Similar presentations:

Chapter 24. Portfolio performance evaluation

1.

CHAPTER 24Portfolio Performance Evaluation

INVESTMENTS | BODIE, KANE, MARCUS

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

2.

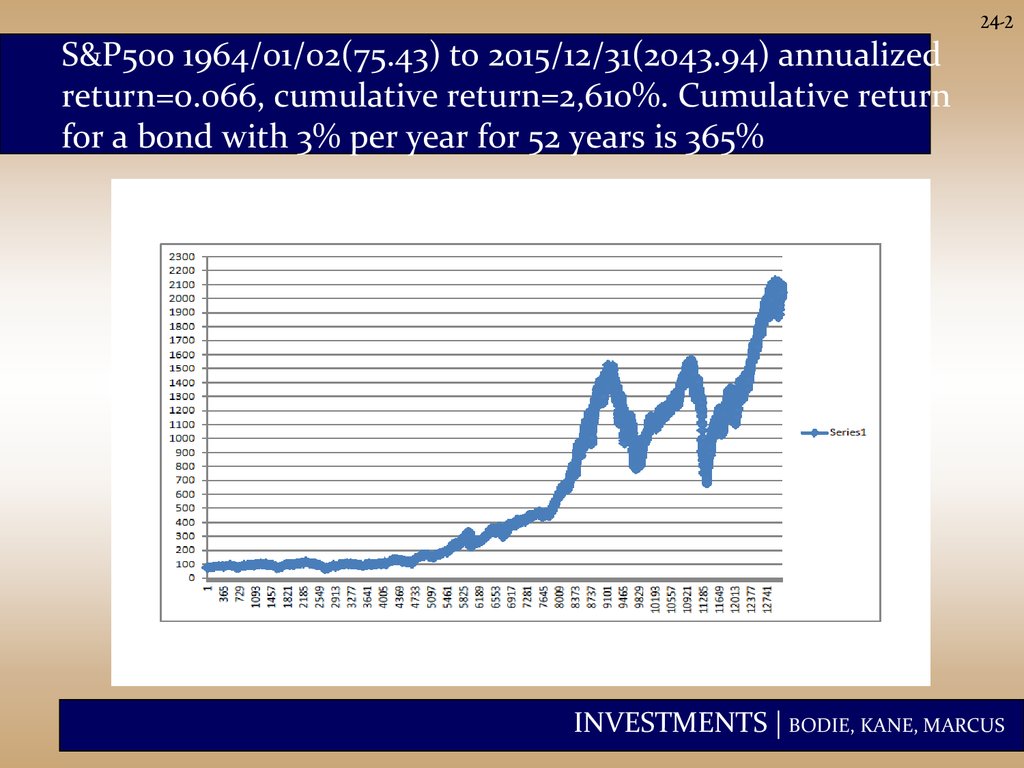

24-2S&P500 1964/01/02(75.43) to 2015/12/31(2043.94) annualized

return=0.066, cumulative return=2,610%. Cumulative return

for a bond with 3% per year for 52 years is 365%

INVESTMENTS | BODIE, KANE, MARCUS

3.

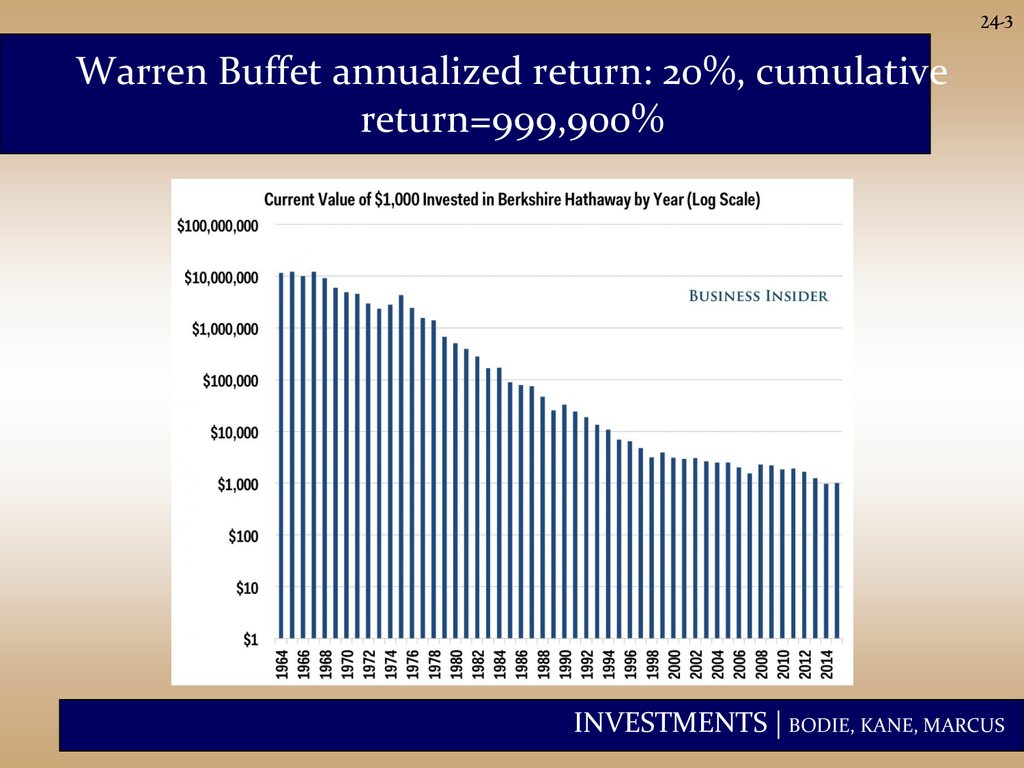

24-3Warren Buffet annualized return: 20%, cumulative

return=999,900%

INVESTMENTS | BODIE, KANE, MARCUS

4.

24-45 Investors With Better Returns Than Warren

Buffett

By Damian Davila on 19 February 2015

1. Carl Icahn: From 1968 through 2011, Icahn grew his original $100,000 investment in his firm at a 31%

annual rate, while Buffett's Berkshire Hathaway had "only" a 20% annual growth

2. George Soros: He is best known for his September 16, 1992 transaction, when he made a

Single day gain of $1 billion dollars by short selling the British pound (a short sale is a bet

that the value of something will drop). This successful bet earned him the nickname of "the

man that broke the Bank of England,“

3. Peter Lynch: If you had invested $1,000 in Fidelity's Magellan Fund

during Lynch's tenure, you would have earned $28,000 (cumulative return=2,700%, annualized

return=70%). During those 13 years, Lynch reportedly beat the S&P 500 Index (a key benchmark of the

stock market) in 11 of those 13 years. He transformed $18 million in assets into more than $14 billion.

4. John "Jack" Bogle: Under Bogle's leadership, Vanguard became the second largest fund company,

commanding $428.4 billion, or 8.83% of all mutual fund assets by Bogle's retirement in 1999. The

number one spot that year went to Lynch's Fidelity.

5. Michael Steinhardt: From 1967 to 1995 (that's 28 years!) his hedge fund returned an average of 24.5%

annually. What's even more impressive about this return is that it was possible even after Steinhardt's

20% cut of the Profits. To put this in perspective, let's imagine that you had $10,000 back in 1967:

If you had invested it all in Steinhardt's hedge fund, you would have ended with $4.8

million by 1995. On the other hand, the same $10,000 in the S&P 500 would have been worth $190,000.

INVESTMENTS | BODIE, KANE, MARCUS

5.

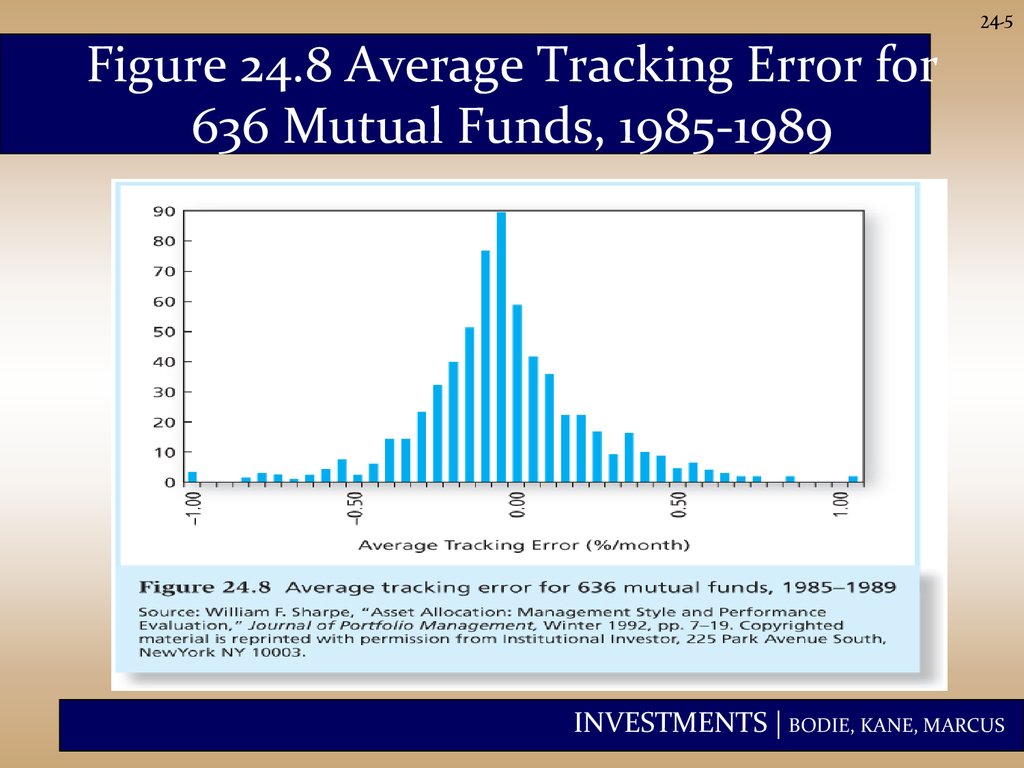

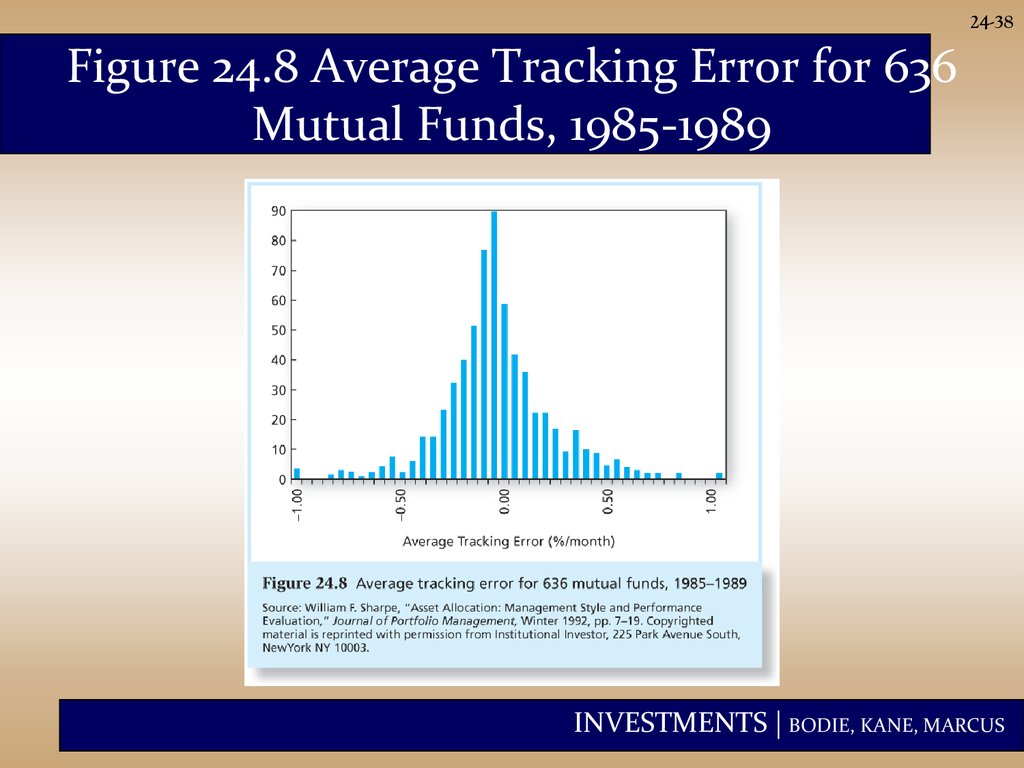

24-5Figure 24.8 Average Tracking Error for

636 Mutual Funds, 1985-1989

INVESTMENTS | BODIE, KANE, MARCUS

6.

