Similar presentations:

European energy transition

1. European Energy Transition: challenges to suppliers

© World Energy Council 2014European Energy Transition:

challenges to suppliers

Ged Davis

Executive Chair, Scenarios

World Energy Council

Astana September 30 2015

2. Table of contents

▶Status of natural gas in Europe

▶

Forces for change

▶

Challenges for natural gas suppliers

© World Energy Council 2014

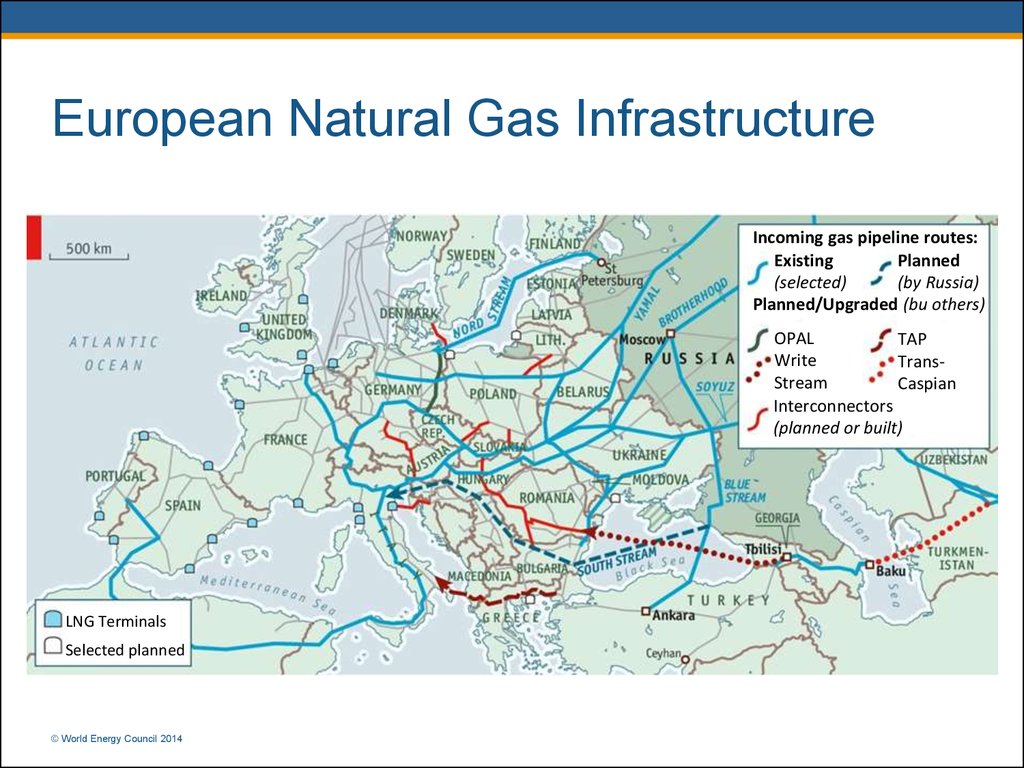

3. European Natural Gas Infrastructure

Incoming gas pipeline routes:Existing

Planned

(selected)

(by Russia)

Planned/Upgraded (bu others)

OPAL

TAP

Write

TransStream

Caspian

Interconnectors

(planned or built)

