Similar presentations:

Comparing alternatives

1. American University of Armenia IE 340 – Engineering Economics Spring Semester, 2016

Ch5- Comparing Alternatives2. Comparing Alternatives

3. The Objective

• To learn how to properly apply the profitabilitymeasures to select the best alternative out of a set of

mutually exclusive alternatives (MEA)

• The cash-flow analysis methods (previously

described) used in this process:

Present Worth ( PW )

Annual Worth ( AW )

Future Worth ( FW )

Internal Rate of Return ( IRR )

External Rate of Return ( ERR )

4. Three groups of investment alternatives

1. Mutually exclusiveAt most one project out of the group can be chosen, i.e. when

one project is chosen all the other ones are excluded

Example: suppose you are shopping for a car. You consider

several cars, but will only buy one from a mutually exclusive

set of choices

2. Independent

The choice of a project is independent of the choice of any

other project in the group, so that all or none of the projects

may be selected or some number in between

3. Contingent

The choice of the project is conditional on the choice of one or

more other projects

5. The fundamental purpose of capital investment is to obtain at least the MARR for each dollar invested

• Basic Rule:Spend the least amount of capital possible unless the

extra capital can be justified by the extra savings or

benefits

In other words, any increment of capital spent (above

the minimum) must be able to pay its own way

6. Investment alternatives and cost alternatives

• An Investment Alternative has an initial investmentproducing positive cash flows resulting from

increased revenues, reduced costs, or both

"Do nothing" (DN) is usually an implicit investment alternative

If ∑positive cash flows > ∑ negative cash flows, then IRR exists

If PW(MARR) ≥0, investment is profitable

if PW(MARR)<0, do nothing (DN) is better

• Cost Alternatives have all negative cash flows

except for the salvage value (if applicable)

These alternatives represent “must do” situations, and DN is not

an option

IRR not defined for cost alternatives. Can you explain why?

7. The study period must be appropriate for the decision being made

• Study Period (or planning horizon): The time intervalover which service is needed to fulfill a specified

function or the interval over which the alternatives

are compared

• Useful Life: The period during which an asset is kept

in productive operation

• We will discuss two cases:

Case 1: Study period = Useful life

Case 2: Study period ≠ Useful life

• Fundamental Principle: Compare MEAs over the

same period of time

8. Case 1: Study period = Useful life

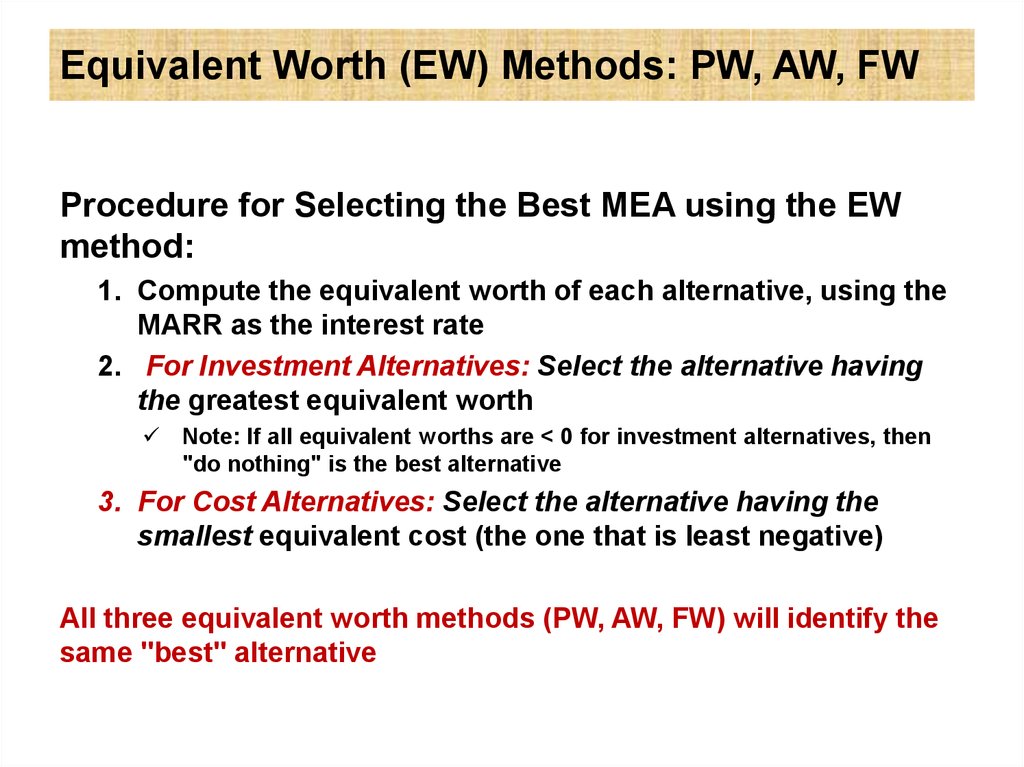

9. Equivalent Worth (EW) Methods: PW, AW, FW

Procedure for Selecting the Best MEA using the EWmethod:

1. Compute the equivalent worth of each alternative, using the

MARR as the interest rate

2. For Investment Alternatives: Select the alternative having

the greatest equivalent worth

Note: If all equivalent worths are < 0 for investment alternatives, then

"do nothing" is the best alternative

3. For Cost Alternatives: Select the alternative having the

smallest equivalent cost (the one that is least negative)

All three equivalent worth methods (PW, AW, FW) will identify the

same "best" alternative

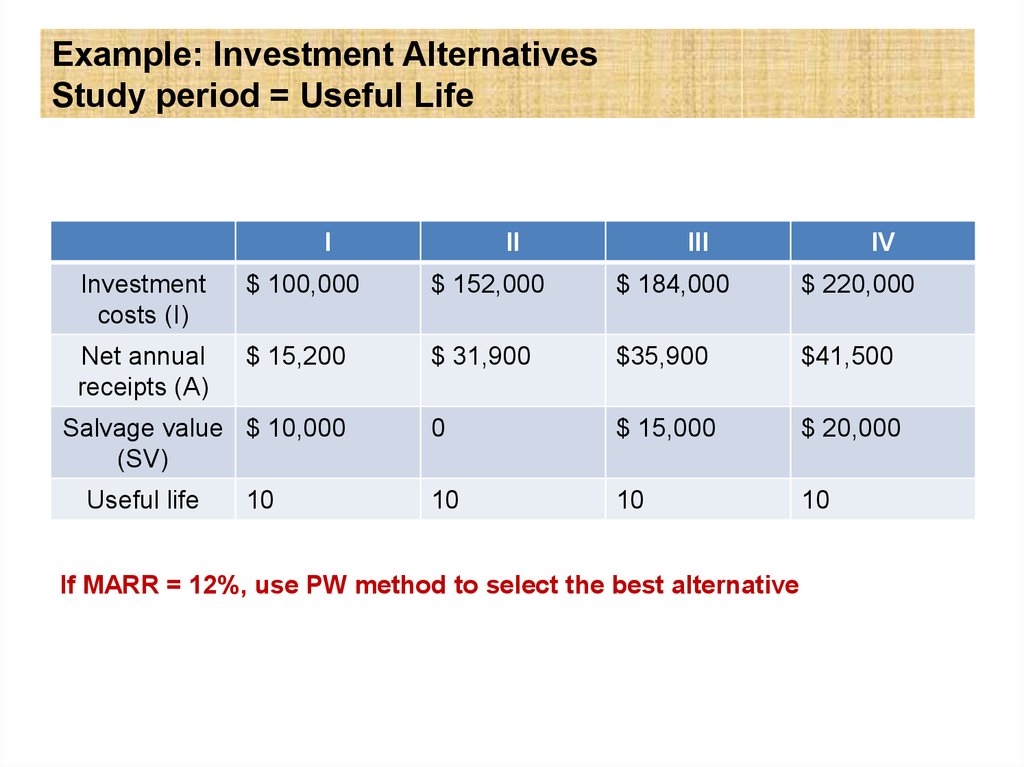

10. Example: Investment Alternatives Study period = Useful Life

III

III

IV

Investment

costs (I)

