Similar presentations:

Bank regulation

1. Bank regulation

2. Need for banking regulation?

• Banks’ fragility• Systemic risk

• Protection of depositors

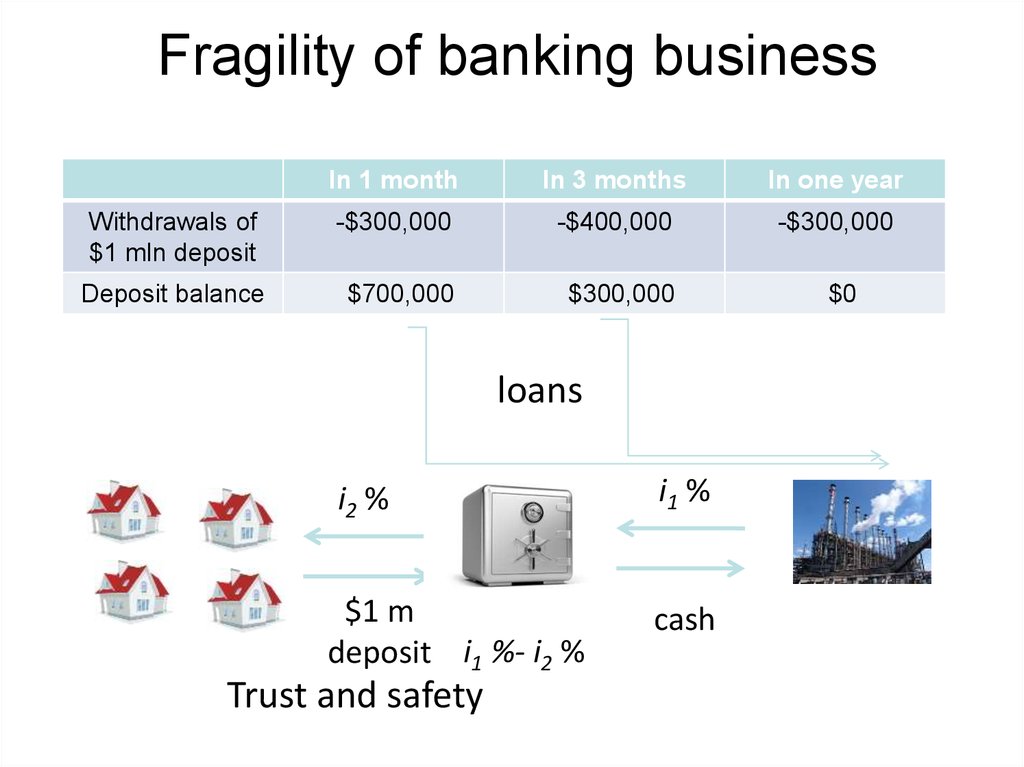

3. Fragility of banking business

In 1 monthIn 3 months

In one year

Withdrawals of

