Similar presentations:

Introduction to ISO 20022 – Universal financial industry message scheme

1. Introduction to ISO 20022 – Universal financial industry message scheme

ISO 20022Introduction to ISO 20022 –

Universal financial industry

message scheme

1

ISO_20022_LV_v187

2. Agenda

ISO 20022:Value proposition

The standard

The actors

The registration process

The Repository

ISO 20022 registration platform

Cross industry harmonization

Interoperability within the financial industry

Q&A

2

ISO_20022_LV_v187

3. The ISO 20022 value proposition (1/5)

ObjectiveTo enable communication interoperability between financial

institutions , their market infrastructures and their end-user

communities

Major obstacle

Numerous overlapping standardization initiatives looking at XML

financial messages:

MDDL, FIX, FinXML, VRXML, RIXML, XBRL, FpML, IFX, TWIST,

RosettaNet, OAGi, ACORD, etc.

3

ISO_20022_LV_v187

4. The ISO 20022 value proposition (2/5)

Proposed solutionA single standardisation approach (methodology, process,

repository) to be used by all financial standards initiatives

ISO 20022

4

ISO_20022_LV_v187

5. The ISO 20022 value proposition (3/5)

Convergence into ONE standard is the long term objective…… but in the interim several standards need to coexist to enable

quick response to competitive pressures and regulatory demands

5

ISO_20022_LV_v187

6. The ISO 20022 value proposition (4/5)

Growth adds exponential complexity and expense…EDIFACT

IFX

OAGi

TWIST

RosettaNet

Without common building

blocks:

SWIFT

Point-to-point connection

Data is mapped directly from

one application to another

Proprietary Costly, unsalable and difficult

format

to implement and maintain

Process, routing, rules logic

needs to be coded to specific

message types

42 interfaces = n * (n-1)

6

ISO_20022_LV_v187

Source: John Mersberg, IBM Corporation

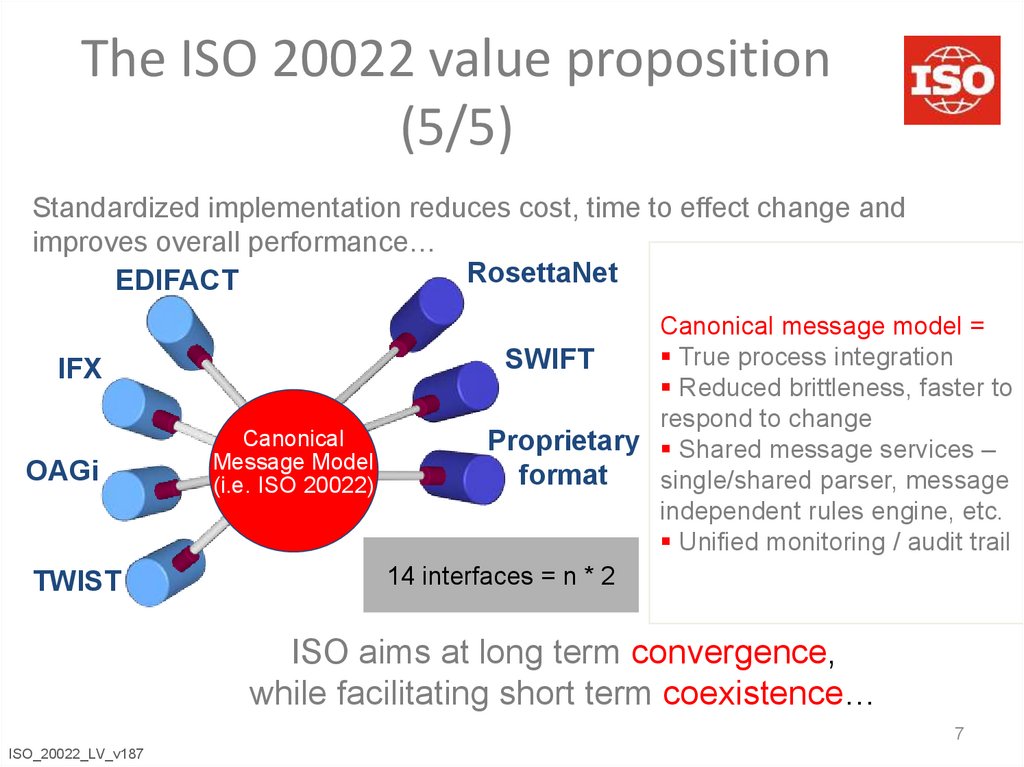

7. The ISO 20022 value proposition (5/5)

Standardized implementation reduces cost, time to effect change andimproves overall performance…

RosettaNet

EDIFACT

IFX

OAGi

TWIST

Canonical message model =

True process integration

SWIFT

Reduced brittleness, faster to

respond to change

Canonical

Proprietary Shared message services –

Message Model

format

single/shared parser, message

(i.e. ISO 20022)

independent rules engine, etc.

Unified monitoring / audit trail

14 interfaces = n * 2

ISO aims at long term convergence,

while facilitating short term coexistence…

7

ISO_20022_LV_v187

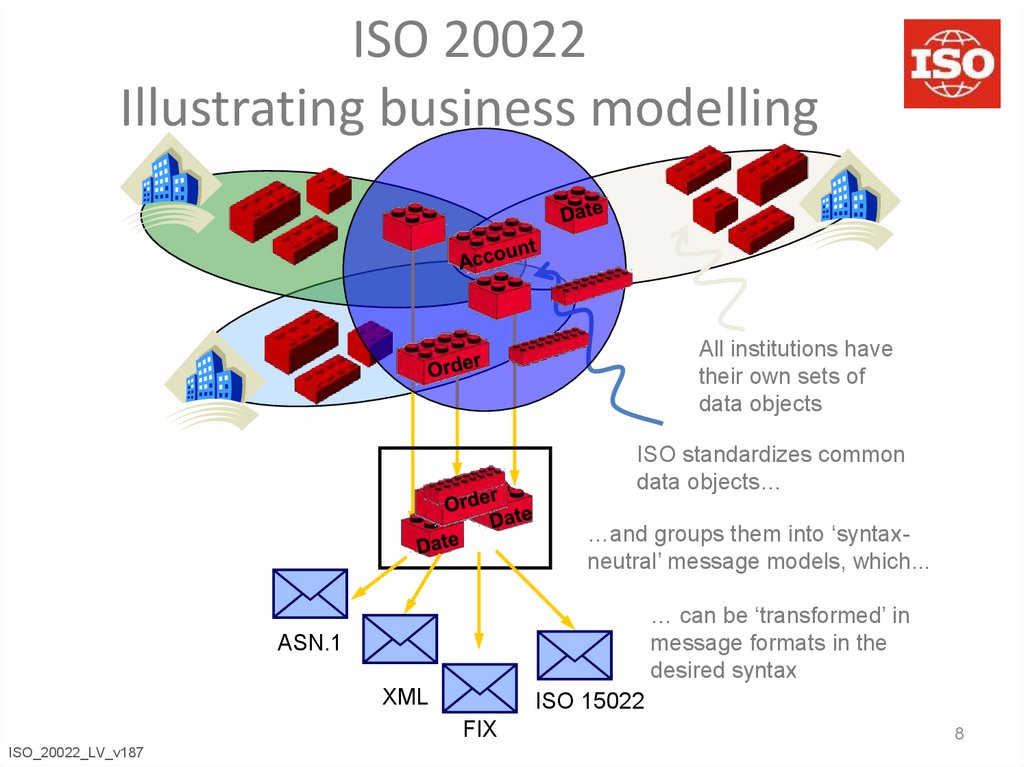

8. ISO 20022 Illustrating business modelling

All institutions havetheir own sets of

data objects

ISO standardizes common

data objects…

…and groups them into ‘syntaxneutral’ message models, which...

… can be ‘transformed’ in

message formats in the

desired syntax

ASN.1

XML

ISO 15022

FIX

ISO_20022_LV_v187

8

9. The ISO 20022 recipe Main ingredients (1/2)

Modelling-based standards developmentSyntax-independent business standard

Validated by the industry

Syntax-specific design rules for XML and ASN.1

Predictable and ‘automatable’

Protect standard from technology evolution

Reverse engineering approach

Protect industry investment and ease interoperability

Prepare for future migration

9

ISO_20022_LV_v187

10. The ISO 20022 recipe Main ingredients (2/2)

Development / registration processClearly identified activities and roles

Business experts and future users involved upfront

Technical experts involved when required

Repository on the ISO 20022 website

Business Process Catalogue & Data Dictionary

Outside of official standard (maintained by registration

bodies)

www.iso20022.org

10

ISO_20022_LV_v187

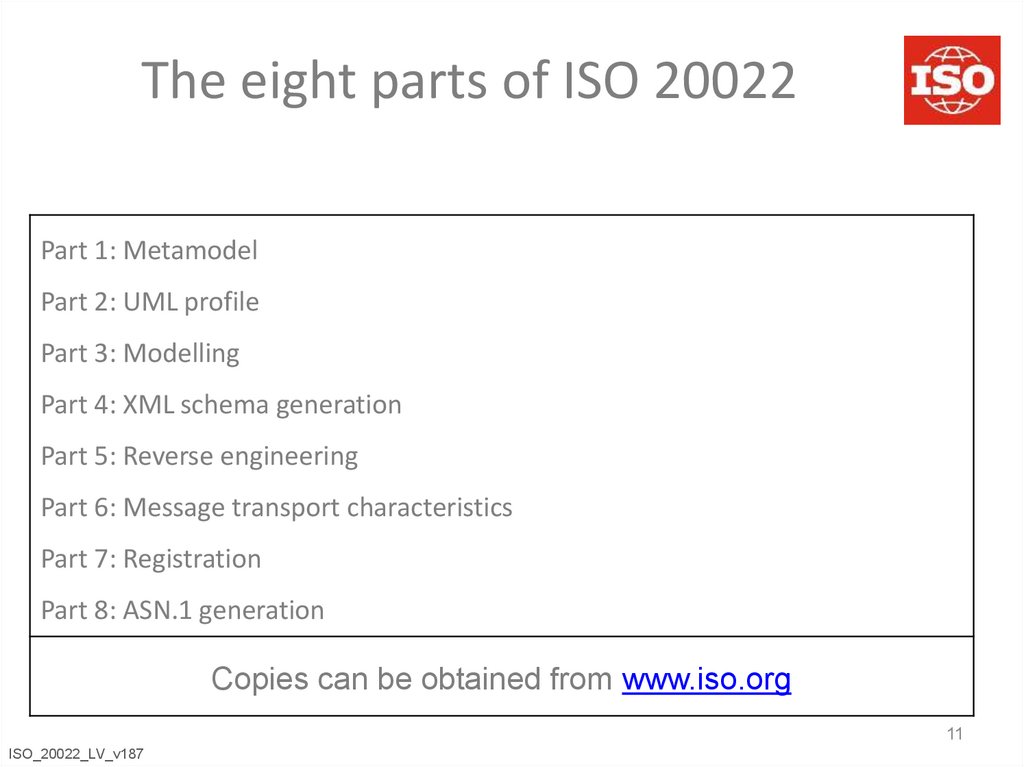

11. The eight parts of ISO 20022

Part 1: MetamodelPart 2: UML profile

Part 3: Modelling

Part 4: XML schema generation

Part 5: Reverse engineering

Part 6: Message transport characteristics

Part 7: Registration

Part 8: ASN.1 generation

Copies can be obtained from www.iso.org

11

ISO_20022_LV_v187

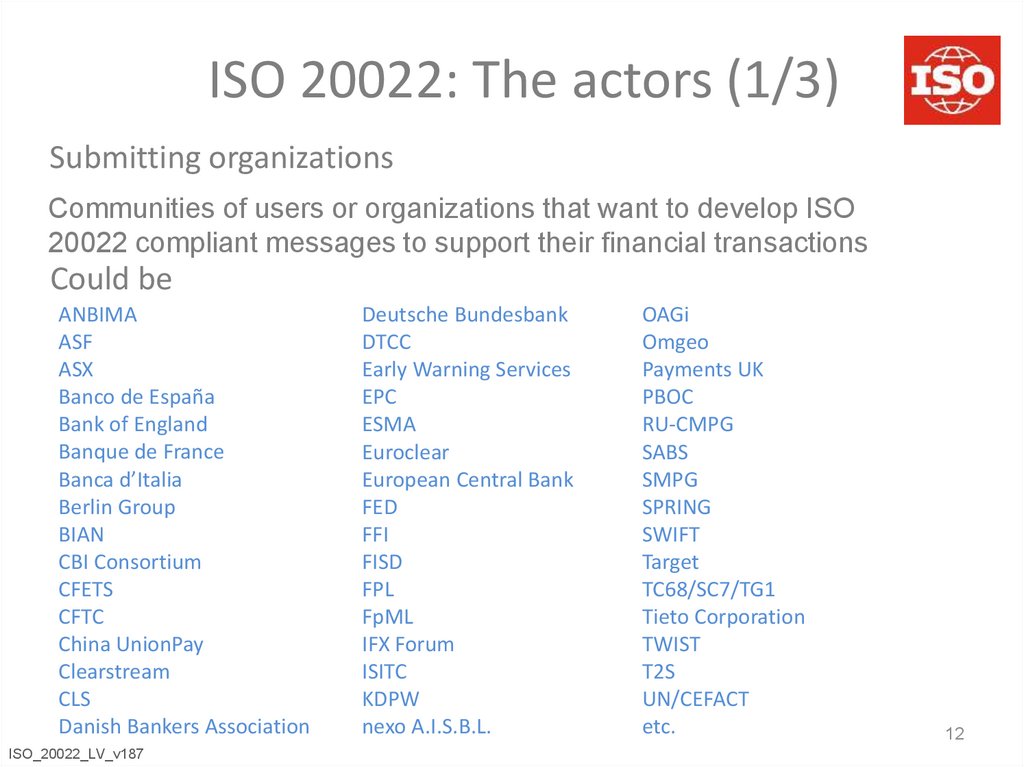

12. ISO 20022: The actors (1/3)

Submitting organizationsCommunities of users or organizations that want to develop ISO