$ 100,000

$ 152,000

$ 184,000

$ 220,000

Net annual

receipts (A)

$ 15,200

$ 31,900

$35,900

$41,500

0

$ 15,000

$ 20,000

10

10

10

Salvage value $ 10,000

(SV)

Useful life

10

If MARR = 12%, use PW method to select the best alternative

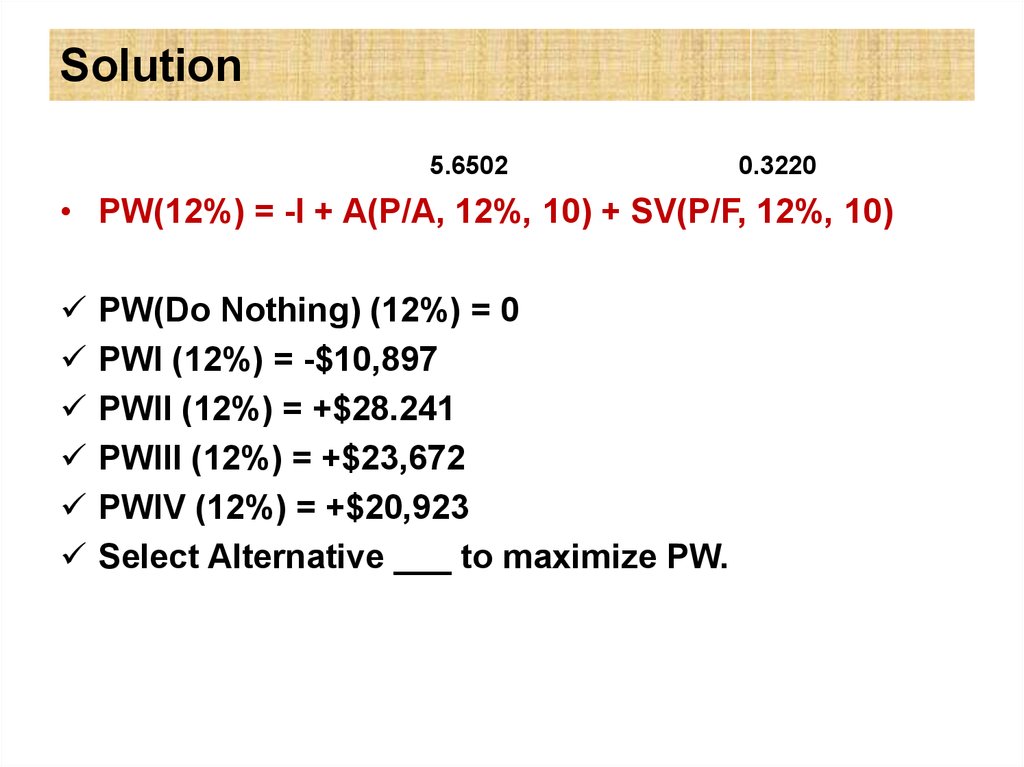

11. Solution

5.65020.3220

• PW(12%) = -I + A(P/A, 12%, 10) + SV(P/F, 12%, 10)

PW(Do Nothing) (12%) = 0

PWI (12%) = -$10,897

PWII (12%) = +$28.241

PWIII (12%) = +$23,672

PWIV (12%) = +$20,923

Select Alternative ___ to maximize PW.

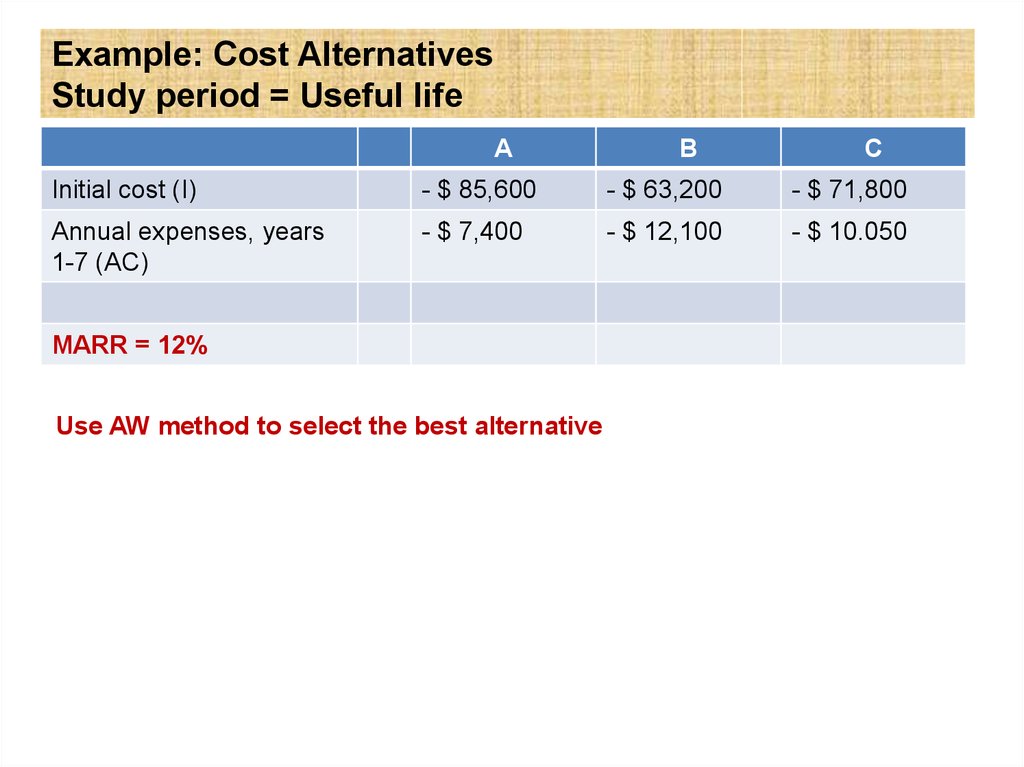

12. Example: Cost Alternatives Study period = Useful life

AB

C

Initial cost (I)

- $ 85,600

- $ 63,200

- $ 71,800

Annual expenses, years

1-7 (AC)

