Similar presentations:

Financial Decision Making and the Law of One Price. Chapter 3

1. BEE1006 Introduction to Finance Chapter 3: Financial Decision Making and the Law of One Price

Dr Weihan DingSpring Term 2022

2.

Chapter Outline3.1 Valuing Decisions

3.2 Interest Rates and the Time Value of Money

3.3 Present Value and the NPV Decision Rule

3.4 Arbitrage and the Law of One Price

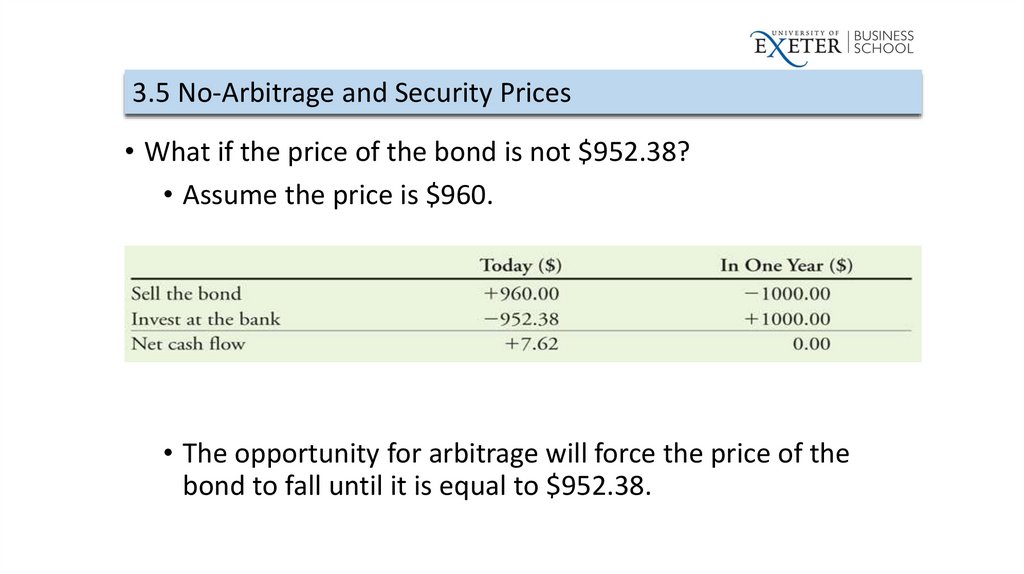

3.5 No-Arbitrage and Security Prices

3.

Learning Objectives1. Assess the relative merits of two-period projects using net

present value.

2. Define the term “competitive market,” give examples of

markets that are competitive and some that aren’t, and

discuss the importance of a competitive market in

determining the value of a good.

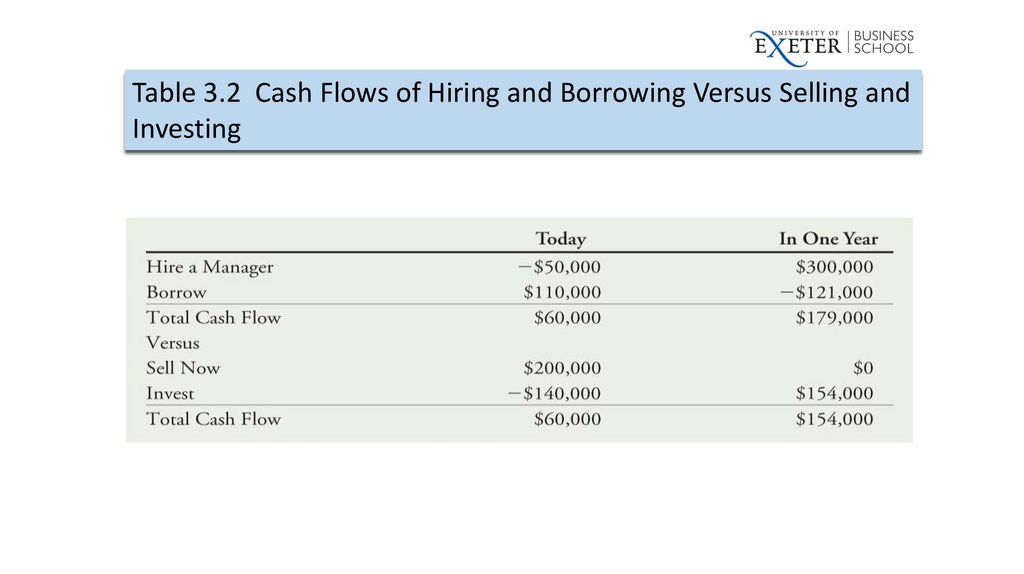

3. Explain why maximizing NPV is always the correct decision

rule.

