Similar presentations:

Determination of the securities market and its types

1.

2. Contents:

1. Determination of the securities marketand its types

2. Functions of the securities market

3. The structure of the securities market

4. Types and models of legal regulation of

the stock market

3. 1. Determination of the securities market and its types

Stock Market - is a set of economic relations over theissue and circulation of securities among its

participants.

Kinds of securities markets:

- International and domestic securities markets;

- National and regional markets;

- Markets for specific types of securities (debt and

equity);

- Markets for government and corporate securities;

- Markets of the primary and derivative securities.

4. Capital investment is depending on many factors:

- The level of profitability of the market;- Terms of regulation and taxation;

- The level of risk as the probability of loss

of capital or non-receipt of expected

income;

- The perfection of market organization

and working conditions of participants,

especially investors.

5. Primary market & Stock market

Primary market & Stock market• Markets, where you can only invest, or the

primary market.

• The process of distribution and redistribution of

financial resources, capital is carried out on the

market of financial resources, the stock market

(Fig.1).

• Temporarily free funds received for the financial

markets, which provide the possibility of their

redistribution in different forms.

6.

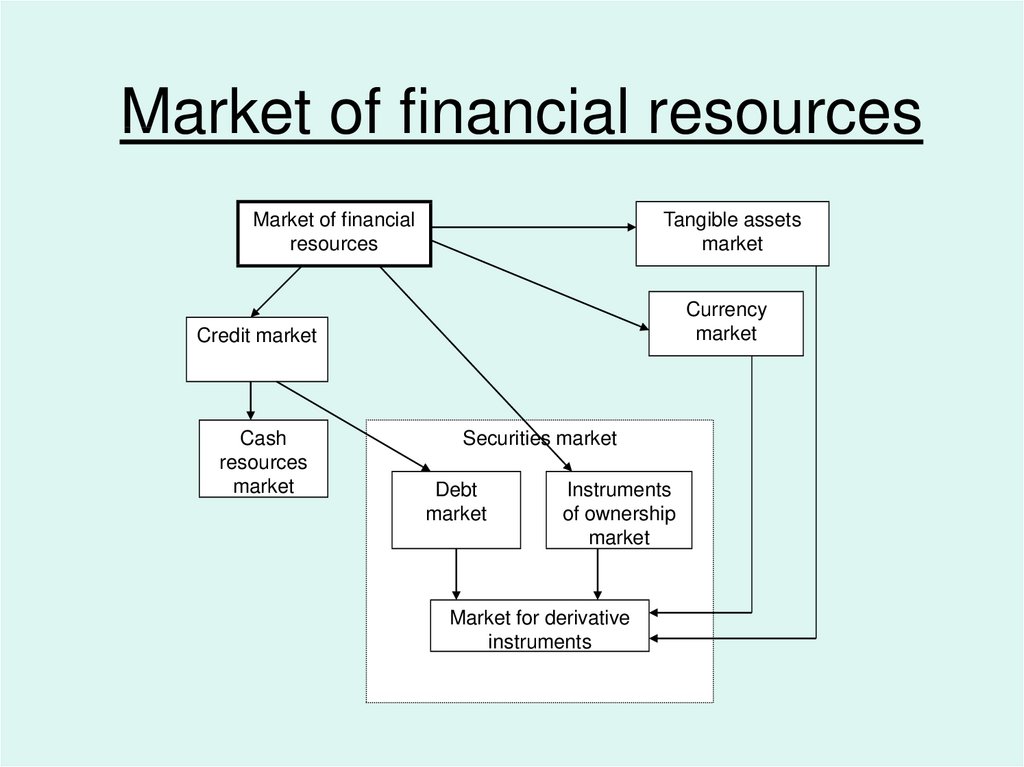

Market of financial resourcesMarket of financial

resources

Tangible assets

market

Currency

market

Credit market

Cash

resources

market

Securities market

Debt

market

Instruments

of ownership

market

Market for derivative

instruments

7. Credit market

• The credit market - a mechanism for therelationship between legal entities (enterprises,

state), which require funds for its development

and operation, on the one hand, and the

businesses and citizens on the other hand, who

can give (lend) the funds.

• Credit market possibilities:

- Integration of small and large funds from various

individuals and entities as a base for cash funds;

- Transformation of these funds in debt capital for

investment;

- The granting of loans government agencies,

businesses and the public.

8. Currency market & tangible assets market

Currency market & tangibleassets market

• Currency market - a mechanism for organizing

economic and legal relationships between consumers

and sellers of currencies, the state organs are the

regulators of the market, engaged in buying and selling

currencies.

• Conversion operations are called transactions in the

currency market to exchange a specified amount in one

currency for funds in another currency at an agreed rate

on a specified date.