24-6Introduction

• Two common ways to measure

average portfolio return:

1. Time-weighted returns

2. Dollar-weighted returns

• Returns must be adjusted for risk.

INVESTMENTS | BODIE, KANE, MARCUS

7.

24-7Dollar- and Time-Weighted Returns

Time-weighted returns

• The geometric average is a timeweighted average.

• Each period’s return has equal weight.

1 rG

n

1 r1 1 r2 ... 1 rn

INVESTMENTS | BODIE, KANE, MARCUS

8.

24-8Dollar- and Time-Weighted Returns

Dollar-weighted returns

• Internal rate of return considering the

cash flow from or to investment

• Returns are weighted by the amount

invested in each period:

PV

Cn

C1

C2

...

1 r 1 1 r 2 1 r n

INVESTMENTS | BODIE, KANE, MARCUS

9.

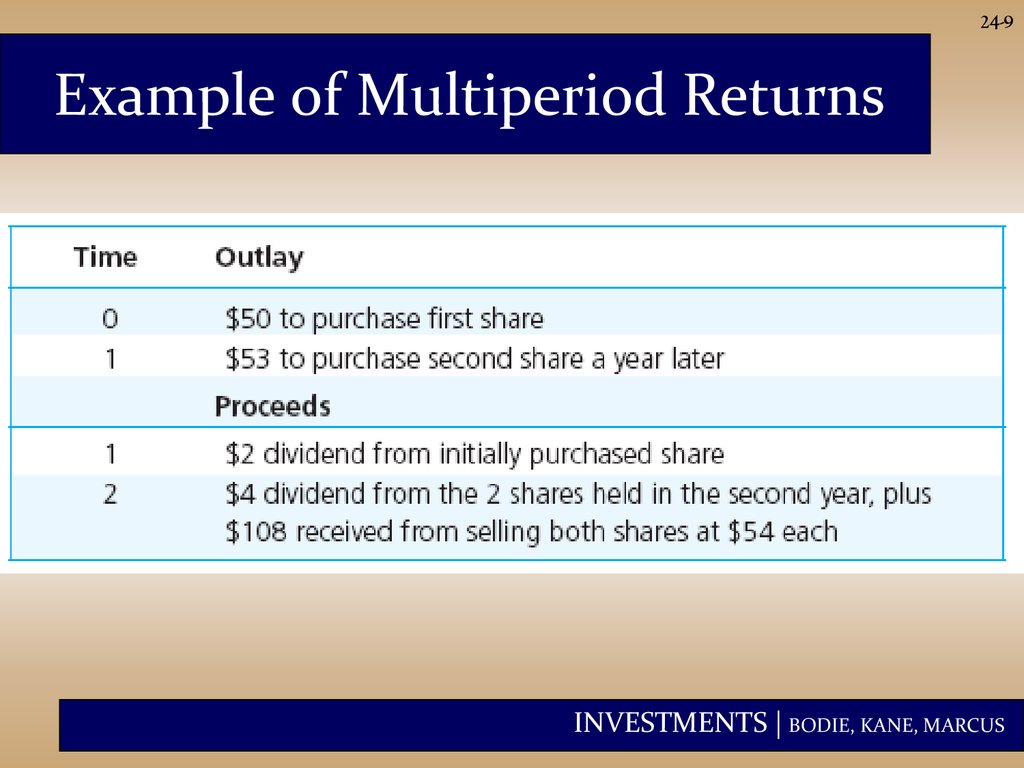

24-9Example of Multiperiod Returns

INVESTMENTS | BODIE, KANE, MARCUS

10.

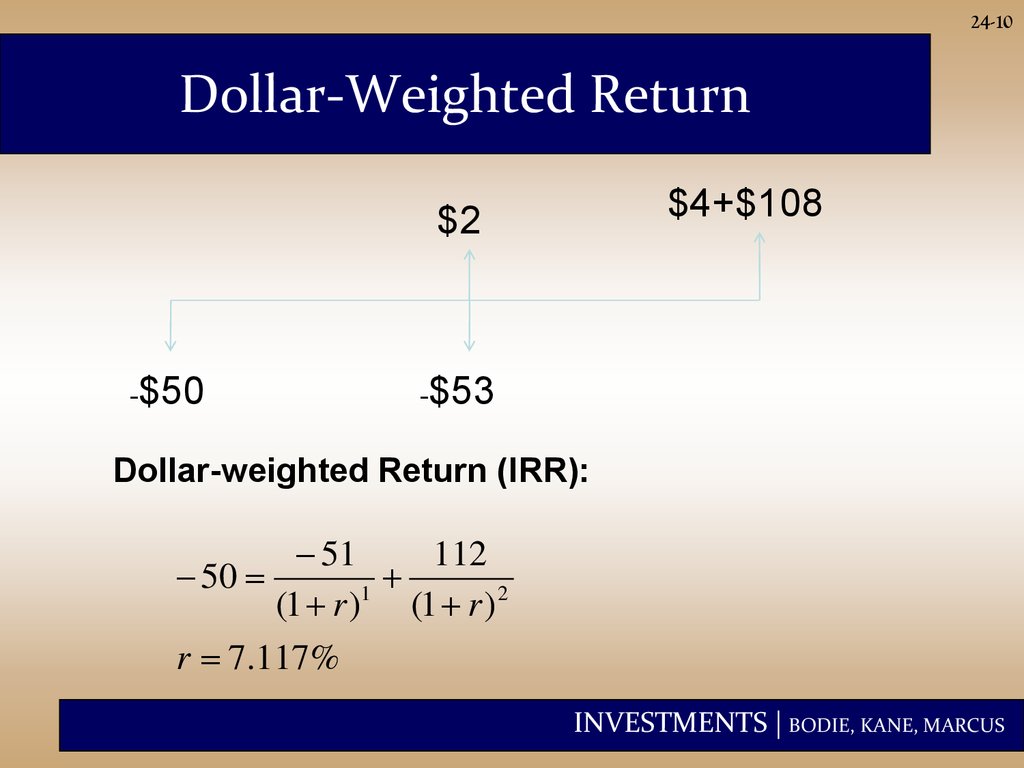

24-10Dollar-Weighted Return

$4+$108

$2

-$50

-$53

Dollar-weighted Return (IRR):

51

112

50

1

(1 r ) (1 r ) 2

r 7.117%

INVESTMENTS | BODIE, KANE, MARCUS

11.

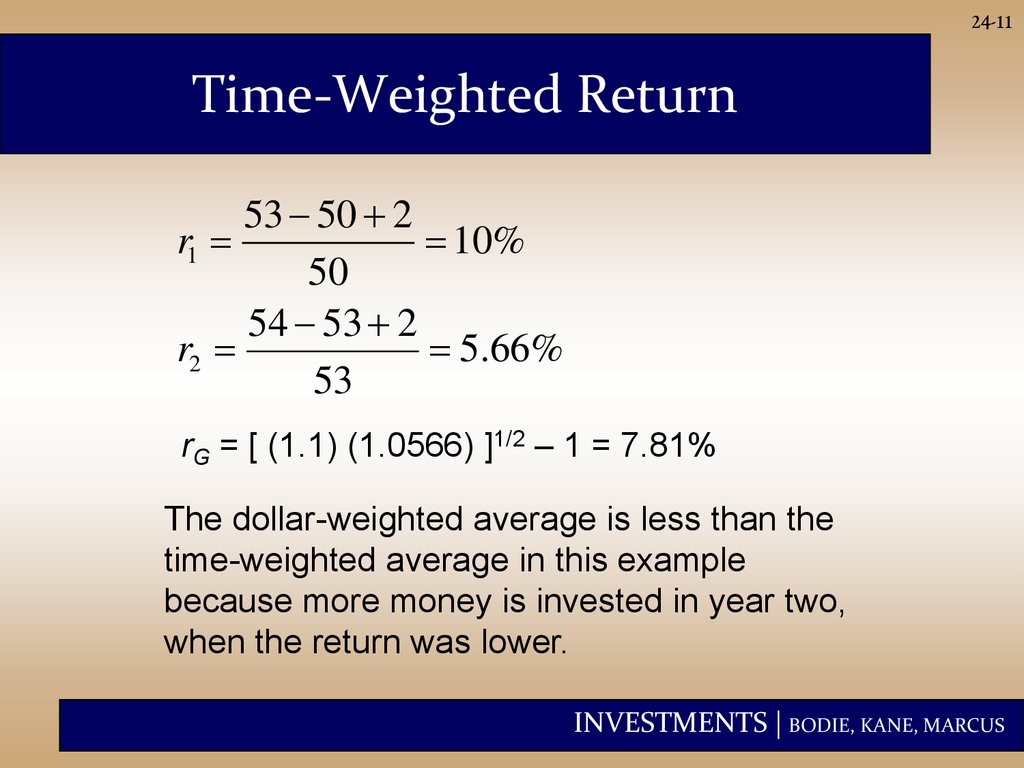

24-11Time-Weighted Return

53 50 2

r1

10%

50

54 53 2

r2

5.66%

53

rG = [ (1.1) (1.0566) ]1/2 – 1 = 7.81%

The dollar-weighted average is less than the

time-weighted average in this example

because more money is invested in year two,

when the return was lower.

INVESTMENTS | BODIE, KANE, MARCUS

12.

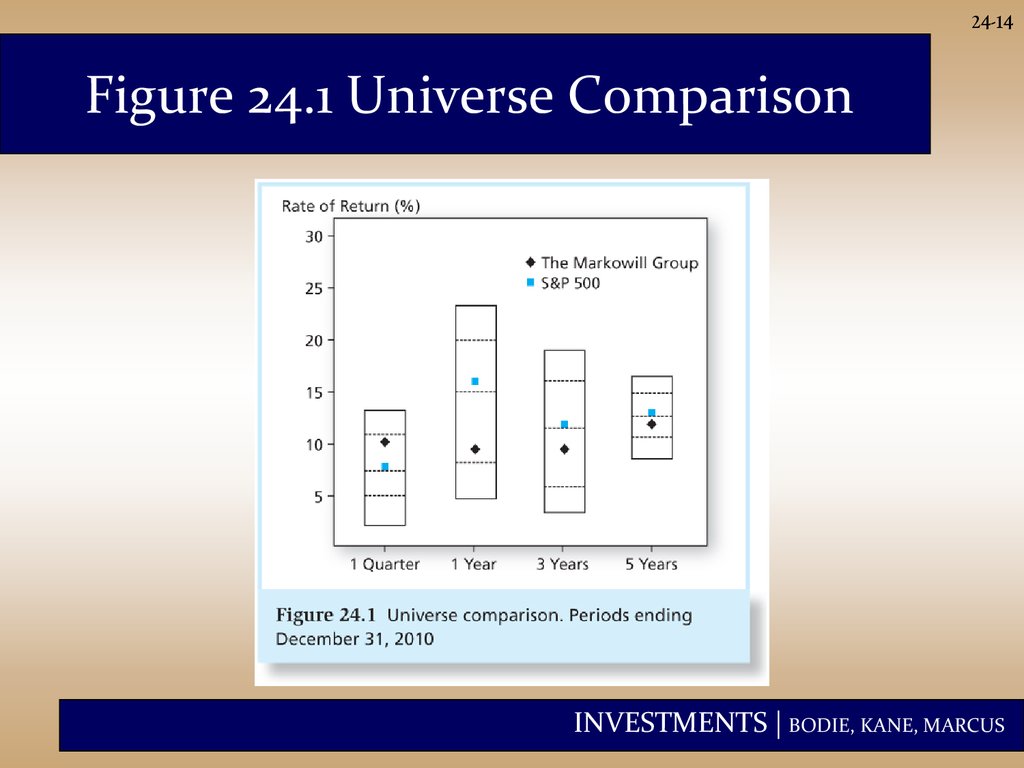

24-12Adjusting Returns for Risk

• The simplest and most popular way to

adjust returns for risk is to compare

the portfolio’s return with the returns

on a comparison universe.

• The comparison universe is a

benchmark composed of a group of

funds or portfolios with similar risk

characteristics, such as growth stock

funds or high-yield bond funds.

INVESTMENTS | BODIE, KANE, MARCUS

13.

