Similar presentations:

International economic relations

1.

INTERNATIONAL ECONOMICRELATIONS

Akad. Year 2018/2019

Prof. zw. dr hab. Bohdan Jeliński

2.

P r o g r a m m e1.

2.

3.

4.

5.

6.

World economy. Basic meanings and relations

Global market development

International trade

Basic forms of international trade

Fundamental theories of international trade

Movement of international production and trade factors

* International trade in services

* International migration

* International technology transfer

* Foreign Direct Investments movements

7. International trade policy

8. World economy sustainable development

3.

1.World economy4.

The modern world economy as a special organicholistic system, began to be formed on the basis of world

market since the end of XIX – beginning XX century.

Now we can talk about the world economy as a global

economic system that is based on:

international economic division of labour

internationalization and integration of production

and exchange,

and operates on principles of market economy.

5.

The history of the world economy begins with theinternational division of labour (IDL) associated with the

exchange activity and its products between states.

The international division of labour exists in two basic forms:

the international specialization

international production cooperation.

International specialization is a form of division of labour

between the countries in which the increase in the concentration

of homogeneous production is based on the progressive

differantiation of the national production.

6.

The international production cooperation isthe result of the specialization of national industries,

which interact in the international division of labour.

The international division of labour (IDL) was

unifying element that created the world economy as a

set of interrelated international exchange of national

economies, projecting its subsystems.

7.

In the second half of the XX century in the evolution of IDL is aqualitative shift, which has resulted in the export of capital acrosss

national borders. Internationalization has covered all stages of the

movement of capital ( monetary industrial, commercial), has found some

form as follows:

the integration of national economies into the regional economic

complexes with the structure and proportions of the opening on

the consumption of the whole region, as well as the regulations

of interstate economic ralations,

transnationalization, that is out of production and business

corporations in the form of branches and subsidiaries across

national boundaries

division of transnational corporations, in the territory of nations,

operating largely as economically, organizationally and legally

independent entities, whose relations with tha national states are

built on special contracts.

8.

Internal angular momentum of the integrationprocesses and transnationalization is the emergence of a new

phenomenon of the global economy:

• world economic division of labour

• intra and inter regional division of labour

• global (transnational) division of labour.

Global economic division of labour is an

extraterritorial nature. It can not be represented on a

territorial basis and in the forms of public – private division

of labour. In such a case, single production proces is divided

into transactions carried out in different countries.

9.

The activities of transnational corporations as oneof the organizational forms of global economic division of

loabour create regular circulation on a planetary scale of:

goods

natural resources

services

financial resources

knowledge

technology

management experience.

10.

Through participation in the transnationaldivision of labour, the national economy has direct access

to the world market .

The product manufactured by transnational enterprises

in one or several multinational corporations, has tendency to

occupy a niche market and become the main suppliers of

niche products that meet the world,s demand.

A single global economic space,

create

multinational business environment in which there are

common economic, technological, legal and socio-cultural

requirements fo the subject of industrial and commercial

activities.

11.

The world community is still in the early formationof a single world economic space. It is still graded on

numerous stages unity.

The main intrinsic subsystems of the world economy

in the second level, should be considered:

economic

technology

legal

socio-cultural .

12.

The economic subsystem is a common economicspace of free movements of goods and services, capital

and labourt, informations across the borders of states and

the free interchange of national curriences.

Economic subsystem is formed as the

development and implementation of uniform standards for

international trade, production and investment and

monetary affairs.

The common economic space also provides for

uniform rules and standards of the organization and

management of international processes embodied in the

principles of international management.

13.

The technological subsystem is a set of requirementsimposed by the STR, and which provide competitive in the

global market. These technology requirements can be

reduced to basic parameters:

the

nature of information and computer

technology,

research intensity

resource-saving, waste-free and envirenmentally

friendly type of technology

biotech, we have the technology, which is besed on

innatural processes.

14.

These paremeters provide maintaining world-classefficiency, productivity, quality and novelty products, implementation

of the principles of modern management, The implementation of these

equirements is virtually impossible and ineffective under seperate

national technology spaces.

Legal subsystem is the reduction of general riles of business

law and the norms of business behawior. They form a single legal

framework, as the creationof rules of private international, civil and

patent low. The trend of further convergence of legal systems od the

states, which extends to human rights, lays the foundation for global

legal space.

15.

Socio-cultural subsystem is formed much moreslowly and contradictory than other subsystems of the single

world economic space. The proces of formation of the unique

social and cultural environment provides:

• achieving a high general standard of living and

reducing disparities between „rich” and „poor”

countries. Created for this purpose the EU structural

funds, various United Nations trust funds

• one approach to social policy

• formation of new thinking, breaking the old way of

thinking

• developing common standards of bisiness conduct

and ethics inmanagement

• peaceful decision national and international

problems.

16.

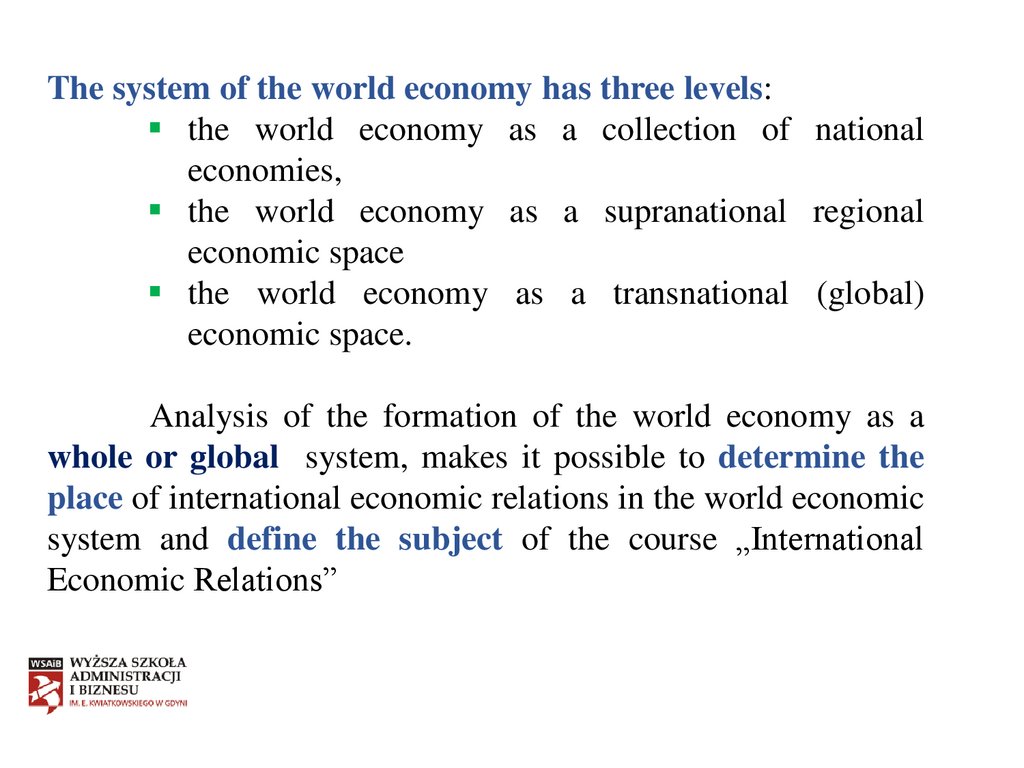

The system of the world economy has three levels:the world economy as a collection of national

economies,

the world economy as a supranational regional

economic space

the world economy as a transnational (global)

economic space.

Analysis of the formation of the world economy as a

whole or global system, makes it possible to determine the

place of international economic relations in the world economic

system and define the subject of the course „International

Economic Relations”

17.

2. Global market developmentG L O B A L IS A NEW SCIENTIFIC CATEGORY, WHICH

TREATS THE PROCESSES AND EVENTS ON A WORLD SCALE

The processes and events on a world scale have the common name –

globalization

Globalization is an approach which expands and deepens the economy

and economic theory as well as other scientific fields.

Subject of economic globalization are:

the state

national companies

international companies

transnational companies

regional economic structures

international economic organizations

18.

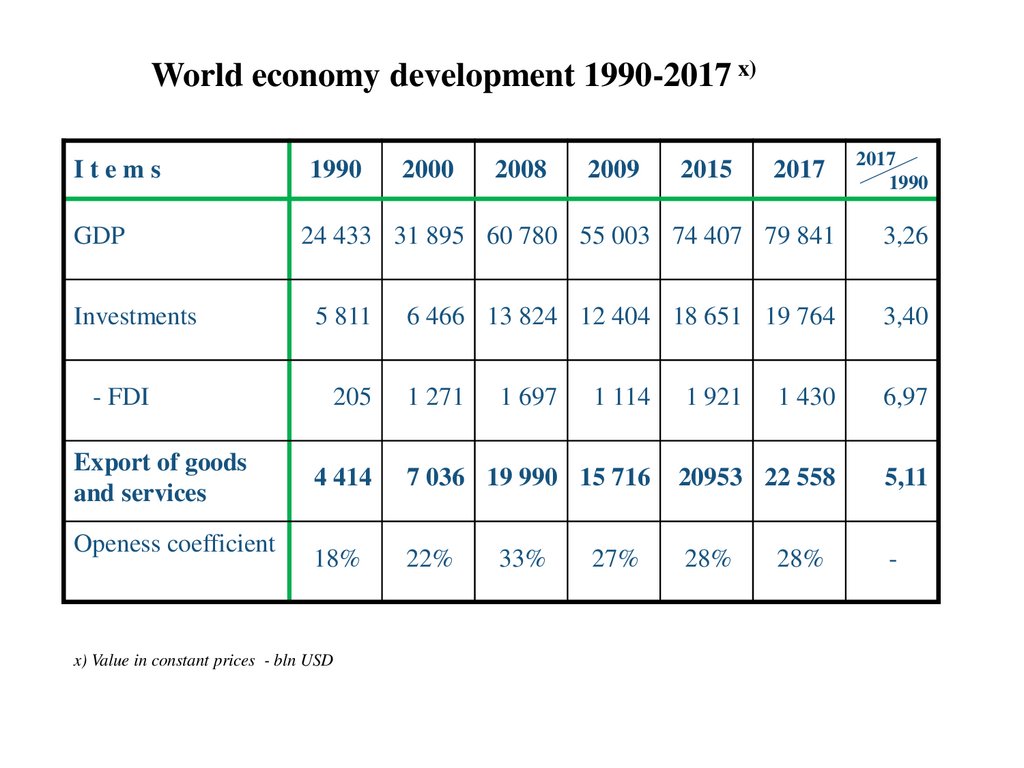

World economy development 1990-2017 x)Items

GDP

Investments

- FDI

Export of goods

and services

Openess coefficient

1990

2000

2008

2009

2015

2017

24 433 31 895 60 780 55 003 74 407 79 841

5 811

205

2017

1990

3,26

6 466 13 824 12 404 18 651 19 764

3,40

1 271

1 430

6,97

1 697

1 114

1 921

4 414

7 036 19 990 15 716

20953 22 558

5,11

18%

22%

28%

-

x) Value in constant prices - bln USD

33%

27%

28%

19.

20.

