Similar presentations:

Banking

1.

CHAPTER 4 – Banking2.

4-1Learning Outcomes

Make account transactions.

Record account transactions.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

3. Make account transactions

4-1-1Section 4-1

Checking Account Transactions

Checking account Registers or records …

provide written documentation of the funds that flow

into & out of the account.

– A transaction is a banking activity that changes the

amount of money in a bank account. + – Funds going into the account are deposits and are

recorded as a credit to the account.

– Funds going out from the account are wothdrawals

and are recorded as a Debit to the account.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

4. Make an account deposit

HOW TO:Section 4-1

Make an account deposit

Checking Account Transactions

STEP 1

Record the date.

STEP 2

Enter the amount of currency and/or coins being

deposited.

STEP 3

List the amount of each check to be deposited

including an identifying name or company.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

MORE

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

5. Make an account deposit

HOW TO:Make an account deposit

Section 4-1

Checking Account Transactions

STEP 4

Add the currency, coins and checks.

STEP 5

If the deposit for a personal account and you need

some money in cash, enter that amount on the line

“less cash received” and sign on the appropriate line.

STEP 6

Subtract the amount of cash received from the total

for the net deposit.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

6. If there is a mistake in the deposit:

Make an account depositHOW TO:

Section 4-1

Checking Account Transactions

If there is a mistake in the deposit:

The bank will issue a bank memo.

– An increase in the balance (or in your favor) is called

a credit memo.

– A decrease in the balance (or in the bank’s favor) is

called a debit memo.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

7.

Examples…Section 4-1

Checking Account Transactions

Suppose Janice’s bank initially cleared a check for

$174.00 which Janice actually wrote for $147.00.

Would she receive a credit memo or a debit

memo once the bank detected its error?

A credit memo.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

8.

Section 4-1Checking Account Transactions

Businesses that permit customers to use credit

cards to charge merchandise ordinarily receive

payment through electronic deposit from the

credit card or check processing company.

– Sometimes called point-of-sale transactions.

Visa®, MasterCard® and Discover® are examples

of major credit card companies that electronically

transmit funds to business accounts.

– Electronic funds transfers (EFTs).

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

9.

Section 4-1Checking Account Transactions

Another type of electronic deposit is direct

deposit for payroll.

– Employees can access their paycheck funds directly

from their accounts.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

10.

Section 4-1Checking Account Transactions

A withdrawal is a transaction which reduces

the amount of funds in the account.

– These transactions are called debits.

One bank record for withdrawals is a check or

bank draft.

– Another type of debit is through the use of a debit

card to pay for goods and services.

Withdrawing funds from an ATM will also

result in a debit to the account.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

