Similar presentations:

Money and Financial market. Lecture 3

1.

Lecture 3.Money and Financial market

Armine Vekilyan

2.

Learning objectivesWhat we want to learn today?

- What is money?

- What is money needed for?

- Where does money come from?

- How is money market defined?

- What is the price of money?

3.

Historically money has been of two kinds:Commodity money:

Takes the form of a commodity with intrinsic value

Examples: gold coins

What are the examples of commodity money?

Fiat money or token money:

Has no intrinsic value

Consists of coins, currency notes, and checks

What are the new possible fiat “money” appearing?

4.

To an economist, money does not refer to all wealth butonly to one type of it: money is the stock of assets that can

be readily used to make transactions.

As a store of value, money is a way to transfer purchasing

power from the present to the future.

As a unit of account, money provides the terms in which

prices are quoted and debts are recorded

As a medium of exchange, money is what we use to buy

goods and services.

As a standard of deferred payment, money is being a

widely accepted way to value a debt, thereby allowing goods

and services to be acquired now and paid for in the future.

5.

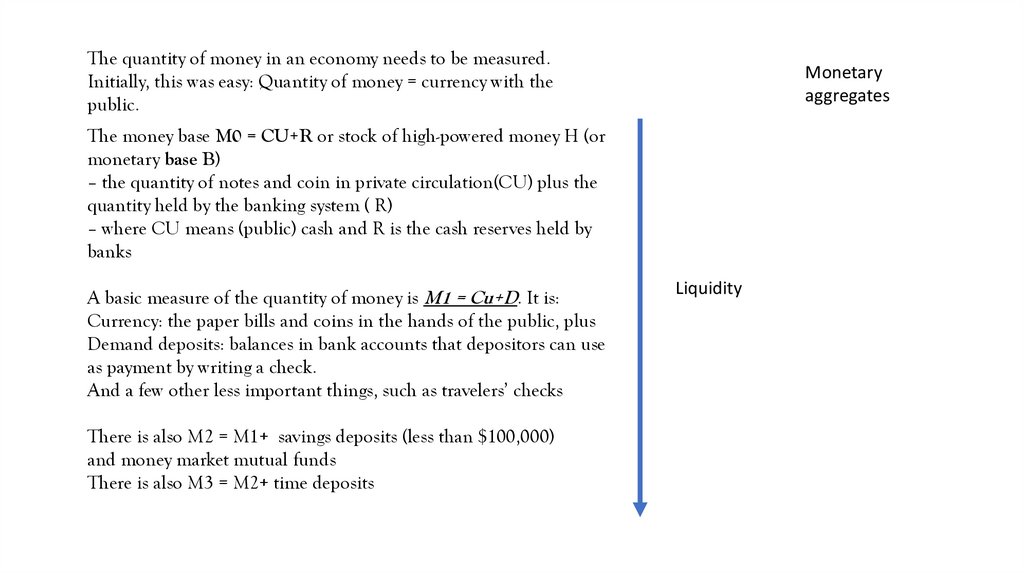

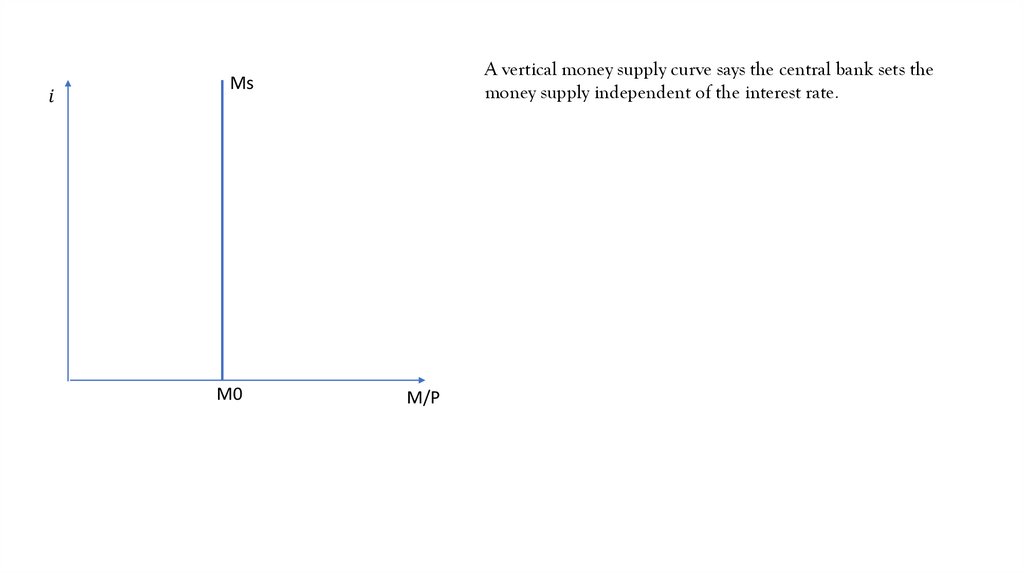

The quantity of money in an economy needs to be measured.Initially, this was easy: Quantity of money = currency with the

public.