20022 compliant messages to support their financial transactions

Could be

ANBIMA

ASF

ASX

Banco de España

Bank of England

Banque de France

Banca d’Italia

Berlin Group

BIAN

CBI Consortium

CFETS

CFTC

China UnionPay

Clearstream

CLS

Danish Bankers Association

ISO_20022_LV_v187

Deutsche Bundesbank

DTCC

Early Warning Services

EPC

ESMA

Euroclear

European Central Bank

FED

FFI

FISD

FPL

FpML

IFX Forum

ISITC

KDPW

nexo A.I.S.B.L.

OAGi

Omgeo

Payments UK

PBOC

RU-CMPG

SABS

SMPG

SPRING

SWIFT

Target

TC68/SC7/TG1

Tieto Corporation

TWIST

T2S

UN/CEFACT

etc.

12

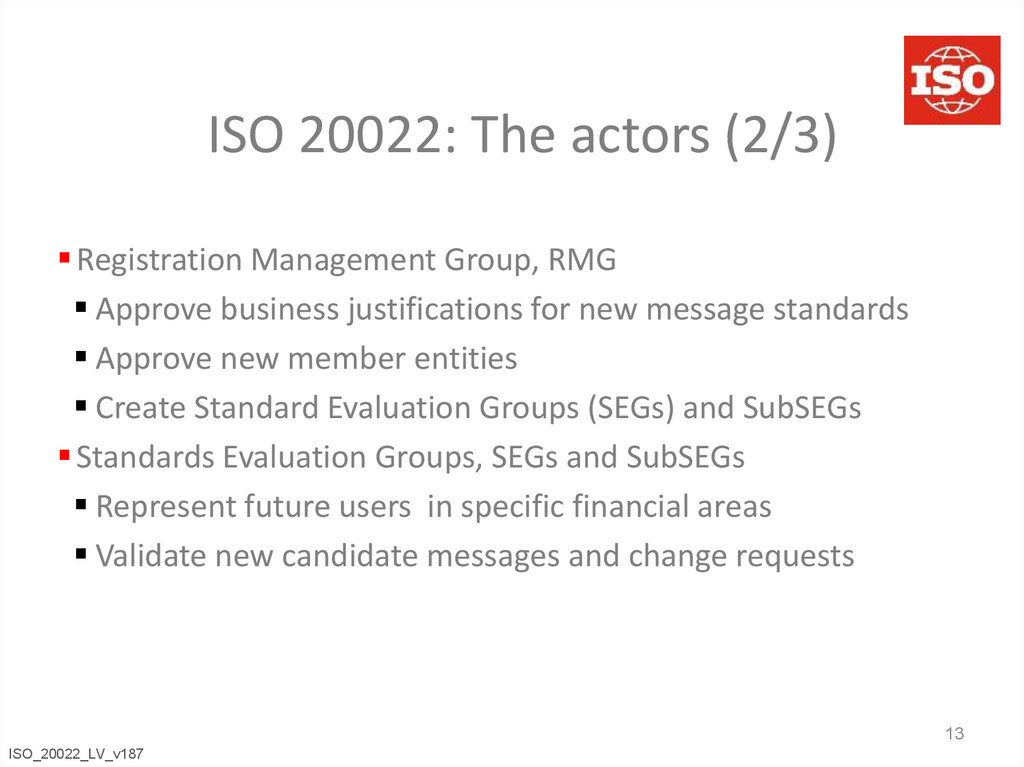

13. ISO 20022: The actors (2/3)

Registration Management Group, RMGApprove business justifications for new message standards

Approve new member entities

Create Standard Evaluation Groups (SEGs) and SubSEGs

Standards Evaluation Groups, SEGs and SubSEGs

Represent future users in specific financial areas

Validate new candidate messages and change requests

13

ISO_20022_LV_v187

14. ISO 20022: The actors (3/3)

Registration Authority, RAEnsure compliance

Maintain and publish ISO 20022 Repository

Technical Support Group, TSG

Assist RMG, SEGs, RA and submitting organisations

14

ISO_20022_LV_v187

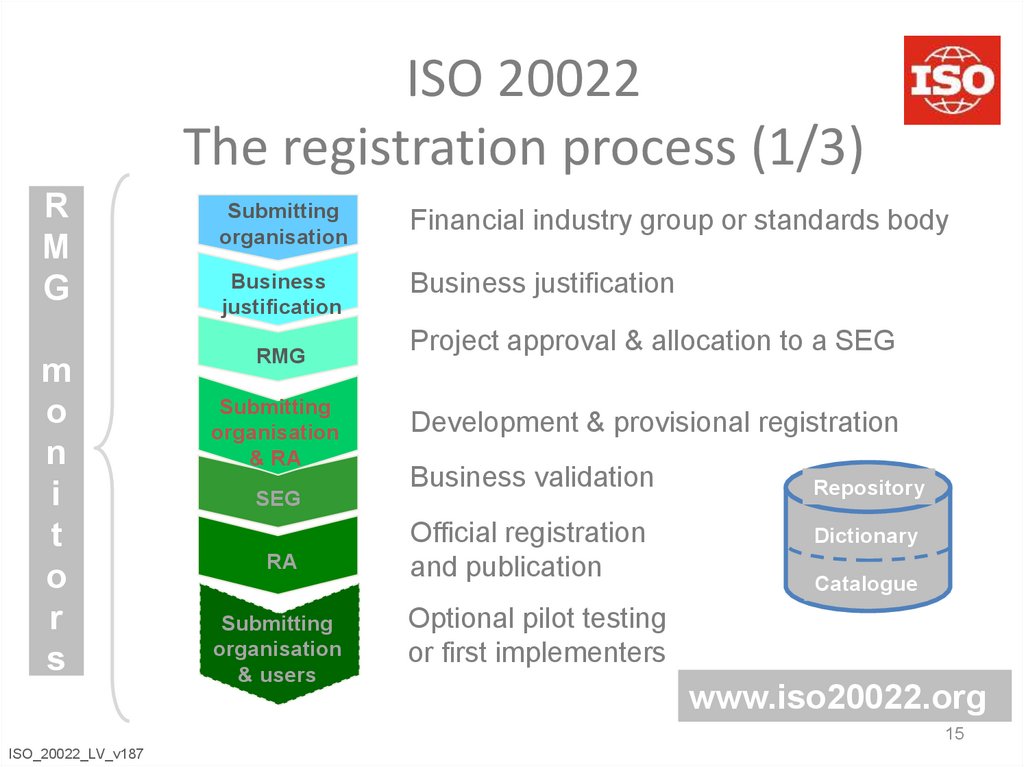

15. ISO 20022 The registration process (1/3)

RM

G

Submitting

organisation

Financial industry group or standards body

Business

justification

Business justification

m

o

n

i

t

o

r

s

RMG

Submitting

organisation

& RA

SEG

RA

Submitting

organisation

& users

Project approval & allocation to a SEG

Development & provisional registration

Business validation

Official registration

and publication

Repository

Dictionary

Catalogue

Optional pilot testing

or first implementers

www.iso20022.org

15

ISO_20022_LV_v187

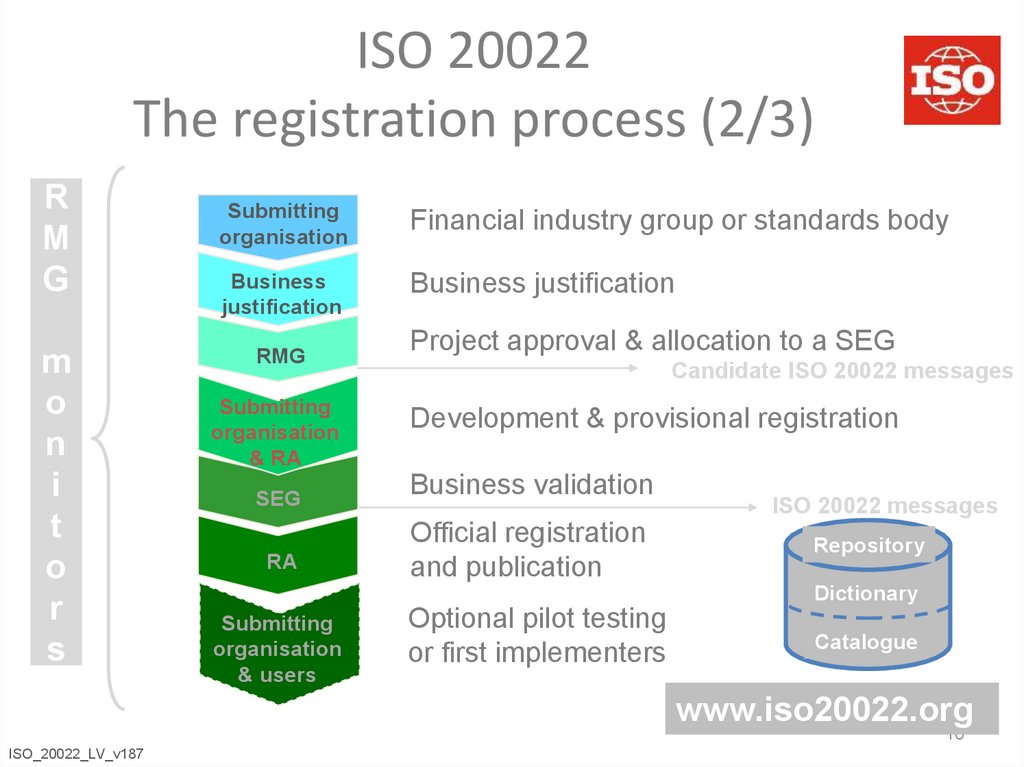

16. ISO 20022 The registration process (2/3)

RM

G

m

o

n

i

t

o

r

s

Submitting

organisation

Financial industry group or standards body

Business

justification

Business justification

RMG

Submitting

organisation

& RA

Project approval & allocation to a SEG

Candidate ISO 20022 messages

Development & provisional registration

SEG

Business validation

RA

Official registration

and publication

ISO 20022 messages

Repository

Dictionary

Submitting

organisation

& users

Optional pilot testing

or first implementers

Catalogue

www.iso20022.org

16

ISO_20022_LV_v187

17. ISO 20022 registration process (3/3) Yearly maintenance process

TimingBy June 1

By July 7

By August 21

Users CRs

SEG

Submitting

organisation

By October 1

SEG

By December 1

By February 1

By February

- May

ISO_20022_LV_v187

Submitting

organisation

& RA

SEG

RA

Submitting

organisation

& users

Users introduce Change Requests to the RA

SEG screens Change Requests (CRs)

