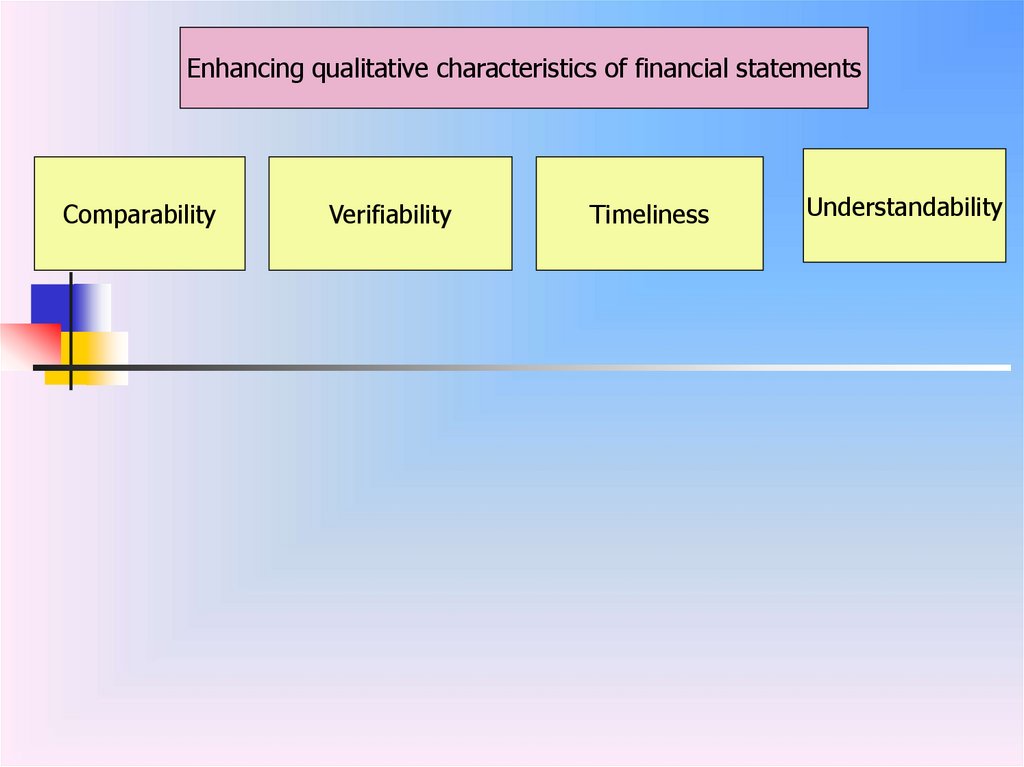

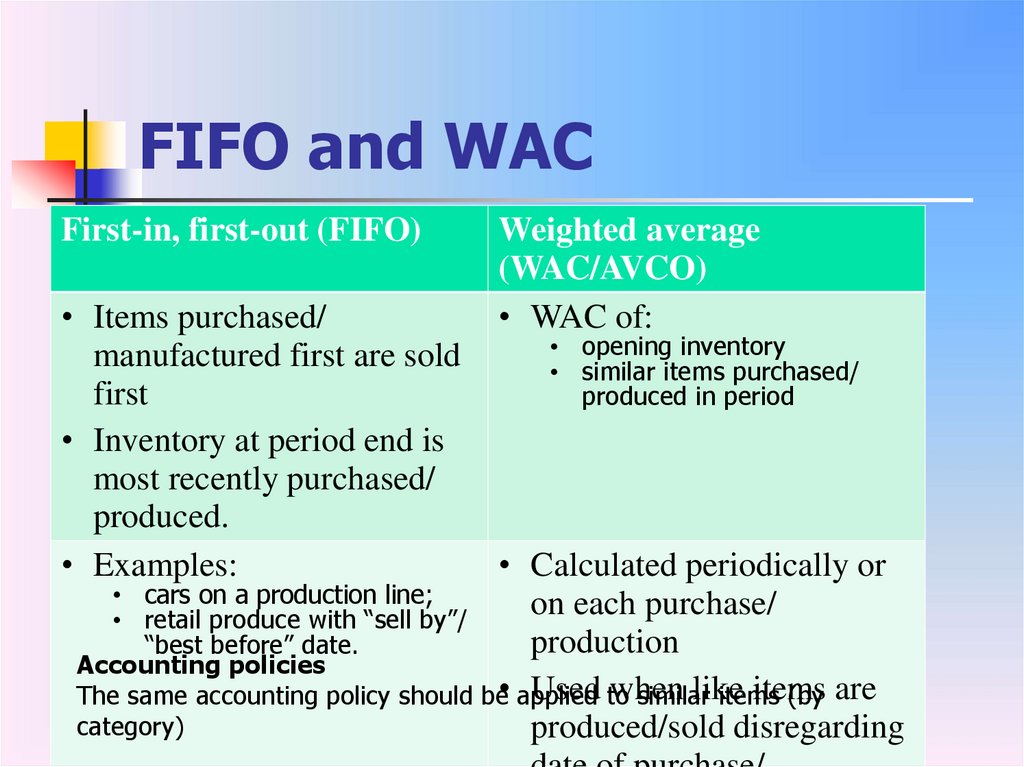

Enhancing qualitative characteristics of financial statementsComparability

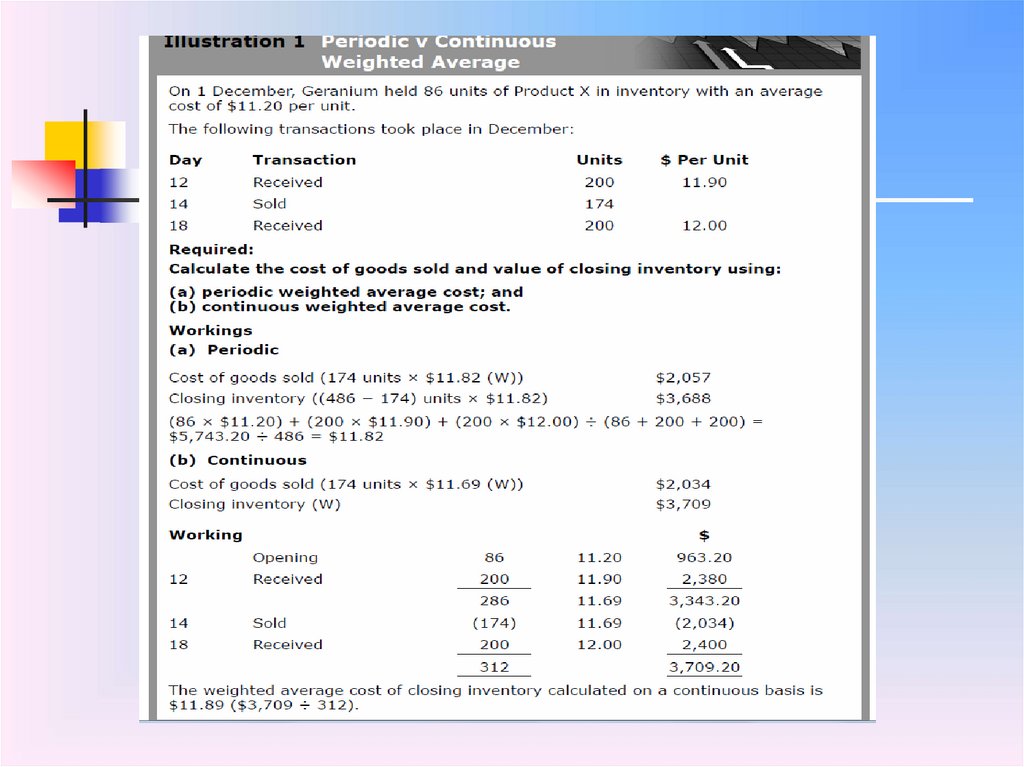

Verifiability

Timeliness

Understandability

23.

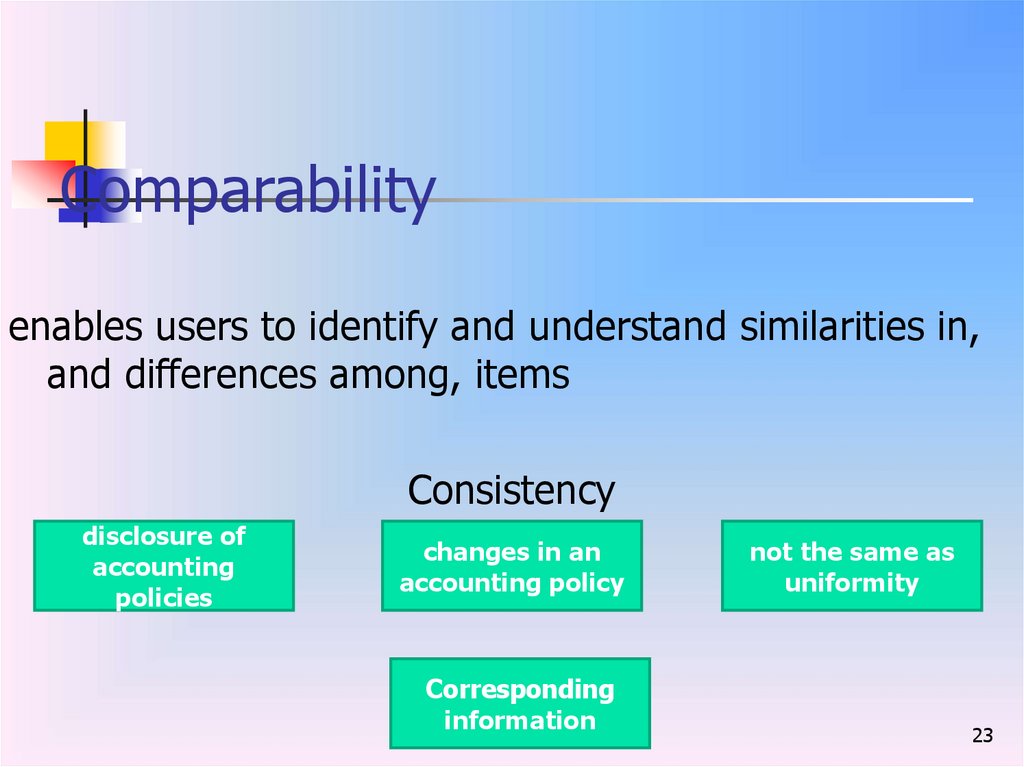

Comparabilityenables users to identify and understand similarities in,

and differences among, items

Consistency

disclosure of

accounting

policies

changes in an

accounting policy

Corresponding

information

not the same as

uniformity

23

24.

Verifiabilitydifferent knowledgeable and independent observers

could reach consensus, although not necessarily

complete agreement, that a particular depiction is a

faithful representation

24

25.

Timelinesshaving information available to decision-makers in time

to be capable of influencing their decisions

25

26.

UnderstandabilityClassifying, characterising and presenting information

clearly and concisely makes it understandable

Financial reports are prepared for users who have a

reasonable knowledge of business and economic

activities and who review and analyse the information

diligently

26

27.

The cost constraint onuseful financial reporting

Benefits must exceed the costs

Providers of financial information - collecting,

processing, verifying and disseminating financial

information

Users of financial information - analysing and

interpreting the information provided

subjective area

28.

Underlying assumptionThe financial statements are normally prepared

on the assumption that an entity is a going

concern and will continue in operation for the

foreseeable future.

29.

The elements of financialstatements

Assets

financial

position

Equity

Liabilities

30.

Financial positionAsset. A present economic resource controlled by the entity as a

result of past events. An economic resource is a right that has

the potential to produce economic benefits (para.4.3-4.4)

Liability. A present obligation of the entity to transfer an

economic resource as a result of past events. (para.4.26)

Equity. The residual interest in the assets of the entity after

deducting all its liabilities (para.4.63).

31.

Consider the following situations In each case, dowe have an asset or liability within the definitions

given by the Conceptual Framework?