Monetary

aggregates

The money base M0 = CU+R or stock of high-powered money H (or

monetary base B)

– the quantity of notes and coin in private circulation(CU) plus the

quantity held by the banking system ( R)

– where CU means (public) cash and R is the cash reserves held by

banks

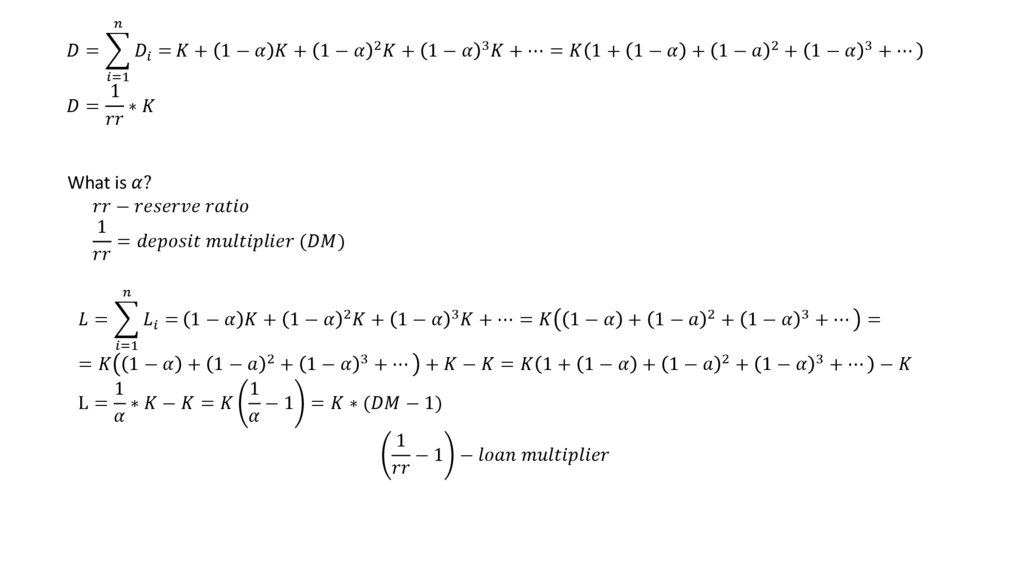

A basic measure of the quantity of money is M1 = Cu+D. It is:

Currency: the paper bills and coins in the hands of the public, plus

Demand deposits: balances in bank accounts that depositors can use

as payment by writing a check.

And a few other less important things, such as travelers’ checks

There is also M2 = M1+ savings deposits (less than $100,000)

and money market mutual funds

There is also M3 = M2+ time deposits

Liquidity

6.

Motives for holding money?Transaction motive

payments and receipts are not

perfectly synchronized

The more transactions => the

more money you need

Transaction motive depends on

GDP (Y)