Submitting organisation prepares ‘Maintenance

Change Request’ with each CR implementation

SEG approval/rejection

Development of candidate new versions

Provisional publication

Validation of new versions

Registration and publication

First implementers

www.iso20022.org

17

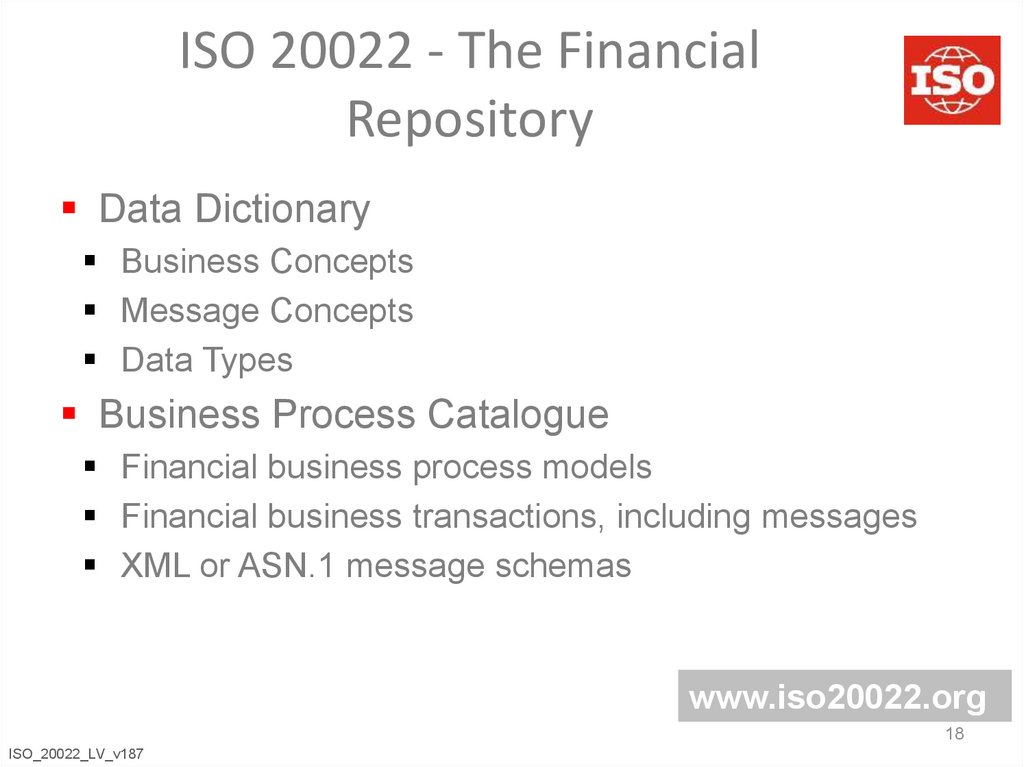

18. ISO 20022 - The Financial Repository

Data DictionaryBusiness Concepts

Message Concepts

Data Types

Business Process Catalogue

Financial business process models

Financial business transactions, including messages

XML or ASN.1 message schemas

www.iso20022.org

18

ISO_20022_LV_v187

19. ISO 20022

Continuing with today’s agenda…ISO 20022

ISO 20022 Registration Platform

19

ISO_20022_LV_v187

20. ISO 20022 - The Deployment

Approval of the international standardSelection of the Registration Authority and set-up of the

www.iso20022.org

Creation of Registration Management Group

Creation of Standards Evaluation Groups

Registration and publication of first ‘ISO 20022 messages’

Approval of a new edition of the international standard in

2013

Ongoing: promotion to developers (standardizers, industry bodies)

and users (market infrastructures, end-users, vendors)

20

ISO_20022_LV_v187

21. ISO 20022 Registration Management Group (RMG)

Members :21 countries: AT, AU, BR, CA, CH, CN, DE, DK, FI, FR, GB, IN, IT, JP,

KR, NL, NO, SE, SG, US, ZA.

18 organisations: ACTUS, Bank of England, CFTC, Clearstream,

DTCC, ECB, EPC, Euroclear, FPL, ISDA/FpML, ISITC, MasterCard,

NACHA/IFX, nexo, OMG, SWIFT, RippleNet, VISA

Convenor: James Whittle (GB); Vice-convenor: Mike Tagai (JP);

Secretary: David Heron (GB)

Meetings: twice a year

Key decisions:

Creation of six SEGs: Payments and Securities in 2005, Trade

Services and Forex in 2006, Cards & Related Retail Financial

Services in 2008, Derivatives SubSEG in 2016

Approval of ISO 20022 message development projects

Approval of new ISO 20022 Member Entities

21

ISO_20022_LV_v187

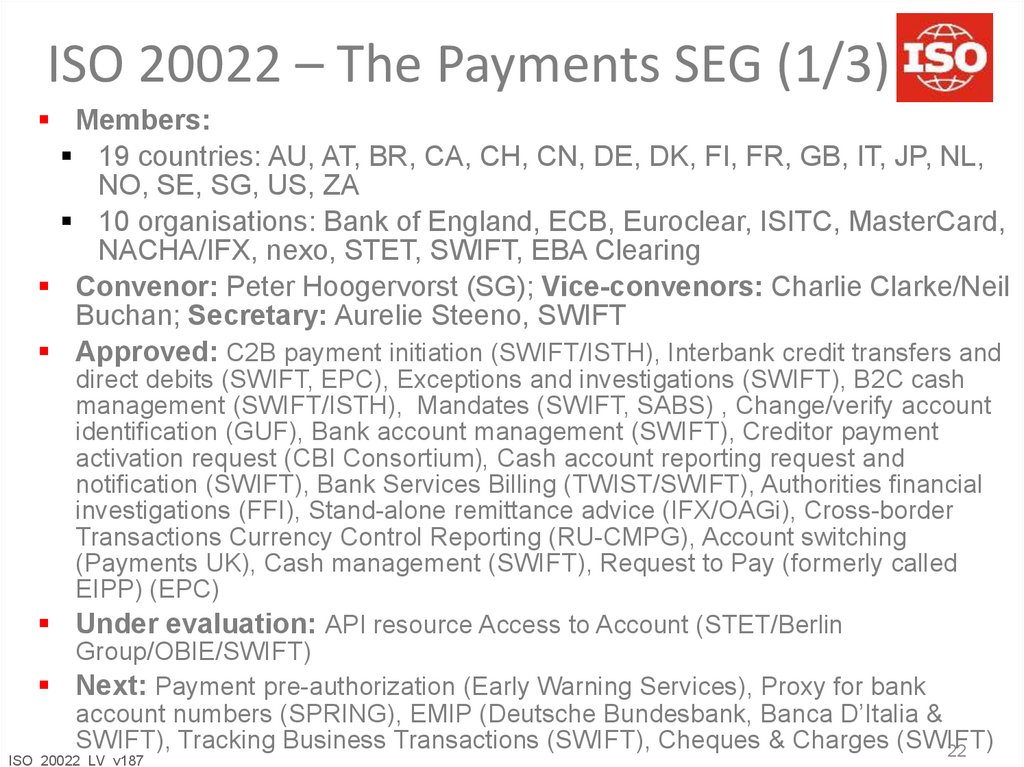

22. ISO 20022 – The Payments SEG (1/3)

Members:19 countries: AU, AT, BR, CA, CH, CN, DE, DK, FI, FR, GB, IT, JP, NL,

NO, SE, SG, US, ZA

10 organisations: Bank of England, ECB, Euroclear, ISITC, MasterCard,

NACHA/IFX, nexo, STET, SWIFT, EBA Clearing

Convenor: Peter Hoogervorst (SG); Vice-convenors: Charlie Clarke/Neil

Buchan; Secretary: Aurelie Steeno, SWIFT

Approved: C2B payment initiation (SWIFT/ISTH), Interbank credit transfers and

direct debits (SWIFT, EPC), Exceptions and investigations (SWIFT), B2C cash

management (SWIFT/ISTH), Mandates (SWIFT, SABS) , Change/verify account

identification (GUF), Bank account management (SWIFT), Creditor payment

activation request (CBI Consortium), Cash account reporting request and

notification (SWIFT), Bank Services Billing (TWIST/SWIFT), Authorities financial

investigations (FFI), Stand-alone remittance advice (IFX/OAGi), Cross-border

Transactions Currency Control Reporting (RU-CMPG), Account switching

(Payments UK), Cash management (SWIFT), Request to Pay (formerly called

EIPP) (EPC)

Under evaluation: API resource Access to Account (STET/Berlin

Group/OBIE/SWIFT)

Next: Payment pre-authorization (Early Warning Services), Proxy for bank

account numbers (SPRING), EMIP (Deutsche Bundesbank, Banca D’Italia &

SWIFT), Tracking Business Transactions (SWIFT), Cheques & Charges (SWIFT)

22

ISO_20022_LV_v187

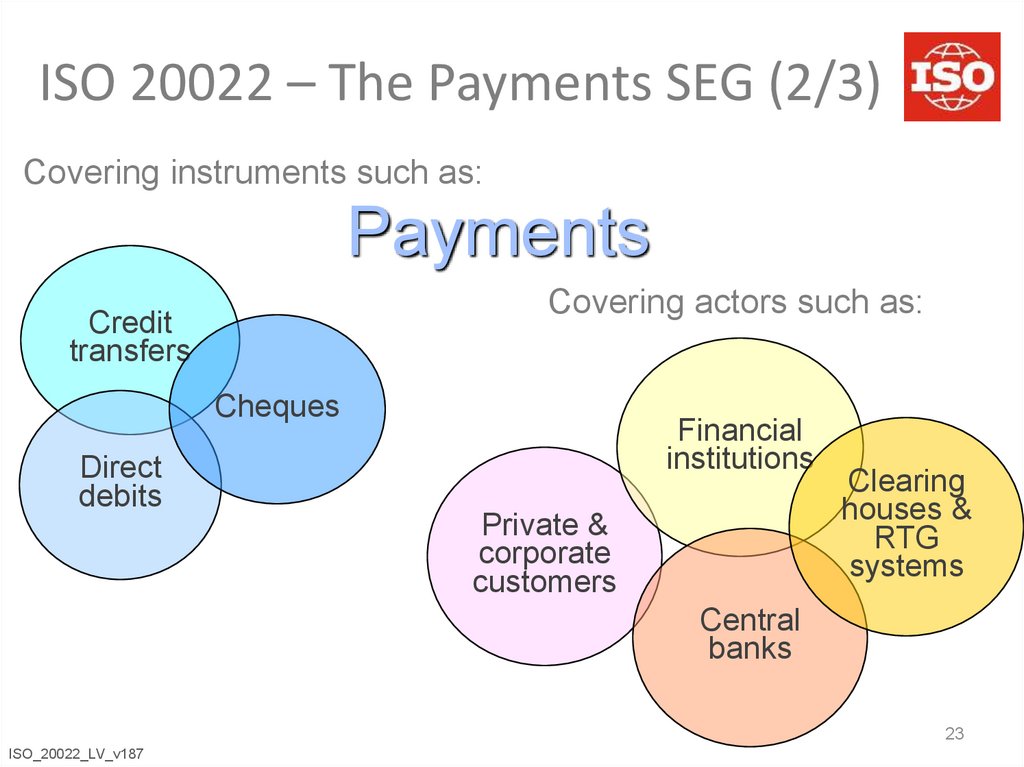

23. ISO 20022 – The Payments SEG (2/3)

Covering instruments such as:Payments

Covering actors such as:

Credit

transfers

Cheques

Direct

debits

Financial

institutions

Private &

corporate

customers

Clearing

houses &

RTG

systems

Central

banks

23

ISO_20022_LV_v187

24. ISO 20022 – The Payments SEG (3/3)

Including business areas such as:Clearing & settlement

Payment initiation

Communications

between the

ordering

customer and its

bank, etc.

Payments

Interbank

transfers via

correspondent

banking or

ACHs, high

value

payments, low

value bulk

payments,

RTGS, etc.

Cash Management between various actors:

Account

opening,

standing orders,

transaction and

account

information,

advices &

statements from

…

...the account

servicing

institutions to

account

owners,

including

reporting from

the financial

institution…

…to the

ordering &

beneficiary

customers,

reconciliation,

exceptions &

investigations

handling.

