Similar presentations:

Шаблоны слайдов от McKinsey

1.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

1

2.

Video content analysis (VCA) technology and infrastructure is readily availableJul. ‘15

in 2-5 years

Sophisticated realtime and

predictive BI solutions

are in pilot stages

Dec. ‘14

Digital CCTV cameras are

installed in many client’s

locations, raw video data is

available

Provider roadmaps indicate

BI solutions for customer

behavior, frontline

management and cloud

analytics

Oct. ‘15

Current technology allows

to perform people count,

queue tracking and

create heat maps

in 1-2 years

Providers currently refine

end-to-end tracking

capabilities in large

perimeters and accuracy

in crowded

environments

2

3.

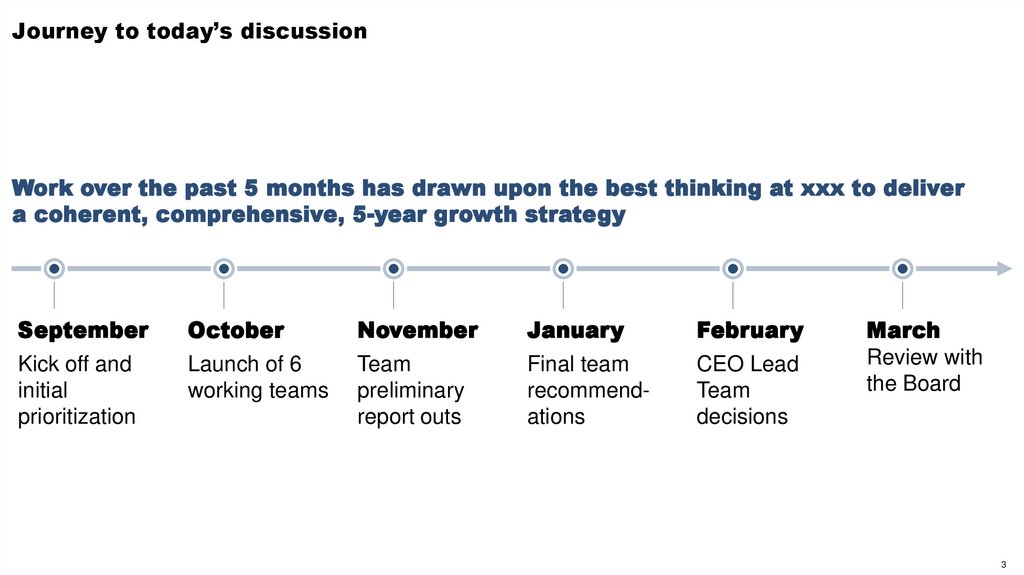

Journey to today’s discussionWork over the past 5 months has drawn upon the best thinking at xxx to deliver

a coherent, comprehensive, 5-year growth strategy

September

October

November

January

February

Kick off and

initial

prioritization

Launch of 6

working teams

Team

preliminary

report outs

Final team

recommendations

CEO Lead

Team

decisions

March

Review with

the Board

3

4.

ScheduleMonth

Sun

Mon

Tue

Wed

Thu

Fri

Sat

хх

1

8

2

3

4

5

6

7

хх

хх

хх

9

10

11

12

13

14

Steering

Committe

e

In-person

Workshop

хх

15

16

17

18

19

20

21

22

23

24

25 Holiday

26

27

28

29

30

31

4

5.

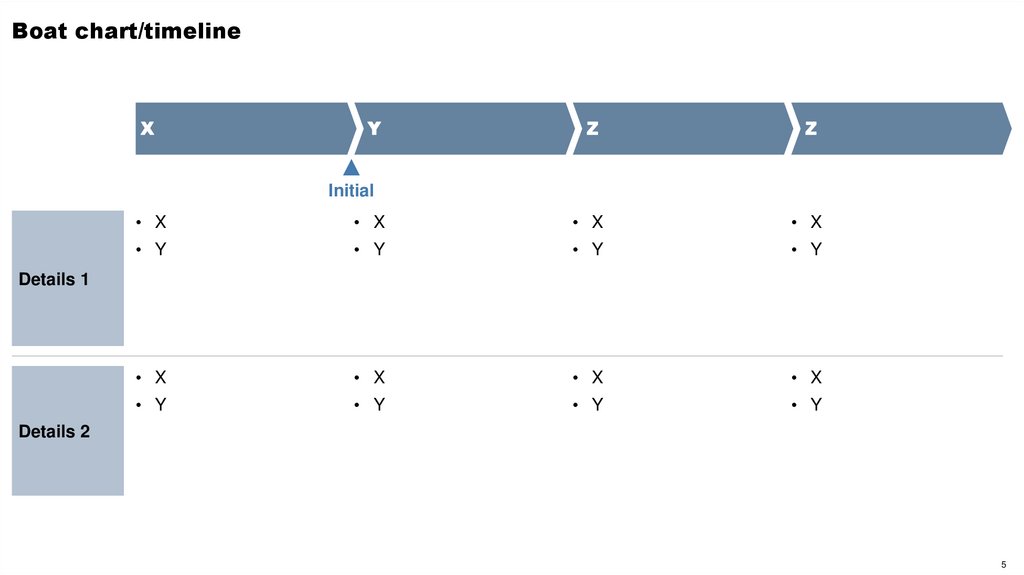

Boat chart/timelineX

Y

Z

Z

Initial

• X

• X

• X

• X

• Y

• Y

• Y

• Y

• X

• X

• X

• X

• Y

• Y

• Y

• Y

Details 1

Details 2

5

6.

TimelineX weeks

X weeks

…

1

2

X weeks

…

…

…

…

…

…

….

….

…

…

6

7.

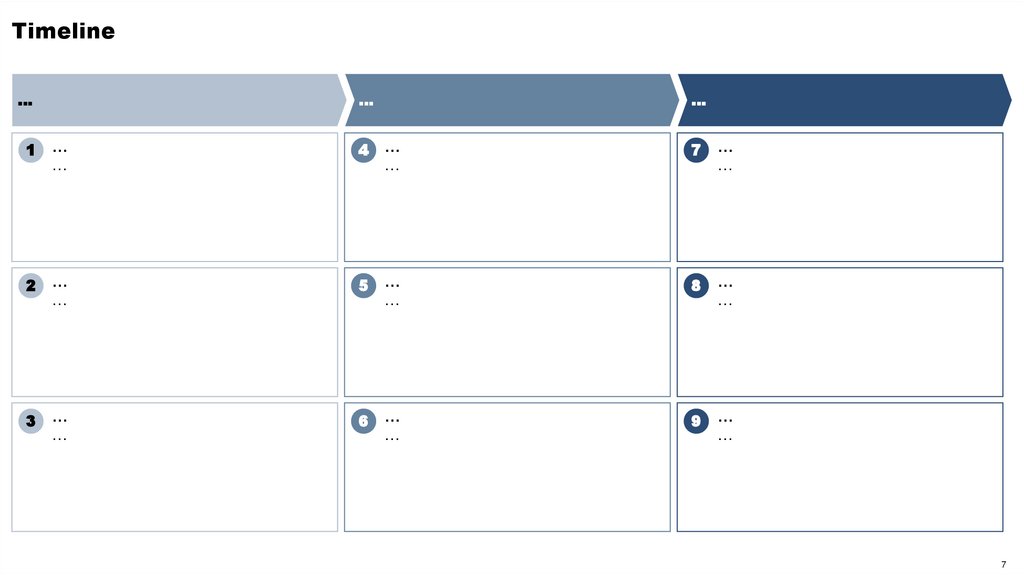

Timeline…

…

…

1

…

…

4

…

…

7

…

…

2

…

…

5

…

…

8

…

…

3

…

…

6

…

…

9

…

…

7

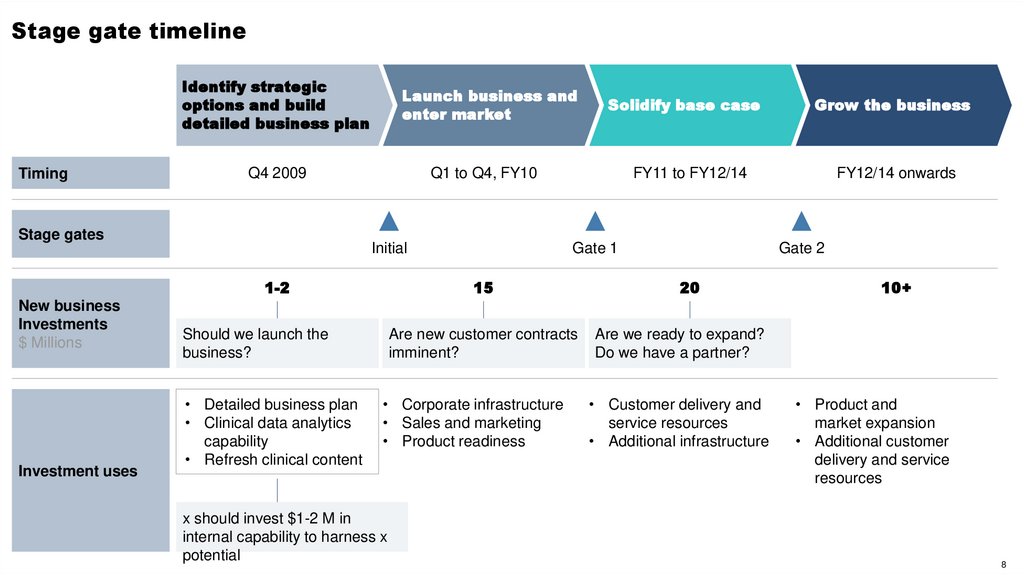

8.

Stage gate timelineIdentify strategic

options and build

detailed business plan

Timing

Launch business and

enter market

Q4 2009

Stage gates

Q1 to Q4, FY10

Initial

1-2

New business

Investments

$ Millions

Investment uses

Gate 1

Are new customer contracts

imminent?

• Corporate infrastructure

• Sales and marketing

• Product readiness

x should invest $1-2 M in

internal capability to harness x

potential

Grow the business

FY11 to FY12/14

15

Should we launch the

business?

• Detailed business plan

• Clinical data analytics

capability

• Refresh clinical content

Solidify base case

FY12/14 onwards

Gate 2

20

10+

Are we ready to expand?

Do we have a partner?

• Customer delivery and

service resources

• Additional infrastructure

• Product and

market expansion

• Additional customer

delivery and service

resources

8

9.

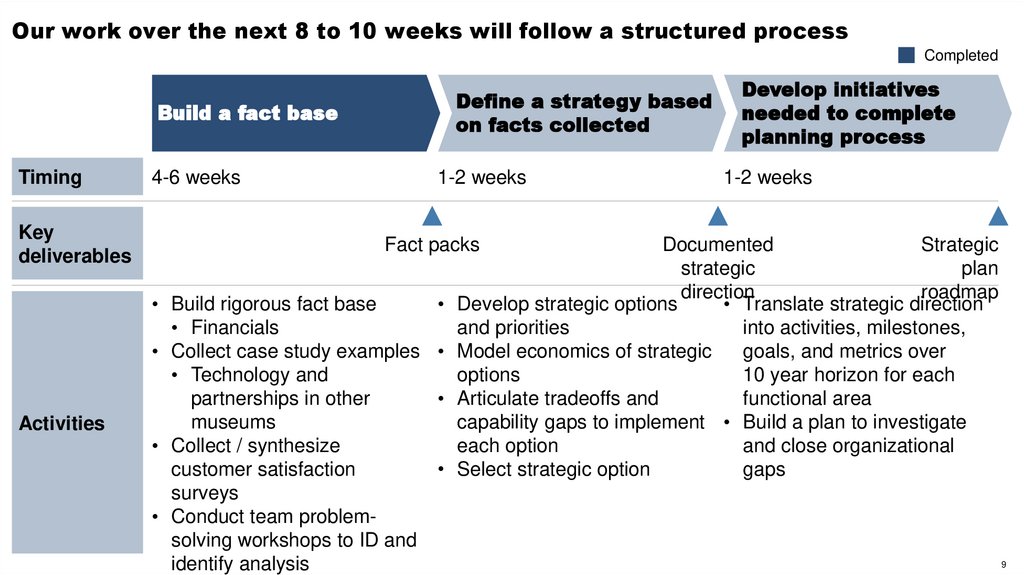

Our work over the next 8 to 10 weeks will follow a structured processCompleted

Define a strategy based

on facts collected

Build a fact base

Timing

Key

deliverables

Activities

4-6 weeks

1-2 weeks

Develop initiatives

needed to complete

planning process

1-2 weeks

Fact packs

• Build rigorous fact base

• Financials

• Collect case study examples

• Technology and

partnerships in other

museums

• Collect / synthesize

customer satisfaction

surveys

• Conduct team problemsolving workshops to ID and

identify analysis

Documented

Strategic

strategic

plan

direction

roadmap

Develop strategic options

• Translate strategic direction

and priorities

into activities, milestones,

Model economics of strategic

goals, and metrics over

options

10 year horizon for each

Articulate tradeoffs and

functional area

capability gaps to implement • Build a plan to investigate

each option

and close organizational

Select strategic option

gaps

9

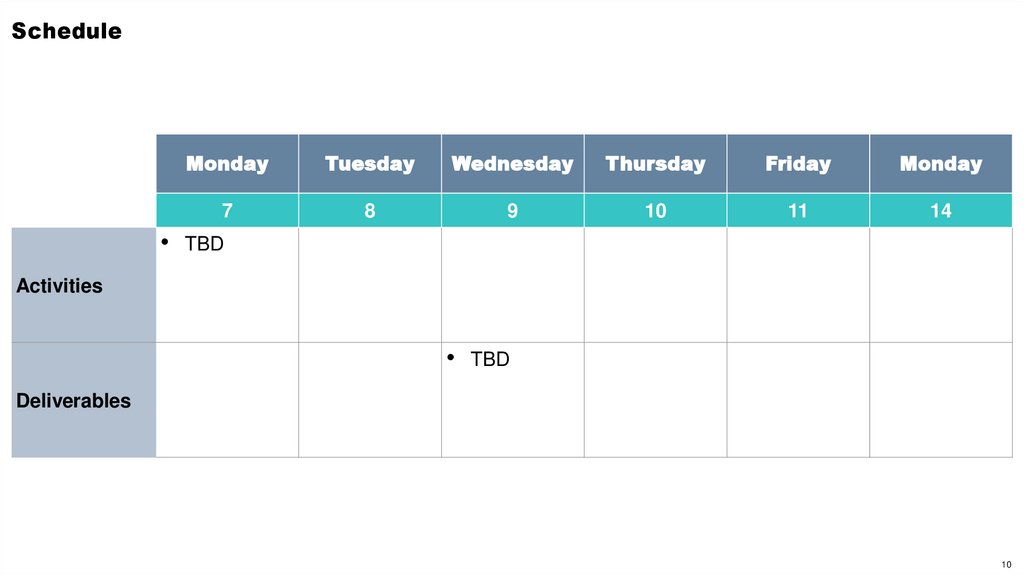

10.

ScheduleMonday

Tuesday

Wednesday

Thursday

Friday

Monday

7

8

9

10

11

14

TBD

Activities

TBD

Deliverables

10

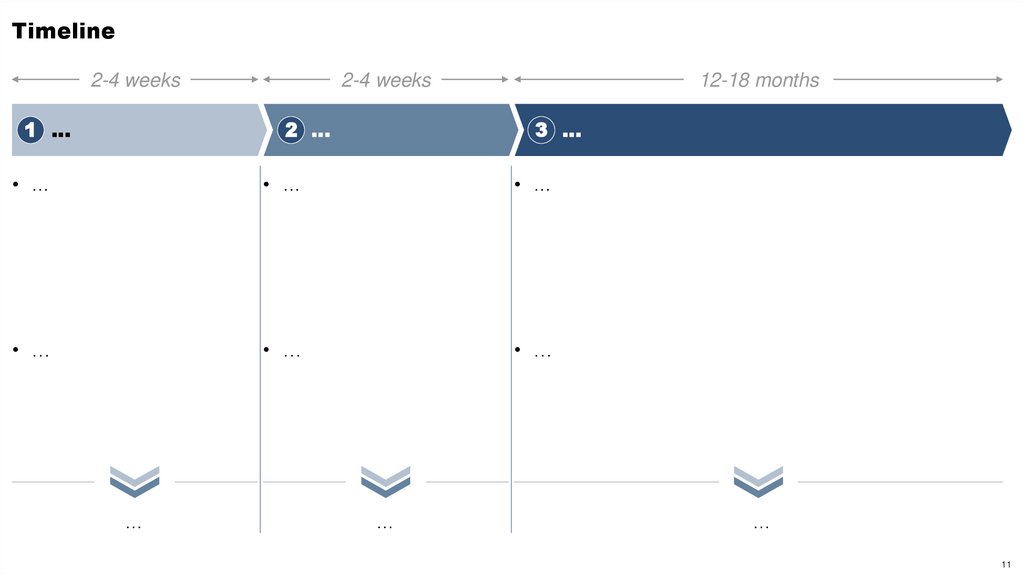

11.

Timeline2-4 weeks

1 …

2-4 weeks

2 …

12-18 months

3 …

• …

• …

• …

• …

• …

• …

…

…

…

11

12.