$1 mln deposit

-$300,000

-$400,000

-$300,000

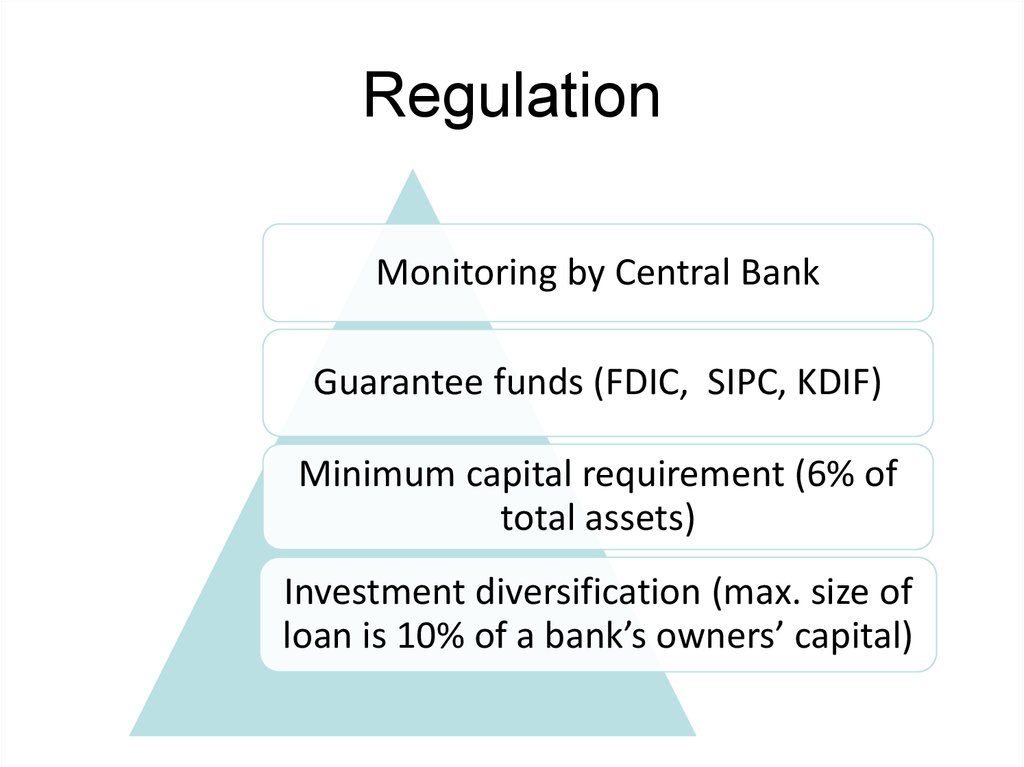

Deposit balance

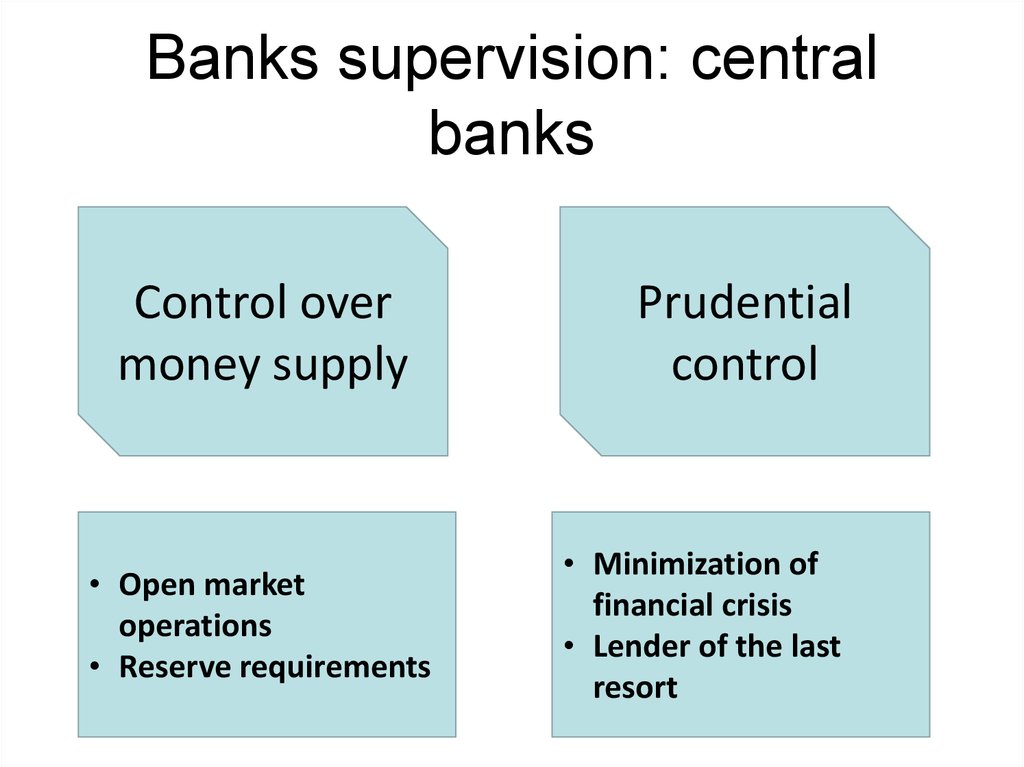

$700,000

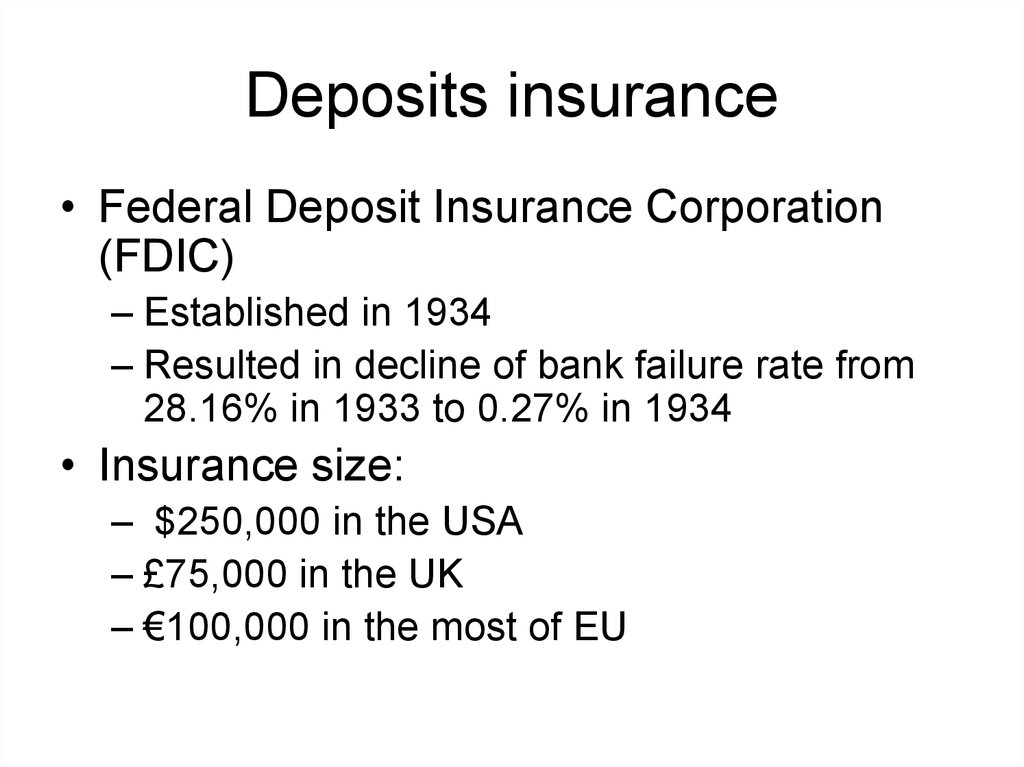

$300,000

$0

loans

i2 %

i1 %

$1 m

deposit i1 %- i2 %

cash

Trust and safety