• The market, which are bought and sold various material

or real resources - tangible assets market or

commodity markets (various food and commodity

exchanges)

9. Cash resources market & Debt market

Cash resources market & Debtmarket

• Cash resources market operates primarily in

the form of banking credits to cover the relations

arising on the provision by credit institutions

repayable loans and paid relating to the design

of special documents, which can not be sold,

bought or redeemed.

• The issue of bonds as the debt is usually carried

out with pre-fixed and pre-negotiated terms of

the full debt plus interest. This operation is

performed on the debt market.

10. Instruments of ownership market & Derivatives market

Instruments of ownership market& Derivatives market

• Attraction of additional owners of the funds through the

sale for each new shareholder of a certain number of

shares, which certifies the right to own a certain

percentage of stock company assets. This operation

relates to the instruments of ownership market.

• The market, which are converted to derivatives securities

(options and futures) is the market for derivative

instruments or derivative securities (derivatives).

Derivative securities - are instruments whose value is

determined by the value of certain assets, called the

base.

11. Securities market & Securities

Securities market & Securities• Securities market includes part of a credit relationship

(bond market) and the relations of co-ownership (stock

market).

• Securities - financial documents that indicate

ownership, or loans, determine the relationship between

the person who issued them and their owner, and

provide, as a rule, the payment of income in the form of

dividends or interest, as well as the possibility of

transferring money and other rights that derived from

these documents to others.

12. 2. Functions of the securities market

• General market functions:- Business function, function of getting profit from

operations in this market;

- Price function, market provides a process of folding of

market prices, their constant movement;

- Information function, market produces and brings to its

members information about the objects of trade and its

participants;

- Control function, market creates the rules of trade and

participation in, the procedure for settling disputes

between the parties, establishes priorities, control

bodies, or even control.

13. Specific functions:

Besides the market functions inherent any market (price,information, commercial, regulating), the equity market

executes two specific functions:

1) the redistributive. it means:

• Redistribution of money resources between branches

and lines of business;

• Transfer of savings from unproductive in the productive

form;

• Public finance financing on not inflationary basis, that is

without issue in the circulation of additional money

resources.

2) insurance of price and financial risks (hedging) which

became possible thanks to occurrence of a class of

derivative securities (in particular options and financial

futures).

14. 3. The structure of the securities market

Depend on the way of trade in this marketthere are such markets:

- Primary and secondary;

- Organized and unorganized;

- Stock and out stock;

- Traditional and computerized;

- Cash and term.

15. Primary market & Secondary market

Primary market & Secondarymarket

• Primary market - a market first and re-issues (issues) of

securities, on which their initial placement among

investors.

• The main task of the primary market is to minimize the

risks of investors.

• Secondary market - this circulation previously issued

securities, change of ownership.

Thus there is a regulation of market prices,

spontaneously and constantly changing market

conditions.

• The main objective is to provide liquidity of securities,

creating the conditions for trade, the conditions for rapid

implementation of securities by the owners at the prices

in the market.

16.

• Organized securities market - their circulation on thebasis of firm rules between licensed professional

intermediaries – by the market participants on behalf of

other market participants.

• Unregulated market - is the circulation of securities

without compliance with the uniform for all participants of

the market rules.

• Stock Market - a trading of securities on stock markets.

This is the organized market with the maximum level of

control and regulation.

• Outstock market encompasses securities transactions

outside the stock exchange.

17. Traditional & Computerized Cash & Term Markets

Traditional & ComputerizedCash & Term Markets

Securities trading may be carried out on traditional and

computerized markets.

Computerized market characterized by:

- Lack of physical place where buyers and sellers, and

therefore, the lack of direct contact between them;

- Full automation of the trading process and its services,

the role of market participants is reduced mainly only for

delivery of their bids for the sale of securities in the

trading system.

Cash market securities (spot market) - is a market with

immediate execution of transactions, with full

implementation of transactions (delivery versus

payment) for 2 or 4 working days.

Term Market - a market in which transactions have the

term of execution more than 4-5 working days. Most of

the terms of execution for 3 months.

18. 4. Types and models of legal regulation of the stock market

• World standards of the stock market have beenworked out by "Group of Thirty" - nongovernmental experts on the organization of the

international financial system.

• The purpose of standards - reduction in time

between the transaction and its implementation,

as well as guaranteeing the performance of the

contract. Recommendations:

- All transactions by securities carried out on the

principle "delivery versus payment";

- Verification of all conditions of the parties made

not later than the day after the transaction (T +1);

19.

• - Agreements executed not later than2 business days after the conclusion of (T +3);

- Cash payments are the same for all

transactions procedures;

- Savings of securities are implemented by a

single central depository;

• To account documents on transactions with

securities and numbering used standards of

the International Organization for

Standardization

20.

Security markets regulation is concerned withoverseeing the circulation of information

about securities that are traded, monitoring

the market for the abuse of information or

financial resources to manipulate market and

prices and supervising the corporate

governance of organized markets.