LNG Terminals

Selected planned

© World Energy Council 2014

4. European Natural Gas Demand/Supply

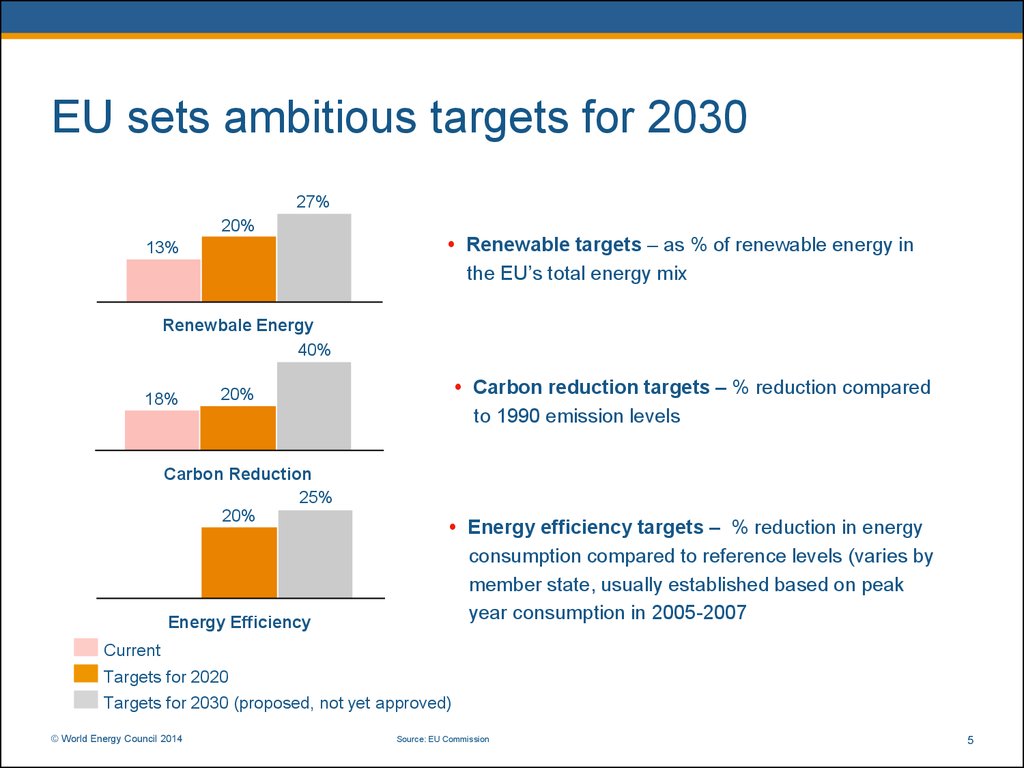

© World Energy Council 20145. EU sets ambitious targets for 2030

27%20%

13%

Renewable targets – as % of renewable energy in

the EU’s total energy mix

Renewbale Energy

40%

18%

Carbon reduction targets – % reduction compared

to 1990 emission levels

20%

Carbon Reduction

25%

20%

Energy Efficiency

Energy efficiency targets – % reduction in energy

consumption compared to reference levels (varies by

member state, usually established based on peak

year consumption in 2005-2007

Current

Targets for 2020

Targets for 2030 (proposed, not yet approved)

© World Energy Council 2014

Source: EU Commission

5

6.

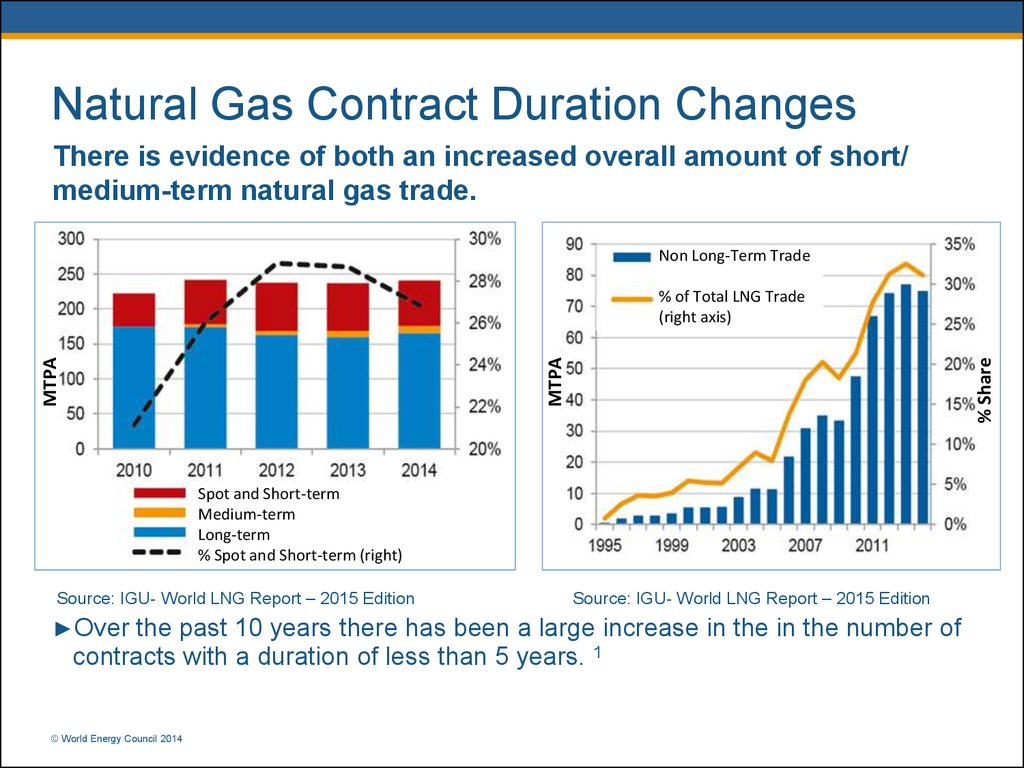

Natural Gas Contract Duration ChangesThere is evidence of both an increased overall amount of short/

medium-term natural gas trade.