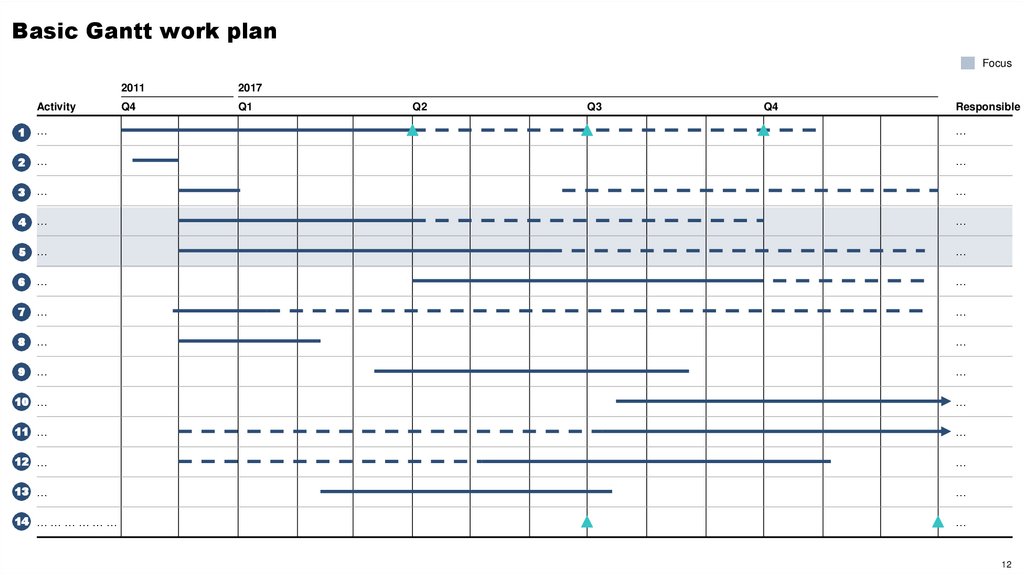

Basic Gantt work planFocus

Activity

2011

2017

Q4

Q1

Q2

Q3

Q4

Responsible

1

…

…

2

…

…

3

…

…

4

…

…

5

…

…

6

…

…

7

…

…

8

…

…

9

…

…

10 …

…

11 …

…

12 …

…

13 …

…

14 … … … … … …

…

12

13.

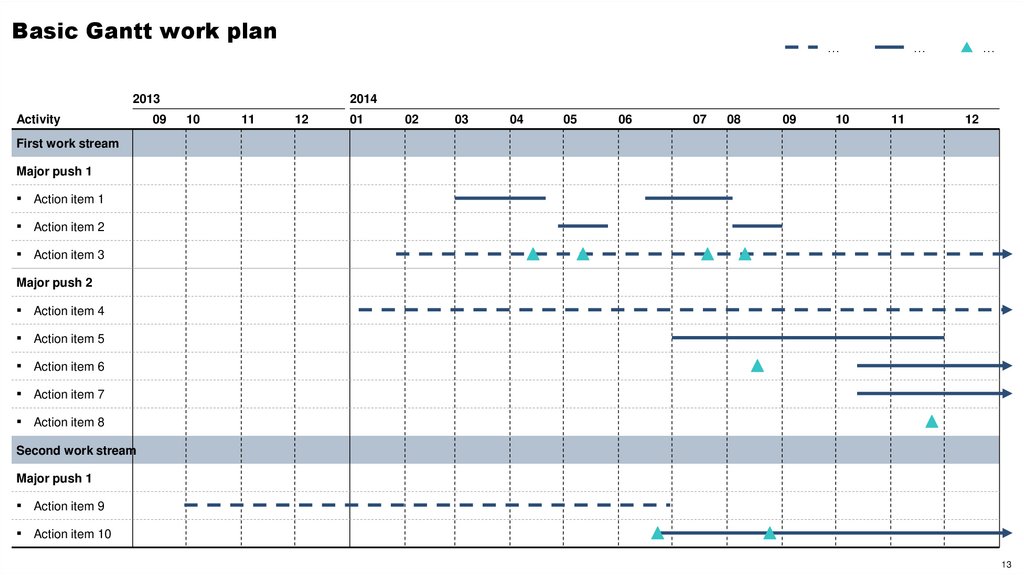

Basic Gantt work plan…

2013

Activity

09

…

…

2014

10

11

12

01

02

03

04

05

06

07

08

09

10

11

12

First work stream

Major push 1

▪ Action item 1

▪ Action item 2

▪ Action item 3

Major push 2

▪ Action item 4

▪ Action item 5

▪ Action item 6

▪ Action item 7

▪ Action item 8

Second work stream

Major push 1

▪ Action item 9

▪ Action item 10

13

14.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

14

15.

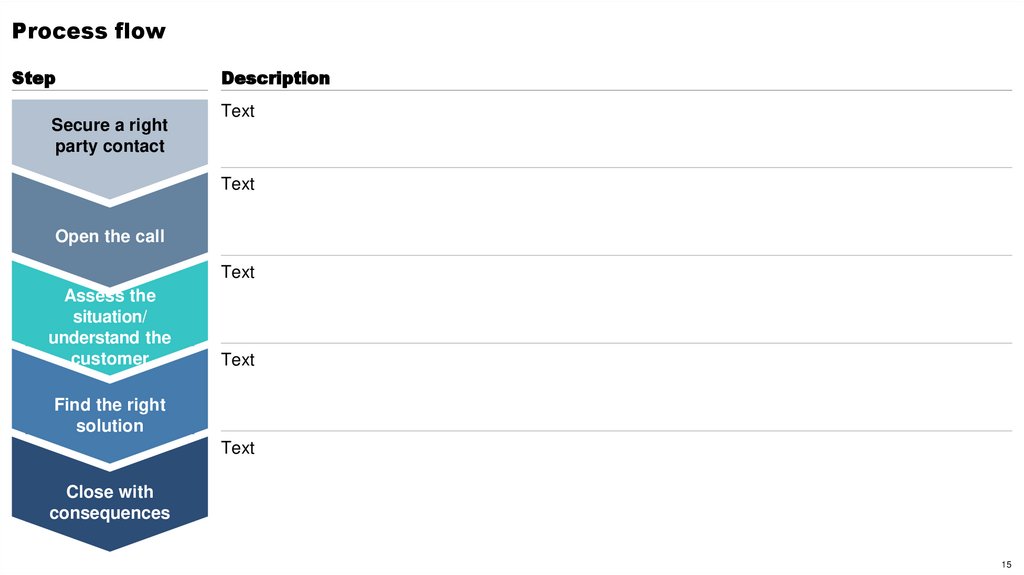

Process flowStep

Secure a right

party contact

Description

Text

Text

Open the call

Text

Assess the

situation/

understand the

customer

Text

Find the right

solution

Text

Close with

consequences

15

16.

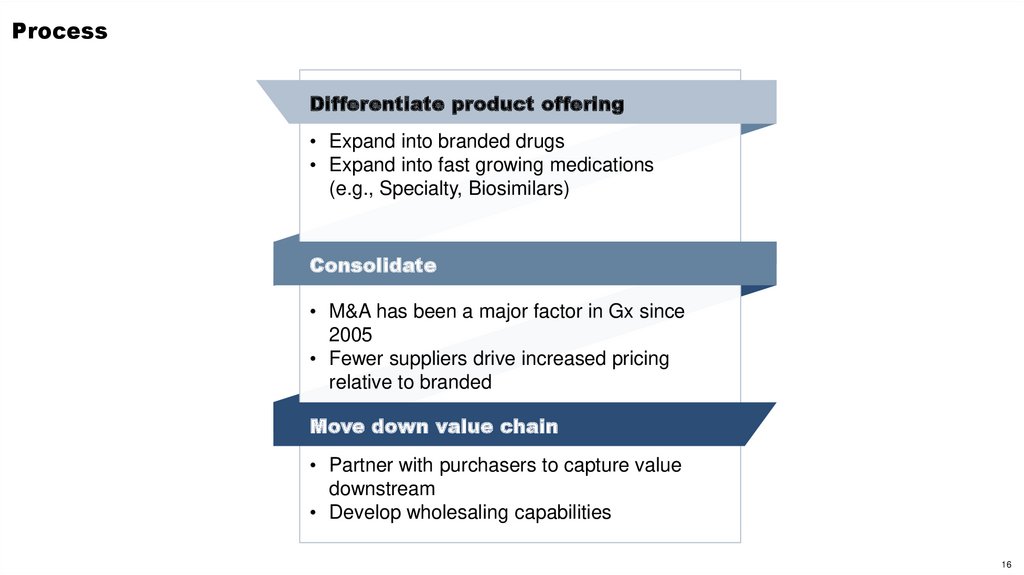

ProcessDifferentiate product offering

• Expand into branded drugs

• Expand into fast growing medications

(e.g., Specialty, Biosimilars)

Consolidate

• M&A has been a major factor in Gx since

2005

• Fewer suppliers drive increased pricing

relative to branded

Move down value chain

• Partner with purchasers to capture value

downstream

• Develop wholesaling capabilities

16

17.

Circular process• …

• …

A. …

B. …

…

• …

• …

D. …

C. …

17

18.

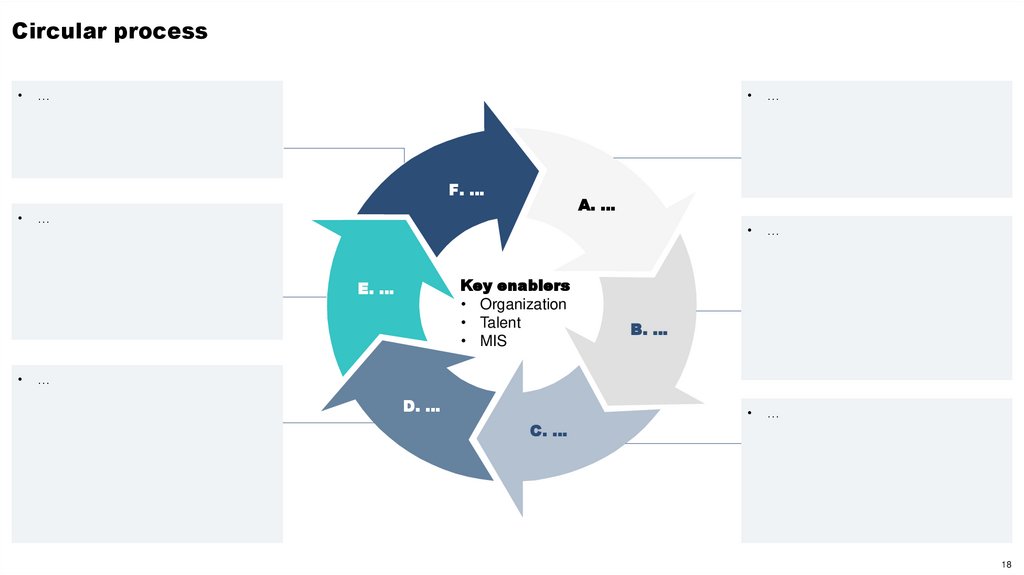

Circular process…

F. …

…

…

…

A. …

…

Key enablers

• Organization

• Talent

• MIS

E. …

B. …

…

D. …

C. …

18

19.

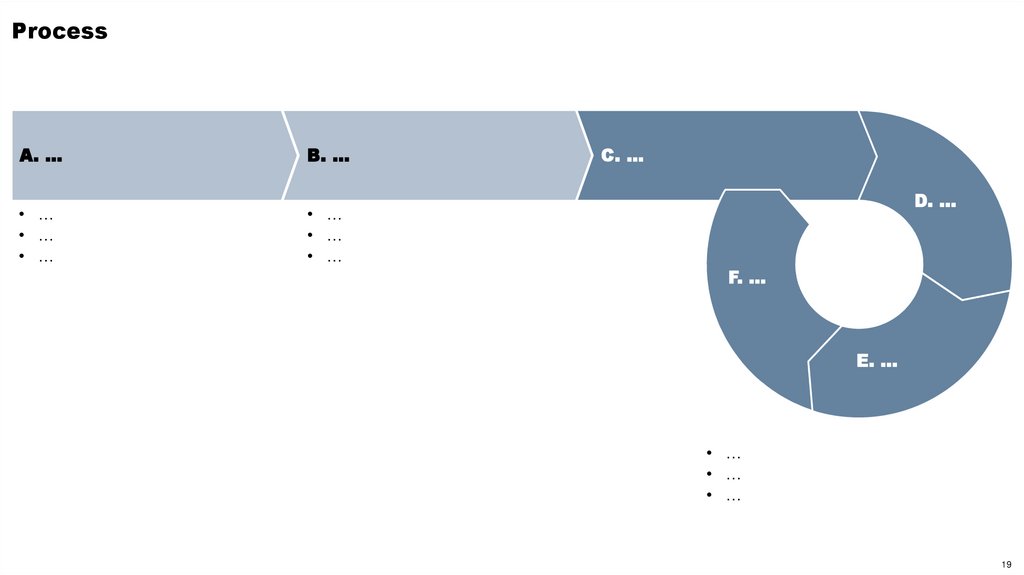

ProcessA. …

B. …

• …

• …

• …

• …

• …

• …

C. …

D. …

F. …

E. …

• …

• …

• …

19

20.

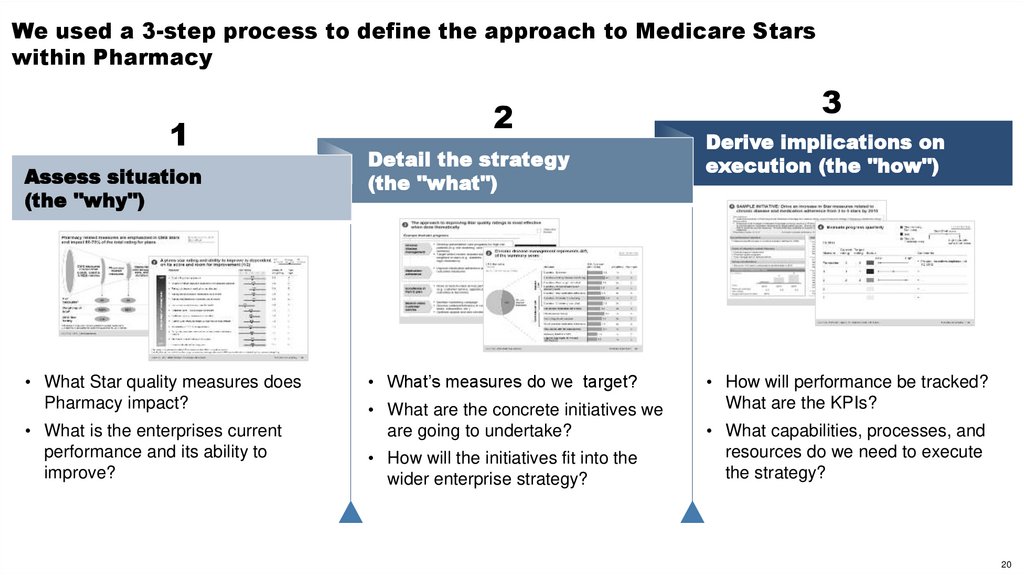

We used a 3-step process to define the approach to Medicare Starswithin Pharmacy

1

Assess situation

(the "why")

• What Star quality measures does

Pharmacy impact?

• What is the enterprises current

performance and its ability to

improve?

2

Detail the strategy

(the "what")

• What’s measures do we target?

• What are the concrete initiatives we

are going to undertake?

• How will the initiatives fit into the

wider enterprise strategy?

3

Derive implications on

execution (the "how")

• How will performance be tracked?

What are the KPIs?

• What capabilities, processes, and

resources do we need to execute

the strategy?

20

21.

Operations readiness assessment overviewSurvey

Readiness assessment

Interviews

Client interviews

Workshop

Initiative read out and

prioritization

Working session

Review client

implementation plan

Timing

January 2013

March 2013

June 2013

2014

Format

10-15 question survey

operational readiness

Interviews with client

functional area leaders

4 hour session with client

leaders to align on capabilities

and priority level

Review working session on

developed implementation

plans with McKinsey experts

• Assessment of high level

• Targeted assessment of

• Review findings to develop

• Present implementation

post reform operational

readiness gaps

• Group consensus on

Outcomes

capability readiness and

prioritization

operational readiness gaps

on "top of mind" post reform

issues

• High level understanding of

gaps and competitive

positioning

common under-standing on

capability current state and

gaps

• Align on priority of capabilities

by strategic need

• Action-plan on how to

plan to McKinsey

operations experts

• Agree on initiatives needed

to close the operational gap

• Align on project timelines

proceed with developing

implementation plans

Client

support

needed

• Identify participants for survey, interviews, and workshop

• Schedule workshop and interview sessions

• Schedule workshop with

operations team and

McKinsey experts

• Create schedule, agenda,

and implementation plans

for working session with

McKinsey operations

experts

21

22.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

22

23.

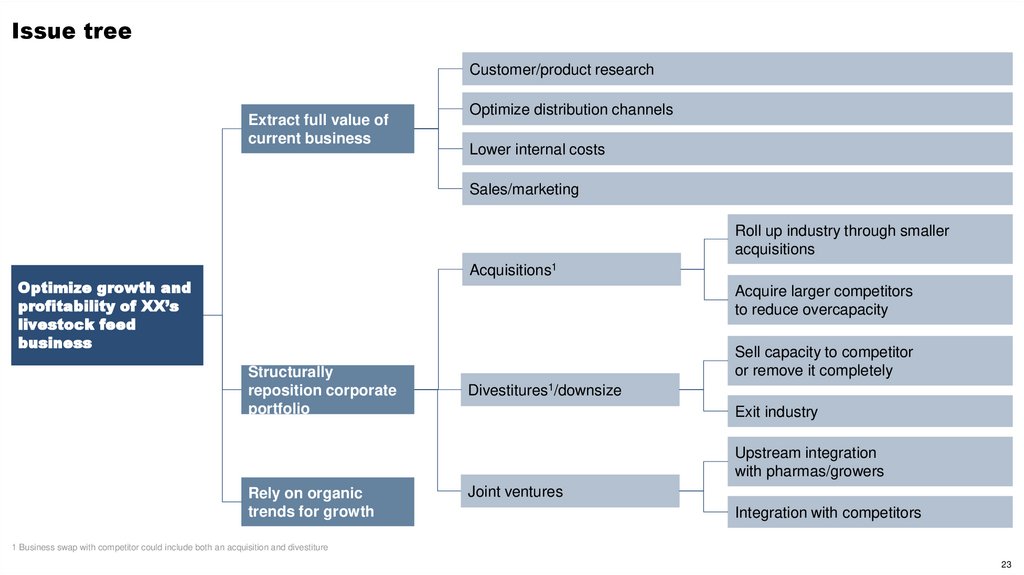

Issue treeCustomer/product research

Extract full value of

current business

Optimize distribution channels

Lower internal costs

Sales/marketing

Roll up industry through smaller

acquisitions

Acquisitions1

Optimize growth and

profitability of XX’s

livestock feed

business

Acquire larger competitors

to reduce overcapacity

Structurally

reposition corporate

portfolio

Sell capacity to competitor

or remove it completely

Divestitures1/downsize

Exit industry

Upstream integration

with pharmas/growers

Rely on organic

trends for growth

Joint ventures

Integration with competitors

1 Business swap with competitor could include both an acquisition and divestiture

23

24.

