Similar presentations:

Making Capital Investment Decisions & Intro to Project Analysis

1.

UCD Lochlann Quinn School of BusinessMaking Capital Investment Decisions

& Intro to Project Analysis

© Business eLearning

2.

Project Cash Flows: A First Look• A relevant cash flow for a project is a change in the

firm’s overall future cash flow that comes about as a

direct consequence of the decision to take that project

• Stand-alone Principle

– The assumption that evaluation of a project may be based on

the project’s incremental cash flows

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

2

3.

Incremental Cash FlowsThe difference between a

firm’s future cash flows with a

project and those without the

project

UCD Lochlann Quinn School of Business

The incremental cash flows

for project evaluation consist

of any and all changes in the

firm’s future cash flows that

are a direct consequence of

taking the project

Dr Sha Liu, Foundations of Finance

3

4.

IncrementalCash

Flows

Incremental Cash Flows (cont’d)

Sunk Costs

Definition

• A sunk cost is a cash

flow that has already

occurred

Rule

• Ignore all sunk costs

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

4

5.

Incremental Cash Flows (cont’d)Opportunity Costs

Definition

• Opportunity costs are lost

revenues that you forego

as a result of making the

proposed investment

Rule

• Incorporate opportunity

costs into your analysis

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

5

6.

Incremental Cash Flows (cont’d)Side Effects

Definition

• A side effect is classified as

either erosion or synergy.

• Erosion is when a new

product reduces the cash

flows of existing products.

• Synergy occurs when a new

project increases the cash

flows of existing projects.

Rule

• Include side effects

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

6

7.

Incremental Cash Flows (cont’d)• Net working capital (NWC)

– NWC = Current Assets − Current Liabilities = Cash + Inventory

+ Receivables Payables

– The firm supplies working capital at the beginning and

recovers it towards the end.

• Financing Cost

– In analysing a proposed investment, we shall not include

interest paid or any other financing costs such as dividends or

principal repaid.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

7

8.

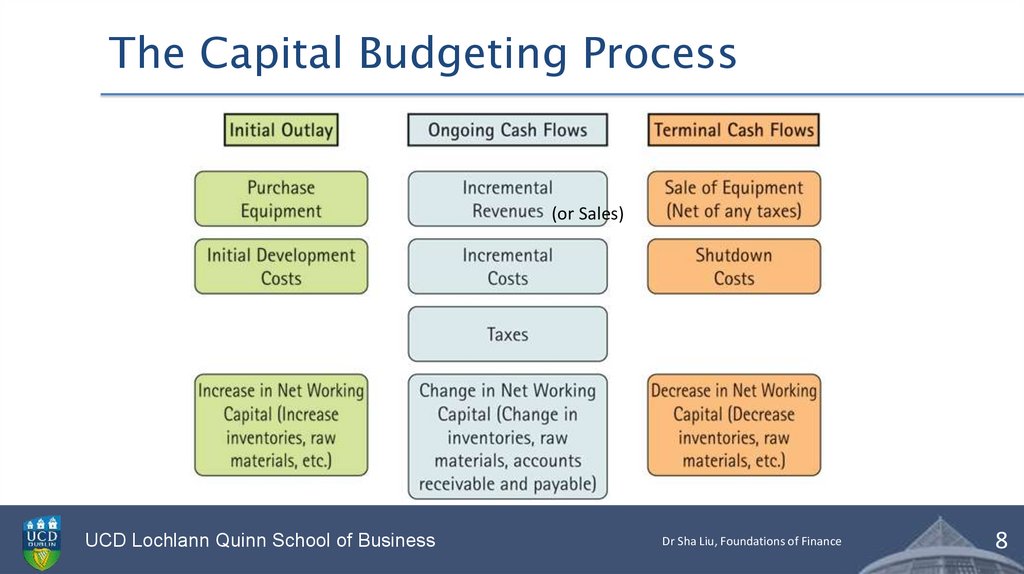

The Capital Budgeting Process(or Sales)

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

8

9.

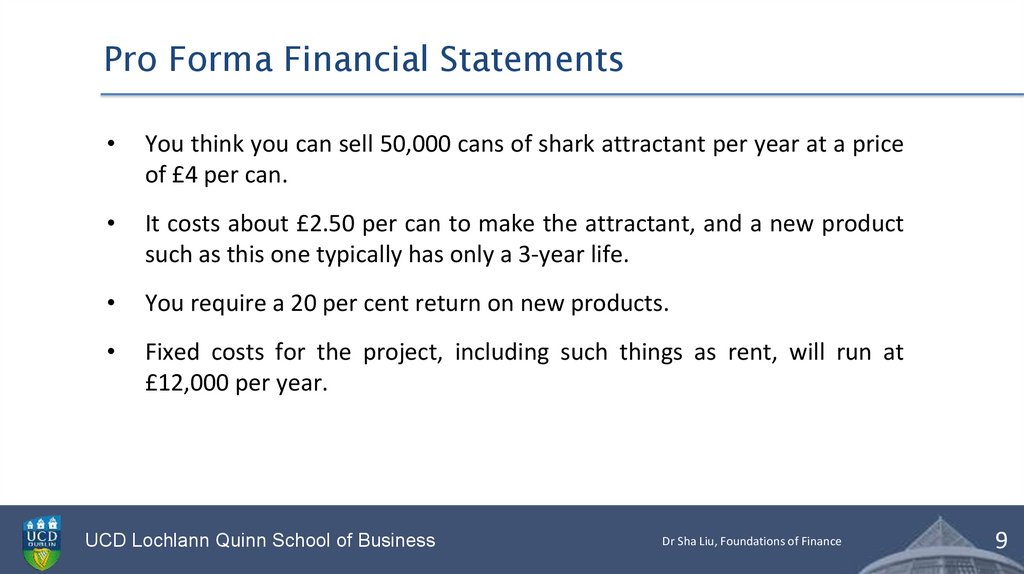

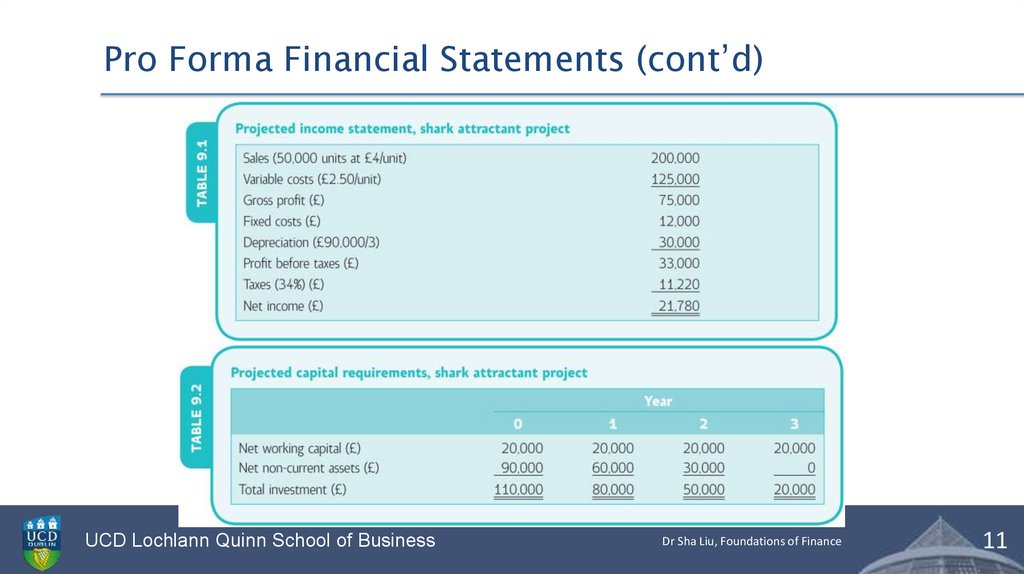

Pro Forma Financial StatementsYou think you can sell 50,000 cans of shark attractant per year at a price

of £4 per can.

