Similar presentations:

Money and monetary policy

1.

Money and monetarypolicy

Shomurodov Tokhir

2.

Look forthe

answers to

these

questions:

What assets are

considered

“money”? What

are the functions

of money? The

types of money?

What is Central

Bank?

What role do

banks play in the

monetary

system? How do

banks “create

money”?

How does the

Central bank

control the

money supply?

2

3.

Theconnection

between

money and

prices

• Inflation rate = the percentage increase

in the average level of prices.

• price = amount of money required to

buy a good.

• Because prices are defined in terms of money,

we need to consider the nature of money,

the supply of money, and how it is controlled.

slide 3

4.

Without moneyWhat

Money Is

and Why

It’s

Important

• Trade would require barter: the exchange

of one good or service for another.

• Requires a double coincidence of wants:

unlikely occurrence that two people each

have a good the other wants.

• Waste of resources: people spend time

searching for others to trade with

Using money

• Solves those problems

4

5.

Money:definition

• Money is the stock

of assets that can be readily

used to make transactions.

slide 5

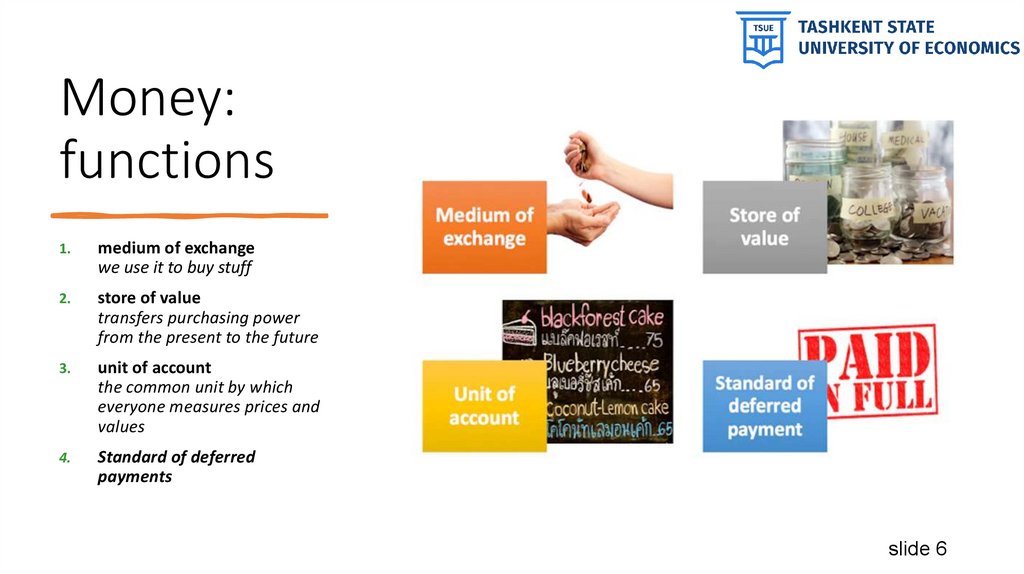

6.

Money:functions

1.

medium of exchange

we use it to buy stuff

2.

store of value

transfers purchasing power

from the present to the future

3.

unit of account

the common unit by which

everyone measures prices and

values

4.

Standard of deferred

payments

slide 6

7.

Money: types1. fiat money

• has no intrinsic value

• example: the paper currency we use

2. commodity money

• has intrinsic value

• examples: gold coins,

cigarettes in P.O.W. camps

slide 7

8.

DiscussionQuestion

Which of these are money?

a.

Currency

b.

Checks

c.

Deposits in checking accounts

(called demand deposits)

d.

Credit cards

e.

Certificates of deposit

(called time deposits)

slide 8

9.

The moneysupply &

monetary

policy

• The money supply is the quantity

of money available in the

economy.

• Monetary policy is the control

over the money supply.

slid

e9

10.

The MoneySupply

• The money supply (or money stock):

• Quantity of money available in

the economy

• Currency:

• Paper bills and coins in the

hands of the (non-bank) public

• Demand deposits:

• Balances in bank accounts that

depositors can access on

demand by writing a check

10

11.

