Similar presentations:

K-1 Export

1. K-1 Export

Anna PhillipsLacerte 2016

6-5-17

2.

The K-1 export will input the Schedule K-1from a client’s business to their personal

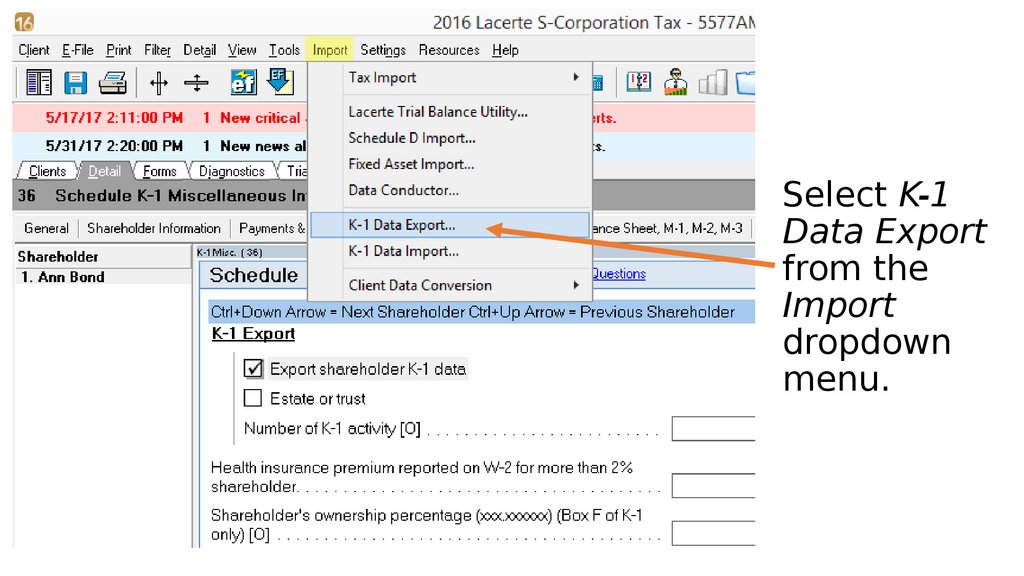

return.

A K-1 export should be done when a

business return input is complete and

again any tme there are changes.

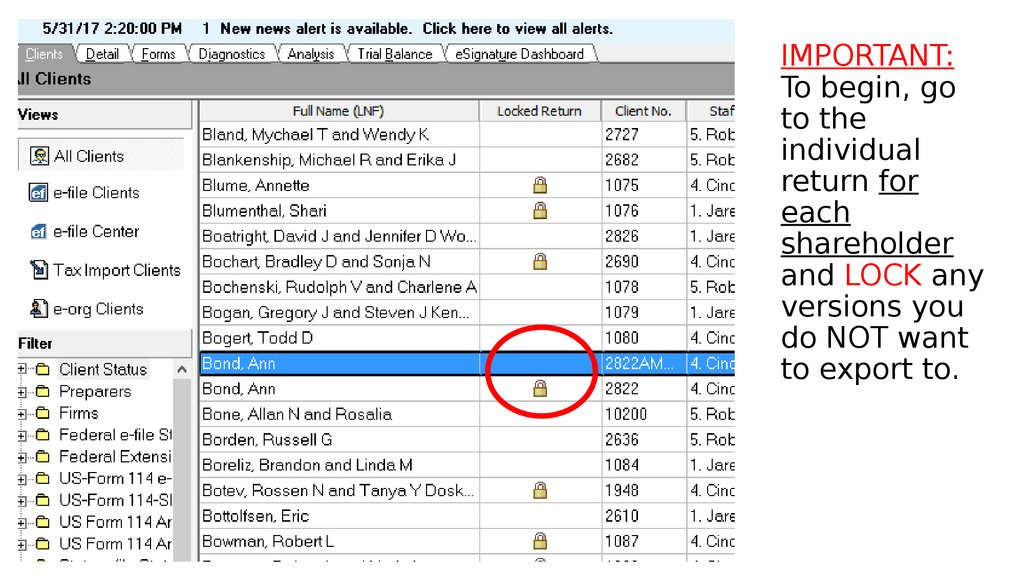

3. IMPORTANT: To begin, go to the individual return for each shareholder and LOCK any versions you do NOT want to export to.

