Similar presentations:

Mezzanine. Mezzanine versus bank and equity

1. Mezzanine

Prof. R. Aernoudt2. ”Don't waste your love on somebody, who doesn't value it.” William Shakespeare, Romeo and Juliet

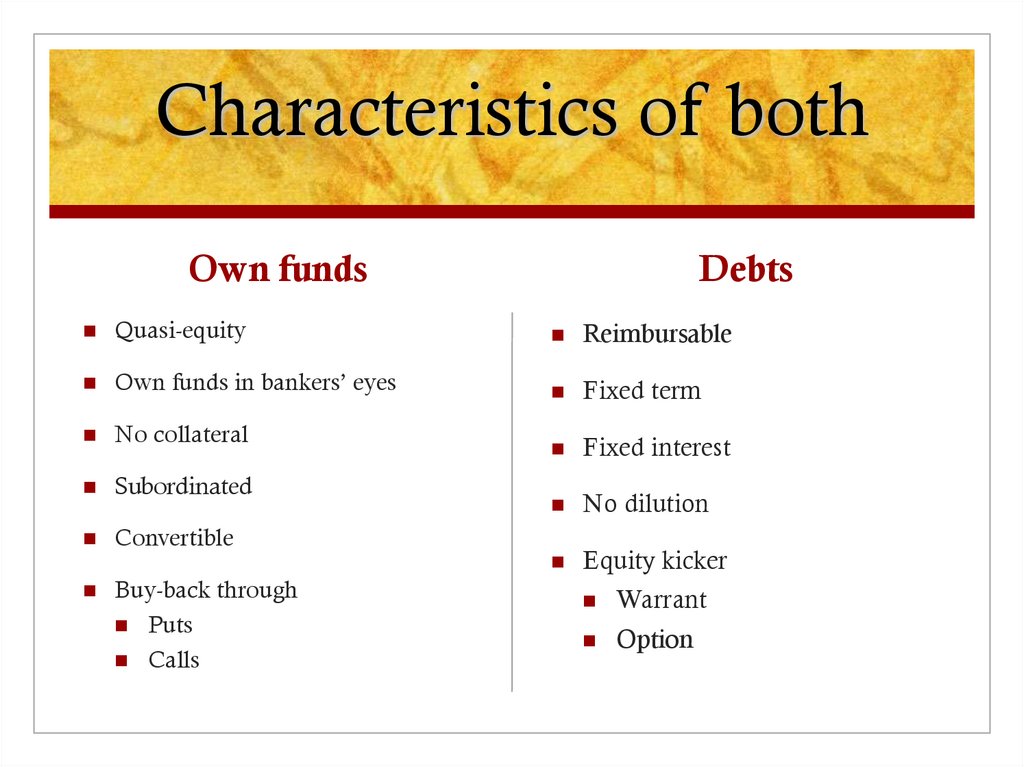

3. Characteristics of both

Own fundsDebts

Quasi-equity

Reimbursable

Own funds in bankers’ eyes

Fixed term

No collateral

Fixed interest

Subordinated

No dilution

Convertible

Equity kicker