It costs about £2.50 per can to make the attractant, and a new product

such as this one typically has only a 3-year life.

You require a 20 per cent return on new products.

Fixed costs for the project, including such things as rent, will run at

£12,000 per year.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

9

10.

Pro Forma Financial Statements (cont’d)You will need to invest a total of £90,000 in manufacturing equipment.

Assume that this £90,000 will be 100 per cent depreciated straight-line

over the 3-year life of the project.

The cost of removing the equipment will roughly equal its actual value in 3

years, so it will be essentially worthless on a market value basis as well.

Finally, the project will require an initial £20,000 investment in net working

capital, and the tax rate is 34 per cent.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

10

11.

Pro Forma Financial Statements (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

11

12.

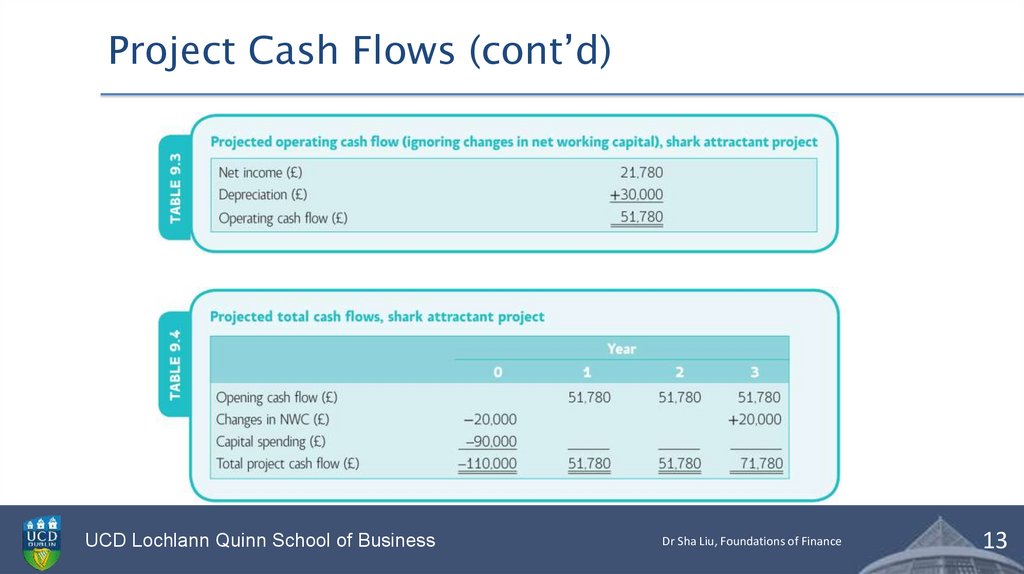

Project Cash Flows• Project cash flow = Project operating cash flow − Pr

oject capital spending (capital expenditure)

• Operating cash flow= Net income+ Depreciation−

Increase (+Decrease) in net working capital

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

12

13.

Project Cash Flows (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

13

14.

Dr Sha Liu, Foundations of Finance14

15.

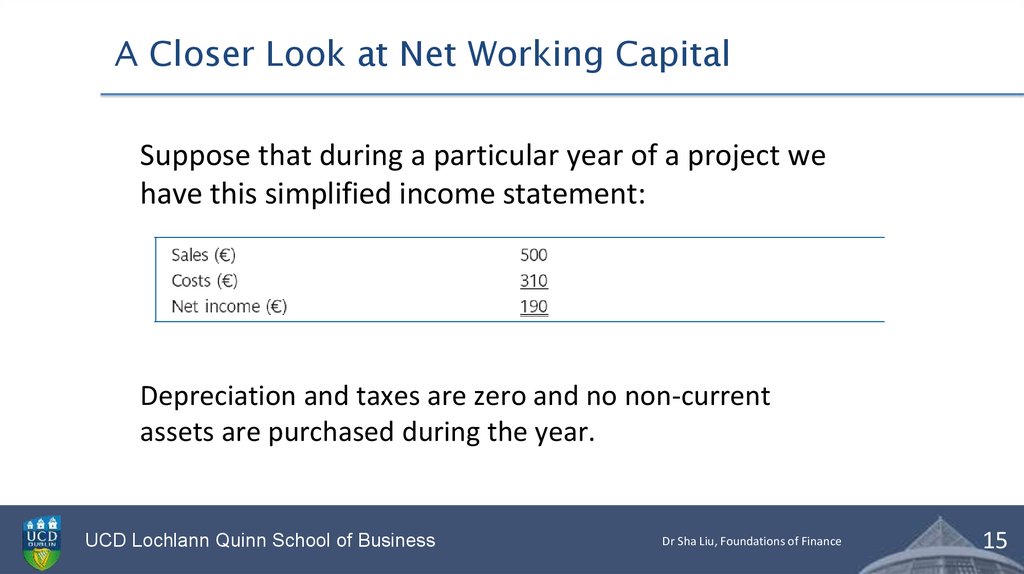

A Closer Look at Net Working CapitalSuppose that during a particular year of a project we

have this simplified income statement:

Depreciation and taxes are zero and no non-current

assets are purchased during the year.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

15

16.

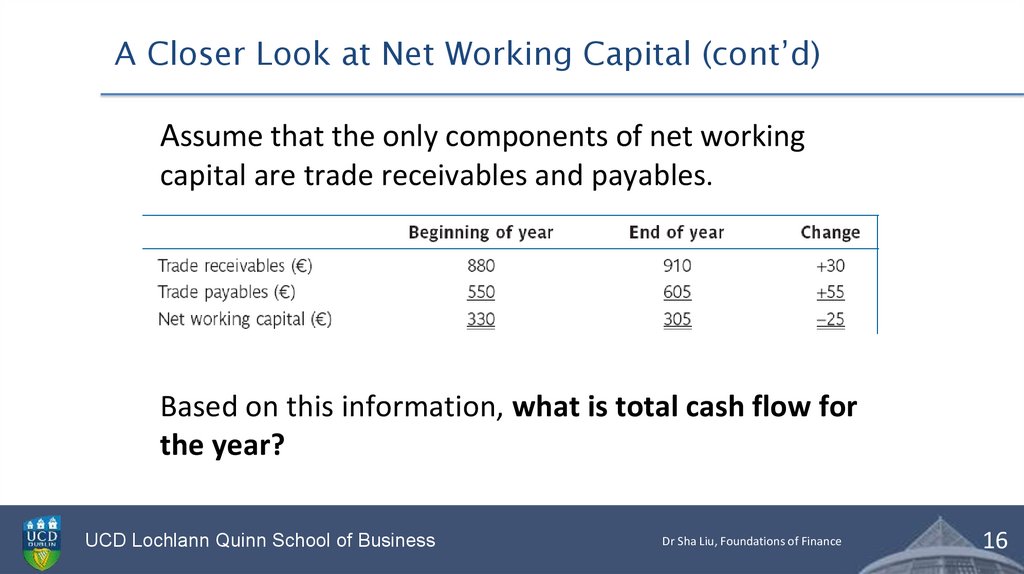

A Closer Look at Net Working Capital (cont’d)Assume that the only components of net working

capital are trade receivables and payables.

Based on this information, what is total cash flow for

the year?

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

16

17.

