Similar presentations:

Macro-statistics on household savings. Lecture 3

1.

Lecture 3 Macro-statistics onhousehold savings

2.

OECD StatHousehold accounts - data on households on

• disposable income

• spending

• savings

• debt

• financial assets.

A household may be a person who makes provision for his or her own

food and other essentials for living, or may be small group of people

who share the same living accommodation, pool some, or all, of their

income and wealth, and consume certain types of goods and services

collectively, mainly housing and food. The household group may be

made up of related or unrelated people, or a combination of both.

3.

OECD StatDisposable income is closest to the concept of income as generally understood in economics.

Household disposable income is income available to households such as

• wages and salaries,

• income from self-employment and unincorporated enterprises,

• income from pensions and other social benefits,

• income from financial investments (less any payments of tax, social insurance contributions and

interest on financial liabilities).

‘Gross’ means that depreciation costs are not subtracted. For gross household disposable income per

capita, growth rates (percentage change from previous period) are presented; these are ‘real’ growth

rates adjusted to remove the effects of price changes.

Information is also presented for gross household disposable income including social transfers in

kind, such as health or education provided for free or at reduced prices by governments and not-forprofit organisations.

This indicator is in US dollars per capita at current prices and PPPs.

In the System of National Accounts, household disposable income including social transfers in kind is

referred to as ‘adjusted household disposable income’.

All OECD countries compile their data according to the 2008 System of National Accounts (SNA

2008).

4.

OECD StatHousehold spending is the amount of final consumption expenditure made by resident

households to meet their everyday needs, such as

• food, clothing, housing (rent), energy, transport, durable goods (notably cars), health

costs, leisure, and miscellaneous services.

It is typically around 60% of gross domestic product (GDP).

Actual individual consumption - household spending including government transfers

(referred to as in national accounts) is equal to households' consumption expenditure plus

those expenditures of general government and non-profit institutions serving households

(NPISHs) that directly benefit households, such as health care and education.

"Housing, water, electricity, gas, and other fuels", one out of the twelve categories

distinguished, consist of both actual rentals (for tenants) and imputed rentals (for owneroccupied housing), housing maintenance, as well as costs for water, electricity, gas.

Total household spending is measured in million USD (in current prices and Private

consumption PPPs), as a percentage of GDP, and in annual growth rates.

Household spending including government transfers is measured as a percentage of GDP.

Spending in housing is presented as a percentage of household disposable income.

All OECD countries compile their data according to the 2008 System of National Accounts

(SNA 2008).

5.

OECD StatHousehold savings

Net household saving - household net disposable income plus the

adjustment for the change in pension entitlements less household final

consumption expenditure (households also include non-profit

institutions serving households - churches and religious societies, sports

and other clubs, trade unions and political parties).

The adjustment item concerns (mandatory) saving of households, by

building up funds in employment-related pension schemes.

The net household saving rate represents the total amount of net

saving as a percentage of net household disposable income.

It thus shows how much households are saving out of current income

and also how much income they have added to their net wealth. All

OECD countries compile their data according to the 2008 System of

National Accounts (SNA).

6.

OECD StatHousehold debt is defined as all liabilities of households (including nonprofit institutions serving households) that require payments of interest

or principal by households to the creditors at a fixed dates in the future.

Debt is calculated as the sum of the following liability categories: loans

(primarily mortgage loans and consumer credit) and other accounts

payable.

The indicator is measured as a percentage of net household disposable

income.

7.

OECD StatHousehold financial assets, such as

• saving depostis,

• investments in equity,

• shares and bonds,

form an important part of overall wealth of households, and are an important

source of revenue, either through the sales of these assets, or as a source of

property income (such as interest and dividends).

Pension entitlements are only included, if they relate to (funded) employmentrelated schemes, which may affect cross-country comparability to a considerable

extent.

Developments in the short term may show quite diverse movements, depending

on the risk profile of the assets. The value of shares, for example, can show a

relatively high volatility over the years.

This indicator represents total financial assets of households per capita in US

dollars at current PPPs.

8.

OECD StatThe indicator household net financial transactions represents the

balancing item of the financial accounts of households (including nonprofit institutions serving households).

It is calculated as the difference, in a given period, between the net

acquisition of financial assets (saving depostis, equity and shares, bonds,

etc.) and the net incurrence of liabilities (especially mortgage loans and

consumer credit).

The indicator is measured as a percentage of net household disposable

income.

9.

OECD StatHousehold total net worth represents the total value of assets (financial as well as non-financial)

minus the total value of outstanding liabilities of households (including non-profit institutions

serving households).

Please note that this indicator only takes into account the value of dwellings, and not other types of

non-financial assets.

The following financial assets and liabilities are included:

• currency and deposits;

• debt securities;

• loans;

• equity and investment fund shares/units;

• insurance,

• pensions and standardised guarantee schemes;

• financial derivatives and employee stock options;

• and other accounts receivable/payable.

The indicator is measured as a percentage of household net disposable income.

10.

OECD Stat• Households' financial assets and liabilities OECD countries (OECD stat

data, country level)

11.

