Similar presentations:

The equity. Implications of taxation. Tax incidence. (Lecture 11-19)

1. The Equity Implications of Taxation: Tax Incidence

b.samojlik 20151

2. The Three Rules of Tax Incidence

I.The Statutory Burden of a Tax Does Not Describe Who Really

Bears the Tax

II. The Side of the Market on Which the Tax Is Imposed Is

Irrelevant to the Distribution of the Tax Burdens

III. Parties with Inelastic Supply or Demand Bear Taxes;

Parties with Elastic Supply or Demand Avoid Them

b.samojlik 2015

2

3. The Statutory Burden of a Tax Does Not Describe Who Really Bears the Tax

• statutory incidence:The burden of a tax borne by the party

that sends tax payment to the tax office.

• economic incidence:

The burden of taxation measured by

the change in the resources available to any economic agent as

a result of taxation.

b.samojlik 2015

3

4. Consumer and producer tax burden

b.samojlik 20154

5. Discription of panels (a) &(b)

Discription of panels (a) &(b)• On the left side (a) there is a pre-tax situation: equilibrium of supply

and demand at the price $1.5 and quantity 100; (the coordinates of

the point A :$1.5;100) .

• On the right side (b) there is tax imposed $0.5per unit (the statutory

burden); supply curve shifts to the left from S1 to S2 and equilibrium

point, intersection of demand curve D and a new supply curve S2 ,

shifts from A to D; the coordinates of the point A changes to

($1.8;90) at the point D.

• The economic tax burden: $0.2 is borne by producers and $0.3 is

borne by consumers.

b.samojlik 2015

5

6. Burden of the Tax on Consumers and Producers

• tax wedge: The difference between what consumers pay andwhat producers receive (net of tax) from a transaction; or

• The difference between what employers are charged and

employees receive (net of tax) from a transaction;

• E.g.: price of gas for producer and consumer due to excise tax,

production tax and VAT ; cost of wages for employers and

employees wage due to social security charges and PIT

b.samojlik 2015

6

7. II.The Side of the Market on Which the Tax Is Imposed Is Irrelevant to the Distribution of the Tax Burdens

• Tax insidence is identical whether the tax is levied on producers orconsumers.

b.samojlik 2015

7

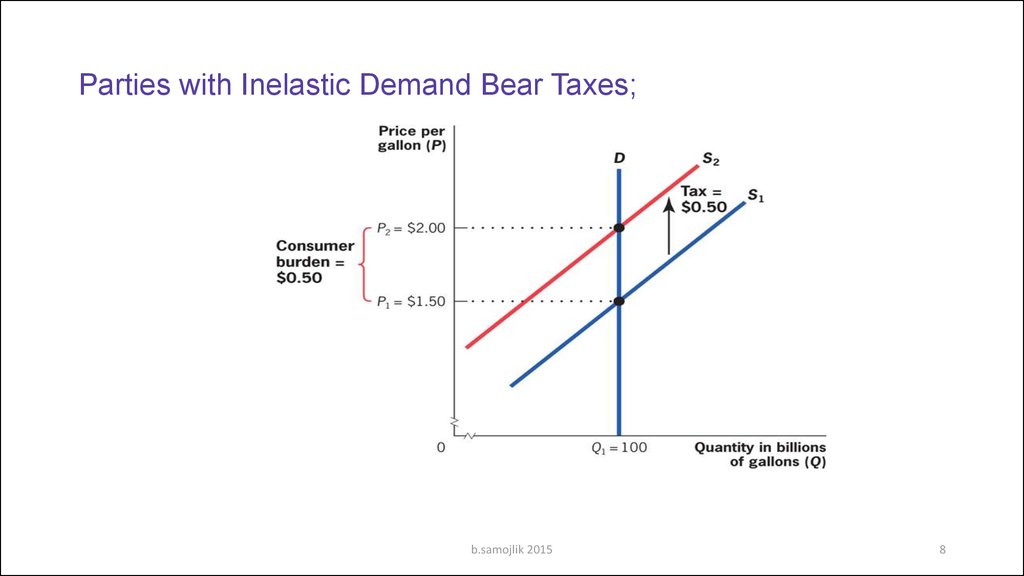

8. Parties with Inelastic Demand Bear Taxes;

b.samojlik 20158

9. Parties with Inelastic Demand Bear Taxes

• Perfectly inelastic demand /demand curve D vertical/ ; increase ofprice due to tax $0,5 per unit; shift of the supply curve to the right;

• Price increases from $1.5 to $2.0;

• Perfectly inelastic demand means that consumers bear the full tax.

• When demand is perfectly inelastic producers bear none of the tax

and consumers bear all of the tax: the full shifting of the tax.

b.samojlik 2015

9

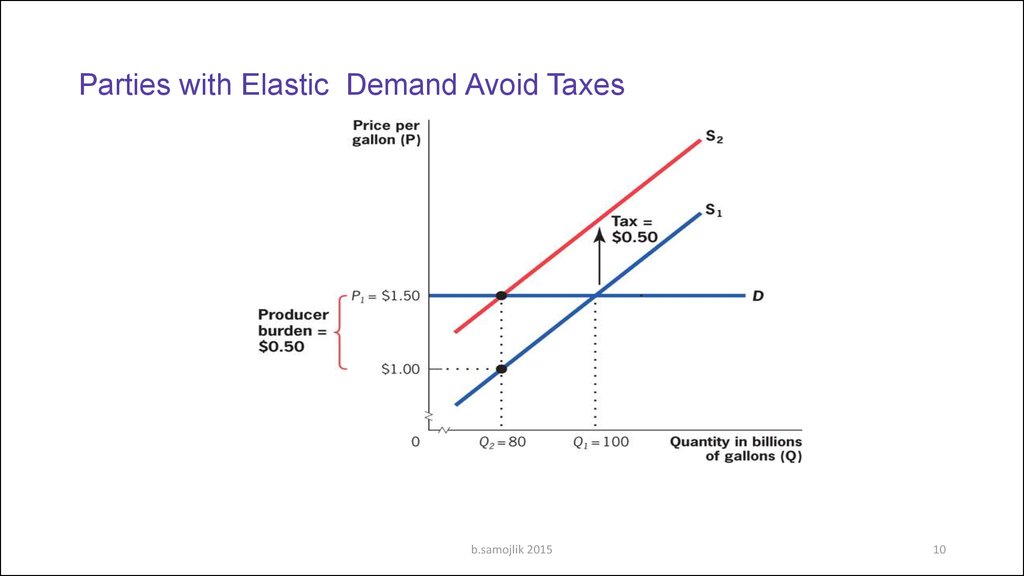

10. Parties with Elastic Demand Avoid Taxes

b.samojlik 201510

11. Parties with Perfectly Elastic Demand Avoid Taxes

•The full burden of tax bears producerbecause of inelastic supply.

•Consumers avoid tax because of elastic

demand.

b.samojlik 2015

11

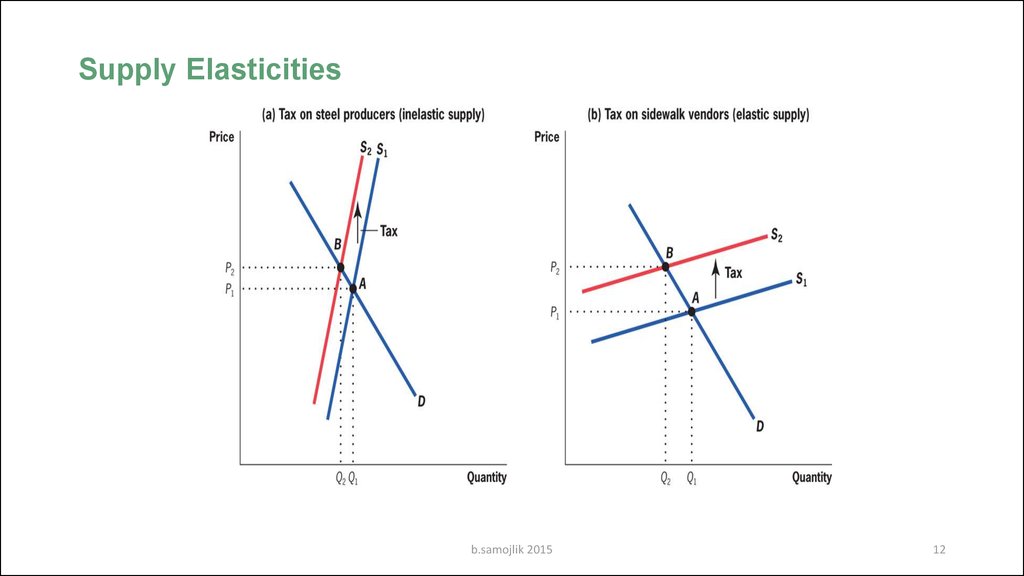

12. Supply Elasticities

b.samojlik 201512

13. Supply Elasticity

• There is two supply cases. On the left side (a) inelastic supply, curve Salmost vertical.

• On the right side (b) elastic supply, curve S almost horizontal.