Money supply measures Billions UZS, January 2023including:

of which:

of which:

Foreign

currency

Other

deposits

deposits in in national

national

currency

currency equivalent

Broad

money

(М2)1)

Money

supply in

national

currency

Narrow

money

(М1)2)

Currency

in

circulation

(М0)

Transfarable

deposits

2=3+8

3=4+7

4=5+6

5

6

7

8

1/1/2023 189,085

138,832

84,046

42,206

41,840

54,786

50,253

Date

1

Statistics - The Central Bank of the Republic of Uzbekistan (cbu.uz)

slide

11

12.

Central Banks & MonetaryPolicy

Central bank:

• Institution that oversees the banking

system and regulates the money supply

Monetary policy:

• Setting of the money supply by

policymakers in the central

• The central bank of the Uzbekistan

12

13.

The central bank• Monetary policy is conducted by a

country’s central bank.

• 1991-1992 years became a turning

period of banking operation.

• 1995 year was characterized by

improvement of banking legal system.

slid

e 13

14.

Definitions of money supply1) Broad money (M2) is calculated based on positions of liabilities of Central bank

and other depository corporations (commercial banks), in accordance with the

concepts and definitions of the Monetary and Financial Statistics Manual and

Compilation Guide, IMF 2016 (MFSMCG 2016). M2 includes cash in circulation

(outside banking system), transferable, saving and time deposits in national and

foreign currency of other financial corporations, public nonfinancial corporations,

private sector and households (except for deposits not included in the broad

money according to the MFSMCG 2016).

2) Narrow money (M1) includes cash in circulation and transferable deposits in

national currency.

15.

The Quantity Theory ofMoney

A simple theory linking

the inflation rate to

the growth rate of the

money supply.

Begins with a concept

called “velocity”…

slide 15

16.

Velocity• basic concept: the rate at which

money circulates

• definition: the number of times

the average dollar bill changes

hands in a given time period

• example: In 2001,

• $500 billion in transactions

• money supply = $100 billion

• The average dollar is used

in five transactions in 2001

• So, velocity = 5

slide 16

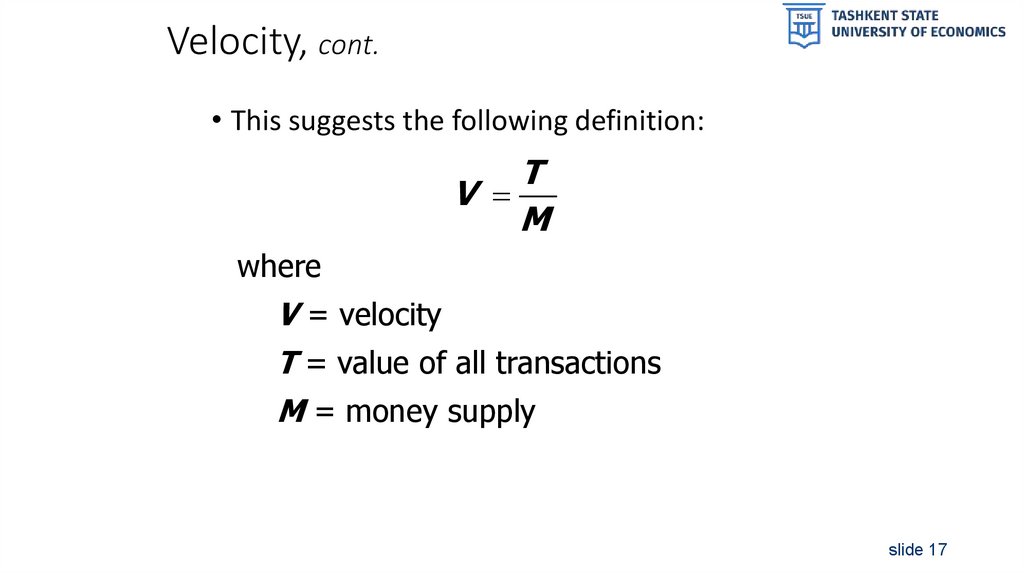

17.

Velocity, cont.• This suggests the following definition:

T

V

M

where

V = velocity

T = value of all transactions

M = money supply

slide 17

18.

Velocity, cont.• Use nominal GDP as a proxy for total

transactions.