(a) Pat Co has purchased a patent for $20,000. The patent gives

the company sole use of a particular manufacturing process which

will save $3,000 a year for the next five years.

(b) Baldwin Co paid Don Brennan $10,000 to set up a car repair

shop, on condition that priority treatment is given to cars from the

company's fleet.

(c) Deals on Wheels Co provides a warranty with every car sold.

32.

ProfitExpenses

Income

Performance

33.

PerformanceIncome. Increases in assets, or decreases in liabilities, that

result in increases in equity, other than those relating to

contributions from holders of equity claims.

Expenses. Decreases in assets, or increases in liabilities, that

result in decreases in equity other than those relating to

distributions to holders of equity claims.

34.

Recognition and derecognitionRecognition. The process of capturing for inclusion in the

statement of financial position or statement(s) of profit or loss

and other comprehensive income an item that meets the

definition of one of the elements of financial statements – an

asset, a liability, equity, income or expenses.

Derecognition is the removal of all or part of a recognised asset

or liability from an entity's statement of financial position.

Derecognition normally occurs when that item no longer meets

the definition of an asset or liability

35.

Measurement of the elements of financialstatements

Historical cost

Value in use

Fair value

Current cost

Measurement. Elements recognised in the financial

statements are quantified in monetary terms. This

requires the selection of a measurement basis

36.

Presentation and disclosureClassification of assets and liabilities of a similar nature together,

according to their nature, function or method of measurement.

This is also avoid the issue of 'offsetting' whereby items of a

dissimilar nature are grouped together, for example an asset

and a liability offset to provide a much smaller number in the

financial statements.

Avoiding unnecessary detail which can obscure the important

facts

Equally, avoiding a standardised approach (often referred to as

'boilerplate') but instead giving the entity an opportunity to

provide details relevant to the organisation and its business

Specific details regarding the classification of assets, liabilities,

equity, income and expenses

37.

Interaction with IAS 1Financial statements should present

fairly the financial position, financial

performance and cash flows of an

entity. Compliance with IFRS is

presumed to result in financial

statements that achieve a fair

presentation

38.

IAS 1 states what is requiredfor a fair presentation

(a) Selection and application of accounting policies

(b) Presentation of information in a manner which

provides relevant, reliable, comparable and

understandable information

(c) Additional disclosures where required

39.

The following points made byIAS 1 expand on this principle

(a) Compliance with IFRS should be disclosed

(b) All relevant IFRS must be followed if compliance with IFRS is

disclosed

(c) Use of an inappropriate accounting treatment cannot be

rectified either by disclosure of accounting policies or

notes/explanatory material

40.

Concepts of capitalfinancial concept

physical concept

41.

Conceptual FrameworkReview:

A conceptual framework underlying financial

accounting is important because it can lead to

consistent standards and it prescribes the

nature, function, and limits of financial

accounting and financial statements.

True

42.

Conceptual FrameworkReview:

A conceptual framework underlying financial

accounting is necessary because future

accounting practice problems can be solved by

reference to the conceptual framework and a

formal standard-setting body will not be

necessary.

False

43.

Conceptual FrameworkReview:

According to the conceptual framework, the

objectives of financial reporting for business

enterprises are based on?

a.

Generally accepted accounting principles

b.

Reporting on management’s stewardship.

c.

The need for conservatism.

d.

The needs of the users of the

information.

44.

Regulatory frameworkprinciples-based

rules-based

45.

IFRS: advantages(a) A business can present its financial statements

on the same basis as its foreign competitors,

making comparison easier

(b) Cross-border listing will be facilitated, making it

easier to raise capital abroad

(c) Companies with foreign subsidiaries will have a

common, company-wide accounting language

(d) Foreign companies which are targets for

takeovers or mergers can be more easily appraised

46.

IFRS: disadvantagesThe cost of implementing IFRS

The lower level of detail in IFRS

47.

Setting of IFRSStep 1 During the early stages of a project, the IASB may establish

an Advisory Committee to give advice on issues arising in the

project. Consultation with the Advisory Committee and the IFRS

Advisory Council occurs throughout the project.

Step 2 IASB may develop and publish Discussion Papers for public

comment.

Step 3 Following the receipt and review of comments, the IASB

would develop and publish an Exposure Draft for public comment.

Step 4 Following the receipt and review of comments, the IASB

would issue a final International Financial Reporting Standard.

48.

Co-ordination with nationalstandard setters

(a) IASB and national standard setters would co-ordinate their work plans so that

when the IASB starts a project, national standard setters would also add it to

their own work plans so that they can play a full part in developing

international consensus.

(b) National standards setters would not be required to vote for the IASB's

preferred solution in their national standards, since each country remains free

to adopt IASB standards with amendments or to adopt other standards.

(c) The IASB would continue to publish its own Exposure Drafts and other

documents for public comment.

(d) National standard setters would publish their own exposure document at

approximately the same time as IASB Exposure Drafts and would seek specific

comments on any significant divergences between the two exposure

documents.

(e) National standard setters would follow their own full due process, which they

would ideally choose to integrate with the IASB's due process.

49.

Interpretation of IFRSs - IFRSInterpretations committee

(a) To interpret the application of International Financial Reporting

Standards and provide timely guidance on financial reporting

issues not specifically addressed in IFRSs or IASs.

(b) To have regard to the Board's objective of working actively with

national standard setters to bring about convergence of national

accounting standards and IFRSs to high quality solutions.

(c) To review on a timely basis, any newly identified financial

reporting issues not already addressed in existing IFRSs.

50.

RussiaIFRS are required for:

the consolidated financial statements of all entities whose securities are

listed on stock exchanges,

for banks and other credit institutions,

insurance companies (except those with activities limited to obligatory

medical insurance),

non-governmental pension funds,

management companies of investment and pension funds, and clearing

houses.

IFRS are mandatory for consolidated financial statements. Standalone

(separate) financial statements for all entities must be prepared using

RAS.

51.

Review:IFRS were issued between 1973 and 2001 by

the Board of the International Accounting

Standards Committee (IASC).

False

52.

IAS 1 Presentation of FinancialStatements

Statement of financial position

Statement of profit or loss and other

comprehensive income

Statement of changes in equity

Statement of cash flows

Notes to the financial statements

53.

IAS 1 specifies disclosures ofcertain items in certain ways

on the face of the SFP of PLOCI.

note to the financial statements

formats

54.

Identification of financialstatements

Name of the reporting entity (or other means of identification)

Whether the accounts cover the single entity only or a group of

entities

The date of the end of the reporting period or the period covered

by the financial statements (as appropriate)

The presentation currency

The level of rounding used in presenting amounts in the financial

statements

55.

Reporting periodAnnually

disclose:

(a) The reason(s) why a period other

than one year is used

(b) The fact that the comparative figures

given are not in fact comparable

56.

Statement of financial position(a) Property, plant and equipment

(b) Investment property

(c) Intangible assets

(d) Financial assets (excluding amounts shown under (e), (h) and

(i))

(e) Investments accounted for using the equity method

(f) Biological assets

(g) Inventories

(h) Trade and other receivables

(i) Cash and cash equivalents

(j) Assets classified as held for sale under IFRS 5

57.

Statement of financial position(k) Trade and other payables

(l) Provisions

(m) Financial liabilities (other than (j) and (k))

(n) Current tax liabilities and assets as in IAS 12

(o) Deferred tax liabilities and assets

(p) Liabilities included in disposal groups under IFRS 5

(q) Non-controlling interests

(r) Issued capital and reserves

58.

Statement of financial positionNature and liquidity of assets and their

materiality

Function within the entity

Amounts, nature and timing of liabilities

59.

The current/non-currentdistinction

An asset should be classified as a current asset when it:

Is expected to be realised in, or is held for sale or consumption

in, the normal course of the entity's operating cycle; or

Is held primarily for trading purposes or for the short-term and

expected to be realised within 12 months of the end of the

reporting period; or

Is cash or a cash equivalent asset which is not restricted in its

use.

All other assets should be classified as non-current assets

The operating cycle of an entity is the time between the acquisition

of assets for processing and their realisation in cash or cash

equivalents.

60.

The current/non-currentdistinction

A liability should be classified as a current liability when it:

Is expected to be settled in the normal course of the entity's

operating cycle; or

Is held primarily for the purpose of trading; or

Is due to be settled within 12 months after the end of the

reporting period; or when

The entity does not have an unconditional right to defer

settlement of the liability for at least 12 months after the end of

the reporting period.

All other liabilities should be classified as non-current liabilities.

61.

Statement of profit or loss and othercomprehensive income

IAS 1 allows income and expense items

to be presented either:

(a) In a single statement of profit or loss

and other comprehensive income; or

(b) In two statements: a separate

statement of profit or loss and

statement of other comprehensive

income.

62.

Statement of profit or lossIAS 1 offers two possible formats for the

statement of profit or loss or separate

profit or loss section – by function or by

nature.

Classification by function is more common

63.

PL – minimum lines(a) Revenue

(b) Finance costs

(c) Share of profits and losses of associates and joint ventures

accounted for using the equity method

(d) A single amount for the total of discontinued operations

(e) Tax expense

CPL

(a) Profit or loss attributable to non-controlling interest

(b) Profit or loss attributable to owners of the parent

64.

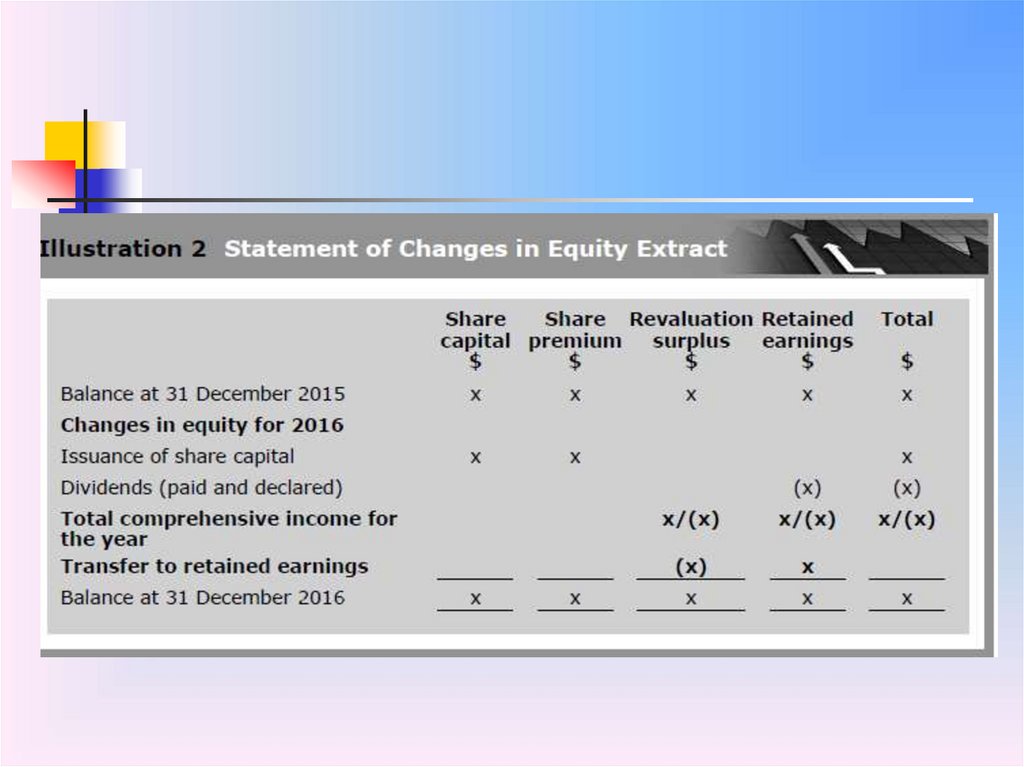

Changes in equityIAS 1 requires a statement of changes in

equity. This shows the movement in the

equity section of the statement of

financial position. A full set of financial

statements includes a statement of

changes in equity

65.