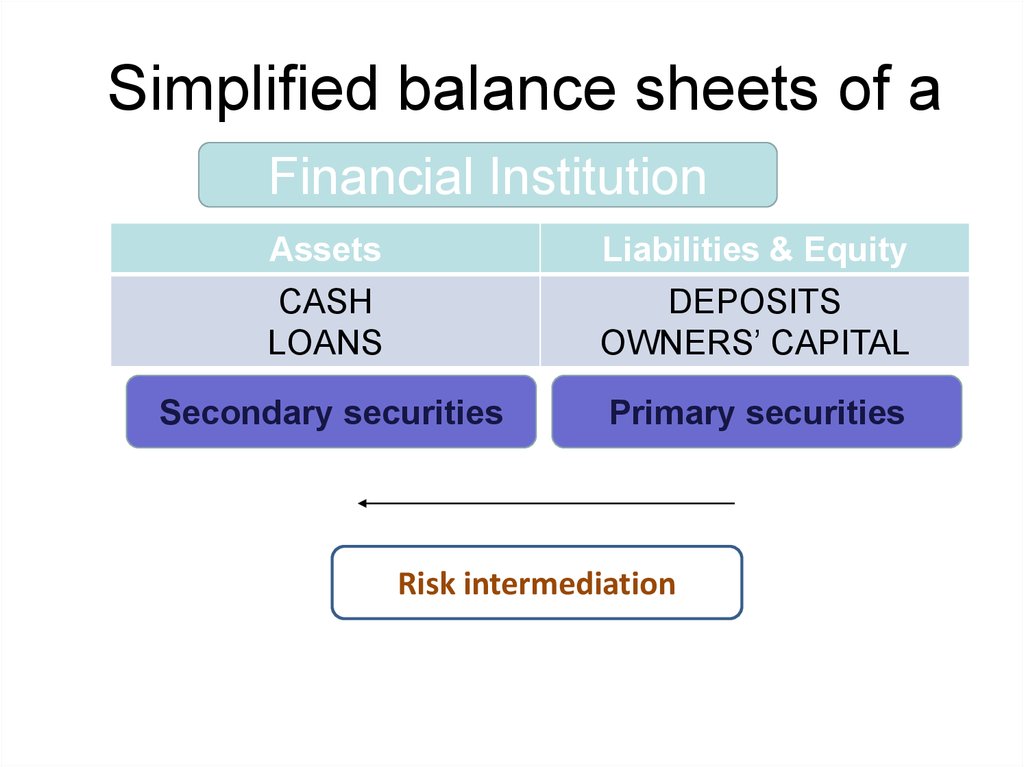

4. Simplified balance sheets of a

Financial InstitutionAssets

Liabilities & Equity

CASH

LOANS

DEPOSITS

OWNERS’ CAPITAL

Secondary securities

Primary securities

Risk intermediation

5. E.g. 1. Deposits’ Withdrawals and Systemic Risk

6.