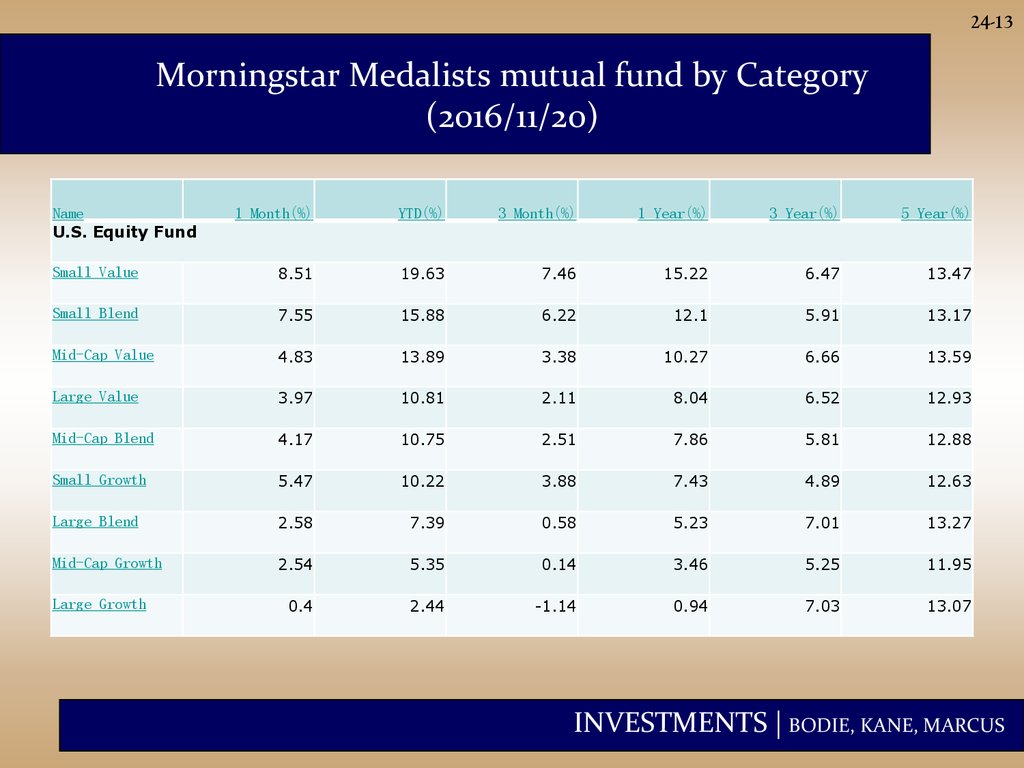

24-13Morningstar Medalists mutual fund by Category

(2016/11/20)

Name

U.S. Equity Fund

1 Month(%)

YTD(%)

3 Month(%)

1 Year(%)

3 Year(%)

5 Year(%)

Small Value

8.51

19.63

7.46

15.22

6.47

13.47

Small Blend

7.55

15.88

6.22

12.1

5.91

13.17

Mid-Cap Value

4.83

13.89

3.38

10.27

6.66

13.59

Large Value

3.97

10.81

2.11

8.04

6.52

12.93

Mid-Cap Blend

4.17

10.75

2.51

7.86

5.81

12.88

Small Growth

5.47

10.22

3.88

7.43

4.89

12.63

Large Blend

2.58

7.39

0.58

5.23

7.01

13.27

Mid-Cap Growth

2.54

5.35

0.14

3.46

5.25

11.95

0.4

2.44

-1.14

0.94

7.03

13.07

Large Growth

INVESTMENTS | BODIE, KANE, MARCUS

14.

24-14Figure 24.1 Universe Comparison

INVESTMENTS | BODIE, KANE, MARCUS

15.

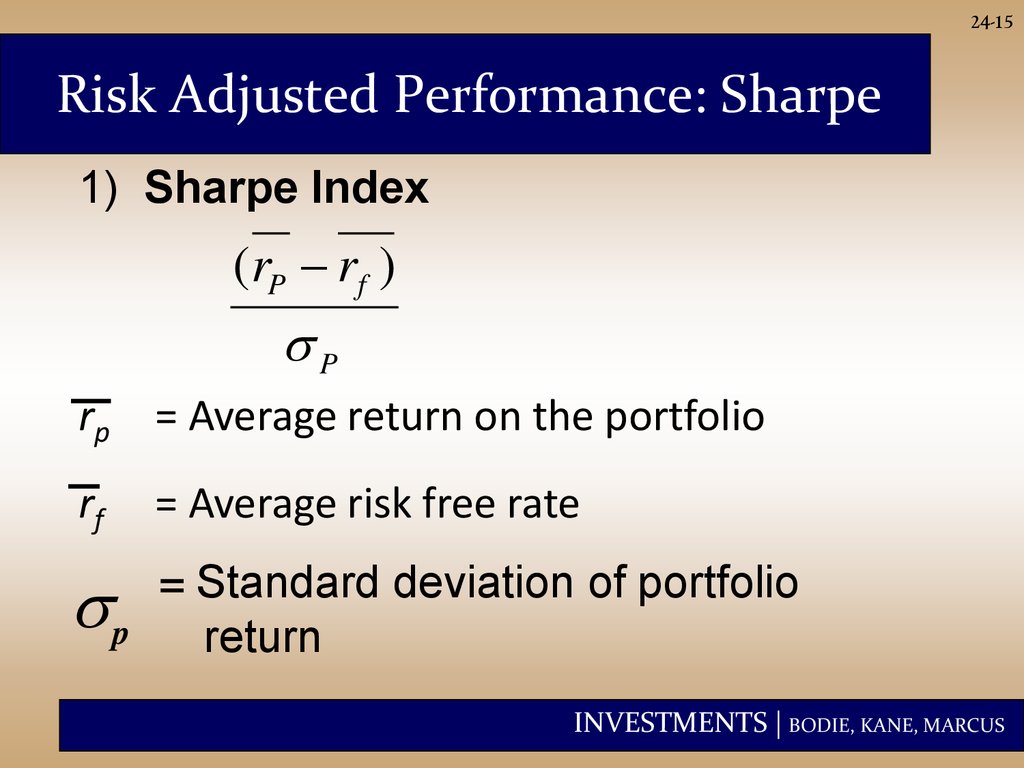

24-15Risk Adjusted Performance: Sharpe

1) Sharpe Index

(rP rf )

P

rp = Average return on the portfolio

rf

= Average risk free rate

p

= Standard deviation of portfolio

return

INVESTMENTS | BODIE, KANE, MARCUS

16.

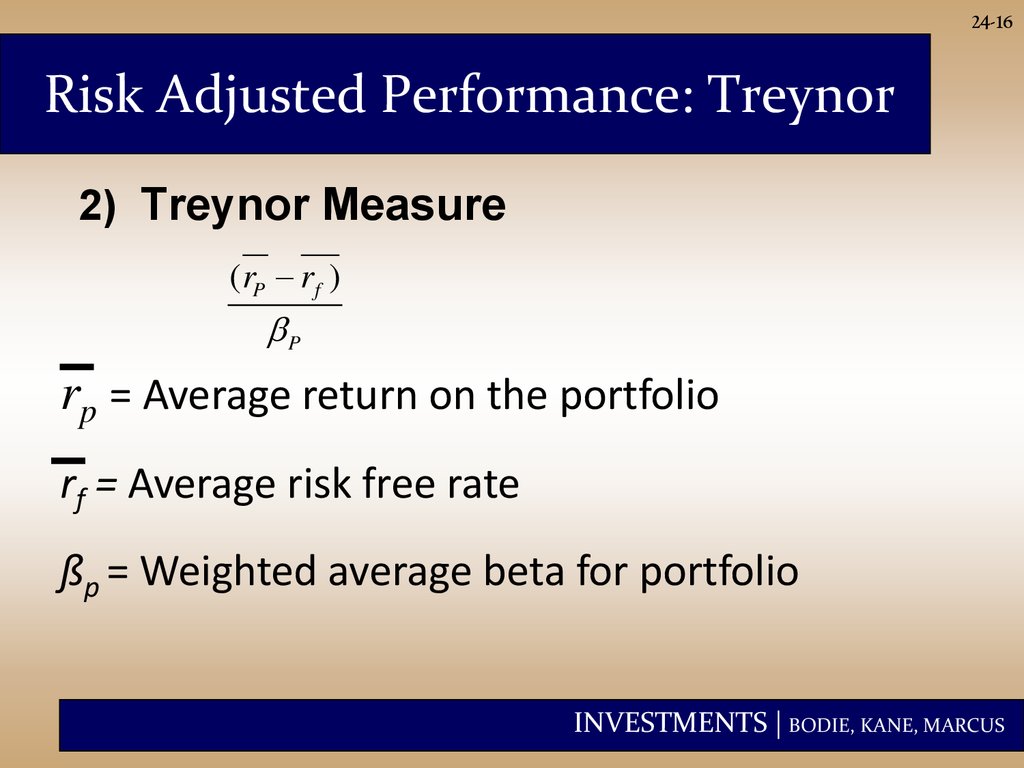

24-16Risk Adjusted Performance: Treynor

2) Treynor Measure

(rP rf )

P

rp = Average return on the portfolio

rf = Average risk free rate

ßp = Weighted average beta for portfolio

INVESTMENTS | BODIE, KANE, MARCUS

17.

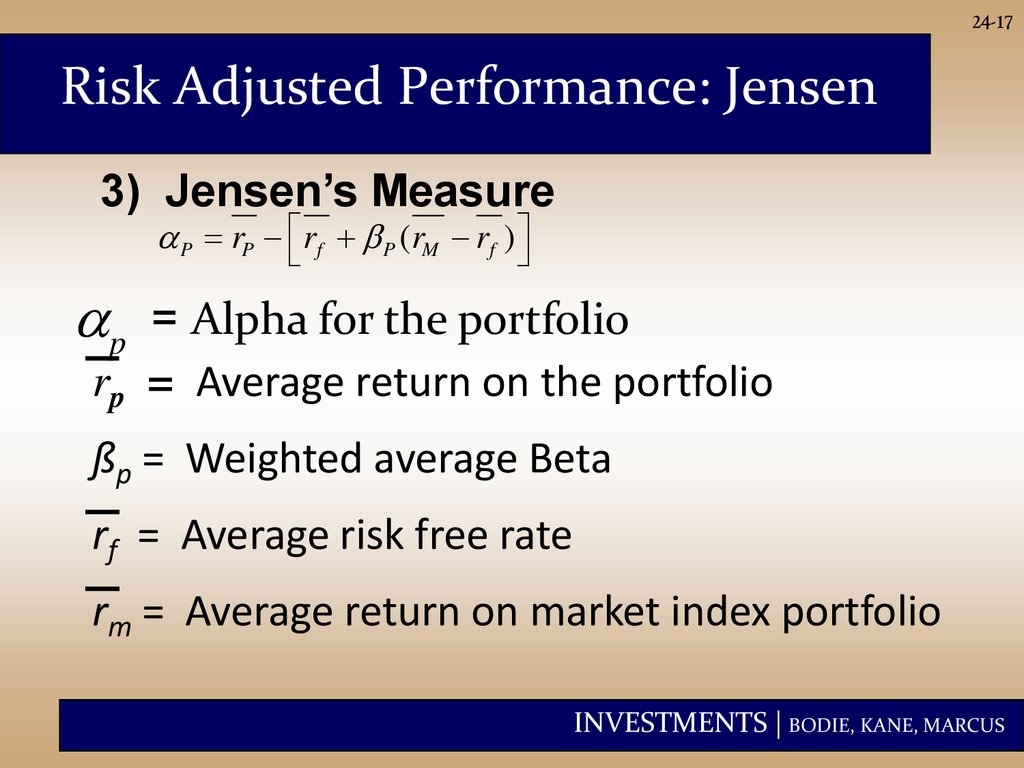

24-17Risk Adjusted Performance: Jensen

3) Jensen’s Measure

P rP rf P (rM rf )

p

= Alpha for the portfolio

rp = Average return on the portfolio

ßp = Weighted average Beta

rf = Average risk free rate

rm = Average return on market index portfolio

INVESTMENTS | BODIE, KANE, MARCUS

18.

