Similar presentations:

Macroeconomics. Classical theory. The monetary system

1.

HSE/NES B.A. ProgramMacroeconomics -1

Friday, 17/9/2013

Lecture - 4

Classical Theory – II

The Monetary System

2.

Introduc)onIn the previous lecture, we have seen

-

Classical theory of distribu)on

-

How in the long-‐run real interest rates are

determined in the market for loanable

funds

-

How technological change and changes in

scal policy (taxes, govt spending) a ect

the long-‐run investment

3.

Introduc)on (cont.)Yet we made several assump)ons:

1) Did not men)on money at all although money is

instrumental for all the market transac)ons

2) We focused on a closed economy, i.e., assumed

away interna)onal trade and capital ows

3) Exogenous capital stock, labor supply and

technology (to be relaxed when we do growth)

4) Perfectly exible prices (due to our focus on the

long-‐run). To be relaxed next semester to analyze

the causes of short-‐run uctua)ons in income

and employment.

4.

OverviewOur end goal: Analyzing the role of money

(changes in money supply) when prices are

exible. But before that...

We need to understand

-

The de ni)on, func)ons, and types of

money

-

How banks “create” money

-

What a central bank is and how it controls

the money supply

5.

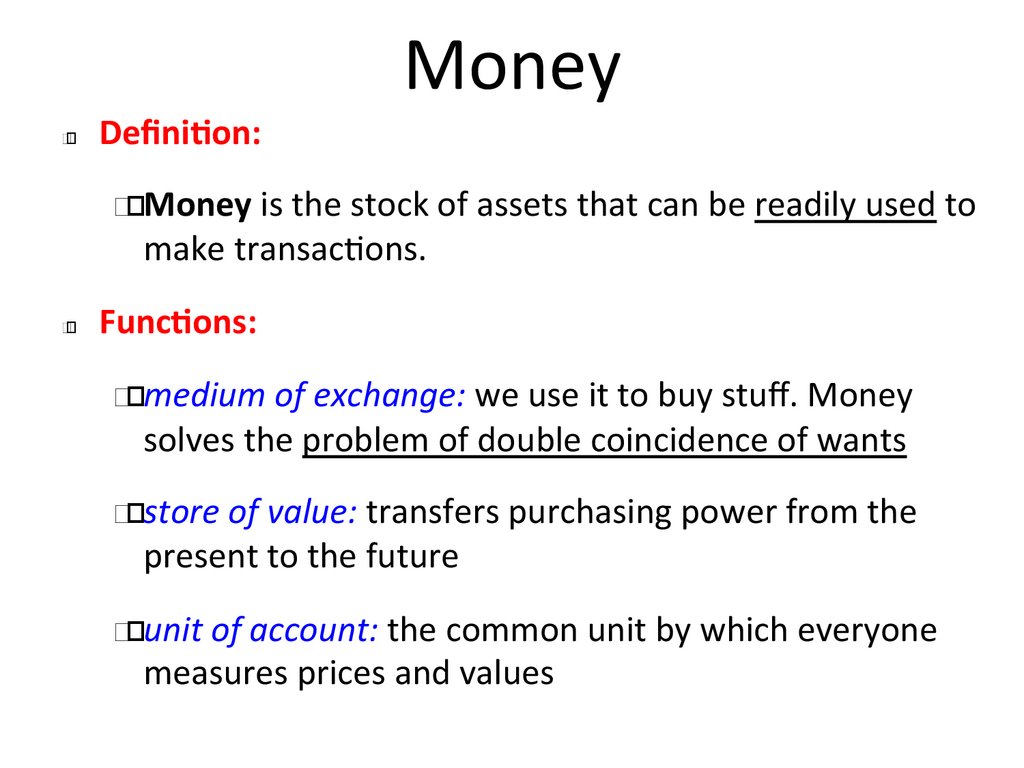

De ni&on:

–

Money

Money is the stock of assets that can be readily used to

make transac)ons.

Func&ons:

–

medium of exchange: we use it to buy stu . Money

solves the problem of double coincidence of wants

–

store of value: transfers purchasing power from the

present to the future

–

unit of account: the common unit by which everyone

measures prices and values

6.

MoneyTypes of money:

Fiat money: has no intrinsic value

1.

example: the paper currency we use

Monopoly over the rights to print money

Trust is needed to support it

Commodity money: has intrinsic value

2.

examples: silver and gold coins, cigareXes in P.O.W.