- $ 7,400

- $ 12,100

- $ 10.050

MARR = 12%

Use AW method to select the best alternative

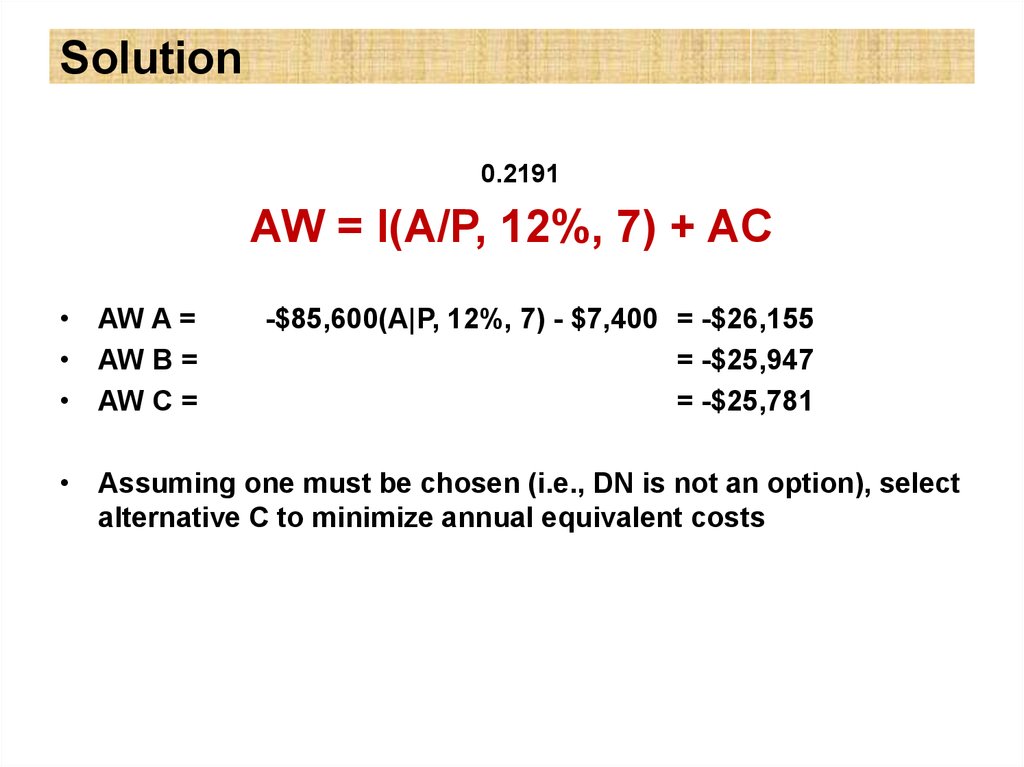

13. Solution

0.2191AW = I(A/P, 12%, 7) + AC

• AW A =

• AW B =

• AW C =

-$85,600(A|P, 12%, 7) - $7,400 = -$26,155

= -$25,947

= -$25,781

• Assuming one must be chosen (i.e., DN is not an option), select

alternative C to minimize annual equivalent costs

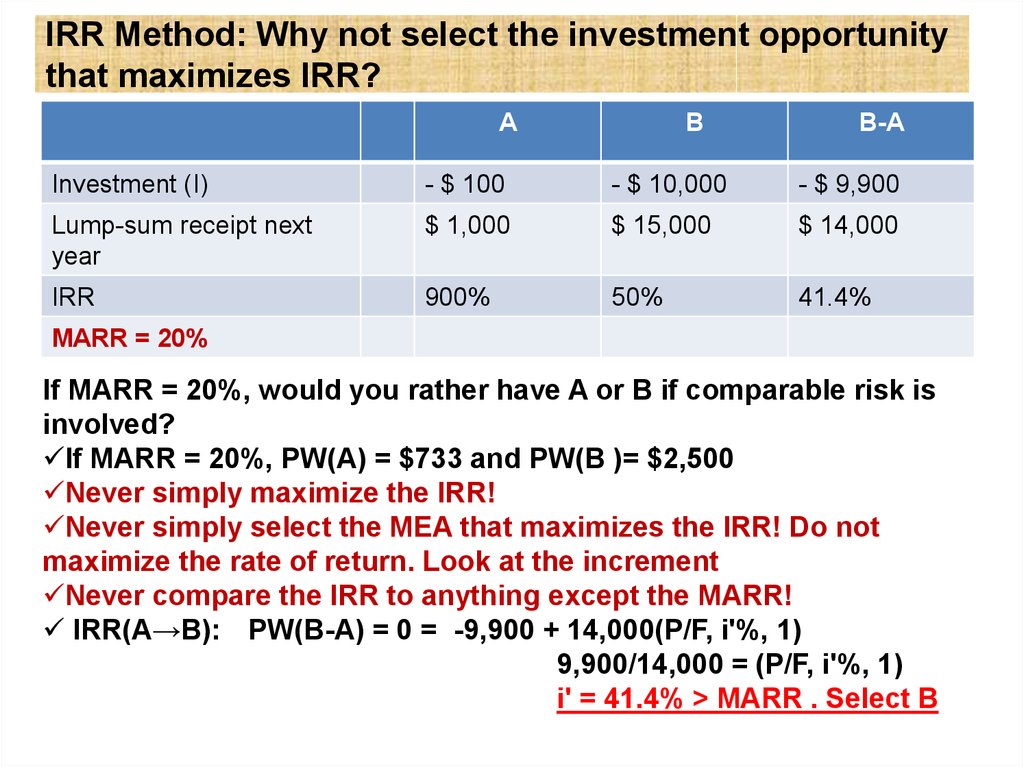

14. IRR Method: Why not select the investment opportunity that maximizes IRR?

AB

B-A

Investment (I)

- $ 100

- $ 10,000

- $ 9,900

Lump-sum receipt next

year

$ 1,000

$ 15,000

$ 14,000

IRR

900%

50%

41.4%

MARR = 20%

If MARR = 20%, would you rather have A or B if comparable risk is

involved?

If MARR = 20%, PW(A) = $733 and PW(B )= $2,500

Never simply maximize the IRR!

Never simply select the MEA that maximizes the IRR! Do not

maximize the rate of return. Look at the increment

Never compare the IRR to anything except the MARR!

IRR(A→B): PW(B-A) = 0 = -9,900 + 14,000(P/F, i'%, 1)

9,900/14,000 = (P/F, i'%, 1)

i' = 41.4% > MARR . Select B

15. IRR Method: Another Example

12

3

Investment (FC)

- $ 28,000

- $ 16,000

- $ 23,500

Net cash flow/year

$ 5,500

$ 3,300

$ 4,800

Salvage value

$ 1,500

0

$ 500

Useful life

10 yrs

10 yrs

10 yrs

Study period

10 yrs

10 yrs

10 yrs

Given three MEAs and MARR = 15% per year

Use the Incremental IRR procedure to choose the best

alternative.