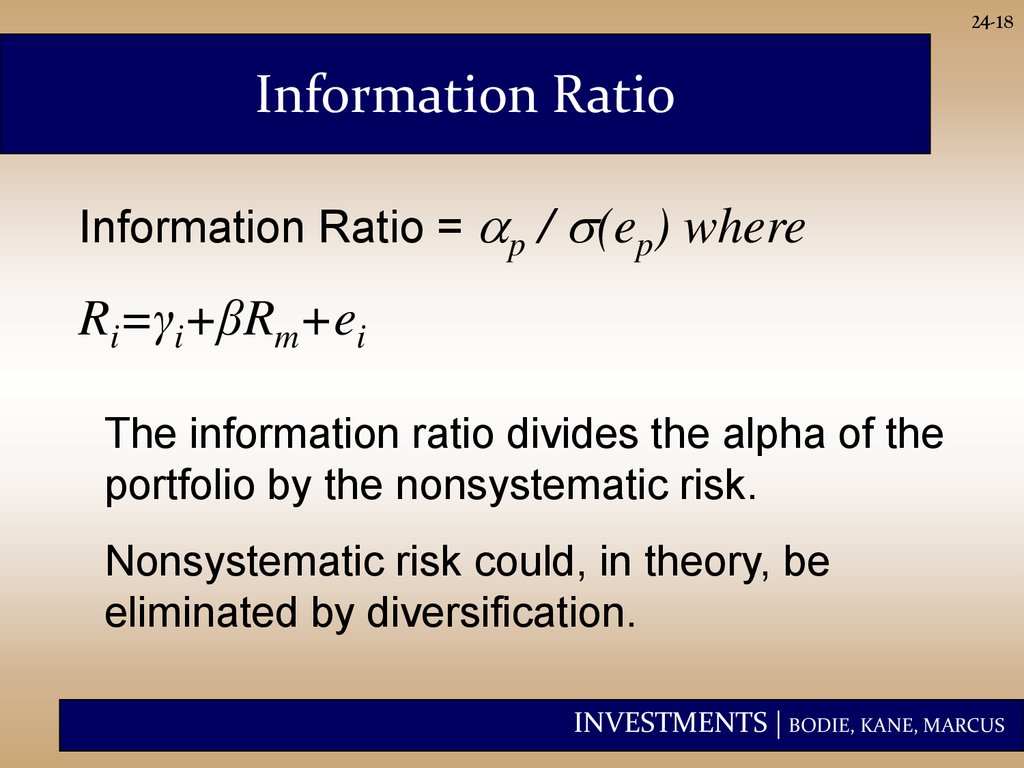

24-18Information Ratio

Information Ratio = p / (ep) where

Ri=γi+βRm+ei

The information ratio divides the alpha of the

portfolio by the nonsystematic risk.

Nonsystematic risk could, in theory, be

eliminated by diversification.

INVESTMENTS | BODIE, KANE, MARCUS

19.

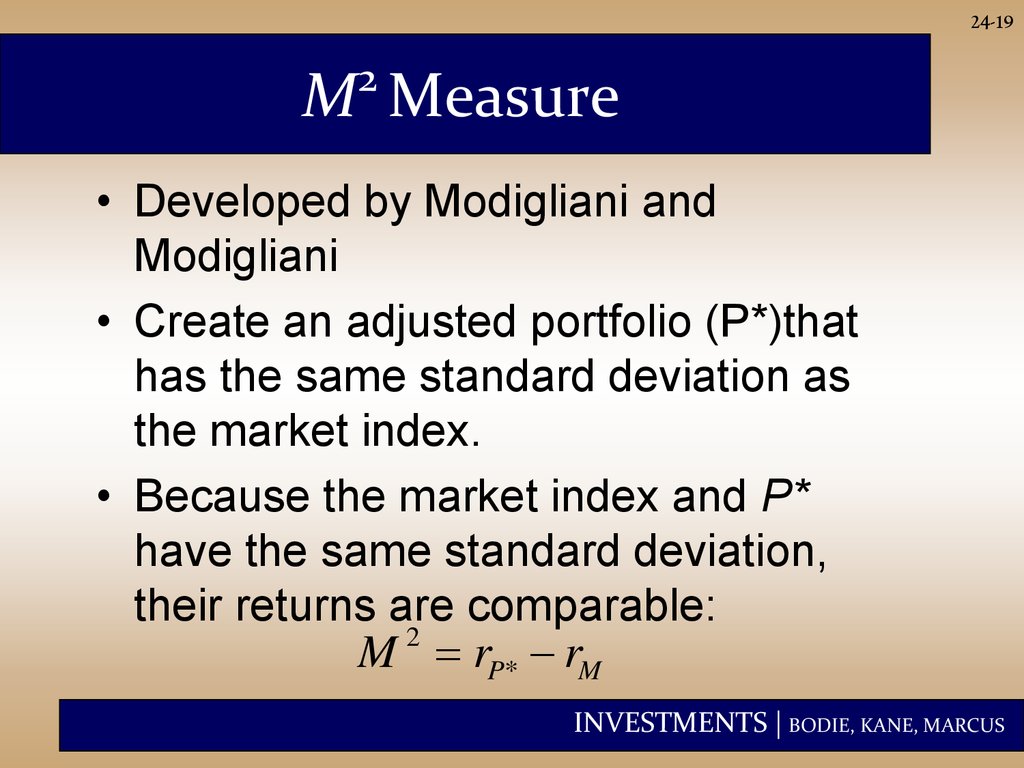

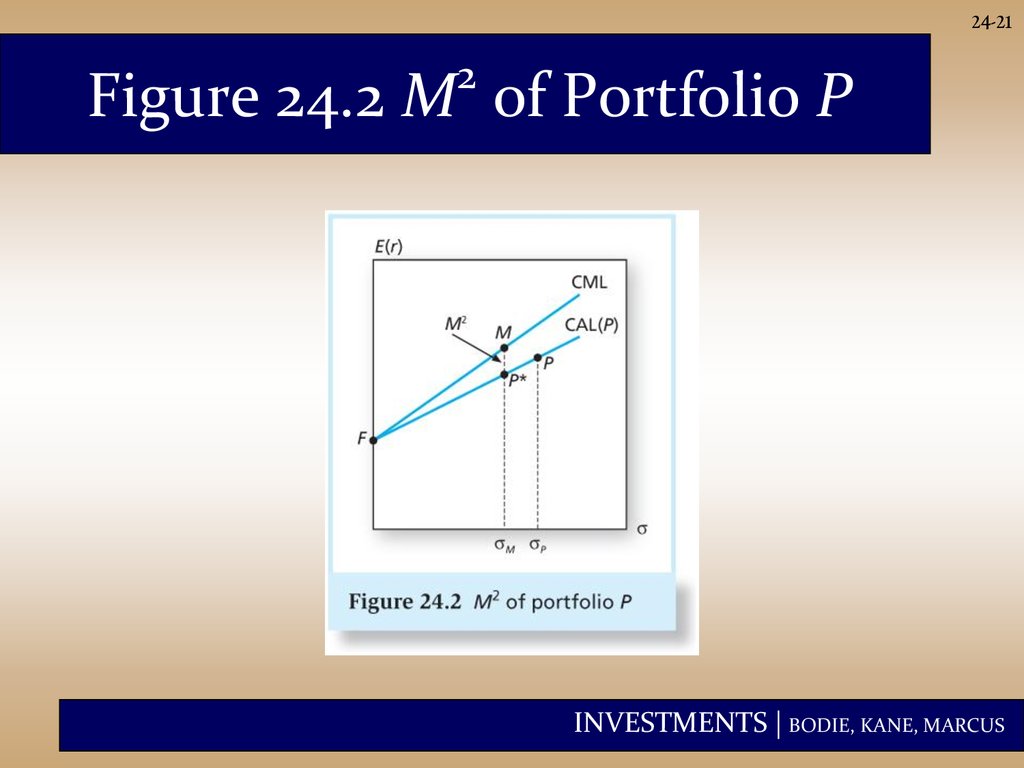

24-192

M Measure

• Developed by Modigliani and

Modigliani

• Create an adjusted portfolio (P*)that

has the same standard deviation as

the market index.

• Because the market index and P*

have the same standard deviation,

their returns are comparable:

2

M rP* rM

INVESTMENTS | BODIE, KANE, MARCUS

20.

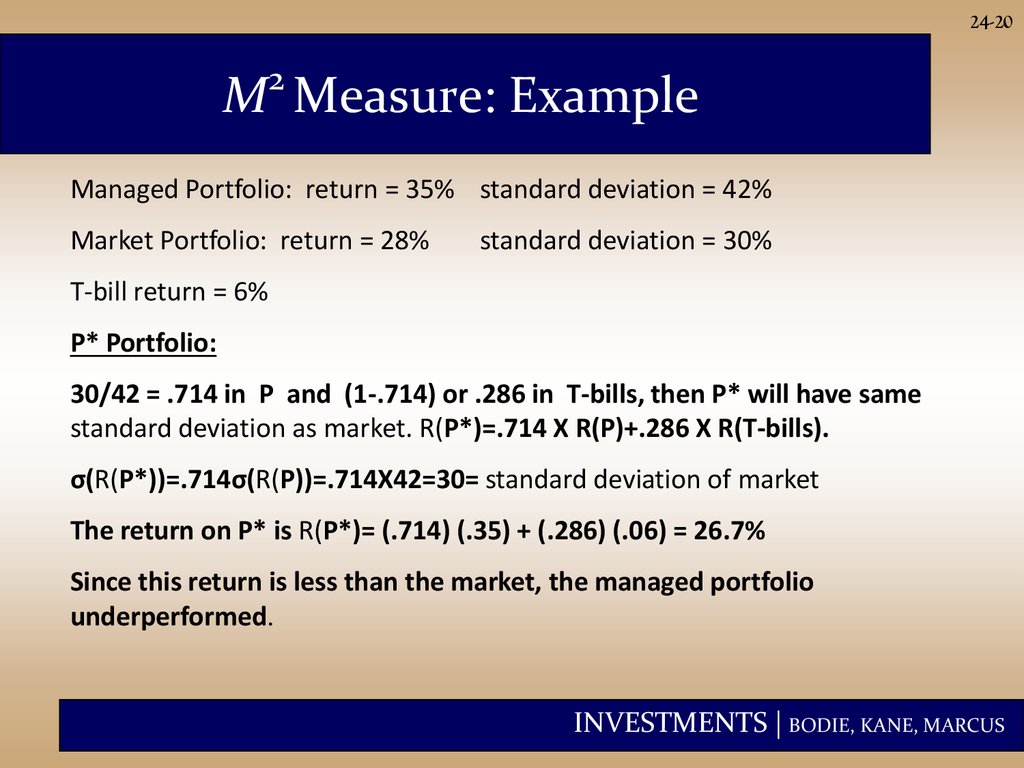

24-202

M Measure: Example

Managed Portfolio: return = 35% standard deviation = 42%

Market Portfolio: return = 28%

standard deviation = 30%

T-bill return = 6%

P* Portfolio:

30/42 = .714 in P and (1-.714) or .286 in T-bills, then P* will have same

standard deviation as market. R(P*)=.714 X R(P)+.286 X R(T-bills).

σ(R(P*))=.714σ(R(P))=.714X42=30= standard deviation of market

The return on P* is R(P*)= (.714) (.35) + (.286) (.06) = 26.7%

Since this return is less than the market, the managed portfolio

underperformed.

INVESTMENTS | BODIE, KANE, MARCUS

21.

24-212

Figure 24.2 M of Portfolio P

INVESTMENTS | BODIE, KANE, MARCUS

22.

