Similar presentations:

The Role and Function of a Stock Exchange

1.

2. The Role and Function of a Stock Exchange

ByEnid E Bissember

GASCI

3. Outline

Overview of financial

markets

Institutional infrastructure

Role and functions of stock

exchange

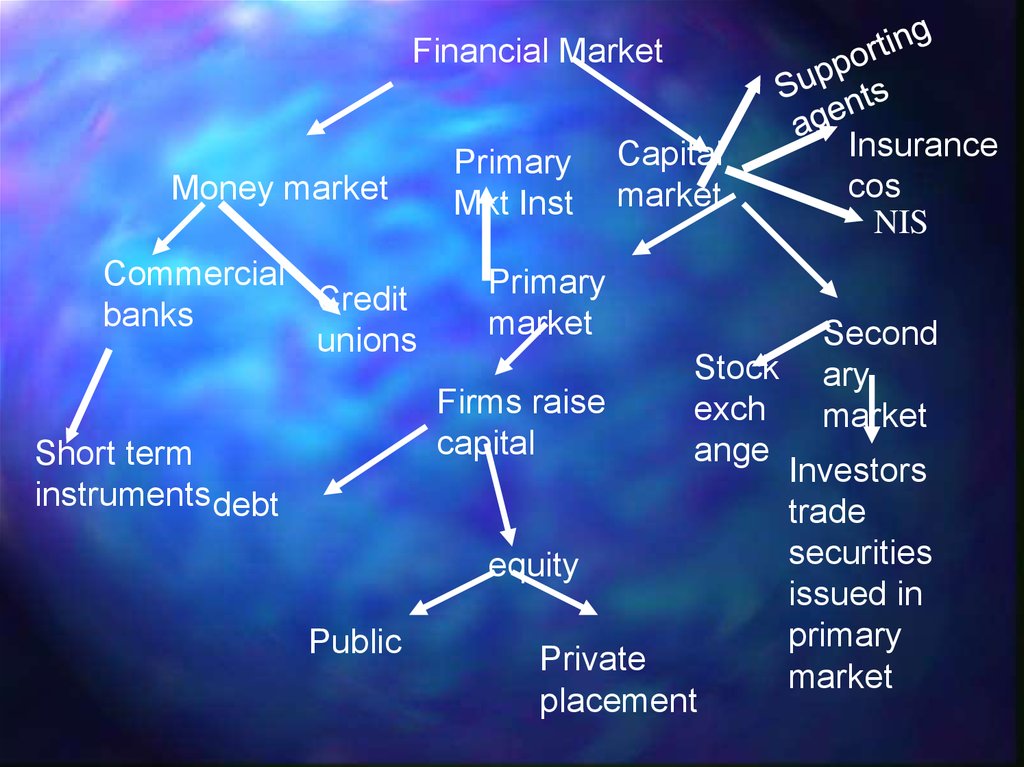

4. Overview of Financial Markets

Two types of financial markets

• Money markets

• Capital markets

• Primary market

• Secondary market

5.

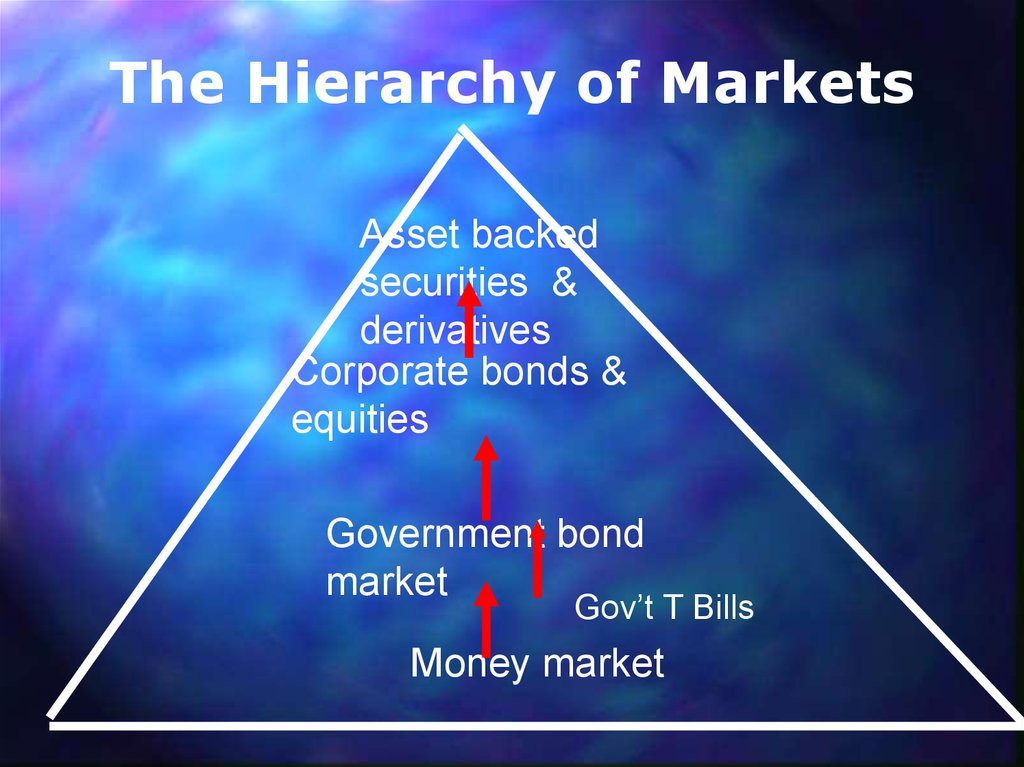

The Hierarchy of MarketsAsset backed

securities &

derivatives

Corporate bonds &

equities

Government bond

market

Gov’t T Bills

Money market

6.