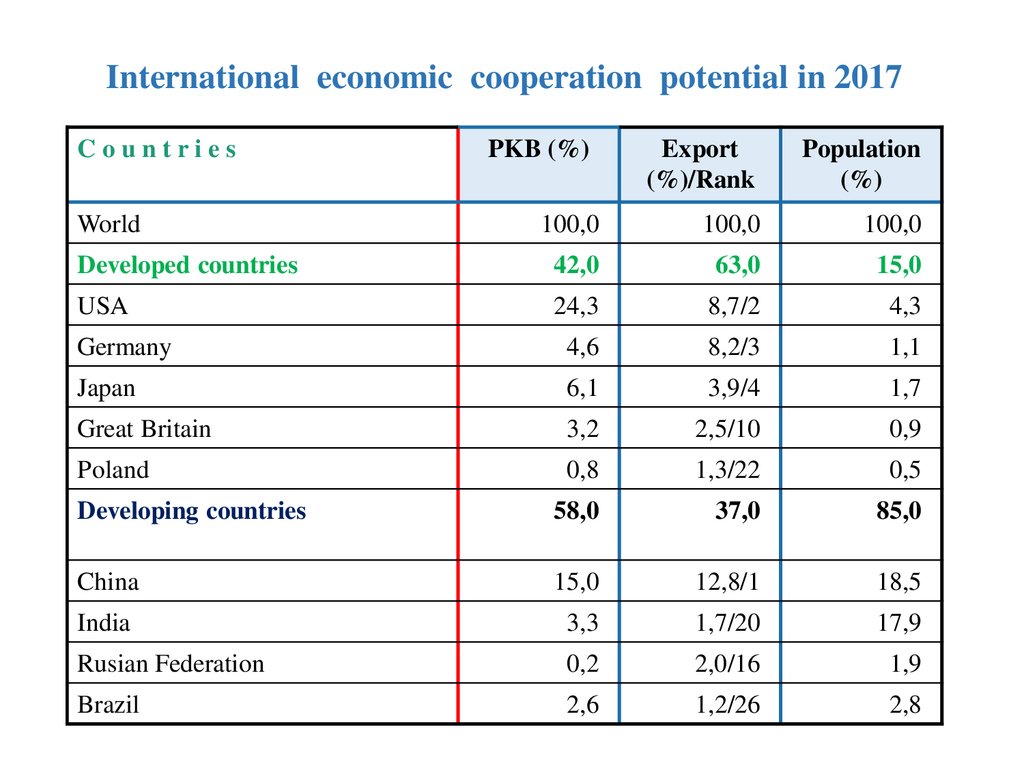

International economic cooperation potential in 2017Countries

Export

(%)/Rank

Population

(%)

100,0

100,0

100,0

Developed countries

42,0

63,0

15,0

USA

24,3

8,7/2

4,3

Germany

4,6

8,2/3

1,1

Japan

6,1

3,9/4

1,7

Great Britain

3,2

2,5/10

0,9

Poland

0,8

1,3/22

0,5

Developing countries

58,0

37,0

85,0

China

15,0

12,8/1

18,5

India

3,3

1,7/20

17,9

Rusian Federation

0,2

2,0/16

1,9

Brazil

2,6

1,2/26

2,8

World

PKB (%)

21.

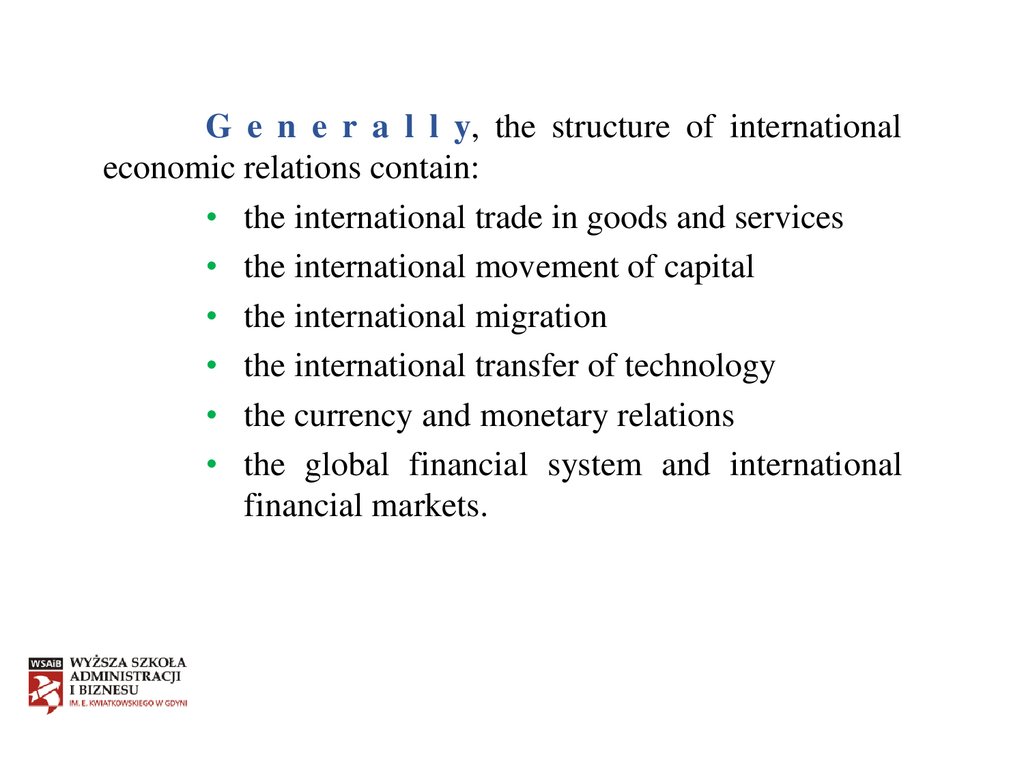

G e n e r a l l y, the structure of internationaleconomic relations contain:

• the international trade in goods and services

• the international movement of capital

• the international migration

• the international transfer of technology

• the currency and monetary relations

• the global financial system and international

financial markets.

22.

3. International trade growthInternational trade is one of major driving

forces of economic development . It appears as a

sphere of international economic relations and is

formed by merchandise trade, trade in services and

products of intelectual labor of all countries in the

world. Today, it accounts about 80 % of all international

operations.

23.

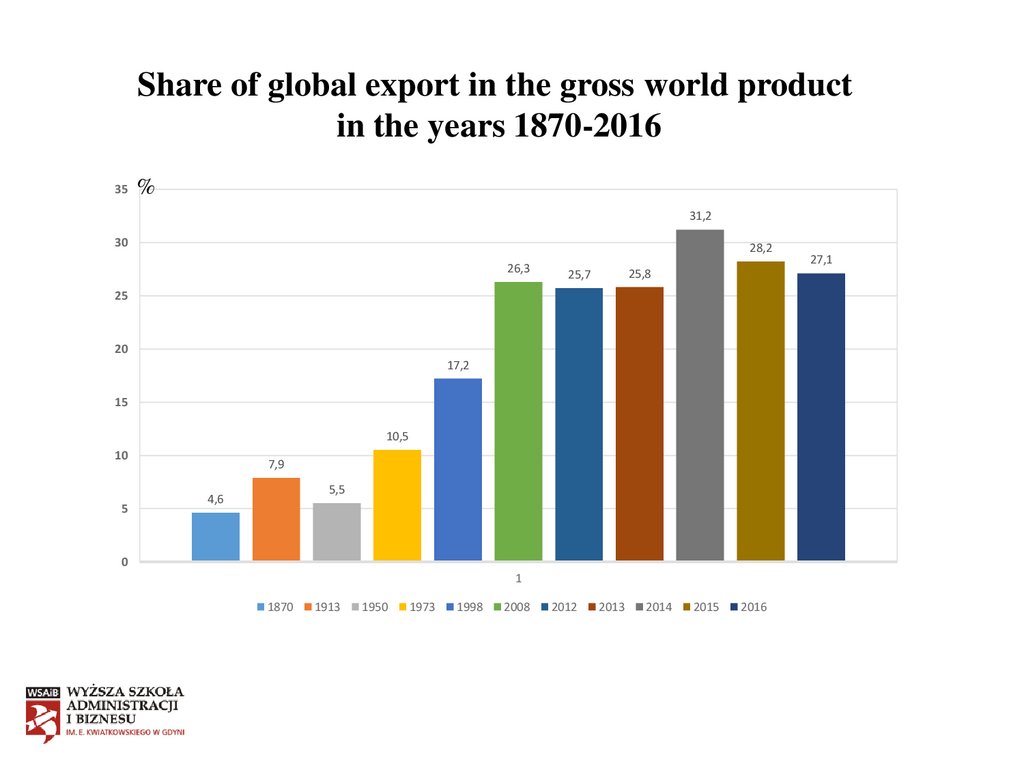

Share of global export in the gross world productin the years 1870-2016

35

%

31,2

30

28,2

26,3

25,8

25,7

25

20

17,2

15

10,5

10

5

7,9

5,5

4,6

0

1

1870

1913

1950

1973

1998

2008

2012

2013

2014

2015

2016

27,1

24.

Intensification of trade relations andmanufacturing cooperation between different

countries is one of the most distinctive features

resulting from changes in the global economy. This

process, known as the internationalization of the

economy, has contributed to a dynamic growth of

foreign trade and consolidation of national

economies. This phenomenon, which has been

gaining speed since the mid – 1970s, has

generated, a new quality in the proces of

internationalization of economic growth, know as

globalization.

25.

Internationalization is the proces of increasinginvolvment of enterprises in international markets.

Those enterpreneurs who are interested in the field

of internatiobalization of business need to possess the ability

to think globally and have an understanding of international

cultures. By appreciating undunderstanding different beliefs,

values, behaviours and business strategies of a variety of

companies within other countries, enterpreneurs will be able

to internationalize succesfully.

26.

Globalization involves three fundamental areas ofchange:

technical and technological

political

economic

Economic globalization is a historical proces which

stems from innovation and technological progres and

causes countries to become increasingly interdependent

on a global scale, in particular through a rise in the

volume of commodity trade and cash flow (IMF).

27.

28.

International trade is the total of tradein goods and services, equalling exports and

imports for countries which partticipate in such

trade.

Export means a paid sale of domestic

goods abrroad or providing services to entities

licated in a different customs area.

29.

Import, as seen from the buyer’sviewpoint, means increasing domestic supply to

include foreign products. Importers meet the

demand of the domestic economy for goods and

services which would be impossible or

unprofitable to create at home due to local

conditions (e.g. climate) or lack of specific

means of production.

30.

The export elasticity coefficientrepresents the supply potential of an economy,

while the import elasticity coefficient – its

demand potential.

During a market downturn, the difference

between the coefficients is minimal.

31.

Foreign commercial exchange contributes to theeconomic growth of a country mainly indirectly through

additions to the national income. It is dificult to state clearly

which portion of the national income accrues thanks of foreign

trade and which due to internal factors related to demand and

supply. There exists, however, a relationship which displays a

direct connection between foreign trade and the gross domestic

product (GDP).

GDP = C + I + G + (X - M)

where:

GDP – Gross Domestic Product (expenditure approach)

C – Personal Consumption Expenditures

I – Gross Private Domestic Investment

G - Government Consumption Expenditures and Gross Investments

(X-M) – foreign trade balance (net exports)

X – export

M - import

32.