4. To LOCK a return, right-click on the appropriate file and choose Lock Return.

To LOCK a return,right-click on the

appropriate fle

and choose Lock

Return.

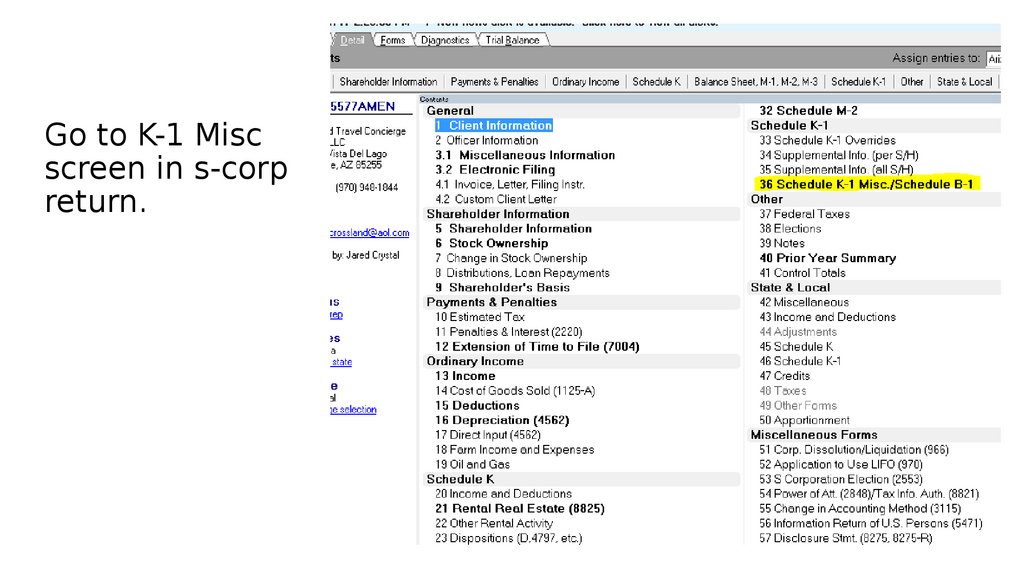

5. Go to K-1 Misc screen in s-corp return.

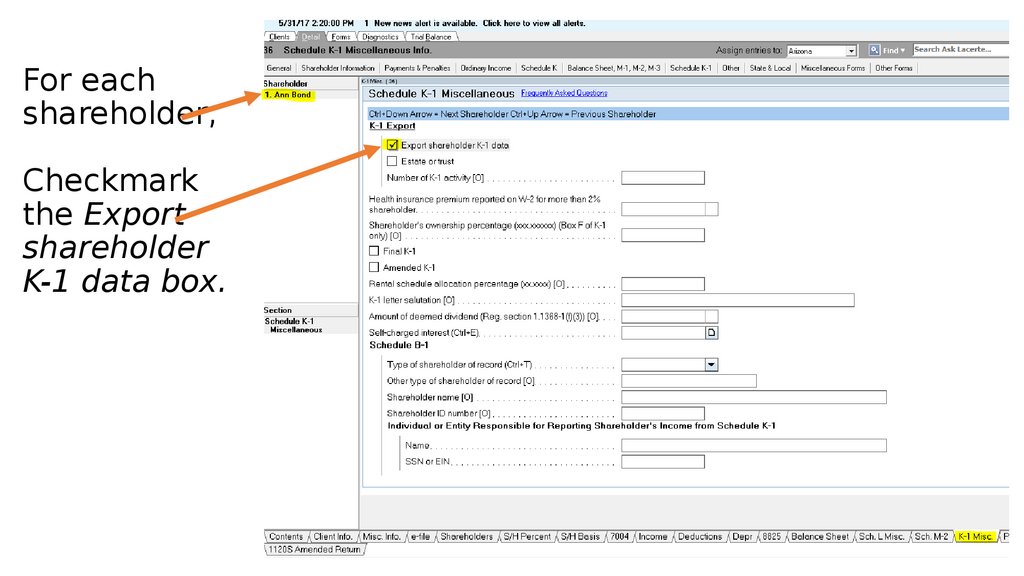

6. For each shareholder, Checkmark the Export shareholder K-1 data box.

7. Select K-1 Data Export from the Import dropdown menu.

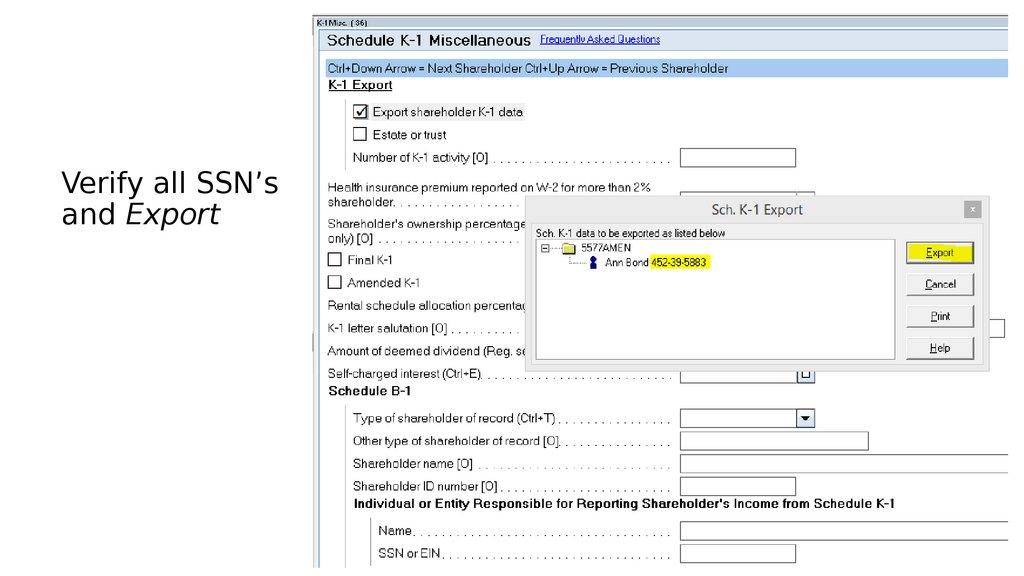