24

ISO_20022_LV_v187

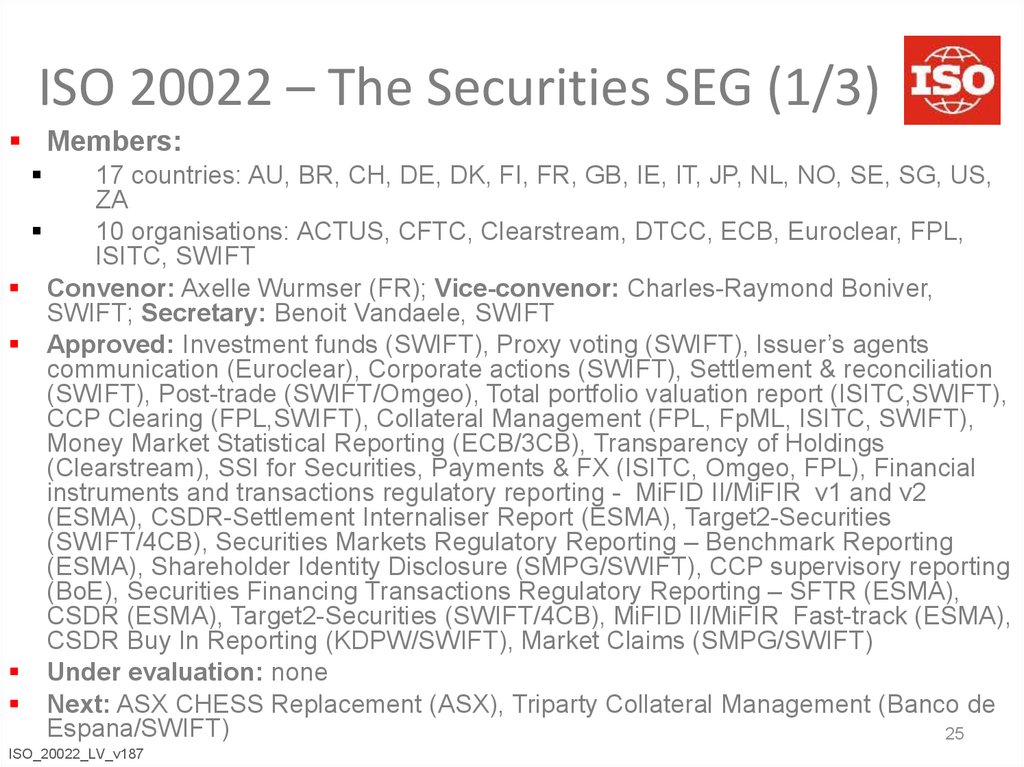

25. ISO 20022 – The Securities SEG (1/3)

Members:17 countries: AU, BR, CH, DE, DK, FI, FR, GB, IE, IT, JP, NL, NO, SE, SG, US,

ZA

10 organisations: ACTUS, CFTC, Clearstream, DTCC, ECB, Euroclear, FPL,

ISITC, SWIFT

Convenor: Axelle Wurmser (FR); Vice-convenor: Charles-Raymond Boniver,

SWIFT; Secretary: Benoit Vandaele, SWIFT

Approved: Investment funds (SWIFT), Proxy voting (SWIFT), Issuer’s agents

communication (Euroclear), Corporate actions (SWIFT), Settlement & reconciliation

(SWIFT), Post-trade (SWIFT/Omgeo), Total portfolio valuation report (ISITC,SWIFT),

CCP Clearing (FPL,SWIFT), Collateral Management (FPL, FpML, ISITC, SWIFT),

Money Market Statistical Reporting (ECB/3CB), Transparency of Holdings

(Clearstream), SSI for Securities, Payments & FX (ISITC, Omgeo, FPL), Financial

instruments and transactions regulatory reporting - MiFID II/MiFIR v1 and v2

(ESMA), CSDR-Settlement Internaliser Report (ESMA), Target2-Securities

(SWIFT/4CB), Securities Markets Regulatory Reporting – Benchmark Reporting

(ESMA), Shareholder Identity Disclosure (SMPG/SWIFT), CCP supervisory reporting

(BoE), Securities Financing Transactions Regulatory Reporting – SFTR (ESMA),

CSDR (ESMA), Target2-Securities (SWIFT/4CB), MiFID II/MiFIR Fast-track (ESMA),

CSDR Buy In Reporting (KDPW/SWIFT), Market Claims (SMPG/SWIFT)

Under evaluation: none

Next: ASX CHESS Replacement (ASX), Triparty Collateral Management (Banco de

Espana/SWIFT)

25

ISO_20022_LV_v187

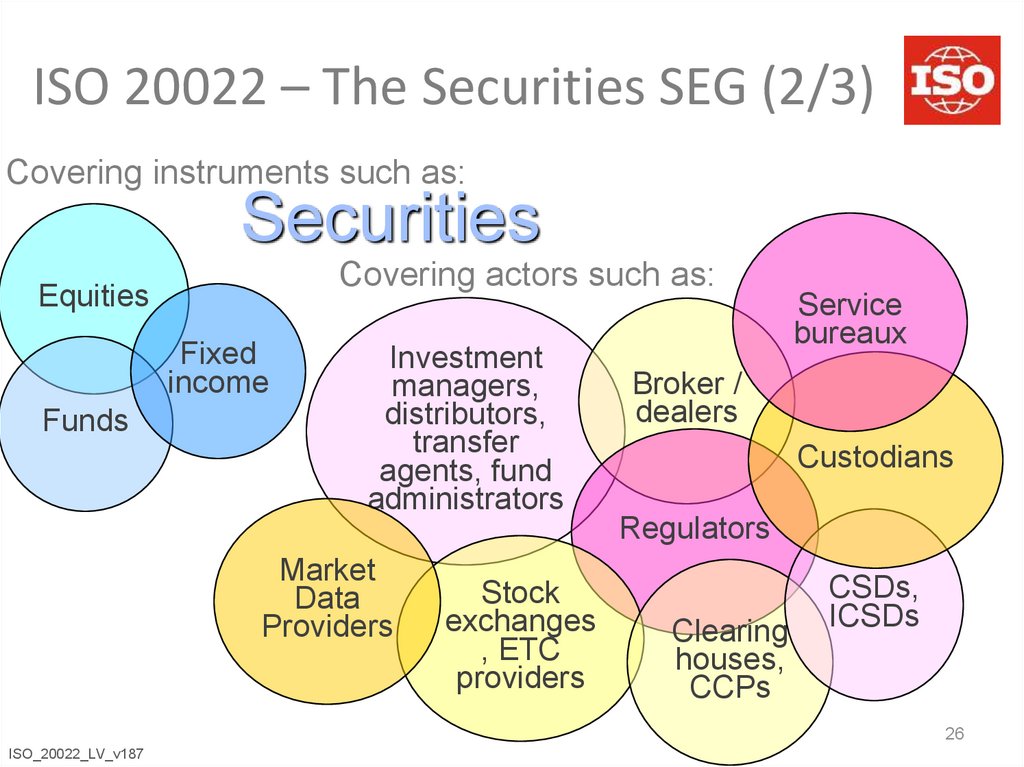

26. ISO 20022 – The Securities SEG (2/3)

Covering instruments such as:Securities

Covering actors such as:

Equities

Fixed

income

Funds

Investment

managers,

distributors,

transfer

agents, fund

administrators

Service

bureaux

Broker /

dealers

Custodians

Regulators

Market

Data

Providers

Stock

exchanges

, ETC

providers

Clearing

houses,

CCPs

CSDs,

ICSDs

26

ISO_20022_LV_v187

27. ISO 20022 – The Securities SEG (3/3)

Including business areas such as:Securities

Issuance

Trade

Initiation,

pretrade

Trade,

posttrade

Securities

Account

opening,

standing orders,

transaction and

account

information,

advices &

statements,

queries &

investigations

Clearing

&

settlement

Custody

Collateral management

Collateral,

repos,

securities

lending &

borrowing

Income,

corporate

actions,

market data,

proxy voting

27

ISO_20022_LV_v187

28. Looking at the advantages ISO 20022 brings over ISO 15022

ISO 20022:Builds on the ISO 15022 data dictionary concept and

registration infrastructure, but strengthens the monitoring

by the industry

Uses a more robust, syntax independent development

methodology based on modelling of business processes

and transactions

Uses XML or ASN.1 as the syntax for the actual physical

messages

Has a wider scope than ISO 15022, which is only for

securities messages

Syntax independent business modelling

is key to the ISO 20022 standard !

28

ISO_20022_LV_v187

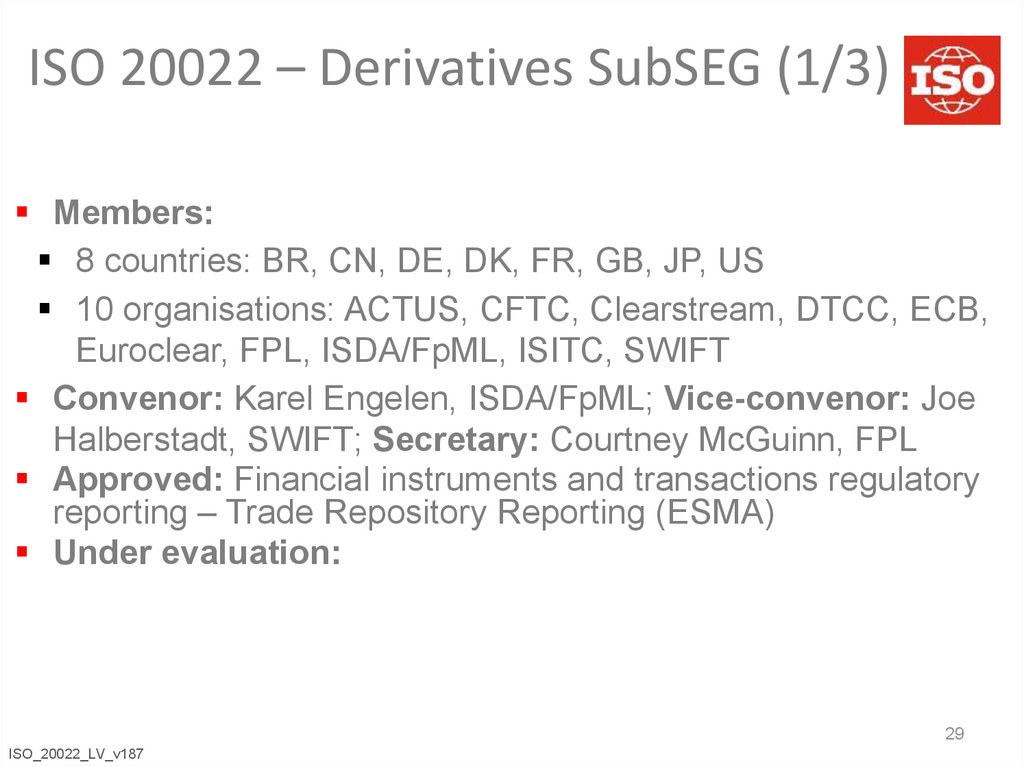

29. ISO 20022 – Derivatives SubSEG (1/3)

Members:8 countries: BR, CN, DE, DK, FR, GB, JP, US

10 organisations: ACTUS, CFTC, Clearstream, DTCC, ECB,

Euroclear, FPL, ISDA/FpML, ISITC, SWIFT

Convenor: Karel Engelen, ISDA/FpML; Vice-convenor: Joe

Halberstadt, SWIFT; Secretary: Courtney McGuinn, FPL

Approved: Financial instruments and transactions regulatory

reporting – Trade Repository Reporting (ESMA)

Under evaluation:

29

ISO_20022_LV_v187

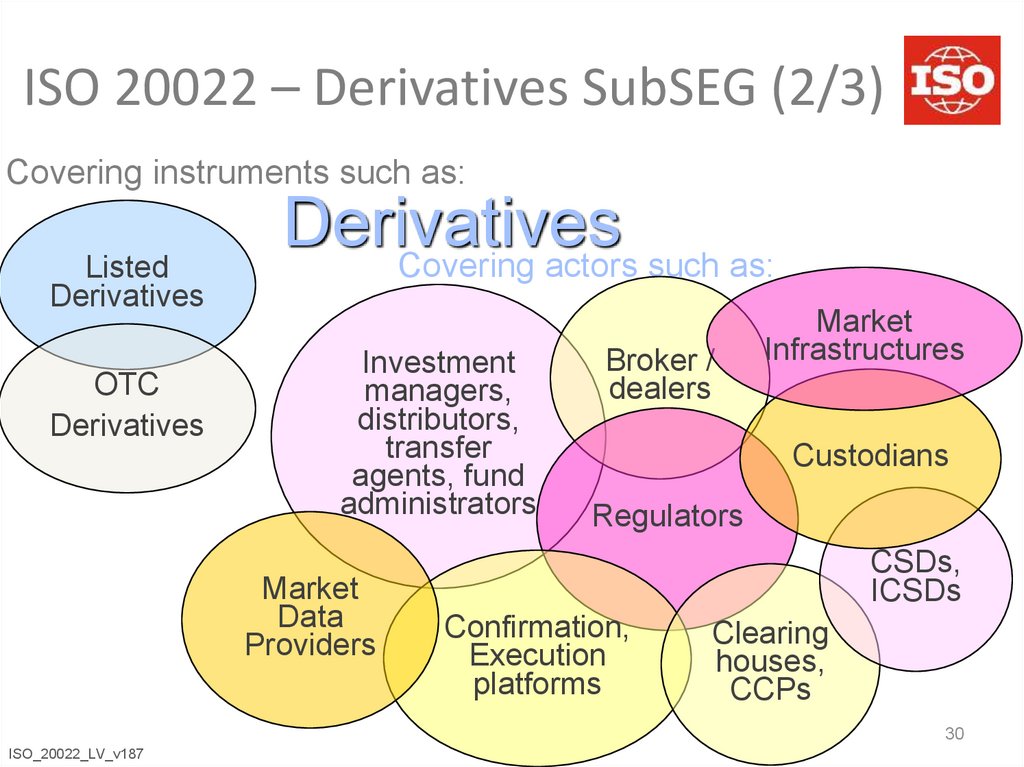

30. ISO 20022 – Derivatives SubSEG (2/3)

Covering instruments such as:Listed

Derivatives

OTC

Derivatives

Derivatives

Covering actors such as:

Investment

managers,

distributors,

transfer

agents, fund

administrators

Market

Data

Providers

Broker /

dealers

Market

Infrastructures

Custodians

Regulators

CSDs,

ICSDs

Confirmation,

Execution

platforms

Clearing

houses,

CCPs

30

ISO_20022_LV_v187

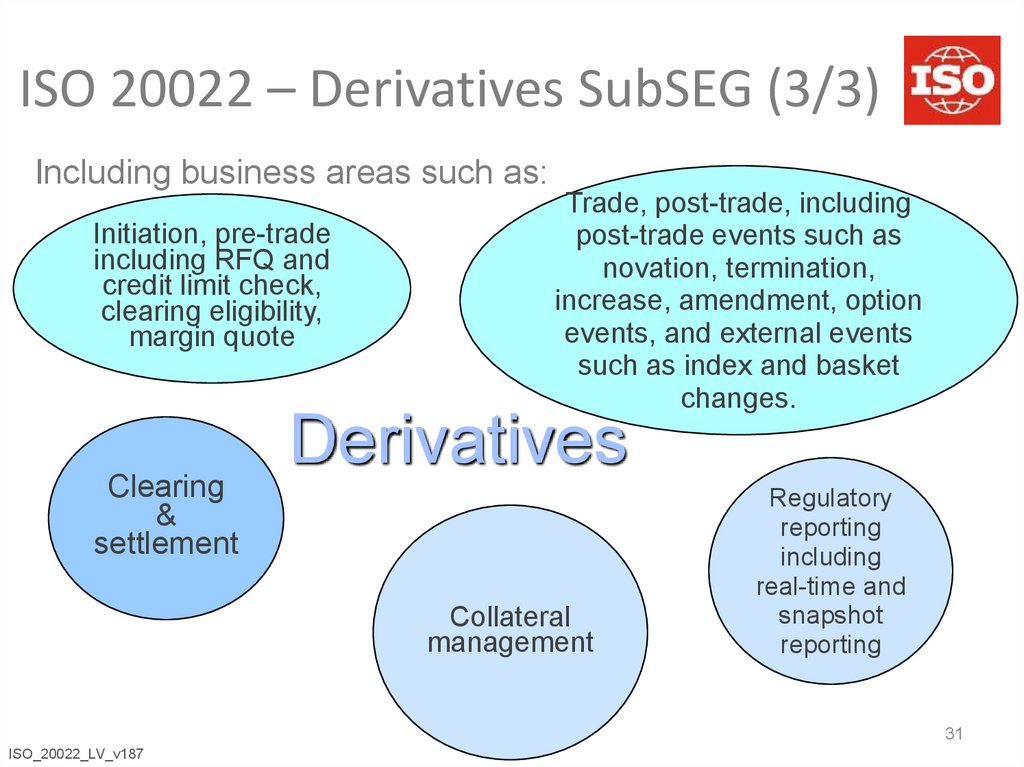

31. ISO 20022 – Derivatives SubSEG (3/3)

Including business areas such as:Initiation, pre-trade

including RFQ and

credit limit check,

clearing eligibility,

margin quote

Clearing

&

settlement

Trade, post-trade, including

post-trade events such as

novation, termination,

increase, amendment, option

events, and external events

such as index and basket

changes.

Derivatives

Collateral

management

Regulatory

reporting

including

real-time and

snapshot

reporting

31

ISO_20022_LV_v187

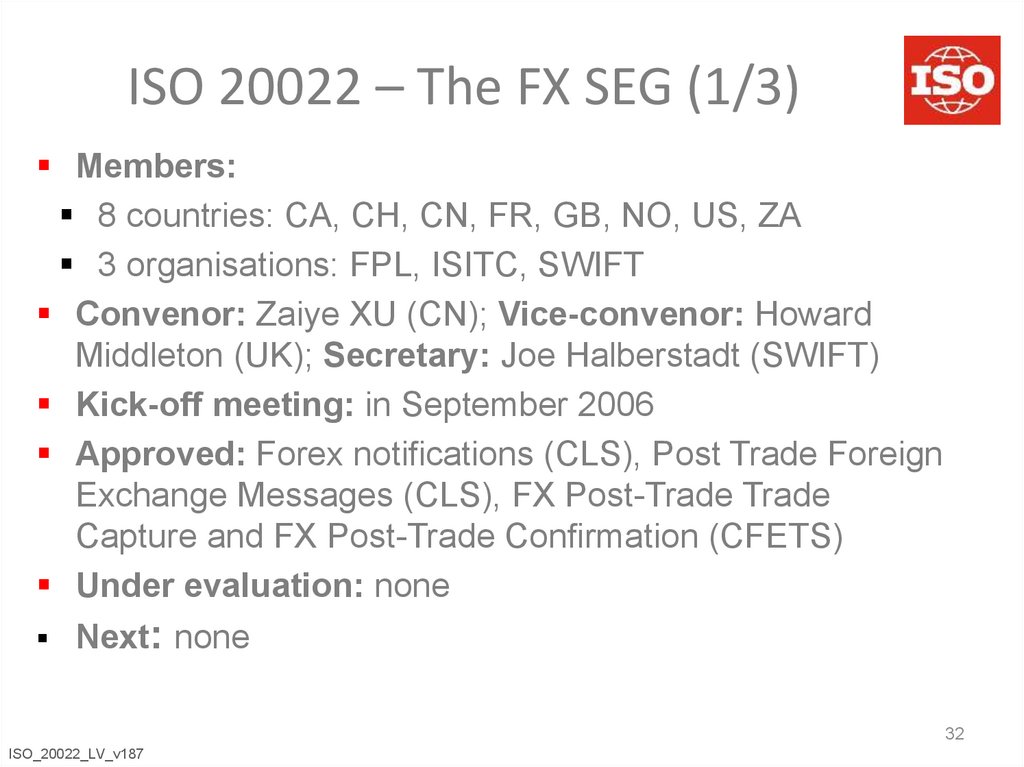

32. ISO 20022 – The FX SEG (1/3)

Members:8 countries: CA, CH, CN, FR, GB, NO, US, ZA

3 organisations: FPL, ISITC, SWIFT

Convenor: Zaiye XU (CN); Vice-convenor: Howard

Middleton (UK); Secretary: Joe Halberstadt (SWIFT)

Kick-off meeting: in September 2006

Approved: Forex notifications (CLS), Post Trade Foreign

Exchange Messages (CLS), FX Post-Trade Trade

Capture and FX Post-Trade Confirmation (CFETS)

Under evaluation: none

Next: none

32

ISO_20022_LV_v187

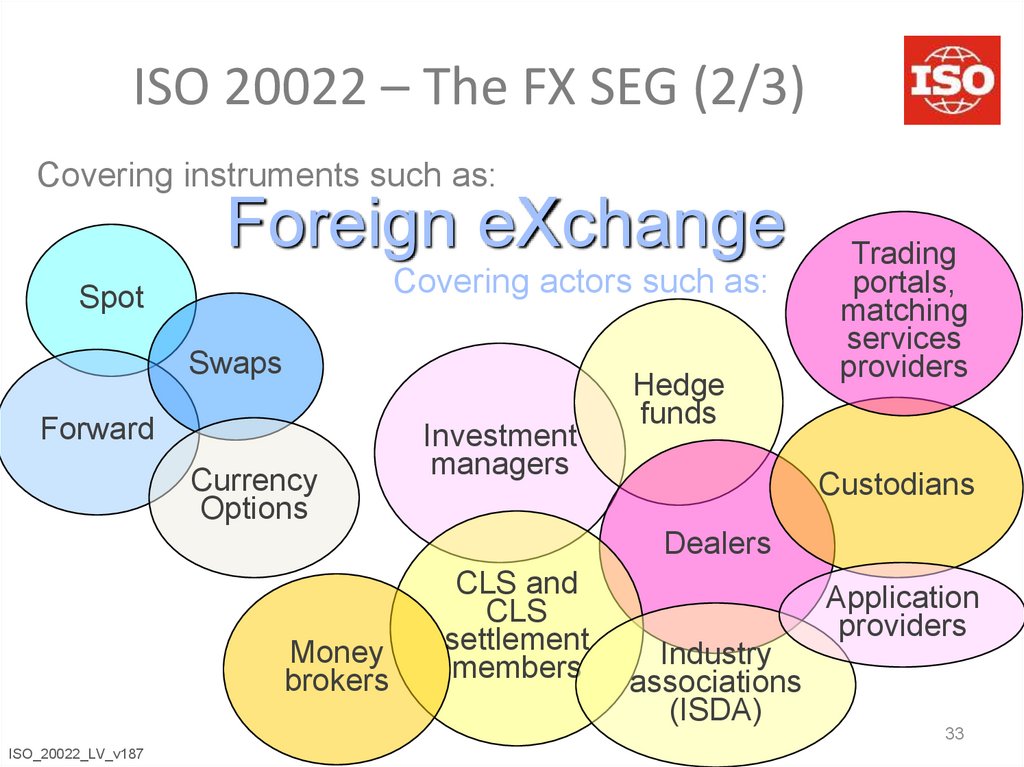

33. ISO 20022 – The FX SEG (2/3)

Covering instruments such as:Foreign eXchange

Covering actors such as:

Spot

Swaps

Forward

Currency

Options

Investment

managers

Hedge

funds

Trading

portals,

matching

services

providers

Custodians

Dealers

Money

brokers

CLS and

CLS

settlement

members

Industry

associations

(ISDA)

Application

providers

33

ISO_20022_LV_v187

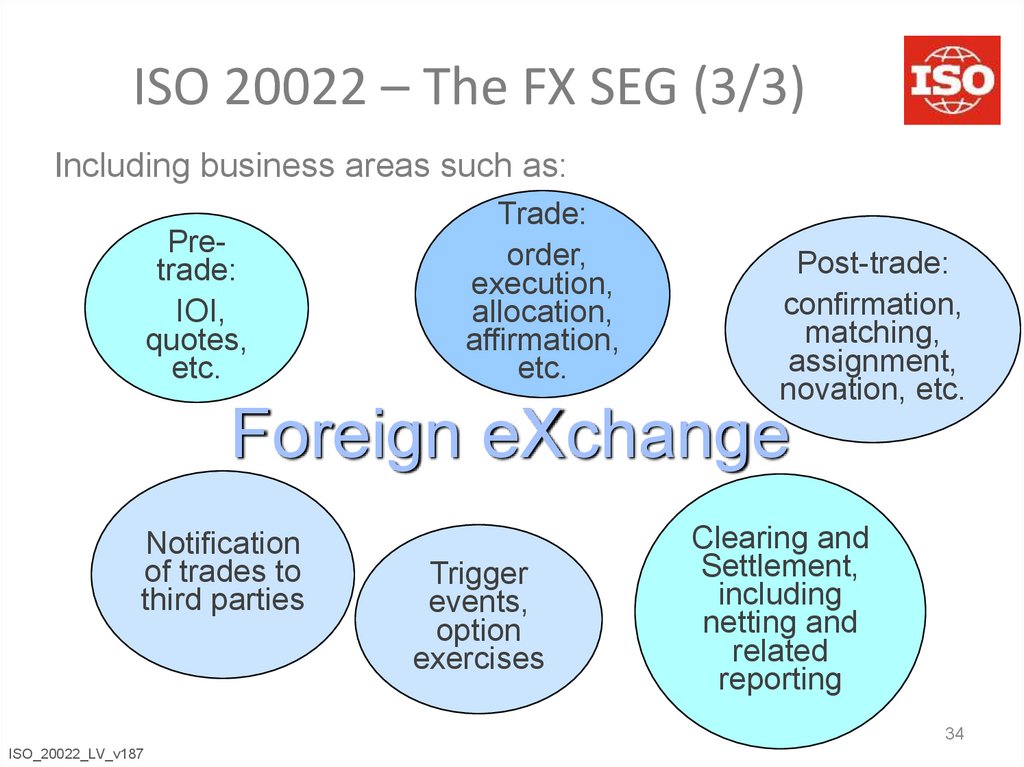

34. ISO 20022 – The FX SEG (3/3)

Including business areas such as:Pretrade:

IOI,

quotes,

etc.