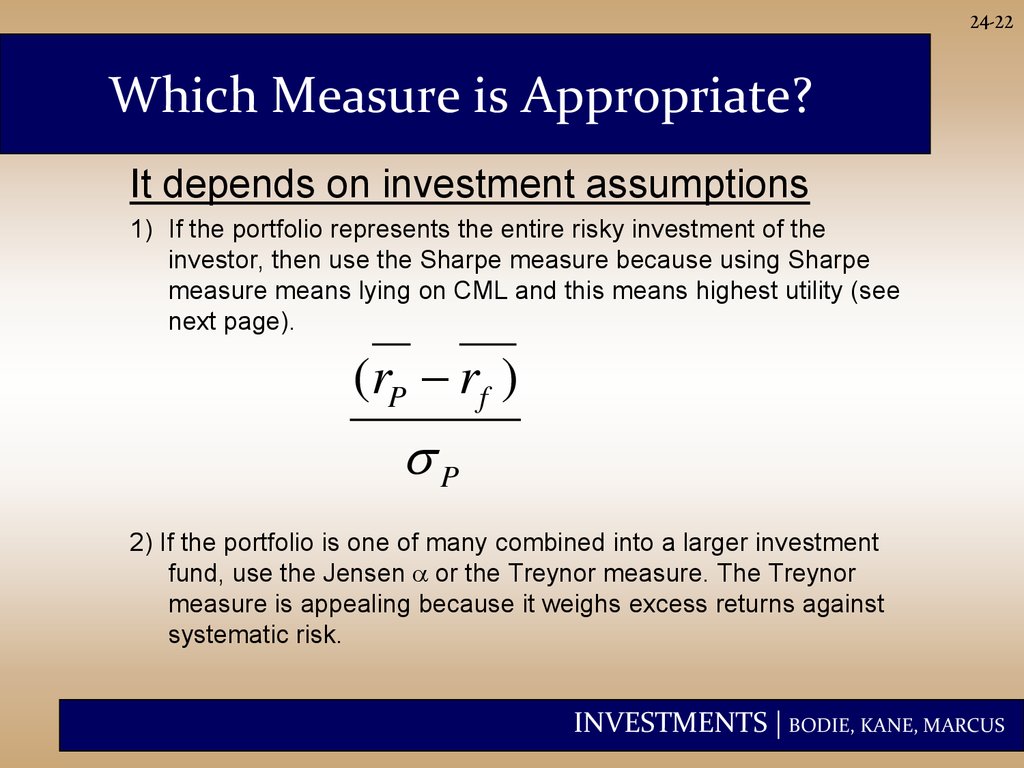

24-22Which Measure is Appropriate?

It depends on investment assumptions

1) If the portfolio represents the entire risky investment of the

investor, then use the Sharpe measure because using Sharpe

measure means lying on CML and this means highest utility (see

next page).

(rP rf )

P

2) If the portfolio is one of many combined into a larger investment

fund, use the Jensen or the Treynor measure. The Treynor

measure is appealing because it weighs excess returns against

systematic risk.

INVESTMENTS | BODIE, KANE, MARCUS

23.

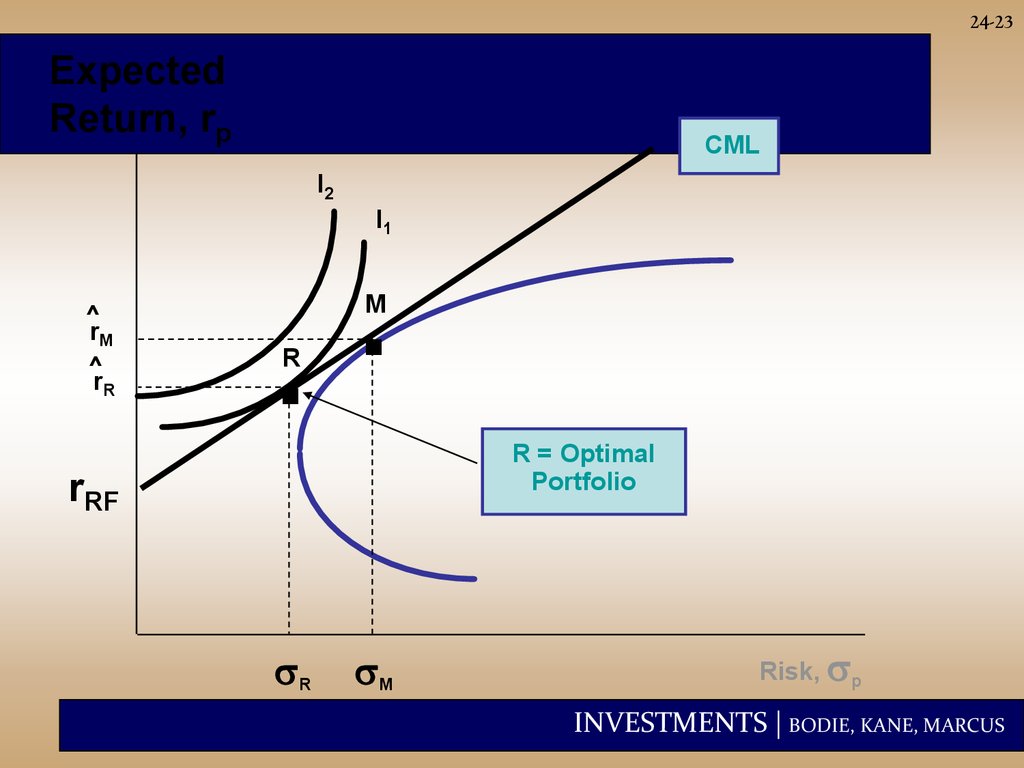

24-23Expected

Return, rp

CML

I2

I1

^

rM

^

rR

.

.

M

R

R = Optimal

Portfolio

rRF

R

M

Risk, p

INVESTMENTS | BODIE, KANE, MARCUS

24.

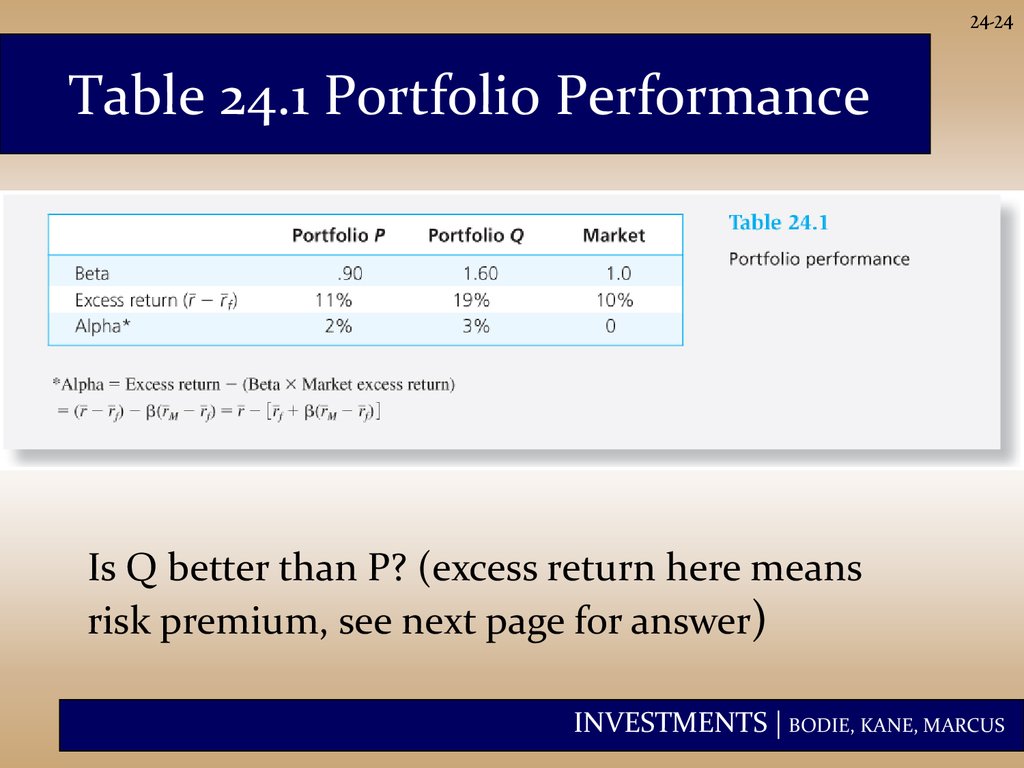

24-24Table 24.1 Portfolio Performance

Is Q better than P? (excess return here means

risk premium, see next page for answer)

INVESTMENTS | BODIE, KANE, MARCUS

25.

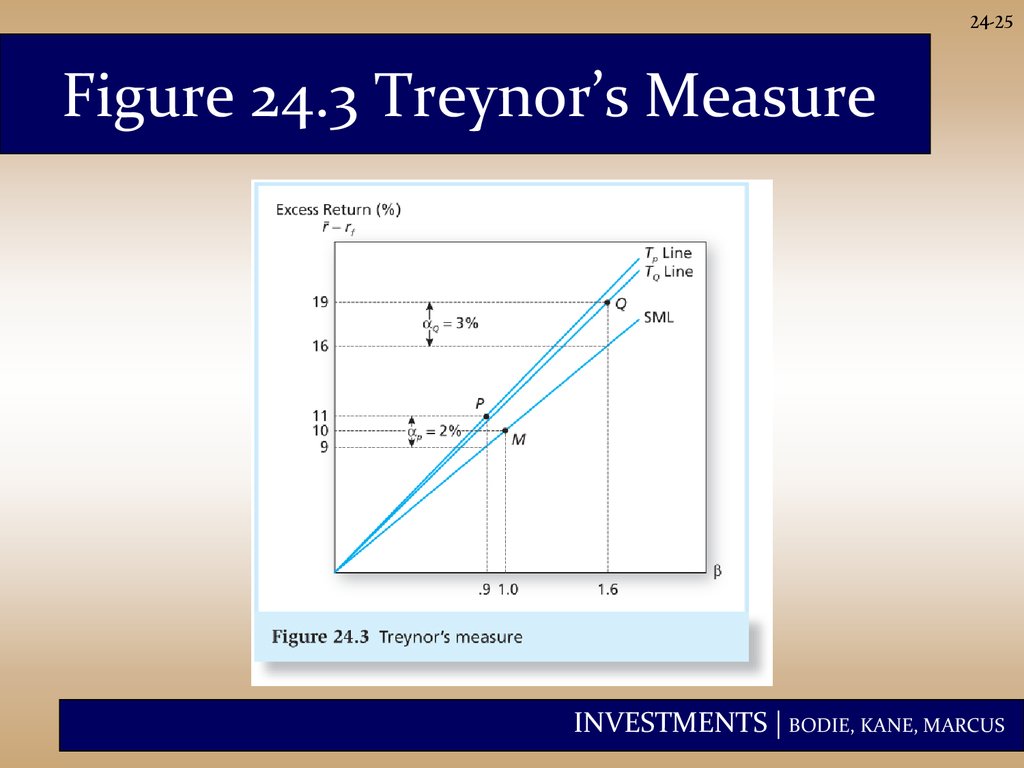

24-25Figure 24.3 Treynor’s Measure

INVESTMENTS | BODIE, KANE, MARCUS

26.

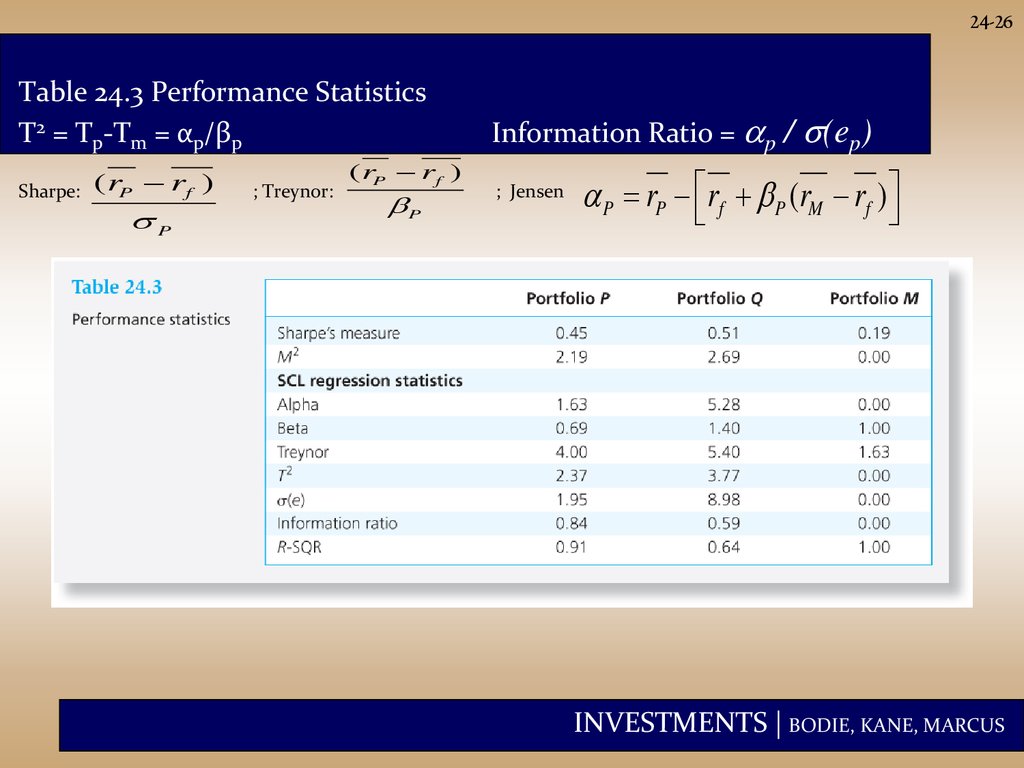

24-26Table 24.3 Performance Statistics

T2 = Tp-Tm = αp/βp

Sharpe:

( rP rf )

P

; Treynor:

( rP rf )

P

Information Ratio = p /

; Jensen

(ep)

P rP rf P (rM rf )

INVESTMENTS | BODIE, KANE, MARCUS

27.