8. Verify all SSN’s and Export

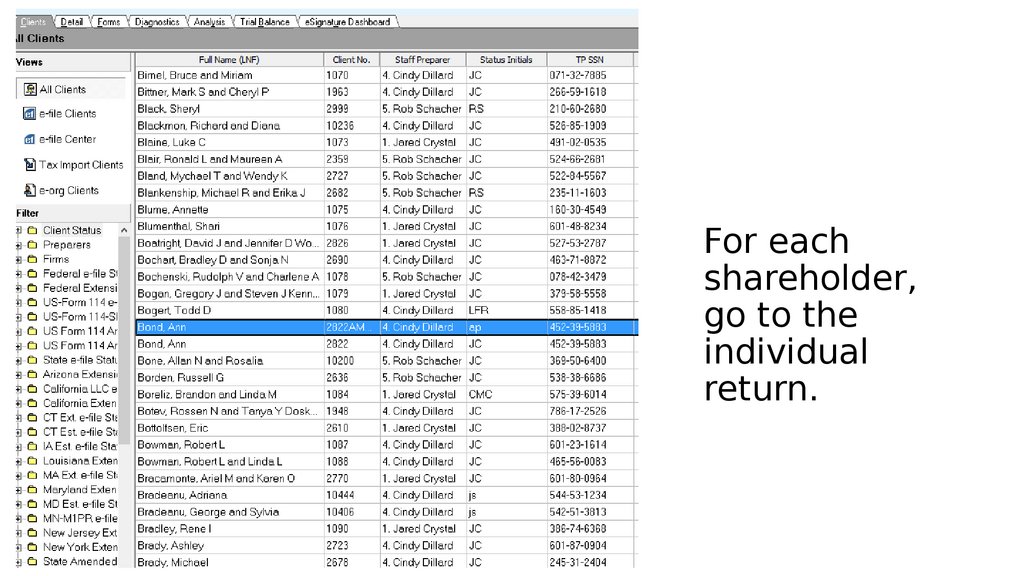

9. For each shareholder, go to the individual return.

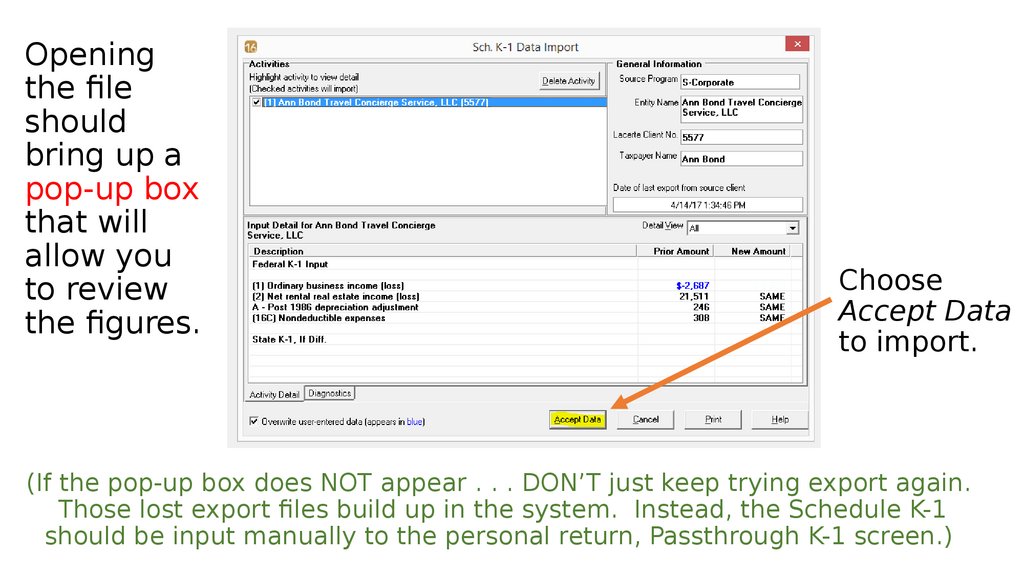

10. Opening the file should bring up a pop-up box that will allow you to review the figures.

Openingthe fle

should

bring up a

pop-up box

that will

allow you

to review

the fgures.

Choose

Accept Data

to import.

(If the pop-up box does NOT appear . . . DON’T just keep trying export again.