Trade:

order,

execution,

allocation,

affirmation,

etc.

Post-trade:

confirmation,

matching,

assignment,

novation, etc.

Foreign eXchange

Notification

of trades to

third parties

Trigger

events,

option

exercises

Clearing and

Settlement,

including

netting and

related

reporting

34

ISO_20022_LV_v187

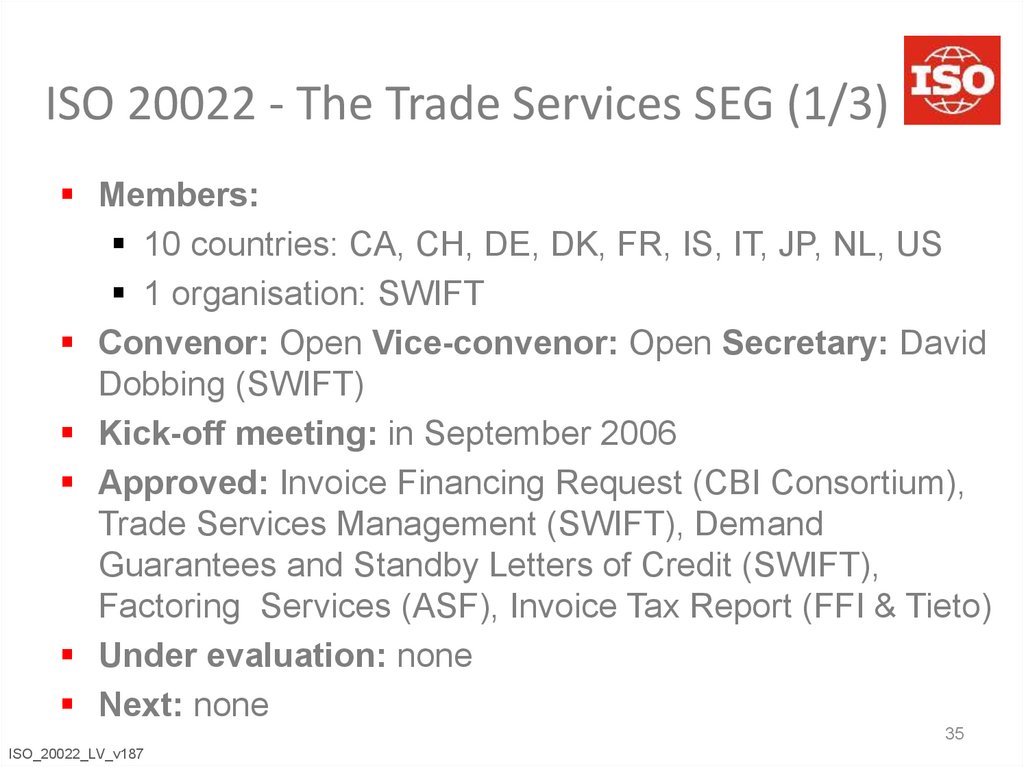

35. ISO 20022 - The Trade Services SEG (1/3)

Members:10 countries: CA, CH, DE, DK, FR, IS, IT, JP, NL, US

1 organisation: SWIFT

Convenor: Open Vice-convenor: Open Secretary: David

Dobbing (SWIFT)

Kick-off meeting: in September 2006

Approved: Invoice Financing Request (CBI Consortium),

Trade Services Management (SWIFT), Demand

Guarantees and Standby Letters of Credit (SWIFT),

Factoring Services (ASF), Invoice Tax Report (FFI & Tieto)

Under evaluation: none

Next: none

35

ISO_20022_LV_v187

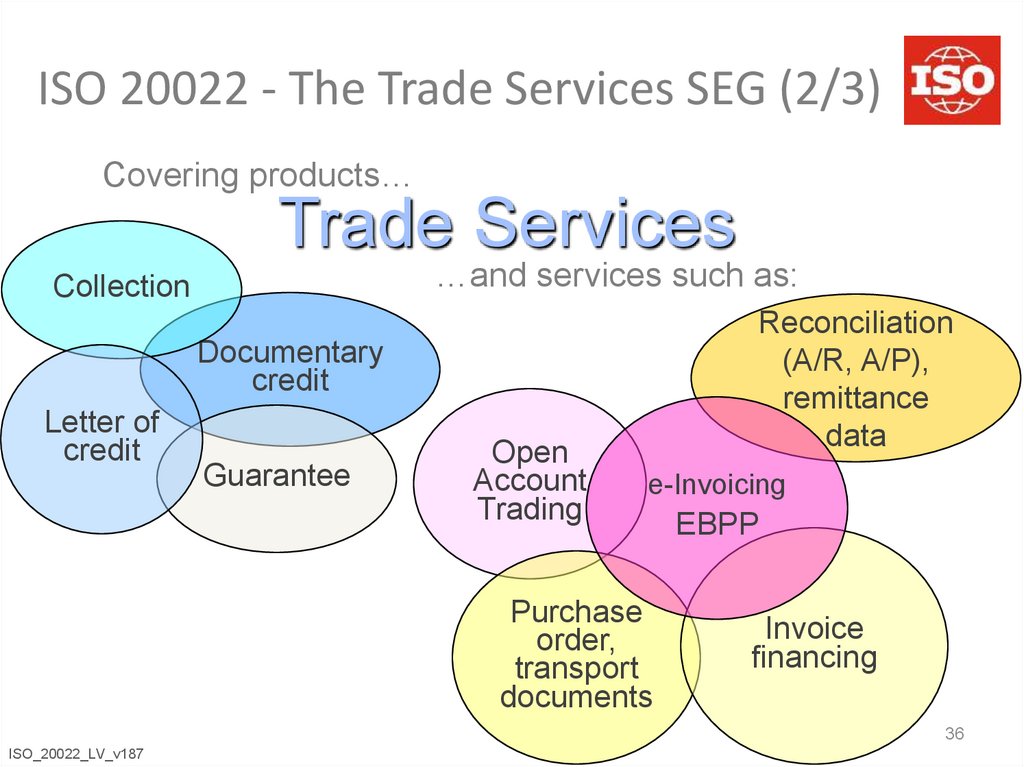

36. ISO 20022 - The Trade Services SEG (2/3)

Covering products…Trade Services

…and services such as:

Collection

Reconciliation

(A/R, A/P),

remittance

data

Documentary

credit

Letter of

credit

Guarantee

Open

Account

Trading

e-Invoicing

Purchase

order,

transport

documents

EBPP

Invoice

financing

36

ISO_20022_LV_v187

37. ISO 20022 The Trade Services SEG (3/3)

Including actors such as:Private and

corporate

customers

(treasurers)

Financial

Institutions

Trade Services

Risk

management

entities

Application

providers

Associations

providing rules

and master

agreements

(eg IFSA, ICC)

Trade facilitators:

chambers of

commerce, insurance

co, freight forwarders,

carriers, customs,

factoring co

37

ISO_20022_LV_v187

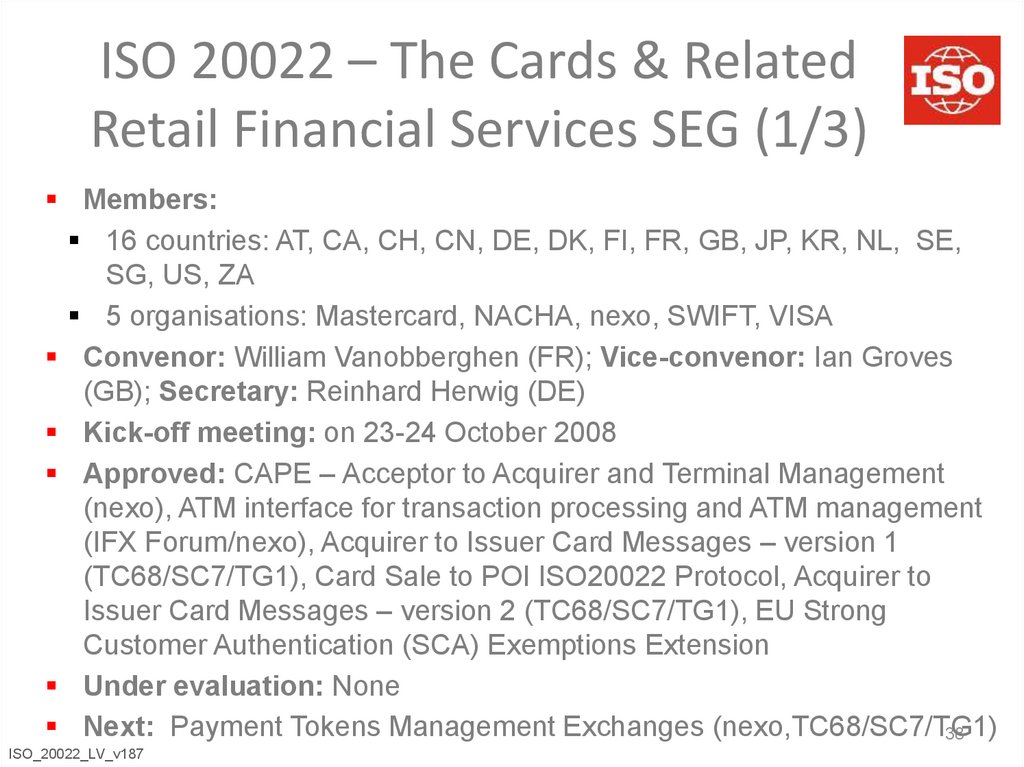

38. ISO 20022 – The Cards & Related Retail Financial Services SEG (1/3)

ISO 20022 – The Cards & RelatedRetail Financial Services SEG (1/3)

Members:

16 countries: AT, CA, CH, CN, DE, DK, FI, FR, GB, JP, KR, NL, SE,

SG, US, ZA

5 organisations: Mastercard, NACHA, nexo, SWIFT, VISA

Convenor: William Vanobberghen (FR); Vice-convenor: Ian Groves

(GB); Secretary: Reinhard Herwig (DE)

Kick-off meeting: on 23-24 October 2008

Approved: CAPE – Acceptor to Acquirer and Terminal Management

(nexo), ATM interface for transaction processing and ATM management

(IFX Forum/nexo), Acquirer to Issuer Card Messages – version 1

(TC68/SC7/TG1), Card Sale to POI ISO20022 Protocol, Acquirer to

Issuer Card Messages – version 2 (TC68/SC7/TG1), EU Strong

Customer Authentication (SCA) Exemptions Extension

Under evaluation: None

Next: Payment Tokens Management Exchanges (nexo,TC68/SC7/TG1)