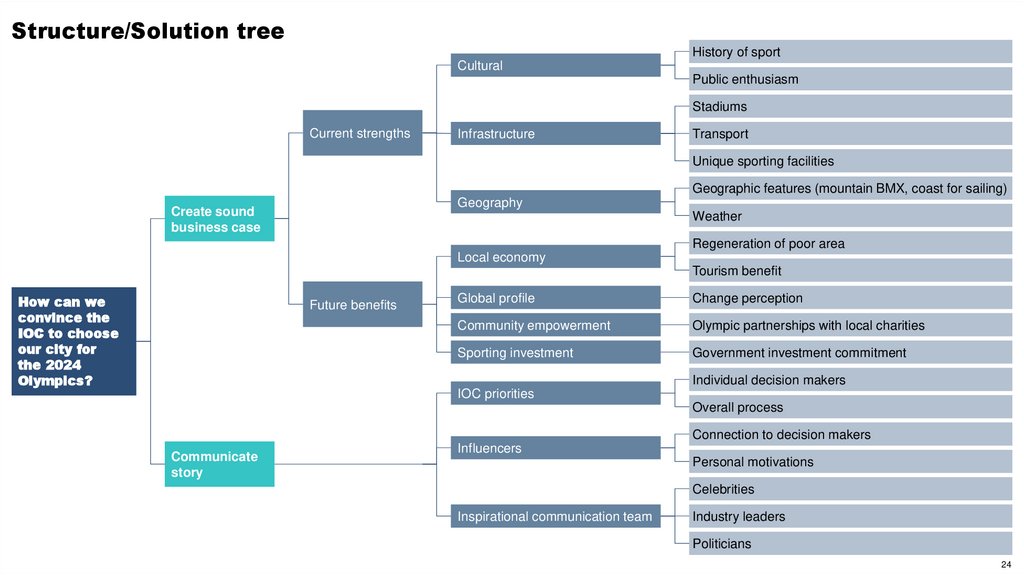

Structure/Solution treeHistory of sport

Cultural

Public enthusiasm

Stadiums

Current strengths

Infrastructure

Transport

Unique sporting facilities

Geographic features (mountain BMX, coast for sailing)

Geography

Create sound

business case

Weather

Regeneration of poor area

Local economy

Tourism benefit

How can we

convince the

IOC to choose

our city for

the 2024

Olympics?

Future benefits

Global profile

Change perception

Community empowerment

Olympic partnerships with local charities

Sporting investment

Government investment commitment

Individual decision makers

IOC priorities

Overall process

Connection to decision makers

Communicate

story

Influencers

Personal motivations

Celebrities

Inspirational communication team

Industry leaders

Politicians

24

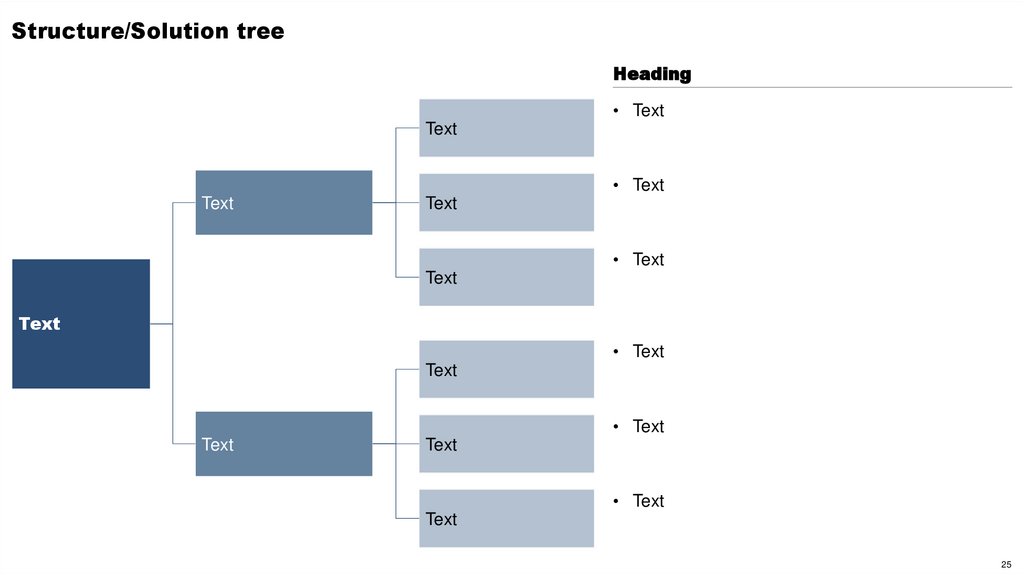

25.

Structure/Solution treeHeading

• Text

Text

• Text

Text

Text

• Text

Text

Text

• Text

Text

• Text

Text

Text

• Text

Text

25

26.

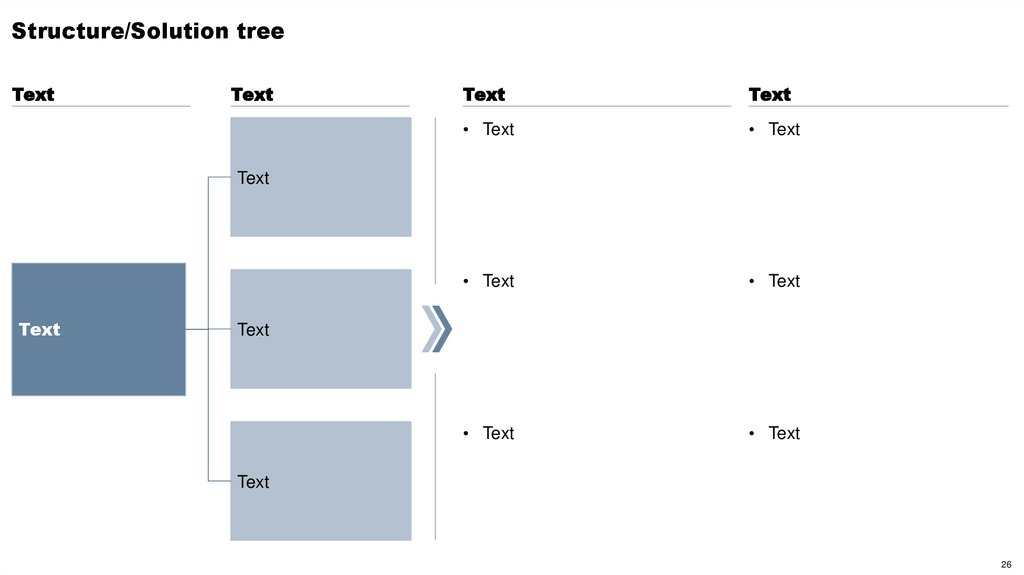

Structure/Solution treeText

Text

Text

Text

• Text

• Text

• Text

• Text

• Text

• Text

Text

Text

Text

Text

26

27.

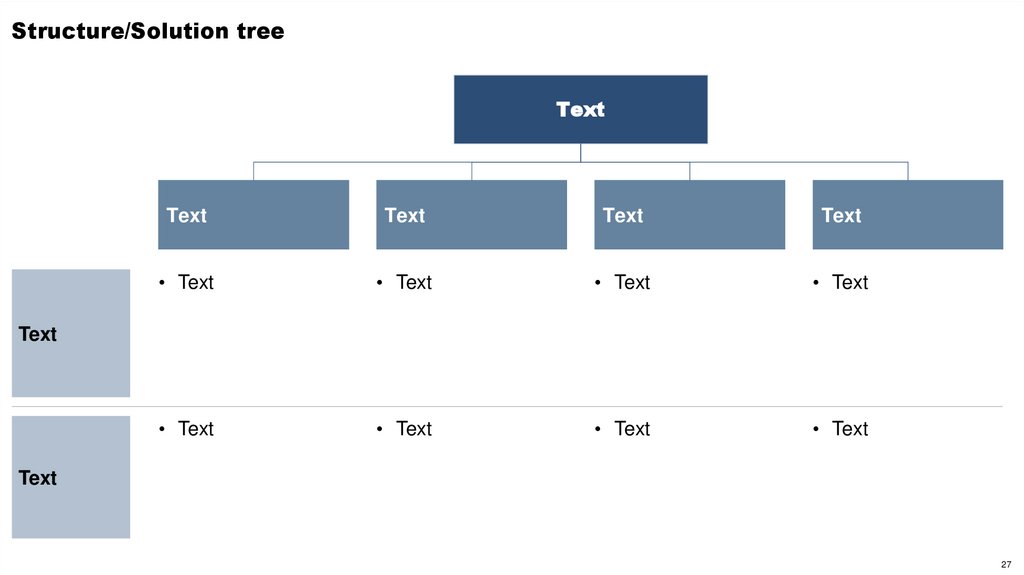

Structure/Solution treeText

Text

Text

Text

Text

• Text

• Text

• Text

• Text

• Text

• Text

• Text

• Text

Text

Text

27

28.

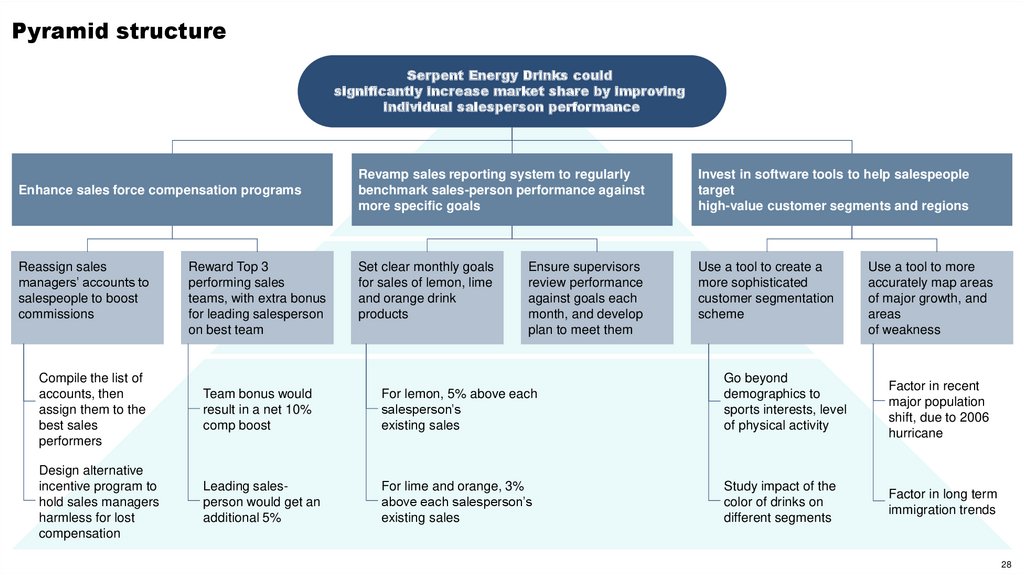

Pyramid structureSerpent Energy Drinks could

significantly increase market share by improving

individual salesperson performance

Enhance sales force compensation programs

Revamp sales reporting system to regularly

benchmark sales-person performance against

more specific goals

Invest in software tools to help salespeople

target

high-value customer segments and regions

Reassign sales

managers’ accounts to

salespeople to boost

commissions

Set clear monthly goals

for sales of lemon, lime

and orange drink

products

Use a tool to create a

more sophisticated

customer segmentation

scheme

Reward Top 3

performing sales

teams, with extra bonus

for leading salesperson

on best team

Ensure supervisors

review performance

against goals each

month, and develop

plan to meet them

Compile the list of

accounts, then

assign them to the

best sales

performers

Team bonus would

result in a net 10%

comp boost

For lemon, 5% above each

salesperson’s

existing sales

Go beyond

demographics to

sports interests, level

of physical activity

Design alternative

incentive program to

hold sales managers

harmless for lost

compensation

Leading salesperson would get an

additional 5%

For lime and orange, 3%

above each salesperson’s

existing sales

Study impact of the

color of drinks on

different segments

Use a tool to more

accurately map areas

of major growth, and

areas

of weakness

Factor in recent

major population

shift, due to 2006

hurricane

Factor in long term

immigration trends

28

29.

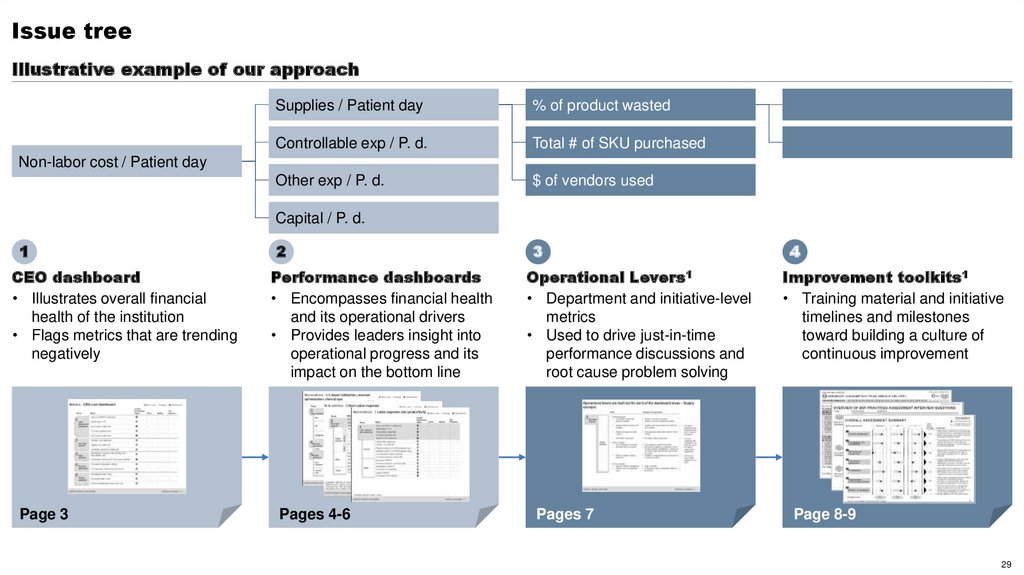

Issue treeIllustrative example of our approach

Supplies / Patient day

% of product wasted

Controllable exp / P. d.

Total # of SKU purchased

Other exp / P. d.

$ of vendors used

Non-labor cost / Patient day

Capital / P. d.

1

CEO dashboard

• Illustrates overall financial

health of the institution

• Flags metrics that are trending

negatively

Page 3

2

Performance dashboards

• Encompasses financial health

and its operational drivers

• Provides leaders insight into

operational progress and its

impact on the bottom line

Pages 4-6

3

Operational Levers1

• Department and initiative-level

metrics

• Used to drive just-in-time

performance discussions and

root cause problem solving

Pages 7

4

Improvement toolkits1

• Training material and initiative

timelines and milestones

toward building a culture of

continuous improvement

Page 8-9

29

30.

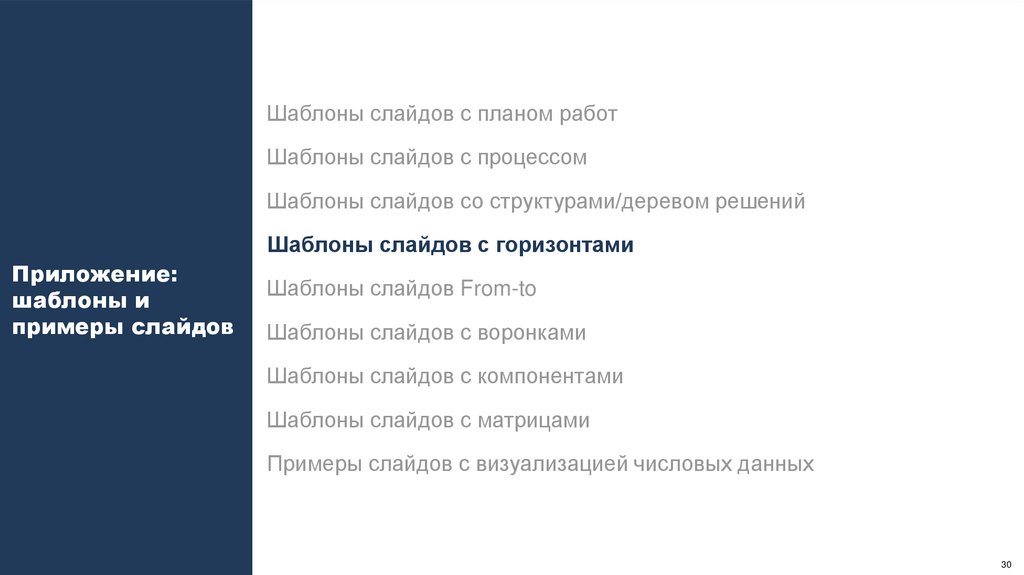

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

30

31.