Then,

P Y

V

M

where

P = price of output

(GDP deflator)

Y = quantity of output (real GDP)

P Y = value of output

(nominal GDP)

slide 18

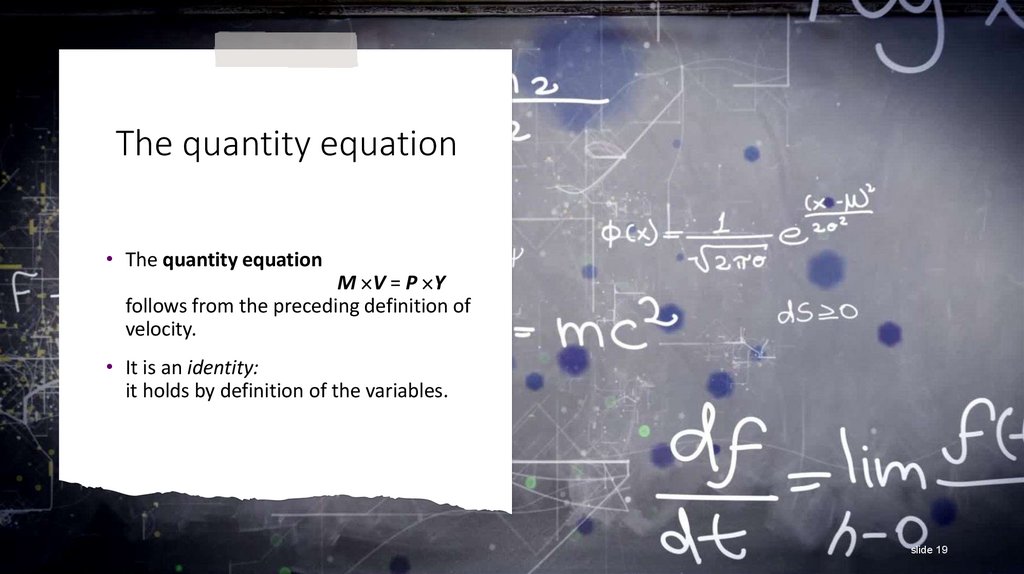

19.

The quantity equation• The quantity equation

M V = P Y

follows from the preceding definition of

velocity.

• It is an identity:

it holds by definition of the variables.

slide 19

20.

Money demand and the quantity equationM/P = real money balances, the

purchasing power of the money

supply.

A simple money demand function:

(M/P )d = k Y

where

k = how much money people wish

to hold for each dollar of income.

(k is exogenous)

slide

20

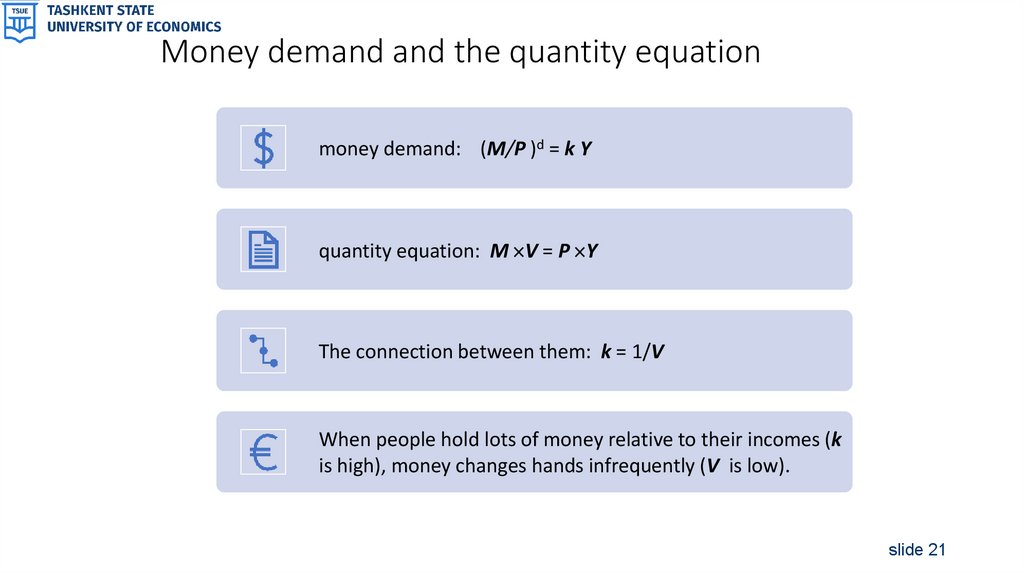

21.