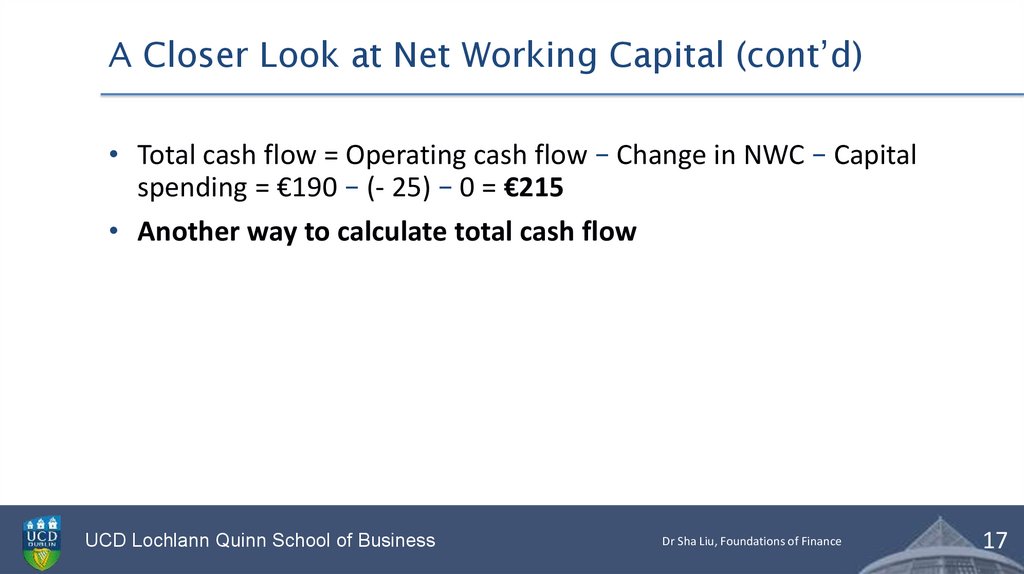

A Closer Look at Net Working Capital (cont’d)• Total cash flow = Operating cash flow – Change in NWC – Capital

spending = €190 – (- 25) – 0 = €215

• Another way to calculate total cash flow

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

17

18.

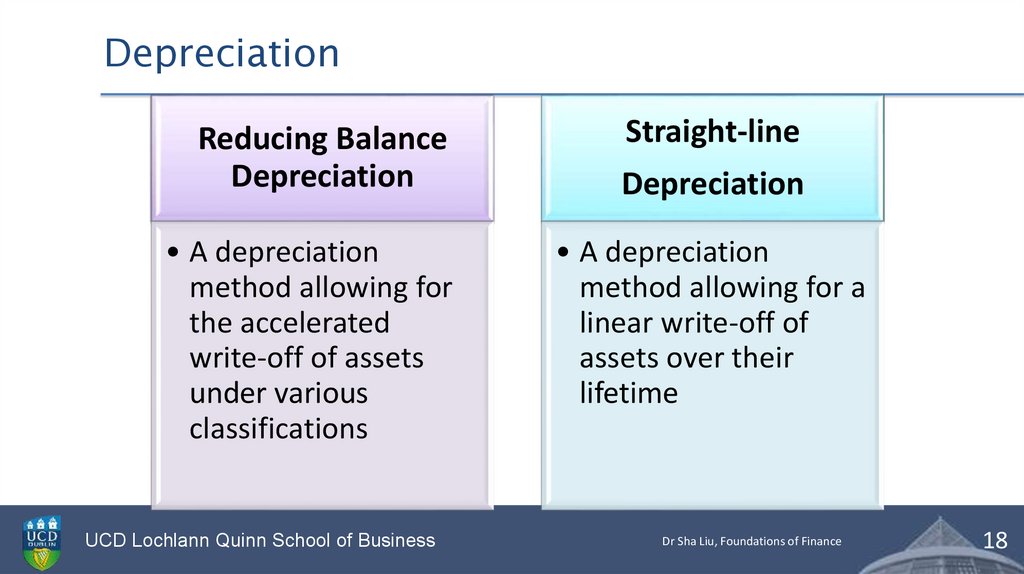

DepreciationReducing Balance

Depreciation

• A depreciation

method allowing for

the accelerated

write-off of assets

under various

classifications

UCD Lochlann Quinn School of Business

Straight-line

Depreciation

• A depreciation

method allowing for a

linear write-off of

assets over their

lifetime

Dr Sha Liu, Foundations of Finance

18

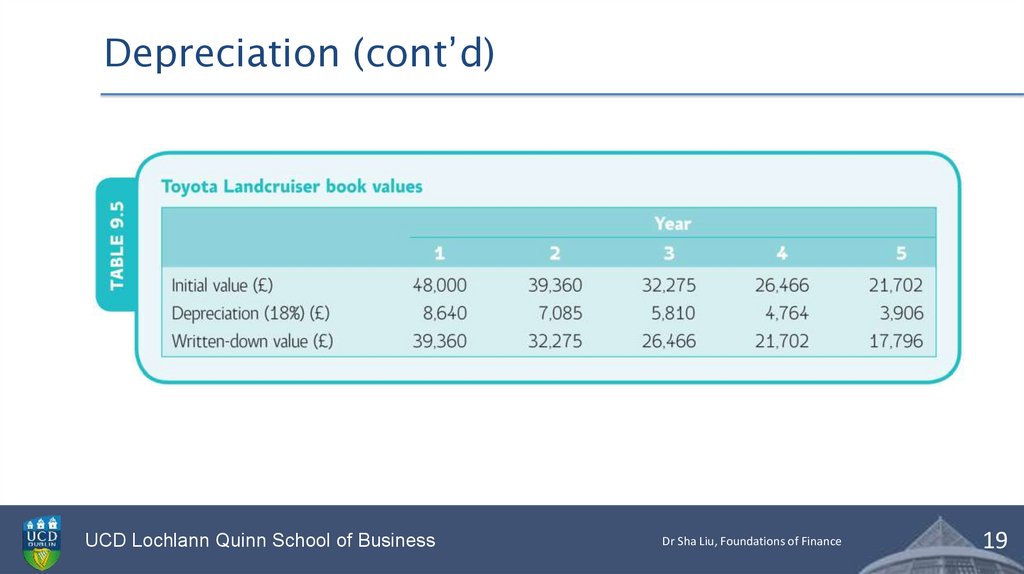

19.

Depreciation (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

19

20.

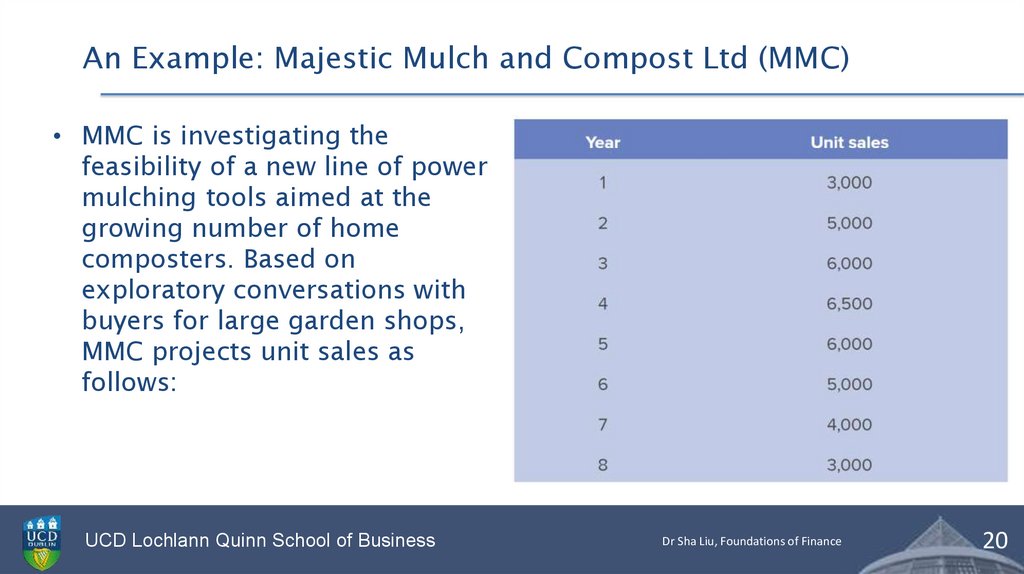

An Example: Majestic Mulch and Compost Ltd (MMC)• MMC is investigating the

feasibility of a new line of power

mulching tools aimed at the

growing number of home

composters. Based on

exploratory conversations with

buyers for large garden shops,

MMC projects unit sales as

follows:

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

20

21.