• On both services(commodities) the same tax is levied;

• Shift of the supply curve is the greater the higher is elasticity of

supply.

• Reaction of demand due to tax increase /=increase of price/ on panel

(a) is minor on panel (b) very strong.

b.samojlik 2015

13

14. Parties with Inelastic Supply Bear Taxes;

• Inelastic supply/demand/ party of the transaction bears tax increase.• Absorption of the tax increase is inversely proportional to the

elasticity of supply/demand/, the higher elasticity of supply/demand/

the lower absorption of tax increase, and reverse.

b.samojlik 2015

14

15. Recap:

The statutory burden of a tax does not describe who really bears the tax.The side of the market on which the tax is imposed is irrelevant to the

distribution of tax burdens.

Parties with inelastic supply or demand bear taxes; parties with elastic supply or

demand avoid them.

b.samojlik 2015

15

16. Tax Inefficiencies and Optimal Taxation

b.samojlik 201516

17. Optimal income and commodity taxation

• 1 Optimal Income Taxes• 2 Optimal Commodity Taxation

• 3 Conclusions

b.samojlik 2015

17

18. Max-min rule as a standard of rational behavior

Rationale behavior : max and min rules

A.Maximize results out of the given resources: max rule or

B.Minimize the costs of the predetermined goal:min rule

In the case of taxation we should apply „min”rule

We should know how much revenue to collect in order to finance projects/ bridges,

roads, hospitals, schools etc. etc./

Taxation provides revenues for budget expenditure

At the same time we know that :every tax is inefficient: distorts the behavior of

producers and consumers/ creates a deadweight loss/

So, taxation should minimize the loss of consumers and producers surplus achieving

predetermined level of tax revenues

The levels of harmfulness of specific taxes are different; there is a room for optimization

of tax structure

b.samojlik 2015

18

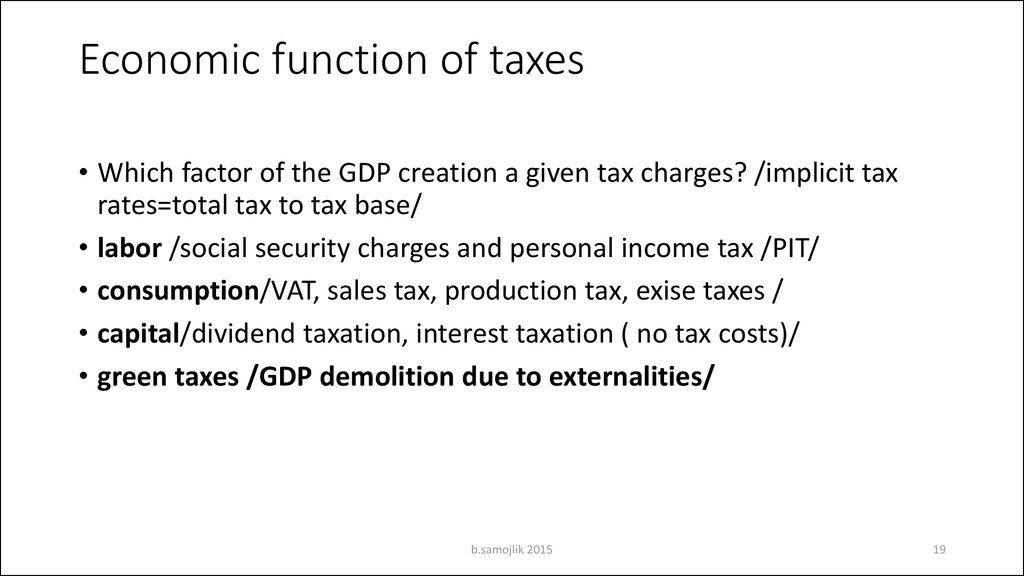

19. Economic function of taxes

• Which factor of the GDP creation a given tax charges? /implicit taxrates=total tax to tax base/

• labor /social security charges and personal income tax /PIT/

• consumption/VAT, sales tax, production tax, exise taxes /

• capital/dividend taxation, interest taxation ( no tax costs)/

• green taxes /GDP demolition due to externalities/

b.samojlik 2015

19

20. Type of taxes

• Direct taxes / on income; PIT, CIT/• Indirect taxes / indirect taxes of income; VAT excise taxes/

• Social security charges /taxes on labor costs/

• Green taxes/diminishing natural resources use/

• Taxes on financial transactions/ The European Commission idea to

have own resources of the EU budget / 3/4 to budget of the UE ¼ to

national budget/

• Tax shifting / forward and backward/ : who finally pay for it/charged

as a result od green taxes and financial transaction taxes?

b.samojlik 2015

20

21. Optimal taxation of income

b.samojlik 201521

22. The importance of the PIT revenues in the EU/% of total tax revenues/

b.samojlik 201522

23. Taxation of income in the UE

• There is no common acceptable rule of taxing income in the UE 28countries

• SK, BG, RO effective tax rate on income 10%; DK effective tax rate on

income 50% /as a pp of the total taxation/

b.samojlik 2015

23

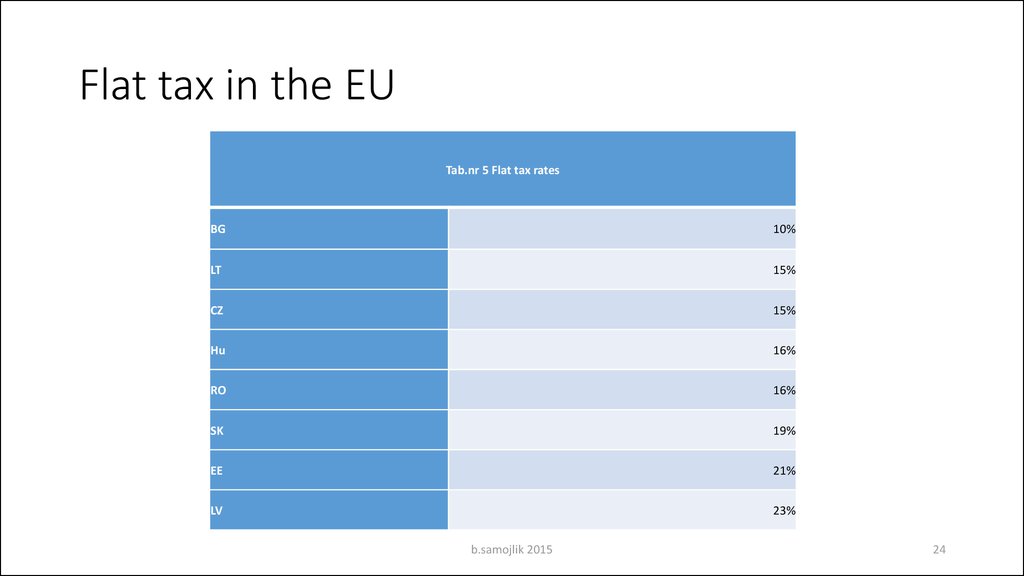

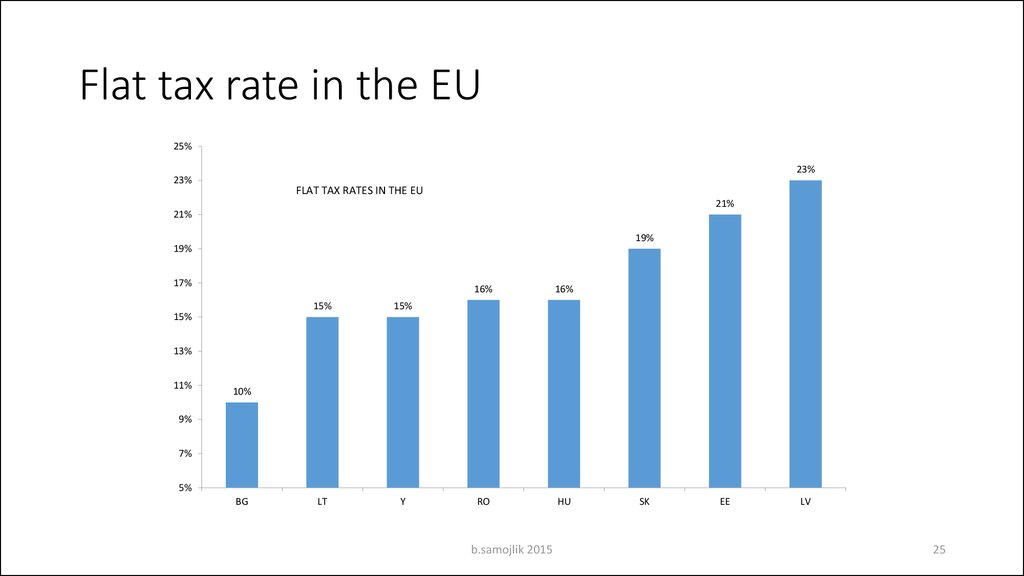

24. Flat tax in the EU

Tab.nr 5 Flat tax ratesBG

10%

LT

15%

CZ

15%

Hu

16%

RO

16%

SK

19%

EE

21%

LV

23%

b.samojlik 2015

24

25. Flat tax rate in the EU

25%23%

23%

FLAT TAX RATES IN THE EU

21%

21%

19%

19%

17%

15%

15%

LT

Y

16%

16%

RO

HU

15%

13%

11%

10%

9%

7%

5%

BG

b.samojlik 2015

SK

EE

LV

25

26. Other countries with a flat tax

• Russia 13%; Serbia-14%; Kirgistan-10%; Georgia-12%; Ukraina-13% ;• according to the IMF:

• “the empirical evidence on flat taxes effects is very limited" ;

• "there is no sign of Laffer-type behavioral responses." / increase of

tax revenues due to decrease of effective tax rate/

b.samojlik 2015

26

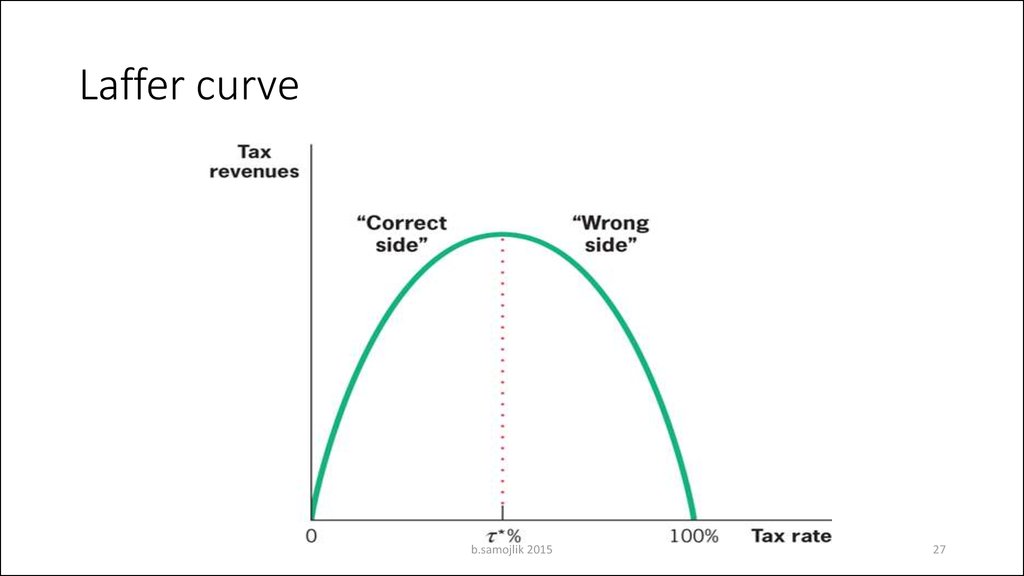

27. Laffer curve

b.samojlik 201527

28. The interpretation of Laffer curve

• If the effective tax rate on income is not to high, tax revenuesincreases but pace of increase is diminishing ; (correct side);

• higher effective tax rates on the wrong side decrease the volume of

tax revenues

• Optimal level of the effective tax rate is unknown/ max of revenues is

unknown/

b.samojlik 2015

28

29. "there is no sign of Laffer-type behavioral responses."

"there is no sign of Laffer-type behavioral responses."• Interpretation:

• If a flat tax have a Laffer-type behavior than decrease of effective tax

rate on a wrong side would increase tax revenues; there is no

evidence of such behavior of taxpayers

b.samojlik 2015

29

30. Flat tax rate

• Flat tax rates on income are not in accordance with optimal taxationof income

• Flat tax rates of personal income are not in accordance with fairness

of taxation

b.samojlik 2015

30

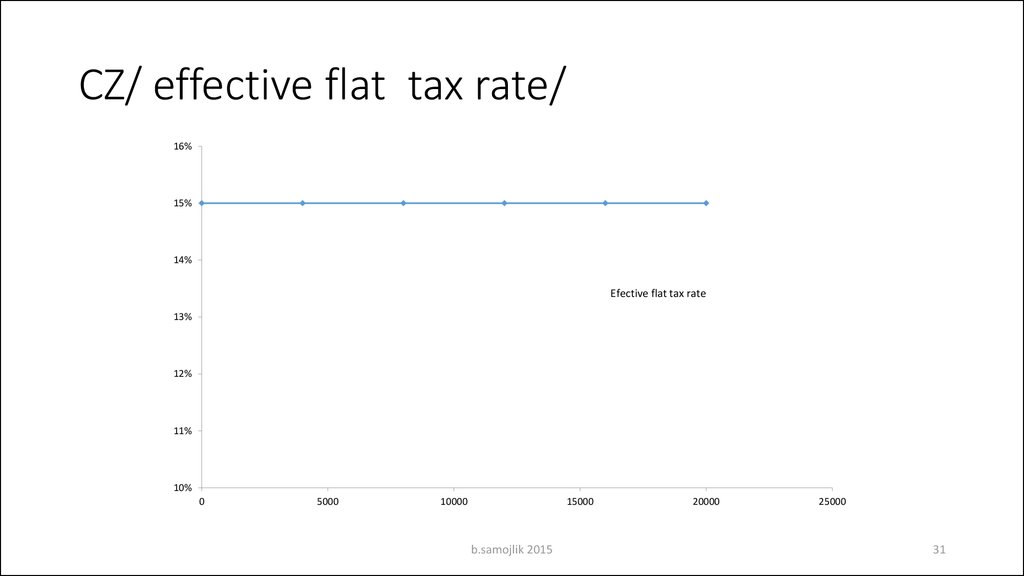

31. CZ/ effective flat tax rate/

16%15%

14%

Efective flat tax rate

13%

12%

11%

10%

0

5000

10000

15000

b.samojlik 2015

20000

25000

31

32. effective flat tax rate

• effective flat tax rate with no general allowance means that nominaland effective tax rates are the same for all taxable income brackets;

flat tax is not a fair taxation of income

b.samojlik 2015

32

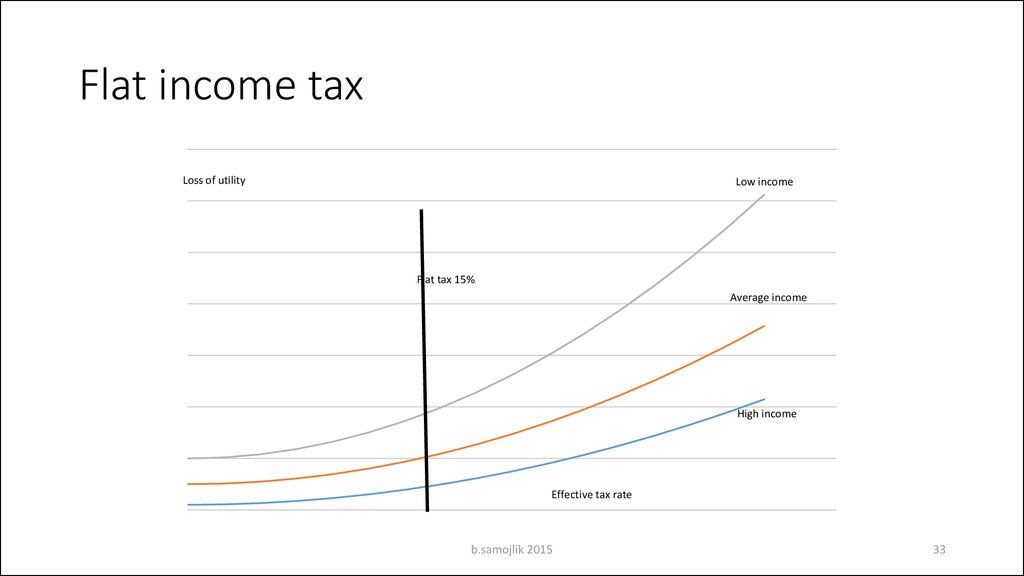

33. Flat income tax

Loss of utilityLow income

Flat tax 15%

Average income

High income

Effective tax rate

b.samojlik 2015

33

34. Flat income tax

• At the flat tax rate effective taxation rate is the same for all incomebrackets;