Camps

Transi)on from commodity to yat money

7.

Which of these are money?a) Currency

b) Checks

c) Deposits in checking accounts (“demand

deposits”)

d) Credit cards

e) Cer) cates of deposit (“)me deposits”)

8.

The money supply andmonetary policy de ni&ons

• The money supply is the quan)ty of money

available in the economy.

• Monetary policy is the control over the

money supply.

• Monetary policy is conducted by a country’s

central bank.

• To control the money supply, central banks

use open market opera&ons, the purchase

and sale of government bonds.

9.

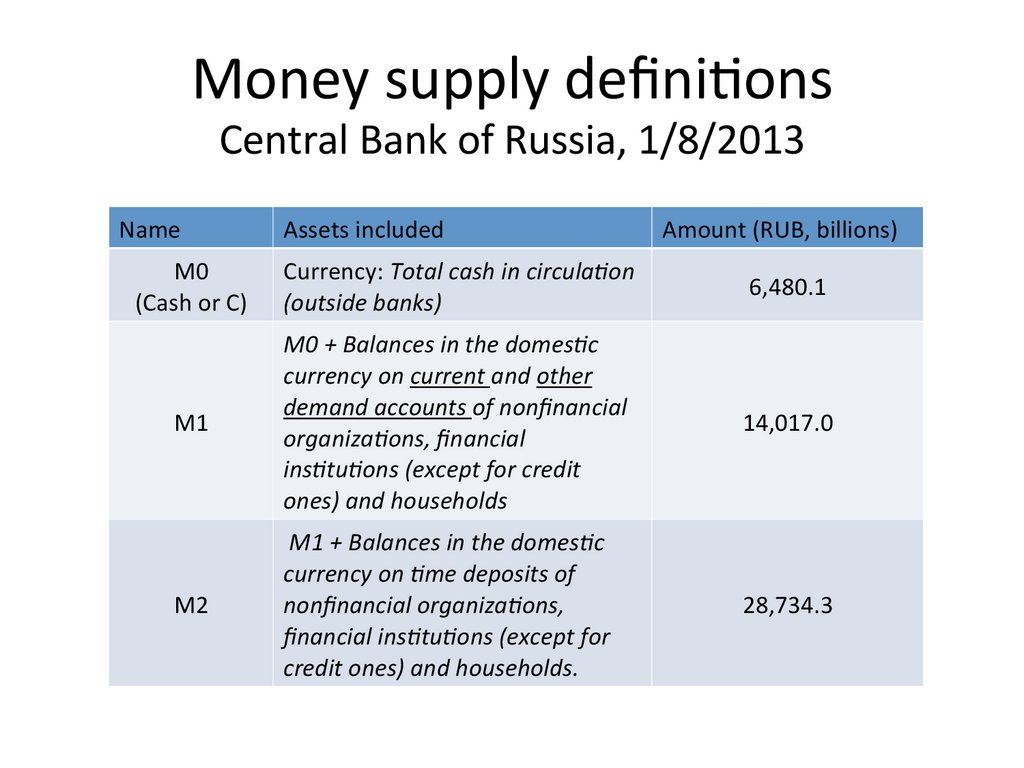

Money supply de ni)onsCentral Bank of Russia, 1/8/2013

Name

Assets included

Amount (RUB, billions)

M0

(Cash or C)

Currency: Total cash in circula6on

(outside banks)

6,480.1

M1

M0 + Balances in the domes6c

currency on current and other

demand accounts of non nancial

organiza6ons, nancial

ins6tu6ons (except for credit

ones) and households

14,017.0

M2

M1 + Balances in the domes6c

currency on 6me deposits of

non nancial organiza6ons,

nancial ins6tu6ons (except for

credit ones) and households.

28,734.3

10.