24-27Interpretation of Table 24.3

• If P or Q represents the entire investment, Q

is better because of its higher Sharpe

measure and better M2.

• If P and Q are competing for a role as one of

a number of subportfolios, Q also dominates

because its Treynor measure is higher.

• If we seek an active portfolio to mix with an

index portfolio, P is better due to its higher

information ratio. (explanation next page)

INVESTMENTS | BODIE, KANE, MARCUS

28.

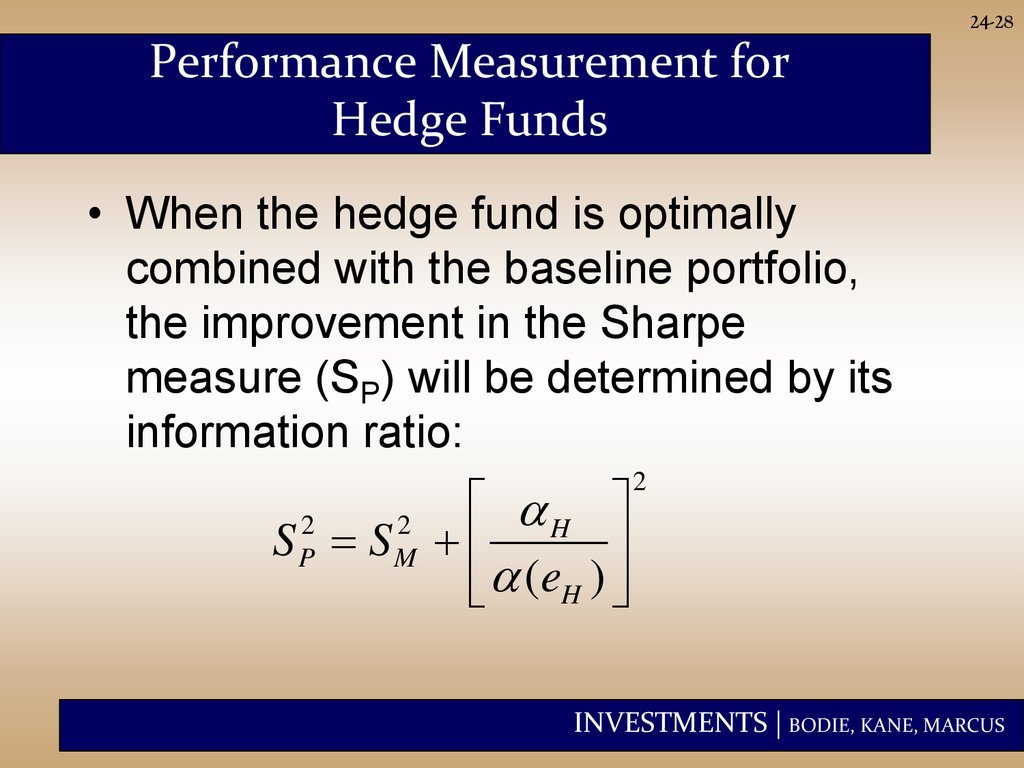

24-28Performance Measurement for

Hedge Funds

• When the hedge fund is optimally

combined with the baseline portfolio,

the improvement in the Sharpe

measure (SP) will be determined by its

information ratio:

H

S S

(eH )

2

P

2

2

M

INVESTMENTS | BODIE, KANE, MARCUS

29.

24-29Performance Measurement with Changing

Portfolio Composition

• We need a very long • What if the mean

observation period

and variance are not

to measure

constant? We need

performance with

to keep track of

any precision, even

portfolio changes.

if the return

distribution is stable

with a constant

mean and variance.

INVESTMENTS | BODIE, KANE, MARCUS

30.

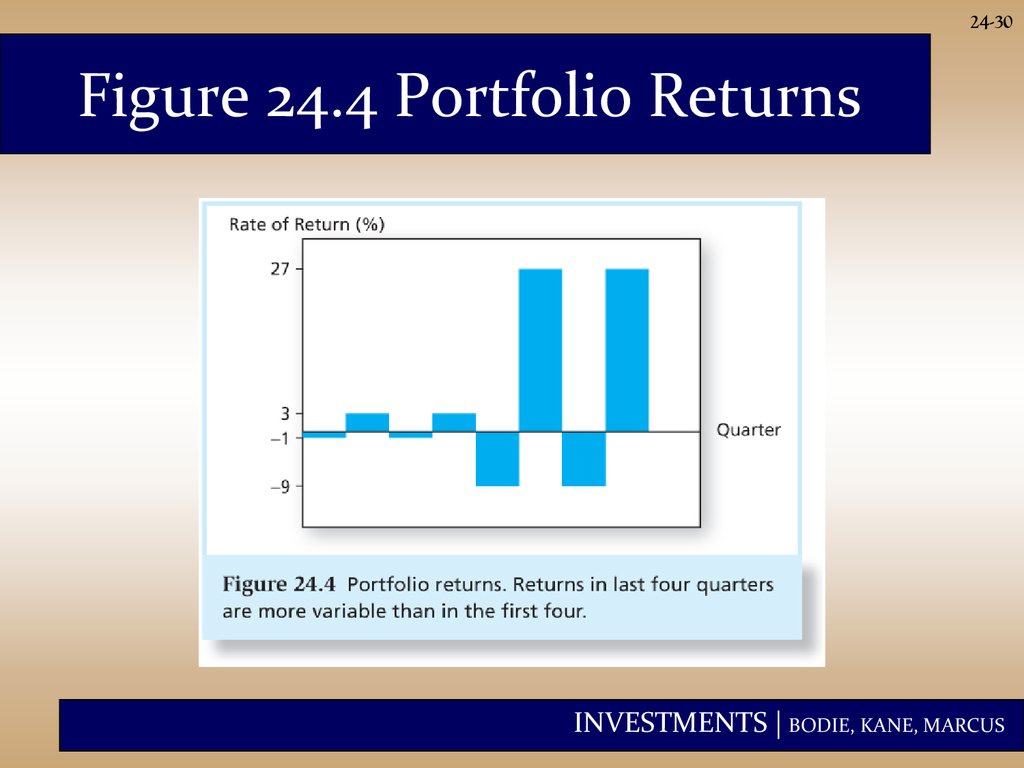

24-30Figure 24.4 Portfolio Returns

INVESTMENTS | BODIE, KANE, MARCUS

31.

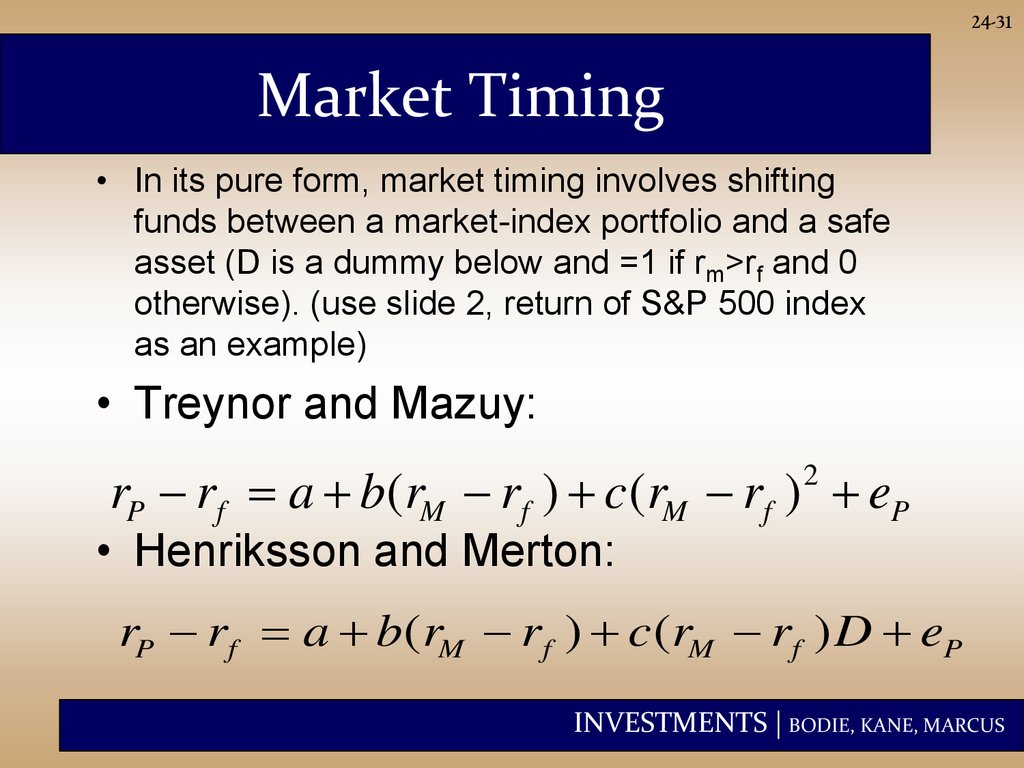

24-31Market Timing

• In its pure form, market timing involves shifting

funds between a market-index portfolio and a safe

asset (D is a dummy below and =1 if rm>rf and 0

otherwise). (use slide 2, return of S&P 500 index

as an example)

• Treynor and Mazuy:

rP rf a b(rM rf ) c(rM rf ) eP

2

• Henriksson and Merton:

rP rf a b(rM rf ) c (rM rf ) D eP

INVESTMENTS | BODIE, KANE, MARCUS

32.

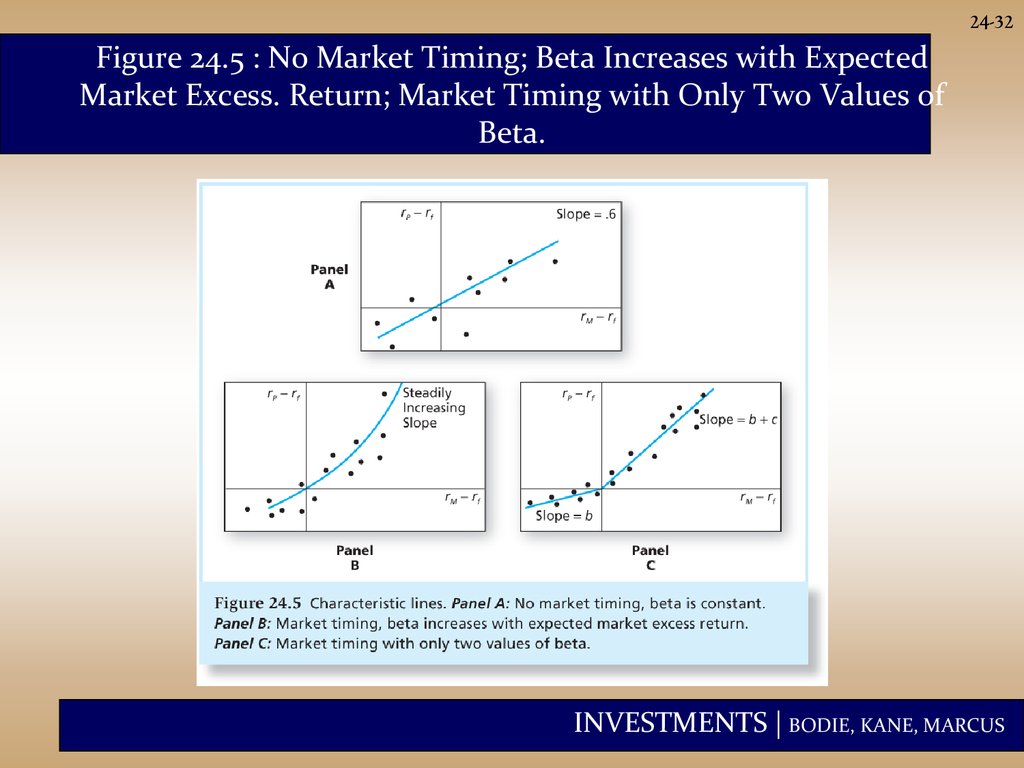

24-32Figure 24.5 : No Market Timing; Beta Increases with Expected

Market Excess. Return; Market Timing with Only Two Values of

Beta.

