Similar presentations:

Principles of Micro

1. Principles of Micro

by Tanya Molodtsova, Fall 2005Chapter 8: “Application: The Cost of

Taxation”

2. We Will Learn:

taxes reduce consumer andproducer surplus

the meaning and causes of the

deadweight loss from a tax

why some taxes have larger

deadweight losses than others

how tax revenue and

deadweight loss vary with the

size of a tax

3. The Deadweight Loss of Taxation

Buyers and sellers receivebenefits from taking part in the

market.

The total welfare of buyers and

sellers is maximized in equilibrium

How do taxes affect the economic

well-being of market participants?

4. The Deadweight Loss of Taxation

It does not matter whether a taxon a good is levied on buyers or

sellers of the good . . . the price

paid by buyers rises, and

the price received by sellers falls.

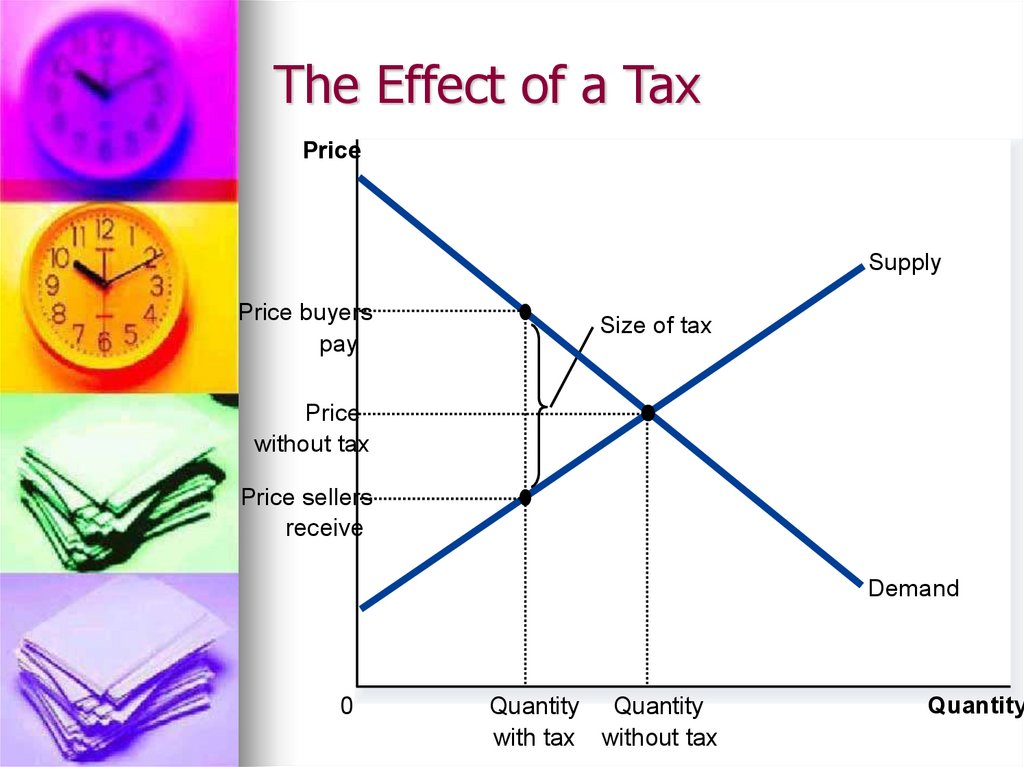

5. The Effect of a Tax

PriceSupply

Price buyers

pay

Size of tax

Price

without tax

Price sellers

receive

Demand

0

Quantity Quantity

with tax without tax

Quantity

6. How a Tax Affects Market Participants

A tax places a wedge betweenthe price buyers pay and the

price sellers receive.

the quantity sold falls below the

level that would be sold without

a tax.