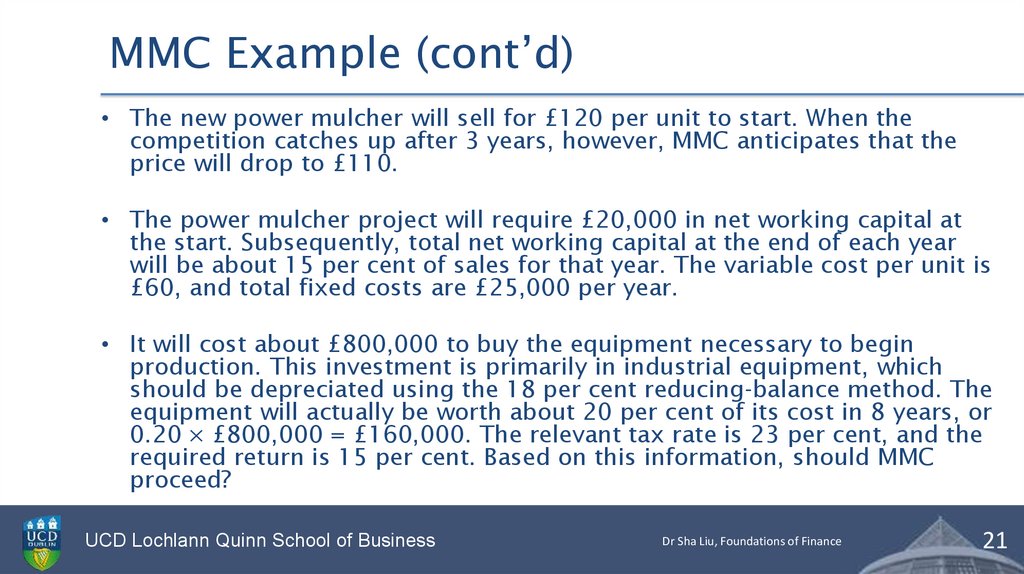

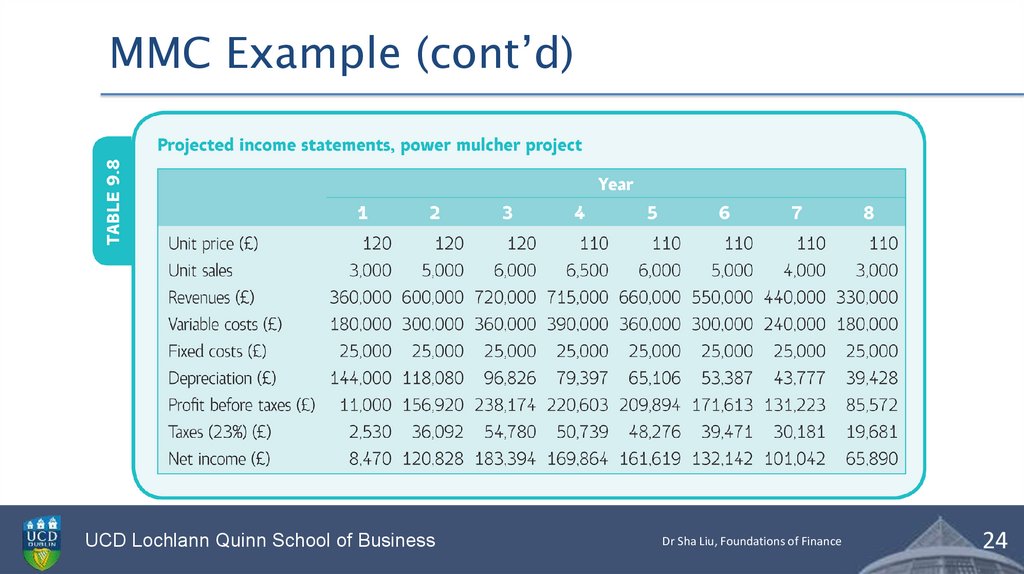

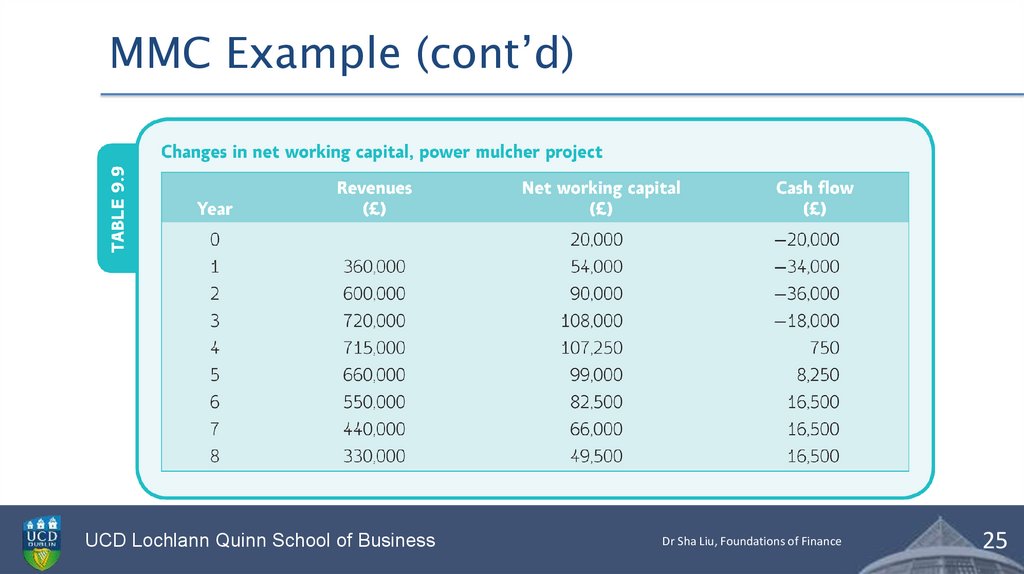

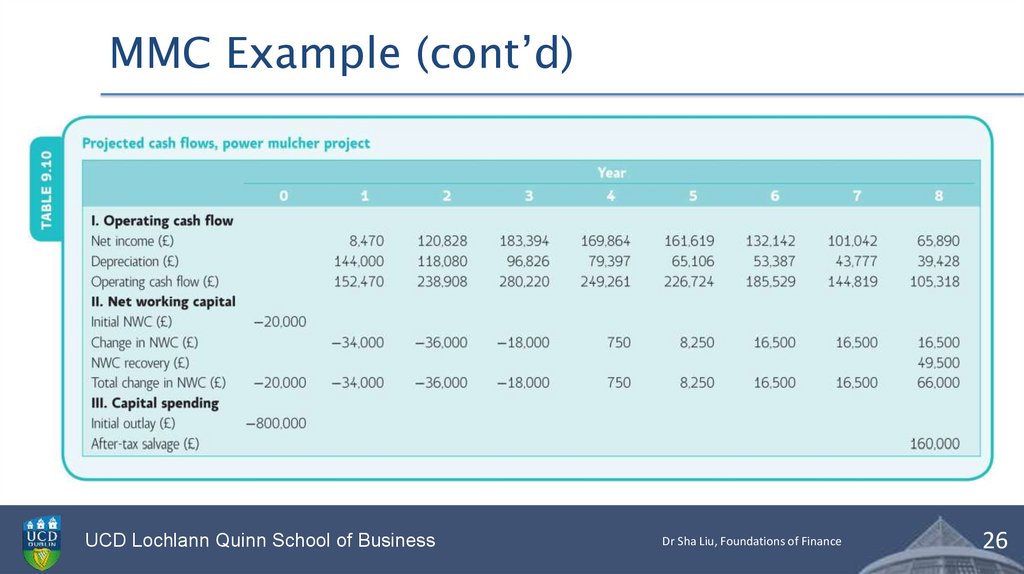

MMC Example (cont’d)• The new power mulcher will sell for £120 per unit to start. When the

competition catches up after 3 years, however, MMC anticipates that the

price will drop to £110.