21. Legal Regulation of Securities and Stock Market in Ukraine

• The EBRD’s 2008 Law in Transition reports that Ukraine’ssecurities legislation was in “high compliance” with the

Objectives and Principles of Securities Regulation established

by the International Organization of Securities Commissions

(IOSCO). Since then Ukraine has adopted the Joint-Stock

Companies Act and other regulations improving the legal

framework in the area of securities even further. Nevertheless,

as with many other laws in Ukraine, the practical application of

the laws and regulations is rather far from perfect.

22.

The Securities Commission is the main regulator of the Ukrainiansecurity market. The Security Commission is a state authority

subordinated to the President of Ukraine and accountable to the

Verkhovna Rada (the Ukrainian Parliament). It is responsible for

developing and implementing uniform state policy on the

functioning of the Ukrainian securities market as well as

monitoring the compliance of all Ukrainian securities market

participants with Ukrainian securities legislation. The Security

Commission has the power to apply sanctions against parties.

23.

Types of legal regulation1. General allowance: it is based on the whole allowance, from which we

take exclusions in the form of prohibitions. Its formula – everything is

allowed, except that ones, that are directly prohibited.

2. General permission: it is based on the whole prohibition of some

kind of action, but in the individual order some prohibited behavior

can be allowed. Its formula – everything, except directly permitted, is

prohibited.

24. How the U.S. Stock Markets are Regulated

Stock markets of different countries have different operatingmodel , its own rules and system of government. But despite their

differences, the organizational structure of the system of regulation

in the vast majority of states , based on the concept of two-tier

system of regulation.

25. Regulatory system

• The organizational structure of the regulatory systembased on the concept of a two-level system of

regulatory authorities. The first level - regulatory

agencies, the second - self-regulatory organizations

(SROs), created by professional securities market

participants. These include various kinds of unions,

associations, leagues of professional participants, stock

exchanges and the organizers of the outstocks trade.

• In almost all countries the investment business is

highlighted in a special area of economic legislation and

administrative oversight.

26. Two main models for regulating the securities market

The first model - the regulation of the stock market is mainlyconcentrated in government and only a small part of the authority

to oversee, control , establish binding rules of conduct passed state

SRO professional market participants. This approach is used in

the United States and France.

27.

The second model - the maximum possible amount ofpowers transferred CPO important in controlling not

take tough regulations and the negotiation process , the

individual agreements with professional market , while

the state reserves the basic control functions , the ability

to intervene at any point in the process of self-regulation .

An example of such a model is the United Kingdom.

28.

From more than 30 countries with developed securities marketsmore than 50% are independent agencies ( Commission on

Securities and Exchange Commission - the U.S. model , the

Bureau of Securities - Japan, the Federal Office for Banking

Supervision - Germany , the Council for Securities and Investment

- UK Commission on exchange transactions - France , the

Commission on securities and stock Exchange and the

Supervisory Board of the Securities - Korea) , about 15 % of the

countries in the stock market is the Ministry of Finance.

29. Ukrainian regulatory system

• In Ukraine, the regulatory system of the stockmarket took two stages. The first phase (1991 1995 years.) Characterized by the fact that the

main regulatory authority of the state was the

Ministry of Finance.

• The second phase began in 1995 when the

Presidential Decree “About the State

Commission on Securities and Stock Market”

was adopted.

30. The State Commission on Securities and Stock Market

• The purpose of the State Commission onSecurities and Stock Market is the policy-making

in the management and development of

securities market that would ensure fair trade

and competition between traders of securities

and ultimately - protect the rights of investors.

• Major tasks of the regulatory bodies:

- registration of Securities Dealers, as well as

those who advise investment

- ensuring transparency

- maintain law and order in the stock market

31. Self-regulation

• This is primarily Stock Exchange, representingthe auction, where the purchase - sale of

securities is, by exchanging oral instructions

between traders and the prices are formed

according to the law of supply and demand.

• Another body of industry self-monitoring and

self-regulation are a professional association

of investment business.

• In Ukraine, a similar function is fulfilled by the

Association of Securities Dealers.

32. IN USA

The U.S. Congress is at the top of the heap. It created most ofthe structure and it passes major laws that affect how the industry

operates. It also authorizes budgets for the Securities and

Exchange Commission and other agencies involved in regulatory

duties.

The SEC is the top regulatory agency responsible for

overseeing the securities industry. It registers new securities and

handles all the filings that public companies must make, such as

annual and quarterly reports.

33. USA

At the next level is the Financial Industry Regulatory Authority(FINRA). It was created in 2007 when the National Association of

Securities Dealers merged with the regulatory functions of the

New York Stock Exchange. This is an industry self-regulatory

body that is responsible for policing the securities industry.

FINRA set standards for stockbrokers and other industry

professionals and licenses them after comprehensive

examinations.

finance

finance