The size of the market for that

good shrinks

7. How a Tax Affects Market Participants

Tax RevenueT = the size of the tax

Q = the quantity of the good sold

T Q = the government’s

tax revenue

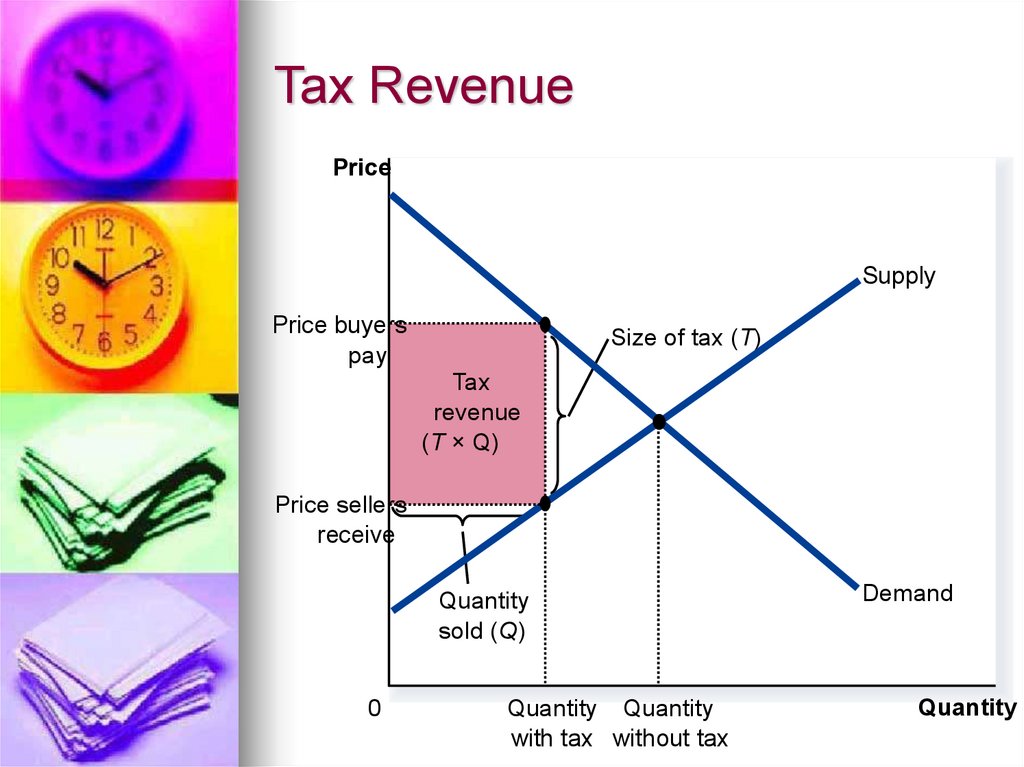

8. Tax Revenue

PriceSupply

Price buyers

pay

Size of tax (T)

Tax

revenue

(T × Q)

Price sellers

receive

Quantity

sold (Q)

0

Quantity Quantity

with tax without tax

Demand

Quantity

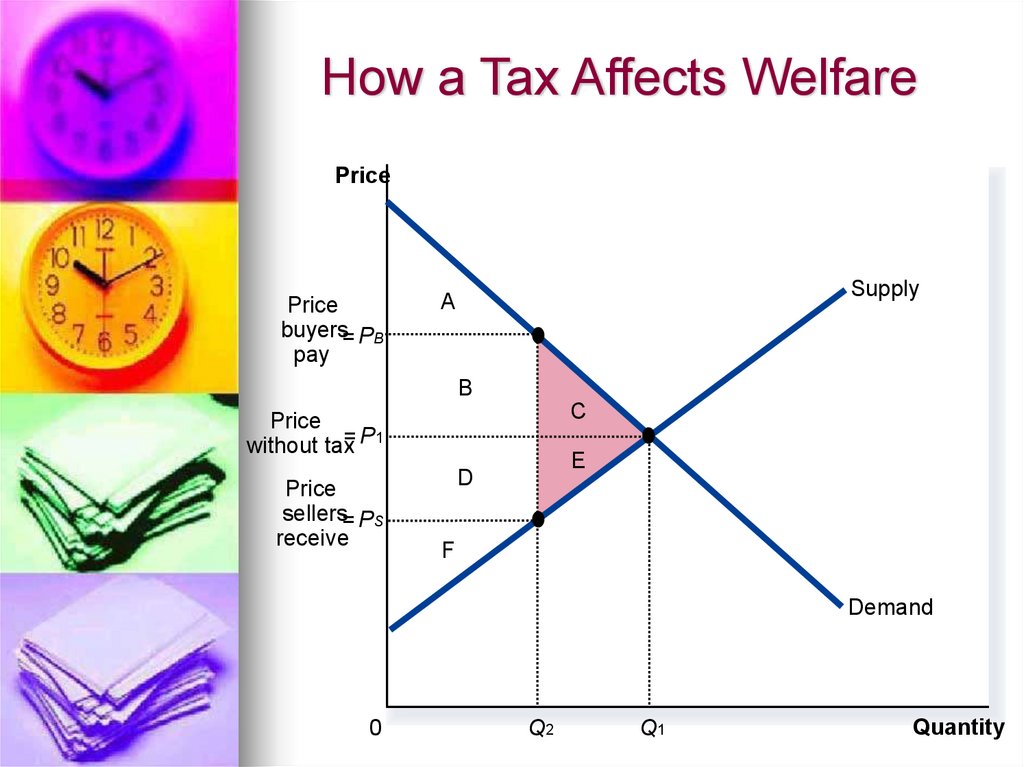

9. How a Tax Affects Welfare

PricePrice

buyers= PB

pay

Supply

A

B

C

Price

= P1

without tax

Price

sellers= PS

receive

E

D

F

Demand

0

Q2

Q1

Quantity

10. How a Tax Affects Welfare

Welfare Before a Tax:Consumer surplus = A + B + C.