• The power mulcher project will require £20,000 in net working capital at

the start. Subsequently, total net working capital at the end of each year

will be about 15 per cent of sales for that year. The variable cost per unit is

£60, and total fixed costs are £25,000 per year.

• It will cost about £800,000 to buy the equipment necessary to begin

production. This investment is primarily in industrial equipment, which

should be depreciated using the 18 per cent reducing-balance method. The

equipment will actually be worth about 20 per cent of its cost in 8 years, or

0.20 × £800,000 = £160,000. The relevant tax rate is 23 per cent, and the

required return is 15 per cent. Based on this information, should MMC

proceed?

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

21

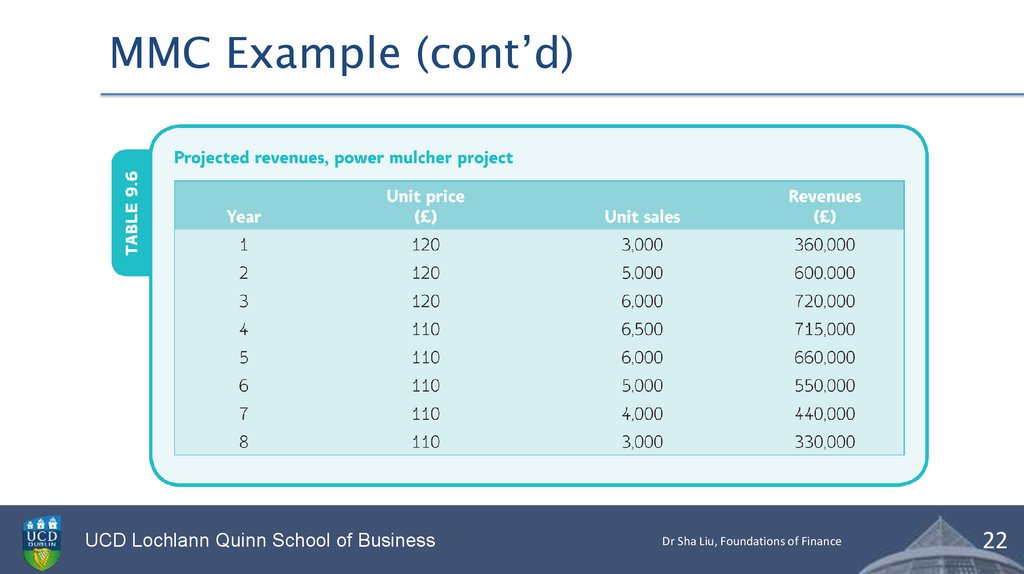

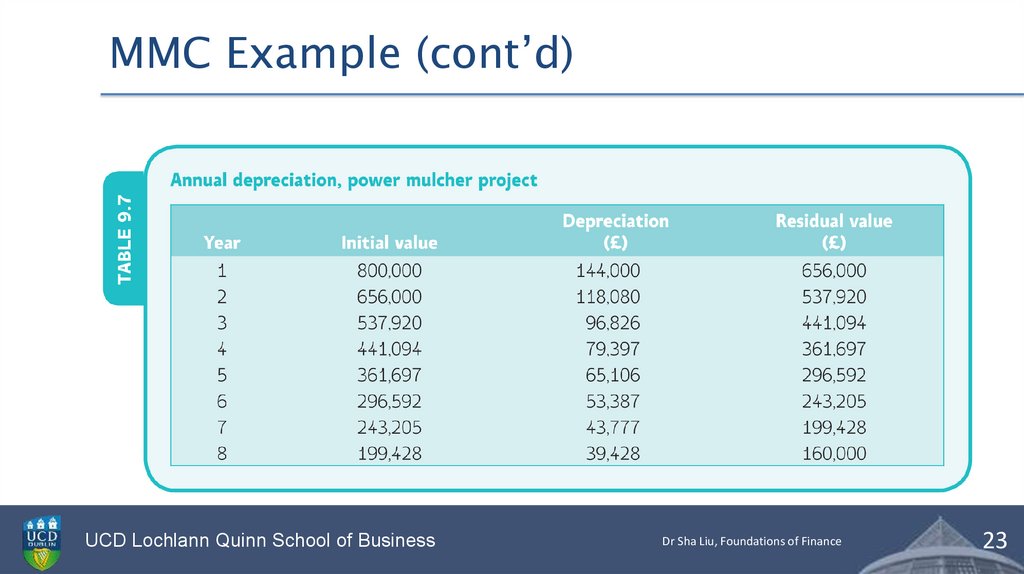

22.

MMC Example (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

22

23.

MMC Example (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

23

24.

MMC Example (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

24

25.

MMC Example (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

25

26.

MMC Example (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

26

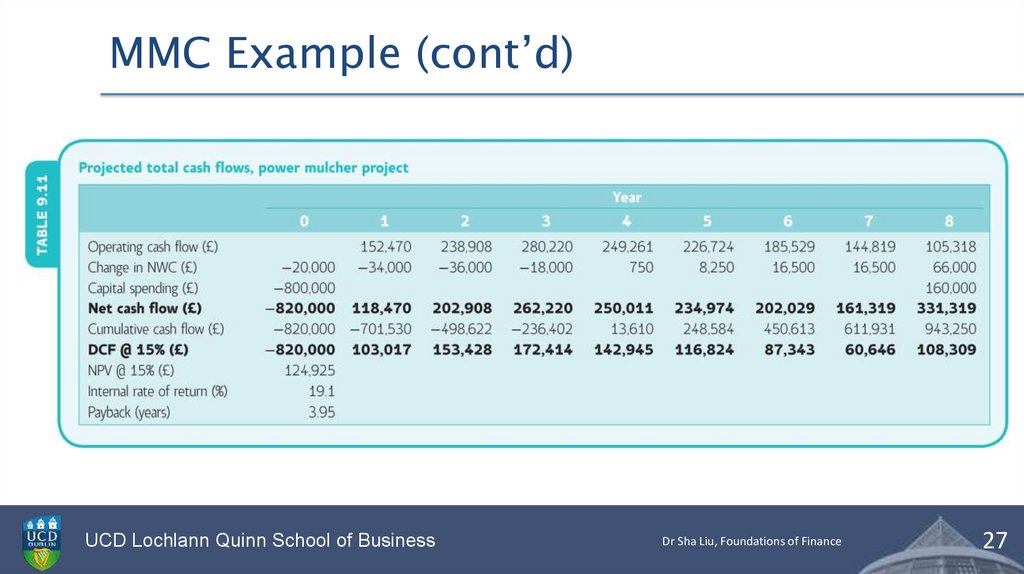

27.

MMC Example (cont’d)UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

27

28.

Intro to Project AnalysisUCD Lochlann Quinn School of Business

29.