Precautionary

motive

Because of

uncertainty

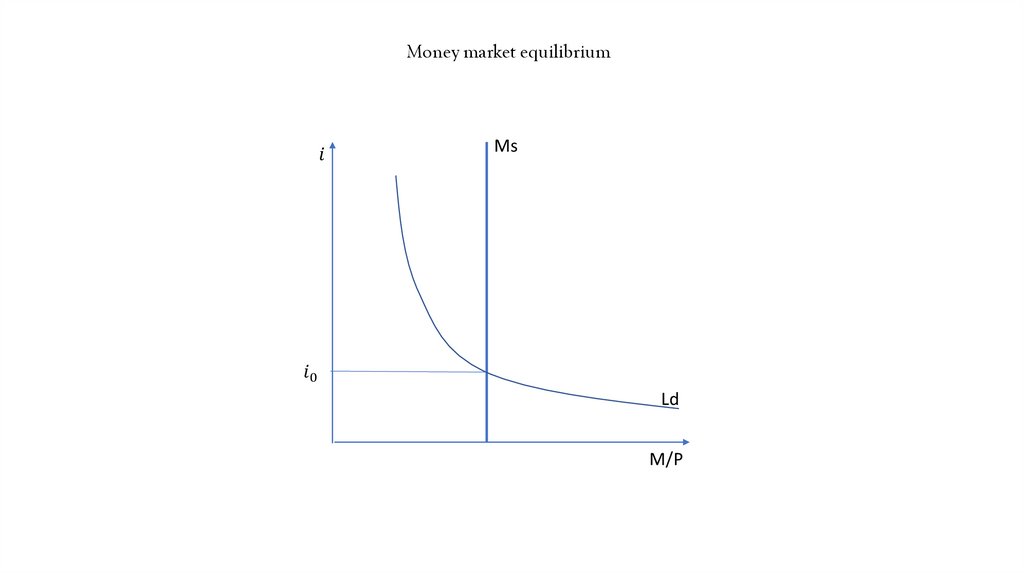

Speculative motive

People may hold money

rather than bonds

Bonds vs money

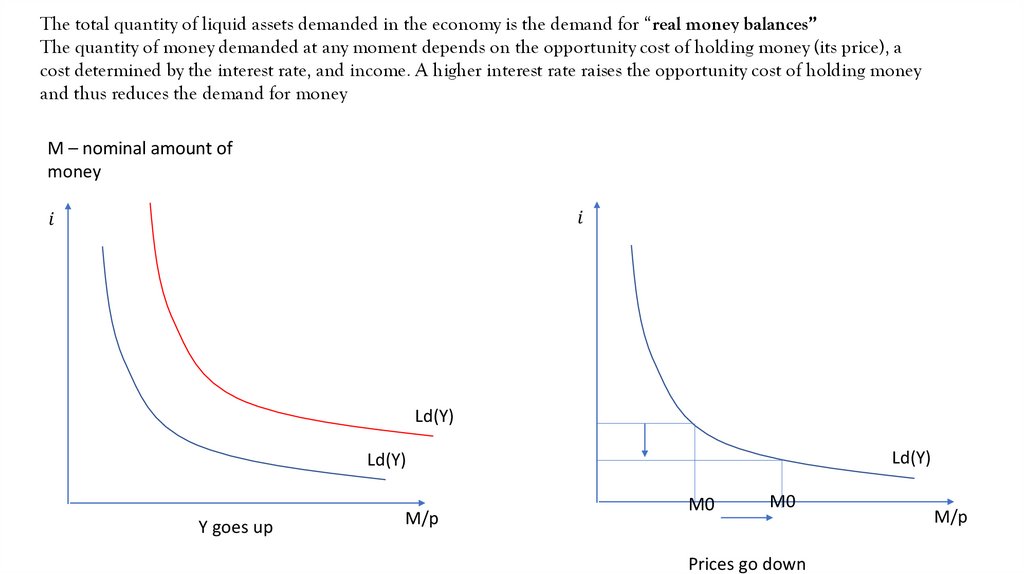

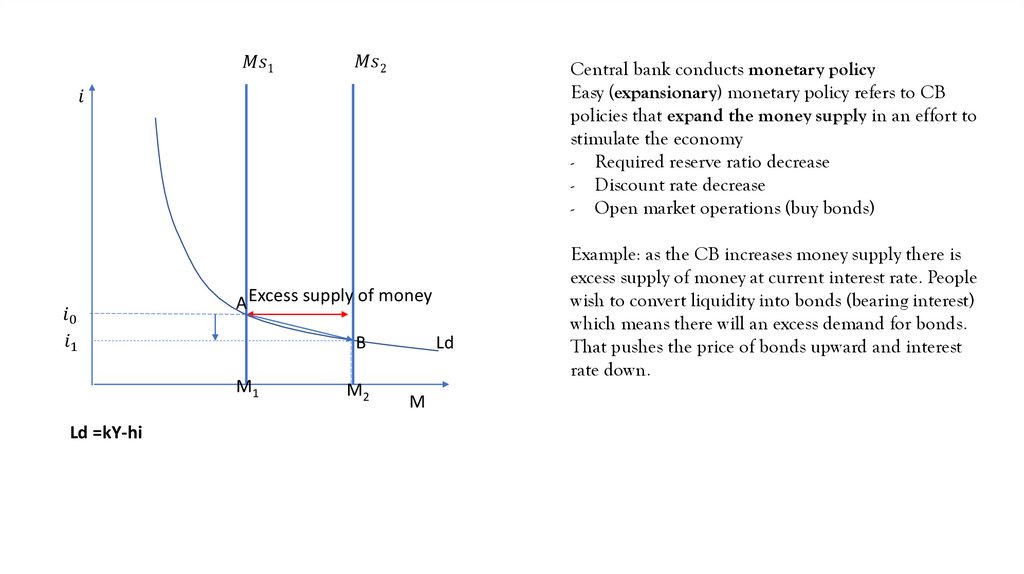

Interest rate and money

demand are inversely

related

7.