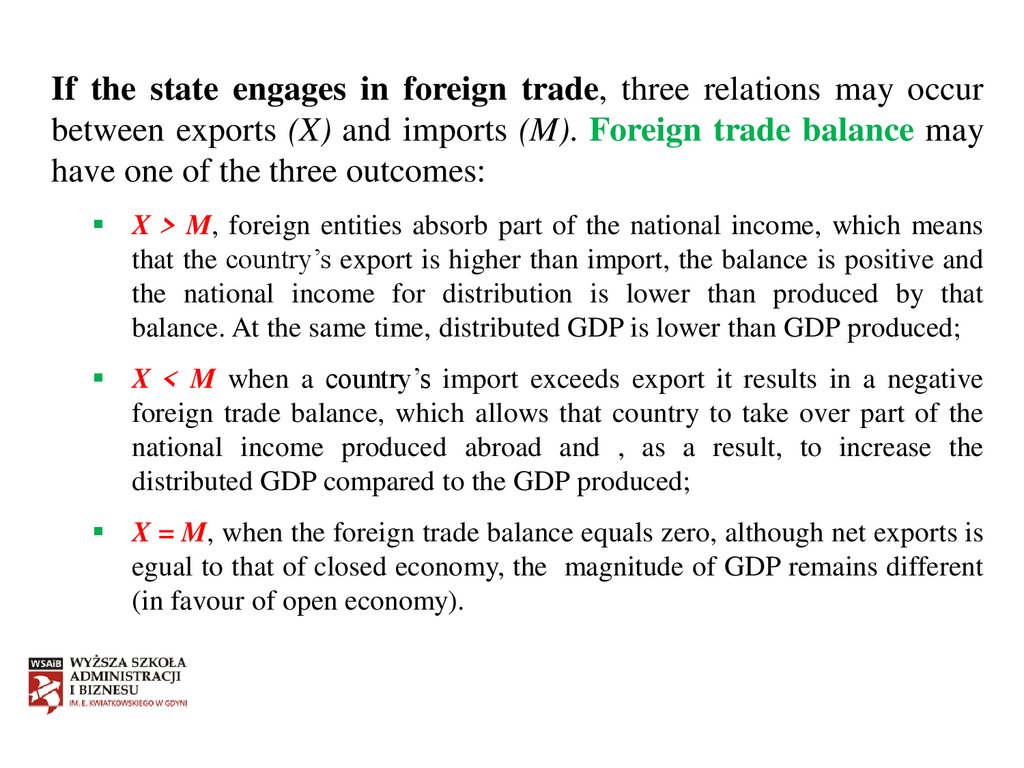

If the state engages in foreign trade, three relations may occurbetween exports (X) and imports (M). Foreign trade balance may

have one of the three outcomes:

X > M, foreign entities absorb part of the national income, which means

that the country’s export is higher than import, the balance is positive and

the national income for distribution is lower than produced by that

balance. At the same time, distributed GDP is lower than GDP produced;

X < M when a country’s import exceeds export it results in a negative

foreign trade balance, which allows that country to take over part of the

national income produced abroad and , as a result, to increase the

distributed GDP compared to the GDP produced;

X = M, when the foreign trade balance equals zero, although net exports is

egual to that of closed economy, the magnitude of GDP remains different

(in favour of open economy).

33.

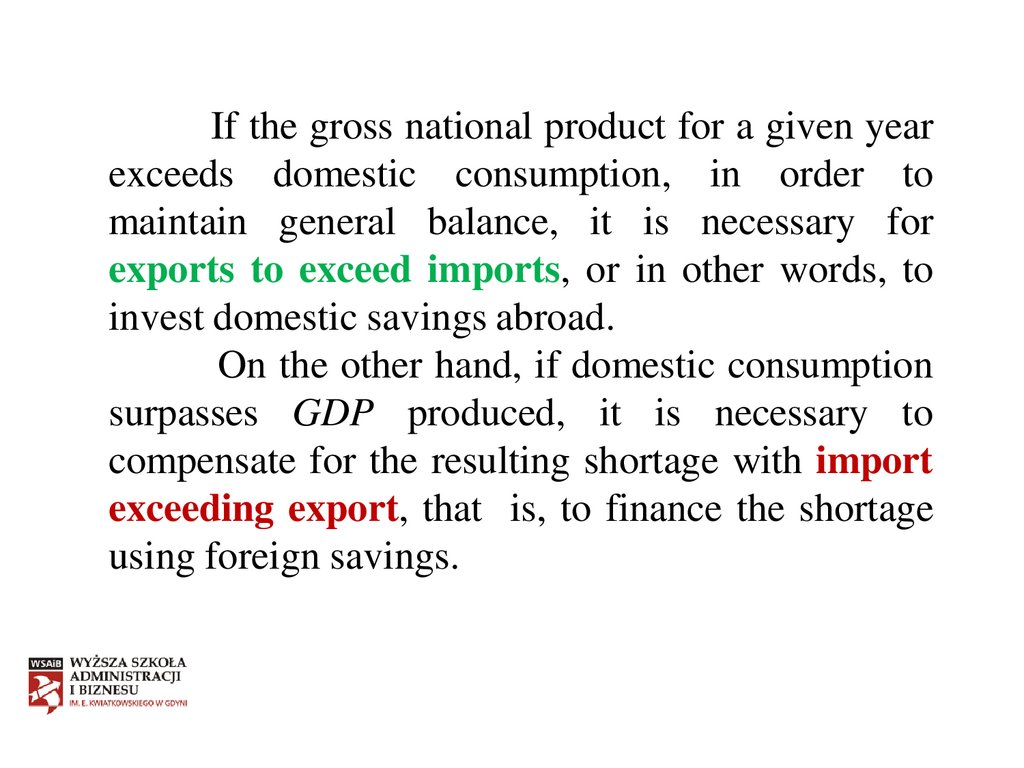

If the gross national product for a given yearexceeds domestic consumption, in order to

maintain general balance, it is necessary for

exports to exceed imports, or in other words, to

invest domestic savings abroad.

On the other hand, if domestic consumption

surpasses GDP produced, it is necessary to

compensate for the resulting shortage with import

exceeding export, that is, to finance the shortage

using foreign savings.

34.

Foreign trade brings the state a variety of directbenefits of a quantitative nature , such like:

● balance of foreign trade turnover

● participation in world export

● economy oppenes coefficient

● terms of trade

35.

Foreign trade brings the state a varity of indirectbenefits of a qualitative nature. It is possible to distinguish four

main functions served by foreign trade in the economic growth

of a given country:

● transformative function which impacts the changes in

the substantive structure of the product produced,

● resource – forming function which impacts country’s

domestic savings,

● multiplier function which impacts the volume of global

supply in a country,

● effectiveness function, which allows improvement in the

effectiveness of governance.

36.

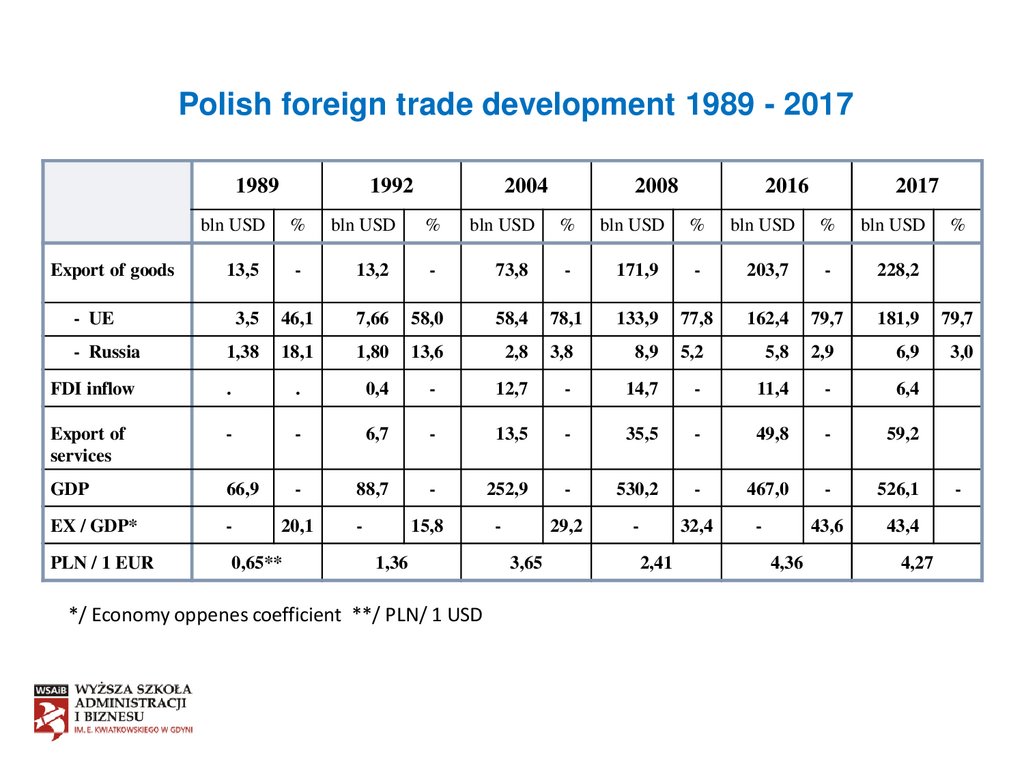

Polish foreign trade development 1989 - 20171989

1992

bln USD

Export of goods

bln USD

%

bln USD

2008

2016

2017

%

bln USD

%

bln USD

%

bln USD

-

13,2

-

73,8

-

171,9

-

203,7

-

228,2

3,5

46,1

7,66

58,0

58,4

78,1

133,9

77,8

162,4

79,7

181,9

79,7

1,38

18,1

1,80

13,6

2,8

3,8

8,9

5,2

5,8

2,9

6,9

3,0

FDI inflow

.

.

0,4

-

12,7

-

14,7

-

11,4

-

6,4

Export of

services

-

-

6,7

-

13,5

-

35,5

-

49,8

-

59,2

GDP

66,9

-

88,7

-

252,9

-

530,2

-

467,0

-

526,1

EX / GDP*

-

29,2

-

32,4

43,6

43,4

PLN / 1 EUR

%

13,5

- UE

- Russia

%

2004

20,1

0,65**

-

15,8

1,36

*/ Economy oppenes coefficient **/ PLN/ 1 USD

3,65

2,41

4,36

4,27

-

37.

YearWo r l d t r a d e

development

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Agriculture

Raw materials

products

298,8

559,9

293,1

542,0

271,0

485,0

267,9

446,0

280,7

442,0

265,5

426,8

294,2

326,0

336,6

361,0

382,6

364,0

401,4

421,0

414,7

488,3

418,2

457,9

447,9

453,9

429,3

437,9

500,9

473,2

589,4

545,3

604,2

622,9

596,2

639,9

568,6

508,1

547,8

587,5

550,8

854,0

552,6

779,2

585,2

790,0

684,1

973,5

784,2

1311,6

853,0

1814,0

946,4

2314,3

1135,3

2670,9

1345,7

3542,8

1182,2

2274,9

1364,9

3029,2

1662,6

4069,5

1651,3

4144,9

1737,2

4023,0

1765,4

3788,9

1569,0

2441,7

1588,9

2079,5

1736,0

2634,2

Industrial

goods

1092,4

1086,3

1047,4

1049,7

1134,8

1182,4

1426,8

1699,8

1982,8

2115,5

2391,2

2470,5

2668,2

2668,4

3097,7

3718,8

3852,6

4031,3

4122,5

4260,1

4689,7

4511,3

4753,3

5501,0

6618,8

7301,6

8255,0

9509,0

10445,9

8362,4

9992,4

11511,0

11472,5

11826,4

12242,9

11418,9

11239,6

12160,5

Services

367,1

377,3

368,2

357,2

368,2

383,5

452,5

536,7

604,7

662,5

788,7

832,6

931,8

950,0

1042,5

1179,4

1273,1

1329,8

1346,9

1405,9

1491,3

1492,7

1597,6

1851,4

2250,4

2516,2

2845,4

3421,4

3847,1

3488,7

3827,7

4295,4

4397,0

4644,4

5197,7

4937,0

4963,0

5351,2

Total export

2318,1

2298,7

2171,6

2120,7

2225,7

2258,2

2499,6

2934,1

3334,2

3600,4

4082,9

4179,2

4501,7

4485,6

5114,3

6032,9

6352,8

6597,1

6546,1

6801,2

7585,8

7335,8

7726,1

9010,0

10965,0

12484,9

14361,1

16736,6

19181,5

15308,1

18214,1

21538,5

21665,7

22450,8

23849,4

21164,2

20686,6

22757,3

38.