Buy-back through

Puts

Calls

Warrant

Option

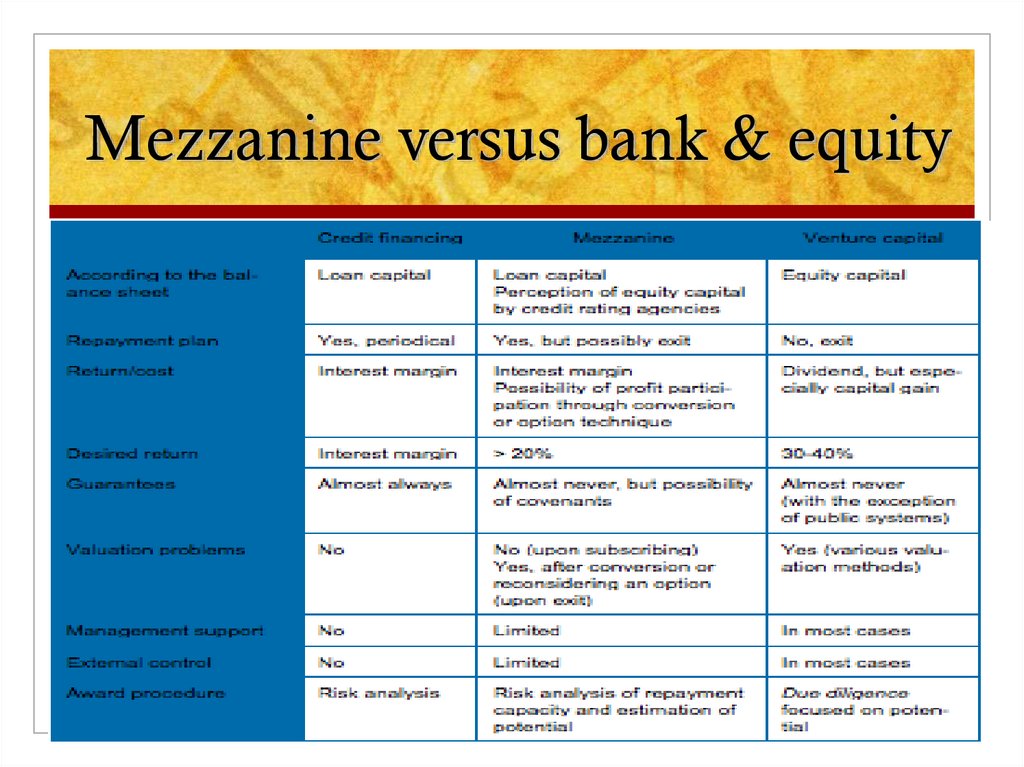

4. Mezzanine versus bank & equity

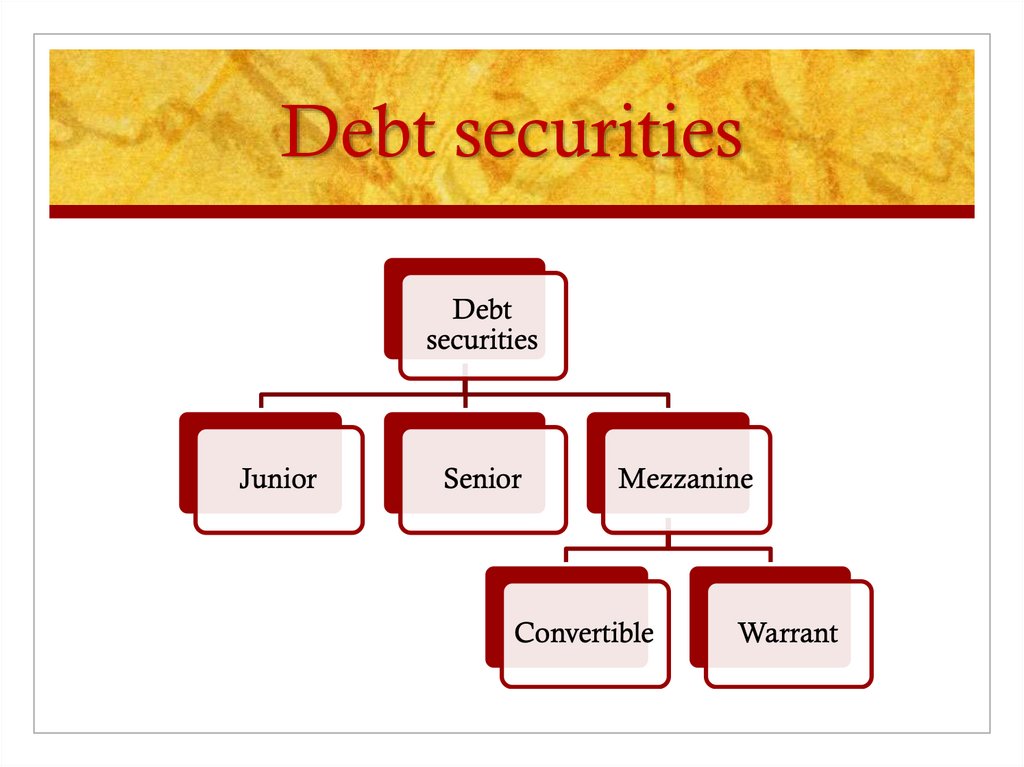

Mezzanine versus bank & equity5. Debt securities