Producer surplus = D + E + F.

Total surplus = A+ B+ C+ D+ E+F.

Welfare After Tax:

Consumer surplus = A.

Producer surplus = F.

Tax revenue = B + D.

Total surplus = A + B + D + F.

11. How a Tax Affects Welfare

Total surplus decreases by C+Edeadweight loss:

the fall in

total surplus that results from

a market distortion, such as a

tax.

12. How a Tax Affects Welfare

The change in total welfareincludes:

The change in consumer surplus,

The change in producer surplus,

and

The change in tax revenue.

The losses to buyers and sellers

exceed the revenue raised by the

government.

This fall in total surplus is called the

deadweight loss.

13. Deadweight Losses and the Gains from Trade

Taxes cause deadweightlosses because they prevent

buyers and sellers from

realizing some of the gains

from trade.

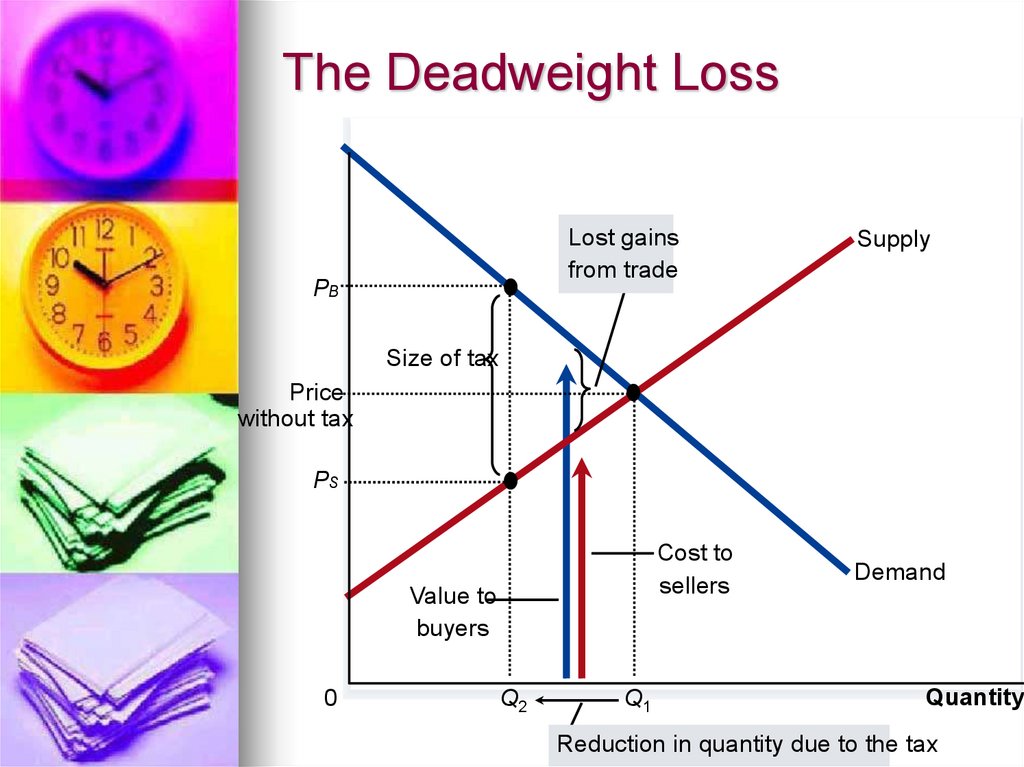

14. The Deadweight Loss

Lost gainsfrom trade

PB

Supply

Size of tax

Price

without tax

PS

Cost to

sellers

Value to

buyers

0

Q2

Q1

Demand

Quantity

Reduction in quantity due to the tax

15. The Determinants of the Deadweight Loss

The magnitude of thedeadweight loss depends on

how much the quantity supplied

and quantity demanded respond

to changes in the price.

That, in turn, depends on the

price elasticities of supply and

demand.