Notes to the financialstatements

(a) Present information about the basis on which the financial

statements were prepared and which specific accounting

policies were chosen and applied to significant

transactions/events

(b) Disclose any information, not shown elsewhere in the financial

statements, which is required by IFRSs

(c) Show any additional information that is relevant to

understanding which is not shown elsewhere in the financial

statements

66.

Notes to the financial statements will amplifythe information shown therein by giving the

following.

(a) More detailed analysis or breakdowns of figures in the

statements

(b) Narrative information explaining figures in the statements

(c) Additional information, eg contingent liabilities and

commitments

67.

Certain order for notes(a) Statement of compliance with IFRSs

(b) Statement of the measurement basis (bases) and accounting

policies applied

(c) Supporting information for items presented in each financial

statement in the same order as each line item and each

financial statement is presented

(d) Other disclosures, eg:

(i) Contingent liabilities, commitments and other financial

disclosures

(ii) Non-financial disclosures

68.

Disclosure of accountingpolicies

(a) The measurement basis (or bases)

used in preparing the financial

statements

(b) The other accounting policies used, as

required for a proper understanding of

the financial statements

69.

IAS 7 STATEMENT OF CASHFLOWS

70.

Cash FlowCash vs Profits

Not all profitable companies are successful

– many fail through lack of cash

Profit or loss is based on accruals concept (includes noncash items)

Major function of statement of cash flows

To inform users

whether or not reported profits are being realised as cash

flows

about the availability of cash to

finance investments

pay dividends

71.

Need to control CFInvestment decisions

Overdrafts

Maintain good relations with suppliers

Funds available

72.

IAS 7Applies to all entities

Benefits of Cash flow information

Provides information to users to evaluate changes in

net assets

financial structure

ability to affect amounts and timing of cash flows

Helps assess ability to generate cash/cash equivalents

Provides “linkage” between other financial statements

Cash is cash – eliminates effects of alternative accounting bases

Historical cash flow information may indicate future cash flows

Focus on cash management can improve results

73.

DrawbacksRelates to past performance

Cash position at reporting date may be

“managed”

Some lack of comparability

choice between direct and indirect methods

alternative classifications of interest/dividends

May be misinterpreted (e.g. net decrease in cash

may not mean poor cash management)

Highlighting a weak cash flow position may

precipitate going concern problems

74.

DefinitionsCash – cash on hand and demand deposits

Cash equivalents – short-term (< 3 months), highly liquid

investments (readily convertible to known amounts of cash)

Cash flows – inflows/outflows of cash/cash equivalents

Operating activities – principal revenue-producing activities

Investing activities – acquisition and disposal of long-term

assets and investments

Financing activities – change amount/composition of

equity/borrowings

75.

ClassificationOperating

Generally from transactions/events that generate profit or loss

Key indicator of sufficiency of cash flows to

repay loans

maintain operating capability

pay dividends

make new investments

Helps forecast future operating cash flows

Investing

Separate disclosure shows expenditure on resources intended to

generate future income and cash flows

Financing

Separate disclosure helps predict claims on future cash flows by

providers of capital/long-term finance

76.

ExamplesOperating activities

Cash receipts (e.g. from sale of goods)

Cash payments (e.g. to suppliers, employees)

Investing activities

Payments to acquire/receipts from sales of property,

plant and equipment, etc

Cash advances/loans (and repayments) to others

Financing activities

Cash proceeds from issuing shares, debentures, loans,

etc

Cash paid to purchase own shares

Repayments of borrowings

77.

Interest and DividendsCash flows should be

disclosed separately and

classified consistently

Interest paid

usually classified as operating

may be classified as financing

Interest/dividends received may be classified as

operating or

investing

Dividends paid may classified as

financing or

operating

78.

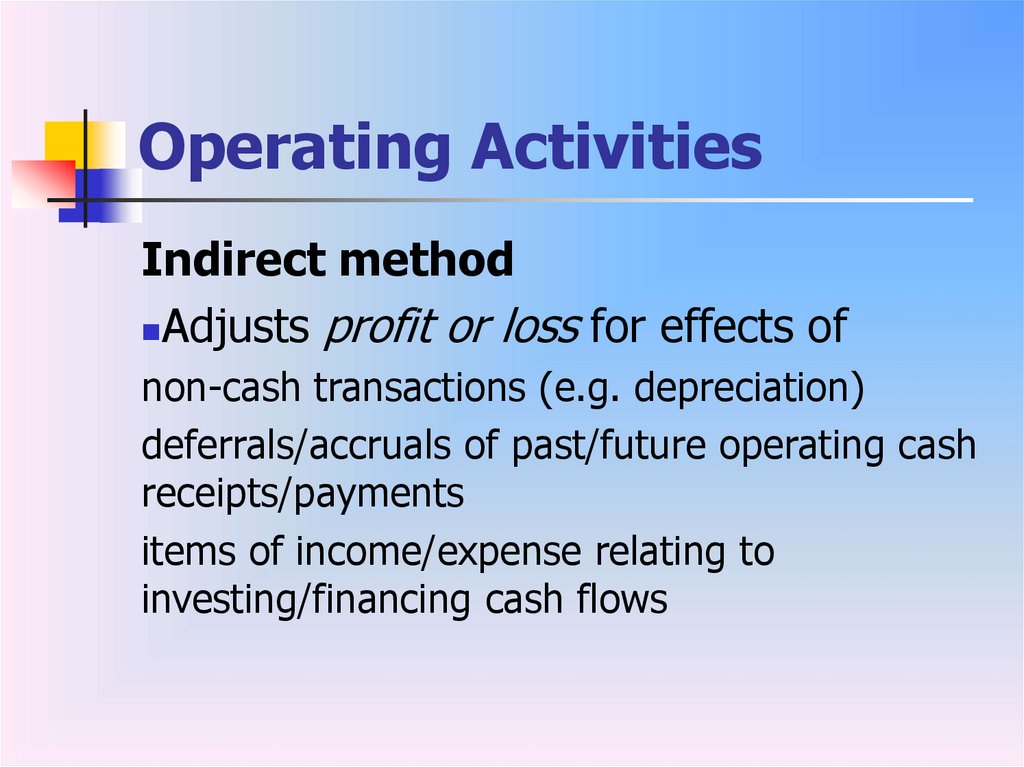

Operating ActivitiesIndirect method

Adjusts profit or loss for effects of

non-cash transactions (e.g. depreciation)

deferrals/accruals of past/future operating cash

receipts/payments

items of income/expense relating to

investing/financing cash flows

79.

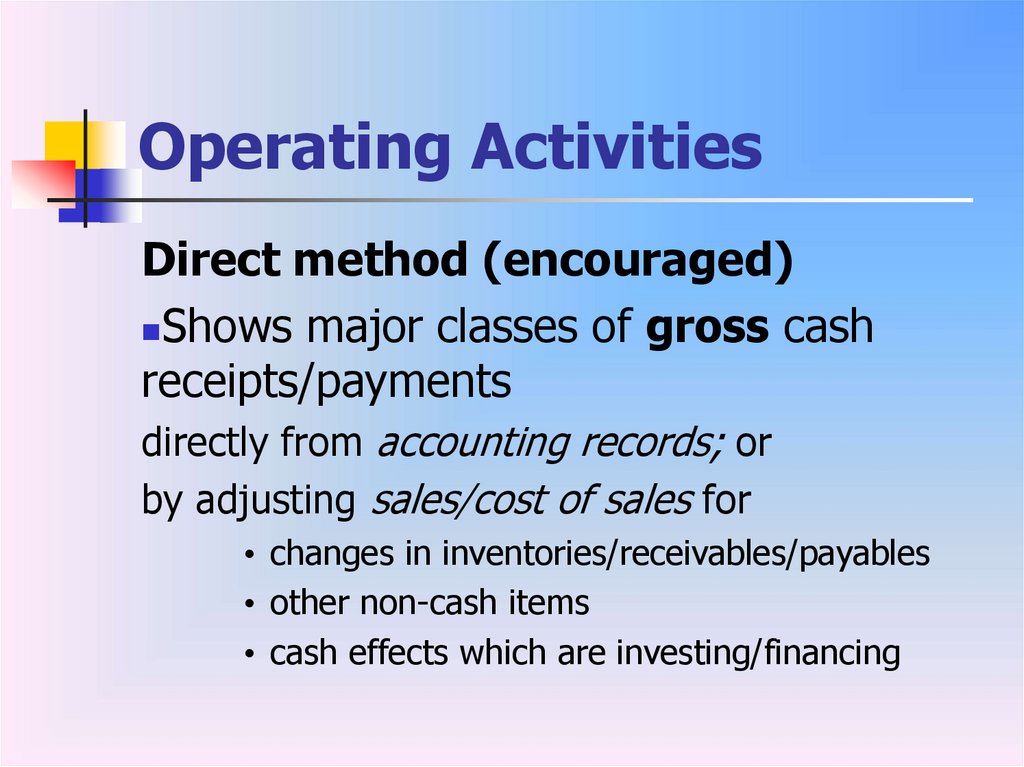

Operating ActivitiesDirect method (encouraged)

Shows major classes of gross cash

receipts/payments

directly from accounting records; or

by adjusting sales/cost of sales for

• changes in inventories/receivables/payables

• other non-cash items

• cash effects which are investing/financing

80.

TechniquesDirect method

1

2

Cash receipts (from customers)

Less: Cash paid (to suppliers/employees)

Cash generated from operations

3

Payments for interest and income taxes

Net cash from operating activities

81.

Techniques4.1 Indirect method

1

2

Start with profit before tax

Adjust for

•non-cash items

•investing/financing items on accruals basis

Operating profit before working capital

changes

3

Make working capital changes

Cash generated from operations

(same figure as for direct method)

Interest and tax (as for direct method)

82.