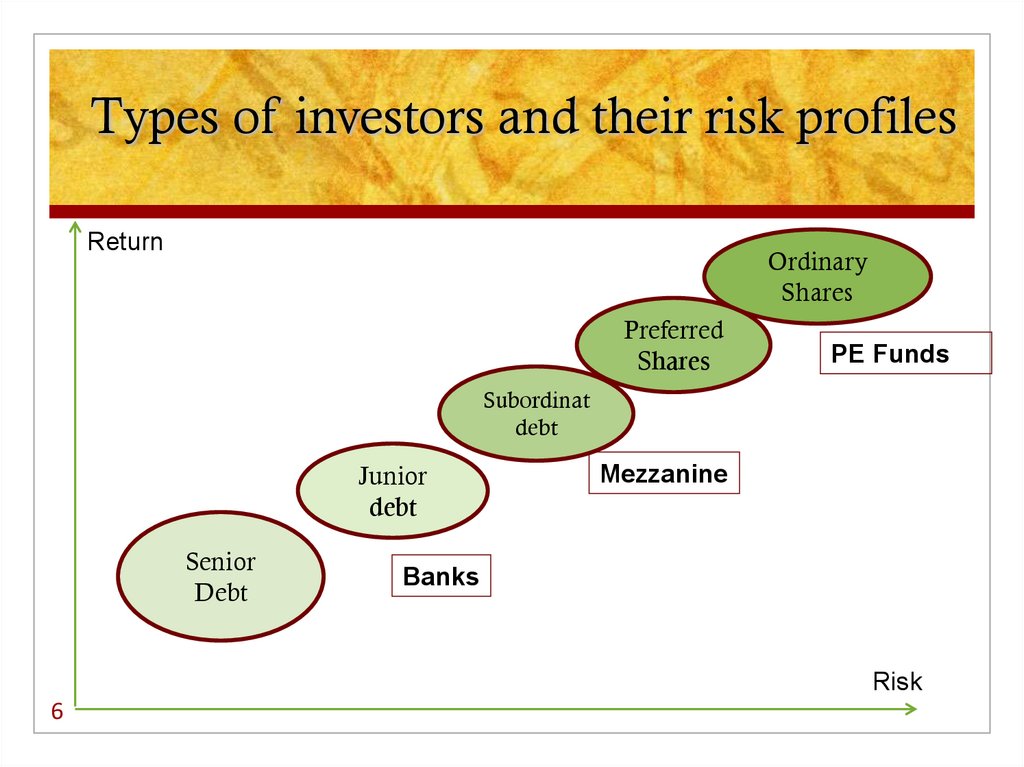

6. Types of investors and their risk profiles

ReturnOrdinary

Shares

Preferred

Shares

PE Funds

Subordinat

debt

Junior

debt

Senior

Debt

Mezzanine

Banks

Risk