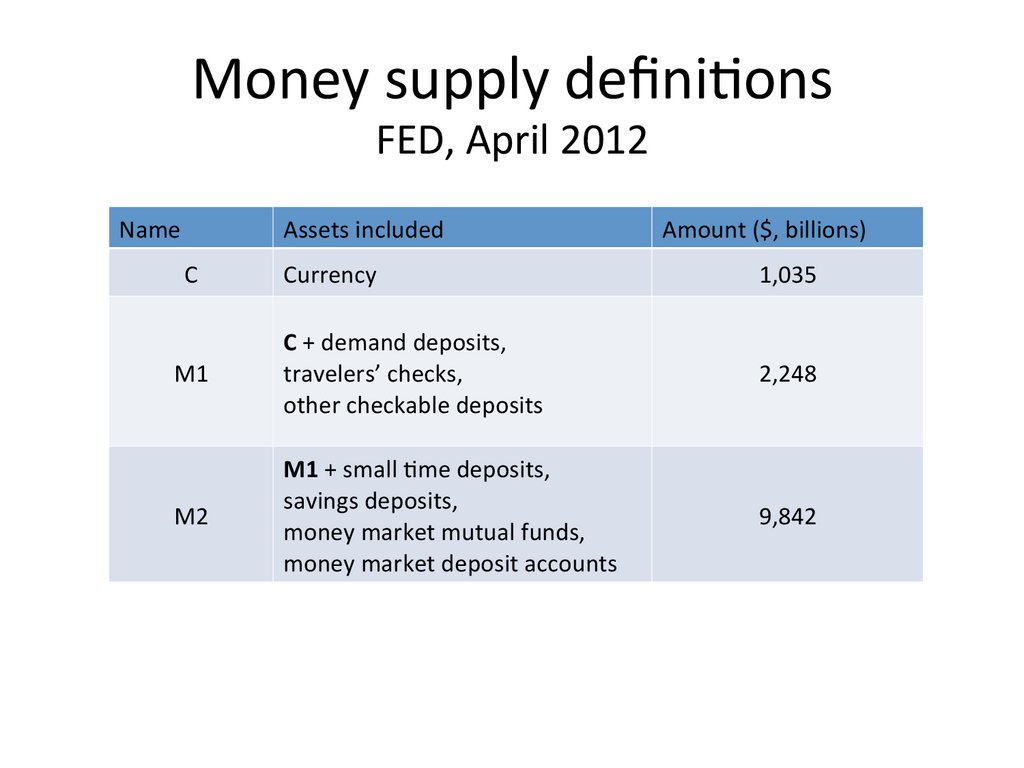

Money supply de ni)onsFED, April 2012

Name

C

Assets included

Amount ($, billions)

Currency

1,035

M1

C + demand deposits,

travelers’ checks,

other checkable deposits

2,248

M2

M1 + small )me deposits,

savings deposits,

money market mutual funds,

money market deposit accounts

9,842

11.

Banks’ role in the monetarysystem

The money supply equals currency plus

demand (checking account) deposits:

M = C + D

Since the money supply includes demand

deposits, the banking system plays an

important role.

12.