Central Bank of RussiaMethodological notes on the publication 'Financial assets and liabilities of the

households sector (transactions and balances) by the type of financial instruments’

https://www.cbr.ru/eng/statistics/macro_itm/households/metod/

Methodological principles for compiling indicators of financial assets and liabilities

of the households sector The System of National Accounts 2008 (SNA 2008)

is the methodological basis for the compiling financial assets and liabilities

of the households sector.

According to the SNA 2008, the balances of financial assets and liabilities show

stocks of financial assets and liabilities at a certain moment in time.

Asset value at a certain moment in time changes each time in accordance with

a transaction, price change, or any other change influencing the amounts of assets

and liabilities.

12.

Central Bank of Russiahttps://www.cbr.ru/eng/statistics/macro_itm/households/hh/

Household savings (trillion rub) and saving rate (%, right axis)

Наличность

Текущие счета

Срочные депозиты

Ценные бумаги

Недвижимость

Кредит

2к23

-4

1к23

-3

4к22

0

3к22

-2

2к22

4

1к22

-1

4к21

8

3к21

0

2к21

12

1к21

1

4к20

16

3к20

2

2к20

20

1к20

3

4к19

24

3к19

4

2к19

28

1к19

5

Норма сбережений

13.

Central Bank of Russia• Households Savings in Russia (Bank of Russia, methodology and

data)

• Saving rate (Bank of Russia, quarterly data 2019-2023)

• Review of the Banking Sector of the Russian Federation

14.

RosstatMethodology – income and expenditures

СБЕРЕЖЕНИЯ

I. Прирост (уменьшение) сбережений во вкладах банков резидентов и нерезидентов

II. Приобретение государственных и других ценных бумаг

III. Прирост (уменьшение) средств на счетах индивидуальных предпринимателей

IV. Прирост (уменьшение) наличных денег у населения в рублях и инвалюте

V. Расходы на покупку недвижимости

VI. Покупка населением и крестьянскими (фермерскими) хозяйствами скота и птицы

VII. Прирост (уменьшение) задолженности по кредитам

VIII. Прочие сбережения

IX. Всего прирост сбережений населения (I + II + III + IV + V + VI -VII +VIII)

15.

Rosstat• Rosstat data on households incomes and savings

• Structure of the use of monetory income of the population of the

Russian Federation (Rosstat 2013-2023)

16.

ECB (EU) and FRS (US)• European Central Bank

https://www.ecb.europa.eu/stats/ecb_statistics/accessing-ourdata/html/index.en.html

• Federal Reserve System https://www.federalreserve.gov/data.htm

17.

Nikolaenko Personal savings 1998• In 1992-1997 official statistics (Goskomstat) the personal savings rate

as about 25%

30%

25%

20%

15%

10%

5%

Official

0%

12.90

12.91

Corrected

12.92

12.93

12.94

12.95

12.96

12.97

12.98

18.

Nikolaenko Personal savings 1998The structure of the use of personal income in 1997

Taxes

6%

Deposits

2%

Cash RUR

2%

Shutle trade

8%

Other

22%

Consumer

expenditures

68%

sales of Hard currency

9%

Tourists expenditures

2%

Net HC cash savings

3%

19.

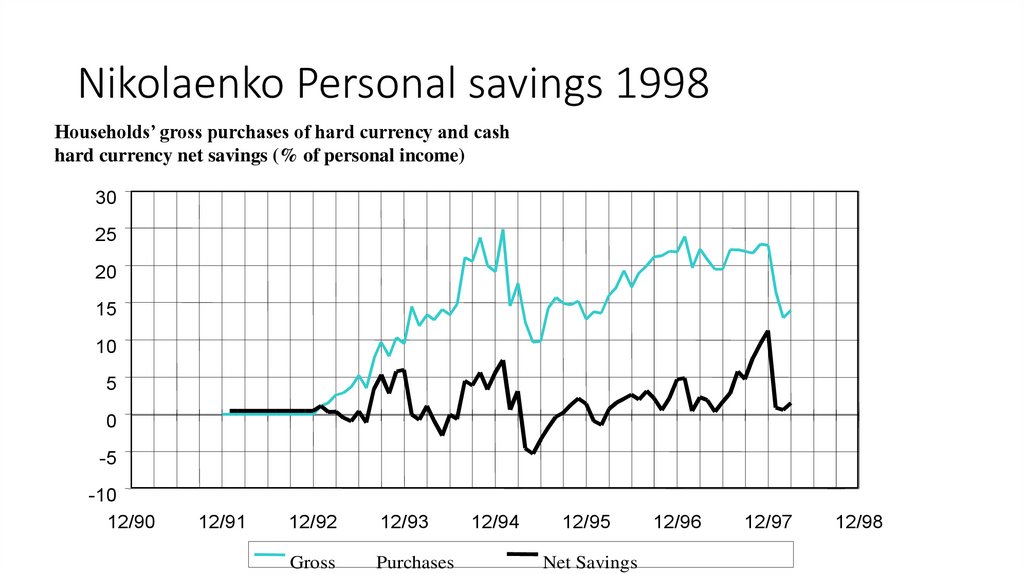

Nikolaenko Personal savings 1998Households’ gross purchases of hard currency and cash

hard currency net savings (% of personal income)

30

25

20

15

10

5

0

-5

-10

12/90

12/91

12/92

12/93

Gross

Purchases

12/94

12/95

Net Savings

12/96

12/97

12/98

finance

finance