6

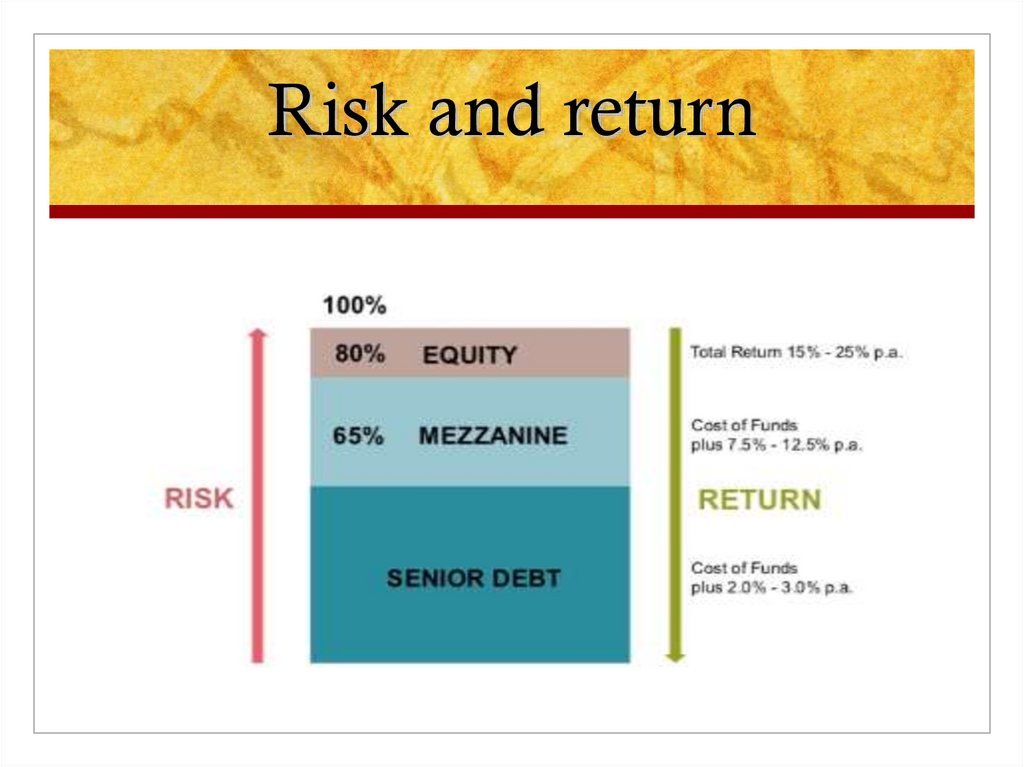

7. Risk and return

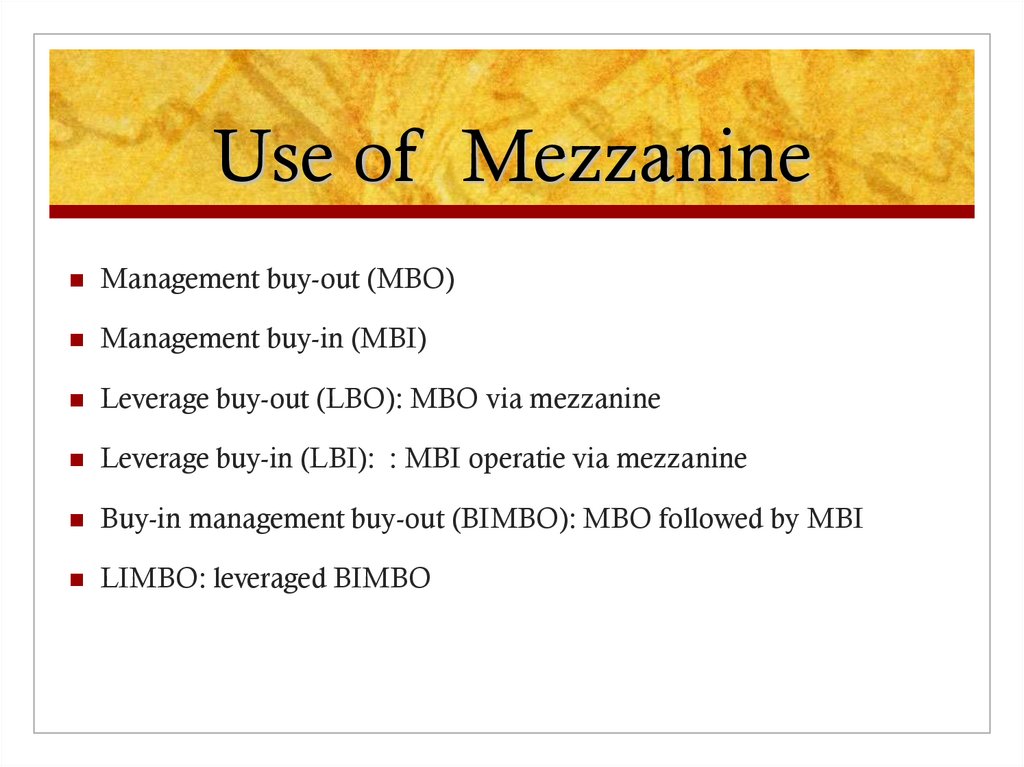

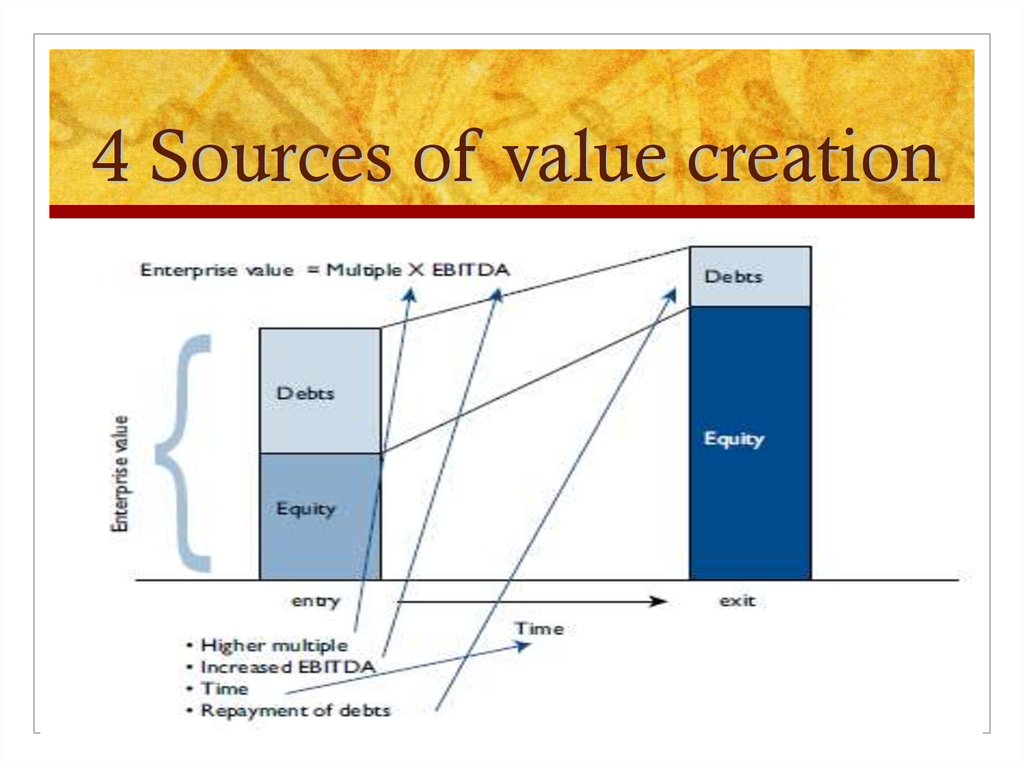

8. Use of Mezzanine

Management buy-out (MBO)Management buy-in (MBI)