4.

Learning Objectives (cont'd)4. Define arbitrage, and discuss its role in asset pricing. How

does it relate to the Law of One Price?

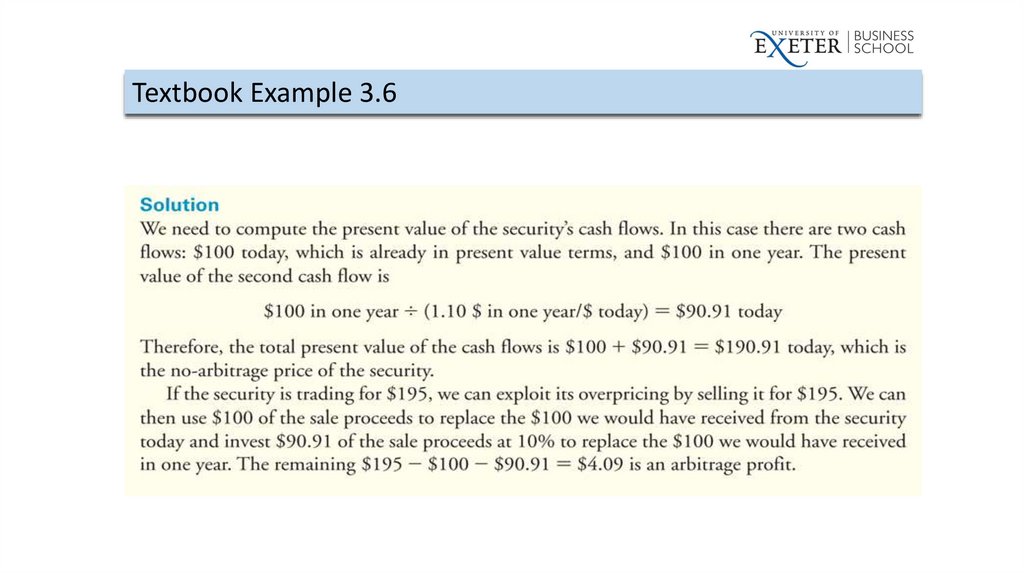

5. Calculate the no-arbitrage price of an investment

opportunity.

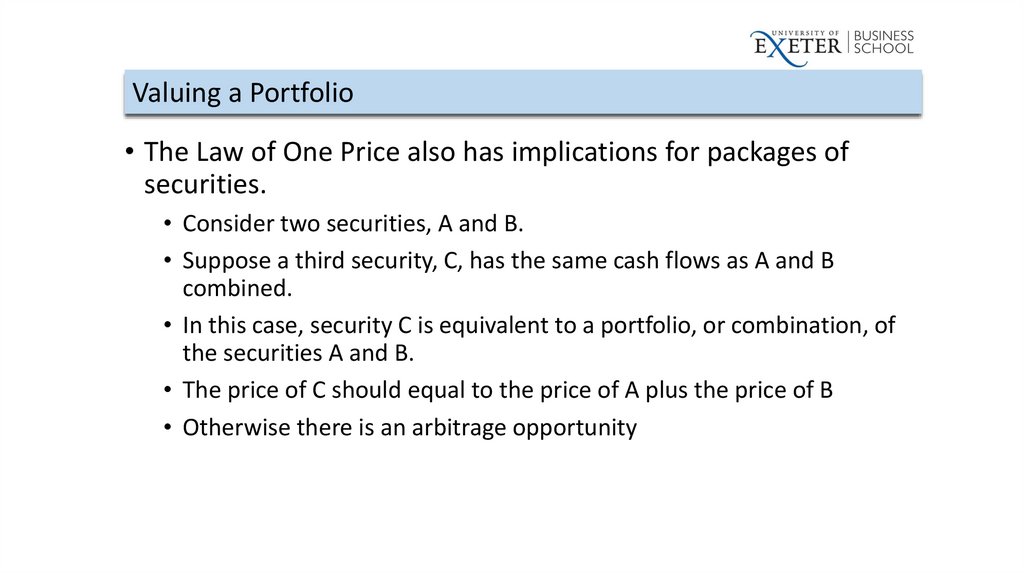

6. Show how value additivity can be used to help managers

maximize the value of the firm.

7. Describe the Separation Principle.

5.

Motivation: Why this Chapter?• This Chapter discusses some very important principles that are

foundations for the incoming chapters (this is probably an incomplete

list):

• Valuation Principle

• Time Value of Money

• NPV Decision Rule

• Arbitrage and the Law of One Price

• Value Additivity

6.