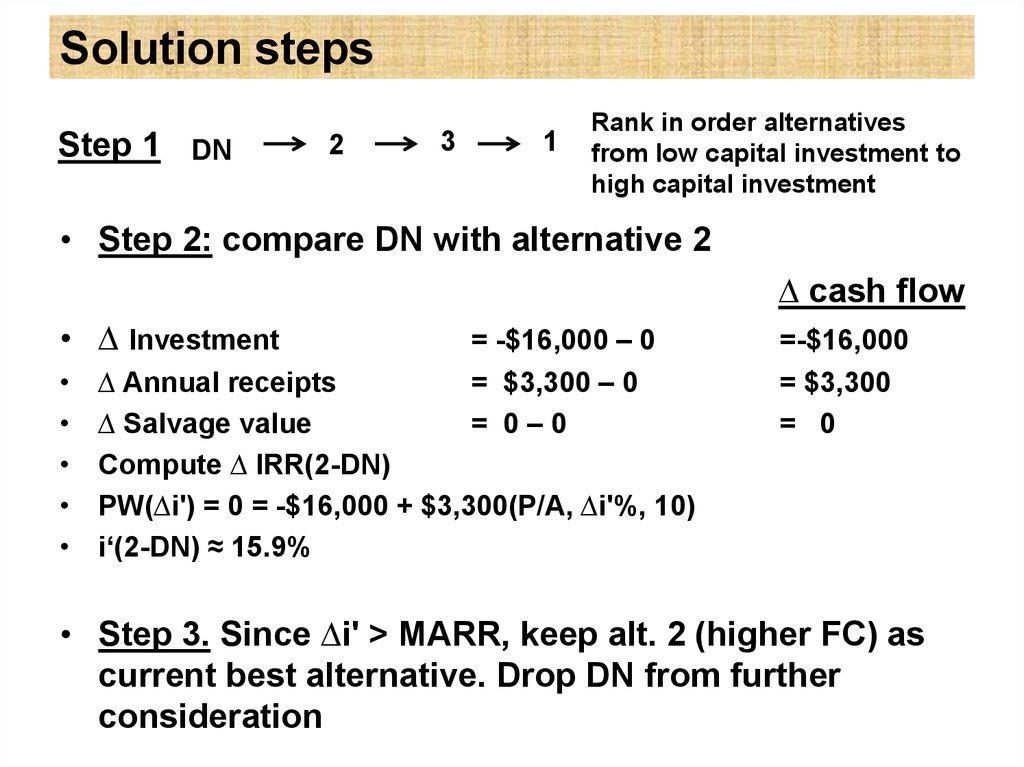

16. Solution steps

Step 1 DN2

3

1

Rank in order alternatives

from low capital investment to

high capital investment

• Step 2: compare DN with alternative 2

∆ cash flow

• ∆ Investment

= -$16,000 – 0

= $3,300 – 0

= 0–0

∆ Annual receipts

∆ Salvage value

Compute ∆ IRR(2-DN)

PW(∆i') = 0 = -$16,000 + $3,300(P/A, ∆i'%, 10)

i‘(2-DN) ≈ 15.9%

=-$16,000

= $3,300

= 0

• Step 3. Since ∆i' > MARR, keep alt. 2 (higher FC) as

current best alternative. Drop DN from further

consideration

17. Solution steps

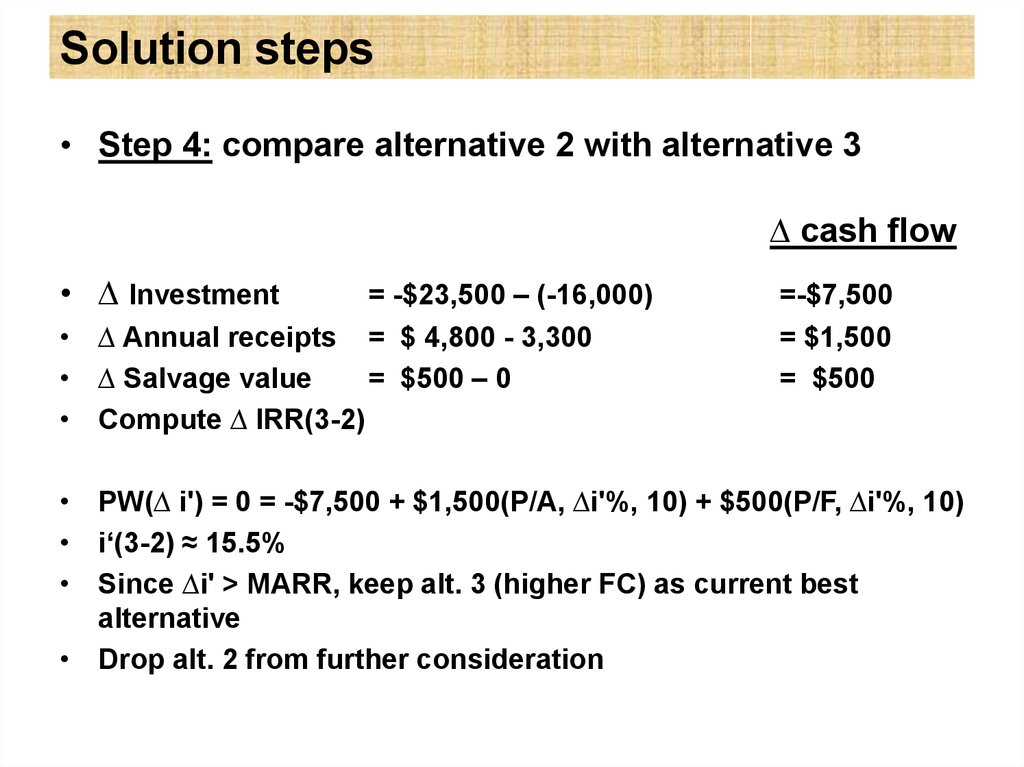

• Step 4: compare alternative 2 with alternative 3∆ cash flow

• ∆ Investment

• ∆ Annual receipts

• ∆ Salvage value

• Compute ∆ IRR(3-2)

= -$23,500 – (-16,000)

= $ 4,800 - 3,300

= $500 – 0

=-$7,500

= $1,500

= $500

• PW(∆ i') = 0 = -$7,500 + $1,500(P/A, ∆i'%, 10) + $500(P/F, ∆i'%, 10)

• i‘(3-2) ≈ 15.5%

• Since ∆i' > MARR, keep alt. 3 (higher FC) as current best

alternative

• Drop alt. 2 from further consideration

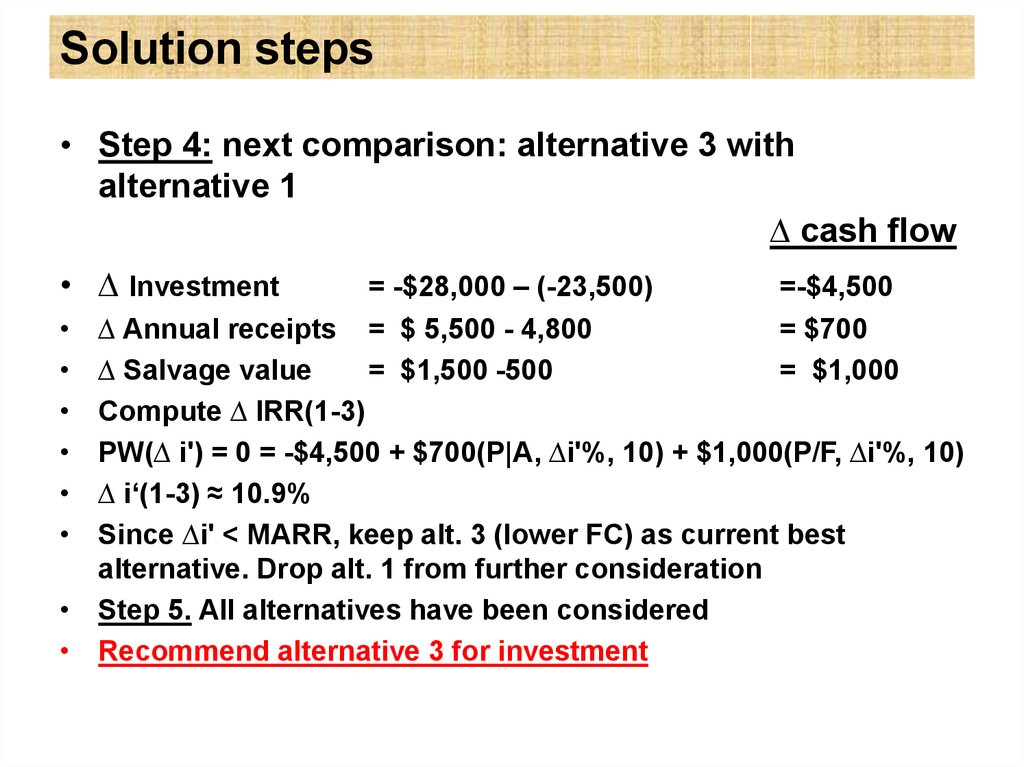

18. Solution steps

• Step 4: next comparison: alternative 3 withalternative 1

∆ cash flow

• ∆ Investment

= -$28,000 – (-23,500)