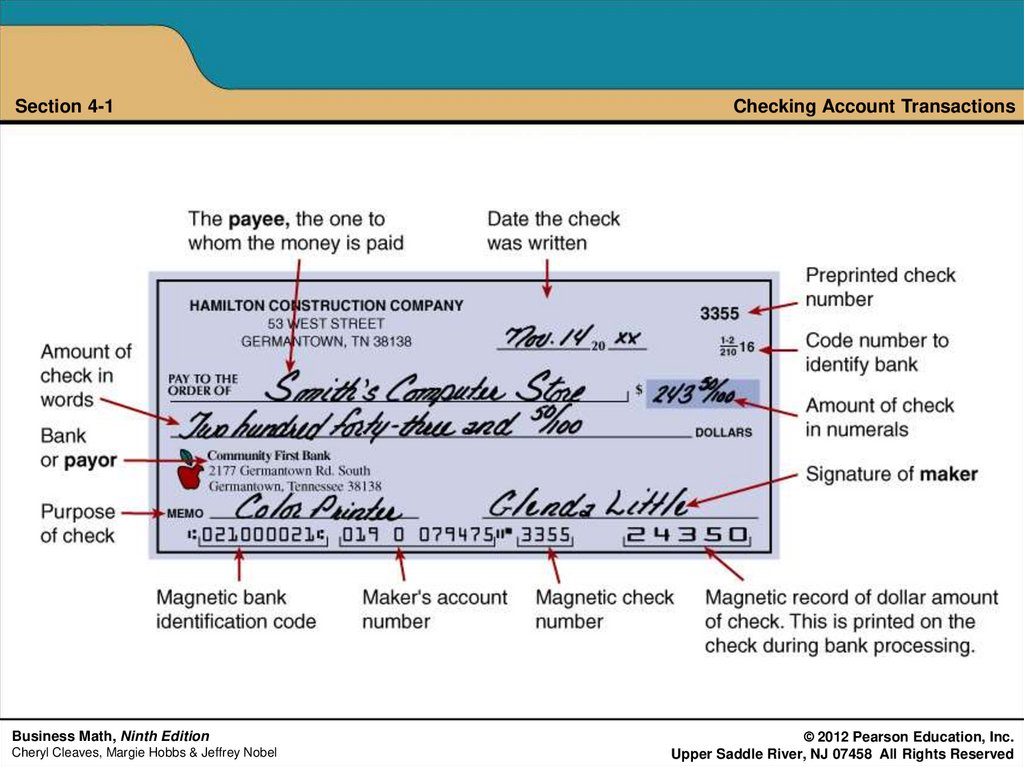

11. Key Terms

Key Terms…Section 4-1

Payee

Checking Account Transactions

Key Terms

– The one to whom the money on a check is paid.

Payor

– The bank or institution that pays the amount of the

check to the payee.

Maker

– The one authorizing the payment of the check.

Automatic Drafts

– Regular withdrawals that the owner of an account

authorizes to be made electronically.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

12. Key Terms

Key Terms…Section 4-1

Signature card:

Checking Account Transactions

Key Terms

– Signature of those authorized to sign the checks for

a given account.

Personal identification number (PIN)

– A private code that is used to authorize a

transaction on a debit card or ATM card.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

13. Identify the elements of a check

Section 4-1Checking Account Transactions

Identify the elements of a check

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

14.

HOW TO:Make a withdrawal with a check

Section 4-1

Checking Account Transactions

STEP 1

Enter the date of the check.

STEP 2

Enter the name of the payee.

STEP 3

Enter the amount of the check in numerals.

MORE

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

15.

HOW TO:Make a withdrawal with a check

Section 4-1

Checking Account Transactions

STEP 4

Write the amount of the check in words. Cents can

be written as a fraction of a dollar or decimal notation.

STEP 5

Explain the purpose of the check.

STEP 6

Sign the check.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

16. Identify the elements of a check

Key Terms…Section 4-1

Check stub

Checking Account Transactions

Identify the elements of a check

– A form attached to the check for recording account

transactions that show the account balance.

Account register

– A separate form for recording all checking account

transactions. It also shows the account balance.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

17. Record account transactions

4-1-2Section 4-1

Checking Account Transactions

Individuals and businesses with banking accounts

must record all transactions made to the account.

Make an entry for every account transaction.

For checks and other debits…

– Enter the date, amount of the check/debit, the

person or company receiving the check/debit,

and the purpose of the check/debit

– Subtract the amount of the check or debit from

the previous balance to obtain the new balance.

– For handwritten checks with stubs, carry the

new balance forward to the next stub.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

18. Record account transactions

4-1-2Section 4-1

Checking Account Transactions

Individuals and businesses with banking accounts

must record all transactions made to the account.

Make an entry for every account transaction.

For deposits and other credits…

– Enter the date, the amount of the deposit or credit,

and a brief explanation of the deposit or credit.

– Add the amount of the deposit or credit to the

previous balance to obtain the new balance.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

19. Record account transactions

4-1-2Section 4-1

Checking Account Transactions

Individuals and businesses with banking accounts

must record all transactions made to the account.

Make an entry for every account transaction.

On an electronic money management system…

– Enter the appropriate details for producing a check.

– Record other debits and all deposits and credits.

• The account register is maintained by the system automatically.

– For business accounts or personal accounts used for

tracking expenses, record the type of expense or

budget account number

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

20.

EndorsementsSection 4-1

Checking Account Transactions

Banks will require payees who are not account

holders to present identification before cashing a

check from their bank.

Account holders will be required to sign the

check and also record their account number

on the back of the check.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

21.

Key Terms…Section 4-1

Checking Account Transactions

Endorsement

– A signature, stamp or electronic imprint on the back

of a check that authorizes payment in cash or directs

payment to a third party or account.

Simple endorsement

– The payee signs or stamps the back of the check to

deposit the amount in an account or to cash the check.

Restricted endorsement

– A type of endorsement that reassigns the check to a

different payee, or directs the check to be deposited

in a specified account.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

22.

HOW TO:Section 4-1

Restricted Endorsements

Checking Account Transactions

In a restricted endorsement, the original payee

writes “pay to the order of,” lists the name of the

new payee, and signs the check.

Another type uses the phrase “for deposit only,”

and listing the account number—without actually

signing or endorsing the check.

These measures are intended to provide

greater security when handling checks.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

23.

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

24.

4-2Learning Outcome

Reconcile a bank statement

with an account register.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

25.