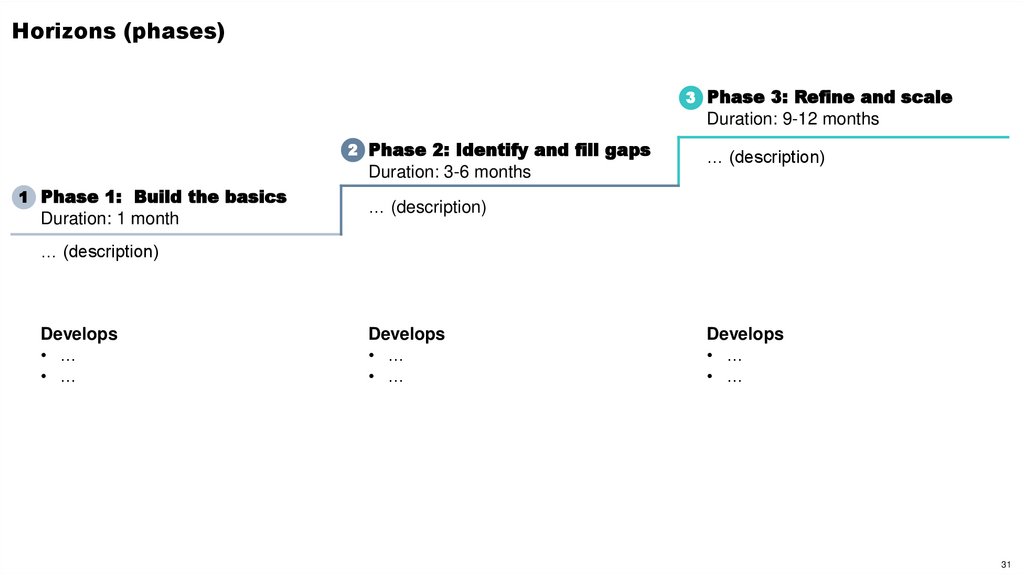

Horizons (phases)3 Phase 3: Refine and scale

Duration: 9-12 months

2 Phase 2: Identify and fill gaps

Duration: 3-6 months

1 Phase 1: Build the basics

Duration: 1 month

… (description)

… (description)

… (description)

Develops

• …

• …

Develops

• …

• …

Develops

• …

• …

31

32.

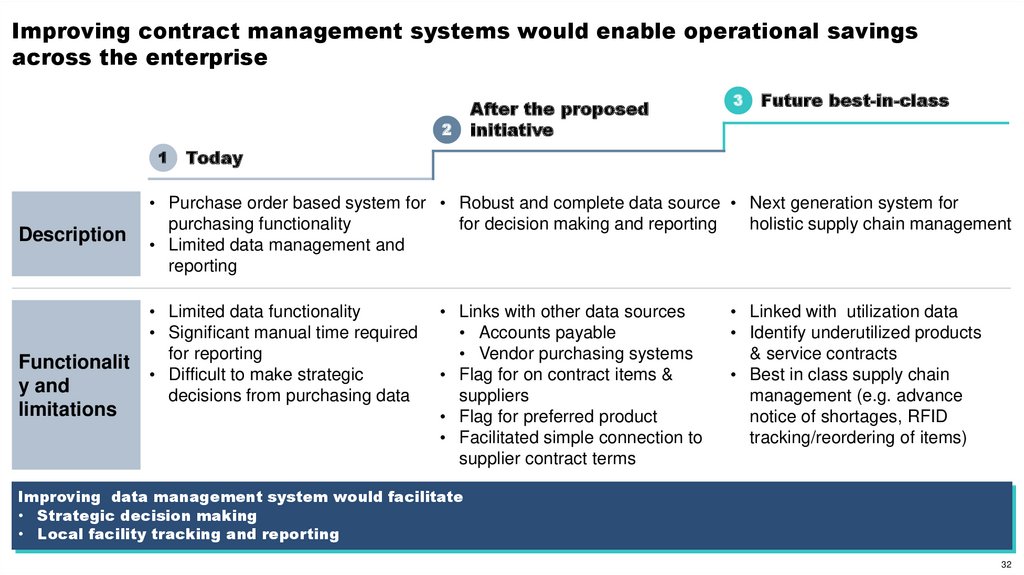

Improving contract management systems would enable operational savingsacross the enterprise

2

1

Description

Functionalit

y and

limitations

After the proposed

initiative

3

Future best-in-class

Today

• Purchase order based system for • Robust and complete data source • Next generation system for

purchasing functionality

for decision making and reporting

holistic supply chain management

• Limited data management and

reporting

• Limited data functionality

• Significant manual time required

for reporting

• Difficult to make strategic

decisions from purchasing data

• Links with other data sources

• Accounts payable

• Vendor purchasing systems

• Flag for on contract items &

suppliers

• Flag for preferred product

• Facilitated simple connection to

supplier contract terms

• Linked with utilization data

• Identify underutilized products

& service contracts

• Best in class supply chain

management (e.g. advance

notice of shortages, RFID

tracking/reordering of items)

Improving data management system would facilitate

• Strategic decision making

• Local facility tracking and reporting

32

33.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

33

34.

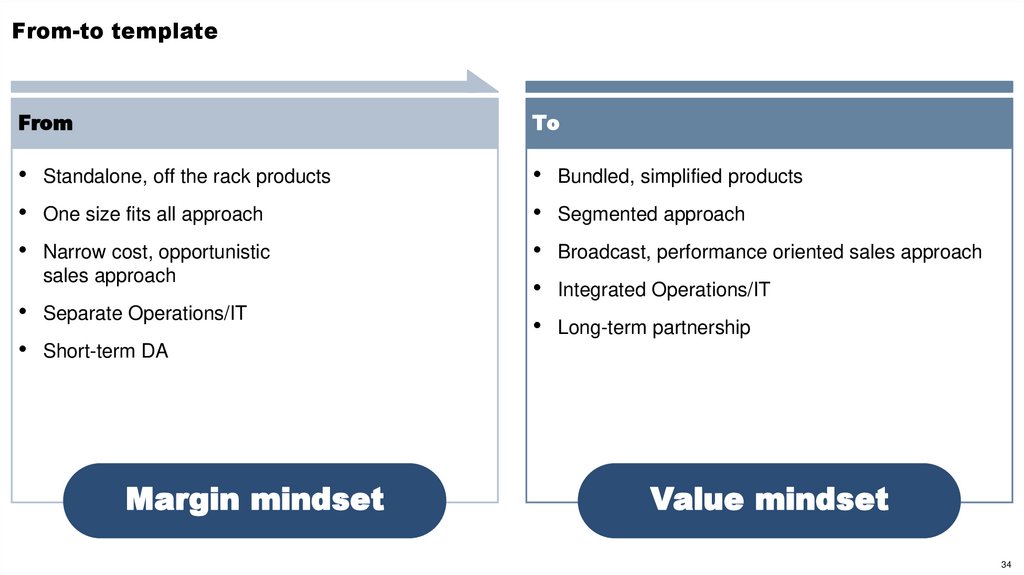

From-to templateFrom

To

Standalone, off the rack products

Bundled, simplified products

One size fits all approach

Segmented approach

Narrow cost, opportunistic

sales approach

Broadcast, performance oriented sales approach

Integrated Operations/IT

Separate Operations/IT

Long-term partnership

Short-term DA

Margin mindset

Value mindset

34

35.

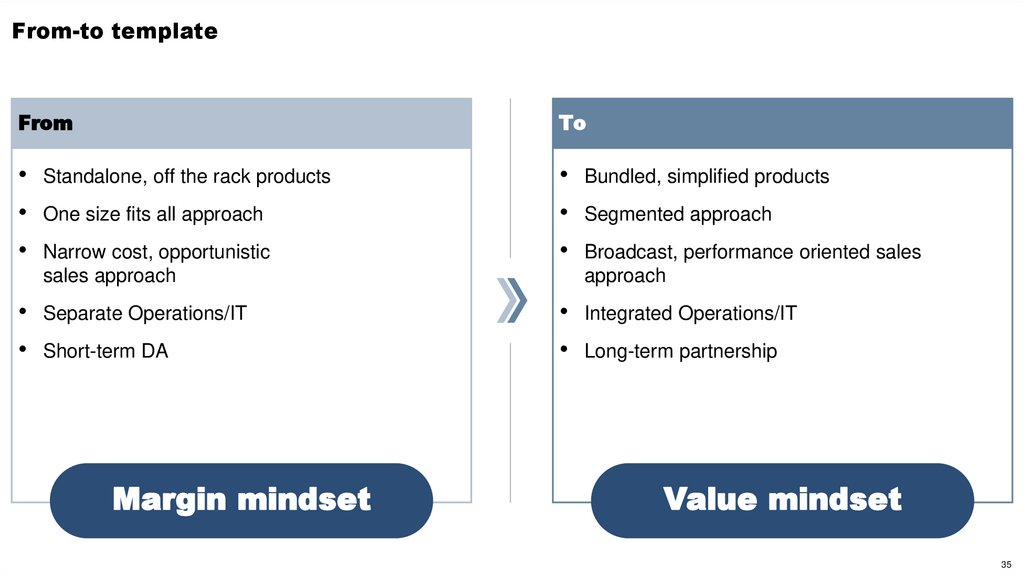

From-to templateFrom

To

Standalone, off the rack products

Bundled, simplified products

One size fits all approach

Segmented approach

Narrow cost, opportunistic

sales approach

Broadcast, performance oriented sales

approach

Separate Operations/IT

Integrated Operations/IT

Short-term DA

Long-term partnership

Margin mindset

Value mindset

35

36.

From-to templateTitle

Title

36

37.

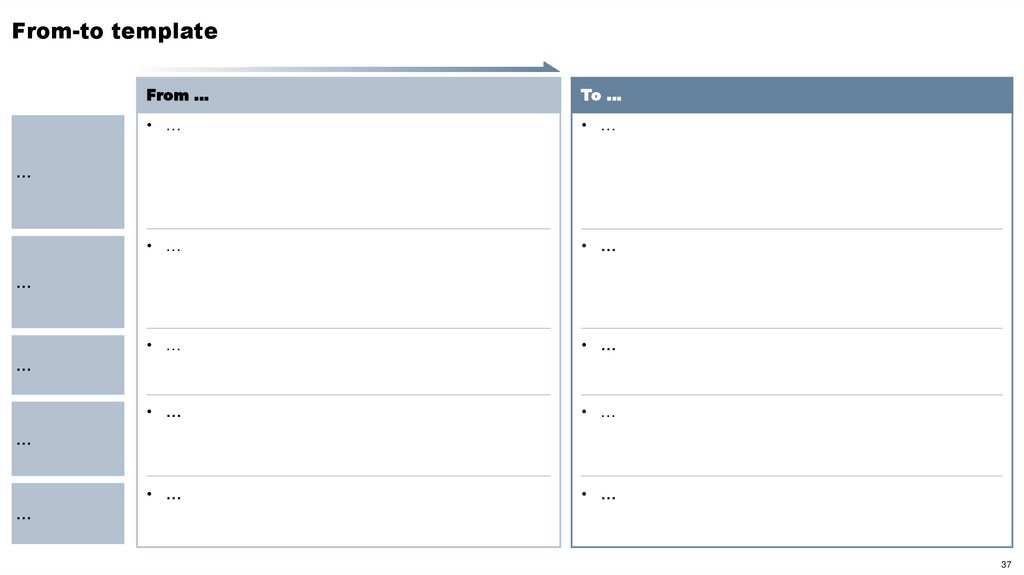

From-to templateFrom …

To …

• …

• …

• …

• …

• …

• …

• …

• …

• …

• …

…

…

…

…

…

37

38.

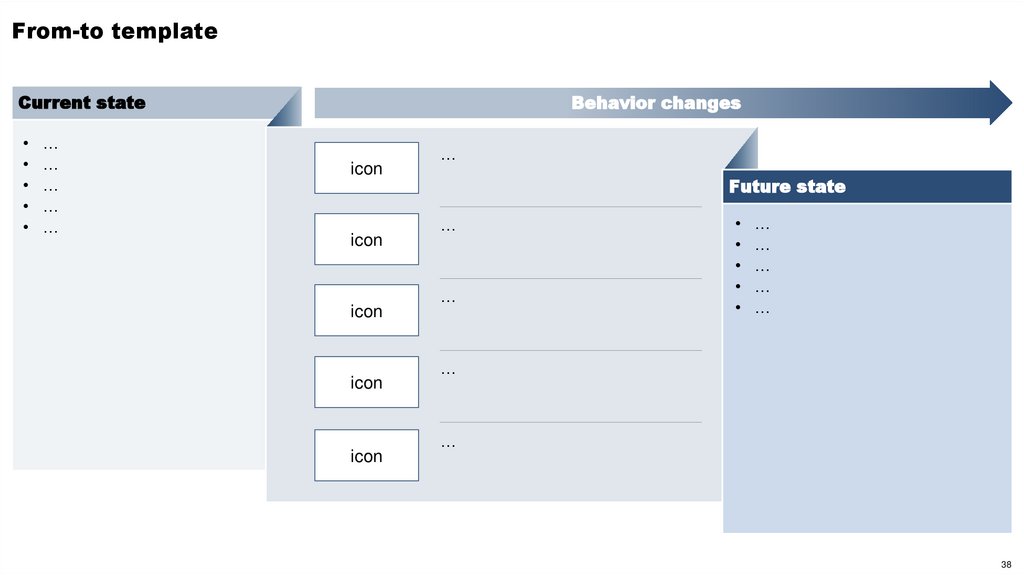

From-to templateCurrent state

Title

• …

• …

• …

• …

• …

Behavior changes

icon

icon

icon

icon

icon

…

Future state

…

…

…

…

…

…

…

…

…

38

39.

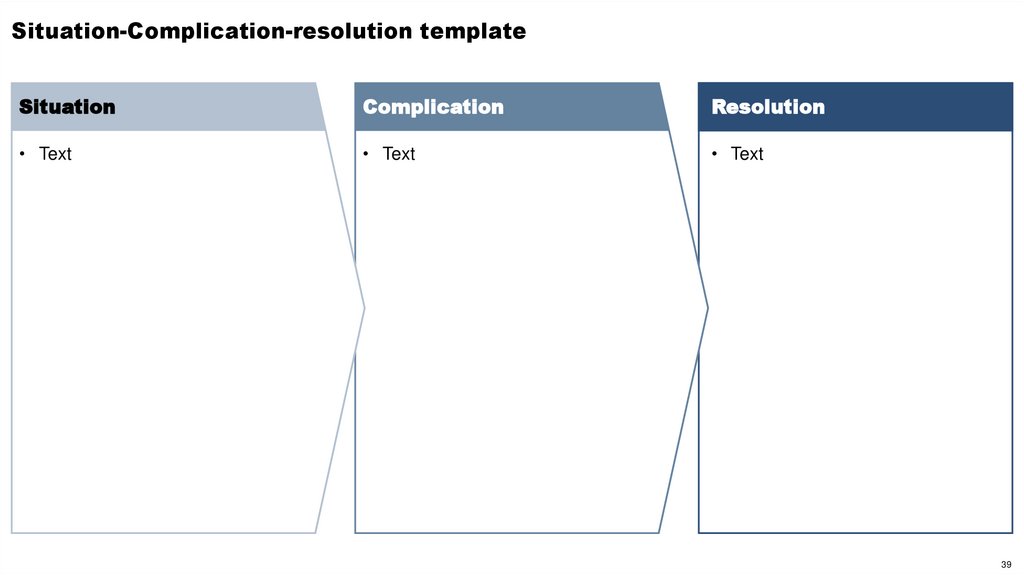

Situation-Complication-resolution templateSituation

Complication

Resolution

• Text

• Text

• Text

39

40.

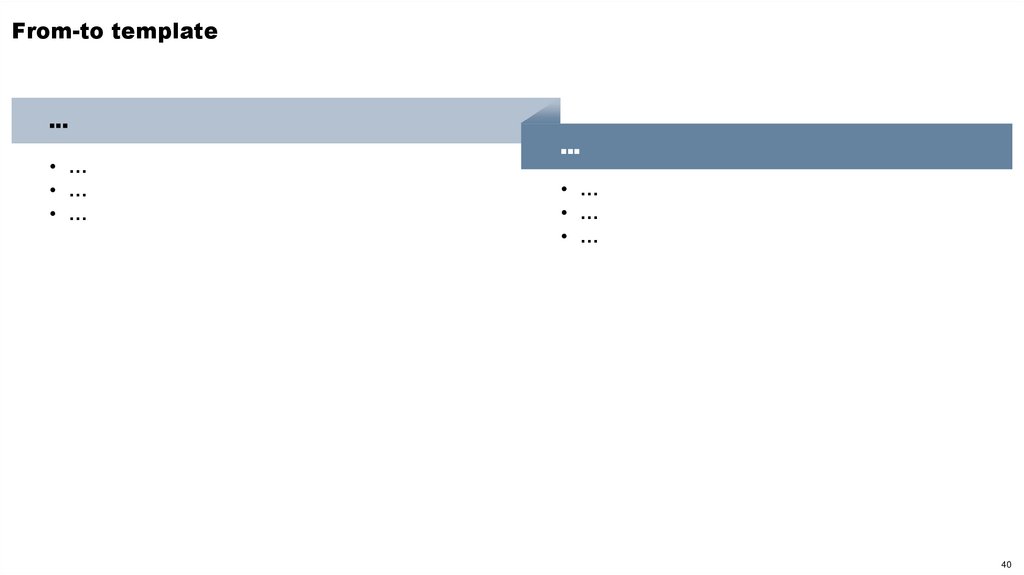

From-to template…

• …

• …

• …

…

• …

• …

• …

40

41.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

41

42.