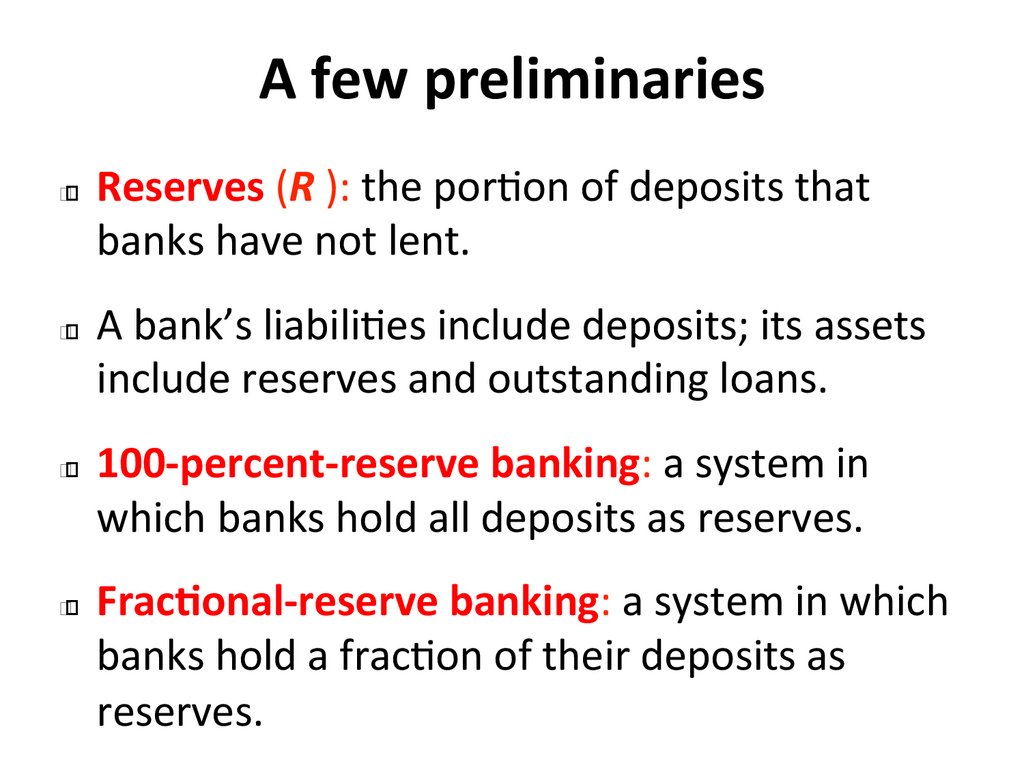

A few preliminariesReserves (R ): the por)on of deposits that

banks have not lent.

A bank’s liabili)es include deposits; its assets

include reserves and outstanding loans.

100-‐percent-‐reserve banking: a system in

which banks hold all deposits as reserves.

Frac&onal-‐reserve banking: a system in which

banks hold a frac)on of their deposits as

reserves.

13.

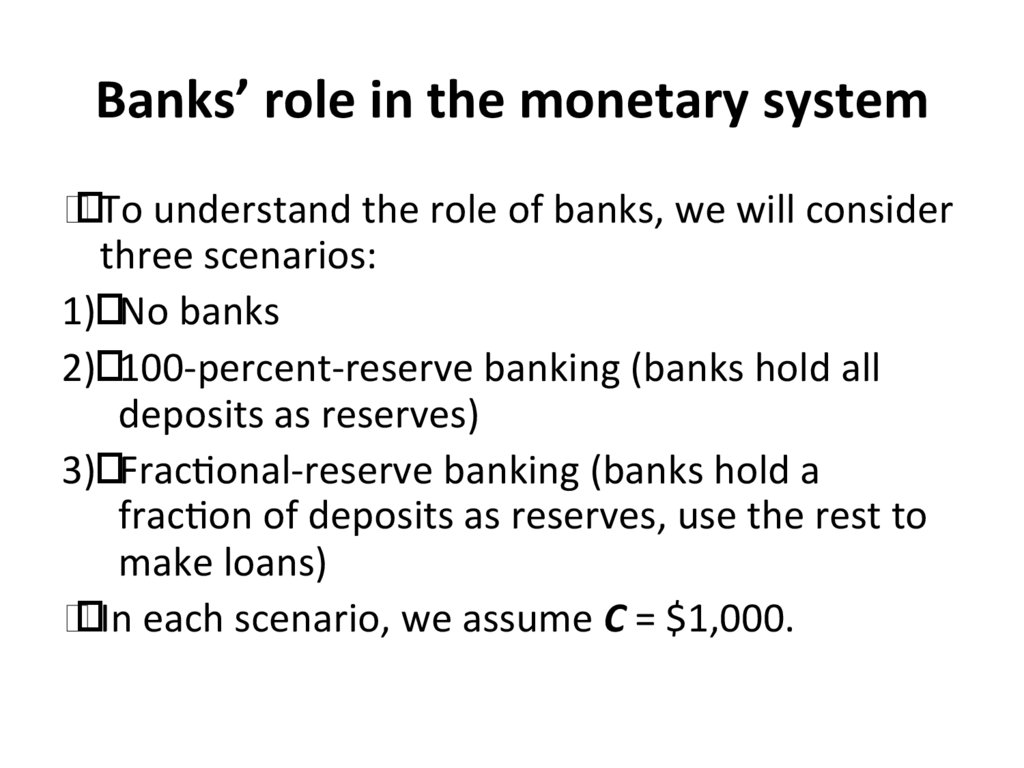

Banks’ role in the monetary system• To understand the role of banks, we will consider

three scenarios:

1) No banks

2) 100-‐percent-‐reserve banking (banks hold all

deposits as reserves)

3) Frac)onal-‐reserve banking (banks hold a

frac)on of deposits as reserves, use the rest to

make loans)

• In each scenario, we assume C = $1,000.

14.