Leverage buy-out (LBO): MBO via mezzanine

Leverage buy-in (LBI): : MBI operatie via mezzanine

Buy-in management buy-out (BIMBO): MBO followed by MBI

LIMBO: leveraged BIMBO

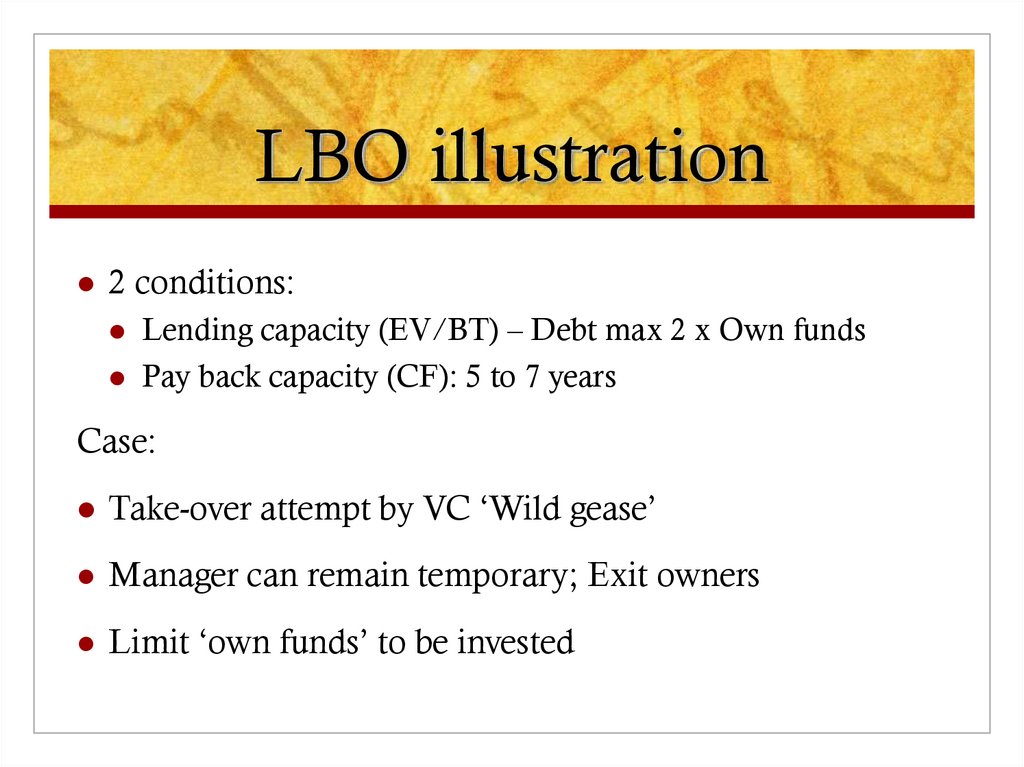

9. LBO illustration

2 conditions:Lending capacity (EV/BT) – Debt max 2 x Own funds

Pay back capacity (CF): 5 to 7 years

Case:

Take-over attempt by VC ‘Wild gease’