todayIn 1 months

In 3 months

-$300,000

-$400,000

$1,000,000

$700,000

$300,000

today

In 1 month

In 3 months

$700,000

$300,000

$1,000,000

$700,000

$300,000

today

In 1 months

In 3 months

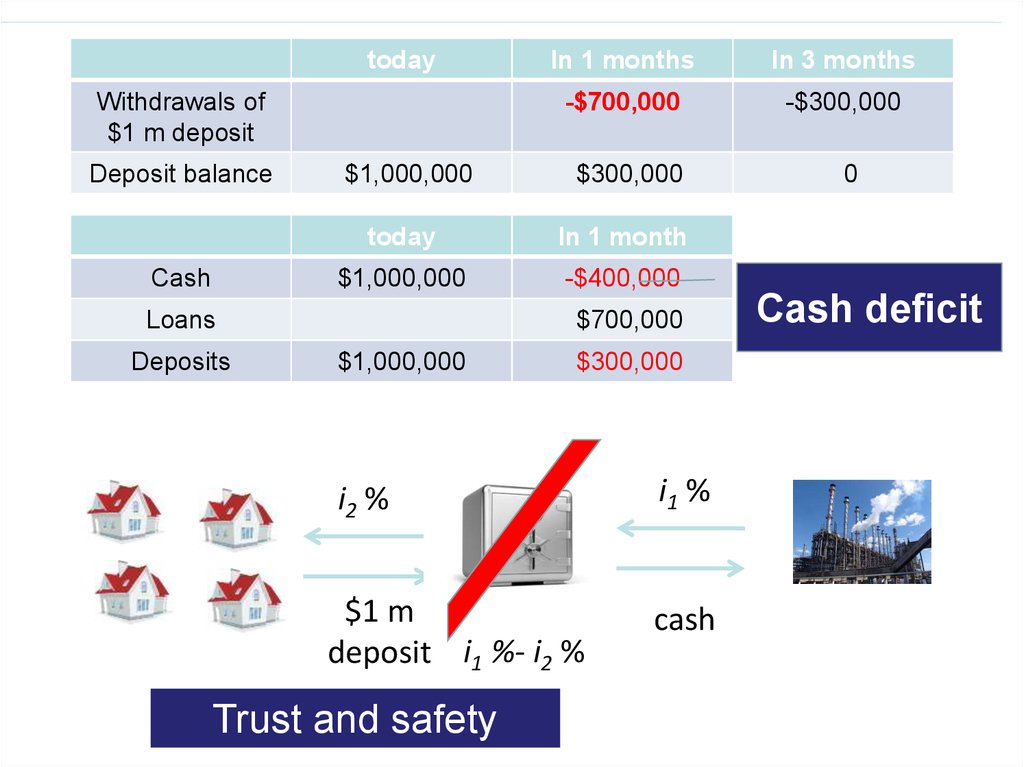

-$700,000

-$300,000

$1,000,000

$300,000

0

today

In 1 month

$1,000,000

-$400,000

Withdrawals of a

$1 m deposit

Deposit balance

Cash

$1,000,000

Loans

Deposits

Withdrawals of

deposit

Deposit balance

Cash

Loans

Deposits

$700,000

$1,000,000

$300,000

Cash deficit

7.