• Low income groups have a large loss of utility

• High income groups have a smaller loss of utility

• Flat tax system is unfair

b.samojlik 2015

34

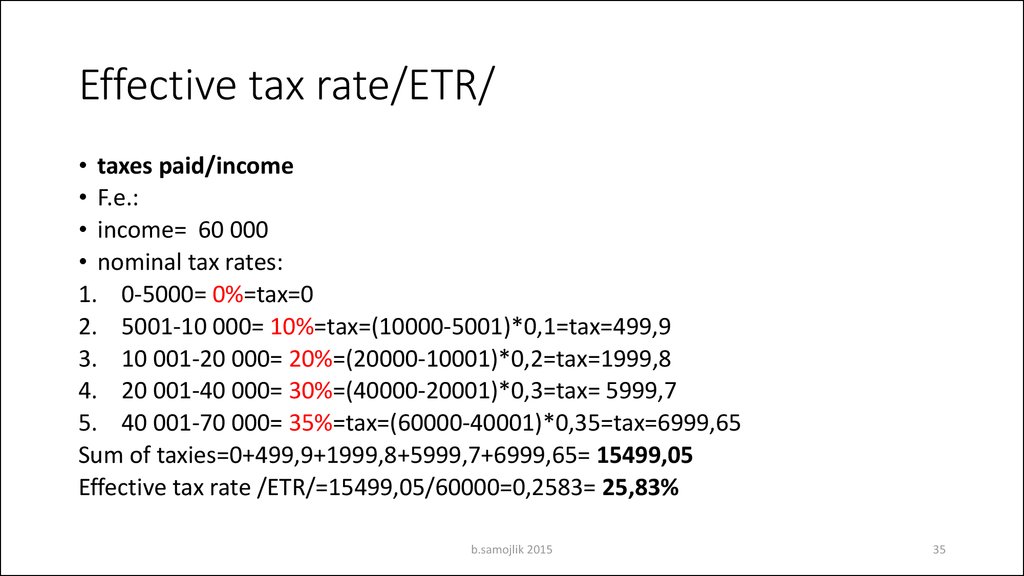

35. Effective tax rate/ETR/

• taxes paid/income• F.e.:

• income= 60 000

• nominal tax rates:

1. 0-5000= 0%=tax=0

2. 5001-10 000= 10%=tax=(10000-5001)*0,1=tax=499,9

3. 10 001-20 000= 20%=(20000-10001)*0,2=tax=1999,8

4. 20 001-40 000= 30%=(40000-20001)*0,3=tax= 5999,7

5. 40 001-70 000= 35%=tax=(60000-40001)*0,35=tax=6999,65

Sum of taxies=0+499,9+1999,8+5999,7+6999,65= 15499,05

Effective tax rate /ETR/=15499,05/60000=0,2583= 25,83%

b.samojlik 2015

35

36. Progressive income tax

Lossof

utility

Low income

average income

The same loss of U for all income

groups

High income

Effective tax rate

25%

15%

b.samojlik 2015

35%

36

37. Progressive income tax

• In the case of progressive income tax marginal tax rates increase withthe increase of taxable income

• Effective increase of taxation depends on the value of the income

brackets and the value of marginal rate

• The more brackets the greater level of taxation fairness ; the loss of

utility the same for all income brackets

b.samojlik 2015

37

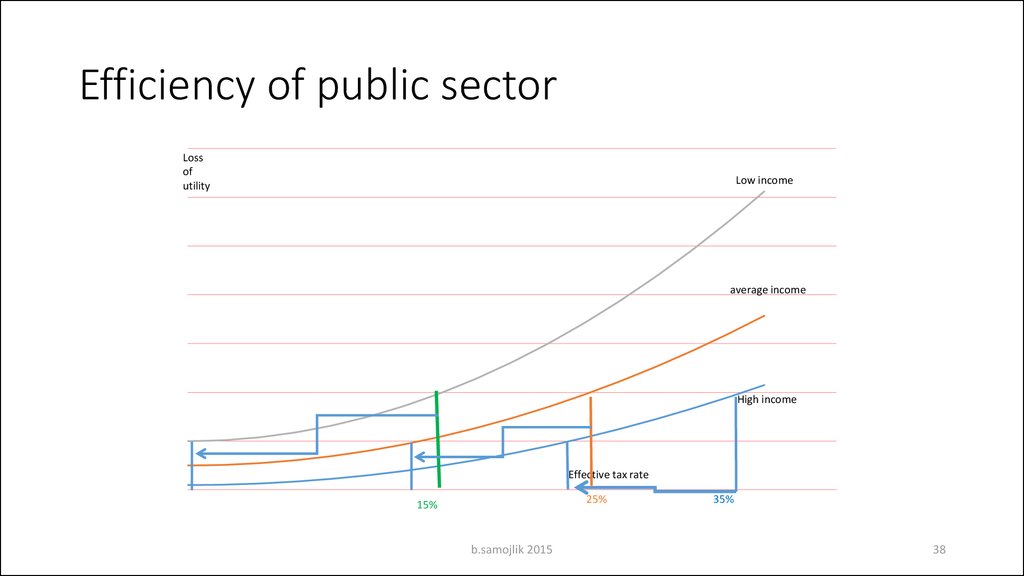

38. Efficiency of public sector

Lossof

utility

Low income

average income

High income

Effective tax rate

25%

15%

b.samojlik 2015

35%

38

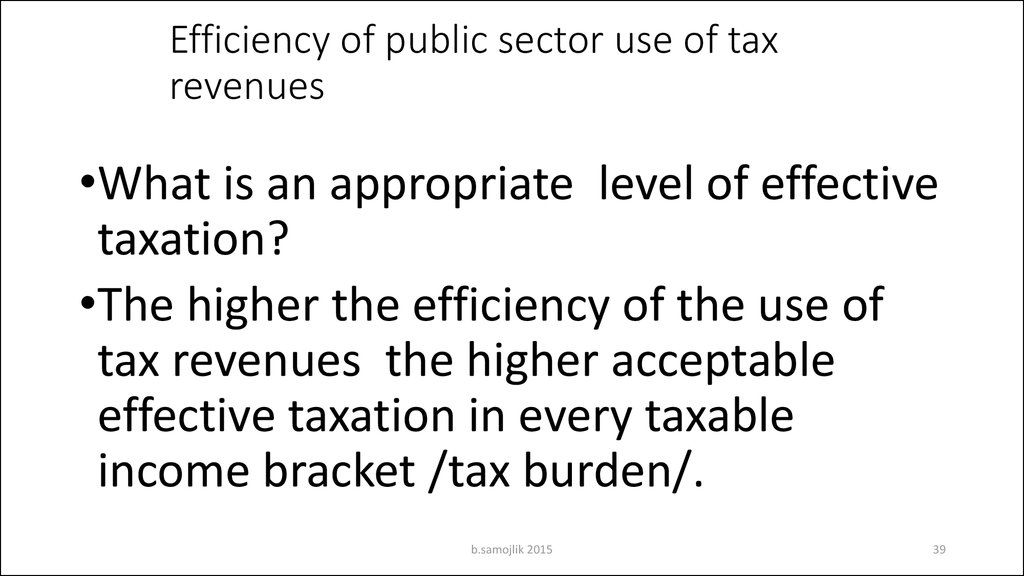

39. Efficiency of public sector use of tax revenues

•What is an appropriate level of effectivetaxation?

•The higher the efficiency of the use of

tax revenues the higher acceptable

effective taxation in every taxable

income bracket /tax burden/.

b.samojlik 2015

39

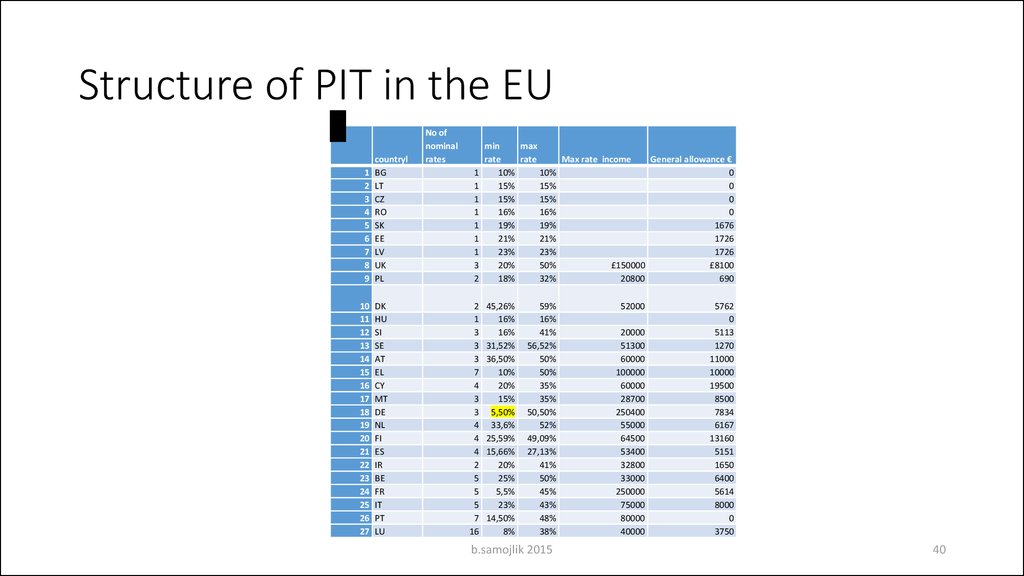

40. Structure of PIT in the EU

.1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

countryl

BG

LT

CZ

RO

SK

EE

LV

UK

PL

DK

HU

SI

SE

AT

EL

CY

MT

DE

NL

FI

ES

IR

BE

FR

IT

PT

LU

No of

nominal

rates

1

1

1

1

1

1

1

3

2

2

1

3

3

3

7

4

3

3

4

4

4

2

5

5

5

7

16

min

max

rate

rate

Max rate income

General allowance €

10%

10%

0

15%

15%

0

15%

15%

0

16%

16%

0

19%

19%

1676

21%

21%

1726

23%

23%

1726

20%

50%

£150000

£8100

18%

32%

20800

690

45,26%

16%

16%

31,52%

36,50%

10%

20%

15%

5,50%

33,6%

25,59%

15,66%

20%

25%

5,5%

23%

14,50%

8%

59%

16%

41%

56,52%

50%

50%

35%

35%

50,50%

52%

49,09%

27,13%

41%

50%

45%

43%

48%

38%

b.samojlik 2015

52000

20000

51300

60000

100000

60000

28700

250400

55000

64500

53400

32800

33000

250000

75000

80000

40000

5762

0

5113

1270

11000

10000

19500

8500

7834

6167

13160

5151

1650

6400

5614

8000

0

3750

40

41. PIT in the EU countries

• PIT in the EU28 is extremely diversified:• Different levels of the general allowance