Reconcile a bank statementwith an account register

4-2-1

Section 4-2

Bank Statements

Financial institutions provide account statements

to their checking account customers.

– To enable them to reconcile any differences between

that statement and the customer’s own account

– Any transactions that had not been posted at that

time are considered “outstanding” and are taken

into account during this process.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

26.

Key Terms…Section 4-2

Bank Statements

Bank reconciliation

– The process of making the account register agree

with the bank statement.

Bank statement

– An account record provided by the bank periodically

designed to match your records to the bank’s records.

Service charge

– A fee the bank charges for maintaining the checking

account or for other banking services.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

27.

Key Terms…Section 4-2

Bank Statements

Returned check

– A deposited check that was returned because the

maker’s account did not have sufficient funds.

Returned check fee

– Bank charges to the depositor for returned checks.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

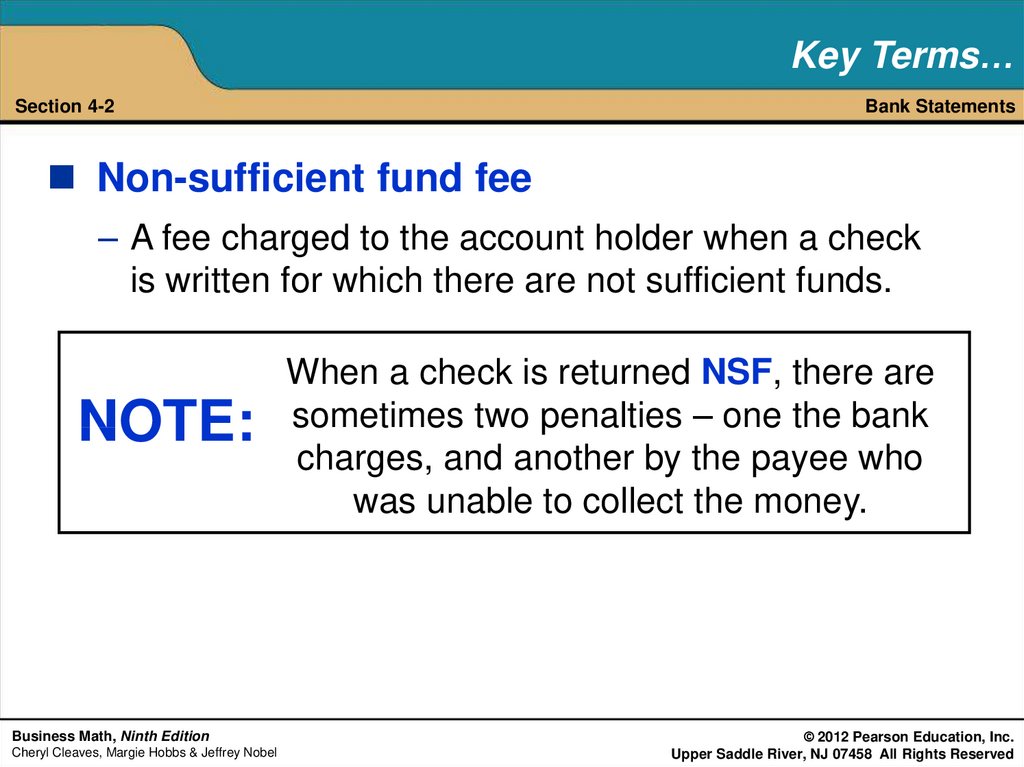

28.

Key Terms…Section 4-2

Bank Statements

Non-sufficient fund fee

– A fee charged to the account holder when a check

is written for which there are not sufficient funds.

NOTE:

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

When a check is returned NSF, there are

sometimes two penalties – one the bank

charges, and another by the payee who

was unable to collect the money.

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

29.