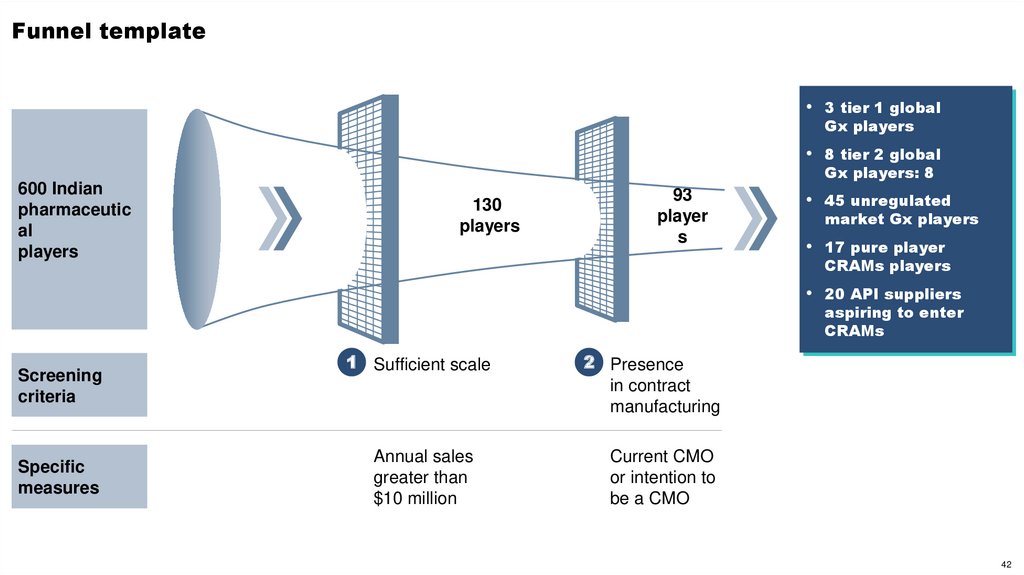

Funnel template• 3 tier 1 global

Gx players

• 8 tier 2 global

Gx players: 8

600 Indian

pharmaceutic

al

players

130

players

93

player

s

• 45 unregulated

market Gx players

• 17 pure player

CRAMs players

• 20 API suppliers

aspiring to enter

CRAMs

Screening

criteria

Specific

measures

1 Sufficient scale

Annual sales

greater than

$10 million

2 Presence

in contract

manufacturing

Current CMO

or intention to

be a CMO

42

43.

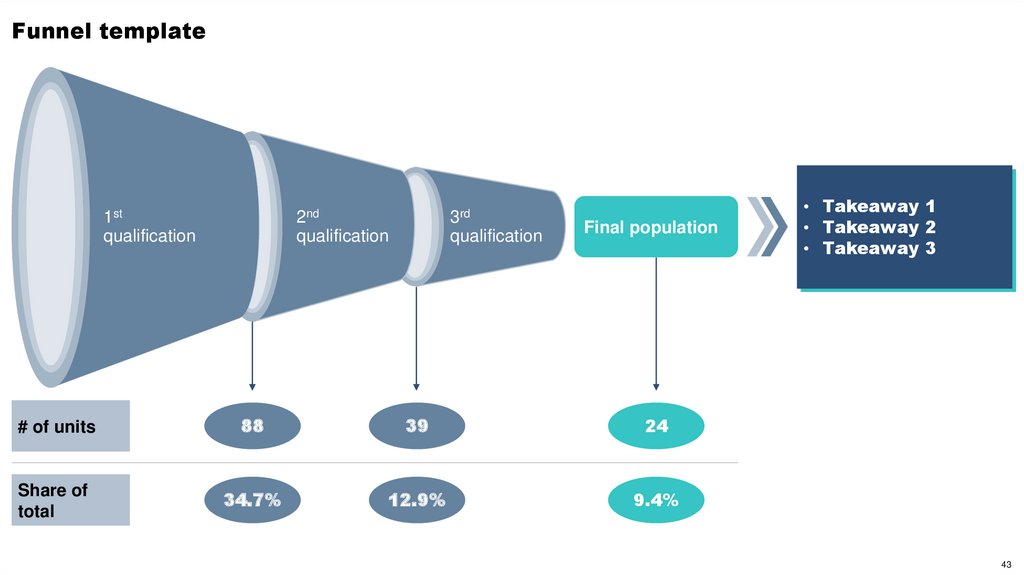

Funnel template1st

qualification

2nd

qualification

3rd

qualification

Final population

# of units

88

39

24

Share of

total

34.7%

12.9%

9.4%

• Takeaway 1

• Takeaway 2

• Takeaway 3

43

44.

Funnel templateText

• ...

• …

Text

• ...

• …

Text

• ...

• …

Text

• ...

• …

44

45.

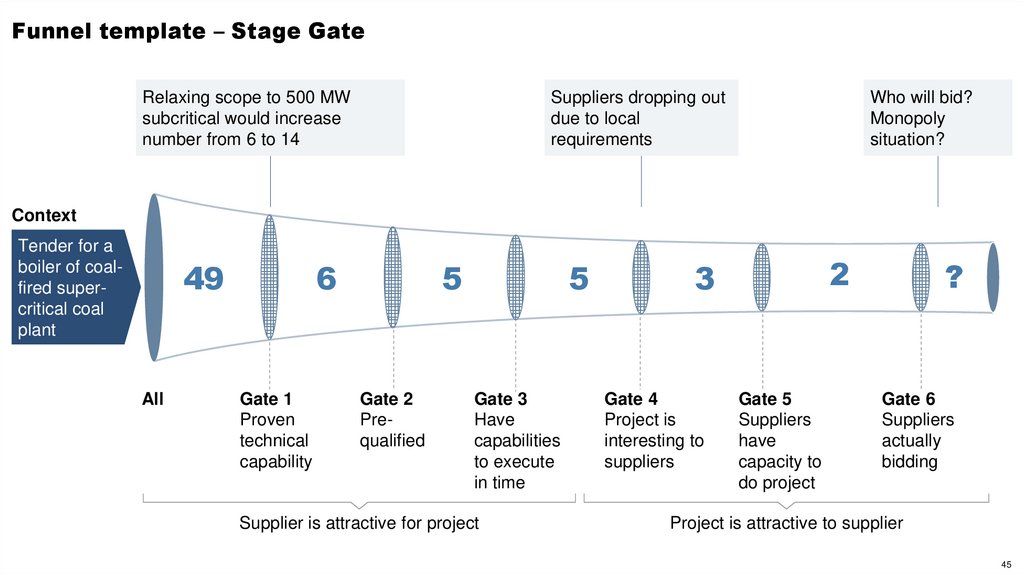

Funnel template – Stage GateRelaxing scope to 500 MW

subcritical would increase

number from 6 to 14

Suppliers dropping out

due to local

requirements

Who will bid?

Monopoly

situation?

Context

Tender for a

boiler of coalfired supercritical coal

plant

49

All

6

Gate 1

Proven

technical

capability

5

Gate 2

Prequalified

5

Gate 3

Have

capabilities

to execute

in time

Supplier is attractive for project

2

3

Gate 4

Project is

interesting to

suppliers

Gate 5

Suppliers

have

capacity to

do project

?

Gate 6

Suppliers

actually

bidding

Project is attractive to supplier

45

46.

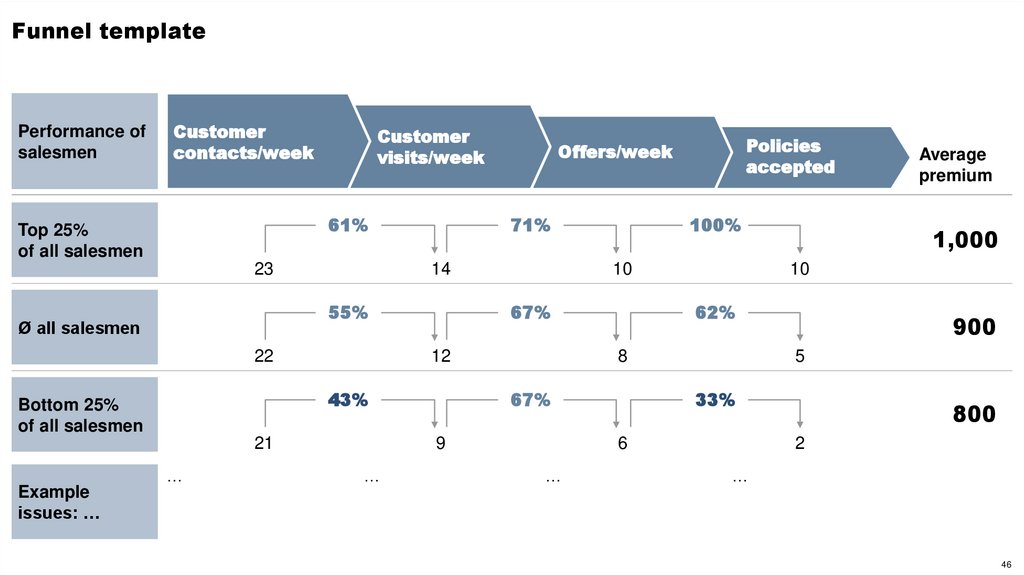

Funnel templatePerformance of

salesmen

Customer

contacts/week

Customer

visits/week

61%

Top 25%

of all salesmen

23

71%

14

55%

Ø all salesmen

22

…

10

12

21

900

5

33%

6

…

1,000

62%

67%

Average

premium

10

8

9

…

100%

67%

43%

Bottom 25%

of all salesmen

Policies

accepted

Offers/week

800

2

…

Example

issues: …

46

47.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

47

48.

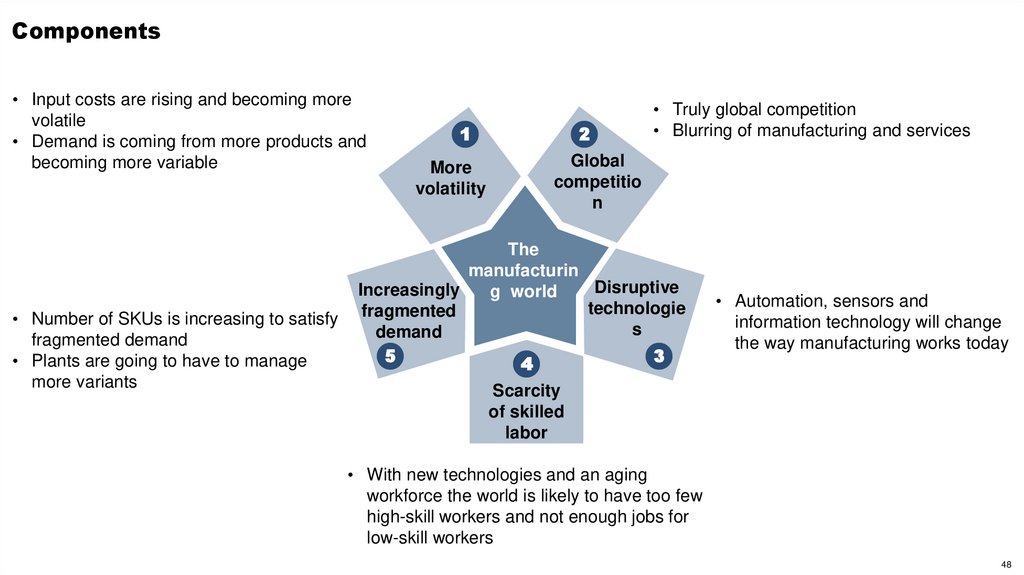

Components• Input costs are rising and becoming more

volatile

• Demand is coming from more products and

becoming more variable

• Number of SKUs is increasing to satisfy

fragmented demand

• Plants are going to have to manage

more variants

1

2

• Truly global competition

• Blurring of manufacturing and services

Global

competitio

n

More

volatility

The

manufacturin

Disruptive

Increasingly

g world

technologie

fragmented

s

demand

5

4

3

• Automation, sensors and

information technology will change

the way manufacturing works today

Scarcity

of skilled

labor

• With new technologies and an aging

workforce the world is likely to have too few

high-skill workers and not enough jobs for

low-skill workers

48

49.

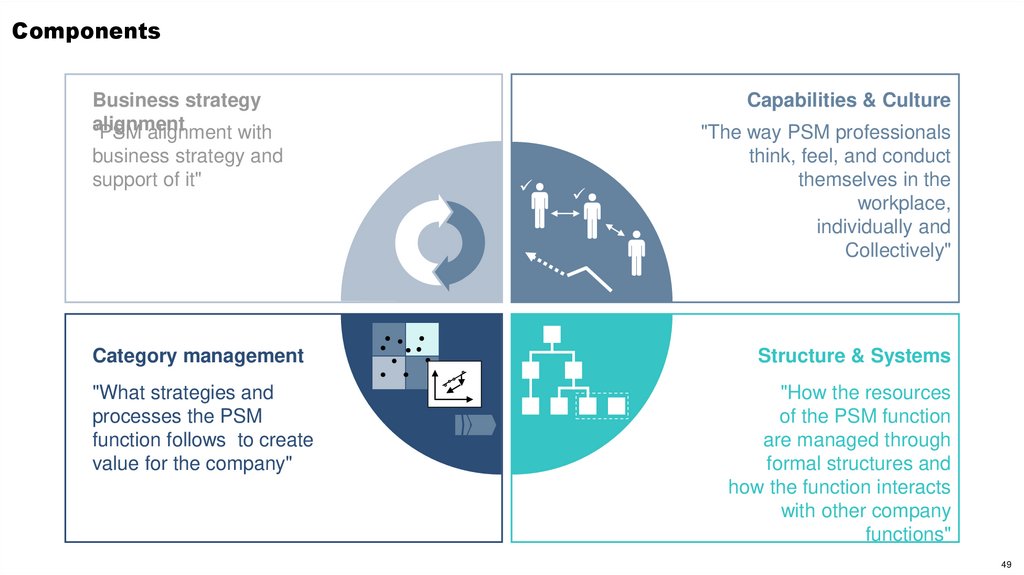

ComponentsBusiness strategy

alignment

"PSM alignment with

business strategy and

support of it"

Category management

"What strategies and

processes the PSM

function follows to create

value for the company"

Capabilities & Culture

"The way PSM professionals

think, feel, and conduct

themselves in the

workplace,

individually and

Collectively"

Structure & Systems

"How the resources

of the PSM function

are managed through

formal structures and

how the function interacts

with other company

functions"

49

50.

Components…

…

…

…

…

…

…

…

…

…

…

…

…

50

51.

Components…

…

…

…

…

…

…

51

52.

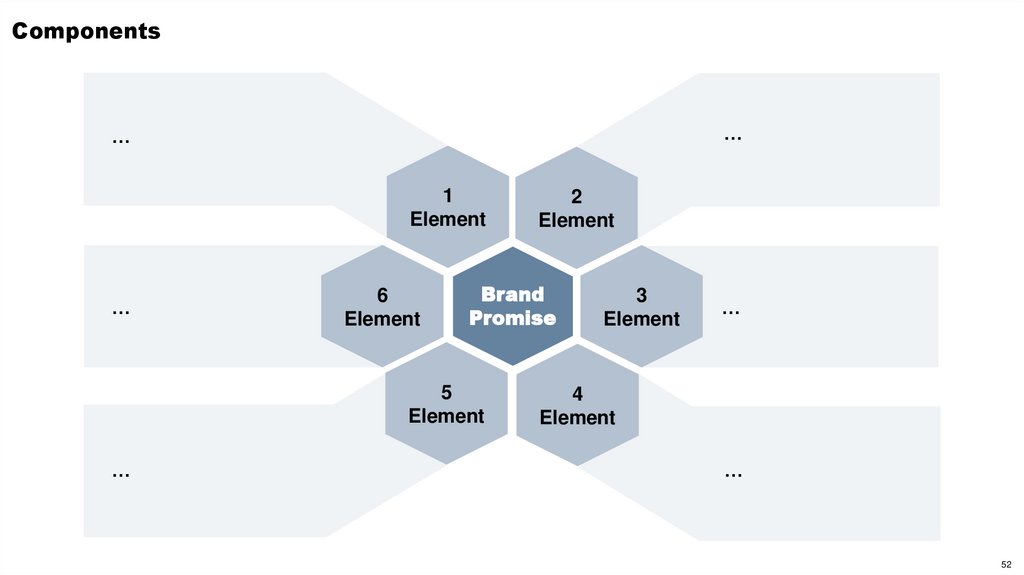

Components…

…

1

Element

…

6

Element

Brand

Promise

5

Element

…

2

Element

3

Element

…

4

Element

…

52

53.