SCENARIO 1: No banks• With no banks,

D = 0 and M = C = $1,000

15.

SCENARIO 2: 100-‐percent-‐reserve banking• Ini)ally C = $1000, D = $0, M = $1,000.

• Now suppose households deposit the $1,000 at

“Firstbank.”

• Aler the deposit:

Firstbank’s

B

alance

S

heet

C = $0,

D = $1,000,

Assets

Liabili)es

M = $1,000

• LESSON: 100%-‐reserve

banking has no impact

Reserves = $1,000 Deposits = $1,000

on size of money

supply.

16.

SCENARIO 3: Frac&onal-‐reserve banking• Suppose banks hold 20% of deposits in reserve,

making loans with the rest.

• Firstbank will make $800 in loans.

Firstbank’s Balance Sheet

Assets

Liabili)es

Reserves = $200

Deposits = $1,000

Loans = $800

The money supply now

equals $1,800:

• Depositor has $1,000

in demand deposits.

• Borrower holds $800

in currency.

17.

SCENARIO 3: Frac&onal-‐reserve banking (cont.)• Suppose the borrower deposits the $800 in

“Secondbank”.

• Ini)ally, Secondbank’s balance sheet is:

Secondbank’s Balance Sheet

Assets

Liabili)es

Reserves = $160

Deposits = $800

Loans = $640

• Secondbank will loan

80% of this deposit.

18.

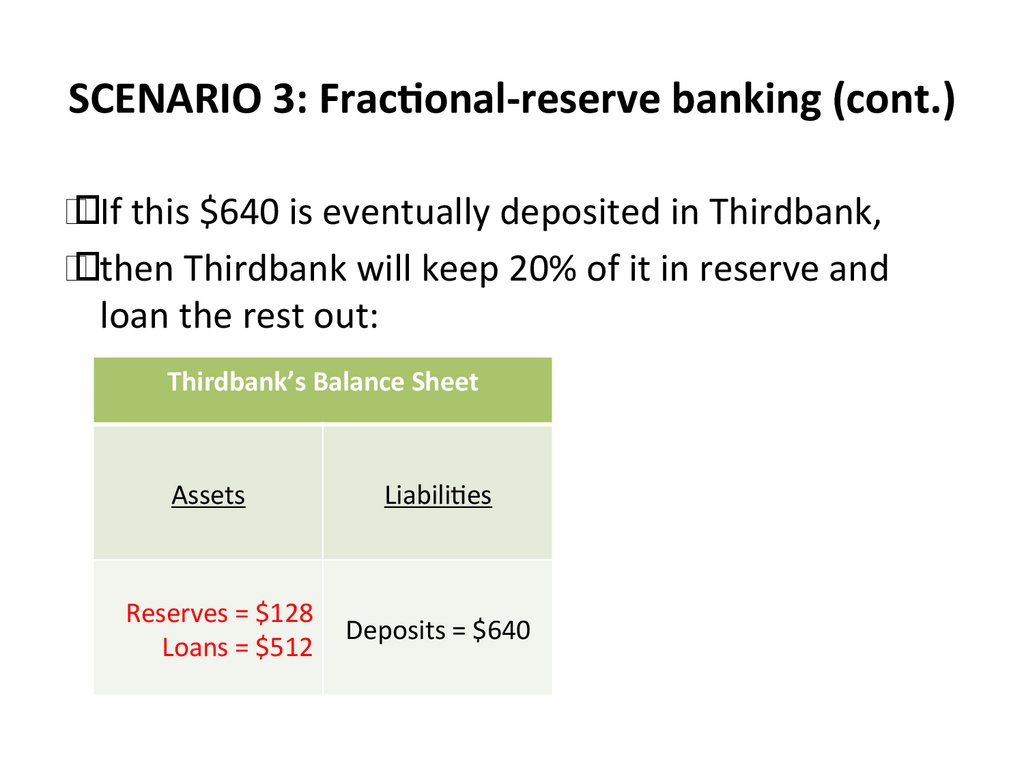

SCENARIO 3: Frac&onal-‐reserve banking (cont.)• If this $640 is eventually deposited in Thirdbank,

• then Thirdbank will keep 20% of it in reserve and

loan the rest out:

Thirdbank’s Balance Sheet

Assets

Liabili)es

Reserves = $128

Deposits = $640

Loans = $512

19.