• Different numbers of taxable income brackets

• different marginal tax rates

• Different effective taxation for a given total income

• Different personal allowances/ because of age of the taxpayer ,

number of children in the family , disability etc. etc./

b.samojlik 2015

41

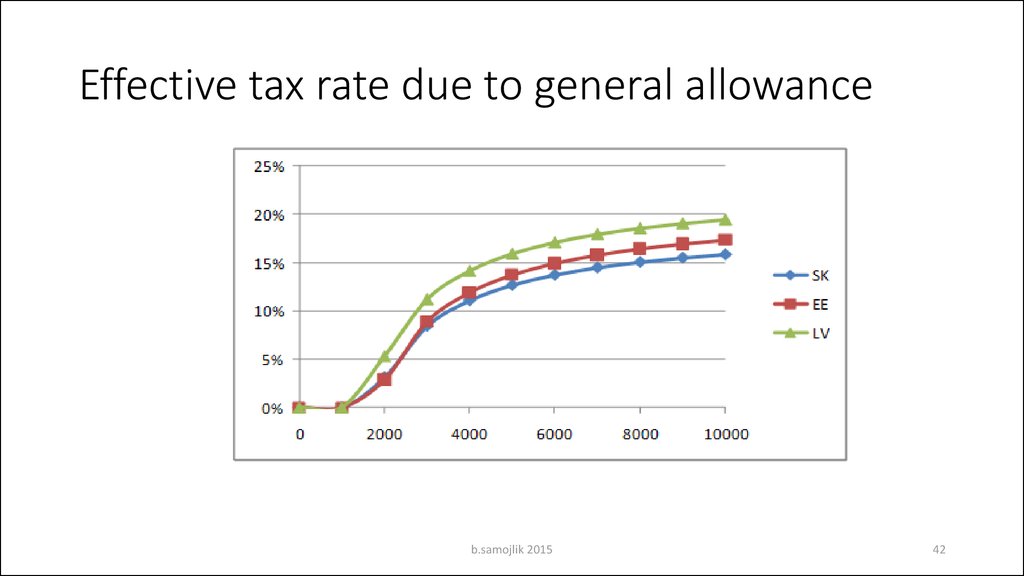

42. Effective tax rate due to general allowance

b.samojlik 201542

43. The importance od sizable general allowance

• General allowance could change an effective tax rate considerably:• Example: general allowance 19500 €/CY/

• First bracket above general allowance level 19500 up to 400000€

,marginal rate 20%

• Effective rate for the yearly taxable income 35000€ / total income

45000€/:

• =(35000-19500)*0,2=3100€

• Effective tax rate =3100/45000=6,9%

b.samojlik 2015

43

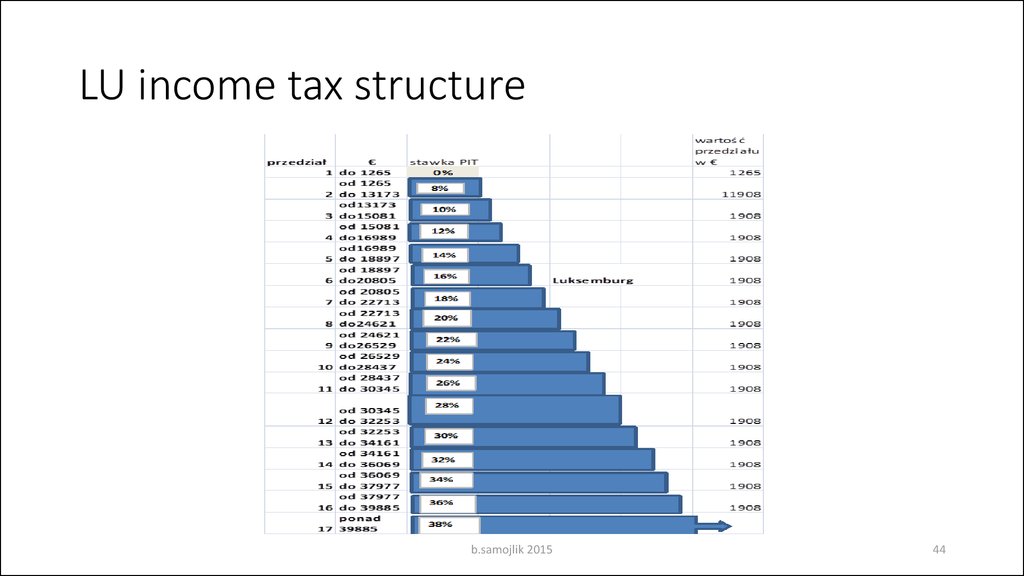

44. LU income tax structure

b.samojlik 201544

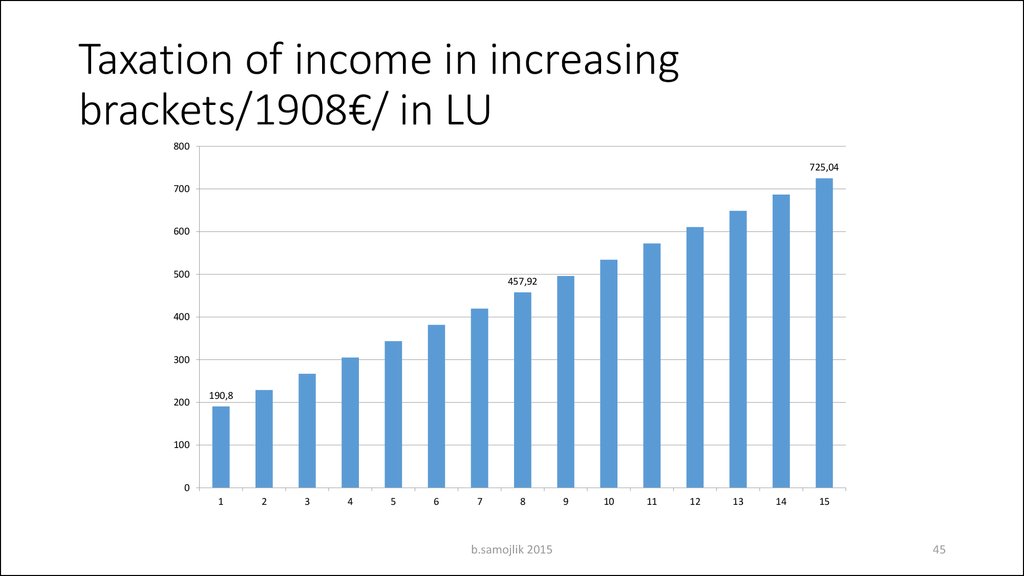

45. Taxation of income in increasing brackets/1908€/ in LU

800725,04

700

600

500

457,92

400

300

200

190,8

100

0

1

2

3

4

5

6

7

8

b.samojlik 2015

9

10

11

12

13

14

15

45

46. LU taxation of income

• LU taxation of income is a perfect fit to optimal taxation of income• The slower loss of utility of income of the higher income groups/

higher brackets / is matched by increase of marginal nominal rate

2pp for every 1908€ increase of taxable income

• Very similar taxation of the personal income there is in the us, Japan.

China, Germany, France, Great Britain, Italy, Spain, Portugal, Greece.