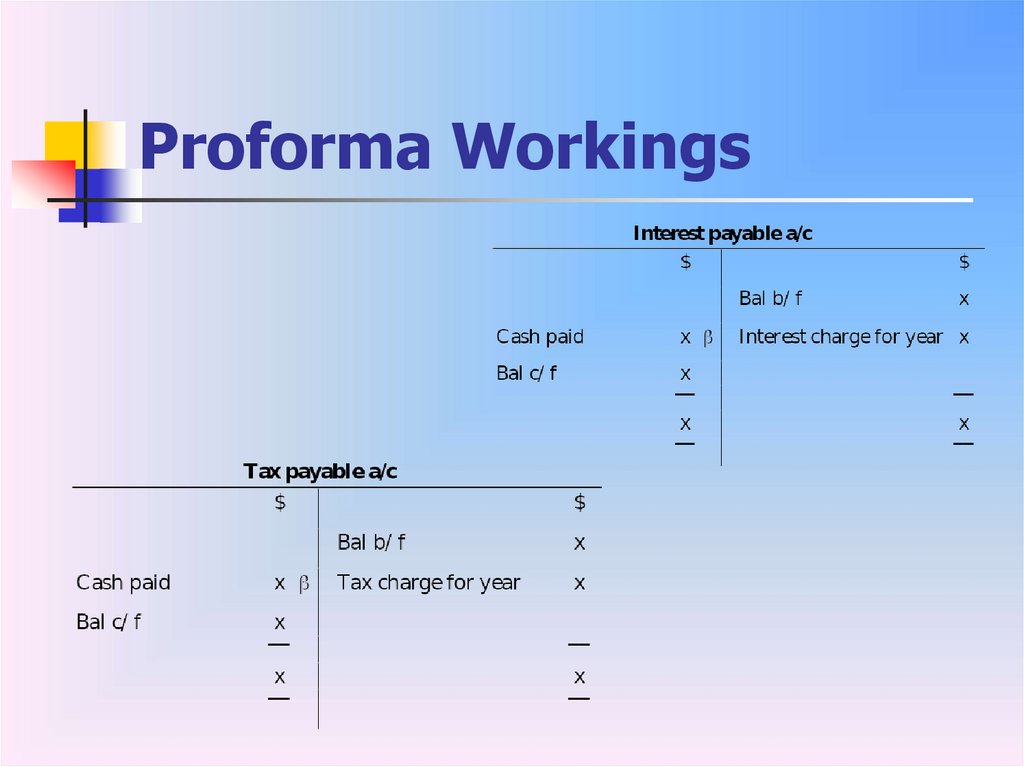

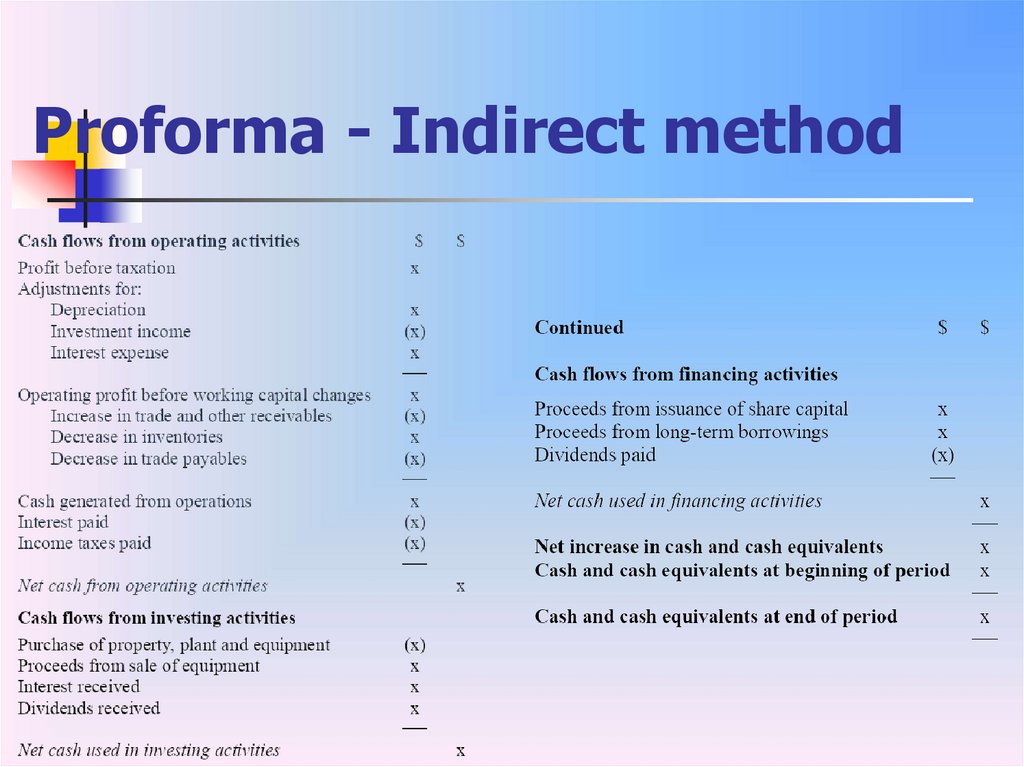

Proforma Workings83.

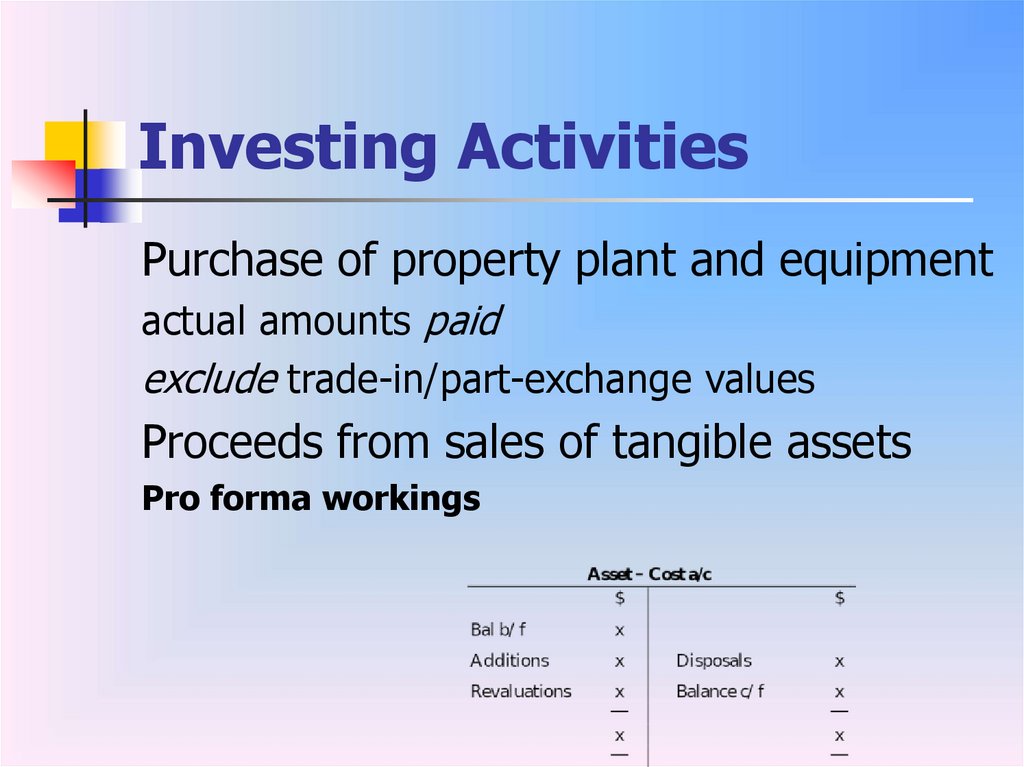

Investing ActivitiesPurchase of property plant and equipment

actual amounts paid

exclude trade-in/part-exchange values

Proceeds from sales of tangible assets

Pro forma workings

84.

Investing ActivitiesRevaluation adjustments are

not cash flows!

85.

FinancingProceeds from issuing share capital (includes

premium paid)

Proceeds from long-term borrowings

Dividends paid1 during the period

declared but not paid in prior period

interim dividends paid in current period

1 Unless classified as operating

86.

Cash and Cash EquivalentsProforma reconciliation

87.

Proforma - Indirect method88.

Direct Method89.

Indirect methodhttps://lukoil.com/FileSystem/9/534848.p

df

90.

Direct methodhttps://www.transneft.ru/u/section_file/5

4061/tn_ifrs_12m2020_eng.pdf

91.

IAS 16 PROPERTY, PLANTAND EQUIPMENT

92.

IAS 16 – TerminologyProperty, plant and equipment are tangible

assets that:

– Are held for use in the production or supply of

goods or services, for rental to others, or for

administrative purposes

– Are expected to be used during more than one

period

93.

IAS 16 – TerminologyCost is the amount of cash or cash equivalents paid or the fair value of the other

consideration given to acquire an asset at the time of its acquisition or

construction.

Residual value is the net amount which the entity expects to obtain for an asset at

the end of its useful life after deducting the expected costs of disposal.

Entity specific value is the present value of the cash flows an entity expects to

arise from the continuing use of an asset and from its disposal at the end of its

useful life, or expects to incur when settling a liability.

Carrying amount is the amount at which an asset is recognised in the statement of

financial position after deducting any accumulated depreciation and accumulated

impairment losses.

An impairment loss is the amount by which the carrying amount of an asset

exceeds its recoverable amount. (IAS 16)

94.

IAS 16 – TerminologyUseful life – period expected to be used

Fair value is the price that would be received to

sell an asset or paid to transfer a liability in an

orderly transaction between market participants

at the measurement date. (IFRS 13)

Impairment loss – excess of carrying amount over

recoverable amount

Recoverable amount – higher of

“fair value less costs to sell” and

“value in use”

95.

Recognition criteriaAs per “Framework”

probable future economic benefits

cost can be measured reliably

96.

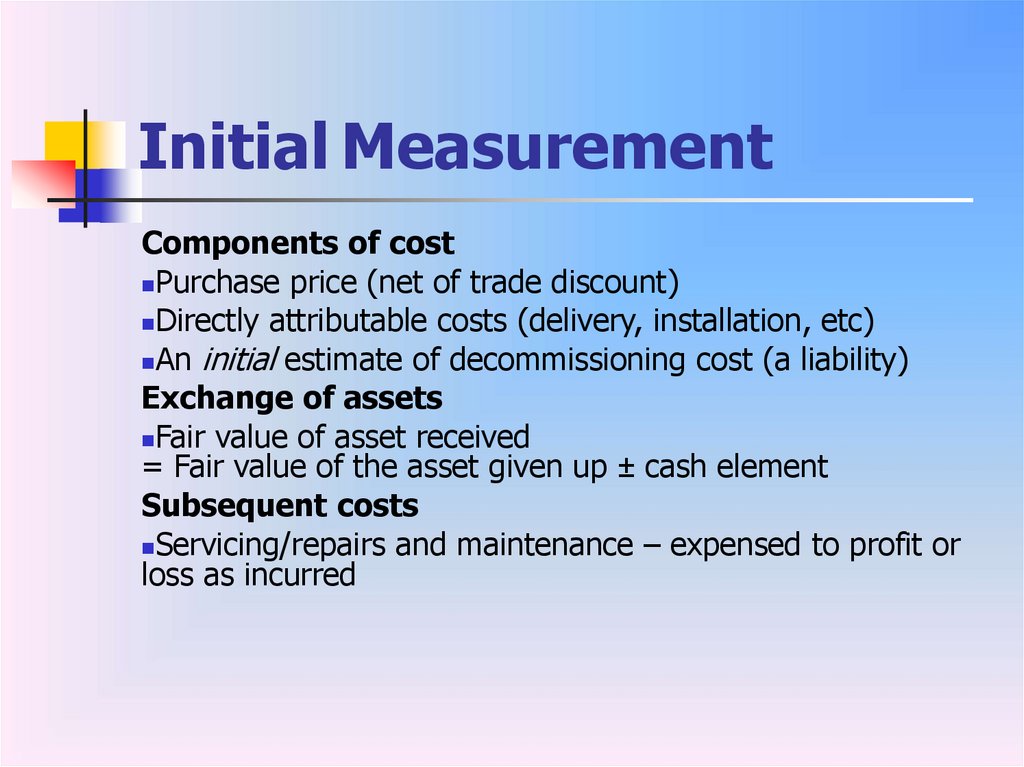

Initial MeasurementComponents of cost

Purchase price (net of trade discount)

Directly attributable costs (delivery, installation, etc)

An initial estimate of decommissioning cost (a liability)

Exchange of assets

Fair value of asset received

= Fair value of the asset given up ± cash element

Subsequent costs

Servicing/repairs and maintenance – expensed to profit or

loss as incurred

97.