= $ 5,500 - 4,800

= $1,500 -500

=-$4,500

= $700

= $1,000

∆ Annual receipts

∆ Salvage value

Compute ∆ IRR(1-3)

PW(∆ i') = 0 = -$4,500 + $700(P|A, ∆i'%, 10) + $1,000(P/F, ∆i'%, 10)

∆ i‘(1-3) ≈ 10.9%

Since ∆i' < MARR, keep alt. 3 (lower FC) as current best

alternative. Drop alt. 1 from further consideration

• Step 5. All alternatives have been considered

• Recommend alternative 3 for investment

19. Case 2: Study period ≠ Useful life

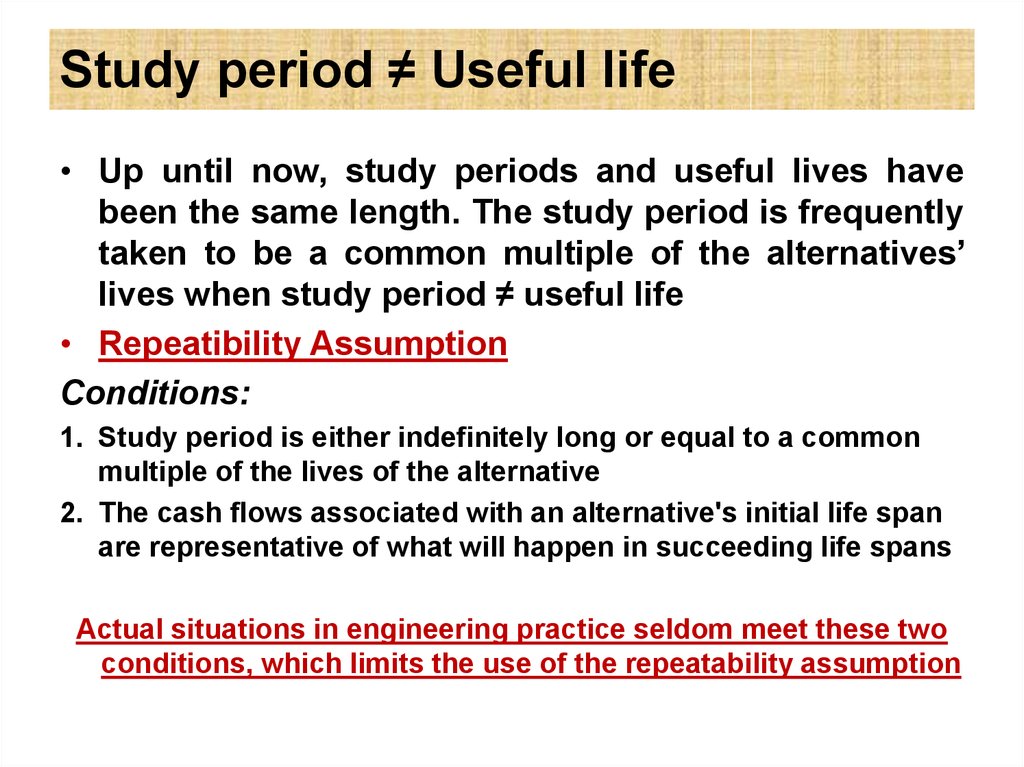

20. Study period ≠ Useful life

• Up until now, study periods and useful lives havebeen the same length. The study period is frequently

taken to be a common multiple of the alternatives’

lives when study period ≠ useful life

• Repeatibility Assumption

Conditions:

1. Study period is either indefinitely long or equal to a common

multiple of the lives of the alternative

2. The cash flows associated with an alternative's initial life span

are representative of what will happen in succeeding life spans

Actual situations in engineering practice seldom meet these two

conditions, which limits the use of the repeatability assumption

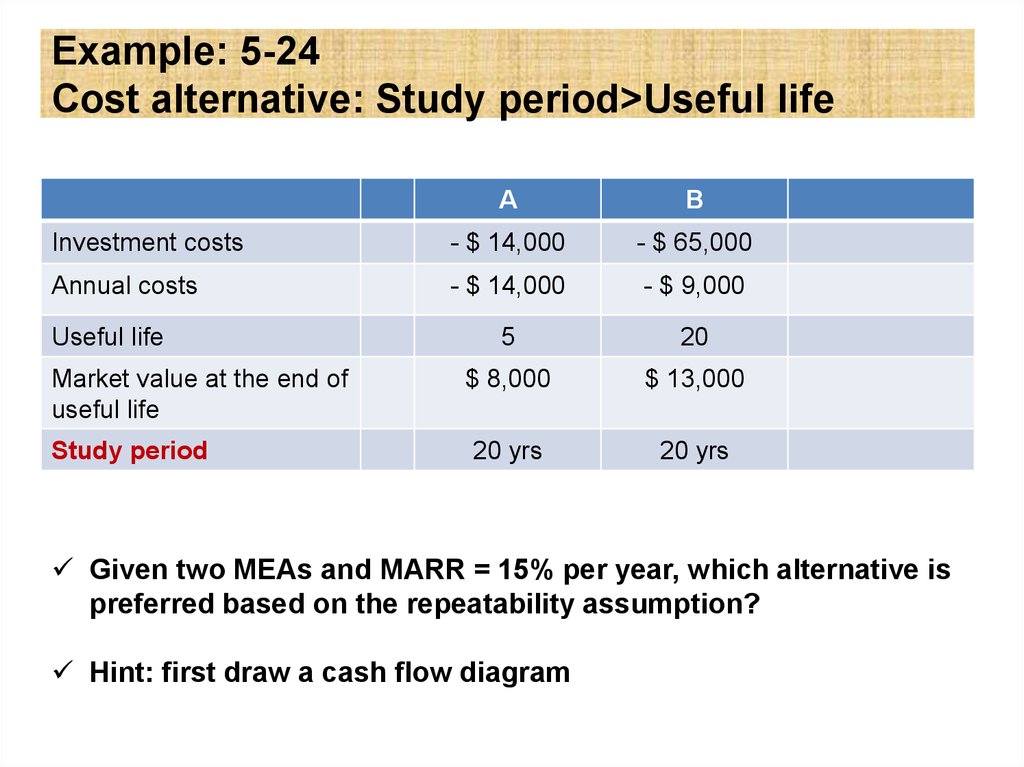

21. Example: 5-24 Cost alternative: Study period>Useful life

Example: 5-24Cost alternative: Study period>Useful life

A

B

Investment costs

- $ 14,000

- $ 65,000

Annual costs

- $ 14,000

- $ 9,000

5

20

$ 8,000

$ 13,000

20 yrs

20 yrs

Useful life

Market value at the end of

useful life

Study period

Given two MEAs and MARR = 15% per year, which alternative is

preferred based on the repeatability assumption?