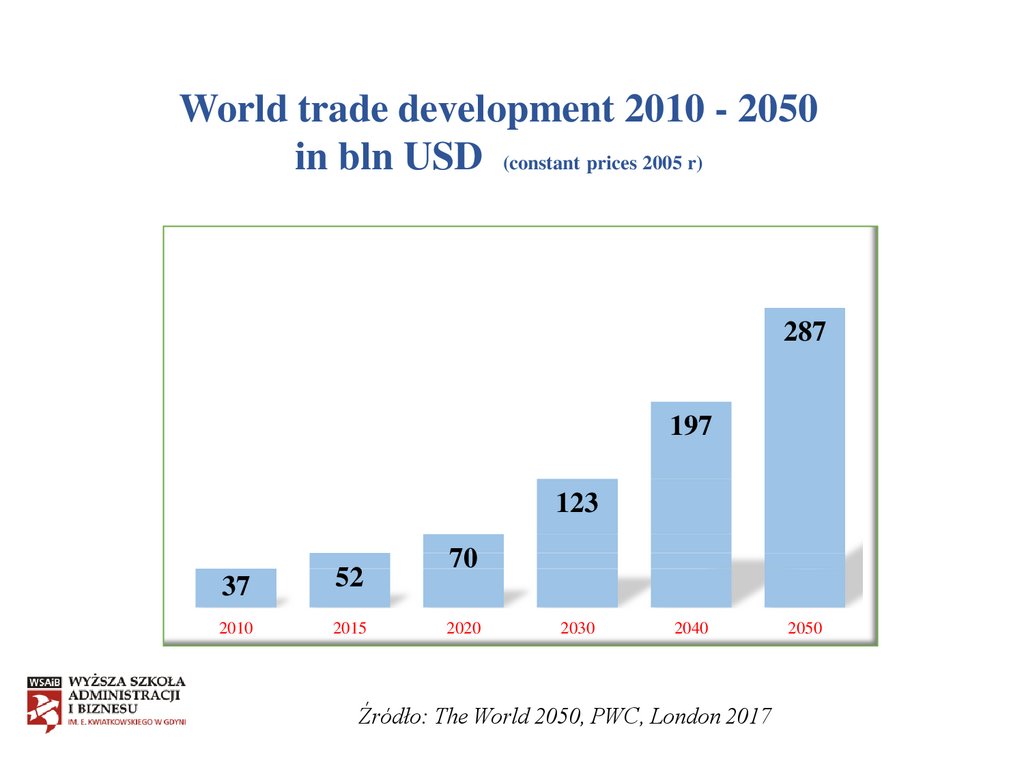

World trade development 2010 - 2050in bln USD (constant prices 2005 r)

287

197

123

37

2010

52

2015

70

2020

2030

2040

Źródło: The World 2050, PWC, London 2017

2050

39.

International trade of goods was historically thefirst and until the certain period od time, the main sphere

of international economic relations. Only at the end of the

20th century, different forms of financial operations

became dominant in the international economic system.

Rapid development of international trade is mainly

connected with strenghening of international relations

liberalization proces, increase of demand on

manufactured goods, percentage of which composes

circa 70 % in total value of international export.

40.

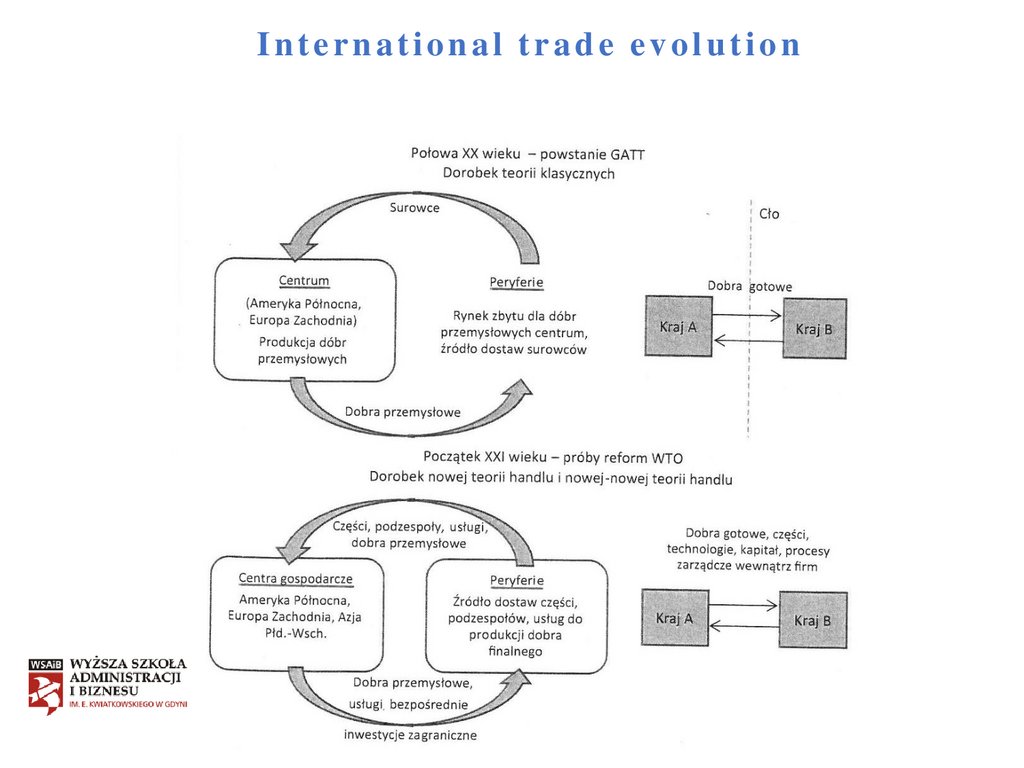

International trade evolution41.

4. Basic forms of international tradeInternational trade is a total value of contracts

signed at world market of different goods. Each one market

has had own specific organization and activity. Becouse of

that , we can divide world market for:

● free markes

● formal markets

● informal markets.

42.

Free market is a sum of individual contracts signed directlybetween two firms from two countries.

Formal market is a sum of contracts signed indirectly under

the given conditions in particular place and time.

Informal market work without any formal regulations.

On formal market is possible to finalize contract only throught

middleman.

Middleman is a firm or person who could has a form/name:

goods stock exchange

dealer

auction

commission

own trade office

join-venture

production division abroad

43.

Informal market exist in a form of:international raw materials agreements

international cartel agreements

regional trade agreements

intercorporations turnovers.

44.

5. International Trade TheoriesInternational trade have a rich history to work out theories of international trade.

Up to now we can identify three grups of international trade theories:

preclassical theories

classical theories

neoclassical theories.

Within preclassical theories we can select:

awe of market deficyt theory

reasonable price theory

mercantilism

45.

Within the group of classical theories we can select:* absolute advantage theory

* comparative advantage theory

* factor proportions theory.

Within the group of neoclassical theories we can select:

product life-cycle theory

country similarity theory

theory of economic of scale.

46.

Mercantilism was the was the first one, whichproposed the theoretical understanding of

international trade three key questions:

why does international trade exist and what

are its economic basis?

how much profitable is the trade for each of

the participating countries?

what is it necessary to choose for economic

growth; free trade or protectionism?

47.

A state, according to mercantilists, shoud:● stimulate export and export more goods than import and

this approach will provide the gold inflow

● restrict the importation of goods, especially luxury goods

that will provide export balance of trade

● forbid the production of final products in its colonies

● forbid the exportation of raw materials from the parent

states to the colonies and allow free importaqtion of raw

materials, which are not obtained within the country

● stimulate an export of mainly cheap raw commodities from

the colonies

● forbid any trade of its colonies with other countries, except

the parent state, which can resell the colonial goods abroad

by itself.

48.

Nowadays, neomercantilism appears to be when the countries withhigh rates of unemployment try to limit importin order to stimulate

domestic production and employment.

Mercantilism school dominated in economy during about

1,5 century. By the beginning od the 18-th century, international trade

had a huge numer of possible restrictions. The rules of trade were

contrary to the needs of production and there waqs a need for a

transition to free trade.

The theory o f international trade found its next

development in the writings of economists of the classical school.

49.

Development of international trade during the transition period of the developedcountries to large machne production led to the emergence of the

absolute advantage theory, developed by A. Smith.

A. Smith hold the view that the wealth of nations depends not so much on the

accumulated stoch of precious metals, but on the possibility of economy to produce final

goods abd services. Therefore, the main task of the country is not the accumulation of

gold and silver, butmaking arrangements to develop production on the basis of

cooperation and divition of labour.

A. Smith was the first one, who answered the guestion „Why is a country

interested in international exchange”. He believed that when two countries are trade

partners, they need to benefit from trade.

A. Smith theory became known as the absolute advantage theory, becouse it

was based on the absolute advantage: a country exports the goods, which costs of

production are lower than in a partner country, and imports the goods produced abroad

with lower costs.

The main conclusion of the theory ofabsolute advantage, is that every

country benefits from international trade and it is decisive for forming the external

sector of economy.

50.

The rule of international trade, depending on absoluteadvantage, excluded countries without absolute advantage

from international trade. D. Ricardo developed the absolute

advantage theory and proved that the existence of absolute

advantege in the national production of any commodity is not

necessary precondition for the development of international

trade. He said that the international exchange is possible and

desirable in the presence of comparative advantages

countries.

51.

Comparative advantage theory states that if countries specialize inthe production of the commodities that have relatively lower costs

in comparisin with other countries, a trade will be mutually

beneficial for bith countries, regardless if whether the production in

one of tchem is more effective than in the other one. In the D.

Ricardo model, domestic prices are determined only by cost – by

supply conditions.

The limitations of the comparative theory are as below:

it does not take into account the impact of foreign trade

on income distribution within a country

impact of fluctuations in prices and wages

impact of international cpital movements

and does not explain the trade between almost identical

52.