38

ISO_20022_LV_v187

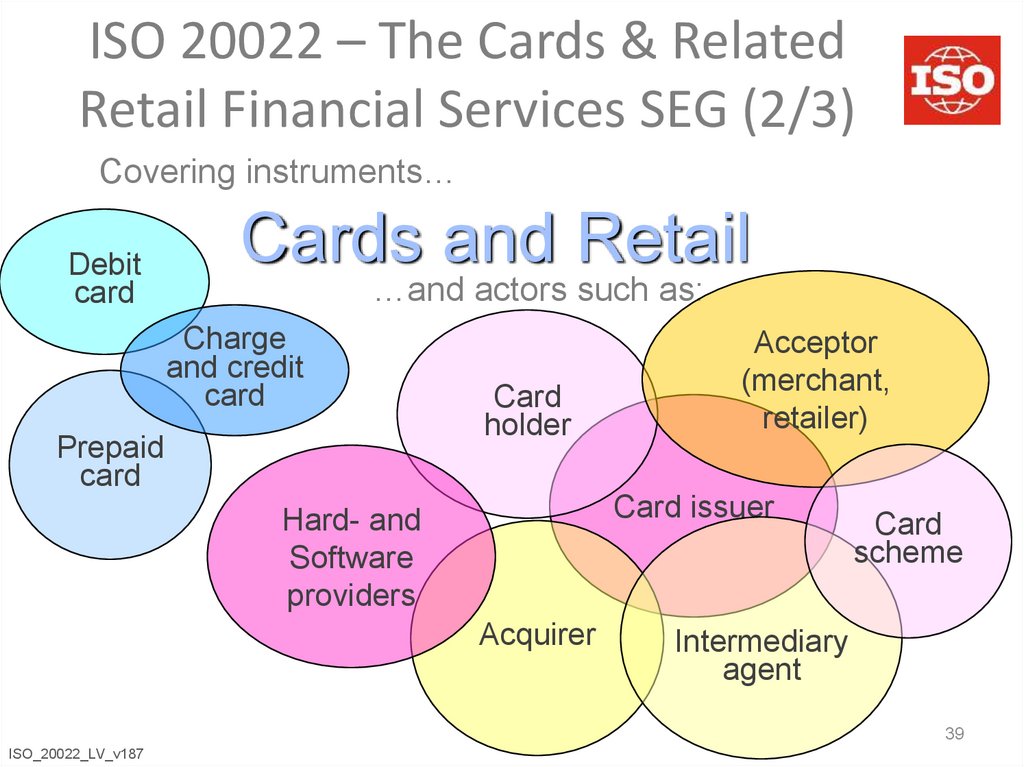

39. ISO 20022 – The Cards & Related Retail Financial Services SEG (2/3)

ISO 20022 – The Cards & RelatedRetail Financial Services SEG (2/3)

Covering instruments…

Debit

card

Cards and Retail

…and actors such as:

Charge

and credit

card

Prepaid

card

Card

holder

Acceptor

(merchant,

retailer)

Card issuer

Hard- and

Software

providers

Acquirer

Card

scheme

Intermediary

agent

39

ISO_20022_LV_v187

40. ISO 20022 – The Cards & Related Retail Financial Services SEG (3/3)

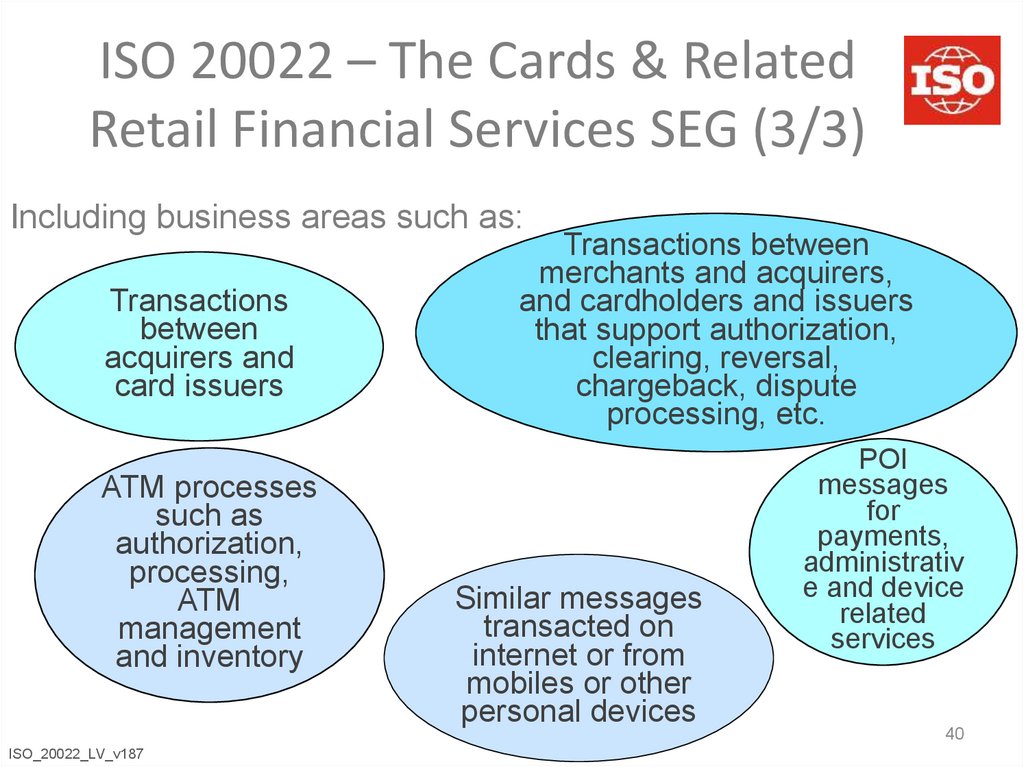

ISO 20022 – The Cards & RelatedRetail Financial Services SEG (3/3)

Including business areas such as:

Transactions

between

acquirers and

card issuers

ATM processes

such as

authorization,

processing,

ATM

management

and inventory

ISO_20022_LV_v187

Transactions between

merchants and acquirers,

and cardholders and issuers

that support authorization,

clearing, reversal,

chargeback, dispute

processing, etc.

Similar messages

transacted on

internet or from

mobiles or other

personal devices

POI

messages

for

payments,

administrativ

e and device

related

services

40

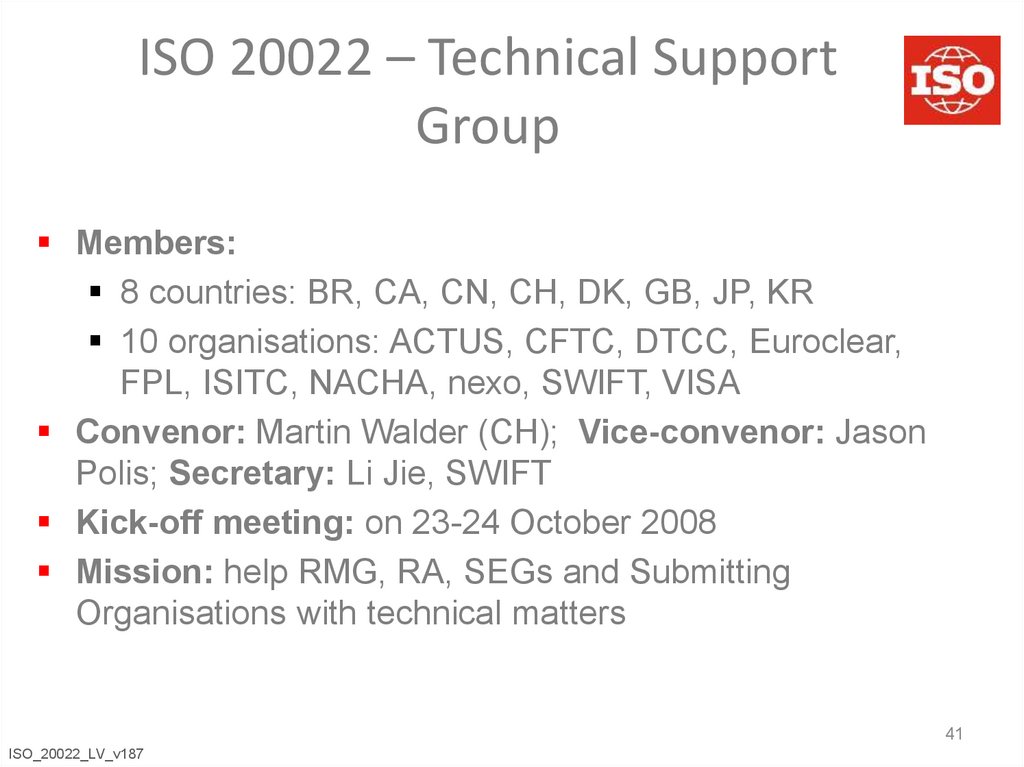

41. ISO 20022 – Technical Support Group

Members:8 countries: BR, CA, CN, CH, DK, GB, JP, KR

10 organisations: ACTUS, CFTC, DTCC, Euroclear,

FPL, ISITC, NACHA, nexo, SWIFT, VISA

Convenor: Martin Walder (CH); Vice-convenor: Jason

Polis; Secretary: Li Jie, SWIFT

Kick-off meeting: on 23-24 October 2008

Mission: help RMG, RA, SEGs and Submitting

Organisations with technical matters

41

ISO_20022_LV_v187

42. ISO 20022

Continuing with today’s agenda…ISO 20022

Interoperability within the financial industry

42

ISO_20022_LV_v187

43.

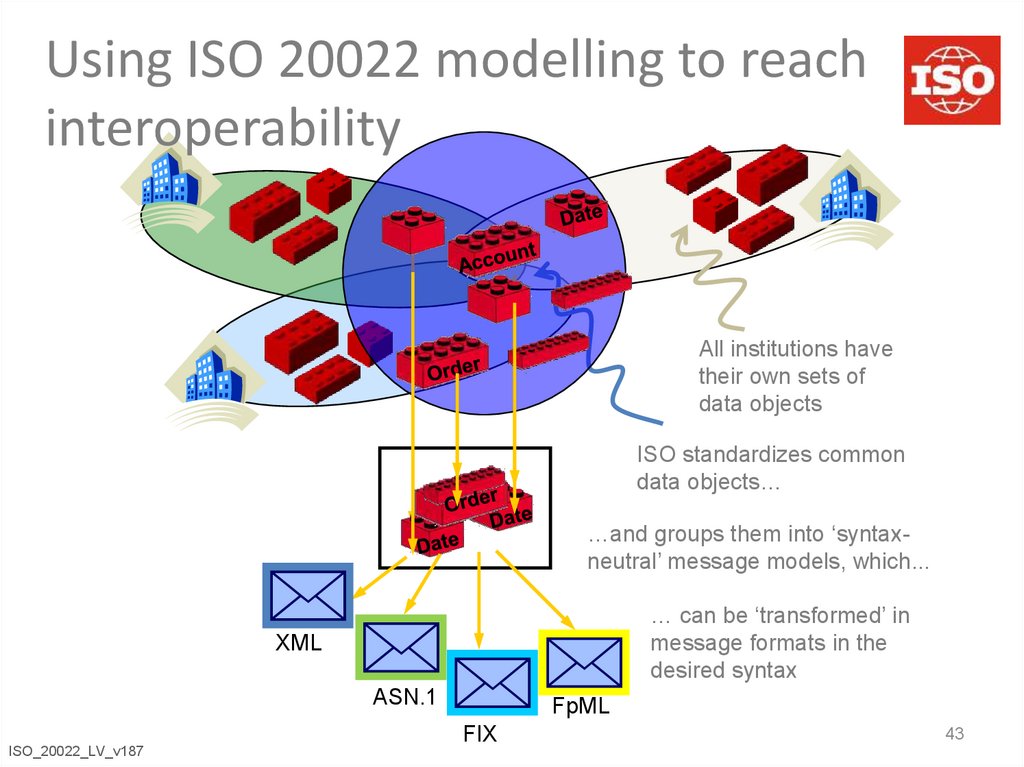

Using ISO 20022 modelling to reachinteroperability

All institutions have

their own sets of

data objects

ISO standardizes common

data objects…

…and groups them into ‘syntaxneutral’ message models, which...