Hint: first draw a cash flow diagram

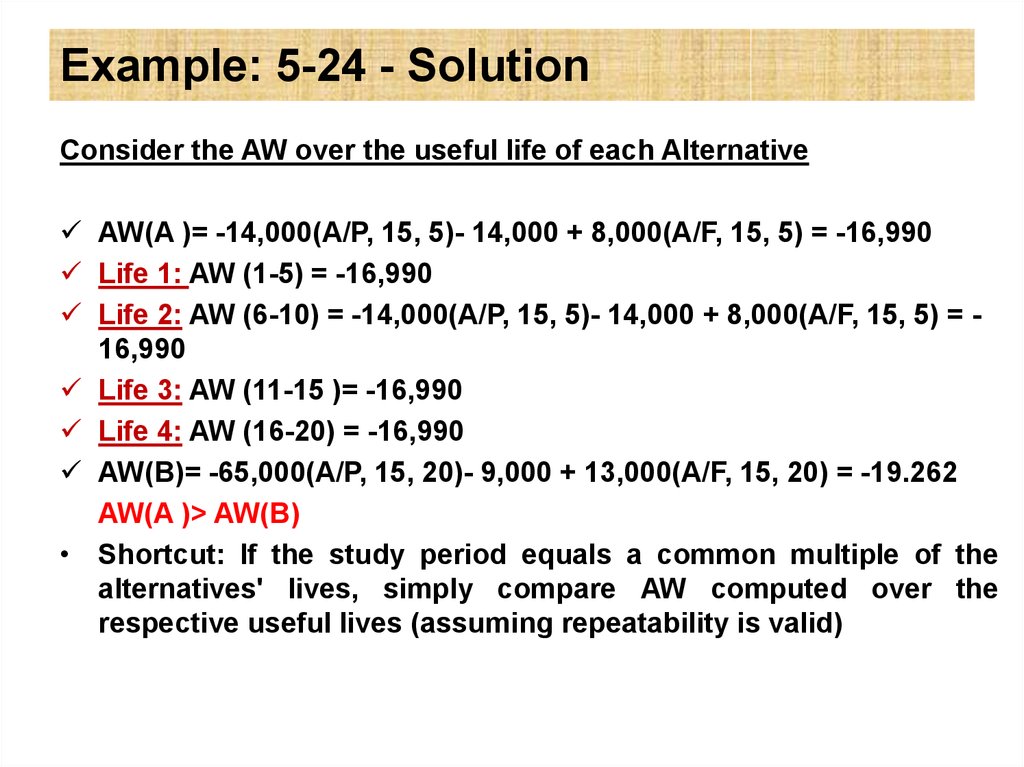

22. Example: 5-24 - Solution

Consider the AW over the useful life of each AlternativeAW(A )= -14,000(A/P, 15, 5)- 14,000 + 8,000(A/F, 15, 5) = -16,990

Life 1: AW (1-5) = -16,990

Life 2: AW (6-10) = -14,000(A/P, 15, 5)- 14,000 + 8,000(A/F, 15, 5) = 16,990

Life 3: AW (11-15 )= -16,990

Life 4: AW (16-20) = -16,990

AW(B)= -65,000(A/P, 15, 20)- 9,000 + 13,000(A/F, 15, 20) = -19.262

AW(A )> AW(B)

• Shortcut: If the study period equals a common multiple of the

alternatives' lives, simply compare AW computed over the

respective useful lives (assuming repeatability is valid)

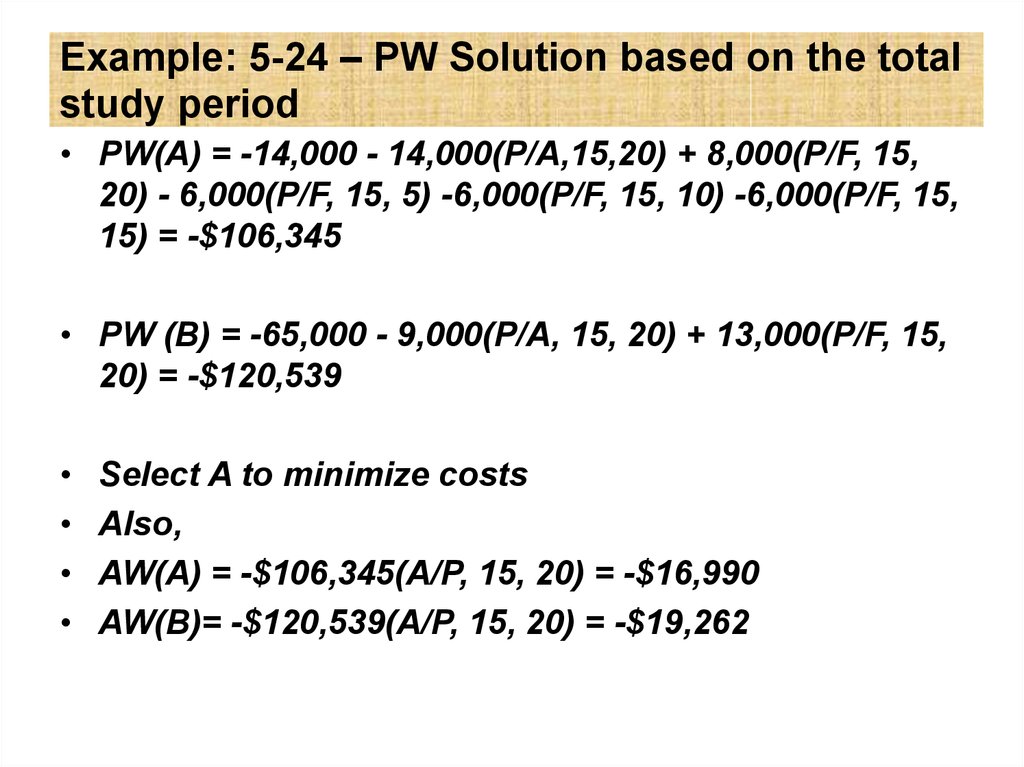

23. Example: 5-24 – PW Solution based on the total study period

• PW(A) = -14,000 - 14,000(P/A,15,20) + 8,000(P/F, 15,20) - 6,000(P/F, 15, 5) -6,000(P/F, 15, 10) -6,000(P/F, 15,

15) = -$106,345

• PW (B) = -65,000 - 9,000(P/A, 15, 20) + 13,000(P/F, 15,

20) = -$120,539

Select A to minimize costs

Also,

AW(A) = -$106,345(A/P, 15, 20) = -$16,990

AW(B)= -$120,539(A/P, 15, 20) = -$19,262

24.

• What if the study period is not acommon multiple of the alternatives‘

lives or repeatability is not

applicable?