Manager can remain temporary; Exit owners

Limit ‘own funds’ to be invested

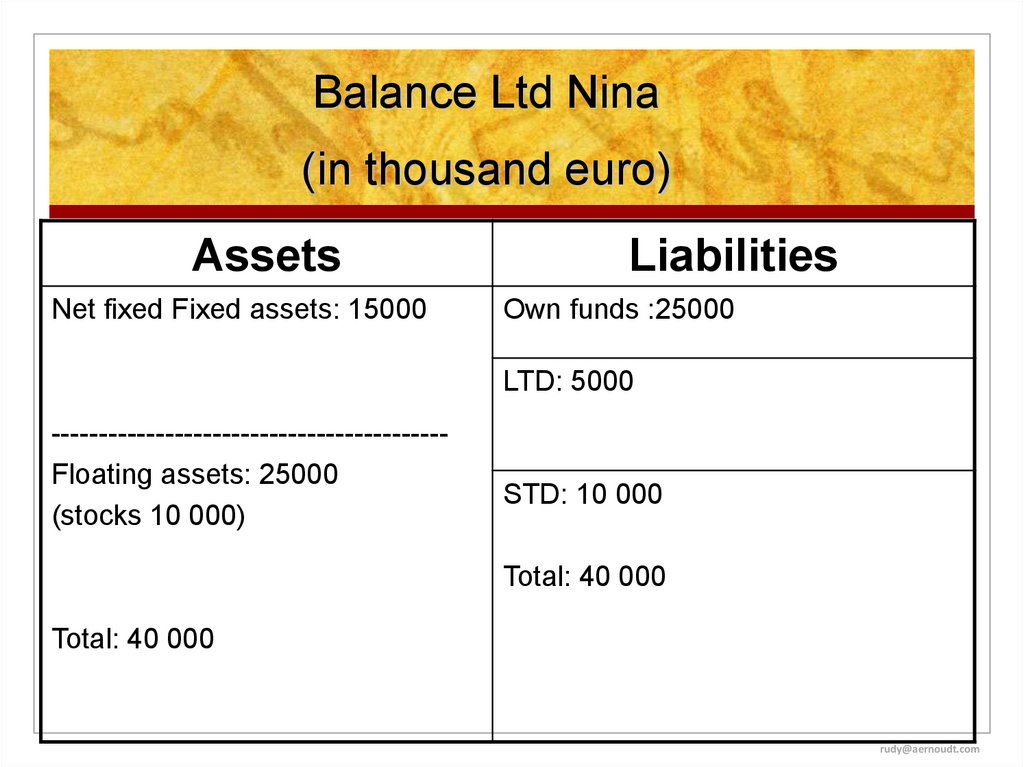

10. Balance Ltd Nina (in thousand euro)

AssetsNet fixed Fixed assets: 15000

Liabilities

Own funds :25000

LTD: 5000

-----------------------------------------Floating assets: 25000

(stocks 10 000)