todayIn 1 months

In 3 months

-$700,000

-$300,000

$1,000,000

$300,000

0

today

In 1 month

$1,000,000

-$400,000

Withdrawals of

$1 m deposit

Deposit balance

Cash

Loans

Deposits

$700,000

$1,000,000

$300,000

i2 %

i1 %

$1 m

deposit i1 %- i2 %

cash

Trust and safety

Cash deficit

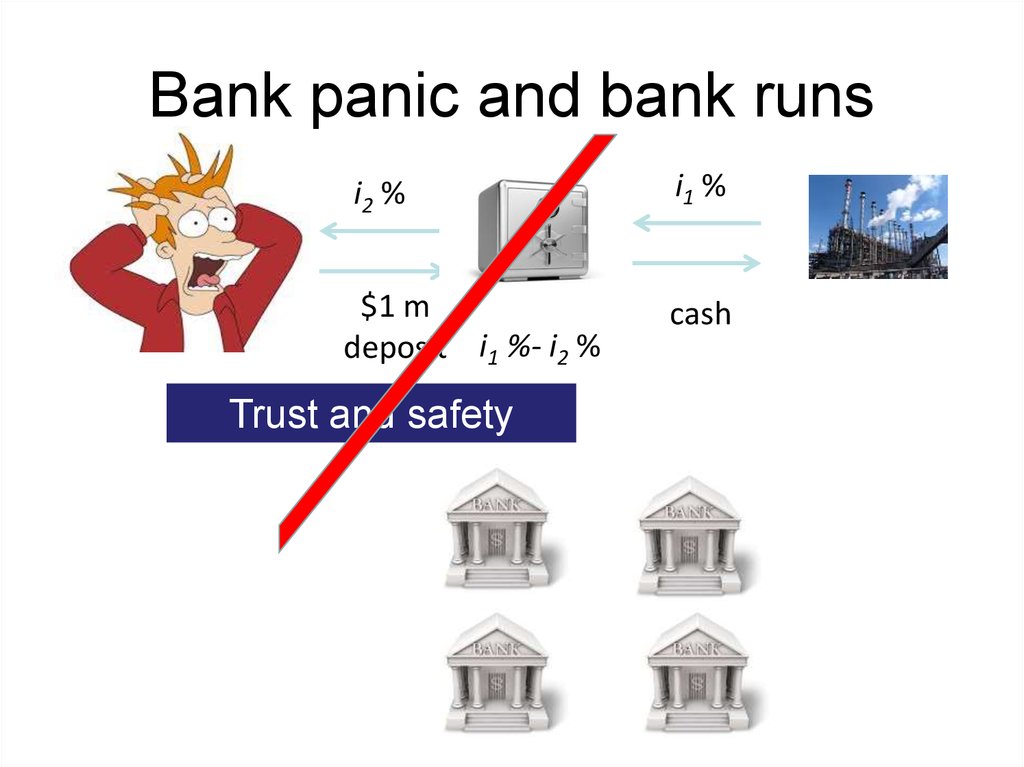

8. Bank panic and bank runs

i2 %i1 %

$1 m

deposit i1 %- i2 %

cash

Trust and safety

9. E.g.2. Deterioration of loans quality

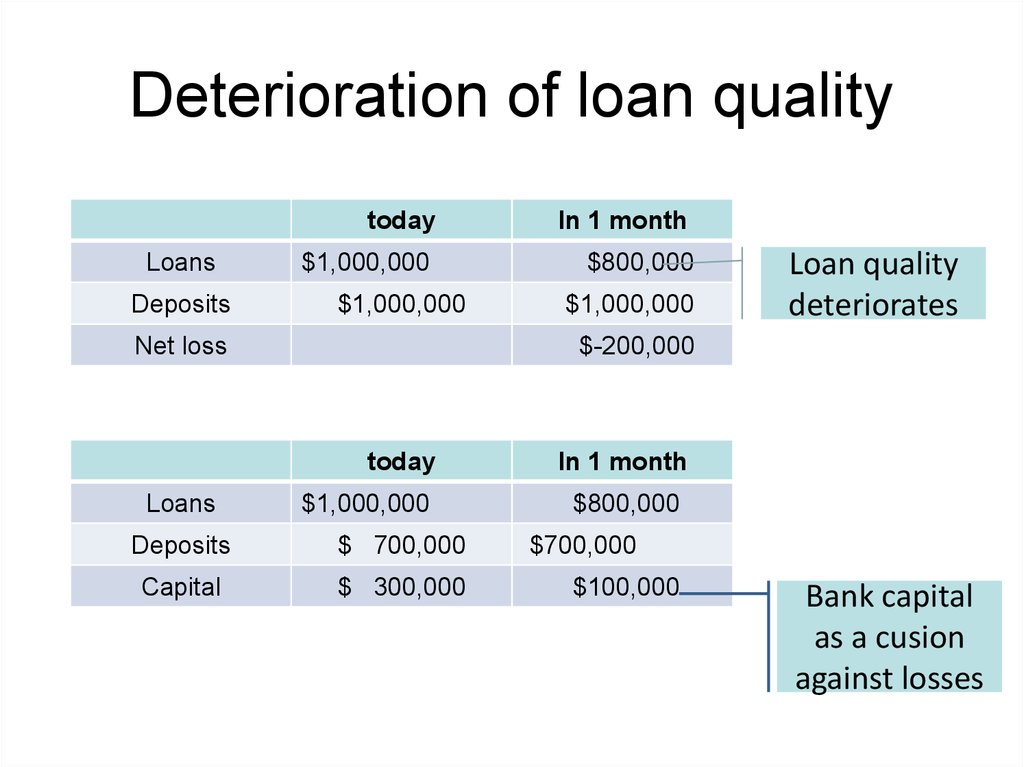

10. Deterioration of loan quality

LoansDeposits

today

In 1 month

$1,000,000

$800,000

$1,000,000

Net loss

$-200,000

today

Loans

$1,000,000

Loan quality

deteriorates

$1,000,000

Deposits

$ 700,000

Capital

$ 300,000

In 1 month

$800,000

$700,000

$100,000

Bank capital

as a cusion

against losses

11. Role in Economy: Transmission of Monetary Policy

Open marketoperations (T-bills)