• Only less developed countries have a taxation schemes flat type.

b.samojlik 2015

46

47. Effective taxation of income in PL and LU /comparison/

20,00%18,00%

17,40%

17,20%

16,70%

15,50%

16,00%

17,30%

17%

16,30%

17,40%

14,00%

13%

12,00%

8,80%

10,00%

7,46%

6,94%

8,00%

7,90%

5,89%

PL

LU

8,02%

6,00%

7,15%

6,59%

4,00%

9,22%

3,77%

2,00%

0,00%

0%

1000

3000

5000

7000

9000

11000

13000

b.samojlik 2015

15000

17000

19000

21000

47

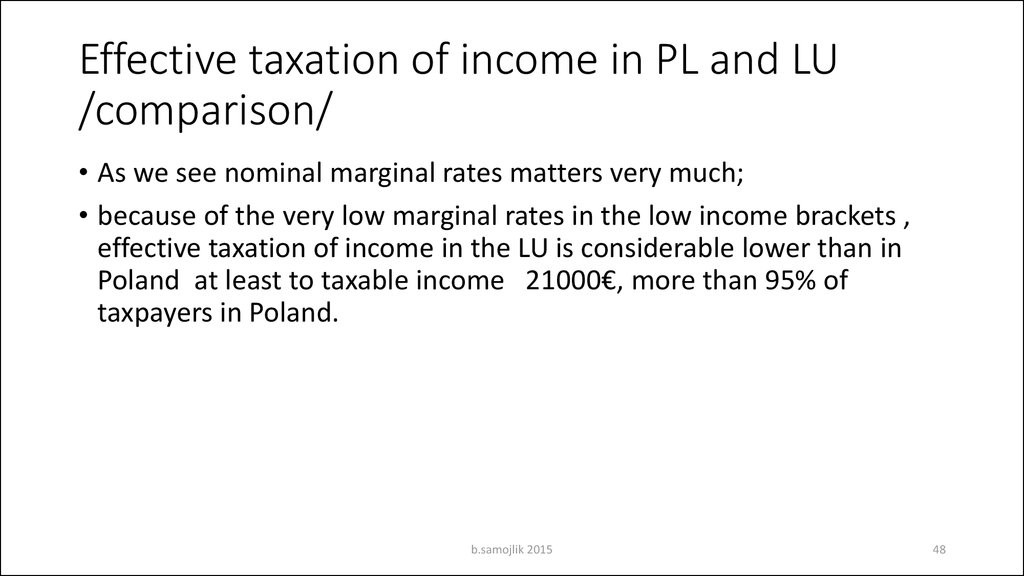

48. Effective taxation of income in PL and LU /comparison/

• As we see nominal marginal rates matters very much;• because of the very low marginal rates in the low income brackets ,

effective taxation of income in the LU is considerable lower than in

Poland at least to taxable income 21000€, more than 95% of

taxpayers in Poland.

b.samojlik 2015

48

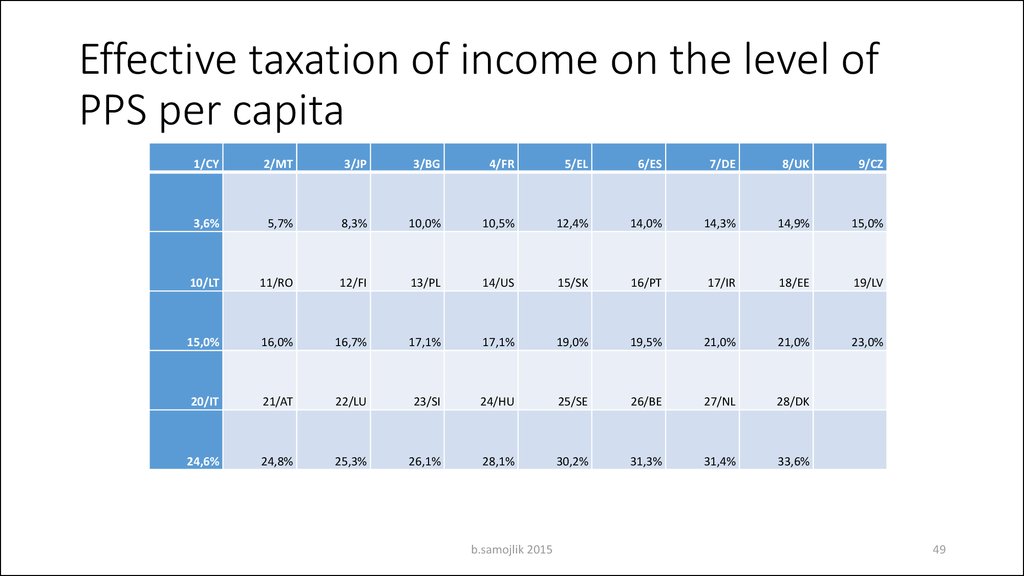

49. Effective taxation of income on the level of PPS per capita

1/CY2/MT

3/JP

3/BG

4/FR

5/EL

6/ES

7/DE

8/UK

9/CZ

3,6%

5,7%

8,3%

10,0%

10,5%

12,4%

14,0%

14,3%

14,9%

15,0%

10/LT

11/RO

12/FI

13/PL

14/US

15/SK

16/PT

17/IR

18/EE

19/LV

15,0%

16,0%

16,7%

17,1%

17,1%

19,0%

19,5%

21,0%

21,0%

23,0%

20/IT

21/AT

22/LU

23/SI

24/HU

25/SE

26/BE

27/NL

28/DK

24,6%

24,8%

25,3%

26,1%

28,1%

30,2%

31,3%

31,4%

33,6%

b.samojlik 2015

49

50. Taxation of the PPS per capita income

• There is a deep differentiation of taxation of the per capitaincome/PPS/ from 3,6% in CY to 33,6% in DK.

• Level of PPS per capita for 7 countries : AT, SE, DK, UK, DE, FI i BE is

comparable: bracket 31000-29000 PPS per capita but taxation differs

very much : from 14,5% in DE to 33,6% in DK.

• PPS per capita in the USA =38700PPS in Poland= 14400PPS. Effective

taxation in US and Poland is the same:17,1%.

• In the US there is a strong tax preference for low income groups in

Poland such a preference does not exists.