INVESTMENTS | BODIE, KANE, MARCUS

33.

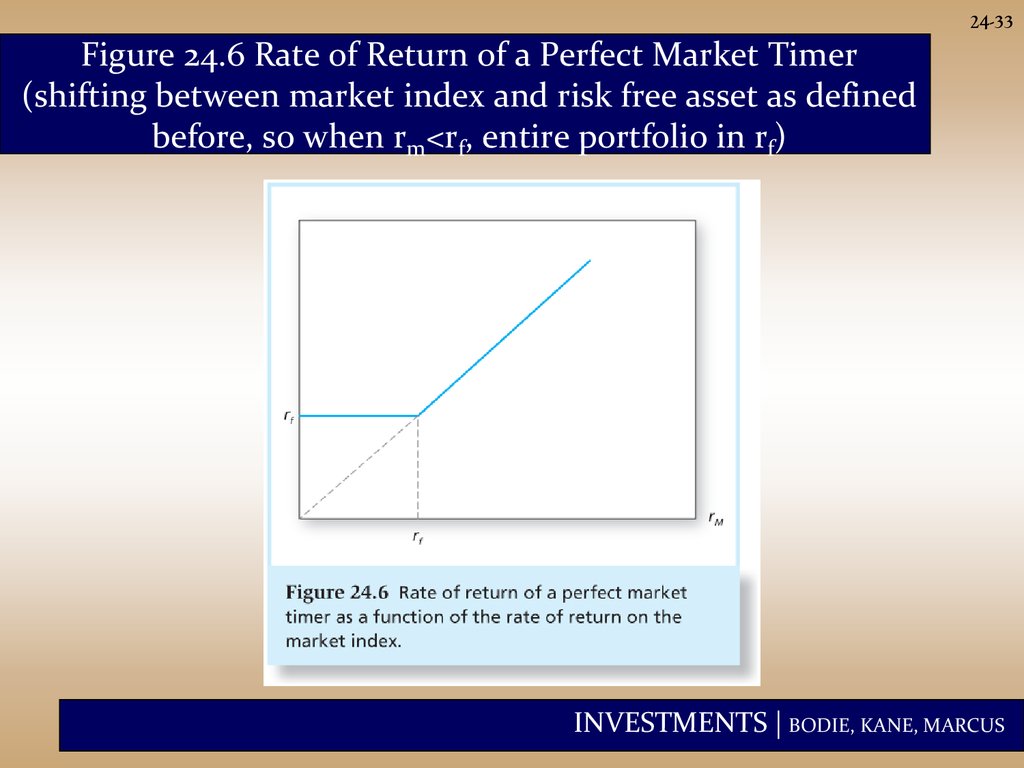

24-33Figure 24.6 Rate of Return of a Perfect Market Timer

(shifting between market index and risk free asset as defined

before, so when rm<rf, entire portfolio in rf)

INVESTMENTS | BODIE, KANE, MARCUS

34.

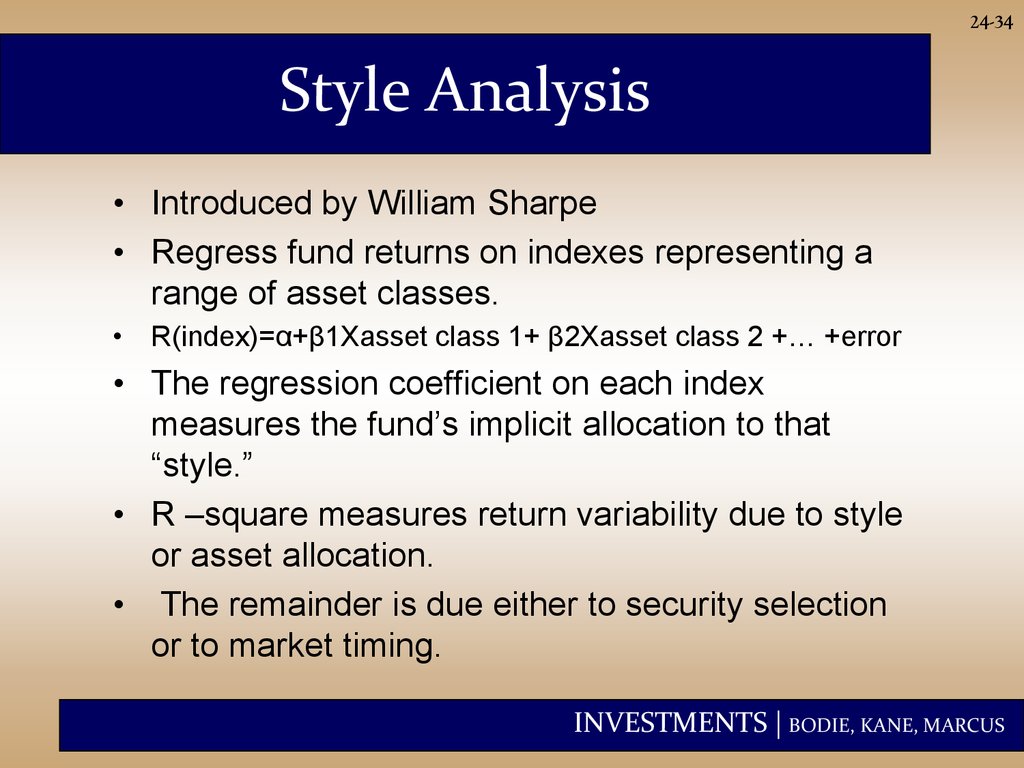

24-34Style Analysis

• Introduced by William Sharpe

• Regress fund returns on indexes representing a

range of asset classes.

• R(index)=α+β1Xasset class 1+ β2Xasset class 2 +… +error

• The regression coefficient on each index

measures the fund’s implicit allocation to that

“style.”

• R –square measures return variability due to style

or asset allocation.

• The remainder is due either to security selection

or to market timing.

INVESTMENTS | BODIE, KANE, MARCUS

35.

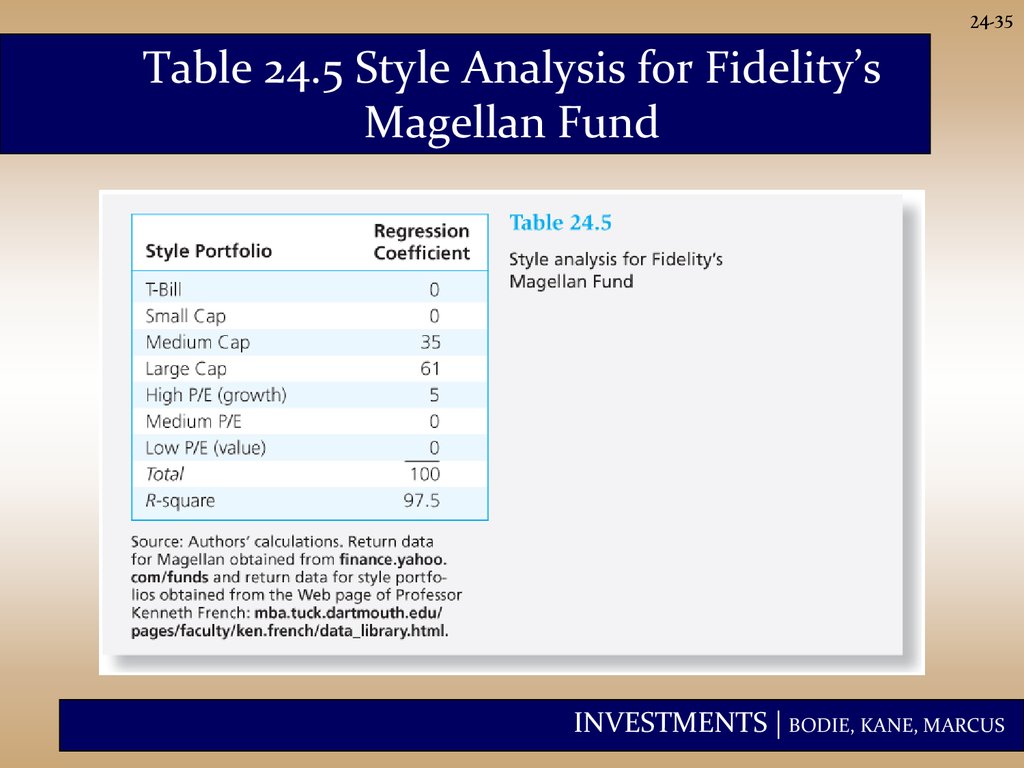

24-35Table 24.5 Style Analysis for Fidelity’s

Magellan Fund

INVESTMENTS | BODIE, KANE, MARCUS

36.

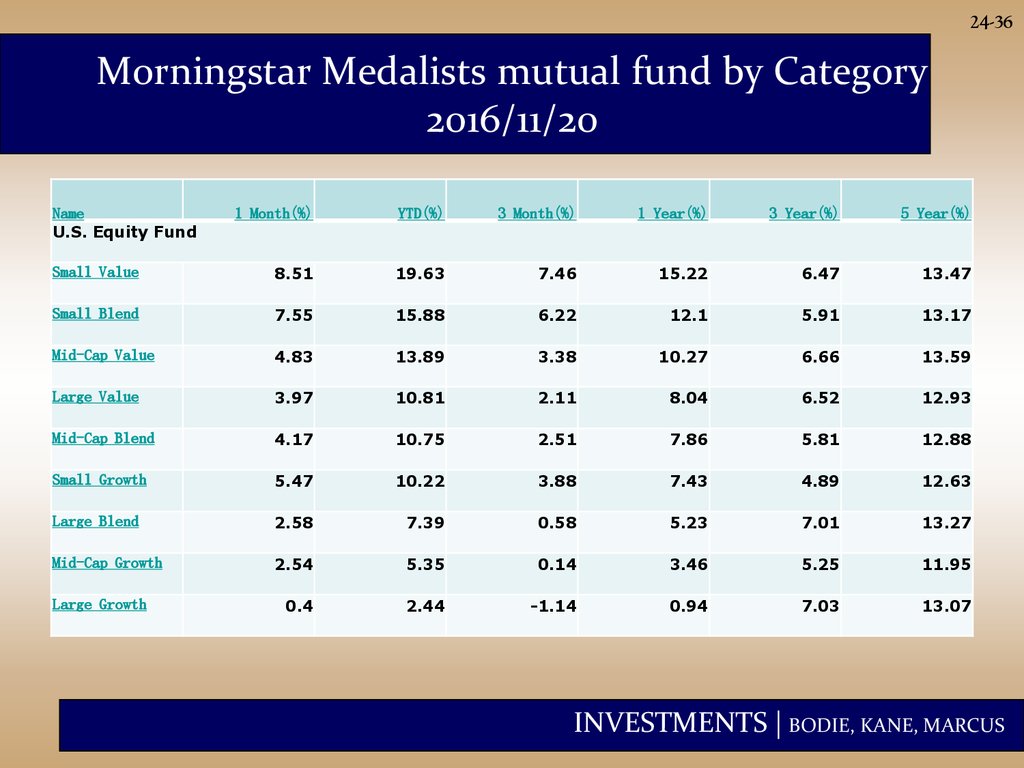

24-36Morningstar Medalists mutual fund by Category

2016/11/20

Name

U.S. Equity Fund

1 Month(%)

YTD(%)

3 Month(%)

1 Year(%)

3 Year(%)

5 Year(%)

Small Value

8.51

19.63

7.46

15.22

6.47

13.47

Small Blend

7.55

15.88

6.22

12.1

5.91

13.17

Mid-Cap Value

4.83

13.89

3.38

10.27

6.66

13.59

Large Value

3.97

10.81

2.11

8.04

6.52

12.93

Mid-Cap Blend

4.17

10.75

2.51

7.86

5.81

12.88

Small Growth

5.47

10.22

3.88

7.43

4.89

12.63

Large Blend

2.58

7.39

0.58

5.23

7.01

13.27

Mid-Cap Growth

2.54

5.35

0.14

3.46

5.25

11.95

0.4

2.44

-1.14

0.94

7.03

13.07

Large Growth

INVESTMENTS | BODIE, KANE, MARCUS

37.