Borrowing of the

last resort

Reserve

requirements

M1

M2

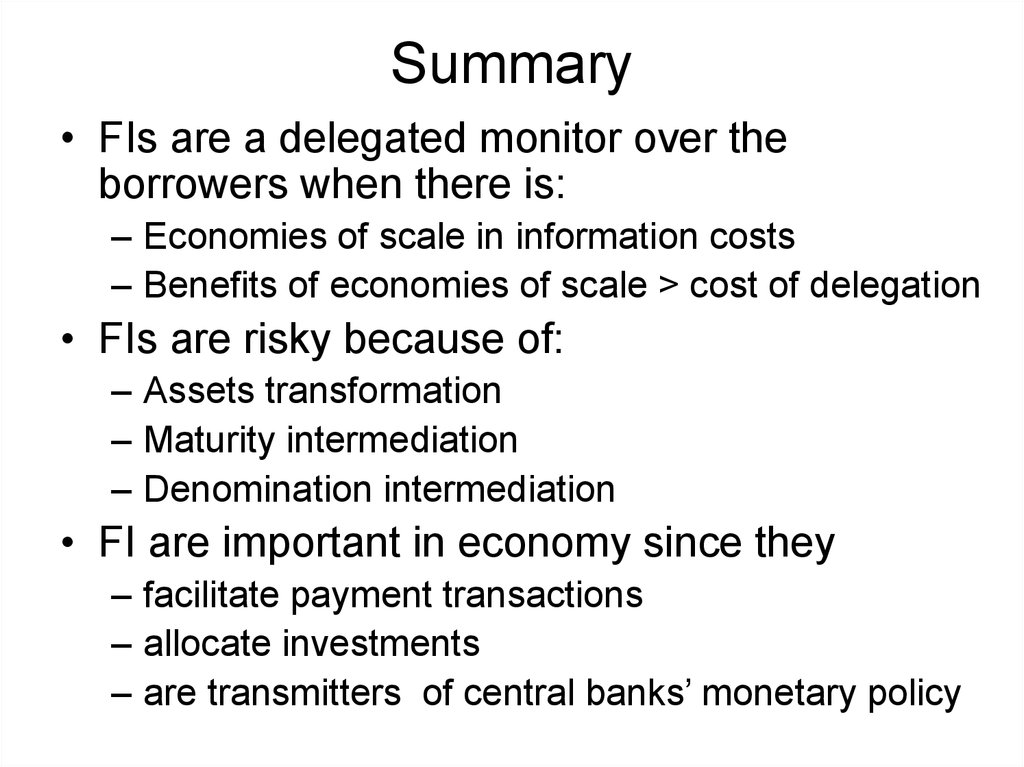

12. Summary

• FIs are a delegated monitor over theborrowers when there is:

– Economies of scale in information costs

– Benefits of economies of scale > cost of delegation

• FIs are risky because of:

– Assets transformation

– Maturity intermediation

– Denomination intermediation

• FI are important in economy since they

– facilitate payment transactions

– allocate investments

– are transmitters of central banks’ monetary policy

13. Central Banks

19911913

1864

1998

14. Regulation

Monitoring by Central BankGuarantee funds (FDIC, SIPC, KDIF)

Minimum capital requirement (6% of

total assets)

Investment diversification (max. size of

loan is 10% of a bank’s owners’ capital)

15. Banks supervision: central banks

Control overmoney supply

• Open market

operations

• Reserve requirements

Prudential

control

• Minimization of

financial crisis

• Lender of the last

resort

16. Deposits insurance

• Federal Deposit Insurance Corporation(FDIC)

– Established in 1934

– Resulted in decline of bank failure rate from

28.16% in 1933 to 0.27% in 1934

• Insurance size:

– $250,000 in the USA

– £75,000 in the UK

– €100,000 in the most of EU

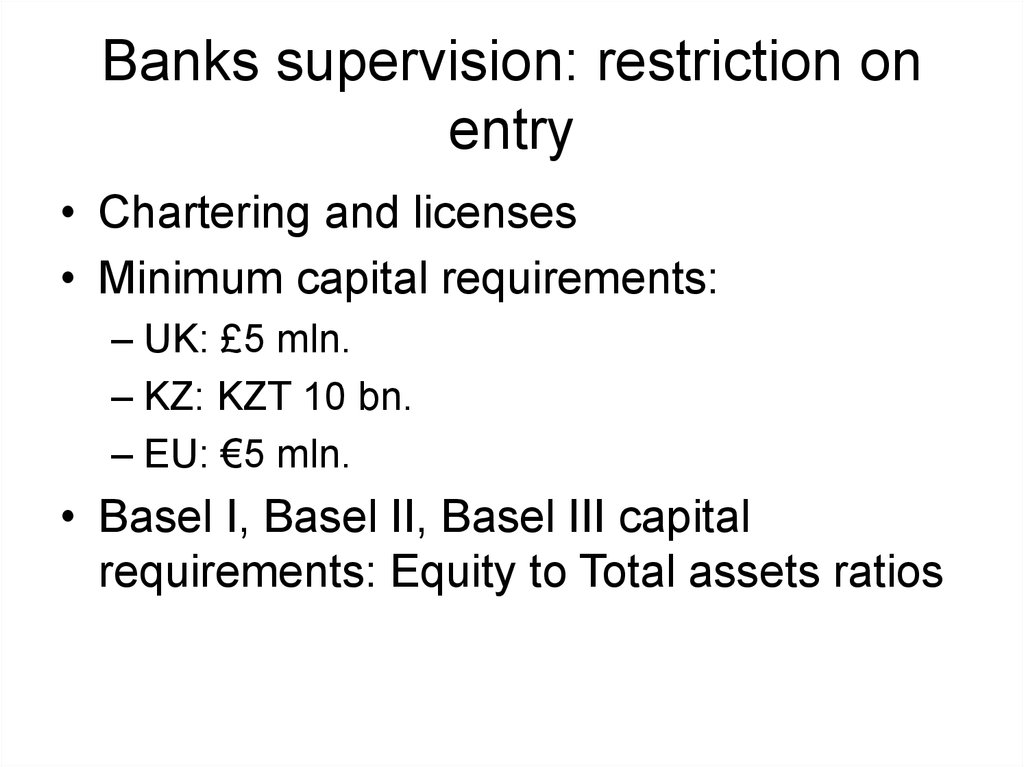

17. Banks supervision: restriction on entry

• Chartering and licenses• Minimum capital requirements:

– UK: £5 mln.

– KZ: KZT 10 bn.

– EU: €5 mln.