b.samojlik 2015

50

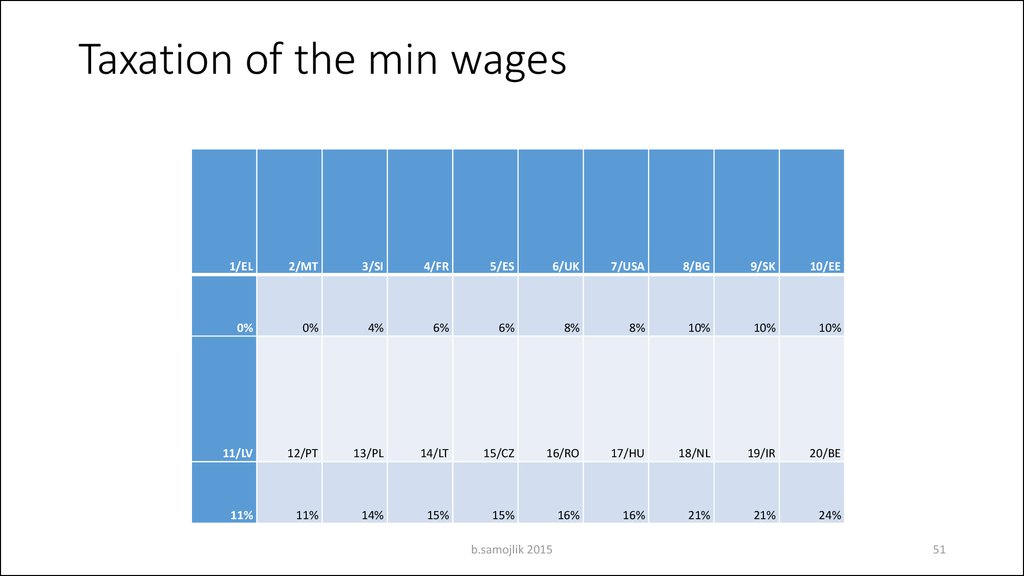

51. Taxation of the min wages

1/EL2/MT

3/SI

4/FR

5/ES

6/UK

7/USA

8/BG

9/SK

10/EE

0%

0%

4%

6%

6%

8%

8%

10%

10%

10%

11/LV

12/PT

13/PL

14/LT

15/CZ

16/RO

17/HU

18/NL

19/IR

20/BE

11%

11%

14%

15%

15%

16%

16%

21%

21%

24%

b.samojlik 2015

51

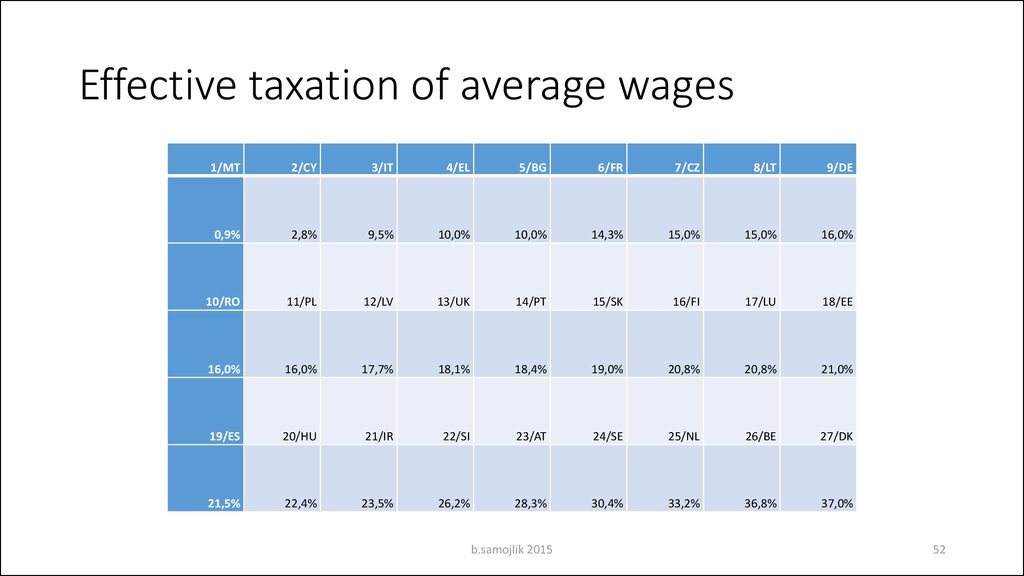

52. Effective taxation of average wages

1/MT2/CY

3/IT

4/EL

5/BG

6/FR

7/CZ

8/LT

9/DE

0,9%

2,8%

9,5%

10,0%

10,0%

14,3%

15,0%

15,0%

16,0%

10/RO

11/PL

12/LV

13/UK

14/PT

15/SK

16/FI

17/LU

18/EE

16,0%

16,0%

17,7%

18,1%

18,4%

19,0%

20,8%

20,8%

21,0%

19/ES

20/HU

21/IR

22/SI

23/AT

24/SE

25/NL

26/BE

27/DK

21,5%

22,4%

23,5%

26,2%

28,3%

30,4%

33,2%

36,8%

37,0%

b.samojlik 2015

52

53. Effective income tax rates in CH, JP and USA

40,0%35,0%

30,0%

25,0%

20,0%

CH

JP

USA

15,0%

10,0%

5,0%

0,0%

0

20000

40000

60000

80000

100000

120000

140000

160000

-5,0%

b.samojlik 2015

53

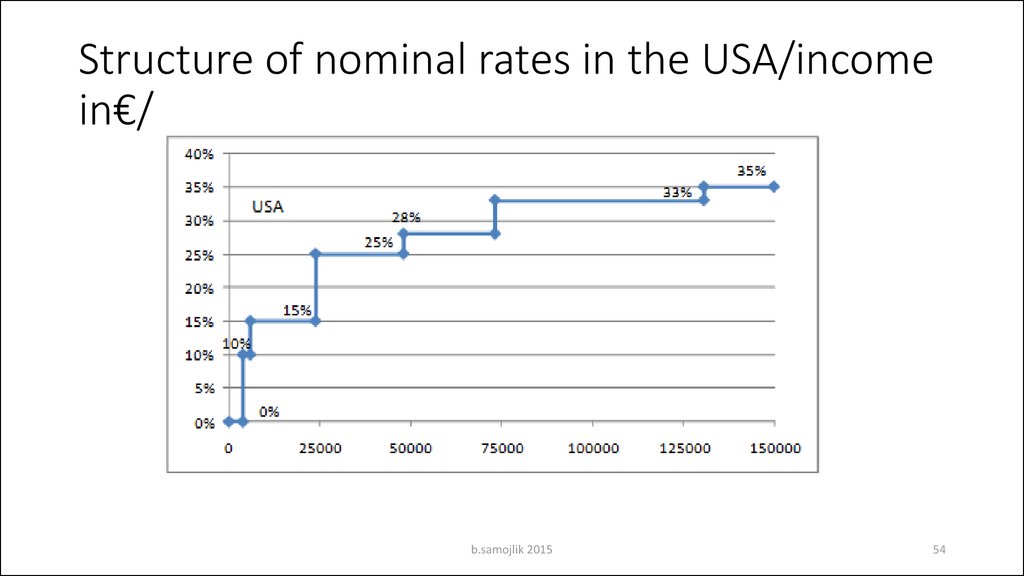

54. Structure of nominal rates in the USA/income in€/

b.samojlik 201554

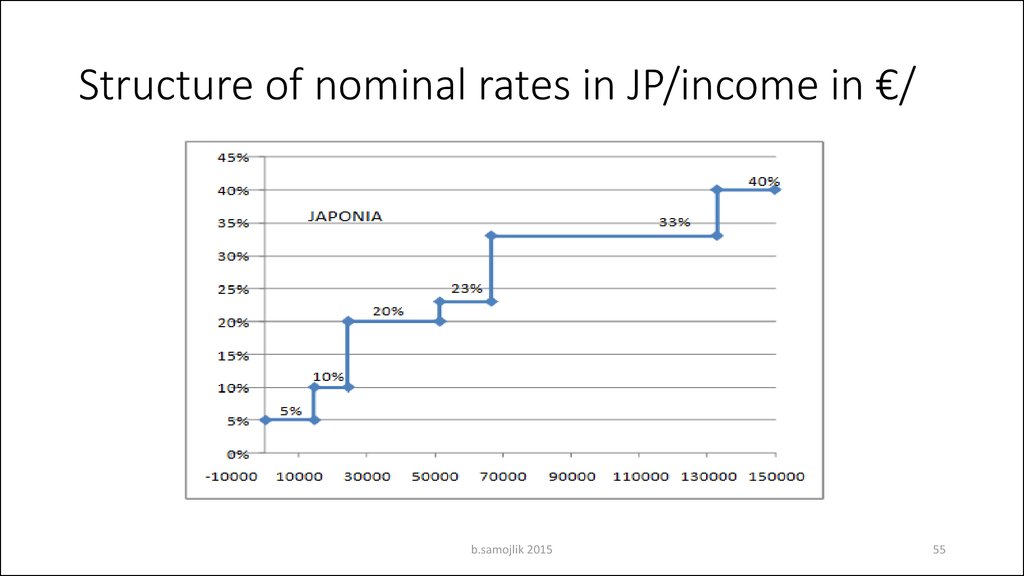

55. Structure of nominal rates in JP/income in €/

b.samojlik 201555

56. Structure of nominal rates in CH /income in€/

b.samojlik 201556

57. Optimal taxation of goods and services

b.samojlik 201557

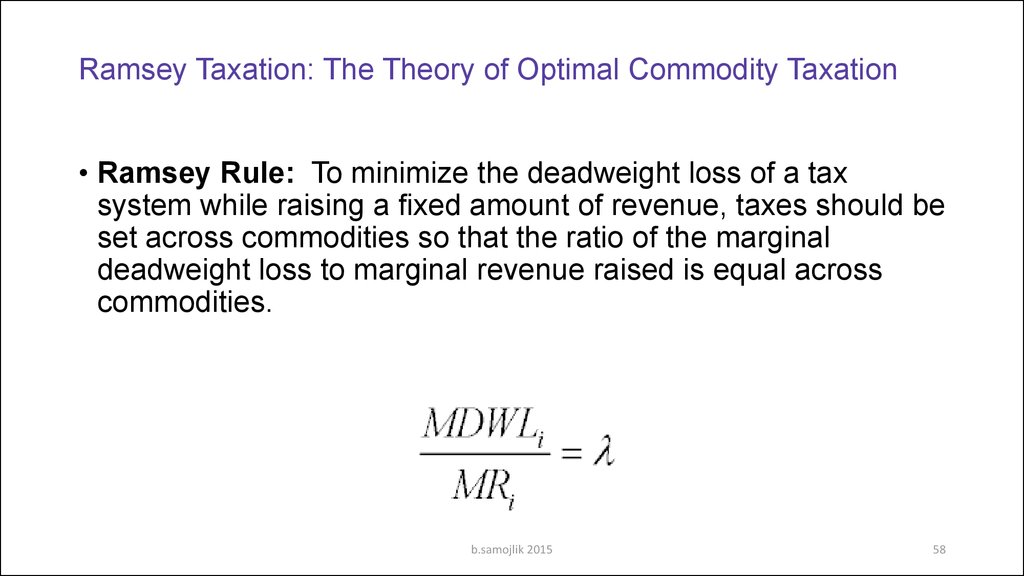

58. Ramsey Taxation: The Theory of Optimal Commodity Taxation

• Ramsey Rule: To minimize the deadweight loss of a taxsystem while raising a fixed amount of revenue, taxes should be

set across commodities so that the ratio of the marginal

deadweight loss to marginal revenue raised is equal across

commodities.

b.samojlik 2015

58

59. The marginal deadweight loss to marginal revenue raised not equal across commodities.

• MDWL1/MR1> MDWL2/MR2> MDWL3/MR3>MDWL4/MR4>…… MDWLn/MRn

When relation of the deadweight loss due to taxation would be

different than decreasing taxation of n-th good or service , decreasing

of taxation of n-1 good or service and increase of the tax rate on good

number 1 , good number two and so forth would reduce the

deadweight loss, reduction of the deadweight loss / due to reduced

tax rates /would be grater than increase of deadweight loss due to

increased tax rates./

b.samojlik 2015

59

60. Inverse Elasticity Rule

• If we assume that the supply side of commodity markets is perfectlycompetitive (elasticity of supply is infinite), then the Ramsey rule

implies that:

• That means: tax rate on good or service should be set inversely to its

elasticity of demand ηi;

• The higher ηi the lower tax; the lower ηi the higher tax.

b.samojlik 2015

60

61. Optimal commodity taxes

• The elasticity rule: When elasticity of demand for a good is high, it should betaxed at a low rate;

• when elasticity is low, the tax rate should be high.