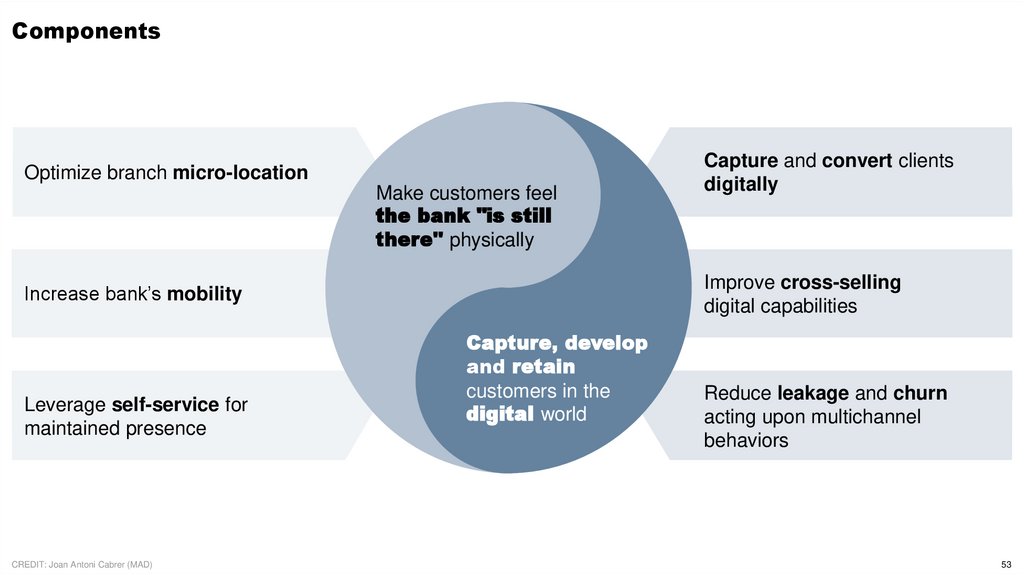

ComponentsOptimize branch micro-location

Make customers feel

the bank "is still

there" physically

Improve cross-selling

digital capabilities

Increase bank’s mobility

Leverage self-service for

maintained presence

CREDIT: Joan Antoni Cabrer (MAD)

Capture and convert clients

digitally

Capture, develop

and retain

customers in the

digital world

Reduce leakage and churn

acting upon multichannel

behaviors

53

54.

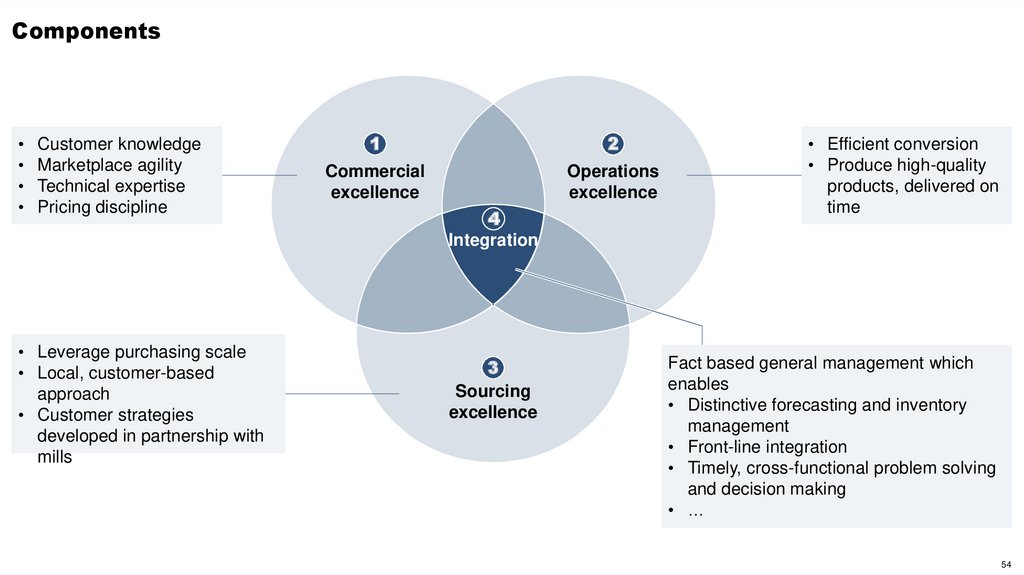

ComponentsCustomer knowledge

Marketplace agility

Technical expertise

Pricing discipline

• Leverage purchasing scale

• Local, customer-based

approach

• Customer strategies

developed in partnership with

mills

1

2

Commercial

excellence

Operations

excellence

4

Integration

3

Sourcing

excellence

• Efficient conversion

• Produce high-quality

products, delivered on

time

Fact based general management which

enables

• Distinctive forecasting and inventory

management

• Front-line integration

• Timely, cross-functional problem solving

and decision making

• …

54

55.

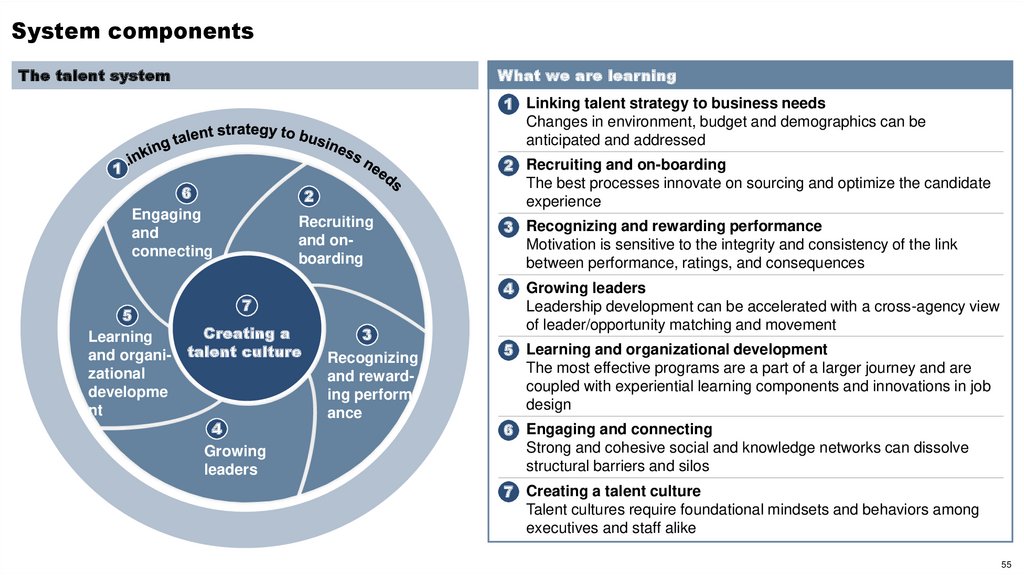

System componentsThe talent system

What we are learning

1 Linking talent strategy to business needs

Changes in environment, budget and demographics can be

anticipated and addressed

2 Recruiting and on-boarding

The best processes innovate on sourcing and optimize the candidate

experience

1

6

Engaging

and

connecting

5

Learning

and organizational

developme

nt

2

Recruiting

and onboarding

7

Creating a

talent culture

4

Growing

leaders

3

Recognizing

and rewarding performance

3 Recognizing and rewarding performance

Motivation is sensitive to the integrity and consistency of the link

between performance, ratings, and consequences

4 Growing leaders

Leadership development can be accelerated with a cross-agency view

of leader/opportunity matching and movement

5 Learning and organizational development

The most effective programs are a part of a larger journey and are

coupled with experiential learning components and innovations in job

design

6 Engaging and connecting

Strong and cohesive social and knowledge networks can dissolve

structural barriers and silos

7 Creating a talent culture

Talent cultures require foundational mindsets and behaviors among

executives and staff alike

55

56.

Components• …

• …

Element 1

• …

• …

Element 2

• …

• …

Element 3

56

57.

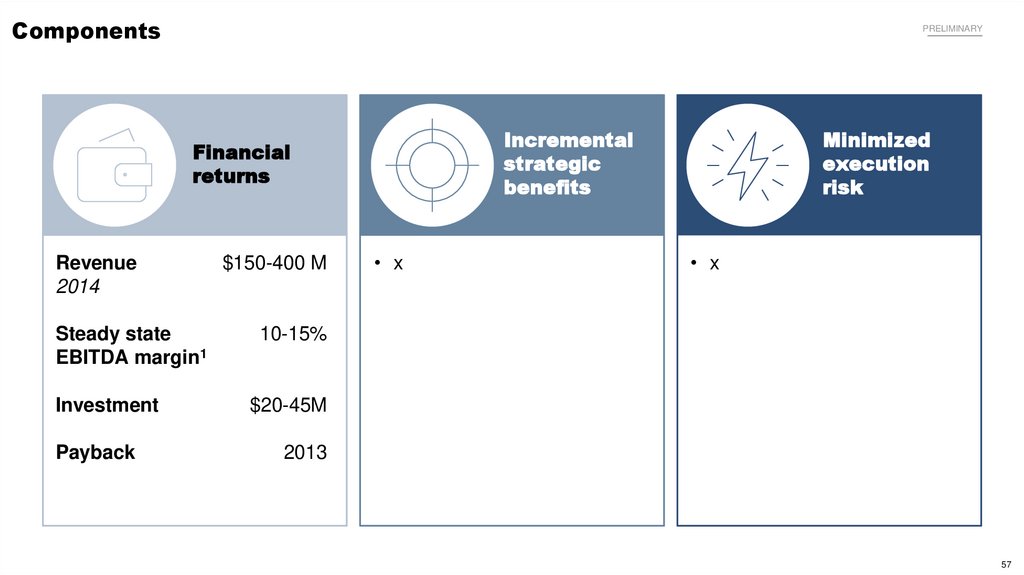

ComponentsPRELIMINARY

Incremental

strategic

benefits

Financial

returns

Revenue

2014

Steady state

EBITDA margin1

Investment

Payback

$150-400 M

• x

Minimized

execution

risk

• x

10-15%

$20-45M

2013

57

58.

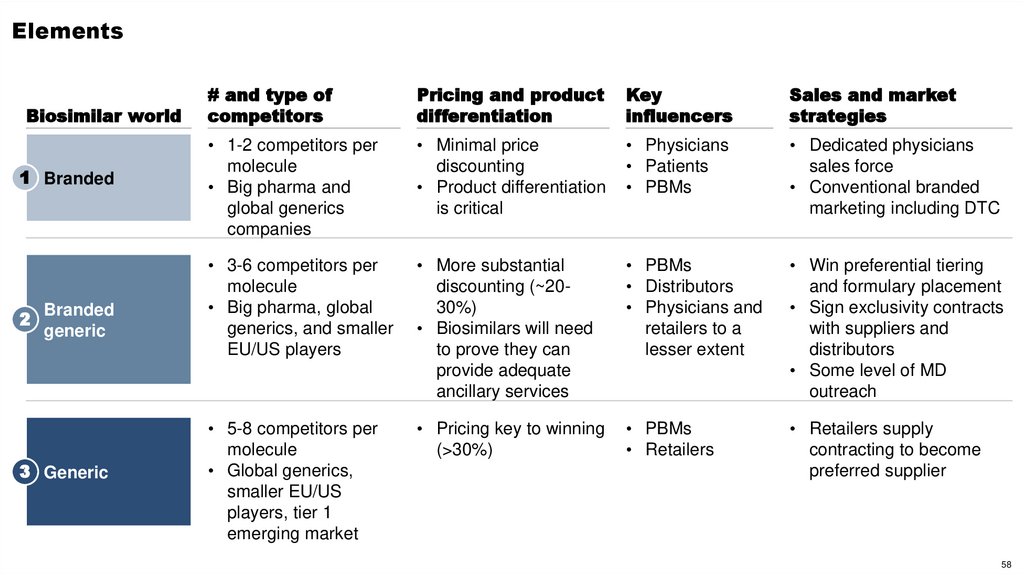

ElementsBiosimilar world

1 Branded

2

Branded

generic

3 Generic

# and type of

competitors

Pricing and product

differentiation

Key

influencers

Sales and market

strategies

• 1-2 competitors per

molecule

• Big pharma and

global generics

companies

• Minimal price

discounting

• Product differentiation

is critical

• Physicians

• Patients

• PBMs

• Dedicated physicians

sales force

• Conventional branded

marketing including DTC

• 3-6 competitors per

molecule

• Big pharma, global

generics, and smaller

EU/US players

• More substantial

discounting (~2030%)

• Biosimilars will need

to prove they can

provide adequate

ancillary services

• PBMs

• Distributors

• Physicians and

retailers to a

lesser extent

• Win preferential tiering

and formulary placement

• Sign exclusivity contracts

with suppliers and

distributors

• Some level of MD

outreach

• 5-8 competitors per

molecule

• Global generics,

smaller EU/US

players, tier 1

emerging market

• Pricing key to winning

(>30%)

• PBMs

• Retailers

• Retailers supply

contracting to become

preferred supplier

58

59.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

59

60.

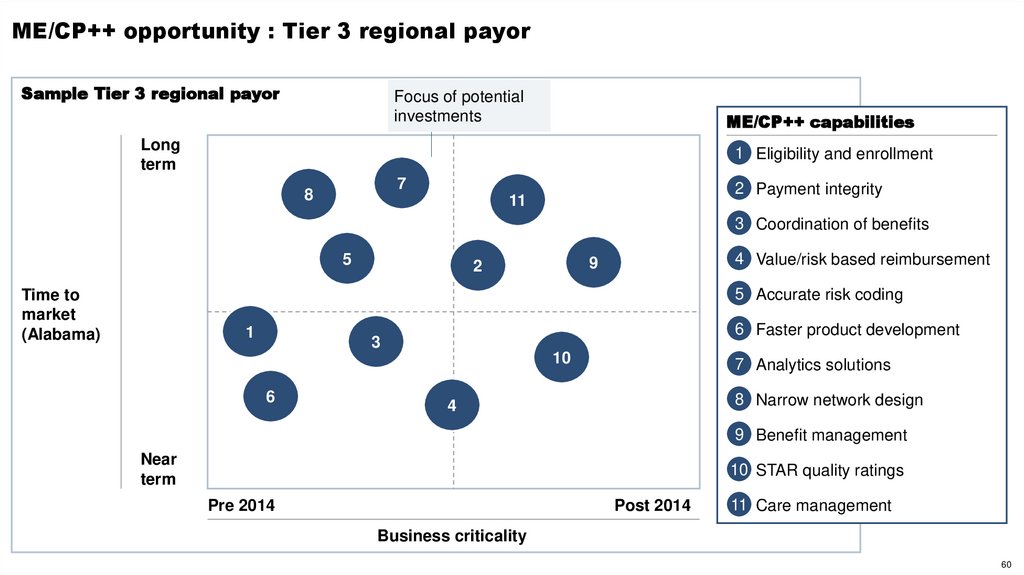

ME/CP++ opportunity : Tier 3 regional payorSample Tier 3 regional payor

Focus of potential

investments

ME/CP++ capabilities

Long

term

1▪ Eligibility and enrollment

2▪ Payment integrity

7

8

11

3▪ Coordination of benefits

5

4▪ Value/risk based reimbursement

9

2

5▪ Accurate risk coding

Time to

market

(Alabama)

1

6▪ Faster product development

3

10

6

7▪ Analytics solutions

8▪ Narrow network design

4

9▪ Benefit management

Near

term

10

▪ STAR quality ratings

Pre 2014

Post 2014

11

▪ Care management

Business criticality

60

61.

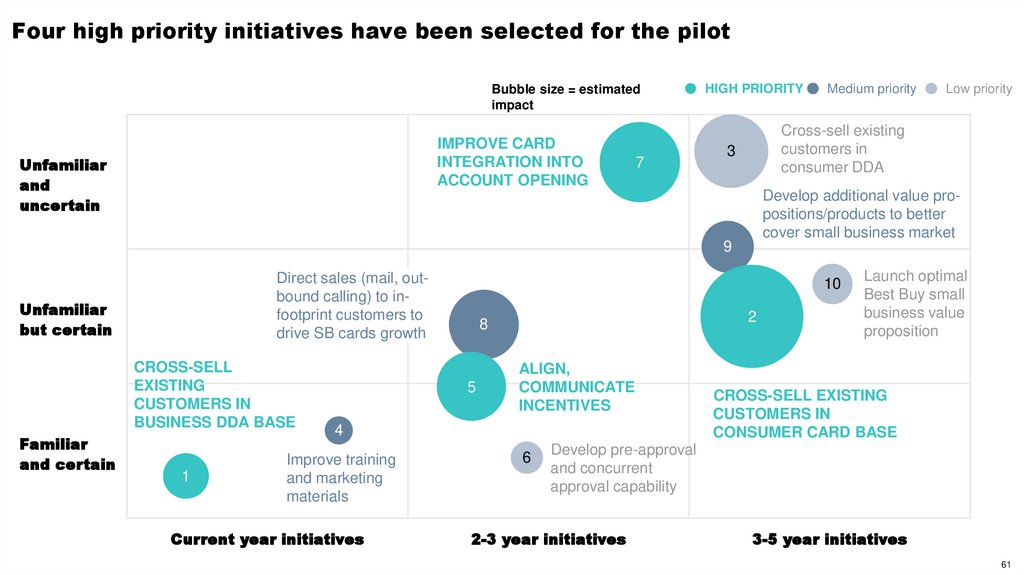

Four high priority initiatives have been selected for the pilotBubble size = estimated

impact

IMPROVE CARD

INTEGRATION INTO

ACCOUNT OPENING

Unfamiliar

and

uncertain

7

HIGH PRIORITY

Medium priority

Low priority

Cross-sell existing

customers in

consumer DDA

3

Develop additional value propositions/products to better

cover small business market

9

Direct sales (mail, outbound calling) to infootprint customers to

drive SB cards growth

Unfamiliar

but certain

CROSS-SELL

EXISTING

CUSTOMERS IN

BUSINESS DDA BASE

Familiar

and certain

1

10

2

8

5

ALIGN,

COMMUNICATE

INCENTIVES

4

Improve training

and marketing

materials

Current year initiatives

6

Launch optimal

Best Buy small

business value

proposition

CROSS-SELL EXISTING

CUSTOMERS IN

CONSUMER CARD BASE

Develop pre-approval

and concurrent

approval capability

2-3 year initiatives

3-5 year initiatives

61

62.