Those lost export fles build up in the system. Instead, the Schedule K-1

should be input manually to the personal return, Passthrough K-1 screen.)

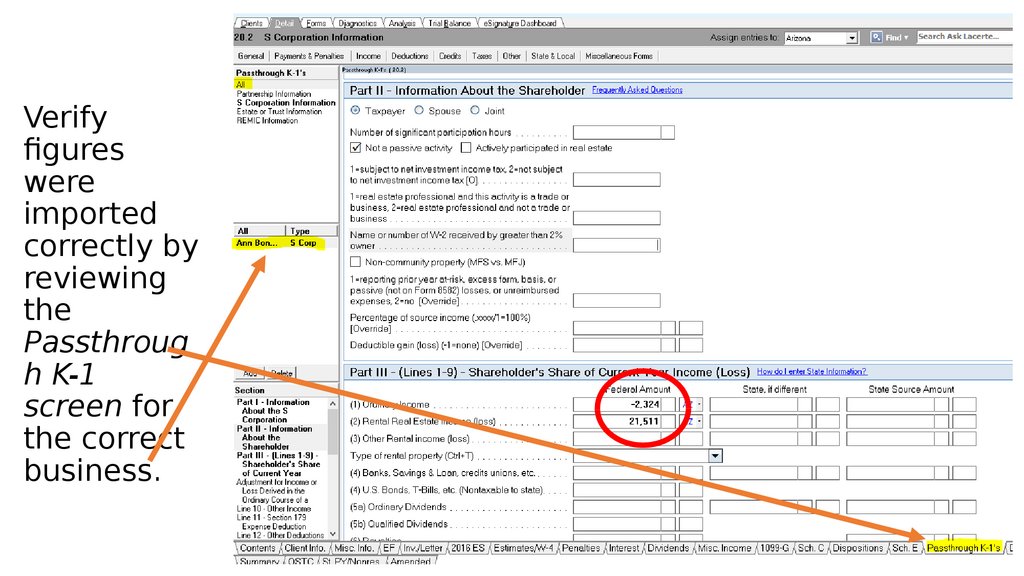

11. Verify figures were imported correctly by reviewing the Passthrough K-1 screen for the correct business.

Verifyfgures

were

imported

correctly by

reviewing

the

Passthroug

h K-1

screen for

the correct

business.

english

english