• The broad base rule: It is better to tax a wide variety of goods at a moderate rate

than to tax very few goods at a high rate.

• Because the marginal deadweight loss from a tax rises with the tax rate, the

government should spread taxes across a large number of commodities and not

tax any one commodity at a very high rate.

b.samojlik 2015

61

62. Equity Implications of the Ramsey Rule

• The elasticity of demand for luxury goods is much higher than that for basicconsumption goods, so the inverse elasticity rule would suggest that the

government tax basic consumption goods much more highly than luxury goods.

• This would mean imposing a tax on a good consumed exclusively by higherincome groups that was much lower than the tax imposed on a good consumed

by all.

This outcome, while efficient, might violate a government’s sense of tax fairness

across income groups (vertical equity) and requires a trade off beetwen fairness

and efficiency of commodity and service taxation .

b.samojlik 2015

62

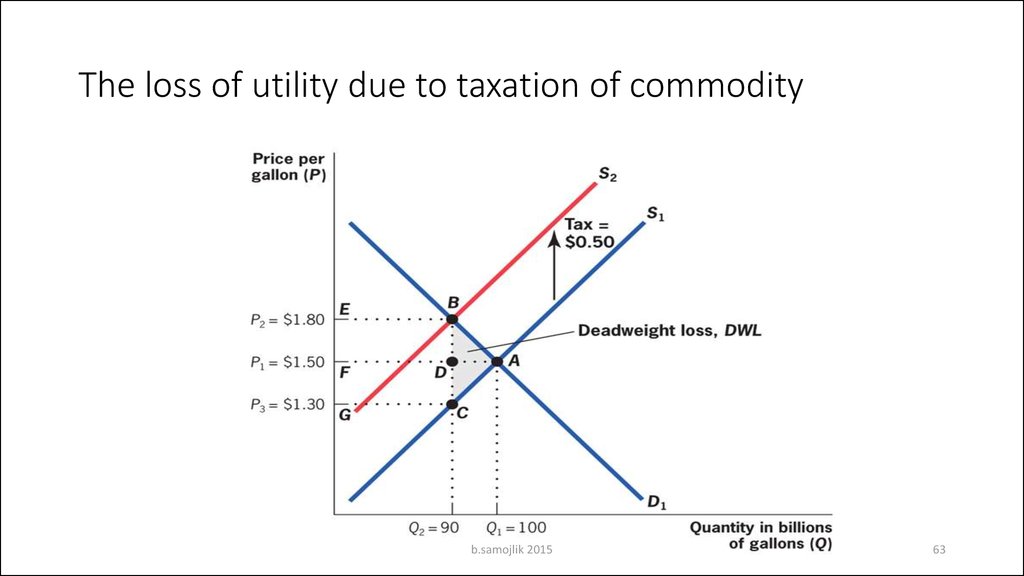

63. The loss of utility due to taxation of commodity

b.samojlik 201563

64. The loss of utility due to taxation

• When a tax $0,5 is imposed the supply curve shifts from S1 to S2 anda deadweight loss ABC occurs / for Q1-Q2 social marginal benefits are

lower than social marginal costs /

b.samojlik 2015

64

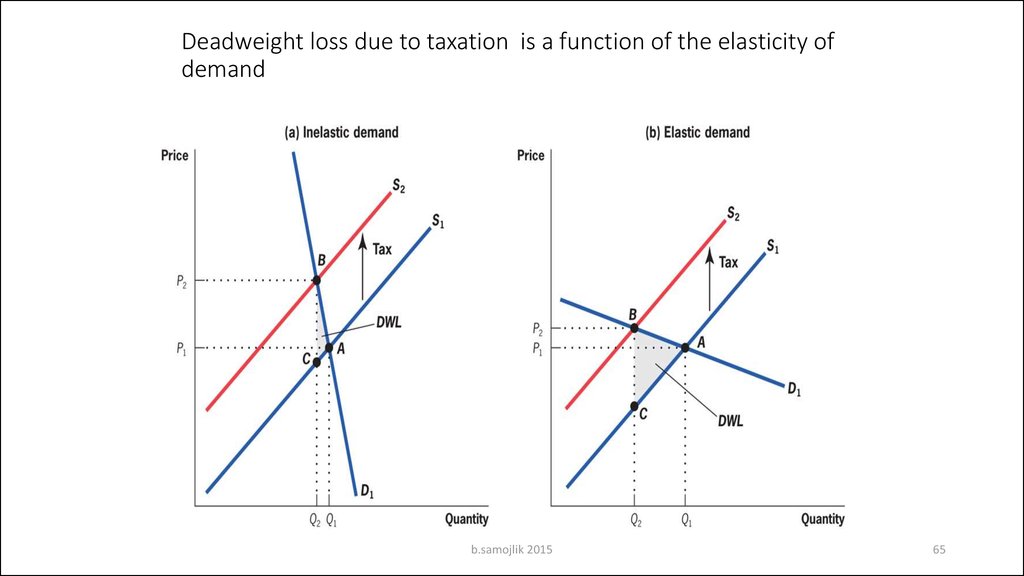

65. Deadweight loss due to taxation is a function of the elasticity of demand

b.samojlik 201565

66. Deadweight loss due to taxation is a function of the elasticity of demand

• The same tax is imposed on a commodity with elastic and inelasticdemand; the shift od supply curve is the same ;

• The deadweight loss increases with the increase of the elasticity of

demand

b.samojlik 2015

66

67. The nature of the deadweight loss

• The inefficiency of any tax is determined by the extent to whichconsumers and producers change their behavior to avoid the tax;

deadweight loss is caused by individuals and firms making inefficient

consumption and production choices in order to avoid taxation.

b.samojlik 2015

67

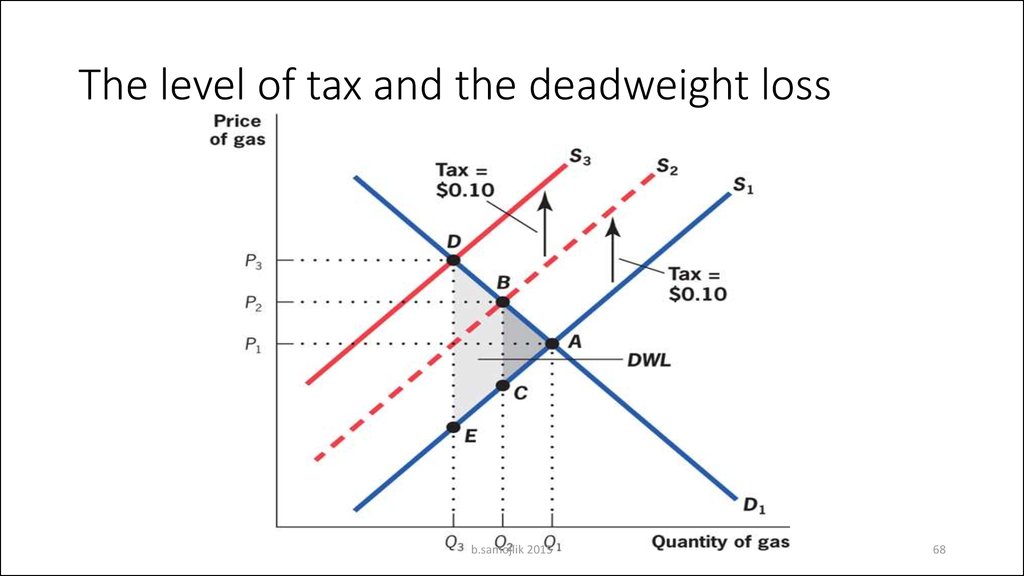

68. The level of tax and the deadweight loss

b.samojlik 201568

69. The level of tax and the deadweight loss

• The deadweight loss increases more than proportionalto increase of tax rate.

b.samojlik 2015

69

70. Conclusion

• The fundamental issue in designing tax policy is the equity-efficiencytrade-off.

• two key principles:

• 1.the more elastically supplied or demanded the good, the larger the

deadweight loss from the tax.

• 2.the higher the tax rate, the larger the incremental deadweight loss of taxation.

b.samojlik 2015

70

71. The EU VAT concept and the Ramsey rule

• The EU concept of VAT:• One standard rate /not lower than 15% for all goods and services/

• Reduced or super reduced rate are only for a determined time, limited and

conditional

• Ramsey rule indicated that commodity and services taxation should be

proportional/ inversely/ to price elasticity of demand.

• So, The EU concept of VAT is wrong; it assumes that elasticity of demand

for all good and services is the same and that is a wrong assumption;

elasticity are different so VAT rates should be diversified to minimize loss

of total surplus; standard rate for every good and service would no

minimize deadweight loss.

b.samojlik 2015

71

72. Quality of taxation

• Taxation structure from growth perspective• Decrease taxation of labor, increase taxation of consumption and

green taxes and decrease taxation of labor

b.samojlik 2015

72

finance

finance english

english