Financial MarketMoney market

Commercial

Credit

banks

unions

Primary

Mkt Inst

Primary

market

Firms raise

capital

Short term

instruments debt

Capital

market

Stock

exch

ange

equity

Public

Private

placement

Insurance

cos

NIS

Second

ary

market

Investors

trade

securities

issued in

primary

market

7. Market infrastructure

• Stock exchange• Clearing and settlement

• Education and training

• Investors’ protection

• Rating agency

8. Instruments

• EquitiesMost popular investing

instruments

Stocks and shares

Bonus issues

Rights issues

• Bonds

Corporate

Government

9. Intermediaries

• Brokerage houses• Stock brokers

• Advisors

Hand in Hand

Beharry

stockbrokers

Trust company

GuyAmerica

10. Regulation & Supervision

Regulation & SupervisionA few questions

• Ever wondered how the capital

markets work

• Who sets the rules

• What does the stock exchange do

• What is the role of the stock broker

• How to become a registered broker

11. The Regulator

• Foremost authority presiding over thecapital markets

• With mission to promote and maintain

Fair, efficient , secure and transparent

market and to facilitate the orderly

development of the stock exchange

12. Role and Functions of a stock exchange

Established for thepurpose of assisting,

regulating and controlling

business of buying,

selling and dealing in

securities

13. Role and Functions of a stock exchange cont’d

• Provides a market for the trading ofsecurities to individuals and

organizations seeking to invest

their saving or excess funds

through the purchase of securities

14. Role and Functions of a stock exchange cont’d

Provides a physical locationfor buying and selling

securities that have been

listed for trading on that

exchange

15. Role and Functions of a stock exchange cont’d

Establishes rules for fairtrading practices and

regulates the trading

activities of its members

according to those rules

16. Role and Functions of a stock exchange cont’d

The exchange itselfdoes not buy or sell the

securities, nor does it

set prices for them

17. Fair

The exchange assuresthat no investor will have

an undue advantage over

other market participants

18. Efficient market

This means that ordersare executed and

transactions are settled

in the fastest possible

way

19. Transparency

Investor make informedand intelligent decision

about the particular stock

based on information

20. Transparency cont’d

Listed companies mustdisclose information in

timely, complete and

accurate manner to the

Exchange and the public

on a regular basis

21. Transparency cont’d

Required information includestock price, corporate

conditions and developments

dividend, mergers and joint

ventures, and management

changes etc

22. Doing business

People who buy or sellstock on an exchange do

so through a broker

23. Doing business cont’d

The broker takes your orderto the floor of the exchange

looks for a broker

representing someone

wanting to buy/sell

• If a mutually agreeable price

is found the trade is made

24. Some type of orders

Limit order

Market order

Day order

Open

All or none

Any part

Good through

25. Price

At any point in time, theprice of previously

issued stock is

determined by the ebb

and flow of supply and

demand

26. Listing requirements

There are specificrequirements for allowing a

public company to list its

securities on the Stock

Exchange these are set out

in the legislation

27. Benefits of listing

• Visibility• Market support

• Investors confidence

• Increased demand for products and

services

• Overall increase in profitability

28. Once traded

• Aura of reliability• Accuracy in reporting

financial data

• Reputation

• Strength

29. Delisting

Stock exchange can delist companiesfor a number of reasons including :• Merger with another company

• Solvency problems

• Name change company asked to be

removed

• Failure to comply with exchange rules

30. Desirable Characteristics of a stock market

LiquidityAbility to sell an asset

quickly at a fairly

known price Low

transactions costs

31. Desirable Characteristics of a stock market cont’d

• Availability of informationMarket efficiency

• Prices react quickly to new

information

• Small price fluctuations

• Narrow price spread

32. Financing the exchange

• Transaction fees paid by members foreach order executed

• Fees paid by firms when their securities

are originally listed

• Annual fees by firms

• Entrance fees from new members

• sale of historic trading and market

information

33. Major challenges for the Exchanges

• Cross border trading• Issuers and investors are

expanding their horizons beyond

their home markets

• Investors becoming much more

demanding

34. Regulatory improvement Transparency and Corporate Governance

•Regulatory improvementTransparency and Corporate

Governance

Protection to

minority

Shareholders

Corporate

Governance

Disclosure

Enhance

market

confidence

Strong

industry

regulator

35.

OwnersOwnership of the

company is by the

public in the form of

shares one share,

one vote

Board is elected by

shareholders to

represent the best

interests of the owners

Managers

Board hires and fires the

management of the

company

finance

finance