3.1 Valuing DecisionsIdentify Costs and Benefits

Financial managers should made decisions where the

benefits exceed the costs

We need to evaluate benefits and costs in the same unit

before we could compare them

Suppose a jewelry manufacturer has the opportunity to trade 400

ounces of silver and receive 10 ounces of gold today.

To compare the costs and benefits, we first need to convert them

to a common unit.

7.

Analyzing Costs and Benefits• If the current market price for gold is $1300 per ounce, then

the 10 ounces of gold we receive has a cash value of

(10 ounces of gold) X ($1300/ounce) = $13,000 today

• Suppose silver can be bought and sold for a current market

price of $17 per ounce. Then the 400 ounces of silver we

give up has a cash value of

(400 ounces of silver) X ($17/ounce) = $6,800 today

8.

Analyzing Costs and Benefits• Therefore, the jeweller's opportunity has a benefit of

$13,000 today and a cost of $6,800 today. In this case, the

net value of the project today is

$13,000 – $6,800 = $6,200 today

• Because the net value is positive, the benefits exceed the

costs, and the jeweller should accept the trade.

• By accepting the trade, the jeweller will be richer by $6200

9.

Using Market Prices to Determine Cash Values• Competitive Market

• A market in which goods can be bought and sold at the

same price.

• In evaluating the jeweller's decision, we used the current

market price to convert from ounces of silver or gold to

dollars.

• We did not concern ourselves with whether the jeweller

thought that the price was fair or whether the jeweller

would use the silver or gold.

10.

Using Market Prices to Determine Cash Values• We know the market value of 10 ounces of gold is $13000

• What if the jeweller do not need gold at all?

• She will still value the gold at $13000

• As she can sell the gold at $13000 in the market

• She will not sell it at a lower price

• What if the jeweller really, really want the gold?

• She will still value the gold at $13000

• As she can buy the gold at $13000 in the market

• She will not buy it a higher price

11.

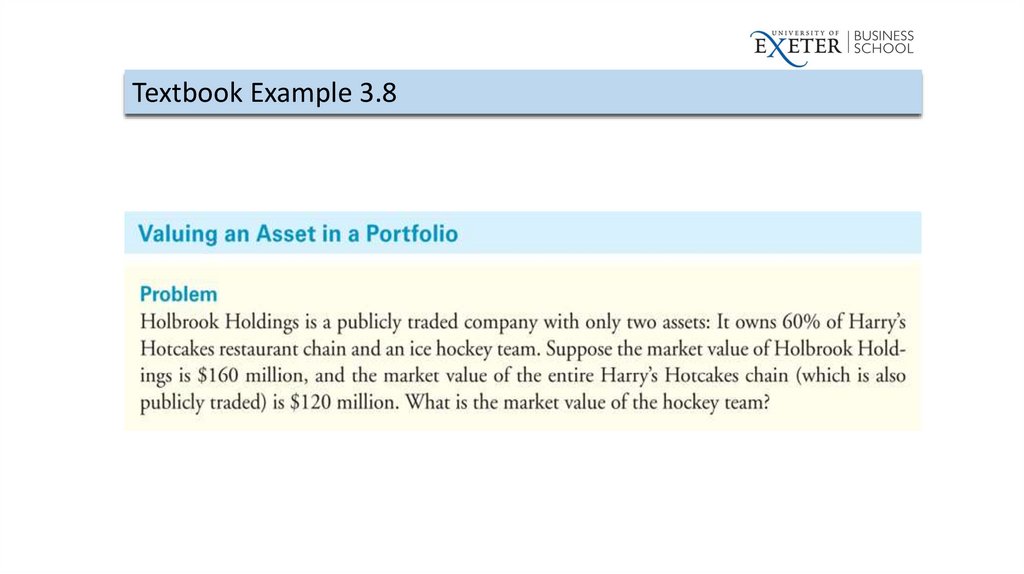

Textbook Example 3.112.

Textbook Example 3.113.

3.1 Valuation PrincipleThe previous example illustrates the point that we can determine

whether a decision will make the firm and its investors wealthier

This is called Valuation Principle:

The value of an asset to the firm or its investors is determined by

its competitive market price. The benefits and costs of a decision

should be evaluated using these market prices, and when the

value of the benefits exceeds the value of the costs, the decision

will increase the market value of the firm.

14.

3.2 Interest Rates and the Time Value of MoneyConsider an investment opportunity with the following certain cash

flows.