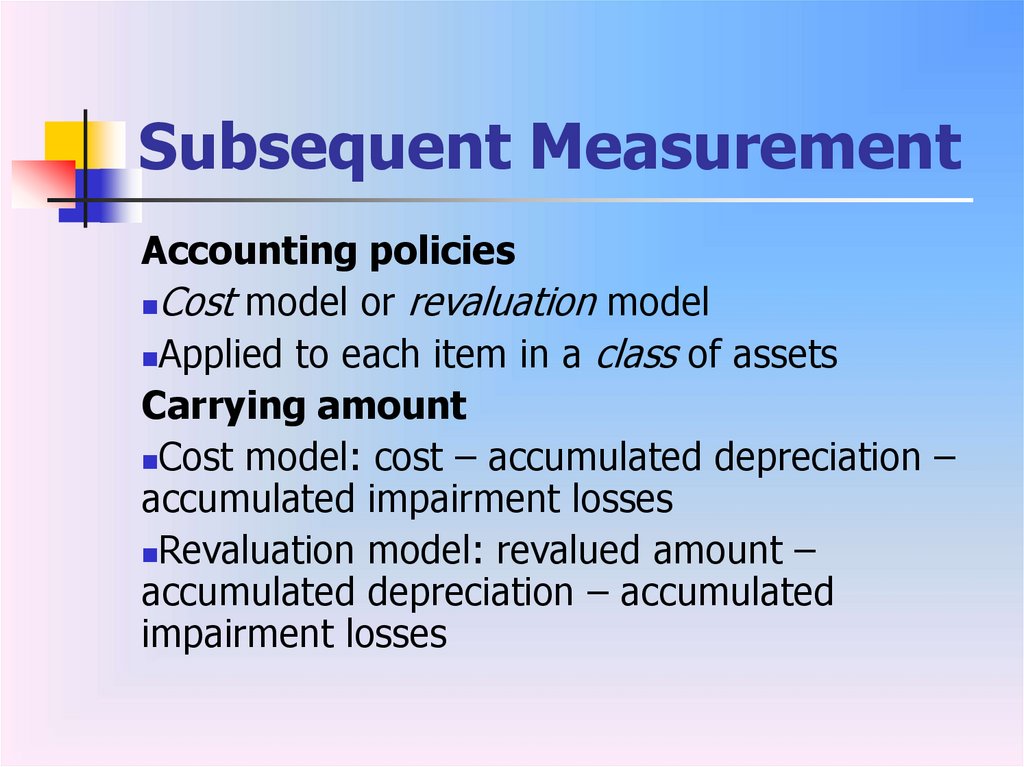

Subsequent MeasurementAccounting policies

Cost model or revaluation model

Applied to each item in a class of assets

Carrying amount

Cost model: cost – accumulated depreciation –

accumulated impairment losses

Revaluation model: revalued amount –

accumulated depreciation – accumulated

impairment losses

98.

RevaluationsFair values

Reliable measurement is essential

Land and buildings – market value

Plant and equipment – usually

• market value (appraised)

• depreciated replacement cost

Frequency

Sufficiently regularly

May be on “rolling” basis (entire class)

Accumulated depreciation

Two methods

restate proportionately

eliminate against gross carrying amount (and restate net)

99.

100.

101.

Solution102.

RevaluationIncrease/Decrease

Increase other comprehensive income

(accumulated in equity as “revaluation surplus”)

Decrease

expense in profit or loss

other comprehensive income (if reversing previous gain)

Subsequent accounting

Transfer to retained earnings is allowed but not required

Annually (depreciation difference)

On disposal

Must not be “recycled” through profit or loss

103.

104.

DepreciationAccounting standards

Depreciable amount is allocated on systematic basis over useful life

Method to reflect consumption of economic benefits

Depreciation charge to be expenses (unless a cost of another asset)

Useful life – factors

Land – unlimited (is not depreciable)

All other assets

expected usage

expected physical wear and tear

technical obsolescence

legal or similar limits on use

asset management policy

repair and maintenance policy

105.

106.

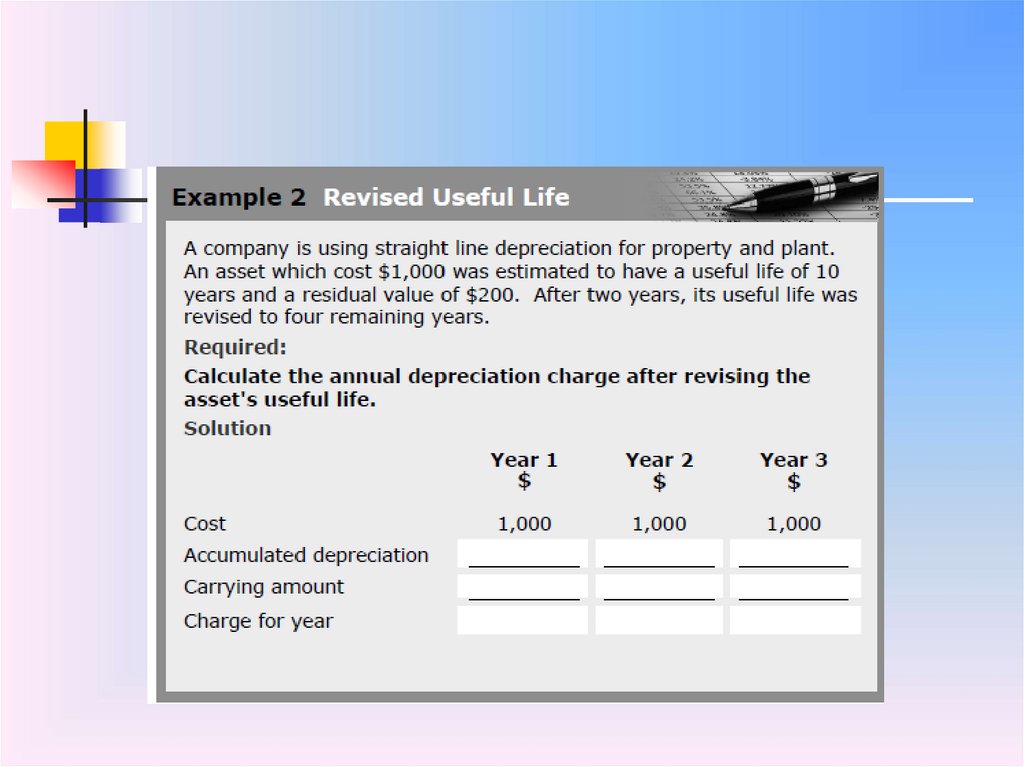

Solution1st

2nd

3rd

cost

1000

1000

1000

Ac depr’n

(80)

(80)+(80)=(160) (160)+(160)=

(320)

Car. amount

1000-80=920

1000-160=840

1000-320=680

Charge for the

year

(1000200)/10=80

(1000200)/10=80

(840200)/4=160

107.

Depreciable AmountResidual value

Often immaterial

If > carrying amount depreciation charge is zero

Depreciation period

Commences when asset is available for use

Ceases when an asset is derecognised

Methods

Straight-line constant charge

Reducing (diminishing) balance a decreasing charge

Units of production charge based on expected

use/production output

Review periodically: Change in method = change in

accounting estimate

108.

Cost=1000, res value=100,usefulStraight-line

life=5 years

Reducing

Units of

balance

production

depr. Charge 1st

year

(1000-100)/5=180

1000/5=200

(1000100)/10000*2500=

225

Car. Value 1 st year

1000-180=820

1000-200=800

1000-225=775

depr. Charge 2nd

year

(1000-100)/5=180

800/5=160

Car. Value 2 nd

year

820-180=640

800-160=640

Expected units of

production for the

useful life 10 000

Actual UoP for the

1st y=2500

109.

DerecognitionAccounting treatment

Statement of financial position: eliminate

on disposal or abandonment

Profit or loss: gain or loss = difference

between net disposal proceeds and

carrying amount

Gains are not revenue

110.

DisclosuresEach class

Measurement bases

Depreciation methods

Useful lives or depreciation rates

Gross carrying amount and accumulated depreciation

at beginning and end of period

Reconciliation of carrying amount

at beginning and end of period showing movements

Other

Restrictions on title/Assets pledged as security

Accounting policy for estimating restoration costs

Expenditure on assets in the course of construction

Contractual commitments

111.

DisclosuresRevalued items

Effective date of revaluation

Whether independent valuer involved

Methods and significant assumptions applied to estimate fair

values

Revaluation surplus – movements and restrictions on distribution

Encouraged

Carrying amount of

temporarily idle assets

fully depreciated assets still in use

assets held for disposal

When cost model is used, the fair value of assets (if materially

different)

112.

IAS 40 INVESTMENTPROPERTY

113.

Investment propertyproperty (land or a building – or part of a

building – or both) held (by the owner or by

the lessee under a finance lease) to earn

rentals or for capital appreciation or both,

rather than for:

(a) Use in the production or supply of goods

or services or for administrative purposes, or

(b) Sale in the ordinary course of business

114.

Key termsOwner-occupied property is property held by the owner (or

by the lessee under a finance lease) for use in the production

or supply of goods or services or for administrative purposes.

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction

between market participants at the measurement date.

Cost is the amount of cash or cash equivalents paid or the

fair value of other consideration given to acquire an asset at

the time of its acquisition or construction.

Carrying amount is the amount at which an asset is

recognised in the statement of financial position.

115.

Examples(a) Land held for long-term capital appreciation

rather than for short-term sale in the ordinary

course of business

(b) A building owned by the reporting entity (or

held by the entity under a finance lease) and

leased out under an operating lease

(c) A building held by a parent and leased to a

subsidiary*.

(d) Property that is being constructed or

developed for future use as an investment

property

116.

Check your understandingRich Co owns a piece of land. The

directors have not yet decided whether

to build a factory on it for use in its

business or to keep it and sell it when

its value has risen.

Would this be classified as an investment

property under IAS 40?

Yes!

117.

Recognition(a) It is probable that the future

economic benefits that are associated

with the investment property will flow

to the entity.

(b) The cost of the investment property

can be measured reliably

118.

measurementInitially at cost, including transaction

costs

The fair value model

The cost model

*should be applied to all of its

investment property

119.

Fair value model(a) After initial recognition, an entity that chooses the

fair value model should measure all of its

investment property at fair value, except in the

extremely rare cases where this cannot be

measured reliably. (*apply the IAS 16 cost model)

(b) A gain or loss arising from a change in the fair

value of an investment property should be

recognised in net profit or loss for the period in

which it arises.

(c) The fair value of investment property should

reflect market conditions at the end of the

reporting period

120.

issues relating to fairvalue

Fair value assumes that an orderly transaction has taken place between market

participants, ie both buyer and seller are reasonably informed about the nature

and characteristics of the investment property.

A buyer participating in an orderly transaction is motivated but not compelled

to buy. A seller participating in an orderly transaction is neither an over-eager

nor a forced seller, nor one prepared to sell at any price or to hold out for a

price not considered reasonable in the current market.

Fair value is not the same as 'value in use' as defined in IAS 36 Impairment of

assets. Value in use reflects factors and knowledge specific to the entity, while

fair value reflects factors and knowledge relevant to the market.

In determining fair value an entity should not double count assets.

In those rare cases where the entity cannot determine the fair value of an

investment property reliably, the cost model in IAS 16 must be applied until the

investment property is disposed of. The residual value must be assumed to be

zero.

121.

Cost modelThe cost model is the cost model in IAS

16.

Investment property should be measured

at depreciated cost, less any accumulated

impairment losses.

An entity that chooses the cost model

should disclose the fair value of its

investment property.

122.

Changing modelsOnce the entity has chosen the fair value or

cost model, it should apply it to all its

investment property.

It should not change from one model to the

other unless the change will result in a more

appropriate presentation.

IAS 40 states that it is highly unlikely that a

change from the fair value model to the cost

model will result in a more appropriate

presentation.

123.

TransfersTransfers to or from investment property should only be made

when there is a change in use. For example, owner occupation

commences so the investment property will be treated under IAS

16 as an owner-occupied property.

When there is a transfer from investment property carried at fair

value to owner-occupied property or inventories, the property's

cost for subsequent accounting under IAS 16 or IAS 2 should be its

fair value at the date of change of use.

Conversely, an owner-occupied property may become an

investment property and need to be carried at fair value. An entity

should apply IAS 16 up to the date of change of use. It should

treat any difference at that date between the carrying amount of

the property under IAS 16 and its fair value as a revaluation under

IAS 16.

124.

exampleA business owns a building which it has been using

as a head office. In order to reduce costs, on 30 June

20X9 it moved its head office functions to one of its

production centres and is now letting out its head

office. Company policy is to use the fair value model

for investment property.

The building had an original cost on 1 January 20X0

of $250,000 and was being depreciated over 50

years. At 31 December 20X9 its fair value was judged

to be $350,000.

How will this appear in the financial statements at 31

December 20X9?

125.