Money demand and the quantity equationmoney demand: (M/P )d = k Y

quantity equation: M V = P Y

The connection between them: k = 1/V

When people hold lots of money relative to their incomes (k

is high), money changes hands infrequently (V is low).

slide 21

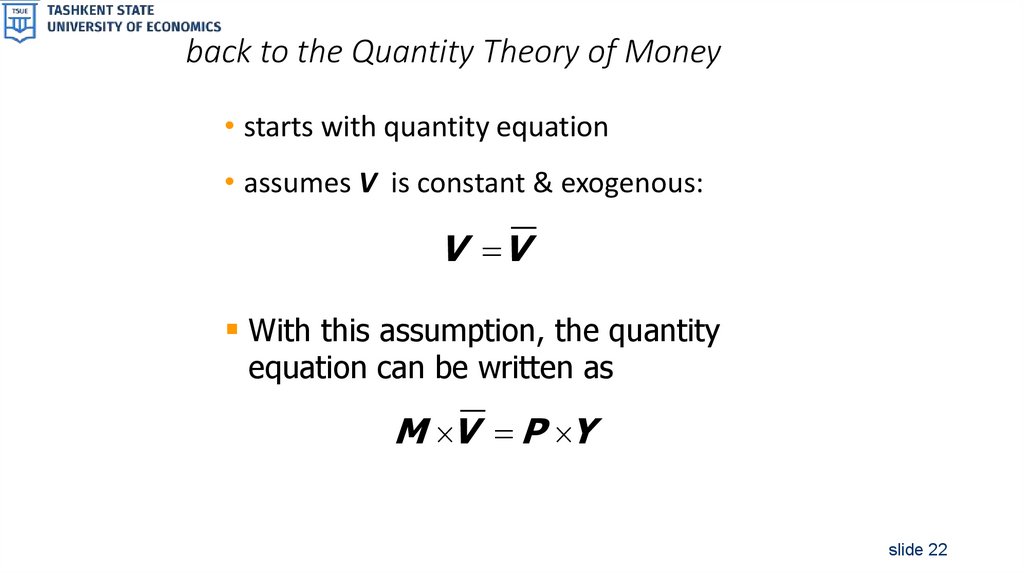

22.

back to the Quantity Theory of Money• starts with quantity equation

• assumes V is constant & exogenous:

V V

With this assumption, the quantity

equation can be written as

M V P Y

slide 22

23.

The Quantity Theory of Money, cont.M V P Y

How the price level is determined:

With V constant, the money supply determines

nominal GDP (P Y )

Real GDP is determined by the economy’s supplies

of K and L and the production function

The price level is

P = (nominal GDP)/(real GDP)

slide 23

24.

The Quantity Theory of Money, cont.• The quantity equation in growth rates:

M

M

V

V

P

P

Y

Y

The quantity theory of money assumes

V is constant, so

V

V

= 0.

slide 24

25.

The Quantity Theory of Money, cont.Let (Greek letter “pi”)

denote the inflation rate:

The result from the

preceding slide was:

Solve this result

for to get

M

M

M

M

P

P

P

P

Y

Y

Y

Y

slide 25

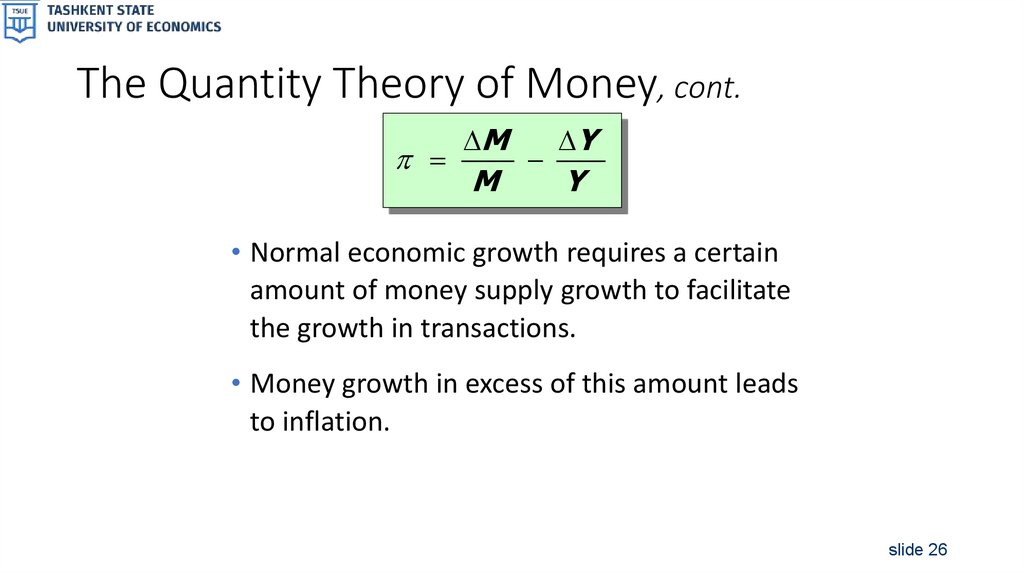

26.

The Quantity Theory of Money, cont.M

M

Y

Y

• Normal economic growth requires a certain

amount of money supply growth to facilitate

the growth in transactions.

• Money growth in excess of this amount leads

to inflation.

slide 26

27.

The Quantity Theory of Money, cont.M

M

Y

Y

Y/Y depends on growth in the factors of

production and on technological progress

(all of which we take as given, for now).

Hence, the Quantity Theory of Money predicts a

one-for-one relation between changes in the money

growth rate and changes in the inflation rate.

slide 27

28.

In a fractional reserve banking system• Banks keep a fraction of deposits as reserves and use the

rest to make loans.

Bank

Reserves

The CB establishes reserve requirements

• Regulations on the minimum amount of reserves that

banks must hold against deposits.

• Banks may hold more than this minimum

The reserve ratio, R

=fraction of deposits that banks hold as reserves

=total reserves as a percentage of total deposits

28

29.

Bank T-Account• T-account: a simplified accounting

statement that shows a bank’s assets &

liabilities.

• Banks’ liabilities include deposits,

• Assets include loans & reserves.

• Notice that R = $10/$100 = 10%.

FIRST NATIONAL BANK

Assets

Reserves

$ 10

Liabilities

Deposits

$100

Loans

$ 90

29

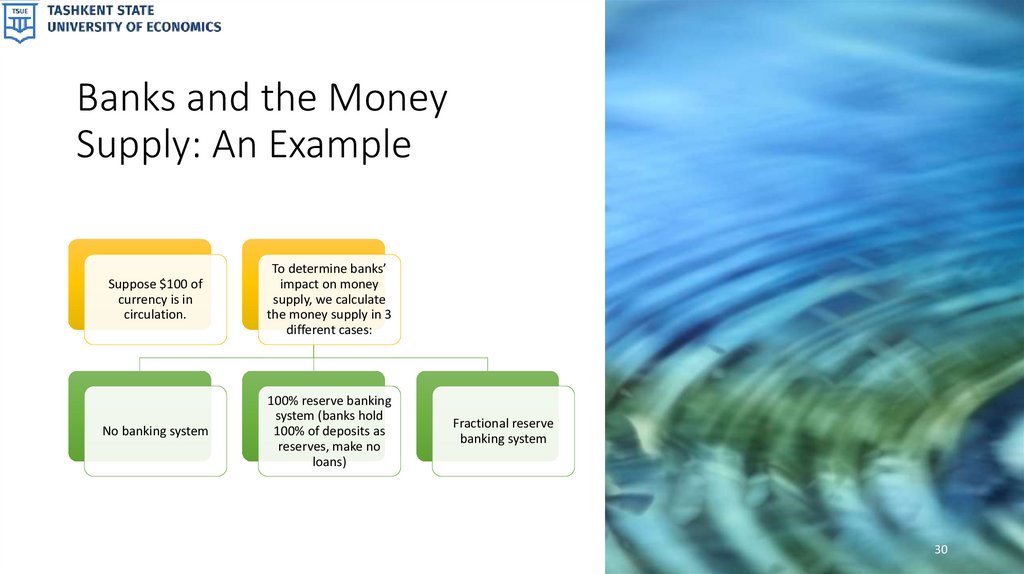

30.

Banks and the MoneySupply: An Example

Suppose $100 of

currency is in

circulation.

To determine banks’

impact on money

supply, we calculate

the money supply in 3

different cases:

No banking system

100% reserve banking

system (banks hold

100% of deposits as

reserves, make no

loans)

Fractional reserve

banking system

30

31.