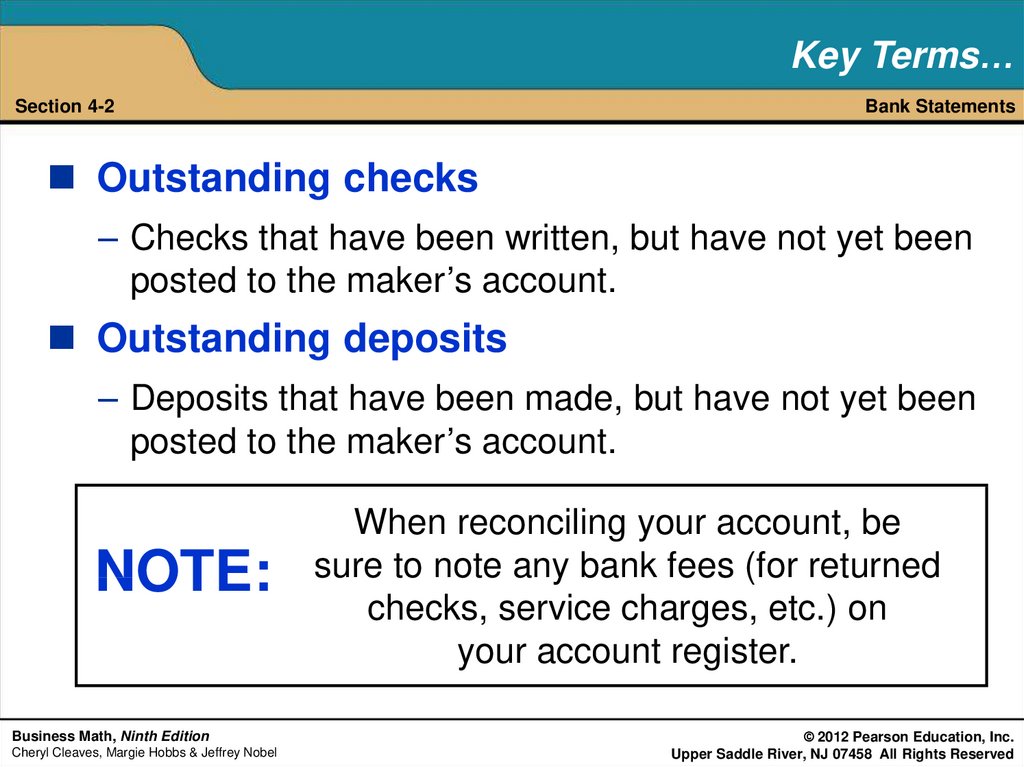

Key Terms…Section 4-2

Bank Statements

Outstanding checks

– Checks that have been written, but have not yet been

posted to the maker’s account.

Outstanding deposits

– Deposits that have been made, but have not yet been

posted to the maker’s account.

NOTE:

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

When reconciling your account, be

sure to note any bank fees (for returned

checks, service charges, etc.) on

your account register.

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

30.