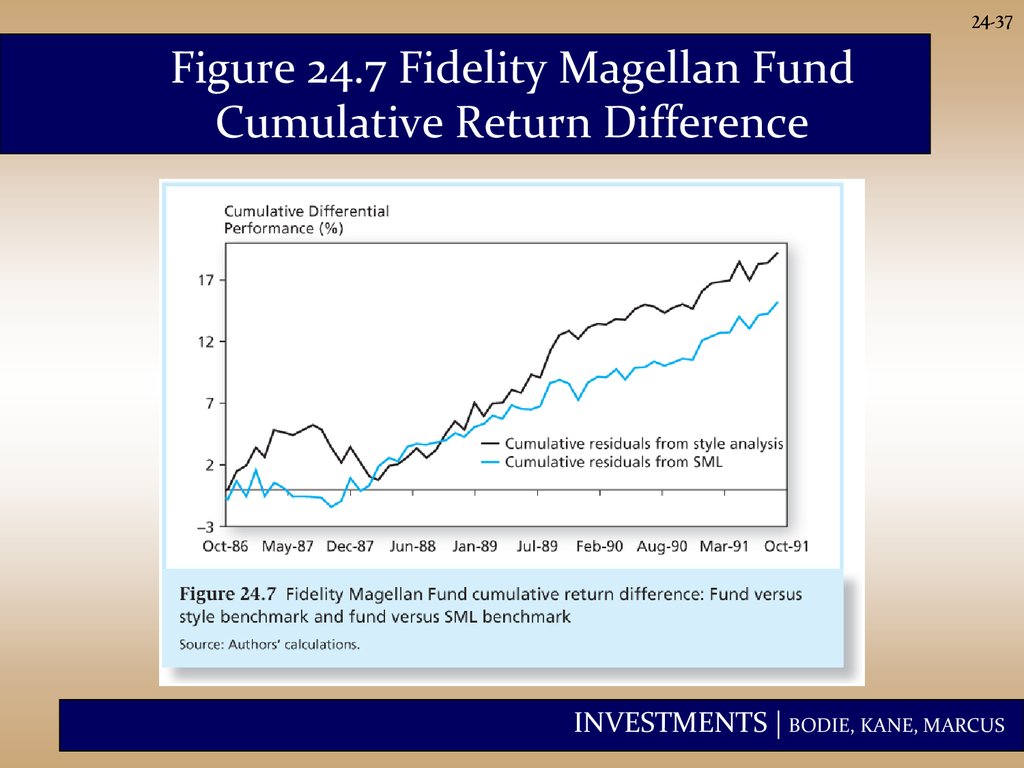

24-37Figure 24.7 Fidelity Magellan Fund

Cumulative Return Difference

INVESTMENTS | BODIE, KANE, MARCUS

38.

24-38Figure 24.8 Average Tracking Error for 636

Mutual Funds, 1985-1989

INVESTMENTS | BODIE, KANE, MARCUS

39.

24-39Evaluating Performance Evaluation

• Performance evaluation has two key

problems:

1. Many observations are needed for

significant results.

2. Shifting parameters when portfolios

are actively managed makes

accurate performance evaluation

all the more elusive.

INVESTMENTS | BODIE, KANE, MARCUS

40.

24-40Performance Attribution

• A common attribution system decomposes

performance into three components:

1. Allocation choices across broad asset

classes.

2. Industry or sector choice within each

market.

3. Security choice within each sector.

INVESTMENTS | BODIE, KANE, MARCUS

41.

24-41Attributing Performance to

Components

Set up a ‘Benchmark’ or ‘Bogey’

portfolio:

• Select a benchmark index portfolio for

each asset class.

• Choose weights based on market

expectations.

• Choose a portfolio of securities within

each class by security analysis.

INVESTMENTS | BODIE, KANE, MARCUS

42.

24-42Attributing Performance to

Components

• Calculate the return on the ‘Bogey’ and on

the managed portfolio.

• Explain the difference in return based on

component weights or selection.

• Summarize the performance differences

into appropriate categories.

INVESTMENTS | BODIE, KANE, MARCUS

43.

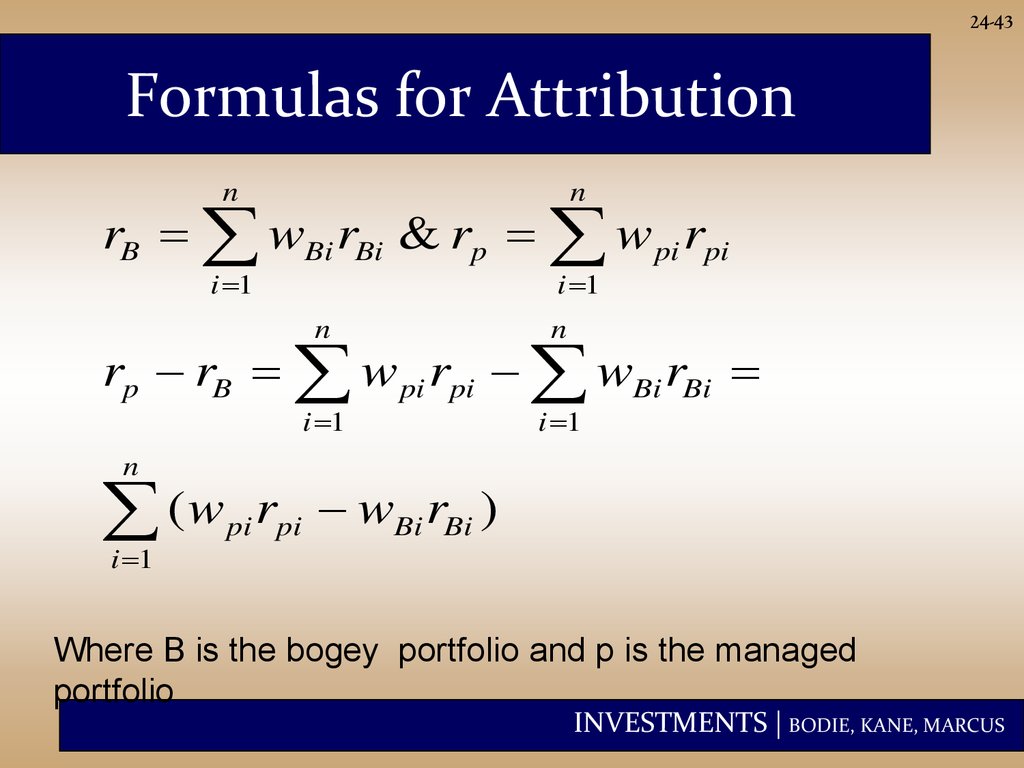

24-43Formulas for Attribution

n

n

i 1

i 1

rB wBi rBi & rp w pi rpi

n

n

i 1

i 1

rp rB w pi rpi wBi rBi

n

(w

i 1

r wBi rBi )

pi pi

Where B is the bogey portfolio and p is the managed

portfolio

INVESTMENTS | BODIE, KANE, MARCUS

44.

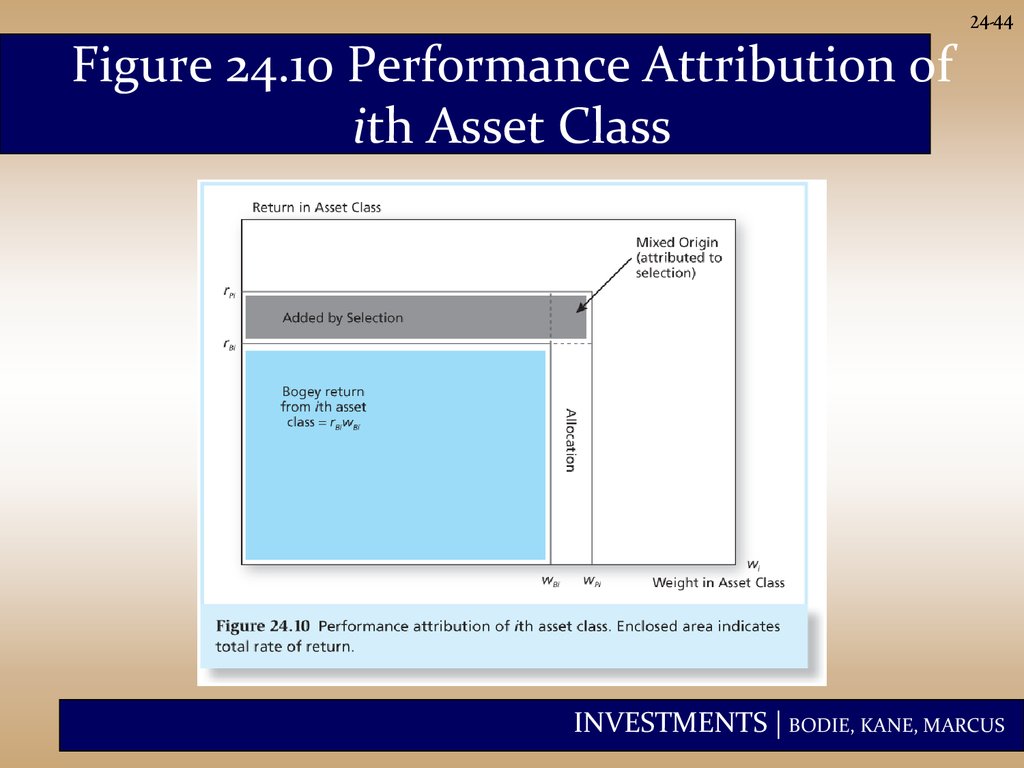

24-44Figure 24.10 Performance Attribution of

ith Asset Class

INVESTMENTS | BODIE, KANE, MARCUS

45.

24-45Performance Attribution

• Superior performance is achieved by:

– overweighting assets in markets that

perform well

– underweighting assets in poorly

performing markets

INVESTMENTS | BODIE, KANE, MARCUS

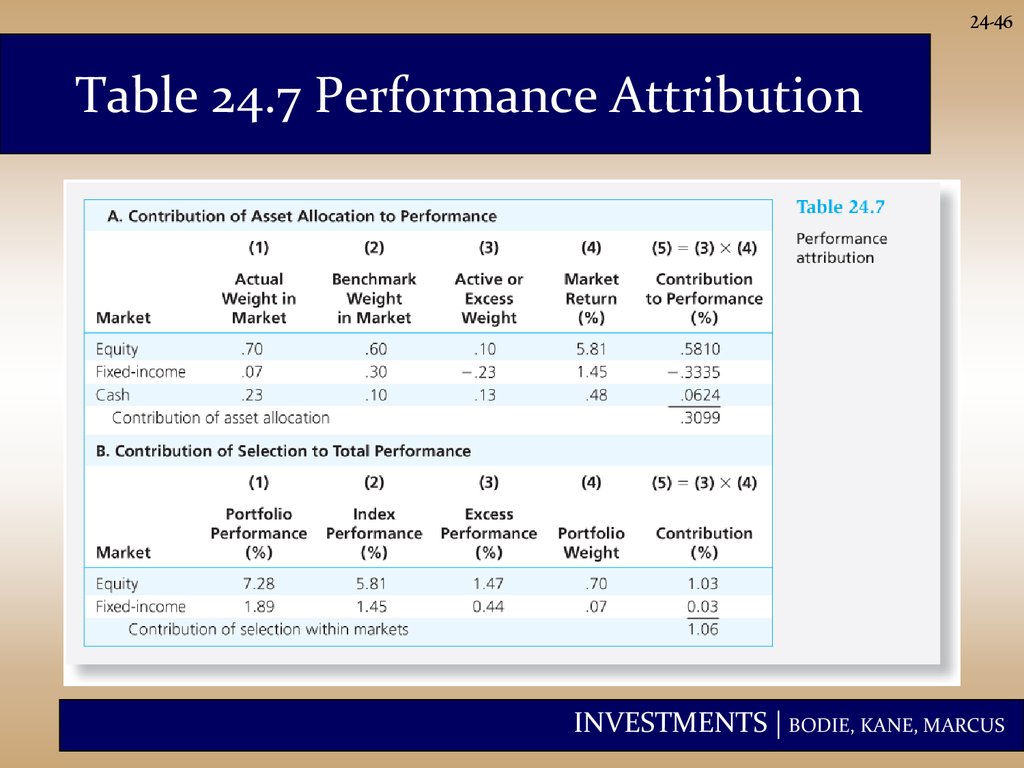

46.

24-46Table 24.7 Performance Attribution

INVESTMENTS | BODIE, KANE, MARCUS

47.

24-47Sector and Security Selection

• Good performance

(a positive

contribution)

derives from

overweighting

high-performing

sectors

• Good performance

also derives from

underweighting

poorly performing

sectors.

INVESTMENTS | BODIE, KANE, MARCUS

economics

economics