Banks and theMoney Supply: An

Example

Case 1: No banking system

• Public holds the $100 as currency.

• Money supply = $100.

31

32.

Banks and the MoneySupply: An Example

Case 2: 100% reserve banking system

FIRST NATIONAL BANK

Public deposits the $100 at First National

Bank (FNB).

Assets

• FNB holds

100% of

deposit

as reserves:

Reserves

Money supply

= currency + deposits = $0 + $100 = $100

Loans

0

Liabilities

Deposits

$1

00

$1

00

$

In a 100% reserve banking system, banks

do not affect size of money supply.

32

33.

Banks and the Money Supply: An ExampleCase 3: Fractional reserve banking system

• Suppose R = 10%. FNB loans all but 10%

of the deposit:

FIRST NATIONAL

FIRST NATIONAL

BANK BANK

Assets

Liabilities

Assets

Liabilities

$100 Deposits

$100

Reserves $10 Reserves Deposits

$100

Loans

$90 Loans

$

0

• Depositors have $100 in deposits, borrowers have $90 in

currency.

Money supply = C + D = $90 + $100 = $190 (!!!)

33

34.

Banks and the Money Supply: An ExampleCase 3: Fractional reserve banking system

How did the money supply suddenly grow?

When banks make loans, they create money.

The borrower gets

• $90 in currency—an asset counted in the money supply

• $90 in new debt—a liability that does not have an offsetting effect on the money

supply

A fractional reserve banking system creates money, but not wealth.

34

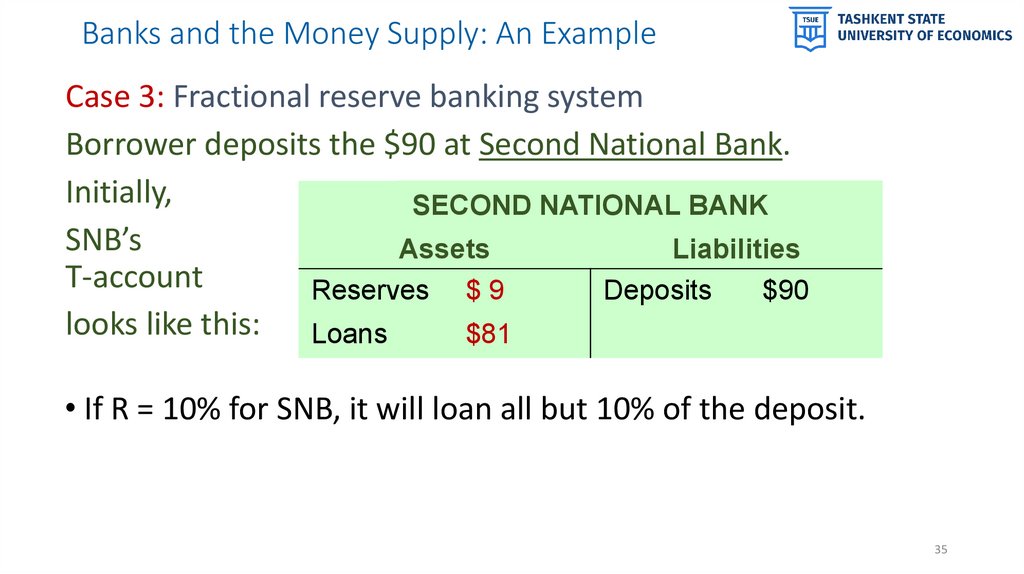

35.

Banks and the Money Supply: An ExampleCase 3: Fractional reserve banking system

Borrower deposits the $90 at Second National Bank.

Initially,

SECOND

NATIONAL

BANK

SECOND

NATIONAL

BANK

SNB’s

Assets

Liabilities

Assets

Liabilities

T-account

Reserves

$90Deposits

Deposits $90 $90

Reserves

$9

looks like this: Loans Loans

$0

$81

• If R = 10% for SNB, it will loan all but 10% of the deposit.

35

36.

Banks and the Money Supply: An ExampleCase 3: Fractional reserve banking system

SNB’s borrower deposits the $81 at Third National

Bank.

THIRD NATIONAL BANK

Initially,

Assets

Liabilities

TNB’s

Reserves $ $81

8.10 Deposits

$81

T-account

Loans

$72.90

$0

looks like this:

• If R = 10% for TNB, it will loan all but 10% of the

deposit.