… can be ‘transformed’ in

message formats in the

desired syntax

XML

ASN.1

ISO_20022_LV_v187

FpML

FIX

43

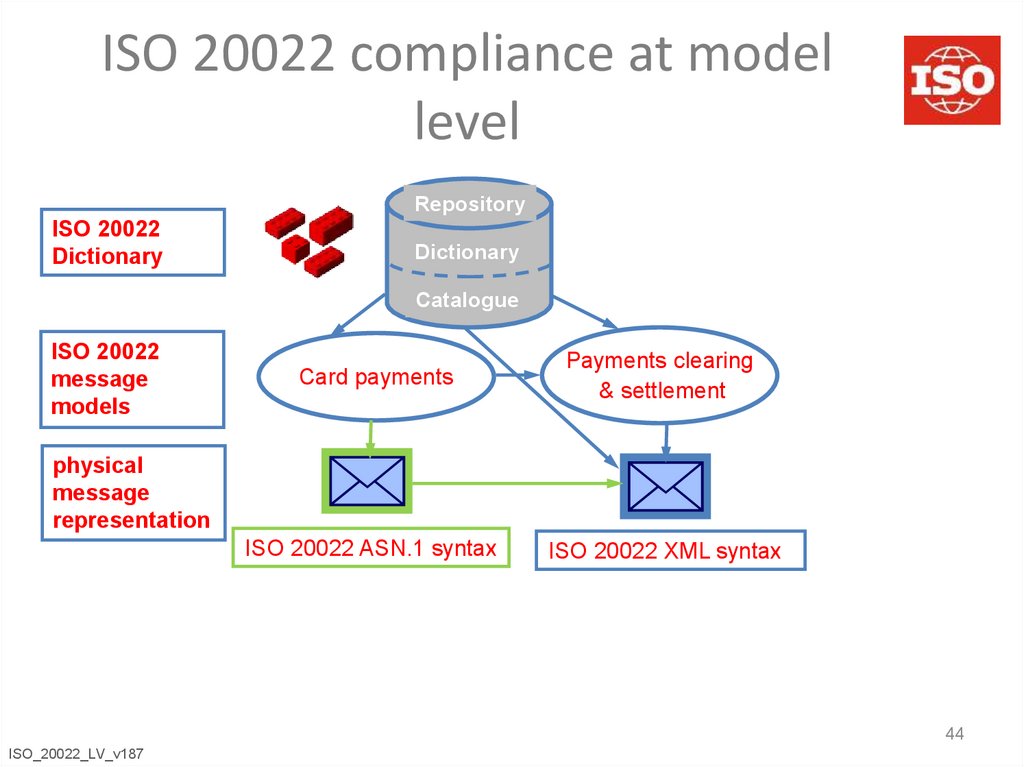

44. ISO 20022 compliance at model level

RepositoryISO 20022

Dictionary

Dictionary

Catalogue

ISO 20022

message

models

Card payments

Payments clearing

& settlement

physical

message

representation

ISO 20022 ASN.1 syntax

ISO 20022 XML syntaxx

44

ISO_20022_LV_v187

45. ISO 20022 compliance at model level

RepositoryISO 20022

Dictionary

Dictionary

ISO 20022 compliant

Catalogue

ISO 20022

message

models

Card payments

Payments clearing

& settlement

physical

message

representation

other syntax

ISO 20022 compliant using

a domain specific syntax

ISO 20022 syntax

ISO 20022 compliant

45

ISO_20022_LV_v187

46. “Investment Roadmap” for ISO, FIX, XBRL and FpML syntaxes

The Investment Roadmap is maintained by the StandardsCoordination Group including the following organisations:

Download the Investment Roadmap and related FAQ

46

ISO_20022_LV_v187

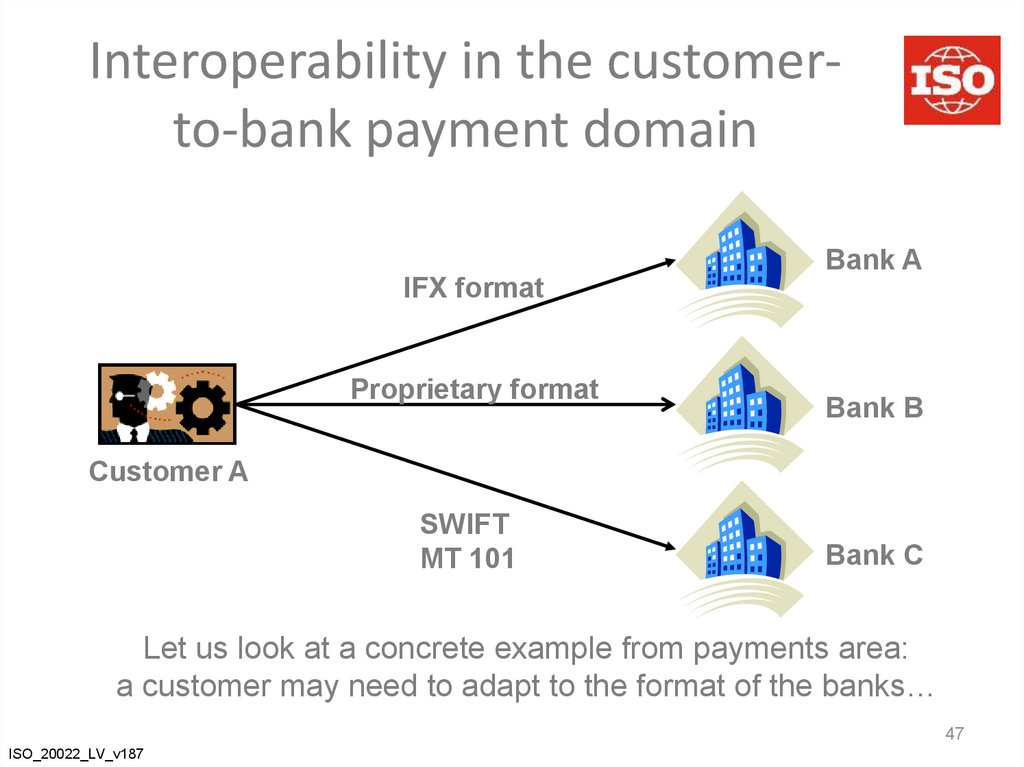

47. Interoperability in the customer-to-bank payment domain

Interoperability in the customerto-bank payment domainBank A

IFX format

Proprietary format

Bank B

Customer A

SWIFT

MT 101

Bank C

Let us look at a concrete example from payments area:

a customer may need to adapt to the format of the banks…

47

ISO_20022_LV_v187

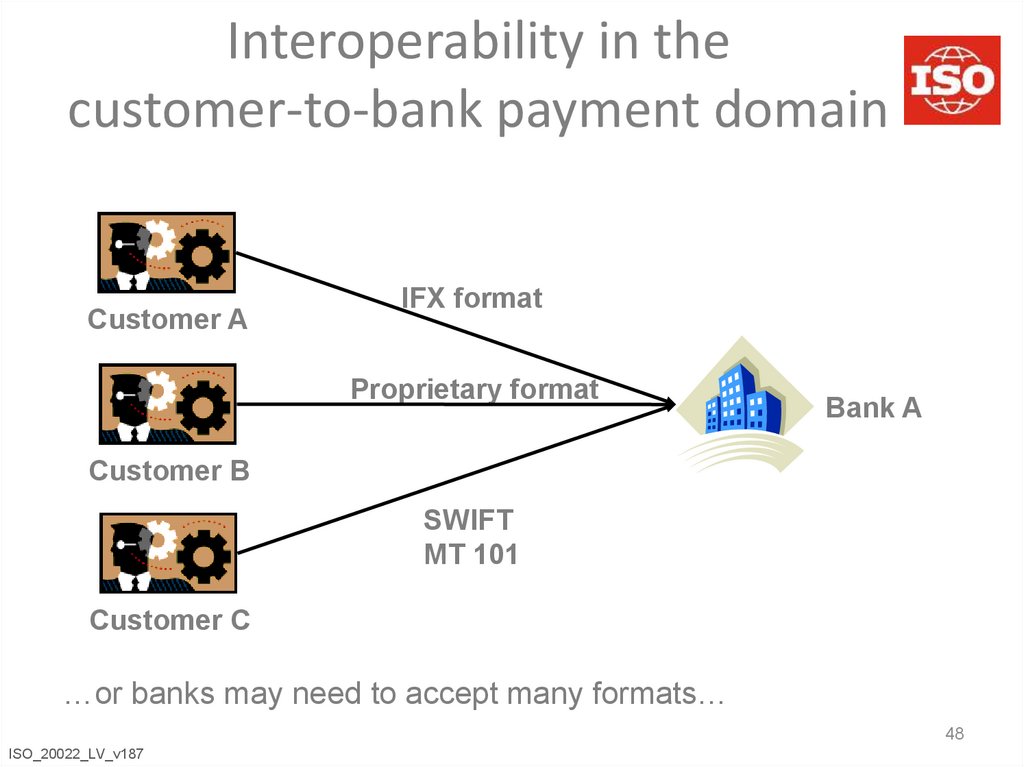

48. Interoperability in the customer-to-bank payment domain

Customer AIFX format

Proprietary format

Bank A

Customer B

SWIFT

MT 101

Customer C

…or banks may need to accept many formats…

48

ISO_20022_LV_v187

49.

Interoperability in the customer-tobank payment domainProprietary

TWIST

ISO 20022

Core Payment

Kernel model

SWIFT MT

OAGi

IFX

The reverse engineering produces a canonical ISO 20022

message model

ISO_20022_LV_v187

49

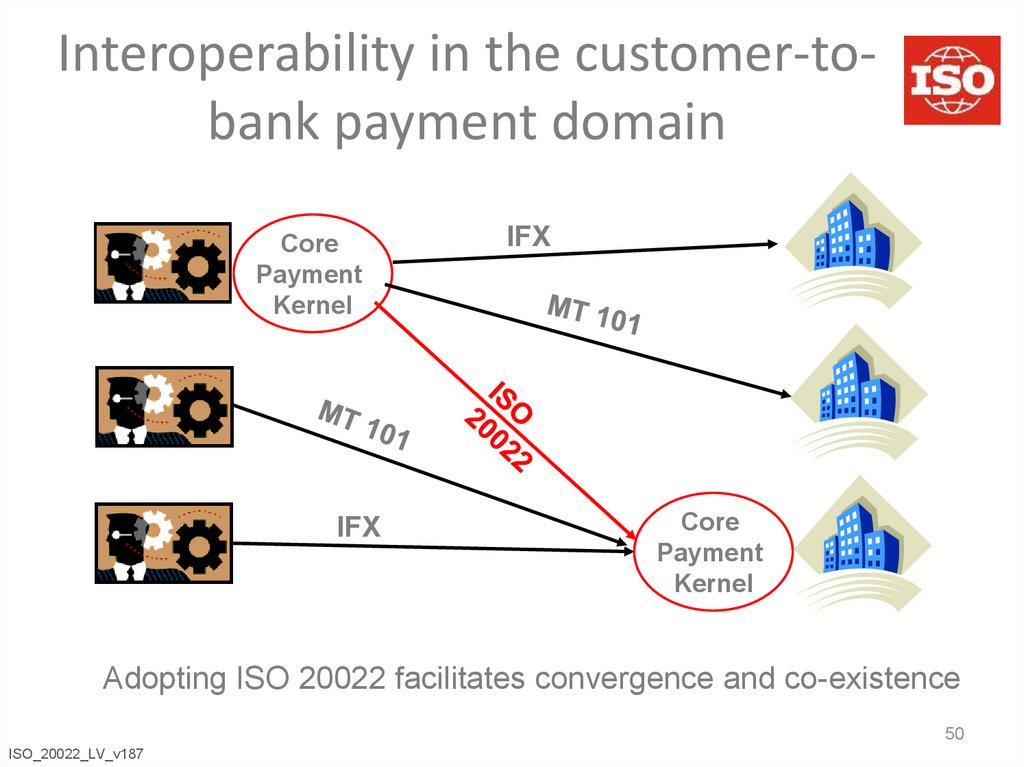

50. Interoperability in the customer-to-bank payment domain

Interoperability in the customer-tobank payment domainCore

Payment

Kernel

IFX

IFX

Core

Payment

Kernel

Adopting ISO 20022 facilitates convergence and co-existence

50

ISO_20022_LV_v187

51.

www.iso20022.orguestions

A

&

nswers

iso20022ra@iso20022.org

51

ISO_20022_LV_v187

finance

finance