Similar presentations:

The problems of the active operations of commercial banks

1. The problems of the active operations of commercial banks

Seitmakhash Aizat2.

Plan of PRESENTATIONGIVING INFORMATION ABOUT THE RESARCH

PROJECT

DESCRIBING PROBLEMS WHICH CONNECTED

WITH THE ACTIVE OPERATIONS OF

COMMERCIAL BANKS

MAKING SOME RECOMMENDATIONS ABOUT

HOW TO AVOID THESE PROBLEMS

3. Active operations of commercial banks

Active operations of banks areoperations for issuing various

kinds of loans.

Active operations:

Mortgages

auto loans

business loans

personal loans.

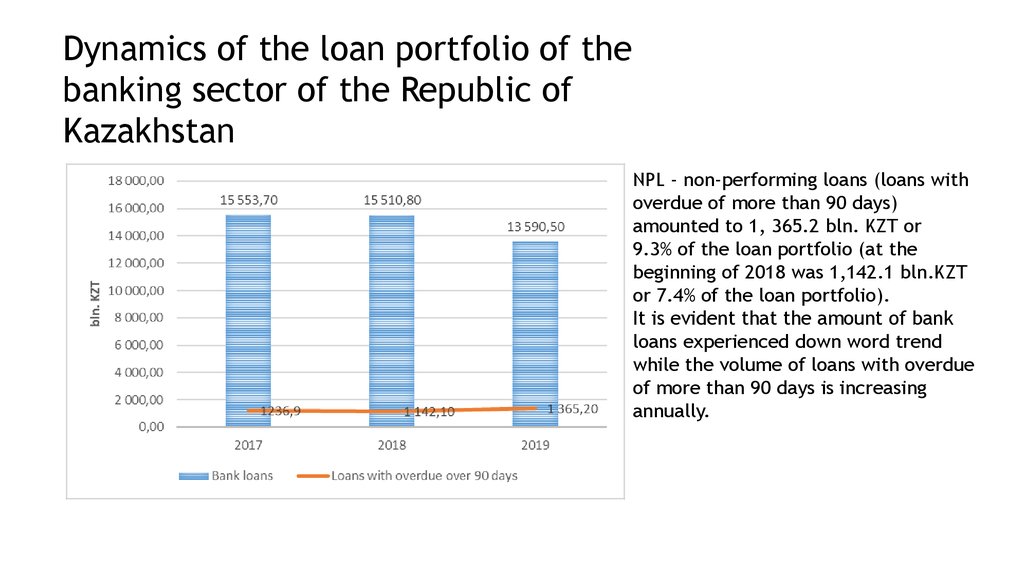

4. Dynamics of the loan portfolio of the banking sector of the Republic of Kazakhstan

NPL - non-performing loans (loans withoverdue of more than 90 days)

amounted to 1, 365.2 bln. KZT or

9.3% of the loan portfolio (at the

beginning of 2018 was 1,142.1 bln.KZT

or 7.4% of the loan portfolio).

It is evident that the amount of bank

loans experienced down word trend

while the volume of loans with overdue

of more than 90 days is increasing

annually.

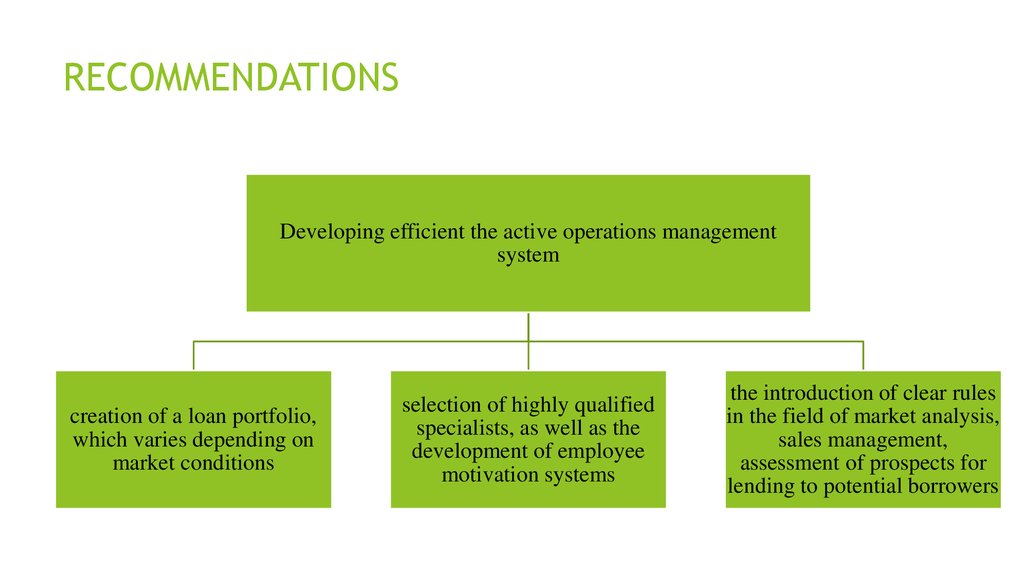

5. RECOMMENDATIONS

Developing efficient the active operations managementsystem

creation of a loan portfolio,

which varies depending on

market conditions

selection of highly qualified

specialists, as well as the

development of employee

motivation systems

the introduction of clear rules

in the field of market analysis,

sales management,

assessment of prospects for

lending to potential borrowers

6. It allows…

To maximizeproviding loans

opportunities of

commercial banks.

To improve of

activity of

commercial bank

To grow of the

country's economy

through loans that

are issued for

production

finance

finance