Non Long-Term Trade

% Share

MTPA

MTPA

% of Total LNG Trade

(right axis)

Spot and Short-term

Medium-term

Long-term

% Spot and Short-term (right)

Source: IGU- World LNG Report – 2015 Edition

►Over

Source: IGU- World LNG Report – 2015 Edition

the past 10 years there has been a large increase in the in the number of

contracts with a duration of less than 5 years. 1

© World Energy Council 2014

7. Table of contents

▶Status of natural gas in Europe

▶

Forces for change

▶

Challenges for natural gas suppliers

© World Energy Council 2014

8. Despite the recent turmoil, the outlook for the world economy in 2020 remains unclear

▶ The current recovery continues to lack momentum …▶ Recent indicators point to tepid economic growth in

most advanced economies

-

Confidence indicators and order books are up

Monetary conditions are still loose, investment is picking up

« Austerity » stances are giving way to more neutral policy stances

Some concerns about possible recession before 2020

▶ Yet, several emerging markets are in difficulty

-

Overemphasis on commodities, lack of reforms, socio-political

mismanagement ?

8

© World Energy Council 2014

9.

In Europe, national energy regulation moreimportant for investment mood than overall growth

Question 2: Which factors are contributing most to the energy infrastructure investment mood?

(please select maximum two that apply best)

National energy regulation (i.e. taxes, subsidies)

Overall economic growth prospects

Profit outlook

Private consumption (of energy efficient goods etc.)

Multilateral energy regulation

Others, please specify

Europe

Rest of World

- National energy regulation more important in Europe than in rest of world, while outside

Europe, overall economic growth prospects more important than regulation

- Higher influence of multilateral energy regulation reflects special European situation

orld Energy Council 2014

Will national regulation become more predictable in a European framework?

©W

10.

Energy transition is happening in a weakmarket and challenging regulatory environment

Regulatory challenges – Examples

Weak macroeconomics

GDP-forecast EU1

2013

2014

2.2%

1.7%

1.0%

1.2%

0.7%

0.0%

0.0%

-0.3%

Forecast

Oct

2011

Forecast

Oct 2012

Forecast

May 2013

Forecast

Nov 2013

Further decreasing power prices

Power Price Germany Base (y+1, €/MWh)2

70

<60

60

<50

50

<40

40

30

1/11

Jun 2010

Nuclear fuel tax

Sep 2010

Preferential treatment Spanish coal

Nov 2010

Retroactive tax on solar power

Feb 2011

Reduction of solar subsidies

Mar 2011

“Retail Market Review”

Mar 2011

Tax increase North Sea oil and gas

May 2011

Withdrawal of nuc. lifetime extension

Aug 2011

Increase “Robin Hood” tax

Nov 2011

Doubling of nuclear tax

Mar 2012

1. tax package to finance tariff deficit

Apr 2012

Coal tax increase

Jul 2012

Adjustments of RES promotion

Feb 2013

Energy tax

Apr 2013

Tariff cut for grid business

Jun 2013

Robin-Hood Tax on PV

Nov 2013

Change in promotion scheme for RES

10

7/11

© World Energy Council 2014

1/12

7/12

1. Source: IHS Global Insight

2. Price for delivery next year

1/13

7/13

11. EU places high priority on improving energy security

▶ Increasing energy efficiency and reaching the proposed 2030▶

▶

▶

▶

energy and climate goals.

Increasing energy production in the EU and diversifying

supplier countries and routes. This includes further deployment

of renewables, sustainable production of fossil fuels, and safe

nuclear where the option is chosen. It also entails working

effectively with current major energy partners, as well as

developing new partners such as countries in the Caspian Basin

region.

Completing the internal energy market and building missing

infrastructure links to quickly respond to supply disruptions

Strengthening emergency and solidarity mechanisms and

protecting critical infrastructure.