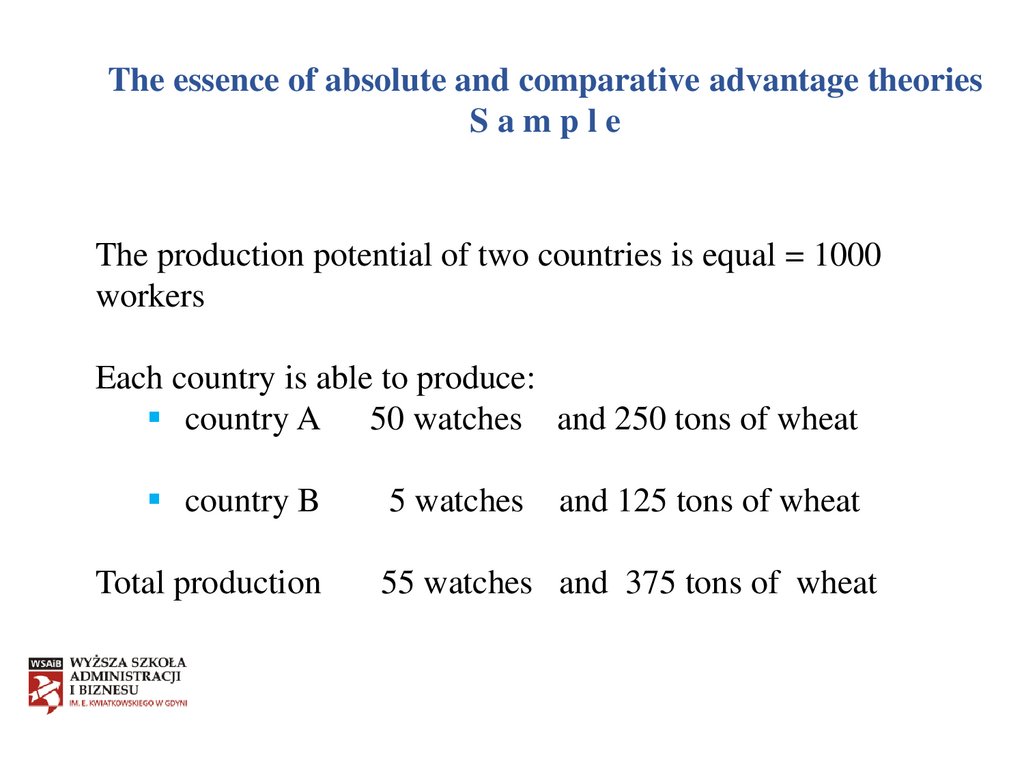

The essence of absolute and comparative advantage theoriesSample

The production potential of two countries is equal = 1000

workers

Each country is able to produce:

country A 50 watches and 250 tons of wheat

country B

Total production

5 watches

and 125 tons of wheat

55 watches and 375 tons of wheat

53.

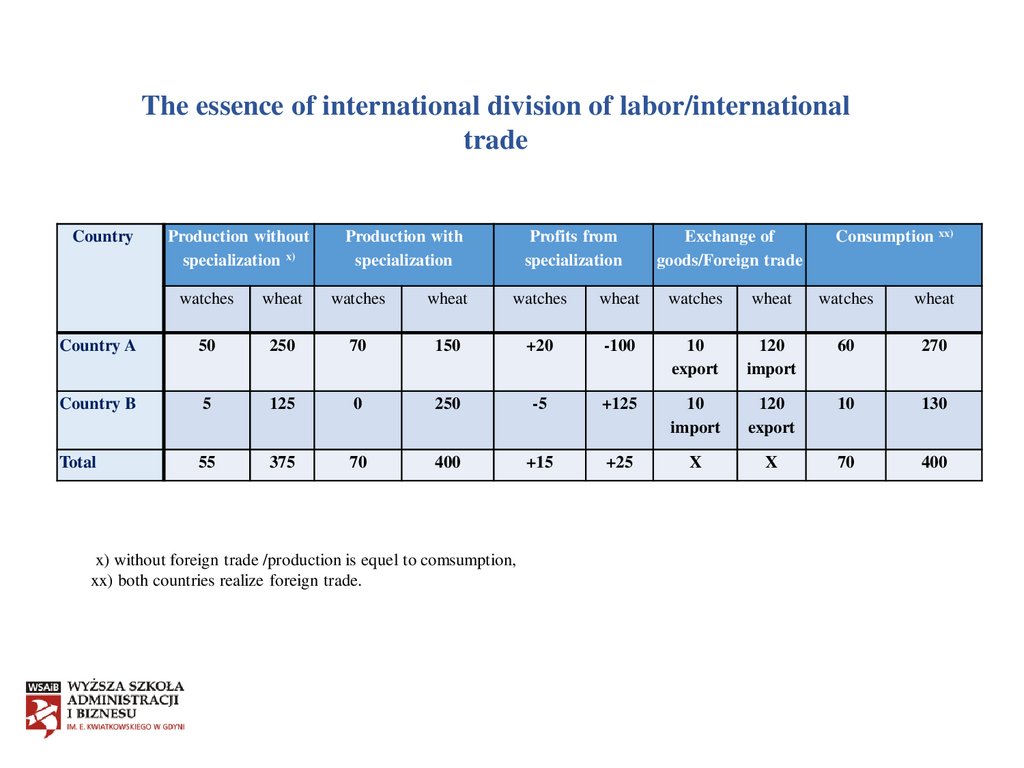

The essence of international division of labor/internationaltrade

Country

Production without

specialization x)

Production with

specialization

Profits from

specialization

Exchange of

goods/Foreign trade

Consumption xx)

watches

wheat

watches

wheat

watches

wheat

watches

wheat

watches

wheat

Country A

50

250

70

150

+20

-100

10

export

120

import

60

270

Country B

5

125

0

250

-5

+125

10

import

120

export

10

130

Total

55

375

70

400

+15

+25

X

X

70

400

x) without foreign trade /production is equel to comsumption,

xx) both countries realize foreign trade.

54.

Two Swedish scientists E. Heckscher and B. Ohlin in 30-s of XXcentury work out new theory of international trade – the factor

proportions theory.

The essence of the Heckscher-Ohlin theory is as follows: each

country will export that factor abundant goods for the production if

which it uses relatively abundant and cheap factor of production and

will import the goods which require relatively scarce and expensive

resources.

The most important assumption of this theory is a different fictor

intensityof individual commodities ( one commodity is labor-intensive, the

other one is capital-intensive) and different abundant of individual countries

( one country has relatively more capital, the other one has relatively less

capital but relatively more labour).

The factor proprtions theory is an important instrument for the

analysis of international economy, showing the principle of general

equilibrium, which is subject to economic development.

55.

In the analysis of trade flows in the „triangle” of the United States – WesternEurope – Japan, the Heckscher-Ohlin theory faces difficulties and contradictions, which

attracted the attention of many economists, particulary the American Nobel Laureate

Wassily Leontief. The results of the Leontief-s research were names „Leontief-s

paradox”.

W . Leontief explain this paradox by division of labour into skilled and

unskilled. The United States exported the goods, whose production in other countries was

impossible or inefficient due to the lower labor skill. W. Leontief created the model of

„labor skill”, according to which, insted of the three factors (capital, land, labor) the

production includes four factors: skilled labor, unskilled labor, capital and land.

The main alternative theories usually include:

the product life-cycle theory,

the country similarity theory

the theory of economies of scale.

56.

The product life-cycle theory were developed by Raymond Vernon in 1966.A product cinsistently passes four stages of life cycle:

The stage of appearence of a new product on the market shows the low sales.

The costs of implememtation of this product make the profits low too.

The stage of growth is characterized by growth of profits and sales growth

In the stage of maturity, the development of competition and marketsaturation

stabilize the sales and profits

In the stage of Decay, the products become obsolete, the sales and profits fall

off.

R. Vernon proves that in building up of trade ralations between countries an

important role played by technologies and researches, that the industrialized countries

have much more technological and scientific possibilities to develop a new product.

57.

The country similarity theorywas deeveloped by Swedish

economist Stefan Linder in 1961, where he takes as a basis the volume of

exchange of similar goods between countries with a comparable level of

development, without regard to the Hecjscher-Ohlin theorem.

The new approach was founded on the following pronciples:

The conditions of production depend on the conditions of demand.

efficiency of production is as high as demand

The conditions of domestic production depend mainly on the

domestic demand. It is the domestic representative demand that is

the basis of production and is necessary, but not a sufficient

conditio to export the goods

The foreign market is just a continuation of internal one, and the

international exchange is only the continuation of the interregional

one.

There is a conclusion, that international trade in manufactured

goods will be more intensive between the countries with the similar

income levels.

58.

The theory of economies of scale is not related to the theoriesof camparative advantage or to the ratio of production factors. It recognizes the

different levels of markets monopolization and non-optimal using of factors of

production.

According to this theory, incountries with a large domestic market,

production must be placed to ensure the growth of the economic of scale effect of

production.

Becouse of the international trade, the number of

firms and variety of manufactured goods manufactured by

them increase and the price of goods reduced.

59.

6. Movements of internationalproduction and trade factors

A.International trade in services

The term „services” covers a heterogeneous range of intangible

products and activities that are difficult to encapsulate within simple

definitione.

Services are the result of a production activity that changes the

conditions of the consuming units (transformation services) or facilitate the

exchange of products or financial assets (margin services). Services are

often difficult to separate from goods with which they may be associated

in varying degrees.

International trade in services provide monetary values by type of

services and by partner country.

.

60.

Services are classified according to the following maincategories:

-

manufacturing services on physical inputs owned by others

maintenance and repair services, not included elsewhere

transport

travel

construction

insurence and pension services

financial services

charges for the use of intellectual property, not included elsewhere

telecommunication, computer and information services

other business services

personal, ciltural and recreational services

government goods and services (public goods), not included

elsewhere.

61.

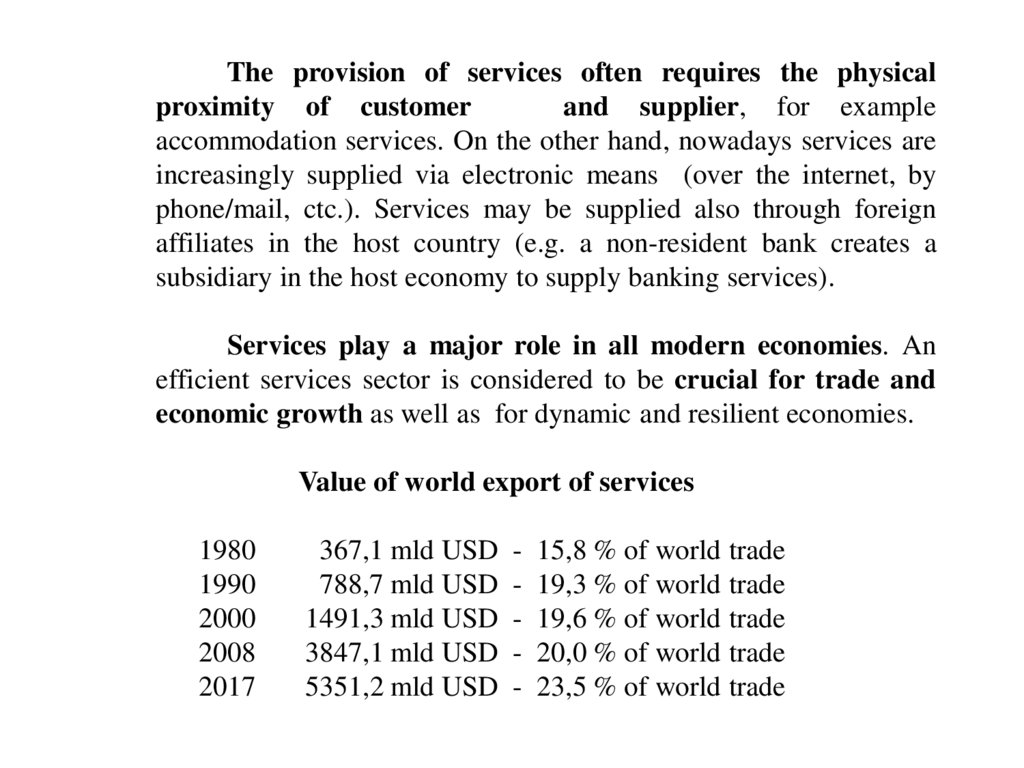

The provision of services often requires the physicalproximity of customer

and supplier, for example

accommodation services. On the other hand, nowadays services are

increasingly supplied via electronic means (over the internet, by

phone/mail, ctc.). Services may be supplied also through foreign

affiliates in the host country (e.g. a non-resident bank creates a

subsidiary in the host economy to supply banking services).