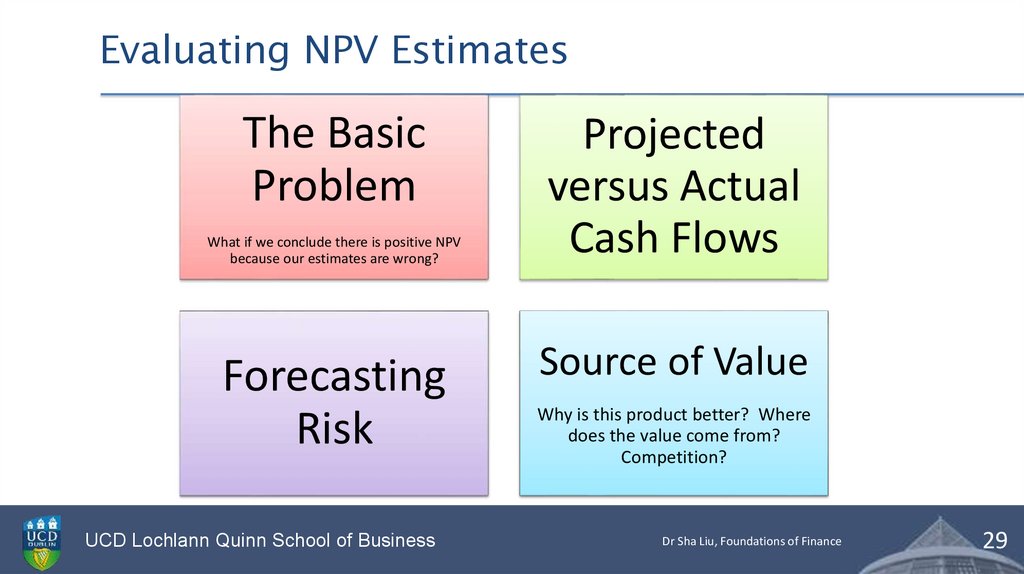

Evaluating NPV EstimatesThe Basic

Problem

What if we conclude there is positive NPV

because our estimates are wrong?

Forecasting

Risk

UCD Lochlann Quinn School of Business

Projected

versus Actual

Cash Flows

Source of Value

Why is this product better? Where

does the value come from?

Competition?

Dr Sha Liu, Foundations of Finance

29

30.

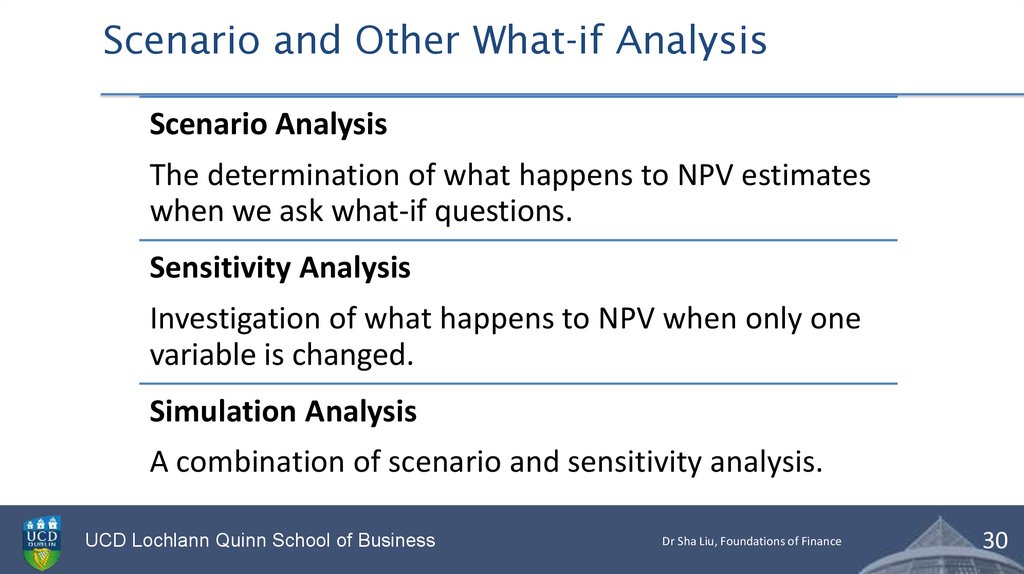

Scenario and Other What-if AnalysisScenario Analysis

The determination of what happens to NPV estimates

when we ask what-if questions.

Sensitivity Analysis

Investigation of what happens to NPV when only one

variable is changed.

Simulation Analysis

A combination of scenario and sensitivity analysis.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

30

31.

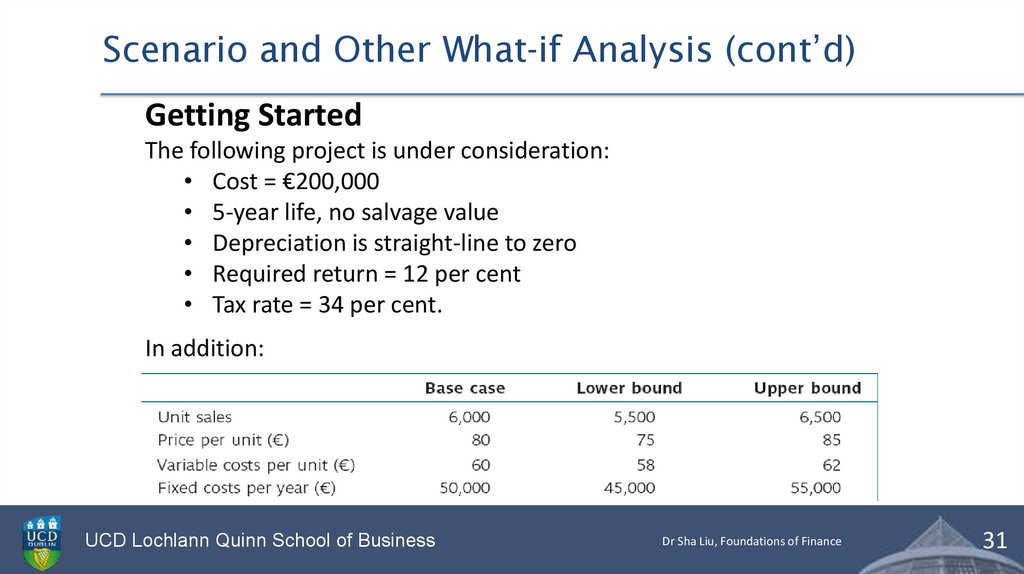

Scenario and Other What-if Analysis (cont’d)Getting Started

The following project is under consideration:

• Cost = €200,000

• 5-year life, no salvage value

• Depreciation is straight-line to zero

• Required return = 12 per cent

• Tax rate = 34 per cent.

In addition:

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

31

32.

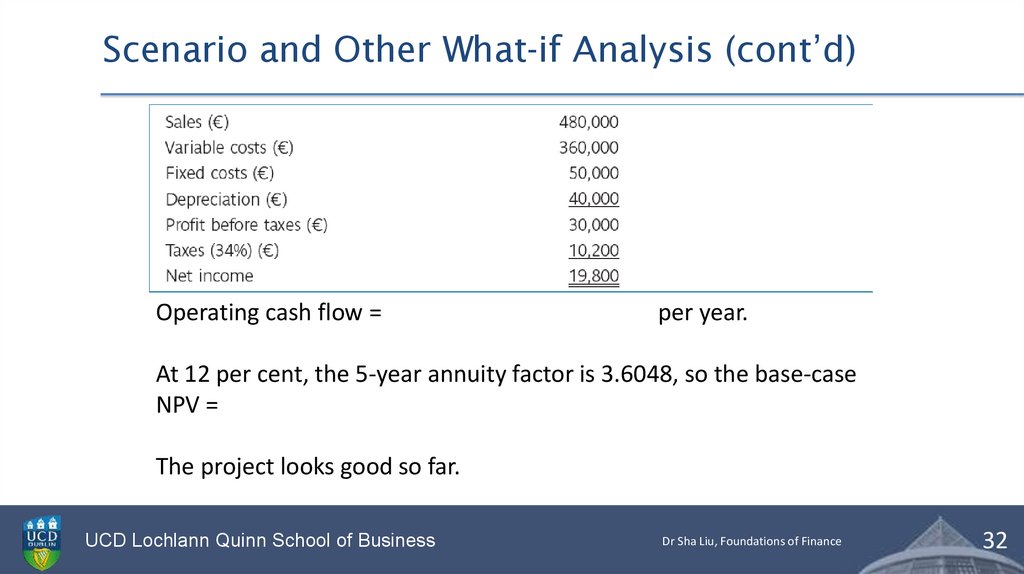

Scenario and Other What-if Analysis (cont’d)Operating cash flow =

per year.