Speaking with one voice in external energy policy

11

© World Energy Council 2014

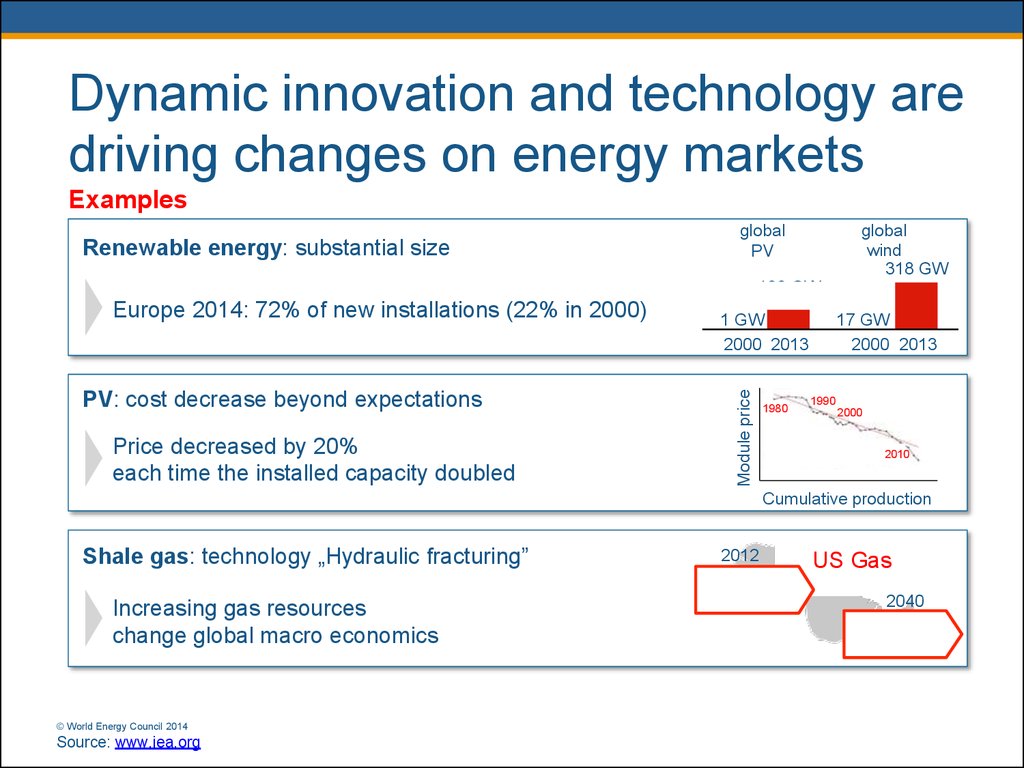

12. Dynamic innovation and technology are driving changes on energy markets

ExamplesRenewable energy: substantial size

global

wind

318 GW

global

PV

139 GW

PV: cost decrease beyond expectations

Price decreased by 20%

each time the installed capacity doubled

1 GW

2000 2013

Module price

Europe 2014: 72% of new installations (22% in 2000)

1980

17 GW

2000 2013

1990

2000

2010

Cumulative production

Shale gas: technology „Hydraulic fracturing”