Cost: $100,000 today

Benefit: $105,000 in one year

Cannot simply compare 1$ today and 1$ tomorrow

For example, if you invest 1$ today, most likely you will get more

than 1$ tomorrow

The difference in value between money today and money in the

future is due to the time value of money.

15.

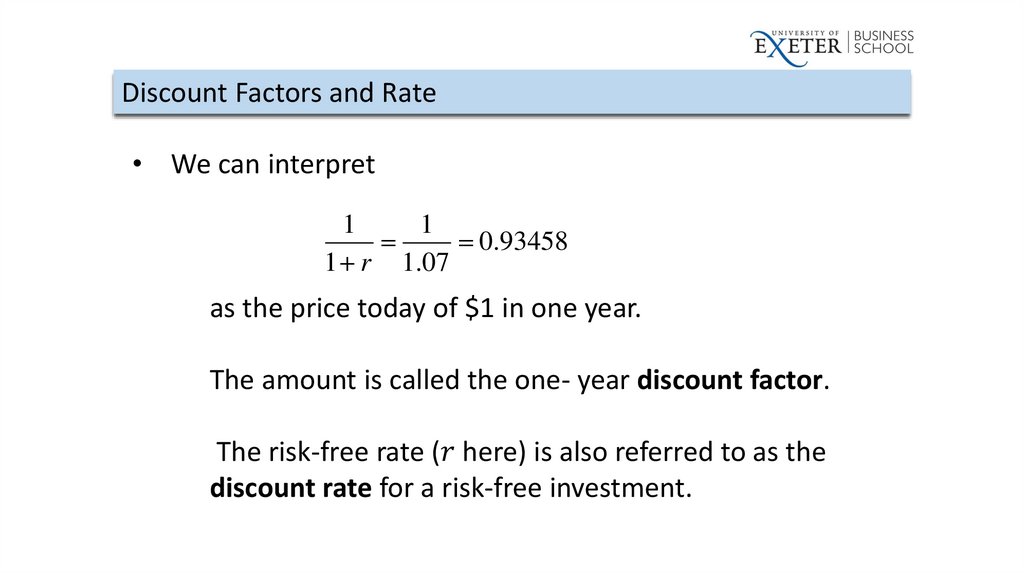

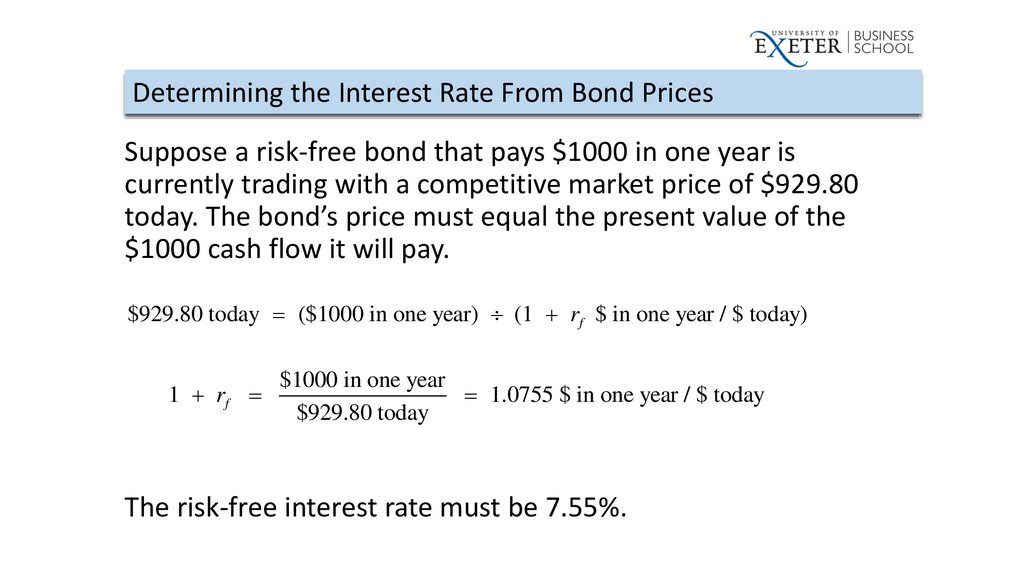

The Interest Rate: An Exchange Rate Across TimeThe rate at which we can exchange money today for money in the

future is determined by the current interest rate.

Suppose the current annual interest rate is 7%.

By investing or borrowing at this rate, we can exchange $1.07 in one year

for each $1 today.

Risk–Free Interest Rate (Discount Rate),

finance

finance