At 12 per cent, the 5-year annuity factor is 3.6048, so the base-case

NPV =

The project looks good so far.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

32

33.

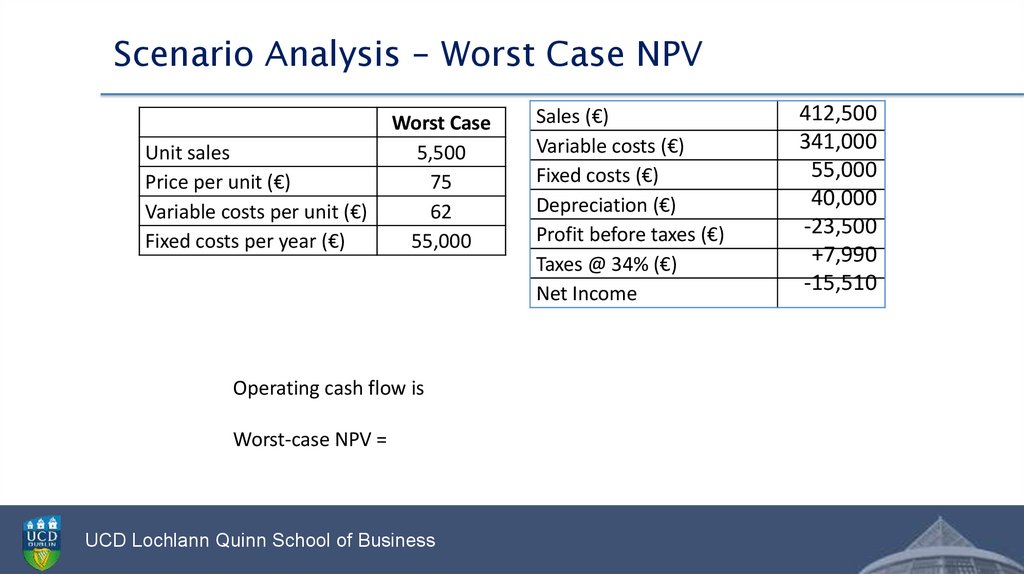

Scenario Analysis – Worst Case NPVScenario Analysis – Worst Case NPV

Unit sales

Price per unit (€)

Variable costs per unit (€)

Fixed costs per year (€)

Worst Case

5,500

75

62

55,000

Operating cash flow is

Worst-case NPV =

UCD Lochlann Quinn School of Business

Sales (€)

Variable costs (€)

Fixed costs (€)

Depreciation (€)

Profit before taxes (€)

Taxes @ 34% (€)

Net Income

412,500

341,000

55,000

40,000

-23,500

+7,990

-15,510

34.

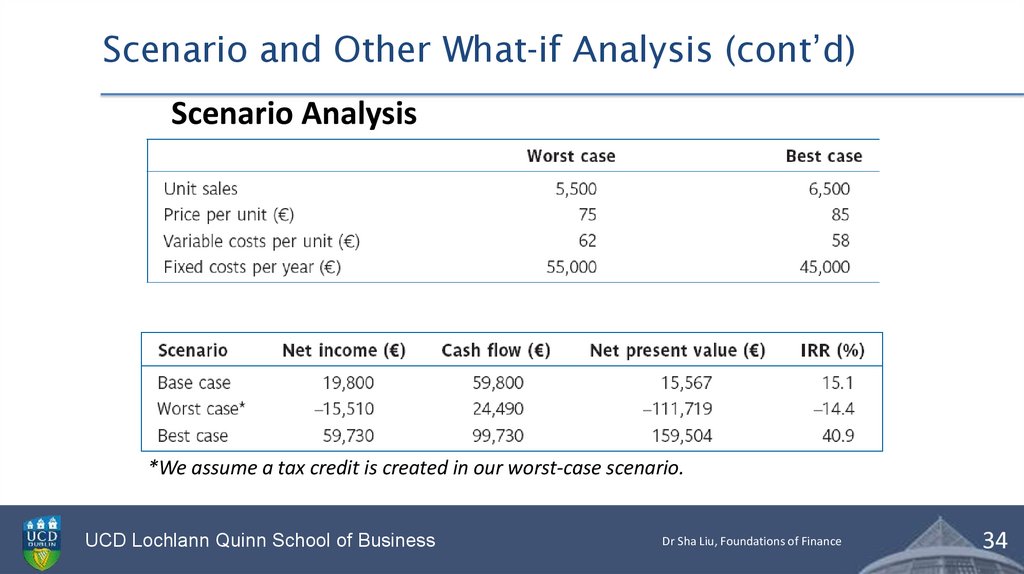

Scenario and Other What-if Analysis (cont’d)Scenario Analysis

*We assume a tax credit is created in our worst-case scenario.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

34

35.

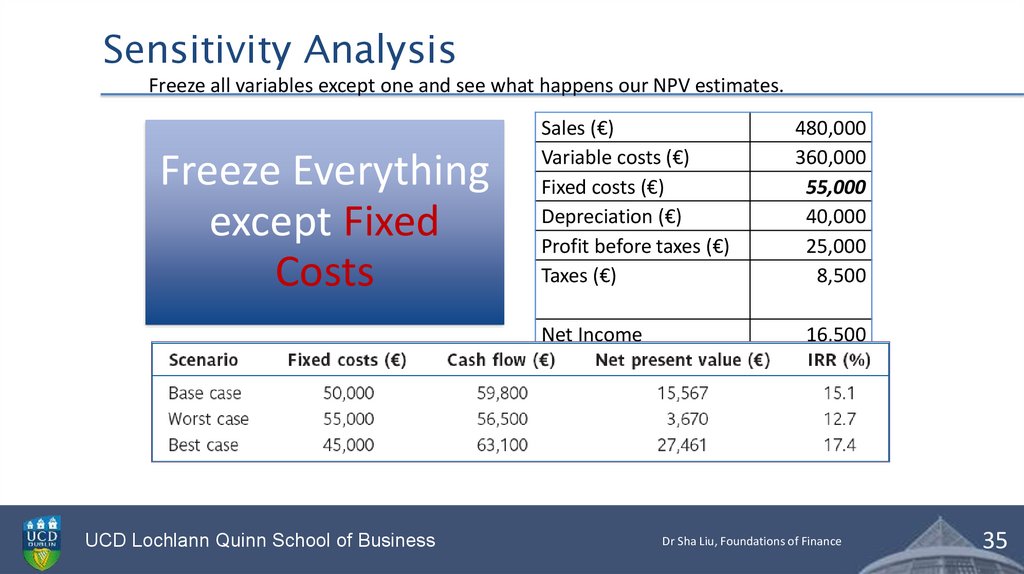

Sensitivity AnalysisFreeze all variables except one and see what happens our NPV estimates.