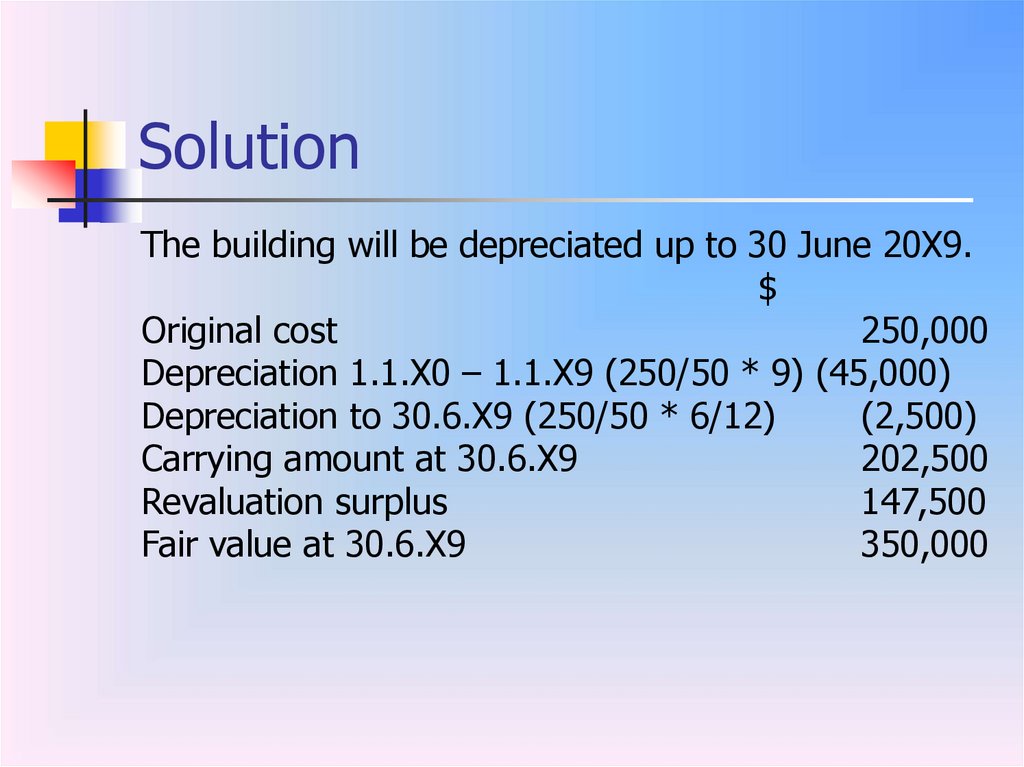

SolutionThe building will be depreciated up to 30 June 20X9.

$

Original cost

250,000

Depreciation 1.1.X0 – 1.1.X9 (250/50 * 9) (45,000)

Depreciation to 30.6.X9 (250/50 * 6/12)

(2,500)

Carrying amount at 30.6.X9

202,500

Revaluation surplus

147,500

Fair value at 30.6.X9

350,000

126.

DisposalsDerecognise (eliminate from the statement of financial

position) an investment property on disposal or when it is

permanently withdrawn from use and no future economic

benefits are expected from its disposal.

Any gain or loss on disposal is the difference between the

net disposal proceeds and the carrying amount of the asset.

It should generally be recognised as income or expense in

profit or loss.

Compensation from third parties for investment property that

was impaired, lost or given up shall be recognised in profit or

loss when the compensation becomes receivable

127.

Disclosure requirementsChoice of fair value model or cost model

Whether property interests held as operating

leases are included in investment property

Criteria for classification as investment property

Assumptions in determining fair value

Use of independent professional valuer

(encouraged but not required)

Rental income and expenses

Any restrictions or obligations

128.

additional disclosuresFair value model - reconciliation of the

carrying amount of the investment

property at the beginning and end of the

period.

Cost model - depreciation method + the

fair value of the investment property

129.

IAS 38 INTANGIBLE ASSETS130.

Intangible AssetsIdentifiable, non-monetary asset without

physical substance

Examples

Computer software

Patents and copyrights

Licences and franchises

Intellectual property

Brand names

131.

Tangible vs. Intangible132.

GoodwillFuture economic benefits deriving from assets that are not

capable of individual identification and separate recognition

The difference between cost of acquiring a business and fair

value of identifiable assets and liabilities acquired

Must be written down for subsequent impairment

Can never be revalued (upwards)

Two types

Acquired/purchased – as results of purchase transaction

Internally-generated (“inherent”) – cannot be recognised (no

reliable measurement)

Purchased

Recognised as an asset (“capitalised”)

Carried at cost but subject to annual impairment review

133.

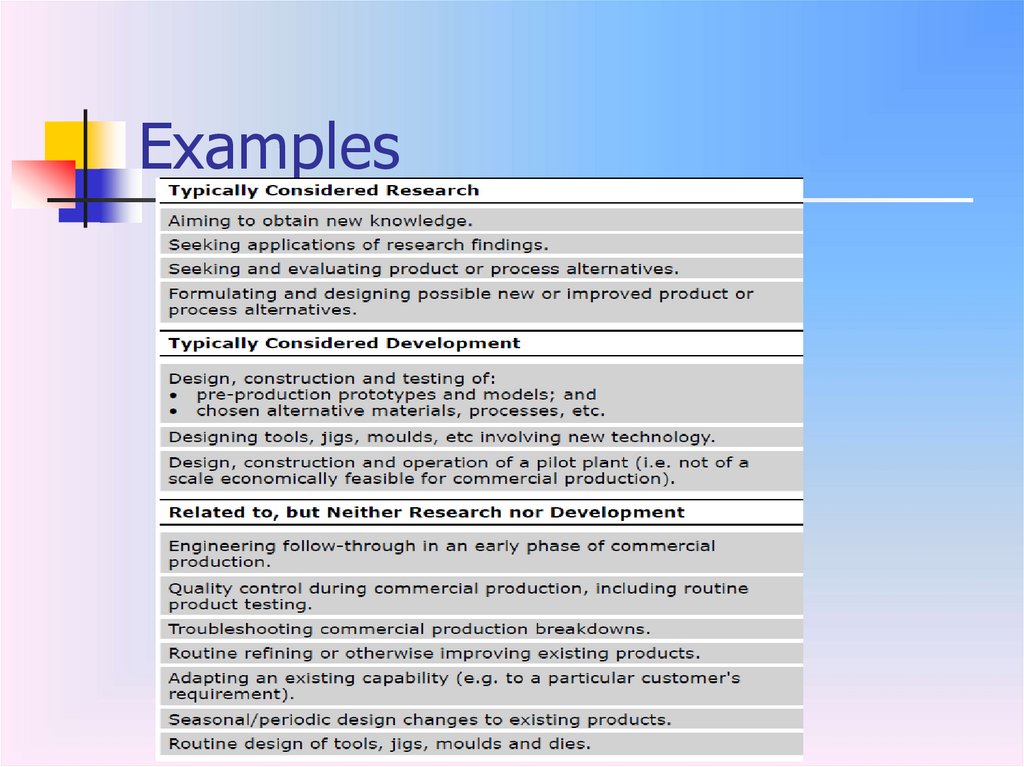

Research andDevelopment

Classification

“Research phase” or “development phase”

If indistinguishable treat as research phase

Research – original and planned investigation . . . to gain new

scientific or technical knowledge . . .

Development – application of research findings to a plan for

production of new or substantially improved materials, products,

etc before commencing commercial production or use

Initial measurement of an asset

At cost = expenditure incurred after recognition criteria met

Expenditure previously recognised is not reinstated

134.

Examples135.

Capitalised costs136.

Research ExpendituresAccounting standard

Not an intangible asset

Expenditure other than research

Always expensed

start-up costs

training

advertising/promotion

relocation

137.

Development ExpendituresAccounting standard

Intangible asset must be recognised if all asset

recognition criteria demonstrated

Criteria

Technical feasibility of completing

Intention to complete and use/sell

Ability to use or sell

Existence of market for output/internal use

Adequate resources to complete and use/sell

Reliable measurement of attributable expenses

138.

AmortisationAs for IAS 16

systematic basis over best estimate of useful life

commences when available for use

ceases when sold or abandoned

Method

Should reflect pattern of consumption

Otherwise use straight-line

Residual value

Assumed to be zero unless there is

a third party commitment to purchase it

an active market for it (unlikely)

139.

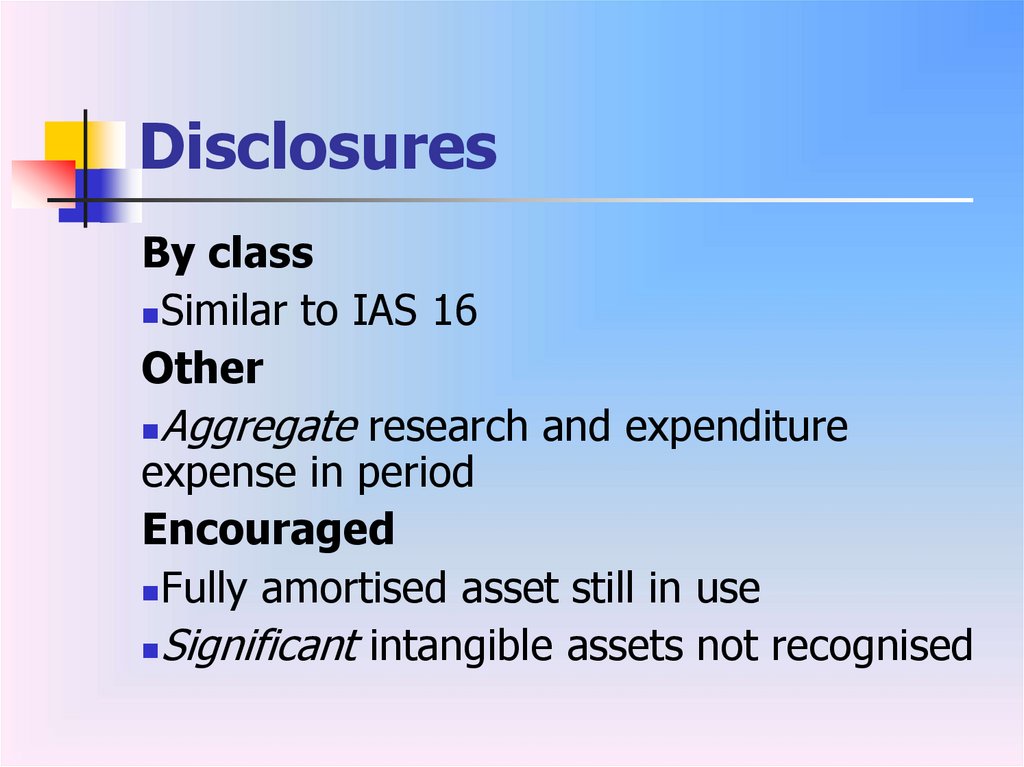

DisclosuresBy class

Similar to IAS 16

Other

Aggregate research and expenditure

expense in period

Encouraged

Fully amortised asset still in use

Significant intangible assets not recognised

140.

IAS 36 IMPAIRMENT OFASSETS

141.

Impairmentis determined by comparing the carrying

amount of the asset with its recoverable

amount.

the higher of its fair value less costs of

disposal and its value in use.

142.