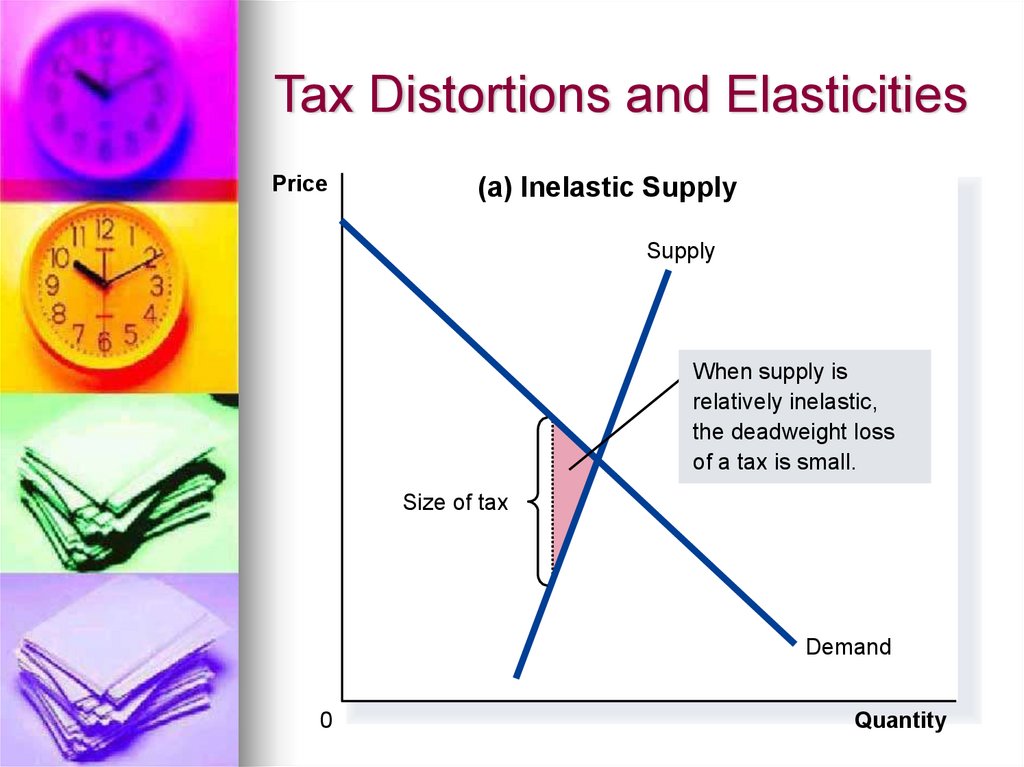

16. Tax Distortions and Elasticities

Price(a) Inelastic Supply

Supply

When supply is

relatively inelastic,

the deadweight loss

of a tax is small.

Size of tax

Demand

0

Quantity

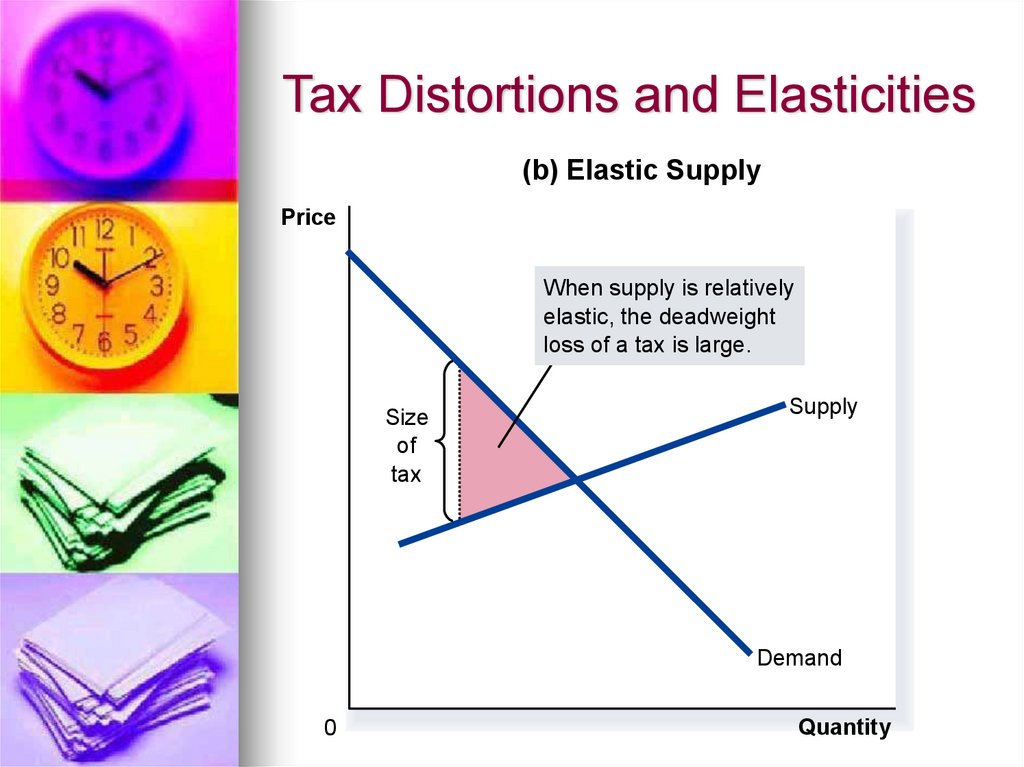

17. Tax Distortions and Elasticities

(b) Elastic SupplyPrice

When supply is relatively

elastic, the deadweight

loss of a tax is large.