• An appropriate study period need to

be selected (coterminated

assumption)

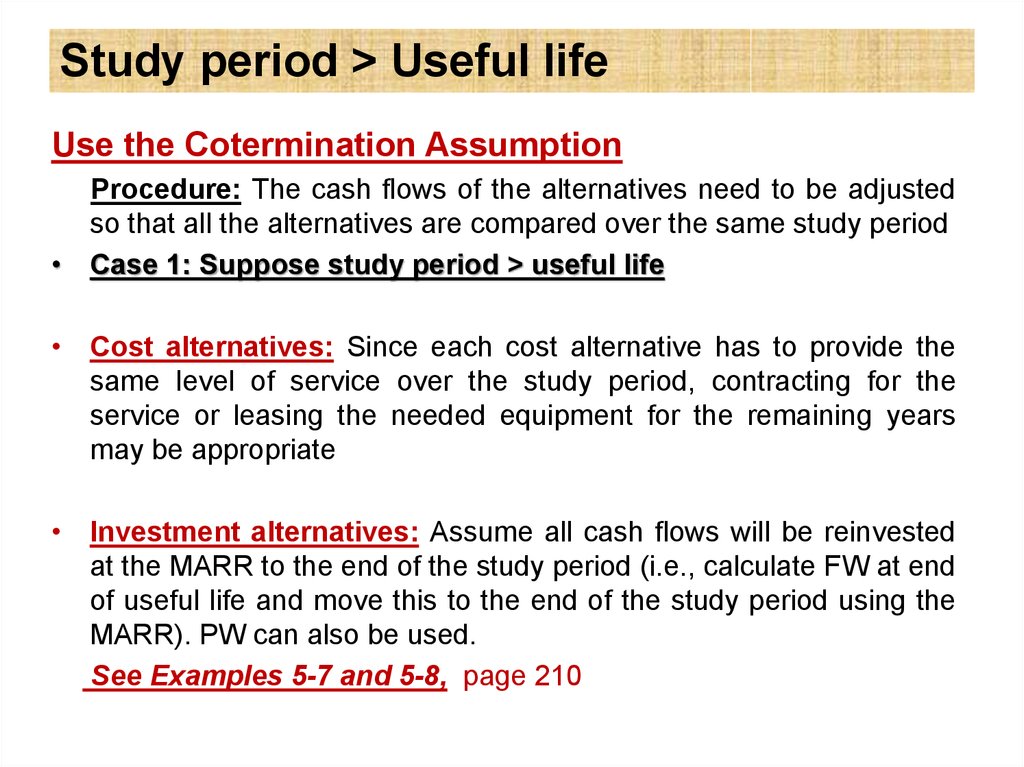

25. Study period > Useful life

Study period > Useful lifeUse the Cotermination Assumption

Procedure: The cash flows of the alternatives need to be adjusted

so that all the alternatives are compared over the same study period

• Case 1: Suppose study period > useful life

• Cost alternatives: Since each cost alternative has to provide the

same level of service over the study period, contracting for the

service or leasing the needed equipment for the remaining years

may be appropriate

• Investment alternatives: Assume all cash flows will be reinvested

at the MARR to the end of the study period (i.e., calculate FW at end

of useful life and move this to the end of the study period using the

MARR). PW can also be used.

See Examples 5-7 and 5-8, page 210

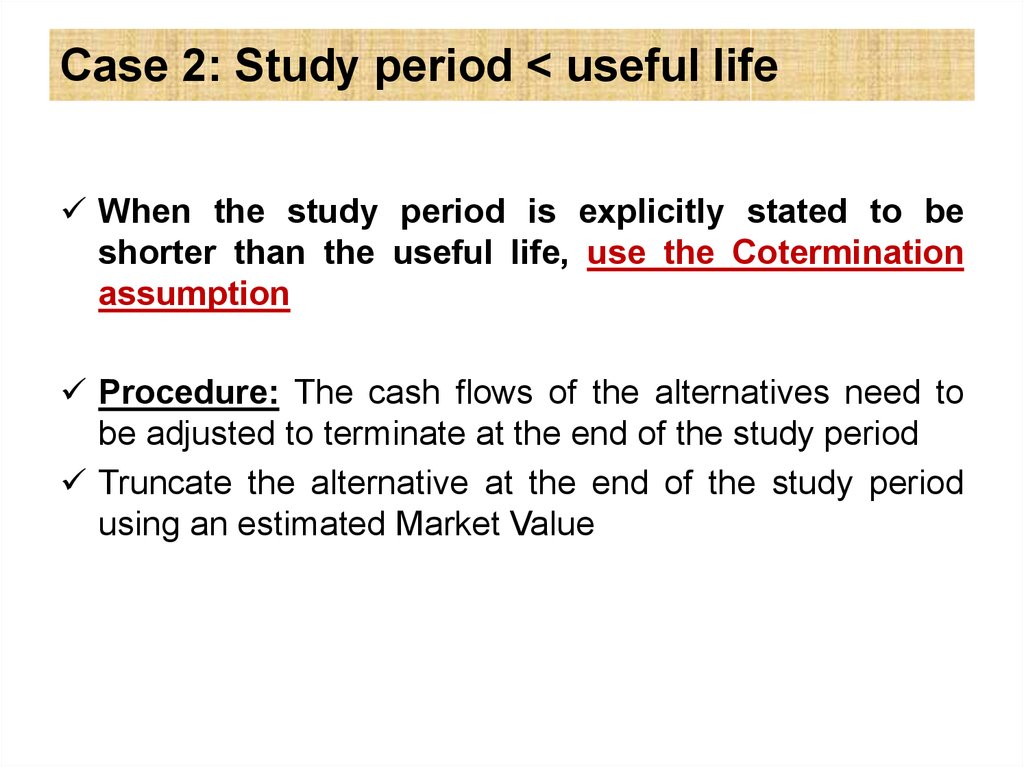

26. Case 2: Study period < useful life

Case 2: Study period < useful lifeWhen the study period is explicitly stated to be