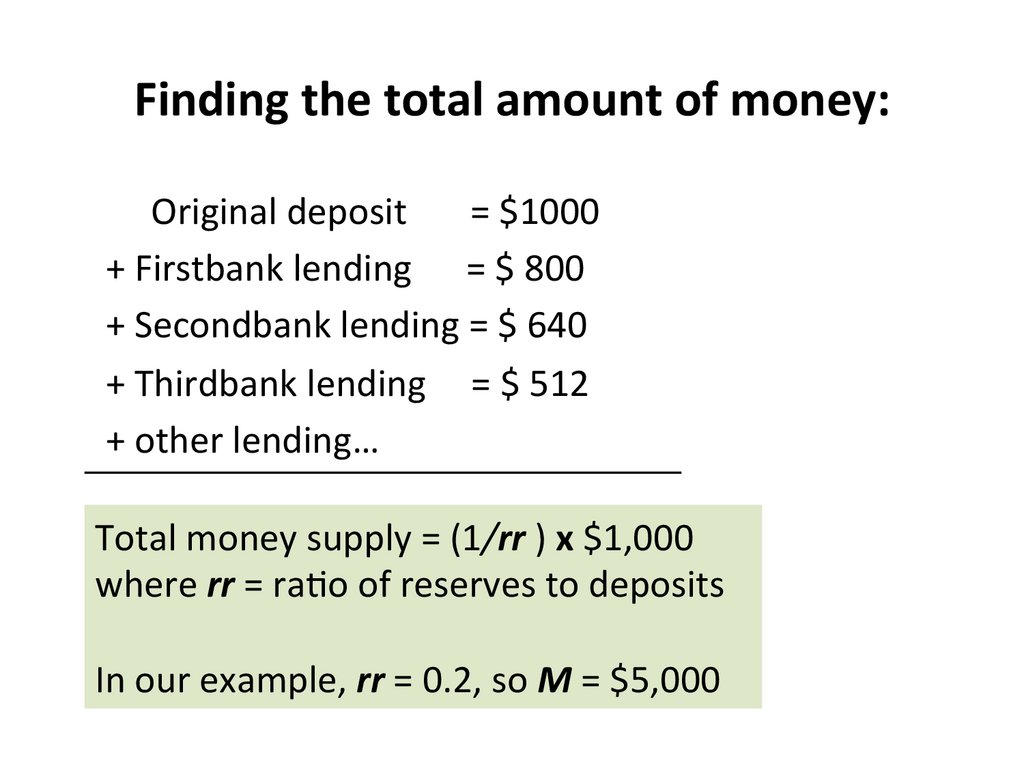

Finding the total amount of money:Original deposit = $1000

+ Firstbank lending = $ 800

+ Secondbank lending = $ 640

+ Thirdbank lending = $ 512

+ other lending…

Total money supply = (1/rr ) x $1,000

where rr = ra)o of reserves to deposits

In our example, rr = 0.2, so M = $5,000

20.

Money crea&on in the bankingsystem

A frac)onal-‐reserve banking system creates

money, but…

it doesn’t create wealth:

–

Bank loans give borrowers some new money and

an equal amount of new debt.

21.