Size

of

tax

Supply

Demand

0

Quantity

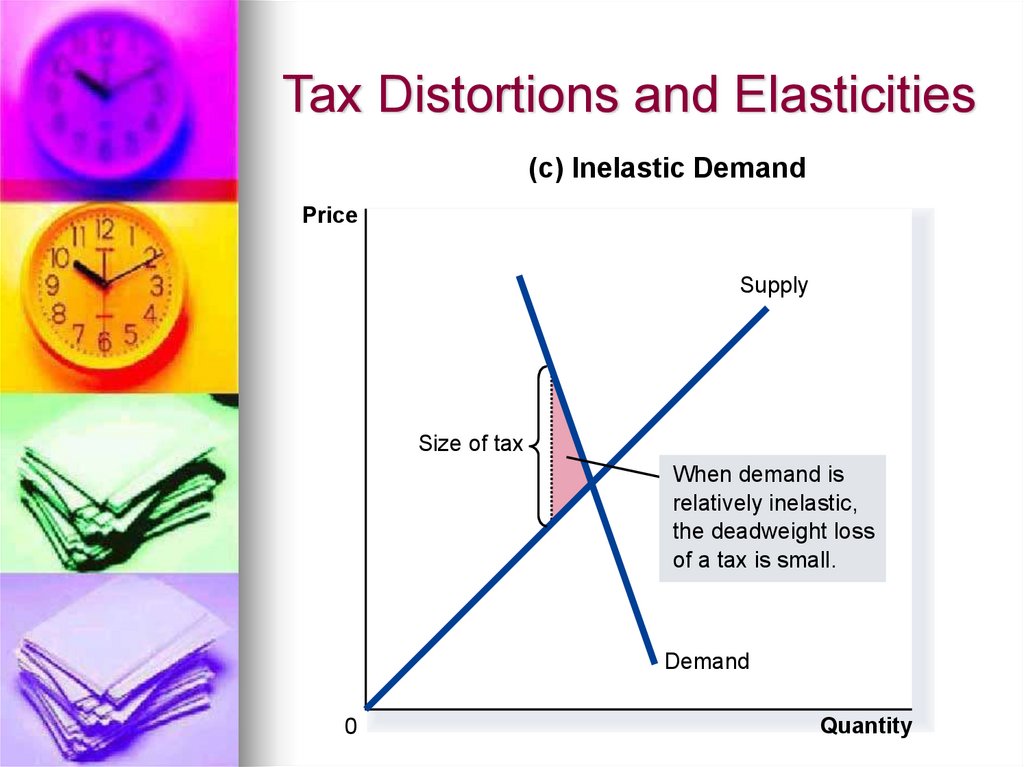

18. Tax Distortions and Elasticities

(c) Inelastic DemandPrice

Supply

Size of tax

When demand is

relatively inelastic,

the deadweight loss

of a tax is small.

Demand

0

Quantity

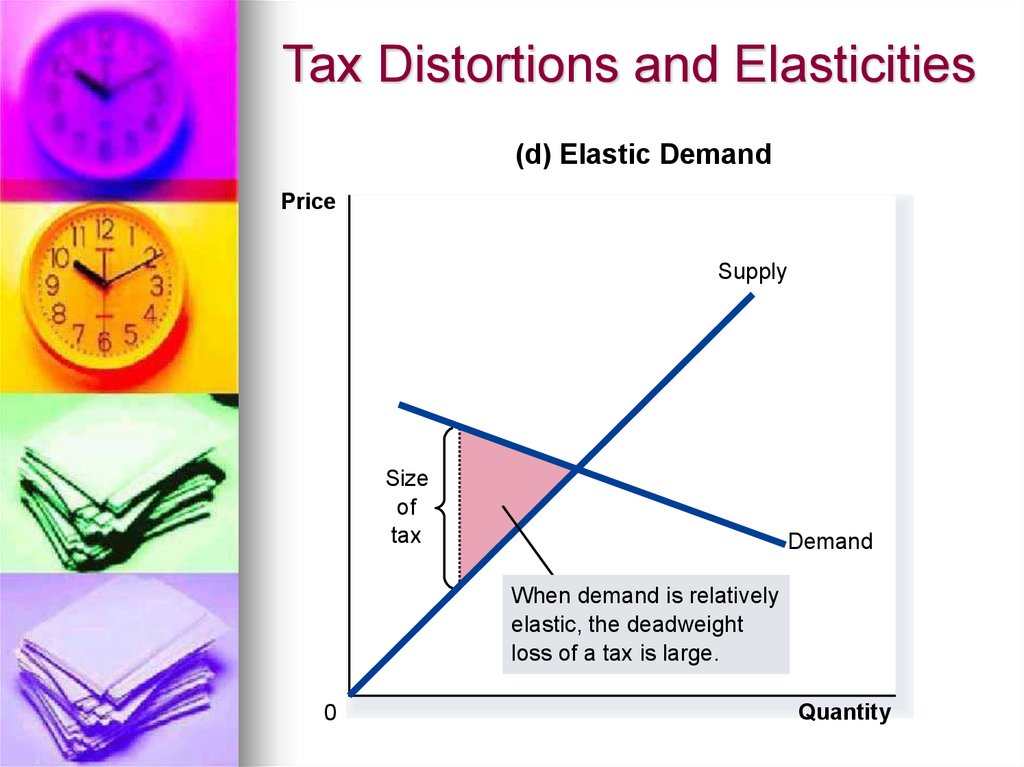

19. Tax Distortions and Elasticities

(d) Elastic DemandPrice

Supply

Size

of

tax

Demand

When demand is relatively

elastic, the deadweight

loss of a tax is large.