STD: 10 000

Total: 40 000

Total: 40 000

rudy@aernoudt.com

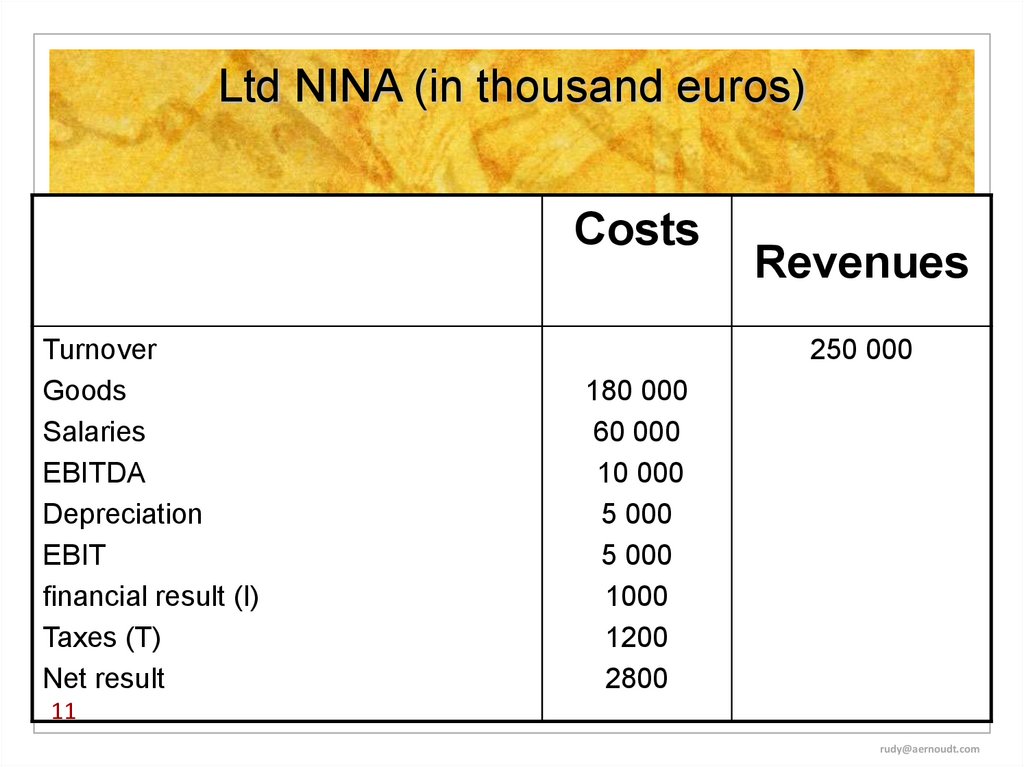

11. Ltd NINA (in thousand euros)

CostsTurnover

Goods

Salaries

EBITDA

Depreciation

EBIT

financial result (I)

Taxes (T)

Net result

Revenues

250 000

180 000

60 000

10 000

5 000

5 000

1000

1200

2800

11

rudy@aernoudt.com

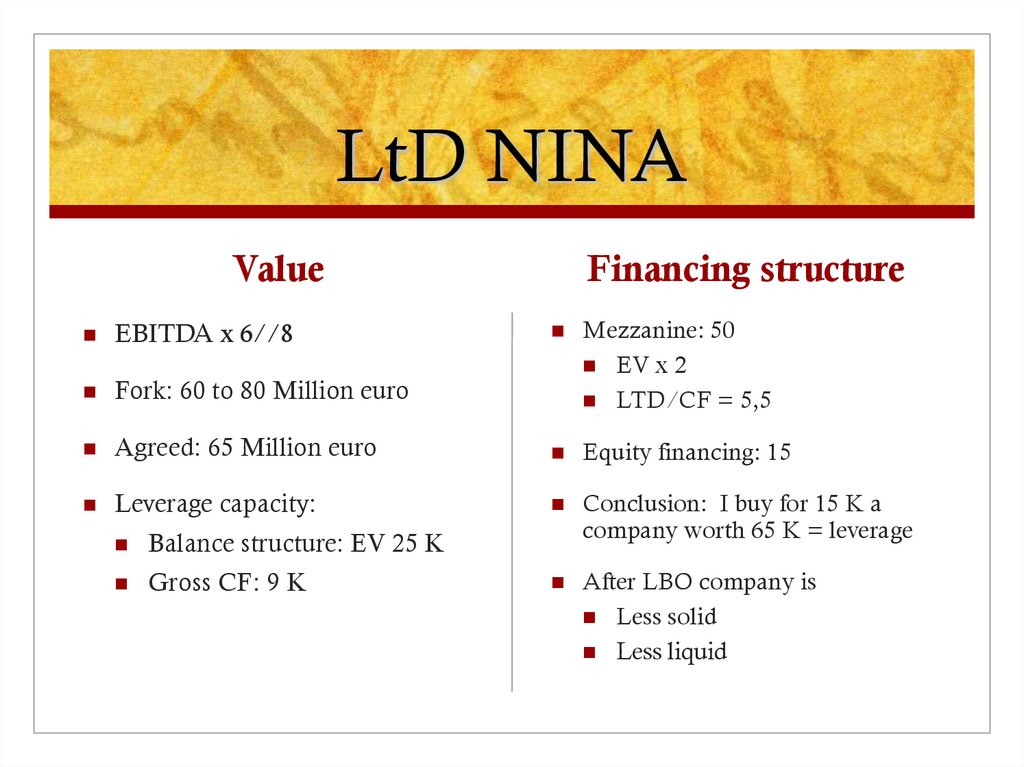

12. LtD NINA

ValueFinancing structure

Mezzanine: 50

EV x 2

LTD/CF = 5,5

Agreed: 65 Million euro

Equity financing: 15

Leverage capacity:

Conclusion: I buy for 15 K a

company worth 65 K = leverage

After LBO company is

Less solid

Less liquid

EBITDA x 6//8

Fork: 60 to 80 Million euro

Balance structure: EV 25 K

Gross CF: 9 K

finance

finance