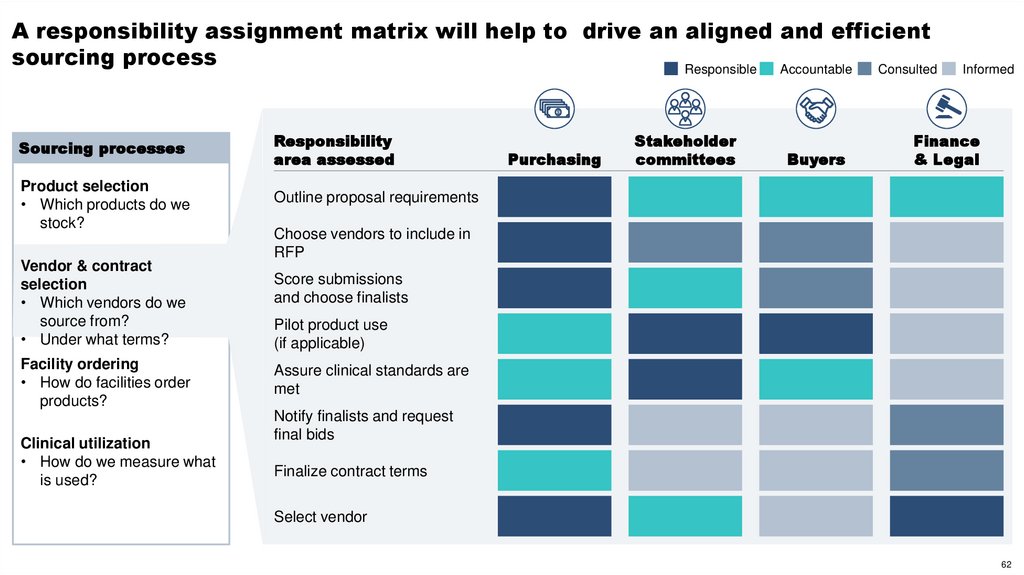

A responsibility assignment matrix will help to drive an aligned and efficientsourcing process

Responsible

Accountable

Consulted

Sourcing processes

Responsibility

area assessed

Product selection

• Which products do we

stock?

Outline proposal requirements

Vendor & contract

selection

• Which vendors do we

source from?

• Under what terms?

Facility ordering

• How do facilities order

products?

Clinical utilization

• How do we measure what

is used?

Purchasing

Stakeholder

committees

Buyers

Informed

Finance

& Legal

Choose vendors to include in

RFP

Score submissions

and choose finalists

Pilot product use

(if applicable)

Assure clinical standards are

met

Notify finalists and request

final bids

Finalize contract terms

Select vendor

62

63.

Шаблоны слайдов с планом работШаблоны слайдов с процессом

Шаблоны слайдов со структурами/деревом решений

Шаблоны слайдов с горизонтами

Приложение:

шаблоны и

примеры слайдов

Шаблоны слайдов From-to

Шаблоны слайдов с воронками

Шаблоны слайдов с компонентами

Шаблоны слайдов с матрицами

Примеры слайдов с визуализацией числовых данных

63

64.

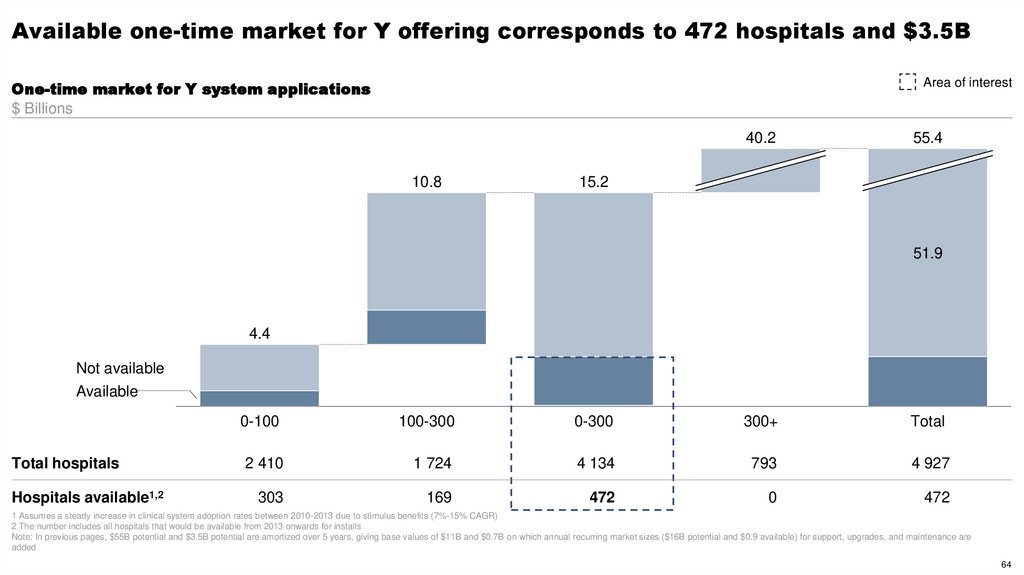

Available one-time market for Y offering corresponds to 472 hospitals and $3.5BArea of interest

One-time market for Y system applications

$ Billions

40.2

10.8

55.4

15.2

8,4

51.9

11,7

4.4

Not available

Available

Total hospitals

Hospitals available1,2

2,5

3,3

3,5

3,6

1,1

0-100

100-300

0-300

300+

Total

2 410

1 724

4 134

793

4 927

303

169

472

0

472

1 Assumes a steady increase in clinical system adoption rates between 2010-2013 due to stimulus benefits (7%-15% CAGR)

2 The number includes all hospitals that would be available from 2013 onwards for installs

Note: In previous pages, $55B potential and $3.5B potential are amortized over 5 years, giving base values of $11B and $0.7B on which annual recurring market sizes ($16B potential and $0.9 available) for support, upgrades, and maintenance are

added

64

65.

Spending on health care exceeded expected levels by $572 billion in 2009 – 23% oftotal spending on health care that year

Total US health care spending, 2009 By category, 2009

Percent

$ Billions

100% = $2,486 billion

Below ESAW

Above ESAW

Total

522

Outpatient care

• Share of US

spending above

Estimated

23%

• Spending

According to

Wealth (ESAW)

Long-term and

home care

498

47

Inpatient care

245

-275

Drugs and

nondurables

120

Health administration

and insurance

Durables

Investment in health

1 019

98

293

163

35

-11

72

5721

233

2 486

65

66.

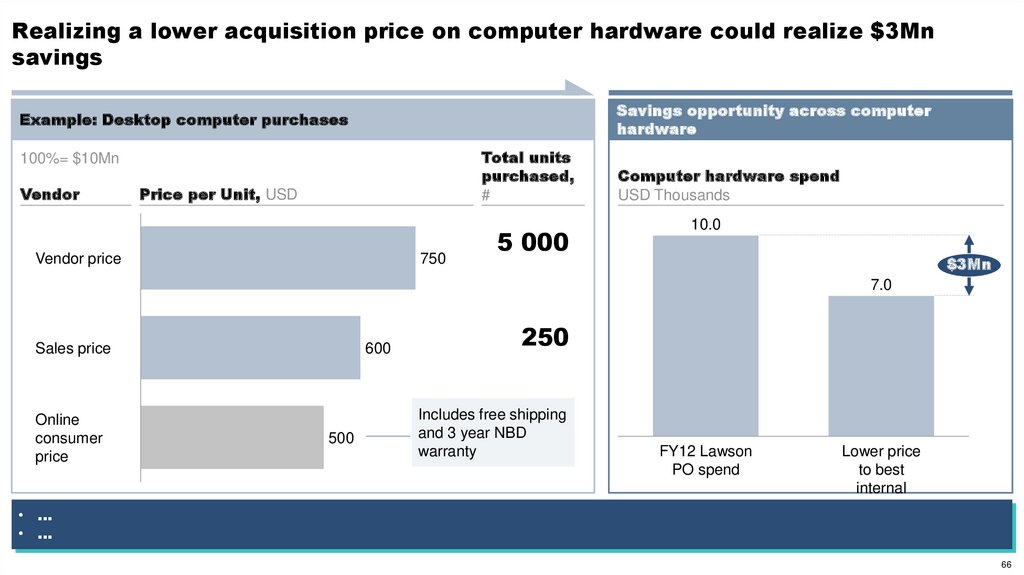

Realizing a lower acquisition price on computer hardware could realize $3Mnsavings

Savings opportunity across computer

hardware

Example: Desktop computer purchases

Total units

purchased,

#

100%= $10Mn

Vendor

Price per Unit, USD

Vendor price

750

5 000

Computer hardware spend

USD Thousands

10.0

$3Mn

7.0

Sales price

Online

consumer

price

600

500

250

Includes free shipping

and 3 year NBD

warranty

FY12 Lawson

PO spend

Lower price

to best

internal

• …

• …

66

67.

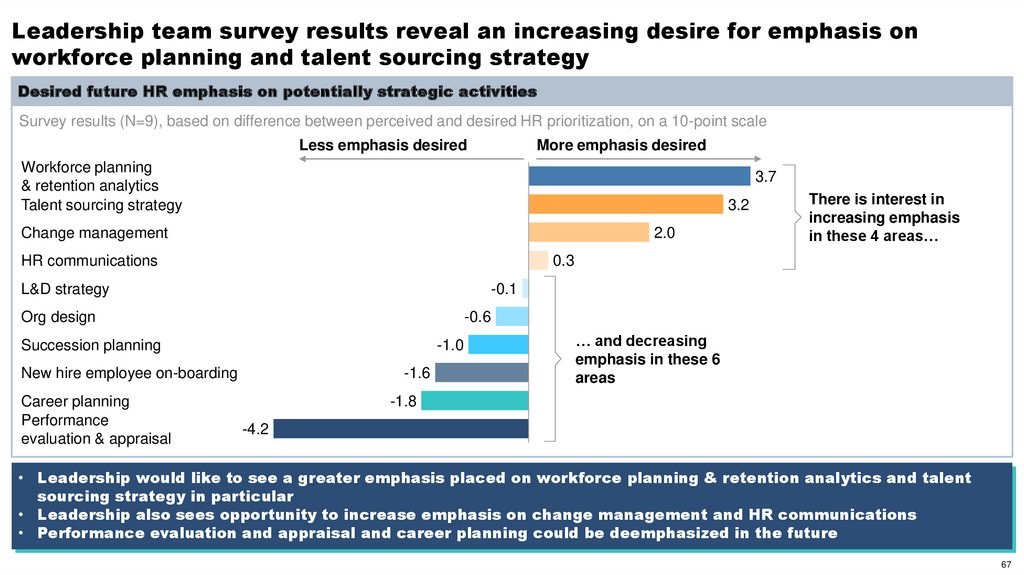

Leadership team survey results reveal an increasing desire for emphasis onworkforce planning and talent sourcing strategy

Desired future HR emphasis on potentially strategic activities

Survey results (N=9), based on difference between perceived and desired HR prioritization, on a 10-point scale

Less emphasis desired

More emphasis desired

Workforce planning

& retention analytics

Talent sourcing strategy

3.7

3.2

Change management

2.0

HR communications

0.3

L&D strategy

-0.1

Org design

-0.6

Succession planning

-1.0

New hire employee on-boarding

Career planning

Performance

evaluation & appraisal

There is interest in

increasing emphasis

in these 4 areas…

-1.6

… and decreasing

emphasis in these 6

areas

-1.8

-4.2

• Leadership would like to see a greater emphasis placed on workforce planning & retention analytics and talent

sourcing strategy in particular

• Leadership also sees opportunity to increase emphasis on change management and HR communications

• Performance evaluation and appraisal and career planning could be deemphasized in the future

67

68.

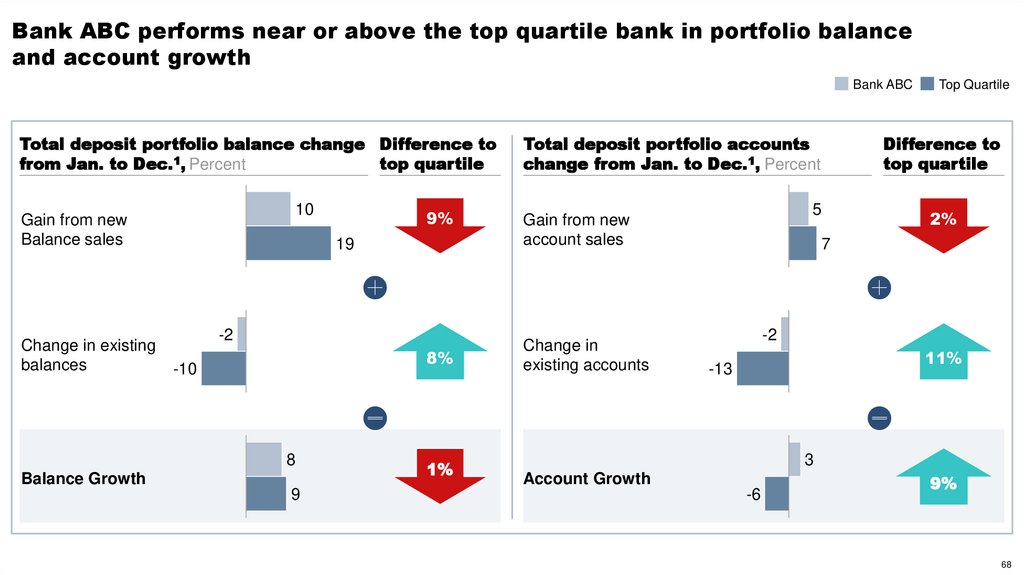

Bank ABC performs near or above the top quartile bank in portfolio balanceand account growth

Bank ABC

Total deposit portfolio balance change Difference to

top quartile

from Jan. to Dec.1, Percent

10

Gain from new

Balance sales

Change in existing

balances

9%

19

-2

8%

-10

8

Balance Growth

9

1%

Total deposit portfolio accounts

change from Jan. to Dec.1, Percent

Change in

existing accounts

Difference to

top quartile

5

Gain from new

account sales

Top Quartile

2%

7

-2

11%

-13

3

Account Growth

-6

9%

68

69.

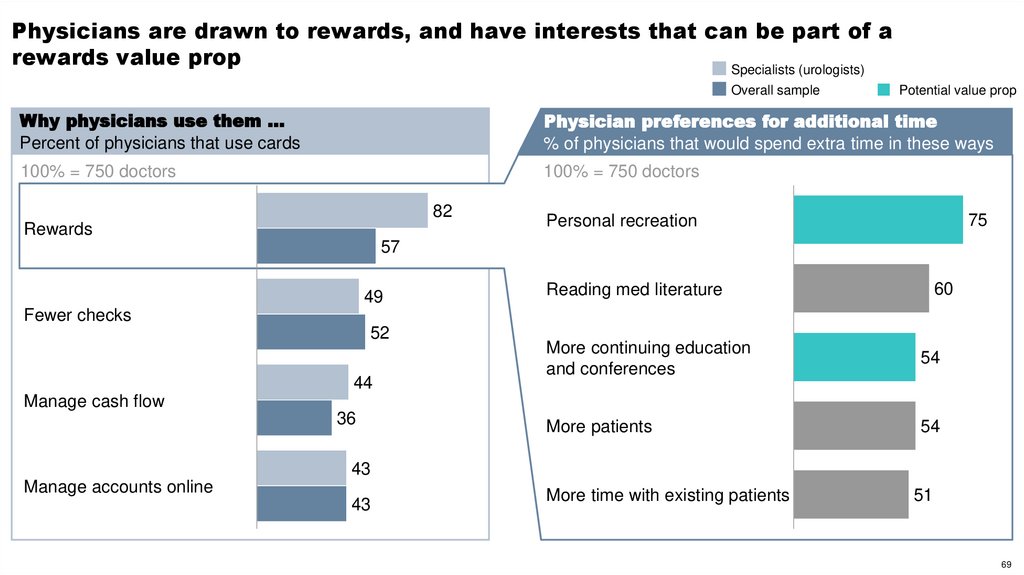

Physicians are drawn to rewards, and have interests that can be part of arewards value prop

Specialists (urologists)

Overall sample

Potential value prop

Why physicians use them …

Percent of physicians that use cards

Physician preferences for additional time

% of physicians that would spend extra time in these ways

100% = 750 doctors

100% = 750 doctors

82

Rewards

75

Personal recreation

57

49

60

Reading med literature

Fewer checks

52

44

More continuing education

and conferences

54

More patients

54

Manage cash flow

36

43

Manage accounts online

43

More time with existing patients

51

69

70.

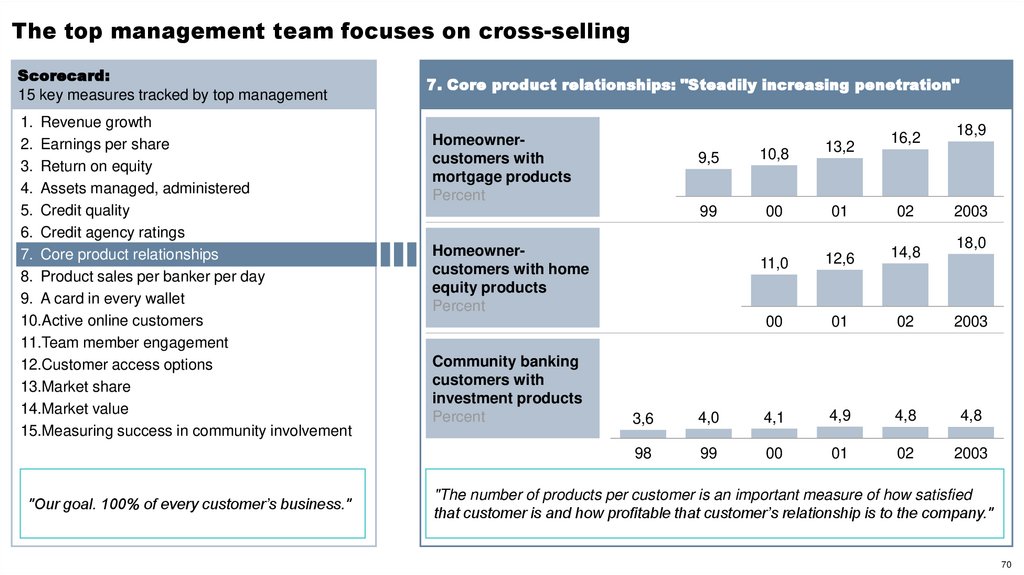

The top management team focuses on cross-sellingScorecard:

15 key measures tracked by top management

1. Revenue growth

2. Earnings per share

3. Return on equity

4. Assets managed, administered

5. Credit quality

6. Credit agency ratings

7. Core product relationships

8. Product sales per banker per day

9. A card in every wallet

10.Active online customers

11.Team member engagement

12.Customer access options

13.Market share

14.Market value

15.Measuring success in community involvement

"Our goal. 100% of every customer’s business."