0

Quantity

20. The Determinants of the Deadweight Loss

The greater the elasticities ofdemand and supply:

the larger will be the decline in

quantity sold and,

the greater the deadweight

loss of a tax.

21. Case Study: The Deadweight Loss Debate

Some economists argue that labortaxes are highly distorting and

believe that labor supply is elastic.

Some examples of workers who

may respond more to incentives:

Workers who can adjust the number of

hours they work

Families with second earners

Elderly who can choose when to retire

Workers in the underground economy

(i.e., those engaging in illegal activity)

22. Deadweight Loss and Tax Revenue as Taxes Vary

1.2.

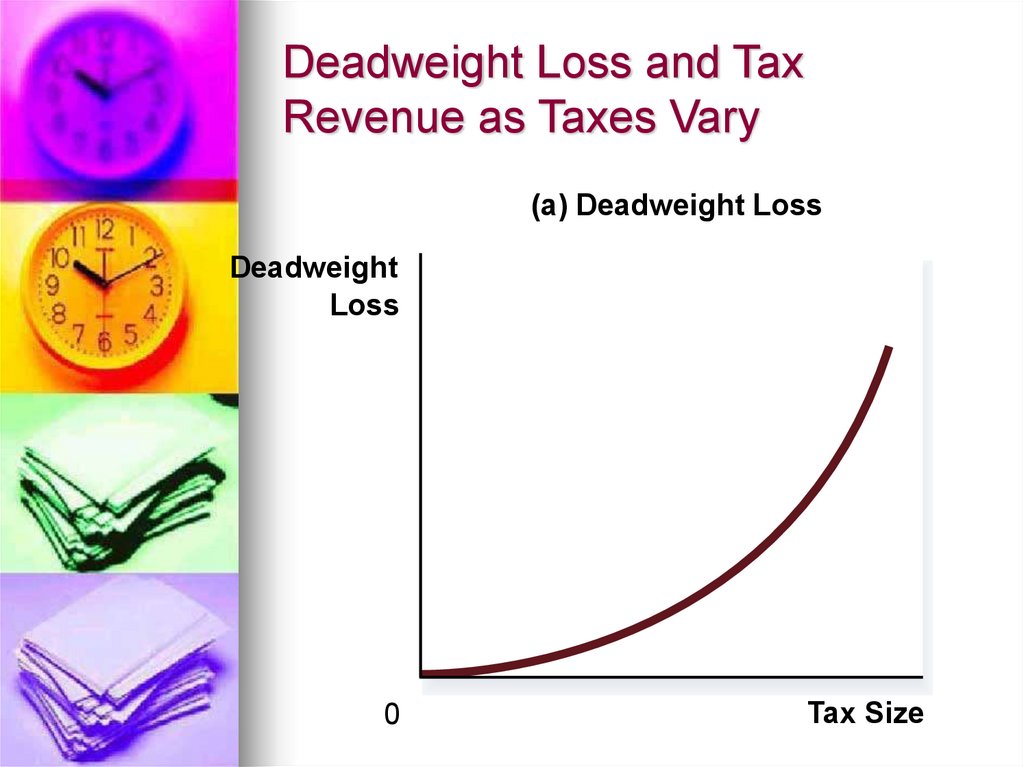

As taxes increase, the deadweight

loss from the tax increases.

In fact, as taxes increase, the

deadweight loss rises more quickly

than the size of the tax.

The deadweight loss is the area of a

triangle.

If we double the size of a tax, the base

and height of the triangle both double

so the area of the triangle (the

deadweight loss) rises by a factor of

four.