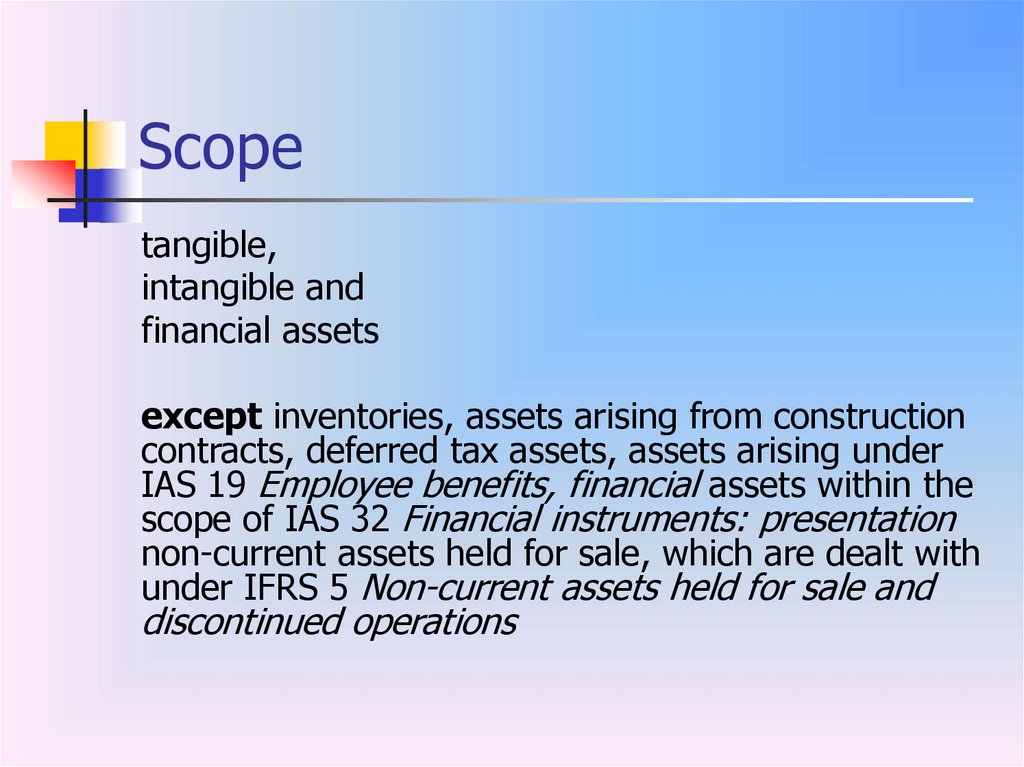

Scopetangible,

intangible and

financial assets

except inventories, assets arising from construction

contracts, deferred tax assets, assets arising under

IAS 19 Employee benefits, financial assets within the

scope of IAS 32 Financial instruments: presentation

non-current assets held for sale, which are dealt with

under IFRS 5 Non-current assets held for sale and

discontinued operations

143.

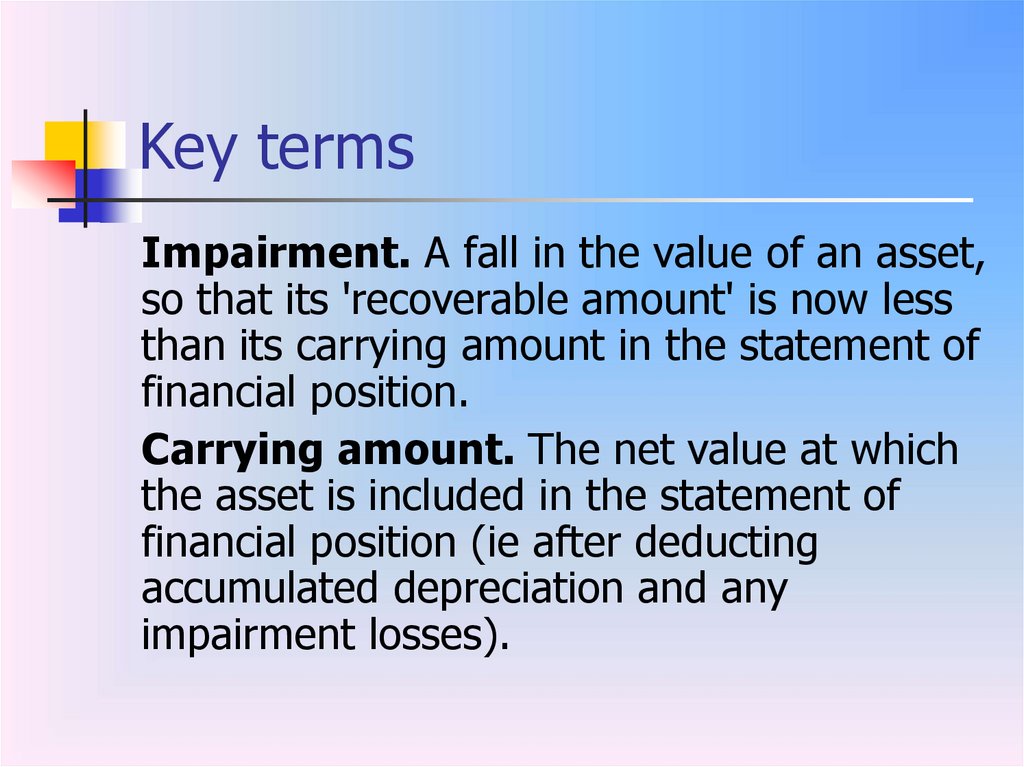

Key termsImpairment. A fall in the value of an asset,

so that its 'recoverable amount' is now less

than its carrying amount in the statement of

financial position.

Carrying amount. The net value at which

the asset is included in the statement of

financial position (ie after deducting

accumulated depreciation and any

impairment losses).

144.

Impairment lossshould be written off against profit

immediately

145.

accounting issuesHow is it possible to identify when an

impairment loss may have occurred?

How should the recoverable amount of

the asset be measured?

How should an 'impairment loss' be

reported in the accounts?

146.

Identifying a potentiallyimpaired asset

concept of materiality

formal estimate of the recoverable

amount

indications of a possible impairment

147.

External sources ofinformation

(i) A fall in the asset's market value that is more

significant than would normally be expected from

passage of time over normal use

(ii) A significant change in the technological,

market, legal or economic environment of the

business in which the assets are employed

(iii) An increase in market interest rates or market

rates of return on investments likely to affect the

discount rate used in calculating value in use

(iv) The carrying amount of the entity's net assets

being more than its market capitalisation

148.

Internal sources ofinformation

evidence of

obsolescence or physical damage,

adverse changes in the use to which the

asset is put, or the asset's economic

performance

149.

Must always be tested forimpairment annually

(a) An intangible asset with an indefinite

useful life

(b) Goodwill acquired in a business

combination

150.

Measuring the recoverableamount of the asset

The recoverable amount of an asset

should be measured as the higher value

of:

(a) The asset's fair value less costs of

disposal

(b) Its value in use

151.

An asset's fair value less costsof disposal

(a) If there is an active market in the asset,

the fair value should be based on the

market price, or on the price of recent

transactions in similar assets.

(b) If there is no active market in the asset it

might be possible to estimate fair value

using best estimates of what market

participants might pay in an orderly

transaction.

152.

‘value in use'measured as the present value of

estimated future cash flows (inflows

minus outflows) generated by the asset,

including its estimated net disposal value

(if any) at the end of its expected useful

life.

153.

Recognition and measurementof an impairment loss

If the recoverable amount of an asset is

lower than the carrying amount, the

carrying amount should be reduced by

the difference (ie the impairment loss)

which should be charged as an expense

in profit or loss.

The impairment loss is to be treated as a

revaluation decrease under the relevant

IAS.

154.

Cash generating unitsWhen it is not possible to calculate the

recoverable amount of a single asset,

then that of its cash generating unit

should be measured instead.

A cash-generating unit is the smallest

identifiable group of assets for which

independent cash flows can be identified

and measured.

155.

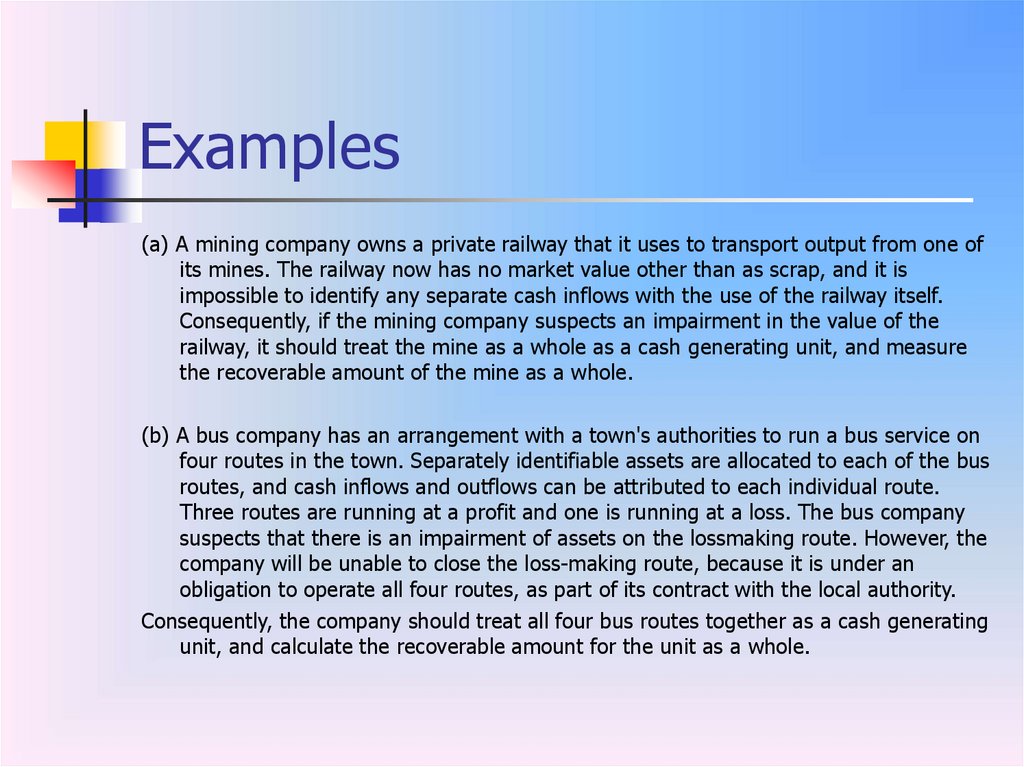

Examples(a) A mining company owns a private railway that it uses to transport output from one of

its mines. The railway now has no market value other than as scrap, and it is

impossible to identify any separate cash inflows with the use of the railway itself.

Consequently, if the mining company suspects an impairment in the value of the

railway, it should treat the mine as a whole as a cash generating unit, and measure

the recoverable amount of the mine as a whole.

(b) A bus company has an arrangement with a town's authorities to run a bus service on

four routes in the town. Separately identifiable assets are allocated to each of the bus

routes, and cash inflows and outflows can be attributed to each individual route.

Three routes are running at a profit and one is running at a loss. The bus company

suspects that there is an impairment of assets on the lossmaking route. However, the

company will be unable to close the loss-making route, because it is under an

obligation to operate all four routes, as part of its contract with the local authority.

Consequently, the company should treat all four bus routes together as a cash generating

unit, and calculate the recoverable amount for the unit as a whole.

156.

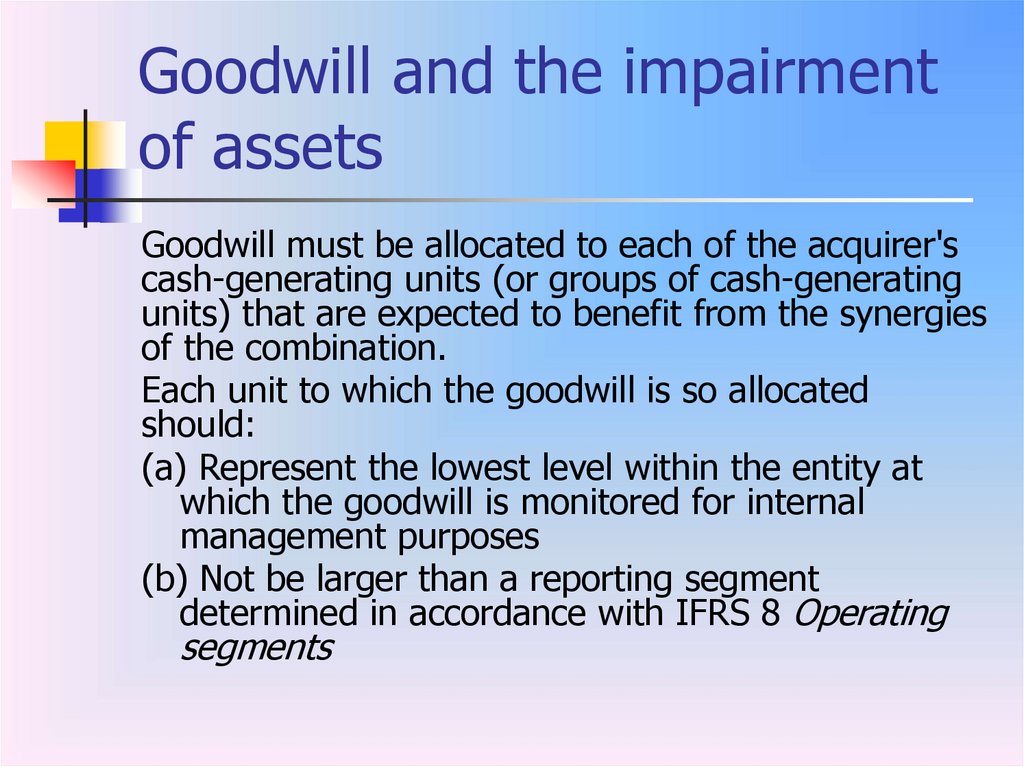

Goodwill and the impairmentof assets

Goodwill must be allocated to each of the acquirer's

cash-generating units (or groups of cash-generating

units) that are expected to benefit from the synergies

of the combination.