Services play a major role in all modern economies. An

efficient services sector is considered to be crucial for trade and

economic growth as well as for dynamic and resilient economies.

Value of world export of services

1980

1990

2000

2008

2017

367,1 mld USD

788,7 mld USD

1491,3 mld USD

3847,1 mld USD

5351,2 mld USD

-

15,8 % of world trade

19,3 % of world trade

19,6 % of world trade

20,0 % of world trade

23,5 % of world trade

62.

In this era of increasingly interconnected economies,enterprises may operate in several countries and have trading

partners all over the world. This is also reflected in the rising

importance of cross-border trade in services. In this setting,

international trade flows have become more complex, forming

global value chains.

Services provide vital suport to the economy as a

whole and more specifically to industry, for example through

finance, logistics and communications. Increased trade in

services and widespread availability of services may boost

economic growth by improving the performance of other

industries, since services can provide key intermediate inputs,

especially in an increasingly interlinked and globalised world.

63.

B . International migrationInternational migration, as a practice, has a long history

with some turning points. Disintegration of the middle age societies

and accompanied changes such as reneissance, commercial revolution,

colonization, agricultyral revelutions, industrial reveolution, emergence

of free market societies, modern education and technological

advancement are some factors which nave contributed to the growth of

international migration.

In the recent past, globalization has further enhanced migration,

mainly through revolutionary changes in information technology.

Economic blocks like the European Union, has opened the gates of

international migration in their member states becouse of working

power shortages and political reasons.

64.

The initial financial cost of migration has been drastically reduceddue to low transport costs, cheap accommodation facilities, online travel

arrangements and availability of reliable destinations with low cost insurence

packages, created easy conditions for migration.

International conventions on migrants, peaceful environment in

many parts of the world, encouragement of skilled and professional labour

migration and modernlow cost cimmunication facilities have become major

incentives for international migration.

Natural disasters and manmade disasters such as wors, conflicts

and deteriorating political environments at oresentpresent, further contribute

towards migration.

The international migration consists of the two basic

interdependent processes: emigration and immigration.

Emmigration is a departure of people/labour from one country to

another.

Immigration is the entrance of labour to the receiving country.

Also as part of international flows of people distinguish

remigration which is the return of the labour to the country of emigration.

65.

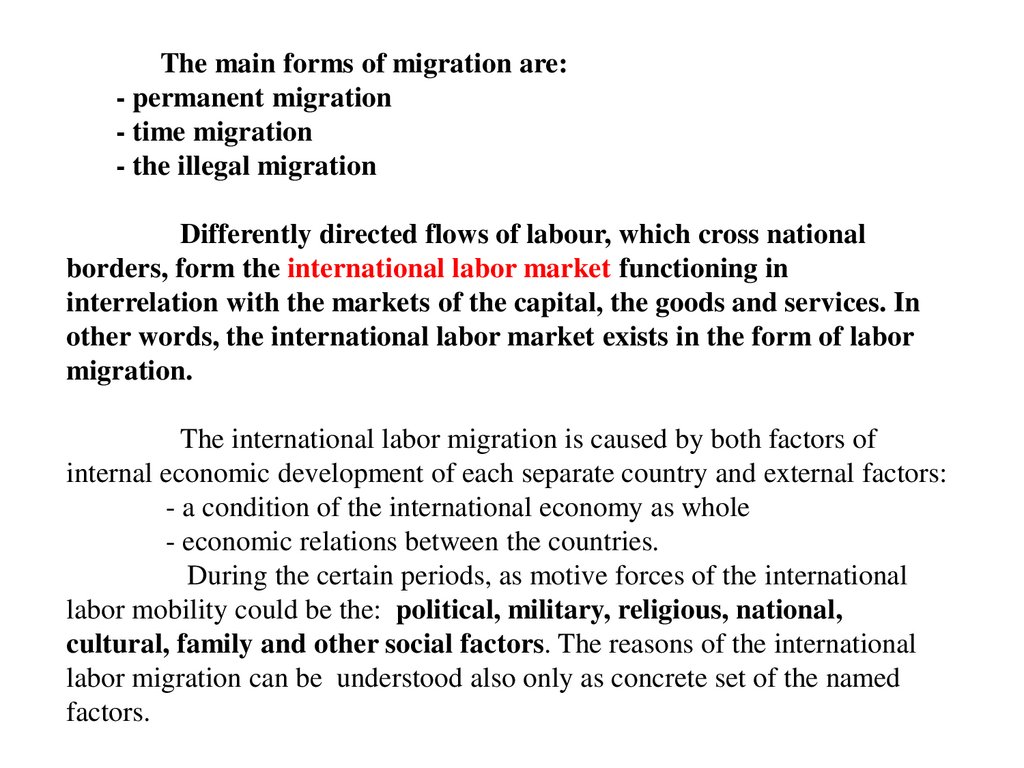

The main forms of migration are:- permanent migration

- time migration

- the illegal migration

Differently directed flows of labour, which cross national

borders, form the international labor market functioning in

interrelation with the markets of the capital, the goods and services. In

other words, the international labor market exists in the form of labor

migration.

The international labor migration is caused by both factors of

internal economic development of each separate country and external factors:

- a condition of the international economy as whole

- economic relations between the countries.

During the certain periods, as motive forces of the international

labor mobility could be the: political, military, religious, national,

cultural, family and other social factors. The reasons of the international

labor migration can be understood also only as concrete set of the named

factors.

66.

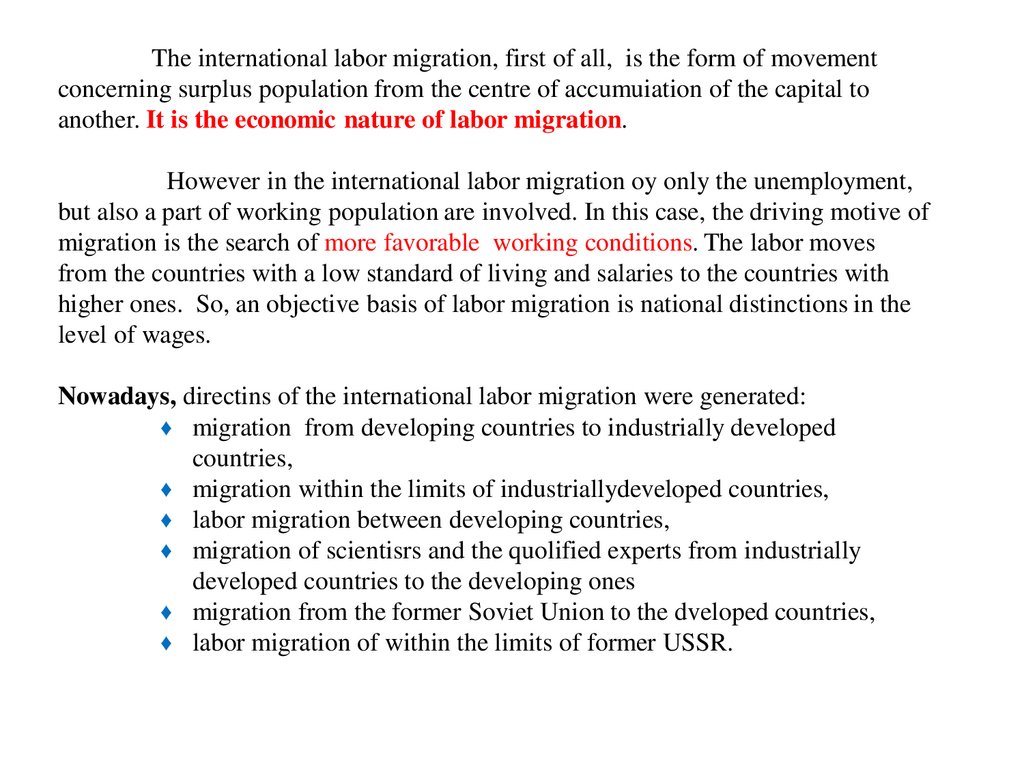

The international labor migration, first of all, is the form of movementconcerning surplus population from the centre of accumuiation of the capital to

another. It is the economic nature of labor migration.

However in the international labor migration oy only the unemployment,

but also a part of working population are involved. In this case, the driving motive of

migration is the search of more favorable working conditions. The labor moves

from the countries with a low standard of living and salaries to the countries with

higher ones. So, an objective basis of labor migration is national distinctions in the

level of wages.

Nowadays, directins of the international labor migration were generated:

♦ migration from developing countries to industrially developed

countries,

♦ migration within the limits of industriallydeveloped countries,

♦ labor migration between developing countries,

♦ migration of scientisrs and the quolified experts from industrially

developed countries to the developing ones

♦ migration from the former Soviet Union to the dveloped countries,

♦ labor migration of within the limits of former USSR.

67.

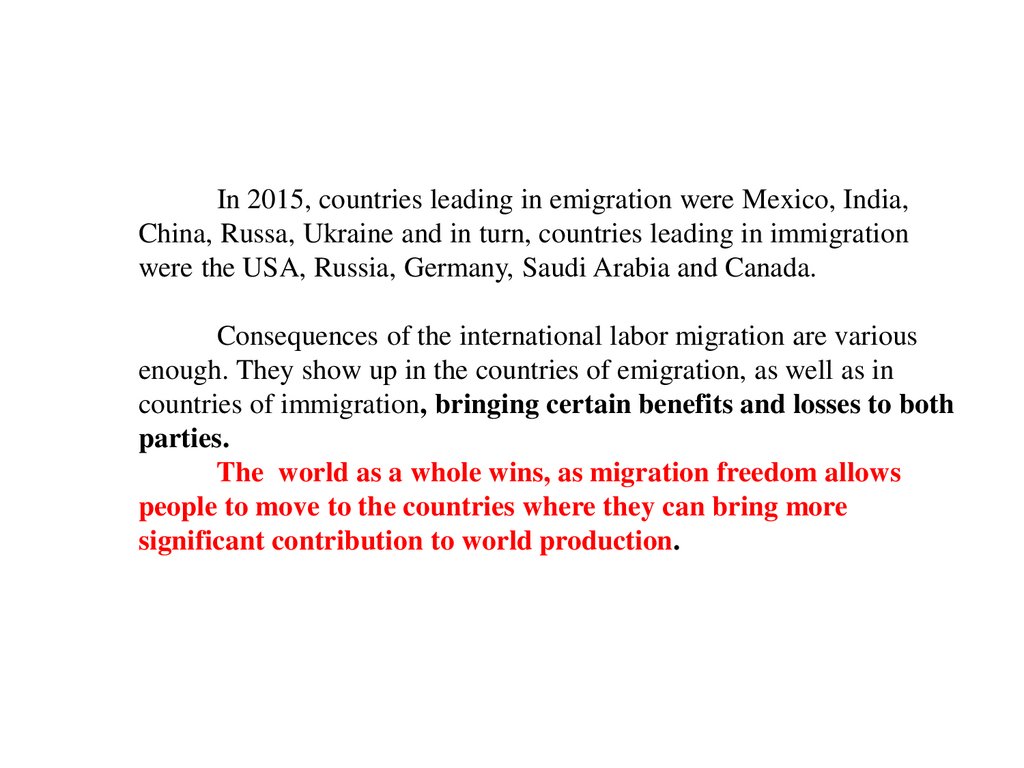

In 2015, countries leading in emigration were Mexico, India,China, Russa, Ukraine and in turn, countries leading in immigration

were the USA, Russia, Germany, Saudi Arabia and Canada.