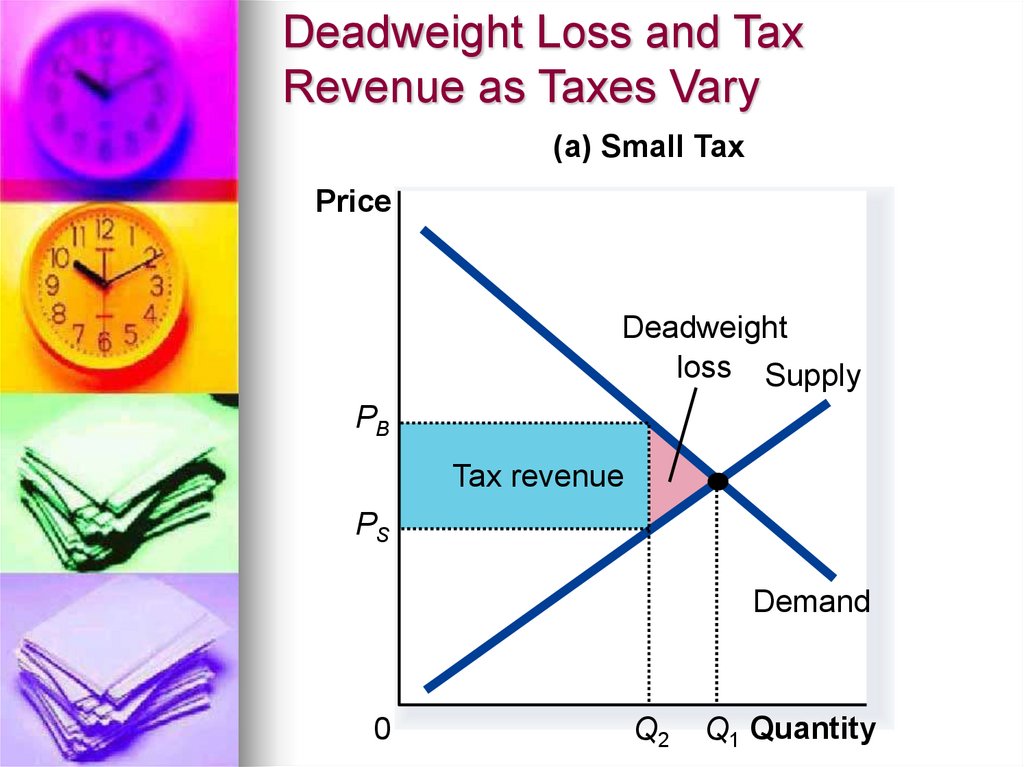

23. Deadweight Loss and Tax Revenue as Taxes Vary

(a) Small TaxPrice

Deadweight

loss Supply

PB

Tax revenue

PS

Demand

0

Q2

Q1 Quantity

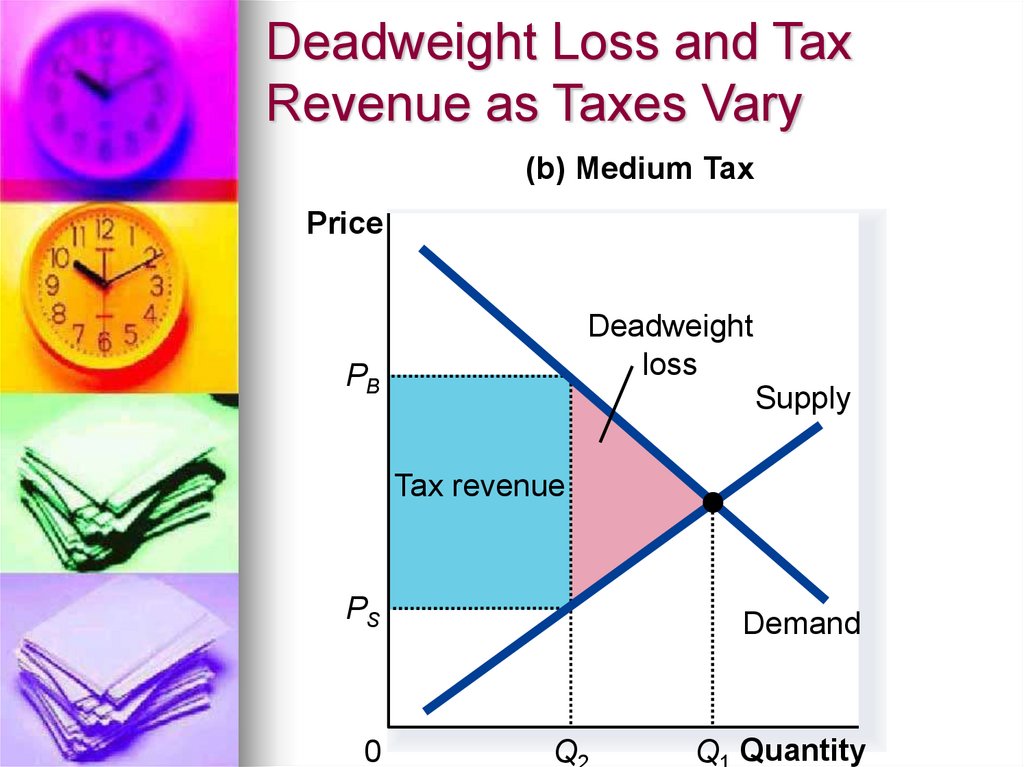

24. Deadweight Loss and Tax Revenue as Taxes Vary

(b) Medium TaxPrice

Deadweight

loss

PB

Supply

Tax revenue

PS

0

Demand

Q

Q Quantity

25. Deadweight Loss and Tax Revenue as Taxes Vary

(c) Large TaxPrice

PB

Tax revenue

Deadweight

loss

Supply

Demand

PS

0

Q2

Q1 Quantity

26. Deadweight Loss and Tax Revenue as Taxes Vary

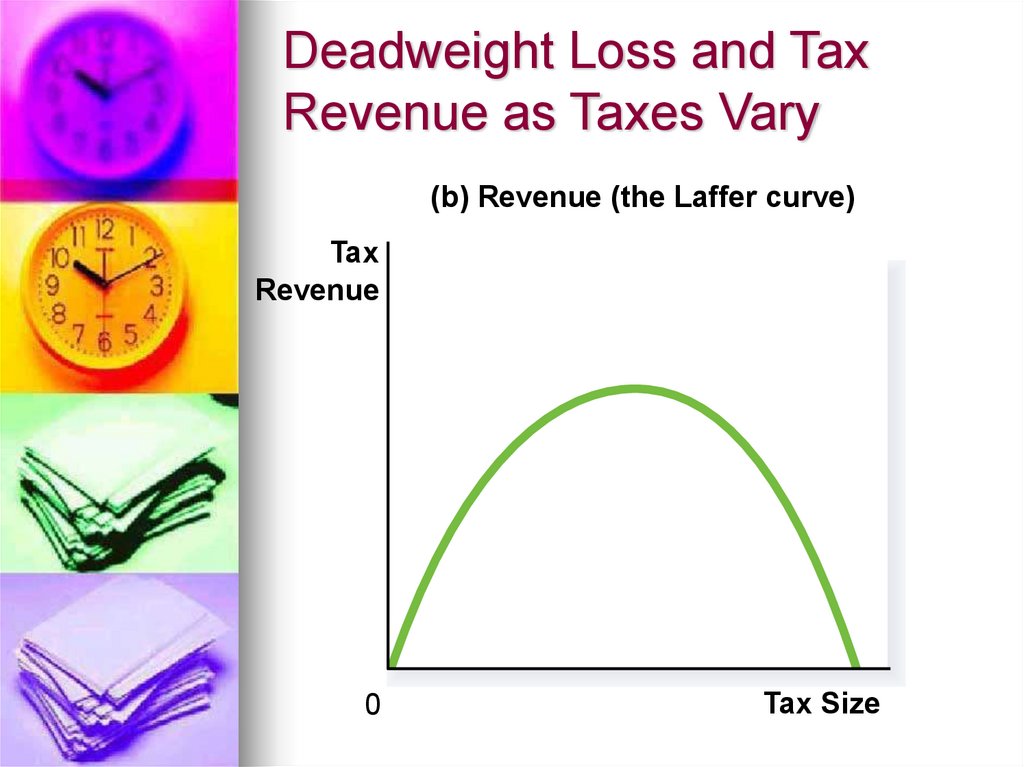

For the small tax, tax revenue issmall.

As the size of the tax rises, tax

revenue grows.

But as the size of the tax

continues to rise, tax revenue

falls because the higher tax

reduces the size of the market.

27. Deadweight Loss and Tax Revenue as Taxes Vary

(a) Deadweight LossDeadweight

Loss

0

Tax Size

28. Deadweight Loss and Tax Revenue as Taxes Vary

(b) Revenue (the Laffer curve)Tax

Revenue

0

Tax Size

29. Deadweight Loss and Tax Revenue as Taxes Vary

As the size of a tax increases,its deadweight loss quickly gets

larger.

By contrast, tax revenue first

rises with the size of a tax, but

then, as the tax gets larger, the

market shrinks so much that tax

revenue starts to fall.

30. Case Study: The Laffer Curve and Supply-Side Economics

The Laffer curve depicts therelationship between tax rates

and tax revenue.

Supply-side economics refers to

the views of Reagan and Laffer

who proposed that a tax cut

would induce more people to

work and thereby have the

potential to increase tax

revenues

31. Summary

A tax on a good reduces thewelfare of buyers and sellers of the

good, and the reduction in

consumer and producer surplus

usually exceeds the revenues

raised by the government.

The fall in total surplus—the sum

of consumer surplus, producer

surplus, and tax revenue — is

called the deadweight loss of the

tax.

32. Summary

Taxes have a deadweight lossbecause they cause buyers to

consume less and sellers to

produce less.

This change in behavior shrinks the

size of the market below the level

that maximizes total surplus.

33. Summary

As a tax grows larger, it distortsincentives more, and its

deadweight loss grows larger.

Tax revenue first rises with the

size of a tax.

Eventually, however, a larger tax

reduces tax revenue because it

reduces the size of the market.

finance

finance