• Basel I, Basel II, Basel III capital

requirements: Equity to Total assets ratios

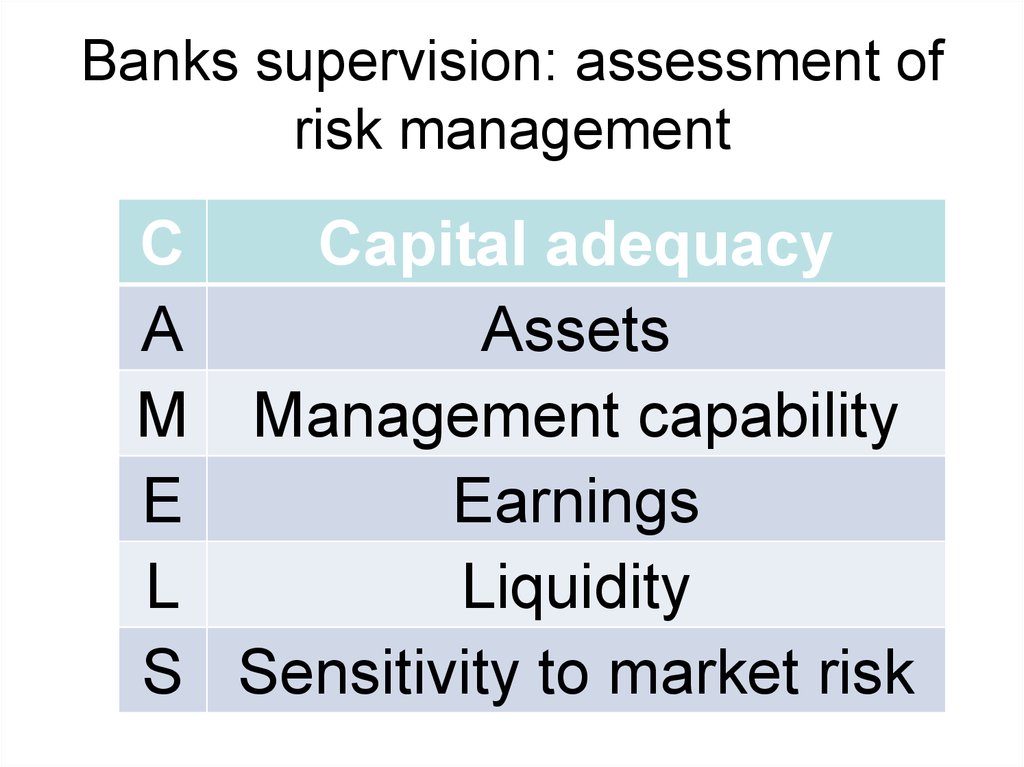

18. Banks supervision: assessment of risk management

CCapital adequacy

A

Assets

M Management capability

E

Earnings

L

Liquidity

S Sensitivity to market risk

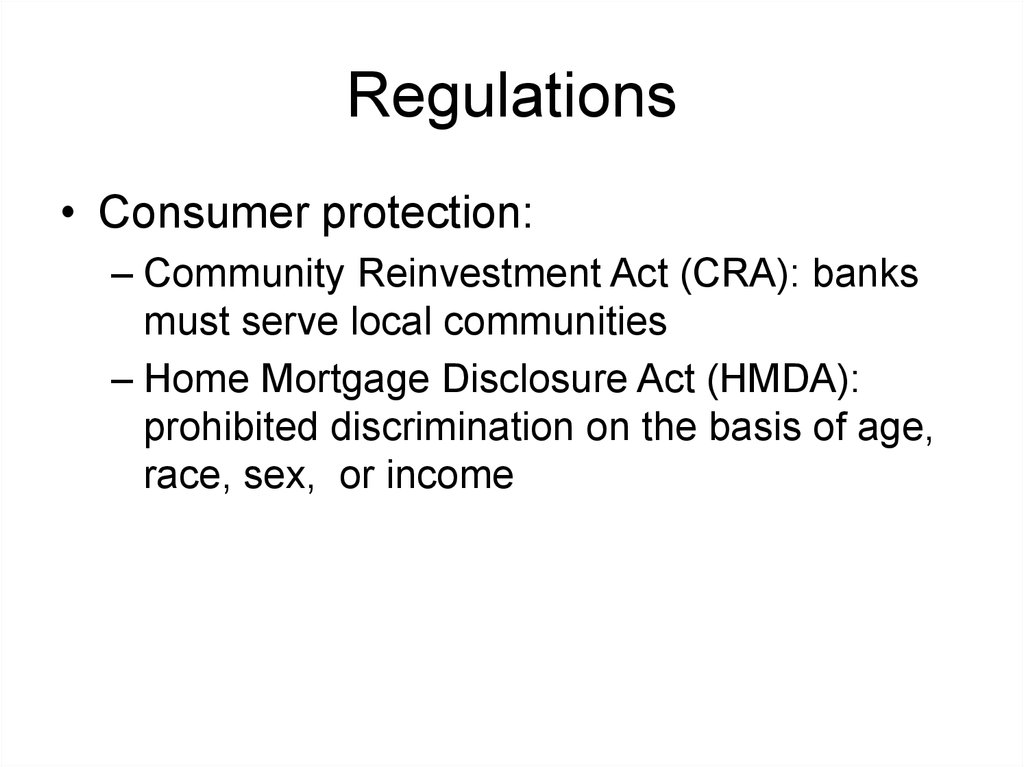

19. Regulations

• Consumer protection:– Community Reinvestment Act (CRA): banks

must serve local communities

– Home Mortgage Disclosure Act (HMDA):

prohibited discrimination on the basis of age,

race, sex, or income

20. Regulation

NOT TO REGULATENOT TO

REGULATE

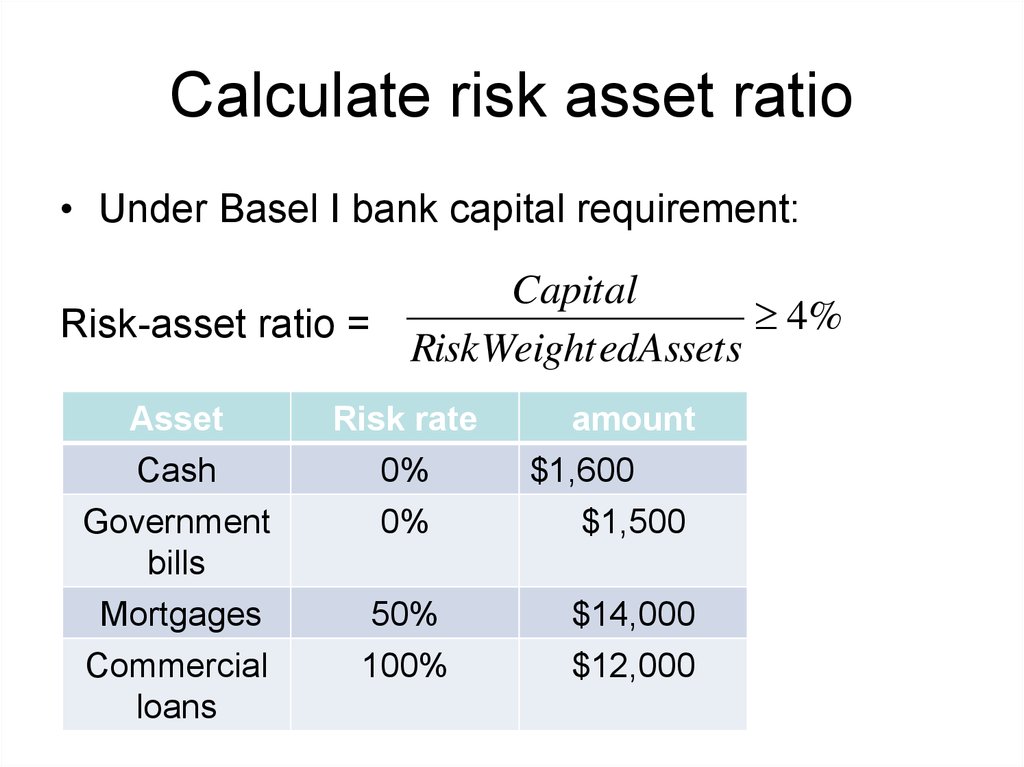

21. Calculate risk asset ratio

• Under Basel I bank capital requirement:Capital

4%

Risk-asset ratio =

RiskWeight edAssets

Asset

Risk rate

Cash

Government

bills

0%

0%

Mortgages

Commercial

loans

50%

100%

amount

$1,600

$1,500

$14,000

$12,000

finance

finance