Consequences of the international labor migration are various

enough. They show up in the countries of emigration, as well as in

countries of immigration, bringing certain benefits and losses to both

parties.

The world as a whole wins, as migration freedom allows

people to move to the countries where they can bring more

significant contribution to world production.

68.

C. International technology transferThe international technological exchange (technology transfer) is

understood to be the complex od the economic relations of different countries

concerning the transfer of scientific and technological achievements.

The scientific and technical knowledge being bought and sold in the

world market, which is the result of scientific, engineering and experience of their

commercial exploitation, as well as engineering services for the use of scientific,

technical, technological an managerial developments. They are the object of

intellectual property, possessing both scientific and commercial values.

The typical subject of international technology transfer are:

a patents and certificates

a copyright

a trademark

original industrial designs

know-how information

a variety of technical, design, commercial and marketing

documentation.

69.

These products of intellectual work belong toso-called nonmaterial forms of technology, and trade

operations in international practice are commonly

referred to as international technological exchange.

Thus, international technological exchange is

understood to be the complex of economic relations

betweencontractors of different countries for transfer of

scientific and technological achievements (nonmaterial

types of technology) with scientific and practical

values, on the commercial basis.

70.

It should be noted that there are also non-commercialforms of international technological exchange:

technical, scientific and professional journals, patent

pulications, periodicals and other specialized literaturę,

database and databanks

international exhibitions, fairs, symposia, conferences

exchange of delegations

migration of scientists and specialists

training of scientists and specialists in companies,

universities and organizations

education of undergraduate and graduate students

activities of international organizations in the field of science

and technology.

71.

Under modern conditions, international technological exchangehas certain features:

the intensive development of market of high technologies

the monopoly of large firms in technological goods markets

predominant position of technology policy of TNCs

special relationship between TNCs and the developing countries

participation in international technological exchange of

„venture” firms

development of international technical assistance.

The main buyers in the market of technologies are as follows:

foreign subsidiaries of TNCs

individual independent firms.

72.

The important role in international technology transferpay licenses. The growth of international license trade is due to a

numer of factors that encourage firms to sell nad buy licenses in the

world market. These factors are as below:

● commercial interests in the technology transfer,

● increased competition in the world market

● acceleration of the placing of new products in the

market

● gain to access to additional resources

● penetration and winning of difficult markets in the

countries with high tariff and non-tariff barriers

73.

● profits from the sale of licenses for the products that do not meetthe new strategic priorities

● countries with limited resources of scientific and technological

dvelopment, participating in international technological

exchange, have an opportunity to take a good position in the

world market without additional costs

● licenses help to create advertising of domestic products and

increase demand in other countries, as well as explore foreign

martkets

● political and legal motivation.

74.

International license relationships are mostly betweenthe developed countries. The proportion of the developed countries

as almost 98 % in the total revenues from international license trade.

In general, the turnover of license trade is about 30 bilion dollars per

year.

The common form of international technological exchange

is engineering.

Engineeringis a complex of engineering and consulting services for

using technology and other scientific and technological

developments.

The essence of international trade in engineering services

is to provide on the basis of the engineering agreement by one party

(a consultant) to the other one (a client) commercial engineering and

design, consulting, construction engineering services.

75.

The main characteristics of the market of engineeringservices are as follows:

● results of the trade in engineering services are not embodied

in material types of product, but in some useful effect, which

may not have a material object

● engineering services related to the preparation and provision

of the process of production and realization, for intermadiate

consumtion of material goods and services

● the objects of sales are services, adapted for the use in

specific contexts and transfer of the average available

scientific and techncal, operational, commercial and other

expertise.

76.

D. Foreign Direct Investments movementsForeign direct investment (FDI) has a special place among the

forms of international capital movements. This is due the following two main

reasons:

foreign direct investments is a real investments which, unlike portfolio

investments, is not purely financial assets denominated in the national

currency. It is investment in business, land and ither capital goods

foreign direct investments, unlike portfolio investment, usually

provides a managerial control over the object of the invested capital.

Foreign direct investment is a kind of foreign investment, intended

to invest in production and to provide the control over the activities of

enterprises by means of acquisition of a controlling interest.

77.

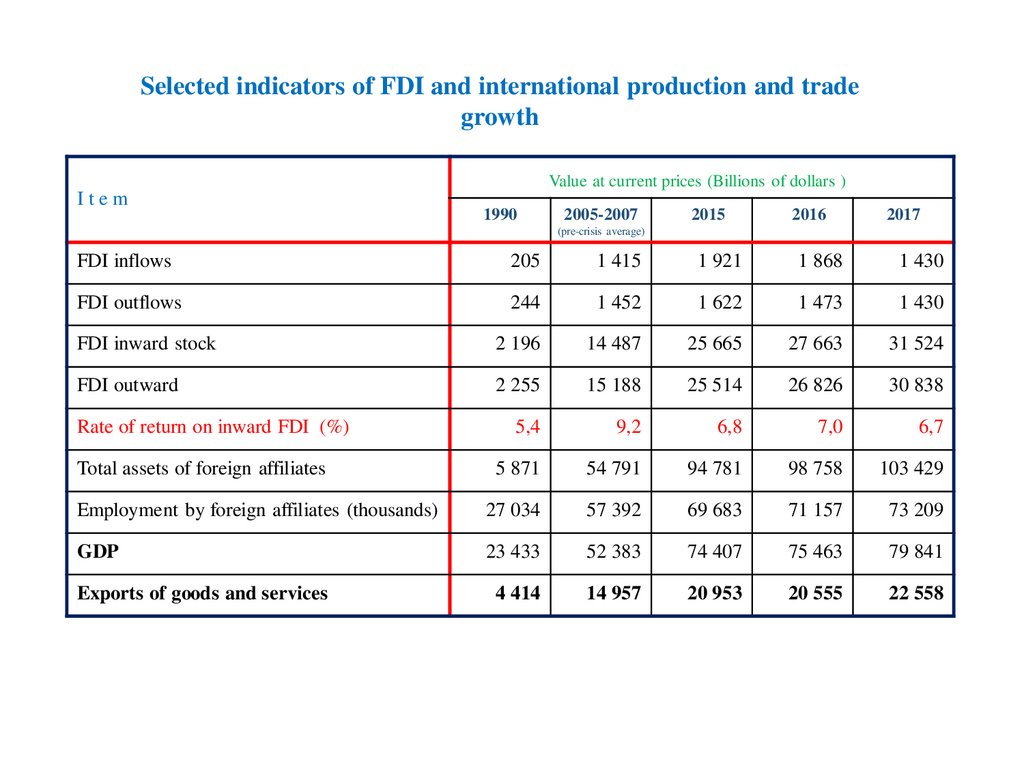

Selected indicators of FDI and international production and tradegrowth

Item

Value at current prices (Billions of dollars ))

1990

2005-2007

2015

2016

2017

(pre-crisis average)

FDI inflows

205

1 415

1 921

1 868

1 430

FDI outflows

244

1 452

1 622

1 473

1 430

FDI inward stock

2 196

14 487

25 665

27 663

31 524

FDI outward

2 255

15 188

25 514

26 826

30 838

5,4

9,2

6,8

7,0

6,7

5 871

54 791

94 781

98 758

103 429

Employment by foreign affiliates (thousands)

27 034

57 392

69 683

71 157

73 209

GDP

23 433

52 383

74 407

75 463

79 841

4 414

14 957

20 953

20 555

22 558

Rate of return on inward FDI (%)

Total assets of foreign affiliates

Exports of goods and services

78.

Foreign direct investments is the basis of TNCs domination inthe world market. They allow the transnational corporations to use enterprises in

foreign countries for production and marketing of products and disseminating

rapidly new products and new technologies at the international level and, thus,

enhance their competitiveness, As far as they concerned, FDI are motivated

ultimately by profits.

The structure of the main factors of FDI from inwestor point of view are

as follows:

* marketing factors :

- market size

- market growth

- a tend to hold a market segment

- a tend to succeed in export of parent company

- the need to maintain close contact with customers

- dissatisfaction with the existing state of market

- export base

- following the buyers

- following the competition

* trade restrictions:

- trade barrirs

- preference of domestic goods by the local consumers

79.

* cost factors:- a desire to be closer to sources of supply

- availability of labour resources

- availability of raw materials

- availibility of capital and technology

- low-cost labor

- low cost of other production costs

- low transport costs

- financial and other incentives offered by the government

- more favorable price level.

* investment climate:

- the overall attitude to foreign investment

- political stability

- restrictions in the ownership

- exchange rates adjustment

- stability of foreign currency

- the structure of taxes

- good knowledge of the country.

80.

The main factors of host country atractiveness for foreigninvestors, are as follows:

- dynamics of the economy (economic potential)

- production capacity of industry

- dynamics of the market

- financial suport of the government

- human capital

- prestige of the state

- availability of raw materials

- the orientation to external markets (export potential)

- innovation potential

- social stability.

On the basis of expert estimates, the most attractive conditions for

FDI are possessed by the following countries: the USA, Canada, Germany,

Switzerland, and Asia-Pacific newly industrialized countries (NICs), as well

as Mid-South Europe countries.

81.

The analysis of FDI impact on the well-being of the individualgroups of population shows that foreign direct investment brings the

following:

* benefits:

to foreign firms and investors

to workers of the receiving country (workplaces)

to the population of the receiving country from possible increase

of social services because of taxes on income from FDI

* losses:

to workers of an investing country, as FDI means exports of

workplaces

to competing firms in the receiving country

to taxpayers of an investing country, as profits of TNCs are more

difficult to tax and the government either shift the shortfall in the tax

revenue to other payers or reduce the budget-funded social

programs.

In many countries in the sphere of investment policy there are

powerful cinflicting pressure groups, seeking to limit FDI inflow or their

wide attraction.

82.

7. International trade policyInternational trade policy means a set of regulations

of international trade supposes purposeful of the state on

trade relations with other countries.

The main goals of foreign trade policy are:

● the volume change of export and imports

● changes in structure of foreign trade

● providing the country with the necessary resources

● the change in the ratio of export and imports prices.

83.

The basic line of government control ofinternational trade is the application of two different

types of foreign trade policy in combination:

liberalization (free trade policy) and protectionism.

Under the free trade policy is understood the

minimum of state interference in foreign trade, which

developed on the basis of free market forces of supply

and demend, and under the protectionism – the state

policy, which provides the protecting of the domestic

market from foreign competition through the use of tariff

and non-tariff trade instruments.

These two types of trade policy characterize

the measure of state intervention into international

trade.

84.

There are such forms of protectionism:selective protectionism

collective protectionism

hidden protectionism.