36

37.

Case 3: Fractional reserve banking systemBanks and

the Money

Supply: An

Example

The process continues, and money is created with

each new loan.

Original deposit

= $100.00

FNB lending

= $ 90.00

SNB lending

= $ 81.00

TNB lending

= $ 72.90

…

…

Total money supply

= $1,000.00

In this example, $100 of reserves generates $1,000

of money.

37

38.

The MoneyMultiplier

• Money multiplier = 1/R

• Amount of money the banking

system generates with each

dollar of reserves

• In our example, R = 10%

• Money multiplier = 1/R = 10

• $100 of reserves creates $1,000

of money

38

39.

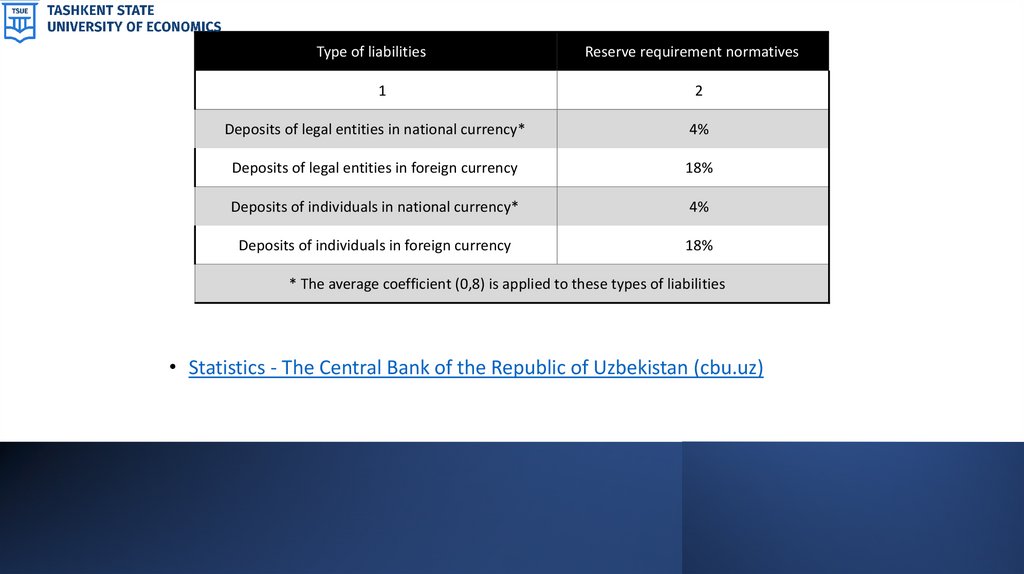

Type of liabilitiesReserve requirement normatives

1

2

Deposits of legal entities in national currency*

4%

Deposits of legal entities in foreign currency

18%

Deposits of individuals in national currency*

4%

Deposits of individuals in foreign currency

18%

* The average coefficient (0,8) is applied to these types of liabilities

• Statistics - The Central Bank of the Republic of Uzbekistan (cbu.uz)

40.

Active Learning 1Banks and

the money supply

While cleaning your apartment, you look

under the sofa cushion and find a $50 bill

(and a half-eaten taco). You deposit the

bill in your checking account.

The CB’s reserve requirement is 20% of

deposits.

A.

What is the maximum amount that

the

money supply could increase?

B.

What is the minimum amount that

the

money supply could increase?

This Photo by Unknown author is licensed under CC BY-NC-ND.

40

41.