Each unit to which the goodwill is so allocated

should:

(a) Represent the lowest level within the entity at

which the goodwill is monitored for internal

management purposes

(b) Not be larger than a reporting segment

determined in accordance with IFRS 8 Operating

segments

157.

Accounting treatment of animpairment loss

impairment loss should be recognised

immediately

(a) The asset's carrying amount should be

reduced to its recoverable amount in the

statement of financial position.

(b) The impairment loss should be

recognised immediately in profit or loss

(unless the asset has been revalued in

which case the loss is treated as a

revaluation decrease).

158.

ExampleA company that extracts natural gas and oil has a drilling platform in the Caspian

Sea. It is required by legislation of the country concerned to remove and

dismantle the platform at the end of its useful life.

Accordingly, the company has included an amount in its accounts for removal and

dismantling costs, and is depreciating this amount over the platform's expected

life. The company is carrying out an exercise to establish whether there has

been an impairment of the platform.

(a) Its carrying amount in the statement of financial position is $3m.

(b) The company has received an offer of $2.8m for the platform from another oil

company. The bidder would take over the responsibility (and costs) for

dismantling and removing the platform at the end of its life.

(c) The present value of the estimated cash flows from the platform's continued use

is $3.3m (before adjusting for dismantling costs).

(d) The carrying amount in the statement of financial position for the provision for

dismantling and removal is currently $0.6m.

What should be the value of the drilling platform in the statement of financial

position, and what, if anything, is the impairment loss?

159.

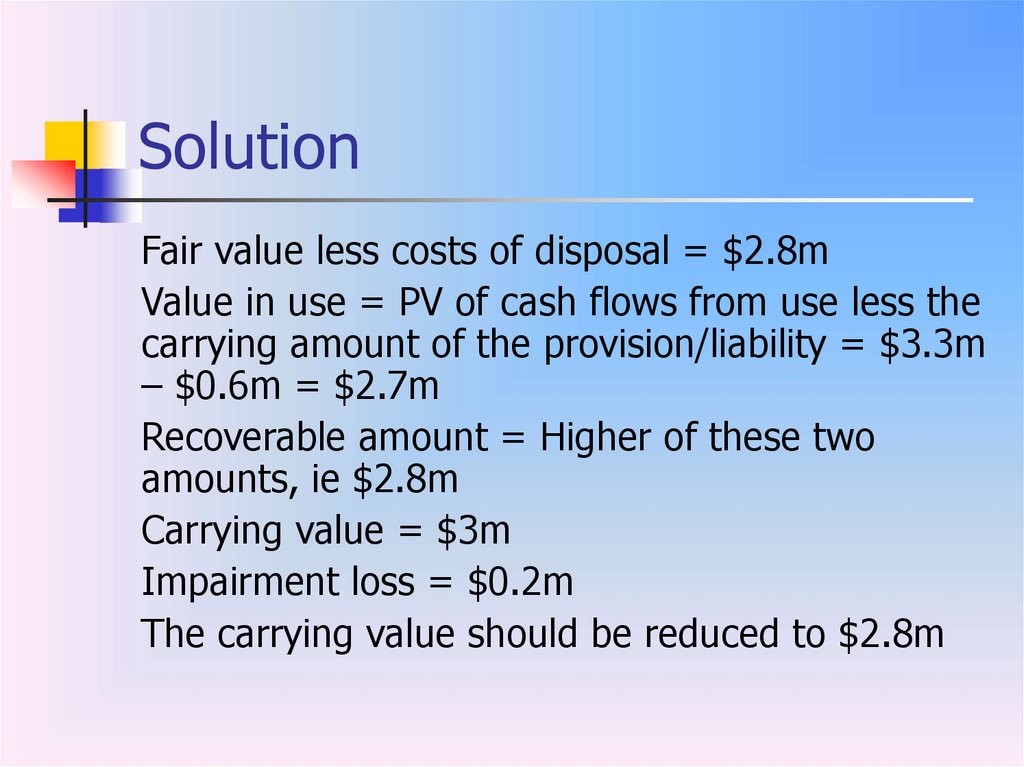

SolutionFair value less costs of disposal = $2.8m

Value in use = PV of cash flows from use less the

carrying amount of the provision/liability = $3.3m

– $0.6m = $2.7m

Recoverable amount = Higher of these two

amounts, ie $2.8m

Carrying value = $3m

Impairment loss = $0.2m

The carrying value should be reduced to $2.8m

160.

Example 2A company has acquired another business for $4.5m:

tangible assets are valued at $4.0m and goodwill at

$0.5m.

An asset with a carrying value of $1m is destroyed in

a terrorist attack. The asset was not insured. The

loss of the asset, without insurance, has prompted

the company to assess whether there has been an

impairment of assets in the acquired business and

what the amount of any such loss is.

The recoverable amount of the business (a single

cash generating unit) is measured as $3.1m.

161.

SolutionThere has been an impairment loss of $1.4m

($4.5m – $3.1m).

The impairment loss will be recognised in profit or

loss. The loss will be allocated between the

assets in the cash generating unit as follows.

(a) A loss of $1m can be attributed directly to the

uninsured asset that has been destroyed.

(b) The remaining loss of $0.4m should be

allocated to goodwill.

The carrying value of the assets will now be $3m

for tangible assets and $0.1m for goodwill.

162.

IAS 2 INVENTORIES163.

IAS 2 – DefinitionsInventories are assets

held for resale in ordinary course of business

in the process of production for resale

consumables supplies

Net realisable value (NRV) – estimated

selling price less estimated costs of

completion/ sale

164.

MeasurementAt the lower of cost and net realisable value

Cost

All costs of purchase (net of trade discounts)

and conversion (including overheads) and

other costs involved in bringing inventories to

present location and condition

Expenditures excluded

-abnormal waste/losses, etc

-storage (unless part of production process)

-administrative overheads

-selling costs

165.

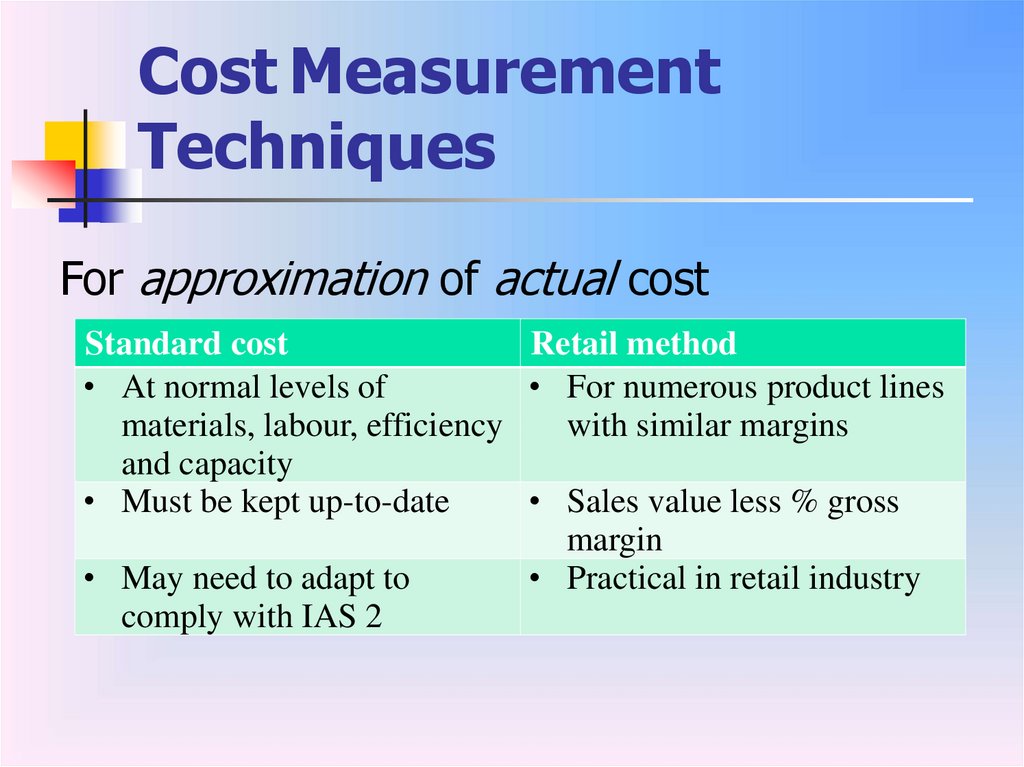

Cost MeasurementTechniques

For approximation of actual cost

Standard cost

Retail method

• At normal levels of

• For numerous product lines

materials, labour, efficiency

with similar margins

and capacity

• Must be kept up-to-date

• Sales value less % gross

margin

• May need to adapt to

• Practical in retail industry

comply with IAS 2

166.

Cost FormulasSpecific identification of individual costs

Items not ordinarily interchangeable

Goods/services produced and segregated for specific

projects

Otherwise formulae

Specific identification of individual costs is not

practicable

Inventories that are “ordinarily interchangeable”

Permitted formulae

FIFO

WAC (= AVCO)

167.

FIFO and WACFirst-in, first-out (FIFO)

• Items purchased/

manufactured first are sold

first

• Inventory at period end is

most recently purchased/

produced.

• Examples:

Weighted average

(WAC/AVCO)

• WAC of:

• opening inventory

• similar items purchased/

produced in period

• Calculated periodically or

• cars on a production line;

on each purchase/

• retail produce with “sell by”/

production

“best before” date.

Accounting policies

Used to

when

like

items

The same accounting policy should be• applied

similar

items

(by are

category)

produced/sold disregarding

168.

Periodic and continuousWAC

Calculated for a period

Recalculated on each receipt of inventory

169.

170.

Net Realisable ValueReasons why cost may not be recoverable

-Damage

-Obsolescence

-Falling selling price

-Increasing estimated costs to completion

Core principle

-Inventories cannot be carried in excess of amounts

expected to be realised from their sale or use

Write down (to NRV) is on an item-by-item basis

171.

Estimating NRVConsiderations

Price/cost fluctuations relating to events after

the period end

Purpose for which inventory is held

(raw materials are rarely written down)

When

At end of each reporting period

On subsequent review must reverse write-down

(if circumstances causing write-down no longer

exist)

172.

RecognitionAs an expense

In “cost of sales” (accruals concept)

Write-downs in period when recognised

Reversals (as a reduction in expense)

when reversal occurs

Inventories capitalised (e.g. in selfconstructed assets) are expensed over

useful life of asset (within depreciation)

173.

DisclosureAccounting policies – including cost formula(s)

used

Carrying amounts

Total – with sub-classifications (e.g. raw materials, goods for

resale)

Carrying amount at fair value less costs to sell

Carrying amount pledged as security for liabilities

Separate disclosure

Any write-down “of such size, incidence or

nature” requires separate disclosure

finance

finance