Every country has economic, social and political

arguments, protecting interests of protectionism. The main

arguments for restrictions on foreign trade are:

♦ necessity of defense providing

♦ increase of domestic employment

♦ deversification for the sake of stability

♦ protection of infant industries

♦ protection for dumping

♦ cheap foreign labor force

85.

The instruments of state regulation ofinternational trade include the following:

► tariff methods that regulate mostly the imports

and protect domestic producers from foreign

competition, becouse they make prices of

foreign goods higher

► Non-tariff methods regulating both imports

and exports becouse they help to bring more

domestic products on the world market

making them more competitive.

86.

Most popular instrument of state regulation arecustoms duties. Duties perform the following functions:

● a fiscal function

● a protectionist function

● a balance function.

Non-tariff barriers for international trade regulation

have quantitative nature. Quantitative restrictions include:

■ quotas (import, export and global)

■ licensing

■ voluntary export restraints

87.

The hidden international trade restrictions play theessential role of non-tariff methods of trade policy. They include:

■ technical barriers

■ internal taxes and charges

■ public procurement

■ local content requirement.

Subsidies are direct payments toan exporter after the

export operation, which are equel to the difference between the

exoenditures and the received profit.

To hide the eport subsidies, governments use export

credits, providing financial incentives to develop exports by

domenstic producers. Export credits can be the following:

♦ subsidized credits for domestic exporters

♦ state credits for foreign importers.

88.

8. World economy sustainabledevelopment

89.

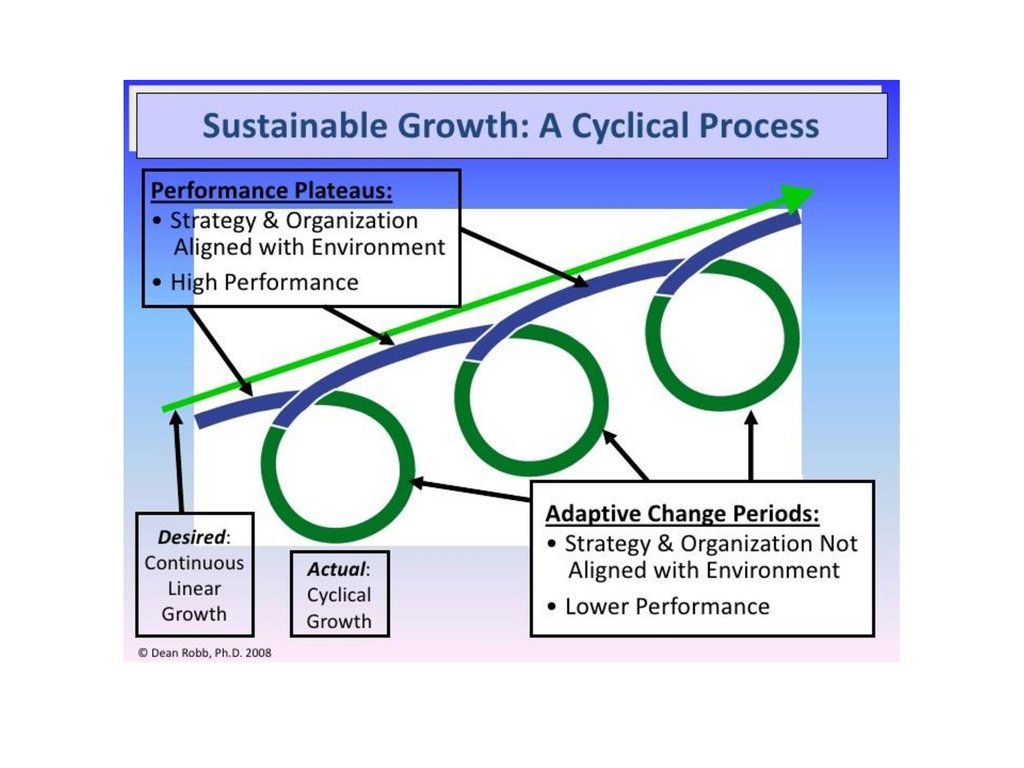

Sustainable growth, traditionally, has meant thereastically achievable growth that a company or national

economy could maintain without running into problems.

Today the term is frequantly used

by

environmentalists, meaning economic growth that can

continue over the long term without creating intolerable

pollution or using up all the non-renevable resources.

90.

91.

92.

Thank you93.

94.

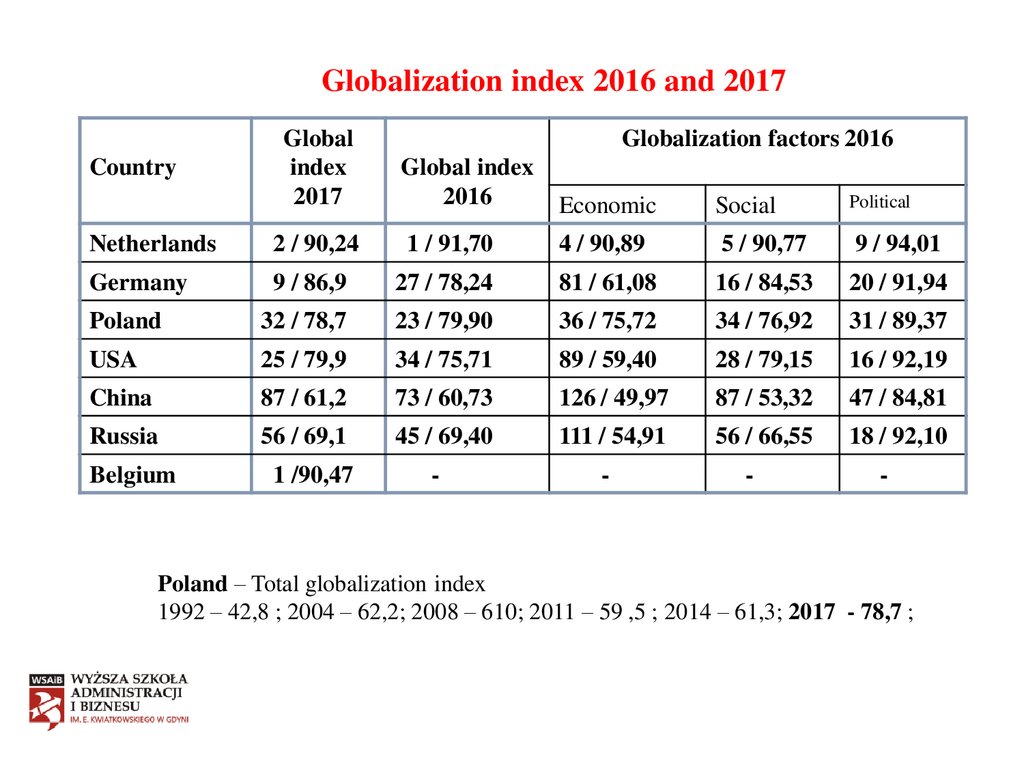

Globalization index 2016 and 2017Country

Global

index

2017

Globalization factors 2016

Global index

2016

Economic

Social

Political

Netherlands

2 / 90,24

1 / 91,70

4 / 90,89

5 / 90,77

9 / 94,01

Germany

9 / 86,9

27 / 78,24

81 / 61,08

16 / 84,53

20 / 91,94

Poland

32 / 78,7

23 / 79,90

36 / 75,72

34 / 76,92

31 / 89,37

USA

25 / 79,9

34 / 75,71

89 / 59,40

28 / 79,15

16 / 92,19

China

87 / 61,2

73 / 60,73

126 / 49,97

87 / 53,32

47 / 84,81

Russia

56 / 69,1

45 / 69,40

111 / 54,91

56 / 66,55

18 / 92,10

Belgium

1 /90,47

-

-

-

-

Poland – Total globalization index

1992 – 42,8 ; 2004 – 62,2; 2008 – 610; 2011 – 59 ,5 ; 2014 – 61,3; 2017 - 78,7 ;

95.

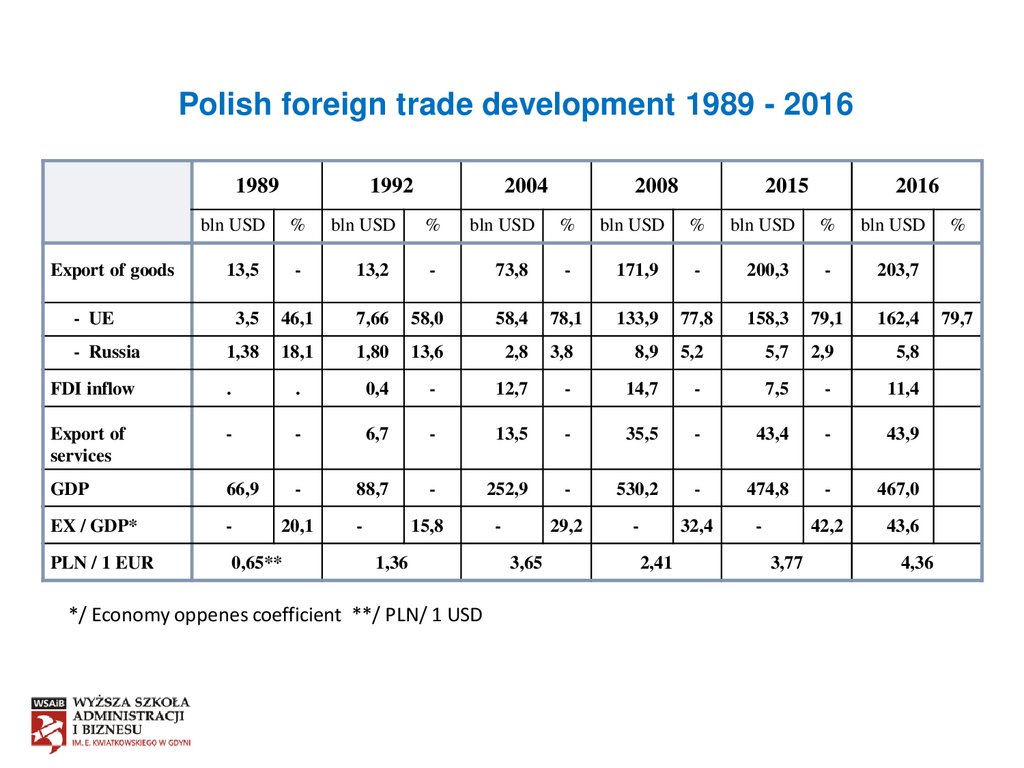

Polish foreign trade development 1989 - 20161989

1992

bln USD

Export of goods

bln USD

%

bln USD

2008

2015

2016

%

bln USD

%

bln USD

%

bln USD

13,5

-

13,2

-

73,8

-

171,9

-

200,3

-

203,7

3,5

46,1

7,66

58,0

58,4

78,1

133,9

77,8

158,3

79,1

162,4

1,38

18,1

1,80

13,6

2,8

3,8

8,9

5,2

5,7

2,9

5,8

- UE

- Russia

%

2004

FDI inflow

.

.

0,4

-

12,7

-

14,7

-

7,5

-

11,4

Export of

services

-

-

6,7

-

13,5

-

35,5

-

43,4

-

43,9

GDP

66,9

-

88,7

-

252,9

-

530,2

-

474,8

-

467,0

EX / GDP*

-

29,2

-

32,4

42,2

43,6

PLN / 1 EUR

20,1

0,65**

-

15,8

1,36

*/ Economy oppenes coefficient **/ PLN/ 1 USD

3,65

2,41

3,77

4,36

%

79,7

economics

economics