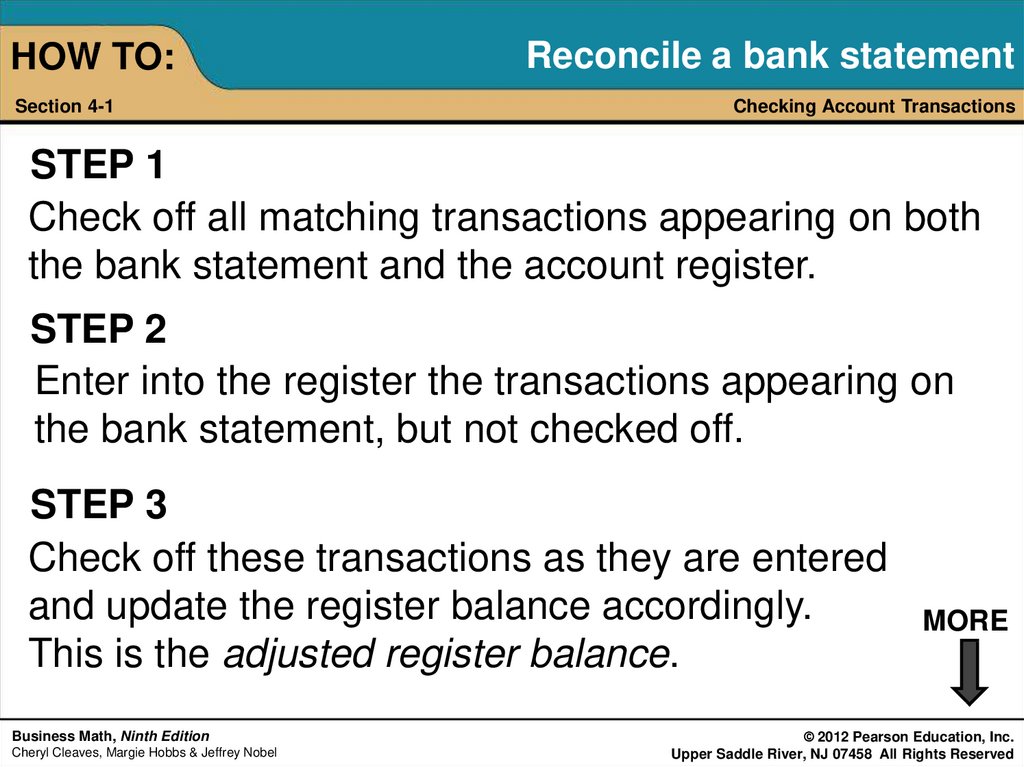

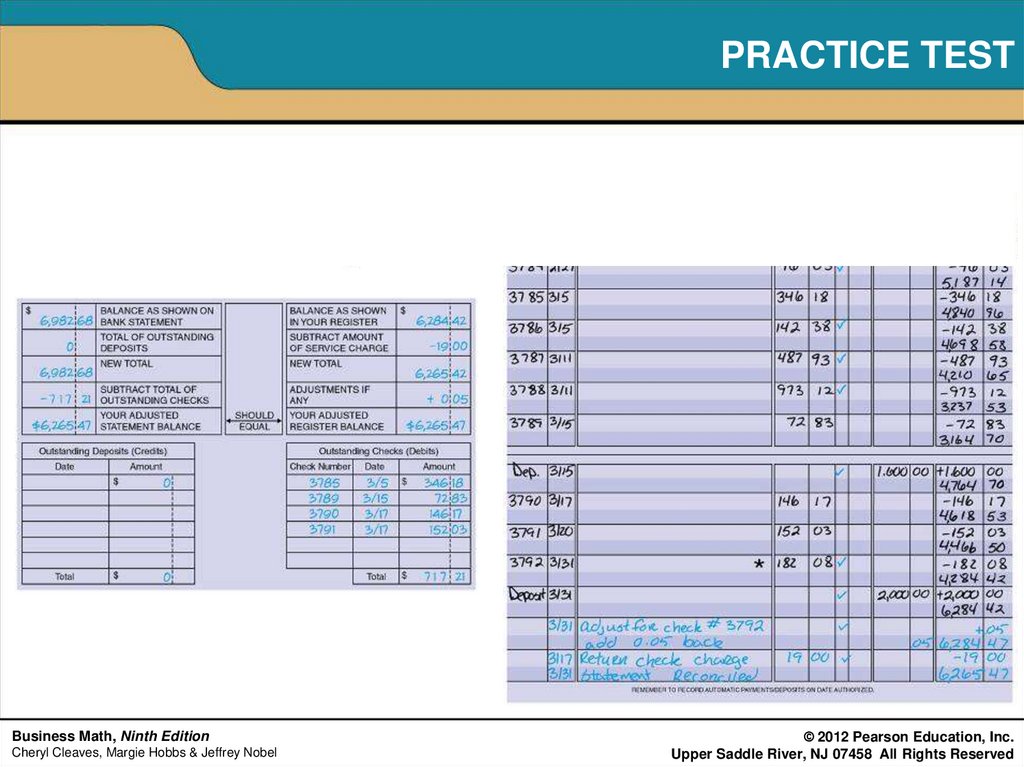

HOW TO:Section 4-1

Reconcile a bank statement

Checking Account Transactions

STEP 1

Check off all matching transactions appearing on both

the bank statement and the account register.

STEP 2

Enter into the register the transactions appearing on

the bank statement, but not checked off.

STEP 3

Check off these transactions as they are entered

and update the register balance accordingly.

This is the adjusted register balance.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

MORE

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

31.

HOW TO:Section 4-1

Reconcile a bank statement

Checking Account Transactions

STEP 4

Make a list of checks and

debits in the register that

have not been checked off.

Add these amounts to find

the total outstanding debits.

Use Figure 4-25

as a guide.

MORE

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

32.

HOW TO:Reconcile a bank statement

Section 4-1

Checking Account Transactions

STEP 5

Make a list of all deposits &

credits in the register that

have not been checked off.

Add these amounts to find

the total outstanding credits.

Use Figure 4-25

as a guide.

MORE

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

33.

HOW TO:Reconcile a bank statement

Section 4-1

Checking Account Transactions

STEP 6

Calculate the adjusted statement balance by adding

the statement balance and total outstanding deposits

& credits, and then subtracting total outstanding

checks and other debits.

Statement balance

+ Total outstanding credits

- Total outstanding debits

Adjusted statement balance

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

MORE

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

34.

HOW TO:Section 4-1

Reconcile a bank statement

Checking Account Transactions

STEP 7

Compare the adjusted statement balance with the

adjusted register balance. The amounts should be

equal.

STEP 8

If the adjusted statement balance does not equal the

register balance, find the cause of the difference and

correct the register, or notify the bank accordingly.

Write statement reconciled on the next blank line in

the account register and record the statement date.

Business Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

35.