Bank capital, leverage, and capitalrequirements

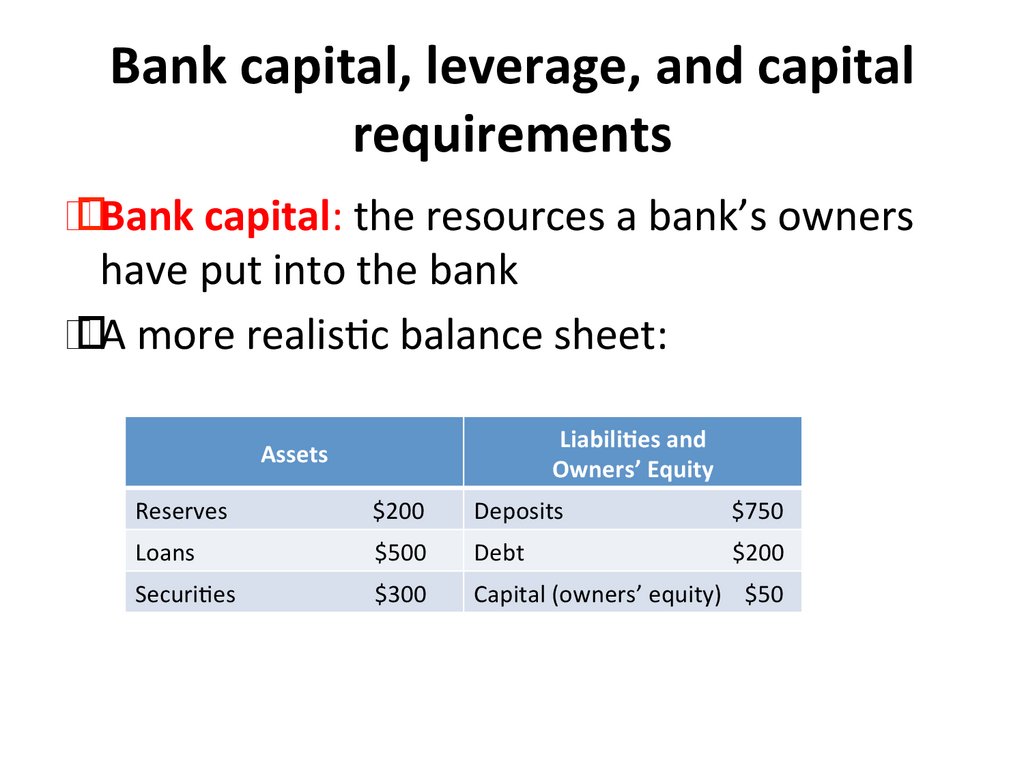

• Bank capital: the resources a bank’s owners

have put into the bank

• A more realis)c balance sheet:

Assets

Liabili&es and

Owners’ Equity

Reserves $200

Deposits $750

Loans $500

Debt $200

Securi)es $300

Capital (owners’ equity) $50

22.

Bank capital, leverage, and capitalrequirements (cont.)

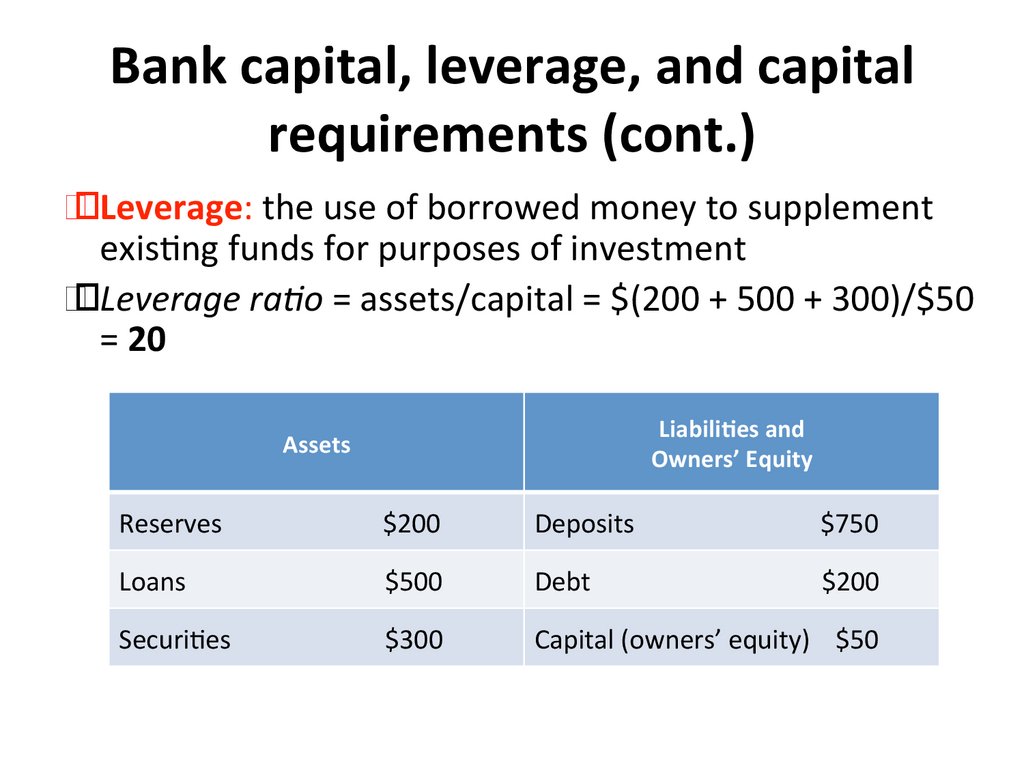

• Leverage: the use of borrowed money to supplement

exis)ng funds for purposes of investment

• Leverage ra6o = assets/capital = $(200 + 500 + 300)/$50

= 20

Assets

Liabili&es and

Owners’ Equity

Reserves $200

Deposits $750

Loans $500

Debt $200

Securi)es $300

Capital (owners’ equity) $50

23.