shorter than the useful life, use the Cotermination

assumption

Procedure: The cash flows of the alternatives need to

be adjusted to terminate at the end of the study period

Truncate the alternative at the end of the study period

using an estimated Market Value

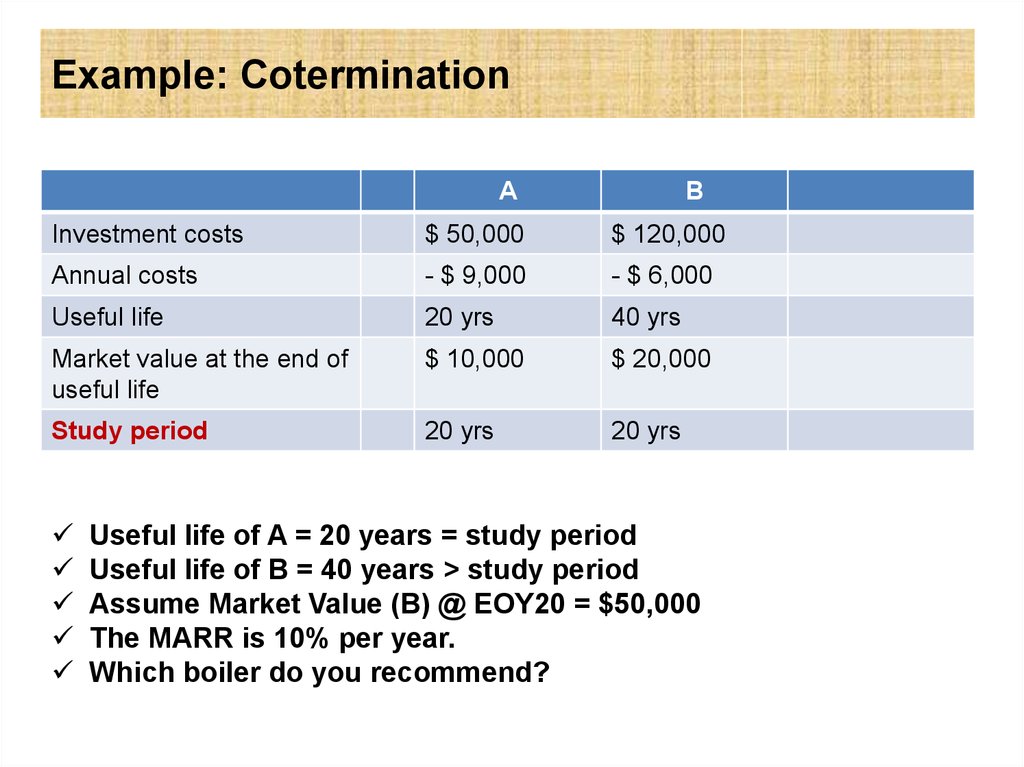

27. Example: Cotermination

AB

Investment costs

$ 50,000

$ 120,000

Annual costs

- $ 9,000

- $ 6,000

Useful life

20 yrs

40 yrs

Market value at the end of

useful life

$ 10,000

$ 20,000

Study period

20 yrs

20 yrs

Useful life of A = 20 years = study period

Useful life of B = 40 years > study period

Assume Market Value (B) @ EOY20 = $50,000

The MARR is 10% per year.

Which boiler do you recommend?

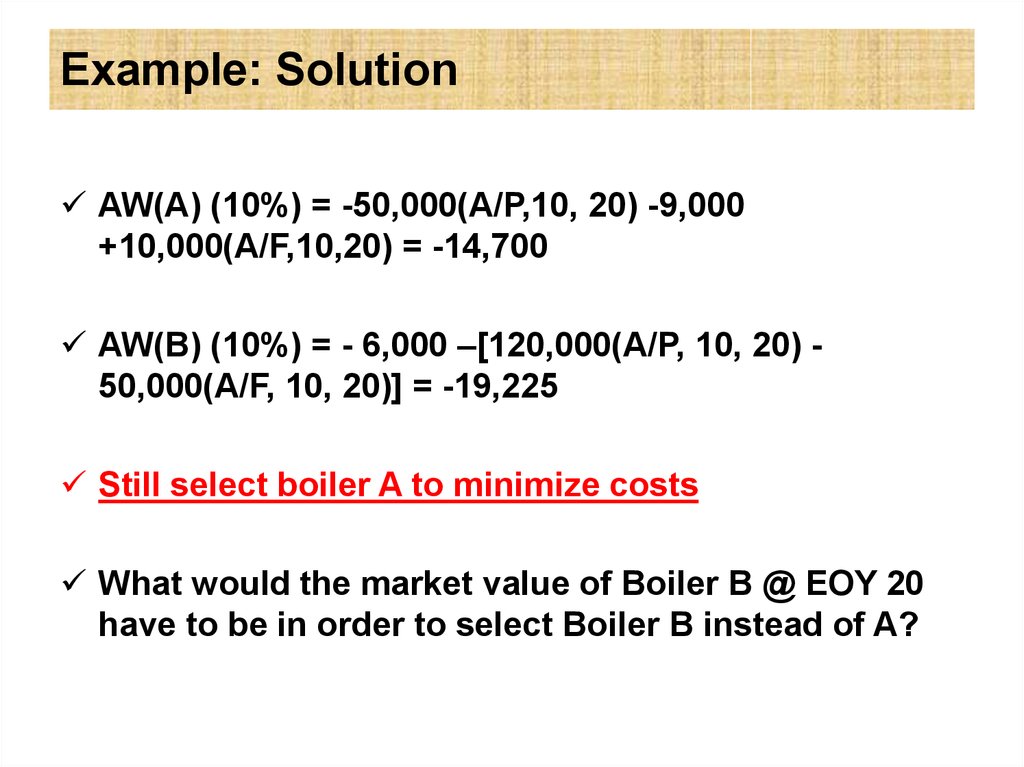

28. Example: Solution

AW(A) (10%) = -50,000(A/P,10, 20) -9,000+10,000(A/F,10,20) = -14,700

AW(B) (10%) = - 6,000 –[120,000(A/P, 10, 20) 50,000(A/F, 10, 20)] = -19,225

Still select boiler A to minimize costs

What would the market value of Boiler B @ EOY 20

have to be in order to select Boiler B instead of A?

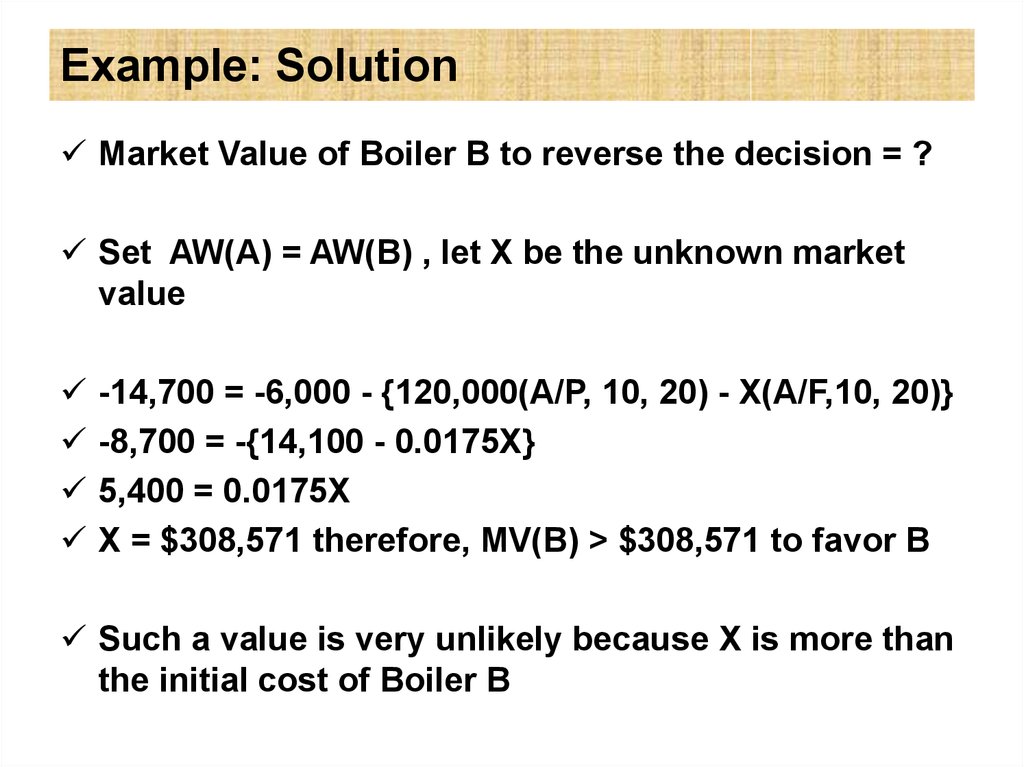

29. Example: Solution

Market Value of Boiler B to reverse the decision = ?Set AW(A) = AW(B) , let X be the unknown market

value

-14,700 = -6,000 - {120,000(A/P, 10, 20) - X(A/F,10, 20)}

-8,700 = -{14,100 - 0.0175X}

5,400 = 0.0175X

X = $308,571 therefore, MV(B) > $308,571 to favor B

Such a value is very unlikely because X is more than

the initial cost of Boiler B

finance

finance