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

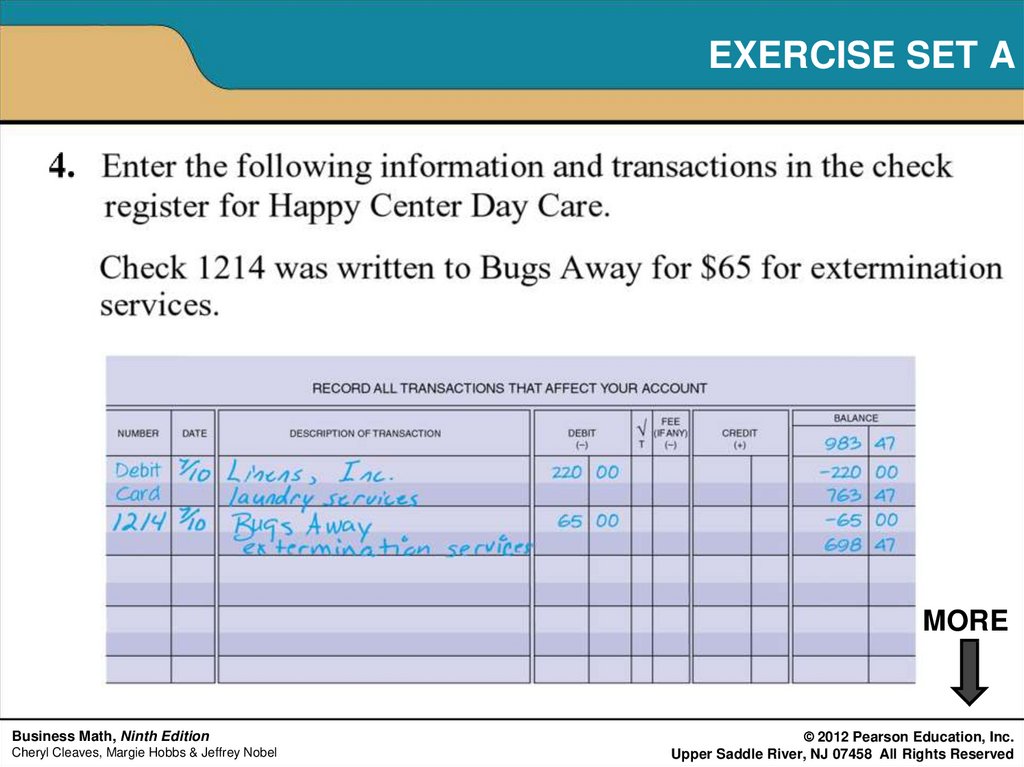

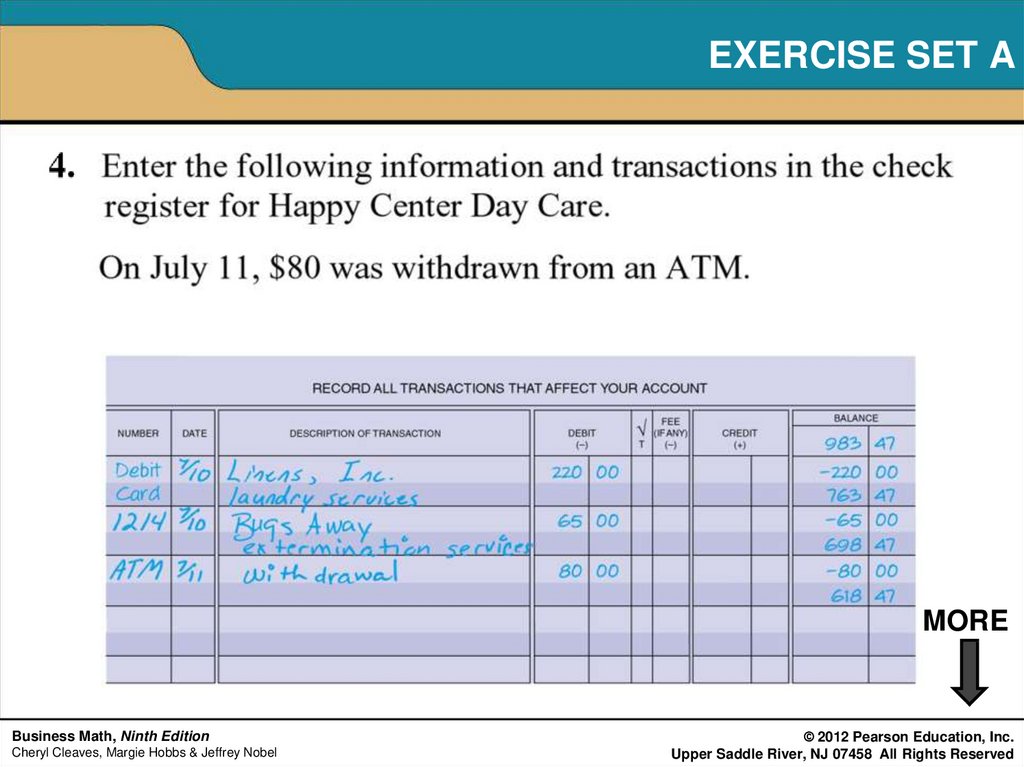

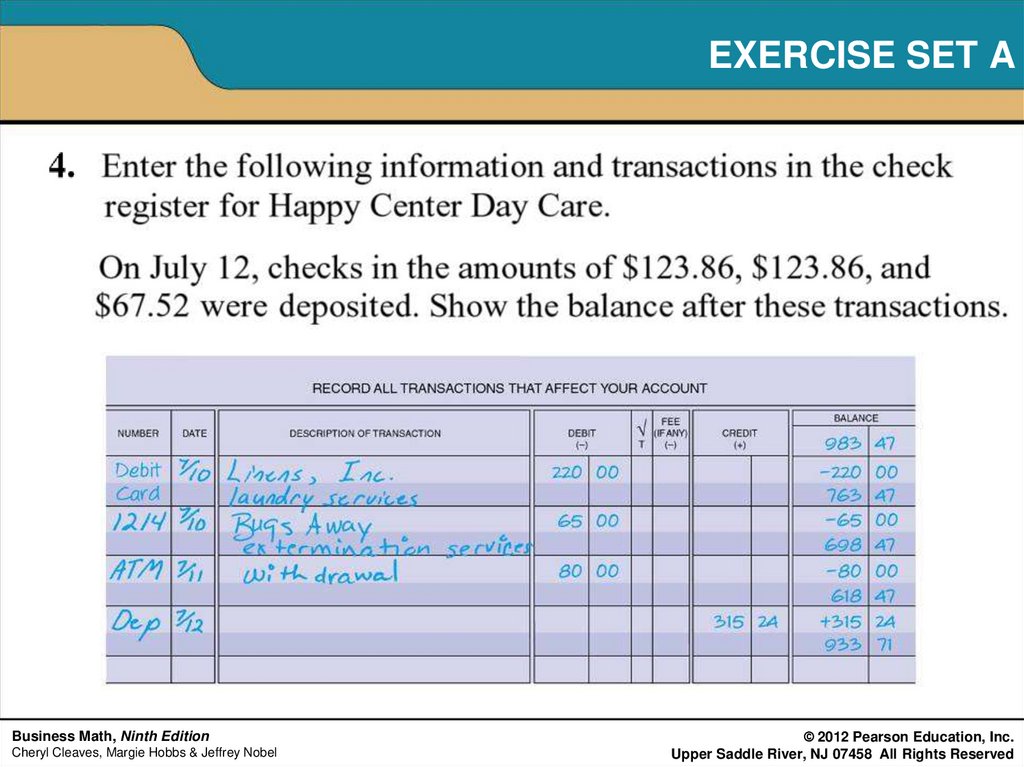

36. EXERCISE SET A

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

37. EXERCISE SET A

MOREBusiness Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

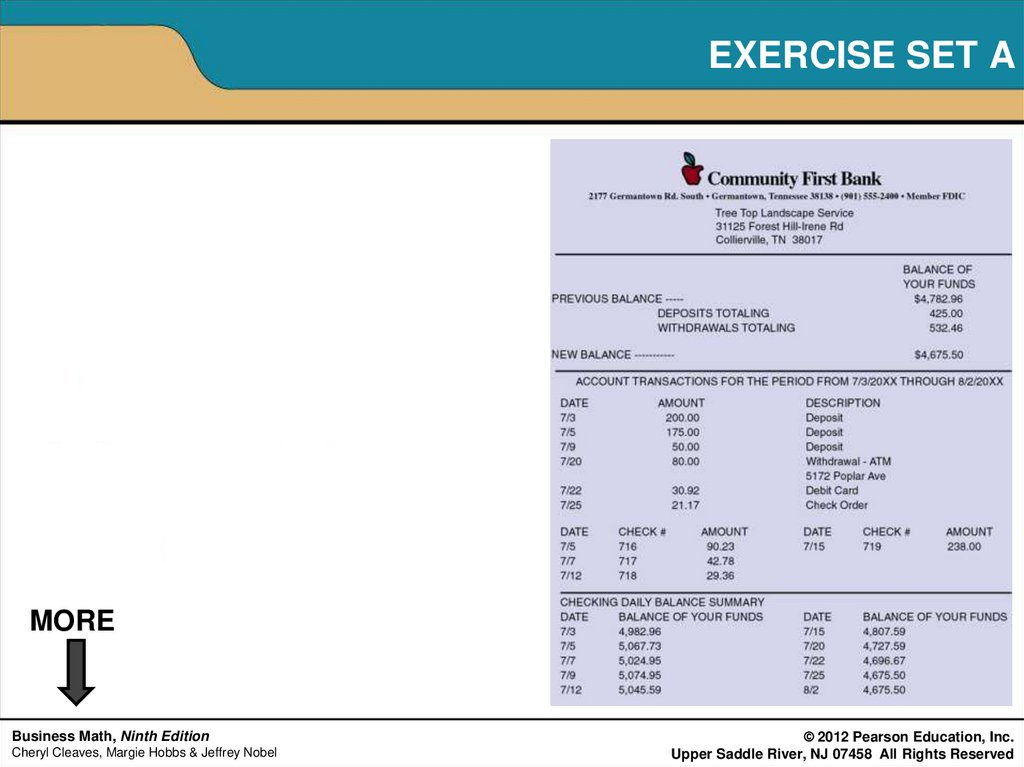

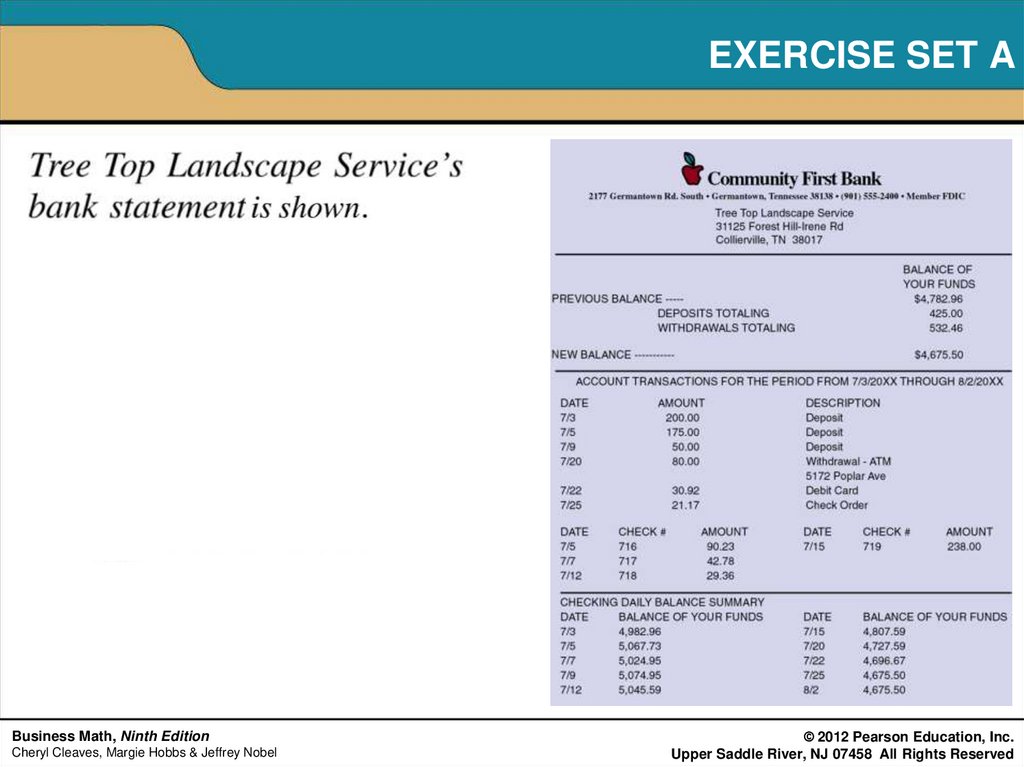

38. EXERCISE SET A

MOREBusiness Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

39. EXERCISE SET A

MOREBusiness Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

40. EXERCISE SET A

MOREBusiness Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

41. EXERCISE SET A

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

42. EXERCISE SET A

MOREBusiness Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

43. EXERCISE SET A

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

44. EXERCISE SET A

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

45.

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

46. PRACTICE TEST

MOREBusiness Math, Ninth Edition

Cheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

47. PRACTICE TEST

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

48. PRACTICE TEST

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

49.

Business Math, Ninth EditionCheryl Cleaves, Margie Hobbs & Jeffrey Nobel

© 2012 Pearson Education, Inc.

Upper Saddle River, NJ 07458 All Rights Reserved

finance

finance business

business