Increasing gas resources

change global macro economics

© World Energy Council 2014

Source: www.iea.org

2012

Net importer

with 42 bcm

US Gas

2040

Net exporter

with 165 bcm

13. Table of contents

▶Status of natural gas in Europe

▶

Forces for change

▶

Challenges for natural gas suppliers

© World Energy Council 2014

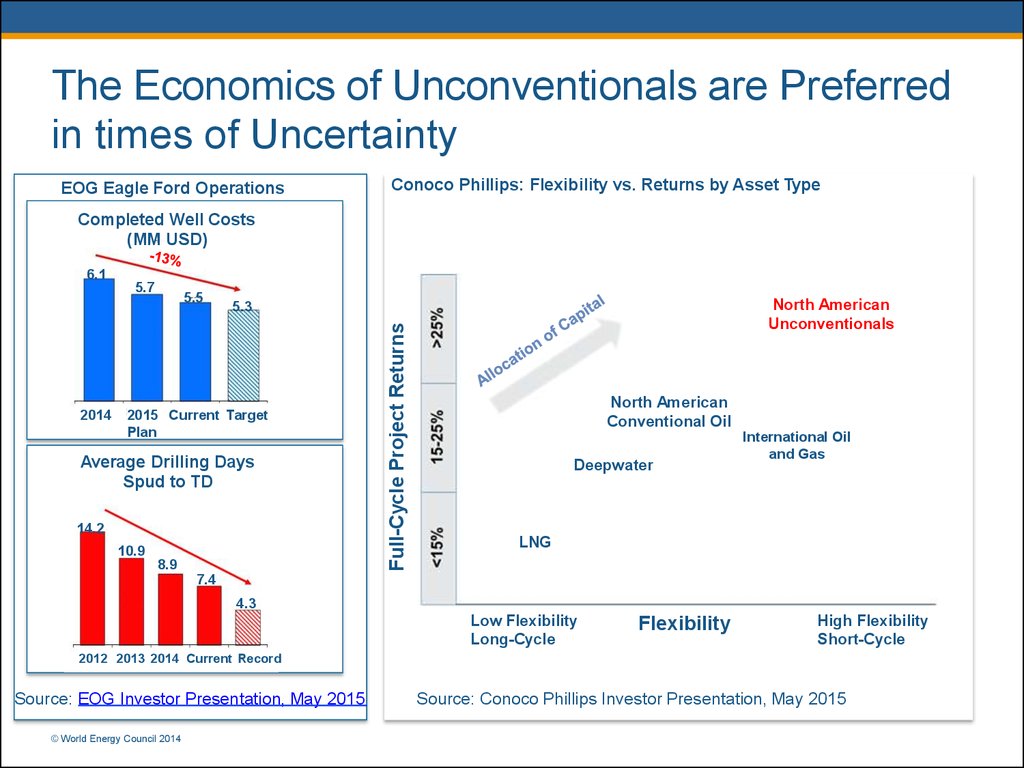

14. The Economics of Unconventionals are Preferred in times of Uncertainty

EOG Eagle Ford OperationsConoco Phillips: Flexibility vs. Returns by Asset Type

Completed Well Costs

(MM USD)

6.1

2014

5.5

North American

Unconventionals

5.3

2015 Current Target

Plan

Average Drilling Days

Spud to TD

14.2

10.9

8.9

Full-Cycle Project Returns

5.7

North American

Conventional Oil

Deepwater

International Oil

and Gas

LNG

7.4

4.3

Low Flexibility

Long-Cycle

Flexibility

High Flexibility

Short-Cycle

2012 2013 2014 Current Record

Source: EOG Investor Presentation, May 2015

© World Energy Council 2014

Source: Conoco Phillips Investor Presentation, May 2015

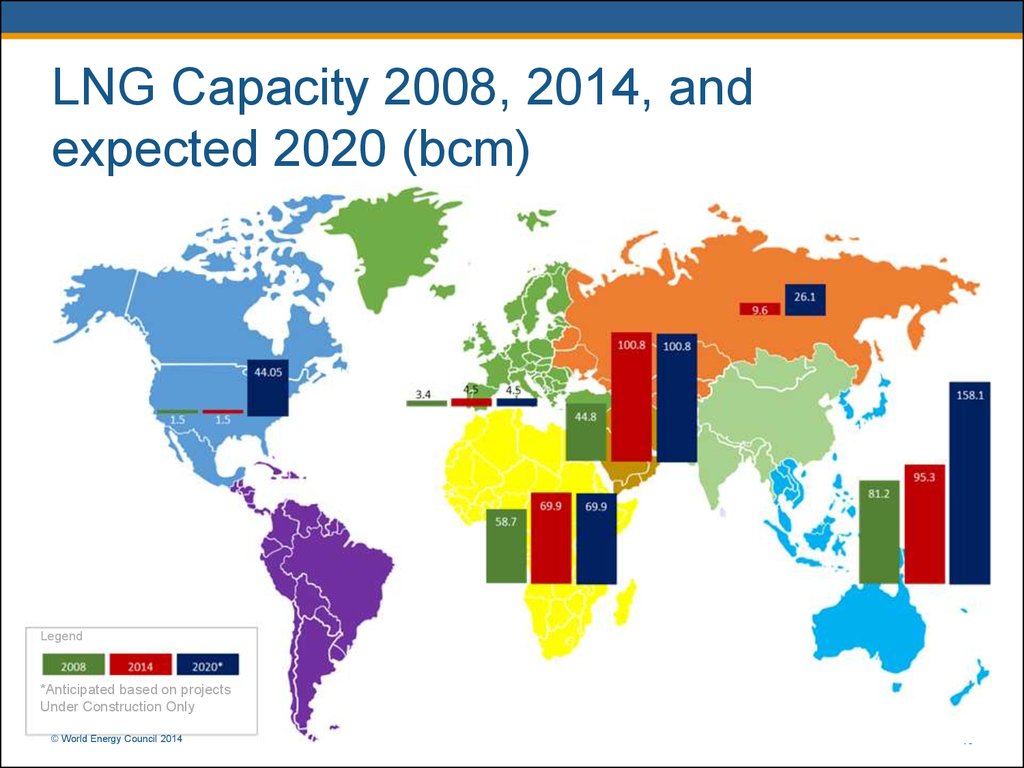

15.

LNG Capacity 2008, 2014, andexpected 2020 (bcm)

Legend

*Anticipated based on projects

Under Construction Only

© World Energy Council 2014

15

industry

industry