The CB’s Tools of Monetary ControlEarlier, we learned

money supply = money multiplier ×

bank reserves

The CB can change the money supply by

• Changing bank reserves or

• Changing the money multiplier

41

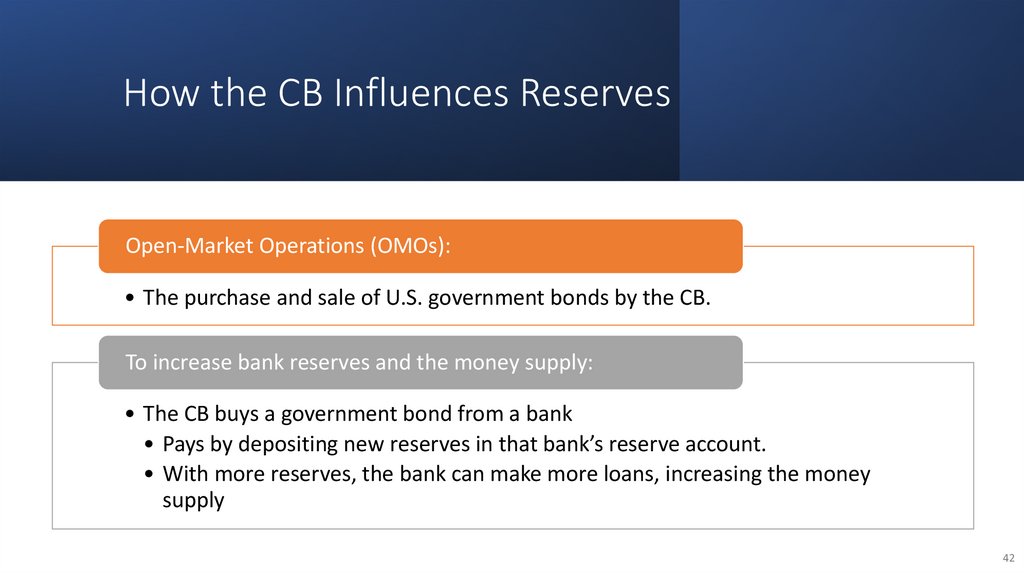

42.

How the CB Influences ReservesOpen-Market Operations (OMOs):

• The purchase and sale of U.S. government bonds by the CB.

To increase bank reserves and the money supply:

• The CB buys a government bond from a bank

• Pays by depositing new reserves in that bank’s reserve account.

• With more reserves, the bank can make more loans, increasing the money

supply

42

43.

How the CB InfluencesReserves

The CB makes loans to banks, increasing

their reserves

• Traditional method: adjusting the

discount rate (interest rate on loans

the CB makes to banks) to influence

the amount of reserves banks borrow

• New method: Term Auction Facility

(the CB chooses the quantity of

reserves it will loan, then banks bid

against each other for these loans.)

The more banks borrow,

• The more reserves they have for

funding new loans and increasing the

money supply.

43

44.

How the CB Influencesthe Reserve Ratio

• The CB sets reserve requirements:

• Regulations on the minimum

amount of reserves banks must

hold against deposits.

• Reducing reserve requirements

would lower the reserve ratio and

increase the money multiplier.

• Raising this interest rate would

increase the reserve ratio and lower

the money multiplier.

This Photo by Unknown author is licensed under CC BY-SA.

44

45.

45Problems

Controlling

the Money

Supply

• The CB does not control:

• The amount of money that households

choose to hold as deposits in banks

• The amount that bankers choose to

lend

Yet, the CB can compensate for household and

bank behavior to retain fairly precise control

over the money supply

46.

• A run on banks:• When people suspect their banks are

in trouble, they may “run” to the bank

to withdraw their funds, holding more

currency and less deposits.

46

• Under fractional-reserve banking

• Banks don’t have enough reserves to

pay off ALL depositors, hence banks

may have to close.

• Also, banks may make fewer loans and

hold more reserves to satisfy

depositors.

• These events increase R,

• Reverse the process of money creation,

cause money supply to fall.

Bank Runs and

the Money

Supply

47.

47The Funds

Rate

• The CB funds rate

• Interest rate at which banks

make overnight loans to one

another

• Lender – has excess

reserves

• Borrower – needs

reserves

• A change in federal funds rate

• Cause changes in other

rates and have a big

impact on the economy.

48.

SummaryMoney serves three functions: medium of exchange, unit of account,

and store of value.

There are two types of money: commodity money has intrinsic value;

fiat money does not.

The Uzbekistan uses fiat money, which includes currency and various

types of bank deposits.

48

49.

SummaryIn a fractional reserve

banking system, banks

create money when they

make loans.

Because banks are highly

leveraged, a small change in

the value of a bank’s assets

causes a large change in

bank capital.

Bank reserves have a

multiplier effect on

the money supply.

To protect depositors

from bank insolvency,

regulators impose

minimum capital

requirements.

49

50.

• The CB controls the money supply50

mainly through open-market

operations.

• Purchasing government bonds

increases the money supply,

selling government bonds

decreases it.

Summary

finance

finance