7. Core product relationships: "Steadily increasing penetration"

Homeownercustomers with

mortgage products

Percent

18,9

9,5

10,8

13,2

99

00

01

02

11,0

12,6

14,8

00

01

02

2003

Homeownercustomers with home

equity products

Percent

Community banking

customers with

investment products

Percent

16,2

2003

18,0

3,6

4,0

4,1

4,9

4,8

4,8

98

99

00

01

02

2003

"The number of products per customer is an important measure of how satisfied

that customer is and how profitable that customer’s relationship is to the company."

70

71.

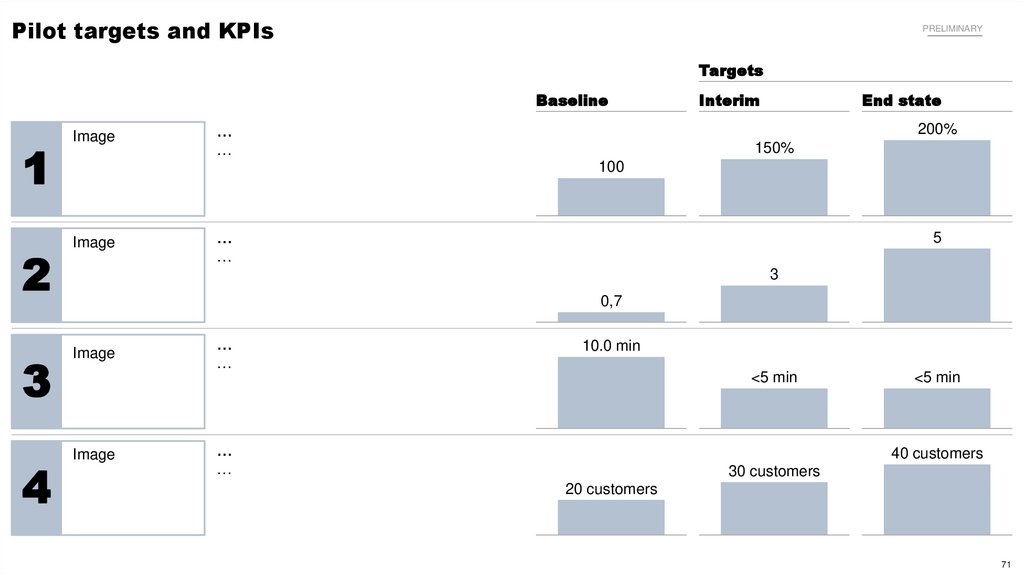

Pilot targets and KPIsPRELIMINARY

Targets

Baseline

1

Image

2

Image

3

Image

4

Image

…

…

Interim

End state

200%

150%

100

…

…

5

3

0,7

…

…

10.0 min

<5 min

…

…

<5 min

40 customers

30 customers

20 customers

71

72.

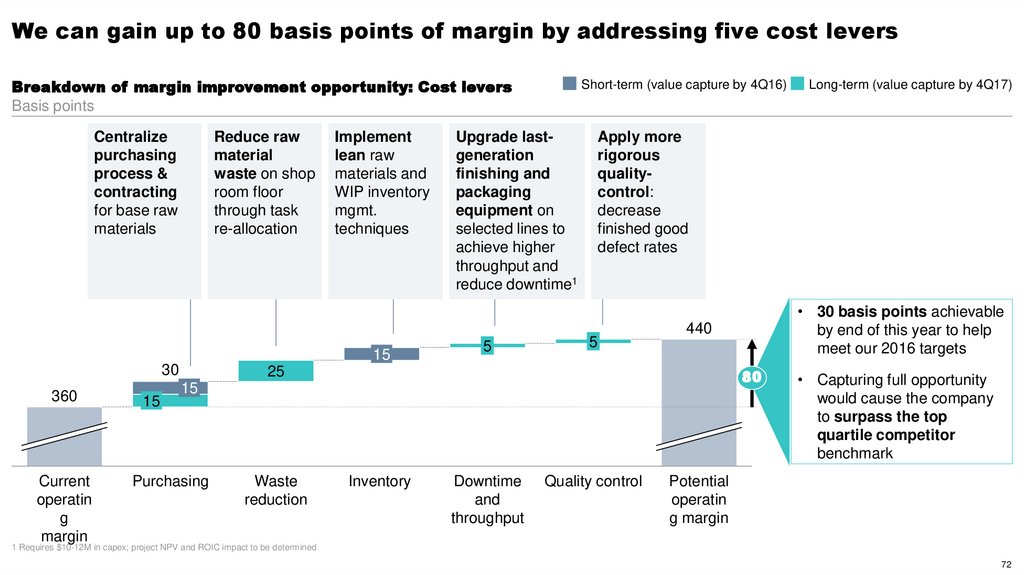

We can gain up to 80 basis points of margin by addressing five cost leversBreakdown of margin improvement opportunity: Cost levers

Basis points

Centralize

purchasing

process &

contracting

for base raw

materials

Reduce raw

material

waste on shop

room floor

through task

re-allocation

Implement

lean raw

materials and

WIP inventory

mgmt.

techniques

15

30

360

Current

operatin

g

margin

15

Short-term (value capture by 4Q16)

Upgrade lastgeneration

finishing and

packaging

equipment on

selected lines to

achieve higher

throughput and

reduce downtime1

5

Apply more

rigorous

qualitycontrol:

decrease

finished good

defect rates

5

80

15

Waste

reduction

• 30 basis points achievable

by end of this year to help

meet our 2016 targets

440

25

Purchasing

Inventory

Downtime

and

throughput

Long-term (value capture by 4Q17)

Quality control

• Capturing full opportunity

would cause the company

to surpass the top

quartile competitor

benchmark

Potential

operatin

g margin

1 Requires $10-12M in capex; project NPV and ROIC impact to be determined

72

73.

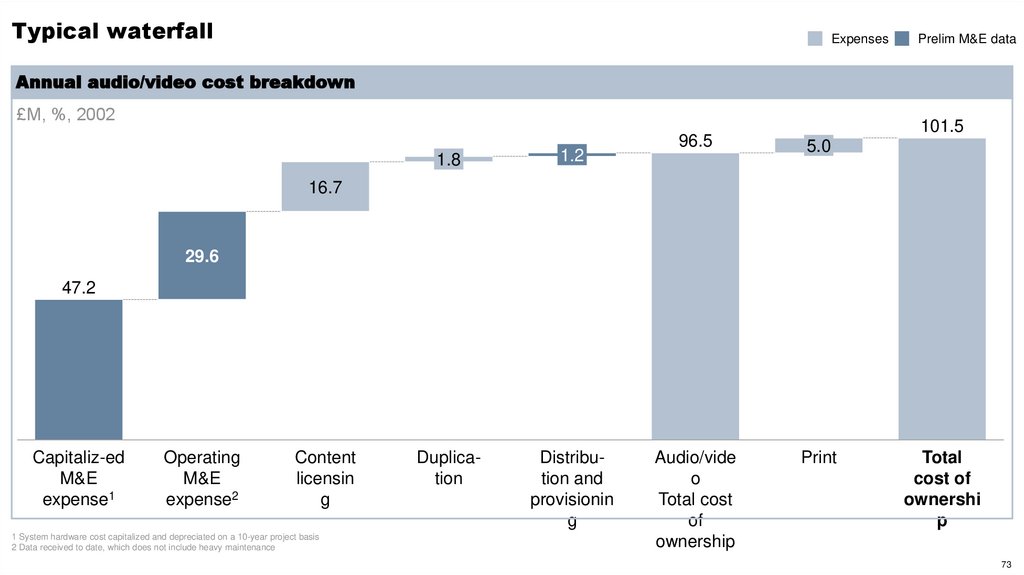

Typical waterfallExpenses

Prelim M&E data

Annual audio/video cost breakdown

£M, %, 2002

1.8

1.2

Duplication

Distribution and

provisionin

g

101.5

96.5

5.0

Audio/vide

o

Total cost

of

ownership

16.7

29.6

47.2

Capitaliz-ed

M&E

expense1

Operating

M&E

expense2

Content

licensin

g

1 System hardware cost capitalized and depreciated on a 10-year project basis

2 Data received to date, which does not include heavy maintenance

Total

cost of

ownershi

p

73

74.

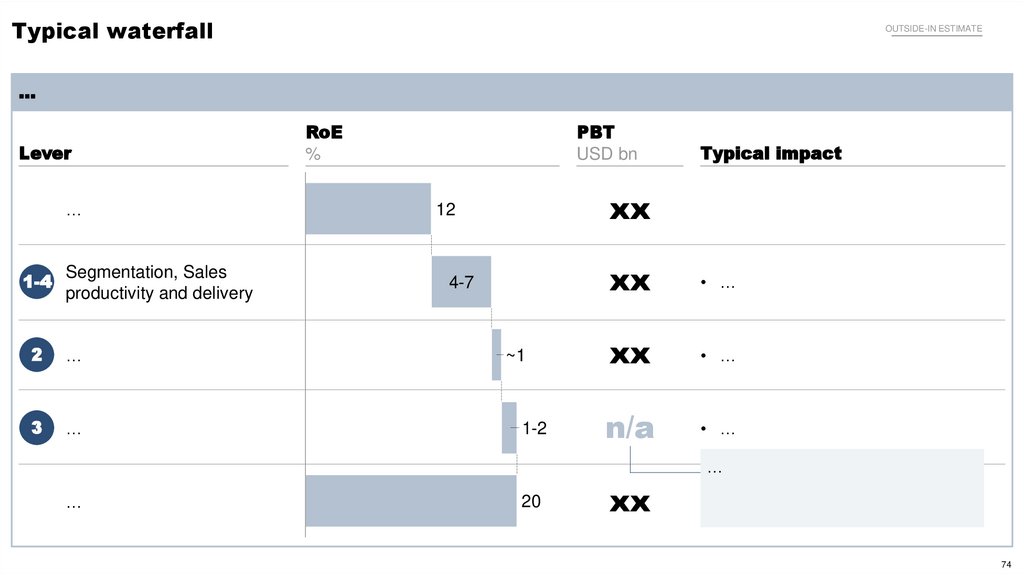

Typical waterfallOUTSIDE-IN ESTIMATE

…

Lever

…

1-4

Segmentation, Sales

productivity and delivery

2

…

3

…

RoE

%

PBT

USD bn

Typical impact

xx

12

4-7

~1

1-2

xx

• …

xx

• …

n/a

• …

…

…

20

xx

74

75.

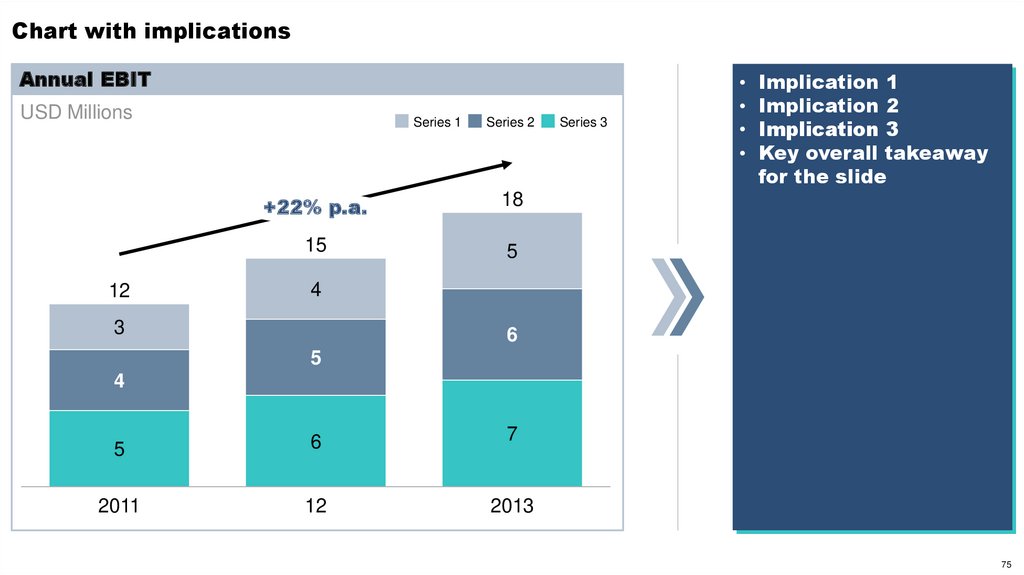

Chart with implicationsAnnual EBIT

USD Millions

12

Series 1

Series 2

+22% p.a.

18

15

5

Series 3

Implication 1

Implication 2

Implication 3

Key overall takeaway

for the slide

4

3

6

5

4

5

6

7

2011

12

2013

75

76.

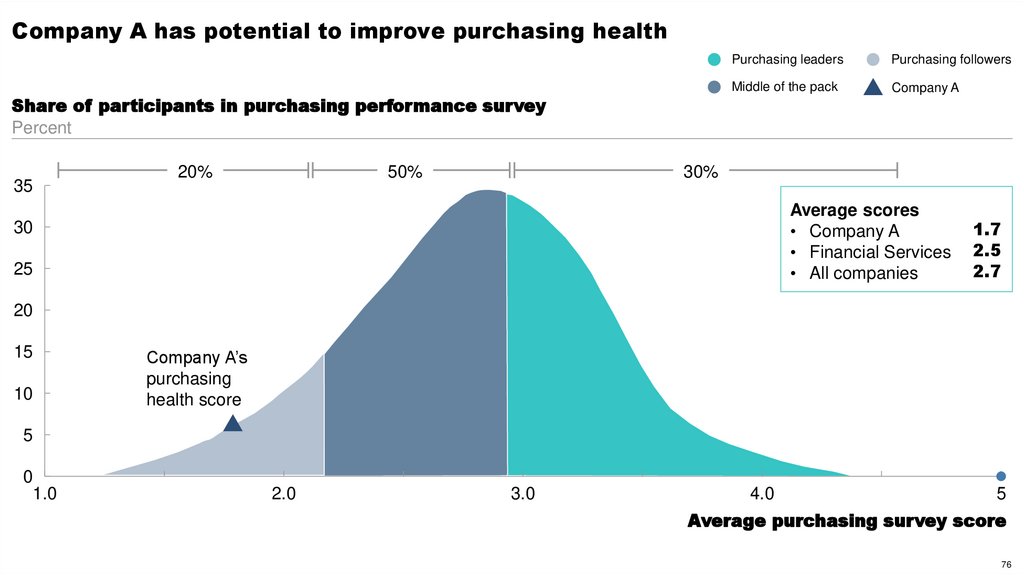

Company A has potential to improve purchasing healthShare of participants in purchasing performance survey

Percent

35

20%

50%

Purchasing leaders

Purchasing followers

Middle of the pack

Company A

30%

Average scores

• Company A

• Financial Services

• All companies

30

25

1.7

2.5

2.7

20

15

10

Company A’s

purchasing

health score

5

0

1.0

2.0

3.0

4.0

5

Average purchasing survey score

76

77.

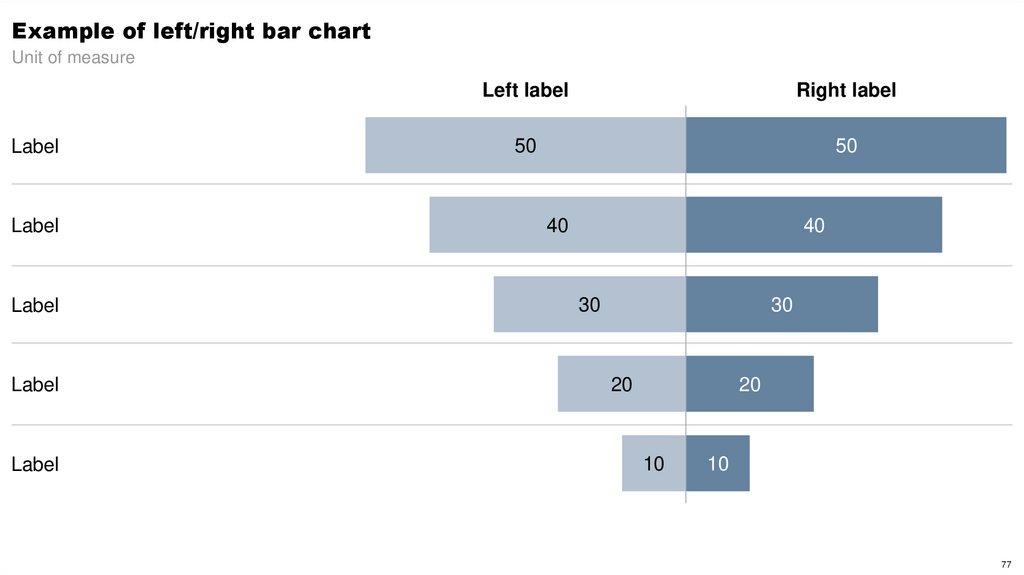

Example of left/right bar chartUnit of measure

Label

Label

Label

Label

Label

Left label

Right label

50

50

40

40

30

30

20

20

10

10

77

informatics

informatics