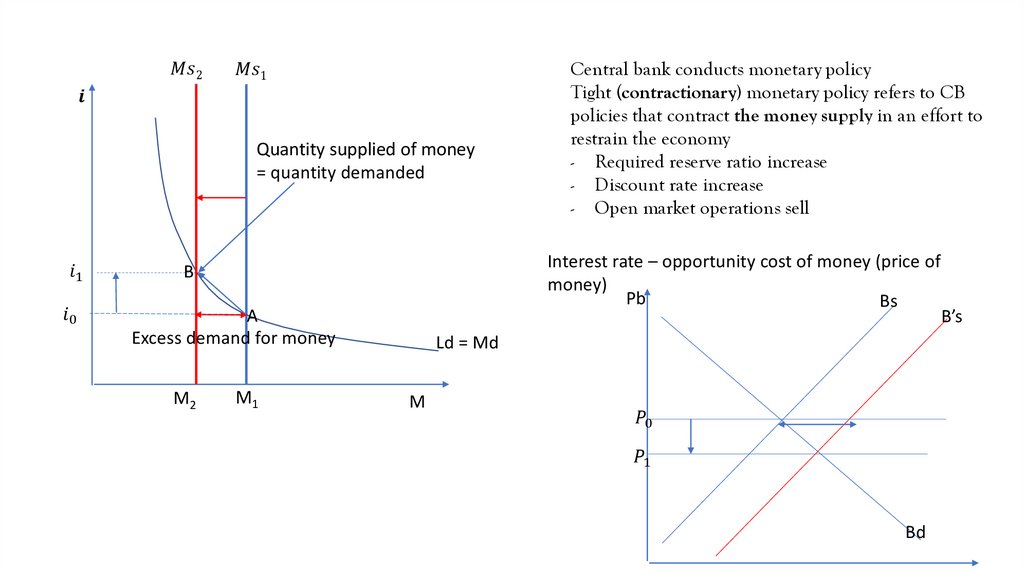

There’s no market for money!So we need to come up with its mirror. because money

is the medium of exchange

The market of relevance is the market for bonds

What is happening explicitly in the market for bonds

determines what is happening in the implicit market

for money

L0+B0=W=LD+ BD where L stands for money

holding

W – total wealth

LD – desired real money

BD – desired real bonds holding

B0–BD =LD–L0

excess supply of bonds = excess demand for money

Price of bonds decreases => increase in

interest

Pb

B1s

B2s

P1b

P2b

Bd

B

8.

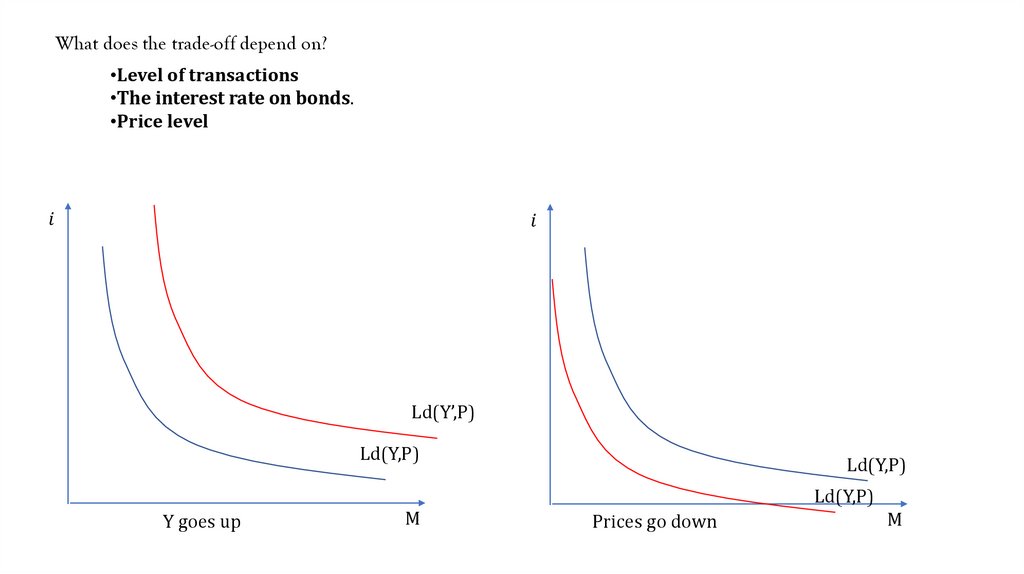

What does the trade-off depend on?•Level of transactions

•The interest rate on bonds.

•Price level

finance

finance