Bank capital, leverage, and capitalrequirements (cont.)

• Being highly leveraged makes banks vulnerable.

• Example: Suppose a recession causes our bank’s

assets to fall by 5%, to $950.

• Then, capital = assets – liabili)es = 950 – 950 = 0

Assets

Liabili&es and

Owners’ Equity

Reserves $200

Deposits $750

Loans $500

Debt $200

Securi)es $300

Capital (owners’ equity) $50

24.

Bank capital, leverage, and capitalrequirements (cont.)

Capital requirement:

minimum amount of capital mandated by regulators

intended to ensure banks will be able to pay o depositors

higher for banks that hold more risky assets

2008-‐2009 nancial crisis:

Losses on mortgages shrank bank capital, slowed lending,

exacerbated the recession.

Govt injected $ billions of capital into banks to ease the crisis

and encourage more lending.

25.

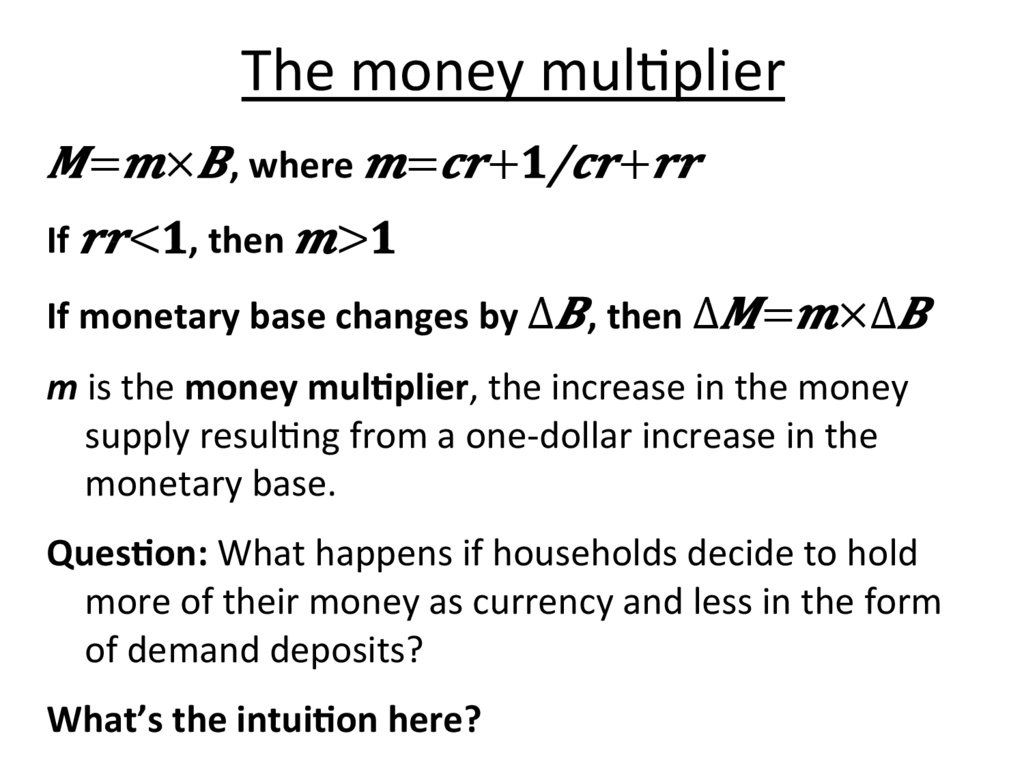

A model of the money supplyExogenous variables:

Monetary base, B = C + R

controlled by the central bank

Reserve-‐deposit ra&o, rr = R/D

depends on regula6ons & bank policies

Currency-‐deposit ra&o, cr = C/D

depends on households’ preferences

economics

economics finance

finance