Freeze Everything

except Fixed

Costs

Sales (€)

Variable costs (€)

Fixed costs (€)

Depreciation (€)

Profit before taxes (€)

Taxes (€)

Net Income

UCD Lochlann Quinn School of Business

480,000

360,000

55,000

40,000

25,000

8,500

16,500

Dr Sha Liu, Foundations of Finance

35

36.

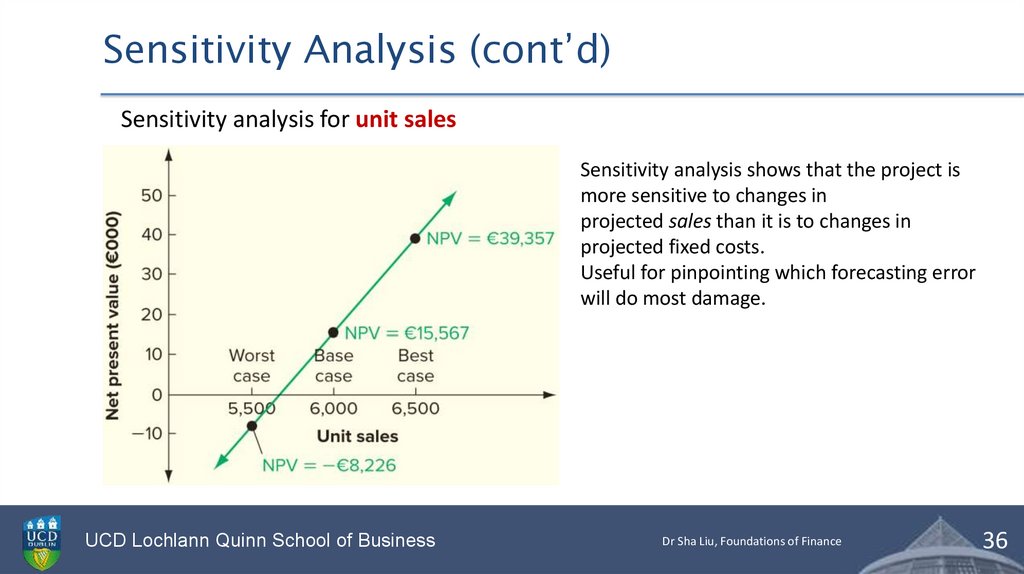

Sensitivity Analysis (cont’d)Sensitivity analysis for unit sales

Sensitivity analysis shows that the project is

more sensitive to changes in

projected sales than it is to changes in

projected fixed costs.

Useful for pinpointing which forecasting error

will do most damage.

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

36

37.

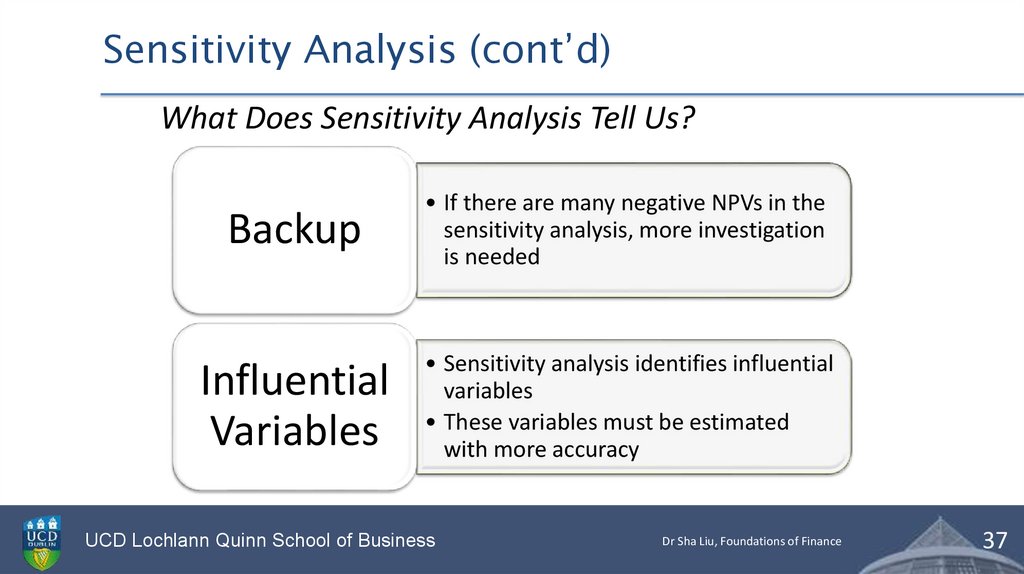

Sensitivity Analysis and Scenario AnalysisSensitivity Analysis (cont’d)

What Does Sensitivity Analysis Tell Us?

Backup

• If there are many negative NPVs in the

sensitivity analysis, more investigation

is needed

Influential

Variables

• Sensitivity analysis identifies influential

variables

• These variables must be estimated

with more accuracy

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

37

38.

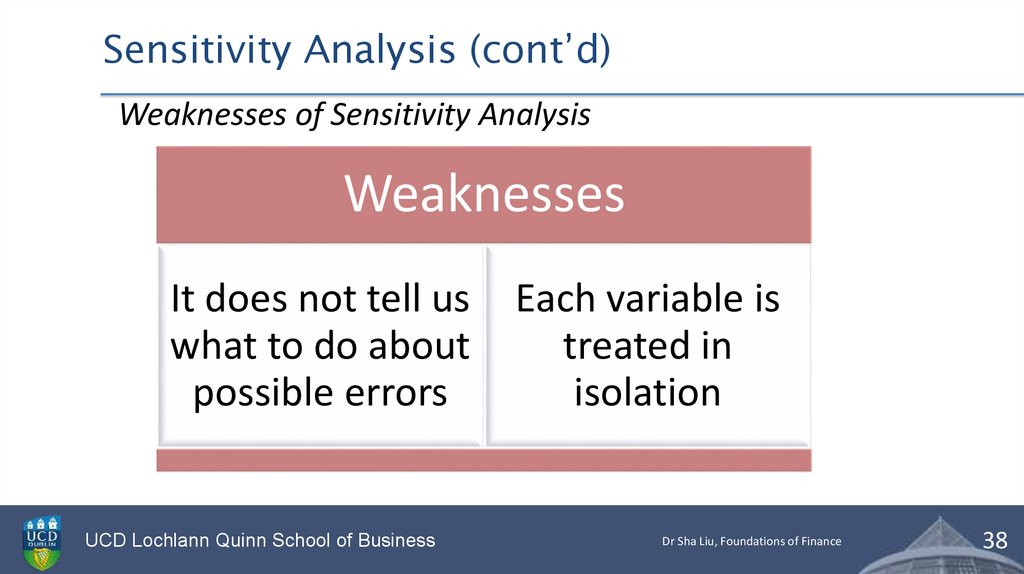

Sensitivity Analysis and Scenario AnalysisSensitivity Analysis (cont’d)

Weaknesses of Sensitivity Analysis

Weaknesses

It does not tell us

what to do about

possible errors

UCD Lochlann Quinn School of Business

Each variable is

treated in

isolation

Dr Sha Liu, Foundations of Finance

38

39.

Readings• Corporate Finance and selected chapters from

Investments for University College Dublin. David Hillier,

Zvi Bodie.

– Week 8 readings

• OR:

• Hillier, D., I. Clacher, S. Ross, R. Westerfield, J. Jaffe, and

B. Jordan. "Fundamentals of Corporate Finance", 3rd

edition, Mcgraw-Hill, 2017.

– Chapter 9 (section 9.1-9.5)

– Chapter 10 (section 10.1-10.2)

UCD Lochlann Quinn School of Business

Dr Sha Liu, Foundations of Finance

39

finance

finance